UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒

|

|

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

For the fiscal year ended March 31, 2017

|

|

☐

|

|

Transition report pursuant to Section 13 or 15(d) of the Exchange Act of 1934

For the transition period from _____ to _____

|

Commission file number: 1-32830

INDIA GLOBALIZATION CAPITAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Maryland

(State or Other Jurisdiction of Incorporation or Organization)

|

|

20-2760393

(I.R.S. Employer Identification No.)

|

4336 Montgomery Avenue, Bethesda, Maryland 20814

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (301) 983-0998

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

NYSE MKT LLC

|

Securities registered pursuant to Section 12(g) of the Act: Common Stock Purchase Warrants

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☑ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☑ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☑ Yes ☐ No

Indicate by check mark disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

(Do not check if a smaller reporting company)

|

Smaller reporting company ☑

|

|

Emerging growth company☐

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☑ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of September 30, 2016 (the last business day of the registrant’s most recently completed second fiscal quarter was $8,785,960 based on the last reported sale price of the registrant’s common stock (its only outstanding equity security) of $0.46 per share on that date. All executive officers and directors of the registrant and all 10% or greater stockholders have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

As of June 25, 2017, there were 30,571,948 shares of our common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

INDIA GLOBALIZATION CAPITAL, INC.

ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED MARCH 31, 2017

|

|

|

Page

|

|

PART I

|

|

|

|

|

|

|

|

Item 1.

|

|

2 |

|

Item 1A.

|

|

10 |

|

Item 1B.

|

|

16 |

|

Item 2.

|

|

16 |

|

Item 3.

|

|

17 |

|

Item 4

|

|

17 |

| |

|

|

|

PART II

|

|

|

|

|

|

|

|

Item 5.

|

|

18 |

|

Item 6.

|

|

19 |

|

Item 7.

|

|

19 |

|

Item 7A.

|

|

26 |

|

Item 8.

|

|

27 |

|

Item 9.

|

|

29 |

|

Item 9A.

|

|

29 |

|

Item 9B.

|

|

30 |

|

|

|

|

|

PART III

|

|

|

|

|

|

|

|

Item 10.

|

|

31 |

|

Item 11.

|

|

34 |

|

Item 12.

|

|

39 |

|

Item 13.

|

|

40 |

|

Item 14.

|

|

41 |

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

|

Item 15.

|

|

43 |

|

|

|

45 |

Unless the context requires otherwise, all references in this report to “IGC,” “we,” “our” and “us” refer to India Globalization Capital, Inc., together with the subsidiaries listed on the Company’s Annual Report on Form 10-K. We exclude our investments and minority non-controlling interests, and any information provided by them is not incorporated by reference in this report, and you should not consider it a part of this report.

PART I

Company Background

IGC, a Maryland based corporation, develops cannabis-based combination therapies to treat Alzheimer’s, pain, nausea, eating disorders, several end points of Parkinson’s, and epilepsy in humans, dogs and cats. In support of this effort, IGC has assembled a portfolio of patent filings and four lead product candidates addressing these conditions. In India, the Company is engaged in heavy equipment rental, and in Malaysia, real-estate management.

Business Strategy

Our long-term goal is to establish IGC as a specialty-pharmaceutical provider of phytocannabinoid-based pharmaceutical and Complimentary Alternative Medicine (“CAM”, “nutraceutical”) products. Our short-term goal is to conduct human and veterinarian medical trials on our four product candidates. Our medium-term goal is to market CAM based therapies through joint ventures and partnerships.

Business Organization

We are a Maryland corporation formed in April 2005 for the purpose of acquiring one or more businesses with operations primarily in India through a merger, capital stock exchange, asset acquisition or other similar business combination. In March 2006, we completed an initial public offering of our common stock. Our principal office in the U.S. is in Bethesda, Maryland, in addition we have a facility in Washington State. Our back office is located in Kochi, Kerala India. In addition, many of our staff and advisors work from their home offices. We maintain a website at http://www.igcinc.us and our telephone number is +1-301-983-0998. The information contained on our website is not incorporated by reference in this report, and you should not consider it a part of this report. As at April 1, 2016 our operational subsidiaries were located in China, Hong Kong, India and Malaysia. As at March 31, 2017 our operational subsidiaries are located in India and Malaysia. Our filings are available on www.sec.gov.

Products

Cannabinoids are chemical compounds that exert a range of effects on the body, including impacting the immune response, gastrointestinal maintenance and motility, muscle functioning, and nervous system response and functioning. Phytocannabinoids are cannabinoids that occur naturally in the cannabis plant, they are abundant in the viscous resin produced by glandular structures called trichomes. There are over 480 different compounds in the cannabis plant. Many of them have been identified as cannabinoids. Of these THC (delta-9-tetrahydrocannabinol) is the main psychoactive component (“high”) in the plant with many therapeutic uses. The other broadly pursued non-psychoactive phytocannabinoid, CBD (Cannabidiol), is pleiotropic influencing many pathways in humans, dogs, and cats and may be used to provide relief to a variety of symptoms including pain, seizures, and eating disorders.

The Company is focused on four products that it is preparing for medical trials: Natrinol is a natural substitute for Marinol, or synthetic THC. This product is aimed at relieving nausea, vomiting and increasing appetite in patients with AIDS and Cancer. Caesafin uses combination therapy to alleviate seizures in dogs and cats. Serosapse addresses several end points in Parkinson’s disease including Rapid Eye Movement (REM) sleep disorder, anxiety, and dyskinesia. Hyalolex is aimed at reducing the buildup of beta-amyloid in Alzheimer’s patients.

Services

The Company provides construction management services for the construction of a 7-star hotel in Genting Malaysia. In India the Company rents heavy equipment with operators to construction companies.

Industry Overview

We believe that there are three factors coalescing to create entrepreneurial opportunities in the cannaceutical industry. The first is deregulation of the industry. This is taking place in the U.S., Canada, Germany, and other parts of the world. We believe that during any major deregulation, it takes several years for market equilibrium to be achieved. Most large companies don’t react quickly and that creates entrepreneurial opportunities, including as a first mover. The second factor is that the plant has cannabinoids that work on several pathways, in humans and animals, and that these cannabinoids can potentially be used to treat many diseases and aliments. The third factor is a rising awareness and demand for natural products including natural complementary and alternative medicines.

Target Markets

We are developing four products using phytocannabinoid-based combination and mono therapies, for the treatment of a) Alzheimer’s disease, b) several end points associated with Parkinson’s disease, c) seizures in cats and dogs, and d) cancer and AIDS induced nausea, vomiting, and eating disorders. Our target market for one of these products is very large and for the other three relatively smaller. There are 5.3 million adults suffering from Alzheimer’s in the U.S., and Medicare and Medicate are projected to spend $175 billion in 2017 on treatment. Alzheimer’s is America’s most expensive disease. The pharmaceutical market for this product, if it is proven effective in medical trials, and approved by the FDA, and we are successful in registering with the USPTO, is significant and rapidly growing. There are over one million adults suffering from Parkinson’s disease in the U.S., it is the second most common neurodegenerative disorder worldwide with an estimated 1% of adults over 60 suffering from the disease. The market for curing the disease is very large. We are testing products for end points (REM sleep disorder, anxiety, dyskinesia) associated with Parkinson’s disease and we believe the market for these products is projected to be around $500 million. There are 160 million domesticated dogs and cats in the U.S. and about 1% suffer from seizures. Our veterinarian product uses combination therapy for the treatment of seizures in dogs and cats. We are also developing a product for cancer and AIDS induced nausea, vomiting, and eating disorders.

The target market for the heavy equipment rental business is cyclical and highly dependent on the fleet of equipment available at the time a need arises. We have a limited fleet of heavy equipment in India and the target market is small and restricted to the city of Kochi in the state of Kerala, India. Similarly, the construction management business is limited to project development in Genting Malaysia. We have, organically and through our investments, developed expertise in building medical grade pesticide free indoor organic farms, and extraction and separation methodologies using a variety of techniques. While we believe the target market for these services will be large, we have not yet begun targeting these markets.

Patents, Development Pipeline, and Licenses

Although, the Company believes the registration of patents is an important part of its business strategy and its success depends in part on such registration, the Company cannot guarantee that such patent filings will result in a successful registration with the USPTO. Please see risk factors.

We have filed six provisional patents with the United States Patent and Trademark Office (“USPTO”), in the phytocannabinoid-based combination therapy space, for the indications of pain, medical refractory epilepsy, and cachexia. In addition, in May 2017, we acquired an exclusive license to a patent filed by the University of South Florida Research Foundation entitled “THC as a Potential Therapeutic Agent for Alzheimer’s Disease”. The table below provides a status of the patent filings:

|

Indication

|

Provisional Filing

|

PCT Filing

|

Subsequent Activity

|

|

Pain (IGC-501)

|

9/16/14

|

9/16/15

|

US National Case Filed – 6/15/16

|

|

Seizures (IGC-502)

|

6/15/15

|

6/14/16

|

US National Case Filed – 6/15/16

|

|

Seizures (IGC-503)

|

4/1/15

|

4/1/16

|

PCT Application Published- 10/6/16

|

|

Eating Disorders (IGC-504)

|

8/12/15

|

8/11/16

|

US and National Filing Anticipated 2/12/18

|

|

Seizures (IGC-505)

|

6/15/16

|

6/15/16

|

US National Filing Anticipated 12/15/18

|

|

Eating Disorders (IGC-506)

|

2/28/17

|

Anticipated- 2/28/18

|

US and National Filing Anticipated 8/28/19

|

|

Alzheimer’s (IGC-AD1)

|

7/30/2015

|

Anticipated -2017

|

US and National Filing Anticipated in 2017

|

Alzheimer’s Disease

Alzheimer’s is known as America’s most expensive disease with an estimated cost in 2017 to Medicare and Medicaid of $175 billion. There are currently over 5.3 million Americans with Alzheimer’s disease (AD) and around 35 million worldwide. The cost of Alzheimer’s is skyrocketing as the baby-boomers age: the number of AD patients is expected to double over the next 20 years and the direct costs are expected to exceed $450 billion in the next 12 years. Although the speed of progression can vary, the average life expectancy following diagnosis is believed to be between three and nine years. It is the most common cause of dementia among older adults. Currently, no treatment can stop or reverse the progression of the disease and there is still no accepted cure for AD. Alzheimer’s is characterized by loss of neurons and synapses in the cerebral cortex and certain subcortical regions – resulting in significant atrophy in the affected regions. In brains of those affected by Alzheimer’s, both amyloid plaques and neurofibrillary tangles are visible by microscopy. Amyloid plaques are dense deposits of beta-amyloid peptide and cellular material around neurons. Neurofibrillary tangles are aggregates of the microtubule-associate protein tau, which accumulates inside the cells. The patent filing made by the University of South Florida Research Foundation claims discovery of a new pathway to disrupt and perhaps reverse the buildup of beta-amyloid plaques from aggregating on neurons.

Pain

The pain market represents a significant component of the healthcare system and The Journal of Pain in September 2012 reported that the annual estimated national cost of pain ranges from $560 billion to $635 billion. This figure exceeds the entire cost of the nation’s priority health conditions. Additionally, The American Pain Society recommends that pain be made more visible and be categorized as the fifth vital sign; recognizing that terminal illnesses are often accompanied by unbearable levels that are so severe and difficult to treat that death seems preferable. According to the Arthritis Foundation, arthritis has been particularly problematic for women; since 1999 there has been a 22 percent increase in the number of women who attribute their disability to arthritis. Current treatment protocols such as the utilization of opioid-based drug therapies present several challenges and may result in debilitating consequences that affect patient day-to-day functioning and patients’ productivity. Commonly reported side effects include hallucinations, constipation, sedation, nausea, respiratory depression, and dysphoria. Our patent filing is based on a novel therapy that uses extracts from the cannabis plant for the treatment of psoriatic arthritis and scleroderma pain. The therapy uses a cream that is applied to the joints, using a variety of delivery mechanisms including a bio-adhesive patch.

Seizures

Approximately 50 million people worldwide are affected by epilepsy (Sanders, 2003). Epilepsy is thought to be due to multiple factors that include sodium, potassium, GABA (gamma amino butyric acid) and NMDA (N-Methyl-d-aspartate). It is believed, for example, that to maximally control epilepsy, modulation of one or more of these receptors is required and that mono therapy is adequate in up to 25% of patients. The onset of epileptic seizures can be life threatening, including long-term implications (Lutz, 2004) such as mental health problems, cognitive deficits and morphological changes (Swann, 2004, Avoli et. al., 2005). The onset of epilepsy also greatly affects lifestyle as sufferers live in fear of consequential injury or the inability to perform daily tasks (Fisher et. al., 2000). The scientific community (1980 Cunha et. al., 1986 Ames, 1990 Trembly et. al. recent testing by GW Pharmaceuticals, among others) have shown that Cannabidiol (CBD) has anti-convulsive properties in humans. Other studies, (Davis and Ramsey) have shown that tetrahydrocannabinol (THC) can also help reduce seizures. Three of our patent filings involving novel therapies use phytocannabinoid extracts from cannabis, in combination with other generic drugs, to treat medical refractory epilepsy in humans and seizures in dogs and cats.

Eating Disorders

Cachexia is a condition that accompanies severe illness such as cancer and results in the weakness and wasting away of the body. Cachexia physically weakens patients to the extent that response to standard treatments is poor. In the U.S., it is estimated that a population of approximately 1.3 million are experiencing cachexia associated with cancer, multiple sclerosis, Parkinson’s disease, HIV/AIDS and other progressive illnesses. Cachexia is secondary to an underlying disease such as cancer or AIDS and is a positive risk factor for death. As an example, cancer induced anorexia cachexia is responsible for about 20% of all cancer deaths. Our patent filing involves a novel therapy that uses phytocannabinoids to stimulate senses (smell and taste) with a combination of drugs to stimulate appetite. Our approach addresses the veterinarian market as dogs and cats also suffer from pain, epilepsy and cachexia and getting a product to market for the veterinarian industry is significantly less time consuming than getting products approved for human healthcare.

Competition

The development of phytocannabinoid-based therapies is currently not very competitive. The largest amount of research in this area is done in Israel. The most significant research and FDA approved trials are done by one large pharmaceutical company, and to a lesser extent by two other large firms. In the United States, there is very little wide spread research while most of the research is concentrated in Israel. This is mostly because the United States Drug Enforcement Administrating (“DEA”) classifies phytocannabinoid extracts as a Schedule 1 drug. This means that phytocannabinoids are characterized as “high potential for abuse,” and “no currently accepted medical use”. Further, any study conducted in the US must be registered and approved by the DEA and raw materials purchased through the National Institute of Drug Abuse (NIDA).

We view competition in two ways, the first: we compete with 15 listed companies and 2 private companies that have articulated a business plan to develop phytocannabinoid based therapies, two large listed well-funded pharmaceutical companies, and three small listed companies. There are several microcap companies listed on the OTC and two private ones that also compete in this space. We have limited competition in the areas of Alzheimer’s, Parkinson’s and seizures for dogs and cats, using phytocannabinoid- based therapies. In the field of epilepsy in humans there is significant competition and so we are focused on seizures in dogs and cats where there is limited competition. The second way we view competition is non-phytocannabinoid based therapies: there is severe competition in all areas that we are working on including for example Alzheimer’s, with almost all the massive and well financed pharmaceutical companies and four pure play listed companies working on the disease, albeit all of them without the use of phytocannabinoids.

Core Business Competencies

Our core competencies include the following:

| · |

A network of doctors, PhDs, and intellectual property legal experts that have a sophisticated understanding of drug discovery, research, FDA filings, intellectual protection and product formulation.

|

| · |

Knowledge of various cannabis strains, their phytocannabinoid profile, extraction methodology, and impact on various pathways.

|

| · |

Knowledge of the legal status of cannabis in various countries, access to medical writers, and clinical trial organizations in foreign countries, universities and research centers in Malaysia, India and Israel.

|

| · |

Knowledge of the equipment rental business in Kerala, India and the construction business in Malaysia.

|

Competitive Advantage

Our competitive advantage is based on experience and deep knowledge of deregulating industries; access to foreign markets where testing has less regulatory hurdles; experienced management; access to intellectual property experts; access to a network of doctors and PhDs; knowledge of FDA trials, extraction techniques, plant strains; and a strategy that is well differentiated.

Our Other Businesses and Investments

In Malaysia, our subsidiary Cabaran Ultima is the project manager of an estimated $262 million five-star hotel planned to be built on approximately 6 plus acres in Genting highlands. Genting is a hill resort one hour from Kuala Lumpur that boasts many attractions including a casino and is home to the 20th Century Fox World theme park slated to open in 2017. The site is located within walking distance to the theme park and casino. HBA Architecture, the hotel’s master planner and designer, have a prestigious design resume that includes numerous developments such as the Hilton Hanoi Opera Hotel Refurbishment in Vietnam, Marrisle Boutique Leisure Resort and Club Med Gongshan Island Resort, both located in China. During the build-out phase we expect to receive revenue from project management. Ultima’s market share of the real estate project planning, construction, and management industry in Malaysia is less than 1%.

According to Deloitte and KOTRA, the total market size of the construction industry in India is estimated at $126 billion. However, various plans by the Indian government to build and modernize Indian infrastructure have been slow to materialize. Through our subsidiary, TBL, we are engaged in renting heavy infrastructure construction equipment. Our subsidiary has experience in the construction industry having in the past, constructed highways, rural roads, tunnels, dams, airport runways and housing complexes, mostly in southern Indian states. Our current share of the overall market in India is less than 1% based on revenue.

In Hong Kong, through a majority owned subsidiary called Golden Gate that we renamed as IGC International, we operated an electronics business. Most of our revenue in fiscal 2016 come from that business. We had no revenue from Golden Gate since the quarter ended June 30, 2016. We decided to exit this business because, we believe, there is a macroeconomic slow-down and consolidation in the electronic-components sector, and without scale, meaningfully competing is difficult. IGC-INT’s share of the electronic trading market is less than 1% based on revenue.

In China, through a majority owned subsidiary called Ironman, we operated our iron ore business. As of March 31, 2016, we had three iron ore beneficiation plants in China, including the one under construction (under capital work-in progress), for about $6.1 million. As of March 31, 2017, IGC has redeemed and subsequently retired as required by Maryland State law, part of the 3,150,000 shares of common stock issued in connection with its purchase of Ironman for all tangible operating assets of Ironman as a treasury stock transaction thus reducing IGC investment in Ironman to zero while still pursuing any and all legal avenues to recover as many of the originally issued shares. After December 31, 2016, Ironman is no longer consolidated. Ironman’s share of the iron ore trading market is less than 1% based on revenue.

In June 2014, we entered into a partnership agreement with TerraSphere Systems LLC to develop multiple facilities to produce organic leafy green vegetables utilizing TerraSphere’s advanced pesticide-free organic indoor farming technology. Under the agreement, we will own 51% of each venture once production is operational, and will have a right of first refusal to participate in all future build-outs. Additionally, in consideration for our issuance of 50,000 shares of common stock, we received a seven-year option to purchase TerraSphere Systems for cash or additional shares of our common stock. As of 2017, we are negotiating a conversion of the investment into shares of a Canadian public vehicle that TerraSphere has merged into.

In December 2014, we acquired 24.9% of the outstanding membership interests in Midtown Partners, a Florida limited liability company registered as a broker-dealer under the Securities Exchange Act of 1934, from Apogee Financial Investments, Inc. The Purchase Agreement expired on June 30, 2015, and the Company is pursuing its rights under the terms of the Purchase Agreement to recover certain damages. In the calendar year 2017, Midtown Partners had a profit. The Company applied the equity method of accounting for investments and increased the value of its investment in Midtown Partners by 24.9% of the profit earned by Midtown Partner in the calendar year 2017. Midtown’s share of the investment banking market is less than 1% based on revenue.

We acquired a 10% stake in a 1,000-room luxury hotel development project encompassing 6+ acres in Genting Highlands, Malaysia by subscribing to 10% stake in Brilliant Hallmark Sdn. Bhd. (“Brilliant”) free and clear of all encumbrances. On April 3, 2017, IGC sold back its ten percent holding in Brilliant Hallmark for a consideration of 4 million shares of IGC’s Common Stock that were returned and retired, thereby reducing the outstanding IGC shares in April 2017. The Company does not expect to record a gain or loss from this transaction.

Revenue Contribution by Business Area

The following table sets out the revenue contribution for fiscal 2017 from our operating subsidiaries:

|

Operating Subsidiaries

|

|

Business Area

|

|

Fiscal Year Ended

March 31, 2017

|

|

|

Cabaran Ultima and TBL (1)

|

|

Construction project management and heavy equipment rental

|

|

$

|

367,279

|

|

| |

|

|

|

|

|

|

|

IGC-INT (2)

|

|

Trading, electronic component

|

|

|

213,093

|

|

| |

|

|

|

|

|

|

|

Total IGC

|

|

|

|

$

|

580,372

|

|

(1) Ultima’s and TBL’s current market share of the construction project management and heavy equipment rental businesses is less than 1% based on revenue.

(2) After March 31, 2017, will no longer be consolidated due to inactivity.

Customers

For the four Phytocannabinoid-based products that are in the development phase, we have no customers and no revenue. For the electronic business we had 32 customers. For the hotel development business located in Malaysia we have one customer. For our equipment leasing business located in India we have seven customers all of whom are construction companies. One customer in Malaysia accounted for more than 42% of our revenue.

Growth and Expansion Strategy

Our growth and expansion strategy is to conduct medical trials on our four products, develop joint venture partners for marketing our products, and continue to develop new products for PTSD and depression. We currently do not expect to expand the real estate management or rental businesses.

Sales and Marketing

For phytocannabinoid-based therapies we have no sales or marketing. For the electronic business, that we have exited, our sales force was located in Hong Kong and China and the sales cycle lasted between one and two weeks. For the hotel development business, our sales force is located in Malaysia where we have one customer, and for our equipment leasing business our sales force is located in Kochi, India where the sales cycle lasts around two months.

Technology and Intellectual Property

We have intellectual property attorneys that file patents or provisional patent applications, copyright, trademark and trade secret laws of general applicability, employee confidentiality, and invention assignment agreements, and other intellectual property protection methods to safeguard our technology, research and development. We have applied for preliminary patents on phytocannabinoid-based therapies in the areas of pain management, medical refractory epilepsy, eating disorders and cachexia. The Company holds all rights to the patents that have been filed by us with the USPTO.

Employees and Consultants

As of March 31, 2017, we employed a work force of approximately 31 employees and contract workers in the United States, India and Malaysia. We have a total of 16 full-time employees with the rest being part-time, seasonal, or advisors that are highly qualified in their specific areas of expertise.

Governmental Regulations and Approvals

In the United States, 26 states, Guam, Puerto Rico and The District of Columbia have allowed (subject to licensing) the cultivation, processing and sale of cannabis. However, cannabis including certain phytocannabinoids derived from the plant, specifically the psychoactive compound Tetrahydrocannabinol (THC) and the non-psychoactive, medically useful compound Cannabidiol (CBD) are both considered to be Schedule 1 drugs under the Control Substances Act (CSA). The implication for us is that testing to determine drug efficacy and toxicity screening of our formulations in the US will require procedural registration and approval from the DEA and sourcing from the NIDA. For our products to be sold we would have to conduct FDA approved trials that will take between two and seven years. Regulatory approvals for applications in the veterinarian space are significantly shorter and this is an area that we are focused on.

Our business is impacted by government regulations surrounding the transfer of money to and from foreign countries. India, Malaysia, and China have strict foreign exchange regulations that make it difficult to move money in and out of these countries. Because we are a US based company we are subject to US laws that govern money laundering and this results in arduous amounts of paper work, delays, and extreme amounts of scrutiny, all of which are expensive.

Corporate History

In February 2007, we incorporated India Globalization Capital, Mauritius, Limited (“IGC-M”), a wholly-owned subsidiary, under the laws of Mauritius. In March 2008, we completed acquisitions of interests in two companies in India, Sricon Infrastructure Private Limited (“Sricon”) and Techni Bharathi Limited (“TBL”). Since March 31, 2013, we beneficially own 100% of TBL after completing the acquisition of the remaining 23.13% of TBL shares that were still owned by the founders of TBL. The 23.13% of TBL was acquired by IGC-MPL, which is a wholly-owned subsidiary of IGC-M. TBL shares are held by IGC-M. TBL is focused on the heavy equipment leasing business. In October 2014, pursuant to a Memorandum of Settlement with Sricon and related parties and in exchange for the 22% minority interest we had in Sricon, we received approximately five acres of prime land in Nagpur, India. The land is located a few miles from MIHAN, which is the largest development zone in terms of investment in India. The Company beneficially registered the land in its name on March 4, 2016.

In February 2009, IGC-M beneficially purchased 100% of IGC Mining and Trading Private Limited (“IGC-IMT”) based in Chennai, India. In July 2009, IGC-M beneficially purchased 100% of IGC Materials, Private Limited (“IGC-MPL”) and 100% of IGC Logistics, Private Limited (“IGC-LPL”) both based in Nagpur, India. Together, these companies conducted our iron ore, cement, aggregate, and other materials, trading, transport and delivery businesses.

In December 2011, we acquired a 95% equity interest in Linxi HeFei Economic and Trade Co., known as Linxi H&F Economic and Trade Co., a People’s Republic of China-based company (“PRC Ironman”), by acquiring 100% of the equity of H&F Ironman Limited, a Hong Kong company (“HK Ironman”). Together, PRC Ironman and HK Ironman are referred to as “Ironman.” In February 2015, IGC filed a lawsuit in the circuit court of Maryland, against 24 defendants related to the acquisition of Ironman, seeking to have the court order rescission of the underlying Acquisition Agreement and to void any past or future transfer of IGC shares. Between December 30, 2016 and February 24, 2017, IGC redeemed and subsequently retired as required by Maryland State law, approximately 2.4 million shares of IGC’s common stock issued in connection with its purchase of Ironman as a treasury stock transaction thus reducing IGC investment in Ironman to zero while still pursuing any and all legal avenues to recover as many of the originally issued shares of 3,150,000. The assets of Ironman are shown on the balance sheet of IGC for the fiscal year ended March 31, 2016 but not for fiscal year ended March 31, 2017. Please see the risk factor on Ironman and the financial Note 3 on the accounting impact on IGC’s balance sheet.

In January 2013, we incorporated IGC HK Mining and Trading Limited (“IGC-HK”) in Hong Kong. IGC-HK is a wholly owned subsidiary of IGC-M. In September 2014, we changed the subsidiary’s name to IGC Cleantech Ltd (“IGC-CT”). See Note 25 Subsequent Events for an update.

In May 2014, we completed the acquisition of 51% of the outstanding share capital of Golden Gate Electronics Limited (“Golden Gate”), a corporation organized and existing under the laws of Hong Kong and now known as IGC International (“IGC-INT”). IGC-INT, headquartered in Hong Kong, operates an e-commerce platform for the trading of commodities and electronic components. The purchase price of the acquisition consisted of up to 1,209,765 shares of our common stock, valued at approximately $1.05 million on the closing date of the acquisition. The terms of the Acquisition Agreement called for the delivery of 205,661 shares of IGC common stock at the signing of the Agreement and the remaining 1,004,094 shares were contingent on the electronics business meeting annual thresholds for revenue and profit through fiscal year ending on March 31, 2017. The contingent shares were not delivered because IGC International was unable to meet the targets. As of March 31, 2017, we exited the business. We retired 205,661 shares of common stock, and returned control of IGC International to the original owners. We also impaired the goodwill associated with the acquisition. We have no disputes with the initial principals of Golden Gate.

In June 2014, we entered into a partnership agreement with TerraSphere Systems LLC to develop multiple facilities to produce organic leafy green vegetables utilizing TerraSphere’s advanced pesticide-free organic indoor farming technology. Under the agreement, we will own 51% of each venture once production is operational, and will have a right of first refusal to participate in all future build-outs. Additionally, in consideration for our issuance of 50,000 shares of common stock, we received a seven-year option to purchase TerraSphere Systems for cash or additional shares of our common stock. In fiscal 2018, we expect to convert this investment into shares of a public Canadian company where assets including this project is being merged.

In December 2014, we entered into a Purchase Agreement with Apogee Financial Investments, Inc. (“Apogee”), the previous majority and sole owner of the outstanding membership interests of Midtown Partners & Co., LLC, a Florida limited liability company registered as a broker-dealer under the Securities Exchange Act of 1934 (“Midtown Partners”), to acquire 24.9% of the outstanding membership interests in Midtown Partners, and pursuant to certain conditions, subsequently 100%. In consideration of the initial membership interest of 24.9%, we issued 1,200,000 shares of our common stock, valued at approximately $888,000 in the name of Apogee.

In February 2016, we completed the acquisition of 100% of the outstanding share capital of Cabaran Ultima Sdn. Bhd., a corporation organized and existing under the laws of Malaysia (“Ultima”), from RGF Land Sdn. Bhd. (“Land”), the sole shareholder of Ultima, pursuant to the terms of a Share Purchase Agreement among the parties. Ultima holds 51% of RGF Cabaran Sdn. Bhd., which holds 75% of RGF Construction Sdn. Bhd. The purchase price of the acquisition consists of up to 998,571 shares of our common stock, valued at approximately $170 thousand on the closing date of the Share Purchase Agreement. Ultima is an international real estate project management company with expertise in (i) building agro-infrastructure for growing medicinal plants and botanical extraction, (ii) construction of high-end luxury complexes such as service apartments, luxury condominiums and hotels, and (iii) design management of other large-scale infrastructure.

In August 2016, we subscribed to 10% of Brilliant Hallmark, Sdn. Bhd. a corporation organized and existing under the laws of Malaysia (“Brilliant”). We paid 4,000,000 shares of common stock with a Fair Market Value of $1.880 million for the 10% stake in Brilliant that holds the exclusive rights to build a hotel and develop the property in Genting Malaysia. IGC had recourse to the land assets in the event of non-performance through a separate Tag Along Agreement dated August 1, 2016 between IGC on the one hand and RGF Land Sdn. Bhd., the shareholders of RGF Land Sdn. Bhd., and Brilliant on the other hand. Pursuant to the terms of the Share Subscription Agreement, Brilliant assigned, sold, and transferred to IGC 11 shares of Brilliant, which shares constituted 10% of the issued and outstanding shares of Brilliant. Likewise, as a consideration for the transaction, IGC issued to Brilliant the 4 million shares of its common stock. Please see Note 25 Subsequent Events for further information.

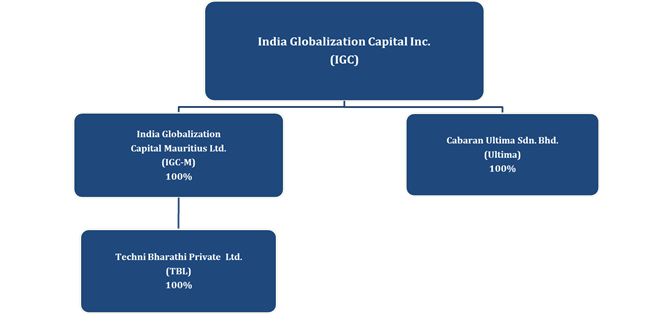

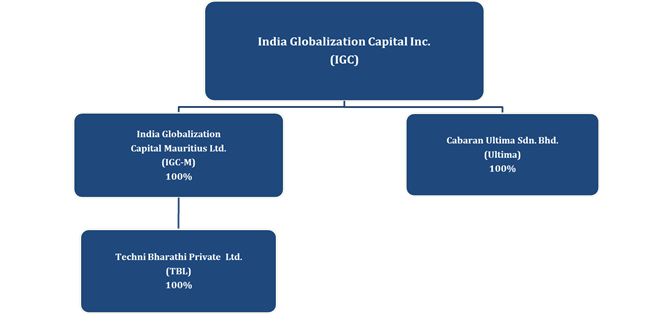

The following chart presents our Company’s direct and indirect consolidated operating subsidiaries.

Available Information

The Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are filed with the Securities and Exchange Commission (the “SEC”). The Company is subject to the informational requirements of the Exchange Act and files or furnishes reports, proxy statements and other information with the SEC. Such reports and other information filed by the Company with the SEC are available free of charge on the Company’s website at www.igcinc.us when such reports are available on the SEC’s website. The public may read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this filing. Further, the Company’s references to the URLs for these websites are intended to be inactive textual references only.

You should carefully consider the following risk factors, together with all of the other information included in this report in evaluating our company and our common stock. If any of the following risks and uncertainties develops into actual events, they could have a material adverse effect on our business, financial condition or results of operations. In that case, the trading price of our common stock and other securities also could be adversely affected. We make various statements in this section, which constitute “forward-looking statements.” See “Forward-Looking Statements.”

Risks Related to Our Business and Expansion Strategy

Our cannaceutical strategy and market capitalization makes it difficult to find accretive acquisitions and attract management.

Attracting management that understand the US regulatory environment, public company compliance, and is comfortable in the foreign countries we operate in is difficult. Finding them in acquired companies is even more difficult. The acquisitions we make will depend on our ability to identify suitable companies to acquire, to complete those acquisitions on terms that are acceptable to us and in the timeframes and within the budgets we expect, and to thereafter improve the results of operations of the acquired companies and successfully integrate their operations on an accretive basis. There can be no assurance that we will be successful in any or all of these steps.

We may be unable to continue to scale our operations, make acquisitions, or continue as a going concern if we do not successfully raise additional capital.

Building facilities, conducting research, and creating products from our formulations either in the pharmaceutical or CAM space require additional capital. If we are unable to successfully raise the capital we need we may need to reduce the scope of our businesses to fully satisfy our future short-term liquidity requirements. If we cannot raise additional capital or reduce the scope of our business, we may be otherwise unable to achieve our goals or continue our operations. We have incurred losses from operations in our prior years including the prior two fiscal years and have a lack of liquidity for expansion. While we believe that we will be able to raise the capital we need to continue our operations, there can be no assurance that we will be successful in these efforts or will be able to raise enough capital for planned expansion.

We have a history of operating losses and there can be no assurance that we can again achieve or maintain profitability.

Our short-term focus is to become profitable. However, there can be no guarantee that our efforts will be successful. Even if we again achieve profitability, given our dependence on foreign country GDP growth and macroeconomic factors, we may not be able to sustain profitability and our failure to do so would adversely affect our businesses, including our ability to raise additional funds.

We expect to acquire companies and we are subject to evolving and often expensive corporate governance regulations and requirements. Our failure to adequately adhere to these requirements, and comply with them with regard to acquired companies, some of which may be non-reporting entities, or the failure or circumvention of our controls and procedures could seriously harm our business and affect our status as a reporting company listed on a national securities exchange.

As a public reporting company whose shares are listed for trading on the NYSE MKT, we are subject to various regulations. Compliance with these evolving regulations is costly and requires a significant diversion of management time and attention, particularly with regard to our disclosure on controls and procedures and our internal control over financial reporting. As we have made and continue to make acquisitions in foreign countries, our internal controls and procedures may not be able to prevent errors or fraud in the future. We cannot guarantee that we can establish internal controls over financial reporting immediately on companies that we acquire. Thus, faulty judgments, simple errors or mistakes, or the failure of our personnel to enforce controls over acquired companies or to adhere to established controls and procedures, may make it difficult for us to ensure that the objectives of our control systems are met. A failure of our controls and procedures to detect other than inconsequential errors or fraud could seriously harm our ability to continue as a reporting company listed on a national securities exchange.

We have a limited senior management team size that may hamper our ability to effectively manage a publicly traded company and manage acquisitions and that may harm our business.

Since we operate in several foreign countries, we use consultants, including lawyers and accountants, to help us comply with regulatory requirements and public company compliance on a timely basis. As we expand, we expect to increase the size of our senior management. However, we cannot guarantee that in the interim period our senior management can adequately manage the requirements of a public company and the integration of acquisitions, and any failure to do so could lead to the imposition of fines, penalties, harm our business, status as a reporting company and our listing on the NYSE MKT.

We own 24.9% of Midtown Partners (MTP) and will be subject to risks associated with being a minority member of the LLC with limited control.

We own 24.9% of MTP and, therefore, the investment will subject us to risks associated with being a minority member of the LLC with limited control. In addition to the specific risks associated with the minority investment in Midtown Partners, we will be subject to general acquisition-related risks discussed more generally in these “Risk Factors.”

Our expansion is dependent on laws pertaining to the legal cannabis industry.

We expect to acquire companies and hire management in the areas that we have identified. These include, among others, bio-pharmaceuticals with a focus on capitalizing on specific niches within these areas such as phytocannabinoid-based therapies. Entry into any of these areas requires special knowledge of the industry and products. In the event that we are perceived to be entering the legal cannabis sector, even indirectly or remotely, we could be subject to increased scrutiny by regulators because, among other things, marijuana is a Schedule-1 controlled substance and is illegal under federal law. Our failure to adequately manage the risk associated with these businesses and adequately manage the requirements of the regulators can adversely affect our business, our status as a reporting company and our listing on the NYSE MKT. Further, any adverse pronouncements from regulators about businesses related to the legal cannabis sector could adversely affect our stock price if we are perceived to be in a company in the cannabis sector.

Our company is in a very new and highly regulated industry. Significant and unforeseen changes in policy may have material impacts on our business.

Continued development in the phytocannabinoids industry is dependent upon continued state legislative authorization of cannabis as well as legislation and regulatory policy at the federal level. The federal Controlled Substances Act currently makes cannabis use and possession illegal on a national level. While there may be ample public support for legislative authorization, numerous factors impact the legislative process. Any one of these factors could slow or halt use and handling of cannabis in the United States or in other jurisdictions, which would negatively impact our development of phytocannabinoid-based therapies and our ability to test and productize these therapies.

Many U.S. state laws are in conflict with the federal Controlled Substances Act. While we do not intend to distribute or sell cannabis in the United States, it is unclear whether regulatory authorities in the United States would object to the registration or public offering of securities in the United States by our company, to the status of our company as a reporting company, or even to investors investing in our company if we engage in legal cannabis production and supply pursuant to the laws and authorization of the jurisdiction where the activity takes place. In addition, the status of cannabis under the Controlled Substances Act may have an adverse effect on federal agency approval of pharmaceutical use of phytocannabinoid products. Any such objection or interference could delay indefinitely or increase substantially the costs to access the equity capital markets, test our therapies, or create products from these phytocannabinoid based therapies.

Banks and clearing houses may make it difficult for us to trade and clear our stock because they believe we are in the cannabis industry.

Continued development of the cannabis industry is dependent upon continued legislative authorization of cannabis. While there may be ample public support for legislative authorization, numerous factors impact the legislative process. Additionally, many U.S. state laws are in conflict with the federal Controlled Substances Act, which makes cannabis use and possession illegal on a national level. While we do not intend to harvest, distribute or sell cannabis in the United States, our presence in the pharmaceutical space can be misunderstood as being in the sale and distribution part of the cannabis industry. This could lead banks, regulators and others to mislabel our company. As such our stock could suffer if investors are unable to deposit their shares with a broker dealer and have those share clear.

Our business is dependent on continuing relationships with clients and strategic partners.

Our business requires developing and maintaining strategic alliances with contractors that undertake turnkey contracts for infrastructure development projects and with government organizations. The business and our results could be adversely affected if we are unable to maintain continuing relationships and pre-qualified status with key clients and strategic partners.

Currency fluctuations may reduce our assets and profitability.

We have assets located in foreign countries that are valued in foreign currencies. Fluctuation of the U.S. Dollar relative to the foreign currency may adversely affect our assets and profit.

Our business relies heavily on our management team and any unexpected loss of key officers may adversely affect our operations.

The continued success of our business is largely dependent on the continued services of our key employees. The loss of the services of certain key personnel, without adequate replacement, could have an adverse effect on our performance. Our senior management, as well as the senior management of our subsidiaries, plays a significant role in developing and executing the overall business plan, maintaining client relationships, proprietary processes and technology. While no one is irreplaceable, the loss of the services of any would be disruptive to our business.

Our quarterly revenue, operating results and profitability will vary.

Factors that may contribute to the variability of quarterly revenue, operating results or profitability include:

|

·

|

Fluctuations in revenue due to seasonality of the market place, which results in uneven revenue and operating results over the year;

|

|

·

|

Additions and departures of key personnel; and

|

|

·

|

Strategic decisions made by us and our competitors, such as acquisitions, divestitures, spin-offs, joint ventures, strategic investments and changes in business strategy.

|

We may not successfully register the provisional patents with the United States Patent and Trademark Office

We have filed six provisional patents with the United States Patent and Trademark Office (“USPTO”), in the combination therapy space, for the indications of pain, medical refractory epilepsy, eating disorders, and cachexia as part of our intellectual property strategy focused on the phytocannabinoid-based health care industry. There is no guarantee that our applications will result in a successful registration with the USPTO. If we are unsuccessful in registering patents, our ability to create a valuable line of products can be adversely affected. This in turn may have a material and adverse impact on the trading price of our common stock.

Risks Related to Ownership of Our Common Stock

Future sales of common stock by us could cause our stock price to decline and dilute your ownership in our company.

There are currently 11,656,668 outstanding public warrants to purchase 1,165, 667 shares of our common stock at an exercise price of $50.00 a share. In addition, we have outstanding 831,768 private warrants to buy 83,176 shares of common stock at an exercise price of $9.0, expiring on December 8, 2017. We also have outstanding 160,000 private options, expiring on October 31, 2023, with an exercise price of $0.10 per share. We are not restricted from issuing additional shares of our common stock or preferred stock, including any securities that are convertible into or exchangeable for, or that represent the right to receive, common stock or preferred stock or any substantially similar securities. The market price of our common stock could decline as a result of sales of a large number of shares of our common stock by us in the market or the perception that such sales could occur. If we raise funds by issuing additional securities in the future or the outstanding warrants or stock options to purchase our common stock are exercised, the newly-issued shares will also dilute your percentage ownership in our company.

The market price for our common stock may be volatile.

The trading volume in our common stock may fluctuate and cause significant price variations to occur. Fluctuations in our stock price may not be correlated in a predictable way to our performance or operating results. Our stock price may fluctuate as a result of a number of events and factors such as those described elsewhere in this “Risk Factors” section, events described in this report, and other factors that are beyond our control. In addition, the stock market, in general, has historically experienced significant price and volume fluctuations. Our common stock has also been volatile, with our 52-week price range being at a low of $0.19 and a high of $0.80 per share. These fluctuations are often unrelated to the operating performance of particular companies. These broad market fluctuations may cause declines in the market price of our common stock. In addition, it is possible, given our current trading price, that we may fail to comply with the minimum trading price required to trade our shares on the NYSE Market.

Our publicly-filed reports are subject to review by the SEC, and any significant changes or amendments required as a result of any such review may result in material liability to us and may have a material adverse impact on the trading price of our common stock.

The reports of publicly-traded companies are subject to review by the SEC from time to time for the purpose of assisting companies in complying with applicable disclosure requirements, and the SEC is required to undertake a comprehensive review of a company’s reports at least once every three years under the Sarbanes-Oxley Act of 2002. SEC reviews may be initiated at any time. We could be required to modify, amend or reformulate information contained in prior filings as a result of an SEC review, as well as state in filings that we have inadequate control or expertise over financial reporting. Any modification, amendment or reformulation of information contained in such reports could be significant and result in material liability to us and have a material and adverse impact on the trading price of our common stock.

We do not anticipate declaring any cash dividends on our common stock.

We have never declared or paid cash dividends on our common stock and do not plan to pay any cash dividends in the near future. Our current policy is to retain all funds and earnings for use in the operation and expansion of our business. In addition, the terms of our debt agreement prohibit the payment of cash dividends or other distributions on any of our capital stock except dividends payable in additional shares of capital stock.

Maryland anti-takeover provisions and certain anti-takeover effects of our Charter and Bylaws may inhibit a takeover at a premium price that may be beneficial to our stockholders.

Maryland anti-takeover provisions and certain anti-takeover effects of our charter and bylaws may be utilized, under some circumstances, as a method of discouraging, delaying or preventing a change of control of our company at a premium price that would be beneficial to our stockholders. For more detailed information about these provisions, please see “Anti-takeover Law, Limitations of Liability and Indemnification” as following.

Business Combinations. Under the Maryland General Corporation Law, some business combinations, including a merger, consolidation, share exchange or, in some circumstances, an asset transfer or issuance or reclassification of equity securities, are prohibited for a period of time and require an extraordinary vote. These transactions include those between a Maryland corporation and the following persons (a “Specified Person”):

| · |

an interested stockholder, which is defined as any person (other than a subsidiary) who beneficially owns 10% or more of the corporation’s voting stock, or who is an affiliate or an associate of the corporation who, at any time within a two-year period prior to the transaction, was the beneficial owner of 10% or more of the voting power of the corporation’s voting stock; or

|

| · |

an affiliate of an interested stockholder.

|

A person is not an interested stockholder if the board of directors approved in advance the transaction by which the person otherwise would have become an interested stockholder. The board of directors of a Maryland corporation also may exempt a person from these business combination restrictions prior to the time the person becomes a Specified Person and may provide that its exemption be subject to compliance with any terms and conditions determined by the board of directors. Transactions between a corporation and a Specified Person are prohibited for five years after the most recent date on which such stockholder becomes a Specified Person. After five years, any business combination must be recommended by the board of directors of the corporation and approved by at least 80% of the votes entitled to be cast by holders of voting stock of the corporation and two-thirds of the votes entitled to be cast by holders of shares other than voting stock held by the Specified Person with whom the business combination is to be effected, unless the corporation’s stockholders receive a minimum price as defined by Maryland law and other conditions under Maryland law are satisfied.

A Maryland corporation may elect not to be governed by these provisions by having its board of directors exempt various Specified Persons, by including a provision in its charter expressly electing not to be governed by the applicable provision of Maryland law or by amending its existing charter with the approval of at least 80% of the votes entitled to be cast by holders of outstanding shares of voting stock of the corporation and two-thirds of the votes entitled to be cast by holders of shares other than those held by any Specified Person. Our Charter does not include any provision opting out of these business combination provisions.

Control Share Acquisitions. The Maryland General Corporation Law also prevents, subject to exceptions, an acquirer who acquires sufficient shares to exercise specified percentages of voting power of a corporation from having any voting rights except to the extent approved by two-thirds of the votes entitled to be cast on the matter not including shares of stock owned by the acquiring person, any directors who are employees of the corporation and any officers of the corporation. These provisions are referred to as the control share acquisition statute.

The control share acquisition statute does not apply to shares acquired in a merger, consolidation or share exchange if the corporation is a party to the transaction, or to acquisitions approved or exempted prior to the acquisition by a provision contained in the corporation’s charter or bylaws. Our Bylaws include a provision exempting us from the restrictions of the control share acquisition statute, but this provision could be amended or rescinded either before or after a person acquired control shares. As a result, the control share acquisition statute could discourage offers to acquire our common stock and could increase the difficulty of completing an offer.

Board of Directors. The Maryland General Corporation Law provides that a Maryland corporation which is subject to the Exchange Act and has at least three outside directors (who are not affiliated with an acquirer of the company) under certain circumstances may elect by resolution of the board of directors or by amendment of its charter or bylaws to be subject to statutory corporate governance provisions that may be inconsistent with the corporation’s charter and bylaws. Under these provisions, a board of directors may divide itself into three separate classes without the vote of stockholders such that only one-third of the directors are elected each year. A board of directors classified in this manner cannot be altered by amendment to the charter of the corporation. Further, the board of directors may, by electing to be covered by the applicable statutory provisions and notwithstanding the corporation’s charter or bylaws:

| · |

provide that a special meeting of stockholders will be called only at the request of stockholders entitled to cast at least a majority of the votes entitled to be cast at the meeting,

|

| · |

reserve for itself the right to fix the number of directors,

|

| · |

provide that a director may be removed only by the vote of at least two-thirds of the votes entitled to be cast generally in the election of directors, and

|

| · |

retain for itself sole authority to fill vacancies created by an increase in the size of the board or the death, removal or resignation of a director.

|

In addition, a director elected to fill a vacancy under these provisions serves for the balance of the unexpired term instead of until the next annual meeting of stockholders. A board of directors may implement all or any of these provisions without amending the charter or bylaws and without stockholder approval. Although a corporation may be prohibited by its charter or by resolution of its board of directors from electing any of the provisions of the statute, we have not adopted such a prohibition. We have adopted a staggered board of directors with three separate classes in our charter and given the board the right to fix the number of directors, but we have not prohibited the amendment of these provisions. The adoption of the staggered board may discourage offers to acquire our common stock and may increase the difficulty of completing an offer to acquire our stock. If our Board chose to implement the statutory provisions, it could further discourage offers to acquire our common stock and could further increase the difficulty of completing an offer to acquire our common stock.

Effect of Certain Provisions of our Charter and Bylaws. In addition to the Charter and Bylaws provisions discussed above, certain other provisions of our Bylaws may have the effect of impeding the acquisition of control of our company by means of a tender offer, proxy fight, open market purchases or otherwise in a transaction not approved by our Board of Directors. These provisions of Bylaws are intended to reduce our vulnerability to an unsolicited proposal for the restructuring or sale of all or substantially all of our assets or an unsolicited takeover attempt, which our Board believes is otherwise unfair to our stockholders. These provisions, however, also could have the effect of delaying, deterring or preventing a change in control of our company.

Our Bylaws provide that with respect to annual meetings of stockholders, (i) nominations of individuals for election to our Board of Directors and (ii) the proposal of business to be considered by stockholders may be made only pursuant to our notice of the meeting, by or at the direction of our Board of Directors, or by a stockholder who is entitled to vote at the meeting and has complied with the advance notice procedures set forth in our Bylaws.

Special meetings of stockholders may be called only by the chief executive officer, the board of directors or the secretary of our company (upon the written request of the holders of a majority of the shares entitled to vote). At a special meeting of stockholders, the only business that may be conducted is the business specified in our notice of meeting. With respect to nominations of persons for election to our Board of Directors, nominations may be made at a special meeting of stockholders only pursuant to our notice of meeting, by or at the direction of our Board of Directors, or if our Board of Directors has determined that directors will be elected at the special meeting, by a stockholder who is entitled to vote at the meeting and has complied with the advance notice procedures set forth in our Bylaws.

These procedures may limit the ability of stockholders to bring business before a stockholders meeting, including the nomination of directors and the consideration of any transaction that could result in a change in control and that may result in a premium to our stockholders.

Risk Related to Our Securities

Our accounting personnel may make unintentional errors.

For most of the fiscal year ended March 31, 2017, our accounting personnel were located in China, Hong Kong, India, Malaysia and the United States, primarily near our businesses. As at March 31, 2017, our accounting personnel are in India, Malaysia, and the U.S. Even a small mistake, given our small size, in the preparation of financial statements and the maintenance of our books and records in accordance with U.S. GAAP, and SEC rules and regulations, could constitute a material weakness in our internal controls over financial reporting unless rectified. For more information, please see Item 9A, “Controls and Procedures.”

We incur costs as a result of operating as a public company. Our management is required to devote substantial time to compliance initiatives. Because we report in U.S. GAAP, we may experience delays in closing our books and records, and delays in the preparation of financial statements and related disclosures.

As part of a public company with operations in foreign countries, we experience increased legal, accounting and other expenses. Our management and other personnel need to devote a substantial amount of time to these compliance initiatives. We do not foresee a problem other than delays in the preparations of financial statements and related disclosures and our liberal use of the routine extensions for filing deadlines automatically granted by the SEC.

FORWARD-LOOKING STATEMENTS AND IMPORTANT FACTORS

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. This report and the documents incorporated in this report by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Additionally, we or our representatives may, from time to time, make other written or verbal forward-looking statements. In this report and the documents incorporated by reference, we discuss plans, expectations and objectives regarding our business, financial condition and results of operations. Without limiting the foregoing, statements that are in the future tense, and all statements accompanied by terms such as “believe,” “project,” “expect,” “trend,” “estimate,” “forecast,” “assume,” “intend,” “plan,” “target,” “anticipate,” “outlook,” “preliminary,” “will likely result,” “will continue” and variations of them and similar terms are intended to be “forward-looking statements” as defined by federal securities laws. We caution you not to place undue reliance on forward-looking statements, which are based upon assumptions, expectations, plans and projections. Forward-looking statements are subject to risks and uncertainties, including those identified in the “Risk Factors” included in this report and in the documents incorporated by reference that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements speak only as of the date when they are made. Except as required by federal securities law, we do not undertake any obligation to update forward-looking statements to reflect events, circumstances, changes in expectations or the occurrence of unanticipated events after the date of those statements. We intend that all forward-looking statements made will be subject to safe harbor protection of the federal securities laws pursuant to Section 27A of the Securities Act and Section 21E of the Exchange Act.

Forward-looking statements are based upon, among other things, our assumptions with respect to:

| · |

our ability to successfully register patents, create and market new products and services, including but not limited to real estate in Malaysia, leasing products in India, and achieve customer acceptance in the industries we serve;

|

| · |

our ability to accurately predict the future demand for our products and services;

|

| · |

competition in using phytocannabinoids for pharmaceutical and nutraceutical therapies;

|

| · |

federal and state legislation and administrative policy regulating phytocannabinoids;

|

| · |

our ability (based in part on regulatory concerns) to build and or lease facilities for vertical farming that can eventually be used by us to produce pharmaceutical grade phytocannabinoids;

|

| · |

our ability to obtain and protect patents for the use of phytocannabinoids;

|

| · |

our ability to enter into new licenses and contracts, and perform them successfully;

|

| · |

current and future economic and political conditions, in specifically but not limited to North America, Malaysia, and India; and

|

| · |

other assumptions described in this prospectus supplement underlying or relating to any forward-looking statements.

|

You should consider the limitations on, and risks associated with, forward-looking statements and not unduly rely on the accuracy of predictions contained in such forward-looking statements. As noted above, these forward-looking statements speak only as of the date when they are made. Moreover, in the future, we may make forward-looking statements through our senior management that involve the risk factors and other matters described in this report, as well as other risk factors subsequently identified, including, among others, those identified in our filings with the SEC in our quarterly reports on Form 10-Q and our current reports on Form 8-K.

Item 1B. Unresolved Staff Comments

None.

Our offices are located in Maryland and Washington State. Our back office is located at TBL’s headquarters in Kochi, India. In addition, we have an office in Nagpur, India. IGC International was located in Hong Kong. PRC Ironman was in Linxi, Inner Mongolia, PRC. Cabaran Ultima is located in Kuala Lumpur, Malaysia.

We pay an affiliate of our CEO $4,500 per month for office space and certain general and administrative services rendered in Maryland. In addition, we pay another affiliate of our CEO $6,100 per month for office and facilities in Washington State. We believe, based on rents and fees for similar services in the Washington, D.C. metropolitan area, and Washington State that the fee charged by the affiliates are at least as favorable as we could have obtained from an unaffiliated third party and these payments are not considered or meant to be compensation. The rental agreement for the Maryland location is on a month-to-month basis and may be terminated by our Board of Directors of the Company at any time without notice. The rental agreement for Washington State facilities expires on December 31, 2017, unless renewed by mutual consent. During fiscal year ended March 31, 2017, the total rent paid to the affiliates were $54,000 for the office space (and services) in Maryland, and $73,200 for the facilities in Washington State. We expect that these expenses will remain at approximately this level during the fiscal year ending March 31, 2018.

In India we have real estate that we may develop. However, we are not involved in real estate mortgages, or securities of or interests in persons primarily engaged in real estate activities. In fiscal 2017, our company operated through its subsidiaries in India, Hong Kong and Malaysia. In India and in the U.S. we lease housing (apartments, and homes) to host staff members for an aggregate annual rental of $17,000.

In fiscal 2017, in India we were involved in renting heavy machinery. Our subsidiary IGC-MPL owns an office space of about 1,500 sq. feet. The office space was acquired in 2010 is located in Nagpur, India, and has an approximate gross value of $53,971. Our subsidiary TBL has an apartment located in Cochin, India with an approximate gross value of $64,765.

PRC Ironman owned three beneficiation plants in Linxi, Inner Mongolia. The beneficiation plants consisted of buildings with a gross value of $1,003,000, plant and equipment with gross value of $4,993,000 and construction in progress with a gross value of $4,027,000 along with other assets such as office equipment, furniture, fixtures, computer equipment and vehicles. These plants have the capacity to beneficiate low-grade iron ore. These plants were not operational in the FYE 2016 or in FYE 2017.

The table below summarizes the nature of activity, type of license required and held and encumbrances in obtaining permit for each location where the company operated through its subsidiaries in the FYE 2017:

|

Location

|

|

Nature of Activity

|

|

Type of License Required

|

|

Type of License held

|

|

Encumbrances in Obtaining Permit

|

|

USA

|

|

Phytocannabinoid

development and facilities

|

|

General business, (DEA clearance, FDA approvals eventually required in the future)

|

|

General business licenses

|

|

In fiscal 2017, we did not apply for DEA permits or FDA approvals.

|

|

India

|

|

Rental of heavy equipment

|

|

General business license required

|

|

All appropriate business registrations with tax authorities in various states in India

|

|

There were no encumbrances in maintaining the license in fiscal 2017.

|

|

China

|

|

1. Beneficiation plant

2. Trading in iron ore

|

|

Permit to beneficiate

|

|

Business license to beneficiate iron ore and trade iron ore

|

|

There were no encumbrances in maintaining the license.

|

|

Hong Kong

|

|

Trading of electronic components

|

|

General business license

|

|

General business license

|

|

There were no encumbrances in maintaining the business license.

|

|

Malaysia

|

|

Real estate management

|

|

General business license to construct and manage real estate

|

|

General business license to construct and manage real estate

|

|

There were no encumbrances in maintaining the business license in fiscal 2017.

|

Item 3. Legal Proceedings

There are no material pending or threatened legal proceedings against IGC.

Item 4. Mine Safety Disclosures