UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to

Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☑ | | | Revised Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

☑ | | | No fee required. | |||

☐ | | | Fee paid previously with preliminary materials. | |||

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. | |||

| | | REVISED PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION DATED JULY 19, 2024 |

One Tribology Center

Oxford, Connecticut 06478

July [ ], 2024

To our stockholders:

You are cordially invited to attend the RBC Bearings Incorporated annual meeting of stockholders to be held at 9:00 a.m., local time, on Thursday, September 5, 2024 in Building B at our offices located at One Tribology Center, 102 Willenbrock Road, Oxford, CT 06478. The attached Notice of Annual Meeting and Proxy Statement describe all items that we currently expect to be acted upon by stockholders at the meeting.

It is important that your shares are represented at the annual meeting, whether or not you plan to attend. To ensure your shares will be represented, please vote your shares as soon as possible.

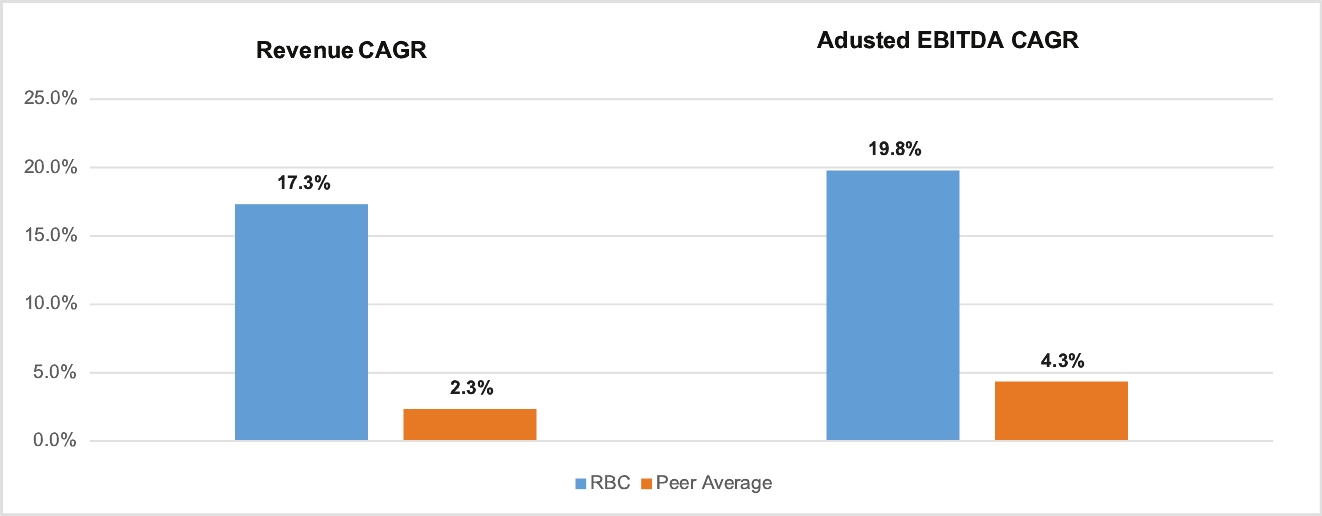

Fiscal 2024 marked another outstanding year for RBC with record revenues, gross margin, adjusted EBITDA and net income. We also generated a record level of free cash flow, which was used to further reduce our debt to a post-Dodge acquisition low. When viewed over a multi-year period, this resulted in a 5-year CAGR of 17.3% for net sales, 19.8% for adjusted EBITDA and 20.2% for free cash flow, more than delivering on RBC’s goal of being a double-digit compounder, and we’re poised to continue this growth in the future.

Your continued support of RBC is greatly appreciated. We look forward to seeing you at the annual meeting.

Sincerely,

Dr. Michael J. Hartnett

Chairman, President and Chief Executive Officer

| | |  | | | 2024 Proxy Statement | | | 01 |

Notice of 2024 Annual

Meeting of Stockholders

Thursday, September 5, 2024

9:00 a.m. Local Time

Building B

One Tribology Center

102 Willenbrock Road

Oxford, CT 06478

Purpose

The 2024 annual meeting of stockholders of RBC Bearings Incorporated will be held in Building B at our executive offices at One Tribology Center, 102 Willenbrock Road, Oxford, CT 06478, on Thursday, September 5, 2024, beginning at 9:00 a.m. local time. At the meeting, the holders of the Company’s outstanding common stock will consider and vote on the following matters:

1. | election of three directors in Class II to serve a term of three years; |

2. | ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2025; |

3. | approval of an amendment to our certificate of incorporation eliminating personal liability of officers for monetary damages for breach of their fiduciary duty of care as officers; |

4. | approval, on a non-binding advisory basis, of the compensation of our named executive officers; and |

5. | any other matter that may properly come before the meeting or any adjournment or postponement thereof. |

Stockholders of record at the close of business on July 9, 2024 are entitled to notice of and to vote at the annual meeting and at any postponements or adjournments thereof. The directions to the meeting can be found in Appendix A of the attached proxy statement.

Your Vote is Important

Whether or not you plan to attend the meeting, please vote your shares. You can find voting instructions in the proxy statement or in the materials you received for the meeting. Any person voting by proxy has the power to revoke it, at any time prior to its exercise at the meeting, in accordance with the procedures described in the attached proxy statement.

If You Plan to Attend

Please note that space limitations make it necessary to limit attendance to stockholders and one guest. Admission to the meeting will be on a first-come, first-served basis. Registration will begin at 8:00 a.m., and seating will begin at 8:30 a.m. Each stockholder may be asked to present valid picture identification, such as a driver’s license or passport. Stockholders holding stock in brokerage accounts (i.e., “street name” holders) will also need to bring a copy of a brokerage statement reflecting RBC stock ownership as of the record date. Cellular phones, cameras, recording devices and other electronic devices will not be permitted at the meeting.

By order of the Board of Directors,

Dr. Michael J. Hartnett

Chairman, President and Chief Executive Officer

July [ ], 2024

02 | | |  | | | 2024 Proxy Statement | | |

| | |  | | | 2024 Proxy Statement | | | 03 |

The Board of Directors (the “Board”) of RBC Bearings Incorporated (the “Company”) is soliciting proxies from our stockholders to be used at the annual meeting of stockholders to be held on Thursday, September 5, 2024, beginning at 9:00 a.m., local time, in Building B at our principal executive offices, located at One Tribology Center, 102 Willenbrock Road, Oxford, Connecticut 06478, and at any postponements or adjournments thereof. This proxy statement, a proxy card and the Company’s Annual Report on Form 10-K for fiscal 2024 are being mailed, or made available via the internet as described below, to stockholders on or about July [ ], 2024.

Our fiscal years end on the Saturday closest to March 31 each year. Fiscal 2024 ended on March 30, 2024 and fiscal 2025 will end on March 29, 2025. As used in this proxy statement, the terms “we,” “us,” “our,” “RBC” and “the Company” mean RBC Bearings Incorporated and its subsidiaries, unless the context indicates another meaning.

The Company is furnishing proxy materials to stockholders via the internet. If you received a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail, you will not receive a printed copy of the proxy materials unless you specifically request one. The Notice instructs you on how to access and review all of the important information contained in this proxy statement and our annual report as well as how to submit your proxy over the internet. If you received the Notice and would still like to receive a printed copy of our proxy materials, you should follow the instructions for requesting these materials included in the Notice. We plan to mail the Notice to stockholders on or about July [ ], 2024. We will mail a printed copy of this proxy statement and form of proxy to certain stockholders and we expect that mailing to begin on or about July [ ], 2024.

You are receiving a proxy statement because you owned shares of our common stock on July 9, 2024 (the “Record Date”), which entitles you to vote at the meeting. By use of a proxy, you can vote whether or not you attend the meeting. This proxy statement

describes the matters on which you may vote and provides information on those matters so that you can make an informed decision.

How may I obtain RBC’s 10-K and other financial information?

Stockholders may find the 2024 Form 10-K and our other filings with the Securities and Exchange Commission (SEC), as well as other information regarding the Company, including environmental/social/governance information, on the Investor Relations page of our website at www.investor.rbcbearings.com.

If you received our proxy statement in the mail, a copy of our 2024 Annual Report on Form 10-K was enclosed with the proxy statement. Stockholders may request a free copy of the 2024 Form 10-K from the Secretary, RBC Bearings Incorporated, 102 Willenbrock Road, Oxford, CT 06478 (203-267-7001).

Who is entitled to vote at the meeting?

Only stockholders of record at the close of business on the Record Date are entitled to receive notice of and to vote at the annual meeting. If you were a stockholder of record on the

Record Date, you will be entitled to vote all of the shares that you held on that date at the meeting, or any postponements or adjournments of the meeting.

04 | | |  | | | 2024 Proxy Statement | | |

What constitutes a quorum for the meeting?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of our common stock outstanding on the Record Date and eligible to vote will constitute a quorum permitting the conduct of business at the meeting. As of July 9, 2024, there were 29,089,082 shares of common stock

outstanding and eligible to vote. Proxies received by the Company but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining if we have a quorum.

What vote is required to approve each item?

Election of Directors (Proposal 1): Directors are elected by a majority of the votes cast. Each share of our common stock is entitled to one vote for each of the director nominees (i.e., stockholders do not have cumulative voting rights).

Approval of Independent Registered Public Accounting Firm (Proposal 2): The ratification of the appointment of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for fiscal 2025 requires the affirmative vote of a majority of the shares represented at the meeting.

Approval of Charter Amendment to Provide Officer Exculpation (Proposal 3): The approval of an amendment to our certificate of incorporation eliminating personal liability of officers for monetary damages for breach of their fiduciary duty of care as officers (commonly known as “officer exculpation”) requires the affirmative vote of two-thirds of the outstanding shares of common stock.

Approval of the Say-on-Pay Proposal (Proposal 4): The approval of the resolution regarding the stockholder advisory vote on named executive officer compensation requires the affirmative vote of a majority of the shares represented at the meeting.

A properly executed proxy marked “ABSTAIN” with respect to a particular proposal will not be voted on that proposal (although it will be counted for purposes of determining whether there is a quorum at the meeting). Therefore, an abstention with respect to Proposal 1 will have no effect on the outcome of that proposal while an abstention with respect to any of Proposals 2, 3 or 4 will have the same effect as an “AGAINST” vote on that proposal.

Will stockholders be asked to vote on any other matters?

To the knowledge of the Company, stockholders will vote only on the matters described in this proxy statement. However, if any other matters properly come before the meeting, the persons

acting as proxy holders will vote on those matters in the manner they consider appropriate.

What are the Board’s recommendations?

The Board’s recommendations are set forth in this proxy statement together with the description of each proposal to be voted upon. In summary, the Board recommends a vote FOR

each of Proposals 1, 2, 3 and 4. Unless you give other instructions when you vote, the persons acting as proxy holders will vote in accordance with the recommendations of the Board.

How do I vote?

If you are a holder of record (that is, your shares are registered in your own name with our transfer agent), you can vote either in person at the annual meeting or by proxy without attending the annual meeting. We urge you to vote by proxy even if you plan to attend the annual meeting so that we will know as soon as possible that enough votes will be present for us to hold the meeting. If you attend the meeting in person, you may vote at the meeting and your proxy will not be counted. You can vote by proxy over the Internet (at www.ProxyVote.com), by telephone (1-800-579-1639) or, if you received paper copies of our proxy materials in the mail, by completing, dating and signing a proxy card and returning it in the enclosed postage-paid envelope.

If you hold your shares in “street name,” you must either direct the bank, broker or other record holder of your shares as to how to vote your shares, or obtain a proxy from the bank, broker or other record holder to vote at the meeting. Please refer to the materials provided by your bank, broker or other record holder for specific instructions on methods of voting available to you.

If you properly submit a proxy, your shares will be voted in accordance with your instructions. If you submit a proxy but do not specify how you want to vote your shares, the proxy holders will vote them in accordance with the recommendations of the Board.

| | |  | | | 2024 Proxy Statement | | | 05 |

What if I Hold My Shares in Street Name?

If you hold your shares in “street name” through a broker, bank or other nominee rather than directly in your own name, then your broker, bank or other nominee is considered the stockholder of record, and you are considered the beneficial owner of your shares. The Company has supplied copies of its proxy materials for the 2024 annual meeting of stockholders to the broker, bank or other nominee holding your shares of record, and they have the responsibility to send these proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote your shares at the annual meeting.

If your broker, bank or other nominee does not receive voting instructions from you, your shares may constitute “broker non-votes.” Generally, broker non-votes occur with respect to a proposal when a broker is not permitted to vote on that proposal without instructions from the beneficial owner and instructions are not given. Shares represented by broker non-votes will be

counted in determining whether there is a quorum at the meeting, but will not be considered voted with respect to those proposals to which the broker non-votes relate. Without instruction from you, your broker may not vote with respect to any of the proposals at the 2024 annual meeting except for the ratification of the appointment of the Company’s independent registered public accounting firm (Proposal 2). Because director nominees are elected by a majority of the votes cast at the meeting, broker non-votes will not affect the outcome of the voting on the election of directors. However, because approval of the officer exculpation proposal (Proposal 3) requires the affirmative vote of two-thirds of the shares of common stock outstanding, and the say-on-pay proposal (Proposal 4) requires the affirmative vote of a majority of the shares of common stock represented at the meeting, a broker non-vote with respect to either of these proposals will have the same effect as an “AGAINST” vote on that proposal.

What should I do if I receive more than one set of voting materials?

You may receive more than one Notice or set of proxy materials. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a

stockholder of record and your shares are registered in more than one name, you will receive more than one Notice or proxy card. Please vote with respect to each Notice or set of proxy materials that you receive.

How and when may I propose actions for consideration at next year’s annual meeting of stockholders or recommend or nominate individuals to serve as directors?

See “Stockholder Proposals and Director Nominations” below.

06 | | |  | | | 2024 Proxy Statement | | |

Business Highlights |

Who We Are

RBC Bearings is a leading international manufacturer of highly engineered precision bearings, components and essential systems for the industrial, aerospace and defense industries.

Founder-Led Growth Company | ||||||

RBC was built through a series of acquisitions led by CEO Dr. Michael J. Hartnett, culminating in 28 transactions over 34 years. The combination of organic and inorganic growth has resulted in double-digit through-cycle revenue growth coupled with healthy margin expansion and free cash flow generation. The Company has been publicly listed since 2005 and is now traded on the NYSE. | ||||||

$7.8 billion Market Capitalization (as of July 1, 2024) | | | 54 Facilities in 11 countries | | | >70% Estimated percentage of sales that are sole, single or primary sourced |

What Differentiates Us

RBC is a product development-centric firm focused on leveraging deep institutional knowledge in engineering and material sciences to solve some of its customers’ biggest challenges. Several differentiators are key to our success:

Focus on Niche / Proprietary Products | | | Strategic Inventory | | | RBC Ops Management System | | | Manufacturing Leadership |

• Managing the Pareto: ~20% of products drive ~80% of revenue • Focus on highly specialized products, with ownership of IP, and product approvals • Estimated >70% sole, single or primary sourced products • High Aftermarket mix: ○ Stable, recurring revenue ○ Continually growing installed base | | | • Long shelf-life products with long-term supply agreements • Allows RBC to level-load production to optimize gross margin • Fast lead times and high on-time delivery rates drive strong customer relationships and opportunities for growth | | | • Monthly Ops meetings underpin a system of focus and accountability • Creates a systematic approach to monitoring: ○ Organic growth drivers ○ Margin performance ○ Strategic inventory levels ○ Staffing and human resources ○ Research and development • Drives CEO- and COO-level focus down to the division level, underpinning a culture of deep engagement | | | • High levels of automation • High levels of vertical integration • Low-cost country leadership • Long track record as exceptional operators • Long tenure of management creates a culture of continuous improvement |

| | |  | | | 2024 Proxy Statement | | | 07 |

Operating Performance Highlights

The Company’s operating results for fiscal 2024 demonstrate excellent execution on the Company’s business plan and strong operating performance, producing record net sales, gross margin and adjusted EBITDA. In fiscal 2024

• | Net sales were $1,560.3 million, a 6.2% increase over fiscal 2023 |

• | Gross margin was 43.0% compared to 41.2% for fiscal 2023 |

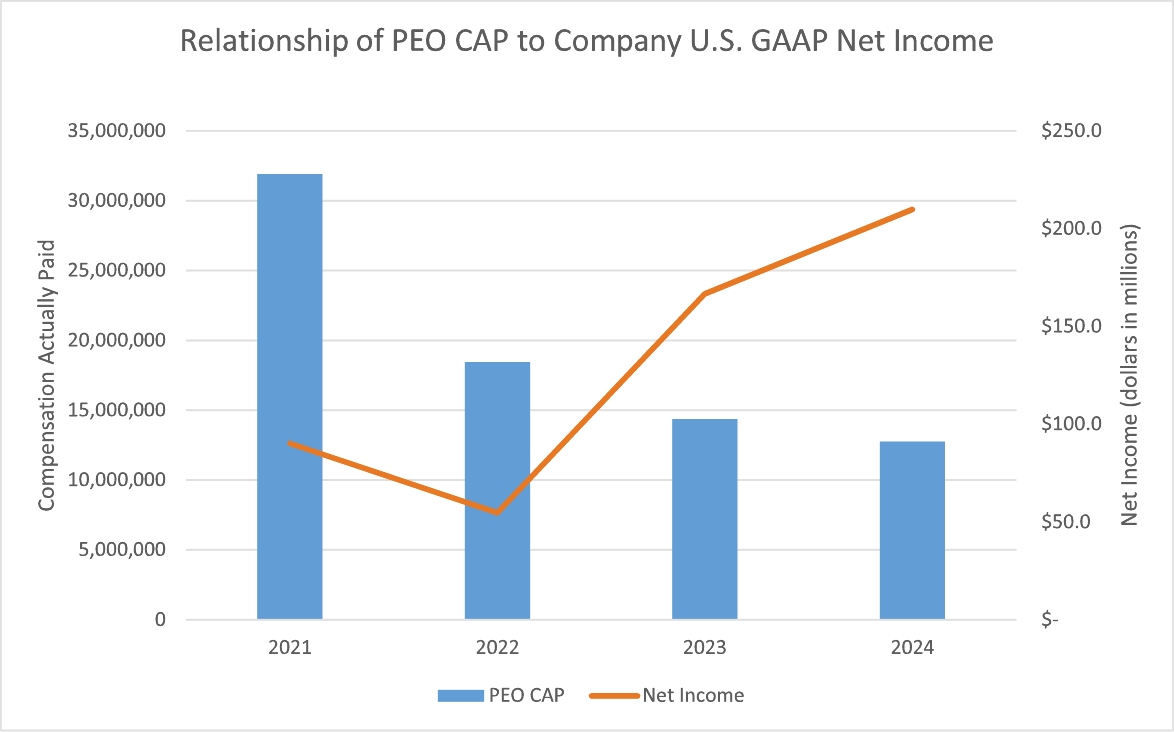

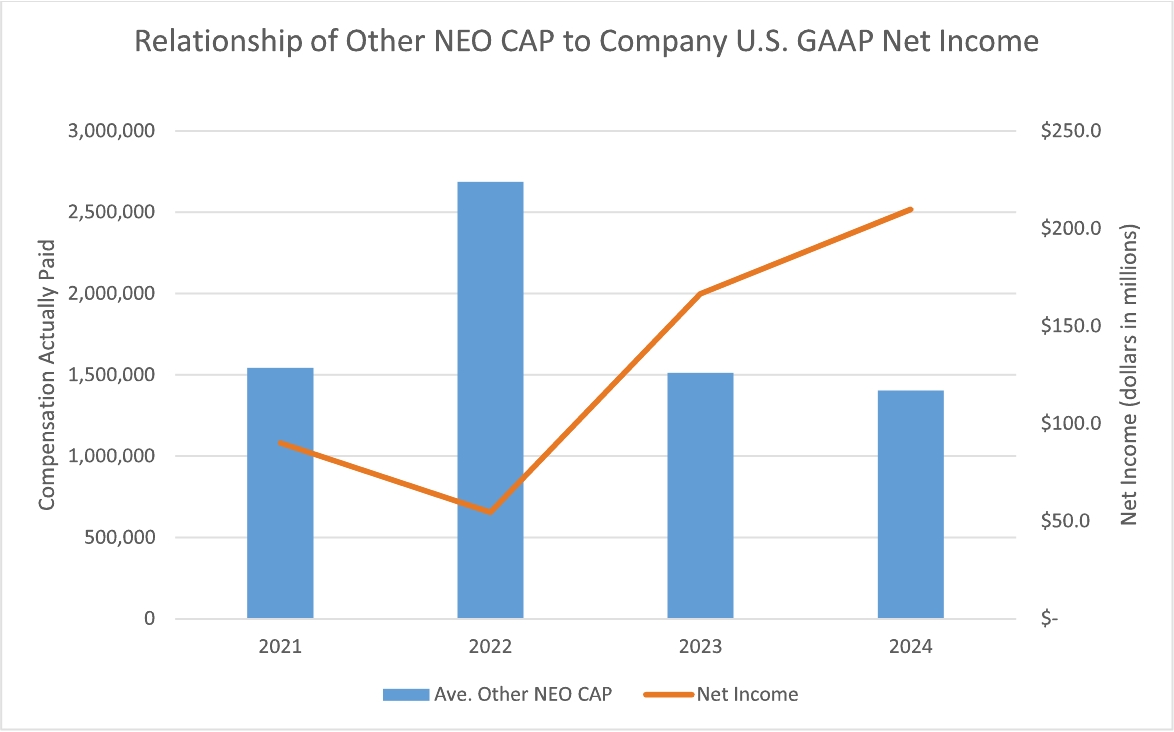

• | Net income was $209.9 million, a 25.9% increase over fiscal 2023 |

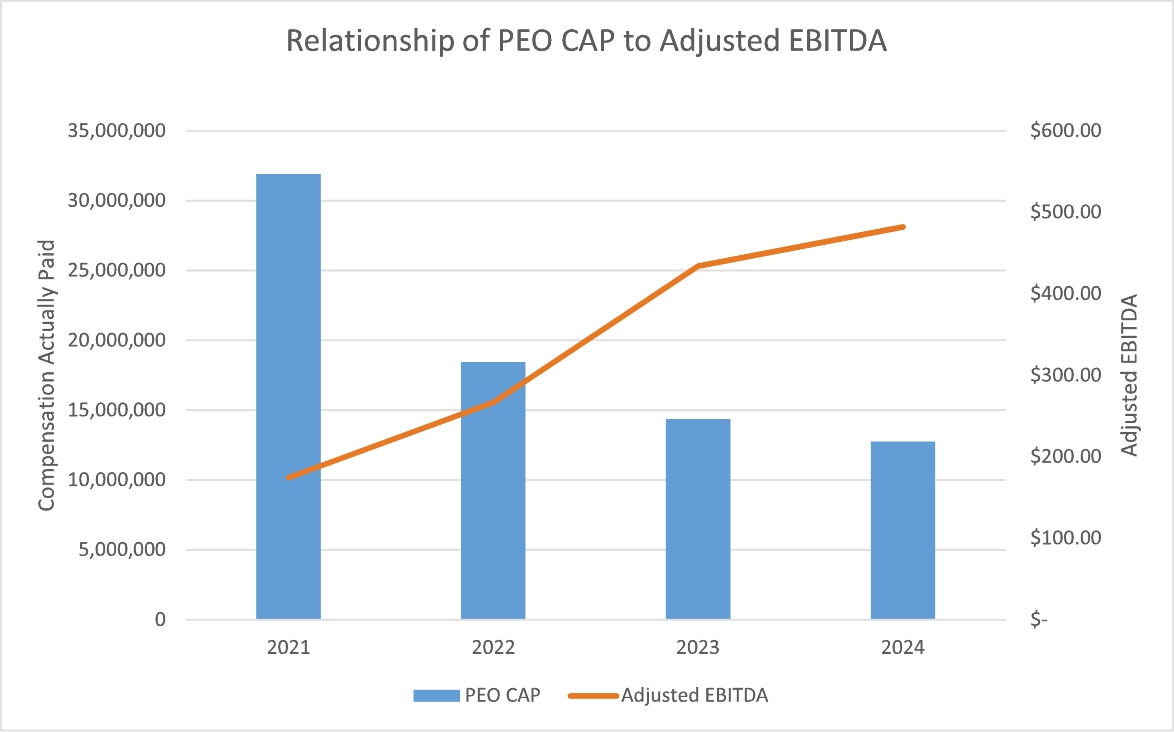

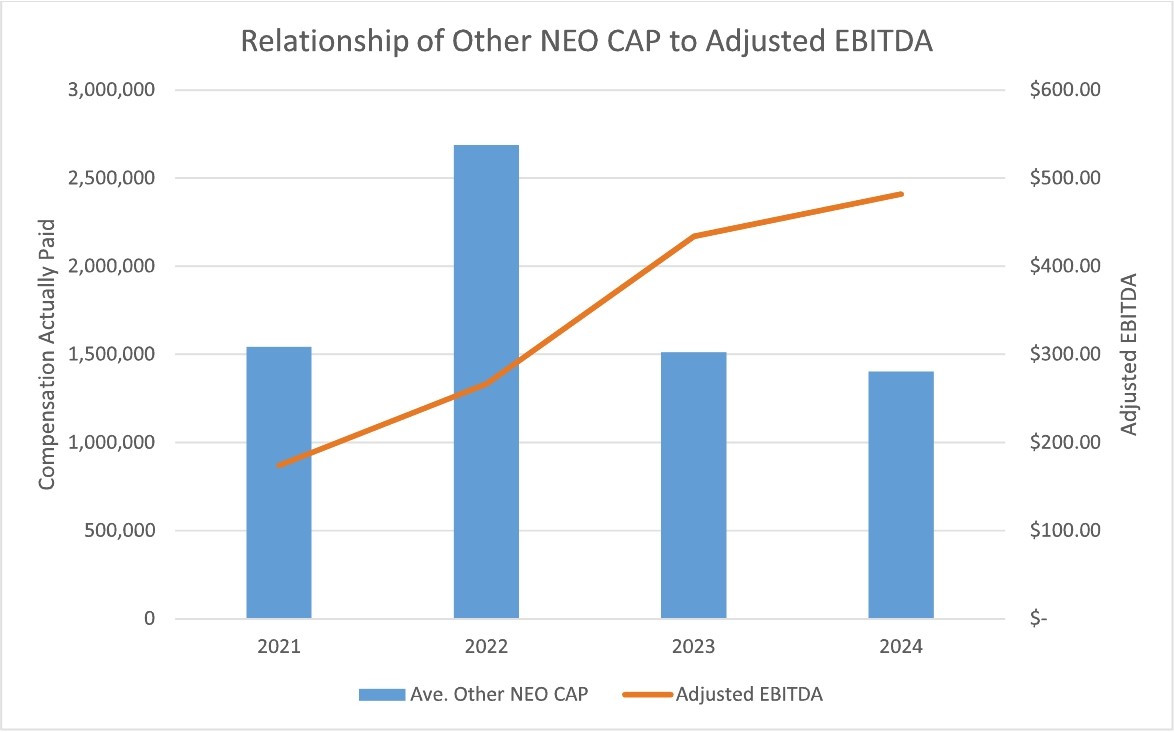

• | Adjusted EBITDA was $482.1 million, an 11.1% increase over fiscal 2023 and 104.7% of our plan for the year1 |

• | Free cash flow conversion (i.e., (operating cash minus capital expenditures) divided by net income) of 115.1% |

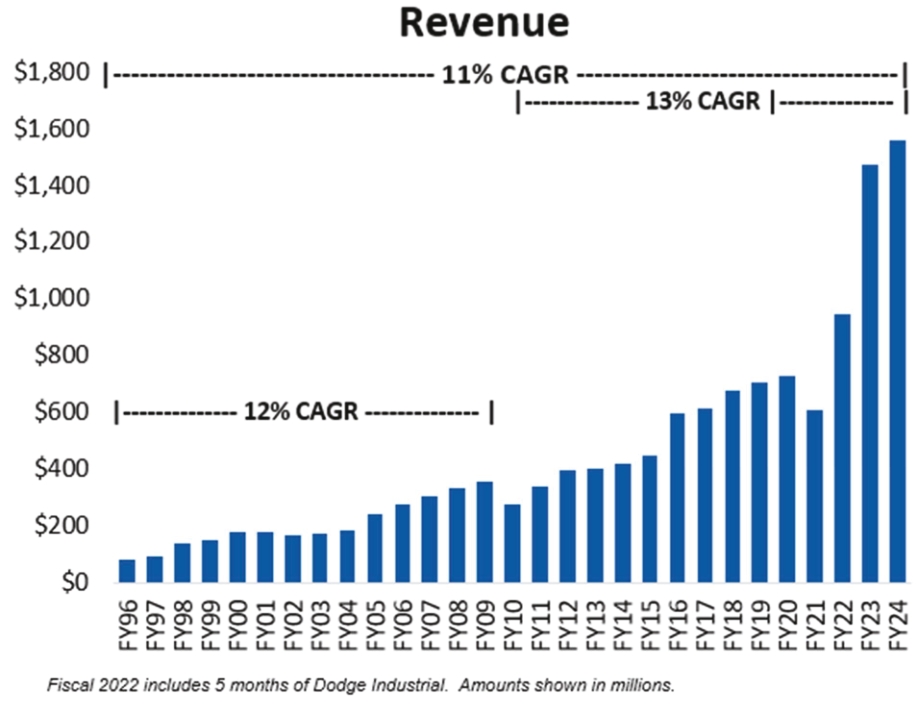

Furthermore, the Company has generated consistent revenue growth over the last two decades, with a 11% compound annual growth rate (CAGR):

The following graph shows the relationship between revenue CAGR and adjusted EBITDA CAGR for the Company versus our peer group average from fiscal 2020 through fiscal 2024. This reflects substantial revenue growth across our business through the expansion of our industrial business and the addition of Dodge Industrial (acquired in fiscal 2022). Importantly, the expansion of our profitability (adjusted EBITDA) occurred at a growth rate beyond revenue, reflecting our ability to improve margins as we build the business.

1 | Adjusted EBITDA is a non-GAAP financial measure. See Appendix B to this proxy statement for a reconciliation of adjusted EBITDA to net income. |

08 | | |  | | | 2024 Proxy Statement | | |

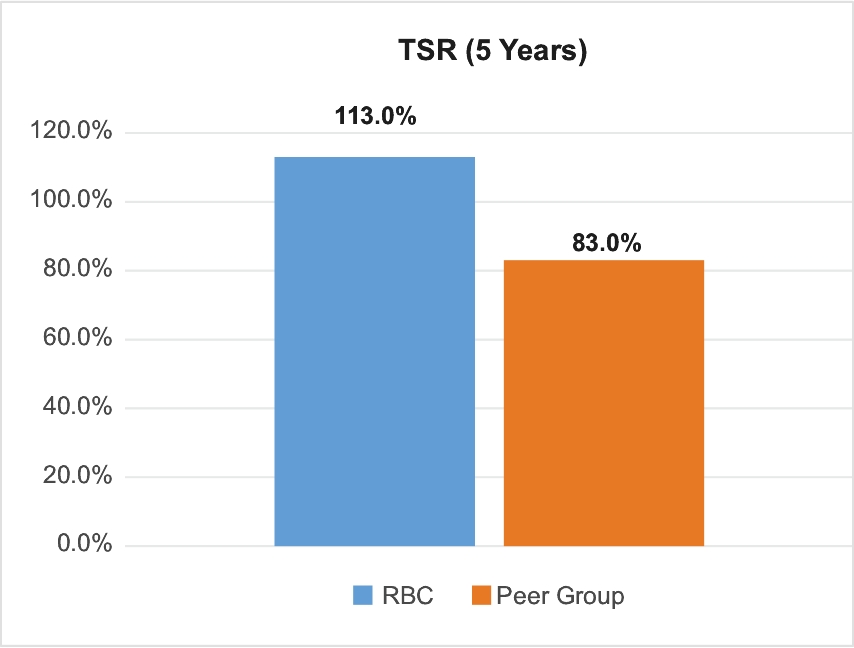

The following graph details our TSR as compared to our peer group average over the last five years. The TSR calculation includes stock price appreciation and the reinvestment of dividends. Dividends are assumed to be reinvested at the closing price of the stock on the ex-date of the dividend. Our TSR exceeded the peer group average by approximately 30.0% over this period, driven by the strong operating performance reflected above.

The above information indicates historical results only and is not necessarily indicative of future results.

| | |  | | | 2024 Proxy Statement | | | 09 |

The Board currently is composed of eight directors serving staggered three-year terms and divided into Class I, Class II and Class III. This year the Class II directors are up for election and our Nominating and Governance Committee has nominated Richard R. Crowell, Dr. Amir Faghri and Dr. Steven H. Kaplan for election at the annual meeting. Mr. Crowell, Dr. Faghri and Dr. Kaplan are currently Class II directors and first joined the Board in 2002, 2004 (and rejoined in 2022) and 2018, respectively. The Nominating and Governance Committee

reviewed the qualifications of the nominees for election to this class and unanimously recommended to the Board that these nominees be submitted for election. We believe that each of our nominees has a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to the Company and the Board.

Richard R. Crowell | | | Mr. Crowell is a Managing Partner of Vance Street Capital LLC, a private equity investment firm, and serves as a director of Micronics, Inc. and Jet Parts Aviation, private companies in the businesses of filtration products, aerospace parts, precision manufacturing, engineered solutions, and related services. Mr. Crowell earned a Bachelor of Arts degree from the University of California, Santa Cruz and a Master of Business Administration degree from the University of California, Los Angeles’s Anderson School. See “Directors and Executive Officers” below. |

Director since 2002 Age: 69 Committees: Audit | | ||

Skills and Expertise Mr. Crowell brings broad business, financial and executive leadership experience to the Board developed through his leadership roles in private equity and investment banking. He has extensive experience with a number of precision manufacturing and aerospace companies. In addition, Mr. Crowell’s experience in private investment enables him to bring a valuable investor’s view to the Board and his relationships across the financial community strengthen the Company’s access to capital markets. His board memberships provide deep understanding of trends in the precision manufacturing and aerospace sectors, both of which present ongoing challenges and opportunities for the Company. | |||

Dr. Amir Faghri | | | Dr. Faghri is Distinguished Professor Emeritus and Distinguished Dean Emeritus of Engineering at the University of Connecticut, and Distinguished Adjunct Professor at the University of California, Los Angeles. He received a Bachelor of Science degree with highest honors from Oregon State University and his Master of Science and Doctoral degrees in Mechanical Engineering from the University of California at Berkeley. See “Directors and Executive Officers” below. |

Director from 2004 to 2020 and rejoined in 2022 Age: 73 Committees: Compensation | | ||

Skills and Expertise Dr. Faghri’s extensive experience as a leader in the engineering profession—as an educator, scientist and administrator—along with his associations with U.S. companies and global academic institutions, provides the Company with valuable state-of-the-art resources in engineering, manufacturing and information technology, as well as unparalleled expertise in workforce development. | |||

10 | | |  | | | 2024 Proxy Statement | | |

Dr. Steven H. Kaplan | | | Dr. Kaplan is President Emeritus of the University of New Haven. He received a Bachelor of Arts degree from the University of California, Los Angeles, and a Master of Arts and a Doctoral degree from Eberhard-Karls Universität in Germany. See “Directors and Executive Officers” below. |

Director since 2018 Age: 71 Committees: Compensation, Nominating and Governance | | ||

Skills and Expertise Dr. Kaplan’s extensive academic and chief executive experience provides the Company with a wealth of valuable information and a perspective that provides the Board a critical resource for management. His association with U.S. companies and global academia provides the Company with a valuable state of the art executive management resource. | |||

Directors are elected by a majority of the votes cast at the meeting. If elected at the meeting, each of Mr. Crowell, Dr. Faghri and Dr. Kaplan would serve until the 2027 annual meeting and until a successor is duly elected and qualified, or until their resignation or removal. If any of Mr. Crowell, Dr. Faghri or Dr. Kaplan should for any reason become unavailable to serve as a director prior to the annual meeting, the Board will (i) reduce the size of the Board to eliminate the position for

which that person was nominated, (ii) nominate a new candidate in place of such person, in which case the proxy holders will vote for the new candidate, or (iii) leave the place vacant to be filled at a later time.

| | | The Board recommends a vote FOR the election to the Board of Directors of the nominees identified above. |

Ernst & Young LLP served as the Company’s independent registered public accounting firm for fiscal 2024 (see “Principal Accountant Fees and Services” below), and the Audit Committee has appointed Ernst & Young to serve in the same capacity for fiscal 2025 and has further directed that the Board submit Ernst & Young’s appointment for ratification by the stockholders at the annual meeting.

While not required, this proposal is being put before the stockholders because the Audit Committee and the Board believe that it is good corporate practice to seek stockholder ratification of the Audit Committee’s appointment of the independent registered public accounting firm. If the appointment of Ernst & Young is not ratified, the Audit Committee will consider the stockholders’ vote, but may ultimately determine to continue Ernst & Young’s engagement or to engage another audit firm without re-submitting the matter to stockholders. Even if the appointment of Ernst & Young is ratified, the Audit Committee may in its sole discretion terminate the engagement and direct the appointment of another independent registered public accounting firm at any time during the year if the Audit Committee determines that such an appointment would be in the best interests of the Company and our stockholders.

Representatives of Ernst & Young are expected to attend the annual meeting, where they will be available to respond to appropriate questions and, if they desire, make a statement.

Ratification of the appointment of Ernst & Young as the Company’s independent registered public accounting firm for fiscal 2025 requires the affirmative vote of a majority of the shares of the Company’s common stock present in person or represented by proxy at the annual meeting and entitled to vote on the proposal.

| | | The Board recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2024. |

| | |  | | | 2024 Proxy Statement | | | 11 |

RBC is a Delaware corporation and for many years our certificate of incorporation filed with the Delaware Secretary of State has included a provision eliminating the personal liability of our directors for monetary damages for breach of fiduciary duty as a director (commonly known as exculpation), except to the extent such elimination is not permitted by the Delaware General Corporation Law (DGCL). The DGCL now permits the Company to provide this exculpation protection to our officers as well as our directors, except that we cannot eliminate or limit an officer’s liability

• | for breach of their duty of loyalty to the Company or our stockholders; |

• | for acts or omission not in good faith or which involve intentional misconduct or a knowing violation of law; |

• | in connection with any transaction from which they derived an improper personal benefit; or |

• | in any action by or in the right of the Company. |

In other words, the officer exculpation provision would only permit exculpation against direct claims brought by stockholders but would not eliminate officers’ monetary liability for breach of duty of care claims brought by the Company itself or derivative claims made by stockholders on behalf of the Company; this is an important difference between director exculpation and officer exculpation in that directors are exculpated from liability in any action brought in the right of the Company. The officer exculpation provision also would not limit an officer’s liability where they had been disloyal, acted in bad faith, knowingly violated the law, or improperly benefited.

The Board is committed to attracting and retaining the best people to serve as our officers and the Board believes that providing officer exculpation will be an important tool in that process, particularly as many of our peers and competitors have adopted or may adopt officer exculpation provisions that would serve as a differentiating factor between them and us if we do not

have our own officer exculpation provision. In the absence of such protection, particularly amidst the recent trend of plaintiffs increasingly naming corporate officers as defendants in stockholder litigation, qualified persons might be deterred from serving as our officers or, while officers, from making business decisions that involve risk, due to potential exposure to personal monetary liability for business decisions that in hindsight are not successful. The Board recognizes that officers are often required to make difficult decisions on crucial matters that can expose them to the risk of litigation, and the Board believes that relieving them of this risk to empower them to better exercise their business judgment is in the best interests of the Company and our stockholders.

You are being asked to approve the amendment of RBC’s certificate of incorporation to provide officer exculpation to the maximum extent permitted by the DGCL. Specifically, Section 1(a) of Article Eight of the certificate would be amended to read as follows:

To the fullest extent permitted by the Delaware General Corporation Law as it now exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Corporation to provide broader indemnification rights than permitted prior thereto), and except as otherwise provided in the Corporation’s Bylaws, no Director or officer of the Corporation shall be liable to the Corporation or its stockholders for monetary damages arising from a breach of fiduciary duty owed to the Corporation and its stockholders.

| | | The Board recommends a vote FOR the proposal to amend the Company’s certificate of incorporation to eliminate personal liability of officers for monetary damages for breach of their fiduciary duty of care as officers to the fullest extent permitted by the DGCL. |

The Exchange Act requires the Company to hold a non-binding advisory stockholder vote to approve the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s rules.

The Company’s executive compensation program is designed to reward executives based on favorable performance and results. Compensation policies and plans (including benefits) are designed to attract and retain top quality and experienced executives by providing incentives that promote both the short-term and long-term financial and strategic objectives of the Company. Achievement of short-term objectives is rewarded

through base salary and annual cash bonuses, while long-term incentive awards encourage executives to focus on and align themselves with the Company’s long-term goals as well. These incentives are based on financial objectives of importance to the Company, including revenue and earnings growth and creation of stockholder value. The Company’s compensation program also accounts for individual performance, which enables the Company to differentiate among executives and emphasize the link between personal performance and compensation.

12 | | |  | | | 2024 Proxy Statement | | |

The Company is committed to the interests of our stockholders and the delivery of long-term value through an executive compensation program and governance actions that

• | drive outstanding Company performance, |

• | align CEO pay with Company performance, |

• | ensure that no problematic pay practices exist (e.g., re-pricing or backdating of stock options, excessive perquisites, or tax gross-ups), and |

• | reflect appropriate communication with and responsiveness to stockholders. |

As part of this commitment, we maintain a periodic dialogue with our stockholders to address any concerns they may have. Following the 2023 annual meeting, at which the say-on-pay proposal received 53% approval (up from 32% in 2022), we conducted extensive stockholder outreach as described under “Compensation Discussion and Analysis—Stockholder Engagement and 2023 Say-on-Pay Results” below, after which the Compensation Committee adopted the following changes:

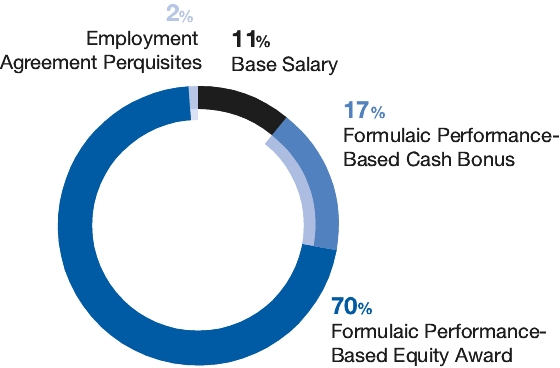

• | Equity-Based Compensation: The long-term equity incentive program for the CEO and COO, which each year awards shares of stock based on the Company’s performance in the prior fiscal year or prior three-fiscal-year period, was revised to (i) eliminate overlapping metrics between the one-year and three-year components, (ii) increase the weighting of the CEO’s three-year component, and (iii) use the Company’s total shareholder return (TSR) as a percentage of our peer group average as an additional metric for the three-year component. |

• | Peer Group: The peer group in place as of the 2023 annual meeting was revised by replacing seven of the 16 companies in the group in order to better align RBC with its peers in light of our increasing revenue and profitability. See “Compensation Discussion and Analysis—Compensation Philosophy and Program—Maintaining a Compensation Peer Group” below. |

Dr. Hartnett is the Company’s founder and has served as our CEO since 1992. Dr. Hartnett is widely regarded as a technology visionary and one of the industry’s most successful business executives. Under Dr. Hartnett’s leadership the Company’s annual revenue has grown from approximately $82 million for

fiscal 1996 to more than $1.5 billion for fiscal 2024. He is also one of our significant stockholders, owning approximately 1.4% of the outstanding common stock, directly aligning his interests with those of all our stockholders. The Compensation Committee believes Dr. Hartnett is extremely important to our success and that, given his role in our operations, strategy and growth, it is appropriate for Dr. Hartnett to receive competitive compensation that performs both retentive and incentivizing functions.

See “Compensation Discussion and Analysis” and “Executive Compensation” below for additional information about our executive officer compensation program.

This proposal gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, we are asking our stockholders to vote FOR the following resolution at the 2024 annual meeting:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed in the Company’s proxy statement for the 2024 annual meeting of stockholders pursuant to Item 402 of SEC Regulation S-K (including the Compensation Discussion and Analysis, the compensation tables and narrative discussion contained therein), is hereby APPROVED.”

The say-on-pay vote is advisory, and therefore not binding on the Company, the Board or the Compensation Committee. However, the Company, the Board and the Compensation Committee value the opinions of our stockholders and to the extent there is any significant vote against the named executive officers’ compensation as disclosed in this proxy statement, we will consider our stockholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

| | | The Board recommends a vote FOR the approval of the compensation of our named executive officers. |

Other Matters to Come Before the Meeting

As of the date of this proxy statement, the Company knows of no business that will be presented for consideration at the 2024 annual meeting other than the four proposals referred to above. If any other matter is properly brought before the meeting for action by stockholders, proxies will be voted in the manner the proxy holder considers appropriate.

| | |  | | | 2024 Proxy Statement | | | 13 |

Board of Directors and Corporate Governance |

The Board currently is composed of eight directors serving staggered three-year terms and divided into three classes: Class I consists of Michael H. Ambrose, Daniel A. Bergeron and Edward D. Stewart; Class II consists of Richard R. Crowell, Dr. Amir Faghri and Dr. Steven H. Kaplan; and Class III consists of Dr. Michael J. Hartnett and Dolores J. Ennico. Class I, Class II and Class III directors will serve until our annual meetings of stockholders in 2025, 2024 and 2026, respectively.

Directors are elected by a majority of the votes cast at the annual stockholders’ meeting, except in a contested election where directors are elected by a plurality of the votes. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class (including vacancies created by an increase in the number of directors) will serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified, or until the director’s resignation or removal.

In our stockholder engagement meetings earlier this year, some stockholders expressed a preference for the declassification of our Board. In response, the Board conducted a formal evaluation of the classified board structure that reviewed the costs and benefits of classification and benchmarking of peers and market practices. Following this evaluation, the Board concluded the classified board is the most appropriate structure for the Company at this time in order to promote stability and support our long-term strategy. However, the Board recognizes this is an important topic for some of our stockholders and is committed to regularly reviewing the structure in the future.

Meetings of the Board and Committees of the Board

The Board held four meetings during fiscal 2024. The standing committees of the Board held an aggregate of 13 meetings during fiscal 2024. Each director attended at least 75% of the meetings of the Board and the Board committees on which they served during fiscal 2024.

The Company’s Corporate Governance Guidelines require the non-employee directors to meet in executive sessions on a periodic basis without management. The presiding director at

these executive sessions is the Chair of the Audit Committee, Edward D. Stewart. The non-employee members of the Board met in executive session during two of the Board meetings held in fiscal 2024.

Directors are encouraged to attend the annual meeting of stockholders. All of the directors attended the 2023 annual meeting of stockholders either in person or by teleconference.

Director Independence

The rules of the New York Stock Exchange (NYSE) require that the Board be comprised of a majority of “independent” directors, and each of the Company’s Audit Committee, Compensation Committee, and Nominating and Governance Committee be comprised solely of “independent” directors as defined in the NYSE’s rules. Based upon the information submitted by each of the directors, and following the recommendation of the Nominating and Governance Committee, the Board has made a determination that all of our current directors, with the exception of Dr. Hartnett

and Mr. Bergeron, satisfy the “independence” requirements of the NYSE, SEC regulations and the Company’s Corporate Governance Guidelines. The standards for determining independence are those set forth in the NYSE Listed Company Manual and the Company’s Corporate Governance Guidelines. The Company’s Corporate Governance Guidelines can be found on our website at www.investor.rbcbearings.com/corporate-governance/governance-highlights.

Communications Between Interested Parties and the Board

Stockholders and any other interested parties may send communications to the Company’s directors as a group or to individual directors (including the director who presides over executive sessions of the independent directors), by writing to those individuals or the group at the following address: RBC Bearings Incorporated, c/o the Secretary, 102 Willenbrock Road, Oxford, CT 06478. The Secretary will review all correspondence received and will forward all correspondence that is relevant to the duties and responsibilities of the Board or the business of the Company to the intended director(s). Examples of inappropriate

communication include business solicitations, advertising, and communication that is frivolous in nature or relates to routine business matters (such as product inquiries, complaints or suggestions) or raises grievances that are personal to the person submitting the communication. Upon request, any director may review any communication that is not forwarded to the directors pursuant to this policy.

14 | | |  | | | 2024 Proxy Statement | | |

The Board has a policy for reporting concerns regarding the Company’s accounting or auditing matters. Reports may be sent to the Audit Committee through either of the following means:

• | calling the Company’s Ethics Hotline at 1-866-247-5449 (which is available 24 hours per day, 365 days per year) and leaving a recorded message, which is transcribed by a third-party service provider to insure the caller’s anonymity, or |

• | sending a written communication marked “Private & Confidential” to the Audit Committee, RBC Bearings Incorporated, c/o the Secretary, 102 Willenbrock Road, Oxford, CT 06478. |

In either case, the report will be forwarded to the Audit Committee and the confidentiality of the report will be maintained to the extent consistent with applicable law.

Committees of the Board of Directors

The Board currently has an Audit Committee, a Compensation Committee, and a Nominating and Governance Committee. The charter for each of the committees is available on the

Company’s website at www.investor.rbcbearings.com/corporate-governance/governance-highlights.

Audit Committee | | | Responsible for • selecting our independent registered public accounting firm, • approving the overall scope of the audit and the associated fees, • assisting the Board in monitoring the integrity of our financial statements, the independent registered public accounting firm’s qualifications and independence, the performance of the independent registered public accounting firm and our internal audit function, and our compliance with legal and regulatory requirements, • annually reviewing the independent registered public accounting firm’s report describing the auditing firms’ internal quality-control procedures, and any material issues raised by the most recent internal quality-control review, or peer review, of the registered public accounting firm, • discussing the annual audited financial and quarterly statements with management and the independent registered public accounting firm, • discussing earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies, • discussing policies with respect to risk assessment and risk management, • meeting separately, periodically, with management and the independent registered public accounting firm, • reviewing with the independent registered public accounting firm any audit problems or difficulties and management’s response, • setting clear hiring policies for employees or former employees of the independent registered public accounting firm, • handling such other matters that are specifically delegated to the Audit Committee by the Board from time to time, and • reporting regularly to the full Board. |

Meetings held in fiscal 2024: five Members: Michael J. Ambrose Richard R. Crowell Edward D. Stewart (Chair) Each member satisfies the financial literacy requirements of the NYSE and the SEC and the NYSE’s independence requirements for audit committee members. The Board has determined that Messers. Crowell and Stewart qualify as “audit committee financial experts” for SEC purposes. | |

Compensation Committee | | | Responsible for • reviewing key employee compensation goals, policies, plans and programs, • reviewing and approving the compensation of our directors, chief executive officer and other executive officers, • reviewing and approving employment contracts and other similar arrangements between the Company and our executive officers, • reviewing and consulting with the Board on the selection of the chief executive officer and evaluation of such officer’s executive performance and other related matters, • administration of stock plans and other incentive compensation plans, • approving overall compensation policies for the Company, and • handling such other matters that are specifically delegated to the Compensation Committee by the Board from time to time. | |

Meetings held in fiscal 2024: six Members: Dolores J. Ennico (Chair) Dr. Amir Faghri Dr. Steven H. Kaplan Each member satisfies the NYSE’s independence requirements for compensation committee members. | | |

| | |  | | | 2024 Proxy Statement | | | 15 |

Nominating and Governance Committee | | | Responsible for • evaluating the composition, size and governance of the Board and its committees and making recommendations regarding future planning and the appointment of directors to committees, • establishing a policy for considering stockholder nominees for election to the Board, • evaluating and recommending candidates for election to the Board, • overseeing the Board’s performance and self-evaluation process and developing continuing education programs for our directors, • reviewing our corporate governance principles and policies and providing recommendations to the Board regarding possible changes, and • reviewing and monitoring compliance with the Company’s Code of Business Conduct and Ethics and our |

Meetings held in fiscal 2024: two Members: Dolores J. Ennico Dr. Steven H. Kaplan Edward D. Stewart Each member satisfies the NYSE’s independence requirements for nominating and governance committee members. | |

Director Qualities and Board Diversity

The Board seeks to have a diverse group of members who possess the background, skills and expertise to make a significant contribution to the Board, the Company and our stockholders. In selecting a nominee for the Board, the Nominating and Governance Committee considers the background, skills and expertise that would complement the existing Board and ensure that its members are of sufficiently diverse and independent backgrounds, recognizing that the Company’s businesses and operations are diverse and global in nature. Desired qualities for Board members include

• | high-level leadership experience in business or administrative activities, and significant accomplishment, |

• | breadth of knowledge about issues affecting the Company, |

• | proven ability and willingness to contribute special competencies to Board activities, |

• | personal integrity, |

• | loyalty to the Company and concern for its success and welfare, |

• | ability and willingness to apply sound and independent business judgment, |

• | awareness of a director’s vital role in assuring the Company’s good corporate citizenship and corporate image, |

• | no present conflicts of interest, |

• | availability for meetings and consultation on Company matters, enthusiasm about the prospect of serving, |

• | willingness to assume broad fiduciary responsibility, and |

• | willingness to become a Company stockholder. |

In evaluating candidates, the Nominating and Governance Committee reviews all candidates in the same manner, regardless of the source of the recommendation. The policy of the Committee is to consider individuals recommended by stockholders for nomination as a director in accordance with the procedures described under “Stockholder Proposals and Director Nominations” below.

The Nominating and Governance Committee considers various kinds of diversity such as diversity of professional background and capabilities, knowledge of specific industries and geographic experience, as well as the more traditional diversity concepts of race, gender and national origin, when considering whether to nominate an individual for Board membership. The Board believes it is important that its members represent diverse viewpoints and perspectives in their application of judgment to Company matters. The Nominating and Governance Committee assesses the effectiveness of this objective when evaluating new director candidates and when assessing the composition of the Board.

16 | | |  | | | 2024 Proxy Statement | | |

The following matrix identifies the primary experience, qualifications, and skills, as well as gender/ethnic/racial diversity, of each of our directors. This matrix does not encompass all the experience, qualifications or skills of our directors, and the fact that a particular experience, qualification, or skill is not listed does not mean that a director does not possess it. The type and degree of experience, qualifications and skills listed below may vary among members of the Board.

Experience, Qualifications, Skills or Diversity | | | Michael Hartnett | | | Michael Ambrose | | | Daniel Bergeron | | | Richard Crowell | | | Dolores Ennico | | | Amir Faghri | | | Steven Kaplan | | | Edward Stewart |

Leadership Experience | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

Industry Experience | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | ||

Corporate Governance/Board Experience | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

Financing/Accounting Experience | | | ✔ | | | | | ✔ | | | ✔ | | | | | | | | | ✔ | ||||

Human Capital Management Experience | | | ✔ | | | | | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | |||

Mergers and Acquisitions Experience | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | | | | | | | ✔ | |||

International Experience | | | ✔ | | | ✔ | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | |

Risk Management Experience | | | | | ✔ | | | ✔ | | | | | ✔ | | | | | | | ✔ | ||||

Academics & Research Experience | | | ✔ | | | | | | | | | | | ✔ | | | ✔ | | | |||||

Technology & Cybersecurity Skills | | | ✔ | | | ✔ | | | | | | | | | ✔ | | | | | |||||

Independence | | | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | ||

Gender/Ethnic/Racial Diversity | | | | | | | | | | | ✔ | | | ✔ | | | |

Corporate Governance Guidelines

The Board maintains Corporate Governance Guidelines, which, among other things, set forth the Company’s expectations and policies with respect to the roles and responsibilities of the Board, director affiliations and conflicts, director compensation, standards of director conduct, and the qualifications and other criteria for director nominees. The Nominating and Governance

Committee is responsible for periodically reviewing and reassessing the adequacy of these guidelines and recommending changes to the Board for approval. Our Corporate Governance Guidelines are available on the Company’s website at www.investor.rbcbearings.com/corporate-governance/governance-highlights.

Code of Conduct and Ethics

The Company’s employees, officers and directors are required to abide by the Company’s Code of Conduct and Ethics (the “Code of Ethics”), which is intended to ensure that the Company’s business is conducted in a consistently legal and ethical manner. The Code of Ethics covers areas of professional conduct such as conflicts of

interest, fair dealing, the protection of confidential information, and compliance with laws, regulations and rules. The Code of Ethics is available on the Company’s website at www.investor.rbcbearings.com/corporate-governance/governance-highlights.

Board Risk and Compensation Risk Oversight

The Board has oversight responsibility of the processes established to report and monitor systems for material risks applicable to the Company. The Board focuses on the Company’s general risk management strategy and the most significant risks facing the Company and ensures that appropriate risk mitigation strategies are implemented by management. The Board has delegated to its various committees the oversight of risk management practices for categories of risk relevant to their functions. For example, the Audit Committee oversees risks associated with the Company’s systems of disclosure controls and internal controls over financial reporting, compliance with legal and regulatory requirements, and risks associated with cyber security, foreign exchange, insurance, credit and debt. The Nominating and Governance Committee oversees risks associated with sustainability. The Compensation

Committee considers risks related to the attraction and retention of talent, and risks related to the design of the compensation program. The full Board is responsible for considering strategic risks and succession planning and receives reports from each Committee as to risk oversight within their areas of responsibility.

The Company’s senior management periodically reports on risk management policies and practices to the relevant Board committee or to the full Board so that any decisions can be made as to any required changes to the Company’s risk management and mitigation strategies or to the Board’s oversight of these.

Finally, as part of its oversight of the Company’s executive compensation program, the Compensation Committee considers the impact of the Company’s executive compensation program, and the incentives created by the compensation

| | |  | | | 2024 Proxy Statement | | | 17 |

awards that it administers, on the Company’s risk profile. In addition, the Compensation Committee reviews all of the Company’s compensation policies and procedures, including the incentives that they create and factors that may reduce the likelihood of excessive risk-taking, as well as our executive

compensation clawback policy, to determine whether they present a significant risk to the Company. Based on this review, the Company has concluded that its compensation policies and procedures are not reasonably likely to have a material adverse effect on the Company.

Board Leadership Structure

The Board has no formal policy with respect to the separation of the offices of the Chairman and the Chief Executive Officer, which are currently combined. However, the Board understands that no single leadership model is right for all companies and at all times. The Board believes that it should have the flexibility to make decisions as to the Chairman position from time to time in the way that it believes will best provide effective leadership for the Company. Accordingly, the Board periodically reviews its leadership structure, including whether these offices should be

separate. The Board has determined that the current structure consisting of combined roles of Chairman and CEO is an effective and appropriate leadership structure for the Company at this time. All the current members of the Board are independent, except for the CEO and COO, and all of our Board committees are composed entirely of independent directors. The Board does not have a lead independent director, although the Chair of the Audit Committee serves as the presiding director at executive sessions of the Board.

Stockholder Outreach

The Board values its relationship with our stockholders, and periodically engages with them in discussions about our performance and corporate practices, including governance and executive compensation. The feedback received is valuable and

helps inform Board decisions. Our most recent stockholder outreach took place earlier this year. See “Compensation Discussion and Analysis—Stockholder Engagement and 2023 Say-on-Pay Results” below.

Environmental, Social and Governance Values

We know that caring about our impact on the environment and society and how we govern RBC are essential to generating long-term value for the Company and our stakeholders, and we are constantly looking for ways to improve our performance in all three areas. On the environmental side, our mission is to develop and produce innovative products that reduce friction and wear in our customers’ products to the lowest level possible, thereby making those products more efficient and longer lasting. This enables the users of our products to further their sustainability efforts by both reducing their consumption of petroleum-based lubricants and fossil fuels, thereby reducing resulting greenhouse gas emissions, and reducing maintenance processes that can adversely affect the environment. From a social perspective,

human capital management is central to the Company’s success. The recruitment, training, advancement and retention of engineers and skilled manufacturing professionals are critical to RBC’s mission to innovate, solve problems, and timely deliver products that exceed our customers’ expectations. Safety is of paramount importance to RBC and so we go to great lengths in striving for a zero-incident workforce that is consistent with our mandate to produce the highest quality, highly engineered products. Finally, we have robust corporate policies and governance frameworks that ensure our reporting is reliable. More information regarding our environmental, social and governance values is available at www.investor.rbcbearings.com/ESG.

Hedging Policy

We have a policy that prohibits any director, officer or employee from purchasing, selling or engaging in any other transaction involving any derivative securities that relate to any equity securities of the Company. A “derivative security” includes any option, warrant, convertible security, stock appreciation right or

similar security with an exercise or conversion price or other value that relates to the value of any equity security of the Company (other than any of the foregoing issued pursuant to our long-term equity incentive plans).

18 | | |  | | | 2024 Proxy Statement | | |

Director Compensation

Non-employee members of the Board receive $50,000 per year, payable quarterly, and the Chairs of the Compensation and Audit Committees each receive an additional $5,000 per year for serving in that capacity. Upon the approval of the Board based on the recommendation of the Compensation Committee, each non-employee director also receives an annual award of restricted stock, which vests over three years, and an annual

award of stock options, which have an exercise price equal to the closing price of our common stock on the award date and vest over five years. Directors are entitled to reimbursement for reasonable out-of-pocket expenses incurred in connection with attendance at Board and committee meetings. During fiscal 2024, the non-employee directors received the following compensation:

Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1) | | | Option Awards ($)(1) | | | Total ($) |

Michael H. Ambrose | | | 50,000 | | | 247,428 | | | 94,160 | | | 391,588 |

Richard R. Crowell | | | 50,000 | | | 247,428 | | | 94,160 | | | 391,588 |

Dolores J. Ennico | | | 55,000 | | | 247,428 | | | 94,160 | | | 396,588 |

Dr. Amir Faghri | | | 50,000 | | | 247,428 | | | 94,160 | | | 391,588 |

Dr. Steven H. Kaplan | | | 50,000 | | | 247,428 | | | 94,160 | | | 391,588 |

Edward D. Stewart | | | 55,000 | | | 247,428 | | | 94,160 | | | 396,588 |

(1) | The amounts represent the fair market value on the date of award of restricted shares and non-qualified stock options awarded during the fiscal year. The fair market value of restricted shares is calculated using the closing stock price on the date of award ($206.19) multiplied by the number of shares awarded (1,200). The fair market value of stock options is calculated using the Black-Scholes model, which determined a fair value of $94.16 per option for the 1,000 options awarded. As these represent values as of the date of award, they do not reflect the actual value that will be received at the time the restricted shares vest or the options are exercised, which value will depend on market conditions at that time. |

The Compensation Committee reviews non-employee director compensation annually and recommends changes to the Board for approval. In May of 2024 the Compensation Committee recommended to the Board that the next annual equity awards to each independent director have a total value of $325,000 with the restricted stock component representing 60% of the value and the stock options making up the remaining 40% of the value (based on the Black-Scholes model). This was in contrast to the Committee’s past practice of recommending awards of specific numbers of restricted stock shares and stock options. The new practice is consistent with the Compensation Committee’s approach to equity compensation for the CEO and COO and will result in more predictable compensation for independent directors. Based on the Compensation Committee’s recommendation, in May 2024 the Board awarded each independent director 678 shares of restricted stock and 974 stock options, having an aggregate value of $325,000.

| | |  | | | 2024 Proxy Statement | | | 19 |

Since the start of fiscal 2024 the Company has not been a party to, nor have we proposed, any transaction or series of similar transactions in which the amount exceeds $120,000 and in which any director, executive officer, holder of more than 5% of our common stock or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest, other than employment agreements and other compensation arrangements that are described in “Executive Compensation” below. The Company’s directors and executive officers are subject to annual related-party certifications and the Code of Ethics requires that an employee or director avoid placing themself in a position in which their personal interests could interfere in any way with the interests of the Company.

While the Company has various controls in place to identify potential related-party transactions, we do not have a formal policy regarding the Board’s review and approval of related party transactions.

We have not made payments to directors other than as described in “Board of Directors and Corporate Governance—Director Compensation” above. We have not made any loans to any director or officer nor have we purchased any shares of our common stock from any director or officer, other than the repurchase of shares from officers at fair market value to cover (i) the exercise price of stock options and (ii) taxes relating to the vesting of shares of restricted stock and exercise of stock options.

The following table sets forth information known to the Company regarding beneficial ownership of the Company’s common stock, as of July 1, 2024, by each director, each of our named executive officers, and by all of our directors and executive officers as a

group. Information in the table is derived from SEC filings made by such persons under Section 16(a) of the Exchange Act and other information received by the Company.

Directors and Officers

Name of Beneficial Owner | | | Amount and Nature of Beneficial Ownership(1)(2)(3) | | | Percent of Class(4) |

Michael J. Hartnett | | | 419,575 | | | 1.4% |

Michael H. Ambrose | | | 8,228 | | | * |

Daniel A. Bergeron | | | 219,002 | | | * |

Richard R. Crowell | | | 33,135 | | | * |

Dolores J. Ennico | | | 7,578 | | | * |

Dr. Amir Faghri | | | 3,978 | | | * |

Dr. Steven H. Kaplan | | | 4,193 | | | * |

Edward D. Stewart | | | 27,461 | | | * |

John J. Feeney | | | 5,372 | | | * |

Richard J. Edwards | | | 16,739 | | | * |

Robert M. Sullivan | | | 32,382 | | | * |

All directors and executive officers as a group (11 persons) | | | 777,643 | | | 2.6% |

(1) | Each person in this table has sole voting and dispositive power with respect to their shares or shares such power with their spouse. None of these shares are held in margin accounts or pledged or otherwise available to a lender as security. |

(2) | Includes the following restricted shares held as of July 1, 2024: Dr. Hartnett – 48,297; Mr. Ambrose – 1,978; Mr. Bergeron – 17,693; Mr. Crowell – 1,978; Ms. Ennico – 1,978; Dr. Faghri – 1,978; Dr. Kaplan – 1,978; Mr. Stewart – 1,978; Mr. Feeney – 1,880; Mr. Edwards – 3,550; Mr. Sullivan – 5,500; all directors and executive officers as a group – 88,788. |

(3) | Includes the following unissued shares that are subject to stock options that are exercisable within 60 days of July 1, 2024: Dr. Hartnett – 126,536; Mr. Ambrose – 1,500; Mr. Bergeron – 107,594; Mr. Crowell – 1,400; Ms. Ennico – 1,200; Dr. Faghri – 600; Dr. Kaplan – 1,600; Mr. Stewart – 4,000; Mr. Feeney – 2,296; Mr. Edwards – 4,200; Mr. Sullivan – 22,200; all directors and executive officers as a group – 273,126. |

(4) | Based on 29,221,224 shares of common stock outstanding as of July 1, 2024 plus the unissued option shares of each person referred to in footnote (3). |

*Less than 1.0%.

20 | | |  | | | 2024 Proxy Statement | | |

Outside Investors

The following table sets forth each stockholder that, as of July 1, 2024, was known by us to be the beneficial owner of more than 5% of our common stock. Information in the table is derived from SEC filings made by such persons prior to February 15, 2024 pursuant to Section 13 of the Exchange Act.

Name and Address of Beneficial Owner | | | Amount and Nature of Beneficial Ownership | | | Percent of Class(1) |

The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355 | | | 2,711,736(2) | | | 9.3% |

BlackRock Inc. 55 East 52nd Street, New York, NY 10055 | | | 2,607,586(3) | | | 8.9% |

Durable Capital Partners LP 5425 Wisconsin Avenue, Chevy Chase, MD 20815 | | | 2,416,738(4) | | | 8.3% |

T. Rowe Price Associates, Inc. 100 E. Pratt Street, Baltimore, MD 21202 | | | 2,077,450(5) | | | 7.1% |

Kayne Anderson Rudnick Investment Management LLC 1800 Avenue of the Stars, Los Angeles, CA 90067 | | | 1,931,657(6) | | | 6.6% |

Wasatch Advisors LP 505 Wakara Way, Salt Lake City, UT 84108 | | | 1,759,189(7) | | | 6.0% |

(1) | Based on 29,221,224 shares of common stock outstanding as of July 1, 2024. |

(2) | A Form 13G/A filed February 13, 2024 indicates that it has (i) sole voting power over zero shares, (ii) shared voting power over 10,316 shares, (iii) sole dispositive power over 2,673,955 shares, and (iv) shared dispositive power over 37,781 shares. |

(3) | A Form 13G/A filed January 25, 2024 indicates that it has (i) sole voting power over 2,548,596 shares, (ii) sole dispositive power over 2,607,586 shares, and (iii) shared voting and dispositive power over zero shares. |

(4) | A Form 13G/A filed February 12, 2024 indicates that it has (i) sole voting and dispositive power over 2,416,738 shares, and (ii) shared voting and dispositive power over zero shares. |

(5) | A Form 13G/A filed February 14, 2024 indicates that it has (i) sole voting power over 436,108 shares, (ii) sole dispositive power over 2,075,116 shares, and (iii) shared voting and dispositive power over zero shares. |

(6) | A Form 13G/A filed February 13, 2024 indicates that it has (i) sole voting power over 1,339,739 shares, (ii) shared voting and dispositive power over 365,280 shares, and (iii) sole dispositive power over 1,566,377 shares. |

(7) | A Form 13G filed February 9, 2024 indicates that it has (i) sole voting and dispositive power over 1,759,189 shares, and (ii) shared voting and dispositive power over zero shares. |

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires that the Company’s executive officers, directors and greater than 10% stockholders file reports of ownership and changes of ownership of the Company’s common stock with the SEC. Based on a review of ownership reports filed during fiscal 2024, the Company believes that all Section 16(a) filing requirements were met during the year on a timely basis except that (i) Richard Crowell’s gift of

113 shares on April 26, 2023 was reported on April 1, 2024, (ii) Dr. Michael Hartnett’s exercise of 9,496 stock options and sale of 6,183 of the resulting shares (to pay his option exercise price and withholding taxes) on June 20, 2023 were reported two days late, (iii) John Feeney’s disposition of 34 shares to the Company (to pay withholding tax on the vesting of restricted stock) on February 2, 2024 was reported on May 28, 2024.

| | |  | | | 2024 Proxy Statement | | | 21 |

Directors and Executive Officers |

Dr. Michael J. Hartnett | | | Dr. Hartnett has been the Company’s President and Chief Executive Officer since 1992 and Chairman of the Board since 1993. Prior to that, Dr. Hartnett served as President and General Manager of our Industrial Tectonics Bearings Corporation, or ITB, subsidiary from 1990, following 18 years at The Torrington Company, one of the three largest bearings manufacturers in the U.S. While at The Torrington Company, Dr. Hartnett held the position of Vice President and General Manager of the Aerospace Business Unit and was, prior to that, Vice President of the Research and Development Division. Dr. Hartnett holds an undergraduate degree from the University of New Haven, a Master’s degree from Worcester Polytechnic Institute and a Doctoral degree in Applied Mechanics from the University of Connecticut. Dr. Hartnett has developed numerous patents, authored more than two dozen technical papers and is well known for his contributions to the field of tribology, the study of friction. Dr. Hartnett served as a director of ATC Technology Corporation, a publicly-owned third-party logistics and automotive aftermarket service provider, until 2010, and served as a director of Process Fab Inc., a private company in the business of precision manufacturing and related services, until 2014. Dr. Hartnett provides the Board with significant leadership and executive experience. His proven leadership capability and his strong knowledge of the complex financial and operational issues facing mid-sized companies provides the Board with a unique and necessary perspective. |

Chairman, President and CEO Joined RBC in 1992 Age: 79 | |

Daniel A. Bergeron | | | Mr. Bergeron has been with the Company since 2003 when he joined us as Vice President, Finance and later that same year was appointed Chief Financial Officer. In 2017, he was additionally appointed Chief Operating Officer and in October 2020 he relinquished the position of Chief Financial Officer. From 2002 until 2003, he served as Vice President and Chief Financial Officer of Allied Healthcare International, Inc., a publicly-held provider of healthcare staffing services. Mr. Bergeron served as Vice President and Chief Financial Officer at Paragon Networks International, Inc., a telecommunications company, from 2000 to 2002. From 1998 to 2000, he served as Vice President and Chief Financial Officer of Tridex Corporation, a publicly-held software company. From 1987 to 1998, Mr. Bergeron held various financial reporting positions with Dorr-Oliver Inc., an international engineering and manufacturing company, including Vice President and Chief Financial Officer. Mr. Bergeron holds a Bachelor of Science degree in Finance from Northeastern University and a Master of Business Administration degree from the University of New Haven. Mr. Bergeron provides the Board with significant financial leadership and executive experience. His proven leadership capability and his strong knowledge of the complex financial and operational issues facing mid-sized companies provides the Board with a unique and necessary perspective. |

Vice President and COO Joined RBC in 2003 Age: 64 | |

22 | | |  | | | 2024 Proxy Statement | | |

Michael H. Ambrose | | | Mr. Ambrose has been a director since 2019. Mr. Ambrose is currently Principal Partner of MH Ambrose Consulting, specializing in Aerospace and Digital Integration consulting. In this capacity, Mr. Ambrose consults with aerospace OEMs, manufacturing suppliers, and advisory boards for private digital solution providers. Additionally, Mr. Ambrose is recognized as a subject matter expert on digital integration. Since 2021, he has given over fifteen significant presentations on digital transformation, including for the World Affairs Council and a NATO summit in Brussels. Mr. Ambrose also currently serves as Chairman of the University of New Haven Board of Governors. In 2023, Mr. Ambrose completed a 39-year career with Sikorsky Aircraft, a Lockheed Martin Company, where he held executive leadership positions in complex aerospace design, manufacturing operations, and program management. He served as the Vice-President of Enterprise Business Transformation (2021-2023), Chief Engineer and Vice President of Engineering and Technology (2017-2021), Vice President of Aircraft Design and Manufacturing Engineering (2011-2017), Vice President of International Government Programs (2008-2011), and General Manager of Precision Machining Operations (2005-2008). Among his responsibilities and accomplishments at Sikorsky, he led organizations of over 3,500 engineers and separately 800 factory employees, was co-chair of the Sikorsky senior safety board with responsibility for air worthiness, and successfully implemented numerous lean and digital transformation projects. Mr. Ambrose holds a Mechanical Engineering Bachelor of Science degree from the University of New Haven and an Engineering Management Master of Science degree from the Massachusetts Institute of Technology. Mr. Ambrose’s diverse and extensive leadership experience in engineering, manufacturing, program management, international business, and digital integration provides the Board with unique and valuable resources pertaining to RBC’s business and understanding of RBC’s customers and industry trends. |

Director Joined RBC in 2019 Age: 62 | |

Richard R. Crowell | | | Mr. Crowell has been a director since 2002. Mr. Crowell is a Managing Partner of Vance Street Capital LLC, a private equity investment firm he founded in 2007. Previously he was the President of Aurora Capital Group, a private equity investment firm he co-founded in 1991. Prior to establishing Aurora, Mr. Crowell was a Partner and President of Acadia Partners, a New York-based investment fund. From 1983 to 1987, he was a Managing Director, Corporate Finance for Drexel Burnham Lambert. He serves on the Board of Visitors of the University of California, Los Angeles Anderson School of Management. Mr. Crowell is a director of Micronics, Inc. and Jet Parts Aviation, all of which are private companies in the businesses of filtration products, aerospace parts, precision manufacturing, engineered solutions, and related services. Mr. Crowell earned a Bachelor of Arts degree from the University of California, Santa Cruz and a Master of Business Administration degree from UCLA’s Anderson School. His extensive financial experience qualifies him as an “audit committee financial expert.” Mr. Crowell brings broad business, financial and executive leadership experience to the Board developed through his leadership roles at Vance Street Capital LLC, Aurora Capital Group LLC, Acadia Partners and Drexel Burnham Lambert. He has extensive experience with a number of precision manufacturing and aerospace companies. In addition, Mr. Crowell’s experience in private investment enables him to bring a valuable investor’s view to the Board and his relationships across the financial community strengthen the Company’s access to capital markets. His board memberships provide deep understanding of trends in the precision manufacturing and aerospace sectors, both of which present ongoing challenges and opportunities for the Company. |

Director Joined RBC in 2002 Age: 69 | |

| | |  | | | 2024 Proxy Statement | | | 23 |

Dolores J. Ennico | | | Ms. Ennico has been a director since 2020. She is currently the Principal of Canterbury Consulting, which provides strategic consulting services in various business initiatives. She was Chief Human Resources Officer of Olin Corporation from 2009 to 2018 and prior to that served Olin in a variety of capacities from 1974 including Vice President, Administration from 2004 to 2009, Director, Corporate Employee Relations from 2000 to 2004, and Director of Retail Marketing, Pool Chemicals from 1997 to 2000. Ms. Ennico is a member of the Board of Governors of the University of New Haven and a member of its Compensation Committee, is a member of the Advisory Council of Sacred Heart Academy in Hamden, Connecticut, and is a member of the Executive Committee of the Board of the Girl Scouts of Connecticut. She earned a Bachelor of Science degree in Microbiology and a Master of Science degree in Biochemistry from Southern Connecticut State University, and a Master of Business Administration degree from the University of New Haven. Ms. Ennico’s vast experience in human capital management, including executive compensation, and her C-suite experience with a Fortune 500 company are valuable resources for the Board. |

Director Joined RBC in 2020 Age: 71 | |