![]()

TABLE OF CONTENTS

ANNUAL INFORMATION FORM | i

![]()

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This annual information form ("AIF") contains "forward-looking information" within the meaning of applicable Canadian securities laws and "forward looking statements" within the meaning of the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. We refer to such forward-looking statements and forward-looking information together in this AIF as forward-looking information. All information contained in this AIF, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "guidance", "scheduled", "estimates", "forecasts", "strategy", "target", "intends", "objective", "goal", "understands", "anticipates" and "believes" (and variations of these or similar words) and statements that certain actions, events or results "may", "could", "would", "should", "might" "occur" or "be achieved" or "will be taken" (and variations of these or similar expressions). All of the forward-looking information in this AIF is qualified by this cautionary note.

Forward-looking information includes, but is not limited to, production, cost and capital and exploration expenditure guidance and potential revisions to such guidance, anticipated production at our mines and processing facilities, expectations regarding the impact of the COVID-19 pandemic on our operations, financial condition and prospects, and our ability to effectively engage with local communities in Peru and other stakeholders, expectations regarding the timing of mining activities at the Pampacancha deposit and any additional delivery obligations under the Constancia stream agreement, the anticipated timing, cost and benefits of developing the Rosemont project and the outcome of litigation challenging Rosemont's permits, expectations regarding the Copper World exploration program, expectations regarding the Lalor gold strategy, including the refurbishment, commissioning and ramp-up of the New Britannia mill and the expectations regarding the mine plan for the 1901 deposit, increasing the mining rate at Lalor and optimizing the Stall and New Britannia mills, the possibility of converting inferred mineral resource estimates to higher confidence categories, the potential and our anticipated plans for advancing our mining properties surrounding Constancia and elsewhere in Peru, anticipated mine plans, anticipated metals prices and the anticipated sensitivity of our financial performance to metals prices, events that may affect our operations and development projects, anticipated cash flows from operations and related liquidity requirements, the anticipated effect of external factors on revenue, such as commodity prices, estimation of mineral reserves and resources, mine life projections, reclamation costs, economic outlook, government regulation of mining operations, and business and acquisition strategies. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by us at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information.

The material factors or assumptions that we identified and were applied by us in drawing conclusions or making forecasts or projections set out in the forward looking information include, but are not limited to:

• our ability to continue to operate safely and at full capacity during the COVID-19 pandemic;

• the availability, global supply and effectiveness of COVID-19 vaccines, the effective distribution of such vaccines in the countries in which we operate, the lessening of restrictions related to COVID-19, and the anticipated rate and timing for each of the foregoing;

• our ability to achieve production and unit cost guidance;

• no significant interruptions to our operations or significant delays to our development projects in Manitoba and Peru due to the COVID-19 pandemic;

• the availability of spending reductions and liquidity options;

• the timing of development and production activities on the Pampacancha deposit;

• the timing for reaching additional agreements with individual community members and no significant unanticipated delays to the development of Pampacancha;

• the successful completion of the New Britannia project on budget and on schedule;

• the successful outcome of the Rosemont litigation;

• the successful renegotiation of collective agreements with the labour unions that represent certain of our employees in Manitoba and Peru;

![]()

• the success of mining, processing, exploration and development activities;

• the scheduled maintenance and availability of our processing facilities;

• the accuracy of geological, mining and metallurgical estimates;

• anticipated metals prices and the costs of production;

• the supply and demand for metals we produce;

• the supply and availability of all forms of energy and fuels at reasonable prices;

• no significant unanticipated operational or technical difficulties;

• the execution of our business and growth strategies, including the success of our strategic investments and initiatives;

• the availability of additional financing, if needed;

• the ability to complete project targets on time and on budget and other events that may affect our ability to develop our projects;

• the timing and receipt of various regulatory and governmental approvals;

• the availability of personnel for our exploration, development and operational projects and ongoing employee relations;

• maintaining good relations with the labour unions that represent certain of our employees in Manitoba and Peru;

• maintaining good relations with the communities in which we operate, including the neighbouring Indigenous communities and local governments;

• no significant unanticipated challenges with stakeholders at our various projects;

• no significant unanticipated events or changes relating to regulatory, environmental, health and safety matters;

• no contests over title to our properties, including as a result of rights or claimed rights of Indigenous peoples or challenges to the validity of our unpatented mining claims;

• the timing and possible outcome of pending litigation and no significant unanticipated litigation;

• certain tax matters, including, but not limited to current tax laws and regulations and the refund of certain value added taxes from the Canadian and Peruvian governments; and

• no significant and continuing adverse changes in general economic conditions or conditions in the financial markets (including commodity prices and foreign exchange rates).

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks associated with the COVID-19 pandemic and its effect on our operations, financial condition, projects and prospects, the possibility of a global recession arising from the COVID-19 pandemic and attempts to control it, the political situation in Peru, risks generally associated with the mining industry, such as economic factors (including future commodity prices, currency fluctuations, energy prices and general cost escalation), uncertainties related to the development and operation of our projects, risks related to the U.S. district court's recent decisions to set aside the U.S. Forest Service's Final Record of Decision ("FROD") and the Biological Opinion for Rosemont and related appeals and other legal challenges, risks related to the new Lalor mine plan, including the schedule for the refurbishment, commissioning and ramp-up of the New Britannia mill and the ability to convert inferred mineral resource estimates to higher confidence categories, risks related to the schedule for mining the Pampacancha deposit (including risks associated with COVID-19, with reaching additional agreements with individual community members and the impact of any schedule delays), dependence on key personnel and employee and union relations, risks related to political or social unrest or change, risks in respect of Indigenous and community relations, rights and title claims, operational risks and hazards, including the cost of maintaining and upgrading the Company's tailings management facilities and any unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks, failure of plant, equipment, processes, transportation and other infrastructure to operate as anticipated, compliance with government and environmental regulations, including permitting requirements and anti-bribery legislation, depletion of our reserves, volatile financial markets that may affect our ability to obtain additional financing on acceptable terms, the failure to obtain required approvals or clearances from government authorities on a timely basis, uncertainties related to the geology, continuity, grade and estimates of mineral reserves and resources, and the potential for variations in grade and recovery rates, uncertain costs of reclamation activities, our ability to comply with our pension and other post-retirement obligations, our ability to abide by the covenants in our debt instruments and other material contracts, tax refunds, hedging transactions, as well as the risks discussed under the heading "Risk Factors".

![]()

Should one or more risk, uncertainty, contingency or other factor materialize or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, you should not place undue reliance on forward-looking information. We do not assume any obligation to update or revise any forward-looking information after the date of this AIF or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

NOTE TO UNITED STATES INVESTORS

This AIF (and documents incorporated by reference herein) has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Canadian reporting requirements for disclosure of mineral properties are governed by the Canadian Securities Administrators' National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"). Subject to the SEC Modernization Rules described below, the United States reporting requirements are currently governed by the United States Securities and Exchange Commission ("SEC") Industry Guide 7 ("SEC Industry Guide 7") under the Securities Act of 1933, as amended.

The definitions used in NI 43-101 are incorporated by reference from the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") - Definition Standards adopted by CIM Council on May 10, 2014 (the "CIM Definition Standards"). For example, the terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve" are Canadian mining terms as defined in NI 43-101, and these definitions differ from the definitions in SEC Industry Guide 7. Furthermore, while the terms "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are defined in and required to be disclosed by NI 43-101, these terms are not defined terms under SEC Industry Guide 7.

Under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. Further, under SEC Industry Guide 7, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Reserve estimates contained in this AIF and documents incorporated by reference herein may not qualify as "reserves" under SEC Industry Guide 7. Further, until recently, the SEC has not recognized the reporting of mineral deposits which do not meet the SEC Industry Guide 7 definition of "reserve".

The SEC adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Securities Exchange Act of 1934, as amended. These amendments became effective February 25, 2019 (the "SEC Modernization Rules") with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical disclosure requirements for mining registrants that were included in SEC Industry Guide 7, which will be rescinded from and after the required compliance date of the SEC Modernization Rules. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards, incorporated by reference in NI 43-101.

United States investors are cautioned that while the above terms are "substantially similar" to CIM definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

![]()

United States investors are also cautioned that while the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any "measured mineral resources", "indicated mineral resources", or "inferred mineral resources" that the Company reports are or will be economically or legally mineable.

Further, "inferred mineral resources" have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the "inferred mineral resources" exist. In accordance with Canadian rules, estimates of "inferred mineral resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

For the above reasons, information contained in this AIF containing descriptions of the Company's mineral reserve and resource estimates is not comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of the SEC and under the United States federal securities laws and the rules and regulations thereunder.

OTHER IMPORTANT INFORMATION

Certain scientific and technical terms and abbreviations used in this AIF are defined in the "Glossary of Mining Terms" attached as Schedule A.

Unless the context suggests otherwise, references to "we", "us", "our" and similar terms, as well as references to "Hudbay" and "Company", refer to Hudbay Minerals Inc. and its direct and indirect subsidiaries.

CURRENCY AND EXCHANGE RATES

This AIF contains references to both United States dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars, and Canadian dollars are referred to as "Canadian dollars" or "C$". For United States dollars to Canadian dollars, the average exchange rate for 2020 and the closing exchange rate at December 31, 2020, as reported by the Bank of Canada, were one United States dollar per 1.3415 and 1.2732 Canadian dollars, respectively.

On March 26, 2021, the Bank of Canada daily exchange rate was one United States dollar per 1.2580 Canadian dollars.

NON-IFRS FINANCIAL PERFORMANCE MEASURES

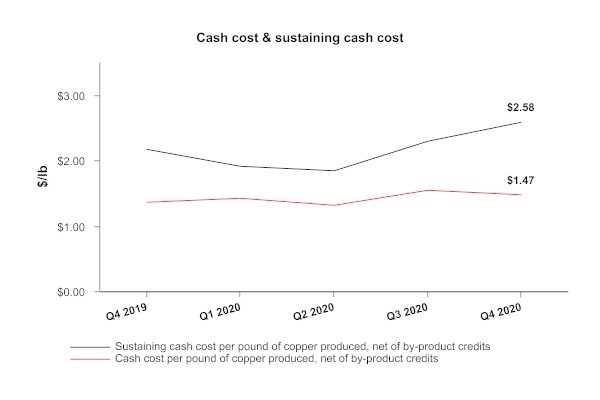

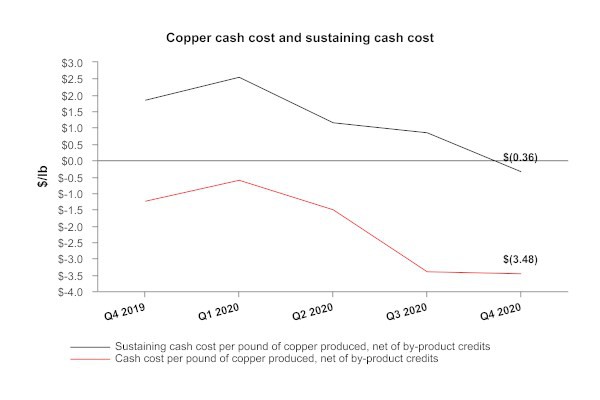

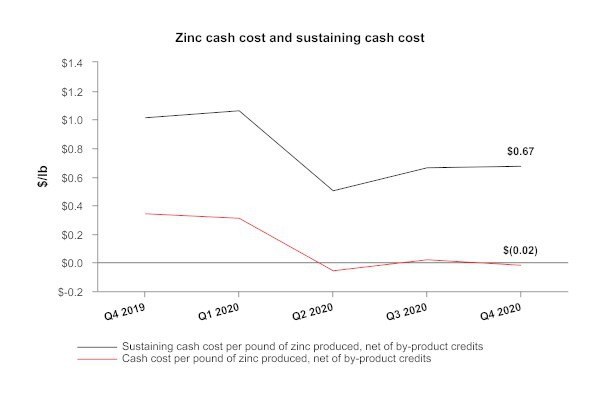

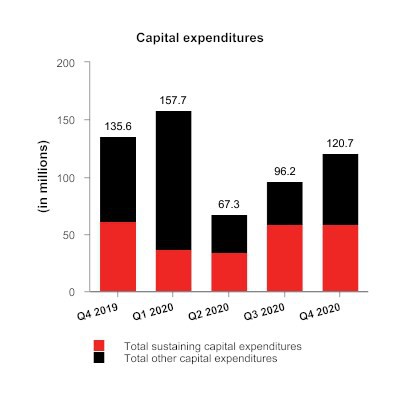

Hudbay uses certain non-IFRS financial performance measures in its financial reports and in this AIF, including adjusted net earnings (loss), adjusted net earnings (loss) per share, adjusted EBITDA, net debt, cash cost, sustaining and all-in sustaining cash cost per pound of copper produced, cash cost and sustaining cash cost per pound of zinc produced, combined unit cost and zinc plant unit cost, cash cost and sustaining cash cost per ounce of gold produced. These measures do not have a meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS and are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate these measures differently. For a description and reconciliation of each of these measures (other than cash cost and sustaining cash cost per ounce of gold produced), please see the Non-IFRS Financial Performance Measures section on pages 53 to 68 of our management's discussion and analysis for the year ended December 31, 2020, a copy of which has been filed on SEDAR at www.sedar.com and EDGAR at www.sec.gov. Further information on the projected cash cost and sustaining cash cost per ounce of gold produced from our Snow Lake operations is contained in Schedule B to this AIF.

![]()

CORPORATE STRUCTURE

INCORPORATION AND REGISTERED OFFICE

We were formed by the amalgamation of Pan American Resources Inc. and Marvas Developments Ltd. on January 16, 1996, pursuant to the Business Corporations Act (Ontario) and changed our name to Pan American Resources Inc. On March 12, 2002, we acquired ONTZINC Corporation, a private Ontario corporation, through a reverse takeover and changed our name to ONTZINC Corporation. On December 21, 2004, we acquired Hudson Bay Mining and Smelting Co., Limited ("HBMS") and changed our name to HudBay Minerals Inc. In connection with the acquisition of HBMS, on December 21, 2004, we amended our articles to consolidate our common shares on a 30 to 1 basis. On October 25, 2005, we were continued under the Canada Business Corporations Act ("CBCA"). On August 15, 2011, we completed a vertical short-form amalgamation under the CBCA with our subsidiary, HMI Nickel Inc. On January 1, 2017, we completed a vertical short-form amalgamation under the CBCA with two of our subsidiaries, HBMS and Hudson Bay Exploration and Development Company Limited, and changed our name from HudBay Minerals Inc. to Hudbay Minerals Inc.

Our registered office is located at 333 Bay Street, Suite 3400, Bay Adelaide Centre, Toronto, Ontario M5H 2S7 and our principal executive office is located at 25 York Street, Suite 800, Toronto, Ontario M5J 2V5.

Our common shares are listed on the Toronto Stock Exchange ("TSX"), New York Stock Exchange ("NYSE") and Bolsa de Valores de Lima under the symbol "HBM".

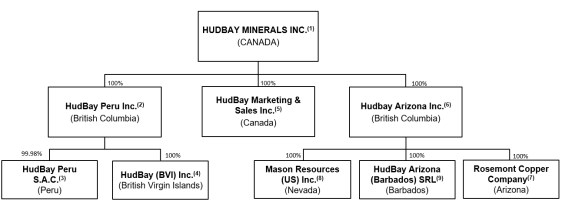

INTERCORPORATE RELATIONSHIPS

The following chart shows our principal subsidiaries, their jurisdiction of incorporation and the percentage of voting securities we beneficially own or over which we have control or direction.

Notes:

1. Hudbay owns our Canadian mining operations, is the borrower under our Canada Facility, the issuer of our Senior Unsecured Notes and a guarantor of our Peru Facility.

2. HudBay Peru Inc. owns 99.98% of HudBay Peru S.A.C. ("Hudbay Peru"). The remaining 0.02% is owned by 6502873 Canada Inc., our wholly-owned subsidiary. HudBay Peru Inc. is a guarantor of our Credit Facilities and our Senior Unsecured Notes.

3. Hudbay Peru owns the Constancia mine, is the borrower under our Peru Facility and is a guarantor of our Canada Facility and our Senior Unsecured Notes.

4. HudBay (BVI) Inc. ("Hudbay BVI") is the party to the precious metals stream agreement in respect of the Constancia mine.

5. HudBay Marketing & Sales Inc. markets and sells our copper concentrate and zinc metal produced in Manitoba and is a guarantor of our Credit Facilities and our Senior Unsecured Notes.

6. Hudbay Arizona Inc., through its subsidiaries, indirectly owns 100% of Rosemont Copper Company and Mason Resources (US) Inc. ("Mason US").

7. Rosemont Copper Company owns a 100% interest in the Rosemont project.

8. Mason US owns a 100% interest in the Mason project in Nevada as well as certain exploration properties in the surrounding area.

9. HudBay Arizona (Barbados) SRL is the party to the precious metals stream agreement in respect of the Rosemont project.

![]()

DEVELOPMENT OF OUR BUSINESS

STRATEGY

Our mission is to create sustainable value through acquisition, development and operation of high quality, long life deposits with exploration potential in jurisdictions that support responsible mining, and to see the regions and communities in which we operate benefit from our presence.

We believe that the greatest opportunities for shareholder value creation in the mining industry are in the discovery and successful development of new mineral deposits, and through highly efficient low-cost operations to profitably extract ore from those deposits. We also believe that our successful development, ramp-up and operation of the Constancia open-pit mine in Peru, along with our long history of underground mining and full life-cycle experience in northern Manitoba provide us with a competitive advantage in these respects relative to other mining companies of similar scale.

Over the past decade, we have built a world-class asset base by employing a consistent long-term growth strategy. We intend to sustainably grow Hudbay through exploration and development of our robust project pipeline, as well as through the acquisition of other properties that fit our stringent strategic criteria. Furthermore, we continuously work to generate strong free cash flow and optimize the value of our producing asset portfolio through exploration, brownfield expansion projects and efficient and safe operations.

To ensure that any capital allocation or acquisition we undertake creates sustainable value for stakeholders, we have established a number of criteria for evaluating mineral property opportunities. These include the following:

- Geography: Potential acquisitions should be located in jurisdictions that support responsible mining activity and have acceptable levels of political and social risk. Given our current scale and geographic footprint, our current geographic focus is on select investment grade countries in the Americas, with strong rule of law and respect for human rights consistent with our long-standing focus on environmental, social and governance ("ESG") principles;

- Commodity: Among the metals we produce, we believe copper has the best long-term supply/demand fundamentals and the greatest opportunities for sustained risk-adjusted returns. While our primary focus is on copper, we appreciate the polymetallic nature of deposits and, in particular, the counter-cyclical nature of gold production in our portfolio;

- Quality: We are focused on adding long-life, low-cost assets to our existing portfolio of high quality assets. Long life assets can capture peak pricing of multiple commodity price cycles and low cost assets can generate free cash flow even through the trough of price cycles;

- Potential: We consider the full spectrum of acquisition and investment opportunities from early-stage exploration to producing assets, but they must meet our stringent risk-adjusted criteria for growth and value creation. Regardless of the stage of development, we look for mineral assets that we believe offer significant incremental potential for exploration, development and optimization beyond the stated resources and mine plan;

- Process: Through a robust due diligence and capital allocation process, we develop a clear understanding of how we can create value from the investment or the acquired property through the application of our technical, social, operational and project execution expertise, as well as through the provision of necessary financial capacity and other operational optimization opportunities;

- Operatorship: We believe real value is created through leading efficient project development and operations. Hudbay's leadership team is well positioned to drive value and deliver effective capital allocation with our proven track record of successful project development and operational excellence.

- Financial: Investments and acquisitions should be accretive to Hudbay on a per share basis. Given that our strategic focus includes capital allocation to non-producing assets at various stages of development, when evaluating accretion, we will consider measures such as internal rate of return ("IRR"), return on invested capital ("ROIC"), net asset value per share and the contained value of reserves and resources per share.

![]()

THREE YEAR HISTORY

COVID-19 and Our Business

Following the onset of the COVID-19 pandemic, the Company's business response planning commenced in January 2020 and company-wide crisis plans were activated in early-March as part of our crisis management protocols. The Board worked with senior management during this time to ensure risks relating to COVID-19 were identified and mitigation plans were put in place. Throughout the rapidly changing environment, we have remained focused on the health and safety of our workforce and local communities and we have actively engaged with local stakeholders and public health authorities to ensure effective implementation of our business response plans.

In Peru, the government declared a state of emergency on March 15, 2020, requiring non-essential businesses to be shut down. Following this declaration, we commenced the temporary and orderly suspension of operations at Constancia. The shutdown lasted approximately eight weeks, during which a smaller workforce was maintained at the site to oversee critical aspects of the operation and in order to facilitate a quick and efficient restart and ramp up of the mine.

In Manitoba, other than an unrelated production interruption at 777 due to an incident that occurred during routine maintenance of the hoist rope and skip, our mines continued to operate and ship concentrate and zinc metal throughout the year, notwithstanding COVID-19 related challenges.

Each of our business units developed site-specific measures intended to identify and limit COVID-19 exposure and transmission and maintain a safe environment for our workers and our communities. Site-specific measures have included testing of incoming workers prior to their travel to site, pre-screening protocols, quarantine periods for incoming workers, workplace physical distancing protocols, and adjustment of work rotation schedules. These measures have continued to evolve as the status of the pandemic changes in each of our operating regions and our measures are adapted to the regional health authorities' latest restrictions and guidelines.

We believe the most important way we can support the communities in which we operate is to manage safe operations that provide income for local employees, businesses, and communities, and that is what we sought to do throughout the year. In addition to our efforts to maintain safe operations, we have also supported public health efforts and provided COVID-19 relief funding, supplies and services to our neighbouring communities and the regions in which we operate.

Pampacancha and Constancia Satellite Properties

In February 2020, the community of Chilloroya formally approved a surface rights agreement with Hudbay for the Pampacancha satellite deposit located near the Constancia mine in Peru. Throughout the remainder of the year, we focused on negotiating individual agreements with those members of the Chilloroya community who made use of the Pampacancha lands and advancing the consultation process between the government and the Chilloroya community in accordance with Peru's Consulta Previa law. Despite challenges presented by the COVID-19 pandemic, the Consulta Previa process was completed at the end of the year, and, in early January 2021, we received the final mining permit for the development and operation of Pampacancha.

In January 2021, Hudbay commenced limited pre-development activities for Pampacancha, including haul road construction and site preparation work. The Company continues to advance discussions with the remaining land user family at Pampacancha. Pre-stripping activities are expected to commence once the remaining land user agreement has been completed.

On March 29, 2021, the Company released an updated mine plan for Constancia that reflects an increase in copper and gold production from 2022 to 2025 as the higher grades from the Pampacancha deposit enter the mine plan. The updated mine plan incorporates higher-grade reserves including the Constancia North pit extension. With the incorporation of Pampacancha and Constancia North, annual production at Constancia is expected to average approximately 102,000 tonnes of copper and 58,000 ounces of gold over the next eight years, an increase of 40% and 367%, respectively, from 2020 levels, which were partially impacted by an eight-week temporary mine interruption related to a government-declared state of emergency.

![]()

In 2018, we acquired control of a large, contiguous block of mineral rights to explore for mineable deposits within trucking distance of the Constancia processing facility, including the past producing Caballito property and the highly prospective Maria Reyna and Kusiorcco properties. Exploration agreement discussions with the community of Uchucarcco on the Maria Reyna and Caballito properties are progressing and, in early 2021, we commenced drilling on the Quehuincha North high-grade skarn target located approximately 10 kilometres from Constancia's processing facilities.

Lalor Mine and New Britannia Project

On February 19, 2019, Hudbay announced the results from the first phase of our Snow Lake gold strategy which repositioned Lalor as a gold mine with precious metals contributing a majority of the life-of-mine revenues. This was the first mine plan to contemplate the processing of gold and copper gold ore from Lalor at the company's New Britannia mill starting in 2022, which has since been accelerated. Refurbishment activities at the gold plant continue to remain ahead of the original schedule with commissioning now expected to be completed in mid-2021.

Following drilling and engineering activities in 2019, on March 30, 2020, we announced the second phase of our Snow Lake gold strategy with the release of an integrated revised mine plan for the Snow Lake operations. This mine plan increased the annual gold production at Lalor and incorporated gold-rich regional deposits to support an 18 year operating life (ending in 2037), based solely on proven and probable reserves and a production rate of 4,500 tonnes per day at Lalor for the first ten years of the mine plan.

Over the past twelve months, we advanced the third phase of our Snow Lake gold strategy focused on expanding and further optimizing operations. On March 29, 2021, we released an updated mine plan for Snow Lake that increased annual gold production to over 180,000 ounces during the first six years of New Britannia's operation at a cash cost and sustaining cash cost, net of by-product credits, of $412 and $788 per ounce of gold, respectively. This enhanced mine plan incorporates the results from several optimization initiatives, including: increasing the production rate at Lalor to 5,300 tonnes per day once the 777 mine closes in 2022; increasing the throughput rate at the Stall mill to 3,800 tonnes per day; incorporating mineral reserves from the 1901 deposit into the mine plan; and implementing a recovery improvement project at the Stall mill to increase copper and precious metal recoveries. These mine plan enhancements optimize the processing capacity of the Snow Lake operations in a manner that maximizes the net present value of the operations. As a result of these initiatives, the production of gold, copper and silver are expected to increase by 18%, 34% and 27%, respectively, from 2022 to 2027 compared to the previous mine plan.

On May 7, 2020, we entered into a gold forward sale and prepay arrangement ("Gold Prepay") with a syndicate of our existing lenders whereby we received an upfront payment of $115 million in exchange for delivering a total of 79,954 gold ounces in 2022 and 2023 based on gold forward curve prices averaging approximately $1,682 per ounce. The Gold Prepay was executed to pre-fund substantially all of the capital costs to complete the New Britannia project. The capital costs are now expected to be approximately $13 million higher than the initial budget of $115 million due to project scope additions and COVID-19 related costs.

For additional information, see "Material Mineral Projects - Lalor".

Rosemont

Since the acquisition of the Rosemont project in 2014, Hudbay has completed an extensive work program and, in March 2017, we filed our first National Instrument 43-101 technical report for Rosemont. The technical report projected that Rosemont would have a 19-year mine life and generate an after-tax, unlevered IRR of 15.5%, based upon a long-term copper price of $3.00 per pound. For additional information, see "Rosemont Technical Report".

In the first half of 2019, Rosemont received the Section 404 Water Permit from the U.S. Army Corps of Engineers and the U.S. Forest Service ("USFS") approved Rosemont's Mine Plan of Operations ("MPO") following an extensive Environmental Impact Statement process. The issuance of the MPO was the final administrative step in the permitting process.

![]()

During the first half of 2019, Hudbay also reached an agreement with United Copper & Moly LLC ("UCM") to acquire UCM's 7.95% joint venture interest in the Rosemont project, and all remaining earn-in rights, for $45 million, plus three annual installments of $10 million per year starting in 2022.

On July 31, 2019, the U.S. District Court for the District of Arizona ("Court") issued a ruling in two of the lawsuits challenging the U.S. Forest Service's issuance of the Final Record of Decision ("FROD") for the Rosemont project (the "US Mining Law Litigation"). The Court ruled to vacate and remand the FROD thereby delaying the expected start of construction of Rosemont. Following the Court's decision in the US Mining Law Litigation, Hudbay suspended its early works program at Rosemont and, as of September 30, 2019, recognized an after-tax impairment loss of $242.1 million related to Rosemont.

In December of 2019, Hudbay and the U.S. Department of Justice each filed a notice of appeal in respect of the Court's decision in the US Mining Law Litigation to the U.S. Ninth Circuit Court of Appeals. The appeal of the unprecedented Rosemont court decision continues to advance with final briefs filed in November 2020 and the oral hearing completed in early February 2021. A decision is expected later in 2021.

On February 10, 2020, the Court issued a ruling in the third lawsuit challenging the U.S. Forest Service's issuance of the FROD for the Rosemont mine. In this lawsuit, the plaintiffs challenged the Biological Opinion that was issued by the U.S. Fish and Wildlife Service and relied on by the U.S. Forest Service as part of the permitting process. The Court ruled to remand certain aspects of the U.S. Fish and Wildlife Service's analysis and findings related to the Biological Opinion back to the agencies for further review.

On March 24, 2021, the U.S. Army Corps of Engineers determined that Rosemont is not subject to the Clean Water Act and, as such, Rosemont does not require the Section 404 Water Permit that was the subject of a litigation claim that was commenced in 2019 and had since been stayed by the Court.

While the litigation is ongoing, Hudbay remains committed to advancing the Rosemont project and finding ways to unlock value for the benefit of all our stakeholders.

On March 29, 2021, Hudbay announced the intersection of high-grade copper sulphide and oxide mineralization at shallow depth on its Copper World properties located on wholly-owned patented mining claims within seven kilometres of Rosemont. The drill program was initiated in 2020 to confirm historical drilling in this past-producing copper region formerly known as Helvetia. After receiving encouraging initial results, the Company launched a larger drill program in early 2021 and has since doubled the number of drill rigs at site to six to further test the four known deposits at Copper World and the potential for additional mineralization.

Acquisition of Mason

On December 19, 2018, Hudbay completed the acquisition of Mason Resources Corp. ("Mason") and its wholly-owned Mason project in Nevada, by way of a plan of arrangement where Hudbay acquired all of the issued and outstanding common shares of Mason which it did not already own for C$0.40 per common share. The Mason project is a large greenfield copper deposit located in the historic Yerington District of Nevada and is one of the largest undeveloped copper porphyry deposits in North America, with measured and indicated resources comparable in size to Constancia and Rosemont.

Since acquiring Mason, Hudbay has consolidated a prospective package of patented and unpatented mining claims contiguous to the Mason project and has advanced a number of technical studies. Hudbay expects to release the results of its preliminary economic assessment of the Mason project in April 2021.

Waterton Settlement and Leadership Transition

On May 3, 2019, Hudbay entered into a settlement agreement with Waterton Global Resource Management, Inc. ("Waterton"), a significant shareholder, to resolve an ongoing proxy contest. Pursuant to the terms of the settlement, Hudbay and Waterton agreed upon eleven nominees for election at Hudbay's 2019 annual shareholders' meeting and customary standstill, voting support and other terms. On March 16, 2020, we agreed to amend certain of the standstill provisions of the agreement, and, in November 2020, the agreement expired. Waterton remains a significant shareholder of the company.

![]()

As part of the Waterton agreement, Hudbay also agreed that, following the 2019 shareholders' meeting, the Company's Corporate Governance and Nominating Committee would initiate a process to identify a suitable successor to the Chair position. On October 3, 2019, Stephen A. Lang was appointed as Chair of Hudbay's Board of Directors, replacing Alan Hibben. Mr. Lang has over 40 years of experience in the mining industry, including engineering, development and production at gold, copper, coal and platinum group metals operations.

On January 22, 2020, Peter Kukielski was appointed Hudbay's President and CEO. Previously, Mr. Kukielski was serving as Interim President and CEO, following the resignation of Alan Hair in July 2019. Mr. Kukielski has more than 30 years of extensive global experience within the base metals, precious metals and bulk materials sectors. Most recently, he was President and Chief Executive Officer of Nevsun Resources Ltd. until its acquisition in December 2018.

Steve Douglas was appointed Hudbay's Senior Vice President and Chief Financial Officer, effective June 30, 2020, following the retirement of David Bryson. Mr. Douglas has over 25 years of resource industry and finance leadership experience. He was Senior Vice President and Chief Financial Officer at Agrium Inc. prior to its merger with Potash Corporation of Saskatchewan Inc. and served as Executive Vice President and Chief Integration Officer at its successor corporation, Nutrien Inc., until January 2019.

Refinancing of Senior Unsecured Notes and Credit Facilities

On August 31, 2020, we completed an amendment to our senior secured revolving credit facilities (the "Credit Facilities"). As a result of the amendment, the total available borrowings under the Credit Facilities was decreased to $400.0 million from $550.0 million to reflect our anticipated business requirements until July 2022 when the Credit Facilities mature. We also revised the financial maintenance covenants to align with our development plans for the Pampacancha and New Britannia projects.

On September 23, 2020, we completed an upsized offering of $600 million aggregate principal amount of 6.125% senior unsecured notes due 2029. The proceeds of this offering were used to redeem $400 million of our then outstanding 7.250% senior unsecured notes due 2023 and for general corporate purposes.

On March 8, 2021, we completed an offering of $600 million aggregate principal amount of 4.50% senior unsecured notes due 2026. The proceeds of this offering were used to redeem $600 million of our then outstanding 7.625% senior unsecured notes due 2025.

Following the bond refinancings, we have an aggregate of $1.2 billion of long-term debt (see "Description of Capital Structure").

DESCRIPTION OF OUR BUSINESS

GENERAL

We are a diversified mining company primarily producing copper concentrate (containing copper, gold, and silver), molybdenum concentrate and zinc metal. Directly and through our subsidiaries, we own three polymetallic mines, four ore concentrators and a zinc production facility in northern Manitoba and Saskatchewan (Canada) and Cusco (Peru), and copper projects in Arizona and Nevada (United States). Our growth strategy is focused on the exploration, development, operation and optimization of properties we already control, as well as other mineral assets we may acquire that fit our strategic criteria. Our vision is to be a responsible, top-tier operator of long-life, low-cost mines in the Americas. Our mission is to create sustainable value through acquisition, development and operation of high quality, long life deposits with exploration potential in jurisdictions that support responsible mining, and to see the regions and communities in which we operate benefit from our presence.

![]()

We have four material mineral projects:

1. our 100% owned Constancia mine, an open pit copper mine in Peru, which achieved commercial production in the second quarter of 2015;

2. our 100% owned Lalor mine, an underground gold, zinc and copper mine near Snow Lake, Manitoba, which achieved commercial production in the third quarter of 2014;

3. our 100% owned Rosemont project, a copper development project in Pima County, Arizona; and

4. our 100% owned 777 mine, an underground copper, zinc, gold and silver mine in Flin Flon, Manitoba, which has been producing since 2004 and which is scheduled to close in 2022.

In addition, we own and operate a portfolio of processing facilities in northern Manitoba, including our primary Flin Flon ore concentrator, which produces zinc and copper concentrates, our Stall concentrator, which produces zinc and copper concentrates and our Flin Flon zinc plant, which produces special high-grade zinc metal and continuous galvanizing grade aluminum alloy zinc metal. In 2015, we acquired the New Britannia mill, located in Snow Lake, which we plan to refurbish and utilize, commencing later in 2021, as part of our revised Lalor mine plan. In Peru, we own and operate a processing facility at Constancia, which produces copper and molybdenum concentrates.

We also own a 100% interest in the Mason project, an early stage copper project in Nevada with a substantial mineral resource, and own or have an interest in exploration properties in close proximity to our material mineral projects. Among these are a large, contiguous block of mineral rights within trucking distance of the Constancia processing facility, including the past producing Caballito property and the highly prospective Maria Reyna and Kusiorcco properties, and a number of properties in the Snow Lake region within trucking distance of the Stall and New Britannia mills that have the potential to provide additional feed to the Lalor mine plan.

![]()

The following map shows where our primary assets and certain exploration properties are located.

MATERIAL MINERAL PROJECTS

Constancia

Constancia is our 100% owned copper mine in Peru. It is located in the Province of Chumbivilcas in southern Peru and consists of the Constancia and Pampacancha deposits. The Constancia mine reached commercial production in the second quarter of 2015 and has an expected mine life of 17 years.

On February 18, 2020, the community of Chilloroya formally approved a surface rights agreement with Hudbay for the Pampacancha satellite deposit located near the Constancia mine in Peru. Throughout the remainder of 2020, we focused on negotiating individual agreements with those members of the Chilloroya community who made use of the Pampacancha lands and advancing the consultation process between the government and the Chilloroya community as per Peru's Consulta Previa law. Despite challenges presented by the COVID-19 pandemic, the Consulta Previa process was completed at the end of the year, and in early January 2021, the Peruvian regulators granted us the final mining permit for the development and operation of Pampacancha.

In January 2021, Hudbay commenced limited pre-development activities for Pampacancha including haul road construction and site preparation work. We continue to advance discussions with the remaining land user family at Pampacancha. Pre-stripping activities are expected to commence once the remaining land user agreement has been completed.

On March 29, 2021, the Company released an updated mine plan for Constancia that reflects an increase in copper and gold production from 2022 to 2025 as the higher grades from the Pampacancha deposit enter the mine plan. The updated mine plan incorporates higher-grade reserves including the Constancia North pit extension. With the incorporation of Pampacancha and Constancia North, annual production at Constancia is expected to average approximately 102,000 tonnes of copper and 58,000 ounces of gold over the next eight years, an increase of 40% and 367%, respectively, from 2020 levels, which were partially impacted by an eight-week temporary mine interruption related to a government-declared state of emergency.

![]()

In 2018, we acquired control of a large, contiguous block of mineral rights to explore for mineable deposits within trucking distance of the Constancia processing facility, including the past producing Caballito property and the highly prospective Maria Reyna and Kusiorcco properties. Exploration agreement discussions with the community of Uchucarcco on the Maria Reyna and Caballito properties are progressing and, in early 2021, we commenced drilling on the Quehuincha North high-grade skarn target located approximately 10 kilometres from Constancia's processing facilities.

100% of the payable silver and 50% of the payable gold at Constancia is subject to a precious metals stream agreement with Wheaton Precious Metals. We receive cash payments equal to the lesser of (i) the market price and (ii) $400 per ounce (for gold) and $5.90 per ounce (for silver), subject to one percent annual escalation starting in 2019. Gold recovery for purposes of calculating payable gold is fixed at 55% for gold mined from Constancia and 70% for gold mined from Pampacancha.

On March 29, 2021, we filed a technical report titled "NI 43-101 Technical Report, Constancia Mine, Cuzco, Peru", effective as of January 1, 2021, prepared by Olivier Tavchandjian (our Vice President, Exploration and Geology) (the "Constancia Technical Report"), a copy of which is available under our profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. For additional details on our Constancia mine, refer to Schedule B of this AIF.

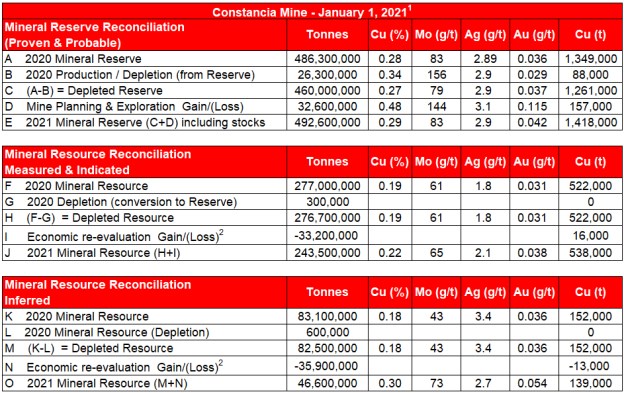

Mineral Reserves and Resources

The following table sets forth our estimates of the mineral reserves at the Constancia mine.

|

Constancia Mineral Reserves - January 1, 2021(1)(2)(3) |

|||||

|

|

Tonnes |

Cu (%) |

Mo (g/t) |

Au (g/t) |

Ag (g/t) |

|

Constancia |

|

|

|

|

|

|

Proven |

436,500,000 |

0.29 |

83 |

0.041 |

2.88 |

|

Probable |

56,100,000 |

0.25 |

69 |

0.045 |

3.09 |

|

Total Proven and Probable |

492,600,000 |

0.29 |

82 |

0.042 |

2.90 |

|

Pampacancha |

|

|

|

|

|

|

Proven |

32,400,000 |

0.59 |

178 |

0.368 |

4.48 |

|

Probable |

7,500,000 |

0.62 |

173 |

0.325 |

5.75 |

|

Total Proven and Probable |

39,900,000 |

0.60 |

177 |

0.360 |

4.72 |

|

Total Mineral Reserve |

532,500,000 |

0.31 |

89 |

0.066 |

3.04 |

Notes:

1. Totals may not add up correctly due to rounding.

2. Metal prices of $3.10 per pound copper, $11.00 per pound molybdenum, $1,500 per ounce gold, and $18.00 per ounce silver were used to estimate mineral reserves.

3. Constancia mineral reserves are estimated using a minimum NSR cut-off of $6.14 per tonne and assuming metallurgical recoveries (applied by ore type) of 85.8% on average for the life of mine.

![]()

The following table sets forth our estimates of the mineral resources (exclusive of mineral reserves) at the Constancia mine.

|

Constancia Mineral Resource Estimates (Exclusive of Mineral Reserves) - January 1, 2021(1)(2)(3)(4)(5)(6) |

|||||

|

|

Tonnes |

Cu (%) |

Mo (g/t) |

Au (g/t) |

Ag (g/t) |

|

Constancia |

|

|

|

|

|

|

Measured |

125,200,000 |

0.22 |

65 |

0.038 |

2.11 |

|

Indicated |

118,300,000 |

0.22 |

65 |

0.037 |

2.05 |

|

Inferred |

46,600,000 |

0.30 |

73 |

0.054 |

2.72 |

|

Pampacancha |

|

|

|

|

|

|

Measured |

11,400,000 |

0.41 |

101 |

0.245 |

4.95 |

|

Indicated |

6,000,000 |

0.35 |

84 |

0.285 |

5.16 |

|

Inferred |

10,100,000 |

0.14 |

143 |

0.233 |

3.86 |

|

Total Measured & Indicated |

260,900,000 |

0.23 |

67 |

0.052 |

2.27 |

|

Total Inferred |

56,700,000 |

0.27 |

86 |

0.086 |

2.92 |

Notes:

1. Totals may not add up correctly due to rounding.

2. Mineral resources are exclusive of mineral reserves and do not have demonstrated economic viability.

3. Mineral resource estimates do not include factors for mining recovery or dilution.

4. Metal prices of $3.10 per pound copper, $11.00 per pound molybdenum, $1,500 per ounce gold, and $18.00 per ounce silver were used to estimate mineral resources.

5. Constancia mineral resources are estimated using a minimum NSR cut-off of $6.14 per tonne and assuming metallurgical recoveries (applied by ore type) of 85.8% on average for the life of mine.

6. Mineral resources are based on resource pit designs containing measured, indicated, and inferred mineral resources.

![]()

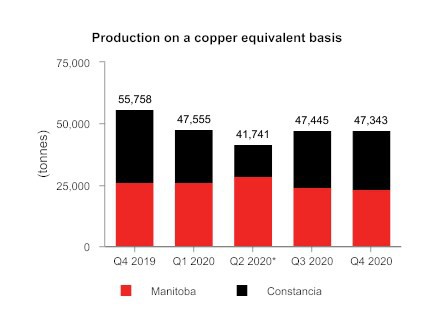

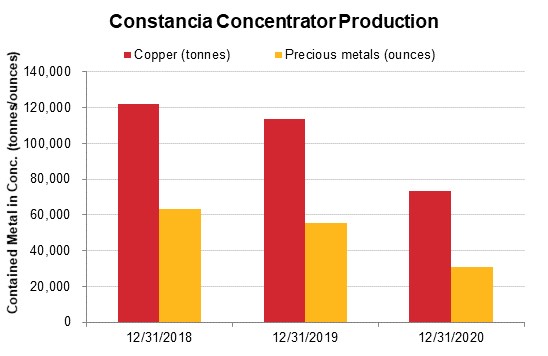

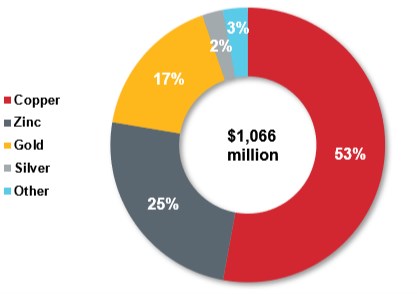

The following chart shows Constancia production (tonnes and grade) for the last three years:

Note:

1. Production in 2020 was affected by an eight-week suspension of operations at Constancia following a government declared state of emergency in response to the COVID-19 pandemic.

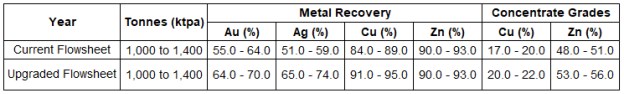

Lalor

Our 100% owned Lalor mine is a gold, zinc and copper mine near the Town of Snow Lake in the province of Manitoba. Lalor is located approximately 208 kilometres by road east of Flin Flon, Manitoba.

The Lalor mine achieved commercial production in 2014 and the production rate has steadily ramped-up since that time.

In February 2019, Hudbay announced the results from the first phase of our Snow Lake gold strategy, which repositioned Lalor as a gold mine with precious metals contributing a majority of the life-of-mine revenues. This was the first mine plan to contemplate the processing of gold and copper gold ore from Lalor at the Company's New Britannia mill. Refurbishment activities at the gold plant are ahead of the original schedule with commissioning now expected to be completed in mid-2021. The New Britannia mill refurbishment costs are expected to be approximately $13 million higher than the initial budget of $115 million due to project scope additions and COVID-19 related costs.

Following drilling and engineering activities in 2019, on March 30, 2020, we announced the second phase of our Snow Lake gold strategy with the release of an extended 18 year mine plan (ending in 2037) for the Snow Lake operations (See "Three Year History" above).

Over the past twelve months, we advanced the third phase of our Snow Lake gold strategy focused on expanding and further optimizing operations. On March 29, 2021, we released an updated mine plan for Snow Lake that increased annual gold production to over 180,000 ounces during the first six years of New Britannia's operation at a cash cost and sustaining cash cost, net of by-product credits, of $412 and $788 per ounce of gold, respectively. This enhanced mine plan incorporates the results from several optimization initiatives, including: increasing the production rate at Lalor to 5,300 tonnes per day once the 777 mine closes in 2022; increasing the throughput rate at the Stall mill to 3,800 tonnes per day; incorporating mineral reserves from the 1901 deposit into the mine plan; and implementing a recovery improvement project at the Stall mill to increase copper and precious metal recoveries. These mine plan enhancements optimize the processing capacity of the Snow Lake operations in a manner that maximizes the net present value of the operations. As a result of these initiatives, the production of gold, copper and silver are expected to increase by 18%, 34% and 27%, respectively, from 2022 to 2027 compared to the previous mine plan.

![]()

There also remains future upside to further enhance the Snow Lake operations through exploration opportunities and additional mill processing projects. Lalor contains 6.2 million tonnes of inferred mineral resources that have the potential to extend the Lalor mine's life beyond ten years and maintain a production rate of 5,300 tonnes per day beyond 2027. The 1901 deposit contains inferred gold resources that have the potential to be converted to a higher confidence category and incorporated into the mine plan and Hudbay's other mineral deposits in the Snow Lake region provide additional opportunities to optimize the operations. The Company is also in the early stages of exploring other metallurgical projects, including the potential to treat the tails from Stall to recover additional gold and the potential to expand the New Britannia mill to its historical rate of 2,000 tonnes per day.

On March 29, 2021, we filed an updated NI 43-101 technical report titled "NI 43-101 Technical Report, Lalor and Snow Lake Operations, Manitoba, Canada", effective as of January 1, 2021, prepared by Olivier Tavchandjian (our Vice President, Exploration and Geology) (the "Lalor Technical Report"), a copy of which is available under our profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. For additional details on our Lalor mine, refer to Schedule B of this AIF.

Mineral Reserves and Resources

The following table sets forth our estimates of the mineral reserves at the Lalor mine and 1901 deposit.

|

Lalor and 1901 Mineral Reserve Estimates - January 1, 2021(1)(2)(3)(4) |

|||||

|

|

Tonnes |

Cu (%) |

Zn (%) |

Au (g/t) |

Ag (g/t) |

|

Base Metal Zone |

|

|

|

|

|

|

Proven |

7,740,000 |

0.49 |

5.88 |

2.5 |

29.2 |

|

Probable |

1,880,000 |

0.50 |

6.23 |

2.6 |

31.1 |

|

Gold Zone |

|

|

|

|

|

|

Proven |

3,950,000 |

0.60 |

1.03 |

5.2 |

27.7 |

|

Probable |

3,630,000 |

1.16 |

0.53 |

5.7 |

27.9 |

|

Total Proven and Probable |

17,200,000 |

0.66 |

3.68 |

3.8 |

28.8 |

Notes:

1. Totals may not add up correctly due to rounding.

2. Metal prices of $1.10 per pound zinc, $1,500 per ounce gold, $3.10 per pound copper, and $18.00 per ounce silver with an exchange rate of 1.30 C$/US$ were used to confirm the economic viability of the mineral reserve estimates.

3. Mineral reserves are estimated using a minimum NSR cut-off of C$105 per tonne for waste filled mining areas and a minimum of C$116 per tonne for paste filled mining areas.

4. For Lalor, individual stope gold grades were capped at 10 grams per tonne, as a prudent estimate until reserves to mill reconciliations can establish that the high-grade gold can indeed be entirely recovered. This capping method resulted in the reduction of the global gold reserve grade by approximately 3%.

![]()

The following table sets forth our estimates of the mineral resources (exclusive of mineral reserves) at the Lalor mine and 1901 deposit.

|

Lalor and 1901 Mineral Resource Estimates |

|||||

|

|

Tonnes |

Cu (%) |

Zn (%) |

Au (g/t) |

Ag (g/t) |

|

Base Metal Zone |

|

|

|

|

|

|

Inferred |

890,000 |

0.50 |

4.49 |

2.5 |

44.6 |

|

Gold Zone |

|

|

|

|

|

|

Inferred |

6,090,000 |

1.13 |

0.37 |

4.8 |

26.9 |

|

Total Inferred |

6,990,000 |

1.05 |

0.89 |

4.5 |

29.2 |

Notes:

1. Totals may not add up correctly due to rounding.

2. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

3. Mineral resources in the above tables do not include mining dilution or recovery factors.

4. Base metal mineral resources are estimated based on the assumptions that they would be processed at the Stall concentrator while gold mineral resources are estimated based on the assumption that they would be processed at the New Britannia concentrator, which is currently being refurbished.

5. Metal prices of $1.10 per pound zinc, $1,500 per ounce gold, $3.10 per pound copper, and $18.00 per ounce silver with an exchange rate of 1.30 C$/US$ were used to estimate mineral resources at Lalor.

6. 1901 mineral resources were initially estimated using metal price assumptions that vary marginally over the assumptions used to estimate mineral resources at Lalor. In the Qualified Person's opinion, the combined impact of these small variations does not have any impact on the mineral resource estimates.

7. Mineral resources are estimated using a minimum NSR cut-off of C$105 per tonne for waste filled mining areas and a minimum of C$116 per tonne for paste filled mining areas.

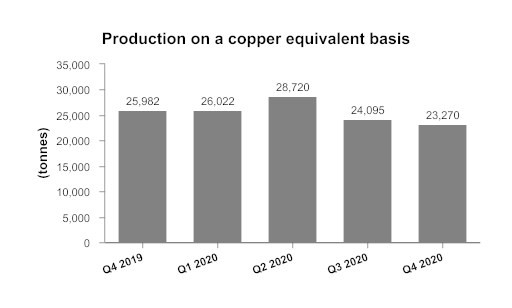

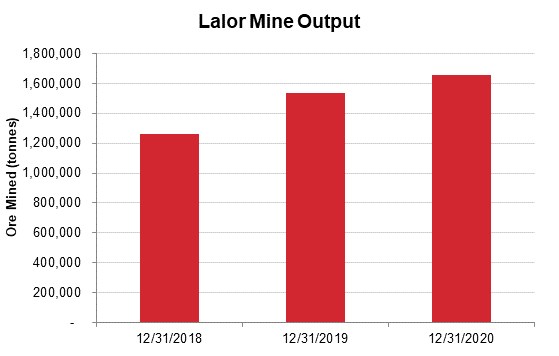

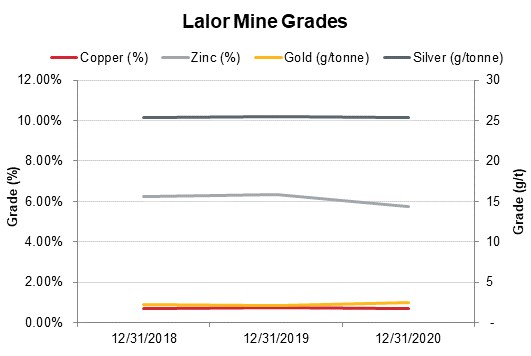

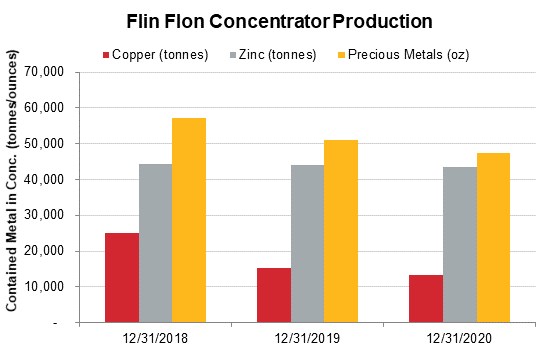

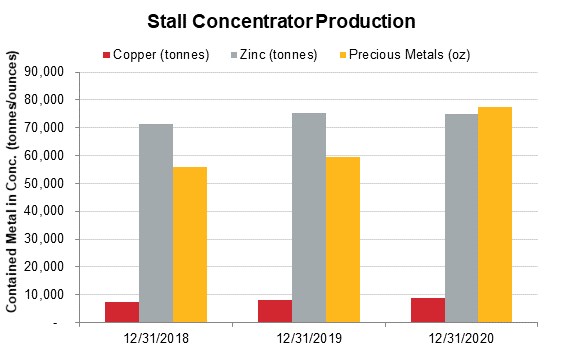

Production

The following charts show Lalor production (tonnes and grade) for the last three years:

![]()

Rosemont

Our 100% owned Rosemont project is a copper development project, located in Pima County, Arizona, approximately 50 kilometres southeast of Tucson. The Rosemont project is designed to be an open pit, shovel and truck operation and has an expected 19-year mine life. Rosemont is expected to generate an after-tax, unlevered IRR of 15.5%, using a long-term copper price of $3.00 per pound, with a capital cost estimate of $1.921 billion based on our technical report for Rosemont filed in March 2017. Rosemont is subject to a precious metals stream agreement with Wheaton that contemplates an upfront initial deposit of $230 million following the receipt of permits, finalization of the financing plan and commencement of construction, in exchange for delivery of approximately 100% of payable silver and gold produced from Rosemont at a cash price of $450 per ounce for gold and $3.90 per ounce for silver, subject to escalation for inflation.

In the first half of 2019, Rosemont received the Section 404 Water Permit from the U.S. Army Corps of Engineers and the USFS approved Rosemont's MPO following an extensive Environmental Impact Statement process. The issuance of the MPO was the final administrative step in the permitting process. During the first half of 2019, Hudbay also reached an agreement with UCM to acquire UCM's 7.95% joint venture interest in the Rosemont project, and all remaining earn-in rights, for $45 million, plus three annual installments of $10 million per year.

On July 31, 2019, the U.S. District Court for the District of Arizona issued a ruling in two of the lawsuits challenging the U.S. Forest Service's issuance of the FROD for the Rosemont project (the "US Mining Law Litigation"). The Court ruled to vacate and remand the FROD thereby delaying the expected start of construction of Rosemont.

In December of 2019, Hudbay and the U.S. Department of Justice each filed a notice of appeal in respect of the Court's decision in the US Mining Law Litigation to the U.S. Ninth Circuit Court of Appeals. The appeal of the unprecedented Rosemont court decision continues to advance with final briefs filed in November 2020 and the oral hearing completed in early February 2021. A decision is expected later in 2021. For a summary of the other litigation currently affecting the Rosemont project and the U.S. Army Corps of Engineers' recent jurisdictional determination in respect of the Section 404 Water Permit, refer to "Three Year History" above.

![]()

While the litigation is ongoing, Hudbay remains committed to advancing the Rosemont project and finding ways to unlock value for the benefit of all our stakeholders.

On March 29, 2021, Hudbay announced the intersection of high-grade copper sulphide and oxide mineralization at shallow depth on its Copper World properties located on wholly-owned patented mining claims within seven kilometres of Rosemont. The drill program was initiated in 2020 to confirm historical drilling in this past-producing copper region formerly known as Helvetia. After receiving encouraging initial results, the Company launched a larger drill program in early 2021 and has since doubled the number of drill rigs at site to six to further test the four known deposits at Copper World and the potential for additional mineralization.

On March 30, 2017, we filed a technical report titled "NI 43-101, Feasibility Study, Updated Mineral Resource, Mineral Reserve and Financial Estimates, Rosemont Project, Pima County, Arizona, USA", effective as of March 30, 2017, prepared by Cashel Meagher, P. Geo (our Chief Operating Officer) (the "Rosemont Technical Report"), a copy of which is available under our profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. For additional details on our Rosemont project, refer to Schedule B of this AIF.

Mineral Reserves and Resources

The following table sets forth our estimates of the mineral reserves at the Rosemont project.

|

Rosemont Mineral Reserve Estimates - January 1, 2021 (1)(2)(3) |

||||

|

|

Tonnes |

Cu (%) |

Mo (g/t) |

Ag (g/t) |

|

Proven |

426,100,000 |

0.48 |

120 |

4.96 |

|

Probable |

111,000,000 |

0.31 |

100 |

3.09 |

|

Total Proven and Probable |

537,100,000 |

0.45 |

120 |

4.58 |

Notes:

1. Blocks were classified as Proven or Probable in accordance with CIM Definition Standards 2014.

2. US$3.15 per pound copper, US$11.00 per pound molybdenum and US$18.00 per ounce of silver were used. Metallurgical recoveries of 90% copper, 63% molybdenum and 75.5% silver were applied. No metallurgical recovery of molybdenum and silver from oxide ore is projected. A $6.60 NSR cut-off grades was based on process recoveries, total processing, and general and administrative operating costs per tonne.

3. Based on 100% ownership of the Rosemont project.

![]()

The following table sets forth our estimates of the mineral resources (exclusive of mineral reserves) at the Rosemont project.

|

Rosemont Mineral Resource Estimates (Exclusive of Mineral Reserves) - January 1, 2021(1)(2)(3) |

||||

|

|

Tonnes |

Cu (%) |

Mo (g/t) |

Ag (g/t) |

|

Measured |

161,300,000 |

0.38 |

90 |

2.72 |

|

Indicated |

374,900,000 |

0.25 |

110 |

2.60 |

|

Total Measured & Indicated |

536,200,000 |

0.29 |

110 |

2.64 |

|

Total Inferred |

62,300,000 |

0.30 |

100 |

1.58 |

Notes:

1. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to Schedule A "Glossary of Mining Terms".

2. Mineral resources are constrained within a computer generated pit using the Lerchs-Grossman algorithm. Estimates of mineral resources exclude mineral reserves and are based on the following long-term metals prices: $3.15 per pound of copper; $11.00 per pound of molybdenum; and $18.00 per ounce of silver. Metallurgical recoveries of 85% copper, 60% molybdenum and 75% silver were applied to sulfide material. Metallurgical recoveries of 40% copper, 30% molybdenum and 40% silver were applied to mixed material. A metallurgical recovery of 65% for copper was applied to oxide material. NSR was calculated for every model block and is an estimate of recovered economic value of copper, molybdenum, and silver combined. Cut-off grades were set in terms of NSR based on current estimates of process recoveries, total processing and general and administrative operating costs of $6.10 per tonne for oxide, mixed and sulfide material.

3. Based on 100% ownership of the Rosemont project.

777 mine

Our 100% owned 777 mine is an underground copper, zinc, gold and silver mine located within the Flin Flon Greenstone Belt, immediately adjacent to our principal concentrator and zinc pressure leach plant in Flin Flon, Manitoba. Development of the 777 mine commenced in 1999 and commercial production began in 2004. Based on the most recent estimate of mineral reserves, the 777 mine will close in the second quarter of 2022.

Ore produced at the 777 mine is transported to our Flin Flon concentrator for processing into copper and zinc concentrates. In the fourth quarter of 2020, we safely resumed full production at the 777 mine following a temporary production interruption due to an incident that occurred during routine maintenance of the hoist rope and skip. The shaft repairs were completed ahead of schedule and the repair costs were below the initial estimate.

Pursuant to the precious metals stream agreement we entered into with Wheaton Precious Metals in respect of the 777 mine, we are required to deliver 50% of the payable gold and 100% of the payable silver from the 777 mine and receive fixed payments equal to the lesser of (i) the market price and (ii) $400 per ounce (for gold) and $5.90 per ounce (for silver), subject to one percent annual escalation that started in 2015.

On November 6, 2012, we filed a NI 43-101 technical report titled "Technical Report, 777 mine, Flin Flon, Manitoba, Canada", prepared by Brett Pearson, P. Geo., Darren Lyhkun, P. Eng., Cassandra Spence, P. Eng., Stephen West, P. Eng. and Robert Carter, P. Eng. and dated effective October 15, 2012 (the "777 Technical Report"), a copy of which is available under our profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. For additional details on our 777 mine refer to Schedule B of this AIF.

![]()

Mineral Reserves and Resources

The following table sets forth our estimates of the mineral reserves at the 777 mine.

|

777 Mineral Reserve Estimates - January 1, 2021(1)(2) |

|||||

|

|

Tonnes |

Cu (%) |

Zn (%) |

Au (g/t) |

Ag (g/t) |

|

Base Metal Zone |

|

|

|

|

|

|

Proven |

1,125,000 |

1.59 |

5.09 |

2.23 |

31 |

|

Probable |

399,000 |

1.11 |

4.46 |

1.86 |

30 |

|

Total Proven and Probable |

1,524,000 |

1.46 |

4.93 |

2.13 |

31 |

Notes:

1. Totals may not add up correctly due to rounding.

2. Life of mine (2021-2022) average zinc price of $1.04 per pound (includes premium), copper price of $2.90 per pound, gold price of $1,767 per ounce and silver price of $20.67 per ounce using an exchange rate of 1.30 C$/US$ was used to estimate mineral reserves and mineral resources.

The following table sets forth our estimates of the mineral resources (exclusive of mineral reserves) at the 777 mine.

|

777 Mineral Resource Estimates (Exclusive of Mineral Reserves) - January 1, 2021(1)(2)(3) |

|||||

|

|

Tonnes |

Cu (%) |

Zn (%) |

Au (g/t) |

Ag (g/t) |

|

Measured |

120,000 |

1.21 |

7.11 |

2.31 |

39 |

|

Indicated |

90,000 |

1.77 |

4.82 |

1.61 |

31 |

|

Total Measured and Indicated |

210,000 |

1.45 |

6.13 |

2.01 |

35 |

|

777 Inferred Mineral Resources - January 1, 2021(1)(2)(3) |

|||||

|

|

Tonnes |

Cu (%) |

Zn (%) |

Au (g/t) |

Ag (g/t) |

|

Inferred |

- |

- |

- |

- |

- |

Notes:

1. Totals may not add up correctly due to rounding.

2. Life of mine (2021-2022) average zinc price of $1.04 per pound (includes premium), copper price of $2.90 per pound, gold price of $1,767 per ounce and silver price of $20.67 per ounce using an exchange rate of 1.30 C$/US$ was used to estimate mineral reserves and mineral resources.

3. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to Schedule A "Glossary of Mining Terms".

![]()

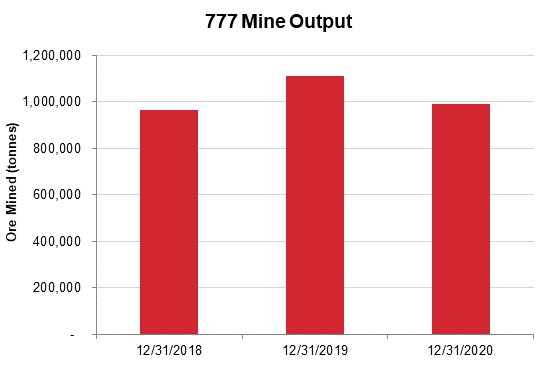

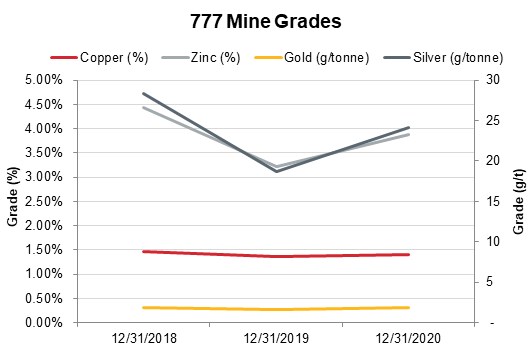

Production

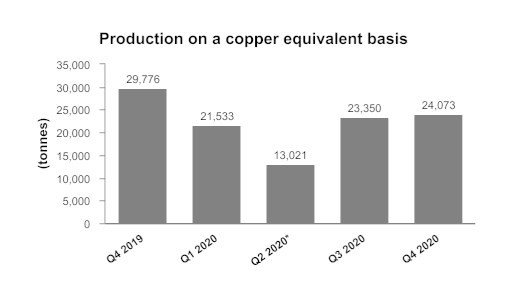

The following charts show 777 production (tonnes and grade) for the last three years:

Note:

1. 2020 production was affected by a six-week suspension of hoisting operations due to an incident that occurred during routine maintenance.

![]()

OTHER ASSETS

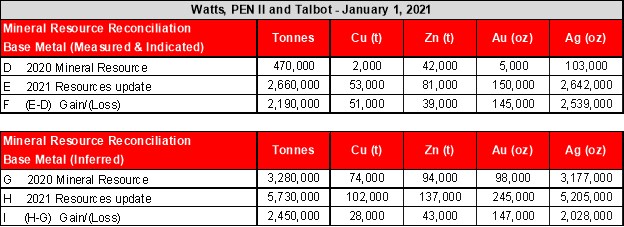

Snow Lake Regional Deposits

As discussed under "Lalor" above, the mineral reserves and resources at Hudbay's satellite deposits in the Snow Lake region, including the copper-gold WIM deposit, the gold-rich 3 Zone and the zinc-rich Watts, Pen II and Talbot deposits, have the potential to provide future feed for the Stall and New Britannia processing facilities and further extend the life of the Snow Lake operations.

The following table sets forth our estimates of the mineral reserves and resources at the Snow Lake regional deposits (excluding Lalor and 1901).

|

Snow Lake Regional Gold Deposits Mineral Reserve Estimates - January 1, 2021(1)(2)(3)(4) |

|||||

|

|

Tonnes |

Cu (%) |

Zn (%) |

Au (g/t) |

Ag (g/t) |

|

Probable Reserves |

|

|

|

|

|

|

WIM |

2,450,000 |

1.63 |

0.25 |

1.6 |

6.3 |

|

3 Zone |

660,000 |

0.00 |

0.00 |

4.2 |

0.0 |

|

Total Probable (Gold) |

3,110,000 |

1.28 |

0.20 |

2.2 |

5.0 |

Notes:

1. Totals may not add up correctly due to rounding.

2. Metal prices of $1.10 per pound zinc, $1,500 per ounce gold, $3.10 per pound copper, and $18.00 per ounce silver with an exchange rate of 1.30 C$/US$ were used to confirm the economic viability of the mineral reserve estimates.

3. WIM mineral reserves are estimated using a minimum NSR cut-off of C$150 per tonne, assuming processing recoveries of 98% for copper, 88% for gold, and 70% for silver based on processing through New Britannia's flotation and tails leach circuits.

4. 3 Zone mineral reserves are estimated using a minimum NSR cut-off of C$150 per tonne, assuming processing recoveries of 85% for gold based on processing through New Britannia's leach circuit.

![]()

|

Snow Lake Regional Gold Deposits Mineral Resource Estimates- January 1, 2021(1)(2)(3)(4)(5) |

||||||

|

|

Tonnes |

Cu (%) |

Zn (%) |

Au (g/t) |

Ag (g/t) |

|

|

Inferred Resources |

|

|

|

|

|

|

|

(Exclusive of Mineral Reserves) |

|

|

|

|

|

|

|

Birch |

570,000 |

0.00 |

0.00 |

4.4 |

0.0 |

|

|

New Britannia |

2,750,000 |

0.00 |

0.00 |

4.5 |

0.0 |

|

|

Total Inferred (Gold) |

3,320,000 |

0.00 |

0.00 |

4.5 |

0.0 |

|

|

Snow Lake Regional Base Metal Deposits Mineral Resource Estimates - January 1, 2021(1)(2)(3)(4)(5)(6)(7)(8)(9) |

||||||

|

|

Tonnes |

Cu (%) |

Zn (%) |

Au (g/t) |

Ag (g/t) |

|

|

Indicated Resources |

|

|

|

|

|

|

|

(Exclusive of Mineral Reserves) |

|

|

|

|

|

|

|

PEN II |

470,000 |

0.49 |

8.89 |

0.3 |

6.8 |

|

|

Talbot |

2,190,000 |

2.33 |

1.79 |

2.1 |

36.0 |

|

|

Total Indicated (Base Metals) |

2,660,000 |

2.01 |

3.04 |

1.8 |

30.9 |

|

|

|

|

|

|

|

|

|

|

Inferred Resources |

|

|

|

|

|

|

|

(Exclusive of Mineral Reserves) |

|

|

|

|

|

|

|

Watts |

3,150,000 |

2.34 |

2.58 |

1.0 |

31.0 |

|

|

PEN II |

130,000 |

0.37 |

9.81 |

0.3 |

6.8 |

|

|

Talbot |

2,450,000 |

1.13 |

1.74 |

1.9 |

25.8 |

|

|

Total Inferred (Base Metals) |

5,730,000 |

1.78 |

2.39 |

1.3 |

28.3 |

|

Notes:

1. Totals may not add up correctly due to rounding.

2. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

3. Mineral resources in the above tables do not include mining dilution or recovery factors.

4. Base metal mineral resources are estimated based on the assumption that they would be processed at the Stall concentrator while gold mineral resources are estimated based on the assumption that they would be processed at the New Britannia concentrator, which is currently being refurbished.

5. New Britannia mineral resource estimates have been reported at a minimum true width of 1.5 metres and with a cut-off grade varying from 2 grams per tonne (at the lower part of New Britannia) to 3.5 grams per tonne (at the upper part of New Britannia).

6. Watts and Pen II mineral resources were initially estimated using metal price assumptions that vary marginally over the assumptions used to estimate mineral resources at Lalor. In the Qualified Person's opinion, the combined impact of these small variations does not have any impact on the mineral resource estimates.

7. Watts mineral resources are estimated using a minimum NSR cut-off of C$150 per tonne, assuming processing recoveries of 90% for copper, 80% for zinc, 70% for gold and 70% for silver.

8. Pen II mineral resources are estimated using a minimum NSR cut-off of C$75 per tonne.

9. The above resource estimates table includes 100% of the Talbot mineral resources reported by Rockcliff Metals Corp. in its 2020 NI 43-101 technical report published on SEDAR. Hudbay currently owns a 51% interest in the Talbot project.

Mason Project

The Mason project is a large greenfield copper deposit located in the historic Yerington District of Nevada and is one of the largest undeveloped copper porphyry deposits in North America. The Mason project's measured and indicated mineral resources are comparable in size to Constancia and Rosemont. We view the Mason project as a long-term option for potential future development and a strong addition to our pipeline of long-term growth opportunities. The Mason project is one of our high priority exploration projects in North America and we have been active in taking steps to optimize this opportunity.