UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

| For Fiscal Year Ended |

| | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from to |

Commission file number:

(Exact Name of Registrant as Specified in Its Charter)

| (State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| (Address of Principal Executive Offices) |

| (Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | |

| (Title of each class) | (Trading Symbol) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☑

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

| Accelerated filer ☐ |

| |

| Smaller reporting company |

| Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management assessment of the effectiveness of its Internal Control Over Financial Reporting under section 404 (b) of the Sarbanes-Oxley by the registered public accounting firm that prepared or issued its annual report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes

The aggregate market value of the voting and non-voting stock held by non-affiliates of the Registrant, as of September 30, 2023, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately $

DOCUMENTS INCORPORATED BY REFERENCE

None

IGC PHARMA, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED MARCH 31, 2024

TABLE OF CONTENTS

|

|

|

Page |

|

PART I |

|

|

|

|

|

|

|

Item 1. |

5 |

|

|

Item 1A. |

21 |

|

|

Item 1B. |

35 |

|

|

Item 1C. |

35 |

|

|

Item 2. |

36 |

|

|

Item 3. |

36 |

|

|

Item 4. |

36 |

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

Item 5. |

37 |

|

|

Item 6. |

38 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 |

|

Item 7A. |

45 |

|

|

Item 8. |

45 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

70 |

|

Item 9A. |

70 |

|

|

Item 9B. |

70 |

|

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

70 |

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

Item 10. |

71 |

|

|

Item 11. |

76 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

78 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

79 |

|

Item 14. |

79 |

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

Item 15. |

82 |

|

|

Item 16. |

83 |

|

|

84 |

||

FORWARD-LOOKING STATEMENTS AND IMPORTANT FACTORS

This Annual Report on Form 10-K and the documents incorporated in this report by reference contain “forward-looking statements” within the meaning of federal securities laws. Additionally, we or our representatives may, from time to time, make other written or verbal forward-looking statements. In this report and the documents incorporated by reference, we discuss plans, expectations, and objectives regarding our business, financial condition, and results of operations. Without limiting the foregoing, statements that are in the future tense, and all statements accompanied by terms such as “believe,” “project,” “expect,” “trend,” “estimate,” “forecast,” “assume,” “intend,” “plan,” “target,” “anticipate,” “outlook,” “preliminary,” “will likely result,” “will continue,” and variations of them and similar terms are intended to be “forward-looking statements” as defined by federal securities laws. We caution you not to place undue reliance on forward-looking statements, which are based upon assumptions, expectations, plans, and projections. In addition, our goals and objectives are aspirational and are not guarantees or promises that such goals and objectives will be met. Forward-looking statements are subject to risks and uncertainties, including those identified in the “Risk Factors” included in this report and in the documents incorporated by reference that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements speak only as of the date when they are made. Except as required by law, we assume no obligation to update forward-looking statements to reflect events, circumstances, changes in expectations, or the occurrence of unanticipated events after the date of those statements.

Forward-looking statements are based upon, among other things, our assumptions with respect to:

|

● |

the sufficiency of our existing cash and cash equivalents and marketable securities to fund our future operating and capital expenses; |

|

● |

our ability to successfully deploy our artificial intelligence initiatives; |

|

● |

our disposal of non-core Company assets; |

|

● |

our ability to successfully register trademarks and patents, create and market new products and services, and achieve customer acceptance in the industries we serve; |

|

● |

current and future economic and political conditions, including in Hong Kong, North America, Colombia, Europe, and India; |

|

● |

our ability to accurately predict the future demand for our products and services; |

|

● |

our ability to successfully market our products in countries and states where our products are legal; |

|

● |

our ability to maintain a stock listing on a national securities exchange; |

|

● |

our ability to obtain and maintain regulatory approval of our existing product candidates and any other product candidates we may develop, and the labeling under any approval we may obtain; |

|

● |

our ability to timely complete regulatory filings; |

|

● |

our ability to obtain the U.S. Food and Drug Administration (“FDA”) approval for an Investigational New Drug Application (“INDA”) and to successfully run medical trials, including a Phase 2 trial for IGC-AD1; |

|

● |

our reliance on third parties to conduct clinical trials and for the manufacture of IGC-AD1 for clinical and non-clinical studies and clinical trials; |

|

● |

our financial performance; |

|

● |

the outcome of medical trials that are conducted on our Investigational Drug Candidates and products; |

|

● |

our ability to fund the costs of clinical trials and other related expenses; |

|

● |

our ability to maintain our intellectual property position and our ability to maintain and protect our intellectual property rights; |

|

● |

competition and general acceptance of alternative, pharmaceutical, and nutraceutical therapies; |

|

● |

our ability to effectively compete and our dependence on market acceptance of our brands and products within and outside the United States; |

|

● |

federal and state legislation and administrative policy regulating our formulations; |

|

● |

our ability (based in part on regulatory concerns) to license our products to processors that can produce pharmaceutical-grade formulations; |

|

● |

our ability to obtain and protect patents for the use of our formulations; |

|

● |

our ability to obtain and install equipment for processing and manufacturing our products; |

|

● |

our ability to successfully navigate disruptions of information technology systems or data security breaches that could adversely affect our business; |

|

● |

our ability to successfully implement our artificial intelligence initiatives; |

|

● |

our disposal of non-core assets; and |

|

● |

our ability to successfully implement our strategy. |

You should consider the limitations on, and risks associated with, forward-looking statements and not unduly rely on the accuracy of predictions contained in such forward-looking statements. As noted above, these forward-looking statements speak only as of the date when they are made. Moreover, in the future, we may make forward-looking statements through our senior management that involve the risk factors and other matters described in this report, as well as other risk factors subsequently identified, including, among others, those identified in our filings with the SEC in our quarterly reports on Form 10-Q and our current reports on Form 8-K.

This document contains statements and claims that are not approved by the FDA, including statements on hemp and hemp extracts, including cannabidiol and other cannabinoids. These statements and claims are intended to be in compliance with state laws, specifically in states where medical cannabis has been legalized, and the diseases which we anticipate our products will target are approved conditions for treatment or usage with cannabis or cannabinoids.

PART I

In this report, unless the context requires otherwise, all references in this report to “IGC,” “the Company,” “we,” “our,” and “us” refer to IGC Pharma, Inc., together with the subsidiaries identified in Exhibit 21.1 of this Annual Report on Form 10-K. We exclude our investments and minority non-controlling interests, and any information provided by them is not incorporated by reference in this report. They should not be considered part of this report.

ITEM 1. BUSINESS

Overview

IGC Pharma, a clinical-stage company developing treatments for Alzheimer’s disease, is committed to transforming patient care by offering faster-acting and more effective solutions. Our lead drug, IGC-AD1, embodies this vision by tackling a critical challenge – managing agitation in Alzheimer’s dementia. Early results from our Phase 2 trial are promising: IGC-AD1 effectively reduced agitation in patients compared to a placebo, and crucially, it did so much faster than traditional medications. While existing anti-psychotics can take a long 6 to 12 weeks to show effects, IGC-AD1 has the potential to act within two weeks. This significantly faster onset of action could significantly improve patient care and represents a potential breakthrough in managing Alzheimer’s-related agitation.

IGC Pharma is on a mission to transform Alzheimer’s treatment. We are building a robust pipeline of five drug candidates, each targeting different aspects of the disease.

|

● |

IGC-AD1: Our lead investigational drug tackles agitation, a major burden for patients and caregivers. By addressing neuroinflammation, it offers a faster-acting solution compared to traditional medications. |

|

● |

TGR-63: Through pre-clinical studies, TGR-63 has demonstrated its potential to disrupt the progression of Alzheimer’s by targeting Aβ plaques, a key disease hallmark. |

|

● |

IGC-1C: At the preclinical stage, IGC-1C represents a potential breakthrough by targeting tau protein and neurofibrillary tangles, aiming to modify the disease course. |

|

● |

IGC-M3: Also in preclinical development, IGC-M3 focuses on early intervention by inhibiting Aβ plaque formation, potentially slowing cognitive decline. |

|

● |

LMP: In preclinical development, LMP is designed to target multiple hallmarks of Alzheimer’s disease, including Aβ plaques and neurofibrillary tangles for a comprehensive therapeutic effect. |

We are also harnessing the power of Artificial Intelligence (“AI”) to develop early detection models, optimize clinical trials, and explore new applications for our drugs. Additionally, our 28 patent filings, including for IGC-AD1, demonstrates our commitment to innovation and protecting our intellectual property.

IGC is a Maryland corporation established in 2005 with a fiscal year ending on March 31, spanning a 52- or 53-week period. IGC has two business segments: Life Sciences Segment and Infrastructure Segment. Please refer to Note 1, “Nature of Operations” and Item 8 of this Annual Report on Form 10-K, for further information on business segments.

Our Business Strategy

The business strategy includes:

|

● |

Subject to FDA approval and clinical trials, developing IGC-AD1 as a drug for treating agitation in dementia due to Alzheimer’s. |

|

● |

Subject to FDA approval, developing IGC-AD1 as a drug for treating Alzheimer’s disease. |

|

● |

Developing TGR-63 for the potential treatment of Alzheimer’s disease. |

|

● |

Driving revenue from in-house OTC brands and formulations. |

Core business competencies and advantages

Our core competencies include:

|

● |

a network of doctors, scientists with Ph.D. degrees, and intellectual property legal experts with a sophisticated understanding of drug discovery, research, FDA filings, intellectual protection, and product formulation; |

|

● |

knowledge of various cannabinoid strains, their phytocannabinoid profile, extraction methodology, and impact on various pathways; |

|

● |

knowledge of plant and cannabinoid-based combination therapies; |

|

● |

knowledge of research and development in the field; |

|

● |

approximately twenty-eight (28) patent applications out of which our portfolio includes twelve (12) granted patents. For more information, please refer to Item I, “Business” of Part I; |

|

● |

facilities and a team with experience in manufacturing, marketing, and selling products. These competencies have enabled us to make progress on our business goals, specifically completing the Phase 1 clinical trial of IGC-AD1, which has the potential to positively impact the lives of millions of patients suffering from the symptoms of Alzheimer’s disease, subject to FDA approval. |

Background on Alzheimer’s Disease Pathology

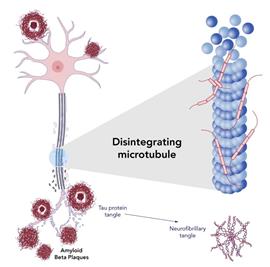

Alzheimer’s disease (“AD”) pathology can be divided into two categories: familial or inherited AD and sporadic AD. The histopathology of early-onset familial AD and late-onset sporadic AD are indistinguishable. Both forms of AD are characterized by extracellular amyloid-β (“Aβ”) plaques and intracellular tau-containing neurofibrillary tangles (Gӧtz, et al., 2011). Simplistically, in normal brain functioning, a large protein called Amyloid Precursor Protein (“APP”) is cleaved into smaller fragments called Aβ proteins. In a normal brain, these are subsequently broken down further and cleared. However, in AD brains, these Aβ proteins are not broken down and cleared; they instead stick to one another and deposit as inter-neuronal sticky plaque—that is, they deposit as plaque between neurons. In the brain, within a neuron, tau (τ) is a key protein that holds together the transport scaffold. As an analogy, it is the brick-and-mortar of the highway over which nutrients are transported within a neuron. In an AD brain, tau breaks down due to a process called hyperphosphorylation and is unable to hold the transport highway. The breakdown results in neurofibrillary tangles (“NFTs”) and eventually leads to neuronal death.

The misfolded structure of Aβ proteins, along with NFTs, generates a characteristic tendency for their aggregation (Chiti & Dobson, 2006) around damaged or dead neurons and within cerebral vasculature in the brain. It manifests in memory loss followed by progressive dementia. It has long been believed that Aβ1–40 (Aβ40) and Aβ1–42 (Aβ42) aggregates are the constituents of the insoluble plaques that are characteristic of AD. This disease is also associated with neuroinflammation, excitotoxicity, and oxidative stress (Campbell & Gowran, 2007; Rich, et al., 1995). However, the continuous aggregation of Aβ proteins along with hyperphosphorylation of tau protein inside the cell, causing NFT formation, are generally accepted as the major etiological factors of the neuronal cell death associated with the progression of Alzheimer’s disease (Octave, 1995; Reitz, et al., 2011; Pillay, et al., 2004). The two hallmarks of Alzheimer’s are shown in Figure 1.

|

Figure 1: Hallmarks of Alzheimer’s

● Extracellular Plaque: β-amyloid (Aβ) ● Tau Neurofibrillary Tangles (NTFs).

Causes loss of neurons & critical neuronal connections.

Also linked to Alzheimer’s: ● Metabolism disruption ● Mitochondrial dysfunction ● Neuroinflammation |

|

Alzheimer’s affects not only cognition but also mood and behavior, changes which increase in intensity as the disease progresses. Approximately 6.5 million individuals in the U.S. live with Alzheimer’s, and a majority experience a medical syndrome called agitation in Alzheimer’s dementia. There are various symptoms associated with this medical syndrome or condition, such as screaming, pacing, biting, disrobing, excessive motor movements, physical aggression, and verbal aggression, among others. This medical condition makes it very difficult for caregivers to manage their loved ones and is associated with increased hospitalization and accelerated cognitive decline.

Agitation is a behavioral syndrome characterized by increased, often undirected, motor activity, restlessness, aggressiveness, and emotional distress. About 76% of AD patients suffer from agitation (Van der Mussele, et al., 2015). While there can be no guarantee, we expect the Phase 2 trial to take between 12 and 18 months to complete, barring a variety of unknown factors, such as a resurgence of COVID and the enforcement of lockdowns and travel restrictions.

Symptoms of AD depend on the stage of the disease: preclinical, mild, moderate, or severe. NPS like agitation, apathy, delusions, hallucinations, and sleep impairment are common accompaniments of dementia. Loss of functionality, including progressive difficulty in performing instrumental and basic activities of daily living, is also seen with disease progression (Tang et al., 2019). There is a spectrum of behavioral disorders that can affect patients with AD. These include agitation, anxiety, disturbance of the sleep cycle, depression, inappropriate sexual behavior, disinhibition, and irritability, among others (Lyketsos, et al., 2011). These behavioral disturbances not only affect the patient’s quality of life but also cause extreme emotional distress for the caregivers. These disturbances can become very difficult to manage, so most of the time, combinational therapy is used (Matsunaga, et al., 2015). This can cause secondary undesirable effects, such as excessive sleepiness, which diminishes the capability of the patient to be active and alert during the day; dizziness, which can increase the risk for falls (Allan, et al., 2005); worsening of cognitive function, which in turn worsens functionality (Paterniti S, et al., 2002); and even death due to cardiovascular complications (Qiu, et. Al., 2006).

Background on Agitation in Alzheimer’s dementia

We are currently developing IGC-AD1 for the treatment of agitation in Alzheimer’s dementia (“AAD”). There is only one FDA-approved pharmacological treatment for the indication of AAD.

The National Institute on Aging (“NIA”) at the National Institutes of Health (“NIH”) defines Alzheimer’s disease (“AD”) as an irreversible, progressive brain disorder that destroys memory and thinking skills. AD is a progressive neurodegenerative disorder that manifests initially as forgetfulness, advancing to severe cognitive impairment and memory loss. It is a common form of dementia and afflicts more than 6.5 million individuals in the United States, a number that is anticipated to increase to approximately 14 million by 2050. In addition to cognitive decline, individuals diagnosed with AD typically experience behavioral and psychological symptoms, including agitation and aggression. These symptoms are seen in a high percentage of AD sufferers, with agitation being reported in over 70% of patients. Agitation is characterized by emotional distress, aggressive behaviors, disruptive irritability, and disinhibition. Agitation in Alzheimer’s dementia has been associated with increased caregiver burden, decreased functioning, earlier nursing home placement, and death.

The NIA categorizes Alzheimer’s in three stages–- mild, moderate, and severe (NIA, 2019). Symptoms of mild Alzheimer’s can include wandering (getting lost, not remembering the way home), trouble handling money and paying bills, repeating questions, and personality or behavior changes. As the disease progresses to moderate, there is damage to the areas of the brain that control language, reasoning, sensory processing, and conscious thought. Patients can have difficulty with multi-step tasks such as getting dressed. Behavioral problems, including hallucinations, delusions, paranoia, and impulsive behavior, can also increase. When severe Alzheimer’s sets in, plaques and tangles spread throughout the patient’s brain, and the brain shrinks significantly. People with severe Alzheimer’s are completely dependent on others for care. They cannot communicate, and near the end of their life, they may be largely bedridden as the body shuts down (NIA, 2021).

Patients with AD are currently treated with various medications, including antipsychotics, which have been considered the mainstay of treatment. These treatments, however, are limited by safety concerns. Typical antipsychotics prescribed for agitation, aggression, or insomnia are associated with functional decline in patients with AD, while studies indicate that atypical antipsychotics may be associated with increased rates of cerebrovascular events and death in patients with dementia.

Currently, there are limited options to help Alzheimer’s patients with agitation or relief the burden placed on their caregivers (Cheng, 2017).

Currently, IGC-AD1 is in a Phase 2 clinical trial, and on March 20, 2024, IGC announced the “Positive Interim Results for IGC-AD1 in Reducing Alzheimer’s agitation”. The interim data validates IGC-AD1’s potential as a transformative therapeutic option with a large market opportunity in Alzheimer’s disease management, although there can be no assurance.

IGC-AD1 as a Treatment for Agitation in Alzheimer’s Dementia

In 2023, the number of Americans living with Alzheimer’s was estimated at 6.7 million. AAD is associated with an accelerated cognitive decline, increased caregiver burden, increased hospitalization, and increased need for medication, all significantly diminishing the quality of life for patients. Current therapies carry black box warnings, indicative of serious adverse reactions that may lead to death or serious injury. IGC-AD1 is designed to target AAD’s underlying causes and address the unmet need for a safe and effective therapy.

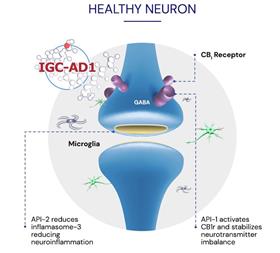

As illustrated in Figure 2, neuroinflammation, neurotransmitter imbalance, and CB1 receptor dysfunctions are all associated with AAD (Yasuno et al., 2023; Manuel et al., 2014). In addition, upregulation of inflammasome-3 has been shown to lead to neuroinflammation, consequently leading to aggressive behavior (Yu et al., 2023). IGC-AD1’s formulation combines a CB1 receptor partial agonist with anti-neuroinflammatory properties that help balance neurotransmitter imbalance and an inflammasome inhibitor that targets the upregulation of inflammasome-3.

The 146-patient IGC-AD1 trial, for which these interim results are presented, continues to enroll in the U.S. and Canada. As the interim results are based on a small number of patients (n=26), there is no guarantee that the positive interim results will hold up as more patients are enrolled in the trial. Learn more and find information about recruitment centers at https://clinicaltrials.gov/study/NCT05543681.

Figure 2: Damaged and Healthy Neuron

|

|

|

IGC-AD1 Clinical Trial Data

To the best of our knowledge, the Company’s Phase 2 clinical trial of IGC-AD1 is the first human clinical trial using low doses of THC, in combination with another molecule, to treat symptoms of dementia in Alzheimer’s patients. THC is a naturally occurring cannabinoid produced by the cannabis plant. It is known for being a psychoactive substance that can impact mental processes in a positive or negative way, depending on the dosage. THC is biphasic, meaning that low and high doses of the substance may affect mental and physiological processes in substantially different ways. For example, in some patients, low doses may relieve a symptom, whereas high doses may amplify a symptom. IGC’s trial is based on low dosing and controlled trials on patients suffering from Alzheimer’s disease.

We conducted a double-blind, single-site, randomized, three-cohort, multiple-ascending dose (“MAD”) clinical trial (FDA IND Number: 146069, NCT04749563) using the investigational new drug (“IND”) IGC-AD1. In this trial, we looked at safety, tolerability, neuropsychiatric symptoms, and pharmacokinetics, among others. The trial concluded that all three dosing levels (once a day, twice a day, and twice a day) were safe, with no serious or life-threatening events or deaths reported.

On December 1, 2021, IGC submitted the Clinical/Statistical Report (“CSR”) to the FDA on its Phase 1 trial titled “A Phase I Randomized Placebo-Controlled MAD Study to Evaluate Safety and Tolerability of IGC-AD1 in Subjects with Dementia Due to Alzheimer’s Disease.” The already disclosed data is presented here for a better understanding of the safety profile of IGC-AD1. The data presented here is not exhaustive and represents a small portion of the data submitted to the FDA.

Phase 1 Primary Endpoint: Safety & Tolerability

Safety and tolerability (“S&T”) was assessed by recording both solicited and non-solicited Adverse Events (“AEs”). The solicited AEs, assessed daily, were somnolence, falls, dizziness, asthenia, suicidal ideation, hypertension, psychiatric symptoms, and paradoxical nausea. All AEs were graded as mild, moderate, severe, life-threatening, and serious (“SAE”). In the phase 1 trial, a) there were no SAEs, b) no life-threatening AEs, and c) no deaths.

Phase 1 Secondary Endpoints: Neuropsychiatric Inventory (“NPI”)

Neuropsychiatric Symptoms (“NPS”) such as agitation/aggression, depression, anxiety, elation/euphoria, apathy, disinhibition, irritability, delusions, hallucinations, aberrant motor behavior, sleep disorders, and appetite/eating disorders are prevalent in patients who have Alzheimer’s disease (Phan et al., 2019). NPS in Alzheimer’s is a significant burden on patients and caregivers, and at some point in the progression of Alzheimer’s disease, more than 97% of patients suffer from at least one symptom. The Neuropsychiatric Inventory (“NPI”) is a scale that measures the severity of each symptom and establishes both individual symptom scores as well as an overall NPI score. Separately, the NPI also scores caregiver distress (NPI-D). The NPI is used by about 50% of neurologists to assess and treat Alzheimer’s patients (Fernandez et al., 2010).

In the Phase 1 trial conducted on patients with Alzheimer’s disease, we measured changes in NPS as assessed by the NPI as well as caregiver distress as assessed by the NPI-D. In the Phase 1 trial (N=10), seven received the active medication, and at baseline, they had agitation scores between two and twelve. The three Cohorts shown in Table 1 received the medication once a day (“qd”), twice a day (“bid”) and three times a day (“tid”). We measured and analyzed the change in the mean NPI score for agitation between Day 1 and Day 10 and between Day 1 and Day 15 for all three cohorts.

|

|

● |

As shown in the Table 1, our analysis shows Cohort 2 (bid) had the largest absolute change in the mean agitation score between Day one and Day ten (53% drop, p=.085) as well as between Day 1 and Day 15 (67% drop, p=.05). |

Table 1: NPI (Agitation) analysis for each of the three cohorts

|

Domain |

Cohort 1 (n=7) qd |

Cohort 2 (n=6) bid |

Cohort 3 (n=5) tid |

||||||

|

NPI (Agitation) |

Baseline |

Day |

Day |

Baseline |

Day |

Day |

Baseline |

Day |

Day |

|

Day 0 |

10 |

15 |

Day 0 |

10 |

15 |

Day 0 |

10 |

15 |

|

|

Mean Score |

4.7 |

3.3 |

3 |

4.3 |

2.1 |

1.5 |

4.2 |

3.2 |

1.4 |

|

Mean Change |

- |

1.4 |

1.7 |

- |

2.2 |

2.8 |

- |

1 |

2.8 |

|

Mean Change% |

- |

37% |

48% |

- |

53% |

67% |

- |

23% |

67% |

|

p-values |

- |

0.058 |

0.045 |

- |

0.085 |

0.05 |

- |

0.29 |

0.045 |

According to the NPI, a reduction of 4 points or 30% in the score is considered clinically meaningful (Cummings et al., 1994). In addition, we used a paired 2-tailed t-test with 9 degrees of freedom to assess the statistical significance of the decrease in the overall NPI agitation domain. As seen in Table 1, the NPI score for Agitation in Cohort 2 at day 15 shows a reduction of 67% (p = .05). Based on this study the dosing of twice a day or bid was selected for the Phase 2 trial.

IGC-AD1 Phase 2 Clinical Trial Update

IGC Pharma launched a Phase 2 trial with a protocol titled “A Phase 2, Multi-Center, Double-Blind, Randomized, Placebo-controlled, trial of the safety and efficacy of IGC-AD1 on agitation in participants with dementia due to Alzheimer’s disease” (clinicaltrials.gov, Identifier: CT05543681). The trial treatment duration is 6 weeks, with the intervention, IGC-AD1 or placebo, administered twice a day. The study is powered to include 146 Alzheimer’s patients; as a superiority trial with parallel groups, half of the participants will receive a placebo and the other half will receive IGC-AD1. The primary and secondary endpoints are the mean change in agitation scores from baseline, compared to placebo, as assessed by the Cohen-Mansfield Agitation Inventory ("CMAI") in Alzheimer’s patients after 6 weeks of treatment and the mean change in CMAI scores after 2 weeks of treatment, respectively. Agitation is rated at the trial site, at baseline, week 2, and week 6, by a trained practitioner using the CMAI, a scale designed and widely used to measure agitation in Alzheimer’s dementia (“AAD”) in clinical trials.

The IGC-AD1 Phase 2 is an ongoing clinical trial that continues to enroll. IGC-AD1 is an oral liquid formulation administered twice daily (“bid”) for six weeks with no placebo run-in and titration to full dose over two days. To date over 1,000 oral doses have been administered, with no dose-limiting adverse events observed, highlighting the safety profile of IGC-AD1. The Investigational product targets different pathways implicated in AAD including CB1 receptor dysfunction, neuroinflammation and neurotransmitter imbalance. The investigational drug contains THC, the principal psychoactive cannabinoid found in Cannabis, as one of two active pharmaceutical agents.

Pre-Specified Interim Results

An experienced third party conducted a protocol pre-specified interim analysis, mean changes from baseline were analyzed using a mixed-effects model for repeated measures (“MMRM”). Findings showed that patients taking IGC-AD1, on average, experienced a significant reduction in agitation scores compared to those on placebo, and the positive effects were observed as early as week two of the trial. Interim results will be discussed in the following sections.

IGC-AD1 Trial Interim Primary and Secondary Endpoints Results

The primary objective is to assess the efficacy of IGC-AD1 in AAD after six weeks of treatment using the CMAI scale. The secondary objective is to assess IGC-AD1 efficacy and early response in AAD using also the CMAI scale, after 2 weeks of treatment.

Based on the CMAI interim results shown in Table 2 below, IGC-AD1 demonstrated a clinical and statistically significant agitation reduction compared to placebo in patients with Alzheimer’s disease (“AD”), indicating strong therapeutic potential and meeting the primary endpoint. The CMAI least-squared (“LS”) mean difference at week 6 was -10.46 (95% CI: -20.53 to -0.40) with a Cohen’s d effect size of 0.79 (p= .042), indicating a large and significant IGC-AD1 effect over placebo. Cohen’s d is a standardized statistical effect size that describes the magnitude of the difference between two groups, taking into account the variability in outcomes.

Based on the interim results, the secondary endpoint was also met; the data demonstrates a clinically significant reduction, approaching statistical significance, in agitation in Alzheimer’s at week two compared to placebo. CMAI LS mean difference at week 2, assessing early response, was -12.19 with an ES of 0.79 (p= .071). The ES, similarly, to the primary endpoint, indicates a large magnitude of difference between the active and placebo groups.

Table 2 Interim CMAI Results for Week 2 and Week 6

|

|

Week 2 |

Week 6 (EOT) |

||||

|

Scale |

LS Mean Change (95% CI) |

p value |

Cohen's d |

LS Mean Change (95% CI) |

p value |

Cohen's d |

|

CMAI |

-12.19 (-25.52, 1.14) |

.071 |

0.79 |

-10.46 (-20.53, -0.4) |

.042 |

0.79 |

Existing Treatments for Agitation in Alzheimer’s Dementia

In May 2023, the U.S. Food and Drug Administration ("FDA") approved the first medication for the treatment of AAD, Brexpiprazole, an atypical antipsychotic, with a boxed warning. This approval followed a significantly larger 12-week Phase 3 trial, which showed a CMAI LS mean difference from baseline at week 12, between active treatment and placebo of -5.32 with a Cohen's d effect size of 0.35, and a p-value of 0.003 (Lee et al., 2023).

Regulatory Environment for IGC-AD1

IGC-AD1 is currently made from federally legal hemp and not from federally illegal marijuana. In addition, IGC-AD1 contains the federally legal amount of THC as defined in the 2018 Farm bill. Therefore IGC-AD1 is federally legal based on the amount of THC in the formulation and the origin of the THC. The Company grew hemp under a license in the state of Arizona. Manufacturing IGC-AD1 from hemp is an extremely inefficient process requiring vast amounts of hemp to manufacture the investigational medication. The regulatory landscape appears to be changing in that the U.S. government is seeking to re-schedule THC from Schedule 1 to Schedule 3. The Company does not use marijuana to manufacture IGC-AD1, it uses hemp which is already legal. However, the re-scheduling could alleviate banking issues, as most large banks either don’t understand or don’t care to differentiate between legal hemp and illegal marijuana. A critical point to note is that moving THC from Schedule 1 to Schedule 3 does not make marijuana or THC, above the legal limit, federally legal. The Company has received permission from the regulators to conduct the IGC-AD1 Phase 2 trial in the U.S., Canada, and Colombia.

TGR-63 and Alzheimer’s disease

Researchers at the Jawaharlal Nehru Centre for Advanced Scientific Research (“JNCASR”), in India, conducted approximately 10 years of research on Naphthalene Monoimide (“NMI”) compounds and the activity of NMI compounds on neurotoxicity associated with Alzheimer’s Disease (AD).

In Alzheimer’s patients, neurotoxicity is linked to beta-amyloid (“Aβ”) plaques and Neuro Fibrillary Tangles (“NFT”). JNCASR’s research based on Alzheimer’s cell lines identified one lead NMI molecule, TGR-63, from a family of NMI molecules with the potential to reduce amyloid beta (Aβ) plaques. Further, they demonstrated that the molecule reduces cognitive decline in a transgenic mouse model of Alzheimer’s. Their results were published in Advanced Therapeutics under the title “Naphthalene Monoimide Derivative Ameliorates Amyloid Burden and Cognitive Decline in a Transgenic Mouse Model of Alzheimer’s Disease” on January 28, 2021.

Pursuant to the signed agreement dated March 28, 2022, IGC Pharma (through Hamsa Biopharma India Pvt. Ltd.) acquired exclusive intellectual property rights to the molecule, which it intends to pursue as a potential new drug candidate, subject to further study, research, and development. IGC Pharma is conducting human trials with IGC-AD1, which is currently being tested as a symptom-modifying agent in Alzheimer’s dementia. TGR-63, on the other hand, could act as a potential disease-modifying agent to expand the Company’s pursuit of a drug that can treat AD.

Figure 3 and Figure 4 show the destabilization of Aβ plaques and Aβ42 peptide with the help of TGR-63.

Computational Studies: A Plausible Mode of Action

|

|

|

|

Figure 3: In silico analysis demonstrated that TGR-63 molecular design enables it to interact with amyloid aggregates, disrupting various types of bonds. This destabilizes plaque’s structure, facilitating their breakdown. (*Adv. Therap. 2021, 4 2000225). |

Figure 4: TGR-63 also shows high affinity for the Aß42 peptide, compromising its tertiary structure and promoting the formation of globular non-toxic structures that can be metabolized. (*Adv. Therap. 2021, 4 2000225). |

Pre-clinical studies of TGR-63

TGR-63 is a patent pending molecule designed to disrupt the structure of the amyloid beta (“Aβ”) plaque, one of the key hallmarks of Alzheimer’s Disease (AD), associated with neuronal toxicity and cognitive decline. TGR-63 targets plaques by inhibiting the aggregation of Aβ42 peptides and destabilizing their tertiary structure.

Specifically, the pre-clinical research on the TGR-63 showed the following:

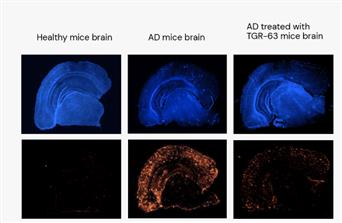

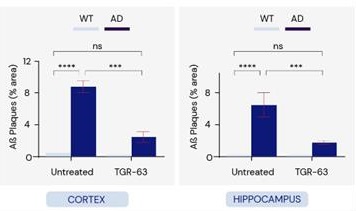

Impact on plaque levels: Studies in PC12 and SHSY5Y cell lines grown in an AD-like environment have showed TGR-63’s ability in decreasing Aβ plaque levels, leading to an increase in 26% neuron viability (neuronal rescue). TGR-63’s potential as a treatment for AD was further evaluated in a genetically modified mouse model mimicking Alzheimer’s amyloid pathology. In that assay, the group treated with TGR-63, compared to the vehicle-treated group, showed a 78% and 85% reduction in the cortical and hippocampal amyloid load, respectively, demonstrating its potential to alleviate amyloid burden. Figure 5 shows the reduction of the amyloid burden by TGR-63 in the APP/PS1 AD mouse model.

|

|

|

Figure 5: Reduction of the amyloid burden by TGR-63 in the APP/PS1 AD phenotypic mice model. A) Visualization of amyloid plaques in the half hemisphere: Confocal microscopy images of coronal section of WT, AD mice, and TGR-63 treated AD mice brain. B) Reduction of cortical and hippocampal amyloid burden by TGR-63 treatment: Higher magnification images of vehicle and TGR-63 treated mice (WT and AD) brain sections to visualize and compare the Aβ plaques deposition in the cortex and hippocampus areas. C, D) Quantification of Aβ plaques: The amount of Aβ plaques (%area) deposited in different regions (cortex and hippocampus) of vehicle and TGR63 treated mice (WT and AD) brain was analyzed. Data represent mean ± SEM, number of mice = 3 per group (*p < 0.05). Scale bar: 20 µm. (*Adv. Therap. 2021, 4 2000225).

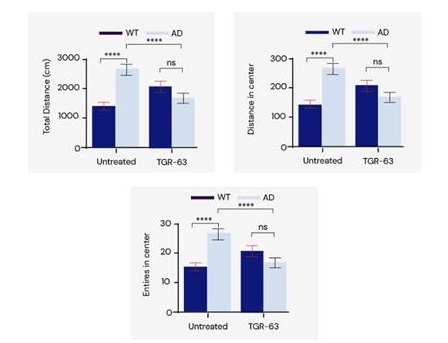

Behavioral Impact: During the investigation, two groups of APP/PS1 mice undertook an Open-Field (“OF”) test, a behavioral assessment designed to measure aberrant behavior, stress and coping responses, and emotional state, among others, in rodent models. The mice in the APP/PS1 group that received TGR-63 treatment showed a 43% reduction in their overall movement within the test area (p<.0001), a 59% reduction in movement within the central zone of the test area (p<.01), and a 55% reduction in entries to the center zone compared to the untreated group (p<.05). These are shown in Figure 6. The results from these multiple tests indicate that TGR-63 treatment helped to improve in their anxious-like and aggressive-like behaviors compared to the group that did not receive the treatment, normalizing emotional and behavioral responses in the mouse model, reinforcing its potential as a promising treatment.

Figure 6 Behavioral Tests

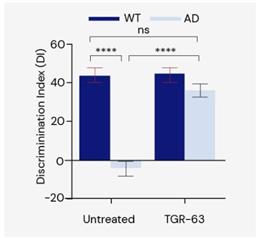

Impact on memory: The cognitive impact of TGR-63 was assessed using two renowned behavioral tests, the Novel Object Recognition (“NOR”) Test and the Morris Water Maze (“MWM”), conducted on APP/PS1 genetically modified Alzheimer’s mice.

During the NOI Test, mice were familiarized with two identical objects, followed by exploration of both novel and familiar objects after 24 and 48 hours, to establish the discrimination index (DI). Alzheimer's disease (AD) mice displayed a significantly lower DI (-3, p<0.0001, 24h; -7, p<0.0001, 48h) compared to wild-type (WT) mice (+49, 24h; +43 48h), indicating impaired long-term memory formation, while AD mice treated with TGR-63 exhibited an improved DI (+50, p<0.0001; +38, p<0.001), indicative of healthy long term memory formation and successful memory retrieval.

In the MWM test, the time to reach a platform hidden in a pool for four training days showed a remarkable improvement for the TGR-63 treated AD model compared to the AD-vehicle group, indicating enhanced spatial memory, as demonstrated by a significant reduction (~60% reduction; p < 0.05) in the time required by the TGR-63 treated AD mice to locate the hidden platform, exhibiting a similar behavior to healthy mice. The results of the novel recognition test and the MWM are shown in Figures 7 and 8 respectively.

|

|

|

|

Figure 7: In the Novel Object Recognition test, mice treated with TGR-63 showed increased exploration of a new object over a familiar one, indicating enhanced learning capacity. (*Adv. Therap. 2021, 4 2000225). |

Figure 8: During the Morris Water Maze test, mice treated with TGR-63 exhibited improved spatial memory, with decreased latency in finding the target compared to the untreated group. (*Adv. Therap. 2021, 4 2000225). |

Contract Research Organization (CRO) and Clinical Trial Software

The IGC-Pharma Electronic Data Capture system (“IGC-EDC”) is a secure and user-friendly data management software designed to collect clinical trial data in electronic format. The software incorporates rigorous security measures that help IGC to protect data and ensure compliance with regulatory requirements and industry standards. This format is designed for our clinical trials, especially our Phase 2 trial. The EDC system is designed to store and organize handwritten source documents, including medical history, concomitant medications, laboratory results, neuropsychiatric scale scores, adverse events, vital signs, safety calls, and demographics, among others. The system allows users to generate data reports that will be used for data analysis and generate computational models to simulate the effects of our investigational drug IGC-AD1 on participants’ outcomes.

At IGC Pharma, we recognize the significance of operational excellence and cost management in clinical trials. One major cost driver in conducting trials is the expense associated with engaging CROs. These costs can significantly impact the overall budget of a trial. To address this challenge and optimize trial costs, we have established an internal CRO, including proprietary software, that we believe sets us apart from the traditional approach of outsourcing. We believe this strategic move should enable us to reduce the costs associated with clinical trials compared to relying on external CROs, although there can be no assurance. We have also begun working on overlaying machine learning technologies and Artificial Intelligence (“AI”) into the software framework for trial management with the expectation that this can lead to improved decision-making, contextual data entry, computational models, trial design (Phase 3), and data analysis, although there can be no assurance.

Intellectual Property

Our goal is to use our intellectual property (“IP”) to develop products that we can bring to market in one or more of the following channels:

1. Pharmaceutical products that are subject to FDA approvals. We currently have one Alzheimer’s symptom- modifying investigational drug candidate (IGC-AD1) in Phase 2 clinical trials under an INDA filed with the FDA and a potential Alzheimer’s disease modifying drug development candidate (TGR-63) in a pre-clinical stage.

2. Branded wellness and lifestyle products to be sold in multiple retail and online channels, subject to applicable federal, state, and local laws and regulations.

3. Partnerships and licensing agreements with third parties who can accelerate bringing our IP to the market.

The Company holds all rights to the patents that it filed with the USPTO. In Fiscal 2017, the Company also acquired exclusive rights to the data and the patent filing from USF. Subsequent to Fiscal 2022, the Company acquired exclusive rights to the data and the patent filing from JNCASR.

The Company believes the registration of patents is an important part of its business strategy and future success. However, the Company cannot guarantee that these patent filings will lead to a successful registration with the USPTO. Please see Item 1A, Risk Factors- “We may not successfully register the provisional patents with the USPTO.”

Table 3 below provides the status of our patent filings:

Table 3 Patent Filings & Status

|

TARGET |

DESCRIPTION |

PATENT PENDING |

GRANTED PATENTS |

|

|

US |

FOREIGN |

|||

|

Alzheimer’s Disease (IGC-AD1) |

Method & Composition for Treating CNS Disorders |

14 |

- |

1 |

|

Alzheimer’s Disease (IGC-AD1) |

Method & Composition for Treating CNS Disorders |

- |

2 |

- |

|

Alzheimer’s Disease (TGR-63) |

Naphthalene Monoimide Derivatives with the ability to impact Aβ protein build-up |

6 |

- |

- |

|

Alzheimer’s Disease (IGC-1C) |

Naphthalene Monoimide Derivatives with the ability to impact Tau aggregation and neurofibrillary tangle formation |

1 |

- |

- |

|

Alzheimer’s Disease (IGC-M3) |

Naphthalene Monoimide Derivatives with the ability to impact Aβ plaque buildup and neurofibrillary tangle formation |

1 |

- |

- |

|

Cancer (Naphthalene Diimdes) |

Naphthalene diimide Derivatives with the ability to self-assemble molecular interactions for biological and nonbiological systems |

- |

1 |

1 |

|

Alzheimer’s Disease (IGC-LMP) |

Composition, Synthesis, & Medical use of Hybrid Cannabinoid |

1 |

- |

- |

|

Epilepsy |

Composition & Method for Treating Seizures in humans & cats/dogs |

2 |

2 |

- |

|

Eating Disorders |

Cannabis formulation with Cyproheptadine for treating Cachexia & Eating Disorders |

1 |

1 |

- |

|

Stuttering & Tourette Syndrome |

Cannabinoid-Based formulation for Treating Stuttering & Symptoms of Tourette Syndrome |

3 |

- |

- |

|

Pain |

Cannabinoid-Based Formulation combined with Cobalamin and method for Pain Management |

1 |

2 |

2 |

|

TOTAL |

28 |

8 |

4 |

|

Patent Term Extension

After NDA approval, owners of relevant drug patents may apply for up to a five-year patent extension. The allowable patent term extension is calculated as half of the drug’s testing phase — the time between IND submission and NDA submission — and all of the review phase — the time between NDA submission and approval up to a maximum of five years. The time can be shortened if the FDA determines that the applicant did not pursue approval with due diligence. The total patent term after the extension may not

exceed 14 years.

For patents that might expire during the application phase, the patent owner may request an interim patent extension. An interim patent extension increases the patent term by one year and may be renewed up to four times. For each interim patent extension granted, the post-approval patent extension is reduced by one year. The director of the PTO must determine that approval of the drug covered by the patent for which a patent extension is being sought is likely. Interim patent extensions are not available for a drug for which an NDA has not been submitted.

Products and Services in the Life Sciences segment

We believe developing a drug for either symptoms or as a disease-modifying agent has less risk due to the need for multi-year trials and FDA approval. However, there is a considerable upside and significant value creation to the extent we obtain a first-to-market advantage, of which there can be no assurance. If we were to obtain a first-to-market advantage, such an advantage could result in significant growth if and when an approved drug launches. Our formulation strategy includes expanding the line of products and formulations and developing online services that connect women with healthcare professionals who can help with PMS and dysmenorrhea. We believe that building an online community that brings women together can create brand equity, loyalty, generate revenue, and drive valuation.

We believe that additional investment in clinical trials, research and development (“R&D”), facilities, marketing, advertising, and acquisition of complementary products and businesses will be critical to the ongoing growth of the Life Sciences segment. These investments will fuel the development and delivery of innovative products that drive positive patient and customer experiences. We hope to leverage our R&D and intellectual property to develop ground-breaking, science-based products that are proven effective through clinical trials, subject to FDA approval. Although there can be no assurance, we believe this strategy can improve our existing products and lead to the creation of new hemp-based products that can provide treatment options for multiple conditions, symptoms, and side effects.

We market our in-house brands and the formulations for the products in accordance with applicable laws and regulations. Although there can be no assurance, we believe the brand and the formulations have significant potential in the growing natural products-based wellness and lifestyle market.

Products and Services in the Infrastructure segment

The Company’s infrastructure business has been operating since 2008, it includes: (i) Execution of Construction Contracts and (ii) Rental of Heavy Construction Equipment.

Markets and Distribution

Life Sciences segment

In Fiscal 2024, our Life Sciences segment is focused on the Phase 2 clinical trial for IGC-AD1 and building a pipeline of other assets. In addition, the Company sells over-the-counter products and formulations made in Vancouver, Washington facilities. Our Life Sciences revenue is less than 1% of the relevant global market, which implies a tremendous opportunity for growth. In Fiscal 2024, our sales and suppliers were concentrated, which represents some risk. Two customers accounted for over 10% of sales.

Infrastructure segment

In Fiscal 2024, our infrastructure business is focused on executing a project in the state of Kerala. Our infrastructure business revenue is less than 1% of the global revenue of the rental, construction, and commodities markets. One customer accounted for over 10% of sales.

Competition

Competition for the Company’s investigational medications, products and services:

|

1. |

Life Sciences segment: We are aware of other companies working to develop therapeutics for the treatment of AAD, including Axsome Therapeutics, Inc., which is working to develop a combination of dextromethorphan and bupropion, and Otsuka and Lundbeck A/S, which recently received approval for Rexulti for this indication. |

|

|

We face competition from well-funded pharmaceutical companies. Our wellness products and services compete with multiple well-established companies in the food and skincare industries. We also face competition from companies with experience in providing white labeling and tolling services. |

|

2. |

Infrastructure segment: The infrastructure industry in India is highly competitive, and our differentiation is based primarily on price and local and industry knowledge of construction requirements in the regions where we operate. |

Licenses, Technology, and Cybersecurity

We have intellectual property attorneys that advise, counsel, and represent the Company regarding the filing of patents or provisional patent applications, copyright applications, and trademark applications; trade secret laws of general applicability; employee confidentiality and invention assignment. Most of our data, including our accounting data, is stored in the cloud, which helps us mitigate the overall risk of losing data. We have a cybersecurity policy in place and are in the process of implementing tighter cybersecurity measures to safeguard against hackers. The Company holds all rights to the patents that have been filed by us with the USPTO.

The table below summarizes the nature of the activity, the type of license required and held, and encumbrances in obtaining permits for each location where the Company operated through its subsidiaries in Fiscal 2024:

|

Location |

Nature of Activity |

Type of License Required |

Type of License held |

Encumbrances in Obtaining Permit |

|

U.S. |

Life Sciences Products and General Management |

General business License to grow hemp; Industrial Alcohol User Permit; Clinical Trials; Good Manufacturing Practices (GMP) certification. FDA approval to run a trial |

General business licenses; Industrial Alcohol User Permit; FDA approval to run a trial. |

None. |

|

India |

Infrastructure Contract, Rental of heavy equipment and land |

General business license |

Business registrations with tax authorities in various states in India |

None. |

|

Colombia |

Life Sciences Products and General Management |

General business license; Instituto Nacional de Vigilancia de Medicamentos y Alimentos (INVIMA) Permits; Fondo Nacional De Estupefacientes (FNE) Permits. |

General business license; Instituto Nacional de Vigilancia de Medicamentos y Alimentos (INVIMA) Permits; Fondo Nacional De Estupefacientes (FNE) Permits. |

None. |

|

Canada |

Clinical Trials |

Permit from Health Canada to conduct a trial in Canada. Permit to import IGC-AD1 into Canada. |

Permit to conduct a trial and to import IGC-AD1 into Canada. |

None |

Governmental Regulations

In the U.S., we are subject to oversight and regulations, for some or all of our activities, by the following agencies: SEC, state regulators, NYSE, FTC, and the FDA. The cannabis plant consists of several strains or varieties. Hemp and Marijuana are both cannabis plants. Under the 2018 Farm Bill, Hemp is classified as a cannabis plant that has 0.3% or less THC by dry weight. Marijuana is classified as a cannabis plant that has THC above 0.3% by dry weight.

Marijuana remains illegal under federal law, including in those states in which the use of marijuana has been legalized for medical and or recreational use. On the other hand, the 2018 Farm Bill, which was effective January 1, 2019, contains provisions that make industrial hemp legal. Although hemp is legal at the federal level, most states have created licensing and testing processes for the growing, processing, and sale of hemp and hemp-derived products.

For our business, we must apply for licenses in states where we desire to grow and process hemp. For example, in the state of Arizona, where we grew hemp, we were required to apply for licenses and register with the state the geo-location of all our operations, including the land on which hemp was grown and the facilities where hemp would be processed. These regulations are evolving, differ from jurisdiction to jurisdiction, and are subject to change.

FDA Approval Process

In the U.S., pharmaceutical products are subject to extensive regulation by the FDA. The Federal Food, Drug, and Cosmetic Act, or the FDC Act, and other federal and state statutes and regulations, govern the research, development, testing, manufacturing, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, post-approval monitoring, and reporting, sampling, and importing and exporting of pharmaceutical products, among other things. Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as the imposition of clinical holds, FDA refusal to approve pending New Drug Applications (“NDA”), warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement, civil penalties, and criminal prosecution.

Pharmaceutical product development in the U.S. typically involves pre-clinical laboratory and animal tests and the submission to the FDA of an Investigational New Drug (“IND”), which must become effective before clinical testing may commence. For commercial approval, the sponsor must submit adequate tests by all methods reasonably applicable to show that the drug is safe for use under the conditions prescribed, recommended, or suggested in the proposed labeling. The sponsor must also submit substantial evidence, generally consisting of adequate, well-controlled clinical trials, to establish that the drug will have the effect it purports or is represented to have under the conditions of use prescribed, recommended, or suggested in the proposed labeling. In certain cases, the FDA may determine that a drug is effective based on one clinical study plus confirmatory evidence. Satisfaction of FDA premarket approval requirements typically takes many years, and the actual time required may vary substantially based upon the type, complexity of the product, or disease.

Pre-clinical tests include laboratory evaluation of product chemistry, formulation, and toxicity, as well as animal trials to assess the characteristics and potential safety and efficacy of the product. The conduct of the pre-clinical tests must comply with federal regulations and requirements, including the FDA’s good laboratory practices regulations and the U.S. Department of Agriculture’s (“USDA’s”) regulations implementing the Animal Welfare Act. The results of pre-clinical testing are submitted to the FDA as part of an IND along with other information, including information about product chemistry, manufacturing and controls, and a proposed clinical trial protocol. Long-term pre-clinical tests, such as animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted.

A 30-day waiting period after the submission of each IND is required prior to the commencement of clinical testing in humans. If the FDA has not imposed a clinical hold on the IND or otherwise commented on or questioned the IND within this 30-day period, the clinical trial proposed in the IND may begin.

Clinical trials involve the administration of an investigational new drug to healthy volunteers or patients under the supervision of a qualified investigator. Clinical trials must be conducted: (i) in compliance with federal regulations; (ii) in compliance with Good Clinical Practice (GCP), an international standard meant to protect the rights and health of patients and to define the roles of clinical trial sponsors, administrators, and monitors; and (iii) under protocols detailing the objectives of the trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. Each protocol involving testing on U.S. patients and subsequent protocol amendments must be submitted to the FDA as part of the IND.

The FDA may order the temporary or permanent discontinuation of a clinical trial at any time or impose other sanctions if it believes that the clinical trial either is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. The trial protocol and informed consent information for patients in clinical trials must also be submitted to an institutional review board, or IRB, for approval. An IRB may also require the clinical trial at the site to be halted, either temporarily or permanently, for failure to comply with the IRB’s requirements or may impose other conditions.

Clinical trials to support NDAs for marketing approval are typically conducted in three sequential phases, but the phases may overlap. In general, in Phase 1, the initial introduction of the drug into healthy human subjects or patients, the drug is tested to assess metabolism, pharmacokinetics, pharmacological actions, side effects associated with increasing doses, and, if possible, early evidence on effectiveness. Phase 2 usually involves trials in a limited patient population to determine the effectiveness of the drug for a particular indication, dosage tolerance, and optimum dosage and to identify common adverse effects and safety risks. If a compound demonstrates evidence of effectiveness and an acceptable safety profile in Phase 2 evaluations, Phase 3 trials are undertaken to obtain additional information about clinical efficacy and safety in a larger number of patients, typically at geographically dispersed clinical trial sites, to permit the FDA to evaluate the overall benefit-risk relationship of the drug and to provide adequate information for the labeling of the drug. In most cases, the FDA requires two adequate and well-controlled Phase 3 clinical trials to demonstrate the efficacy of the drug. The FDA may, however, determine that a drug is effective based on one clinical study plus confirmatory evidence. Only a small percentage of investigational drugs complete all three phases and obtain marketing approval. In some cases, the FDA may require post-market studies, known as Phase 4 studies, to be conducted as a condition of approval in order to gather additional information on the drug’s effect in various populations and any side effects associated with long-term use. Depending on the risks posed by the drugs, other post-market requirements may be imposed.

After completion of the required clinical testing, an NDA is prepared and submitted to the FDA. The FDA approval of the NDA is required before marketing of the product may begin in the U.S. The NDA must include the results of all pre-clinical, clinical, and other testing and a compilation of data relating to the product’s pharmacology, chemistry, manufacture, and controls. The cost of preparing and submitting an NDA is substantial.

The FDA has 60 days from its receipt of an NDA to determine whether the application will be accepted for filing based on the agency’s threshold determination that it is sufficiently complete to permit substantive review. Once the submission is accepted for filing, the FDA begins an in-depth review. Under the statute and implementing regulations, the FDA has 180 days (the initial review cycle) from the date of filing to issue either an approval letter or a complete response letter unless the review period is adjusted by mutual agreement between the FDA and the applicant or as a result of the applicant submitting a major amendment. In practice, the performance goals established pursuant to the Prescription Drug User Fee Act have effectively extended the initial review cycle beyond 180 days. The FDA’s current performance goals call for the FDA to complete a review of 90 percent of standard (non-priority) NDAs within 10 months of receipt and within six months for priority NDAs, but two additional months are added to standard and priority NDAs for a new molecular entity (“NME”).

The FDA may also refer applications for novel drug products, or drug products that present difficult questions of safety or efficacy, to an advisory committee, which is typically a panel that includes clinicians and other experts, for review, evaluation, and a recommendation as to whether the application should be approved. The FDA is not bound by the recommendation of an advisory committee, but it generally follows such recommendations. Before approving an NDA, the FDA will typically inspect one or more clinical sites to assure compliance with GCP. Additionally, the FDA will inspect the facility or the facilities at which the drug is manufactured. The FDA will not approve the product unless compliance with the current GMP is satisfactory, and the NDA contains data that provides substantial evidence that the drug is safe and effective in the indication studied.

After the FDA evaluates the NDA and the manufacturing facilities, it issues either an approval letter or a complete response letter. A complete response letter generally outlines the deficiencies in the submission and may require substantial additional testing or information for the FDA to reconsider the application. If, or when, those deficiencies have been addressed to the FDA’s satisfaction in a resubmission of the NDA, the FDA will issue an approval letter. The FDA has committed to reviewing 90 percent of resubmissions within two to six months, depending on the type of information included.

An approval letter authorizes commercial marketing of the drug with specific prescribing information for specific indications. As a condition of NDA approval, the FDA may require a risk evaluation and mitigation strategy (“REMS”) to help ensure that the benefits of the drug outweigh the potential risks. REMS can include medication guides, communication plans for health care professionals, and elements to assure safe use (“ETASU”). ETASU can include but is not limited to, special training or certification for prescribing or dispensing, dispensing only under certain circumstances, special monitoring, and the use of patient registries. The requirement for a REMS can materially affect the potential market and profitability of the drug. Moreover, product approval may require substantial post-approval testing and surveillance to monitor the drug’s safety or efficacy. Once granted, product approvals may be withdrawn if compliance with regulatory standards is not maintained, or problems are identified following initial marketing.

Expedited Development:

Designations such as Breakthrough Therapy Designation (BTD) and Fast Track Designation can speed up the development process by allowing for more frequent communication with the FDA and potentially faster review timelines. This can translate to getting the drug to market quicker.

|

● |

Breakthrough Therapy Designation (“BTD”): This designation is given by the FDA to drugs that have the potential to significantly improve treatment for serious or life-threatening conditions. It allows for more intensive interaction with the FDA during development and can expedite the review process. |

|

● |

Fast Track Designation: This designation is designed to facilitate the development and expedite the review of drugs that address unmet medical needs. It offers some advantages like more frequent meetings with the FDA and potential for rolling review (reviewing data as it becomes available). |

Disclosure of Clinical Trial Information

Sponsors of clinical trials of certain FDA-regulated products, including prescription drugs, are required to register and disclose certain clinical trial information on a public website maintained by the U.S. National Institutes of Health. Information related to the product, patient population, phase of the investigation, study sites, investigator, and other aspects of the clinical trial is made public as part of the registration. Disclosure of the results of these trials can be delayed for up to two years if the sponsor certifies that it is seeking approval of an unapproved product or that it will file an application for approval of a new indication for an approved product within one year. Competitors may use this publicly available information to gain knowledge regarding the design and progress of our development programs.

The Hatch-Waxman Act

Orange Book Listing

In seeking approval for a drug through an NDA, applicants are required to list with the FDA each patent the claims of which cover the applicant’s product. Upon approval of a drug, each of the patents listed in the application for the drug is then published in the FDA’s Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the Orange Book. Drugs listed in the Orange Book can, in turn, be cited by potential generic competitors in support of approval of an abbreviated new drug application (“ANDA”). An ANDA provides for the marketing of a drug product that has the same active ingredients in the same strengths and dosage form as the listed drug and has been shown through bioequivalence testing to be bioequivalent to the listed drug. Other than the requirement for bioequivalence testing, ANDA applicants are not required to conduct or submit results of pre-clinical or clinical tests to prove the safety or effectiveness of their drug product. Drugs approved in this way are considered to be therapeutically equivalent to the listed drug, are commonly referred to as “generic equivalents” to the listed drug and can often be substituted by pharmacists under prescriptions written for the original listed drug in accordance with state law.

The ANDA applicant is required to certify to the FDA concerning any patents listed for the approved product in the FDA’s Orange Book. Specifically, the applicant must certify that: (i) the required patent information has not been filed; (ii) the listed patent has expired; (iii) the listed patent has not expired but will expire on a particular date, and approval is sought after patent expiration; or (iv) the listed patent is invalid or will not be infringed by the new product. The ANDA applicant may also elect to submit a section viii statement, certifying that its proposed ANDA labeling does not contain (or carves out) any language regarding the patented method-of-use rather than certify to a listed method-of-use patent. If the applicant does not challenge the listed patents, the ANDA application will not be approved until all the listed patents claiming the referenced product have expired.

A certification that the new product will not infringe the already approved product’s listed patents or that such patents are invalid is called a Paragraph IV certification. If the ANDA applicant has provided a Paragraph IV certification to the FDA, the applicant must also send notice of the Paragraph IV certification to the NDA and patent holders once the ANDA has been accepted for filing by the FDA. The NDA and patent holders may then initiate a patent infringement lawsuit in response to the notice of the Paragraph IV certification. The filing of a patent infringement lawsuit within 45 days of the receipt of a Paragraph IV certification automatically prevents the FDA from approving the ANDA until the earlier of 30 months, expiration of the patent, settlement of the lawsuit, or a decision in the infringement case that is favorable to the ANDA applicant. The ANDA application also will not be approved until any applicable non-patent exclusivity listed in the Orange Book for the referenced product has expired.

Exclusivity

Upon NDA approval of a new chemical entity or NCE, which is a drug that contains no active component that has been approved by the FDA in any other NDA, that drug receives five years of marketing exclusivity, during which time the FDA cannot receive any ANDA or 505(b)(2) application seeking approval of a drug that references a version of the NCE drug. Certain changes to a drug, such as the addition of a new indication to the package insert, are associated with a three-year period of exclusivity during which the FDA cannot approve an ANDA or 505(b)(2) application that includes the change. An ANDA or 505(b)(2) application may be submitted one year before NCE exclusivity expires if a Paragraph IV certification is filed. If there is no listed patent in the Orange Book, there may not be a Paragraph IV certification, and thus, no ANDA or 505(b)(2) application may be filed before the expiration of the exclusivity period.

For a botanical drug, the FDA may determine that the active moiety is one or more of the principal components or the complex mixture as a whole. This determination would affect the utility of any five-year exclusivity as well as the ability of any potential generic competitor to demonstrate that it is the same drug as the original botanical drug. Five-year and three-year exclusivities do not preclude FDA approval of a 505(b)(1) application for a duplicate version of the drug during the period of exclusivity, provided that the 505(b)(1) applicant conducts or obtains a right of reference to all of the preclinical studies and adequate and well-controlled clinical trials necessary to demonstrate safety and effectiveness.

Orphan Drug Act

Under the Orphan Drug Act, the FDA may grant orphan drug designation to drugs intended to treat a rare disease or condition, generally a disease or condition that affects fewer than 200,000 individuals in the U.S. (or affects more than 200,000 in the U.S. and for which there is no reasonable expectation that the cost of developing and making available in the U.S. a drug for such disease or condition will be recovered from sales in the U.S. of such drug). Orphan drug designation must be requested before submitting an NDA. After the FDA grants orphan drug designation, the generic identity of the drug and its potential orphan use are disclosed publicly by the FDA. Orphan drug designation does not convey any advantage in or shorten the duration of the regulatory review and approval process. The first NDA applicant to receive FDA approval for a particular active ingredient to treat a particular disease with FDA orphan drug designation is entitled to a seven-year exclusive marketing period in the U.S. for that product for that indication. During the seven-year exclusivity period, the FDA may not approve any other applications to market the same drug for the same disease, except in limited circumstances, such as a showing of clinical superiority to the product with orphan drug exclusivity. If the FDA designates an orphan drug based on a finding of clinical superiority, the FDA must provide a written notification to the sponsor that states the basis for orphan designation, including “any plausible hypothesis” relied upon by the FDA. The FDA must also publish a summary of its clinical superiority findings upon granting orphan drug exclusivity based on clinical superiority. Orphan drug exclusivity does not prevent the FDA from approving a different drug for the same disease or condition or the same drug for a different disease or condition. Among the other benefits of orphan drug designation are tax credits for certain research and a waiver of the NDA application user fee.

Special Protocol Assessment