Exhibit 99.2

AMENDED AND RESTATED

PRECIOUS METALS PURCHASE AGREEMENT

BETWEEN

SILVER WHEATON (CAYMANS) LTD.

— AND —

HUDBAY (BVI) INC.

— AND —

HUDBAY MINERALS INC.

Dated November 4, 2013

TABLE OF CONTENTS

|

DESCRIPTION |

|

PAGE NO. | ||

|

|

|

| ||

|

ARTICLE 1 INTERPRETATION |

|

2 | ||

|

|

1.1 |

Definitions |

|

2 |

|

|

1.2 |

Affiliates |

|

18 |

|

|

1.3 |

Control |

|

18 |

|

|

1.4 |

Statutory References |

|

18 |

|

|

1.5 |

Headings |

|

18 |

|

|

1.6 |

Construction |

|

18 |

|

|

1.7 |

Plural, Gender |

|

18 |

|

|

1.8 |

Days |

|

18 |

|

|

1.9 |

Dollar Amounts |

|

19 |

|

|

1.10 |

Schedules |

|

19 |

|

|

1.11 |

Original Agreement |

|

19 |

|

|

|

|

|

|

|

ARTICLE 2 PURCHASE AND SALE |

|

19 | ||

|

|

2.1 |

Purchase and Sale |

|

19 |

|

|

2.2 |

Delivery Obligations |

|

20 |

|

|

2.3 |

Invoicing |

|

22 |

|

|

2.4 |

Purchase Price |

|

22 |

|

|

2.5 |

Payment |

|

23 |

|

|

|

|

|

|

|

ARTICLE 3 DEPOSIT |

|

23 | ||

|

|

3.1 |

Deposit |

|

23 |

|

|

3.2 |

Payment of Deposit |

|

24 |

|

|

3.3 |

Conditions Precedent to First Deposit Payment |

|

24 |

|

|

3.4 |

Conditions Precedent to Second Deposit Payment |

|

25 |

|

|

3.5 |

Conditions Precedent to Third Deposit Payment |

|

26 |

|

|

3.6 |

Conditions Precedent to the Payment of the Gold Deposit |

|

27 |

|

|

3.7 |

Conditions Precedent in Favour of the Supplier |

|

29 |

|

|

3.8 |

Payment of the Gold Deposit Payment Shares |

|

30 |

|

|

3.9 |

Satisfaction of Conditions Precedent |

|

31 |

|

|

3.10 |

Refund of Deposit and Other Payments |

|

31 |

|

|

3.11 |

Use of Deposit |

|

35 |

|

|

3.12 |

Uncredited Deposit |

|

35 |

|

|

|

|

|

|

|

ARTICLE 4 CONSTRUCTION, DEVELOPMENT AND COMPLETION |

|

35 | ||

|

|

4.1 |

Construction Period |

|

35 |

|

|

4.2 |

Completion |

|

35 |

|

|

4.3 |

Completion Target Date — Capacity Related Refund |

|

36 |

|

|

|

|

|

|

|

ARTICLE 5 TERM |

|

37 | ||

|

|

5.1 |

Term |

|

37 |

|

|

|

|

|

|

|

ARTICLE 6 REPORTING; BOOKS AND RECORDS |

|

37 | ||

|

|

6.1 |

Reporting Requirements |

|

37 |

|

|

6.2 |

Books and Records |

|

38 |

|

|

6.3 |

Technical Reports |

|

38 |

|

|

6.4 |

Inspections |

|

38 |

|

|

6.5 |

Confidentiality |

|

39 |

|

|

6.6 |

Inventory True-Up |

|

40 |

|

|

6.7 |

Schedule K |

|

42 |

|

ARTICLE 7 COVENANTS |

|

42 | ||

|

|

7.1 |

Conduct of Operations |

|

42 |

|

|

7.2 |

Processing/Commingling |

|

43 |

|

|

7.3 |

Preservation of Corporate Existence |

|

43 |

|

|

7.4 |

Adverse Impact to Payable Silver and Payable Gold |

|

44 |

|

|

7.5 |

Owner of Project Assets |

|

44 |

|

|

7.6 |

Insurance |

|

44 |

|

|

7.7 |

Transfers and Change of Control |

|

45 |

|

|

7.8 |

Encumbrances |

|

48 |

|

|

7.9 |

Offtake Agreements |

|

49 |

|

|

7.10 |

Right of First Refusal |

|

50 |

|

|

|

|

|

|

|

ARTICLE 8 SECURITY |

|

51 | ||

|

|

8.1 |

Security |

|

51 |

|

|

8.2 |

Parent Company Guarantee |

|

53 |

|

|

8.3 |

Inter Creditor Agreement |

|

56 |

|

|

|

|

|

|

|

ARTICLE 9 REPRESENTATIONS AND WARRANTIES |

|

57 | ||

|

|

9.1 |

Representations and Warranties of Parent Company and the Supplier |

|

57 |

|

|

9.2 |

Representations and Warranties of Silver Wheaton |

|

57 |

|

|

9.3 |

Survival of Representations and Warranties |

|

58 |

|

|

9.4 |

Knowledge |

|

58 |

|

|

|

|

|

|

|

ARTICLE 10 POLITICAL RISK CONTROL EVENT |

|

58 | ||

|

|

10.1 |

Political Risk Control Event |

|

58 |

|

|

10.2 |

Sharing of Compensation |

|

59 |

|

|

|

|

|

|

|

ARTICLE 11 DEFAULTS AND DISPUTES |

|

59 | ||

|

|

11.1 |

Supplier Events of Default |

|

59 |

|

|

11.2 |

Silver Wheaton Remedies |

|

60 |

|

|

11.3 |

Exceptions |

|

60 |

|

|

11.4 |

SW Events of Default |

|

61 |

|

|

11.5 |

Supplier Remedies |

|

61 |

|

|

11.6 |

Indemnity |

|

61 |

|

|

11.7 |

Disputed Reports |

|

62 |

|

|

11.8 |

Disputes |

|

62 |

|

|

11.9 |

Stage 2 Process Disputes |

|

63 |

|

|

|

|

|

|

|

ARTICLE 12 ADDITIONAL PAYMENT TERMS |

|

63 | ||

|

|

12.1 |

Payments |

|

63 |

|

|

12.2 |

Taxes |

|

63 |

|

|

12.3 |

New Tax Laws |

|

64 |

|

|

12.4 |

Interest |

|

64 |

|

|

12.5 |

Set Off |

|

64 |

|

|

|

|

|

|

|

ARTICLE 13 GENERAL |

|

65 | ||

|

|

13.1 |

Further Assurances |

|

65 |

|

|

13.2 |

No Joint Venture |

|

65 |

|

|

13.3 |

Governing Law |

|

65 |

|

|

13.4 |

Time |

|

65 |

|

|

13.5 |

Costs and Expenses |

|

65 |

|

|

13.6 |

Survival |

|

65 |

|

|

13.7 |

Invalidity |

|

65 |

|

|

13.8 |

Notices |

|

66 |

|

|

13.9 |

Press Releases |

|

67 |

|

|

13.10 |

Amendments |

|

67 |

|

|

13.11 |

Beneficiaries |

|

67 |

|

|

13.12 |

Entire Agreement |

|

67 |

|

|

13.13 |

Waivers |

|

68 |

|

|

13.14 |

Assignment |

|

68 |

|

|

13.15 |

Unenforceability |

|

68 |

|

|

13.16 |

Counterparts |

|

68 |

THIS AMENDED AND RESTATED PRECIOUS METALS PURCHASE AGREEMENT dated as of November 4, 2013

BETWEEN:

SILVER WHEATON (CAYMANS) LTD., a company existing under the laws of the Cayman Islands

(“Silver Wheaton”)

- and -

HUDBAY (BVI) INC., a company existing under the laws of the British Virgin Islands

(the “Supplier”)

- and -

HUDBAY MINERALS, INC., a company existing under the federal laws of Canada

(“Parent Company”)

WITNESSES THAT:

WHEREAS the Parties entered into a silver purchase agreement dated as of August 8, 2012 (the “Original Agreement”), pursuant to which the Supplier agreed to sell to Silver Wheaton, and Silver Wheaton agreed to purchase from the Supplier, an amount of Refined Silver (as hereinafter defined) equal to the Payable Silver (as hereinafter defined) subject to and in accordance with the terms and conditions of the Original Agreement;

AND WHEREAS the conditions precedent related to the First Deposit Payment (as hereinafter defined) and the Second Deposit Payment (as hereinafter defined) under the Original Agreement were satisfied by the Supplier and Silver Wheaton paid to the Supplier the First Deposit Payment and the Second Deposit Payment, all in accordance with the provisions of Sections 3.3, 3.4, 3.6 and 3.7 of the Original Agreement;

AND WHEREAS following the execution and delivery of the Original Agreement, the Parties executed (i) a side letter agreement dated January 11, 2013, and (ii) a side letter agreement dated March 14, 2013 (collectively, the “Side Letter Agreements”), pursuant to which the Parties agreed on certain exclusions, waivers and other agreements relating to their covenants set out in the Original Agreement;

AND WHEREAS the Parties wish to amend and restate the Original Agreement in order to provide that (i) by entering into this Amended and Restated Precious Metals Purchase Agreement, the Supplier agrees to sell to Silver Wheaton, and Silver Wheaton agrees to purchase from the Supplier, an amount of Refined Silver equal to the Payable Silver and an amount of Refined Gold equal to the Payable Gold, subject to and in accordance with the terms and conditions of this Agreement, and (ii) reflect the agreements of the Parties in accordance with the Side Letter Agreements;

AND WHEREAS the Supplier is a wholly-owned subsidiary of Parent Company;

AND WHEREAS Parent Company has agreed to guarantee the payment and performance of certain of the covenants and obligations of the Supplier under this Agreement;

NOW THEREFORE in consideration of the mutual covenants and agreements herein contained and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the Parties (as defined below) hereto, the Parties mutually agree as follows:

ARTICLE 1

INTERPRETATION

1.1 Definitions

In this Agreement:

“2010 Credit Facilities” means Parent Company’s credit facility with the lenders party thereto from time to time and The Bank of Nova Scotia, as administrative agent, dated as of November 3, 2010, as amended, amended and restated or otherwise modified from time to time.

“Actual Silver Production” means, for any period, the number of ounces of Produced Silver in doré or concentrate that (i) is produced through the Mineral Processing Facility during such period, and (ii) is from ore mined, produced, extracted or otherwise recovered from the Mining Properties.

“Adverse Impact” means any effect, event, occurrence, amendment or other change that is reasonably likely to:

(i) result in a Supplier Event of Default;

(ii) cause any significant decrease to or delay in the expected silver or gold production from the Mining Properties or otherwise decrease or delay the expected Payable Silver or Payable Gold in any significant respect; or

(iii) materially limit, restrict or impair the ability of the Supplier or Parent Company to perform their respective obligations under this Agreement.

“Affected Properties” means that portion of the Mining Properties to which a Political Risk Control Event pertains.

“Agreement” means this Amended and Restated Precious Metals Purchase Agreement and all attached schedules, in each case as the same may be amended, amended and restated or otherwise modified from time to time in accordance with the terms hereof.

“Amended Security Agreements” means the Security Agreements listed in Schedule I hereto, each of which shall be amended and restated as set out in Schedule I prior to the Gold Closing Date.

“Approvals” means all authorizations, licences, permits, concessions, franchises, consents, orders and other approvals required to be obtained from any person, including any federal, state, territorial or local government, agency, department, ministry, authority, tribunal, commission, official, court, stock exchange, or securities commission.

“Arbitration Rules” has the meaning set out in paragraph 1 of Annex I to Schedule H of this Agreement.

“Assignment, Subordination and Postponement of Claims” has the meaning set out in Section 8.1(c).

“Auditor’s Report” means a written report prepared by a national accounting firm in Canada that is independent of Parent Company, the Supplier and Silver Wheaton, is mutually agreeable to the Parties and has experience and expertise in determining the quantity of silver and gold mined, produced, extracted or otherwise recovered from mining projects.

“Books and Records” means the records, data, documentation, scientific and technical information, and other information relating to operations and activities with respect to the Mining Properties and the Mineral Processing Facility, including the progress to Completion and the mining and production of Minerals therefrom and the treatment, processing, milling, concentrating and transportation of Minerals and weight, moisture and assay certificates, and including the books and records contemplated in Section 6.2 and in Schedule K.

“Business Day” means any day other than a Saturday or Sunday or a day that is a statutory or bank holiday under the laws of the Province of Ontario, the Cayman Islands or Peru.

“Capacity Related Refund” has the meaning set out in Section 4.3.

“Change of Control” of a person (the “Subject Person”) means the consummation of any transaction, including any consolidation, arrangement, amalgamation or merger or any issue, Transfer or acquisition of voting shares, the result of which is that any other person or group of other persons acting jointly or in concert for purposes of such transaction: (i) becomes the beneficial owner, directly or indirectly, of more than 50% of the voting shares of the Subject Person; or (ii) acquires control of the Subject Person; provided that a Change of Control shall not include any transaction that results in: (A) a change in the beneficial share ownership of a person, or acquisition of control of a person, if a majority of that person’s voting shares were listed on a public exchange immediately prior to such transaction and, for greater certainty, shall not include any transaction that results in a change in the beneficial share ownership, or acquisition of control, of a person that directly or indirectly controls the Subject Person, if a majority of that controlling person’s voting shares were listed on a public exchange immediately prior to such transaction, or (B) the Subject Person (if a Hudbay Group Entity) continuing to be, directly or indirectly, wholly-owned by Parent Company or, with respect to the Supplier continuing to be, directly or indirectly, owned by Parent Company and any person party to a minority interest disposition, joint venture or other similar commercial arrangement in accordance with Section 7.7(e).

“Collateral” means the Owner Collateral and the Subsidiary Collateral.

“Commingling Plan” has the meaning set at in Section 7.2.

“Committed Ounces” means 265,000 ounces of Refined Gold (or such lesser amount as may be determined pursuant to this Agreement).

“Community Agreements” means [Redacted — Commercially sensitive information] [Definition redacted].

“Completion” means the achievement of Actual Silver Production equal to or greater than 90% of the Target Silver Production, calculated for any consecutive 90 day period; provided that such event occurs prior to any termination of this Agreement.

“Completion Certificate” has the meaning set out in Section 4.2(b).

“Completion Target Date” means December 31, 2020.

“Compensation” has the meaning set out in Section 10.2.

“Confidential Information” has the meaning set out in Section 6.5(a).

“Constancia Feed Gold” means the total number of ounces of Produced Gold contained in ore or other material that is (i) mined, produced, extracted or otherwise recovered from the Mining Properties other than the Pampacancha Property, and (ii) processed through the Mineral Processing Facility in a calendar month, as determined in accordance with Schedule K.

“Deemed Gold” means with respect to any Unallocated Shipment Tonnage in any Offtaker Delivery, the number of ounces that is the result of the application of the following formula, which formula shall be reapplied until such time as the Unallocated Shipment Tonnage for such Offtaker Delivery is nil:

(i) the Unallocated Monthly Tonnage for the earliest Monthly Lot that has any Unallocated Monthly Tonnage; subject to a maximum equal to the remaining Unallocated Shipment Tonnage for such Offtaker Delivery (which number of tonnes shall be considered allocated and reduce the Unallocated Monthly Tonnage for such Monthly Lot, and the Unallocated Shipment Tonnage for such Offtaker Delivery upon each application under this formula); provided that if there is any remaining Unallocated Shipment Tonnage but there is no remaining Unallocated Monthly Tonnage, then the Unallocated Shipment Tonnage shall be deemed to be nil;

(ii) multiplied by the total Monthly Lot Reference Gold deemed to be contained in the Monthly Lot to which such Unallocated Monthly Tonnage applies (for greater certainty, the Monthly Lot Reference Gold deemed to be contained in a Monthly Lot shall not be reduced for any previous allocation of such Monthly Lot Reference Gold pursuant to this subsection); and

(iii) divided by the total number of tonnes in the Monthly Lot to which such Unallocated Monthly Tonnage applies (and for greater certainty, the total number of tonnes in a Monthly Lot shall not be reduced for any previous allocation of such number of tonnes pursuant to this subsection).

For greater certainty, the Parties agree that the intent of the application of the foregoing formula is as follows:

(x) to deem the gold content of each tonne of copper concentrate contained in an Offtaker Delivery to be equal to the deemed gold content of each tonne of the earliest produced Monthly Lot that has not already been allocated to a previous Offtaker Delivery, on a first in, first out basis; and

(y) that at the end of each calendar month, the actual physical inventory of tonnes of copper concentrate containing Produced Gold that has not been the subject of an Offtaker Delivery should equal the total Unallocated Monthly Tonnage for all Monthly Lots prior to the time such physical inventory is conducted. Despite the foregoing, Section 6.6 and the proviso in item (i) above are intended to address a

situation where the actual physical inventory of tonnes of copper concentrate containing Produced Gold that has not been the subject of an Offtaker Delivery does not equal the total Unallocated Monthly Tonnage for all Monthly Lots at the time such physical inventory is conducted.

“Deposit” means collectively the sum of the amounts that have actually been advanced by Silver Wheaton to the Supplier and not returned in accordance with Article 3 and includes, for greater certainty, any and all amounts (or the value of payments in lieu of amounts), advanced by Silver Wheaton as part of the Silver Deposit and the Gold Deposit.

“Design Feed Rate” means [Redacted — Commercially sensitive information] [Definition redacted].

“Development Plan” means a comprehensive plan for the construction, development and acquisition of the Project Assets that, among other things, shall be consistent with the Engineering Documentation in all material respects and sets out in reasonable detail, the construction control capital budget, planned monthly expenditure and level 2 project schedule for achieving Completion and the general source and application of funds intended to achieve Completion, which plan includes (i) the Technical Report titled “National Instrument 43-101, Technical Report, Constancia Project, Province of Chumbivilcas, Department of Cusco, November 6, 2012, and (ii) all construction progress monthly reports received from Ausenco Limited or any other replacement EPCM firm which shall be in form and content substantially similar to the report entitled “Hudbay Peru S.A.C. Constancia Project Monthly Report May 2013” and such other monthly progress reports issued from time to time and after the date hereof, together with any such other documents which, at any given time are necessary to correct or update any material information contained in any such documentation, as such plan may be amended from time to time in accordance with the provisions of Section 4.1.

“Disclosing Party” has the meaning set out in Section 6.5(a).

“Dispute” means any and all claims, controversies, or disputes among the Parties arising out of or relating to the validity, construction, interpretation, meaning, performance, effect or breach of this Agreement or the rights and liabilities arising hereunder, other than a Schedule K Dispute.

“Dispute Notice” has the meaning set out in Section 11.7(a).

“Disputed Report” has the meaning set out in Section 11.7.

“Distribution” means, with respect to the Owner and the Supplier, any payment, directly or indirectly, by the Owner or the Supplier, of any:

(i) dividend in cash or other property or assets or return of any capital to any of its affiliates;

(ii) management fee paid or comparable payment to any affiliate of the Owner or the Supplier or to any director or officer of the Owner or the Supplier or affiliate of the Owner or the Supplier, or to any person not dealing at arm’s length with the Owner, the Supplier or affiliate, director or officer; or

(iii) indebtedness owing by the Owner or the Supplier to an obligor that is an affiliate by way of intercompany debt or otherwise.

“Effective Date” means August 1, 2012.

“EIA” means the Environmental and Social Impact Assessment of the Owner that was approved by the Peruvian Ministry of Energy and Mines on November 24, 2010 by means of Resolution No. 390-2010 MEM-AAM.

“Encumbrances” means all mortgages, charges, assignments by way of security, hypothecs, pledges, security interests, liens and other encumbrances of every nature and kind.

“Engineering Documentation” means the model provided to Silver Wheaton on August 7th, 2012, which model is based on the front end engineering and design work completed by the Owner in respect of the Project Assets, as such model may be amended from time to time in accordance with the provisions of Section 4.1.

“Equipment Financing Facility” means the equipment financing facility for the Constancia mobile fleet provided pursuant to the Joint Undertaking and Guarantee Agreement dated October 18, 2013 among the Parent Company, the Owner, HudBay Peru Inc., Caterpillar Leasing Chile S.A. and Caterpillar Financial SARL, as such agreement may be amended, amended and restated or otherwise modified from time to time.

“Estimated Monthly Lot” has the meaning set out in Section 2.2(g)(i).

“Estimated Monthly Lot Reference Gold” has the meaning set out in Section 2.2(g)(i).

“Excepted Lands Transfer” has the meaning set out in Section 8.1(i).

“Excepted Surface Lands” means the surface lands described in Schedule J.

“Excess Ounces of Refined Gold” has the meaning set out in Section 6.6(b).

“Financing” means any indebtedness for borrowed money of, or lending facility or other financing arrangement in favour of, any Hudbay Group Entity that is secured by all or any part of the Project Assets.

“First Deposit Payment” has the meaning set out in Section 3.2(a)(i).

“Gold Deposit” has the meaning set out in Section 3.1(b).

“Gold Deposit Cash Payment” has the meaning set out in Section 3.2(b)

“Gold Deposit Closing Date” has the meaning set out in Section 3.6.

“Gold Deposit Payment Shares” means that number of SW Shares that is equal to $135,000,000 in value, calculated in the manner set out in Section 3.8(a), to be delivered to the Supplier (or as the Supplier may direct) on the Gold Deposit Closing Date in payment of the Gold Deposit, if Silver Wheaton so elects.

“Gold Deposit Reduction Date” means the date on which the Gold Deposit is reduced to nil in accordance with the formula set out in Section 2.4(b).

“Gold Fixed Price” means:

(i) during the Initial Term, $400 plus, commencing on the third anniversary of the date on which Completion occurs and upon each anniversary of the date on which Completion occurs thereafter until the expiry of the Initial Term, an increase of one percent per annum (compounded); and

(ii) for the remainder of the term of this Agreement, $550 plus, commencing on the first anniversary of the date on which Completion occurs after this paragraph (ii) comes into effect and upon each anniversary of the date on which Completion occurs thereafter, an increase of one percent per annum (compounded).

“Gold Market Price” means, with respect to any day, the per ounce gold afternoon (p.m.) fixing price in U.S. dollars quoted by the London Bullion Market Association on such day or the immediately preceding trading day if such day is not a trading day; provided that, if for any reason, the London Bullion Market Association is no longer in operation or the price of gold is not confirmed, acknowledged by or quoted by the London Bullion Market Association on such trading day, the Gold Market Price shall be determined by reference to the price of gold on another commercial exchange mutually acceptable to the Parties, acting reasonably.

“Gold Purchase Price” has the meaning set out in Section 2.4(b).

“Governmental Authority” means any federal, state, provincial, territorial or local government, agency, department, ministry, authority, tribunal, commission, official, court or securities commission.

“Guaranteed Obligations” has the meaning set out in Section 8.2(a).

“Hudbay Group Entity” means the Hudbay PMPA Entities and any of their respective affiliates.

“Hudbay PMPA Entity” means the Supplier, Parent Company, the Owner and any subsidiary of the Supplier, the Owner or Parent Company (now or hereafter incorporated) to which the Mining Properties or the Mineral Processing Facility have been Transferred in accordance with Section 7.7(d).

[Redacted — Commercially sensitive information] [Term redacted].

“Increased Monthly Lots” has the meaning set out in Section 6.6(b).

“including” or “includes” means including without limitation or includes without limitation.

“Initial Term” has the meaning set out in Section 5.1.

“Initial Transfer” has the meaning set out in Section 8.1(i).

“Insolvency Event” means, in relation to any person, any one or more of the following events or circumstances:

(i) proceedings are commenced for the winding-up, liquidation or dissolution of it, unless it in good faith actively and diligently contests such proceedings resulting in a dismissal or stay thereof within 90 days of the commencement of such proceedings;

(ii) a decree or order of a court of competent jurisdiction is entered adjudging it to be bankrupt or insolvent (unless vacated), or a petition seeking reorganization, arrangement or adjustment of or in respect of it is approved under applicable laws relating to bankruptcy, insolvency or relief of debtors;

(iii) it makes an assignment for the benefit of its creditors, or petitions or applies to any court or tribunal for the appointment of a receiver or trustee for itself or any substantial part of its property, or commences for itself or acquiesces in or approves or has filed or commenced against it any proceeding under any bankruptcy, insolvency, reorganization, arrangement or readjustment of debt law or statute or any proceeding for the appointment of a receiver or trustee for itself or any substantial part of its assets or property, or has a liquidator, administrator, receiver, trustee, conservator or similar person appointed with respect to it or any substantial portion of its property or assets, unless such assignment or appointment is dismissed within 90 days of commencement of such proceeding;

(iv) a resolution is passed for the receivership, winding-up or liquidation of it; or

(v) anything analogous or having a similar effect to an event listed in paragraphs (i) to (iv) above occurs in respect of that person.

“Inter-creditor Agreement” has the meaning set out in Section 8.3(a).

“Interim Monthly Period” has the meaning set out in Section 2.2(g).

“Intermediate Inter-creditor Agreement” has the meaning set out in Section 8.3(c).

“Lender” means any person that provides any Financing, excluding any Hudbay Group Entity.

“Lender Event” means (i) an event of default under any Financing resulting in an acceleration of payment obligations under such Financing or (ii) any action is taken by a person to enforce any Encumbrance (other than an Encumbrance set out in clauses (v) or (vi) of the definition of “Permitted Encumbrances”) in, over or against any of the Collateral or any of the Project Assets, which, if successful, would result in an Adverse Impact or adversely affect in any significant respect any Collateral or Security Agreement.

“Losses” means all claims, demands, proceedings, fines, losses, damages, liabilities, obligations, deficiencies, costs and expenses (including all legal and other professional fees and disbursements, interest, penalties, judgment and amounts paid in settlement of any demand, action, suit, proceeding, assessment, judgment or settlement or compromise).

“Material Contracts” means any contract or agreement entered into by a Hudbay Group Entity that is material to the construction, development or operation of the Project Assets and that would have an Adverse Impact if it was terminated or suspended or any party thereto failed to perform its obligations thereunder.

“Mineral Processing Facility” means any mill or other processing facility owned or operated or both by any Hudbay Group Entity located on or near the Mining Properties, to the extent that such mill or processing facility was built with the primary intention of processing ore from the Mining Properties, and at which Minerals are processed.

“Minerals” means any and all marketable metal bearing material in whatever form or state (including Produced Silver and Produced Gold) that is mined, produced, extracted or otherwise recovered from the Mining Properties, including any such material derived from any processing or reprocessing of any tailings, waste rock or other waste products originally derived from the Mining Properties, and including ore and any other products resulting from the further milling, processing or other beneficiation of Minerals, including concentrates or doré bars.

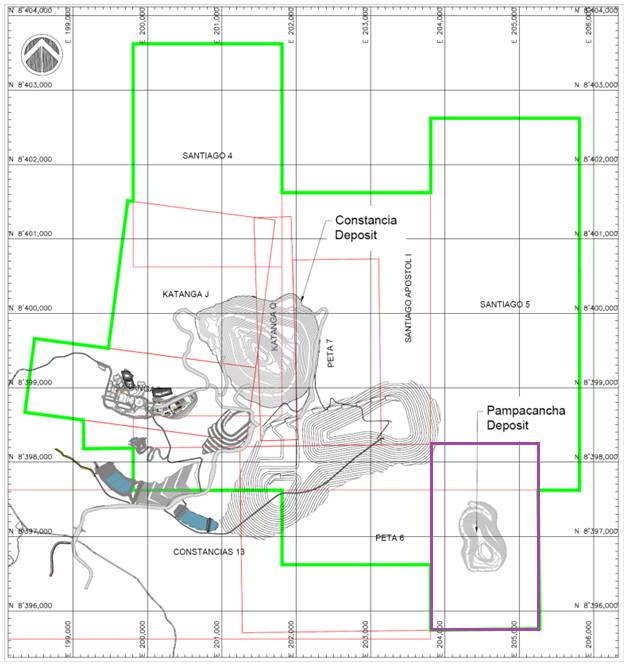

“Mining Properties” means the mining concessions and other mining rights and interests listed in Schedule A attached hereto, including all buildings, structures, improvements, appurtenances and fixtures that form part of the Owner’s mine project known as Constancia (including, for greater certainty, the Pampacancha Property), whether created privately or through the actions of any Governmental Authority having jurisdiction, and including any extension, renewal, replacement, conversion or substitution of any such mining concessions and other mining rights and interests. The Mining Properties are depicted in the map attached as Schedule B.

“Monthly Lot” means the total number of tonnes of copper concentrate, that (i) is produced in a calendar month through the Mineral Processing Facility, and (ii) is from ore mined, produced, extracted or otherwise recovered from the Mining Properties, as determined in accordance with Schedule K.

“Monthly Lot Reference Gold” means, with respect to any Monthly Lot, 55% of the Constancia Feed Gold for the same calendar month to which such Monthly Lot applies, plus 70% of the Pampacancha Feed Gold for the same calendar month to which such Monthly Lot applies, in each case expressed in ounces.

“Monthly Report” means a written report (which report may use metric or imperial measurements), in relation to any calendar month, detailing:

(i) the types (e.g. supergene, hypogene, mixed, skarn, leached, high zn), tonnages and head grades of ore mined from the Mining Properties (including a breakdown between Constancia and Pampacancha (hereinafter referred to as “each of the Mining Properties”)) during such calendar month;

(ii) the types, tonnages and grades of ore processed from each of the Mining Properties during such calendar month;

(iii) with respect to any Mineral Processing Facility, the types of product produced (i.e., concentrate, doré or other material), tonnages and concentrate grades (copper percentage, gold grams/tonne and silver grams/tonne) during such calendar month and the resulting recoveries, including the calculation for that month, in accordance with Schedule K, of the Monthly Lot, the Constancia Feed Gold, the Pampacancha Feed Gold, the Monthly Lot Reference Gold, the Constancia Throughput, the Pampacancha Throughput, the Estimated Constancia Feed Gold, the Estimated Pampacancha Feed Gold, the Estimated Crusher Feed Grade of each of the Mining Properties, and the Reported Mineral Processing Facility Feed Grade;

(iv) the number of ounces of silver and gold, and pounds of copper, contained in the product produced (i.e. concentrate, doré or other material) during such calendar month in respect of which the Supplier reasonably expects to receive an Offtaker Payment which would give rise to Payable Silver or Payable Gold;

(v) the tonnes and copper, silver and gold grade of any product delivered or shipped offsite by Offtaker Delivery during such calendar month in respect of which the Supplier reasonably expects to receive an Offtaker Payment which would give rise to Payable Silver or Payable Gold;

(vi) the tonnes and copper, silver and gold grade of any product contained in each Offtaker Delivery during such calendar month in respect of which the Supplier received an Offtaker Payment which gave rise to Payable Silver or Payable Gold and the identification of the associated Monthly Lot with respect to Payable Gold;

(vii) the number of ounces of silver and gold, and pounds of copper, contained in each Offtaker Delivery in respect of which an Offtaker Payment was received during that calendar month which gave rise to Payable Silver or Payable Gold, prior to any Offtaker Charges or payable rates and the identification of the associated Monthly Lot with respect to Payable Gold;

(viii) the amount of Payable Silver and Payable Gold for that calendar month by Offtaker Delivery and the drawdown of the associated Monthly Lot with respect to Payable Gold;

(ix) a reconciliation between (vii) and (viii), including details regarding payable rates and provisional percentages;

(x) a calculation of the outstanding Unallocated Monthly Tonnage by Monthly Lot at the start and end of such month, showing reductions resulting from Offtaker Deliveries during such month;

(xi) stockpile of saleable product in respect of which the Supplier reasonably expects to receive an Offtaker Payment that is reasonably expected to result in Payable Silver or Payable Gold (tonnage, moisture content and grade) not yet subject to an Offtaker Delivery;

(xii) the most recent update to the forecast of production of produced Minerals or Payable Silver and Payable Gold to the extent such forecast has been updated by the Supplier or Parent Company from the forecast most recently provided to Silver Wheaton, and the related assumptions as set out in Section 6.1(b)(iii) to the extent also updated, provided that such report is not required to be provided more than once per calendar quarter; and

(xiii) such other information in respect of Produced Silver and Produced Gold or the determination of Payable Silver and Payable Gold as may be reasonably requested by Silver Wheaton.

“NI 43-101” means National Instrument 43-101 — Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

“Offtake Agreement” means any agreement entered into by a Hudbay Group Entity in respect of: (i) the sale of Produced Silver or Produced Gold to a counterparty; or (ii) the smelting, refining or other beneficiation of Produced Silver or Produced Gold by a counterparty for the benefit of a Hudbay Group Entity, as the same may be supplemented, amended, restated or superseded from time to time.

“Offtaker” means (i) any person other than an affiliate of the Supplier that purchases Minerals from a Hudbay Group Entity; or (ii) any person that takes delivery of Minerals for the purpose of smelting, refining or other beneficiation of such Minerals for the benefit of a Hudbay Group Entity both pursuant to an Offtake Agreement; provided that if a Hudbay Group Entity smelts, refines or beneficiates such Minerals, then Offtaker shall mean such Hudbay Group Entity.

“Offtaker Charges” means any refining charges, treatment charges, penalties, insurance charges, transportation charges, settlement charges, financing charges or price participation charges, or other charges, penalties or deductions that may be charged or levied by an Offtaker, regardless of whether such charges, penalties or deductions are expressed as a specific metal deduction, a percentage or otherwise.

“Offtaker Delivery” means the delivery of Produced Silver or Produced Gold to an Offtaker, which for greater certainty, shall not include any deliveries of Produced Silver or Produced Gold to persons subsequent to the first Offtaker acquiring such Produced Silver or Produced Gold.

“Offtaker Payment” means (i) with respect to Minerals purchased by an Offtaker from a Hudbay Group Entity, the receipt by a Hudbay Group Entity of payment or other consideration from the Offtaker in respect of any Produced Silver or Produced Gold; and (ii) with respect to Minerals refined, smelted or otherwise beneficiated by an Offtaker on behalf of a Hudbay Group Entity, the receipt by a Hudbay Group Entity of Refined Silver or Refined Gold in accordance with the applicable Offtake Agreement; provided that, if a Hudbay Group Entity is the Offtaker, then Offtaker Payment shall mean the creation of Refined Silver or Refined Gold from the smelting, refining or beneficiating of any Produced Silver or Produced Gold, respectively.

“Original Agreement” has the meaning set out in the recitals of this Agreement.

“Other Minerals” means ores or other minerals mined, produced, extracted or otherwise recovered from properties that are not one of or do not constitute part of the Mining Properties.

“Overdue Gold Ounces” means the balance, from time to time, if any, of the number of ounces of Refined Gold that the Supplier has a current obligation to deliver to Silver Wheaton in accordance with this Agreement but has not yet done so.

“Overdue Silver Ounces” means the balance, from time to time, if any, of the number of ounces of Refined Silver that the Supplier has a current obligation to deliver to Silver Wheaton in accordance with this Agreement but has not yet done so.

“Overestimated Monthly Lots” has the meaning set out in Section 6.6(a).

“Overdelivered Ounces of Gold” has the meaning set out in Section 6.6(b).

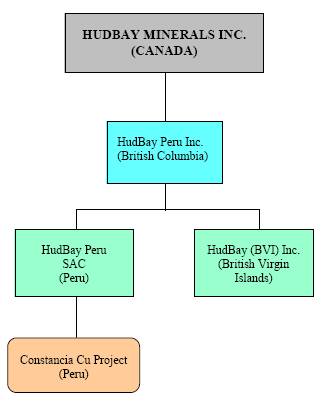

“Owner” means HudBay Peru S.A.C., a company incorporated under the laws of Peru, and a wholly-owned subsidiary of HudBay Peru Inc., a company incorporated under the laws of British Columbia, and any transferee of the Mining Properties pursuant to Section 7.7, and their respective successors and permitted assigns.

“Owner Collateral” has the meaning set out in Section 8.1(a).

“Owner Security Agreements” has the meaning set out in Section 8.1(a).

“Pampacancha Feed Gold” means the total number of ounces of Produced Gold contained in ore or other material that (i) is mined, produced, extracted or otherwise recovered from the Pampacancha Property, and (ii) processed through the Mineral Processing Facility in a calendar month, as determined in accordance with Schedule “K”.

“Pampacancha Property” means the portion of the “Peta 6” mining concession which is delineated by the northern, eastern and southern boundaries of Peta 6, and to the west by E203,800, as shown delineated in purple in the attached Schedule “B”, and any other mining rights and interests (including all buildings, structures, improvements, appurtenances and fixtures) relating thereto, and including any extension, renewal, replacement, conversion or substitution of any such mining concession and other rights and interests.

“Parties” means Silver Wheaton, Parent Company and the Supplier.

“Payable Gold” means:

(i) with respect to any Offtaker Delivery occurring on or prior to the date on which the Committed Ounces have been delivered by Supplier to Silver Wheaton, 50% of the Deemed Gold contained in any copper concentrate and 50% of the Produced Gold contained in any product other than copper concentrate, in each case contained in such Offtaker Delivery (prior to any Offtaker Charges) reduced in accordance with the requirements set out in Part A of Schedule C; and

(ii) with respect to any Offtaker Delivery occurring after the date on which the Committed Ounces have been delivered by Supplier to Silver Wheaton, 50% of the Produced Gold contained in such Offtaker Delivery (prior to any Offtaker Charges) reduced in accordance with the requirements set out in Part A of Schedule C.

“Payable Silver” means 100% of the Produced Silver contained in each Offtaker Delivery occurring from and after the Effective Date until the termination of this Agreement (prior to any Offtaker Charges) reduced in accordance with the requirements set out in Part B of Schedule C.

“Permitted Distributions” means (i) any payment of Distributions required to satisfy any obligation under the terms of a Financing as a result of any affiliates of the Supplier not otherwise having sufficient funds to satisfy such obligation, and (ii) Distributions to the Supplier.

“Permitted Encumbrances” means any Encumbrance in respect of the Project Assets constituted by the following:

(i) inchoate or statutory liens for Taxes, assessments, royalties, rents or charges not at the time due or payable, or being contested in good faith through appropriate proceedings;

(ii) any reservations or exceptions contained in the original grants of land or by applicable statute or the terms of any lease in respect of any Mining Properties or comprising the Mining Properties;

(iii) minor discrepancies in the legal description or acreage of or associated with the Mining Properties or any adjoining properties which would be disclosed in an up to date survey and any registered easements and registered restrictions or covenants that run with the land which do not materially detract from the value

of, or materially impair the use of the Mining Properties for the purpose of conducting and carrying out mining operations thereon;

(iv) rights of way for or reservations or rights of others for, sewers, water lines, gas lines, electric lines, telegraph and telephone lines, and other similar utilities, or zoning by-laws, ordinances, surface access rights or other restrictions as to the use of the Mining Properties, which do not in the aggregate materially detract from the use of the Mining Properties by the Supplier for the purpose of conducting and carrying out mining operations thereon;

(v) equipment financing, equipment leases or purchase money security interests with a value of less than $200,000,000 in the aggregate, including, for greater certainty, the Equipment Financing Facility;

(vi) liens not otherwise herein expressly permitted incurred in the ordinary course of business of the Supplier with respect to obligations that do not exceed $100,000,000 at any one time outstanding;

(vii) liens or other rights granted by a Hudbay Group Entity to secure performance of statutory obligations or regulatory requirements (including reclamation obligations);

(viii) encumbrances relating to a Political Event;

(ix) [Redacted — Commercially sensitive information] [Definition redacted].

(x) the royalties comprised of (a) any royalty payable to the Government of Peru, and (b) a 0.5% net smelter return royalty to a maximum of $10,000,000 in respect of Minera Livitaca and Katanga Properties;

(xi) encumbrances as security for the payment and performance, when due, of obligations granted pursuant to the 2010 Credit Facilities;

(xii) encumbrances as security for the payment and performance, when due, of obligations granted in accordance with Section 8.3; and

(xiii) encumbrances as security for the payment and performance, when due of obligations granted in accordance with Section 7.8(a).

“person” means and includes a Party, individuals, corporations, bodies corporate, limited or general partnerships, joint stock companies, limited liability corporations, joint ventures, associations, companies, trusts, banks, trust companies, government or any other type of organization, whether or not a legal entity.

“PMPA Obligations” means all present and future debts, liabilities and obligations of Parent Company, the Supplier and the Owner or all of them to Silver Wheaton under or in connection with this Agreement.

“Political Event” means [Redacted — Commercially sensitive information] [Definition redacted].

“Political Risk Control Event” means [Redacted — Commercially sensitive information] [Definition redacted].

“Prime” means the variable annual reference rate of interest from time to time established by The Bank of Nova Scotia as its “US Base Rate” of interest for commercial loans in Canada denominated in United States dollars (provided that, if, for any reason, The Bank of Nova Scotia is no longer in operation then one of the three largest chartered Canadian banks (based on assets), at the sole discretion of Silver Wheaton, shall be substituted therefor and this definition shall apply mutatis mutandis to such substitute bank).

“Prior Ranking Permitted Encumbrances” means items (i) to (xii) of the definition of Permitted Encumbrances.

“Produced Gold” means any and all gold in whatever form or state that is mined, produced, extracted or otherwise recovered from the Mining Properties, including any gold derived from any processing or reprocessing of any tailings, waste rock or other waste products originally derived from the Mining Properties, and including gold contained in any ore or other products resulting from the further milling, processing or other beneficiation of Minerals, including concentrates and doré bars.

“Produced Silver” means any and all silver in whatever form or state that is mined, produced, extracted or otherwise recovered from the Mining Properties, including any silver derived from any processing or reprocessing of any tailings, waste rock or other waste products originally derived from the Mining Properties, and including silver contained in any ore or other products resulting from the further milling, processing or other beneficiation of Minerals, including concentrates and doré bars.

“Project Assets” means the Mining Properties and the Mineral Processing Facility and all other present and after-acquired real or personal property, principally used or acquired for use by any Hudbay Group Entity in connection with the development or construction of a mine at, on or under the Mining Properties or the mining, production or extraction of the Minerals.

“Project Costs” means any costs and expenses that are incurred and paid by the Owner on or in connection with the development, construction and acquisition of the Project Assets and capitalized by the Owner to the Constancia Copper Project in amounts consistent with the Development Plan and Engineering Documentation in all material respects; provided that, for greater certainty, such costs and expenses shall exclude land and usage costs, capitalized interest and asset retirement obligations relating to property, plant and equipment.

“Proposed Inter-creditor Agreement” has the meaning set out in Section 8.3(c).

“Receiving Party” has the meaning set out in Section 6.5(a).

“Referee” has the meaning set out in Annex 1 to Schedule K.

“Refined Gold” means marketable metal bearing material in the form of gold that is refined to standards meeting or exceeding 995 parts per 1,000 fine gold.

“Refined Silver” means marketable metal bearing material in the form of silver that is refined to standards meeting or exceeding 999 parts per 1,000 fine silver.

“Relevant Jurisdictions” has the meaning set out in Section 3.4(e).

“Reserves” means proven and probable reserves as defined and incorporated under NI 43-101.

“Resources” means indicated, inferred and measured resources as defined and incorporated under NI 43-101.

“ROFR Interest” means:

(i) the payment of any consideration measured, quantified or calculated based on, in whole or in part any Produced Silver or Produced Gold; or

(ii) the sale of any Produced Silver or Produced Gold;

pursuant to:

(iii) an agreement which provides for a transaction structure that is similar in nature to this Agreement having a term of more than one year; or

(iv) an agreement which does not provide for a transaction structure that is similar in nature to this Agreement, but has an economic impact that is similar to this Agreement (which includes a royalty interest payable on any Produced Silver or Produced Gold);

but shall not include any such sale or royalty to, in favour of, or imposed by or required by any Governmental Authority.

“ROFR Offer” has the meaning set out in Section 7.10(a).

“Second Deposit Payment” has the meaning set out in Section 3.2(a)(ii).

“Secured Party” has the meaning set out in Section 7.8.

“Securities Laws” has the meaning set out in paragraph 14 of Schedule “G”.

“Security Agreements” means, collectively, the Owner Security Agreements, the Subsidiary Security Agreements, the Assignment, Subordination and Postponement of Claims, and upon execution, delivery and registration as provided in Sections 8.1(d) and 8.1(j), the SW Trust Agreement and the Amended Security Agreements, as applicable.

“Side Letter Agreements” has the meaning set out in the recitals of this Agreement.

“Silver Closing Date” means September 28, 2012.

“Silver Deposit” has the meaning set out in Section 3.1(a).

“Silver Deposit Reduction Date” means the date on which the Silver Deposit is reduced to nil in accordance with the formula set out in Section 2.4(a).

“Silver Fixed Price” means:

(i) during the Initial Term, $5.90 plus, commencing on the third anniversary of the date on which Completion occurs and upon each anniversary of the date on which Completion occurs thereafter until the expiry of the Initial Term, an increase of one percent per annum (compounded); and

(ii) for the remainder of the term of this Agreement, $9.90 plus, commencing on the first anniversary of the date on which Completion occurs after this paragraph (ii) comes into effect and upon each anniversary of the date on which Completion occurs thereafter, an increase of one percent per annum (compounded).

“Silver Market Price” means, with respect to any day, the per ounce silver fixing price in U.S. dollars quoted by the London Bullion Market Association on such day or the immediately preceding trading day if such day is not a trading day; provided that if for any reason, the London Bullion Market Association is no longer in operation or the price of silver is not confirmed, acknowledged by or quoted by the London Bullion Market Association, the Market Price shall be determined by reference to the price of silver on another commercial exchange mutually acceptable to the Parties, acting reasonably.

“Silver Purchase Price” has the meaning set out in Section 2.4(a).

“Silver Wheaton Security” means the charges and security interests granted in favour of Silver Wheaton pursuant to the Security Agreements.

“Stage 2 Process” has the meaning set out in Schedule K.

“Stage 2 Process Dispute” has the meaning set out in Schedule K.

“Stipulation and Proposal” has the meaning set out in Section 8.3(c).

“Subsequent Transfer” has the meaning set out in Section 8.1(i).

“subsidiary” means a person that is controlled directly or indirectly by another person and includes a subsidiary of that subsidiary.

“Subsidiary Collateral” has the meaning set out in Section 8.1(b).

“Subsidiary Security Agreements” has the meaning set out in Section 8.1(b).

“Supplier Event of Default” has the meaning set out in Section 11.1.

“SW Event of Default” has the meaning set out in Section 11.4.

“SW Shares” means common shares in the capital of Silver Wheaton Corp.

“SW Trust Agreement” has the meaning set out in Section 8.1(d).

“SW Trust Agreement Notice” has the meaning set out in Section 8.1(e)(i).

“Target Silver Production” means [Redacted — Commercially sensitive information] [Definition redacted].

“Target Silver Recovery Rate” means [Redacted — Commercially sensitive information] [Definition redacted].

“Tax” or “Taxes” means all taxes, assessments and other governmental charges, duties, and impositions, including any interest, penalties, tax instalment payments or other additions that may become payable in respect thereof, imposed by any federal, provincial, state or local government, or any agency or political subdivision of any such government, which taxes shall include all income or profits taxes (including federal, provincial, and state income taxes), non-resident withholding taxes, sales and use taxes, branch profit taxes, ad valorem taxes, excise taxes, franchise taxes, gross receipts taxes, business licence taxes, occupation taxes, real and personal property taxes, stamp taxes, environmental taxes, transfer taxes, land transfer taxes, capital taxes, extraordinary income taxes, surface area taxes, property taxes, asset transfer taxes, and other governmental charges, and other obligations of the same or of a similar nature to any of the foregoing.

“Termination Election” has the meaning set out in Section 3.10(d).

“Third Deposit Payment” has the meaning set out in Section 3.2(a)(iii).

“Third Party Agreement” has the meaning set out in Section 7.10(c).

“Third Party Offer” has the meaning set out in Section 7.10(a).

“Time of Delivery” has the meaning set out in Section 2.2(d).

“Transfer” means to sell, transfer, assign, convey, dispose or otherwise grant a right, title or interest (including expropriation or other transfer required or imposed by law or any Governmental Authority, whether voluntary or involuntary).

“Trust Agreement Defaults” has the meaning set out in Section 8.1(e)(i).

“Trustee” has the meaning set out in Section 8.1(d).

“TSX” means the Toronto Stock Exchange.

“Unallocated Monthly Tonnage” means the number of tonnes of each Monthly Lot that have not been allocated to an Offtaker Delivery in accordance with item (i) of the formula set out in the definition of “Deemed Gold”.

“Unallocated Shipment Tonnage” means, with respect to any Offtaker Delivery, the number of tonnes of copper concentrate contained in such Offtaker Delivery that have not been allocated in accordance with item (i) of the formula set out in the definition of “Deemed Gold”.

“Undelivered Ounces of Gold” has the meaning set out in Section 6.6(a).

“Underestimated Monthly Lots” has the meaning set out in Section 6.6(b).

“Vendor” has the meaning set out in Section 7.10(a).

“Volume Adjustment” means [Redacted — Commercially sensitive information] [Definition redacted].

1.2 Affiliates

A person is an affiliate of another person if one of them is the subsidiary of the other, or each of them is controlled by the same person.

1.3 Control

A person (first person) is considered to control another person (second person) if:

(a) the first person beneficially owns or directly or indirectly exercises control or direction over securities of the second person carrying votes which, if exercised, would entitle the first person to elect a majority of the directors of the second person, unless that first person holds the voting securities only to secure an obligation;

(b) the second person is a partnership, other than a limited partnership, and the first person holds more than 50% of the interests of the partnership; or

(c) the second person is a limited partnership and the general partner of the limited partnership is the first person.

1.4 Statutory References

Any reference in this Agreement to a statute or a regulation or rule promulgated under a statute or to any provision contained therein shall be a reference to the statute, regulation, rule or provision as may be amended, restated, re-enacted or replaced from time to time.

1.5 Headings

Headings of Sections are inserted for convenience of reference only and shall not affect the construction or interpretation of this Agreement.

1.6 Construction

The Parties hereby agree that any rule of construction to the effect that any ambiguity is to be resolved against the drafting Party shall not be applicable in the interpretation of this Agreement.

1.7 Plural, Gender

Unless the context otherwise requires, words importing the singular include the plural and vice versa and words importing gender include all genders.

1.8 Days

In this Agreement, a period of days shall be deemed to begin on the first day after the event which began the period and to end at 5:00 p.m. (Toronto time) on the last day of the period. If, however, the last day of the period does not fall on a Business Day, the period shall terminate at 5:00 p.m. (Toronto time) on the next Business Day.

1.9 Dollar Amounts

Unless specified otherwise in this Agreement, all statements or references to dollar amounts in this Agreement are to United States of America dollars.

1.10 Schedules

The following schedules are attached to and form part of this Agreement:

|

Schedule A |

– |

Mining Properties |

|

Schedule B |

– |

Map of Mining Properties |

|

Schedule C |

– |

Determination of Payable Gold and Payable Silver |

|

Schedule D |

– |

Capacity Related Refund Calculation |

|

Schedule E |

– |

Corporate Structure and Organization Chart |

|

Schedule F |

– |

Representations and Warranties of the Supplier and Parent Company |

|

Schedule G |

– |

Representations and Warranties of Silver Wheaton |

|

Schedule H |

– |

Inter-Creditor Terms |

|

Schedule I |

– |

Amended Security Agreements |

|

Schedule J |

– |

Excepted Surface Lands |

|

Schedule K |

– |

Constancia Feed Gold and Pampacancha Feed Gold |

|

Schedule L |

– |

Referee Arbitration Procedure for Disputed Reports |

1.11 Original Agreement

The Parties confirm that all prior actions taken by them pursuant to the Original Agreement are effective as if taken under, and are subject to, this Agreement. Each reference herein, or in the Original Agreement to “this Agreement”, “hereunder”, “hereof”, “herein”, “hereby” or words of like import shall mean and be a reference to the Original Agreement as amended and restated hereby, and each reference to the Original Agreement in any other document, instrument or agreement executed and/or delivered in connection with the Original Agreement shall mean and be a reference to the Original Agreement, as amended and restated hereby. This Agreement will not discharge or constitute a novation of any debt, obligation, covenant or agreement contained in the Original Agreement or in any agreements, certificates and other documents executed and delivered by or on behalf of the Supplier or others in respect thereof or in connection therewith, which shall remain in full force and effect except to the extent modified by this Agreement.

ARTICLE 2

PURCHASE AND SALE

2.1 Purchase and Sale

(a) Subject to and in accordance with the terms of this Agreement, from and after the Effective Date, the Supplier hereby agrees to sell to Silver Wheaton, and Silver Wheaton hereby agrees to purchase from the Supplier: (i) an amount of Refined Silver equal to the Payable Silver and (ii) an amount of Refined Gold equal to the Payable Gold, free and clear of all Encumbrances. For greater certainty, Payable Silver and Payable Gold shall not be reduced for, and Silver Wheaton shall not be responsible for, any Offtaker Charges, all of which shall be for the account of the Supplier.

(b) The Supplier shall not sell to Silver Wheaton any Refined Silver or Refined Gold that has been directly or indirectly purchased on a commodities exchange. The Supplier shall not

sell and deliver to Silver Wheaton the Refined Silver resulting from Produced Silver or the Refined Gold resulting from Produced Gold, as applicable. The Supplier’s obligation to sell and deliver Refined Silver and Refined Gold to Silver Wheaton shall be solely to sell and deliver Refined Silver and Refined Gold in a manner and in an amount determined in accordance with the terms of this Agreement.

2.2 Delivery Obligations

(a) Subject to Section (c), within five Business Days of each Offtaker Payment, the Supplier shall sell and deliver to Silver Wheaton Refined Silver in an amount equal to the Payable Silver in respect of the Offtaker Delivery to which such Offtaker Payment relates.

(b) Subject to Section 2.2(c), within five Business Days of each Offtaker Payment, the Supplier shall sell and deliver to Silver Wheaton Refined Gold in an amount equal to the Payable Gold in respect of the Offtaker Delivery to which such Offtaker Payment relates.

(c) In the event an Offtaker Payment consists of a provisional payment that may be adjusted upon final settlement of an Offtaker Delivery, then:

(i) the Supplier shall sell and deliver to Silver Wheaton, within five Business Days of such provisional Offtaker Payment, Refined Silver and Refined Gold in an amount equal to: (1) the percentage paid on a provisional basis, such percentage being equal to the total amount of payment or other consideration received by a Hudbay Group Entity in respect of the Minerals in such Offtaker Delivery divided by the total value of the Minerals determined on a provisional basis (determined in accordance with the applicable Offtake Agreement and after any Offtaker Charges other than deductions on account of the Offtaker Payment being made on a provisional basis) contained in such Offtaker Delivery; multiplied by (2) (A) in respect of silver, the Payable Silver in respect of such Offtaker Delivery and (B) in respect of gold, the Payable Gold in respect of such Offtaker Delivery, which, for greater certainty, shall be reported in accordance with the provisions of Section 2.3; and

(ii) within five Business Days of the date of final settlement of the Offtaker Delivery with the Offtaker, the Supplier shall sell and deliver to Silver Wheaton Refined Silver and Refined Gold in an amount, if positive, equal to the Payable Silver and Payable Gold determined pursuant to the final settlement, less the number of ounces of Refined Silver and Refined Gold previously delivered to Silver Wheaton in respect of such Offtaker Delivery pursuant to Section 2.2(c)(i), which, for greater certainty, shall be reported in accordance with the provisions of Section 2.3. If such difference is negative, then: (1) the Supplier shall be entitled to set off and deduct such excess amount of Refined Silver and Refined Gold from the next required deliveries of Refined Silver and Refined Gold by the Supplier to Silver Wheaton under this Agreement, or if no such further deliveries are to be made, Silver Wheaton shall within five Business Days pay the applicable Silver Purchase Price or Gold Purchase Price in respect of any excess ounces delivered to the extent not already paid; and (2) any Silver Purchase Price or Gold Purchase Price paid by Silver Wheaton in respect of such excess amount of Refined Silver and Refined Gold shall be an amount owing by the Supplier to Silver Wheaton, which amount shall be set off and deducted from the payment for the next required deliveries of Refined Silver and Refined Gold, if any, by the Supplier to Silver Wheaton under this Agreement.

(d) The Supplier shall sell and deliver to Silver Wheaton all Refined Silver and Refined Gold to be sold and delivered under this Agreement by way of credit to the metal account designated by Silver Wheaton with a bank located in London, England, or such other location specified by Silver Wheaton from time to time on two Business Days’ prior written notice and consented to by the Supplier, such consent not to be unreasonably withheld. Delivery of Refined Silver and Refined Gold to Silver Wheaton shall be deemed to have been made at the time Refined Silver and Refined Gold is credited to the designated metal account of Silver Wheaton (the “Time of Delivery”). Title to, and risk of loss of, Refined Silver and Refined Gold shall pass from the Supplier to Silver Wheaton at the Time of Delivery. All costs and expenses pertaining to each delivery of Refined Silver and Refined Gold shall be borne by the Supplier.

(e) The Supplier represents, warrants and covenants that, at each Time of Delivery:

(i) it is the legal and beneficial owner of the Refined Silver and Refined Gold delivered and credited to the designated metal account of Silver Wheaton;

(ii) it has good, valid and marketable title to such Refined Silver and Refined Gold; and

(iii) such Refined Silver and Refined Gold is free and clear of all Encumbrances.

(f) The obligations in Section 2.1(a)(ii) and 2.2(b) are conditional upon the satisfaction and fulfilment of the conditions set forth in Sections 3.6 and 3.7 (or the waiver thereof). Any Refined Gold that would have been sold and delivered by the Supplier to Silver Wheaton under Sections 2.1(a)(ii) and 2.2(b) between the date of this Agreement and the Gold Deposit Closing Date had such conditions been satisfied as of the date of this Agreement, shall be sold and delivered to Silver Wheaton within five Business Days after the Gold Deposit Closing Date.

(g) With respect to the obligations of the Supplier in Section 2.2(b), in the event an Offtaker Payment: (i) is received in respect of an Offtaker Delivery which occurs on or prior to the date on which the Committed Ounces have been delivered by the Supplier to Silver Wheaton; and (ii) the Offtaker Delivery in respect of which the Offtaker Payment was received contains concentrate or other product that was produced during any part of a calendar month in which a Monthly Lot or Monthly Lot Reference Gold has not yet been determined as of the date an Offtaker Payment has been received in respect of such Offtaker Delivery (an “Interim Monthly Period”), then:

(i) the Supplier shall use its reasonable best efforts based on daily metallurgical accounting to estimate the Monthly Lot Reference Gold contained in such Offtaker Delivery for such Interim Monthly Period (the “Estimated Monthly Lot Reference Gold”), and the Monthly Lot for such Interim Monthly Period contained in such Offtaker Delivery (the “Estimated Monthly Lot”) and for purposes of the calculation of Deemed Gold with respect to such Offtaker Delivery for such Interim Monthly Period, the reference to Monthly Lot in the definitions of “Deemed Gold”, “Monthly Lot Reference Gold” and “Unallocated Monthly Tonnage” shall be a reference to the Estimated Monthly Lot and the reference to Monthly Lot Reference Gold in the definitions of “Deemed Gold” shall be a reference to the Estimated Monthly Lot Reference Gold; and

(ii) within five Business Days of the final determination of the Monthly Lot to which such Estimated Monthly Lot applies and the Monthly Lot Reference Gold to which such Estimated Monthly Lot Reference Gold applies, the Supplier shall re-calculate the Deemed Gold for such Offtaker Delivery and the Supplier shall sell and deliver to Silver Wheaton Refined Gold in an amount, if positive, equal to the Payable Gold for such Offtaker Delivery determined pursuant to the final determination of such Monthly Lot and Monthly Lot Reference Gold, less the number of ounces of Refined Gold previously delivered to Silver Wheaton in respect of such Offtaker Delivery pursuant to Section 2.2(g)(i). If such difference is negative, then: (1) the Supplier shall be entitled to set off and deduct such excess amount of Refined Gold from the next required deliveries of Refined Gold by the Supplier to Silver Wheaton under this Agreement, or if no such further deliveries are to be made, Silver Wheaton shall within five Business Days pay the applicable Gold Purchase Price in respect of any excess ounces delivered to the extent not already paid; and (2) any Gold Purchase Price paid by Silver Wheaton in respect of such excess amount of Refined Gold shall be an amount owing by the Supplier to Silver Wheaton, which amount shall be set off and deducted from the payment for the next required deliveries of Refined Gold, if any, by the Supplier to Silver Wheaton under this Agreement.

2.3 Invoicing

(a) The Supplier shall notify Silver Wheaton in writing at least one Business Day before any delivery and credit to the account of Silver Wheaton of:

(i) the number of ounces of Refined Silver and Refined Gold to be delivered and credited; and

(ii) the estimated date and time of delivery and credit.

(b) At the Time of Delivery, the Supplier shall deliver to Silver Wheaton an invoice setting out:

(i) the number of ounces of Refined Silver and Refined Gold so credited,

(ii) the Silver Purchase Price for such Refined Silver, and

(iii) the Gold Purchase Price for such Refined Gold.

2.4 Purchase Price

(a) From and after the Effective Date, Silver Wheaton shall pay to the Supplier a purchase price for each ounce of Refined Silver sold and delivered by the Supplier to Silver Wheaton pursuant to Sections 2.1 or 2.2 (the “Silver Purchase Price”) equal to:

(i) prior to the Silver Deposit Reduction Date, the Silver Market Price on the day immediately prior to the Time of Delivery; provided that if the Silver Market Price is greater than the Silver Fixed Price, then an amount equal to the Silver Fixed Price will be payable in cash and the difference between the Silver Market Price and the Silver Fixed Price shall be payable by crediting such amount against the Silver Deposit in order to reduce the uncredited balance of the Silver

Deposit until the uncredited balance of the Silver Deposit has been credited and reduced to nil; and

(ii) from and after the Silver Deposit Reduction Date, the lesser of the Silver Fixed Price and the Silver Market Price on the day immediately prior to the Time of Delivery, payable in cash.

(b) From and after the Effective Date, Silver Wheaton shall pay to the Supplier a purchase price for each ounce of Refined Gold sold and delivered by the Supplier to Silver Wheaton pursuant to Sections 2.1, 2.2 or 6.6 (the “Gold Purchase Price”) equal to:

(i) prior to the Gold Deposit Reduction Date, the Gold Market Price on the day immediately prior to the Time of Delivery; provided that if the Gold Market Price is greater than the Gold Fixed Price, then an amount equal to the Gold Fixed Price will be payable in cash and the difference between the Gold Market Price and the Gold Fixed Price shall be payable by crediting such amount against the Gold Deposit in order to reduce the uncredited balance of the Gold Deposit until the uncredited balance of the Gold Deposit has been credited and reduced to nil; and

(ii) from and after the Gold Deposit Reduction Date, the lesser of the Gold Fixed Price and the Gold Market Price on the day immediately prior to the Time of Delivery, payable in cash.

2.5 Payment

Payment by Silver Wheaton for each delivery of Refined Silver and Refined Gold shall be made promptly and in any event not later than five Business Days after the Time of Delivery.

ARTICLE 3

DEPOSIT

3.1 Deposit

(a) In consideration for the sale and delivery of Refined Silver by the Supplier to Silver Wheaton under and pursuant to the terms of this Agreement, Silver Wheaton hereby agrees to pay to the Supplier a deposit against the Silver Purchase Price, in the amount of $294,900,000 (the “Silver Deposit”), payable in accordance with Sections 3.2, 3.3, 3.4, 3.5, 3.7 and 3.11. No interest will be payable by the Supplier on or in respect of the Silver Deposit except as expressly provided in this Agreement. Silver Wheaton will not be entitled to demand repayment of the Silver Deposit except to the extent expressly set forth in this Agreement.

(b) In consideration for the sale and delivery of Refined Gold by the Supplier to Silver Wheaton under and pursuant to the terms of this Agreement, Silver Wheaton hereby agrees to pay to the Supplier a deposit against the Gold Purchase Price, in the amount of $135,000,000 (the “Gold Deposit”), payable in accordance with Sections 3.2, 3.6, 3.7, 3.8 and 3.11. No interest will be payable by the Supplier on or in respect of the Gold Deposit except as expressly provided in this Agreement. Silver Wheaton will not be entitled to demand repayment of the Gold Deposit except to the extent expressly set forth in this Agreement.

3.2 Payment of Deposit

(a) Silver Wheaton paid or shall pay the Silver Deposit to the Supplier as follows:

(i) the amount of $44,900,000 (the “First Deposit Payment”), in cash, on the Silver Closing Date, subject to and in accordance with the provisions of Section 3.3;

(ii) the amount of $125,000,000 (the “Second Deposit Payment”), in cash, subject to and in accordance with the provisions of Section 3.4; and

(iii) the amount of $125,000,000 (the “Third Deposit Payment”), in cash, subject to and in accordance with the provisions of Section 3.5.

(b) At the sole discretion of Silver Wheaton, Silver Wheaton shall pay the Gold Deposit to the Supplier in either (i) Gold Deposit Payment Shares, or (ii) cash (the “Gold Deposit Cash Payment”) subject to and in accordance with the provisions of Section 3.6 and 3.8; provided that Silver Wheaton shall provide irrevocable written notice to the Supplier no later than 10 Business Days prior to the Gold Deposit Closing Date of its election to pay the Gold Deposit by delivering Gold Deposit Payment Shares or paying the Gold Deposit Cash Payment.

3.3 Conditions Precedent to First Deposit Payment

Silver Wheaton paid the First Deposit Payment to the Supplier on the Silver Closing Date after the satisfaction and fulfilment of each of the following conditions on or prior to the Silver Closing Date:

(a) each entity that is, at the Silver Closing Date, a Hudbay PMPA Entity shall deliver to Silver Wheaton a certificate of status, good standing or compliance (or equivalent) for each such Hudbay PMPA Entity, each issued by the relevant Governmental Authority dated no earlier than two (2) Business Days prior to the Silver Closing Date;

(b) Parent Company and the Supplier shall execute and deliver to Silver Wheaton a certificate of a senior officer of each entity that is, at the Silver Closing Date, a Hudbay PMPA Entity, in form and substance satisfactory to Silver Wheaton, acting reasonably, as to the constating documents of each such Hudbay PMPA Entity, the resolutions of the board of directors or other comparable authority of each such Hudbay PMPA Entity authorizing the execution, delivery and performance of this Agreement and the transactions contemplated hereby and thereby, the names, positions and true signatures of the persons authorized to sign this Agreement, and such other matters pertaining to the transactions contemplated hereby as Silver Wheaton may reasonably require;

(c) Parent Company and the Supplier shall deliver to Silver Wheaton favourable opinions, in form and substance satisfactory to Silver Wheaton, acting reasonably, from external legal counsel to the Hudbay PMPA Entities as to, among other things: (A) the legal status of the Hudbay PMPA Entities; (B) the authority of the Hudbay PMPA Entities to execute and deliver this Agreement, and (C) the execution and delivery of this Agreement and the enforceability thereof against the Hudbay PMPA Entities;

(d) Parent Company and the Supplier shall execute and deliver to Silver Wheaton a certificate of a director or senior officer of each such entity, in form and substance satisfactory to Silver Wheaton, acting reasonably, certifying that, on and as of the Silver Closing Date:

(i) all of the representations and warranties made by each Hudbay PMPA Entity pursuant to this Agreement are true and correct in all material respects as of such date; and

(ii) none of the Hudbay PMPA Entities are in breach or default and there is no Supplier Event of Default that has occurred and is continuing (or an event which with notice or lapse of time or both would become a breach, default or Supplier Event of Default) under this Agreement.

The Parties acknowledge and agree that the First Deposit Payment was paid by Silver Wheaton to the Supplier on the Silver Closing Date.

3.4 Conditions Precedent to Second Deposit Payment

Silver Wheaton paid the Second Deposit Payment within 10 Business Days after the satisfaction and fulfilment of each of the following conditions: