UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No.2

|

x ANNUAL REPORT UNDER SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission File Number 000-51364

SINO GAS INTERNATIONAL HOLDINGS, INC.

(Name of small business issuer in its charter)

| Utah | 90-0438712 |

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

No. 18 Zhong Guan Cun Dong St.

Haidian District

Beijing, P. R. China 100083

(Address of Principal Executive Offices) (Zip Code)

Issuer’s Telephone Number: 86-10-8260-0527

Securities registered under Section 12 (b) of the Act: NONE

Securities to be registered under Section 12 (g) of the Act:

COMMON STOCK, PAR VALUE $.001 PER SHARE

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Check whether the issuer is not required to file reports pursuant to Sections 13 or 15(d) of the Exchange Act. Yes o No x

Check whether the issuer (1) filed all reports required to be filed by Sections 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Sec. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K/A or any amendment to this Form 10-K/A. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the 24,583,563 shares of voting and non-voting common equity stock held by non-affiliates of the registrant was $10 million as of June 29, 2012, the last business day of the registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $0.41 per share, as reported by The Over-The-Counter Bulletin Board.

As of December 31, 2012 the Registrant had 31,802,382 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

| Document | Parts Into Which Incorporated | |

| None | Not applicable |

Explanatory Note

This Amendment No. 2 (this “Amendment”) on Form 10-K/A amends the consolidated financial statements of the Annual Report on Form 10-K filed by the registrant with the Securities and Exchange Commission (the “SEC”) on April 11, 2013 (the “Original Filing”), as amended on a Form 10-K/A filed with the SEC on December 10, 2013.

ASC 220-10-45-5 requires the presentation of amounts of comprehensive income attributable to the parent as well as comprehensive income attributable to the non-controlling interest. We are filing this Amendment to revise our financial statements to include comprehensive income attributable to the non-controlling interest. This change affects presentation only and does not impact the Company’s financial results.

Except as described above, no other changes have been made to the Original Filing, as amended. This Amendment continues to describe conditions as of the date of the Original Filing and the Company has not modified or updated other disclosures presented in the Original Filing. This Amendment does not reflect events occurring after the date of the Original Filing nor does it modify or update disclosures affected by subsequent events occurring after the date of the Original Filing nor does it modify or update disclosures affected by subsequent events. Accordingly, this Amendment should be read in conjunction with the Company’s Form 10-K for the fiscal year ended December 31, 2012 and subsequent filings made with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended.

TABLE OF CONTENTS

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | ||

| PART I | ||

| ITEM 1 | BUSINESS | 4 |

| ITEM 1A | RISK FACTORS | 23 |

| ITEM 1B | UNRESOLVED STAFF COMMENTS | 34 |

| ITEM 2 | PROPERTIES | 34 |

| ITEM 3 | LEGAL PROCEEDINGS | 35 |

| ITEM 4 | MINE SAFETY DISCLOSURES | 35 |

| PART II | ||

| ITEM 5 | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 36 |

| ITEM 6 | SELECTED FINANCIAL DATA | 36 |

| ITEM 7 | MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 37 |

| ITEM 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 45 |

| ITEM 8 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 45 |

| ITEM 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 45 |

| ITEM 9A | CONTROLS AND PROCEDURES | 45 |

| ITEM 9B | OTHER INFORMATION | 46 |

| PART III | ||

| ITEM 10 | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 47 |

| ITEM 11 | EXECUTIVE COMPENSATION | 49 |

| ITEM 12 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 51 |

| ITEM 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, DIRECTOR INDEPENDENCE | 52 |

| ITEM 14 | PRINCIPAL ACCOUNTING FEES AND SERVICES | 53 |

| PART IV | ||

| ITEM 15 | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 54 |

| SIGNATURES | 58 | |

| 2 |

Except as otherwise indicated by the context, references in this Form 10-K/A to:

| · | “Sino Gas International Holdings, Inc.,” the “Company,” “Sino Gas,” “we,” “us” or “our” are references to the combined business of Sino Gas International Holdings, Inc. and its direct and indirect subsidiaries. |

| · | “U.S. Dollar,” “$” and “US$” mean the legal currency of the United States of America. |

| · | “RMB” means Renminbi, the legal currency of China. |

| · | “China” or the “PRC” are references to the People’s Republic of China. |

| · | “U.S.” is a reference to the United States of America |

| · | “SEC” is a reference to the Securities & Exchange Commission of the United States of America. |

| · | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

Unless otherwise noted, all currency figures in this filing are in U.S. Dollars. According to the currency exchange website www.xe.com, on December 31, 2012, $1.00 = 6.23 Renminbi.

Unless otherwise indicated, “2012” “2011” and “2010” refer to the fiscal years ended December 31, 2012, December 31, 2011, and December 31, 2010, respectively.

This report contains additional trade names and trademarks of other companies other than the Company. We do not intend our use or display of other companies’ trade names or trademarks to imply an endorsement of us by such companies, or any relationship with any of these companies.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including, but not limited to, statements regarding our future financial position, business strategy and plans and objectives of management for future operations. When used in this filing, the words believe, may, will, estimate, continue, anticipate, intend, expect, and similar expressions are intended to identify forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to the risks discussed under the heading “Risk Factors”. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements.

In light of these risks, uncertainties, and assumptions, the forward-looking events and circumstances discussed in this annual report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, readers are cautioned not to place undue reliance on such forward-looking statements.

| 3 |

PART I

Item 1. Business

Overview

We are engaged in the development of natural gas distribution systems and the distribution, through our indirectly owned subsidiaries in the PRC, Beijing Zhongran Weiye Gas Co., Ltd. (“Beijing Gas”) and its subsidiaries, of natural gas to residential and industrial customers in small- and medium-sized cities in the People’s Republic of China (the “PRC” or “China”).

The company owns and operates natural gas distribution systems in 34 small and medium size cities and serves approximately 293,758 residential and seven industrial customers. Our facilities include approximately 2,039 kilometers (“km”) of pipeline and delivery networks with a daily distribution of approximately 150,000 cubic meters of natural gas. We have two types of customers: (i) residential and (ii) industrial. The following table presents, for the periods indicated, selected operating data:

| At and for the year ended December 31 | ||||||||

| 2012 | 2011 | |||||||

| Total gas distributed and supplied (US$ millions) | 27.0 | 20.6 | ||||||

| Distribution network (km) | 2,039 | 1,635 | ||||||

| Number of industrial customers | 7 | 7 | ||||||

| Number of residential customers | 293,758 | 234,749 | ||||||

We own and operate natural gas distribution systems in small and medium sized cities in Hebei, Jiangsu, Jilin, Anhui and Yunnan Provinces in addition to natural gas distribution systems in the suburbs of Beijing. Beijing is not a province but a municipality directly under the jurisdiction of China’s State Council and has many urban districts in the suburbs.

| 4 |

We generate revenues in two ways: (i) connection fees for connecting to our natural gas distribution system and (ii) the sale of natural gas. The following table presents, for the periods indicated, the revenues generated from each of our major categories of operation:

| At and for the year ended December 31 | ||||||||||||||||

| 2012 | 2011 | |||||||||||||||

| (in US$ millions) | (in US$ millions) | |||||||||||||||

| Connection fees (as % of total Sales) | 23.4 | 46.5 | % | 21.1 | 50.5 | % | ||||||||||

| Gas sales | 27.0 | 53.5 | % | 20.6 | 49.5 | % | ||||||||||

| Other sales | — | |||||||||||||||

Our cost of sales consists of cost of gas sales and cost of connections. Cost of gas sales consists of cost of natural gas purchased from our suppliers, transportation costs, depreciation of plants and equipment, and amortization of the capitalized construction costs as our expenditures in constructing our pipeline infrastructure are generally capitalized as fixed assets and amortized over a period of time. Cost of connections includes certain construction costs that are expensed. The following table presents Beijing Gas’s cost of sales for the periods indicated:

| For the year ended December 31 | ||||||||

| 2012 (US$ millions) | 2011 (US$ millions) | |||||||

| Gas costs | 25.3 | 19.0 | ||||||

| Connection costs | 7.0 | 4.4 | ||||||

| 5 |

We buy natural gas for distribution in three forms: (i) compressed natural gas (“CNG”); (ii) liquefied natural gas (“LNG”) and (iii) directly from the primary natural gas pipeline (“NG”). Both CNG and LNG are natural gas that has been compressed into canisters so as to enable transportation, usually by truck, to a point of distribution or consumption. Typically CNG is compressed under pressure to less than 1% of its volume and is transported at normal temperatures, while LNG, which can take up about 1/600th of the volume, is natural gas that has been converted temporarily to liquid form for ease of storage or transport. The key difference is that CNG is in compressed form, while LNG is in liquefied form. CNG has a lower cost of production and storage compared to LNG because CNG does not require an expensive cooling process and cryogenic tanks. However, it is more cost-efficient to transport LNG over long distances because of the reduction in volume. Generally, we transport CNG to a city if it is located within 300 km of the natural gas supplier and we transport LNG to a city if it is located more than 300 km away from the natural gas supplier. If the NG pipeline’s connection point is within 50 km of the city we serve, we connect directly to the NG pipeline. Approximately 83.6% of the natural gas we purchase is CNG, approximately 0.9% is LNG and approximately 15.4% is NG.

Our business is generally affected by two seasonal factors. First, between December and March, the cold weather in northern China makes construction very difficult. For a given gas distribution project, to avoid running into this time period, we generally start the process of pipeline installation, which has a duration of six to eight months, in April so as to complete the process before December. As a result, our revenues from connection fees are higher in the third and fourth quarters than those in the first and second quarters. Second, gas sales in winter are generally higher than in summer, as our customers tend to consume more natural gas for heating purposes during the winter.

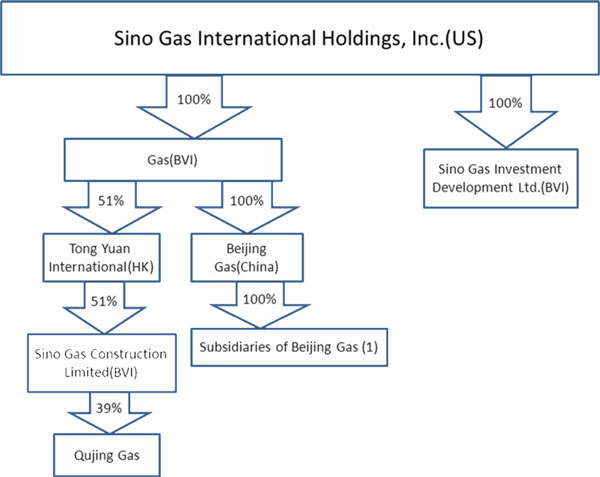

Organization and Structure of the Company

We operate through our indirectly-owned subsidiaries in the PRC, Beijing Gas and its subsidiaries. As of December 31, 2012, our corporate structure is set forth below

| (1) | The subsidiaries of Beijing Gas are set forth below: |

| 6 |

| Name of Company | Place of Incorporation | Date of Incorporation | Beneficiary Interest % | Equity Interest % | ||||

| Jiangsu Zhongran Weiye Energy Investment Co., Ltd. | PRC | 3/10/2011 | 100 | 99 | ||||

| Jiangsu Zhongran Weiye Gas Co., Ltd. | PRC | 8/22/2005 | 100 | 98.9 | ||||

| Guannan Weiye Gas Co., Ltd. | PRC | 6/19/2003 | 100 | 100 | ||||

| Sihong Weiye Gas Co., Ltd. | PRC | 12/3/2004 | 100 | 95 | ||||

| Wuhe Weiye Gas Co., Ltd. | PRC | 1/30/2007 | 100 | 100 | ||||

| Sixian Weiye Gas Co., Ltd. | PRC | 9/3/2007 | 100 | 100 | ||||

| Beijing Chenguang Gas Co., Ltd. | PRC | 10/30/2002 | 100 | 100 | ||||

| Yutian Zhongran Weiye Gas Co., Ltd. | PRC | 12/19/2003 | 100 | 100 | ||||

| Zhangjiakou City Xiahuayuan Jinli Gas Co., Ltd. | PRC | 9/30/2005 | 100 | 100 | ||||

| Yuxian Jinli Gas Co., Ltd. | PRC | 11/8/2005 | 100 | 100 | ||||

| Changli Weiye Gas Co., Ltd. | PRC | 12/8/2006 | 100 | 100 | ||||

| Chenan Chenguang Gas Co., Ltd. | PRC | 1/23/2007 | 100 | 100 | ||||

| Luquan Chenguang Gas Co., Ltd. | PRC | 4/27/2007 | 100 | 100 | ||||

| Shijiazhuang Chenguang Gas Co., Ltd. | PRC | 6/14/2007 | 100 | 100 | ||||

| Gaocheng Weiye Gas Co., Ltd. | PRC | 1/27/2 010 | 100 | 100 | ||||

| Hebei Weiye Gas (Group) Co., Ltd. | PRC | 12/18/2009 | 100 | 100 | ||||

| Ningjin Weiye Gas Co., Ltd. | PRC | 12/3/2003 | 100 | 100 | ||||

| Longyao Zhongran Weiye Gas Co., Ltd. | PRC | 10/13/2005 | 100 | 100 | ||||

| Xingtang Weiye Gas Co., Ltd. | PRC | 2/18/2004 | 100 | 100 | ||||

| Wuqiao Gas Co., Ltd. | PRC | 6/30/2004 | 100 | 100 | ||||

| Linzhang Weiye Gas Co., Ltd. | PRC | 7/6/2005 | 100 | 100 | ||||

| Hengshui Weiye Gas Co., Ltd. | PRC | 12/20/2005 | 100 | 100 | ||||

| Gucheng Weiye Gas Co., Ltd. | PRC | 3/21/2007 | 100 | 100 | ||||

| Nangong Weiye Gas Co., Ltd. | PRC | 6/25/2007 | 100 | 100 | ||||

| Xinhe Weiye Gas Co., Ltd. | PRC | 7/2/2009 | 100 | 100 | ||||

| Jize Weiye Gas Co., Ltd. | PRC | 9/20/2011 | 100 | 100 | ||||

| Baishan Weiye Gas Co., Ltd. | PRC | 7/13/2007 | 100 | 100 | ||||

| Langfang Weixian Huowu Transportation Co., Ltd. | PRC | 3/22/2005 | 100 | 95 |

| 7 |

Organizational History of Sino Gas

Sino Gas International Holdings, Inc. was incorporated under the laws of the State of Utah on August 19, 1983 as Evica Resources, Inc. On April 5, 1984, we changed our name to American Arms, Inc. American Arms, Inc. commenced the manufacture and sale of weapons and laser sights. On April 12, 1988, we changed our name to American Industries, Inc. as we were no longer engaged in the manufacturing and sale of weapons and laser sights. American Industries, Inc. was in the business of providing room safes for hotels.

On February 19, 2002, we formed a subsidiary corporation named Pegasus Tel, Inc. under the laws of the State of Delaware, in order to enter into the telecommunications business. On March 28, 2002, Pegasus Tel, Inc. merged with Pegasus Communications, Inc., a New York corporation, with Pegasus Tel, Inc. (“Pegasus”) as the surviving entity. On January 14, 2002 we purchased payphone assets consisting of 29 payphones and associated equipment from the Margaretville Telephone Company for $11,600.

On May 21, 2002, we changed our name to Dolce Ventures, Inc. We were an inactive shell company from May 2002 until September 7, 2006.

On September 7, 2006, the shareholders holding 72,569,764 shares of our common stock, which constituted 72.01% of the then outstanding shares of our capital stock, sold all of their shares to GAS Investment China Co., Ltd. (“Gas (BVI)”), the parent company of Beijing Gas, for cash consideration of $675,000. On the same date, we consummated a share exchange transaction with the shareholders of Gas (BVI), whereby we exchanged 14,361,646 shares of our Series A Convertible Preferred Stock, par value $0.001 per share (“Series A Preferred”), which constituted all of the then outstanding shares of our Series A Preferred, for all of the issued and outstanding stock of Gas (BVI) held by the shareholders of Gas (BVI). As a result of the share exchange transaction, Gas (BVI) became our wholly-owned subsidiary, and Beijing Gas became our indirectly wholly-owned subsidiary. In addition, as a result of the share exchange transaction, we ceased being a shell company as such term is defined in Rule 12b-2 under the Exchange Act and have since been engaged in the development of natural gas distribution systems and the distribution and supply of natural gas in the PRC.

On November 17, 2006, we changed our name to Sino Gas International Holdings, Inc. and effected a 304.44-for-1 reverse stock split which reduced the number of the outstanding shares of our common stock from 100,770,140 to 331,002. Upon the effectiveness of the reverse stock split, each of the 14,361,646 shares of the then outstanding Series A Preferred was automatically converted into one share of our common stock, resulting in all of the shareholders of Gas (BVI) immediately prior to the share exchange owning approximately 97.7% of the outstanding shares of our common stock immediately after the reverse stock split, with Mr. Yuchuan Liu, the CEO of the Company, owning 36.7%, Gas (BVI) owning 1.6% and the original shareholders of Dolce Ventures, Inc. immediately prior to the share exchange owning 0.6%. On August 18, 2008, Sino Gas consummated a spin-off of Pegasus to Sino Gas’ stockholders of record as of August 15, 2008 (the “Spin-off”). The ratio of distribution of the Spin-off was one share of common stock of Pegasus for every twelve shares of common stock of Sino Gas (1:12). Fractional shares were rounded up to the nearest whole-number. An aggregate of 2,215,136 shares of Pegasus common stock were issued pursuant to the Spin-off to an aggregate of 167 Sino Gas stockholders.

Organizational History of Gas (BVI) and Beijing Gas

Gas (BVI) was incorporated on June 19, 2003 in the British Virgin Islands with Mr. Yuchuan Liu as its sole shareholder. Gas (BVI) is the holding company for Beijing Gas. Prior to the acquisition of all of the equity interests of Beijing Gas by Gas (BVI) as described below, Gas (BVI) had no business operations, assets or liabilities, apart from organizational expenses and fees.

Beijing Gas was originally formed as a limited liability company under the laws of the PRC in 2001 under the name Beijing Yuan Wang Yu Cheng Construction Ltd., and, in June 2003, changed its name to its current name, Beijing Zhongran Weiye Gas Co., Ltd. On February 17, 2004, Gas (BVI) acquired all the outstanding capital stock of Beijing Gas from its then shareholders. On July 14, 2004, Gas (BVI) transferred 1% of the capital stock of Beijing Gas to Shenzhen Shenqi Cheng Tong Investment Ltd., a limited liability company organized under the laws of the PRC (“Shenzhen Shenqi”), and, simultaneously, Shenzhen Shenqi invested RMB 20 million in Beijing Gas in exchange for 50% of the capital stock of Beijing Gas. As a result, Gas (BVI) and Shenzhen Shenqi held 49% and 51% of the capital stock of Beijing Gas, respectively. On April 30, 2006, Gas (BVI) acquired all of the capital stock of Beijing Gas held by Shenzhen Shenqi in exchange for 20.4 million RMB. As a result of this transaction, Beijing Gas became a “wholly foreign owned entity” under PRC law by virtue of its status as a wholly-owned subsidiary of Gas (BVI).

| 8 |

Beijing Gas has subsidiaries, known as project companies, in four provinces, and four branch offices in Beijing. The project companies are the operating subsidiaries of Beijing Gas. Each project company operates as a local natural gas distributor in a city or county, which we refer to as an operational location, pursuant to an exclusive franchise agreement with the local government or entities responsible for administering and/or regulating gas utilities, pursuant to which Beijing Gas is granted the exclusive right to develop and operate natural gas distribution systems and distribute natural gas at the operational location.

As of December 31, 2012, we now have operations in Hebei Province, Jiangsu Province, Anhui Province, Yunnan province and Jilin province and in the suburbs of Beijing through our four branch offices in Beijing. We have operations in 20 cities in Hebei, 2 cities in Anhui, 4 cities in Jiangsu, 6 city in Yunnan, and 2 city in Jilin province. Most of these cities have an urban population of less than 300,000 but are experiencing quick urbanization. Hebei Province is the closest province to the Chinese capital city Beijing, where our headquarters is located. Jiangsu Province and Anhui Province are two provinces in eastern China that are close to Shanghai. Jilin Province is located in north-eastern China.

Most of the project companies are organized as limited liability companies under PRC law with Beijing Gas holding an equity interest of 100%. Three of our project companies are still in the process of transferring the interests of their remaining minority shareholders (<5%) back to Beijing Gas.

In addition, Beijing Gas holds a 40% equity interest in Beijing Zhongran Xiangke Oil and Gas Technology Co., Ltd., a PRC joint venture entity engaged in the business of development, licensing and sale of oil and gas technologies and equipment, and the sale of self-produced chemicals for use in oil field exploration. We have not derived any material amounts of revenues from this joint venture.

From 2007 through 2012, we made the following acquisitions:

On January 15, 2007, Beijing Gas acquired a 100% equity interest in Beijing Chenguang Gas Co., Ltd. (“Beijing Chenguang”) for a purchase price of 26,000,000 RMB in cash. Beijing Chenguang became a wholly-owned subsidiary of Beijing Gas. Beijing Chenguang is primarily engaged in the business of developing, transferring and licensing of technologies for natural gas purification, compression and transportation, as well as installation of natural gas equipment and supplying natural gas. Mr. Zhicheng Zhou, our Chief Operating Officer, owned 30% of Beijing Chenguang immediately prior to the acquisition.

On June 20, 2007, Beijing Gas acquired 100% equity interest of Guannan Weiye Gas Co., Ltd. (“Guannan”) for a purchase price of 7,500,000 RMB in cash. Guannan is a regional natural gas distributor and developer of natural gas distribution networks in China’s Jiangsu Province. The acquisition of Guannan included all of the assets and customer relationships of Guannan, including concession rights to be the exclusive natural gas distributor in Guannan County, Jiangsu Province, for a period of 30 years beginning June 29, 2007. This acquisition was not with related parties.

On July 9, 2007, we purchased the assets of Baishan Weiye Gas Co., Ltd. (“Baishan”) a regional distributor and developer of distribution networks for natural gas in Jilin Province for a price of 7,000,000 RMB. Under the asset purchase agreement, we are responsible for paying the outstanding debts of Baishan in the amount of $4,000,000, which are due in periodic installments through 2030. This acquisition was not with related parties.

On April 22, 2008, we entered into an agreement with the Qujing Development Investment Co., Ltd. a PRC state-owned company and Yunnan Investment Group Co., Ltd, also a PRC state-owned company, to set up Qujing Gas Co., Ltd. (“Qujing Gas”) to operate in the City of Qujing, Yunnan Province. The Company held a 39% equity interest in Qujing Gas. The initial registered capital of the Qujing Gas was 30 million RMB. On December 17, 2010, we entered into an agreement with Asia Giant Investment Fund (“AGIF”) pursuant to which Sino Gas Construction Co., Ltd. (“Sino Gas Construction”) issued to AGIF the number of ordinary shares of Sino Gas Construction representing 49% of the total issued capital of Sino Gas Construction for consideration of US$2.0 million. In addition, the equity interest in Qujing Gas held by Beijing Gas was transferred to Sino Gas Construction so that Sino Gas Construction became the beneficial holder of the 39% equity interest in Qujing Gas. In 2011, the registered capital of Qujing Gas was increased to 130 million RMB. On April 2, 2012, the company transferred its 51% ownership in Sino Gas Construction to Tong Yuan International Limited (HK) (“Tong Yuan International”) and sold 49% of the ownership interest in Tong Yuan International to Yida Energy Inc. (Seychelles) for foreign currency amounting to approximately 12,669,930 RMB. As a result of the transactions, the Company, via Gas (BVI), holds 51% of Tong Yuan International, which holds 51% of Sino Gas Construction, which holds 39% of the equity interests of Qujing Gas.

On June 8, 2011, the company entered into an agreement with Hebei Natural Gas Co., Ltd. to sell assets and ownership of three of its subsidiaries in Hebei province, Xinji Zhongchen Gas Co., Ltd., Jinzhou Weiye Gas Co., Ltd., and Shengzhou Weiye Gas Co., Ltd., for a selling price of 44.8 million RMB. This acquisition was not with related parties.

| 9 |

Our Industry

China’s Macro-Economic Environment for the Natural Gas Market

Natural gas is playing an increasingly large role in the PRC national energy development strategy. The Twelfth Five Year Plan (2011-2015), encourages consumption of natural gas. One goal of the plan is to increase the use of natural gas as a portion of the total primary energy consumption mix in the PRC from 4% in 2011 to 8% by 2015. This is lower than the world average of 24%, and the Asian average of 11%. China’s natural gas consumption increased from 69.5 billion cubic meters in 2007 to 107 billion cubic meters in 2010. It is estimated that by 2015, the total natural gas consumption will be 230-260 billion cubic meters, with an annual growth rate approaching 25% during the 2011-2015 period. (Source: National Bureau of Statistics of China, China Energy Bureau, Petro China).

China is also focusing on the development of its clean energy sector, and one of its goals is to reduce coal consumption in the PRC primary energy consumption mix from 70% in 2009 to 63% in 2015. The use of coal, causes air pollution and other negative consequences to the environment. In the PRC, the heavy use of unwashed coal has led to large emissions of sulfur dioxide and particulate matter. As such, there have been serious environmental concerns in many countries around the world and these concerns have led to a global trend to reduce coal usage.

Recognizing the serious problems caused by heavy reliance on coal usage, the PRC government has aggressively moved to reduce coal usage by substituting coal with other, more environmentally friendly, forms of fuel, such as natural gas. As a result, at the local government level, in many locations where natural gas supply is available, local governments often require all new residential buildings to incorporate piped gas connections in their designs as a condition to the issuance of the construction or occupancy permits. Before 2000, gas distribution had principally been provided by local municipal governments. Since 2000, the industry has been open to the private sector, whose investments have fostered the wide use of natural gas in the PRC. The natural gas industry has been deemed by the PRC government as a suitable industry for public and private investments.

Demand for Natural Gas in China

Currently, natural gas consumption in the PRC accounts for about 4% of its total energy consumption. However, driven by environmental pressures, improvements in social infrastructure due to economic growth, and the necessity of a stable energy supply, it is anticipated that the use of natural gas will grow very rapidly in the PRC. According to the statistics of the China National Development and Reform Commission (the “NDRC”), the consumption of natural gas increased from 24.5 billion cubic meters in 2000 to 107 billion cubic meters in 2010, which represents average growth of 12.6% per year.

China’s Natural Gas Reserves and Gas Pipeline Infrastructure

The PRC abounds in rich natural gas reserves, which are primarily located in Xinjiang, Sichuan and Inner Mongolia. According to the statistics of the Energy Information Administration, proven natural gas reserves in China were estimated to be 63.36 trillion cubic feet in 2008. In recent years, China has actively explored its shale gas potential. According to preliminary estimates from the United States Energy Information Administration published in April of 2011, China’s shale gas reserves could reach 100 trillion cubic meters, of which 36 trillion can be explored, which is equivalent to the United States’ total reserves. In December of 2011, the State Council officially recognized shale gas as the 172nd independent mineral of China’s natural reserves. On March 16 of 2012, the Twelfth Five-Year Plan for Shale Gas was announced and set a goal of producing 6.5 billion cubic meters of shale gas by 2015 and 60-100 billion cubic meters by 2020. Because the PRC’s largest reserves of natural gas are located in western and north-central China, it requires a significant investment in gas transport infrastructure to carry natural gas to eastern cities and the rest of the PRC. Until recent years, the PRC’s natural gas consumption was limited to local natural gas producing provinces because of the lack of national long-distance pipeline infrastructure.

The principal method for transport of natural gas from a source to end users is by means of pipelines. In order to develop the natural gas industry, it is essential that the necessary pipeline infrastructure be in place so that natural gas is easily accessed for distribution to end users at affordable cost.

Under the PRC government’s Tenth Five-Year Plan (2001-2005), the country’s longest pipeline, known as the West-East Pipeline, was constructed and went into operation in January 2005. It transports natural gas from deposits in the western Xinjiang province to Shanghai, picking up additional gas in the Ordos Basin. The full length of the pipeline is about 4,200 km with a designed annual capacity of 20 billion cubic meters, a delivery pressure of 10 megapascals and 35 processing stations along the pipeline.

| 10 |

There are other pipelines linking smaller natural gas deposits to consumers, such as the pipeline linking the Sebei natural gas field in the Qaidam Basin with consumers in the city of Lanzhou, Ganshu province in the northwest, and a pipeline linking natural gas deposits in Sichuan province in the southwest to demand centers in the Hubei and Hunan provinces in the central PRC.

In its Twelfth Five-Year Plan (20011-2015), the PRC government re-affirmed its commitment to making significant investments over a period of 20 years to expand the natural gas pipeline infrastructure and natural gas distribution network.

Natural Gas Suppliers

The natural gas supply in China is dominated by the three large state-owned oil and gas holding companies, namely China National Petroleum Corporation Group (“PetroChina”), China Petroleum and Chemical Corporation Group (“Sinopec”), and China National Offshore Oil Corporation Group (“CNOOC”). In the first nine months of 2011, production by PetroChina, Sinopec and CNOOC accounted for 64.4%, 14.2% and 11.96%, respectively of the total national production. PetroChina and Sinopec own and operate onshore pipelines while CNOOC owns and operates virtually all off shore pipelines (Source: 2011 National Oil and Natural Gas Industry Development Report by CNPC Economy & Technology Research Center).

Natural Gas Distributors

Before 2000, natural gas distribution had been principally provided by local municipal governments. Since then, the natural gas industry has been designated by the PRC government as a suitable industry for public and private investment and has been open to private investment, which has fueled the development of the industry and fostered wider use of natural gas in the PRC. In large cities where the population exceeds 500,000, the natural gas distribution business is dominated by state owned companies, while in cities where the population is less than 500,000, natural gas distribution is provided mainly by privately owned companies, most of whom only operate in a few locations.

The Gas Delivery Process

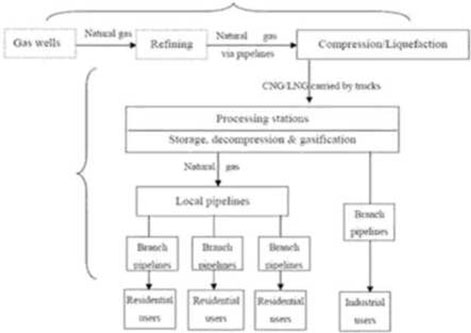

The natural gas delivery process can be broken down into three segments: production, transmission and distribution, as shown in the chart below:

| 11 |

Production involves underground exploration, drilling, extraction and purification of the natural gas. After extraction from a gas well, natural gas is transported to nearby refineries for removal of water and other impurities. The natural gas is then transported from the refineries via long distance pipelines, thereby facilitating supply to a large number of locations. The long distance pipelines are owned and operated by PRC state owned oil and gas exploration and production companies such as Sinopec and PetroChina.

Distribution companies (such as our company) distribute natural gas to end users and often own the gas pipeline infrastructure rights of an operational location (including the local pipelines, the processing stations, and the branch pipelines). A distribution company purchases natural gas from oil and gas exploration and production companies. The distribution company determines the method of delivering natural gas to its desired destination after taking into account factors such as the distance between the stations along the major pipeline and delivery points and the expected demand for gas from the relevant gas supply locations.

The transportation of CNG and LNG involves the delivery of natural gas by trucks from gas wells or stations located along the relevant long distance pipeline to a processing station. Such processing stations may contain CNG or LNG pressure regulating facilities, which depressurize the CNG or LNG to reduce the pressure of natural gas from high pressure to medium pressure, before transferring the natural gas to a local pipeline.

The processing station is usually located on the outskirts of an operational location for safety reasons and it provides certain ancillary facilities, including facilities for the addition of bromine to the gas to enable the detection of leaks when the gas is transmitted through the pipelines, and for storing the gas under high, medium or low pressure to be used as reserves for future unexpected fluctuations in demand. High pressure gas storage tanks usually have thicker walls, and, therefore, are more expensive to construct than gas storage tanks for storage of gas under medium or low pressure.

After processing, the gas is transmitted under medium pressure to the local pipelines. Local pipelines are laid within an operational location and represent the backbone of the local gas delivery system. Different sections of the local pipelines operate at slightly different pressures, with computer controlled regulators controlling the flow of natural gas for delivery to end users via the branch pipelines and customer inlets.

When there is demand for a gas connection to a particular area, the distribution company will invest in the construction of branch pipelines to connect the local pipelines to the pressure regulating boxes located in the end-users’ buildings or premises. The pressure regulating box reduces the natural gas to a lower pressure before the natural gas is transmitted to the customer inlets. Customer inlets transmit the natural gas from the pressure regulating box to the end users.

Our Strategy

Our strategy involves: (i) expanding our presence in small and medium sized cities; (ii) acquiring existing gas distribution systems and/or franchises; and (iii) expanding our business upstream by developing and maintaining pipelines that connect China’s East-West Gas Pipeline with the cities where our gas stations are located or where other distributors own distribution networks.

(i) Expand Our Presence in Small and Medium Sized Cities by Obtaining Additional Exclusive Franchises. We have focused on small (with urban population in the city proper of less than 300,000) and medium sized (with urban population in the city proper of less than 1,000,000) cities, generally near a larger metropolitan area where there is little competition to obtain a franchise, and where our franchise agreement grants us exclusivity. In such places in the PRC, we are in a better position to obtain exclusive natural gas distribution system development and supply franchise agreements during negotiations with the cities. These smaller cities urgently need to provide their citizens with energy and usually do not have the negotiating leverage of very large cities, which usually attract multiple bidders for their franchises. Accordingly, we require and receive an exclusive franchise entitling us to be the sole natural gas utility in such cities. Usually, our franchises have a term of 25 to 30 years. Since our founding, we have successfully obtained 29 franchises in small and medium sized cities.

(ii) Acquire Existing Franchises and Gas Distribution Networks to Facilitate Growth. Our expanded presence in small and medium sized cities was accomplished not only by securing franchises and developing gas distribution networks ourselves but also by acquiring existing franchises and networks from other operators. We believe acquisitions will provide us opportunities for growth as well as enable us to explore opportunities in bigger cities (with urban populations in the city proper of more than 300,000). Normally we target companies with strategic locations that have valuable assets and good market prospects.

| 12 |

(iii) Expand into Upstream Business. We currently develop gas distribution networks that deliver gas from our storage and distribution station in a particular city to residential or industrial customers in that city. We do not have pipelines that connect the national main pipeline that runs across China from the West to the East with the cities where our customers are located. We have to deliver the gas we purchase from the main pipeline operator to our gas storage facilities by trucks. We intend to expand into the upstream business by developing regional distribution networks to connect the West-East main pipeline with cities that are not located near the passageway of the national main pipeline. By developing and maintaining regional pipelines, we believe we can deliver natural gas to our customers more efficiently and with potentially higher margins. In addition, such regional distribution networks can be used by other gas distributors along the pipelines, which will add potential revenue sources for us. As the development of such regional networks requires a significant capital outlay, we intend to start exploring such projects in the future after we are able to raise a significant amount of funds.

(iv) Raise Additional Capital. We are in a capital-intensive business in that a major part of our activities encompasses building local natural gas distribution networks, which require a large capital outlay. Although to a large degree the connection fees we charge our customers provide us with the capital needed for building local natural gas distribution networks, these fees may not provide sufficient capital to carry out the acquisitions and upstream expansions we have planned. Our growth will, therefore, depend on our ability to raise additional funds. We anticipate using our financing strategy as a competitive tool. Our goal is to duplicate the types of financing and related financial instruments used by utility companies in the United States, including the issuance of subsidiary level, non-recourse debt, preferred stock and holding company fixed income issuances. Such a financing plan would not only give us a favorable cost of capital, but also enhance investor returns and minimize investor dilution.

Competitive Advantages

We believe we have the following competitive advantages:

(i) Better Relationships with Natural Gas Suppliers. We have been able to develop good relationships and therefore secure contracts with large state-owned natural gas producers such as PetroChina and China Petroleum Chemical. These contracts have ensured a stable supply of natural gas for us.

(ii) Experienced Management and Technical Personnel. We have a team of senior executives who are industry experts in managing larger Chinese petroleum and/or gas companies with decades of combined experience in running our company or managing businesses in our industry. Our founder and Chief Executive Officer, Mr. Yuchuan Liu, is a natural gas industry expert with over 20 years of experience in senior management positions at PetroChina and China Gas Holdings Limited, a Hong Kong Stock Exchange-listed PRC company. Our Chief Operating Officer, Mr. Zhicheng Zhou, served as the Director and General Manager of Beijing Chenguang Gas Co., Ltd. from late 2002 to 2006. Our Chief Engineer, Mr. Shukui Bian, is one of the draftsmen of the PRC National Standards for Urban Gas Supply, and was previously the Chief Executive Officer of the First Oil Extraction Plant of North China Oilfield. Our company was one of the earliest to engage in the natural gas distribution business in small and medium sized cities, and thus has gained significant experience in this market segment.

(iii) Experienced Sales and Marketing Team. Our sales and marketing team has gained significant experience in working with local governments and identifying potential markets in small and medium sized cities. Due to their efforts, we have won franchises in 29 locations.

(iv) U.S. Capital Markets Access. By becoming a U.S. public company, we have gained access to the size and efficiency of the U.S. capital market. We will be able to raise funds, as we have done, for our expansion and growth. That said, our ability to raise funds in the U.S. is a limited one because we have not been listed on any major U.S. national stock exchanges. Very few Chinese companies that are in the natural gas distribution business have become U.S. public companies.

Products and Services

Currently, we generate revenues primarily from the connection fees we charge our customers for connecting them to the pipelines in our natural gas distribution systems, which we have constructed, and for usage of the natural gas we supply to them.

| 13 |

Connection Fees

We charge our real estate developer customers a flat connection fee for the installation of gas lines to each of their apartments or housing units. The amounts of connection fees vary and they are determined based on a detailed analysis of factors such as estimated capital expenditure, fees charged in surrounding cities, number of users, expected penetration rates, income levels and affordability to local residents and whether the fees are approved by the relevant local state price bureau. Connection fees are usually paid in installments, with 30% paid within a certain number of days after the start of each project, 30% paid at milestones set out in the contracts, 30% paid upon completion of the project and 10% in the form of a guarantee, which is paid after one year. Connection fees generally provide a 60-80% profit margin. The connection fees are set by the local state price bureau based on the connection fees charged by other gas distributors in surrounding areas and can vary in different cities. In most cases, we accept the price set by the local state price bureau. But if we find the price does not offer a profit margin equal to or greater than 20%, we will negotiate with local governments for an increase and local governments usually agree to increase our connection fees under such circumstances. The connection fees in most cities are very close to our average connection fee per household. Gas usage fees are also subject to the approval of the local state price bureau. Future price increases are also subject to the same approval process. In considering applications for an increase in gas usage charges, the local state price bureau may consider factors such as increases in the wholesale price of gas or operating expenses, inflation, additional capital expenditures, and whether the profit margin remains fair and reasonable.

When entering into master supply contracts for mass connections, we usually require the payment of a deposit by customers while the balance is payable in accordance with the terms set out in the contracts. In the event customers default on the payment of connection fees, we will not start the supply of natural gas until the connection fees are paid.

Gas Usage Charges

We calculate gas usage charges after taking into consideration the wholesale price of gas, operating costs, prices of substitute products, internal business model margins and the purchasing power of local residents. Gas usage charges are based on actual usage on a per cubic meter basis. The gas usage charges per cubic meter vary between operational locations and the payment mechanism between different categories of customers varies.

Since our inception, the majority of our residential customers have purchased gas units in cash at our sales outlets with details of the prepaid gas units stored electronically on a debit card. The debit card is inserted into a debit card gas meter installed at the end user’s premises to activate the gas supply. Units of gas used are deducted from the debit card. When the level of prepaid gas units drops to a certain level (currently pre-set at three cubic meters), the gas meter will produce a sound signal to remind the customer to replenish the value stored in the debit card. Over 85% of our residential customers utilize the debit card payment method. This payment method provides significant advantages to us as all gas purchases are prepaid - not at the point of sale or in arrears.

For those residential customers without a debit card gas meter installed and for commercial and industrial customers, payments for natural gas usage are made in arrears. Gas meters that record actual gas consumption are installed at the end users’ premises and meter readings are taken physically by our staff every month. Monthly bills based on the prior month’s actual usage are then sent to customers. In the event customers default in payment of gas usage charges, gas supply will be suspended within one month of billing.

Our Business Activities

Our major business activities include development and construction of local gas distribution networks, transport of natural gas from suppliers to our storage facilities in a given operational location, and operating and maintaining our gas distribution networks.

Development

(i) Identifying distribution opportunities in new operational locations:

Our business development team actively explores and identifies suitable areas of service by conducting market research on potential operational locations where there is sufficient demand for piped natural gas. Because of our experience and ongoing cooperation with governmental authorities, we also receive invitations from local governments to bid for new natural gas projects or to take over existing natural gas projects.

As the piped natural gas supply industry in the PRC is still in the early stages of development, most areas in the PRC are not yet supplied with natural gas even though they may be in close proximity to natural gas sources. Due to the capital intensive nature of new natural gas distribution projects, we are very selective in our choices for new operational locations.

The selection of new operational locations is determined after conducting preliminary evaluations and studies of the target locations and the potential returns on investment. The criteria that are investigated and documented by us for any potential operational location are:

| 14 |

| 1. | Size and density of the population. |

| 2. | Economic statistics of the targeted locations. |

| 3. | Extent and concentration of industrial and commercial activities. |

| 4. | New property development in the target location. |

| 5. | Projected levels of connection fees and gas usage charges. |

| 6. | Extent of the local government’s commitment to environmental protection, environmental policies in place, and the local population’s awareness of environmental issues. |

| 7. | Likelihood of obtaining exclusive operational rights and preferential tax and government fee treatment. |

| 8. | Types of gas supply (piped natural gas, CNG or LNG) and methods of delivery. CNG trucks are deployed if the gas source, or long distance pipeline, is located within 300 km of the destination. Generally, LNG trucks are used if the gas source, or long distance pipeline, is located beyond 300 km from the destination. |

| 9. | For an acquisition of existing natural gas projects, the cost of acquisition, quality of assets and/or business are also valued. In addition, the liabilities of the business are analyzed along with any other perceived or actual problems encountered. |

Based on the findings of the investigation, our business development team will decide whether to make a recommendation to management for approval to proceed with discussions and negotiations for a new project. We have conducted dozens of preliminary evaluations since our inception in 2003.

(ii) Securing a new operational location. Once we have approved a potential natural gas distribution project in an operational location, we normally set up a local independent subsidiary, also known as a project company, to administer the project. We then prepare and submit a detailed gas project proposal to the local government and commence negotiations on major issues such as the granting of exclusive rights or rights of first refusal to supply gas to that location, proposed connection fees and gas usage charges and whether any tax and other concessions or favorable policies will be granted by the local government. Once established, the project company will conduct a series of marketing and promotional campaigns (which may include joint promotional campaigns with the local government) to increase public awareness of piped natural gas in the operational location. Concurrently, we begin actively seeking out potential customers in the operational location and negotiating the terms of supply contracts with the aim of entering into supply contracts as soon as possible with such customers.

(iii) Construction.

(a) Design stage. The design of the gas pipeline infrastructure for a natural gas distribution project includes the processing stations, the local pipelines and other ancillary facilities such as gas storage tanks. This is carried out by a government approved design institute in accordance with our requirements and specifications. It also takes into account the local population size, the development of the economy, the utilization of energy resources and the environmental conditions. The master design is subject to approval by the local city construction department. The design stage normally takes two to three months.

(b) Construction Stage. Once the design is approved, we invite independent qualified contractors to tender bids for the construction work. The selection criteria for the contractors include their qualifications, experience, expertise, reputation, familiarity with the local environment, prior experience with us and price. We generally enter into turnkey contracts with independent contractors for construction, installation and maintenance of the natural gas pipelines. We pay a down payment with the remainder to be paid upon completion of the project. At the time of entering into turnkey contracts, we source raw materials such as piping, gas regulating equipment and machinery. We have strict quality control procedures for the sourcing of supplies for all construction purposes.

Our internal engineers and independent external inspectors monitor the entire construction process to ensure that each stage of construction meets our quality and safety standards and the relevant regulatory requirements.

For a given operational location, although the gas pipeline infrastructure is designed to cover the entire operational location, our construction program focuses on early gas delivery to areas of concentrated customer demand within such operational location. This ensures that natural gas supply can begin as soon as the essential gas pipeline infrastructure and facilities such as the processing stations are completed. Construction work in a target area, which typically takes two to five years, will gradually extend to cover the whole operational location.

| 15 |

Operation

Once the necessary gas pipeline infrastructure is in place in a given operational location, we begin the design and construction of the branch pipelines and customer inlets pursuant to the gas supply contracts with our customers. The designs of the branch pipelines and customer inlets are normally prepared by us, reviewed by a government approved design institute, and carried out by external contractors. Upon completion of the construction of the branch pipelines and the customer inlets in the operational location, we begin to supply and sell natural gas and related services to customers within the operational location pursuant to supply contracts with such customers. The natural gas to be supplied to the residential or industrial customers is carried by trucks containing CNG or LNG to our storage facilities for storage, decompression and gasification. From those storage facilities, the gas is transported through our pipeline system to our end users.

Intellectual Property

We have developed a proprietary natural gas compression process that allows us to effectively and economically compress natural gas and distribute it.

In 2012, one Certificates of Utility Model Patent was granted to Beijing Gas and six Certificates of Utility Model Patents were granted to Beijing Chenguang Gas by the State Intellectual Property Office of the People’s Republic of China.

We own and operate a website under the internet domain name www.sino-gas.com.

Research and Development

We have full-time employees engaged in company-sponsored research and development efforts. These employees specialize in the fields of energy, mechanical and electrical engineering. Areas that are targets of our ongoing research and development activities include:

| · | Methodology and practices to increase operating efficiency and safety standards. | |

| · | Expansion of the applications for natural gas, such as gas-fuelled air conditioners, washing machines and dryers, and the use of CNG in motor vehicles. | |

| · | Improvements in gas storage and transportation systems, with an emphasis on the reduction of the size of the storage facilities. |

On October 28 of 2011, Beijing Gas was re-certified to be a High Tech Company of Beijing (GF201111001905) for three more years.

Sales and Marketing

Our main sales and marketing team is responsible for managing our overall sales policies and devising our marketing strategy. They are responsible for developing and maintaining accounts with major industrial customers and large real estate developers. They regularly visit potential customers and conduct meetings with them to determine if demand exists and to introduce the advantages of using natural gas.

Our sales and marketing staff at our operational locations target residential customers by working with local neighborhood committees and government agencies. In addition, they coordinate with our national office to target industrial customers and local developers. We establish a project company at each operational location and the local sales and marketing team for each project company works together with the main office team to structure an appropriate plan accommodating the specific needs and conditions of the operational location. Our marketing team plays an active role in lobbying the relevant government authorities during the negotiation process.

The sales and marketing team is responsible for our company image and brand building, as well as promoting the advantages and concept of using natural gas as a necessary part of modern day life. Once established, a project company will implement a series of promotional campaigns (which may include joint promotional campaigns with the local government) to increase public awareness of piped natural gas in an operational location. At the same time, the project company begins to actively seek out potential customers in the operational location and negotiate the terms of supply contracts with the aim of entering into supply contracts with such customers as soon as possible.

| 16 |

Our Customers

We have two principal types of customers: (i) residential customers and (ii) industrial customers.

Residential Customers

Natural gas is primarily used by residential owners for cooking as well as water and space heating. We market directly to property developers, government departments and organizations, private companies and state-owned enterprises, as these entities enter into master supply contracts with us for the connection of gas to all the units within a residential development (new or existing, owned by such entities or their respective employees). These entities are responsible for making or facilitating collection of the advance payment of connection fees. Gas usage charges are paid by the individual end users. For new residential developments, connection fees are usually paid in installments, with 30% paid within a certain number of days after the start of each project, 30% paid at milestones set out in the contracts, 30% paid upon completion, and the final 10% is paid as a guarantee used to incentivize quality workmanship from the developer and is normally received after one year.

We also perform gas connection services to existing buildings formerly without piped natural gas supplies. Representatives of the buildings will consult individual households as to whether they wish to have a piped natural gas supply and will coordinate the collection of connection fees from the end users on our behalf. Both connection fees and gas usage charges are payable in advance by the individual end users. We build pipelines to connect these customers to our gas storage facilities and supply gas at market price after receiving payment. The inlets that are located inside the home are owned by the end users, and come with a one-year quality guarantee from us. We maintain the pipelines outside the end users’ homes. The contracts are generally renewable on a yearly basis.

At present, we have approximately 293,758 end users in Beijing, Hebei, Jiangsu, Jilin and Anhui. Our top five residential customers in 2012 and 2011, who are developers or owners of residential areas, are shown below:

| Percentage of Connections | ||||||||

| Fees for the year ended December 31, | ||||||||

| Customers | 2012 | 2011 | ||||||

| ChangBaiShan International Resort Development Co., Ltd. | 8.9 | % | 17.03 | % | ||||

| Tongshan Hengying Jiaye Gas | 3.0 | % | * | |||||

| Tangshan Changchun Real Estate Co. | 1.7 | % | * | |||||

| Shanghai Datun Energy Jiangsu Subsidiary | 1.3 | % | * | |||||

| Suqian Fuyuan Real Estate Co. | 1.5 | % | * | |||||

| Total | 16.4 | % | 28.83 | % | ||||

*less than 1% or new customers in 2012

Industrial and Commercial Customers

Our industrial customers use natural gas primarily for heating, air conditioning, water heating and cooking purposes. The customers we target include manufacturers, owners of hotels, restaurants, office buildings, shopping centers, hospitals, educational establishments, sports and leisure facilities and exhibition halls. Natural gas has a wide variety of applications for industrial customers such as fuelling industrial boilers, furnaces, ovens, incinerators, foundries and steamers as well as water and space heating in staff canteens and dormitories within the industrial customers’ premises. We enter into supply contracts with these customers for the distribution of gas to their premises, and both connection fees and gas usage charges are borne by such customers.

| 17 |

The table below presents information about our top five industrial customers for 2012 and 2011:

| Percentage of Sales | ||||||||

| Fiscal year ended December 31, | ||||||||

| Customers | 2012 | 2011 | ||||||

| Hebei Zhong Gang Steel | 14.05 | % | 22.88 | % | ||||

| PetroChina Qingxian Special Oil Pipe Equipment | 3.67 | % | 4.58 | % | ||||

| Jiangsu Huachang Aluminum | 6.98 | % | * | |||||

| Peixiang Baoyi Footwear Co. | 1.20 | % | * | |||||

| Qinghua Yangguang Energy Changping Subsidiary | 0.91 | % | * | |||||

| Total | 26.80 | % | 29.78 | % | ||||

* less than 1% or new customers in 2012

Materials and Supplies

Natural Gas

The principal supplies purchased for our business are natural gas. Generally, approximately 83.6% of the natural gas we purchase is CNG, approximately 0.9% is LNG, and approximately 15.4% is pipeline NP.

Our principal CNG supplier has been the Fourth Oil Extraction Plant of the North China Oilfield (the “North China Oilfield”), a subsidiary of PetroChina. Our LNG supplier has been Henan Zhongyuan Lvneng Advanced Technology Co., Ltd. (“Henan Zhong Yuan”), a subsidiary of Sinopec. Historically, we have purchased the majority of our CNG from North China Oilfield and the majority of our total purchases of LNG from Henan Zhong Yuan. Our Supplier of NG via pipeline has been Petro China Kunlun Gas’s subsidiary in Xuzhou, Jiangsu province.

We have supply contracts (with terms from one to three years renewable but no fixed price, which price is set indirectly by the PRC National Development and Reform Commission (the “NDRC”) irregularly and can be passed along to the end customers) with these suppliers. To prepare for growth, we have also entered into agreements with new suppliers to meet our growing demands. These contractual relationships with our suppliers allow us to pursue natural gas distribution projects in a wide range of operational locations.

The wholesale price of natural gas is agreed upon between the suppliers and us with reference to the wellhead price which is determined by the NDRC with approval from the PRC State Council, distance of transportation, purification fees and the supplier’s operating costs. The wellhead price of natural gas is determined with a 10% allowance for upward or downward adjustments as a result of negotiations between suppliers and distribution companies. Generally, we are only required to pay for the actual quantity purchased and there is no penalty should we purchase less than the stated amount.

Piping, Machinery and Equipment

Piping, machinery and equipment constitute 60-70% of our construction expenditures. We purchase such supplies through a bidding process, which is administered by the procurement committee. Potential suppliers are evaluated on their proposed terms including technical specifications, price, payment terms and post-sale services. The procurement committee keeps a scoring system based on these parameters. After validation of the various suppliers’ services and capabilities for stable supply, we acquire the needed materials and parts from the supplier offering the best terms.

Domestically we purchase pipes of various size and thickness according to PRC standards and regulations for installation in different segments of our natural gas pipeline infrastructure. Payments for equipment, pipes and machinery are purchased with credit terms ranging from 30 to 90 days. We generally do not purchase gas appliances, except gas meters, which we purchase in bulk directly from manufacturers in China. We also provide repair and maintenance services for the gas appliances supplied. We generally provide a one-year warranty on our gas distribution system to our customers, during which time we provide free check-ups of the pipeline and repair for any appliances we provided.

Competition

Since our inception, we have focused on supplying natural gas to small and medium sized cities in the PRC where the average urban population is below 300,000, where the natural gas penetration rate is typically 0%, and where we are able to obtain exclusivity for natural gas distribution from the local government. In entering into these small and medium sized cities, we are generally authorized to be the sole supplier of natural gas by the local governments pursuant to franchise agreements for a typical term of 25 to 30 years. This differs from the bigger natural gas distribution companies, which have focused on a few areas with large populations. The larger cities are very competitive markets that tend to offer less flexibility for advantageous pricing arrangements. Due to our smaller city focus where the operating costs are lower and competition is much less intense, we believe we generate profit margins and returns at or above industry-average levels.

| 18 |

As we compete principally with small- to medium- sized private companies in the natural gas distribution industry, the information about our competition and competitive position is limited. Based on the information available to us, we estimate that there are approximately 200 small- to medium- sized private gas distribution companies in the PRC. Most of these companies target local towns, rather than take the approach that we do, of targeting cities in different provinces. Also, most of these companies operate an average of three or four natural gas distributions systems, as compared the 34 natural gas distribution systems that we operate; therefore, we believe we are one of the largest players among our peer businesses that target the natural gas market in smaller cities.

Based on the division of the administrative districts in the PRC as of 2004, there were 34 1st tier provincial level administrative districts (“Sheng Ji” in Chinese), 333 2nd tier regional level administrative districts (“Di Ji” in Chinese) and 2,862 3rd tier county level administrative districts (“Xian Ji” in Chinese) in China.

In 2010, according to the Small & Mid- Sized City Green Book (a Chinese government publication), cities under 500,000 people are classified as small sized cites, and cities with 500,000 to 1 million are classified as mid-sized cities. As of 2010, China had a total of 2,160 small to mid- sized cities. Among them, we estimated approximately 800 small to mid- sized cities have the potential to be supplied with natural gas.

The following are our natural gas competitors in China:

| Ticker |

2011 Revenue (in US$ millions) |

2011 Net Income (in US$ millions) |

||||||||||

| Towngas China Co., Ltd. (Panva Gas) (1) | 1083.HK | 561 | 92 | |||||||||

| ENN Energy Holdings Limited (Xinao Gas Holdings Ltd.) (2) | 2688.HK | 1,957 | 163 | |||||||||

| China Gas Holdings Limited(3) | 0384.HK | 2,060 | 81 | |||||||||

| (1) | Towngas China Company Ltd., formerly Panva Gas Holding Limited, is a supplier of gas, including liquefied petroleum gas (“LPG”) and natural gas in eight Chinese provinces, where over 40 companies of the group are providing gas fuel services. |

| (2) | ENN Energy Holdings Limited, formerly Xinao Gas Holdings Limited, is principally engaged in the investment in, and the operation and management of, gas pipeline infrastructure and the sale and distribution of piped and bottled gas in China with operations in four divisions: gas connection, sales of piped gas, distributions of bottled LPG and sales of gas appliances. |

| (3) | China Gas Holdings Limited (“China Gas”) is an investment holding company. The Company is an operator of natural gas services principally engaged in the investment in and operation and management of city gas pipeline infrastructure, long-distance, high-pressure pipelines, distribution of natural gas to residential, commercial, industrial and vehicle users, construction and operation of oil stations, and gas stations, as well as liquefied natural Gas (“LNG”) liquefaction plants, and development and application of oil and natural gas related technologies. The Company has four operating divisions: property investment, financial and securities investment, gas connection and sales of piped gas. |

Safety and Quality Control

Safety Control

We are focused on safety, have implemented a safety system and have set up a safety department to oversee safety issues for all of our operations. We carry out routine inspections of our branch pipelines, customer inlets, gas meters and gas appliances at the customers’ premises twice annually. These semi-annual inspections are free unless major repairs are required in which case we charge the customers for labor, replacement parts and other materials used in the repairs.

We believe in educating users about safety procedures. Before gas is actually supplied, we provide a thorough explanation of safety procedures to end users, hold regular seminars, and distribute brochures and booklets on safety. We have a 24-hour telephone help line for inquiries and reporting of emergency matters.

| 19 |

In order for us to monitor the operations of the pipelines for abnormal gas usage, gas leaks, or any other irregularities, we collect information about the temperature, pressure and volume of gas from key points along the local pipelines. The information is collected at the control center located at the head office of each operational location for analysis. We use process control instruments known as Supervisory Control and Data Acquisition Systems, in which a number of small detectors are installed along the pipelines to collect information and that data is then processed electronically in real time at the control center. Each project company conducts a major inspection of its pipelines, processing station(s) and other equipment at least once annually. If gas leaks or any other irregularities are detected, we will take remedial action immediately.

We believe that due to our strict implementation of safety control procedures, there have been no major accidents that have resulted in serious injury or death since our inception.

Quality Control

Quality control begins in the design and construction phase of the natural gas supply infrastructure. Our quality control team regularly makes inspection visits and conducts tests to ensure that any construction work conforms to our standards as well as national and local regulations.

We also have strict quality control procedures for the sourcing of raw materials. We only purchase from our approved list of qualified suppliers and such suppliers have fulfilled the relevant requirements in accordance with national standards.

In order to monitor the quality of gas purchased by us, we obtain gas composition reports regularly from our gas suppliers that contain data on important measures such as the heat content and composition of impurities in our gas supply. We also conduct regular tests on the gas purchased in order to verify its quality.

Insurance

We currently do not carry any product liability or other similar insurance, and we have only basic property insurance covering our plants, manufacturing equipment and office buildings.

We maintain social insurance for our staff and employees in accordance with relevant requirements under PRC law. We provide D&O insurance for our directors and officers.

Government Regulations

Pricing Regulations

We purchase natural gas from natural gas wholesalers, which are state-owned enterprises and which must comply with PRC natural gas pricing regulations. The wholesale price of natural gas payable by distribution companies, such as Beijing Gas, to the suppliers of natural gas is comprised of three components, the wellhead price, the pipeline transportation tariff and the purification fee. The wellhead price is fixed by the NDRC, with a 10% allowance for upward or downward adjustments for negotiation between suppliers and distribution companies. The pipeline transmission tariffs are determined by reference to the investment costs of the relevant long distance pipeline, depreciation, wear and tear and the distance of delivery. The purification fee is based on the actual purification costs of the suppliers. Both the pipeline transmission tariffs and the purification fee must also be approved by the NDRC.

The price we charge our residential customers for natural gas is based on the wholesale price plus cost and a profit margin of 10% to 15%. This price must be approved by the local price bureau.

Operational and Construction Permits

In the PRC, companies in the gas distribution business must also obtain an operational permit from the local municipal government to begin operation. In addition, a construction permit must be obtained if such gas distribution company also engages in construction. In both cases, the local municipal government will review the qualifications and experience of the management and technical staff of the distribution company and consider whether the distribution company is capable of fulfilling the operational and construction standards.

| 20 |

As of December 31, 2012, Beijing Gas and most of our project companies and branch offices have the necessary operational permits. We believe failure to obtain such permits in the timeframe required by applicable regulations for certain projects will not have a materially adverse effect on our operations.

Safety Regulations

As a natural gas distributor, Beijing Gas is regulated by the Administrative Rules on City Gas Safety jointly promulgated by the PRC Ministry of Construction, standards set by Standards Bureau and those set by the Fire Safety Bureau of the PRC Ministry of Public Security effective in May 1991. According to such rules, the manufacture, storage, transportation, operation, usage of city gas, design and construction of gas-related projects, and the manufacture of gas-related facilities shall be subject to relevant safety requirements and qualifications. Fuel service station standards are subject to regulation by the PRC’s Ministry of Construction, the General Administration of Quality Supervision, and the Bureau of Inspection and Quarantine. Required certificates are issued upon satisfactory inspection of service stations. In addition, there are various standards that must be met for filling stations, including standards for the handling and storage of gas, tanker handling, and compressor operation. These standards are regulated by local construction and gas operations regulating authorities. Inspections are carried out and certificates for the handling of dangerous agents are issued by the relevant local authorities. As of December 31, 2012, most of our project companies have received such certificates. We believe failure to obtain such certificates in the timeframe required by applicable regulations for certain projects will not have a materially adverse effect on our operations.

Environmental Assessment