fhlbdm-20231231FALSE2023-12-312023FY0001325814--12-31—X1001001009http://fasb.org/us-gaap/2022#InterestReceivablehttp://fasb.org/us-gaap/2022#InterestReceivableTRUETRUEhttp://fasb.org/us-gaap/2022#InterestReceivablehttp://fasb.org/us-gaap/2022#InterestReceivableTRUETRUEhttp://fasb.org/us-gaap/2022#InterestReceivablehttp://fasb.org/us-gaap/2022#InterestReceivablehttp://fasb.org/us-gaap/2022#InterestReceivablehttp://fasb.org/us-gaap/2022#InterestReceivableTRUETRUEP1D0000000000http://fasb.org/us-gaap/2022#InterestReceivablehttp://fasb.org/us-gaap/2022#InterestReceivable00http://fasb.org/us-gaap/2022#InterestReceivablehttp://fasb.org/us-gaap/2022#InterestReceivable0100013258142023-01-012023-12-3100013258142023-06-30iso4217:USD00013258142024-02-29xbrli:shares0001325814fhlbdm:WellsFargoBankNAMember2023-12-31xbrli:pure00013258142023-12-3100013258142022-12-3100013258142022-01-012022-12-3100013258142021-01-012021-12-310001325814fhlbdm:FairValueOptionElectionMemberfhlbdm:ConsolidatedObligationDiscountNotesMember2023-12-310001325814fhlbdm:FairValueOptionElectionMemberfhlbdm:ConsolidatedObligationDiscountNotesMember2022-12-310001325814us-gaap:CommonClassBMember2022-12-31iso4217:USDxbrli:shares0001325814us-gaap:CommonClassBMember2023-12-310001325814us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001325814us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-12-310001325814us-gaap:RetainedEarningsUnappropriatedMember2020-12-310001325814us-gaap:RetainedEarningsAppropriatedMember2020-12-310001325814us-gaap:RetainedEarningsMember2020-12-310001325814us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-3100013258142020-12-310001325814us-gaap:RetainedEarningsUnappropriatedMember2021-01-012021-12-310001325814us-gaap:RetainedEarningsAppropriatedMember2021-01-012021-12-310001325814us-gaap:RetainedEarningsMember2021-01-012021-12-310001325814us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001325814us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-01-012021-12-310001325814us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-12-310001325814us-gaap:RetainedEarningsUnappropriatedMember2021-12-310001325814us-gaap:RetainedEarningsAppropriatedMember2021-12-310001325814us-gaap:RetainedEarningsMember2021-12-310001325814us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100013258142021-12-310001325814us-gaap:RetainedEarningsUnappropriatedMember2022-01-012022-12-310001325814us-gaap:RetainedEarningsAppropriatedMember2022-01-012022-12-310001325814us-gaap:RetainedEarningsMember2022-01-012022-12-310001325814us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001325814us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-01-012022-12-310001325814us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001325814us-gaap:RetainedEarningsUnappropriatedMember2022-12-310001325814us-gaap:RetainedEarningsAppropriatedMember2022-12-310001325814us-gaap:RetainedEarningsMember2022-12-310001325814us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001325814us-gaap:RetainedEarningsUnappropriatedMember2023-01-012023-12-310001325814us-gaap:RetainedEarningsAppropriatedMember2023-01-012023-12-310001325814us-gaap:RetainedEarningsMember2023-01-012023-12-310001325814us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001325814us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-01-012023-12-310001325814us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310001325814us-gaap:RetainedEarningsUnappropriatedMember2023-12-310001325814us-gaap:RetainedEarningsAppropriatedMember2023-12-310001325814us-gaap:RetainedEarningsMember2023-12-310001325814us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31fhlbdm:bank0001325814fhlbdm:InterestBearingDepositsAndFederalFundsSoldMember2022-12-310001325814fhlbdm:InterestBearingDepositsAndFederalFundsSoldMember2023-12-310001325814fhlbdm:SecuritiesBorrowedOrPurchasedUnderAgreementsToResellMember2023-12-310001325814fhlbdm:SecuritiesBorrowedOrPurchasedUnderAgreementsToResellMember2022-12-310001325814us-gaap:USTreasurySecuritiesMember2023-12-310001325814us-gaap:USTreasurySecuritiesMember2022-12-310001325814us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001325814us-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001325814us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2023-12-310001325814us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2022-12-310001325814us-gaap:OtherDebtSecuritiesMember2023-12-310001325814us-gaap:OtherDebtSecuritiesMember2022-12-310001325814fhlbdm:OtherThanMortgageBackedSecuritiesMember2023-12-310001325814fhlbdm:OtherThanMortgageBackedSecuritiesMember2022-12-310001325814us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMembersrt:MultifamilyMember2023-12-310001325814us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMembersrt:MultifamilyMember2022-12-310001325814us-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001325814srt:SingleFamilyMemberfhlbdm:MortgageBackedSecuritiesOtherU.S.ObligationsMember2023-12-310001325814srt:SingleFamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2023-12-310001325814us-gaap:MortgageBackedSecuritiesMember2023-12-310001325814us-gaap:USStatesAndPoliticalSubdivisionsMember2022-12-310001325814srt:SingleFamilyMemberfhlbdm:MortgageBackedSecuritiesOtherU.S.ObligationsMember2022-12-310001325814srt:SingleFamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2022-12-310001325814us-gaap:MortgageBackedSecuritiesMember2022-12-310001325814us-gaap:AvailableforsaleSecuritiesMember2023-01-012023-12-310001325814us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310001325814us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2022-12-310001325814us-gaap:HeldtomaturitySecuritiesMember2023-01-012023-12-310001325814us-gaap:InterestBearingDepositsMember2023-12-310001325814us-gaap:InterestBearingDepositsMember2022-12-310001325814us-gaap:RepurchaseAgreementsMember2023-12-310001325814us-gaap:RepurchaseAgreementsMember2022-12-310001325814srt:MaximumMember2023-01-012023-12-310001325814srt:MinimumMember2023-01-012023-12-310001325814us-gaap:FederalHomeLoanBankAdvancesMember2023-12-310001325814us-gaap:FederalHomeLoanBankAdvancesMember2022-12-310001325814us-gaap:FederalHomeLoanBankAdvancesCallableOptionMember2023-12-310001325814us-gaap:FederalHomeLoanBankAdvancesCallableOptionMember2022-12-310001325814fhlbdm:WellsFargoBankNAMember2022-12-310001325814us-gaap:FinancialAssetPastDueMemberfhlbdm:FederalHomeLoanBankAdvancesReceivableMember2023-12-310001325814us-gaap:FinancialAssetPastDueMemberfhlbdm:FederalHomeLoanBankAdvancesReceivableMember2022-12-310001325814fhlbdm:FederalHomeLoanBankAdvancesReceivableMember2023-12-310001325814fhlbdm:FederalHomeLoanBankAdvancesReceivableMember2022-12-310001325814srt:SingleFamilyMemberfhlbdm:LoansReceivableWithFixedRatesOfInterestLongTermMember2023-12-310001325814srt:SingleFamilyMemberfhlbdm:LoansReceivableWithFixedRatesOfInterestLongTermMember2022-12-310001325814srt:SingleFamilyMemberfhlbdm:LoansReceivableWithFixedRatesOfInterestMediumTermMember2023-12-310001325814srt:SingleFamilyMemberfhlbdm:LoansReceivableWithFixedRatesOfInterestMediumTermMember2022-12-310001325814us-gaap:ResidentialPortfolioSegmentMember2023-12-310001325814us-gaap:ResidentialPortfolioSegmentMember2022-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:ConventionalLoanMember2023-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:ConventionalLoanMember2022-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:UsGovernmentAgencyInsuredLoansMember2023-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:UsGovernmentAgencyInsuredLoansMember2022-12-310001325814us-gaap:ConventionalLoanMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2023-12-310001325814us-gaap:FinancingReceivables60To89DaysPastDueMemberus-gaap:ConventionalLoanMember2023-12-310001325814fhlbdm:FinancingReceivables90to179DaysPastDueMemberus-gaap:ConventionalLoanMember2023-12-310001325814fhlbdm:FinancingReceivablesGreaterthan180DaysPastDueMemberus-gaap:ConventionalLoanMember2023-12-310001325814us-gaap:FinancialAssetPastDueMemberus-gaap:ConventionalLoanMember2023-12-310001325814us-gaap:FinancialAssetNotPastDueMemberus-gaap:ConventionalLoanMember2023-12-310001325814us-gaap:ConventionalLoanMember2023-12-310001325814us-gaap:ConventionalLoanMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2022-12-310001325814us-gaap:FinancingReceivables60To89DaysPastDueMemberus-gaap:ConventionalLoanMember2022-12-310001325814fhlbdm:FinancingReceivables90to179DaysPastDueMemberus-gaap:ConventionalLoanMember2022-12-310001325814fhlbdm:FinancingReceivablesGreaterthan180DaysPastDueMemberus-gaap:ConventionalLoanMember2022-12-310001325814us-gaap:FinancialAssetPastDueMemberus-gaap:ConventionalLoanMember2022-12-310001325814us-gaap:FinancialAssetNotPastDueMemberus-gaap:ConventionalLoanMember2022-12-310001325814us-gaap:ConventionalLoanMember2022-12-310001325814us-gaap:UsGovernmentAgencyInsuredLoansMember2023-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:ConventionalLoanMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:UsGovernmentAgencyInsuredLoansMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001325814us-gaap:UsGovernmentAgencyInsuredLoansMember2022-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:ConventionalLoanMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2022-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:UsGovernmentAgencyInsuredLoansMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2022-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2022-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:UsGovernmentAgencyInsuredLoansMember2023-12-310001325814us-gaap:ResidentialPortfolioSegmentMemberus-gaap:UsGovernmentAgencyInsuredLoansMember2022-12-310001325814us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-12-310001325814us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2022-12-310001325814us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2023-12-310001325814us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2022-12-310001325814us-gaap:MortgageBackedSecuritiesMemberus-gaap:ForwardContractsMemberus-gaap:NondesignatedMember2023-12-310001325814us-gaap:MortgageBackedSecuritiesMemberus-gaap:ForwardContractsMemberus-gaap:NondesignatedMember2022-12-310001325814us-gaap:MortgageReceivablesMemberus-gaap:ForwardContractsMemberus-gaap:NondesignatedMember2023-12-310001325814us-gaap:MortgageReceivablesMemberus-gaap:ForwardContractsMemberus-gaap:NondesignatedMember2022-12-310001325814us-gaap:NondesignatedMember2023-12-310001325814us-gaap:NondesignatedMember2022-12-310001325814us-gaap:InterestIncomeMemberfhlbdm:AdvancesMemberus-gaap:InterestRateContractMember2023-01-012023-12-310001325814us-gaap:InterestIncomeMemberus-gaap:AvailableforsaleSecuritiesMemberus-gaap:InterestRateContractMember2023-01-012023-12-310001325814fhlbdm:ConsolidatedObligationBondsMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateContractMember2023-01-012023-12-310001325814us-gaap:InterestIncomeMemberfhlbdm:AdvancesMemberus-gaap:InterestRateContractMember2022-01-012022-12-310001325814us-gaap:InterestIncomeMemberus-gaap:AvailableforsaleSecuritiesMemberus-gaap:InterestRateContractMember2022-01-012022-12-310001325814fhlbdm:ConsolidatedObligationBondsMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateContractMember2022-01-012022-12-310001325814us-gaap:InterestIncomeMemberfhlbdm:AdvancesMemberus-gaap:InterestRateContractMember2021-01-012021-12-310001325814us-gaap:InterestIncomeMemberus-gaap:AvailableforsaleSecuritiesMemberus-gaap:InterestRateContractMember2021-01-012021-12-310001325814fhlbdm:ConsolidatedObligationBondsMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateContractMember2021-01-012021-12-310001325814fhlbdm:AdvancesMember2023-12-310001325814us-gaap:AvailableforsaleSecuritiesMember2023-12-310001325814fhlbdm:ConsolidatedObligationBondsMember2023-12-310001325814fhlbdm:AdvancesMember2022-12-310001325814us-gaap:AvailableforsaleSecuritiesMember2022-12-310001325814fhlbdm:ConsolidatedObligationBondsMember2022-12-310001325814us-gaap:InterestRateSwapMember2023-01-012023-12-310001325814us-gaap:InterestRateSwapMember2022-01-012022-12-310001325814us-gaap:InterestRateSwapMember2021-01-012021-12-310001325814us-gaap:MortgageBackedSecuritiesMemberus-gaap:ForwardContractsMember2023-01-012023-12-310001325814us-gaap:MortgageBackedSecuritiesMemberus-gaap:ForwardContractsMember2022-01-012022-12-310001325814us-gaap:MortgageBackedSecuritiesMemberus-gaap:ForwardContractsMember2021-01-012021-12-310001325814us-gaap:MortgageReceivablesMemberus-gaap:ForwardContractsMember2023-01-012023-12-310001325814us-gaap:MortgageReceivablesMemberus-gaap:ForwardContractsMember2022-01-012022-12-310001325814us-gaap:MortgageReceivablesMemberus-gaap:ForwardContractsMember2021-01-012021-12-310001325814fhlbdm:NetInterestSettlementsMember2023-01-012023-12-310001325814fhlbdm:NetInterestSettlementsMember2022-01-012022-12-310001325814fhlbdm:NetInterestSettlementsMember2021-01-012021-12-310001325814fhlbdm:DerivativesNotDesignatedAsHedgingBeforePriceAlignmentMember2023-01-012023-12-310001325814fhlbdm:DerivativesNotDesignatedAsHedgingBeforePriceAlignmentMember2022-01-012022-12-310001325814fhlbdm:DerivativesNotDesignatedAsHedgingBeforePriceAlignmentMember2021-01-012021-12-310001325814fhlbdm:PriceAlignmentAmountMember2023-01-012023-12-310001325814fhlbdm:PriceAlignmentAmountMember2022-01-012022-12-310001325814fhlbdm:PriceAlignmentAmountMember2021-01-012021-12-310001325814us-gaap:OverTheCounterMember2023-12-310001325814us-gaap:ExchangeClearedMember2023-12-310001325814us-gaap:OverTheCounterMember2022-12-310001325814us-gaap:ExchangeClearedMember2022-12-310001325814fhlbdm:FhlbanksMember2023-12-310001325814fhlbdm:FhlbanksMember2022-12-310001325814us-gaap:ShortTermDebtMember2023-12-310001325814us-gaap:ShortTermDebtMember2022-12-310001325814fhlbdm:ConsolidatedObligationBondsMember2023-12-310001325814fhlbdm:NoncallableOrNonputableMember2023-12-310001325814fhlbdm:NoncallableOrNonputableMember2022-12-310001325814fhlbdm:CallableMember2023-12-310001325814fhlbdm:CallableMember2022-12-310001325814fhlbdm:EarlierofContractualMaturityorNextCallDateMember2023-12-310001325814fhlbdm:EarlierofContractualMaturityorNextCallDateMember2022-12-310001325814srt:MaximumMember2023-12-310001325814srt:MinimumMember2023-12-310001325814us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310001325814us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001325814us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-01-012021-12-310001325814us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001325814us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001325814us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001325814us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-12-310001325814us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001325814us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001325814us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001325814us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-12-310001325814us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310001325814us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001325814us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001325814us-gaap:FairValueInputsLevel1Member2023-12-310001325814us-gaap:FairValueInputsLevel2Member2023-12-310001325814us-gaap:FairValueInputsLevel3Member2023-12-310001325814us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001325814us-gaap:CarryingReportedAmountFairValueDisclosureMemberfhlbdm:ConsolidatedObligationDiscountNotesMember2023-12-310001325814us-gaap:FairValueInputsLevel1Memberfhlbdm:ConsolidatedObligationDiscountNotesMember2023-12-310001325814us-gaap:FairValueInputsLevel2Memberfhlbdm:ConsolidatedObligationDiscountNotesMember2023-12-310001325814us-gaap:FairValueInputsLevel3Memberfhlbdm:ConsolidatedObligationDiscountNotesMember2023-12-310001325814us-gaap:EstimateOfFairValueFairValueDisclosureMemberfhlbdm:ConsolidatedObligationDiscountNotesMember2023-12-310001325814fhlbdm:ConsolidatedObligationBondsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001325814fhlbdm:ConsolidatedObligationBondsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001325814us-gaap:FairValueInputsLevel2Memberfhlbdm:ConsolidatedObligationBondsMember2023-12-310001325814fhlbdm:ConsolidatedObligationBondsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001325814fhlbdm:ConsolidatedObligationBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001325814us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001325814us-gaap:FairValueInputsLevel1Member2022-12-310001325814us-gaap:FairValueInputsLevel2Member2022-12-310001325814us-gaap:FairValueInputsLevel3Member2022-12-310001325814us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001325814us-gaap:CarryingReportedAmountFairValueDisclosureMemberfhlbdm:ConsolidatedObligationDiscountNotesMember2022-12-310001325814us-gaap:FairValueInputsLevel1Memberfhlbdm:ConsolidatedObligationDiscountNotesMember2022-12-310001325814us-gaap:FairValueInputsLevel2Memberfhlbdm:ConsolidatedObligationDiscountNotesMember2022-12-310001325814us-gaap:FairValueInputsLevel3Memberfhlbdm:ConsolidatedObligationDiscountNotesMember2022-12-310001325814us-gaap:EstimateOfFairValueFairValueDisclosureMemberfhlbdm:ConsolidatedObligationDiscountNotesMember2022-12-310001325814fhlbdm:ConsolidatedObligationBondsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001325814fhlbdm:ConsolidatedObligationBondsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001325814us-gaap:FairValueInputsLevel2Memberfhlbdm:ConsolidatedObligationBondsMember2022-12-310001325814fhlbdm:ConsolidatedObligationBondsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001325814fhlbdm:ConsolidatedObligationBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2023-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasurySecuritiesMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001325814us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001325814us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001325814us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001325814us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001325814us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001325814us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberfhlbdm:MortgageBackedSecuritiesOtherU.S.ObligationsMember2023-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberfhlbdm:MortgageBackedSecuritiesOtherU.S.ObligationsMember2023-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberfhlbdm:MortgageBackedSecuritiesOtherU.S.ObligationsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberfhlbdm:MortgageBackedSecuritiesOtherU.S.ObligationsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2023-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2023-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMembersrt:MultifamilyMember2023-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMembersrt:MultifamilyMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel3Membersrt:MultifamilyMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMembersrt:MultifamilyMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel1Member2023-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel3Member2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MortgageReceivablesMember2023-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageReceivablesMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageReceivablesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageReceivablesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberfhlbdm:ConsolidatedObligationDiscountNotesMember2023-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberfhlbdm:ConsolidatedObligationDiscountNotesMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberfhlbdm:ConsolidatedObligationDiscountNotesMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberfhlbdm:FairValueOptionElectionMemberfhlbdm:ConsolidatedObligationDiscountNotesMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForwardContractsMember2023-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForwardContractsMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ForwardContractsMember2023-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2022-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasurySecuritiesMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001325814us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001325814us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001325814us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMembersrt:MultifamilyMember2022-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMembersrt:MultifamilyMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel3Membersrt:MultifamilyMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMembersrt:MultifamilyMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001325814us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001325814us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001325814us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberfhlbdm:MortgageBackedSecuritiesOtherU.S.ObligationsMember2022-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberfhlbdm:MortgageBackedSecuritiesOtherU.S.ObligationsMember2022-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberfhlbdm:MortgageBackedSecuritiesOtherU.S.ObligationsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberfhlbdm:MortgageBackedSecuritiesOtherU.S.ObligationsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2022-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2022-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel3Member2022-12-310001325814srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel1Member2022-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel3Member2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberfhlbdm:ConsolidatedObligationDiscountNotesMember2022-12-310001325814us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberfhlbdm:ConsolidatedObligationDiscountNotesMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberfhlbdm:ConsolidatedObligationDiscountNotesMember2022-12-310001325814us-gaap:FairValueMeasurementsRecurringMemberfhlbdm:FairValueOptionElectionMemberfhlbdm:ConsolidatedObligationDiscountNotesMember2022-12-310001325814us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001325814us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001325814fhlbdm:ConsolidatedObligationDiscountNotesMember2023-12-310001325814fhlbdm:ConsolidatedObligationDiscountNotesMember2022-12-310001325814us-gaap:StandbyLettersOfCreditMember2023-12-310001325814us-gaap:StandbyLettersOfCreditMember2022-12-310001325814us-gaap:FinancialStandbyLetterOfCreditMember2023-12-310001325814us-gaap:FinancialStandbyLetterOfCreditMember2022-12-310001325814us-gaap:MortgageReceivablesMemberus-gaap:ForwardContractsMember2023-12-310001325814us-gaap:MortgageReceivablesMemberus-gaap:ForwardContractsMember2022-12-310001325814fhlbdm:CommitmentsToIssueBondsMember2023-12-310001325814fhlbdm:CommitmentsToIssueBondsMember2022-12-310001325814fhlbdm:CommitmentstoIssueDiscountNotesMember2023-12-310001325814fhlbdm:CommitmentstoIssueDiscountNotesMember2022-12-310001325814us-gaap:LoanOriginationCommitmentsMember2023-12-310001325814us-gaap:LoanOriginationCommitmentsMember2022-12-310001325814fhlbdm:StandbyLettersOfCreditIssuanceCommitmentsMember2022-12-310001325814fhlbdm:StandbyLettersOfCreditIssuanceCommitmentsMember2023-12-31fhlbdm:Institutions0001325814srt:DirectorMember2023-12-310001325814srt:DirectorMember2022-12-310001325814srt:MinimumMemberus-gaap:StockholdersEquityTotalMemberfhlbdm:StockholdersCapitalStockOutstandingConcenetrationRiskMember2023-01-012023-12-310001325814fhlbdm:WellsFargoBankNAMember2023-01-012023-12-310001325814fhlbdm:SuperiorGuarantyInsuranceCompanyMember2023-12-310001325814fhlbdm:SuperiorGuarantyInsuranceCompanyMember2023-01-012023-12-310001325814us-gaap:PrincipalOwnerMember2023-12-310001325814us-gaap:PrincipalOwnerMember2023-01-012023-12-310001325814fhlbdm:WellsFargoBankNAMember2022-01-012022-12-310001325814fhlbdm:SuperiorGuarantyInsuranceCompanyMember2022-12-310001325814fhlbdm:SuperiorGuarantyInsuranceCompanyMember2022-01-012022-12-310001325814us-gaap:PrincipalOwnerMember2022-12-310001325814us-gaap:PrincipalOwnerMember2022-01-012022-12-310001325814us-gaap:StandbyLettersOfCreditMemberfhlbdm:WellsFargoBankNAMember2023-12-310001325814srt:FederalHomeLoanBankOfChicagoMember2022-12-310001325814srt:FederalHomeLoanBankOfChicagoMember2023-01-012023-12-310001325814srt:FederalHomeLoanBankOfChicagoMember2023-12-310001325814srt:FederalHomeLoanBankOfNewYorkMember2022-12-310001325814srt:FederalHomeLoanBankOfNewYorkMember2023-01-012023-12-310001325814srt:FederalHomeLoanBankOfNewYorkMember2023-12-310001325814srt:FederalHomeLoanBankOfSanFranciscoMember2022-12-310001325814srt:FederalHomeLoanBankOfSanFranciscoMember2023-01-012023-12-310001325814srt:FederalHomeLoanBankOfSanFranciscoMember2023-12-310001325814srt:FederalHomeLoanBankOfChicagoMember2021-12-310001325814srt:FederalHomeLoanBankOfChicagoMember2022-01-012022-12-310001325814srt:FederalHomeLoanBankOfSanFranciscoMember2021-12-310001325814srt:FederalHomeLoanBankOfSanFranciscoMember2022-01-012022-12-310001325814srt:FederalHomeLoanBankOfChicagoMember2020-12-310001325814srt:FederalHomeLoanBankOfChicagoMember2021-01-012021-12-310001325814srt:FederalHomeLoanBankOfBostonMember2022-12-310001325814srt:FederalHomeLoanBankOfBostonMember2023-01-012023-12-310001325814srt:FederalHomeLoanBankOfBostonMember2023-12-310001325814srt:FederalHomeLoanBankOfCincinnatiMember2022-12-310001325814srt:FederalHomeLoanBankOfCincinnatiMember2023-01-012023-12-310001325814srt:FederalHomeLoanBankOfCincinnatiMember2023-12-310001325814srt:FederalHomeLoanBankOfTopekaMember2022-12-310001325814srt:FederalHomeLoanBankOfTopekaMember2023-01-012023-12-310001325814srt:FederalHomeLoanBankOfTopekaMember2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | | | | | | | | | | |

| ☒ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2023

OR

| | | | | | | | | | | | | | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934 | |

Commission File Number: 000-51999

FEDERAL HOME LOAN BANK OF DES MOINES

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Federally chartered corporation of the United States | | 42-6000149 | |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification number) | |

| | | | |

| 909 Locust Street | | 50309 | |

| Des Moines, IA | | (Zip code) | |

| (Address of principal executive offices) | | | |

Registrant’s telephone number, including area code: (515) 412-2100

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

Securities registered pursuant to Section 12(g) of the Act: Class B Stock, par value $100

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ | | Non-accelerated filer | x | | Smaller reporting company | ☐ | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to 17 CFR 240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

Registrant’s stock is not publicly traded and is only issued to members of the registrant. Such stock is issued and redeemed at par value, $100 per share, subject to certain regulatory and statutory limits. At June 30, 2023, the aggregate par value of the stock held by current and former members of the registrant was $6,462,027,100. At February 29, 2024, 66,734,674 shares of stock were outstanding.

| | | | | | | | |

| Table of Contents |

| | |

| | |

| | |

Part I | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Part II | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Part III | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Part IV | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND DEFINITIONS

Statements contained in this report, including statements describing the objectives, projections, estimates, or future predictions in our operations, may be forward-looking statements. These statements may be identified by the use of forward-looking terminology, such as believes, projects, expects, anticipates, estimates, intends, strategy, plan, could, should, may, and will or their negatives or other variations on these terms. By their nature, forward-looking statements involve risk or uncertainty, and actual results could differ materially from those expressed or implied or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. As a result, you are cautioned not to place undue reliance on such statements. These risks and uncertainties include, but are not limited to, the following:

•political or economic events, including legislative, regulatory, monetary, judicial, or other developments that affect us, our members, our counterparties, and/or our investors in the consolidated obligations of the 11 FHLBanks, including the Finance Agency’s comprehensive review of the FHLBank System;

•the ability to meet capital and other regulatory requirements;

•competitive forces, including without limitation, other sources of funding available to our borrowers that could impact the demand for our advances, other entities purchasing mortgage loans in the secondary mortgage market, and other entities borrowing funds in the capital markets;

•reliance on a relatively small number of member institutions for a large portion of our advance business;

•member consolidations and failures;

•disruptions in the credit and debt markets and the effect on future funding costs, sources, and availability;

•general economic and market conditions that could impact the business we do with our members, including, but not limited to, the timing and volatility of market activity, inflation/deflation, employment rates, geopolitical instability or conflicts, housing market activity and housing prices, the level of mortgage prepayments, the valuation of pledged collateral, and the condition of the capital markets and the impact it has on our consolidated obligations;

•ineffective use of hedging strategies or the availability of derivative instruments in the types and quantities needed for risk management purposes from acceptable counterparties;

•the volatility of reported results due to changes in the fair value of certain assets, liabilities, and derivative instruments;

•risks related to the other FHLBanks that could trigger our joint and several liability for debt issued by the other FHLBanks;

•changes in the relative attractiveness of consolidated obligations due to actual or perceived changes in the FHLBanks’ credit ratings as well as the U.S. Government’s long-term credit rating;

•increases in delinquency or loss estimates on mortgage loans;

•the ability to develop and support internal controls, business processes, information systems, and other operating technologies that effectively manage the risks we face, including but not limited to, cyber-attacks, widespread health emergencies, and other business interruptions;

•significant business interruptions resulting from third-party failures;

•the volatility of credit quality, market prices, interest rates, and other factors that could affect the value of collateral held by us as security for borrower and counterparty obligations;

•the ability to attract and retain key personnel; and

•natural disasters, including those from significant climate change.

These forward-looking statements apply only as of the date they are made, and we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. A detailed discussion of the more important risks and uncertainties that could cause actual results and events to differ from such forward-looking statements is included under “Item 1A. Risk Factors.”

Throughout this Form 10-K, acronyms and terms used are defined in the Glossary of Terms. Unless the context otherwise requires, the terms “Bank,” “we,” “us,” and “our” refer to the Federal Home Loan Bank of Des Moines or its management.

PART I

ITEM 1. BUSINESS

OVERVIEW

The Bank is a federally chartered corporation that is exempt from all federal, state, and local taxation (except real property taxes and certain employer payroll taxes) and is one of 11 district FHLBanks. The FHLBanks are GSEs and were created under the authority of the FHLBank Act to serve the public by enhancing the availability of funds for residential mortgages and targeted community development. The Bank is regulated by the Finance Agency.

We are a cooperative, meaning we are owned by our customers, whom we call members. As a condition of membership, all members must purchase and maintain capital stock to support business activities with us. In return, we provide a readily available source of funding and liquidity to our member institutions and eligible housing associates in Alaska, Hawaii, Idaho, Iowa, Minnesota, Missouri, Montana, North Dakota, Oregon, South Dakota, Utah, Washington, Wyoming, and the U.S. Pacific territories of American Samoa, Guam, and the Commonwealth of the Northern Mariana Islands. Commercial banks, savings institutions, credit unions, insurance companies, and CDFIs may apply for membership. While not considered members, we also conduct certain business activities with state and local housing associates meeting statutory criteria.

BUSINESS MODEL

Our mission is to be a reliable provider of funding, liquidity, and services for our members so that they can meet the housing, business, and economic development needs of the communities they serve. In addition, we help to meet the economic and housing needs of our communities through our affordable housing and community investment initiatives. Our operating model balances the trade-off between attractively priced products, reasonable returns on capital stock, maintaining an adequate level of capital to meet regulatory capital requirements, and maintaining adequate retained earnings to preserve the par value of member-owned capital stock.

We are capitalized through the purchase of capital stock by our members. As a condition of membership, all of our members must purchase and maintain membership capital stock based on a percentage of their total assets as of the preceding December 31st subject to a cap of $10 million and a floor of $10,000. Each member is also required to purchase and maintain activity-based capital stock to support certain business activities with us. Member demand for our products expands and contracts with economic and market conditions. Our self-capitalizing capital structure, which allows us to repurchase or require additional capital stock based on member activity, provides us with the flexibility to effectively and efficiently meet the changing needs of our membership. While eligible to borrow, housing associates are not members and, as such, are not permitted to purchase capital stock.

Our capital stock is not publicly traded. It is purchased and redeemed by members or repurchased by us at a par value of $100 per share. Our current and former members own all of our outstanding capital stock. Former members own capital stock (included in MRCS) to support business transactions still outstanding with us. All stockholders, including current and former members, may receive dividends on their capital stock investment to the extent declared by our Board of Directors.

Our primary business activities are providing collateralized loans, known as advances, to members and housing associates and acquiring residential mortgage loans from our members. In addition, we maintain a portfolio of investments, all of which we believe are investment quality at the time of purchase. Our primary source of funding and liquidity is the issuance of debt securities, referred to as consolidated obligations, in the capital markets. Consolidated obligations are the joint and several obligations of all FHLBanks and are backed only by the financial resources of the FHLBanks. A critical component to the success of our operations is the ability to issue consolidated obligations regularly in the capital markets under a wide range of maturities, structures, and amounts, and at relatively favorable spreads to market interest rates.

Our net income is primarily attributable to the difference between the interest income we earn on our advances, mortgage loans, and investments, and the interest expense we pay on our consolidated obligations. A portion of our annual net income is used to fund our AHP, which provides grants and subsidized advances to members to support housing for very low-, low-, or moderate-income households. By regulation, we recognize AHP assessment expense equal to the greater of 10 percent of our annual income subject to assessment, or our prorated sum required to ensure the aggregate contribution by the FHLBanks is no less than $100 million for each year. For purposes of the statutory AHP assessment, income subject to assessment is defined as net income before AHP assessments, plus interest expense related to MRCS. In addition to our statutory AHP contributions, we engage in a variety of community investment initiatives to help meet the economic and housing needs of our communities. For additional details, refer to the “Affordable Housing and Community Investment” section of Item 1. We have risk management policies, established by our Board of Directors, that allow us to monitor and control our exposure to various risks, including interest rate, liquidity, credit, operational, model, information security, legal, regulatory and compliance, DEI, strategic, and reputational, as well as capital adequacy. Our primary risk management objective is to manage our assets and liabilities in ways that ensure liquidity is available to our members and protect the par redemption value of our capital stock. For additional information on our risk management practices, refer to “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Risk Management.”

MEMBERSHIP

Our membership includes commercial banks, savings institutions, credit unions, insurance companies, and CDFIs. The majority of depository institutions in our district that are eligible for membership are currently members.

The following table summarizes our membership by type of institution:

| | | | | | | | | | | | | | | | |

| | December 31, |

| Institutional Entity | | 2023 | | 2022 | | |

| Commercial banks | | 878 | | | 894 | | | |

| Savings institutions | | 31 | | | 32 | | | |

| Credit unions | | 270 | | | 257 | | | |

| Insurance companies | | 72 | | | 69 | | | |

| | | | | | |

| | | | | | |

| CDFIs | | 6 | | | 6 | | | |

| Total | | 1,257 | | | 1,258 | | | |

The following table summarizes our membership by asset size:

| | | | | | | | | | | | | | | | |

| | December 31, |

Membership Asset Size1 | | 2023 | | 2022 | | |

Depository institutions2 | | | | | | |

| Less than $100 million | | 16 | % | | 17 | % | | |

| $100 million to $500 million | | 46 | | | 47 | | | |

| Greater than $500 million | | 32 | | | 31 | | | |

| Insurance companies | | | | | | |

| | | | | | |

| $100 million to $500 million | | 1 | | | 1 | | | |

| Greater than $500 million | | 5 | | | 4 | | | |

| | | | | | |

| | | | | | |

| Total | | 100 | % | | 100 | % | | |

1 Membership asset size is based on the preceding September 30th financial information provided by members.

2 Depository institutions consist of commercial banks, savings institutions, credit unions, and CDFIs.

Our membership level remained relatively stable during 2023. At December 31, 2023, approximately 64 percent of our members were CFIs. For 2023, CFIs were defined under the FHLBank Act to include all FDIC insured institutions with average total assets over the previous three-year period of less than $1.4 billion. In addition to collateral types eligible for all members, CFIs may also pledge collateral consisting of secured small business, small agri-business, or small farm loans.

BUSINESS SEGMENTS

We manage our operations as one business segment. Management and our Board of Directors review enterprise-wide financial information in order to make operating decisions and assess performance.

PRODUCTS AND SERVICES

Advances

We carry out our mission primarily through lending funds, which we call advances, to our members and eligible housing associates (collectively, borrowers). Our advance products are designed to provide liquidity and help borrowers meet the credit needs of their communities while competing effectively in their markets. Borrowers generally use our advance products as sources of wholesale funding and general asset-liability management.

Our advance products currently offered include the following:

•Overnight Advances. These advances can renew automatically for a period up to 90 days. Interest rates are set daily.

•Fixed Rate Advances. These advances are available over a variety of terms in amortizing and non-amortizing structures. Using an amortizing advance, a borrower makes predetermined principal and interest payments at scheduled intervals throughout the term of the advance. Forward starting advances are a type of fixed rate non-amortizing advance with settlement dates up to two years in the future, allowing members to lock in an interest rate at the outset, while delaying the receipt of funding and principal and interest payments. Delayed amortizing advances are a type of fixed rate advance with a feature that delays commencement of the repayment of the principal up to five years, allowing members control over the principal cash flows and the repayment of the advance. Certain long-term fixed rate and amortizing advances contain a symmetrical prepayment feature. This feature allows borrowers to prepay an advance and potentially realize a gain if interest rates rise to a level greater than those existing when the advance was originated.

•Variable Rate Advances. These advances have interest rates that reset periodically to a specified interest rate index such as SOFR or to consolidated obligation yields.

•Callable Advances. These advances may be prepaid by borrowers on predetermined dates (call dates) without incurring a prepayment fee and therefore provide borrowers a source of long-term financing with prepayment flexibility. Callable advances can be either fixed or variable in nature. Variable rate callable advances may reset at different frequencies generally ranging from one to six months and are callable at each rate reset date. For certain variable rate callable advances, we retain the flexibility to adjust the spread relative to our cost of funds on each rate reset date. Fixed rate callable advances may have different call schedules based on member specifications, and principal balances may be amortizing in nature.

•Community Investment Advances. These advances are below-market rate funds used by borrowers in both eligible housing projects and community development. Interest rates on these advances represent our cost of funds plus a mark-up to cover our administrative expenses.

For the years ended December 31, 2023, 2022, and 2021, advances represented 65, 59, and 54 percent of our total average assets and generated 68, 63, and 56 percent of our total interest income. For additional information on our advances, including our top five borrowers, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Statements of Condition — Advances.” In addition, refer to “Item 1A. Risk Factors” for a discussion on our exposure to customer concentration risk.

COLLATERAL

We are required by regulation to obtain sufficient collateral to fully secure our advances, standby letters of credit, and other extensions of credit to borrowers (collectively, credit products). The estimated value of the collateral required to secure each borrower’s credit products is calculated by applying collateral discounts, or haircuts, to the unpaid principal balance or market value, as applicable, of the collateral.

Borrowers may pledge collateral to us by executing a blanket pledge agreement, specifically assigning collateral, or placing physical possession of collateral with us or our custodians. We perfect our security interest in all pledged collateral by filing Uniform Commercial Code financing statements or by taking possession or control of the collateral. Under the FHLBank Act, any security interest granted to us by our members, or any affiliates of our members, has priority over the claims and rights of any party (including any receiver, conservator, trustee, or similar party having rights of a lien creditor), unless those claims and rights would be entitled to priority under otherwise applicable law and are held by actual purchasers or by parties that have perfected security interests.

HOUSING ASSOCIATES

The FHLBank Act permits us to provide advances to eligible housing associates. Housing associates are eligible if they are approved mortgagees under Title II of the National Housing Act that meet certain criteria, including: (i) chartered under law and have succession, (ii) subject to inspection and supervision by some governmental agency, and (iii) lend their own funds as their principal activity in the mortgage field. The same regulatory lending requirements that apply to our members generally apply to housing associates. Because housing associates are not members, they are not subject to certain provisions of the FHLBank Act applicable to members and cannot own our capital stock. In addition, they may only pledge certain types of collateral including, but not limited to: (i) FHA mortgages, (ii) Ginnie Mae securities backed by FHA mortgages, (iii) certain residential mortgage loans, and (iv) cash deposited with us.

PREPAYMENT FEES

We generally charge a prepayment fee for advances that a borrower elects to terminate prior to the stated maturity or outside of a predetermined call date. The fees charged are priced to make us financially indifferent to the prepayment of the advance. For certain advances with symmetrical prepayment features, we may charge the borrower a prepayment fee or pay the borrower a prepayment credit, depending on certain circumstances, such as movements in interest rates, when the advance is prepaid.

Standby Letters of Credit

We may issue standby letters of credit on behalf of our members to support certain obligations of the members to third-party beneficiaries. Standby letters of credit may be offered to assist members and non-member housing associates in facilitating residential housing finance, community lending, and asset-liability management, and to provide liquidity. In particular, members often use standby letters of credit as collateral for deposits from federal and state government agencies. For additional details on our standby letters of credit, refer to “Item 8. Financial Statements and Supplementary Data — Note 14 — Commitments and Contingencies.” Mortgage Loans

We invest in mortgage loans through the MPF program, a secondary mortgage market structure developed by the FHLBank of Chicago to help fulfill the housing mission of the FHLBanks. In the past, we also acquired mortgage loans purchased under the MPP; however, we currently do not purchase mortgage loans under this program. For the years ended December 31, 2023, 2022, and 2021, mortgage loans represented five, seven, and nine percent of our total average assets and generated three, nine, and 24 percent of our total interest income.

Under the MPF program, we purchase eligible mortgage loans from members or housing associates called PFIs. We may also acquire MPF loans through participations with other FHLBanks. MPF loans are conforming conventional or government-insured fixed rate mortgage loans secured by one-to-four family residential properties.

The FHLBank of Chicago (in this capacity, the MPF Provider) provides the infrastructure and operational support for the MPF program and is responsible for publishing and maintaining the MPF Guides, which detail the requirements PFIs must follow in originating, selling, and servicing MPF loans. In exchange for providing these services, the MPF Provider receives a fee from each of the FHLBanks participating in the MPF program. The MPF Provider has engaged Computershare Limited as the master servicer for the MPF program. Throughout the servicing process, the master servicer monitors each PFI’s compliance with certain MPF program requirements and makes periodic reports to the MPF Provider.

Participating Financial Institutions

Our members and eligible housing associates must apply to become a PFI. In order to do MPF business with us, each member or eligible housing associate must meet certain eligibility standards and sign a PFI Agreement. The PFI Agreement provides the terms and conditions for the sale of MPF loans, including the servicing of MPF loans.

PFIs may either retain the servicing of MPF loans or sell the servicing to an approved third-party provider. If a PFI chooses to retain the servicing, it receives a servicing fee to manage the servicing activities. If a PFI chooses to sell the servicing rights to an approved third-party provider, the servicing is transferred concurrently with the sale of the MPF loans and a servicing fee is paid to the third-party provider.

MPF Loan Types

We currently offer MPF closed loan products in which we purchase loans acquired or originated by the PFI. In addition, we offer certain off-balance sheet loan products. MPF Xtra is an off-balance sheet loan product in which we assign 100 percent of our interest in PFI master commitments to the FHLBank of Chicago. The FHLBank of Chicago then purchases mortgage loans from our PFIs and sells MPF Xtra loans to Fannie Mae. MPF Government MBS is an off-balance sheet loan product where our PFIs sell government loans directly to the FHLBank of Chicago where they are pooled and securitized into Ginnie Mae MBS. Under these off-balance sheet products, we receive a small fee for our continued management of the PFI relationship.

The PFI performs all traditional retail loan origination functions on our MPF loan products. We are responsible for managing the interest rate risk and liquidity risk associated with the MPF loans we purchase and carry on our Statements of Condition. In order to limit our credit risk exposure to approximately that of an investor in an investment grade MBS, we require a credit risk sharing arrangement with the PFI on all MPF loans at the time of purchase.

MPF Loan Volume

Our member base for MPF loans is primarily a diverse mix of commercial banks and credit unions. Our ability to price MPF loans, coupled with changes in the interest rate environment, has allowed us to serve the liquidity needs of a broad range of members. During the years ended December 31, 2023, 2022, and 2021, we purchased $2.4 billion, $1.9 billion, and $1.9 billion of MPF loan products (excluding off-balance sheet loan products). In addition, during the years ended December 31, 2023, 2022, and 2021, we had off-balance sheet loan volumes of $0.3 billion, $0.7 billion, and $3.2 billion.

LOAN MODIFICATION PLANS

We offer loan modification plans for our PFIs. Under these plans, we generally reduce the interest rate, extend the maturity date, or permit the capitalization of past due amounts, escrow, or advance balances up to the original loan amount. We may also grant a forbearance period or offer payment deferrals in limited circumstances.

Investments

We maintain an investment portfolio primarily to provide liquidity as well as investment income. Our investment portfolio consists of both short- and long-term investments. Our short-term investments may include, but are not limited to, interest-bearing deposits, federal funds sold, securities purchased under agreements to resell, certificates of deposit, commercial paper, and U.S. Treasury obligations. Our long-term investments may include, but are not limited to, U.S. Treasury obligations, other U.S. obligations, GSE and TVA obligations, state or local housing agency obligations, taxable municipal bonds, and agency MBS. For the years ended December 31, 2023, 2022, and 2021, investments represented 29, 32, and 36 percent of our total average assets and generated 29, 28, and 20 percent of our total interest income.

Standby Bond Purchase Agreements

We currently hold standby bond purchase agreements with state housing finance agencies within our district pursuant to which, for a fee, we agree to serve as a standby liquidity provider if required, to purchase and hold the bonds until the designated marketing agent can find a suitable investor or the state housing finance agency repurchases the bonds according to a schedule established by the agreement. Each standby bond purchase agreement includes the provisions under which we would be required to purchase the bonds and typically allows the Bank to terminate the agreement upon the occurrence of a default event of the issuer. If purchased, the bonds would be classified as AFS or trading securities on our Statements of Condition. For additional details on our standby bond purchase agreements, refer to “Item 8. Financial Statements and Supplementary Data — Note 14 — Commitments and Contingencies.” Deposits

We accept uninsured deposits from our members, eligible housing associates, and/or counterparties. We offer deposit programs, including demand, overnight, and term deposits. Deposit programs provide us funding while providing members a low-risk, interest-earning asset.

Consolidated Obligations

Our primary source of funding and liquidity is the issuance of debt securities, referred to as consolidated obligations, in the capital markets. Consolidated obligations (bonds and discount notes) are the joint and several obligations of all FHLBanks and are backed only by the financial resources of the FHLBanks. They are not obligations of the U.S. Government, and the U.S. Government does not guarantee them. At February 29, 2024, S&P and Moody’s rated the consolidated obligations AA+/A-1+ with a stable outlook and Aaa/P-1 with a negative outlook. In addition, as of February 29, 2024, our consolidated obligations were rated AA+ with a stable outlook by Fitch Ratings.

The FHLBanks’ Office of Finance issues all consolidated obligations on behalf of the FHLBanks. It is also responsible for servicing all outstanding debt, coordinating transfers of debt between the FHLBanks, serving as a source of information for the FHLBanks on capital market developments, managing the FHLBank System’s relationship with the rating agencies with respect to consolidated obligations, and preparing and making available the FHLBank System’s Combined Financial Reports.

Although we are primarily responsible for the portion of consolidated obligations issued on our behalf, we are also jointly and severally liable with the other FHLBanks for the payment of principal and interest on all consolidated obligations. The Finance Agency, at its discretion, may require any FHLBank to make principal and/or interest payments due on any consolidated obligation, whether or not the primary obligor FHLBank has defaulted on the payment of that consolidated obligation. The Finance Agency has never exercised this discretionary authority.

To the extent that an FHLBank makes any payment on a consolidated obligation on behalf of another FHLBank, the paying FHLBank is entitled to reimbursement from the FHLBank otherwise responsible for the payment. However, if the Finance Agency determines that an FHLBank is unable to satisfy its obligations, then the Finance Agency may allocate the outstanding liability among the remaining FHLBanks on a pro-rata basis in proportion to each FHLBank’s participation in all consolidated obligations outstanding, or on any other basis that it may determine.

BONDS

Bonds are generally issued to satisfy our short-, intermediate-, and long-term funding needs. They may have maturities ranging up to 30 years, although there is no statutory or regulatory limitation as to their maturity. Bonds are issued with either fixed or variable rate payment terms, such as SOFR. To meet the specific needs of investors, both fixed and variable rate bonds may also contain certain embedded features, which result in complex coupon payment terms and/or call features. When bonds are issued on our behalf, we may concurrently enter into a derivative agreement to effectively convert the fixed rate payment stream to variable or to offset the embedded features in the bond.

Depending on the amount and type of funding needed, bonds may be issued through negotiated or competitively bid transactions with approved underwriters or selling group members (i.e., TAP Issue Program, auction, and Global Debt Program), or through debt transfers between FHLBanks.

The TAP Issue Program is used to issue fixed rate, non-callable bonds with maturities ranging up to 30 years. The goal of the TAP Issue Program is to aggregate frequent smaller bond issues into a larger bond issue that may have greater market liquidity.

An auction process is used to issue fixed rate, callable bonds. Auction structures are determined by the FHLBanks in consultation with the Office of Finance and the securities dealer community. We may receive zero to 100 percent of the proceeds of the bonds issued via the callable auction depending on (i) the amounts and costs for the bonds bid by underwriters, (ii) the maximum costs we or other FHLBanks participating in the same issue, if any, are willing to pay for the obligations, and (iii) the guidelines for allocation of bond proceeds among multiple participating FHLBanks administered by the Office of Finance.

The Global Debt Program allows the FHLBanks to diversify their funding sources to include overseas investors. Global Debt Program bonds may be issued in maturities ranging up to 30 years and can be customized with different terms and currencies. The FHLBanks approve the terms of the individual issues under the Global Debt Program.

DISCOUNT NOTES

Discount notes are generally issued to satisfy our short-term funding needs. They have maturities of up to one year and are offered daily through a discount note selling group and other authorized underwriters. Discount notes are generally sold at a discount and mature at par.

On a daily basis, we may request that specific amounts of discount notes with specific maturity dates be offered by the Office of Finance for sale through certain securities dealers. We may receive zero to 100 percent of the proceeds of the discount notes issued via this sales process depending on (i) the time of the request, (ii) the maximum costs we or other FHLBanks participating in the same issue, if any, are willing to pay for the discount notes, and (iii) the amount of orders for the discount notes submitted by dealers.

Twice weekly, we may request that specific amounts of discount notes with fixed maturities of four to 26 weeks be offered by the Office of Finance through competitive auctions conducted with securities dealers in the discount note selling group. One or more of the FHLBanks may also request that amounts of those same discount notes be offered for sale for their benefit through the same auction. The discount notes offered for sale through competitive auction are not subject to a limit on the maximum costs the FHLBanks are willing to pay. We may receive zero to 100 percent of the proceeds of the discount notes issued through a competitive auction depending on the amounts of the discount notes bid by underwriters and the guidelines for allocation of discount note proceeds among multiple participating FHLBanks administered by the Office of Finance.

Derivatives

We use derivatives to manage interest rate risk. Finance Agency regulations and our risk management policies establish guidelines for derivatives, prohibit the speculative use of derivatives, and limit credit risk arising from derivatives. The goal of our interest rate risk management strategy is not to eliminate interest rate risk, but to manage it within appropriate limits.

We can use interest rate swaps, swaptions, interest rate caps and floors, options, and future/forward contracts as part of our interest rate risk management strategies. These derivatives can be used as either a fair value hedge of a financial instrument or firm commitment or an economic hedge to manage certain defined risks. We use economic hedges primarily to (i) manage mismatches between the coupon features of our assets and liabilities, (ii) offset prepayment risk in certain assets, (iii) mitigate the income statement volatility that occurs when financial instruments are recorded at fair value and hedge accounting is not permitted by accounting guidance, or (iv) reduce exposure to reset risk.

CAPITAL AND DIVIDENDS

Capital Stock

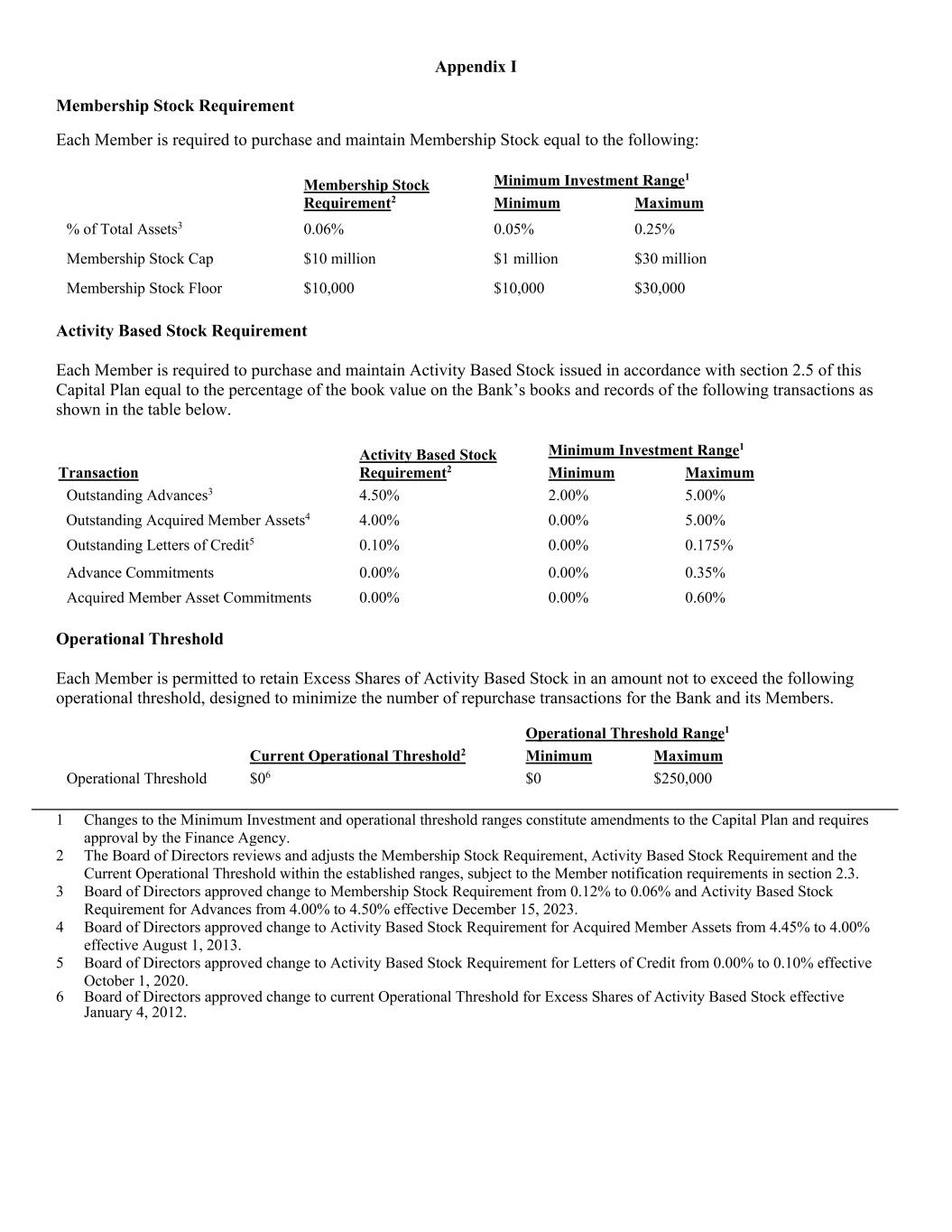

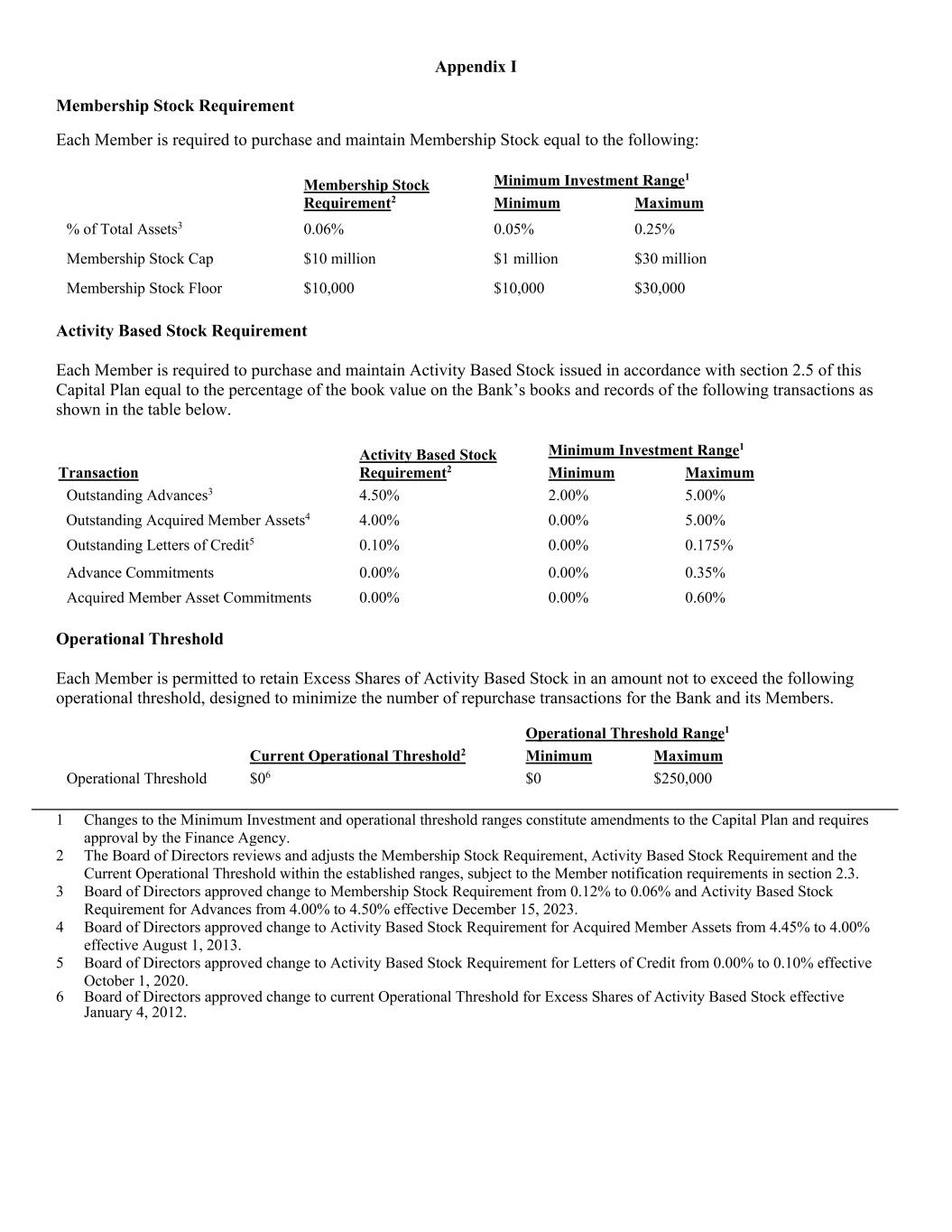

Our capital stock has a par value of $100 per share, and all shares are issued, redeemed, and repurchased only at the stated par value. We issue a single class of capital stock (Class B capital stock) and have two subclasses of Class B capital stock: membership and activity-based. Effective December 15, 2023, each member must purchase and hold membership capital stock in an amount equal to 0.06 percent of its total assets as of the preceding December 31st, subject to a cap of $10 million and a floor of $10,000. In addition, each member is required to purchase activity-based capital stock equal to 4.50 percent of its outstanding advances, 4.00 percent of its outstanding mortgage loans, and 0.10 percent of its outstanding standby letters of credit. Prior to December 15, 2023, members were required to purchase and hold membership capital stock in an amount equal to 0.12 percent of their total assets as of the preceding December 31st, subject to a cap of $10 million and a floor of $10,000. They were also required to purchase activity-based capital stock equal to 4.00 percent of their outstanding advances and mortgage loans and 0.10 percent of their outstanding standby letters of credit. All capital stock issued is subject to a notice of redemption period of five years.

The capital stock requirements established in our Capital Plan are designed so that we can remain adequately capitalized as member activity changes. Our Board of Directors may make adjustments to the capital stock requirements within ranges established in our Capital Plan.

Capital stock owned by members in excess of their investment requirement is deemed excess capital stock. Under our Capital Plan, we, at our discretion and upon 15 days written notice, may repurchase excess membership capital stock. We, at our discretion, may also repurchase excess activity-based capital stock to the extent that (i) the excess capital stock balance exceeds an operational threshold set forth in the Capital Plan, which is currently set at zero, or (ii) a member submits a notice to redeem all or a portion of the excess activity-based capital stock.

We reclassify capital stock subject to redemption from equity to a liability, which represents MRCS, when a member provides written notice of intention to withdraw from membership, becomes ineligible for continuing membership, or attains non-member status by merger or consolidation, charter termination, or other involuntary termination from membership. Dividends on MRCS are classified as interest expense on the Statements of Income.

Retained Earnings