Consolidated Financial Statements

(In US dollars)

HUDBAY MINERALS INC.

Years ended December 31, 2018 and 2017

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management of HudBay Minerals Inc. (“Hudbay” or the “Company”) is responsible for establishing and maintaining internal control over financial reporting (“ICFR”).

Under the supervision of and with the participation of the Chief Executive Officer and the Chief Financial Officer, Hudbay’s management assessed the effectiveness of the Company’s ICFR as at December 31, 2018 based upon the Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, management concluded that Hudbay’s ICFR was effective as of December 31, 2018.

The effectiveness of the Company’s ICFR as at December 31, 2018 has been audited by Deloitte LLP, Independent Registered Public Accounting Firm, as stated in their report immediately preceding the Company’s audited consolidated financial statements for the year ended December 31, 2018.

| Alan Hair | David Bryson |

| President and Chief Executive Officer | Senior Vice President and Chief Financial Officer |

Toronto, Canada

February 19, 2019

|

Deloitte Canada Bay Adelaide Centre 8 Adelaide Street West Suite 200 Toronto, ON. M5H 0A9 Canada Tel: +1 (416) 601 6150 Fax: +1 (416) 601 6151 www.deloitte.ca |

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Directors of Hudbay Minerals Inc.

Opinion on the Financial Statements

We have audited

the accompanying consolidated balance sheets of Hudbay Minerals Inc. and

subsidiaries (the "Company") as of December 31, 2018, December 31, 2017, and

January 1, 2017, the related consolidated income statements, consolidated

statements of comprehensive income, changes in equity and cash flows for each of

the two years in the period ended December 31, 2018, and the related notes

(collectively referred to as the "financial statements"). In our opinion, the

financial statements present fairly, in all material respects, the financial

position of the Company as of December 31, 2018, December 31, 2017, and January

1, 2017, and its financial performance and its cash flows for each of the two

years in the period ended December 31, 2018, in conformity with International

Financial Reporting Standards (“IFRS”) as issued by the International Accounting

Standards Board.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company's internal control over financial reporting as of December 31, 2018, based on criteria established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated February 19, 2019, expressed an unqualified opinion on the Company's internal control over financial reporting.

Change in Accounting Principle

As discussed in Note

4 to the financial statements, effective January 1, 2018, the Company has

retrospectively changed its method of accounting for revenue due to the adoption

of IFRS 15, Revenue from Contracts with Customers.

Basis for Opinion

These financial statements are the

responsibility of the Company's management. Our responsibility is to express an

opinion on the Company's financial statements based on our audits. We are a

public accounting firm registered with the PCAOB and are required to be

independent with respect to the Company in accordance with the U.S. federal

securities laws and the applicable rules and regulations of the Securities and

Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

| Chartered Professional Accountants |

| Licensed Public Accountants |

| Toronto, Canada |

February 19, 2019

We have served as the Company's auditor since 2005.

|

Deloitte Canada Bay Adelaide Centre 8 Adelaide Street West Suite 200 Toronto, ON. M5H 0A9 Canada Tel: +1 (416) 601 6150 Fax: +1 (416) 601 6151 www.deloitte.ca |

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Directors of Hudbay Minerals Inc.

Opinion on Internal Control over Financial Reporting

We have audited the internal control over financial reporting of Hudbay

Minerals Inc. and subsidiaries (the “Company”) as of December 31, 2018, based on

criteria established in Internal Control - Integrated Framework (2013) issued by

the Committee of Sponsoring Organizations of the Treadway Commission (COSO). In

our opinion, the Company maintained, in all material respects, effective

internal control over financial reporting as of December 31, 2018, based on

criteria established in Internal Control - Integrated Framework (2013) issued by

COSO.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated financial statements as of and for the year ended December 31, 2018 of the Company and our report dated February 19, 2019, expressed an unqualified opinion on those financial statements and included an explanatory paragraph regarding the Company’s change in method of accounting for revenue due to the adoption of IFRS 15, Revenue from Contracts with Customers.

Basis for Opinion

The Company’s management is

responsible for maintaining effective internal control over financial reporting

and for its assessment of the effectiveness of internal control over financial

reporting, included in the accompanying Management’s Report on Internal Control

over Financial Reporting. Our responsibility is to express an opinion on the

Company’s internal control over financial reporting based on our audit. We are a

public accounting firm registered with the PCAOB and are required to be

independent with respect to the Company in accordance with the U.S. federal

securities laws and the applicable rules and regulations of the Securities and

Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

Definition and Limitations of Internal Control over

Financial Reporting

A company’s internal control over financial

reporting is a process designed to provide reasonable assurance regarding the

reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting

principles. A company’s internal control over financial reporting includes those

policies and procedures that (1) pertain to the maintenance of records that, in

reasonable detail, accurately and fairly reflect the transactions and

dispositions of the assets of the company; (2) provide reasonable assurance that

transactions are recorded as necessary to permit preparation of financial

statements in accordance with generally accepted accounting principles, and that

receipts and expenditures of the company are being made only in accordance

with authorizations of management and directors of the company; and (3) provide

reasonable assurance regarding prevention or timely detection of unauthorized

acquisition, use, or disposition of the company’s assets that could have a

material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

| Chartered Professional Accountants |

| Licensed Public Accountants |

| Toronto, Canada |

| February 19, 2019 |

| HUDBAY MINERALS INC. |

| Consolidated Balance Sheets |

| (in thousands of US dollars) |

| Dec. 31, 2018 | Dec. 31, 2017 | Jan 1, 2017 | ||||||||||

| Restated | Restated | |||||||||||

| Note | (note 4 | ) | (note 4 | ) | ||||||||

| Assets | ||||||||||||

| Current assets | ||||||||||||

| Cash and cash equivalents | 7 | $ | 515,497 | $ | 356,499 | $ | 146,864 | |||||

| Trade and other receivables | 8 | 117,153 | 155,522 | 152,567 | ||||||||

| Inventories | 9 | 118,474 | 141,682 | 112,464 | ||||||||

| Prepaid expenses and other current assets | 8,894 | 8,995 | 3,992 | |||||||||

| Other financial assets | 10 | 10,366 | 2,841 | 3,397 | ||||||||

| Taxes receivable | 2,008 | 3 | 17,319 | |||||||||

| 772,392 | 665,542 | 436,603 | ||||||||||

| Receivables | 8 | 39,121 | 32,459 | 32,648 | ||||||||

| Inventories | 9 | 19,476 | 5,809 | 4,537 | ||||||||

| Other financial assets | 10 | 15,159 | 22,461 | 30,848 | ||||||||

| Intangible assets - computer software | 11 | 4,162 | 5,575 | 6,614 | ||||||||

| Property, plant and equipment | 12 | 3,819,812 | 3,964,233 | 3,953,752 | ||||||||

| Deferred tax assets | 22b | 15,513 | 31,937 | 40,162 | ||||||||

| $ | 4,685,635 | $ | 4,728,016 | $ | 4,505,164 | |||||||

| Liabilities | ||||||||||||

| Current liabilities | ||||||||||||

| Trade and other payables | 13 | $ | 171,952 | $ | 199,117 | $ | 169,662 | |||||

| Taxes payable | 5,508 | 10,794 | 4,419 | |||||||||

| Other liabilities | 14 | 30,551 | 51,962 | 42,207 | ||||||||

| Other financial liabilities | 15 | 12,425 | 26,760 | 13,495 | ||||||||

| Finance lease obligations | 16 | 20,472 | 18,327 | 3,172 | ||||||||

| Long term debt | 17 | — | — | 16,490 | ||||||||

| Deferred revenue | 18 | 86,256 | 107,194 | 87,411 | ||||||||

| 327,164 | 414,154 | 336,856 | ||||||||||

| Other financial liabilities | 15 | 18,771 | 20,801 | 28,343 | ||||||||

| Finance lease obligations | 16 | 53,763 | 66,246 | 9,760 | ||||||||

| Long term debt | 17 | 981,030 | 979,575 | 1,215,674 | ||||||||

| Deferred revenue | 18 | 479,822 | 494,736 | 528,835 | ||||||||

| Provisions | 19 | 204,648 | 200,138 | 179,702 | ||||||||

| Pension obligations | 20 | 23,863 | 22,221 | 28,379 | ||||||||

| Other employee benefits | 21 | 93,628 | 108,397 | 89,273 | ||||||||

| Deferred tax liabilities | 22b | 324,090 | 309,403 | 328,263 | ||||||||

| 2,506,779 | 2,615,671 | 2,745,085 | ||||||||||

| Equity | ||||||||||||

| Share capital | 23b | 1,777,340 | 1,777,409 | 1,588,319 | ||||||||

| Reserves | (41,254 | ) | (26,463 | ) | (53,633 | ) | ||||||

| Retained earnings | 442,770 | 361,399 | 225,393 | |||||||||

| 2,178,856 | 2,112,345 | 1,760,079 | ||||||||||

| $ | 4,685,635 | $ | 4,728,016 | $ | 4,505,164 | |||||||

| Commitments (note 28) |

1

| HUDBAY MINERALS INC. |

| Consolidated Statements of Cash Flows |

| (in thousands of US dollars) |

| Year ended December 31, | |||||||||

| 2018 | 2017 | ||||||||

| Restated | |||||||||

| Note | (note 4 | ) | |||||||

| Cash generated from (used in) operating activities: | |||||||||

| Profit for the year | $ | 85,416 | $ | 139,692 | |||||

| Tax expense | 22a | 85,421 | 33,219 | ||||||

| Items not affecting cash: | |||||||||

| Depreciation and amortization | 6b | 333,144 | 297,825 | ||||||

| Share- based payment (recoveries) expenses | 6c | (2,373 | ) | 15,919 | |||||

| Net finance expense | 6f | 143,550 | 166,593 | ||||||

| Change in fair value of derivatives | 6f | (1,514 | ) | 1,790 | |||||

| Amortization of deferred revenue | 18 | (93,382 | ) | (88,744 | ) | ||||

| Change in taxes receivable/payable, net | 30a | (7,881 | ) | (39,326 | ) | ||||

| Unrealized (gain) on warrants | 6f | (6,748 | ) | (1,051 | ) | ||||

| (Gain) loss on investments | 6f | 3,798 | (3,511 | ) | |||||

| Pension and other employee benefit payments, net of accruals | (94 | ) | 3,142 | ||||||

| Asset impairment losses | 6g | — | 11,320 | ||||||

| Other and foreign exchange | (8,571 | ) | 4,310 | ||||||

| Taxes paid | (37,295 | ) | (10,617 | ) | |||||

| Operating cash flow before change in non-cash working capital | 493,471 | 530,561 | |||||||

| Change in non-cash working capital | 30a | (13,919 | ) | 9,015 | |||||

| 479,552 | 539,576 | ||||||||

| Cash generated from (used in) investing activities: | |||||||||

| Acquisition of property, plant and equipment | (190,899 | ) | (249,763 | ) | |||||

| Net sale (purchase) of investments | 53 | (2,245 | ) | ||||||

| Acquisition of Mason | 5 | (19,050 | ) | — | |||||

| Proceeds from disposition of property, plant and equipment | 4,224 | — | |||||||

| Change in restricted cash | (3,196 | ) | 16,854 | ||||||

| Net interest received | 6,732 | 890 | |||||||

| (202,136 | ) | (234,264 | ) | ||||||

| Cash generated from (used in) financing activities: | |||||||||

| Long term borrowing | — | 25,000 | |||||||

| Principal repayments | — | (281,439 | ) | ||||||

| Interest paid on long-term debt | (74,750 | ) | (52,743 | ) | |||||

| Financing costs | (20,564 | ) | (26,597 | ) | |||||

| Sale leaseback | — | 67,275 | |||||||

| Payment of finance lease | (20,926 | ) | (7,509 | ) | |||||

| Net proceeds from equity transactions | (69 | ) | 186,852 | ||||||

| Dividends paid | 23b | (4,045 | ) | (3,686 | ) | ||||

| (120,354 | ) | (92,847 | ) | ||||||

| Effect of movement in exchange rates on cash and cash equivalents | 1,936 | (2,830 | ) | ||||||

| Net increase in cash and cash equivalents | 158,998 | 209,635 | |||||||

| Cash and cash equivalents, beginning of the year | 356,499 | 146,864 | |||||||

| Cash and cash equivalents, end of the year | $ | 515,497 | $ | 356,499 | |||||

| For supplemental information, see note 30. | |||||||||

2

| HUDBAY MINERALS INC. |

| Consolidated Income Statements |

| (in thousands of US dollars) |

| Year ended December 31, | |||||||||

| 2018 | 2017 | ||||||||

| Restated | |||||||||

| Note | (note 4 | ) | |||||||

| Revenue | 6a | $ | 1,472,366 | $ | 1,402,339 | ||||

| Cost of sales | |||||||||

| Mine operating costs | 765,959 | 695,728 | |||||||

| Depreciation and amortization | 6b | 332,667 | 297,470 | ||||||

| 1,098,626 | 993,198 | ||||||||

| Gross profit | 373,740 | 409,141 | |||||||

| Selling and administrative expenses | 27,243 | 42,283 | |||||||

| Exploration and evaluation expenses | 28,570 | 15,474 | |||||||

| Other operating expenses (income) | 6e | 19,071 | (12,440 | ) | |||||

| Asset impairment loss | 6g | — | 11,320 | ||||||

| Results from operating activities | 298,856 | 352,504 | |||||||

| Finance income | 6f | (8,450 | ) | (2,849 | ) | ||||

| Finance expenses | 6f | 152,000 | 169,442 | ||||||

| Other finance (gain) losses | 6f | (15,531 | ) | 13,000 | |||||

| Net finance expense | 128,019 | 179,593 | |||||||

| Profit before tax | 170,837 | 172,911 | |||||||

| Tax expense | 22a | 85,421 | 33,219 | ||||||

| Profit for the year | $ | 85,416 | $ | 139,692 | |||||

| Earnings per share | |||||||||

| Basic and diluted | $ | 0.33 | $ | 0.57 | |||||

| Weighted average number of common shares outstanding (note 25): | |||||||||

| Basic and Diluted | 261,271,621 | 243,500,696 | |||||||

3

| HUDBAY MINERALS INC. |

| Consolidated Statements of Comprehensive Income |

| (in thousands of US dollars) |

| Year ended December | ||||||

| 31, | ||||||

| 2017 | ||||||

| 2018 | Restated | |||||

| (note 4 | ) | |||||

| Profit for the year | $ | 85,416 | $ | 139,692 | ||

| Other comprehensive (loss) income: | ||||||

| Item that will be reclassified subsequently to profit or loss: | ||||||

| Recognized directly in equity: | ||||||

| Net exchange (loss) gain on translation of foreign currency balances | (24,371 | ) | 21,695 | |||

| (24,371 | ) | 21,695 | ||||

| Items that will not be reclassified subsequently to profit or loss: | ||||||

| Recognized directly in equity: | ||||||

| Remeasurement - actuarial gain | 9,060 | 6,299 | ||||

| Tax effect | 520 | (3,845 | ) | |||

| 9,580 | 2,454 | |||||

| Transferred to income statement: | ||||||

| Wind up of subsidiaries | — | 3,021 | ||||

| — | 3,021 | |||||

| Other comprehensive (loss) income net of tax, for the year | (14,791 | ) | 27,170 | |||

| Total comprehensive income for the year | $ | 70,625 | $ | 166,862 | ||

4

| HUDBAY MINERALS INC. |

| Consolidated Statements of Changes in Equity |

| (in thousands of US dollars) |

| Foreign currency | ||||||||||||||||||

| Share capital | Other capital | translation reserve | Remeasurement | Retained earnings | Total equity | |||||||||||||

| (note 23 | ) | reserves | (Restated, note 4 | ) | reserve | (Restated, note 4 | ) | (Restated, note 4 | ) | |||||||||

| Balance, January 1, 2017 | $ | 1,588,319 | $ | 28,837 | $ | (12,164 | ) | $ | (70,306 | ) | $ | 225,393 | $ | 1,760,079 | ||||

| Profit | — | — | — | — | 139,692 | 139,692 | ||||||||||||

| Other comprehensive income | — | — | 24,716 | 2,454 | — | 27,170 | ||||||||||||

| Total comprehensive income | — | — | 24,716 | 2,454 | 139,692 | 166,862 | ||||||||||||

| Contributions by and distributions to owners: | ||||||||||||||||||

| Equity issuance (note 23b) | 195,295 | — | — | — | — | 195,295 | ||||||||||||

| Share issue costs, net of tax (note 23b) | (6,205 | ) | — | — | — | — | (6,205 | ) | ||||||||||

| Dividends (note 23b) | — | — | — | — | (3,686 | ) | (3,686 | ) | ||||||||||

| Total contributions by and distributions to owners | 189,090 | — | — | — | (3,686 | ) | 185,404 | |||||||||||

| Balance, December 31, 2017 | $ | 1,777,409 | $ | 28,837 | $ | 12,552 | $ | (67,852 | ) | $ | 361,399 | $ | 2,112,345 |

5

| HUDBAY MINERALS INC. |

| Consolidated Statements of Changes in Equity |

| (in thousands of US dollars) |

| Share capital | Other capital | Foreign currency | Remeasurement | |||||||||||||||

| (note 23 | ) | reserves | translation reserve | reserve | Retained earnings | Total equity | ||||||||||||

| Balance, January 1, 2018 | $ | 1,777,409 | $ | 28,837 | $ | 12,552 | $ | (67,852 | ) | $ | 361,399 | $ | 2,112,345 | |||||

| Profit | — | — | — | — | 85,416 | 85,416 | ||||||||||||

| Other comprehensive (loss) income | — | — | (24,371 | ) | 9,580 | — | (14,791 | ) | ||||||||||

| Total comprehensive (loss) income | — | — | (24,371 | ) | 9,580 | 85,416 | 70,625 | |||||||||||

| Contributions by and distributions to owners: | ||||||||||||||||||

| Share issue costs, net of tax (note 23b) | (80 | ) | — | — | — | — | (80 | ) | ||||||||||

| Warrants exercised (note 23b) | 11 | — | — | — | — | 11 | ||||||||||||

| Dividends (note 23b) | — | — | — | — | (4,045 | ) | (4,045 | ) | ||||||||||

| Total contributions by and distributions to owners | (69 | ) | — | — | — | (4,045 | ) | (4,114 | ) | |||||||||

| Balance, December 31, 2018 | $ | 1,777,340 | $ | 28,837 | $ | (11,819 | ) | $ | (58,272 | ) | $ | 442,770 | $ | 2,178,856 |

6

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

| 1. |

Reporting entity |

|

On January 1, 2017, HudBay Minerals Inc. amalgamated under the Canada Business Corporations Act with its subsidiaries Hudson Bay Mining and Smelting Co., Limited and Hudson Bay Exploration and Development Company Limited to form Hudbay Minerals Inc. (“HMI” or the “Company”). The address of the Company's principal executive office is 25 York Street, Suite 800, Toronto, Ontario. The consolidated financial statements of the Company for the year ended December 31, 2018 and 2017 represent the financial position and the financial performance of the Company and its subsidiaries (together referred to as the “Group” or “Hudbay” and individually as “Group entities”). | |

|

Wholly owned subsidiaries as at December 31, 2018 include HudBay Marketing & Sales Inc. (“HMS”), HudBay Peru Inc., HudBay Peru S.A.C. ("Hudbay Peru"), HudBay (BVI) Inc., Hudbay Arizona Inc. and Rosemont Copper Company (“Rosemont”). | |

|

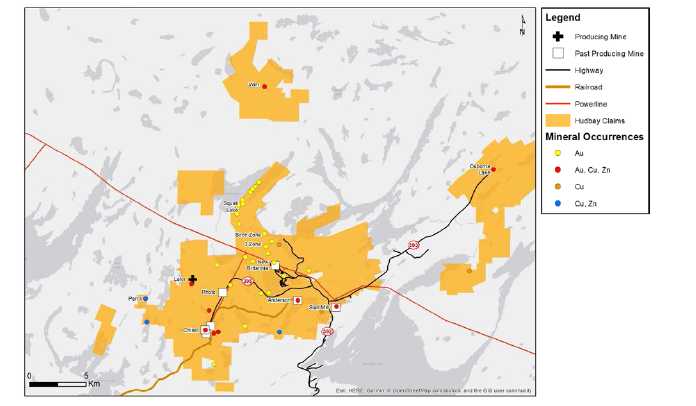

Hudbay is an integrated mining company primarily producing copper concentrate (containing copper, gold and silver), molybdenum concentrate and zinc metal. With assets in North and South America, the Group is focused on the discovery, production and marketing of base and precious metals. Directly and through its subsidiaries, Hudbay owns three polymetallic mines, four ore concentrators and a zinc production facility in northern Manitoba and Saskatchewan (Canada) and Cusco (Peru) and copper projects in Arizona and Nevada (United States). The Group also has equity investments in a number of junior exploration companies. The Company is governed by the Canada Business Corporations Act and its shares are listed under the symbol "HBM" on the Toronto Stock Exchange, New York Stock Exchange and Bolsa de Valores de Lima. | |

| 2. |

Basis of preparation |

| (a) |

Statement of compliance: | ||

|

These consolidated financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") effective for the year ended December 31, 2018. | |||

|

The Board of Directors approved these consolidated financial statements on February 19, 2019. | |||

| (b) |

Functional and presentation currency: | ||

|

The Group's consolidated financial statements are presented in US dollars, which is the Company’s and all material subsidiaries' functional currency, except the Company’s Manitoba business unit, which has a functional currency of Canadian dollars. All values are rounded to the nearest thousand ($000) except where otherwise indicated. | |||

| (c) |

Basis of measurement: | ||

|

The consolidated financial statements have been prepared on the historical cost basis except for the following items in the consolidated balance sheets: | |||

|

- |

Derivatives, embedded derivatives, other financial instruments, and financial assets measured at fair value through profit or loss ("FVTPL"); | ||

|

- |

Liabilities for cash-settled share-based payment arrangements are measured at fair value; and | ||

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

|

– |

A defined benefit liability is recognized as the net total of the plan assets, unrecognized past service costs and unrecognized actuarial losses, less unrecognized actuarial gains and the present value of the defined benefit obligation. | |||

| (d) |

Use of judgements and estimates: | |||

|

The preparation of the consolidated financial statements in conformity with IFRS requires the Group to make judgements, estimates and assumptions that affect the application of accounting policies, reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and reported amounts of revenue and expenses during the reporting period. Actual results may differ from these estimates. | ||||

|

The Group reviews these estimates and underlying assumptions on an ongoing basis, based on experience and other factors, including expectations of future events that the Group believe to be reasonable under the circumstances. Revisions to accounting estimates are recognized prospectively in the period in which the estimates are revised and in any future periods affected. | ||||

|

The following are critical and significant judgements and estimates impacting the consolidated financial statements: | ||||

|

- |

Indicators and testing of impairment (reversal of impairment) of non-financial assets (notes 3h, 3j and 12) - there are a number of potential indicators that could trigger non-financial asset impairment or reversal of impairment. These indicators may require critical judgements to determine the extent that external and/or internal environmental business changes may impact the Group’s overall assessment of the recoverability of non-financial assets. Such business changes include changes to the life of mine (“LOM”) plan, changes to budget, and changes to long-term commodity prices. If an impairment or impairment reversal indicator is noted then there are also critical estimates involved in the determination of the recoverable amount of cash generating units (“CGU”). Recoverable amounts are calculated using discounted after-tax cash flows based on cash flow projections and assumptions in the Group’s most LOM plans. LOM plans are based on optimized mine and processing plans and the assessment of capital expenditure requirements of a mine site. LOM plans incorporate management’s best estimates of key assumptions which include future commodity prices, the value of mineral resources not included in the Constancia and Arizona LOM plan, production based on current estimates of recoverable reserves, discount rates, future operating and capital costs and future foreign exchange rates. Most critical to the value of the recoverable amount are the assumptions of future commodity prices and the value of mineral resources not included in the Constancia and Arizona LOM plan. Expected future cash flows used to determine the recoverable amount during impairment testing are inherently uncertain and could materially change over time. Should management’s estimate of the future not reflect actual events, impairments may be identified, which could have a material effect on the Group’s consolidated financial statements. Although it is reasonably possible for a change in key assumptions to occur, the possible effects of a change in any single assumption may not fairly reflect the impact on a CGU’s fair value as the assumptions are inextricably linked. | |||

8

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

|

– |

IFRS 15 - Revenue - adoption for stream transactions (note 18) - upon adoption of IFRS 15 as of January 1, 2018, the Group has determined that precious metals stream contracts are subject to variable consideration and contain a significant financing component. As such, the Group started recognizing a financing charge at each reporting period and will gross up the deferred revenue balance to recognize the significant financing element that is part of these contracts. The Group restated prior year comparative information to reflect the impact of the adoption of this standard in the Company’s consolidated financial statements. Critical judgements were required in the adoption of IFRS 15 for stream accounting in determining appropriate discount rates for the significant financing component, assessing variable consideration as to its impact on the amortization of deferred revenue and determining the extent and nature the restatement would have on previous impairments and the capitalization of borrowing costs. In addition, significant judgement was required in determining if the stream transactions were to be accounted for as deferred revenue. Management has determined that the stream transactions are not derivatives as such obligations will be satisfied through the delivery of non-financial items (i.e., gold and silver credits) rather than cash or financial assets. It is management’s intention to settle the obligations under the stream transactions through its own production and if this is not possible, this would lead to the stream transactions becoming a derivative since a cash settlement payment may be required. This would cause a change to the accounting treatment, resulting in the revaluation of the fair value of the agreement through the income statement on a recurring basis. | ||

|

|

|

|

|

|

– |

Mineral reserves and resources (notes 3i, 3m, 3o and 18) - the Group estimates mineral reserves and resources to determine future recoverable mine production based on assessment of geological, engineering and metallurgical analyses, estimates of future production costs, capital costs and reclamation costs, as well as long term commodity prices and foreign exchange rates. There are numerous uncertainties inherent in estimating mineral reserves and resources, including many factors beyond the Group’s control. The estimates are based on information compiled by appropriately qualified persons relating to the geological data on the size, depth and shape of the ore body and interpreting this data requires complex geological judgements. Changes in assumptions, including economic assumptions such as metals prices and market conditions, could have a material effect on the financial position and results of operations. | ||

|

|

|

|

|

|

|

|

Changes in the mineral reserve or resource estimates may affect: | |

|

– |

the carrying value of exploration and evaluation assets, capital works in progress, mining properties and plant and equipment; | ||

|

– |

depreciation expense for assets depreciated either on a unit-of-production basis or on a straight line basis where useful lives are restricted by the life of the related mine or plan; | ||

|

|

|

– |

the provision for decommissioning, restoration and similar liabilities; |

|

|

|

– |

the carrying value of deferred tax assets; and |

|

|

|

– |

the amortization of deferred revenue. |

|

|

|

|

|

|

– |

Property, plant and equipment (notes 3i and 12) - the carrying amounts of property, plant and equipment and exploration and evaluation assets on the Group’s consolidated balance sheets are significant and reflect multiple estimates and applications of judgement. Management exercises judgement in determining whether the costs related to exploration and evaluation are eligible for capitalization and whether they are likely to be recoverable by future exploration, which may be based on assumptions about future events and circumstances. Judgement and estimates are used when determining whether exploration and evaluation assets should be transferred to capital works in progress within property, plant and equipment. For mines in the production stage, management applies judgement to determine development costs to be capitalized based on the extent they are incurred in order to access reserves mineable over more than one year. | ||

9

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

|

For depreciable property, plant and equipment assets, management makes estimates to determine depreciation. For assets depreciated using the straight line method, residual value and useful lives of the assets or components are estimated. A significant estimate is required to determine the total production basis for units-of-production depreciation. The most currently available reserve and resource report is utilized in determining the basis which has material impacts on the amount of depreciation recorded through inventories and the consolidated income statements. There are numerous uncertainties inherent in estimating mineral reserves, and assumptions that were valid at the reporting date may change when new information becomes available. The actual volume of ore extracted and any changes in these assumptions could affect prospective depreciation rates and carrying values. | ||

|

| ||

|

In determining whether stripping costs incurred during the production phase of a mining property relate to mineral reserves and mineral resources that will be mined in a future period and therefore should be capitalized, the Group makes estimates of the proportion of stripping activity which relates to extracting current ore and the proportion which relates to obtaining access to ore reserves which will be mined in the future. | ||

|

| ||

| – |

Acquisition method accounting (notes 3a and 5) - during the acquisition of Mason Resources, judgement was required to determine if the acquisition represented a business combination or an asset purchase. More specifically, management concluded that the Mason Resource acquisition did not represent a business, as the assets acquired were not an integrated set of activities with inputs, processes and outputs. Since it was concluded that the acquisition represented the purchase of assets, there was no goodwill generated on the transaction and acquisition costs were capitalized to the assets purchased rather than expensed. | |

|

| ||

| – |

Tax provisions (notes 3o and 22) - management makes estimates in determining the measurement and recognition of deferred tax assets and liabilities recorded on the consolidated balance sheets. The measurement of deferred tax assets and deferred tax liabilities is based on tax rates that are expected to apply in the period that the asset is realized or liability is settled based on tax rates that have been enacted or substantively enacted by the end of the reporting period. Deferred tax assets, including those arising from unutilized tax losses, require management to assess the likelihood of taxable income in future periods in order to utilize recognized deferred tax assets. Estimates of future taxable income are based on forecasted cash flows from operations and the application of existing tax laws in each jurisdiction. To the extent that future cash flows and taxable income differ significantly from estimates, the ability to realize the net deferred tax assets recorded at the balance sheet date could be affected. At the end of each reporting period, management reassesses the period that assets are expected to be realized or liabilities are settled and the likelihood of taxable income in future periods in order to support and adjust the deferred tax assets and deferred tax liabilities recognized on the consolidated balance sheets. | |

|

| ||

| – |

Assaying utilized to determine revenue and recoverability of inventories (notes 3c and 3f) - assaying of contained metal is a key estimate in determining the amount of revenues recorded in the consolidated income statements. The estimate is finalized after final surveying is completed, which may extend to six months in certain transactions. Since assays are utilized to determine the value of recorded revenues, significant differences in given assays may result in a material misstatement of revenues on the consolidated income statements. Assay survey results are also a factor utilized to determine if inventories on hand have a net realizable value that exceeds cost. Material differences in assay results may lead to misstatements of inventory balances in the consolidated balance sheets. |

10

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

| – |

Decommissioning and restoration obligations (notes 3m and 19) - significant judgement and estimates are utilized in the determination of the decommissioning and restoration provisions in the consolidated balance sheets. Judgement is involved in determining the timing and extent of cash outflows required to satisfy constructive obligations based on the timing of site closures in the LOM plans, expected unit costs to determine cash obligations to remediate disturbances and regulatory and constructive requirements to determine the extent of the remediation required. The timing of cash outflows and discount rates associated with discounting the provision are also key estimates. Changes in these estimates may result in a change in classification of the provision between non-current and current as well as material differences in the total provision recorded in the consolidated balance sheets. | |

| – |

Pensions and other employee benefits (notes 3l, 20 and 21) - the Group’s post retirement obligations relate mainly to ongoing health care benefit plans. The Group estimates obligations related to the pension and other employee benefits plans using actuarial determinations that incorporate assumptions using management’s best estimates of factors including plan performance, salary escalation, retirement dates of employees and drug cost escalation rates. Due to the complexity of the valuation, the underlying assumptions and its long term nature, a defined benefit obligation is highly sensitive to changes in these assumptions. Management reviews all assumptions at each reporting date. In determining the appropriate discount rate, the Group considers the interest rates on corporate bonds in the respective currency with at least an AA rating, with extrapolated maturities corresponding to the expected duration of the defined benefit obligation. The mortality rate is based on publicly available mortality tables for the specific country, and the Group bases future salary increases and pension increases on expected future inflation rates for the respective country. |

| 3. |

Significant accounting policies |

The accounting policies set out below have been applied consistently to all periods presented in these consolidated financial statements and by all Group entities.

| (a) |

Basis of consolidation: | |

|

Intercompany balances and transactions are eliminated upon consolidation. When a Group entity transacts with an associate or jointly controlled entity of the Group, unrealized profits and losses are eliminated to the extent of the Group’s interest in the relevant associate or joint venture. The accounting policies of Group entities are changed when necessary to align them with the policies adopted by the Company. | ||

|

Subsidiaries | ||

|

A subsidiary is an entity controlled by the Group. The financial statements of subsidiaries are included in the consolidated financial statements from the date that control commences until the date that control ceases. | ||

|

Business combinations and goodwill | ||

|

When the Group makes an acquisition, it first determines whether the assets acquired and liabilities assumed constitute a business, in which case the acquisition requires accounting as a business combination. Management applies judgement in determining whether the acquiree is capable of being conducted and managed for the purpose of providing a return, considering the inputs of the acquiree and processes applied to those inputs that have the ability to create outputs. |

11

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

The Group applies the acquisition method of accounting to business combinations, whereby the goodwill is measured at the acquisition date as the fair value of the consideration transferred including the recognized amount of any non-controlling interests in the acquiree. When the excess is negative, a bargain purchase gain is recognized immediately in the consolidated income statements. The assessment of fair values on acquisition includes those mineral reserves and resources that are able to be reliably measured. In determining these fair values, management must also apply judgement in areas including future cash flows, metal prices, exchange rates and appropriate discount rates. Changes in such estimates and assumptions could result in significant differences in the amount of goodwill recognized.

The consideration transferred is the aggregate of the fair values at the date of acquisition of the sum of the assets transferred, the liabilities incurred or assumed, and the equity instruments issued by the acquirer in exchange for control of the acquiree. Acquisition-related costs are recognized in the consolidated income statements as incurred, unless they relate to issuance of debt or equity securities.

Where applicable, the consideration transferred includes any asset or liability resulting from a contingent consideration arrangement and measured at its acquisition date fair value. Subsequent changes in such fair values are adjusted against the cost of acquisition where they qualify as measurement period adjustments. All other subsequent changes in the fair value of contingent consideration classified as an asset or liability are accounted for in accordance with relevant IFRS. Changes in the fair value of contingent consideration classified as equity are not recognized.

Where a business combination is achieved in stages, the Group's previously held interests in the acquired entity are remeasured to fair value at the acquisition date, which is the date the Group attains control, and any resulting gain or loss is recognized in the consolidated income statements. Amounts previously recognized in other comprehensive income (“OCI”) related to interests in the acquiree prior to the acquisition date are reclassified to the consolidated income statements, where such treatment would be appropriate if that interest were disposed of.

After initial recognition, goodwill is measured at cost less any accumulated impairment losses. For the purpose of impairment testing, goodwill acquired in a business combination is, from the acquisition date, allocated to each of the Group’s CGUs that are expected to benefit from the synergies of the combination, irrespective of whether other assets or liabilities of the acquiree are assigned to those units. Goodwill is allocated to the lowest level at which it is monitored for internal management purposes and is not larger than an operating segment before aggregation. Where goodwill forms part of a CGU and part of the operation within that unit is disposed of, the goodwill associated with the disposed operation is included in the determination of any gain or loss on disposal.

Goodwill is not amortized and is tested for impairment annually and whenever there is an indication of impairment. If any such indication exists, the recoverable amount of the CGU is estimated in order to determine the extent of the impairment, if any. The recoverable amount is determined as the higher of fair value less direct costs to sell and the CGU’s value in use. An impairment loss in respect of goodwill is not reversed.

Fair value for mineral interests and related goodwill is generally determined as the present value of the estimated future cash flows expected to arise from the continued use of the asset, including any expansion prospects, and its eventual disposal, using assumptions that an independent market participant may take into account.

12

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

|

Value in use is determined as the present value of the estimated future cash flows expected to arise from the continued use of the asset in its present form and its eventual disposal. Value in use is determined by applying assumptions specific to the Group’s continued use and cannot take into account future development. | ||

|

The weighted average cost of capital of the Group or comparable market participants is used as a starting point for determining the discount rates, with appropriate adjustments for the risk profile of the countries in which the individual CGUs operate and the specific risks related to the development of the project. | ||

|

Where the asset does not generate cash flows that are independent of other assets, the Group estimates the recoverable amount of the CGU to which the asset belongs. If the carrying amount of an asset or CGU exceeds its recoverable amount, the carrying amount of the asset or CGU is reduced to its recoverable amount. An impairment loss is recognized as an expense in the consolidated income statements. | ||

| (b) |

Translation of foreign currencies: | |

|

Management determines the functional currency of each Group entity as the currency of the primary economic environment in which the entity operates. | ||

|

Foreign currency transactions | ||

|

Transactions in foreign currencies are translated to the respective functional currencies of Group entities at exchange rates in effect at the transaction dates. | ||

|

At the end of each reporting period, monetary assets and liabilities denominated in foreign currencies are translated to the functional currency using the noon exchange rate. Non-monetary assets and liabilities measured at fair value are translated using the exchange rates at the date when fair value was determined. Non-monetary assets and liabilities measured at historical cost in a foreign currency are translated using exchange rates that were in effect at the transaction dates. The same translations are applied when an entity prepares its financial statements from books and records maintained in a currency other than its functional currency, except revenue and expenses may be translated at monthly average exchange rates that approximate those in effect at the transaction dates. | ||

|

Foreign currency gains and losses arising on period-end revaluations are recognized in the consolidated income statements, except for a financial liability designated as a hedge of a net investment in a foreign operation, or qualifying cash flow hedges, which are recognized in OCI. | ||

|

Foreign operations | ||

|

For the purpose of the consolidated financial statements, assets and liabilities of Group entities that have functional currencies other than the US dollar are translated to US dollars at the reporting date using the noon exchange rate. Revenue and expenses are translated at monthly average exchange rates that approximate those in effect at the transaction dates. Differences arising from these foreign currency translations are recognized in OCI and presented within equity in the foreign currency translation reserve. When a foreign operation is disposed, the relevant exchange differences accumulated in the foreign currency translation reserve are transferred to the consolidated income statements as part of the profit or loss on disposal. On the partial disposal of a subsidiary that includes a foreign operation, the relevant proportion of such amount is reattributed to non-controlling interests. On disposal of a partial investment in an associate or joint venture that includes a foreign operation while retaining significant influence or joint control, the relevant proportion is reclassified to profit or loss. |

13

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

|

Net investment in a foreign operation | ||

|

Foreign currency gains and losses arising on translation of a monetary item receivable from or payable to a foreign operation for which settlement is neither planned nor likely to occur in the foreseeable future are considered to form part of a net investment in the foreign operation. Such gains and losses are recognized in OCI and presented within equity in the foreign currency translation reserve. | ||

| (c) |

Revenue recognition: | |

|

Revenue from the sale of goods is measured at the fair value of the consideration received or receivable, net of treatment and refining charges and pre-production revenue. Revenue from the sale of by-products is included within revenue. | ||

|

Sales revenue is recognized when control of the goods sold has been transferred to the buyer. Control is deemed to have passed to the customer when significant risk and reward of the product has passed to the buyer, Hudbay has a present right to payment and physical possession of the product has been transferred to the buyer. Sale of concentrate and finished zinc frequently occur under the following terms, and management has assessed these terms in order to determine timing of transfer of control. |

| Incoterms used by Hudbay | Revenue recognized when goods: |

| Cost, Insurance and Freight (CIF) | Are loaded on board the vessel |

| Free on Board (FOB) | Are loaded on board the vessel |

| Delivered at place (DAP) | Arrive at the named place of destination |

| Delivered at terminal (DAT) | Arrive at the named place of destination |

| Free Carrier (FCA) | Arrive at the named place of delivery |

Sales of concentrate and certain other products are provisionally priced. For these contracts, sales prices are subject to final adjustment at the end of a future period after shipment, based on quoted market prices during the quotational period specified in the contract. Revenue is recognized when the above criteria are achieved, using weight and assay results and forward market prices to estimate the fair value of the total consideration receivable. Therefore, revenue is initially recorded based on an initial provisional invoice. Subsequently, at each reporting date, until the provisionally priced sale is finalized, sales receivables are marked to market, with adjustments (both gains and losses) recorded within revenue separately as “Pricing and volume adjustments” in the notes to the consolidated financial statements and in trade and other receivables on the consolidated balance sheets. As per IFRS 15 Revenue, variability in price is deemed to be fair value movements on provisionally priced receivables under the scope of IFRS 9 Financial Instruments; variability in quantities is deemed to be variable consideration. The variable consideration from weights and assay changes to quantities has been assessed to be insignificant to warrant precluding revenue being recorded as a result of possible future sales reversals. An annual analysis of the accuracy of our weights and assays is completed, and if the accuracy rate falls below a certain threshold, management may record a provision due to a high risk of a significant revenue reversal.

The Group only includes in the transaction price an amount which is not highly likely to be subject to significant subsequent revenue reversal. Within sales contracts with customers, separate performance obligations may arise pertaining to the shipping of goods sold. Where significant, costs and the transaction price are allocated on a relative stand alone selling basis to any separate performance obligations and are recognized over the period of time the goods sold are shipped, on a gross basis.

14

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

|

The Group recognizes deferred revenue in the event it receives payments from customers before a sale meets criteria for revenue recognition. There is a significant financing component associated with the Group's precious metal streaming arrangements since funds were received in advance of the delivery of concentrate. When a significant financing component is recognized, finance expense will be higher and revenues will be higher as the larger deferred revenue balance is amortized to revenues. A market-based discount rate is utilized at the inception of each of the respective stream agreements to determine a discount rate for computing the interest charges for the significant financing component of the deferred revenue balance. As product is delivered, the deferred revenue amount including accreted interest will be drawn down. The draw down rate requires the use of proven and probable reserves and certain resources in the calculation that are beyond proven and probable reserves which management is reasonably confident are transferable to reserves. Key estimates used in determining the significant financing component include the discount rate and the reserve and resources assumed for conversion. | ||

| (d) |

Cost of sales: | |

|

Cost of sales consists of those costs previously included in the measurement of inventory sold during the period, as well as certain costs not included in the measurement of inventory, such as the cost of warehousing and distribution to customers, provisional pricing adjustments related to purchased concentrates, profit sharing, royalty payments, share-based payments and other indirect expenses related to producing operations. | ||

| (e) |

Cash and cash equivalents: | |

|

Cash and cash equivalents include cash, demand deposits and short-term, highly liquid investments that are readily convertible to known amounts of cash and are subject to an insignificant risk of changes in value. Cash equivalents have maturities of three months or less at the date of acquisition. Interest earned is included in finance income on the consolidated income statements and in investing activities on the consolidated statements of cash flows. | ||

|

Amounts that are restricted from being used for at least twelve months after the reporting date are classified as non-current assets and presented in restricted cash on the consolidated balance sheets. Changes in restricted cash balances are classified as investing activities on the consolidated statements of cash flows. |

15

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

| (f) |

Inventories: | |

|

Inventories consist of stockpiles, in-process inventory (concentrates and metals), metal products and supplies. Concentrates, metals and all other saleable products are valued at the lower of cost and estimated net realizable value. Net realizable value represents the estimated selling price for inventories less all estimated costs of completion and costs necessary to make the sale. Where the net realizable value is less than cost, the difference is charged to the consolidated income statements as an impairment charge in cost of sales. Costs associated with stripping activities in an open pit mine are capitalized to inventory and recorded through cost of sales unless the stripping activity can be shown to improve access to further quantities of ore that will be mined in future periods, in which case, the stripping costs are capitalized. | ||

|

Cost of production of concentrate inventory is determined on a weighted average cost basis and the cost of production of finished metal inventory is determined using the first in first out basis. The cost of production includes direct costs associated with conversion of production inventory: material, labour, contractor expenses, purchased concentrates, and an attributable portion of production overheads and depreciation of all property, plant and equipment involved with the mining and production process. Hudbay measures in- process inventories based on assays of material received at metallurgical plants and estimates of recoveries in the production processes. Due to significant uncertainty associated with volume and metal content, immaterial costs are not allocated to routine operating levels of stockpiled ore. Estimates and judgements are required to assess the nature of any significant changes to levels of ore stockpiles and determining whether allocation of costs is required. | ||

|

Supplies are valued at the lower of average cost and net realizable value. A regular review is undertaken to determine the extent of any provision for obsolescence. | ||

| (g) |

Intangible assets: | |

|

Computer software is measured at cost less accumulated amortization and accumulated impairment losses. Costs include all directly attributable costs necessary to create, produce and prepare the asset to be capable of operating it in the manner intended by management. | ||

|

Amortization methods, useful lives, and residual values if any, are reviewed at each year end and adjusted prospectively, if required. When an intangible asset is disposed of, or when no further economic benefits are expected, the asset is derecognized, and any resulting gain or loss is recorded in the consolidated income statements. | ||

|

Currently, the Group’s intangible assets relate primarily to enterprise resource planning (“ERP”) information systems, which are amortized over their estimated useful lives. | ||

| (h) |

Exploration and evaluation expenditures: | |

|

Exploration and evaluation activity begins when the Group obtains legal rights to explore a specific area and involves the search for mineral reserves, the determination of technical feasibility, and the assessment of commercial viability of an identified resource. Expenditures incurred in the exploration and evaluation phase include the cost of acquiring interests in mineral rights, licenses and properties and the costs of the Group’s exploration activities, such as researching and analyzing existing exploration data, gathering data through geological studies, exploratory drilling, trenching, sampling, and certain feasibility studies. |

16

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

|

The Group expenses the cost of its exploration and evaluation activities and capitalizes the cost of acquiring interests in mineral rights, licenses and properties in business combinations, asset acquisitions or option agreements. Amounts capitalized are recognized as exploration and evaluation assets and presented in property, plant and equipment. Exploration and evaluation assets acquired as a result of an asset acquisition or option agreement are initially recognized at cost, and those acquired in a business combination are recognized at fair value on the acquisition date. They are subsequently carried at cost less accumulated impairment. No depreciation is charged during the exploration and evaluation phase. The Group expenses the cost of subsequent exploration and evaluation activity related to acquired exploration and evaluation assets. Cash flows associated with acquiring exploration and evaluation assets are classified as investing activities in the consolidated statements of cash flows; those associated with exploration and evaluation expenses are classified as operating activities. | ||

|

Judgement is required in determining whether the respective costs are eligible for capitalization where applicable, and whether they are likely to be recoverable, which may be based on assumptions about future events and circumstances. Estimates and assumptions made may change if new information becomes available. | ||

|

The Group monitors exploration and evaluation assets for factors that may indicate their carrying amounts are not recoverable. If such indicators are identified, the Group tests the exploration and evaluation assets or their CGUs, as applicable, for impairment. The Group also tests impairment when assets reach the end of the exploration and evaluation phase. | ||

|

Exploration and evaluation assets are transferred to capital works in progress within property, plant and equipment once the Group determines that probable future economic benefits will be generated as a result of the expenditures. The Group’s determination of probable future economic benefit is based on management’s evaluation of the technical feasibility and commercial viability of the geological properties of a given ore body based on information obtained through evaluation activities, including metallurgical testing, resource and reserve estimates and the economic assessment of whether the ore body can be mined economically. Tools that may be used to determine this include a preliminary feasibility study, confidence in converting resources into reserves and the probability that the property could be developed into a mine site. At that time, the property is considered to enter the development phase, and subsequent evaluation costs are capitalized. | ||

| (i) |

Property, plant and equipment: | |

|

The Group measures items of property, plant and equipment at cost less accumulated depreciation and any accumulated impairment losses. | ||

|

The initial cost of an item of property, plant and equipment includes its purchase price or construction costs, including import duties and non-refundable purchase taxes, any costs directly attributable to bringing the asset into operation, and for qualifying assets, borrowing costs. The initial cost of property, plant and equipment also includes the initial estimate of the cost of dismantling and removing the item and restoring the site on which it is located, the obligation for which the Group incurs either when the item is acquired or as a consequence of having used the item during a particular period for purposes other than to produce inventories during that period. |

17

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

Capitalization of costs ceases once an asset is in the location and condition necessary for it to be capable of operating in the manner intended by management. At this time, depreciation commences. For a new mine, this occurs upon commencement of commercial production. Any revenue earned in the process of preparing an asset to be capable of operating in the manner intended by management is included in the cost of the constructed asset. Any other incidental revenue earned prior to commencement of commercial production is recognized in the consolidated income statements.

Carrying amounts of property, plant and equipment, including assets under finance leases, are depreciated to their estimated residual value over the estimated useful lives of the assets or the estimated life of the related mine or plant, if shorter. Where components of an asset have different useful lives, depreciation is calculated on each separate component. Components may be physical or non-physical, including the cost of regular major inspections and overhauls required in order to continue operating an item of property, plant and equipment.

Certain items of property, plant and equipment are depreciated on a unit-of-production basis. The unit-of-production method is based on proven and probable tonnes of ore reserves. There are numerous uncertainties inherent in estimating ore reserves, and assumptions that were valid at the reporting date may change when new information becomes available. The actual volume of ore extracted and any changes in these assumptions could affect prospective depreciation rates and carrying values.

The carrying amount of an item of property, plant and equipment is derecognized on disposal or when no future economic benefits are expected from its use or disposal. Upon derecognition of an item of property, plant and equipment, the difference between its carrying value and net sales proceeds, if any, is presented as a gain or loss in other operating income or expense in the consolidated income statements.

| (i) |

Capital works in progress: | |

|

Capital works in progress consist of items of property, plant and equipment in the course of construction or mineral properties in the course of development, including those transferred upon completion of the exploration and evaluation phase. On completion of construction or development, costs are transferred to plant and equipment and/or mining properties as appropriate. Capital works in progress are not depreciated. | ||

| (ii) |

Mining properties: | |

|

Mining properties consist of costs transferred from capital works in progress when a mining property reaches commercial production, costs of subsequent mine and exploration development, and acquired mining properties in the production stage. | ||

|

Mining properties include costs directly attributable to bringing a mineral asset into the state where it is capable of operating in the manner intended by management and includes such costs as the cost of shafts, ramps, track haulage drifts, ancillary drifts, pumps, electrical substations, refuge stations, ventilation raises, permanent manways, and ore and waste pass raises. The determination of development costs to be capitalized during the production stage of a mine operation requires the use of judgements and estimates such as estimates of tonnes of waste to be removed over the life of the mining area and economically recoverable reserves extracted as a result. |

18

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

|

A mining property is considered to be capable of operating in a manner intended by management when it commences commercial production. Upon commencement of commercial production, a mining property is depreciated on a unit-of-production method. Unit-of-production depreciation rates are determined based on the related proven and probable mineral reserves and associated future development costs. | ||

|

Subsequent mine development costs are capitalized to the extent they are incurred in order to access reserves mineable over more than one year. Ongoing maintenance and development expenditures are expensed as incurred and included in cost of sales in profit or loss. These include ore stope access drifts, footwall and hangingwall drifts in stopes, drawpoints, drill drifts, sublevels, slots, drill raises, stope manway access raises and definition diamond drilling. | ||

| (iii) |

Plant and equipment: | |

|

Plant and equipment consists of buildings and fixtures, surface and underground fixed and mobile equipment and assets under finance lease. | ||

|

Plant and equipment are depreciated on either unit-of-production or straight-line basis based on factors including the production life of assets and mineable reserves. In general, mining assets are depreciated using a unit-of-production method; equipment is depreciated using the straight-line method, based on the shorter of its useful life and that of the related mine or facility; and plants are depreciated using the straight-line method, with useful lives limited by those of related mining assets. | ||

| (iv) |

Depreciation rates of major categories of assets: |

| • Capital works in progress | - not depreciated | |||

| • Mining properties | - unit-of-production | |||

| • Mining assets | - unit-of-production | |||

| • Plant and Equipment | ||||

| – | Equipment | - straight-line over 1 to 21 years | ||

| – | Other plant assets | - straight-line over 1 to 21 years / unit-of-production | ||

|

The Group reviews its depreciation methods, remaining useful lives and residual values at least annually and accounts for changes in estimates prospectively. | ||

| (v) |

Commercial production: | |

|

Commercial production is the level of activities intended by management for a mine, or a mine and mill complex, to be capable of operating in the manner intended by management. The Group considers a range of factors when determining the level of activity that represents commercial production for a particular project, including a pre-determined percentage of design capacity for the mine and mill; achievement of continuous production, ramp- ups, or other output; or specific factors such as recoveries, grades, or inventory build-ups. In a phased mining approach, management may consider achievement of specific milestones at each phase of completion. In a non-phased mining approach, management considers average actual metrics that are at least 60% of average design capacity or plan over a continuous period. Management assesses the operation’s ability to sustain production over a period of approximately one to three months, depending on the complexity related to the stability of continuous operation. Commercial production is considered to have commenced, and depreciation expense is recognized, at the beginning of the month after criteria have been met. |

19

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

| (vi) |

Capitalized borrowing costs: | |

|

The Group capitalizes borrowing costs that are directly attributable to the acquisition, construction or production of qualifying assets, which are assets that necessarily take a substantial period of time to get ready for their intended use or sale. Capitalization of borrowing costs ceases once the qualifying assets commence commercial production or are otherwise ready for their intended use or sale. | ||

|

Where funds are borrowed specifically to finance a project, the amount capitalized represents the actual borrowing costs incurred. Where the funds used to finance a project form part of general borrowings, the amount capitalized is calculated using a weighted average of interest rates applicable to relevant general borrowings of the Group during the period, to a maximum of actual borrowing costs incurred. Investment income earned by temporarily investing specific borrowings pending their expenditure on qualifying assets is deducted from the borrowing costs eligible for capitalization. Capitalization of interest is suspended during extended periods in which active development is interrupted. | ||

|

All other borrowing costs are recognized in the consolidated income statements in the period in which they are incurred. | ||

| (vii) |

Capitalized stripping costs: | |

|

Costs associated with stripping activities in an open pit mine are capitalized to inventory and recorded through cost of sales unless the stripping activity can be shown to improve access to further quantities of ore that will be mined in future periods, in which case, the stripping costs are capitalized. Capitalized stripping costs are included in “mining properties” within property, plant and equipment. | ||

|

Capitalized stripping costs are depreciated using a units-of-production method over the expected reserves within a given phase of mine development. |

| (j) |

Impairment of non-financial assets: | |

|

At the end of each reporting period, the Group reviews the carrying amounts of property, plant and equipment, exploration and evaluation assets and intangible assets - computer software to determine whether there is any indication of impairment. If any such indication exists, the Group estimates the recoverable amount of the asset in order to determine the extent of the impairment loss, if any. The Group generally assesses impairment at the level of CGUs, which are the smallest identifiable groups of assets that generate cash inflows that are largely independent of cash inflows from other assets. | ||

|

The Group's CGUs consist of Manitoba, Peru, Arizona and greenfield exploration and evaluation assets. | ||

|

The Group allocates near mine exploration and evaluation assets to CGUs based on their operating segment, geographic location and management’s intended use for the property. Near mine exploration and evaluation assets are allocated to CGUs separate from those containing producing or development-phase assets, except where such exploration and evaluation assets have the potential to significantly affect the future production of producing or development-phase assets. | ||

|

Goodwill, if recorded, is tested for impairment annually and whenever there is an indication that the asset may be impaired. |

20

| HUDBAY MINERALS INC. |

| Notes to Consolidated Financial Statements |

| (in thousands of US dollars, except where otherwise noted) |

| Years ended December 31, 2018 and 2017 |

Where an indicator of impairment exists, a formal estimate of the recoverable amount of the asset or CGU is made. The recoverable amount is the higher of the fair value less costs of disposal and value in use:

| – | Fair value less costs of disposal is the amount obtainable from the sale of the asset or CGU in an arm’s length transaction between knowledgeable, willing parties, less costs of disposal. Fair value for mineral assets is often determined as the present value of the estimated future cash flows expected to arise from the continued use of the asset, including any expansion prospects, and its eventual disposal, using assumptions that an independent market participant may take into account. These cash flows are discounted by an appropriate discount rate that reflects current market assessments of the time value of money and the risks specific to the asset to arrive at a net present value of the asset. | |

| – | Value in use is determined as the present value of the estimated future cash flows expected to arise from the continued use of the asset or CGU in its present form and its eventual disposal, discounted using a pre-tax rate that reflects current market assessments of the time value of money and risks specific to the asset for which estimates of future cash flows have not been adjusted. Value in use calculations apply assumptions specific to the Group’s continued use and cannot take into account future development. These assumptions are different to those used in calculating fair value, and consequently the value in use calculation is likely to give a different result to a fair value calculation. |

The Group estimates future cash flows based on estimated future recoverable mine production, expected sales prices (considering current and historical commodity prices, price trends and related factors), production levels and cash costs of production, all based on detailed engineering LOM plans. Future recoverable mine production is determined from reserves and resources after taking into account estimated dilution and recoveries during mining, and estimated losses during ore processing and treatment. Estimates of recoverable production from measured, indicated and inferred mineral resources not included in the LOM plan are assessed for economic recoverability and may also be included in the valuation of fair value less costs of disposal. Gains from the expected disposal of assets are not included in estimated future cash flows. Assumptions underlying future cash flow estimates are subject to risks and uncertainties. Changes in estimates may affect the expected recoverability of the Group's investments in mining properties.

If the carrying amount of an asset or CGU exceeds its recoverable amount, the carrying amount is reduced to the recoverable amount, and an impairment loss is recognized in the consolidated income statements in the expense category consistent with the function of the impaired asset or CGU. The Group presents impairment losses on the consolidated income statements as part of results from operating activities. Impairment losses recognized in respect of a CGU are allocated first to reduce the carrying amount of any goodwill allocated to the CGU and then to reduce the carrying amounts of other assets in the CGU on a pro-rata basis for depreciable assets.