![]()

Management's Discussion and Analysis of

Results of Operations

and Financial Condition

For the three months ended

March 31, 2018

May 2, 2018

![]()

![]()

INTRODUCTION

This Management's Discussion and Analysis ("MD&A") dated May 2, 2018 is intended to supplement Hudbay Minerals Inc.'s unaudited condensed consolidated interim financial statements and related notes for the three months ended March 31, 2018 and 2017 (the "consolidated interim financial statements"). The consolidated interim financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS"), including International Accounting Standard 34, Interim Financial Reporting, as issued by the International Accounting Standards Board (“IASB”).

References to “Hudbay”, the “Company”, “we”, “us”, “our” or similar terms refer to Hudbay Minerals Inc. and its direct and indirect subsidiaries as at March 31, 2018. "Hudbay Peru" refers to HudBay Peru S.A.C., our wholly-owned subsidiary which owns a 100% interest in the Constancia mine, and “Hudbay Arizona” refers to Hudbay Arizona Inc., our wholly-owned subsidiary, which indirectly owns a 92.05% interest in the Rosemont project.

Readers should be aware that:

| − | This MD&A contains certain “forward-looking statements” and “forward-looking information” (collectively, “forward-looking information”) that are subject to risk factors set out in a cautionary note contained in our MD&A. | |

| − | This MD&A has been prepared in accordance with the requirements of the securities laws in effect in Canada, which may differ materially from the requirements of United States securities laws applicable to US issuers. | |

| − | We use a number of non-IFRS financial performance measures in our MD&A. | |

| − | The technical and scientific information in this MD&A has been approved by qualified persons based on a variety of assumptions and estimates. |

For a discussion of each of the above matters, readers are urged to review the “Notes to Reader” discussion beginning on page 35 of this MD&A.

Additional information regarding Hudbay, including the risks related to our business and those that are reasonably likely to affect our financial statements in the future, is contained in our continuous disclosure materials, including our most recent Annual Information Form (“AIF”), consolidated financial statements and Management Information Circular available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

As of January 1, 2018 we have adopted IFRS 9, Financial Instruments (“IFRS 9”) and IFRS 15, Revenue from Contracts with Customers (“IFRS 15”). The Group applied this amendment retrospectively. Changes to previously reported balances are disclosed in Note 4(d) of the consolidated interim financial statements. Disclosures in this MD&A are restated for the impacts of these accounting changes.

All amounts are in US dollars unless otherwise noted.

OUR BUSINESS

We are an integrated mining company primarily producing copper concentrate (containing copper, gold and silver), zinc concentrate and zinc metal. With assets in North and South America, we are focused on the discovery, production and marketing of base and precious metals. Directly and through our subsidiaries, we own four polymetallic mines, four ore concentrators and a zinc production facility in northern Manitoba and Saskatchewan (Canada) and Cusco (Peru), and a copper project in Arizona (United States). Our growth strategy is focused on the exploration and development of properties we already control, as well as other mineral assets we may acquire that fit our strategic criteria. Our vision is to be a responsible, top-tier operator of long-life, low-cost mines in the Americas. Our mission is to create sustainable value through the acquisition, development and operation of high-quality, long-life deposits with exploration potential in jurisdictions that support responsible mining, and to see the regions and communities in which we operate benefit from our presence. We are governed by the Canada Business Corporations Act and our shares are listed under the symbol "HBM" on the Toronto Stock Exchange, New York Stock Exchange and Bolsa de Valores de Lima. We also have warrants listed under the symbol “HBM.WT” on the Toronto Stock Exchange and “HBM/WS” on the New York Stock Exchange.

1

![]()

SUMMARY

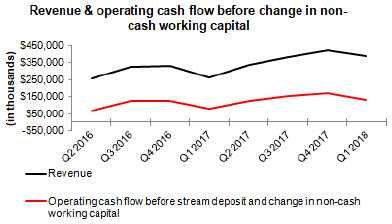

In the first quarter of 2018, operating cash flow before changes in non-cash working capital increased to $131.8 million, compared to $80.6 million in the first quarter of 2017, mainly as a result of comparably higher realized prices of all metals and higher copper sales volumes.

Net profit and earnings per share in the first quarter of 2018 were $41.4 million and $0.16, respectively, compared to a net loss and loss per share of $10.0 million and $0.04, respectively, in the first quarter of 2017, mainly for the same reasons noted above. Net profit and earnings per share in the first quarter of 2018 were affected by, among other things, the following items:

| (in $ millions, except per share amounts) | Pre-tax | After-tax | Per share | ||||||

| gain (loss) | gain (loss) | gain (loss) | |||||||

| Changes in accounting standards | (3.4 | ) | (3.8 | ) | (0.01 | ) | |||

| Foreign exchange gain | 4.0 | 3.4 | 0.01 | ||||||

| Mark-to-market adjustments of various items | 10.2 | 8.5 | 0.03 | ||||||

| Pampacancha delivery obligation | (7.2 | ) | (7.2 | ) | (0.03 | ) | |||

| Non-cash deferred tax adjustments | - | (2.8 | ) | (0.01 | ) |

Effective January 1, 2018, a new revenue accounting standard issued by the IASB was implemented and applied retrospectively. Under the new standard, our stream agreements with Wheaton Precious Metals now incorporate a significant financing component. The accretion of financing expense on the deferred revenue balance increases the deferred revenue balance over time and the resulting higher deferred revenue balance is amortized to revenue, resulting in higher revenue per ounce of metal sold under the stream, and higher finance expense. The impact to the first quarter of 2018 is an increase to gross margin of $12.8 million, offset by an increase in finance expenses of $16.2 million. The net impact to after-tax earnings per share is a loss of $0.01. All of these changes are non-cash.

During the first quarter of 2018, we recognized an obligation to deliver additional precious metal credits to Wheaton Precious Metals as a result of our expectation that mining at the Pampacancha deposit will not begin until 2019.

Compared to the same quarter in 2017, production of copper, gold and silver in concentrate in the first quarter of 2018 increased as a result of higher milled throughput in all operations together with higher grades for precious metals in Manitoba. Zinc production decreased by 6% as Lalor zinc grades have declined in line with the mine plan.

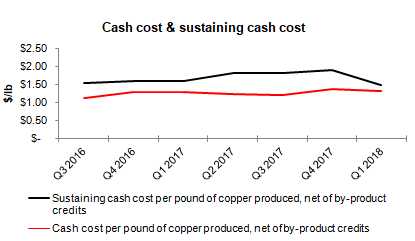

In the first quarter of 2018, consolidated cash cost per pound of copper produced, net of by-product credits, was $0.98, an increase compared to $0.88 in the same period last year1. The increase is mainly due to increased operational costs at our 777 and Reed mines in Manitoba as the mines approach the later stages of their mine lives and reduced capitalized stripping at Constancia, resulting in higher operating expense. Incorporating sustaining capital, capitalized exploration, royalties and corporate selling and administrative expenses, consolidated all-in sustaining cash cost per pound of copper produced, net of by-product credits, in the first quarter of 2018 was $1.45, down slightly from $1.46 in the first quarter of 20171.

Net debt1 declined by $37.7 million from December 31, 2017 to $585.4 million at March 31, 2018, as a result of cash flow from our operations. At March 31, 2018, total liquidity, including cash and available credit facilities was $810.0 million, up from $777.9 million at December 31, 2017.

| 1 |

Cash cost and sustaining cash cost per pound of copper produced, net of by-product credits, and net debt are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under "Non-IFRS Financial Reporting Measures" beginning on page 27 of this MD&A. |

2

![]()

Given our expectation that mining at Pampacancha will not begin until 2019, we expect that Peru precious metals production2 will be 50,000 to 70,000 ounces in 2018, a decrease of 20% compared to our initial 2018 guidance issued on January 17, 2018 and consistent with the 25% sensitivity noted in our initial guidance. The majority of the estimated $45 million of Peru growth capital, which includes expenditures for developing the Pampacancha deposit and acquiring surface rights from the local community, is expected to be deferred to 2019. Based on results to date, we expect to meet all other production and cost guidance for 2018.

3

![]()

KEY FINANCIAL RESULTS

| Financial Condition | ||||||

| (in $ thousands) | Mar. 31, 2018 | Dec. 31, 2017 | ||||

| (Restated) | ||||||

| Cash and cash equivalents | 392,796 | 356,499 | ||||

| Total long-term debt | 978,190 | 979,575 | ||||

| Net debt 1 | 585,394 | 623,076 | ||||

| Working capital | 335,800 | 251,388 | ||||

| Total assets | 4,690,748 | 4,728,016 | ||||

| Equity | 2,145,321 | 2,112,345 |

| 1 |

Net debt is a non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under "Non-IFRS Financial Reporting Measures" beginning on page 27 of this MD&A. |

| 2 |

Precious metals production includes gold and silver production on a gold equivalent basis. Silver converted to gold at a ratio of 70:1. |

| Financial Performance | Three months ended | |||||

| Mar. 31, | Mar. 31, | |||||

| (in $ thousands except per share and cash cost amounts) | 2018 | 2017 | ||||

| (Restated) | ||||||

| Revenue | 386,656 | 261,767 | ||||

| Cost of sales | 265,885 | 205,121 | ||||

| Profit before tax | 73,103 | 4,637 | ||||

| Profit (loss) for the period | 41,445 | (10,029 | ) | |||

| Basic and diluted earnings (loss) per share | 0.16 | (0.04 | ) | |||

| Operating cash flow before change in non-cash working capital | 131,791 | 80,595 | ||||

4

![]()

KEY PRODUCTION RESULTS

| Three months ended | Three months ended | ||||||||||||||||||||

| Mar. 31, 2018 | Mar. 31, 2017 | ||||||||||||||||||||

| Peru | Manitoba | Total | Peru | Manitoba | Total | ||||||||||||||||

| Contained metal in concentrate produced 1 | |||||||||||||||||||||

| Copper | tonnes | 31,551 | 7,655 | 39,206 | 27,211 | 7,520 | 34,731 | ||||||||||||||

| Gold | oz | 5,418 | 25,675 | 31,093 | 3,935 | 16,788 | 20,723 | ||||||||||||||

| Silver | oz | 645,886 | 331,252 | 977,138 | 539,534 | 198,360 | 737,894 | ||||||||||||||

| Zinc | tonnes | - | 28,782 | 28,782 | - | 30,570 | 30,570 | ||||||||||||||

| Payable metal in concentrate sold | |||||||||||||||||||||

| Copper | tonnes | 29,568 | 6,938 | 36,506 | 18,565 | 7,850 | 26,415 | ||||||||||||||

| Gold | oz | 4,907 | 21,150 | 26,057 | 1,475 | 23,995 | 25,470 | ||||||||||||||

| Silver | oz | 595,630 | 290,826 | 886,456 | 383,263 | 293,302 | 676,565 | ||||||||||||||

| Zinc 2 | tonnes | - | 25,452 | 25,452 | - | 26,832 | 26,832 | ||||||||||||||

| Cash cost 3 | $/lb | 1.32 | (0.38 | ) | 0.98 | 1.30 | (0.66 | ) | 0.88 | ||||||||||||

| Sustaining cash cost 3 | $/lb | 1.47 | 1.03 | 1.61 | 0.28 | ||||||||||||||||

| All-in sustaining cash cost 3 | $/lb | 1.45 | 1.46 | ||||||||||||||||||

| 1 |

Metal reported in concentrate is prior to deductions associated with smelter contract terms. |

| 2 |

Includes refined zinc metal sold and payable zinc in concentrate sold. |

| 3 |

Cash cost, sustaining cash cost and all-in sustaining cash cost per pound of copper produced, net of by-product credits are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under "Non-IFRS Financial Reporting Measures" beginning on page 27 of this MD&A. |

RECENT DEVELOPMENTS

Rosemont Developments

Work continues with the U.S. Forest Service on the draft Mine Plan of Operations, which is progressing as planned. The remaining key federal permit outstanding is the Section 404 Water Permit from the U.S. Army Corps of Engineers.

Opponents of the Rosemont project have filed lawsuits against the U.S. Forest Service challenging, among other things, the issuance of the final Record of Decision in respect of Rosemont. Hudbay is confident that Rosemont’s permits will continue to be upheld.

New Technical Report for Constancia

During the first quarter of 2018, we filed an updated National Instrument 43-101 technical report in respect of our 100% owned Constancia mine in Peru (the “2018 Technical Report”). The 2018 Technical Report includes updates to the mineral reserves and resources and mine plan, including anticipated throughput, recoveries and capital and operating costs for the remaining life of mine at Constancia. For more information, refer to the News Release dated March 29, 2018.

5

![]()

Lalor Gold Zone Update

The Lalor mine plan for 2018 includes some mining of the gold zone for processing at Flin Flon, which we included in our precious metals guidance issued in January. Trade-off studies have been ongoing in order to assess the mining and processing options for the gold mineral resources at Lalor. Test mining of Zone 25 began in February 2018 in order to better understand the characteristics of the gold zone and to inform the evaluation of options for its processing. The test mining has confirmed the possibility of utilizing selective methods to mine fewer tonnes at a higher grade than reported in the current mineral resource estimate. Year to date, we have mined 4,500 tonnes at 14.5 g/t, confirming the opportunity to operate successfully at a higher cut-off grade. A batch sample of gold-rich ore sent to the Flin Flon concentrator in late 2017 achieved gold recoveries of 65%. Currently, the gold ore is being shipped to Flin Flon for processing.

In parallel, we are continuing exploration in an attempt to further extend gold- and copper-rich veins down plunge from the existing resources and targeting possible extensions of the base metals lenses both up and down plunge from known resources. Highlights from the drill program that focused on extensions of gold- and copper-rich veins, each of which is outside of the current reserve, are provided in the below table.

| Hole ID | From (m) |

To (m) |

Intercept (m) |

Depth (m) |

Estimated

true width(m)1 |

Cu

(%)2 |

Au

(g/t)2 |

| 189W01 | 1197.0 | 1205.0 | 8.0 | 1154 | 7.1 | 0.1 | 9.3 |

| 193W01 | 1041.2 | 1046.5 | 5.4 | 1028 | 4.1 | 1.1 | 2.8 |

| 267W01 | 1120.8 | 1127.2 | 6.3 | 1098 | 4.5 | 2.7 | 11.3 |

| 273 | 1211.8 | 1215.8 | 4 | 1202 | 2.9 | 1.9 | 1.2 |

| 283 | 1242.7 | 1249.0 | 6.3 | 1240 | 4.2 | 7.8 | 5.9 |

| 283W02 | 1270.8 | 1276.3 | 5.5 | 1263 | 4.1 | 7.8 | 2.5 |

| 296 | 1227.5 | 1233.0 | 5.5 | 1184 | 4.2 | 5.2 | 5.6 |

| 296W01 | 1220.5 | 1228.3 | 7.8 | 1175 | 6.1 | 3.7 | 5.4 |

| 1 |

True widths are estimated based on drill angle and interpreted geometry of mineralization. |

| 2 |

All gold and copper values are uncut. |

In 2018, we will continue to conduct test mining of the gold lenses, which will support continued trade-off studies to assess the mining and processing options for Lalor gold and advance the permitting process for the potential refurbishment of the New Britannia mill. Ongoing exploration is targeted at converting gold mineral resources to mineral reserves at Lalor and greenfield gold exploration efforts in Snow Lake.

6

![]()

CONSTANCIA OPERATIONS REVIEW

| Three months ended | Guidance | |||||||||||

| Mar. 31 | Mar. 31 | Annual | ||||||||||

| 2018 | 2017 | 2018 | ||||||||||

| Ore mined | tonnes | 9,489,769 | 7,213,200 | |||||||||

| Copper | % | 0.50 | 0.55 | |||||||||

| Gold | g/tonne | 0.05 | 0.05 | |||||||||

| Silver | g/tonne | 4.19 | 4.03 | |||||||||

| Ore milled | tonnes | 7,851,169 | 6,317,609 | |||||||||

| Copper | % | 0.50 | 0.54 | |||||||||

| Gold | g/tonne | 0.05 | 0.04 | |||||||||

| Silver | g/tonne | 4.10 | 4.27 | |||||||||

| Copper concentrate | tonnes | 128,548 | 108,536 | |||||||||

| Concentrate grade | % Cu | 24.54 | 25.07 | |||||||||

| Copper recovery | % | 80.7 | 80.1 | |||||||||

| Gold recovery | % | 44.9 | 44.5 | |||||||||

| Silver recovery | % | 62.5 | 62.2 | |||||||||

| Combined unit operating costs 1 | $/tonne | 8.92 | 9.22 | 7.50 - 9.20 | ||||||||

| 1 |

Reflects combined mine, mill and general and administrative ("G&A") costs per tonne of ore milled. Reflects the deduction of expected capitalized stripping costs. |

Ore mined at our Constancia mine during the first quarter of 2018 increased by 32% compared to the same period in 2017 in line with improved mill availability and reduced scheduled maintenance. Milled copper grades in the first quarter were approximately 7% lower than the same period in 2017 as we entered lower grade phases of the mine plan. Mill throughput improved 24% due to increased plant availability as well as plant optimization initiatives during the fourth quarter of 2017.

Recoveries of copper, gold and silver were slightly higher in the first quarter of 2018, compared to the same period in 2017. Improved recoveries were due to continued plant optimization and processing less transitional ore types.

Combined mine, mill and G&A unit operating costs in the first quarter of 2018 were 3% lower than the same period in 2017. The lower combined unit costs are mostly related to higher mill throughput partially offset by higher mining costs due to a decrease in the mining costs that are capitalized.

| Three months ended | Guidance | |||||||||||

| Contained metal in | Mar. 31, | Mar. 31, | Annual | |||||||||

| concentrate produced | 2018 | 2017 | 2018 | |||||||||

| Copper | tonnes | 31,551 | 27,211 | 95,000 - 115,000 | ||||||||

| Gold | oz | 5,418 | 3,935 | |||||||||

| Silver | oz | 645,886 | 539,534 | |||||||||

| Precious metals1 | oz | 14,645 | 11,643 | 50,000 - 70,0002 | ||||||||

| 1 |

Precious metals production includes gold and silver production on a gold equivalent basis. Silver converted to gold at a ratio of 70:1. |

| 2 |

Initial 2018 guidance for Constancia precious metals production was 65,000 to 85,000 ounces. |

7

![]()

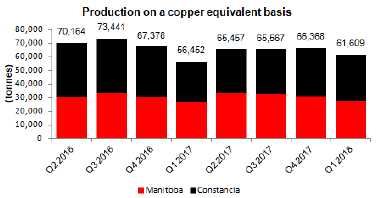

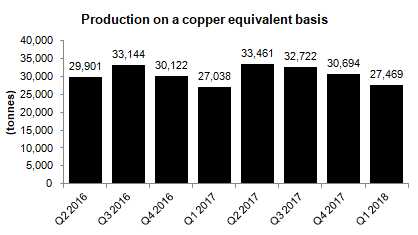

Copper equivalent production in the first quarter of 2018 was higher than in the same period in 2017 as there were higher gold grades and higher mill throughput, partially offset by lower copper grades.

Peru Cash Cost and Sustaining Cash Cost

| Three months ended | |||||||||

| Mar. 31, | Mar. 31, | ||||||||

| 2018 | 2017 | ||||||||

| Cash cost per pound of copper produced, net of by-product credits 1 | $/lb | 1.32 | 1.30 | ||||||

| Sustaining cash cost per pound of copper produced, net of by-product credits 1 | $/lb | 1.47 | 1.61 | ||||||

| 1 |

Cash cost and sustaining cash costs per pound of copper produced, net of by-product credits, are not recognized under IFRS. For more detail on this non-IFRS financial performance measure, please see the discussion under "Non-IFRS Financial Performance Measures" beginning on page 27 of this MD&A. |

Cash cost per pound of copper produced, net of by-product credits, for the three months ended March 31, 2018 was $1.32, an increase of 2% from the same period in 2017 mainly as a result of lower capitalized mining costs, higher freight and treatment and refining costs, partially offset by higher copper production and by-product credits.

Sustaining cash cost per pound of copper produced, net of by-product credits, for the three months ended March 31, 2018 was $1.47, a decrease of 9% from the same period in 2017 as a result of the factors noted above as well as reduced sustaining capital in heavy civil works.

8

![]()

Metal Sold

| Three months ended | |||||||||

| Mar. 31, | Mar. 31, | ||||||||

| 2018 | 2017 | ||||||||

| Payable metal in concentrate | |||||||||

| Copper | tonnes | 29,568 | 18,565 | ||||||

| Gold | oz | 4,907 | 1,475 | ||||||

| Silver | oz | 595,630 | 383,263 | ||||||

9

![]()

MANITOBA OPERATIONS REVIEW

Mines

| Three months ended | |||||||||

| Mar. 31 | Mar. 31 | ||||||||

| 2018 | 2017 | ||||||||

| 777 | |||||||||

| Ore | tonnes | 258,386 | 288,364 | ||||||

| Copper | % | 1.22 | 1.51 | ||||||

| Zinc | % | 4.86 | 4.55 | ||||||

| Gold | g/tonne | 2.08 | 1.76 | ||||||

| Silver | g/tonne | 30.11 | 21.14 | ||||||

| Lalor | |||||||||

| Ore | tonnes | 322,554 | 279,618 | ||||||

| Copper | % | 0.67 | 0.53 | ||||||

| Zinc | % | 5.67 | 8.11 | ||||||

| Gold | g/tonne | 2.06 | 1.50 | ||||||

| Silver | g/tonne | 27.24 | 19.91 | ||||||

| Reed 1 | |||||||||

| Ore | tonnes | 122,309 | 119,534 | ||||||

| Copper | % | 3.54 | 2.96 | ||||||

| Zinc | % | 0.93 | 0.67 | ||||||

| Gold | g/tonne | 0.70 | 0.44 | ||||||

| Silver | g/tonne | 9.43 | 5.64 | ||||||

| Total Mines | |||||||||

| Ore | tonnes | 703,249 | 687,516 | ||||||

| Copper | % | 1.37 | 1.36 | ||||||

| Zinc | % | 4.55 | 5.32 | ||||||

| Gold | g/tonne | 1.83 | 1.43 | ||||||

| Silver | g/tonne | 25.20 | 17.95 | ||||||

| 1 |

Includes 100% of Reed mine production. We purchase 30% of the Reed ore production from our joint venture partner on market-based terms. |

10

![]()

| Three months ended | |||||||||

| Mar. 31 | Mar. 31 | ||||||||

| Unit Operating Costs | 2018 | 2017 | |||||||

| Mines | |||||||||

| 777 | C$/tonne | 80.19 | 59.00 | ||||||

| Lalor | C$/tonne | 86.78 | 83.40 | ||||||

| Reed | C$/tonne | 92.63 | 54.37 | ||||||

| Total Mines | C$/tonne | 84.98 | 68.87 | ||||||

Ore production at our Manitoba mines for the first quarter of 2018 increased by 2% compared to the same period in 2017 as a result of higher production at our Lalor and Reed mines, partially offset by lower production at our 777 mine. Copper, gold and silver grades in the first quarter of 2018 were higher than the first quarter of 2017 by 1%, 28% and 40%, respectively, while zinc grades were lower than in 2017 by 14%. Unit operating costs for all mines for the first quarter of 2018 increased by 23% compared to the same period in 2017. The increase is a function of higher mobile and fixed infrastructure maintenance costs and higher expensed development costs.

Ore mined at Lalor increased as the ramp-up of production continues and the mine transitions to higher gold and copper grades with lower zinc as outlined in the life of mine plan. Higher unit costs reflect increased cement rock filling, extensive cable bolting as well as continued operating and capital development that are required to increase Lalor’s production rate to 4,500 tonnes per day, which is on track to be completed by the third quarter of 2018. The commissioning of the paste backfill plant, which is on track for mid-2018, is expected to improve scoop availability and provide flexibility to the mine planning and sequencing.

The Reed mine maintained consistent production with higher copper grades as we mine out Zone 10 at depth. We are no longer capitalizing development costs at Reed with the pending closure of the mine in the third quarter of 2018, resulting in higher unit operating costs compared to prior periods.

Ore mined at 777 declined as ground conditions warranted rehabilitation of headings and a more conservative stope sequence in order to adapt to more challenging operating conditions as the mine ages. Higher 777 unit operating costs were driven by higher mobile and fixed infrastructure maintenance costs and ground rehabilitation work completed in the quarter, together with the impact of lower production.

11

![]()

Processing Facilities

| Three months ended | |||||||||

| Mar. 31, | Mar. 31, | ||||||||

| 2018 | 2017 | ||||||||

| Flin Flon Concentrator | |||||||||

| Ore | tonnes | 391,627 | 373,894 | ||||||

| Copper | % | 1.73 | 1.89 | ||||||

| Zinc | % | 4.16 | 3.45 | ||||||

| Gold | g/tonne | 1.76 | 1.36 | ||||||

| Silver | g/tonne | 24.55 | 16.64 | ||||||

| Copper concentrate | tonnes | 27,176 | 27,437 | ||||||

| Concentrate grade | % Cu | 22.91 | 23.54 | ||||||

| Zinc concentrate | tonnes | 27,808 | 21,538 | ||||||

| Concentrate grade | % Zn | 49.57 | 51.50 | ||||||

| Copper recovery | % | 91.9 | 91.4 | ||||||

| Zinc recovery | % | 84.7 | 86.0 | ||||||

| Gold recovery | % | 64.8 | 59.4 | ||||||

| Silver recovery | % | 58.8 | 53.5 | ||||||

| Contained metal in concentrate produced | |||||||||

| Copper | tonnes | 6,226 | 6,458 | ||||||

| Zinc | tonnes | 13,784 | 11,092 | ||||||

| Precious metals 1 | oz | 16,938 | 11,260 | ||||||

| Stall Concentrator | |||||||||

| Ore | tonnes | 276,742 | 263,152 | ||||||

| Copper | % | 0.61 | 0.51 | ||||||

| Zinc | % | 5.85 | 7.98 | ||||||

| Gold | g/tonne | 2.07 | 1.51 | ||||||

| Silver | g/tonne | 27.72 | 19.83 | ||||||

| Copper concentrate | tonnes | 7,709 | 5,773 | ||||||

| Concentrate grade | % Cu | 18.53 | 18.40 | ||||||

| Zinc concentrate | tonnes | 29,403 | 37,362 | ||||||

| Concentrate grade | % Zn | 51.01 | 52.13 | ||||||

| Copper recovery | % | 85.1 | 79.0 | ||||||

| Zinc recovery | % | 92.7 | 92.8 | ||||||

| Gold recovery | % | 61.4 | 55.2 | ||||||

| Silver recovery | % | 60.6 | 54.5 | ||||||

| Contained metal in concentrate produced | |||||||||

| Copper | tonnes | 1,429 | 1,062 | ||||||

| Zinc | tonnes | 14,998 | 19,478 | ||||||

| Precious metals 1 | oz | 13,469 | 8,362 | ||||||

| 1 |

Precious metals production includes gold and silver production on a gold-equivalent basis. Silver is converted to gold at a 70:1 ratio. |

12

![]()

| Three months ended | Guidance | |||||||||||

| Mar. 31, | Mar. 31, | Annual | ||||||||||

| Unit Operating Costs | 2018 | 2017 | 2018 | |||||||||

| Concentrators | ||||||||||||

| Flin Flon | C$/tonne | 22.93 | 21.12 | |||||||||

| Stall | C$/tonne | 27.35 | 36.02 | |||||||||

| Combined mine/mill unit operating costs 1 | ||||||||||||

| Manitoba | C$/tonne | 138.22 | 119.32 | 110 -123 | ||||||||

| 1 |

Reflects combined mine, mill and G&A costs per tonne of ore milled. Includes the cost of ore purchased from our joint venture partner at the Reed mine. |

Ore processed in Flin Flon in the first quarter of 2018 was 5% higher than the same period in 2017 as a result of increased ore availability due to the transfer of excess Lalor ore to the Flin Flon concentrator. Copper and precious metals recoveries were higher in the first quarter of 2018 compared to the first quarter in 2017 as a result of higher head grades. Unit operating costs at the Flin Flon concentrator were 9% higher in the first quarter of 2018 compared to the same period in 2017 as a result of increased material handling costs driven by the management of large stockpiles, and initial difficulties in processing Lalor ore through the Flin Flon concentrator crushing plant due to the impact of cold winter weather.

Ore processed at the Stall concentrator in the first quarter of 2018 was 5% higher than the same period in 2017 as a result of improved mechanical reliability. Copper and precious metals recoveries were higher in the first quarter of 2018 compared to the first quarter in 2017 as a result of higher head grades. Unit operating costs at the Stall concentrator were 24% lower in the first quarter of 2018 compared to the first quarter of 2017 as damage to the crusher in December 2016 had necessitated the use of higher-cost temporary crushing facilities during the first quarter of 2017.

Manitoba combined mine, mill and G&A unit operating costs in the first quarter of 2018 were 16% higher than in the same period in 2017 as a result of higher costs at our mines and the Flin Flon concentrator.

Combined unit costs are expected to be within the guidance range for 2018, as the higher costs in the first quarter were caused in part by the colder than normal winter.

| Three months ended | Guidance1 | |||||||||||

| Manitoba contained metal in | Mar. 31 | Mar. 31 | Annual | |||||||||

| concentrate produced 1,2 | 2018 | 2017 | 2018 | |||||||||

| Copper | tonnes | 7,655 | 7,520 | 27,500 - 32,500 | ||||||||

| Gold | oz | 25,675 | 16,788 | - | ||||||||

| Silver | oz | 331,252 | 198,360 | - | ||||||||

| Zinc | tonnes | 28,782 | 30,570 | 105,000 - 130,000 | ||||||||

| Precious metals 3 | oz | 30,407 | 19,622 | 120,000 - 145,000 | ||||||||

| 1 |

Includes 100% of Reed mine production. We own a 70% interest in the Reed mine and purchase 30% of the Reed ore production from our joint venture partner on market based terms. |

| 2 |

Metal reported in concentrate is prior to deductions associated with smelter terms. |

| 3 |

Precious metals production includes gold and silver production on a gold-equivalent basis. Silver is converted to gold at a 70:1 ratio. |

In the first quarter of 2018, production of gold and silver was 53% and 67% higher respectively, than the same period in 2017 as a result of higher precious metals grades, while zinc production was 6% lower compared to the same period of 2017 as a result of lower grades at Lalor in line with the mine plan. Copper production remained consistent compared to the same period in 2017. Production of all metals in Manitoba for full year 2018 is forecast to be within the guidance ranges.

13

![]()

Zinc Plant

| Three months ended | Guidance | |||||||||||

| Mar. 31 | Mar. 31 | Annual | ||||||||||

| Zinc Production | 2018 | 2017 | 2018 | |||||||||

| Zinc Concentrate Treated | ||||||||||||

| Domestic | tonnes | 54,408 | 57,135 | |||||||||

| Refined Metal Produced | ||||||||||||

| Domestic | tonnes | 25,331 | 28,818 | 110,000-115,000 | ||||||||

| Three months ended | Guidance | |||||||||||

| Mar. 31 | Mar. 31 | Annual | ||||||||||

| Unit Operating Costs | 2018 | 2017 | 2018 | |||||||||

| Zinc Plant 1 | C$/lb | 0.51 | 0.41 | 0.40 - 0.50 | ||||||||

| 1 |

Zinc unit operating costs include G&A costs. |

Refined zinc metal production was 12% lower in the first quarter of 2018 compared to the same period in 2017 as a result of reduced availability of zinc concentrate. Operating costs per pound of zinc metal produced in the first quarter of 2018 were 24% higher compared to the first quarter of 2017 as a result of lower production and timing of shutdown maintenance. Refined zinc metal production and operating costs are both expected to be within guidance ranges for 2018 with improved expected zinc concentrate availability and reduced maintenance spending for the rest of the year.

14

![]()

Manitoba Cash Cost and Sustaining Cash Cost

| Three months ended | |||||||||

| Mar. 31 | Mar. 31 | ||||||||

| 2018 | 2017 | ||||||||

| Cost per pound of copper produced | |||||||||

| Cash costs per pound of copper produced, net of by-product credits 1 | $/lb | (0.38 | ) | (0.66 | ) | ||||

| Sustaining cash costs per pound of copper produced, net of by-product credits 1 | $/lb | 1.03 | 0.28 | ||||||

| Cost per pound of zinc produced | |||||||||

| Cash costs per pound of zinc produced, net of by-product credits 1 | $/lb | 0.65 | 0.29 | ||||||

| Sustaining cash costs per pound of zinc produced, net of by-product credits 1 | $/lb | 1.03 | 0.52 | ||||||

| 1 |

Cash cost and sustaining cash costs per pound of copper and zinc produced, net of by-product credits, are not recognized under IFRS. For more detail on this non-IFRS financial performance measure, please see the discussion under "Non-IFRS Financial Performance Measures" beginning on page 27 of this MD&A. |

In Manitoba, cash cost per pound of copper produced, net of by-product credits, in the first quarter of 2018 was negative $0.38 per pound of copper produced. This was higher compared to the same period in 2017, primarily as a result of the factors affecting unit operating costs described above.

Sustaining cash cost per pound of copper produced, net of by-product credits, in the first quarter of 2018 was $1.03, compared to $0.28 in the prior year period as a result of the same factors described above, and planned increased sustaining and exploration capital spending.

Cash cost and sustaining cash cost per pound of zinc produced, net of by-product credits, were higher compared to the same period last year as a result of the same cost factors and capital spending described above with decreased zinc production.

15

![]()

Metal Sold

| Three months ended | |||||||||

| Mar. 31 | Mar. 31 | ||||||||

| 2018 | 2017 | ||||||||

| Payable metal in concentrate | |||||||||

| Copper | tonnes | 6,938 | 7,850 | ||||||

| Gold | oz | 21,150 | 23,995 | ||||||

| Silver | oz | 290,826 | 293,302 | ||||||

| Zinc | tonnes | 1,700 | - | ||||||

| Refined zinc | tonnes | 23,752 | 26,832 | ||||||

FINANCIAL REVIEW

Financial Results

We recorded a profit of $41.4 million in the first quarter of 2018, an increase of $51.5 million compared to the first quarter of 2017. The following table provides further details on this variance:

| Three months ended | |||

| (in $ millions) | Mar. 31, 2018 | ||

| Increase (decrease) in net earnings resulting from these components: | |||

| Revenues | 124.9 | ||

| Cost of sales | |||

| Mine operating costs | (42.8 | ) | |

| Depreciation and amortization | (17.9 | ) | |

| Net finance expense | 18.3 | ||

| Other | (14.0 | ) | |

| Tax | (17.0 | ) | |

| Increase in profit for the period | 51.5 |

16

![]()

Revenue

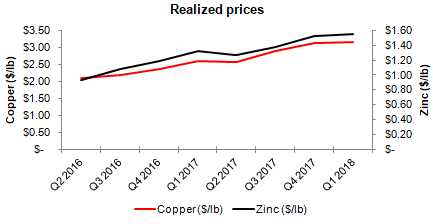

Total revenue for the first quarter of 2018 was $386.7 million, $124.9 million higher than the same period in 2017. This increase was primarily due to higher copper sales volumes compared to the first quarter of 2017, along with higher overall prices for all metals, partially offset by higher treatment and refining charges.

The following table provides further details of this variance:

| Three months ended | |||

| (in $ millions) | Mar. 31, 2018 | ||

| Metals prices1 | |||

| Higher copper prices | 38.2 | ||

| Higher zinc prices | 17.6 | ||

| Higher gold prices | 2.9 | ||

| Higher silver prices | 4.2 | ||

| Sales volumes | |||

| Higher copper sales volumes | 63.6 | ||

| Lower zinc sales volumes | (4.0 | ) | |

| Higher silver sales volumes | 5.3 | ||

| Other | |||

| Other volume and pricing differences | 2.4 | ||

| Effect of higher treatment and refining charges | (5.3 | ) | |

| Increase in revenue in 2018 compared to 2017 | 124.9 |

| 1 |

See discussion below for further information regarding metals prices. |

Our revenue by significant product type is summarized below:

| Three months ended | ||||||

| Mar. 31, | Mar. 31, | |||||

| (in $ millions) | 2018 | 2017 | ||||

| (Restated) | ||||||

| Copper | 256.9 | 157.9 | ||||

| Zinc | 90.9 | 77.3 | ||||

| Gold | 36.6 | 35.5 | ||||

| Silver | 22.2 | 17.0 | ||||

| Other | 4.2 | 1.2 | ||||

| Gross revenue | 410.8 | 288.9 | ||||

| Revenue not derived from contracts1 | - | (8.3 | ) | |||

| Treatment and refining charges | (24.1 | ) | (18.8 | ) | ||

| Revenue | 386.7 | 261.8 | ||||

| 1 |

Revenue not derived from contracts represents mark-to-market adjustments on provisionally priced sales, realized and unrealized changes to fair value for non-hedge derivative contracts and adjustments to originally invoiced weights and assays. |

17

![]()

Realized sales prices

This measure is intended to enable management and investors to understand the average realized price of metals sold to third parties in each reporting period. The average realized price per unit sold does not have any standardized meaning prescribed by IFRS, is unlikely to be comparable to similar measures presented by other issuers, and should not be considered in isolation or a substitute for measures of performance prepared in accordance with IFRS.

For sales of copper, gold and silver we may enter into non-hedge derivatives (“QP hedges”) which are intended to manage the provisional pricing risk arising from quotational period terms in concentrate sales agreements. The QP hedges are not removed from the calculation of realized prices. We expect that gains and losses on QP hedges will offset provisional pricing adjustments on concentrate sales contracts.

Our realized prices for the first quarter of 2018 and 2017 are summarized below:

| Realized prices1 for the | ||||||||||||

| three months ended | ||||||||||||

| LME Q1 | Mar. 31 | Mar. 31 | ||||||||||

| 20182 | 2018 | 20173 | ||||||||||

| (Restated) | ||||||||||||

| Prices | ||||||||||||

| Copper | $/lb. | 3.16 | 3.15 | 2.61 | ||||||||

| Zinc 4 | $/lb. | 1.55 | 1.64 | 1.32 | ||||||||

| Gold 5 | $/oz | 1,343 | 1,307 | |||||||||

| Silver 5 | $/oz | 28.95 | 24.02 | |||||||||

| 1 |

Realized prices exclude refining and treatment charges and are on the sale of finished metal or metal in concentrate. Realized prices include the effect of provisional pricing adjustments on prior period sales. |

| 2 |

London Metal Exchange average for copper and zinc prices. |

| 3 |

Gold and Silver realized prices for 2017 have been restated due to IFRS 15 impacts. Please refer to note 4 of the financial statements for further information. |

| 4 |

This amount includes a realized sales price of $1.63 for cast zinc metal and $1.74 for zinc concentrate sold for the three months ended March 31, 2018. Zinc realized prices include premiums paid by customers for delivery of refined zinc metal, but exclude unrealized gains and losses related to non-hedge derivative contracts that are included in zinc revenues. |

| 5 |

Sales of gold and silver from our 777 and Constancia mines are subject to our precious metals stream agreement with Wheaton Precious Metals, pursuant to which we recognize deferred revenue for precious metals deliveries and also receive cash payments. Stream sales are included within realized prices and their respective deferred revenue and cash payments can be found on page 20. |

18

![]()

The following table provides a reconciliation of average realized price per unit sold, by metal, to revenues as shown in the consolidated financial statements before treatment and refining charges:

| Three months ended March 31, 2018 | ||||||||||||||||||

| (in $ millions)1 | Copper | Zinc | Gold | Silver | Other | Total | ||||||||||||

| Revenue per financial statements | 256.9 | 90.9 | 36.6 | 22.2 | 4.2 | 410.8 | ||||||||||||

| Revenue not derived from contracts2 | (3.2 | ) | 0.3 | - | 2.1 | 0.8 | - | |||||||||||

| Derivative mark-to-market and other3 | - | 0.5 | (1.6 | ) | 1.4 | - | 0.3 | |||||||||||

| Revenue excluding mark-to-market on non-QP hedges | 253.7 | 91.7 | 35.0 | 25.7 | 5.0 | 411.1 | ||||||||||||

| Payable metal in concentrate sold4 | 36,506 | 25,452 | 26,057 | 886,456 | - | - | ||||||||||||

| Realized price5,6 | 6,951 | 3,605 | 1,343 | 28.95 | - | - | ||||||||||||

| Realized price7 | 3.15 | 1.64 | - | - | - | - | ||||||||||||

| Three months ended March 31, 2017(Restated) | ||||||||||||||||||

| (in $ millions)1 | Copper | Zinc | Gold | Silver | Other | Total | ||||||||||||

| Revenue per financial statements | 157.9 | 77.3 | 35.5 | 17.0 | 1.2 | 288.9 | ||||||||||||

| Revenue not derived from contracts2 | (6.0 | ) | 0.6 | (2.2 | ) | (0.8 | ) | 0.1 | (8.3 | ) | ||||||||

| Derivative mark-to-market and other3 | - | 0.3 | - | - | - | 0.3 | ||||||||||||

| Revenue excluding mark-to-market on non-QP hedges | 151.9 | 78.2 | 33.3 | 16.2 | 1.3 | 280.9 | ||||||||||||

| Payable metal in concentrate sold4 | 26,415 | 26,832 | 25,470 | 676,565 | - | - | ||||||||||||

| Realized price5,6 | 5,754 | 2,911 | 1,307 | 24.02 | - | - | ||||||||||||

| Realized price7 | 2.61 | 1.32 | - | - | - | - | ||||||||||||

| 1 |

Average realized price per unit sold may not calculate based on amounts presented in this table due to rounding. |

| 2 |

Revenue not derived from contracts represents mark-to-market adjustments on provisionally priced sales, realized and unrealized changes to fair value for non-hedge derivative contracts and adjustments to originally invoiced weights and assays. |

| 3 |

Derivative mark-to-market excludes mark-to-market on QP hedges. |

| 4 |

Copper and zinc shown in metric tonnes and gold and silver shown in ounces. |

| 5 |

Realized price for copper and zinc in $/metric tonne and realized price for gold and silver in $/oz. |

| 6 |

Gold and Silver realized prices for 2017 have been restated due to IFRS 15 impacts. Please refer to note 4 of the financial statements for further information. |

| 7 |

Realized price for copper and zinc in $/lb. |

The price, quantity and mix of metals sold affect our revenue, operating cash flow and profit. Revenue from metals sales can vary from quarter to quarter due to production levels, shipping volumes and transfer of control with customers.

19

![]()

Stream Sales

The following table shows stream sales included within realized prices and their respective deferred revenue and cash payment rates:

| Three months ended | |||||||||

| Mar. 31, 2018 | |||||||||

| Manitoba | Peru | ||||||||

| Gold | oz | 5,132 | 3,247 | ||||||

| Silver | oz | 152,906 | 574,392 | ||||||

| Gold deferred revenue drawdown rate1 | $/oz | 1,290 | 967 | ||||||

| Gold cash rate 2 | $/oz | 412 | 400 | ||||||

| Silver deferred revenue drawdown rate1 | $/oz | 24.95 | 21.79 | ||||||

| Silver cash rate 2 | $/oz | 6.08 | 5.90 | ||||||

| Three months ended | |||||||||

| Mar. 31, 2017 | |||||||||

| Manitoba | Peru | ||||||||

| Gold | oz | 6,286 | 2,048 | ||||||

| Silver | oz | 142,106 | 383,263 | ||||||

| Gold deferred revenue drawdown rate1 | $/oz | 1,280 | 1,013 | ||||||

| Gold cash rate 2 | $/oz | 408 | 400 | ||||||

| Silver deferred revenue drawdown rate1 | $/oz | 23.83 | 21.53 | ||||||

| Silver cash rate 2 | $/oz | 6.02 | 5.90 | ||||||

| 1 |

Deferred revenue amortization is recorded in Manitoba at C$1,635/oz and C$31.88/oz for gold and silver, respectively, (2016 - C$1,635/oz and C$31.88/oz) and converted to US dollars at the exchange rate in effect at the time of revenue recognition. |

| 2 |

The gold and silver cash rate for Manitoba increased by 1% from $400/oz and $5.90/oz effective August 1, 2015. Subsequently every year, on August 1, the cash rate will increase by 1% compounded. The weighted average cash rate is disclosed. |

The deferred revenue drawdown rates for gold and silver have been restated as a result of the implementation of IFRS 15, and 2017 comparatives have been restated accordingly. For additional information, refer to Note 4(d) of the consolidated interim financial statements.

20

![]()

Cost of sales

Our detailed cost of sales is summarized as follows:

| Three months ended | ||||||

| Mar. 31 | Mar. 31 | |||||

| (in $ thousands) | 2018 | 2017 | ||||

| (Restated) | ||||||

| Manitoba | ||||||

| Manitoba mines | 44,743 | 33,915 | ||||

| Manitoba concentrators | 13,088 | 13,138 | ||||

| Zinc plant | 18,834 | 16,606 | ||||

| Purchased ore (before inventory changes) | 7,528 | 3,401 | ||||

| Changes in domestic inventory | (9,444 | ) | 259 | |||

| Depreciation and amortization | 26,912 | 31,167 | ||||

| Freight and royalties | 10,309 | 10,287 | ||||

| G&A and other charges | 13,472 | 13,396 | ||||

| Total Manitoba cost of sales | 125,442 | 122,169 | ||||

| Peru | ||||||

| Mine | 23,838 | 13,288 | ||||

| Concentrator | 32,451 | 32,311 | ||||

| Changes in domestic inventory | (1,381 | ) | (17,558 | ) | ||

| Depreciation and amortization | 53,696 | 31,498 | ||||

| Freight, royalties and profit sharing | 14,383 | 9,954 | ||||

| G&A and other charges | 17,456 | 13,459 | ||||

| Total Peru cost of sales | 140,443 | 82,952 | ||||

| Cost of sales | 265,885 | 205,121 | ||||

Total cost of sales for the first quarter of 2018 was $265.9 million, an increase of $60.8 million from the first quarter of 2017.

Higher mining costs in Manitoba reflected higher mobile and fixed infrastructure maintenance costs and higher expensed development costs. Mining costs in Peru were affected by the addition of a fourth shift in accordance with the new three year collective bargaining agreement, as well as reduced capitalized stripping causing the transfer of mining costs from capital to operating expense. In addition, depreciation and amortization was higher due to the comparably lower depreciation charges in the first quarter of 2017 as a result of a build up of inventory at that time.

For details on unit operating costs refer to the respective tables in the Operations Review section beginning on page 7 of this MD&A.

For the first quarter of 2018, other significant variances in expenses, compared to the same period in 2017, include the following:

| − |

Selling and administrative expenses decreased by $4.6 million compared to the same period in 2017. The decrease was primarily due to lower stock based compensation charges as a result of the revaluation of previously issued shares to lower share prices during the current quarter compared to the same period last year. |

21

![]()

| − |

Other operating expenses were $7.8 million in the first quarter of 2018, an increase of $13.1 million compared to the same period in 2017. This is primarily due to the recognition of an obligation to deliver additional precious metal credits to Wheaton as a result of our expectation that mining at the Pampacancha deposit will not begin until 2019. Additionally in the first quarter of 2017, Hudbay recorded a recovery of $8.7 million for insurance proceeds related to the Constancia grinding line 2 failure in 2015. |

| − | Exploration expenses were $7.3 million in the first quarter of 2018, an increase of $5.4 million compared to the same period in 2017, reflecting our increased funding for brownfield and grassroots exploration in 2018. |

| − | Finance expenses decreased by $4.6 million compared to the same period in 2017. The reduction in costs is reflective of the full repayment of cash borrowings on our senior secured revolving credit facilities over the course of 2017. |

| − |

Other finance gains increased by $12.8 million compared to the same period in 2017. This increase is due to higher foreign exchange gains of $6.3 million compared to the same period last year which is a function of a weakening Canadian dollar benefiting certain Canadian monetary liabilities. In addition, there was a gain of $6.5 million arising mainly from a decrease in the fair value of our various financial instruments liabilities subject to fair value accounting. |

Tax Expense

For the three months ended March 31, 2018, tax expense increased by $17.0 million compared to the same period in 2017.

| Three months ended | ||||||

| Mar. 31 | Mar. 31 | |||||

| 2018 | 2017 | |||||

| (in $ thousands) | (Restated) | |||||

| Deferred tax expense / (recovery) - income tax 1 | 9,035 | 2,670 | ||||

| Deferred tax expense / (recovery) - mining tax 1 | (299 | ) | 764 | |||

| Total deferred tax expense / (recovery) | 8,736 | 3,434 | ||||

| Current tax expense - income tax | 15,979 | 7,028 | ||||

| Current tax expense - mining tax | 6,943 | 4,204 | ||||

| Total current tax expense | 22,922 | 11,232 | ||||

| Tax expense | 31,658 | 14,666 | ||||

| 1 |

Deferred expense / (recovery) represents our draw down/increase of non-cash deferred income and mining tax assets/liabilities. |

Income Tax Expense

For the first quarter of 2018, applying the estimated Canadian statutory income tax rate of 27.0% to our income before taxes of $73.1 million would have resulted in a tax expense of approximately $19.7 million; however, we recorded an income tax expense of $25.0 million (first quarter of 2017 - $9.7 million). The significant items causing our effective income tax rate to be different than the 27.0% estimated Canadian statutory income tax rate include:

| − | Certain deductible temporary differences with respect to our foreign operations are recorded using an income tax rate other than the Canadian statutory tax rate of 27.0%, resulting in an increase in deferred tax expense of $3.4 million; and |

| − | Increases in deferred tax expense of approximately $1.6 million due to the fact that certain Canadian non- monetary assets are recognized at historical cost while the tax bases of the assets change as exchange rates fluctuate, which rise to taxable temporary differences. |

22

![]()

Mining Tax Expense

Applying a Manitoba statutory mining tax rate of 10.0% to our income before taxes for the period of $73.1 million would have resulted in a tax expense of approximately $7.3 million and we recorded a mining tax expense of $6.6 million (first quarter of 2017 - $4.9 million). Effective mining tax rates can vary significantly based on the composition of our earnings and the expected amount of mining taxable profits. Corporate costs and other costs not related to mining operations are not deductible in computing mining profits. A brief description on how mining taxes are calculated in our various business units is discussed below.

Manitoba

The Province of Manitoba imposes mining tax on profit related to the sale of mineral products mined in the Province of Manitoba (mining taxable profit) at the following rates:

| − | 10% of total mining taxable profit if mining profit is $50 million or less; |

| − | 15% of total mining taxable profit if mining profits are between $55 million and $100 million; and |

| − | 17% of total mining taxable profit if mining profits exceed $105 million. |

We have accumulated mining tax pools over the years and recorded the related benefits as deferred mining tax assets. We estimate that the tax rate that will be applicable when temporary differences reverse will be approximately 10.0% .

Peru

The Peruvian government imposes two parallel mining tax regimes, the Special Mining Tax and Modified Royalty, on companies' operating mining income on a sliding scale, with progressive rates ranging from 2.0% to 8.4% and 1.0% to 12.0%, respectively. Based on financial forecasts, we have recorded a deferred tax liability as at March 31, 2018 at the tax rate we expect to apply when temporary differences reverse.

LIQUIDITY AND CAPITAL RESOURCES

Senior Secured Revolving Credit Facilities

We have two revolving credit facilities (the “Credit Facilities”) for our Canadian and Peruvian businesses, with combined total availability of $550 million and substantially similar terms and conditions. As at March 31, 2018, between our Credit Facilities we have drawn $132.8 million in letters of credit, leaving total undrawn availability of $417.2 million. As at March 31, 2018, we were in compliance with our covenants under the Credit Facilities.

23

![]()

Financial Condition

Financial Condition as at March 31, 2018 compared to December 31, 2017

Cash and cash equivalents increased by $36.3 million during the first quarter of 2018 to $392.8 million as at March 31, 2018. This increase was mainly a result of cash generated from operating activities of $131.4 million. This inflow was partly offset by $48.7 million of financing expenditures primarily driven by $37.4 million in interest paid on outstanding debt, and $46.0 million of capital investments primarily at our Peru and Manitoba operations. We hold the majority of our cash and cash equivalents in low-risk, liquid investments with major Canadian and Peruvian financial institutions.

In addition to the increased cash and cash equivalents position, working capital increased by $84.4 million to $335.8 million from December 31, 2017 to March 31, 2018, primarily due to the following factors:

| − | Inventories increased by $17.5 million as a result of the timing of zinc metal and concentrate shipments; |

| − | Trade and other payables decreased by $23.4 million primarily as a result of the timing of interest payments on our long term debt; |

| − | Other financial liabilities decreased by $19.9 million as a result of the marked to market value of non-hedge derivative liabilities used to manage certain price risks on outstanding provisionally priced receivables; partially offset by |

| − | Trade and other receivables decreased by $31.3 million, primarily as a result of the timing of cash receipts from customers; |

Cash Flows

The following table summarizes our cash flows for the three months ended March 31, 2018 and March 31, 2017:

| Three months ended | ||||||

| Mar. 31 | Mar. 31 | |||||

| 2018 | 2017 | |||||

| (in $ thousands) | (Restated) | |||||

| Profit (loss) for the period | 41,445 | (10,029 | ) | |||

| Tax expense | 31,658 | 14,666 | ||||

| Items not affecting cash | 73,168 | 80,640 | ||||

| Taxes paid | (14,480 | ) | (4,682 | ) | ||

| Operating cash flows before change in non-cash working capital | 131,791 | 80,595 | ||||

| Change in non-cash working capital | (429 | ) | 29,795 | |||

| Cash generated from operating activities | 131,362 | 110,390 | ||||

| Cash used in investing activities | (45,974 | ) | (40,284 | ) | ||

| Cash used in financing activities | (48,739 | ) | (84,602 | ) | ||

| Effect of movement in exchange rates on cash and cash equivalents | (352 | ) | 215 | |||

| Increase (decrease) in cash and cash equivalents | 36,297 | (14,281 | ) | |||

24

![]()

Cash Flow from Operating Activities

Operating cash flows before change in non-cash working capital were $131.8 million during the first quarter of 2018, reflecting an increase of $51.2 million compared to the first quarter of 2017, mainly as a result of higher realized overall metals sales prices, along with higher copper sales volumes.

Cash Flow from Investing and Financing Activities

During the first quarter of 2018, we used $94.7 million in investing and financing activities primarily driven by capital expenditures of $46.4 million and interest payments of $37.4 million.

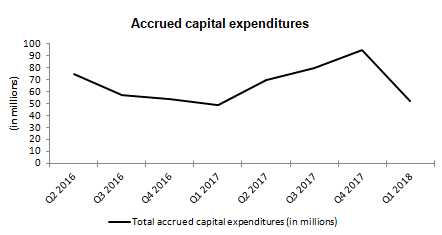

Capital Expenditures

The following summarizes accrued additions to capital assets and a reconciliation to cash additions to capital assets for the periods indicated:

| Three months ended | Guidance | ||||||||

| Mar. 31, | Mar. 31, | Annual | |||||||

| (in $ millions) | 2018 | 2017 | 2018 | ||||||

| Manitoba sustaining capital expenditures | 20.2 | 12.8 | 85.0 | ||||||

| Peru sustaining capital expenditures | 9.3 | 17.5 | 50.0 | ||||||

| Total sustaining capital expenditures | 29.5 | 30.3 | 135.0 | ||||||

| Arizona capitalized costs | 5.4 | 6.2 | 35.0 | ||||||

| Peru growth capital expenditures 1 | 1.4 | - | - | ||||||

| Manitoba growth capital expenditures | 8.6 | 1.7 | 20.0 | ||||||

| Other capitalized costs 2 | 3.2 | 6.7 | |||||||

| Capitalized exploration | 1.2 | 0.3 | 10.0 | ||||||

| Capitalized interest | 3.3 | 3.3 | |||||||

| Total other capitalized costs | 23.1 | 18.2 | |||||||

| Total accrued capital additions | 52.6 | 48.5 | |||||||

| Reconciliation to cash capital additions: | |||||||||

| Decommissioning and restoration obligation | (1.1 | ) | (5.8 | ) | |||||

| Capitalized interest | (3.3 | ) | (3.3 | ) | |||||

| Changes in capital accruals and other | (1.8 | ) | 1.2 | ||||||

| Total cash capital additions | 46.4 | 40.6 | |||||||

| 1 |

Initial 2018 guidance for Peru growth capital expenditures was $45.0 million. This included expenditures for developing the Pampacancha deposit and acquiring surface rights from the local community, which is now expected to be deferred to 2019. |

| 2 |

Other capitalized costs include decommissioning and restoration activities. |

Sustaining capital expenditures in Manitoba were higher in the first quarter of 2018 as compared to the same period in 2017 as a result of major equipment purchases and capital development at Lalor and 777.

Sustaining capital expenditures in Peru were lower in the first quarter of 2018 as compared to the same period in 2017 due to lower heavy civil works, mining equipment purchases and capitalized stripping costs in the current quarter.

Other capitalized costs include growth capital projects and decommissioning and restoration adjustments.

25

![]()

Capital Commitments

As at March 31, 2018, we had outstanding capital commitments in Canada of approximately $17.9 million primarily related to committed long-lead orders for the paste plant, of which approximately $1.8 million cannot be terminated by Hudbay; approximately $87.9 million in Peru related to sustaining capital costs, all of which can be terminated by Hudbay; and approximately $161.4 million in Arizona, primarily related to the Rosemont project and expected to be paid after the commencement of Rosemont construction, of which approximately $78.2 million cannot be terminated by Hudbay.

Contractual Obligations

The following table summarizes our contractual obligations as at March 31, 2018:

| Less than | 13 - 36 | 37 - 60 | More than | ||||||||||||

| Payment Schedule (in $ millions) | Total | 12 months | months | months | 60 months | ||||||||||

| Long-term debt obligations1 | 1,483.5 | 41.5 | 160.4 | 152.7 | 1,128.9 | ||||||||||

| Capital lease obligations | 87.5 | 21.4 | 41.3 | 24.8 | - | ||||||||||

| Operating lease obligations | 22.9 | 8.2 | 10.1 | 2.8 | 1.8 | ||||||||||

| Purchase obligation - capital commitments | 267.2 | 60.0 | 59.9 | 18.0 | 129.3 | ||||||||||

| Purchase obligation - other commitments2 | 549.9 | 121.3 | 186.8 | 113.9 | 127.9 | ||||||||||

| Pension and other employee future benefits obligations | 142.6 | 20.8 | 25.4 | 7.1 | 89.3 | ||||||||||

| Decommissioning and restoration obligations3 | 200.8 | 2.3 | 4.3 | 9.8 | 184.4 |

| 1 |

Long-term debt obligations include scheduled interest payments. |

| 2 |

Primarily made up of long-term agreements with operational suppliers, obligations for power purchase, concentrate handling, fleet and port services. |

| 3 |

Before inflation. |

Liquidity

As at March 31, 2018, we had total liquidity of approximately $810.0 million, including $392.8 million in cash and cash equivalents, as well as $417.2 million in availability under our Credit Facilities. We expect that our current liquidity and future cash flows will be sufficient to meet our obligations in the coming year.

26

![]()

Outstanding Share Data

As of May 1, 2018, there were 261,271,188 common shares of Hudbay issued and outstanding. In addition, Hudbay warrants to acquire an aggregate of 22,391,490 common shares of Hudbay were outstanding.

TREND ANALYSIS AND QUARTERLY REVIEW

The following table sets forth selected consolidated financial information for each of our eight most recently completed quarters:

| 2018 | 2017 | 2016 | ||||||||||||||||||||||

| (Restated) | (Restated) | |||||||||||||||||||||||

| (in $ millions) | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | ||||||||||||||||

| Revenue | 386.7 | 424.4 | 380.2 | 336.0 | 261.8 | 330.6 | 323.3 | 258.4 | ||||||||||||||||

| Gross margin | 120.8 | 145.0 | 119.6 | 88.0 | 56.6 | 91.1 | 79.2 | 58.7 | ||||||||||||||||

| Profit (loss) before tax | 73.1 | 79.6 | 53.8 | 34.9 | 4.6 | (31.9 | ) | 37.4 | 3.0 | |||||||||||||||

| Profit (loss) | 41.4 | 94.3 | 36.3 | 19.1 | (10.0 | ) | (52.6 | ) | 29.6 | (8.8 | ) | |||||||||||||

| Earnings (loss) per share: | ||||||||||||||||||||||||

| Basic and Diluted | 0.16 | 0.36 | 0.15 | 0.08 | (0.04 | ) | (0.22 | ) | 0.13 | (0.04 | ) | |||||||||||||

| Operating cash flow1 | 131.8 | 171.9 | 153.9 | 124.1 | 80.6 | 122.3 | 123.9 | 69.8 | ||||||||||||||||

| 1 |

Operating cash flow before changes in non-cash working capital |

Revenue decreased in the first quarter of 2018 compared to the fourth quarter of 2017, mainly due to a decrease in copper, gold and zinc sales volumes, offset by higher realized metal prices which continue to be a key factor in the improvement of gross profit and operating cash flow compared to prior quarters.

Profit after tax was lower in the first quarter of 2018 compared to the fourth quarter of 2017 mainly due to a $45.4 million non-recurring deferred tax adjustment in the fourth quarter, primarily as a result of the changes in U.S tax legislation.

For information on previous trends and quarterly reviews, refer to our MD&A dated February 21, 2018.

NON-IFRS FINANCIAL PERFORMANCE MEASURES

Net debt is shown because it is a performance measure used by the Company to assess our financial position. Cash cost, sustaining and all-in sustaining cash cost per pound of copper produced are shown because we believe they help investors and management assess the performance of our operations, including the margin generated by the operations and the company. Cash cost and sustaining cash cost per pound of zinc produced are shown because we believe they help investors and management assess the performance of our Manitoba operations. These measures do not have a meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS and are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate these measures differently.

27

![]()

Net Debt

The following table presents our calculation of net debt as at March 31, 2018 and December 31, 2017:

| Mar. 31 | Dec. 31 | |||||

| (in $ thousands) | 2018 | 2017 | ||||

| Total long-term debt | $ | 978,190 | $ | 979,575 | ||

| Cash and cash equivalents | (392,796 | ) | (356,499 | ) | ||

| Net Debt | $ | 585,394 | $ | 623,076 |

Cash Cost, Sustaining and All-in Sustaining Cash Cost (Copper Basis)

Cash cost per pound of copper produced (“cash cost”) is a non-IFRS measure that management uses as a key performance indicator to assess the performance of our operations. Our calculation designates copper as our primary metal of production as it has been the largest component of revenues. The calculation is presented in four manners:

| − |

Cash cost, before by-product credits - This measure is gross of by-product revenues and is a function of the efforts and costs incurred to mine and process all ore mined. However, the measure divides this aggregate cost over only pounds of copper produced, our primary metal of production. This measure is generally less volatile from period to period, as it is not affected by changes in the price received for by-product metals. It is, however, significantly affected by the relative mix of copper concentrate and finished zinc production, where the sale of the zinc will occur later, and an increase in production of zinc metal will tend to result in an increase in cash cost under this measure. |

| − |

Cash cost, net of by-product credits - In order to calculate the net cost to produce and sell copper, the net of by-product credits measure subtracts the revenues realized from the sale of the metals other than copper. The by-product revenues from zinc, gold, and silver are significant and are integral to the economics of our operations. The economics that support our decision to produce and sell copper would be different if we did not receive revenues from the other significant metals being extracted and processed. This measure provides management and investors with an indication of the minimum copper price consistent with positive operating cash flow and operating margins, assuming realized by-product metal prices are consistent with those prevailing during the reporting period. It also serves as an important operating statistic that management and investors utilize to measure our operating performance versus that of our competitors. However, it is important to understand that if by-product metal prices decline alongside copper prices, the cash cost net of by-product credits would increase, requiring a higher copper price than that reported to maintain positive cash flows and operating margins. |

| − |

Sustaining cash cost, net of by-product credits - This measure is an extension of cash cost that includes sustaining capital expenditures, capitalized exploration and net smelter returns royalties. It does not include corporate selling and administrative expenses. It provides a more fulsome measurement of the cost of sustaining production than cash cost, which is focused on operating costs only. |

| − |

All-in sustaining cash cost, net of by-product credits - This measure is an extension of sustaining cash cost that includes corporate G&A. Due to the inclusion of corporate selling and administrative expenses, all-in sustaining cash cost is presented on a consolidated basis only. |

The tables below present a detailed build-up of cash cost and sustaining cash cost, net of by-product credits, by business unit in addition to consolidated all-in sustaining cash cost, net of by-product credits, and reconciliations between cash cost, net of by-product credits, to the most comparable IFRS measures of cost of sales for the three months ended March 31, 2018 and 2017. Cash cost, net of by-product credits may not calculate exactly based on amounts presented in the tables below due to rounding.

28

![]()

| Consolidated | Three months ended | |||||

| Net pounds of copper produced | ||||||

| (in thousands) | Mar. 31, 2018 | Mar. 31, 2017 | ||||

| Manitoba | 16,876 | 16,579 | ||||

| Peru | 69,559 | 59,990 | ||||

| Net pounds of copper produced | 86,435 | 76,569 | ||||

| Consolidated | Three months ended | |||||||||||

| Mar. 31, 2018 | Mar. 31, 2017 | |||||||||||

| Cash cost per pound of copper produced | $000s | $/lb | $000s | $/lb | ||||||||

| Cash cost, before by-product credits | 216,159 | 2.50 | 173,986 | 2.27 | ||||||||

| By-product credits | (131,077 | ) | (1.52 | ) | (106,801 | ) | (1.39 | ) | ||||

| Cash cost, net of by-product credits | 85,082 | 0.98 | 67,185 | 0.88 | ||||||||

| Consolidated | Three months ended | |||||||||||

| Mar. 31, 2018 | Mar. 31, 2017 | |||||||||||

| Supplementary cash cost information | $000s | $/lb 1 | $000s | $/lb 1 | ||||||||

| By-product credits: | ||||||||||||

| Zinc | 91,261 | 1.06 | 77,851 | 1.02 | ||||||||

| Gold | 36,563 | 0.42 | 33,279 | 0.43 | ||||||||

| Silver | 24,250 | 0.28 | 16,251 | 0.21 | ||||||||

| Other | 4,939 | 0.06 | 1,178 | 0.02 | ||||||||

| Total by-product credits | 157,013 | 1.82 | 128,559 | 1.68 | ||||||||

| Less: deferred revenue | (25,936 | ) | (0.30 | ) | (21,758 | ) | (0.28 | ) | ||||

| Total by-product credits | 131,077 | 1.52 | 106,801 | 1.39 | ||||||||

| Reconciliation to IFRS: | ||||||||||||

| Cash cost, net of by-product credits | 85,082 | 67,185 | ||||||||||

| By-product credits | 157,013 | 128,559 | ||||||||||

| Change in deferred revenues | (25,936 | ) | (21,758 | ) | ||||||||

| Treatment and refining charges | (24,103 | ) | (18,789 | ) | ||||||||

| Share-based payment | 17 | 438 | ||||||||||

| Adjustments related to inventory writedown | 161 | 803 | ||||||||||

| Change in product inventory | (10,825 | ) | (17,299 | ) | ||||||||

| Royalties | 3,868 | 3,317 | ||||||||||

| Depreciation and amortization 2 | 80,608 | 62,665 | ||||||||||

| Cost of sales | 265,885 | 205,121 | ||||||||||

| 1 |

Per pound of copper produced. |

| 2 |

Depreciation is based on concentrate sold. |

29

![]()

Peru Cash Cost

| Peru | Three months ended | |||||

| (in thousands) | Mar. 31, 2018 | Mar. 31, 2017 | ||||

| Net pounds of copper produced1 | 69,559 | 59,990 | ||||

| 1 |

Contained copper in concentrate. |

| Peru | Three months ended | |||||||||||

| Mar. 31, 2018 | Mar. 31, 2017 | |||||||||||

| Cash cost per pound of copper produced | $000s | $/lb | $000s | $/lb | ||||||||

| Mining | 23,838 | 0.34 | 13,288 | 0.22 | ||||||||

| Milling | 32,451 | 0.47 | 32,311 | 0.54 | ||||||||

| G&A | 17,285 | 0.25 | 12,585 | 0.21 | ||||||||

| Onsite costs | 73,574 | 1.06 | 58,184 | 0.97 | ||||||||

| Treatment & refining | 16,251 | 0.23 | 11,251 | 0.19 | ||||||||

| Freight & other | 12,944 | 0.19 | 9,093 | 0.15 | ||||||||

| Cash cost, before by-product credits | 102,769 | 1.48 | 78,528 | 1.31 | ||||||||

| By-product credits | (11,241 | ) | (0.16 | ) | (399 | ) | (0.01 | ) | ||||

| Cash cost, net of by-product credits | 91,528 | 1.32 | 78,129 | 1.30 | ||||||||

| Peru | Three months ended | |||||||||||

| Mar. 31, 2018 | Mar. 31, 2017 | |||||||||||

| Supplementary cash cost information | $000s | $/lb 1 | $000s | $/lb 1 | ||||||||

| By-product credits: | ||||||||||||

| Gold | 5,294 | 0.08 | 1,137 | 0.02 | ||||||||

| Silver | 17,505 | 0.25 | 9,588 | 0.16 | ||||||||

| Other | 3,944 | 0.06 | - | - | ||||||||

| Total by-product credits | 26,743 | 0.39 | 10,725 | 0.18 | ||||||||

| Less: deferred revenue | (15,502 | ) | (0.23 | ) | (10,326 | ) | (0.17 | ) | ||||

| Total by-product credits | 11,241 | 0.16 | 399 | 0.01 | ||||||||

| Reconciliation to IFRS: | ||||||||||||

| Cash cost, net of by-product credits | 91,528 | 78,129 | ||||||||||

| By-product credits | 26,743 | 10,725 | ||||||||||

| Change in deferred revenues | (15,502 | ) | (10,326 | ) | ||||||||

| Treatment and refining charges | (16,251 | ) | (11,251 | ) | ||||||||

| Share-based payment | 10 | 71 | ||||||||||

| Adjustments related to inventory writedown | 161 | 803 | ||||||||||

| Change in product inventory | (1,381 | ) | (17,558 | ) | ||||||||

| Royalties | 1,439 | 861 | ||||||||||

| Depreciation and amortization 2 | 53,696 | 31,498 | ||||||||||

| Cost of sales | 140,443 | 82,952 | ||||||||||

| 1 |

Per pound of copper produced. |

| 2 |

Depreciation is based on concentrate sold. |

30

![]()

Manitoba Cash Cost

| Manitoba | Three months ended | |||||

| (in thousands) | Mar. 31, 2018 | Mar. 31, 2017 | ||||

| Net pounds of copper produced1 | 16,876 | 16,579 | ||||

| 1 |

Contained copper in concentrate. |

| Manitoba | Three months ended | |||||||||||

| Mar. 31, 2018 | Mar. 31, 2017 | |||||||||||

| Cash cost per pound of copper produced | $000s | $/lb | $000s | $/lb | ||||||||

| Mining | 44,743 | 2.65 | 33,915 | 2.05 | ||||||||

| Milling | 13,088 | 0.78 | 13,138 | 0.79 | ||||||||

| Refining (zinc) | 18,834 | 1.12 | 16,606 | 1.00 | ||||||||

| G&A | 13,465 | 0.80 | 13,029 | 0.79 | ||||||||

| Purchased ore | 7,528 | 0.45 | 3,401 | 0.21 | ||||||||

| Onsite costs | 97,658 | 5.79 | 80,089 | 4.83 | ||||||||

| Treatment & refining | 7,852 | 0.47 | 7,538 | 0.45 | ||||||||

| Freight & other | 7,880 | 0.47 | 7,831 | 0.47 | ||||||||

| Cash cost, before by-product credits | 113,390 | 6.72 | 95,458 | 5.76 | ||||||||

| By-product credits | (119,836 | ) | (7.10 | ) | (106,402 | ) | (6.42 | ) | ||||

| Cash cost, net of by-product credits | (6,446 | ) | (0.38 | ) | (10,944 | ) | (0.66 | ) | ||||

31

![]()

| Manitoba | Three months ended | |||||||||||

| Mar. 31, 2018 | Mar. 31, 2017 | |||||||||||

| Supplementary cash cost information | $000s | $/lb 1 | $000s | $/lb 1 | ||||||||

| By-product credits: | ||||||||||||

| Zinc | 91,261 | 5.41 | 77,851 | 4.70 | ||||||||

| Gold | 31,269 | 1.85 | 32,142 | 1.94 | ||||||||

| Silver | 6,745 | 0.40 | 6,663 | 0.40 | ||||||||

| Other | 995 | 0.06 | 1,178 | 0.07 | ||||||||

| Total by-product credits | 130,270 | 7.72 | 117,834 | 7.11 | ||||||||

| Less: deferred revenue | (10,434 | ) | (0.62 | ) | (11,432 | ) | (0.69 | ) | ||||

| Total by-product credits | 119,836 | 7.10 | 106,402 | 6.42 | ||||||||

| Reconciliation to IFRS: | ||||||||||||

| Cash cost, net of by-product credits | (6,446 | ) | (10,944 | ) | ||||||||

| By-product credits | 130,270 | 117,834 | ||||||||||

| Change in deferred revenues | (10,434 | ) | (11,432 | ) | ||||||||

| Treatment and refining charges | (7,852 | ) | (7,538 | ) | ||||||||

| Share-based payment | 7 | 367 | ||||||||||

| Adjustments related to inventory writedown | - | - | ||||||||||

| Change in product inventory | (9,444 | ) | 259 | |||||||||

| Royalties | 2,429 | 2,456 | ||||||||||

| Depreciation and amortization 2 | 26,912 | 31,167 | ||||||||||

| Cost of sales | 125,442 | 122,169 | ||||||||||

| 1 |

Per pound of copper produced. |

| 2 |

Depreciation is based on concentrate and metal sold |

| Consolidated | Three months ended | |||||||||||

| Mar. 31, 2018 | Mar. 31, 2017 | |||||||||||

| All-in sustaining cash cost per pound of copper produced | $000s | $/lb | $000s | $/lb | ||||||||

| Cash cost, net by-product credits | 85,082 | 0.98 | 67,185 | 0.88 | ||||||||

| Sustaining capital expenditures | 29,426 | 0.34 | 30,354 | 0.40 | ||||||||

| Capitalized exploration | 1,211 | 0.01 | 326 | - | ||||||||

| Royalties | 3,868 | 0.04 | 3,317 | 0.04 | ||||||||

| Sustaining cash cost, net of by-product credits | 119,587 | 1.38 | 101,182 | 1.32 | ||||||||

| Corporate G&A | 5,715 | 0.07 | 10,285 | 0.14 | ||||||||

| All-in sustaining cash cost, net of by-product credits | 125,302 | 1.45 | 111,467 | 1.46 | ||||||||

32

![]()

| Peru | Three months ended | |||||||||||

| Mar. 31, 2018 | Mar. 31, 2017 | |||||||||||

| Sustaining cash cost per pound of copper produced | $000s | $/lb | $000s | $/lb | ||||||||

| Cash cost, net by-product credits | 91,528 | 1.32 | 78,129 | 1.30 | ||||||||

| Sustaining capital expenditures | 9,264 | 0.13 | 17,508 | 0.29 | ||||||||

| Royalties | 1,439 | 0.02 | 861 | 0.01 | ||||||||

| Sustaining cash cost, net of by-product credits | 102,231 | 1.47 | 96,498 | 1.61 | ||||||||

| Manitoba | Three months ended | |||||||||||

| Mar. 31, 2018 | Mar. 31, 2017 | |||||||||||

| Sustaining cash cost per pound of copper produced | $000s | $/lb | $000s | $/lb | ||||||||

| Cash cost, net by-product credits | (6,446 | ) | (0.38 | ) | (10,944 | ) | (0.66 | ) | ||||

| Sustaining capital expenditures | 20,162 | 1.20 | 12,846 | 0.77 | ||||||||

| Capital exploration | 1,211 | 0.07 | 326 | 0.02 | ||||||||

| Royalties | 2,429 | 0.14 | 2,456 | 0.15 | ||||||||

| Sustaining cash cost, net of by-product credits | 17,356 | 1.03 | 4,684 | 0.28 | ||||||||

Zinc Cash Cost and Zinc Sustaining Cash Cost

Cash cost per pound of zinc produced (“zinc cash cost”) is a non-IFRS measure that management uses as a key performance indicator to assess the performance of our Manitoba operations. This alternative cash cost calculation designates zinc as our primary metal of production as it is becoming the largest component of revenues for our Manitoba business unit, and should therefore be less volatile over time than Manitoba cash cost per pound of copper. The calculation is presented in three manners:

| − |

Zinc cash cost, before by-product credits - This measure is gross of by-product revenues and is a function of the efforts and costs incurred to mine and process all ore mined. However, the measure divides this aggregate cost over only pounds of zinc produced, our primary metal of production. This measure is generally less volatile from period to period, as it is not affected by changes in the price received for by-product metals. It is, however, significantly affected by the relative mix of copper concentrate and finished zinc production, where the sale of the copper will occur later, and an increase in production of copper metal will tend to result in an increase in zinc cash cost under this measure. |

| − |