Exhibit 10.1

EXECUTION VERSION

THIS RESTRUCTURING SUPPORT AGREEMENT IS PROTECTED BY RULE 408 OF THE FEDERAL RULES OF EVIDENCE AND ANY OTHER APPLICABLE STATUTES OR DOCTRINES PROTECTING THE USE OR DISCLOSURE OF CONFIDENTIAL SETTLEMENT DISCUSSIONS.

THIS RESTRUCTURING SUPPORT AGREEMENT IS NOT AN OFFER WITH RESPECT TO ANY SECURITIES OR A SOLICITATION OF VOTES WITH RESPECT TO A PLAN OF REORGANIZATION. ANY SUCH OFFER OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE.

|

Eagle Bulk Shipping Inc. |

|

Restructuring Support Agreement |

| August 6, 2014 |

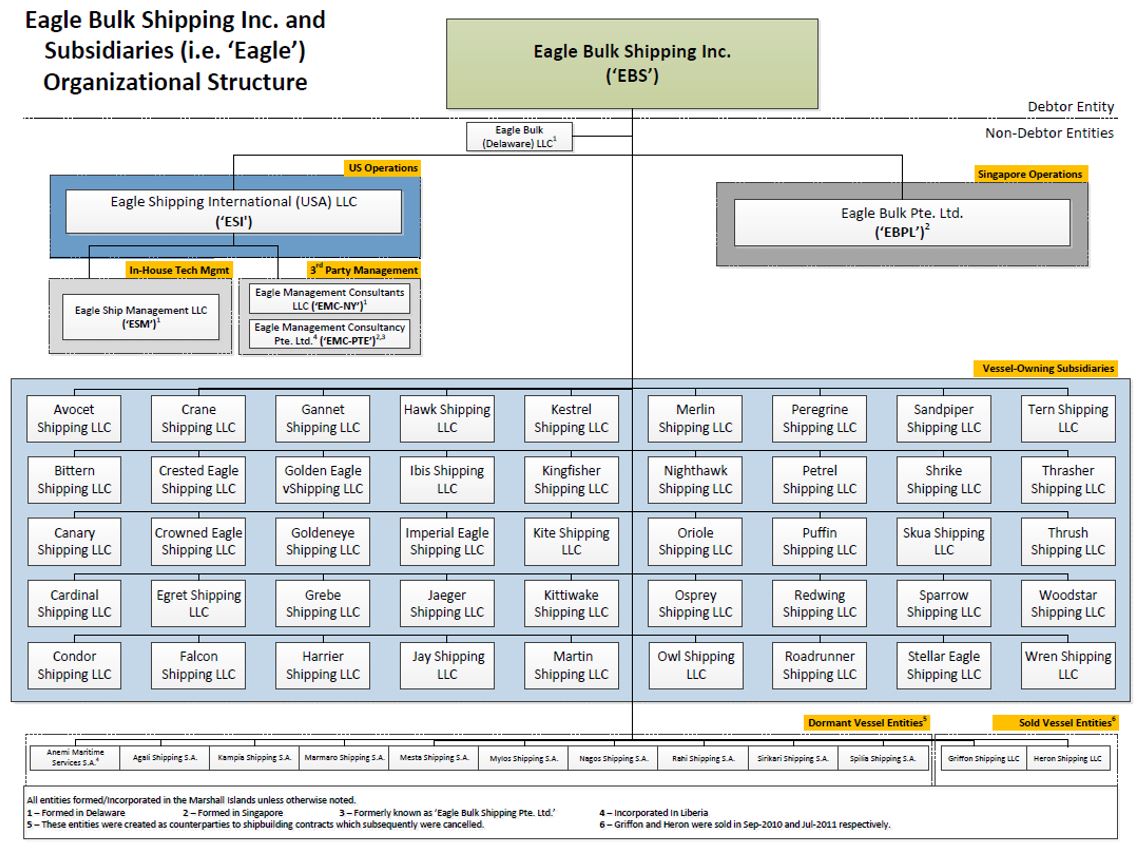

This Restructuring Support Agreement (together with the exhibits annexed hereto, and as may be amended, restated, supplemented, or otherwise modified from time to time in accordance with the terms hereof, this “Agreement”), dated as of August 6, 2014, is entered into by and among: (i) Eagle Bulk Shipping Inc., a Marshall Islands corporation (“EBS”), and each of its direct and indirect subsidiaries (each an “Eagle Entity” and, collectively, the “Eagle Entities” or the “Company”) and (ii) the lenders under the Credit Agreement (as defined herein) that are (or may become in accordance with Section 11 hereof) signatories hereto (in their capacity as lenders under the Credit Agreement, holders of Warrants (as defined below), and/or holders of common stock or other equity interests in EBS, the “Consenting Lenders”). Each of the Eagle Entities, the Consenting Lenders, and each other person that becomes a party to this Agreement in accordance with its terms shall be referred to herein individually as a “Party” and collectively as the “Parties.”

RECITALS

WHEREAS, the Company and certain lenders under that certain Fourth Amended and Restated Credit Agreement, dated as of June 20, 2012 (as amended to date and as may be further amended, restated, supplemented, or otherwise modified from time to time in accordance with its terms, the “Credit Agreement”), entered into that certain Waiver and Forbearance Agreement, dated as of March 19, 2014 (as amended, restated, supplemented or otherwise modified from time to time, the “Waiver and Forbearance Agreement”);

WHEREAS, the Waiver and Forbearance Agreement terminates, subject to the terms and conditions set forth therein, on August 5, 2014 if the Company and the Majority Lenders (as defined in the Credit Agreement) have not, on or before such date, (i) agreed on the terms of a restructuring of the obligations outstanding under the Credit Agreement and (ii) executed a binding restructuring support agreement or similar agreement documenting such agreed-upon terms, including milestones for the commencement, implementation, and closing of the restructuring;

WHEREAS, certain lenders under the Credit Agreement are holders of (i) warrants to purchase common stock of EBS (the “Warrants”) issued under that certain Warrant Agreement, dated as of June 20, 2012, between EBS and the other parties thereto (as amended to date and as may be further amended, restated, supplemented, or otherwise modified from time to time in accordance with its terms, the “Warrant Agreement”) and/or (ii) common stock in EBS.

WHEREAS, the Parties have engaged in good faith, arm’s-length negotiations regarding a restructuring transaction (the “Restructuring”) pursuant to the terms and conditions set forth in this Agreement (the general terms of which are reflected in the term sheet annexed hereto as Exhibit A (together with all exhibits thereto, the “Term Sheet”) for illustrative purposes only), including the proposed prepackaged chapter 11 plan of reorganization for EBS annexed hereto as Exhibit B (the “Plan”), and the related disclosure statement annexed hereto as Exhibit C (the “Disclosure Statement”), each of which may be amended, restated, supplemented, or otherwise modified from time to time pursuant to the mutual consent of EBS and the Majority Consenting Lenders (as defined below) and which is incorporated by reference pursuant to Section 2 hereof; 1

WHEREAS, it is contemplated that the Restructuring will be implemented through a voluntary case commenced by EBS and, if necessary, one or more of the Eagle Entities (the “Chapter 11 Case(s)”) under chapter 11 of title 11 of the United States Code, 11 U.S.C. §§ 101–1532 (as amended, the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”), pursuant to the Plan;

WHEREAS, certain of the Consenting Lenders have agreed to provide financing and otherwise extend credit to the Company and consent to the use of cash collateral during the pendency of the Chapter 11 Case(s) pursuant to and subject to the terms and conditions of the Financing Orders and the DIP Credit Agreement (each as defined below);

NOW, THEREFORE, in consideration of the promises and mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each of the Parties, intending to be legally bound, hereby agrees as follows:

AGREEMENT

1. Effective Date. This Agreement shall become effective, and the obligations contained herein shall become binding upon the Parties (the “Effective Date”), upon the execution and delivery of counterpart signature pages to this Agreement by and among (a) the Company and (b) the Consenting Lenders constituting collectively more than 50% of the current Lenders under the Credit Agreement and holding claims equal to at least 66 2/3% in amount of the total outstanding Loans under the Credit Agreement (the “Required Lenders”).

2. Exhibits and Schedules. Each of the Exhibits and Schedules annexed hereto is expressly incorporated herein and made a part of this Agreement, and all references to this Agreement shall include the Exhibits and Schedules. Subject to the following sentence, in the event of any inconsistencies between the terms of this Agreement and the Plan, (i) prior to the entry of the Confirmation Order (as defined below), this Agreement shall govern, and (ii) on and after the entry of the Confirmation Order, the Plan shall govern. The use of cash collateral and debtor-in-possession financing prior to the Consummation Date shall be governed by the terms of, as applicable, (a) the interim order authorizing the use of cash collateral and debtor-in-possession financing, in the form annexed hereto as Exhibit D or such other form as is reasonably acceptable to the Company and the Majority Consenting Lenders (the “Interim Financing Order”), (b) the final order authorizing the use of cash collateral and debtor-in-possession financing in such form as is reasonably acceptable to the Company and the Majority Consenting Lenders (the “Final Financing Order” and together with the Interim Financing Order, the “Financing Orders”), and (c) the debtor-in-possession credit agreement (the “DIP Credit Agreement”) to be entered into in accordance with the Financing Orders. For the avoidance of doubt, the Term Sheet annexed hereto as Exhibit A is provided solely for illustrative purposes and shall have no binding effect on any of the Parties except as expressly provided herein.

|

1 |

Capitalized terms not otherwise defined herein shall have the meaning ascribed to them in the Plan or Credit Agreement, as applicable. |

3. Definitive Documentation. The definitive documents and agreements (the “Definitive Documentation”) governing the Restructuring shall include: (a) the Plan (and all schedules, exhibits and supplements thereto) and the Confirmation Order; (b) the Disclosure Statement (and all exhibits thereto) with respect to the Plan; (c) the solicitation materials with respect to the Plan (collectively, the “Solicitation Materials”); (d) the documents identified on Exhibit E hereto (collectively, the “Consummation Documents”); (e) the DIP Credit Agreement, (f) the Financing Orders; and (g) the new credit agreement (the “Exit Financing”). Other than the Plan (excluding the schedules, exhibits and supplements thereto that have not been negotiated and completed as of the date of this Agreement), the Disclosure Statement, and the Interim Financing Order, the Definitive Documentation identified in the foregoing sentence (i) remains subject to negotiation and completion and (ii) shall upon completion (x) contain terms, conditions, representations, warranties, and covenants consistent with the terms of this Agreement and (y) be in form and substance reasonably acceptable to the Company and the Majority Consenting Lenders.

4. Milestones. The Company shall implement the Restructuring on the following timeline (in each case, a “Milestone”):

|

(a) |

on or before August 6, 2014, EBS shall commence a solicitation of the Lenders seeking the approval and acceptance of the Plan; |

|

(b) |

on or before August 6, 2014, EBS shall receive the approval and acceptance of the Plan by Lenders collectively constituting the Required Lenders as of such date (the “Lender Class Acceptance”); |

|

(c) |

upon the occurrence of the Lender Class Acceptance, EBS shall commence the Chapter 11 Case on or before August 6, 2014; |

|

(d) |

no later than the date of the commencement of the Chapter 11 Case (the “Petition Date”), EBS shall file with the Bankruptcy Court the Plan, the Disclosure Statement, a motion seeking approval of the DIP Facility (as defined below), and a motion seeking a joint hearing to consider the adequacy of the Disclosure Statement, approval of the Company’s prepetition solicitation of the Lenders, and confirmation of the Plan (the “Joint Disclosure Statement and Plan Confirmation Hearing”); |

|

(e) |

no later than 5 business days after the Petition Date, the Bankruptcy Court shall enter a final order scheduling the Joint Disclosure Statement and Plan Confirmation Hearing; |

|

(f) |

no later than 5 business days after the Petition Date, the Bankruptcy Court shall enter the Interim Financing Order in the form annexed hereto or in such other form as is reasonably acceptable to the Company and the Majority Consenting Lenders, authorizing the Company to enter into a post-petition credit facility (the “DIP Facility”) and use cash collateral, and scheduling a final hearing with respect to such matters; |

|

(g) |

no later than 37 days after the Petition Date, the Bankruptcy Court shall enter the Final Financing Order in a form reasonably acceptable to the Company and the Majority Consenting Lenders; |

|

(h) |

no later than 37 days after the Petition Date, the Bankruptcy Court shall commence the Joint Disclosure Statement and Plan Confirmation Hearing; |

|

(i) |

no later than 45 days after the Petition Date, the Bankruptcy Court shall enter an order (1) approving the adequacy of the Disclosure Statement and the Company’s prepetition solicitation of the Lenders and (2) confirming the Plan (the “Confirmation Order”); and |

|

(j) |

no later than 60 days after the Petition Date, the effective date of the Plan (the “Consummation Date”) shall occur. |

Notwithstanding the above, a specific Milestone may be extended or waived with the express prior written consent of both the Company and the Majority Consenting Lenders; provided, however, that in the event that the Company or the Majority Consenting Lenders determine, in their exercise of their reasonable discretion and after consultation with the professionals for the other parties, that commencing a Chapter 11 Case for one or more Eagle Entities (other than EBS) is necessary or advisable to facilitate the consummation of the Restructuring, then any of the foregoing Milestone dates that falls on or after the date of such decision shall automatically be deferred by 20 business days.

5. Commitment of Consenting Lenders. Subject to compliance in all material respects by the other Parties with the terms of this Agreement, from the Effective Date and until the occurrence of a Termination Date, each Consenting Lender shall (severally and not jointly):

|

(a) |

support and take all actions necessary or reasonably requested by the Company to facilitate consummation of the Restructuring, including without limitation, to (i) timely vote all of its claims (as defined in section 101(5) of the Bankruptcy Code) against, and interests in, the Company, now or hereafter owned by such Consenting Lender or for which it now or hereafter serves as the nominee, investment manager, or advisor for holders thereof, to accept the Plan in accordance with the applicable procedures set forth in the Disclosure Statement and the solicitation materials with respect to the Plan, provided, further, that any Consenting Lender, simultaneously with its execution of this Agreement, shall deliver and release to the Company’s solicitation agent such Consenting Lender’s executed ballot accepting the Plan, and (ii) to the extent such election is available, not elect on its ballot to preserve claims, if any, that each Consenting Lender may own or control that may be affected by any releases contemplated by the Plan; |

|

(b) |

not withdraw, amend, or revoke (or cause to be withdrawn, amended, or revoked) its vote with respect to the Plan; |

|

(c) |

(i) support the confirmation of the Plan and approval of the Disclosure Statement and the solicitation procedures and (ii) not (1) object to, delay, interfere, impede, or take any other action to delay, interfere or impede, directly or indirectly, with the Restructuring, confirmation of the Plan, or approval of the Disclosure Statement or the solicitation procedures (including, but not limited to, joining in or supporting any efforts to object to or oppose any of the foregoing), or (2) propose, file, support, or vote for, directly or indirectly, any restructuring, workout, or chapter 11 plan for the Company other than the Restructuring and the Plan; |

|

(d) |

not commence any proceeding to oppose or alter any of the terms of the Plan or any other document filed by EBS or the Company in connection with the confirmation of the Plan (as long as such documents are materially consistent with the terms and conditions of this Agreement); |

|

(e) |

support (and not object to) the “first day” motions and other motions consistent with this Agreement filed by EBS or the Company in furtherance of the Restructuring, including, but not limited to, any motion seeking approval of the DIP Facility on the terms set forth in the Financing Orders; |

|

(f) |

not, nor encourage any other person or entity to, take any action, including, without limitation, initiating or joining in any legal proceeding, which is inconsistent with this Agreement, or delay, impede, appeal, or take any other negative action, directly or indirectly, that could reasonably be expected to interfere with the approval, acceptance, confirmation, consummation, or implementation of the Restructuring or the Plan, as applicable; |

|

(g) |

use commercially reasonable efforts to execute any document and give any notice, order, instruction, or direction necessary or reasonably requested by the Company to support, facilitate, implement, consummate, or otherwise give effect to the Restructuring; |

|

(h) |

use good faith efforts to negotiate, execute and implement the Definitive Documentation on terms not materially inconsistent with the Term Sheet, including the exhibits thereto; |

|

(i) |

support (and not object to) the Company’s efforts to obtain the Exit Financing Facility, and not object to, or support the efforts of any other Person to oppose or object to, the Exit Financing Facility; |

|

(j) |

support (and not object to), and enter into any amendments to the Finance Documents and/or provide direction and instructions to the Agent and the Security Trustee (each as defined in the Credit Agreement) as may be reasonably requested by the Company to effectuate, the priming, subordination and/or release of (i) all claims against the Company (including, for the avoidance of doubt, EBS’ subsidiaries) under the Finance Documents and (ii) the liens, security interests, mortgages and other encumbrances granted by the Company (including, for the avoidance of doubt, EBS’ subsidiaries) securing the obligations under the Finance Documents, in each case as contemplated pursuant to, and in order to facilitate the implementation and/or consummation of, (1) the DIP Facility and the Financing Orders, (2) the Plan, and (3) the Exit Financing Facility (as defined in the Plan); |

|

(k) |

support the Company’s efforts to remain listed on the NASDAQ Global Select Market (“NASDAQ”) and, if the Company loses its NASDAQ listing for any reason prior to the consummation of the Restructuring, support the Company’s good faith efforts to become relisted on NASDAQ; |

|

(l) |

not exercise any right or remedy or take any action (or initiate, join in, or encourage in any way an instruction or direction to any other party, including, but not limited to, the Agent or the Security Trustee, to take any action) in respect of any potential, actual, or alleged occurrence of any “Default” or “Event of Default” under the Credit Agreement that exists or otherwise has been acknowledged as of the date hereof and is described on Schedule 1 hereto or that would be triggered as a result of the commencement or pendency of the Chapter 11 Case(s); and |

|

(m) |

not instruct (or join in any direction requesting that) the Agent and/or Security Trustee under the Credit Agreement or the related loan documents to take any action, or refrain from taking any action, that would be inconsistent with this Agreement or the Restructuring. |

Notwithstanding the foregoing, nothing in this Agreement and neither a vote to accept the Plan by any Consenting Lender nor the acceptance of the Plan by any Consenting Lender shall (w) be construed to prohibit any Consenting Lender from contesting whether any matter, fact, or thing is a breach of, or is inconsistent with, this Agreement, (x) be construed to prohibit any Consenting Lender from appearing as a party-in-interest in any matter to be adjudicated in the Chapter 11 Cases, so long as such appearance and the positions advocated in connection therewith are not inconsistent with this Agreement and are not for the purpose of hindering, delaying, or preventing the consummation of the Restructuring, (y) impair or waive the rights of any Consenting Lender to assert or raise any objection permitted under this Agreement in connection with any hearing on confirmation of the Plan or in the Bankruptcy Court, or (z) impair or waive the rights of any Consenting Lender under any applicable credit agreement, indenture, or other loan document except as contemplated by this Agreement; nor shall anything in this Agreement or a vote to accept the Plan cast by any Consenting Lender limit any rights a Consenting Lender has in its capacity as a post-petition lender under (and subject to) the DIP Credit Agreement and the Financing Orders, including to take or direct any action relating to maintenance, protection, or preservation of any collateral securing the DIP Facility.

6. Commitment of the Company. Subject to compliance in all material respects by the Consenting Lenders with the terms of this Agreement, from the Effective Date and until the occurrence of a Termination Date (as defined below):

|

(a) |

Subject to paragraph (b) immediately below, the Company (i) agrees to (A) support and complete the Restructuring and all transactions set forth in the Plan and this Agreement, (B) complete the Restructuring and all transactions set forth or described in the Plan in accordance with the Milestones set forth in Section 3 of this Agreement, (C) negotiate in good faith all Definitive Documentation that is subject to negotiation as of the Effective Date, (D) take any and all necessary actions in furtherance of the Restructuring, this Agreement, and the Plan, (E) make commercially reasonable efforts to obtain any and all required regulatory and/or third-party approvals for the Restructuring, and (F) use good faith efforts to negotiate, execute and implement the Definitive Documentation on terms not materially inconsistent with the Term Sheet, including the exhibits thereto, and (ii) shall not undertake any actions materially inconsistent with the adoption and implementation of the Plan and confirmation thereof. |

|

(b) |

Notwithstanding anything to the contrary herein, (i) the Company’s obligations hereunder (including, without limitation, the obligations of the Company’s board of directors and officers) are subject at all time to the fulfillment of their respective fiduciary duties, (ii) nothing in this Agreement shall require the Company, the board of directors, or officers of any Eagle Entity to take any action, or to refrain from taking any action, that is required to comply with such director’s, officer’s, or manager’s fiduciary obligations under applicable law, and (iii) to the extent that such fiduciary obligations require the Company, the board of directors, or officers to terminate the Company’s obligations under this Agreement, the Company, the board of directors, and/or the officers may do so without incurring any liability to any Party under this Agreement except as otherwise set forth herein. |

7. Consenting Lenders’ Termination Events. A Consenting Lender shall have the right, but not the obligation, to terminate its own obligations under this Agreement, upon five (5) days’ prior written notice to all Parties setting forth the basis for termination following the occurrence of any of the following events (each, a “Lender Termination Event”), unless such event has been waived, in writing, by such Consenting Lender or the Majority Consenting Lenders (as defined herein):

|

(a) |

the failure to meet any Milestone, unless such failure is the result of any act, omission, or delay on the part of any Consenting Lender or such Milestone is waived in accordance herewith; |

|

(b) |

the occurrence of a material breach of this Agreement by the Company that has not been cured (if susceptible to cure) within five (5) days after the receipt by the Company of written notice of such breach; |

|

(c) |

the occurrence of (i) any Event of Default under (and as defined in) the Credit Agreement (other than any Acknowledged Default or any Event of Default triggered as a result of the commencement or pendency of the Chapter 11 Cases) or the DIP Credit Agreement or (ii) a violation of the Company’s obligations under Financing Orders, in each case, which Event of Default or violation has not been cured (if susceptible to cure) in accordance with the terms set forth therein; |

|

(d) |

entry of an order by the Bankruptcy Court converting the Chapter 11 Case to a case under chapter 7 of the Bankruptcy Code; |

|

(e) |

entry of an order by the Bankruptcy Court appointing a trustee, receiver, or examiner with expanded powers beyond those set forth in section 1106(a)(3) and (4) of the Bankruptcy Code in the Chapter 11 Case; |

|

(f) |

entry of an order by the Bankruptcy Court terminating any Eagle Entity’s exclusive right to file a plan of reorganization pursuant to section 1121 of the Bankruptcy Code; |

|

(g) |

any Eagle Entity amends or modifies, or files a pleading seeking authority to amend or modify, the Definitive Documentation, unless such amendment or modification is (i) consistent with this Agreement or (ii) reasonably acceptable to the Majority Consenting Lenders; |

|

(h) |

entry of an order by the Bankruptcy Court amending or modifying the Definitive Documentation, unless such amendment or modification is (i) consistent with this Agreement or (ii) reasonably acceptable to the Majority Consenting Lenders; |

|

(i) |

either (i) the board of directors of any Eagle Entity and the officers of such Eagle Entity determine to pursue any Alternative Transaction (as defined below), including any plan of reorganization (other than the Plan) or (ii) any Eagle Entity files, propounds, or otherwise publicly supports or announces that any Eagle Entity will support any Alternative Transaction, including any plan of reorganization other than the Plan, or files any motion or application seeking authority to sell any material assets, without the prior written consent of the Majority Consenting Lenders; |

|

(j) |

the issuance by any governmental authority, including the Bankruptcy Court, any regulatory authority, or any other court of competent jurisdiction, of any ruling or order enjoining the substantial consummation of the Restructuring; provided, however, that the Company shall have five (5) days after issuance of such ruling or order to obtain relief that would allow consummation of the Restructuring in a manner that (i) does not prevent or diminish in a material way compliance with the terms of the Plan and this Agreement or (ii) is reasonably acceptable to the Majority Consenting Lenders; |

|

(k) |

the Bankruptcy Court enters any order authorizing the use of cash collateral or post-petition financing that is not substantially in the form of the Interim Financing Order or otherwise consented to by the Majority Consenting Lenders; |

|

(l) |

either (i) any Eagle Entity files a motion, application or adversary proceeding (or supports such a filing) (1) challenging the validity, enforceability, perfection or priority of, or seeking avoidance or subordination of, the loans under the Credit Agreement or the DIP Credit Agreement or the liens securing such obligations, (2) asserting any other cause of action against and/or with respect or relating to such obligations or the liens securing such obligations, or (3) challenging the validity of the Warrants, the Warrant Agreement (as amended) or any claims asserted by a holder of such Warrants (to the extent such holder is also a Consenting Lender) in respect of such Warrants; or (ii) the Bankruptcy Court (or any court with jurisdiction over the Chapter 11 Cases) enters an order providing relief against the interests of the Consenting Lenders (in their capacity as holders of loans under the Credit Agreement or the DIP Credit Agreement or as holders of Warrants) with respect to any of the foregoing causes of action or proceedings; |

|

(m) |

a breach by any Eagle Entity of any representation, warranty, or covenant of such Eagle Entity set forth in Section 16(b) of this Agreement that could reasonably be expected to have a material adverse impact on the Restructuring or the consummation of the Restructuring that (if susceptible to cure) remains uncured for a period of five (5) days after the receipt by the Company of written notice of such breach; |

|

(n) |

a breach by any Eagle Entity of any of its obligations under this Agreement that could reasonably be expected to have a material adverse impact on the Restructuring or the consummation of the Restructuring that (if susceptible to cure) remains uncured for a period of five (5) days after the receipt by the Company of written notice of such breach; |

|

(o) |

the Exit Financing amount or terms differ in a meaningful way from the terms of that certain financing proposal received by the Company on July 29, 2014 reflecting a $225,000,000 term loan component and a $50,000,000 revolving credit facility component; or |

|

(p) |

the Consummation Date shall not have occurred by November 30, 2014. |

As used herein, the term “Majority Consenting Lenders” shall mean at least four (4) Consenting Lenders who are not affiliates of each other and who hold, in the aggregate, at least 66 2/3% of the principal amount of total outstanding Loans under the Credit Agreement held by all Consenting Lenders. Notwithstanding the foregoing, Sections 7(o) and (p) hereof may not be amended, waived or otherwise modified without the consent of such affected Consenting Lender.

8. Company’s Termination Events. The Company may, in its sole discretion, terminate this Agreement as to all Parties upon five (5) days’ prior written notice to the Consenting Lenders setting forth the basis for termination, delivered in accordance with this Agreement, following the occurrence of any of the following events (each a “Company Termination Event” and, together with the Lender Termination Events, the “Termination Events”):

|

(a) |

a breach by a Consenting Lender of any of the representations, warranties, or covenants of such Consenting Lender set forth in Section 15 of this Agreement that that could reasonably be expected to have a material adverse impact on the Restructuring or the consummation of the Restructuring that (if susceptible to cure) remains uncured for a period of five (5) days after the receipt by the Consenting Lenders of written notice of such breach; |

|

(b) |

a breach by any Consenting Lender of any of its obligations under this Agreement that could reasonably be expected to have a material adverse impact on the Restructuring or the consummation of the Restructuring that (if susceptible to cure) remains uncured for a period of five (5) days after the receipt by the Consenting Lenders of written notice of such breach; |

|

(c) |

the Company’s board of directors determines, (i) consistent with Section 6(b) above that continued pursuit or support of the Restructuring (including, without limitation, the Plan or the solicitation of the Plan) would be inconsistent with the exercise of its fiduciary duties or (ii) to pursue an Alternative Transaction consistent with Section 17 below; |

|

(d) |

the Consenting Lenders at any time constitute less than the Required Lenders; |

|

(e) |

the issuance by any governmental authority, including the Bankruptcy Court or any other regulatory authority or court of competent jurisdiction, of any injunction, judgment, decree, charge, ruling, or order preventing the consummation of a material portion of the Restructuring; or |

|

(f) |

the Consummation Date shall not have occurred by November 30, 2014. |

9. Mutual Termination; Automatic Termination. This Agreement, and the obligations of all Parties hereunder, may be terminated by mutual agreement by and among the Company and the Majority Consenting Lenders. This Agreement and the obligations of all Parties hereunder shall terminate automatically on the Consummation Date.

10. Effect of Termination.

(a) The earliest date on which a Party’s termination of this Agreement is effective in accordance with Section 7, Section 8, or Section 9 of this Agreement shall be referred to as a “Termination Date.” Termination shall not relieve any Party from liability for its breach or non-performance of its obligations hereunder prior to the Termination Date. Upon any Party’s termination of this Agreement in accordance with its terms prior to the date on which the Confirmation Order is entered by the Bankruptcy Court, such Party shall have the immediate right, without further order of the Bankruptcy Court, and without the consent of the Company, to withdraw or change any vote previously tendered by such Party, irrespective of whether any voting deadline or similar deadline or bar date has passed, provided that such Party is not then in material breach of its obligations under this Agreement; provided further that, for the avoidance of doubt, the foregoing shall not be construed to prohibit any Party from contesting whether such terminating Party’s termination of this Agreement is in accordance with the terms of this Agreement. Any Consenting Lender withdrawing or changing its vote(s) pursuant to this Section 10(a) shall promptly provide written notice of such withdrawal or change to each other Party and, if such withdrawal or change occurs on or after the Petition Date, file notice of such withdrawal or change with the Bankruptcy Court.

(b) All Parties’ obligations under this Agreement shall be terminated effective immediately, and all Parties hereto shall be released from their respective commitments, undertakings, and agreements upon the occurrence of termination of this Agreement (i) by the Required Lenders pursuant to Section 7 or (ii) as provided in Section 8 or 9. Notwithstanding the foregoing, each of the following shall survive termination of the Agreement by any Party, and all rights and remedies with respect to such claims shall not be prejudiced in any way: (i) any claim for breach of this Agreement that occurs prior to the Termination Date, (ii) the Company’s obligations in Sections 13 and 14 of this Agreement (subject to the terms and conditions of such Sections), (iii) Section 10(a) and (iv) this Section 10(b).

(c) Except with respect to Section 8(c) of this Agreement, no occurrence shall constitute a Termination Event if such occurrence is the result of the action or omission of the Party seeking to terminate this Agreement.

11. Cooperation and Support. The Company shall provide draft copies of all “first day” motions and “second day” motions that any Eagle Entity intends to file with the Bankruptcy Court to counsel for the Consenting Lenders at least four (4) calendar days (or as soon thereafter as is reasonably practicable under the circumstances) prior to the date when such Eagle Entity intends to file such document, and shall consult in good faith with such counsel regarding the form and substance of any such proposed filing with the Bankruptcy Court. The Company will use reasonable efforts to provide draft copies of all other material pleadings any Eagle Entity intends to file with the Bankruptcy Court to counsel to the Consenting Lenders at least three (3) calendar days prior to filing such pleading to the extent practicable and shall consult in good faith with such counsel regarding the form and substance of any such proposed pleading. For the avoidance of doubt, the Parties agree to negotiate in good faith the Definitive Documentation that is subject to negotiation and completion, consistent with the last sentence of Section 3 hereof.

12. Transfers of Claims and Interests.

(a) Each Consenting Lender shall not (i) sell, transfer, assign, hypothecate, pledge, grant a participation interest in, or otherwise dispose of, directly or indirectly, its right, title, or interest in respect of any of such Consenting Lender’s interests in the Credit Agreement, or any other claim against, or interests in, the Company, as applicable, in whole or in part, or (ii) grant any proxies, deposit any of such Consenting Lender’s interests in the Credit Agreement, or any other claim against or interests in the Company, as applicable, into a voting trust, or enter into a voting agreement with respect to any such claims or interests (the actions described in clauses (i) and (ii) are collectively referred to herein as a “Transfer” and the Consenting Lender making such Transfer is referred to herein as the “Transferor”), unless such Transfer is to another Consenting Lender or any other entity that (x) first agrees, in writing, to be bound by the terms of this Agreement by executing and delivering to the Company, at least five (5) business days prior to effectiveness of the relevant Transfer, a Transferee Joinder substantially in the form annexed hereto as Exhibit F (the “Transferee Joinder”) and (y) is reasonably capable, after due inquiry and investigation by the Transferor, of fulfilling its obligations under this Agreement. With respect to the Credit Agreement and any other claims against, or interests in, the Company held by the relevant transferee upon consummation of a Transfer, such transferee shall be deemed to make all of the representations and warranties of a Consenting Lender set forth in this Agreement, and shall be deemed to be a Party and a Consenting Lender for all purposes under the Agreement. Upon compliance with the foregoing, the Transferor shall be deemed to relinquish its rights under this Agreement solely to the extent of such transferred rights and obligations but shall otherwise remain party to this Agreement as a Consenting Lender with respect to any interest in the Credit Agreement or other claim not so transferred. Any Transfer made in violation of this Section 11 shall be deemed null and void and of no force or effect, regardless of any prior notice provided to the Company and/or the Consenting Lenders, and shall not create any obligation or liability of the Company to the purported transferee (it being understood that the putative transferor shall continue to be bound by the terms and conditions set forth in this Agreement).

(b) Notwithstanding Section 12(a), (i) a Consenting Lender may transfer (by purchase, sale, assignment, participation or otherwise) its right, title, and/or interest in respect of any of such Consenting Lender’s interests in the Credit Agreement to an entity that is acting in its capacity as a Qualified Marketmaker without the requirement that the Qualified Marketmaker be or become a Consenting Lender, provided that such transfer shall only be valid if such Qualified Marketmaker transfers (by purchase, sale, assignment, participation or otherwise) such right, title and/or interest within five (5) business days of its receipt thereof to a transferee that is, or concurrent with such transfer becomes, a Consenting Lender, and (ii) to the extent that a party to this Agreement is acting in its capacity as a Qualified Marketmaker, it may transfer (by purchase, sale, assignment, participation or otherwise) any right, title, or interest in respect of any interests in the Credit Agreement that the Qualified Marketmaker acquires from a holder of such interests who is not a Consenting Lender without the requirement that the transferee be or become a Consenting Lender. For these purposes, a “Qualified Marketmaker” means an entity that (x) holds itself out to the market as standing ready in the ordinary course of its business to purchase from customers and sell to customers claims against the Eagle Entities (including debt securities or other debt) or enter with customers into long and short positions in claims against the Eagle Entities (including debt securities or other debt), in its capacity as a dealer or market maker in such claims against the Eagle Entities, and (y) is in fact regularly in the business of making a market in claims against issuers or borrowers (including debt securities or other debt).

13. RSA Fee. In exchange for the Consenting Lenders’ agreement to pursue the Restructuring on the terms set forth in the Plan and entry into this Agreement, each Consenting Lender shall earn a cash fee equal to 3.0% of the total outstanding principal amount of Loans owed to such Consenting Lender (the “RSA Fee”). Payment of the RSA Fee shall be deferred so long as this Agreement remains in full force and effect, provided, however, that the RSA Fee shall automatically be cancelled, discharged, and forfeited by each Consenting Lender (a) upon the Consummation Date of the Plan, or (b) if EBS commenced the Chapter 11 Case and the Minimum Consenting Lender Condition (as defined below) no longer remains satisfied (unless the failure to satisfy the Minimum Consenting Lender Condition is based on the Consenting Lenders’ termination of this Agreement pursuant to Section 7 hereof); provided, further, that each Consenting Lender’s respective portion of the RSA Fee automatically shall be cancelled, discharged and forfeited if such Consenting Lender (i) breaches any of its material obligations under this Agreement, or (ii) breaches any of the representations, warranties, or covenants of such Consenting Lender set forth in Section 16(a) of this Agreement. If the RSA Fee becomes due and payable, then, at the Company’s election, the RSA Fee may be converted on a dollar-for-dollar basis into additional PIK Loans for each Consenting Lender entitled to the RSA Fee; provided, however, that if this Agreement is terminated by virtue of the Company’s entry into and consummation of an Alternative Transaction, the RSA Fee shall be paid in cash upon the substantial consummation of such Alternative Transaction.

“Minimum Consenting Lender Condition” as that term is used herein means that the Required Lenders remain party to and bound by this Agreement.

14. Professional Fees and Expenses. Until the occurrence of a Termination Date, the Company shall pay or reimburse when due all reasonable and documented fees and expenses of the Consenting Lenders incurred by the following advisors to the Consenting Lenders in connection with the Restructuring: (i) Paul, Weiss, Rifkind, Wharton & Garrison LLP (“Paul Weiss”) as set forth in that certain fee letter, dated as of January 1, 2014, between Eagle and Paul Weiss; (ii) Houlihan Lokey Capital, Inc. (“Houlihan”) as set forth in that certain letter agreement, dated as of February 1, 2014, among Eagle, Houlihan, Paul Weiss, and the Lender Group (as defined therein); (iii) maritime and appropriate foreign counsel engaged by Paul Weiss; and (iv) to the extent reasonably necessary, local counsel. For the avoidance of doubt, nothing in this Section 14 shall be construed as limiting any of the Company’s obligations under the Credit Agreement.

15. Acknowledgment. No securities of the Company are being offered or sold hereby and this Agreement neither constitutes an offer to sell nor a solicitation of an offer to buy any securities of the Company. This Agreement is not, and shall not be deemed to be, a solicitation of a vote for the acceptance of the Plan. The acceptance of the Plan by each of the Consenting Lenders will not be solicited until such Parties have received the Disclosure Statement and related ballots in accordance with applicable law (including as provided under sections 1125(g) and 1126(b) of the Bankruptcy Code) and will be subject to sections 1125, 1126, and 1127 of the Bankruptcy Code.

16. Representations and Warranties.

|

(a) |

Each of the Consenting Lenders hereby represents and warrants on a several and not joint basis for itself and not any other person or entity that the following statements are true, correct, and complete as of the date hereof: |

|

(i) |

it is duly organized, validly existing, and in good standing under the laws of the jurisdiction of its organization, and it has the requisite corporate power and authority to enter into this Agreement and to carry out the transactions contemplated by, and perform its respective obligations under, this Agreement; |

|

(ii) |

the execution and delivery of this Agreement and the performance of its obligations hereunder have been duly authorized by all necessary corporate or other organizational action on its part and no other proceedings on its part are necessary to authorize and approve this Agreement or any of the transactions contemplated herein; |

|

(iii) |

this Agreement has been duly executed and delivered by the Consenting Lender and constitutes the legal, valid, and binding agreement of the Consenting Lender, enforceable against the Consenting Lender in accordance with its terms; |

|

(iv) |

the execution, delivery, and performance by it of this Agreement does not and shall not (A) violate any provision of law, rule, or regulation applicable to it, or its certificate of incorporation or bylaws or other organizational documents, or (B) conflict with, result in a breach of, or constitute (with due notice or lapse of time or both) a default under any material contractual obligation to which it is a party; |

|

(v) |

the execution, delivery, and performance by it of this Agreement does not and shall not require any registration or filing with, consent or approval of, notice to, or any other action to, with, or by any federal, state or other governmental authority or regulatory body, except (A) any of the foregoing as may be necessary and/or required for disclosure by the Securities and Exchange Commission and applicable state securities or “blue sky” laws, (B) any of the foregoing as may be necessary and/or required in connection with the Chapter 11 Cases, including the approval of the Disclosure Statement and confirmation of the Plan, (C) filings of amended certificates of incorporation or articles of formation or other organizational documents with applicable state authorities, and other registrations, filings, consents, approvals, notices, or other actions that are reasonably necessary to maintain permits, licenses, qualifications, and governmental approvals to carry on the business of the Company, and (D) any other registrations, filings, consents, approvals, notices, or other actions, the failure of which to make, obtain, or take, as applicable, would not be reasonably likely, individually or in the aggregate, to materially delay or materially impair the ability of any Party hereto to consummate the transactions contemplated hereby; |

|

(vi) |

subject to the provisions of sections 1125 and 1126 of the Bankruptcy Code, this Agreement is the legally valid and binding obligation of it, enforceable against it in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, moratorium, or other similar laws relating to or limiting creditors’ rights generally, or by equitable principles relating to enforceability; |

|

(vii) |

it (A) is a sophisticated party with respect to the transactions described herein with sufficient knowledge and experience in financial and business matters and is capable of evaluating the merits and risks of owning and investing in securities of the Company (including any securities that may be issued in connection with the Restructuring), making an informed decision with respect thereto, and evaluating properly the terms and conditions of the Plan and this Agreement, (B) has been represented and advised by legal and financial advisors in connection with this Agreement, (C) has been afforded the opportunity to discuss the Plan, the Disclosure Statement and other information concerning the Company with the Company’s representatives, (D) has independently and without reliance upon the Company or any officer, employee, agent, or representative thereof, and based on such information as the Consenting Lender has deemed appropriate, made its own analysis and decision to enter into this Agreement and will not seek rescission or revocation of this Agreement, and (E) acknowledges that it has entered into this Agreement voluntarily and of its own choice and not under coercion or duress; |

|

(viii) |

it (A) is the sole legal or beneficial owner of the principal amount of claims set forth on Exhibit G, has all necessary investment or voting discretion with respect to such claims, or otherwise has the power and authority to bind any other legal or beneficial holder of such claims, free and clear of any pledge, lien, security interest, charge, claim, equity, option, proxy, voting restriction, right of first refusal or other limitation on disposition, or encumbrances of any kind, and (B) is exclusively entitled (for its own accounts or for the accounts of such other legal or beneficial owners) to all of the rights and economic benefits of such claims; and |

|

(ix) |

it has made no prior assignment, sale, participation, grant, conveyance, or other transfer of, and has not entered into any other agreement to assign, sell, participate, grant, convey, or otherwise transfer, in whole or in part, any portion of its right, title, or interest in any claim set forth on Exhibit G, except to the extent such agreement is in accordance with the terms of this Agreement. |

|

(b) |

Each of the Eagle Entities hereby represents and warrants on a several and not joint basis for itself and not any other person or entity that the following statements are true, correct, and complete as of the date hereof: |

|

(i) |

it is duly organized, validly existing, and in good standing under the laws of the jurisdiction of its organization, and it has the requisite corporate power and authority to enter into this Agreement and to carry out the transactions contemplated by, and perform its respective obligations under, this Agreement; |

|

(ii) |

the execution and delivery of this Agreement and the performance of its obligations hereunder have been duly authorized by all necessary corporate or other organizational action on its part, including approval of each of the independent director(s) of each of the corporate entities that comprise the Eagle Entities; |

|

(iii) |

the execution, delivery, and performance by it of this Agreement does not and shall not (A) violate any provision of law, rule, or regulation applicable to it, or its certificate of incorporation or bylaws or other organizational documents, or (B) conflict with, result in a breach of, or constitute (with due notice or lapse of time or both) a default under any material contractual obligation to which it is a party (other than, for the avoidance of doubt, a default that would be triggered as a result of the Chapter 11 Case(s) or any Eagle Entity’s undertaking to implement the Restructuring through the Chapter 11 Case(s)) |

|

(iv) |

this Agreement has been duly executed and delivered by the Company and constitutes the legal, valid, and binding agreement of the Company, enforceable against the Company in accordance with its terms; |

|

(v) |

the execution, delivery, and performance by it of this Agreement does not and shall not require any registration or filing with, consent or approval of, notice to, or any other action to, with, or by any federal, state or other governmental authority or regulatory body, except (A) any of the foregoing as may be necessary and/or required for disclosure by the Securities and Exchange Commission and applicable state securities or “blue sky” laws, (B) any of the foregoing as may be necessary and/or required in connection with the Chapter 11 Cases, including the approval of the Disclosure Statement and confirmation of the Plan, (C) filings of amended certificates of incorporation or articles of formation or other organizational documents with applicable state authorities, and other registrations, filings, consents, approvals, notices, or other actions that are reasonably necessary to maintain permits, licenses, qualifications, and governmental approvals to carry on the business of the Company, and (D) any other registrations, filings, consents, approvals, notices, or other actions, the failure of which to make, obtain or take, as applicable, would not be reasonably likely, individually or in the aggregate, to materially delay or materially impair the ability of any Party hereto to consummate the transactions contemplated hereby; |

|

(vi) |

it (A) is a sophisticated party with respect to the transactions described herein with sufficient knowledge and experience in financial and business matters and is capable of evaluating the merits and risks of the Restructuring, making an informed decision with respect thereto, and evaluating properly the terms and conditions of the Plan and this Agreement, (B) has been represented and advised by legal and financial advisors in connection with this Agreement, (C) has independently and without reliance upon the Consenting Lenders or any officer, employee, agent, or representative thereof, and based on such information as the Company has deemed appropriate, made its own analysis and decision to enter into this Agreement and will not seek rescission or revocation of this Agreement, and (D) acknowledges that it has entered into this Agreement voluntarily and of its own choice and not under coercion or duress; |

|

(vii) |

subject to the provisions of sections 1125 and 1126 of the Bankruptcy Code, this Agreement is the legally valid and binding obligation of it, enforceable against it in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, moratorium, or other similar laws relating to or limiting creditors’ rights generally, or by equitable principles relating to enforceability; and |

|

(viii) |

except as disclosed to the Consenting Lenders and described on Schedule 1 annexed hereto, it has no knowledge of any “Default” or “Event of Default” under the Credit Agreement which has occurred and is continuing. |

17. Right to Solicit Alternative Transactions. The Company shall not be entitled to solicit, encourage, and initiate any offer or proposal from, enter into any agreement with, or engage in any discussions or negotiations with, any person or entity concerning any actual or proposed transaction involving any or all of (i) another financial and/or corporate restructuring of any Eagle Entity, (ii) the issuance, sale, or other disposition of any equity or debt interests, or any material assets, of any Eagle Entity, (iii) a merger, consolidation, business combination, liquidation, recapitalization, refinancing, or similar transaction involving any Eagle Entity, and/or (iv) any chapter 11 plan of reorganization other than the Plan (each, an “Alternative Transaction”); provided, however, that the Company may respond to any proposal or offer for an Alternative Transaction to the extent that the board of directors of the Company determines in good faith, and consistent with its fiduciary duties, that such a response is necessary; provided, further, however, that the Company shall promptly, and in no event later than 4 calendar days after receipt, provide copies of all such documentations and materials received by the Company concerning such an Alternative Transaction to the advisors to the Consenting Lenders.

18. Survival of Agreement. Each of the Parties acknowledges and agrees that this Agreement is being executed in connection with negotiations concerning a possible financial restructuring of the Company and in contemplation of possible chapter 11 filings by the Company and the rights granted in this Agreement are enforceable by each signatory hereto without approval of any court, including the Bankruptcy Court.

19. No Waiver or Admissions. If the transactions contemplated herein are or are not consummated, or if this Agreement is terminated for any reason, nothing herein shall be construed as a waiver by any Party of any or all of such Party’s rights, remedies, or interests, and the Parties expressly reserve any and all of their respective rights, remedies, and interests. This Agreement shall in no event be construed as or be deemed to be evidence of an admission or concession on the part of any Party of any claim or fault or liability or damages whatsoever. Each of the Parties denies any and all wrongdoing or liability of any kind and does not concede any infirmity in the claims or defenses which it has asserted or could assert. No Party shall have, by reason of this Agreement, a fiduciary relationship in respect of any other Party or any person or entity, and nothing in this Agreement, expressed or implied, is intended to or shall be so construed as to impose upon any Party any obligations in respect of this Agreement except as expressly set forth herein. This Agreement and the Restructuring are part of a proposed settlement of a dispute among the Parties. Except as otherwise expressly provided herein, including, but not limited to, Section 33 hereof, pursuant to Federal Rule of Evidence 408 and any applicable state rules of evidence, this Agreement and all negotiations relating thereto shall not be admissible into evidence in any proceeding other than a proceeding involving enforcement of the terms of this Agreement.

20. Relationship Among Parties. Notwithstanding anything herein to the contrary, the duties and obligations of the Parties under this Agreement shall be several, not joint. No prior history, pattern, or practice of sharing confidences among or between Parties shall in any way affect or negate this understanding and Agreement.

21. Specific Performance; Remedies Cumulative. Each Party acknowledges and agrees that the exact nature and extent of damages resulting from a breach of this Agreement are uncertain at the time of entering into this Agreement and that any such breach of this Agreement would result in damages that would be difficult to determine with certainty. It is understood and agreed by the Parties that money damages may not be a sufficient remedy for any breach of this Agreement by any Party, and that each non-breaching Party shall be entitled to seek specific performance and injunctive or other equitable relief as a remedy of any such breach, including, without limitation, an order of the Bankruptcy Court or other court of competent jurisdiction requiring any Party to comply promptly with any of its obligations hereunder. Such remedy shall not be deemed to be the exclusive remedy for the breach of this Agreement by any Party or its representatives. All rights, powers, and remedies provided under this Agreement or otherwise available in respect hereof at law or in equity shall be cumulative and not alternative, and the exercise of any right, power, or remedy by any Party hereto shall not preclude the simultaneous or later exercise of any other such right, power, or remedy hereunder.

22. Governing Law & Jurisdiction. This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York, without regard to such state’s choice of law provisions which would require the application of the law of any other jurisdiction. By its execution and delivery of this Agreement, each of the Parties irrevocably and unconditionally agrees for itself that any legal action, suit, or proceeding against it with respect to any matter arising under, arising out of, or in connection with this Agreement or for recognition or enforcement of any judgment rendered in any such action, suit, or proceeding, shall be brought in either the United States District Court for the Southern District of New York or any New York State court sitting in New York City, and by execution and delivery of this Agreement, each of the Parties irrevocably accepts and submits itself to the exclusive jurisdiction of such court, generally and unconditionally, with respect to any such action, suit or proceeding. Notwithstanding the foregoing, if the Chapter 11 Cases are commenced, each Party agrees that the Bankruptcy Court shall have exclusive jurisdiction of all matters arising under, arising out of, or in connection with this Agreement. By execution and delivery of this Agreement, and upon commencement of the Chapter 11 Cases, each of the Parties irrevocably and unconditionally submits to the personal jurisdiction of the Bankruptcy Court solely for purposes of any action, suit, or proceeding or other contested matter arising under, arising out of, or in connection with this Agreement, or for recognition or enforcement of any judgment rendered or order entered in any such action, suit, proceeding, or other contested matter.

23. Waiver of Right to Trial by Jury. Each of the Parties waives any right to have a jury participate in resolving any dispute, whether sounding in contract, tort, or otherwise, between any of them arising out of, arising under, in connection with, relating to, or incidental to the relationship established between any of them in connection with this Agreement. Instead, any disputes resolved in court shall be resolved in a bench trial without a jury.

24. Successors and Assigns. This Agreement shall inure to the benefit of and be binding upon each of the Parties and their respective successors, assigns, heirs, transferees, executors, administrators, and representatives, in each case solely as such parties are permitted under this Agreement; provided, however, that nothing contained in this Section 24 shall be deemed to permit any transfer, tender, vote, or consent of any claims other than in accordance with the terms of this Agreement.

25. No Third-Party Beneficiaries. This Agreement shall be solely for the benefit of the Parties hereto (or any other party that may become a Party to this Agreement pursuant to Section 11 of this Agreement), and no other person or entity shall be a third-party beneficiary of this Agreement.

26. Notices. All notices (including, without limitation, any notice of termination) and other communications from any Party given or made pursuant to this Agreement shall be in writing and shall be deemed to have been duly given: (a) upon personal delivery to the Party to be notified, (b) when sent by confirmed electronic mail if sent during normal business hours of the recipient, and if not so confirmed, on the next business day, (c) three (3) days after having been sent by registered or certified mail, return receipt requested, postage prepaid, or (d) one (1) business day after deposit with a nationally recognized overnight courier, specifying next day delivery, with written verification of receipt. All communications shall be sent:

|

(a) |

To the Company: |

Eagle Bulk Shipping Inc.

477 Madison Avenue

New York, NY 10022

Attn: Adir Katzav, Chief Financial Officer

Tel: (212) 785-2500

Fax: (212) 785-3311

Email: akatzav@eagleships.com

With a copy (which shall not constitute notice) to:

Milbank, Tweed, Hadley & McCloy LLP

601 S. Figueroa St., 30th Floor

Los Angeles, CA 90017

Attn: Paul S. Aronzon

Tel: (213) 892-4377

Fax: (213) 629-5063

Email: paronzon@milbank.com

Milbank, Tweed, Hadley & McCloy LLP

1 Chase Manhattan Plaza

New York, NY 10005

Attn: Tyson M. Lomazow

Tel: (212) 530-5367

Fax: (212) 822-5367

Email: tlomazow@milbank.com

|

(b) |

To the address set forth on each Consenting Lender’s signature page (or as directed by any transferee thereof), as the case may be, with a copy (which shall not constitute notice) to: |

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, NY 10019

Attn: Andrew N. Rosenberg

Tel: (212) 373-3158

Fax: (212) 492-0158

Email: arosenberg@paulweiss.com

Attn: Alice B. Eaton

Tel: (212) 373-3125

Fax: (212) 492-0125

Email: aeaton@paulweiss.com

27. Entire Agreement. This Agreement, including the Exhibits and Schedules hereto, constitutes the entire agreement of the Parties with respect to the subject matter of this Agreement, and supersedes all other prior negotiations, agreements, representations, warranties, term sheets, proposals, and understandings, whether written, oral, or implied, among the Parties with respect to the subject matter of this Agreement; provided, however, that any confidentiality agreement executed by any Party shall survive this Agreement and shall continue in full force and effect, subject to the terms thereof, irrespective of the terms hereof.

28. Time Periods. If any time period or other deadline provided in this Agreement expires on a day that is not a business day, then such time period or other deadline, as applicable, shall be deemed extended to the next succeeding business day.

29. Severability of Provisions. If any provision of this Agreement for any reason is held by a court of competent jurisdiction to be invalid, illegal, or unenforceable in any respect, the remaining provisions shall remain in full force and effect if the essential terms and conditions of this Agreement for each party remain valid, binding, and enforceable.

30. Amendments. Except as otherwise provided herein, this Agreement may not be modified, amended, or supplemented without the prior written consent of the Company and the Majority Consenting Lenders.

31. Reservation of Rights. If the transactions contemplated by this Agreement and the Plan are not consummated as provided herein, if a Termination Event occurs, or if this Agreement is otherwise terminated for any reason, the Consenting Lenders and the Company each fully reserve any and all of their respective rights, remedies, and interests under the Credit Agreement (and all documents executed and delivered in connection therewith), applicable law, and in equity.

32. Counterparts. This Agreement may be executed in one or more counterparts, each of which, when so executed, shall be deemed an original and all of which shall constitute one and the same Agreement. The signatures of all of the Parties need not appear on the same counterpart. Delivery of an executed signature page of this Agreement by facsimile or electronic mail shall be effective as delivery of a manually executed signature page of this Agreement.

33. Public Disclosure. The Company may, in its sole discretion, disclose this Agreement (including the signature pages hereto) in a press release and/or public filing, including the Chapter 11 Case; provided, however, that after the commencement of the Chapter 11 Case, the Parties may disclose the existence of, or the terms of, this Agreement, the Plan, the Disclosure Statement, or any other material term of the transaction contemplated herein without the express written consent of the other Parties.

34. Headings. The section headings of this Agreement are for convenience only and shall not affect the interpretation hereof. References to sections, unless otherwise indicated, are references to sections of this Agreement.

35. Interpretation. This Agreement constitutes a fully negotiated agreement among commercially sophisticated parties and therefore shall not be construed or interpreted for or against any Party, and any rule or maxim of construction to such effect shall not apply to this Agreement.

[Signatures and exhibits follow]

|

BORROWER: |

EAGLE BULK SHIPPING INC., |

|||

|

By: |

/s/ Adir Katzav | |||

|

Name: |

Adir Katzav |

|||

|

Title: |

Chief Financial Officer |

|||

|

GUARANTORS: |

AVOCET SHIPPING LLC |

|

BITTERN SHIPPING LLC | |

|

CANARY SHIPPING LLC | |

|

CARDINAL SHIPPING LLC | |

|

CONDOR SHIPPING LLC | |

|

CRANE SHIPPING LLC | |

|

CRESTED EAGLE SHIPPING LLC | |

|

CROWNED EAGLE SHIPPING LLC | |

|

EGRET SHIPPING LLC | |

|

FALCON SHIPPING LLC | |

|

GANNET SHIPPING LLC | |

|

GOLDEN EAGLE SHIPPING LLC | |

|

GOLDENEYE SHIPPING LLC | |

|

GREBE SHIPPING LLC | |

|

HARRIER SHIPPING LLC | |

|

HAWK SHIPPING LLC | |

|

IBIS SHIPPING LLC | |

|

IMPERIAL EAGLE SHIPPING LLC | |

|

JAEGER SHIPPING LLC | |

|

JAY SHIPPING LLC | |

|

KESTREL SHIPPING LLC | |

|

KINGFISHER SHIPPING LLC | |

|

KITE SHIPPING LLC | |

|

KITTIWAKE SHIPPING LLC | |

|

MARTIN SHIPPING LLC | |

|

MERLIN SHIPPING LLC | |

|

NIGHTHAWK SHIPPING LLC | |

|

ORIOLE SHIPPING LLC | |

|

OSPREY SHIPPING LLC | |

|

OWL SHIPPING LLC | |

|

PEREGRINE SHIPPING LLC | |

|

PETREL SHIPPING LLC | |

|

PUFFIN SHIPPING LLC | |

|

REDWING SHIPPING LLC | |

|

ROADRUNNER SHIPPING LLC | |

|

SANDPIPER SHIPPING LLC | |

|

SHRIKE SHIPPING LLC | |

|

SKUA SHIPPING LLC |

[Signature Page to Restructuring Support Agreement]

|

SPARROW SHIPPING LLC | |

|

STELLAR EAGLE SHIPPING LLC | |

|

TERN SHIPPING LLC | |

|

THRASHER SHIPPING LLC | |

|

THRUSH SHIPPING LLC | |

|

WOODSTAR SHIPPING LLC | |

|

WREN SHIPPING LLC | |

|

GRIFFON SHIPPING LLC | |

|

HERON SHIPPING LLC | |

|

EAGLE BULK (DELAWARE) LLC | |

|

EAGLE SHIPPING INTERNATIONAL | |

|

(USA) LLC |

|

By: Eagle Bulk Shipping Inc., its Sole Member |

||||

|

By: |

/s/ Adir Katzav |

| ||

|

Name: |

Adir Katzav |

|||

|

|

Title: |

Chief Financial Officer |

||

|

EAGLE MANAGEMENT CONSULTANTS LLC |

||||

|

EAGLE SHIP MANAGEMENT LLC |

||||

|

By: Eagle Shipping International (USA) LLC, its Sole Member |

||||

|

By: Eagle Bulk Shipping Inc., its Sole Member |

||||

|

By: |

/s/ Adir Katzav |

| ||

|

Name: |

Adir Katzav |

|||

|

|

Title: |

Chief Financial Officer |

||

|

AGALI SHIPPING S.A. | |

|

KAMPIA SHIPPING S.A. | |

|

MARMARO SHIPPING S.A. | |

|

MESTA SHIPPING S.A. | |

|

MYLOS SHIPPING S.A. | |

|

NAGOS SHIPPING S.A. | |

|

RAHI SHIPPING S.A. | |

|

SIRIKARI SHIPPING S.A. | |

|

SPILIA SHIPPING S.A. |

[Signature Page to Restructuring Support Agreement]

|

ANEMI MARITIME SERVICES S.A. |

||||

|

By: |

/s/ Adir Katzav |

|||

| Name: | Adir Katzav | |||

|

Title: |

Attorney-In-Fact |

|||

|

EAGLE BULK PTE. LTD. |

||||

|

EAGLE MANAGEMENT CONSULTANCY PTE. LTD. |

||||

|

By: |

/s/ Adir Katzav |

|||

| Name: | Adir Katzav | |||

| Title: | Attorney-In-Fact | |||

[Signature Page to Restructuring Support Agreement]

|

LENDERS: |

OAKTREE HUNTINGTON INVESTMENT FUND, L.P. |

|

By: Oaktree Huntington Investment Fund GP, L.P. | |

|

Its: General Partner | |

|

By: Oaktree Huntington Investment Fund GP Ltd. | |

|

Its: General Partner | |

|

By: Oaktree Capital Management, L.P. | |

|

Its: Director |

|

By: |

/s/ Emily Stephens |

|||

|

Name: |

Emily Stephens |

|||

|

Title: |

Managing Director |

|||

|

By: |

/s/ Mahesh Balakrishnan |

|||

|

Name: |

Mahesh Balakrishnan | |||

|

Title: |

Senior Vice President |

|

OAKTREE OPPORTUNITIES FUND VIIIB DELAWARE, L.P. | |

|

By: Oaktree Fund GP, LLC | |

|

Its: General Partner | |

|

By: Oaktree Capital I, L.P. | |

|

Its: General Partner | |

|

By: OCM Holdings I, LLC | |

|

Its: General Partner | |

|

\ |

|

|

By: Oaktree Fund GP I, L.P. | |

|

Its: Managing Member |

|

By: |

/s/ Emily Stephens |

|||

|

Name: |

Emily Stephens |

|||

|

Title: |

Managing Director |

|||

|

By: |

/s/ Mahesh Balakrishnan |

|||

|

Name: |

Mahesh Balakrishnan |

|||

|

Title: |

Senior Vice President |

|

OAKTREE OPPS IX HOLDCO LTD. | |

|

OAKTREE OPPS IX (PARALLEL 2) HOLDCO LTD. | |

|

OAKTREE VOF (CAYMAN) 1 CTB LTD. | |

|

OAKTREE HUNTINGTON (CAYMAN) 5 CTB LTD. | |

|

OAKTREE OPPS VIII (CAYMAN) 3 CTB LTD. | |

|

OAKTREE OPPS IX PARALLEL (CAYMAN) 1 CTB LTD. | |

|

OAKTREE OPPS IX (CAYMAN) 1 CTB LTD. | |

|

OAKTREE OPPS IX PARALLEL 2 (CAYMAN) 1 CTB LTD. | |

|

By: Oaktree Capital Management, L.P. | |

|

Their: Director |

|

By: |

/s/ Emily Stephens |

|||

|

Name: |

Emily Stephens |

|||

|

Title: |

Managing Director |

|||

|

By: |

/s/ Mahesh Balakrishnan |

|||

|

Name: |

Mahesh Balakrishnan |

|||

|

Title: |

Senior Vice President |

|

OAKTREE VALUE OPPORTUNITIES FUND HOLDINGS, L.P. | |

|

By: Oaktree Value Opportunities Fund GP, L.P. | |

|

Its: General Partner | |

|

By: Oaktree Value Opportunities Fund GP, Ltd. | |

|

Its: General Partner | |

|

By: Oaktree Capital Management, L.P. | |

|

Its: Director |

|

By: |

/s/ Emily Stephens |

|||

|

Name: |

Emily Stephens |

|||

|

Title: |

Managing Director |

|||

|

By: |

/s/ Mahesh Balakrishnan |

|||

|

Name: |

Mahesh Balakrishnan |

|||

|

Title: |

Senior Vice President |

|

CANYON BALANCED MASTER FUND, LTD. | |

|

CANYON BLUE CREDIT INVESTMENT FUND L.P. | |

|

CANYON DISTRESSED OPPORTUNITY INVESTING FUND, L.P. | |

|

CANYON DISTRESSED OPPORTUNITY MASTER FUND, L.P. | |

|

CANYON VALUE REALIZATION FUND L.P. | |

|

CANYON VALUE REALIZATION MAC 18 LTD. | |

|

CANYON-GRF MASTER FUND II, LP | |

|

CANYON-TCDRS FUND, LLC | |

|

CITI CANYON LTD. | |

|

PERMAL CANYON FUND LTD | |

|

THE CANYON VALUE REALIZATION MASTER FUND, L.P. | |

|

AAI CANYON FUND PLC, an umbrella investment company with variable capital and segregated liability between sub-funds, solely in respect of Canyon Reflection Fund | |

|

By: Canyon Capital Advisors LLC | |

|

On behalf of the above-referenced funds and accounts | |

|

By: |

/s/ John P. Plaga |

|||

|

Name: |

John P. Plaga |

|||

|

Title: |

Authorized Signatory |

|

Please send notices to: | |

|

Canyon Partners, LLC | |

|

2000 Avenue of the Stars, 11th Floor | |

|

Los Angeles, CA 90067 |

|

Attn: Canyon Legal | |

|

Facsimile: (310) 272-1371 | |

|

EMAIL: Legal@canyonpartners.com | |

|

MIDTOWN ACQUISITIONS L.P. | |

|

By: Midtown Acquisitions GP LLC, its general partner |

|

By: |

/s/ Connor Bastable |

|||

|

Name: |

Connor Bastable |

|||

|

Title: |

Manager |

|

Please send notices to: | |

|

Midtown Acquisitions L.P. | |

|

65 East 55th Street, 19th Floor | |

|

New York, NY 10022 | |

|

Attn: Scott Vogel, Christian Cantalupo | |

|

Facsimile: 212-371-4318 | |

|

EMAIL: svogel@dkpartners.com | |

| ccantalupo@dkpartners.com | |

|

GOLDMAN SACHS LENDING PARTNERS |

|

By: |

/s/ Dennis Lafferty |

|||

|

Name: |

Dennis Lafferty |

|||

|

Title: |

Managing Director |

|

Please send notices to: | |

|

Goldman, Sachs & Co. | |

|

30 Hudson Street, 5th Floor | |

|

Jersey City, NJ 07302 | |

|

Attn: Michelle Latzoni | |

|

Facsimile: 646-769-7700 | |

|

EMAIL: gs-sbd-admin-contacts@ny.email.gs.com |

|

BRIGADE OPPORTUNISTIC CREDIT FUND 16 LLC | |

|

By: Brigade Capital Management, LP, as Investment Manager |

|

By: |

/s/ Raymond Luis |

|||

|

Name: |

Raymond Luis |

|||

|

Title: |

CFO |

|

Please send notices to: | |

|

Brigade Capital Management, LP | |

|

399 Park Avenue, 16th Floor | |

|

New York, NY 10022 | |

|

Attn: Jim Keogh | |

|

Facsimile: 469-304-2965 | |

|

EMAIL:14693042965@tls.ldsprod.com | |

|

BankDebt@brigadecapital.com | |

|

BRIGADE OPPORTUNISTIC CREDIT LBG FUND LTD. | |

|

By: Brigade Capital Management, LP, as Investment Manager |

|

By: |

/s/ Raymond Luis |

|||

|

Name: |

Raymond Luis |

|||

|

Title: |

CFO |

|

Please send notices to: | |

|

Brigade Capital Management, LP | |

|

399 Park Avenue, 16th Floor | |

|

New York, NY 10022 | |

|

Attn: Jim Keogh | |

|

Facsimile: 469-304-2965 | |

|

EMAIL:14693042965@tls.ldsprod.com | |

|

BankDebt@brigadecapital.com |

|

BIRCH CAPITAL FUND SPC LIMITED –BOND SEGREGATED PORTFOLIO | |

|

By: Brigade Capital Management, LP, as Investment Manager |

|

By: |

/s/ Raymond Luis |

|||

|

Name: |

Raymond Luis |

|||

|

Title: |

CFO |

|

Please send notices to: | |

|

Brigade Capital Management, LP | |

|

399 Park Avenue, 16th Floor | |

|

New York, NY 10022 | |

|

Attn: Jim Keogh | |

|

Facsimile: 469-304-2965 | |

|

EMAIL:14693042965@tls.ldsprod.com | |

|

BankDebt@brigadecapital.com | |

|

BIG RIVER GROUP FUND SPD LIMITED –BOND SEGREGATED PORTFOLIO | |

|

By: Brigade Capital Management, LP, as Investment Manager |

|

By: |

/s/ Raymond Luis |

|||

|

Name: |

Raymond Luis |

|||

|

Title: |

CFO |

|

Please send notices to: | |

|

Brigade Capital Management, LP | |

|

399 Park Avenue, 16th Floor | |

|

New York, NY 10022 | |

|

Attn: Jim Keogh | |

|

Facsimile: 469-304-2965 | |

|

EMAIL:14693042965@tls.ldsprod.com | |

|

BankDebt@brigadecapital.com |

|

BRIGADE CREDIT FUND II LTD. | |

|

By: Brigade Capital Management, LP, as Investment Manager |

|

By: |

/s/ Raymond Luis |

|||

|

Name: |

Raymond Luis |

|||

|

Title: |

CFO |

|

Please send notices to: | |

|

Brigade Capital Management, LP | |

|

399 Park Avenue, 16th Floor | |

|

New York, NY 10022 | |

|

Attn: Jim Keogh | |

|

Facsimile: 469-304-2965 | |

|

EMAIL:14693042965@tls.ldsprod.com | |

|

BankDebt@brigadecapital.com | |

|

BRIGADE DISTRESSED VALUE MASTER FUND, LTD. | |

|

By: Brigade Capital Management, LP, as Investment Manager |

|

By: |

/s/ Raymond Luis |

|||

|

Name: |

Raymond Luis |

|||

|

Title: |

CFO |

|

Please send notices to: | |

|

Brigade Capital Management, LP | |

|

399 Park Avenue, 16th Floor | |

|

New York, NY 10022 | |

|

Attn: Jim Keogh | |

|

Facsimile: 469-304-2965 | |

|

EMAIL:14693042965@tls.ldsprod.com | |

|