THE

FIRST

TEN

YEARS

WE ARE NOW THE LARGEST PURE PRECIOUS METALS STREAMING COMPANY IN THE WORLD. FROM ASSETS LOCATED THROUGHOUT THE AMERICAS AND EUROPE, SILVER WHEATON HAD ATTRIBUTABLE PRODUCTION OF OVER 35 MILLION SILVER EQUIVALENT OUNCES THIS YEAR. OUR COMPANY HAS THE HIGHEST MARGINS OF ALL SENIOR PRECIOUS METALS PRODUCERS WORLDWIDE, AND STREAMING IS NOW CONSIDERED A MAINSTREAM SOURCE OF FUNDING FOR THE MINING INDUSTRY.

CORPORATE PROFILE

| SILVER WHEATON IS THE WORLD’S LARGEST PURE PRECIOUS METALS STREAMING COMPANY. THE COMPANY OFFERS INVESTORS COST CERTAINTY, LEVERAGE TO INCREASING SILVER AND GOLD PRICES, AND A HIGH-QUALITY ASSET BASE. ITS BUSINESS MODEL IS BASED ON PAYING LOW, PREDICTABLE COSTS FOR PRECIOUS METALS STREAMS FROM A DIVERSE PORTFOLIO OF MINES, WITH ANY INCREASES IN PRECIOUS METAL PRICES FLOWING DIRECTLY TO THE BOTTOM LINE. | Top row from left to right: | Bottom row from |

| left to right: | ||

| RANDY SMALLWOOD | ||

| President & | MAURICE TAGAMI | |

| Chief Executive Officer | Vice President, | |

| Mining Operations | ||

| GARY BROWN | ||

| Senior Vice President | BETTINA CHARPENTIER | |

| & Chief Financial Officer | Vice President, Tax | |

| CURT BERNARDI | NEIL BURNS | |

| Senior Vice President, | Vice President, | |

| Legal & Corporate Secretary | Technical Services | |

| HAYTHAM HODALY | JAMIE BEIRNES | |

| Senior Vice President, | Vice President, | |

| Corporate Development | Controller | |

| PATRICK DROUIN | VINCENT LAU | |

| Senior Vice President, | Vice President, | |

| Investor Relations | Finance |

2

| 2014 REVIEW |

|

|

Silver Wheaton’s sales volume increased 10% year over year, while production decreased 2% in 2014. Attributable production was 35.3 million silver equivalent ounces, resulting in adjusted net earnings of $268.0 million ($0.75 per share) and operating cash flows of $431.9 million ($1.20 per share). With an average annual realized silver equivalent price of $18.86 per ounce, and cash operating costs of $4.59 per silver equivalent ounce, our cash operating margin in 2014 was $14.27 per silver equivalent ounce. | |

|

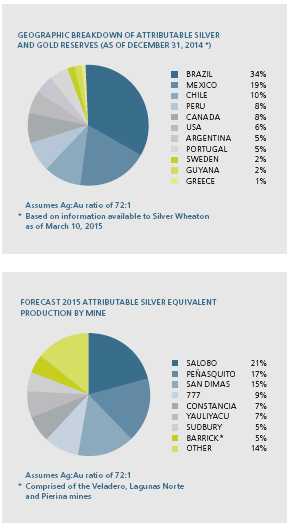

In 2015, based upon the company's current portfolio of low-cost, long-life assets, attributable production is forecast to be approximately 43.5 million silver equivalent ounces, including 230,000 ounces of gold. By 2019, annual attributable production is anticipated to increase over 40% to approximately 51 million silver equivalent ounces, including 325,000 ounces of gold. | |

|

Silver Wheaton’s future growth profile is expected to be driven by precious metal and gold streams on Vale’s Salobo and Sudbury operations and the anticipated commencement of commercial operations at Hudbay’s Constancia project. | |

|

The company’s unique business model creates shareholder value by providing: | |

|

• Leverage to increases in the price of silver and gold; | |

|

• Additional growth through the accretive acquisition of

| |

|

• A dividend yield tied to precious metal prices and our

| |

|

• Potential participation in the exploration success of

the | |

|

Silver Wheaton offers these benefits while at the same time seeks to reduce many of the downside risks faced by traditional mining companies. In particular, Silver Wheaton offers its investors both capital and operating cost certainty. Other than the initial upfront payment, the company typically has no ongoing capital or exploration costs. Furthermore, operating costs have been historically fixed at around $4 per ounce of silver produced and $400 per ounce of gold produced, subject to inflationary adjustments. | |

SILVER WHEATON 2014 ANNUAL REPORT 3

LETTER

FROM

THE PRESIDENT &

CEO

Silver Wheaton celebrated its ten year anniversary in 2014. We also celebrated the first decade of the streaming business model, which we introduced in 2004 with the vision of creating the best alternative for investing in precious metals. Since the company’s inception, our model has shown a propensity to perform in all phases of the commodity price cycle, including the low points that we saw in 2014. Despite a substantial drop in precious metal prices this past year, we continued to generate cash operating margins of over 70%, while maintaining one of the highest production levels in the silver industry. Furthermore, we saw significant de-risking of two of our key growth assets, as Vale’s Salobo mine completed its expansion and Hudbay’s Constancia mine saw first production late in 2014.

Overall, Silver Wheaton was able to weather the storm of the tumultuous commodity price environment of 2014. This is not to say that we were completely unscathed; the weak commodity prices that plagued the entire industry did impact two of the smaller mines on which we have streams, resulting in a writedown in our third quarter. These were, however, the only assets in our portfolio that were found to be impaired, as the rest of the portfolio performed well. This year highlighted the strategic importance of Silver Wheaton’s focus of investing in low-cost, high-quality assets, which can be profitable even in tough times. Even with these comparatively minor bumps in 2014, Silver Wheaton remained profitable and fared well compared to its peer group, and to the mining industry as a whole.

Silver Wheaton’s attributable production in 2014 was 35.3 million silver equivalent ounces, a slight decrease from 2013. Operating cash flows were $431.9 , a drop of 20% from 2013, but still reasonable given that the silver equivalent price dropped 20% during 2014. This again underscores the strength of our business model, as we maintained strong cash operating margins given our relatively fixed and very low cash cost structure.

Last year, our cornerstone assets included Vale’s Salobo mine, Primero’s San Dimas mine, and Goldcorp’s Peñasquito mine. In 2013, we acquired 25% of the life of mine gold production from the Salobo mine, the largest copper deposit ever found in Brazil. The mine began operating in 2012 at a capacity of 12 million tons per annum, and completed an expansion in capacity to 24 million tons per annum in mid-2014. This expansion is expected to continue ramping up through 2015. This past year the mine produced for us a record 40,000 ounces of gold, which bodes well, as in March 2015 we announced the acquisition of another 25% of the Salobo gold production from Vale. We are now entitled to 50% of the life of mine gold production from the Salobo mine, the additional 25% immediately increasing our production and cash flow profile by adding expected average gold production of 70,000 ounces per year for the first 10 years from the mine. Salobo has significant expansion and exploration potential, and it is expected to be a lead contributor to our growth in 2015.

In 2014, Primero had an excellent year at the San Dimas mine. They not only reported record production, but also completed one expansion, announced another, and celebrated a string of exploration successes. Early in the year, Primero’s expansion increased the mine’s throughput capacity from 2,150 to 2,500 tonnes per day. Just as additional tonnes were beginning to flow through the mill, Primero announced plans to expand further, to 3,000 tonnes per day by mid-2016. San Dimas contributed 5.8 million ounces to our production in 2014, and we look forward to their growth in 2015 and beyond. Goldcorp’s Peñasquito mine became our largest producer in 2014 at over 7.3 million ounces of attributable silver, despite water issues caused by an unprecedented drought. Goldcorp has diligently pursued remedies to increase throughput and is currently constructing the Northern Well Field, which should alleviate current water constraints once completed in mid-2015. Despite these challenges, Goldcorp continues to focus on the opportunities at Peñasquito. They have identified two new initiatives that could add materially to recovered silver production, and have also had significant exploration success with the identification of high-grade skarn deposits adjacent to the current pit design.

In December 2014, Silver Wheaton reached a significant milestone in our growth as Hudbay began first production at its Constancia mine. Constancia is expected to ramp-up to commercial production in mid-2015, and is forecast to produce on average 35,000 ounces of gold and 2.4 million ounces of silver annually for Silver Wheaton for the first few years of full production.

With the expansion of the Salobo mine, the ramp up at the Constancia mine, and commissioning of the Rosemont mine, we expect overall production growth of over 40% over the next five years.

Silver Wheaton also remains focussed on supporting our community, both in Canada and abroad. We have become increasingly dedicated to helping communities located near the mines where we have streaming agreements. In 2014, we initiated a new program providing financial support to our partners’ social projects located in mining communities where we purchase precious metals. In August, we announced that we have committed to supporting programs led by Primero and Barrick, for their recreation and irrigation projects, respectively. We look

4

forward to seeing the benefits of these projects, and to creating new agreements in the future.

On the corporate development front, we continue to focus on finding well-managed, high-quality assets producing in the lowest-half of their respective cost-curves. In the current environment, little capital is being invested by the industry as major and mid-tier mining companies concentrate on shaving costs and focusing on profitability. Consequently, many of the current opportunities under consideration are to help existing producers strengthen their balance sheets, to assist in asset acquisitions, and to provide support to single asset companies.

2014 was a significant year for Silver Wheaton as we marked our ten-year anniversary. We now have 27 assets in our portfolio, and our streaming model has been adopted across the industry. Significantly, Silver Wheaton’s share price has climbed over 500% over our first ten years, while the price of silver rose less than 140%. More importantly, as a result of real, hard growth, Silver Wheaton shareholders now have over 3.5 silver equivalent reserve ounces backing every share in the company, a 760% increase to the 0.4 reserve ounces that backed every share in 2004. Moreover, this does not include the additional return provided by our dividend policy which links our payout directly to operating cash flows, giving shareholders direct exposure to both precious metal prices and our production growth profile. We are proud of the value created to date, and we look forward to creating further opportunities and adding value over the next ten years.

To our shareholders, operating partners, board of directors and employees: thank you for your continued commitment and support as we continue to strive to make Silver Wheaton the premier investment vehicle for precious metals investors worldwide.

RANDY SMALLWOOD, President & CEO

March 18, 2015

SILVER WHEATON 2014 ANNUAL REPORT 5

CORNERSTONE &

GROWTH ASSETS

Silver Wheaton’s diversified portfolio of precious metal streams includes 21 operating mines and 6 development projects. Cornerstone assets in 2014 included the San Dimas, Peñasquito, and Salobo mines. Our newest producing asset, the Constancia mine, started producing in late 2014 and is expected to ramp-up over 2015 providing a key component of Silver Wheaton’s growth.

SAN DIMAS

Primero’s San Dimas

mine had another very strong year in 2014, contributing 5.8 million silver

ounces to Silver Wheaton. In the first quarter of 2014, Primero completed an

expansion which increased the mine’s throughput capacity from 2,150 tonnes per

day (tpd) to 2,500 tpd. In late-2014, Primero announced plans to further expand to

3,000 tpd by mid-2016. Fourth quarter 2014 production showed that they are well

on their way towards that goal.

PEÑASQUITO

Goldcorp’s Peñasquito

mine produced over 7.3 million ounces of silver for Silver Wheaton in 2014

despite water issues caused by an unprecedented drought which limited mill

throughput. Goldcorp is currently constructing the Northern Well Field, a new

well field which should alleviate water constraints, which is expected to be

completed by mid-2015. Goldcorp is currently reviewing two new initiatives at

the Peñasquito mine: the Concentrate Enrichment Project and the Pyrite Leach

project. Goldcorp reports that successful implementation of one or both of these

new process improvements has the potential to significantly improve the overall

economics and life of mine duration.

SALOBO

Vale’s Salobo mine

produced a record 40 thousand ounces of gold in 2014 for Silver Wheaton. The

Salobo mine, the largest copper deposit ever found in Brazil, began operating in

2012 at a capacity of 12 million tonnes per annum (mtpa). An expansion to 24

mtpa was completed in mid-2014, and it is expected to continue ramping up

through 2015. Salobo is forecast to produce approximately 70,000 ounces of gold

to Silver Wheaton annually for the first ten years of full production,

representing 50 percent of total gold production from the mine.

CONSTANCIA – NEAR TERM GROWTH

Hudbay’s Constancia mine began production in December of 2014 and is

expected to ramp-up to commercial production in mid-2015. Constancia is forecast

to produce on average 35,000 ounces of gold and 2.4 million ounces of silver

annually for the first five years of production.

LONG-TERM GROWTH

We forecast

production growth of over 40%, to approximately 51 million silver equivalent

ounces, over the next five years. This anticipated growth is expected to be

driven by the company’s portfolio of low-cost and long-life assets, including

precious metal and gold streams on Hudbay’s Constancia project and Vale’s Salobo

mine. We do not include any production from the Rosemont project or the

Pascua-Lama project in our guidance. During 2014, Barrick placed Pascua-Lama on

care and maintenance and stated that a decision to re-start development will

depend on improved economics and more certainty on legal and permitting matters.

SILVER WHEATON 2014 ANNUAL REPORT 7

PERFORMANCE HIGHLIGHTS

| 2014 | 2013 | 2012 | |||||||

| (As of December 31 for each year) | |||||||||

| Financials | |||||||||

| Revenue ($000’s) | $ | 620,176 | $ | 706,472 | $ | 849,560 | |||

| Net earnings ($000’s) | $ | 199,826 | $ | 375,495 | $ | 586,036 | |||

| Adjusted net earnings 1 ($000’s) | $ | 267,977 | $ | 375,495 | $ | 586,036 | |||

| Operating cash flow ($000’s) | $ | 431,873 | $ | 534,133 | $ | 719,404 | |||

| Net earnings per share | |||||||||

| Basic | $ | 0.56 | $ | 1.06 | $ | 1.66 | |||

| Diluted | $ | 0.56 | $ | 1.05 | $ | 1.65 | |||

| Adjusted net earnings 1 per share | |||||||||

| Basic | $ | 0.75 | $ | 1.06 | $ | 1.66 | |||

| Diluted | $ | 0.74 | $ | 1.05 | $ | 1.65 | |||

| Operating cash flow per share 2 | $ | 1.20 | $ | 1.50 | $ | 2.03 | |||

| Dividends paid ($000’s) | $ | 93,400 3 | $ | 160,013 | $ | 123,852 | |||

| Dividends paid per share | $ | 0.26 | $ | 0.45 | $ | 0.35 | |||

| Cash and cash equivalents ($000’s) | $ | 308,098 | $ | 95,832 | $ | 778,216 | |||

| Weighted average basic number of shares outstanding (000’s) | 359,401 | 355,588 | 353,874 | ||||||

| Share price (NYSE) | $ | 20.33 | $ | 20.19 | $ | 36.08 | |||

| Operating | |||||||||

| Attributable silver ounces produced (000’s) | 25,674 | 26,754 | 26,669 | ||||||

| Attributable gold ounces produced | 142,815 | 151,204 | 50,482 | ||||||

| Attributable silver equivalent ounces produced (000’s) 4 | 35,285 | 35,832 | 29,372 | ||||||

| Silver ounces sold (000’s) | 23,484 | 22,823 | 24,850 | ||||||

| Gold ounces sold | 139,522 | 117,319 | 46,094 | ||||||

| Silver equivalent ounces sold (000’s) 4 | 32,891 | 29,963 | 27,328 | ||||||

| Average realized silver price per ounce sold | $ | 18.92 | $ | 23.86 | $ | 31.03 | |||

| Average realized gold price per ounce sold | $ | 1,261 | $ | 1,380 | $ | 1,701 | |||

| Average silver cash cost per ounce sold 5 | $ | 4.14 | $ | 4.12 | $ | 4.06 | |||

| Average gold cash cost per ounce sold 5 | $ | 386 | $ | 386 | $ | 362 |

| 1 |

Refer to discussion on non-IFRS measure (i) on page 40 of the MD&A. |

| 2 |

Refer to discussion on non-IFRS measure (ii) on page 41 of the MD&A. |

| 3 |

Dividends paid during 2014 were comprised of $79.8 million in cash and $13.6 million in common shares issued, with the Company issuing 646,618 common shares (an average of $21.08 per share) under the Company’s dividend reinvestment plan. |

| 4 |

G old ounces produced and sold are converted to a silver equivalent basis based on either (i) the ratio of the average silver price received to the average gold price received during the period from the assets that produce both gold and silver; or (ii) the ratio of the price of silver to the price of gold on the date of sale as per the London Bullion Metal Exchange for the assets which produce only gold. |

| 5 |

Refer to discussion on non-IFRS measure (iii) on page 42 of the MD&A. |

8

PRECIOUS METALS

STREAMING

SILVER WHEATON CREATED PRECIOUS METALS STREAMING IN ORDER TO UNLOCK HIDDEN VALUE BY ACQUIRING BY-PRODUCT PRECIOUS METAL FROM HIGH-QUALITY, LOW-COST MINES, WITH A GOAL OF PROVIDING INVESTORS SUPERIOR RETURNS AND SOME OF THE HIGHEST MARGINS IN THE INDUSTRY.

PRECIOUS METAL STREAMING – UNLOCKING

VALUE

Silver Wheaton introduced the streaming model ten years ago

after recognizing that silver produced as a by-product was not being fully

valued by the financial markets. Streaming was created to unlock this value,

both for Silver Wheaton’s shareholders and for Silver Wheaton’s partner mine

owners. Since its introduction, the streaming model has also been applied to

gold and other precious metals.

Streaming allows Silver Wheaton to purchase, in exchange for an upfront payment, a fixed percentage of the precious metals produced from a mine. Once an agreement is entered into, Silver Wheaton has the right to purchase the precious metal at a predetermined price as it is delivered. The production payment is set at a level intended to offset Silver Wheaton’s partners’ typical cost to produce an ounce of silver or gold.

Silver Wheaton does not own or operate mines and is therefore not exposed to rising capital and operating costs. However, the company’s agreements are typically for the life of the operation, giving Silver Wheaton exposure to the mine’s future expansions and exploration success.

Silver remains a core focus of streaming, as 70% of worldwide silver is produced as a by-product and is therefore generally considered to be a non-core asset at the mine where it is produced. In many large base metal operations, gold production represents only a small fraction of the overall economics of the mine and it is therefore also considered non-core. While Silver Wheaton believes streaming creates the most value when targeting by-product precious metals, given its value-enhancement and flexibility, the streaming model has also proven successful with primary metal production.

Benefits to Silver Wheaton’s

Shareholders:

The key benefit of streaming to Silver Wheaton’s

shareholders is cost certainty, which translates into direct leverage to

increases in precious metal prices. Inflationary cost pressures have plagued the

mining industry for the past few years, driving capital and operating costs

higher for traditional miners and cutting into their profit margins. Once Silver

Wheaton makes the upfront payment, the company typically has no ongoing capital

or exploration costs. Furthermore, Silver Wheaton’s operating costs are set at

the time a stream is entered into at a predetermined, fixed production payment.

Fixed costs allow us to consistently deliver amongst the highest cash operating

margins in the mining industry.

Benefits to Partner Mining Company’s

Shareholders:

At Silver Wheaton, our goal is first and foremost to

generate superior returns for our shareholders; however, we recognize that the

sustainability of our model is dependent on uncovering value for all of the

parties involved in a streaming agreement. Silver Wheaton is able to do this by

unlocking the value of silver and gold typically produced as a by-product. By

entering into a streaming agreement, mining companies can receive greater value

for their precious metals than what is reflected in the market. These companies

can use the upfront payment to continue growing their core business, either

through exploration, production expansions or acquisitions, or, alternatively,

the proceeds can be used to strengthen their balance sheet.

SILVER WHEATON 2014 ANNUAL REPORT 9

CORPORATE SOCIAL

RESPONSIBILITY

SILVER WHEATON HAS STREAMS WITH MINES IN CANADA AND AROUND THE WORLD. WE ARE COMMITTED TO CREATING A SUSTAINABLE, POSITIVE IMPACT ON THE COMMUNITIES WHERE OUR EMPLOYEES LIVE AND WORK, AND WE SUPPORT A NUMBER OF WORTHY CAUSES IN CANADA AND ABROAD EACH YEAR.

In 2014, we initiated an exciting new corporate social responsibility program to help our mining communities. We now provide financial support for our mining partners’ CSR projects in mining communities where our precious metals are produced. In August, we announced the launch of the program by supporting projects led by two of our mining partners, Primero Mining and Barrick Gold.

Silver Wheaton is helping Primero to finance the building of three community facilities in Tayoltita, Mexico, a town located near the San Dimas mine, one of our largest producers. This project is expected to provide much-needed recreational opportunities for the community of Tayoltita. Primero expects the project to be completed in 2015.

We are also helping to support a key initiative lead by Barrick. They are executing an irrigation project in the communities of Jachal and Iglesia of San Juan Province, Argentina, located near the Veladero mine and Pascua-Lama project. Barrick’s goal is to enhance water conservation and agricultural outputs by conserving and optimizing water resources through the implementation of drip and sprinkling irrigation technology. This project is also expected to be completed in 2015.

We believe that our financial contributions will positively impact the communities where these mining operations are located, providing long-term, sustainable benefits. We look forward to seeing the benefits of these projects and are committed to creating new agreements with existing and future mining partners.

10

| FINANCIALS | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

13 |

| FINANCIAL STATEMENTS |

67 |

Management’s Discussion and Analysis of Results of Operations and Financial Condition for the Year Ended December 31, 2014

|

•

|

Attributable silver equivalent production for the three months and year ended December 31, 2014 of 9.0 million ounces (6.4 million ounces of silver and 34,500 ounces of gold) and 35.3 million ounces (25.7 million ounces of silver and 142,800 ounces of gold), respectively, representing a decrease of 8% and 2% over the comparable periods in 2013.

|

|

•

|

Attributable silver equivalent sales volume for the three months and year ended December 31, 2014 of 8.5 million ounces (5.7 million ounces of silver and 37,900 ounces of gold) and 32.9 million ounces (23.5 million ounces of silver and 139,500 ounces of gold), respectively, representing an increase of 7% and 10% over the comparable periods in 2013, with ounces sold for the most recently completed twelve month period representing a record for the Company.

|

|

•

|

Average realized sale price per silver equivalent ounce sold for the three months and year ended December 31, 2014 of $16.43 ($16.46 per ounce of silver and $1,213 per ounce of gold) and $18.86 ($18.92 per ounce of silver and $1,261 per ounce of gold), representing a decrease of 22% and 20%, respectively, as compared to the comparable periods of 2013.

|

|

•

|

Revenue for the three months and year ended December 31, 2014 of $140.4 million and $620.2 million, respectively, compared with $167.4 million and $706.5 million for the comparable periods in 2013, representing a decrease of 16% and 12%, respectively.

|

|

•

|

Net earnings for the three months and year ended December 31, 2014 was $52.0 million ($0.14 per share) and $199.8 million ($0.56 per share), respectively, compared with $93.9 million ($0.26 per share) and $375.5 million ($1.06 per share) for the comparable periods in 2013, representing a decrease of 45% and 47%, respectively.

|

|

•

|

During the third quarter of 2014, the Company recognized an impairment charge of $68.2 million related to its Mineral Park and Campo Morado silver interests.

|

|

•

|

After removing the impact of the impairment charge, adjusted net earnings¹ for the three months and year ended December 31, 2014 of $52.0 million ($0.14 per share) and $268.0 million ($0.75 per share), respectively, compared with net earnings of $93.9 million ($0.26 per share) and $375.5 million ($1.06 per share) for the comparable periods in 2013, representing a decrease of 45% and 29%, respectively.

|

|

•

|

Operating cash flows for the three months and year ended December 31, 2014 of $94.1 million ($0.26 per share²) and $431.9 million ($1.20 per share²), respectively, compared with $124.6 million ($0.35 per share²) and $534.1 million ($1.50 per share²) for the comparable periods in 2013, representing a decrease of 24% and 19%, respectively.

|

|

•

|

On March 18, 2015, the Board of Directors declared a dividend in the amount of $0.05 per common share as per the Company’s stated dividend policy whereby the quarterly dividend will be equal to 20% of the average of the operating cash flow of the previous four quarters. This dividend is payable to shareholders of record on March 31, 2015 and is expected to be distributed on or about April 14, 2015. The Company has implemented a dividend reinvestment plan (“DRIP”) whereby shareholders can elect to have dividends reinvested directly into additional Silver Wheaton common shares at a discount of 3% of the Average Market Price, as defined in the DRIP.

|

| 1 | Refer to discussion on non-IFRS measure (i) of page 40 of this MD&A |

| 2 | Refer to discussion on non-IFRS measure (ii) of page 41 of this MD&A |

|

•

|

Average cash costs¹ for the three months and year ended December 31, 2014 of $4.51 and $4.59 per silver equivalent ounce, respectively.

|

|

•

|

Cash operating margin² for the three months and year ended December 31, 2014 of $11.92 and $14.27 per silver equivalent ounce, respectively, representing a decrease of 27% and 25% relative to the comparable periods in 2013.

|

|

•

|

As at December 31, 2014, approximately 4.8 million payable silver equivalent ounces attributable to the Company have been produced at the various mines and will be recognized in future sales as they are delivered to the Company under the terms of their contracts. This represents a decrease of 0.3 million payable silver equivalent ounces during the three month period ended December 31, 2014.

|

|

•

|

On March 2, 2015, the Company announced that it had agreed to amend its agreement with Vale S.A (“Vale”) to acquire an additional amount of gold equal to 25% of the life of mine gold production from any minerals from the Salobo mine that enter the Salobo mineral processing facility from and after January 1, 2015. This acquisition is in addition to the 25% of the Salobo mine gold production that the Company acquired pursuant to its agreement in 2013.

|

|

•

|

On March 31, 2014, with the unanimous consent of lenders, the term of the Company’s $1 billion non-revolving term-loan (“NRT Loan”) was extended by one year.

|

|

•

|

On February 27, 2015, the Company announced that it had amended its $1 billion revolving credit facility (the “Revolving Facility”) by increasing the available credit from $1 billion to $2 billion and extending the term by 2 years, with the facility now maturing on February 27, 2020. The Company used proceeds drawn from this amended Revolving Facility together with cash on hand to repay the NRT Loan.

|

|

•

|

On March 26, 2014, the Company paid $125 million to Hudbay Minerals Inc. ("Hudbay") in satisfaction of the final upfront payment relative to the silver stream on the Constancia project.

|

|

•

|

On May 8, 2014, the Company announced that it had implemented a dividend reinvestment plan whereby shareholders can elect to have dividends reinvested directly into additional Silver Wheaton common shares.

|

|

•

|

On September 26, 2014 the Company paid $135 million to Hudbay in satisfaction of the upfront payment relative to the gold stream on the Constancia project through the issuance of 6,112,282 common shares, at an average issuance price of $22.09 per share.

|

|

•

|

On January 5, 2015, the Company announced that it had amended its silver purchase agreement related to Barrick Gold Corporation’s (“Barrick”) Pascua-Lama project (“Pascua-Lama”). The amendment entails Silver Wheaton being entitled to 100% of the silver production from Barrick’s Lagunas Norte, Pierina and Veladero mines until March 31, 2018 - an extension of 1 ¼ years, and extending the completion test deadline an additional 2 ½ years to June 30, 2020. As a reminder, if the requirements of the completion test have not been satisfied by the amended completion date, the agreement may be terminated by Silver Wheaton. In such an event, Silver Wheaton will be entitled to the return of the upfront cash consideration of $625 million less a credit for any silver delivered up to that date.

|

|

•

|

On January 5, 2015, the Company announced that it had reached an agreement with Nyrstar Mining Ltd. (“Nyrstar”) resulting in the cancellation of the silver purchase agreement relating to the Campo Morado mine in Mexico in exchange for cash consideration of $25 million payable on or before January 31, 2015, with this payment being received on January 30, 2015. As part of this agreement, Silver Wheaton will be entitled to 75% of the silver contained in concentrate produced at the Campo Morado mine on or prior to December 31, 2014, and will be granted a five year right of first refusal on any silver streaming or royalty transaction in relation to any Nyrstar group property, globally.

|

| 1 | Refer to discussion on non-IFRS measure (iii) of page 42 of this MD&A |

| 2 | Refer to discussion on non-IFRS measure (iv) of page 43 of this MD&A |

|

•

|

As per Hudbay’s January 15, 2015 press release, initial concentrate production was achieved from Hudbay’s Constancia project during the fourth quarter of 2014 with commercial production projected for the second quarter of 2015 and full capacity thereafter.

|

|

•

|

On March 2, 2015, the Company announced that, in connection with the amended Salobo precious metal purchase agreement, it had entered into an agreement with a syndicate of underwriters led by Scotiabank, pursuant to which they have agreed to purchase, on a bought deal basis, 38,930,000 common shares of Silver Wheaton at a price of $20.55 per share (the "Offering"), for aggregate gross proceeds to Silver Wheaton of approximately $800 million. Silver Wheaton also agreed to grant to the underwriters an option to purchase up to an additional 5,839,500 common shares at a price of $20.55 per share, on the same terms and conditions as the Offering, exercisable at any time, in whole or in part, until the date that is 30 days following the closing of the Offering (the “Over Allotment Option”).

|

|

•

|

On March 17, 2015, the Company announced that it had closed the Offering and received $800 million in gross proceeds (net proceeds of approximately $769 million after payment of underwriters’ fees and expenses). The underwriters have until April 16, 2015 to exercise the Over Allotment Option. In the event that the option is exercised in its entirety, the aggregate gross proceeds of the Offering to Silver Wheaton will be approximately $920 million.

|

|

1

|

Statements made in this section contain forward-looking information with respect to forecast production, funding outstanding commitments and continuing to acquire accretive precious metal stream interests and readers are cautioned that actual outcomes may vary. Please see “Cautionary Note Regarding Forward-Looking Statements” for material risks, assumptions and important disclosure associated with this information.

|

|

Silver and Gold

Interests

|

Mine

Owner

|

Location of

Mine

|

Upfront Consideration ¹

|

Attributable

Production to be

Purchased

|

Term of

Agreement

|

Date of

Original

Contract

|

|

|

Silver

|

Gold

|

||||||

|

San Dimas

|

Primero

|

Mexico

|

$ 189,799

|

100% 2

|

0%

|

Life of Mine

|

15-Oct-04

|

|

Yauliyacu

|

Glencore

|

Peru

|

$ 285,000

|

100% 3

|

0%

|

20 years

|

23-Mar-06

|

|

Peñasquito

|

Goldcorp

|

Mexico

|

$ 485,000

|

25%

|

0%

|

Life of Mine

|

24-Jul-07

|

|

777

|

Hudbay

|

Canada

|

$ 455,100

|

100%

|

100%/50% 4

|

Life of Mine

|

8-Aug-12

|

|

Salobo

|

Vale

|

Brazil

|

$ 2,230,000 5

|

0%

|

50%

|

Life of Mine

|

28-Feb-13

|

|

Sudbury

|

$ 623,572 6

|

||||||

|

Coleman

|

Vale

|

Canada

|

0%

|

70%

|

20 years

|

28-Feb-13

|

|

|

Copper Cliff

|

Vale

|

Canada

|

0%

|

70%

|

20 years

|

28-Feb-13

|

|

|

Garson

|

Vale

|

Canada

|

0%

|

70%

|

20 years

|

28-Feb-13

|

|

|

Stobie

|

Vale

|

Canada

|

0%

|

70%

|

20 years

|

28-Feb-13

|

|

|

Creighton

|

Vale

|

Canada

|

0%

|

70%

|

20 years

|

28-Feb-13

|

|

|

Totten

|

Vale

|

Canada

|

0%

|

70%

|

20 years

|

28-Feb-13

|

|

|

Victor

|

Vale

|

Canada

|

0%

|

70%

|

20 years

|

28-Feb-13

|

|

|

Barrick

|

$ 625,000

|

||||||

|

Pascua-Lama

|

Barrick

|

Chile/Argentina

|

25%

|

0%

|

Life of Mine

|

8-Sep-09

|

|

|

Lagunas Norte

|

Barrick

|

Peru

|

100%

|

0%

|

8.5 years

|

8-Sep-09

|

|

|

Pierina

|

Barrick

|

Peru

|

100%

|

0%

|

8.5 years 7

|

8-Sep-09

|

|

|

Veladero

|

Barrick

|

Argentina

|

100% 8

|

0%

|

8.5 years

|

8-Sep-09

|

|

|

Other

|

|||||||

|

Los Filos

|

Goldcorp

|

Mexico

|

$ 4,463

|

100%

|

0%

|

25 years

|

15-Oct-04

|

|

Zinkgruvan

|

Lundin

|

Sweden

|

$ 77,866

|

100%

|

0%

|

Life of Mine

|

8-Dec-04

|

|

Stratoni

|

Eldorado Gold 9

|

Greece

|

$ 57,500

|

100%

|

0%

|

Life of Mine

|

23-Apr-07

|

|

Minto

|

Capstone

|

Canada

|

$ 54,805

|

100%

|

100% 10

|

Life of Mine

|

20-Nov-08

|

|

Cozamin

|

Capstone

|

Mexico

|

$ 41,959

|

100%

|

0%

|

10 years

|

4-Apr-07

|

|

Neves-Corvo

|

Lundin

|

Portugal

|

$ 35,350

|

100%

|

0%

|

50 years

|

5-Jun-07

|

|

Aljustrel

|

I'M SGPS

|

Portugal

|

$ 2,451

|

100% 11

|

0%

|

50 years

|

5-Jun-07

|

|

Keno Hill

|

Alexco

|

Canada

|

$ 50,000

|

25%

|

0%

|

Life of Mine

|

2-Oct-08

|

|

Rosemont

|

Hudbay

|

United States

|

$ 230,000 12

|

100%

|

100%

|

Life of Mine

|

10-Feb-10

|

|

Loma de La Plata

|

Pan American

|

Argentina

|

$ 43,289 13

|

12.5%

|

0%

|

Life of Mine

|

n/a 14

|

|

Constancia

|

Hudbay

|

Peru

|

$ 429,900

|

100%

|

50% 15

|

Life of Mine

|

8-Aug-12

|

|

Early Deposit

|

|

||||||

|

Toroparu

|

Sandspring

|

Guyana

|

$ 148,500 16

|

0%

|

10% 16

|

Life of Mine

|

11-Nov-13

|

|

1)

|

Expressed in United States dollars, rounded to the nearest thousand; excludes closing costs and capitalized interest, where applicable.

|

|

2)

|

Until August 6, 2014, Primero delivered to Silver Wheaton a per annum amount equal to the first 3.5 million ounces of payable silver produced at San Dimas and 50% of any excess, plus Silver Wheaton received an additional 1.5 million ounces of silver per annum which was delivered by Goldcorp. Beginning August 6, 2014, Primero will deliver a per annum amount to Silver Wheaton equal to the first 6 million ounces of payable silver produced at San Dimas and 50% of any excess.

|

|

3)

|

To a maximum of 4.75 million ounces per annum. In the event that silver sold and delivered to Silver Wheaton in any year totals less than 4.75 million ounces, the amount sold and delivered to Silver Wheaton in subsequent years will be increased to make up for any cumulative shortfall, to the extent production permits.

|

|

4)

|

Silver Wheaton is entitled to acquire 100% of the life of mine gold production from Hudbay’s 777 mine until Hudbay’s Constancia project satisfies a completion test, or the end of 2016, whichever is later. At that point, Silver Wheaton’s share of gold production from 777 will be reduced to 50% for the life of the mine.

|

|

5)

|

Does not include the contingent payment related to the Salobo mine expansion. Vale has recently completed the expansion of the mill throughput capacity at the Salobo mine to 24 million tonnes per annum (“Mtpa”) from its previous 12 Mtpa. If actual throughput is expanded above 28 Mtpa within a predetermined period, Silver Wheaton will be required to make an additional payment to Vale based on a set fee schedule ranging from $88 million if throughput is expanded beyond 28 Mtpa by January 1, 2036, up to $720 million if throughput is expanded beyond 40 Mtpa by January 1, 2018.

|

|

6)

|

Comprised of a $570 million upfront cash payment plus warrants to purchase 10 million shares of Silver Wheaton common stock at a strike price of $65, with a term of 10 years.

|

|

7)

|

As per Barrick’s disclosure, closure activities were initiated at Pierina as of August 2013.

|

|

8)

|

Silver Wheaton's attributable silver production is subject to a maximum of 8% of the silver contained in the ore processed at Veladero during the period.

|

|

9)

|

95% owned by Eldorado Gold Corporation.

|

|

10)

|

The Company is entitled to acquire 100% of the first 30,000 ounces of gold produced per annum and 50% thereafter.

|

|

11)

|

As part of an agreement with I’M SGPS dated July 16, 2014, Silver Wheaton agreed to waive its rights to silver contained in copper concentrate at the Aljustrel mine while retaining the right to silver contained in zinc concentrate.

|

|

12)

|

The upfront consideration is currently reflected as a contingent obligation, payable on an installment basis to partially fund construction of the Rosemont mine once certain milestones are achieved, including the receipt of key permits and securing the necessary financing to complete construction of the mine.

|

|

13)

|

Comprised of $10.9 million allocated to the silver interest upon the Company’s acquisition of Silverstone Resources Corp. in addition to a contingent liability of $32.4 million, payable upon the satisfaction of certain conditions, including Pan American receiving all necessary permits to proceed with the mine construction.

|

|

14)

|

Definitive terms of the agreement to be finalized.

|

|

15)

|

Gold recoveries will be set at 55% for the Constancia deposit and 70% for the Pampacancha deposit until 265,000 ounces of gold have been delivered to the Company.

|

|

16)

|

Comprised of $13.5 million paid to date in addition to $135 million to be payable on an installment basis to partially fund construction of the mine. During the 60 day period following the delivery of a feasibility study, environmental study and impact assessment, and other related documents (collectively, the “Feasibility Documentation”), or after December 31, 2015 if the Feasibility Documentation has not been delivered to Silver Wheaton by such date, Silver Wheaton may elect not to proceed with the precious metal purchase agreement, at which time Silver Wheaton will be entitled to a return of $11.5 million of the early deposit (on the basis that $2 million of the advanced $13.5 million is non-refundable) or, at Sandspring’s option, the stream percentage will be reduced from 10% to 0.774% (equivalent to the pro-rata stream based on a full purchase price of $11.5 million).

|

|

1

|

Statements made in this section contain forward-looking information including the timing and amount of estimated future production and readers are cautioned that actual outcomes may vary. Please see “Cautionary Note Regarding Forward-Looking Statements” for material risks, assumptions and important disclosure associated with this information.

|

|

1

|

Payable silver equivalent ounces produced but not yet delivered are based on management estimates, and may be updated in future periods as additional information is received.

|

|

1

|

Payable silver equivalent ounces produced but not yet delivered are based on management estimates, and may be updated in future periods as additional information is received.

|

|

2

|

Silver Wheaton's attributable silver production is subject to a maximum of 8% of the silver contained in the ore processed at Veladero during the period.

|

|

i.

|

Pascua-Lama Challenge to SMA Regulatory Sanction

|

|

1

|

Payable silver equivalent ounces produced but not yet delivered are based on management estimates, and may be updated in future periods as additional information is received.

|

|

ii.

|

Pascua-Lama Environmental Damage Claim

|

|

iii.

|

Argentine Glacier Legislation

|

|

1

|

Payable silver equivalent ounces produced but not yet delivered are based on management estimates, and may be updated in future periods as additional information is received.

|

|

1

|

Payable silver equivalent ounces produced but not yet delivered are based on management estimates, and may be updated in future periods as additional information is received.

|

|

i.

|

As part of the agreement with Goldcorp to acquire silver from the Luismin mining operations, on October 15, 2004, the Company entered into an agreement with Goldcorp to acquire 100% of the silver production from its Los Filos mine in Mexico for a period of 25 years, commencing October 15, 2004. In addition, pursuant to Goldcorp’s sale of the San Dimas mine, Goldcorp delivered to Silver Wheaton 1.5 million ounces of silver per year until August 6, 2014, which is reflected in this MD&A and financial statements as part of the silver production and sales relating to San Dimas;

|

|

ii.

|

On December 8, 2004, the Company entered into an agreement with Lundin Mining Corporation (“Lundin”) to acquire 100% of the silver produced by Lundin’s Zinkgruvan mining operations in Sweden for the life of mine;

|

|

iii.

|

On April 23, 2007, the Company entered into an agreement with European Goldfields Limited, which was acquired by Eldorado Gold Corporation (“Eldorado Gold”) on February 24, 2012, to acquire 100% of the life of mine silver production from its 95% owned Stratoni mine in Greece;

|

|

iv.

|

On October 2, 2008, the Company entered into an agreement with Alexco Resource Corp. (“Alexco”) to acquire an amount equal to 25% of the life of mine silver production from its Keno Hill silver district in Canada, including the Bellekeno mine (see additional discussion below);

|

|

v.

|

On May 21, 2009, the Company completed the acquisition of Silverstone Resources Corp. (the “Silverstone Acquisition”). As part of the Silverstone Acquisition, the Company acquired a precious metal purchase agreement with Capstone Mining Corp. (“Capstone”) to acquire 100% of the silver and gold produced (subject to certain thresholds) from Capstone’s Minto mine in Canada for the life of mine. The Company is entitled to acquire 100% of all the silver produced and 100% of the first 30,000 ounces of gold produced per annum and 50% thereafter;

|

|

vi.

|

As part of the Silverstone Acquisition, the Company acquired a silver purchase agreement with Capstone to acquire 100% of the silver produced from Capstone’s Cozamin mine in Mexico for a period of 10 years, commencing on April 4, 2007;

|

|

vii.

|

As part of the Silverstone Acquisition, the Company acquired an agreement with Lundin to acquire 100% of the silver production from its Neves-Corvo mine in Portugal for a period of 50 years, commencing June 5, 2007;

|

|

viii.

|

As part of the Silverstone Acquisition, the Company acquired an agreement with I’M SGPS to acquire 100% of the silver production from its Aljustrel mine in Portugal for a period of 50 years, commencing June 5, 2007. As part of an agreement with I'M SGPS dated July 16, 2014, Silver Wheaton agreed to waive its rights to silver contained in copper concentrate at the Aljustrel mine while retaining the right to silver contained in zinc concentrate;

|

|

ix.

|

As part of the Silverstone Acquisition, the Company acquired an agreement with Aquiline Resources Inc., which was acquired by Pan American Silver Corp. (“Pan American”) on December 22, 2009, to acquire an amount equal to 12.5% of the life of mine silver production from the Loma de La Plata zone of the Navidad project in Argentina, the definitive terms of which are to be finalized. The Company is committed to pay Pan American total upfront cash payments of $32.4 million following the satisfaction of certain conditions, including Pan American receiving all necessary permits to proceed with the mine construction;

|

|

x.

|

On February 10, 2010, the Company entered into an agreement with Augusta Resource Corporation, which was acquired by Hudbay on July 16, 2014, to acquire an amount equal to 100% of the life of mine silver and gold production from the Rosemont Copper project (“Rosemont”) in the United States. The Company is committed to pay Hudbay total upfront cash payments of $230 million, payable on an installment basis to partially fund construction of the Rosemont mine once certain milestones are achieved, including the receipt of key permits and securing the necessary financing to complete construction of the mine; and

|

|

xi.

|

On August 8, 2012, the Company entered into an agreement with Hudbay to acquire an amount equal to 100% of the life of mine silver production from the Constancia project (“Constancia”) in Peru. On November 4, 2013, the Company amended its agreement with Hudbay to include the acquisition of an amount equal to 50%1 of the life of mine gold production from Constancia. If the Constancia processing plant fails to achieve at least 90% of expected throughput and silver recovery by December 31, 2016, Silver Wheaton would be entitled to continued delivery of 100% of the gold production from Hudbay’s 777 mine. If the completion test has not been satisfied by December 31, 2020, Silver Wheaton would be entitled to a proportionate return of the upfront cash consideration relating to Constancia. In addition, Silver Wheaton would be entitled to additional compensation in respect of the gold stream should there be a delay in achieving completion or mining the Pampacancha deposit beyond the end of 2018. Hudbay has granted Silver Wheaton a right of first refusal on any future streaming agreement, royalty agreement, or similar transaction related to the production of silver or gold from Constancia (see additional discussion below).

|

|

1

|

Payable silver equivalent ounces produced but not yet delivered are based on management estimates, and may be updated in future periods as additional information is received.

|

|

2

|

Mineral reserves and mineral resources are reported as of December 31, 2014, other than as disclosed in footnote 6 to the Attributable Reserves and Resources tables on page 59 of this MD&A.

|

|

December 31

|

December 31

|

|||

|

(in thousands)

|

2014

|

2013

|

||

|

Common shares held

|

$

|

32,872

|

$

|

40,801

|

|

Warrants held

|

-

|

-

|

||

|

|

$

|

32,872

|

$

|

40,801

|

|

Dec 31, 2014

|

Three Months

Ended

Dec 31, 2014

|

Year

Ended

Dec 31, 2014

|

|

|

(in thousands)

|

Fair Value

|

Fair Value Adjustment Gains

(Losses) Included in OCI

|

|

|

Bear Creek

|

$ 16,236

|

$ (5,658)

|

$ (1,972)

|

|

Revett

|

3,873

|

(2,022)

|

47

|

|

Other

|

12,763

|

(3,469)

|

(6,004)

|

|

|

$ 32,872

|

$ (11,149)

|

$ (7,929)

|

|

Dec 31, 2013

|

Three Months

Ended

Dec 31, 2013

|

Year

Ended

Dec 31, 2013

|

|

|

(in thousands)

|

Fair Value

|

Fair Value Adjustment Losses

Included in OCI

|

|

|

Bear Creek

|

$ 18,208

|

$ (11,713)

|

$ (25,922)

|

|

Revett

|

3,827

|

(2,186)

|

(10,997)

|

|

Other

|

18,766

|

(3,942)

|

(40,962)

|

|

|

$ 40,801

|

$ (17,841)

|

$ (77,881)

|

|

Dec 31, 2013

|

Three Months

Ended

Dec 31, 2013

|

Year

Ended

Dec 31, 2013

|

|

|

(in thousands)

|

Fair Value

|

Fair Value Adjustment Losses

Included in Net Earnings

|

|

|

Warrants held

|

$ -

|

$ -

|

$ (2,694)

|

|

2014

|

2013

|

2012

|

|

|

Silver equivalent production 1

|

|||

|

Attributable silver ounces produced (000’s)

|

25,674

|

26,754

|

26,669

|

|

Attributable gold ounces produced

|

142,815

|

151,204

|

50,482

|

|

Attributable silver equivalent ounces produced (000’s) 1

|

35,285

|

35,832

|

29,372

|

|

Silver equivalent sales 1

|

|||

|

Silver ounces sold (000’s)

|

23,484

|

22,823

|

24,850

|

|

Gold ounces sold

|

139,522

|

117,319

|

46,094

|

|

Silver equivalent ounces sold (000’s) 1

|

32,891

|

29,963

|

27,328

|

|

Average realized price ($'s per ounce)

|

|||

|

Average realized silver price

|

$ 18.92

|

$ 23.86

|

$ 31.03

|

|

Average realized gold price

|

$ 1,261

|

$ 1,380

|

$ 1,701

|

|

Average realized silver equivalent price 1

|

$ 18.86

|

$ 23.58

|

$ 31.09

|

|

Average cash cost ($'s per ounce) 2

|

|||

|

Average silver cash cost

|

$ 4.14

|

$ 4.12

|

$ 4.06

|

|

Average gold cash cost

|

$ 386

|

$ 386

|

$ 362

|

|

Average silver equivalent cash cost 1

|

$ 4.59

|

$ 4.65

|

$ 4.30

|

|

Total revenue ($000's)

|

$ 620,176

|

$ 706,472

|

$ 849,560

|

|

Net earnings ($000's)

|

$ 199,826

|

$ 375,495

|

$ 586,036

|

|

Add back - impairment loss

|

68,151

|

-

|

-

|

|

Adjusted net earnings 3 ($000's)

|

$ 267,977

|

$ 375,495

|

$ 586,036

|

|

Earnings per share

|

|||

|

Basic

|

$ 0.56

|

$ 1.06

|

$ 1.66

|

|

Diluted

|

$ 0.56

|

$ 1.05

|

$ 1.65

|

|

Adjusted earnings per share 3

|

|||

|

Basic

|

$ 0.75

|

$ 1.06

|

$ 1.66

|

|

Diluted

|

$ 0.74

|

$ 1.05

|

$ 1.65

|

|

Cash flow from operations ($000's)

|

$ 431,873

|

$ 534,133

|

$ 719,404

|

|

Dividends

|

|||

|

Dividends paid ($000's)

|

$ 93,4004

|

$ 160,013

|

$ 123,852

|

|

Dividends paid per share

|

$ 0.26

|

$ 0.45

|

$ 0.35

|

|

Total assets ($000's)

|

$ 4,647,763

|

$ 4,389,844

|

$ 3,189,337

|

|

Total non-current financial liabilities ($000’s)

|

$ 1,001,914

|

$ 999,973

|

$ 23,555

|

|

Total other liabilities ($000’s)

|

$ 17,113

|

$ 23,325

|

$ 58,708

|

|

Shareholders' equity ($000's)

|

$ 3,628,736

|

$ 3,366,546

|

$ 3,107,074

|

|

Shares outstanding

|

364,777,928

|

357,396,778

|

354,375,852

|

|

1)

|

Gold ounces produced and sold are converted to a silver equivalent basis based on either (i) the ratio of the average silver price received to the average gold price received during the period from the assets that produce both gold and silver; or (ii) the ratio of the price of silver to the price of gold on the date of sale as per the London Bullion Metal Exchange for the assets which produce only gold.

|

|

2)

|

Refer to discussion on non-IFRS measure (iii) on page 42 of this MD&A.

|

|

3)

|

Refer to discussion on non-IFRS measure (i) on page 40 of this MD&A.

|

|

4)

|

Dividends paid during 2014 were comprised of $79.8 million in cash and $13.6 million in common shares issued, with the Company issuing 646,618 common shares (an average of $21.08 per share) under the Company's dividend reinvestment plan.

|

|

2014

|

2013

|

|||||||

|

Q4

|

Q3

|

Q2

|

Q1

|

Q4

|

Q3

|

Q2

|

Q1

|

|

|

Silver ounces produced 2

|

||||||||

|

San Dimas 3

|

1,744

|

1,290

|

1,118

|

1,608

|

1,979

|

1,660

|

1,160

|

1,743

|

|

Yauliyacu

|

687

|

875

|

658

|

718

|

687

|

639

|

668

|

624

|

|

Peñasquito

|

1,582

|

1,630

|

2,054

|

2,052

|

2,047

|

1,636

|

1,440

|

1,093

|

|

Barrick 4

|

690

|

397

|

299

|

301

|

423

|

465

|

556

|

741

|

|

Other 5

|

1,701

|

1,903

|

2,182

|

2,185

|

2,119

|

2,450

|

2,586

|

2,038

|

|

Total silver ounces produced

|

6,404

|

6,095

|

6,311

|

6,864

|

7,255

|

6,850

|

6,410

|

6,239

|

|

Gold ounces produced 2

|

||||||||

|

777

|

9,669

|

12,105

|

11,611

|

12,785

|

14,134

|

18,259

|

16,986

|

16,951

|

|

Sudbury 6

|

9,165

|

12,196

|

7,473

|

6,426

|

7,060

|

7,341

|

8,840

|

9,869

|

|

Salobo

|

12,253

|

10,415

|

8,486

|

8,903

|

10,067

|

8,061

|

6,342

|

4,677

|

|

Other 7

|

3,435

|

6,959

|

5,185

|

5,749

|

9,530

|

2,894

|

4,226

|

5,967

|

|

Total gold ounces produced

|

34,522

|

41,675

|

32,755

|

33,863

|

40,791

|

36,555

|

36,394

|

37,464

|

|

Silver equivalent ounces of gold produced 8

|

2,560

|

2,786

|

2,144

|

2,121

|

2,476

|

2,237

|

2,269

|

2,096

|

|

Silver equivalent ounces produced 8

|

8,964

|

8,881

|

8,455

|

8,985

|

9,731

|

9,087

|

8,679

|

8,335

|

|

Silver equivalent ounces produced - as originally reported 2, 8

|

n.a.

|

8,447

|

8,365

|

8,977

|

9,723

|

8,948

|

8,615

|

8,046

|

|

Increase (Decrease) 2 |

n.a.

|

434

|

90

|

8

|

8

|

139

|

64

|

289

|

|

Silver ounces sold

|

||||||||

|

San Dimas 3

|

1,555

|

1,295

|

1,194

|

1,529

|

2,071

|

1,560

|

1,194

|

1,850

|

|

Yauliyacu

|

761

|

1,373

|

111

|

1,097

|

674

|

13

|

559

|

149

|

|

Peñasquito

|

1,640

|

1,662

|

1,958

|

1,840

|

1,412

|

1,388

|

1,058

|

1,459

|

|

Barrick 4

|

671

|

377

|

291

|

361

|

397

|

447

|

560

|

753

|

|

Other 5

|

1,106

|

1,592

|

1,673

|

1,398

|

1,510

|

2,257

|

1,771

|

1,741

|

|

Total silver ounces sold

|

5,733

|

6,299

|

5,227

|

6,225

|

6,064

|

5,665

|

5,142

|

5,952

|

|

Gold ounces sold

|

||||||||

|

777

|

8,718

|

15,287

|

13,599

|

6,294

|

15,889

|

16,972

|

23,483

|

9,414

|

|

Sudbury 6

|

11,251

|

5,566

|

6,718

|

6,878

|

6,551

|

6,534

|

4,184

|

111

|

|

Salobo

|

14,270

|

7,180

|

11,902

|

10,560

|

6,944

|

6,490

|

2,793

|

720

|

|

Other 7

|

3,665

|

8,685

|

2,559

|

6,390

|

1,840

|

5,287

|

3,409

|

6,698

|

|

Total gold ounces sold

|

37,904

|

36,718

|

34,778

|

30,122

|

31,224

|

35,283

|

33,869

|

16,943

|

|

Silver equivalent ounces of gold sold 8

|

2,808

|

2,441

|

2,267

|

1,891

|

1,909

|

2,163

|

2,097

|

971

|

|

Silver equivalent ounces sold 8

|

8,541

|

8,740

|

7,494

|

8,116

|

7,973

|

7,828

|

7,239

|

6,923

|

|

Gold / silver ratio 8

|

74.1

|

66.5

|

65.2

|

62.8

|

61.1

|

61.3

|

61.9

|

57.3

|

|

Cumulative payable silver equivalent ounces produced but not yet delivered 9

|

4,839

|

5,147

|

5,996

|

6,042

|

5,997

|

5,283

|

4,736

|

4,082

|

|

1)

|

All figures in thousands except gold ounces produced and sold.

|

|

2)

|

Ounces produced represent the quantity of silver and gold contained in concentrate or doré prior to smelting or refining deductions. Production figures are based on information provided by the operators of the mining operations to which the silver or gold interests relate or management estimates in those situations where other information is not available. Certain production figures may be updated in future periods as additional information is received.

|

|

3)

|

The ounces produced and sold include ounces received from Goldcorp in connection with Goldcorp’s four year commitment, commencing August 6, 2010, to deliver to Silver Wheaton 1.5 million ounces of silver per annum resulting from their sale of San Dimas to Primero.

|

|

4)

|

Comprised of the Lagunas Norte, Pierina and Veladero silver interests.

|

|

5)

|

Comprised of the Los Filos, Zinkgruvan, Keno Hill, Mineral Park, Cozamin, Neves-Corvo, Stratoni, Minto, 777, Aljustrel, Constancia and Campo Morado silver interests.

|

|

6)

|

Comprised of the Coleman, Copper Cliff, Garson, Stobie, Creighton and Totten gold interests.

|

|

7)

|

Comprised of the Minto and Constancia gold interests.

|

|

8)

|

Gold ounces produced and sold are converted to a silver equivalent basis based on either (i) the ratio of the average silver price received to the average gold price received during the period from the assets that produce both gold and silver; or (ii) the ratio of the price of silver to the price of gold on the date of sale as per the London Bullion Metal Exchange for the assets which produce only gold.

|

|

9)

|

Payable silver equivalent ounces produced but not yet delivered are based on management estimates. These figures may be updated in future periods as additional information is received.

|

|

2014

|

2013

|

|||||||||||||||||||||||

|

Q4

|

Q3

|

Q2

|

Q1

|

Q4

|

Q3

|

Q2

|

Q1

|

|||||||||||||||||

|

Total silver ounces sold (000's)

|

5,733

|

6,299

|

5,227

|

6,225

|

6,064

|

5,665

|

5,142

|

5,952

|

||||||||||||||||

|

Average realized silver price¹

|

$

|

16.46

|

$

|

18.98

|

$

|

19.81

|

$

|

20.36

|

$

|

21.03

|

$

|

21.22

|

$

|

23.12

|

$

|

29.89

|

||||||||

|

Silver sales (000's)

|

$

|

94,395

|

$

|

119,535

|

$

|

103,540

|

$

|

126,744

|

$

|

127,549

|

$

|

120,255

|

$

|

118,885

|

$

|

177,898

|

||||||||

|

Total gold ounces sold

|

37,904

|

36,718

|

34,778

|

30,122

|

31,224

|

35,283

|

33,869

|

16,943

|

||||||||||||||||

|

Average realized gold price¹

|

$

|

1,213

|

$

|

1,261

|

$

|

1,295

|

$

|

1,283

|

$

|

1,277

|

$

|

1,308

|

$

|

1,417

|

$

|

1,645

|

||||||||

|

Gold sales (000's)

|

$

|

45,980

|

$

|

46,317

|

$

|

45,030

|

$

|

38,635

|

$

|

39,867

|

$

|

46,150

|

$

|

48,005

|

$

|

27,863

|

||||||||

|

Total silver equivalent ounces sold (000's) 2

|

8,541

|

8,740

|

7,494

|

8,116

|

7,973

|

7,828

|

7,239

|

6,923

|

||||||||||||||||

|

Average realized silver equivalent price 1, 2

|

$

|

16.43

|

$

|

18.98

|

$

|

19.83

|

$

|

20.38

|

$

|

21.00

|

$

|

21.26

|

$

|

23.05

|

$

|

29.72

|

||||||||

|

Total sales (000's)

|

$

|

140,375

|

$

|

165,852

|

$

|

148,570

|

$

|

165,379

|

$

|

167,416

|

$

|

166,405

|

$

|

166,890

|

$

|

205,761

|

||||||||

|

Average cash cost,

silver 1, 3

|

$

|

4.13

|

$

|

4.16

|

$

|

4.15

|

$

|

4.12

|

$

|

4.14

|

$

|

4.13

|

$

|

4.14

|

$

|

4.08

|

||||||||

|

Average cash cost,

gold 1, 3

|

$

|

391

|

$

|

378

|

$

|

393

|

$

|

381

|

$

|

394

|

$

|

386

|

$

|

391

|

$

|

362

|

||||||||

|

Average cash cost, silver equivalent 1, 2, 3

|

$

|

4.51

|

$

|

4.59

|

$

|

4.72

|

$

|

4.57

|

$

|

4.70

|

$

|

4.73

|

$

|

4.77

|

$

|

4.39

|

||||||||

|

Net earnings (000's)

|

$

|

52,030

|

$

|

4,496

|

$

|

63,492

|

$

|

79,809

|

$

|

93,900

|

$

|

77,057

|

$

|

71,117

|

$

|

133,421

|

||||||||

|

Add back - impairment loss

|

-

|

68,151

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||

|

Adjusted net earnings 4 (000's)

|

$

|

52,030

|

$

|

72,647

|

$

|

63,492

|

$

|

79,809

|

$

|

93,900

|

$

|

77,057

|

$

|

71,117

|

$

|

133,421

|

||||||||

|

Earnings per share

|

||||||||||||||||||||||||

|

Basic

|

$

|

0.14

|

$

|

0.01

|

$

|

0.18

|

$

|

0.22

|

$

|

0.26

|

$

|

0.22

|

$

|

0.20

|

$

|

0.38

|

||||||||

|

Diluted

|

$

|

0.14

|

$

|

0.01

|

$

|

0.18

|

$

|

0.22

|

$

|

0.26

|

$

|

0.22

|

$

|

0.20

|

$

|

0.37

|

||||||||

|

Adjusted earnings per share 4

|

||||||||||||||||||||||||

|

Basic

|

$

|

0.14

|

$

|

0.20

|

$

|

0.18

|

$

|

0.22

|

$

|

0.26

|

$

|

0.22

|

$

|

0.20

|

$

|

0.38

|

||||||||

|

Diluted

|

$

|

0.14

|

$

|

0.20

|

$

|

0.18

|

$

|

0.22

|

$

|

0.26

|

$

|

0.22

|

$

|

0.20

|

$

|

0.37

|

||||||||

|

Cash flow from operations (000's)

|

$

|

94,120

|

$

|

120,379

|

$

|

102,543

|

$

|

114,832

|

$

|

124,591

|

$

|

118,672

|

$

|

125,258

|

$

|

165,612

|

||||||||

|

Cash flow from operations per share 5

|

||||||||||||||||||||||||

|

Basic

|

$

|

0.26

|

$

|

0.34

|

$

|

0.29

|

$

|

0.32

|

$

|

0.35

|

$

|

0.33

|

$

|

0.35

|

$

|

0.47

|

||||||||

|

Diluted

|

$

|

0.26

|

$

|

0.34

|

$

|

0.29

|

$

|

0.32

|

$

|

0.35

|

$

|

0.33

|

$

|

0.35

|

$

|

0.46

|

||||||||

|

Dividends

|

||||||||||||||||||||||||

|

Dividends declared (000's)

|

$

|

21,861

|

$

|

21,484

|

$

|

25,035

|

$

|

25,019 6

|

$

|

32,165

|

$

|

35,629

|

$

|

42,573

|

$

|

49,646 7

|

||||||||

|

Dividends declared per share

|

$

|

0.06

|

$

|

0.06

|

$

|

0.07

|

$

|

0.07

|

$

|

0.09

|

$

|

0.10

|

$

|

0.12

|

$

|

0.14

|

||||||||

|

Total assets (000's)

|

$

|

4,647,763

|

$

|

4,618,131

|

$

|

4,521,595

|

$

|

4,476,865

|

$

|

4,389,844

|

$

|

4,398,445

|

$

|

4,396,012

|

$

|

4,400,253

|

||||||||

|

Total liabilities (000's)

|

$

|

1,019,027

|

$

|

1,017,815

|

$

|

1,021,391

|

$

|

1,045,190

|

$

|

1,023,298

|

$

|

1,078,137

|

$

|

1,178,859

|

$

|

1,174,470

|

||||||||

|

Total shareholders' equity (000's)

|

$

|

3,628,736

|

$

|

3,600,316

|

$

|

3,500,204

|

$

|

3,431,675

|

$

|

3,366,546

|

$

|

3,320,308

|

$

|

3,217,153

|

$

|

3,225,783

|

||||||||

|

1)

|