UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER

REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21749

CRM Mutual Fund Trust

(Exact

name of registrant as specified in charter)

c/o Cramer

Rosenthal McGlynn, LLC.

300 First

Stamford Place, Suite 440

Stamford, CT 06902

(Address

of principal executive offices) (Zip code)

Corporation

Service Company

2711 Centerville

Road Suite 400

Wilmington,

DE 19808

(Name

and address of agent for service)

Copy to:

Lea Anne

Copenhefer

Morgan,

Lewis & Bockius LLP

One Federal

Street

Boston,

MA 02110

Registrant’s telephone number, including area code: 212-326-5300

Date of fiscal year end: June 30

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

(a)

0001322252falseN-CSRCRM Mutual Fund TrustN-1A2024-06-300001322252cmft:C000037909Member2023-07-012024-06-3000013222522023-07-012024-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2014-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2014-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2015-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2015-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2016-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2016-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2017-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2017-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2018-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2018-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2019-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2019-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2020-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2020-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2021-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2021-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2022-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2022-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2023-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2023-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2024-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2024-06-300001322252cmft:C000037909Memberoef:WithoutSalesLoadMember2023-07-012024-06-300001322252cmft:C000037909Memberoef:WithoutSalesLoadMember2019-07-012024-06-300001322252cmft:C000037909Memberoef:WithoutSalesLoadMember2014-07-012024-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2023-07-012024-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2019-07-012024-06-300001322252cmft:Russell3000TotalReturn2134BroadBasedIndexMember2014-07-012024-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2023-07-012024-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2019-07-012024-06-300001322252cmft:Russell3000ValueTotalReturn2134AdditionalIndexMember2014-07-012024-06-300001322252cmft:C000037909Member2024-06-300001322252cmft:C000037909Membercmft:InvestmentTypeCollateralforSecuritiesLoanedCTIMember2024-06-300001322252cmft:C000037909Membercmft:InvestmentTypeCommonStocksCTIMember2024-06-300001322252cmft:C000037909Membercmft:InvestmentTypeMoneyMarketFundsCTIMember2024-06-300001322252cmft:C000037909Membercmft:RepurchaseAgreementsSectorMember2024-06-300001322252cmft:C000037909Memberoef:ConsumerStaplesSectorMember2024-06-300001322252cmft:C000037909Memberoef:UtilitiesSectorMember2024-06-300001322252cmft:C000037909Membercmft:MoneyMarketFundsSectorMember2024-06-300001322252cmft:C000037909Memberus-gaap:EnergySectorMember2024-06-300001322252cmft:C000037909Memberoef:ConsumerDiscretionarySectorMember2024-06-300001322252cmft:C000037909Memberus-gaap:RealEstateSectorMember2024-06-300001322252cmft:C000037909Memberus-gaap:HealthcareSectorMember2024-06-300001322252cmft:C000037909Membercmft:IndustrialsSectorMember2024-06-300001322252cmft:C000037909Memberoef:MaterialsSectorMember2024-06-300001322252cmft:C000037909Membercmft:FinancialsSectorMember2024-06-300001322252cmft:C000037909Memberus-gaap:TechnologySectorMember2024-06-300001322252cmft:C000037909Membercmft:A31620M106CTIMember2024-06-300001322252cmft:C000037909Membercmft:A565849106CTIMember2024-06-300001322252cmft:C000037909Membercmft:A88146M101CTIMember2024-06-300001322252cmft:C000037909Membercmft:G25508105CTIMember2024-06-300001322252cmft:C000037909Membercmft:A866674104CTIMember2024-06-300001322252cmft:C000037909Membercmft:A15872M104CTIMember2024-06-300001322252cmft:C000037909Membercmft:A122017106CTIMember2024-06-300001322252cmft:C000037909Membercmft:A00790R104CTIMember2024-06-300001322252cmft:C000037909Membercmft:A09062W204CTIMember2024-06-300001322252cmft:C000037909Membercmft:A69370C100CTIMember2024-06-300001322252cmft:C000037908Member2023-07-012024-06-300001322252cmft:C000037908Member2013-07-012014-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2013-07-012014-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2013-07-012014-06-300001322252cmft:C000037908Member2014-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2014-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2014-06-300001322252cmft:C000037908Member2015-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2015-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2015-06-300001322252cmft:C000037908Member2016-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2016-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2016-06-300001322252cmft:C000037908Member2017-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2017-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2017-06-300001322252cmft:C000037908Member2018-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2018-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2018-06-300001322252cmft:C000037908Member2019-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2019-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2019-06-300001322252cmft:C000037908Member2020-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2020-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2020-06-300001322252cmft:C000037908Member2021-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2021-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2021-06-300001322252cmft:C000037908Member2022-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2022-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2022-06-300001322252cmft:C000037908Member2023-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2023-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2023-06-300001322252cmft:C000037908Member2024-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2024-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2024-06-300001322252cmft:C000037908Memberoef:WithoutSalesLoadMember2023-07-012024-06-300001322252cmft:C000037908Memberoef:WithoutSalesLoadMember2019-07-012024-06-300001322252cmft:C000037908Memberoef:WithoutSalesLoadMember2014-07-012024-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2023-07-012024-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2019-07-012024-06-300001322252cmft:Russell3000TotalReturn2115BroadBasedIndexMember2014-07-012024-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2023-07-012024-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2019-07-012024-06-300001322252cmft:Russell3000ValueTotalReturn2115AdditionalIndexMember2014-07-012024-06-300001322252cmft:C000037908Membercmft:InvestmentTypeCollateralforSecuritiesLoanedCTIMember2024-06-300001322252cmft:C000037908Membercmft:InvestmentTypeCommonStocksCTIMember2024-06-300001322252cmft:C000037908Membercmft:InvestmentTypeMoneyMarketFundsCTIMember2024-06-300001322252cmft:C000037908Membercmft:RepurchaseAgreementsSectorMember2024-06-300001322252cmft:C000037908Memberoef:ConsumerStaplesSectorMember2024-06-300001322252cmft:C000037908Memberoef:UtilitiesSectorMember2024-06-300001322252cmft:C000037908Membercmft:MoneyMarketFundsSectorMember2024-06-300001322252cmft:C000037908Memberus-gaap:EnergySectorMember2024-06-300001322252cmft:C000037908Memberoef:ConsumerDiscretionarySectorMember2024-06-300001322252cmft:C000037908Memberus-gaap:RealEstateSectorMember2024-06-300001322252cmft:C000037908Memberus-gaap:HealthcareSectorMember2024-06-300001322252cmft:C000037908Membercmft:IndustrialsSectorMember2024-06-300001322252cmft:C000037908Memberoef:MaterialsSectorMember2024-06-300001322252cmft:C000037908Membercmft:FinancialsSectorMember2024-06-300001322252cmft:C000037908Memberus-gaap:TechnologySectorMember2024-06-300001322252cmft:C000037908Membercmft:A31620M106CTIMember2024-06-300001322252cmft:C000037908Membercmft:A565849106CTIMember2024-06-300001322252cmft:C000037908Membercmft:A88146M101CTIMember2024-06-300001322252cmft:C000037908Membercmft:G25508105CTIMember2024-06-300001322252cmft:C000037908Membercmft:A866674104CTIMember2024-06-300001322252cmft:C000037908Membercmft:A15872M104CTIMember2024-06-300001322252cmft:C000037908Membercmft:A122017106CTIMember2024-06-300001322252cmft:C000037908Membercmft:A00790R104CTIMember2024-06-300001322252cmft:C000037908Membercmft:A09062W204CTIMember2024-06-300001322252cmft:C000037908Membercmft:A69370C100CTIMember2024-06-300001322252cmft:C000171454Member2023-07-012024-06-300001322252cmft:C000171454Member2014-07-012024-06-300001322252cmft:C000171454Memberoef:WithoutSalesLoadMember2023-07-012024-06-300001322252cmft:C000171454Memberoef:WithoutSalesLoadMember2019-07-012024-06-300001322252cmft:C000171454Memberoef:WithoutSalesLoadMember2016-08-162024-06-300001322252cmft:SP500Index2128BroadBasedIndexMember2023-07-012024-06-300001322252cmft:SP500Index2128BroadBasedIndexMember2019-07-012024-06-300001322252cmft:SP500Index2128BroadBasedIndexMember2016-08-162024-06-300001322252cmft:C000171454Member2024-06-300001322252cmft:C000171454Membercmft:InvestmentTypeCommonStocksCTIMember2024-06-300001322252cmft:C000171454Membercmft:InvestmentTypeExchangeMinusTradedFundsCTIMember2024-06-300001322252cmft:C000171454Membercmft:InvestmentTypeMoneyMarketFundsCTIMember2024-06-300001322252cmft:C000171454Memberoef:ConsumerStaplesSectorMember2024-06-300001322252cmft:C000171454Memberus-gaap:EnergySectorMember2024-06-300001322252cmft:C000171454Memberoef:CommunicationsSectorMember2024-06-300001322252cmft:C000171454Memberus-gaap:HealthcareSectorMember2024-06-300001322252cmft:C000171454Membercmft:EquityFundSectorMember2024-06-300001322252cmft:C000171454Memberus-gaap:RealEstateSectorMember2024-06-300001322252cmft:C000171454Membercmft:FinancialsSectorMember2024-06-300001322252cmft:C000171454Memberoef:UtilitiesSectorMember2024-06-300001322252cmft:C000171454Memberoef:MaterialsSectorMember2024-06-300001322252cmft:C000171454Memberus-gaap:TechnologySectorMember2024-06-300001322252cmft:C000171454Memberoef:ConsumerDiscretionarySectorMember2024-06-300001322252cmft:C000171454Membercmft:MoneyMarketFundsSectorMember2024-06-300001322252cmft:C000171454Membercmft:IndustrialsSectorMember2024-06-300001322252cmft:C000171454Membercmft:BlackrockLiquidityFundsTMinusFundCTIMember2024-06-300001322252cmft:C000171454Membercmft:FederatedHermesTreasuryObligationsFundCTIMember2024-06-300001322252cmft:C000171454Membercmft:ArcosaIncCTIMember2024-06-300001322252cmft:C000171454Membercmft:BurlingtonStoresIncCTIMember2024-06-300001322252cmft:C000171454Membercmft:CanadianPacificKansasCityLtdCTIMember2024-06-300001322252cmft:C000171454Membercmft:CleanHarborsIncCTIMember2024-06-300001322252cmft:C000171454Membercmft:ItronIncCTIMember2024-06-300001322252cmft:C000171454Membercmft:NextEraEnergyIncCTIMember2024-06-300001322252cmft:C000171454Membercmft:SkylineChampionCorporationCTIMember2024-06-300001322252cmft:C000171454Membercmft:DigitalRealtyTrustIncCTIMember2024-06-300001322252cmft:C000003538Member2023-07-012024-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2014-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2014-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2015-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2015-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2016-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2016-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2017-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2017-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2018-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2018-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2019-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2019-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2020-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2020-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2021-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2021-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2022-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2022-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2023-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2023-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2024-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2024-06-300001322252cmft:C000003538Memberoef:WithoutSalesLoadMember2023-07-012024-06-300001322252cmft:C000003538Memberoef:WithoutSalesLoadMember2019-07-012024-06-300001322252cmft:C000003538Memberoef:WithoutSalesLoadMember2014-07-012024-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2023-07-012024-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2019-07-012024-06-300001322252cmft:RussellMidcapValueTotalReturn2123AdditionalIndexMember2014-07-012024-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2023-07-012024-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2019-07-012024-06-300001322252cmft:Russell3000TotalReturn2123BroadBasedIndexMember2014-07-012024-06-300001322252cmft:C000003538Member2024-06-300001322252cmft:C000003538Membercmft:InvestmentTypeCollateralforSecuritiesLoanedCTIMember2024-06-300001322252cmft:C000003538Membercmft:InvestmentTypeCommonStocksCTIMember2024-06-300001322252cmft:C000003538Membercmft:InvestmentTypeMoneyMarketFundsCTIMember2024-06-300001322252cmft:C000003538Membercmft:RepurchaseAgreementsSectorMember2024-06-300001322252cmft:C000003538Membercmft:CollateralforSecuritiesLoanedSectorMember2024-06-300001322252cmft:C000003538Membercmft:MoneyMarketFundsSectorMember2024-06-300001322252cmft:C000003538Memberus-gaap:HealthcareSectorMember2024-06-300001322252cmft:C000003538Memberoef:UtilitiesSectorMember2024-06-300001322252cmft:C000003538Memberus-gaap:EnergySectorMember2024-06-300001322252cmft:C000003538Memberoef:ConsumerDiscretionarySectorMember2024-06-300001322252cmft:C000003538Memberus-gaap:RealEstateSectorMember2024-06-300001322252cmft:C000003538Membercmft:FinancialsSectorMember2024-06-300001322252cmft:C000003538Memberus-gaap:TechnologySectorMember2024-06-300001322252cmft:C000003538Memberoef:MaterialsSectorMember2024-06-300001322252cmft:C000003538Membercmft:IndustrialsSectorMember2024-06-300001322252cmft:C000003538Membercmft:FidelityNationalInformationServicesIncCTIMember2024-06-300001322252cmft:C000003538Membercmft:VontierCorporationCTIMember2024-06-300001322252cmft:C000003538Membercmft:ChampionXCorporationCTIMember2024-06-300001322252cmft:C000003538Membercmft:BurlingtonStoresIncCTIMember2024-06-300001322252cmft:C000003538Membercmft:NisourceIncCTIMember2024-06-300001322252cmft:C000003538Membercmft:TerrenoRealtyCorporationCTIMember2024-06-300001322252cmft:C000003538Membercmft:WoodwardIncCTIMember2024-06-300001322252cmft:C000003538Membercmft:MartinMariettaMaterialsIncCTIMember2024-06-300001322252cmft:C000003538Membercmft:CanadianPacificKansasCityLtdCTIMember2024-06-300001322252cmft:C000003538Membercmft:AshlandIncCTIMember2024-06-300001322252cmft:C000003539Member2023-07-012024-06-300001322252cmft:C000003539Member2013-07-012014-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2013-07-012014-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2013-07-012014-06-300001322252cmft:C000003539Member2014-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2014-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2014-06-300001322252cmft:C000003539Member2015-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2015-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2015-06-300001322252cmft:C000003539Member2016-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2016-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2016-06-300001322252cmft:C000003539Member2017-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2017-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2017-06-300001322252cmft:C000003539Member2018-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2018-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2018-06-300001322252cmft:C000003539Member2019-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2019-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2019-06-300001322252cmft:C000003539Member2020-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2020-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2020-06-300001322252cmft:C000003539Member2021-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2021-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2021-06-300001322252cmft:C000003539Member2022-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2022-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2022-06-300001322252cmft:C000003539Member2023-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2023-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2023-06-300001322252cmft:C000003539Member2024-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2024-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2024-06-300001322252cmft:C000003539Memberoef:WithoutSalesLoadMember2023-07-012024-06-300001322252cmft:C000003539Memberoef:WithoutSalesLoadMember2019-07-012024-06-300001322252cmft:C000003539Memberoef:WithoutSalesLoadMember2014-07-012024-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2023-07-012024-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2019-07-012024-06-300001322252cmft:RussellMidcapValueTotalReturn2124AdditionalIndexMember2014-07-012024-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2023-07-012024-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2019-07-012024-06-300001322252cmft:Russell3000TotalReturn2124BroadBasedIndexMember2014-07-012024-06-300001322252cmft:C000003539Membercmft:InvestmentTypeCollateralforSecuritiesLoanedCTIMember2024-06-300001322252cmft:C000003539Membercmft:InvestmentTypeCommonStocksCTIMember2024-06-300001322252cmft:C000003539Membercmft:InvestmentTypeMoneyMarketFundsCTIMember2024-06-300001322252cmft:C000003539Membercmft:RepurchaseAgreementsSectorMember2024-06-300001322252cmft:C000003539Membercmft:CollateralforSecuritiesLoanedSectorMember2024-06-300001322252cmft:C000003539Membercmft:MoneyMarketFundsSectorMember2024-06-300001322252cmft:C000003539Memberus-gaap:HealthcareSectorMember2024-06-300001322252cmft:C000003539Memberoef:UtilitiesSectorMember2024-06-300001322252cmft:C000003539Memberus-gaap:EnergySectorMember2024-06-300001322252cmft:C000003539Memberoef:ConsumerDiscretionarySectorMember2024-06-300001322252cmft:C000003539Memberus-gaap:RealEstateSectorMember2024-06-300001322252cmft:C000003539Membercmft:FinancialsSectorMember2024-06-300001322252cmft:C000003539Memberus-gaap:TechnologySectorMember2024-06-300001322252cmft:C000003539Memberoef:MaterialsSectorMember2024-06-300001322252cmft:C000003539Membercmft:IndustrialsSectorMember2024-06-300001322252cmft:C000003539Membercmft:FidelityNationalInformationServicesIncCTIMember2024-06-300001322252cmft:C000003539Membercmft:VontierCorporationCTIMember2024-06-300001322252cmft:C000003539Membercmft:ChampionXCorporationCTIMember2024-06-300001322252cmft:C000003539Membercmft:BurlingtonStoresIncCTIMember2024-06-300001322252cmft:C000003539Membercmft:NisourceIncCTIMember2024-06-300001322252cmft:C000003539Membercmft:TerrenoRealtyCorporationCTIMember2024-06-300001322252cmft:C000003539Membercmft:WoodwardIncCTIMember2024-06-300001322252cmft:C000003539Membercmft:MartinMariettaMaterialsIncCTIMember2024-06-300001322252cmft:C000003539Membercmft:CanadianPacificKansasCityLtdCTIMember2024-06-300001322252cmft:C000003539Membercmft:AshlandIncCTIMember2024-06-300001322252cmft:C000003540Member2023-07-012024-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2014-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2014-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2015-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2015-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2016-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2016-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2017-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2017-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2018-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2018-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2019-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2019-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2020-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2020-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2021-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2021-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2022-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2022-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2023-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2023-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2024-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2024-06-300001322252cmft:C000003540Memberoef:WithoutSalesLoadMember2023-07-012024-06-300001322252cmft:C000003540Memberoef:WithoutSalesLoadMember2019-07-012024-06-300001322252cmft:C000003540Memberoef:WithoutSalesLoadMember2014-07-012024-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2023-07-012024-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2019-07-012024-06-300001322252cmft:Russell3000TotalReturn2118BroadBasedIndexMember2014-07-012024-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2023-07-012024-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2019-07-012024-06-300001322252cmft:Russell2000ValueTotalReturn2118AdditionalIndexMember2014-07-012024-06-300001322252cmft:C000003540Member2024-06-300001322252cmft:C000003540Membercmft:InvestmentTypeCollateralforSecuritiesLoanedCTIMember2024-06-300001322252cmft:C000003540Membercmft:InvestmentTypeCommonStocksCTIMember2024-06-300001322252cmft:C000003540Membercmft:InvestmentTypeMoneyMarketFundsCTIMember2024-06-300001322252cmft:C000003540Membercmft:RepurchaseAgreementsSectorMember2024-06-300001322252cmft:C000003540Membercmft:MoneyMarketFundsSectorMember2024-06-300001322252cmft:C000003540Memberoef:MaterialsSectorMember2024-06-300001322252cmft:C000003540Memberoef:UtilitiesSectorMember2024-06-300001322252cmft:C000003540Memberus-gaap:HealthcareSectorMember2024-06-300001322252cmft:C000003540Memberus-gaap:EnergySectorMember2024-06-300001322252cmft:C000003540Memberoef:ConsumerDiscretionarySectorMember2024-06-300001322252cmft:C000003540Memberus-gaap:RealEstateSectorMember2024-06-300001322252cmft:C000003540Memberus-gaap:TechnologySectorMember2024-06-300001322252cmft:C000003540Membercmft:FinancialsSectorMember2024-06-300001322252cmft:C000003540Membercmft:IndustrialsSectorMember2024-06-300001322252cmft:C000003540Membercmft:ArcosaIncCTIMember2024-06-300001322252cmft:C000003540Membercmft:EnvestnetIncCTIMember2024-06-300001322252cmft:C000003540Membercmft:ChampionXCorporationCTIMember2024-06-300001322252cmft:C000003540Membercmft:CentralPacificFinancialCorporationCTIMember2024-06-300001322252cmft:C000003540Membercmft:ACVAuctionsIncCTIMember2024-06-300001322252cmft:C000003540Membercmft:SkylineChampionCorporationCTIMember2024-06-300001322252cmft:C000003540Membercmft:HoraceMannEducatorsCorporationCTIMember2024-06-300001322252cmft:C000003540Membercmft:MuellerWaterProductsIncCTIMember2024-06-300001322252cmft:C000003540Membercmft:ItronIncCTIMember2024-06-300001322252cmft:C000003540Membercmft:StericycleIncCTIMember2024-06-300001322252cmft:C000003541Member2023-07-012024-06-300001322252cmft:C000003541Member2013-07-012014-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2013-07-012014-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2013-07-012014-06-300001322252cmft:C000003541Member2014-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2014-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2014-06-300001322252cmft:C000003541Member2015-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2015-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2015-06-300001322252cmft:C000003541Member2016-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2016-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2016-06-300001322252cmft:C000003541Member2017-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2017-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2017-06-300001322252cmft:C000003541Member2018-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2018-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2018-06-300001322252cmft:C000003541Member2019-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2019-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2019-06-300001322252cmft:C000003541Member2020-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2020-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2020-06-300001322252cmft:C000003541Member2021-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2021-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2021-06-300001322252cmft:C000003541Member2022-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2022-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2022-06-300001322252cmft:C000003541Member2023-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2023-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2023-06-300001322252cmft:C000003541Member2024-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2024-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2024-06-300001322252cmft:C000003541Memberoef:WithoutSalesLoadMember2023-07-012024-06-300001322252cmft:C000003541Memberoef:WithoutSalesLoadMember2019-07-012024-06-300001322252cmft:C000003541Memberoef:WithoutSalesLoadMember2014-07-012024-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2023-07-012024-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2019-07-012024-06-300001322252cmft:Russell3000TotalReturn2119BroadBasedIndexMember2014-07-012024-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2023-07-012024-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2019-07-012024-06-300001322252cmft:Russell2000ValueTotalReturn2119AdditionalIndexMember2014-07-012024-06-300001322252cmft:C000003541Membercmft:InvestmentTypeCollateralforSecuritiesLoanedCTIMember2024-06-300001322252cmft:C000003541Membercmft:InvestmentTypeCommonStocksCTIMember2024-06-300001322252cmft:C000003541Membercmft:InvestmentTypeMoneyMarketFundsCTIMember2024-06-300001322252cmft:C000003541Membercmft:RepurchaseAgreementsSectorMember2024-06-300001322252cmft:C000003541Membercmft:MoneyMarketFundsSectorMember2024-06-300001322252cmft:C000003541Memberoef:MaterialsSectorMember2024-06-300001322252cmft:C000003541Memberoef:UtilitiesSectorMember2024-06-300001322252cmft:C000003541Memberus-gaap:HealthcareSectorMember2024-06-300001322252cmft:C000003541Memberus-gaap:EnergySectorMember2024-06-300001322252cmft:C000003541Memberoef:ConsumerDiscretionarySectorMember2024-06-300001322252cmft:C000003541Memberus-gaap:RealEstateSectorMember2024-06-300001322252cmft:C000003541Memberus-gaap:TechnologySectorMember2024-06-300001322252cmft:C000003541Membercmft:FinancialsSectorMember2024-06-300001322252cmft:C000003541Membercmft:IndustrialsSectorMember2024-06-300001322252cmft:C000003541Membercmft:ArcosaIncCTIMember2024-06-300001322252cmft:C000003541Membercmft:EnvestnetIncCTIMember2024-06-300001322252cmft:C000003541Membercmft:ChampionXCorporationCTIMember2024-06-300001322252cmft:C000003541Membercmft:CentralPacificFinancialCorporationCTIMember2024-06-300001322252cmft:C000003541Membercmft:ACVAuctionsIncCTIMember2024-06-300001322252cmft:C000003541Membercmft:SkylineChampionCorporationCTIMember2024-06-300001322252cmft:C000003541Membercmft:HoraceMannEducatorsCorporationCTIMember2024-06-300001322252cmft:C000003541Membercmft:MuellerWaterProductsIncCTIMember2024-06-300001322252cmft:C000003541Membercmft:ItronIncCTIMember2024-06-300001322252cmft:C000003541Membercmft:StericycleIncCTIMember2024-06-300001322252cmft:C000003543Member2023-07-012024-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2014-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2014-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2015-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2015-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2016-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2016-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2017-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2017-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2018-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2018-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2019-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2019-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2020-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2020-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2021-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2021-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2022-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2022-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2023-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2023-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2024-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2024-06-300001322252cmft:C000003543Memberoef:WithoutSalesLoadMember2023-07-012024-06-300001322252cmft:C000003543Memberoef:WithoutSalesLoadMember2019-07-012024-06-300001322252cmft:C000003543Memberoef:WithoutSalesLoadMember2014-07-012024-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2023-07-012024-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2019-07-012024-06-300001322252cmft:Russell3000TotalReturn2125BroadBasedIndexMember2014-07-012024-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2023-07-012024-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2019-07-012024-06-300001322252cmft:Russell2500ValueTotalReturn2125AdditionalIndexMember2014-07-012024-06-300001322252cmft:C000003543Member2024-06-300001322252cmft:C000003543Membercmft:InvestmentTypeCommonStocksCTIMember2024-06-300001322252cmft:C000003543Membercmft:InvestmentTypeMoneyMarketFundsCTIMember2024-06-300001322252cmft:C000003543Membercmft:MoneyMarketFundsSectorMember2024-06-300001322252cmft:C000003543Memberoef:ConsumerStaplesSectorMember2024-06-300001322252cmft:C000003543Memberus-gaap:EnergySectorMember2024-06-300001322252cmft:C000003543Memberoef:UtilitiesSectorMember2024-06-300001322252cmft:C000003543Memberoef:MaterialsSectorMember2024-06-300001322252cmft:C000003543Memberus-gaap:RealEstateSectorMember2024-06-300001322252cmft:C000003543Memberus-gaap:HealthcareSectorMember2024-06-300001322252cmft:C000003543Memberoef:ConsumerDiscretionarySectorMember2024-06-300001322252cmft:C000003543Memberus-gaap:TechnologySectorMember2024-06-300001322252cmft:C000003543Membercmft:FinancialsSectorMember2024-06-300001322252cmft:C000003543Membercmft:IndustrialsSectorMember2024-06-300001322252cmft:C000003543Membercmft:BurlingtonStoresIncCTIMember2024-06-300001322252cmft:C000003543Membercmft:AshlandIncCTIMember2024-06-300001322252cmft:C000003543Membercmft:StericycleIncCTIMember2024-06-300001322252cmft:C000003543Membercmft:ItronIncCTIMember2024-06-300001322252cmft:C000003543Membercmft:MatadorResourcesCompanyCTIMember2024-06-300001322252cmft:C000003543Membercmft:TerrenoRealtyCorporationCTIMember2024-06-300001322252cmft:C000003543Membercmft:CleanHarborsIncCTIMember2024-06-300001322252cmft:C000003543Membercmft:ArcosaIncCTIMember2024-06-300001322252cmft:C000003543Membercmft:FirstAmericanFinancialCorporationCTIMember2024-06-300001322252cmft:C000003543Membercmft:BioLifeSolutionsIncCTIMember2024-06-300001322252cmft:C000003544Member2023-07-012024-06-300001322252cmft:C000003544Member2013-07-012014-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2013-07-012014-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2013-07-012014-06-300001322252cmft:C000003544Member2014-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2014-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2014-06-300001322252cmft:C000003544Member2015-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2015-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2015-06-300001322252cmft:C000003544Member2016-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2016-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2016-06-300001322252cmft:C000003544Member2017-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2017-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2017-06-300001322252cmft:C000003544Member2018-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2018-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2018-06-300001322252cmft:C000003544Member2019-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2019-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2019-06-300001322252cmft:C000003544Member2020-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2020-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2020-06-300001322252cmft:C000003544Member2021-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2021-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2021-06-300001322252cmft:C000003544Member2022-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2022-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2022-06-300001322252cmft:C000003544Member2023-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2023-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2023-06-300001322252cmft:C000003544Member2024-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2024-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2024-06-300001322252cmft:C000003544Memberoef:WithoutSalesLoadMember2023-07-012024-06-300001322252cmft:C000003544Memberoef:WithoutSalesLoadMember2019-07-012024-06-300001322252cmft:C000003544Memberoef:WithoutSalesLoadMember2014-07-012024-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2023-07-012024-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2019-07-012024-06-300001322252cmft:Russell3000TotalReturn2127BroadBasedIndexMember2014-07-012024-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2023-07-012024-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2019-07-012024-06-300001322252cmft:Russell2500ValueTotalReturn2127AdditionalIndexMember2014-07-012024-06-300001322252cmft:C000003544Membercmft:InvestmentTypeCommonStocksCTIMember2024-06-300001322252cmft:C000003544Membercmft:InvestmentTypeMoneyMarketFundsCTIMember2024-06-300001322252cmft:C000003544Membercmft:MoneyMarketFundsSectorMember2024-06-300001322252cmft:C000003544Memberoef:ConsumerStaplesSectorMember2024-06-300001322252cmft:C000003544Memberus-gaap:EnergySectorMember2024-06-300001322252cmft:C000003544Memberoef:UtilitiesSectorMember2024-06-300001322252cmft:C000003544Memberoef:MaterialsSectorMember2024-06-300001322252cmft:C000003544Memberus-gaap:RealEstateSectorMember2024-06-300001322252cmft:C000003544Memberus-gaap:HealthcareSectorMember2024-06-300001322252cmft:C000003544Memberoef:ConsumerDiscretionarySectorMember2024-06-300001322252cmft:C000003544Memberus-gaap:TechnologySectorMember2024-06-300001322252cmft:C000003544Membercmft:FinancialsSectorMember2024-06-300001322252cmft:C000003544Membercmft:IndustrialsSectorMember2024-06-300001322252cmft:C000003544Membercmft:BurlingtonStoresIncCTIMember2024-06-300001322252cmft:C000003544Membercmft:AshlandIncCTIMember2024-06-300001322252cmft:C000003544Membercmft:StericycleIncCTIMember2024-06-300001322252cmft:C000003544Membercmft:ItronIncCTIMember2024-06-300001322252cmft:C000003544Membercmft:MatadorResourcesCompanyCTIMember2024-06-300001322252cmft:C000003544Membercmft:TerrenoRealtyCorporationCTIMember2024-06-300001322252cmft:C000003544Membercmft:CleanHarborsIncCTIMember2024-06-300001322252cmft:C000003544Membercmft:ArcosaIncCTIMember2024-06-300001322252cmft:C000003544Membercmft:FirstAmericanFinancialCorporationCTIMember2024-06-300001322252cmft:C000003544Membercmft:BioLifeSolutionsIncCTIMember2024-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureutr:Dcmft:Holding

Institutional Class (CRIEX)

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about CRM All Cap Value Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.crmfunds.com/funds-overview/shareholder-resources/documents/. You can also request this information by contacting us at 800-CRM-2883.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Institutional | $128 | 1.20% |

How did the Fund perform during the reporting period?

During the fiscal year, the Fund underperformed the Primary Benchmark Index (Russell 3000 Total Return Index) and outperformed the Secondary Benchmark Index (Russell 3000 Value Total Return Index). Against the Secondary Benchmark Index, relative outperformance was attributed to stock selection within the Consumer Discretionary, Industrials, and Materials sectors. Conversely, stock selection within the Consumer Staples, Information Technology, and Real Estate sectors was a headwind to relative performance. We saw an improving earnings outlook for small to mid-cap companies as we progressed through 2024. Down cap companies’ earnings were more negatively impacted by the inflationary pressures and rise in interest rates than larger cap companies in 2023. Updated performance information is available at www.crmfunds.com/funds-overview/performance/.

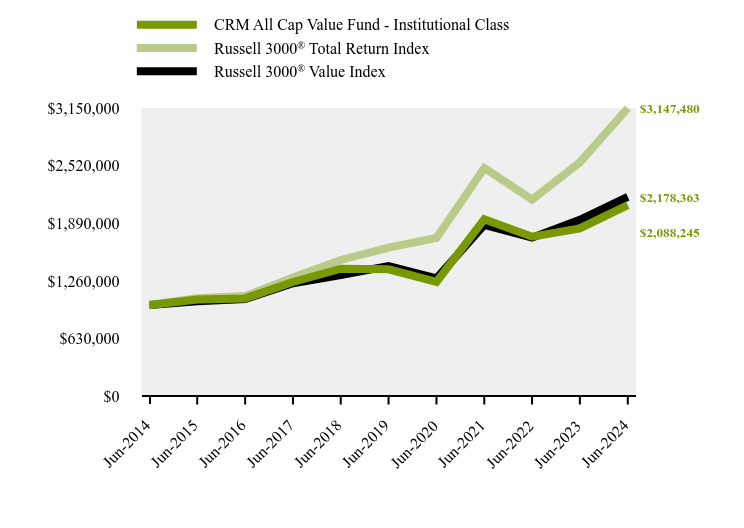

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| CRM All Cap Value Fund - Institutional Class | Russell 3000® Total Return Index | Russell 3000® Value Index |

|---|

Jun-2014 | $1,000,000 | $1,000,000 | $1,000,000 |

Jun-2015 | $1,058,164 | $1,072,942 | $1,038,621 |

Jun-2016 | $1,070,916 | $1,095,885 | $1,063,729 |

Jun-2017 | $1,249,906 | $1,298,727 | $1,236,135 |

Jun-2018 | $1,395,242 | $1,490,655 | $1,325,770 |

Jun-2019 | $1,388,140 | $1,624,553 | $1,423,059 |

Jun-2020 | $1,251,143 | $1,730,629 | $1,288,997 |

Jun-2021 | $1,935,045 | $2,494,951 | $1,874,152 |

Jun-2022 | $1,745,151 | $2,149,011 | $1,734,307 |

Jun-2023 | $1,835,577 | $2,556,327 | $1,928,888 |

Jun-2024 | $2,088,245 | $3,147,480 | $2,178,363 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

CRM All Cap Value Fund - Institutional Class | 13.77% | 8.51% | 7.64% |

Russell 3000® Total Return Index | 23.13% | 14.14% | 12.15% |

Russell 3000® Value Index | 12.93% | 8.89% | 8.10% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Effective May 23, 2024, the Fund adopted the Russell 3000 Total Return Index as its broad-based benchmark index that represents the overall equity market. The Fund also compares its performance to the Russell 3000 Value Index, which is a more narrowly based index that reflects the market sector in which the Fund invests. The Russell 3000 Value Index was formerly the Fund's primary benchmark. These changes were made to comply with a new regulatory requirement.

Net Assets | $23,338,121 |

Number of Portfolio Holdings | 47 |

Advisory Fee (net of waivers) | $152,323 |

Portfolio Turnover | 54% |

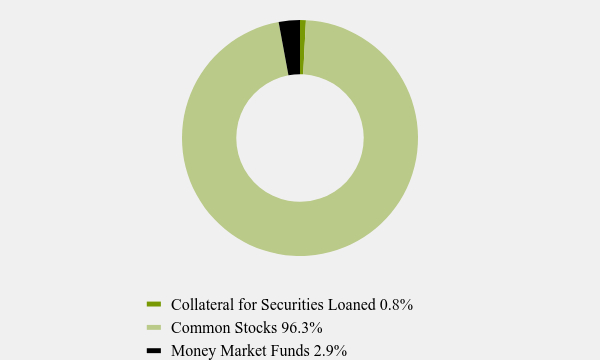

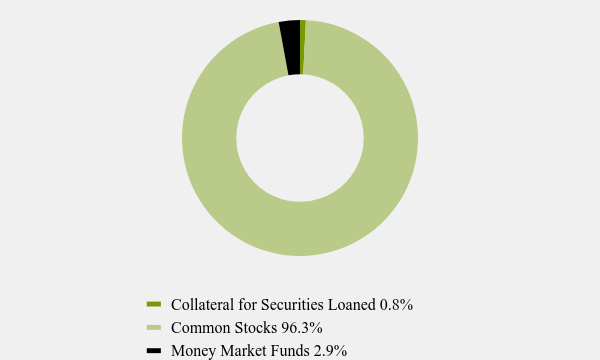

Asset Weighting (% of total investments)

Value | Value |

|---|

Collateral for Securities Loaned | 0.8% |

Common Stocks | 96.3% |

Money Market Funds | 2.9% |

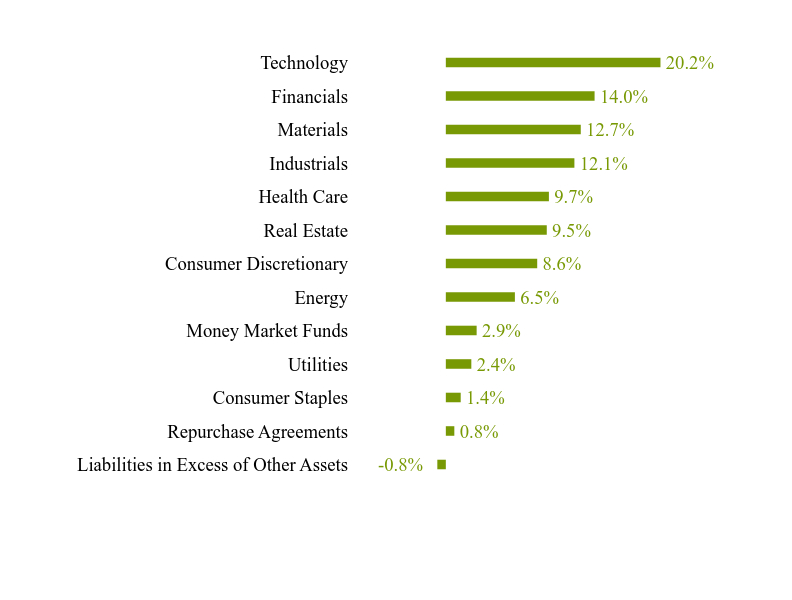

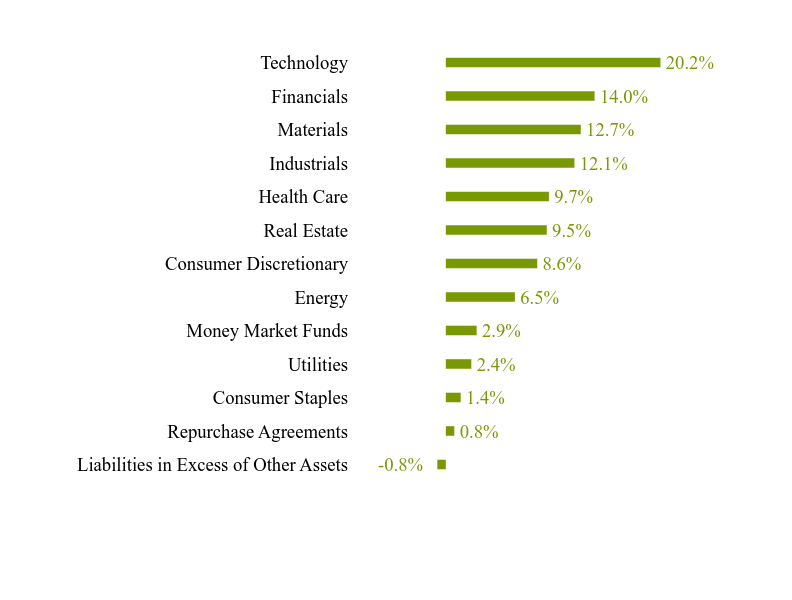

What did the Fund invest in?

Sector Weighting (% of net assets)

Value | Value |

|---|

Liabilities in Excess of Other Assets | -0.8% |

Repurchase Agreements | 0.8% |

Consumer Staples | 1.4% |

Utilities | 2.4% |

Money Market Funds | 2.9% |

Energy | 6.5% |

Consumer Discretionary | 8.6% |

Real Estate | 9.5% |

Health Care | 9.7% |

Industrials | 12.1% |

Materials | 12.7% |

Financials | 14.0% |

Technology | 20.2% |

Top 10 Holdings (% of net assets)

Holding Name | % of Net Assets |

Fidelity National Information Services, Inc. | 3.7% |

Marathon Oil Corporation | 3.7% |

Terreno Realty Corporation | 3.1% |

CRH PLC | 2.9% |

Sun Communities, Inc. | 2.9% |

ChampionX Corporation | 2.8% |

Burlington Stores, Inc. | 2.8% |

Advanced Drainage Systems, Inc. | 2.8% |

BioLife Solutions, Inc. | 2.7% |

PTC, Inc. | 2.7% |

No material changes occurred during the year ended June 30, 2024.

Institutional Class (CRIEX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( http://www.crmfunds.com/funds-overview/shareholder-resources/documents/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Distributed by ALPS Distributors, Inc.

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about CRM All Cap Value Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.crmfunds.com/funds-overview/shareholder-resources/documents/. You can also request this information by contacting us at 800-CRM-2883.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Investor | $155 | 1.45% |

How did the Fund perform during the reporting period?

During the fiscal year, the Fund underperformed the Primary Benchmark Index (Russell 3000 Total Return Index) and outperformed the Secondary Benchmark Index (Russell 3000 Value Total Return Index). Against the Secondary Benchmark Index, relative outperformance was attributed to stock selection within the Consumer Discretionary, Industrials, and Materials sectors. Conversely, stock selection within the Consumer Staples, Information Technology, and Real Estate sectors was a headwind to relative performance. We saw an improving earnings outlook for small to mid-cap companies as we progressed through 2024. Down cap companies’ earnings were more negatively impacted by the inflationary pressures and rise in interest rates than larger cap companies in 2023. Updated performance information is available at www.crmfunds.com/funds-overview/performance/.

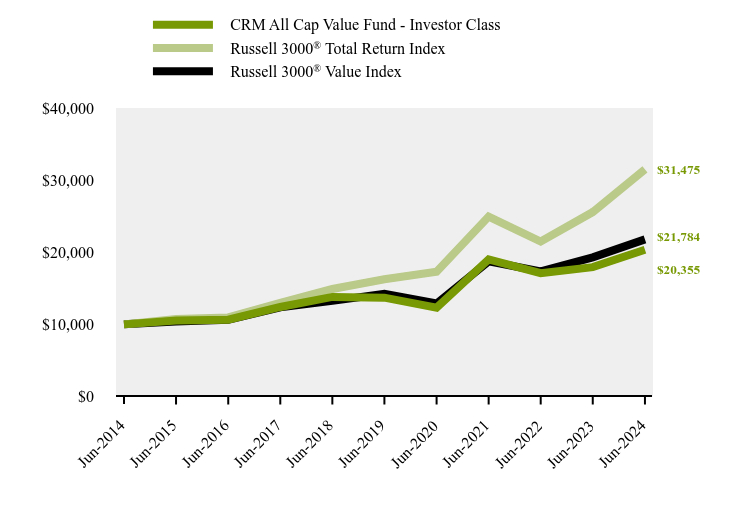

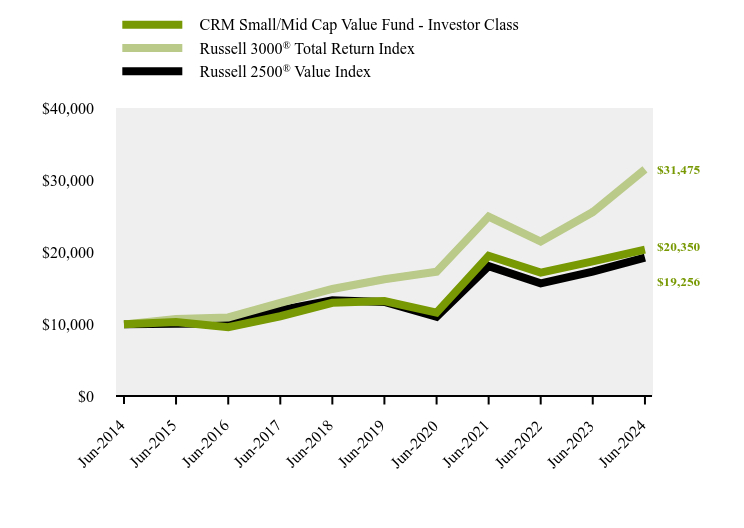

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| CRM All Cap Value Fund - Investor Class | Russell 3000® Total Return Index | Russell 3000® Value Index |

|---|

Jun-2014 | $10,000 | $10,000 | $10,000 |

Jun-2015 | $10,548 | $10,729 | $10,386 |

Jun-2016 | $10,640 | $10,959 | $10,637 |

Jun-2017 | $12,413 | $12,987 | $12,361 |

Jun-2018 | $13,803 | $14,907 | $13,258 |

Jun-2019 | $13,704 | $16,246 | $14,231 |

Jun-2020 | $12,312 | $17,306 | $12,890 |

Jun-2021 | $19,013 | $24,950 | $18,742 |

Jun-2022 | $17,095 | $21,490 | $17,343 |

Jun-2023 | $17,939 | $25,563 | $19,289 |

Jun-2024 | $20,355 | $31,475 | $21,784 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

CRM All Cap Value Fund - Investor Class | 13.47% | 8.23% | 7.37% |

Russell 3000® Total Return Index | 23.13% | 14.14% | 12.15% |

Russell 3000® Value Index | 12.93% | 8.89% | 8.10% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Effective May 23, 2024, the Fund adopted the Russell 3000 Total Return Index as its broad-based benchmark index that represents the overall equity market. The Fund also compares its performance to the Russell 3000 Value Index, which is a more narrowly based index that reflects the market sector in which the Fund invests. The Russell 3000 Value Index was formerly the Fund's primary benchmark. These changes were made to comply with a new regulatory requirement.

Net Assets | $23,338,121 |

Number of Portfolio Holdings | 47 |

Advisory Fee (net of waivers) | $152,323 |

Portfolio Turnover | 54% |

Asset Weighting (% of total investments)

Value | Value |

|---|

Collateral for Securities Loaned | 0.8% |

Common Stocks | 96.3% |

Money Market Funds | 2.9% |

What did the Fund invest in?

Sector Weighting (% of net assets)

Value | Value |

|---|

Liabilities in Excess of Other Assets | -0.8% |

Repurchase Agreements | 0.8% |

Consumer Staples | 1.4% |

Utilities | 2.4% |

Money Market Funds | 2.9% |

Energy | 6.5% |

Consumer Discretionary | 8.6% |

Real Estate | 9.5% |

Health Care | 9.7% |

Industrials | 12.1% |

Materials | 12.7% |

Financials | 14.0% |

Technology | 20.2% |

Top 10 Holdings (% of net assets)

Holding Name | % of Net Assets |

Fidelity National Information Services, Inc. | 3.7% |

Marathon Oil Corporation | 3.7% |

Terreno Realty Corporation | 3.1% |

CRH PLC | 2.9% |

Sun Communities, Inc. | 2.9% |

ChampionX Corporation | 2.8% |

Burlington Stores, Inc. | 2.8% |

Advanced Drainage Systems, Inc. | 2.8% |

BioLife Solutions, Inc. | 2.7% |

PTC, Inc. | 2.7% |

No material changes occurred during the year ended June 30, 2024.

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( http://www.crmfunds.com/funds-overview/shareholder-resources/documents/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Distributed by ALPS Distributors, Inc.

CRM Long/Short Opportunities Fund

Institutional Class (CRIHX)

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about CRM Long/Short Opportunities Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.crmfunds.com/funds-overview/shareholder-resources/documents/. You can also request this information by contacting us at 800-CRM-2883.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Institutional | $236 | 2.25% |

How did the Fund perform during the reporting period?

Despite positive absolute performance during the fiscal year, the Fund underperformed relative to the stated benchmark during the period. From a sector perspective, Industrials, Information Technology, and Materials contributed most to Fund performance during the fiscal year. The Consumer Staples and Consumer Discretionary sectors were the largest detractors to performance. In terms of exposure during the period, the Fund averaged approximately 94% gross long, 45% gross short, and 49% net long. Fund net exposure increased during the period from roughly 37% net long to 55% net long, largely through the reduction in short exposure. The largest sector exposure changes were: Consumer Discretionary and Financials net exposure increased by over 7% each while Real Estate and Information Technology increased by a more modest amount. At the same time, both Consumer Staples and Health Care net exposure decreased by roughly 2% each. Updated performance information is available at www.crmfunds.com/funds-overview/performance/.

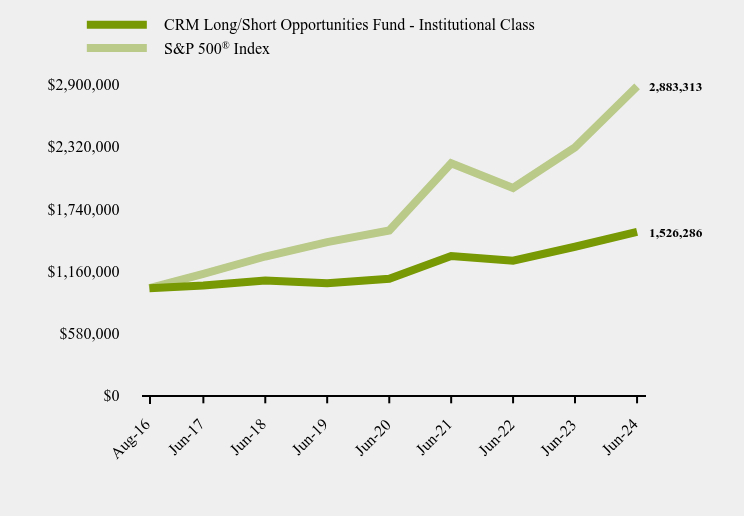

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| CRM Long/Short Opportunities Fund - Institutional Class | S&P 500® Index |

|---|

Aug-16 | $1,000,000 | $1,000,000 |

Jun-17 | 1,025,000 | 1,132,863 |

Jun-18 | 1,071,538 | 1,295,702 |

Jun-19 | 1,047,197 | 1,430,681 |

Jun-20 | 1,088,390 | 1,538,054 |

Jun-21 | 1,300,532 | 2,165,491 |

Jun-22 | 1,257,278 | 1,935,607 |

Jun-23 | 1,386,638 | 2,314,870 |

Jun-24 | 1,526,286 | 2,883,313 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (August 16, 2016) |

|---|

CRM Long/Short Opportunities Fund - Institutional Class | 10.07% | 7.83% | 5.52% |

S&P 500® Index | 24.56% | 15.05% | 14.40% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Net Assets | $195,995,806 |

Number of Portfolio Holdings | 106 |

Advisory Fee (net of waivers) | $2,519,234 |

Portfolio Turnover | 113% |

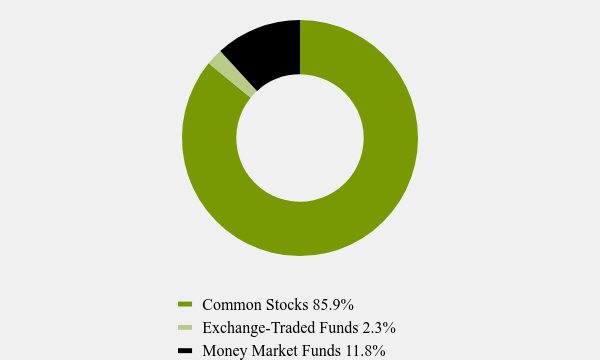

Asset Weighting (% of total investments)

Value | Value |

|---|

Common Stocks | 85.9% |

Exchange-Traded Funds | 2.3% |

Money Market Funds | 11.8% |

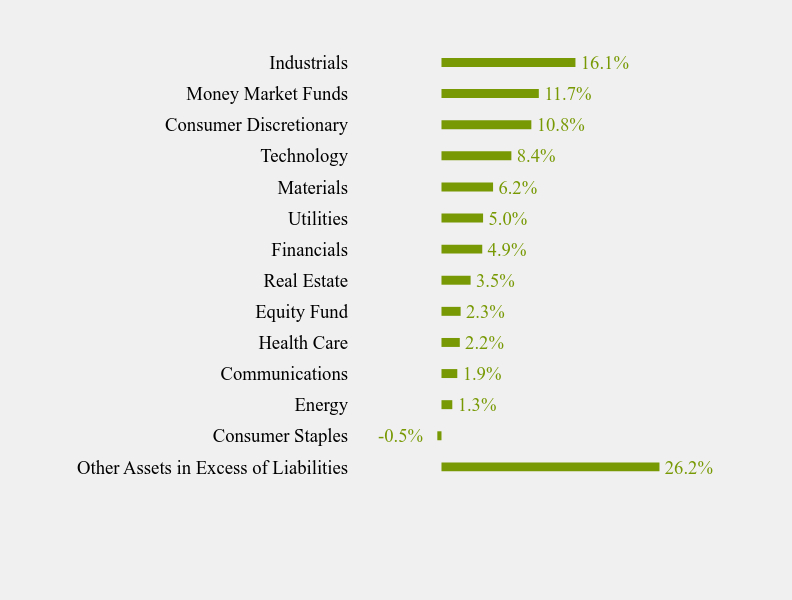

What did the Fund invest in?

Sector Weighting (% of net assets)

Value | Value |

|---|

Other Assets in Excess of Liabilities | 26.2% |

Consumer Staples | |

Energy | 1.3% |

Communications | 1.9% |

Health Care | 2.2% |

Equity Fund | 2.3% |

Real Estate | 3.5% |

Financials | 4.9% |

Utilities | 5.0% |

Materials | 6.2% |

Technology | 8.4% |

Consumer Discretionary | 10.8% |

Money Market Funds | 11.7% |

Industrials | 16.1% |

Top 10 Holdings (% of net assets)

Holding Name | % of Net Assets |

Blackrock Liquidity Funds T-Fund, Institutional Shares | 5.8% |

Federated Hermes Treasury Obligations Fund, Institutional Shares | 5.8% |

Arcosa, Inc. | 4.0% |

Burlington Stores, Inc. | 3.9% |

Canadian Pacific Kansas City Ltd. | 3.7% |

Clean Harbors, Inc. | 3.6% |

Itron, Inc. | 3.1% |

NextEra Energy, Inc. | 3.1% |

Skyline Champion Corporation | 3.0% |

Digital Realty Trust, Inc. | 2.8% |

No material changes occurred during the year ended June 30, 2024.

CRM Long/Short Opportunities Fund

Institutional Class (CRIHX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( http://www.crmfunds.com/funds-overview/shareholder-resources/documents/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Distributed by ALPS Distributors, Inc.

Institutional Class (CRIMX)

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about CRM Mid Cap Value Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.crmfunds.com/funds-overview/shareholder-resources/documents/. You can also request this information by contacting us at 800-CRM-2883.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Institutional | $104 | 0.99% |

How did the Fund perform during the reporting period?

During the fiscal year, the Fund underperformed both the Primary Benchmark Index (Russell 3000 Total Return Index) and Secondary Benchmark Index (Russell MidCap Value Total Return Index). Against the Secondary Benchmark Index, relative underperformance during the fiscal year was mainly attributed to stock selection within the Industrials, Health Care, and Utilities sectors. Stock selection within the Consumer Discretionary and Materials sectors was a tailwind to performance. We saw an improving earnings outlook for mid-cap companies as we progressed through 2024. Down cap companies’ earnings were more negatively impacted by the inflationary pressures and rise in interest rates than larger cap companies in 2023. Updated performance information is available at www.crmfunds.com/funds-overview/performance/.

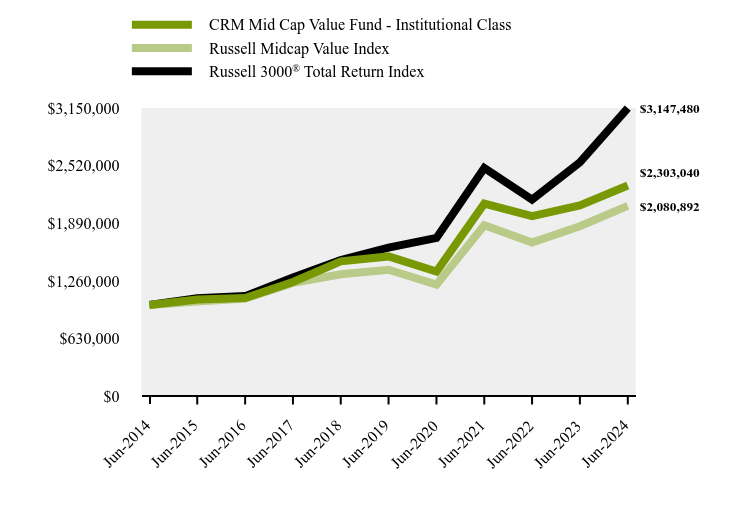

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| CRM Mid Cap Value Fund - Institutional Class | Russell Midcap Value Index | Russell 3000® Total Return Index |

|---|

Jun-2014 | $1,000,000 | $1,000,000 | $1,000,000 |

Jun-2015 | $1,059,112 | $1,036,717 | $1,072,942 |

Jun-2016 | $1,076,173 | $1,070,367 | $1,095,885 |

Jun-2017 | $1,250,393 | $1,240,829 | $1,298,727 |

Jun-2018 | $1,476,002 | $1,335,073 | $1,490,655 |

Jun-2019 | $1,529,270 | $1,384,221 | $1,624,553 |

Jun-2020 | $1,363,659 | $1,220,718 | $1,730,629 |

Jun-2021 | $2,105,998 | $1,868,481 | $2,494,951 |

Jun-2022 | $1,968,100 | $1,681,690 | $2,149,011 |

Jun-2023 | $2,086,229 | $1,858,313 | $2,556,327 |

Jun-2024 | $2,303,040 | $2,080,892 | $3,147,480 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

CRM Mid Cap Value Fund - Institutional Class | 10.39% | 8.53% | 8.70% |

Russell Midcap Value Index | 11.98% | 8.49% | 7.60% |

Russell 3000® Total Return Index | 23.13% | 14.14% | 12.15% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Effective May 23, 2024, the Fund adopted the Russell 3000 Total Return Index as its broad-based benchmark index that represents the overall equity market. The Fund also compares its performance to the Russell MidCap Value Index, which is a more narrowly based index that reflects the market sector in which the Fund invests. The Russell MidCap Value Index was formerly the Fund's primary benchmark. These changes were made to comply with a new regulatory requirement.

Net Assets | $372,057,285 |

Number of Portfolio Holdings | 62 |

Advisory Fee | $2,889,555 |

Portfolio Turnover | 47% |

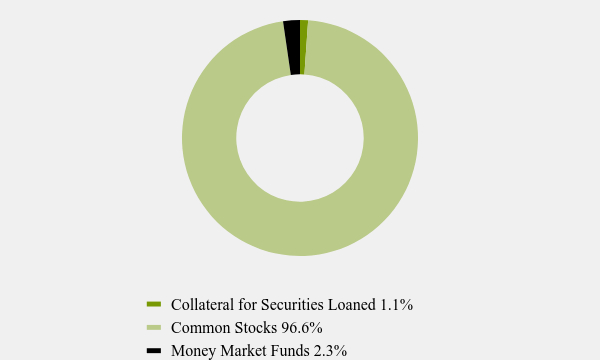

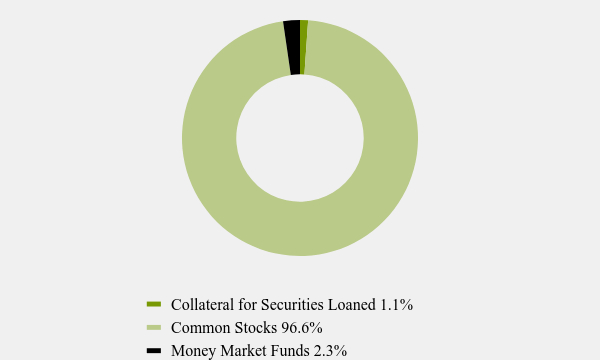

Asset Weighting (% of total investments)

Value | Value |

|---|

Collateral for Securities Loaned | 1.1% |

Common Stocks | 96.6% |

Money Market Funds | 2.3% |

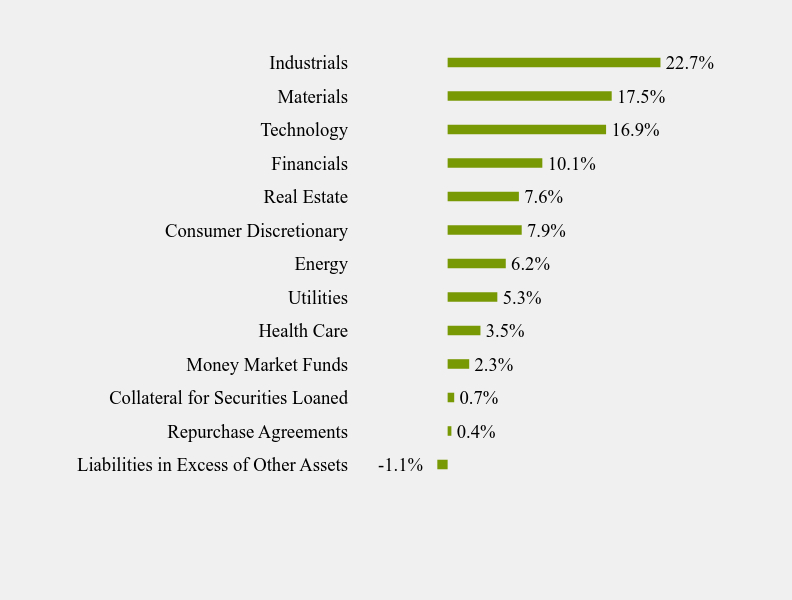

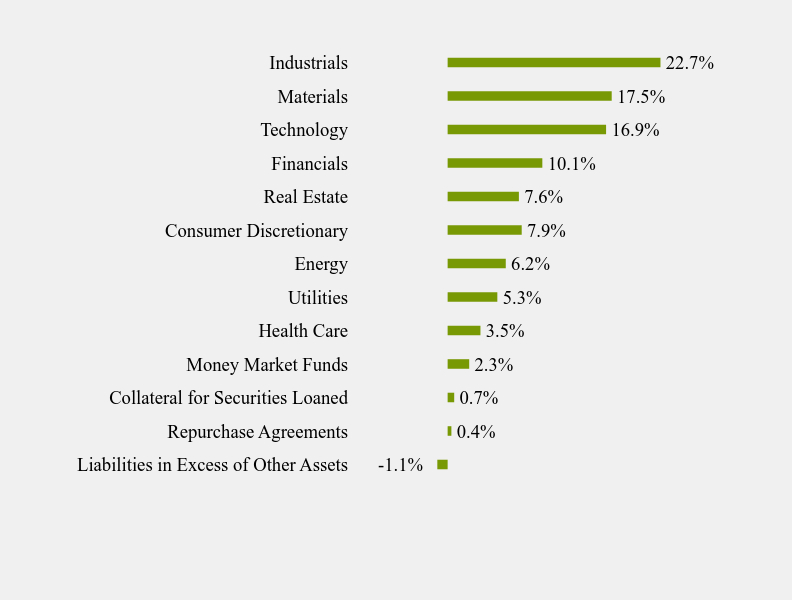

What did the Fund invest in?

Sector Weighting (% of net assets)

Value | Value |

|---|

Liabilities in Excess of Other Assets | -1.1% |

Repurchase Agreements | 0.4% |

Collateral for Securities Loaned | 0.7% |

Money Market Funds | 2.3% |

Health Care | 3.5% |

Utilities | 5.3% |

Energy | 6.2% |

Consumer Discretionary | 7.9% |

Real Estate | 7.6% |

Financials | 10.1% |

Technology | 16.9% |

Materials | 17.5% |

Industrials | 22.7% |

Top 10 Holdings (% of net assets)

Holding Name | % of Net Assets |

Fidelity National Information Services, Inc. | 3.7% |

Vontier Corporation | 3.5% |

ChampionX Corporation | 2.9% |

Burlington Stores, Inc. | 2.9% |

Nisource, Inc. | 2.9% |

Terreno Realty Corporation | 2.8% |

Woodward, Inc. | 2.8% |

Martin Marietta Materials, Inc. | 2.8% |

Canadian Pacific Kansas City Ltd. | 2.8% |

Ashland, Inc. | 2.7% |

No material changes occurred during the year ended June 30, 2024.

CRM Mid Cap Value Fund - Institutional (CRIMX)

Institutional Class (CRIMX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( http://www.crmfunds.com/funds-overview/shareholder-resources/documents/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Distributed by ALPS Distributors, Inc.

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about CRM Mid Cap Value Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.crmfunds.com/funds-overview/shareholder-resources/documents/. You can also request this information by contacting us at 800-CRM-2883.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Investor | $122 | 1.16% |

How did the Fund perform during the reporting period?

During the fiscal year, the Fund underperformed both the Primary Benchmark Index (Russell 3000 Total Return Index) and Secondary Benchmark Index (Russell MidCap Value Total Return Index). Against the Secondary Benchmark Index, relative underperformance during the fiscal year was mainly attributed to stock selection within the Industrials, Health Care, and Utilities sectors. Stock selection within the Consumer Discretionary and Materials sectors was a tailwind to performance. We saw an improving earnings outlook for mid-cap companies as we progressed through 2024. Down cap companies’ earnings were more negatively impacted by the inflationary pressures and rise in interest rates than larger cap companies in 2023. Updated performance information is available at www.crmfunds.com/funds-overview/performance/.

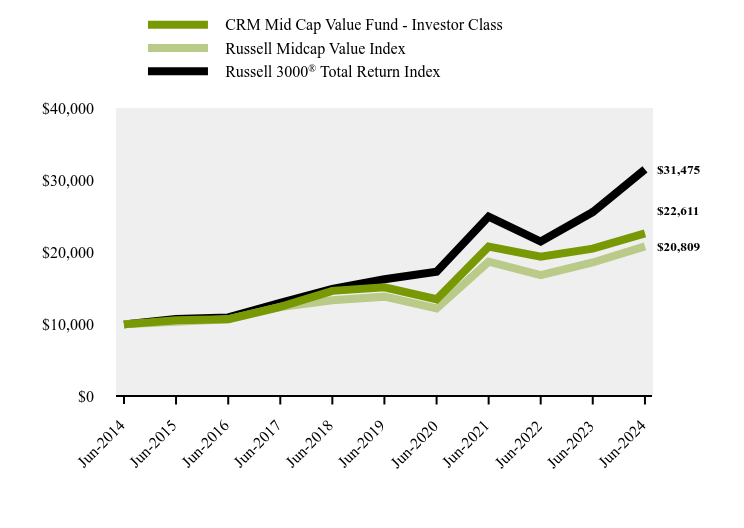

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| CRM Mid Cap Value Fund - Investor Class | Russell Midcap Value Index | Russell 3000® Total Return Index |

|---|

Jun-2014 | $10,000 | $10,000 | $10,000 |

Jun-2015 | $10,573 | $10,367 | $10,729 |

Jun-2016 | $10,724 | $10,704 | $10,959 |

Jun-2017 | $12,432 | $12,408 | $12,987 |

Jun-2018 | $14,646 | $13,351 | $14,907 |

Jun-2019 | $15,143 | $13,842 | $16,246 |

Jun-2020 | $13,480 | $12,207 | $17,306 |

Jun-2021 | $20,771 | $18,685 | $24,950 |

Jun-2022 | $19,384 | $16,817 | $21,490 |

Jun-2023 | $20,505 | $18,583 | $25,563 |

Jun-2024 | $22,611 | $20,809 | $31,475 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

CRM Mid Cap Value Fund - Investor Class | 10.27% | 8.35% | 8.50% |

Russell Midcap Value Index | 11.98% | 8.49% | 7.60% |

Russell 3000® Total Return Index | 23.13% | 14.14% | 12.15% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Effective May 23, 2024, the Fund adopted the Russell 3000 Total Return Index as its broad-based benchmark index that represents the overall equity market. The Fund also compares its performance to the Russell MidCap Value Index, which is a more narrowly based index that reflects the market sector in which the Fund invests. The Russell MidCap Value Index was formerly the Fund's primary benchmark. These changes were made to comply with a new regulatory requirement.

Net Assets | $372,057,285 |

Number of Portfolio Holdings | 62 |

Advisory Fee | $2,889,555 |

Portfolio Turnover | 47% |

Asset Weighting (% of total investments)

Value | Value |

|---|

Collateral for Securities Loaned | 1.1% |

Common Stocks | 96.6% |

Money Market Funds | 2.3% |

What did the Fund invest in?

Sector Weighting (% of net assets)

Value | Value |

|---|

Liabilities in Excess of Other Assets | -1.1% |

Repurchase Agreements | 0.4% |

Collateral for Securities Loaned | 0.7% |

Money Market Funds | 2.3% |

Health Care | 3.5% |

Utilities | 5.3% |

Energy | 6.2% |

Consumer Discretionary | 7.9% |

Real Estate | 7.6% |

Financials | 10.1% |

Technology | 16.9% |

Materials | 17.5% |

Industrials | 22.7% |

Top 10 Holdings (% of net assets)

Holding Name | % of Net Assets |

Fidelity National Information Services, Inc. | 3.7% |

Vontier Corporation | 3.5% |

ChampionX Corporation | 2.9% |

Burlington Stores, Inc. | 2.9% |

Nisource, Inc. | 2.9% |

Terreno Realty Corporation | 2.8% |

Woodward, Inc. | 2.8% |

Martin Marietta Materials, Inc. | 2.8% |

Canadian Pacific Kansas City Ltd. | 2.8% |

Ashland, Inc. | 2.7% |

No material changes occurred during the year ended June 30, 2024.

CRM Mid Cap Value Fund - Investor (CRMMX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( http://www.crmfunds.com/funds-overview/shareholder-resources/documents/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Distributed by ALPS Distributors, Inc.

Institutional Class (CRISX)

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about CRM Small Cap Value Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.crmfunds.com/funds-overview/shareholder-resources/documents/. You can also request this information by contacting us at 800-CRM-2883.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Institutional | $114 | 1.07% |

How did the Fund perform during the reporting period?

During the fiscal year, the Fund underperformed the Primary Benchmark Index (Russell 3000 Total Return Index) and outperformed the Secondary Benchmark Index (Russell 2000 Value Total Return Index). Against the Secondary Benchmark Index, stock selection was the primary driver of outperformance during the period, most notably in the Information Technology, Industrials, and Consumer Staples sectors. The portfolio also benefited from our underweight to the Communication Services sector relative to the Russell 2000® Value Total Return Index. We saw an improving earnings outlook for small-cap companies as we progressed through 2024. Down cap companies’ earnings were more negatively impacted by the inflationary pressures and rise in interest rates than larger cap companies in 2023. Updated performance information is available at www.crmfunds.com/funds-overview/performance/.

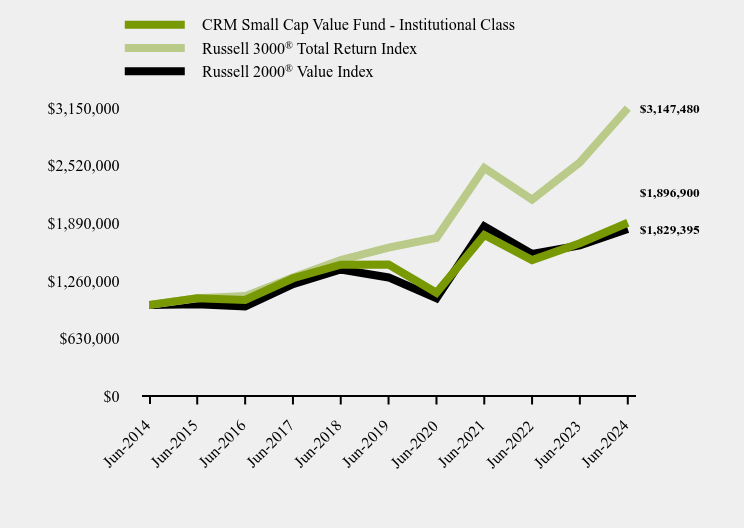

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| CRM Small Cap Value Fund - Institutional Class | Russell 3000® Total Return Index | Russell 2000® Value Index |

|---|

Jun-2014 | $1,000,000 | $1,000,000 | $1,000,000 |

Jun-2015 | $1,073,833 | $1,072,942 | $1,007,756 |

Jun-2016 | $1,053,585 | $1,095,885 | $981,738 |

Jun-2017 | $1,290,740 | $1,298,727 | $1,225,768 |

Jun-2018 | $1,438,359 | $1,490,655 | $1,386,334 |

Jun-2019 | $1,439,982 | $1,624,553 | $1,299,890 |

Jun-2020 | $1,132,771 | $1,730,629 | $1,072,708 |

Jun-2021 | $1,763,548 | $2,494,951 | $1,858,785 |

Jun-2022 | $1,489,719 | $2,149,011 | $1,556,166 |

Jun-2023 | $1,673,336 | $2,556,327 | $1,649,653 |

Jun-2024 | $1,896,900 | $3,147,480 | $1,829,395 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

CRM Small Cap Value Fund - Institutional Class | 13.36% | 5.67% | 6.61% |

Russell 3000® Total Return Index | 23.13% | 14.14% | 12.15% |

Russell 2000® Value Index | 10.90% | 7.07% | 6.23% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Effective May 23, 2024, the Fund adopted the Russell 3000 Total Return Index as its broad-based benchmark index that represents the overall equity market. The Fund also compares its performance to the Russell 2000 Value Index, which is a more narrowly based index that reflects the market sector in which the Fund invests. The Russell 2000 Value Index was formerly the Fund's primary benchmark. These changes were made to comply with a new regulatory requirement.

Net Assets | $75,275,015 |

Number of Portfolio Holdings | 48 |

Advisory Fee | $556,273 |

Portfolio Turnover | 77% |

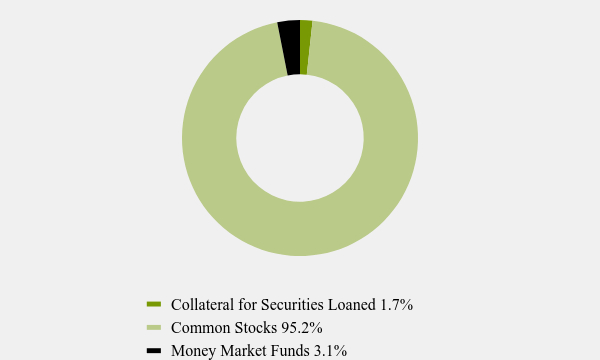

Asset Weighting (% of total investments)

Value | Value |

|---|

Collateral for Securities Loaned | 1.7% |

Common Stocks | 95.2% |

Money Market Funds | 3.1% |

What did the Fund invest in?

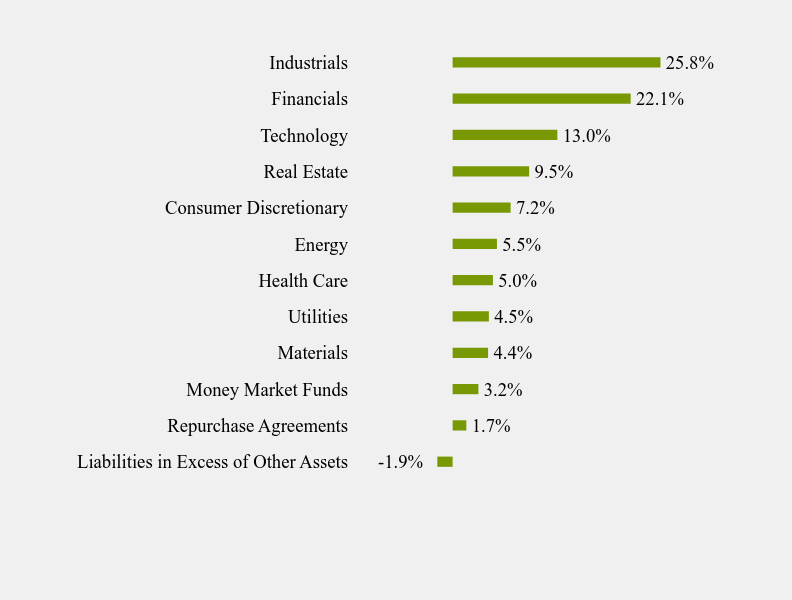

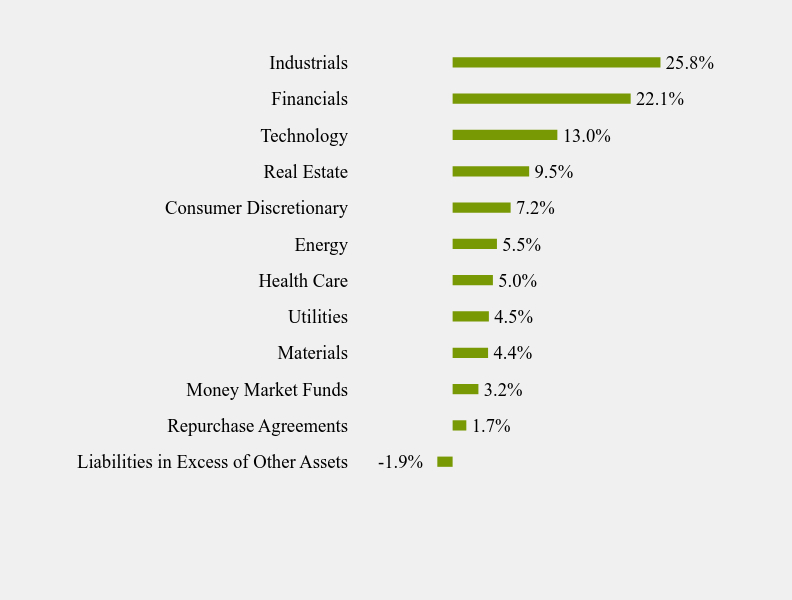

Sector Weighting (% of net assets)

Value | Value |

|---|

Liabilities in Excess of Other Assets | -1.9% |

Repurchase Agreements | 1.7% |

Money Market Funds | 3.2% |

Materials | 4.4% |

Utilities | 4.5% |

Health Care | 5.0% |

Energy | 5.5% |

Consumer Discretionary | 7.2% |

Real Estate | 9.5% |

Technology | 13.0% |

Financials | 22.1% |

Industrials | 25.8% |

Top 10 Holdings (% of net assets)

Holding Name | % of Net Assets |

Arcosa, Inc. | 3.7% |

Envestnet, Inc. | 3.5% |

ChampionX Corporation | 3.1% |

Central Pacific Financial Corporation | 3.0% |

ACV Auctions, Inc. | 3.0% |

Skyline Champion Corporation | 2.9% |

Horace Mann Educators Corporation | 2.9% |

Mueller Water Products, Inc. | 2.8% |

Itron, Inc. | 2.7% |

Stericycle, Inc. | 2.7% |

No material changes occurred during the year ended June 30, 2024.

CRM Small Cap Value Fund - Institutional (CRISX)

Institutional Class (CRISX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( http://www.crmfunds.com/funds-overview/shareholder-resources/documents/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Distributed by ALPS Distributors, Inc.

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about CRM Small Cap Value Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.crmfunds.com/funds-overview/shareholder-resources/documents/. You can also request this information by contacting us at 800-CRM-2883.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Investor | $134 | 1.26% |

How did the Fund perform during the reporting period?

During the fiscal year, the Fund underperformed the Primary Benchmark Index (Russell 3000 Total Return Index) and outperformed the Secondary Benchmark Index (Russell 2000 Value Total Return Index). Against the Secondary Benchmark Index, stock selection was the primary driver of outperformance during the period, most notably in the Information Technology, Industrials, and Consumer Staples sectors. The portfolio also benefited from our underweight to the Communication Services sector relative to the Russell 2000® Value Total Return Index. We saw an improving earnings outlook for small-cap companies as we progressed through 2024. Down cap companies’ earnings were more negatively impacted by the inflationary pressures and rise in interest rates than larger cap companies in 2023. Updated performance information is available at www.crmfunds.com/funds-overview/performance/.

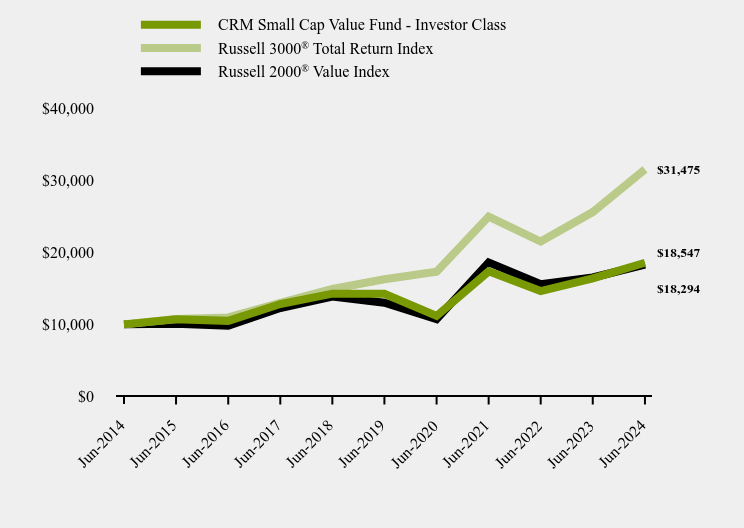

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| CRM Small Cap Value Fund - Investor Class | Russell 3000® Total Return Index | Russell 2000® Value Index |

|---|

Jun-2014 | $10,000 | $10,000 | $10,000 |

Jun-2015 | $10,714 | $10,729 | $10,078 |

Jun-2016 | $10,486 | $10,959 | $9,817 |

Jun-2017 | $12,823 | $12,987 | $12,258 |

Jun-2018 | $14,255 | $14,907 | $13,863 |

Jun-2019 | $14,231 | $16,246 | $12,999 |

Jun-2020 | $11,167 | $17,306 | $10,727 |

Jun-2021 | $17,350 | $24,950 | $18,588 |

Jun-2022 | $14,620 | $21,490 | $15,562 |

Jun-2023 | $16,388 | $25,563 | $16,497 |

Jun-2024 | $18,547 | $31,475 | $18,294 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

CRM Small Cap Value Fund - Investor Class | 13.17% | 5.44% | 6.37% |

Russell 3000® Total Return Index | 23.13% | 14.14% | 12.15% |

Russell 2000® Value Index | 10.90% | 7.07% | 6.23% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Effective May 23, 2024, the Fund adopted the Russell 3000 Total Return Index as its broad-based benchmark index that represents the overall equity market. The Fund also compares its performance to the Russell 2000 Value Index, which is a more narrowly based index that reflects the market sector in which the Fund invests. The Russell 2000 Value Index was formerly the Fund's primary benchmark. These changes were made to comply with a new regulatory requirement.

Net Assets | $75,275,015 |

Number of Portfolio Holdings | 48 |

Advisory Fee | $556,273 |

Portfolio Turnover | 77% |

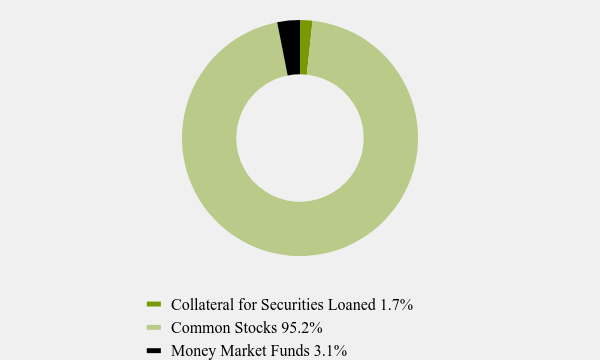

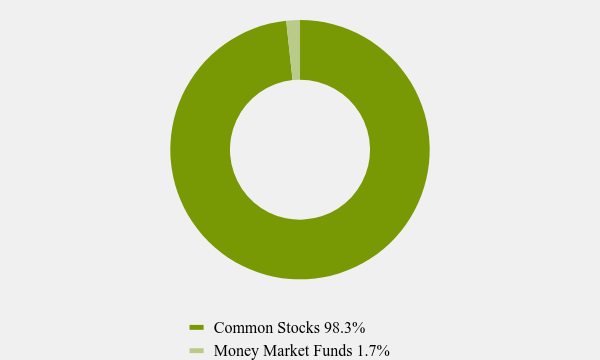

Asset Weighting (% of total investments)

Value | Value |

|---|

Collateral for Securities Loaned | 1.7% |

Common Stocks | 95.2% |

Money Market Funds | 3.1% |

What did the Fund invest in?

Sector Weighting (% of net assets)

Value | Value |

|---|

Liabilities in Excess of Other Assets | -1.9% |

Repurchase Agreements | 1.7% |

Money Market Funds | 3.2% |

Materials | 4.4% |

Utilities | 4.5% |

Health Care | 5.0% |

Energy | 5.5% |

Consumer Discretionary | 7.2% |

Real Estate | 9.5% |

Technology | 13.0% |

Financials | 22.1% |

Industrials | 25.8% |

Top 10 Holdings (% of net assets)

Holding Name | % of Net Assets |

Arcosa, Inc. | 3.7% |

Envestnet, Inc. | 3.5% |

ChampionX Corporation | 3.1% |

Central Pacific Financial Corporation | 3.0% |

ACV Auctions, Inc. | 3.0% |

Skyline Champion Corporation | 2.9% |

Horace Mann Educators Corporation | 2.9% |

Mueller Water Products, Inc. | 2.8% |

Itron, Inc. | 2.7% |

Stericycle, Inc. | 2.7% |

No material changes occurred during the year ended June 30, 2024.

CRM Small Cap Value Fund - Investor (CRMSX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( http://www.crmfunds.com/funds-overview/shareholder-resources/documents/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Distributed by ALPS Distributors, Inc.

CRM Small/Mid Cap Value Fund

Institutional Class (CRIAX)

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about CRM Small/Mid Cap Value Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.crmfunds.com/funds-overview/shareholder-resources/documents/. You can also request this information by contacting us at 800-CRM-2883.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Institutional | $110 | 1.05% |

How did the Fund perform during the reporting period?

During the fiscal year, the Fund underperformed both the Primary Benchmark Index (Russell 3000 Total Return Index) and Secondary Benchmark Index (Russell 2500 Value Total Return Index). Against the Secondary Benchmark Index, relative underperformance during the period was mainly attributed to stock selection, most notably in the Utilities, Financials, and Consumer Staples sectors. Conversely, stock selection in Materials, Information Technology, and Consumer Discretionary was a positive contributor to performance. We saw an improving earnings outlook for small to mid-cap companies as we progressed through 2024. Down cap companies’ earnings were more negatively impacted by the inflationary pressures and rise in interest rates than larger cap companies in 2023. Updated performance information is available at www.crmfunds.com/funds-overview/performance/.

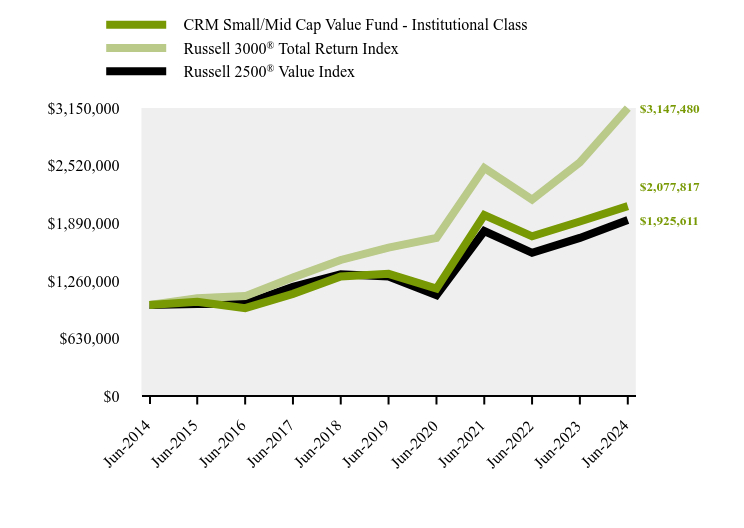

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| CRM Small/Mid Cap Value Fund - Institutional Class | Russell 3000® Total Return Index | Russell 2500® Value Index |

|---|

Jun-2014 | $1,000,000 | $1,000,000 | $1,000,000 |

Jun-2015 | $1,034,074 | $1,072,942 | $1,009,939 |

Jun-2016 | $964,358 | $1,095,885 | $1,012,110 |

Jun-2017 | $1,120,461 | $1,298,727 | $1,197,940 |

Jun-2018 | $1,311,266 | $1,490,655 | $1,335,570 |

Jun-2019 | $1,339,182 | $1,624,553 | $1,309,872 |

Jun-2020 | $1,177,754 | $1,730,629 | $1,106,860 |

Jun-2021 | $1,981,669 | $2,494,951 | $1,806,736 |

Jun-2022 | $1,748,309 | $2,149,011 | $1,568,366 |

Jun-2023 | $1,910,634 | $2,556,327 | $1,731,014 |

Jun-2024 | $2,077,817 | $3,147,480 | $1,925,611 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

CRM Small/Mid Cap Value Fund - Institutional Class | 8.75% | 9.18% | 7.59% |

Russell 3000® Total Return Index | 23.13% | 14.14% | 12.15% |

Russell 2500® Value Index | 11.24% | 8.01% | 6.77% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Effective May 23, 2024, the Fund adopted the Russell 3000 Total Return Index as its broad-based benchmark index that represents the overall equity market. The Fund also compares its performance to the Russell 2500 Value Index, which is a more narrowly based index that reflects the market sector in which the Fund invests. The Russell 2500 Value Index was formerly the Fund's primary benchmark. These changes were made to comply with a new regulatory requirement.

Net Assets | $169,225,405 |

Number of Portfolio Holdings | 48 |

Advisory Fee | $1,526,156 |

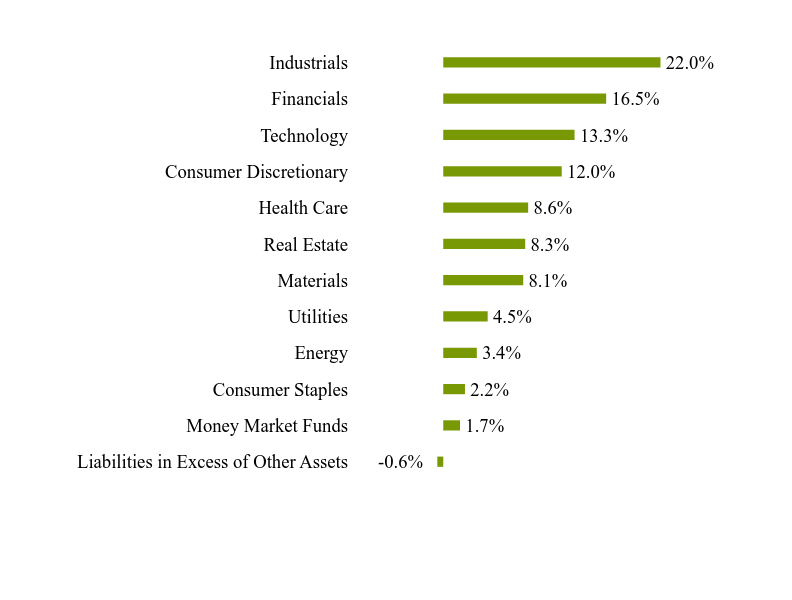

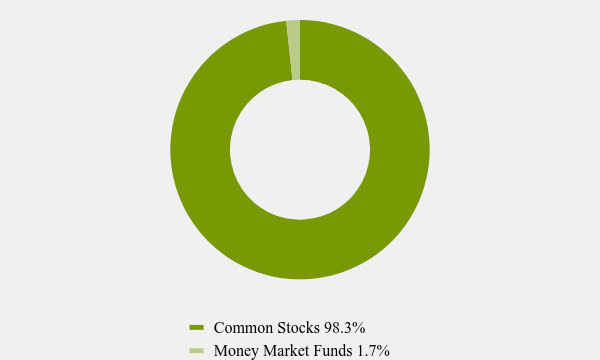

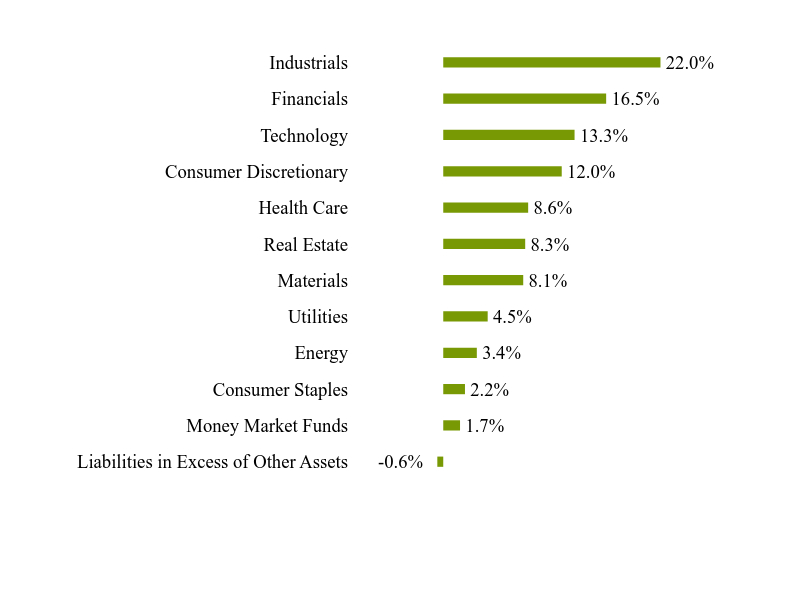

Portfolio Turnover | 72% |