false--12-31Q120200001320695P12MP6M0.33330.010.019000000090000000562000005640000056200000564000009000000.010.01100000001000000000P3YP3Y

0001320695

2020-01-01

2020-03-31

0001320695

ths:StructureToWinImprovementProgramMember

2020-01-01

2020-03-31

0001320695

ths:RestructuringAndMarginImprovementActivitiesCategoriesMember

2020-01-01

2020-03-31

0001320695

ths:TreeHouse2020RestructuringPlanMember

2020-01-01

2020-03-31

0001320695

2020-05-01

0001320695

2019-12-31

0001320695

2020-03-31

0001320695

2019-01-01

2019-03-31

0001320695

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-03-31

0001320695

us-gaap:AdditionalPaidInCapitalMember

2020-03-31

0001320695

us-gaap:CommonStockMember

2018-12-31

0001320695

us-gaap:TreasuryStockMember

2020-03-31

0001320695

2019-03-31

0001320695

us-gaap:CommonStockMember

2019-12-31

0001320695

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-01-01

2020-03-31

0001320695

us-gaap:CommonStockMember

2019-03-31

0001320695

2018-12-31

0001320695

us-gaap:AdditionalPaidInCapitalMember

2018-12-31

0001320695

us-gaap:RetainedEarningsMember

2018-12-31

0001320695

us-gaap:CommonStockMember

2020-01-01

2020-03-31

0001320695

us-gaap:TreasuryStockMember

2019-03-31

0001320695

us-gaap:TreasuryStockMember

2019-12-31

0001320695

us-gaap:TreasuryStockMember

2018-12-31

0001320695

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-01-01

2019-03-31

0001320695

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-12-31

0001320695

us-gaap:CommonStockMember

2019-01-01

2019-03-31

0001320695

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-03-31

0001320695

us-gaap:RetainedEarningsMember

2019-01-01

2019-03-31

0001320695

us-gaap:AdditionalPaidInCapitalMember

2019-03-31

0001320695

us-gaap:RetainedEarningsMember

2020-01-01

2020-03-31

0001320695

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-03-31

0001320695

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-03-31

0001320695

us-gaap:RetainedEarningsMember

2019-03-31

0001320695

us-gaap:RetainedEarningsMember

2019-12-31

0001320695

us-gaap:CommonStockMember

2020-03-31

0001320695

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-12-31

0001320695

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001320695

us-gaap:RetainedEarningsMember

2020-03-31

0001320695

2019-01-01

2019-01-01

0001320695

us-gaap:OtherRestructuringMember

ths:StructureToWinImprovementProgramMember

2020-03-31

0001320695

ths:AssetRelatedCostsMember

ths:StructureToWinImprovementProgramMember

2020-03-31

0001320695

ths:EmployeeRelatedCostsMember

ths:StructureToWinImprovementProgramMember

2020-03-31

0001320695

ths:AssetRelatedCostsMember

ths:StructureToWinImprovementProgramMember

2019-01-01

2019-03-31

0001320695

ths:StructureToWinImprovementProgramMember

2020-03-31

0001320695

ths:AssetRelatedCostsMember

ths:StructureToWinImprovementProgramMember

2020-01-01

2020-03-31

0001320695

ths:EmployeeRelatedCostsMember

ths:StructureToWinImprovementProgramMember

2019-01-01

2019-03-31

0001320695

us-gaap:OtherRestructuringMember

ths:StructureToWinImprovementProgramMember

2020-01-01

2020-03-31

0001320695

ths:EmployeeRelatedCostsMember

ths:StructureToWinImprovementProgramMember

2020-01-01

2020-03-31

0001320695

ths:StructureToWinImprovementProgramMember

2019-01-01

2019-03-31

0001320695

us-gaap:OtherRestructuringMember

ths:StructureToWinImprovementProgramMember

2019-01-01

2019-03-31

0001320695

us-gaap:OtherRestructuringMember

ths:TreeHouse2020RestructuringPlanMember

2020-03-31

0001320695

ths:EmployeeRelatedCostsMember

ths:TreeHouse2020RestructuringPlanMember

2019-01-01

2019-03-31

0001320695

ths:TreeHouse2020RestructuringPlanMember

2020-03-31

0001320695

ths:TreeHouse2020RestructuringPlanMember

2019-01-01

2019-03-31

0001320695

ths:AssetRelatedCostsMember

ths:TreeHouse2020RestructuringPlanMember

2020-03-31

0001320695

ths:EmployeeRelatedCostsMember

ths:TreeHouse2020RestructuringPlanMember

2020-03-31

0001320695

us-gaap:OtherRestructuringMember

ths:TreeHouse2020RestructuringPlanMember

2019-01-01

2019-03-31

0001320695

ths:AssetRelatedCostsMember

ths:TreeHouse2020RestructuringPlanMember

2020-01-01

2020-03-31

0001320695

ths:EmployeeRelatedCostsMember

ths:TreeHouse2020RestructuringPlanMember

2020-01-01

2020-03-31

0001320695

ths:AssetRelatedCostsMember

ths:TreeHouse2020RestructuringPlanMember

2019-01-01

2019-03-31

0001320695

us-gaap:OtherRestructuringMember

ths:TreeHouse2020RestructuringPlanMember

2020-01-01

2020-03-31

0001320695

ths:StructureToWinImprovementProgramMember

2019-12-31

0001320695

ths:RestructuringAndMarginImprovementActivitiesCategoriesMember

ths:StructureToWinImprovementProgramMember

2019-01-01

2019-03-31

0001320695

ths:RestructuringAndMarginImprovementActivitiesCategoriesMember

ths:TreeHouse2020RestructuringPlanMember

2020-01-01

2020-03-31

0001320695

ths:RestructuringAndMarginImprovementActivitiesCategoriesMember

2019-01-01

2019-03-31

0001320695

ths:RestructuringAndMarginImprovementActivitiesCategoriesMember

ths:TreeHouse2020RestructuringPlanMember

2019-01-01

2019-03-31

0001320695

ths:RestructuringAndMarginImprovementActivitiesCategoriesMember

ths:StructureToWinImprovementProgramMember

2020-01-01

2020-03-31

0001320695

us-gaap:OtherOperatingIncomeExpenseMember

2020-01-01

2020-03-31

0001320695

us-gaap:CostOfSalesMember

2019-01-01

2019-03-31

0001320695

us-gaap:GeneralAndAdministrativeExpenseMember

2020-01-01

2020-03-31

0001320695

us-gaap:OtherOperatingIncomeExpenseMember

2019-01-01

2019-03-31

0001320695

us-gaap:CostOfSalesMember

2020-01-01

2020-03-31

0001320695

us-gaap:GeneralAndAdministrativeExpenseMember

2019-01-01

2019-03-31

0001320695

us-gaap:EmployeeSeveranceMember

ths:OtherRestructuringAndPlantClosingCostsMember

2020-03-31

0001320695

us-gaap:EmployeeSeveranceMember

ths:OtherRestructuringAndPlantClosingCostsMember

2019-12-31

0001320695

us-gaap:OperatingExpenseMember

us-gaap:EmployeeSeveranceMember

ths:OtherRestructuringAndPlantClosingCostsMember

2020-01-01

2020-03-31

0001320695

us-gaap:EmployeeSeveranceMember

ths:OtherRestructuringAndPlantClosingCostsMember

2020-01-01

2020-03-31

0001320695

srt:MaximumMember

2020-03-31

0001320695

us-gaap:DiscontinuedOperationsHeldforsaleMember

2020-03-31

0001320695

us-gaap:DiscontinuedOperationsHeldforsaleMember

2019-12-31

0001320695

us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember

ths:InStoreBakeryFacilitiesMember

2019-12-31

0001320695

us-gaap:SegmentDiscontinuedOperationsMember

ths:SnacksMember

2019-08-01

0001320695

us-gaap:DiscontinuedOperationsHeldforsaleMember

ths:RTECerealMember

2020-01-01

2020-03-31

0001320695

ths:AtlasHoldingsLLCMember

us-gaap:ServiceMember

srt:MaximumMember

2020-01-01

2020-03-31

0001320695

ths:AtlasHoldingsLLCMember

us-gaap:ServiceMember

srt:MinimumMember

2020-01-01

2020-03-31

0001320695

us-gaap:TrademarksMember

2020-03-31

0001320695

us-gaap:TrademarksMember

2019-12-31

0001320695

ths:SnackingandBeveragesMember

2020-03-31

0001320695

ths:MealPreparationMember

2020-01-01

2020-03-31

0001320695

ths:SnackingandBeveragesMember

2019-12-31

0001320695

ths:MealPreparationMember

2019-12-31

0001320695

ths:MealPreparationMember

2020-03-31

0001320695

ths:SnackingandBeveragesMember

2020-01-01

2020-03-31

0001320695

us-gaap:ContractualRightsMember

2020-03-31

0001320695

us-gaap:CustomerRelatedIntangibleAssetsMember

2019-12-31

0001320695

us-gaap:TradeSecretsMember

2019-12-31

0001320695

us-gaap:CustomerRelatedIntangibleAssetsMember

2020-03-31

0001320695

us-gaap:TradeSecretsMember

2020-03-31

0001320695

us-gaap:ComputerSoftwareIntangibleAssetMember

2019-12-31

0001320695

us-gaap:TrademarksMember

2019-12-31

0001320695

us-gaap:TrademarksMember

2020-03-31

0001320695

us-gaap:ComputerSoftwareIntangibleAssetMember

2020-03-31

0001320695

us-gaap:ContractualRightsMember

2019-12-31

0001320695

us-gaap:RevolvingCreditFacilityMember

2020-03-31

0001320695

ths:TermLoanA1FacilityMember

2020-03-31

0001320695

us-gaap:RevolvingCreditFacilityMember

2019-12-31

0001320695

ths:SeniorNotesDueTwentyTwentyTwoMember

2019-12-31

0001320695

ths:SeniorNotesDueTwentyTwentyFourMember

2020-03-31

0001320695

ths:TermLoanA1FacilityMember

2019-12-31

0001320695

ths:TermLoanAMember

2020-03-31

0001320695

ths:TermLoanAMember

2019-12-31

0001320695

ths:SeniorNotesDueTwentyTwentyTwoMember

2020-03-31

0001320695

ths:SeniorNotesDueTwentyTwentyFourMember

2019-12-31

0001320695

us-gaap:RestrictedStockUnitsRSUMember

2020-01-01

2020-03-31

0001320695

us-gaap:RestrictedStockUnitsRSUMember

2019-01-01

2019-03-31

0001320695

srt:MaximumMember

us-gaap:PerformanceSharesMember

2020-01-01

2020-03-31

0001320695

us-gaap:EmployeeStockOptionMember

2020-01-01

2020-03-31

0001320695

us-gaap:PerformanceSharesMember

2020-01-01

2020-03-31

0001320695

ths:EquityIncentivePlanMember

2020-03-31

0001320695

srt:MinimumMember

us-gaap:PerformanceSharesMember

2020-01-01

2020-03-31

0001320695

us-gaap:PerformanceSharesMember

2020-03-31

0001320695

us-gaap:EmployeeStockOptionMember

2020-03-31

0001320695

us-gaap:RestrictedStockUnitsRSUMember

2020-03-31

0001320695

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementNonemployeeMember

2020-03-31

0001320695

us-gaap:PerformanceSharesMember

2019-01-01

2019-03-31

0001320695

us-gaap:EmployeeStockOptionMember

2019-01-01

2019-12-31

0001320695

us-gaap:EmployeeStockOptionMember

2019-12-31

0001320695

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

2020-03-31

0001320695

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

2020-01-01

2020-03-31

0001320695

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementNonemployeeMember

2020-01-01

2020-03-31

0001320695

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementNonemployeeMember

2019-12-31

0001320695

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

2019-12-31

0001320695

us-gaap:PerformanceSharesMember

2019-12-31

0001320695

us-gaap:AccumulatedTranslationAdjustmentMember

2019-01-01

2019-03-31

0001320695

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-01-01

2019-03-31

0001320695

us-gaap:AccumulatedTranslationAdjustmentMember

2020-01-01

2020-03-31

0001320695

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2020-01-01

2020-03-31

0001320695

us-gaap:AccumulatedTranslationAdjustmentMember

2018-12-31

0001320695

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-03-31

0001320695

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-12-31

0001320695

us-gaap:AccumulatedTranslationAdjustmentMember

2019-12-31

0001320695

us-gaap:AccumulatedTranslationAdjustmentMember

2019-03-31

0001320695

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2020-03-31

0001320695

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-12-31

0001320695

us-gaap:AccumulatedTranslationAdjustmentMember

2020-03-31

0001320695

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2019-01-01

2019-03-31

0001320695

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2020-01-01

2020-03-31

0001320695

us-gaap:PensionPlansDefinedBenefitMember

2020-01-01

2020-03-31

0001320695

us-gaap:PensionPlansDefinedBenefitMember

2019-01-01

2019-03-31

0001320695

ths:ClassActionsFiledByShareholdersMember

2020-03-31

0001320695

ths:Suchaneketalv.SturmFoodsInc.andTreeHouseIncMember

us-gaap:PendingLitigationMember

2020-03-31

0001320695

2019-12-16

2019-12-16

0001320695

2020-03-10

2020-03-10

0001320695

ths:Suchaneketalv.SturmFoodsInc.andTreeHouseIncMember

us-gaap:PendingLitigationMember

2020-01-01

2020-03-31

0001320695

us-gaap:InterestRateSwapMember

ths:OtherIncomeExpenseNetMember

2019-01-01

2019-03-31

0001320695

us-gaap:CommodityContractMember

ths:OtherIncomeExpenseNetMember

2019-01-01

2019-03-31

0001320695

us-gaap:InterestRateSwapMember

us-gaap:InterestExpenseMember

2020-01-01

2020-03-31

0001320695

us-gaap:CommodityContractMember

us-gaap:SellingAndMarketingExpenseMember

2019-01-01

2019-03-31

0001320695

us-gaap:InterestRateSwapMember

us-gaap:InterestExpenseMember

2019-01-01

2019-03-31

0001320695

us-gaap:CommodityContractMember

ths:OtherIncomeExpenseNetMember

2020-01-01

2020-03-31

0001320695

us-gaap:ForeignExchangeContractMember

ths:OtherIncomeExpenseNetMember

2019-01-01

2019-03-31

0001320695

us-gaap:InterestRateSwapMember

ths:OtherIncomeExpenseNetMember

2020-01-01

2020-03-31

0001320695

us-gaap:CommodityContractMember

us-gaap:SellingAndMarketingExpenseMember

2020-01-01

2020-03-31

0001320695

us-gaap:ForeignExchangeContractMember

ths:OtherIncomeExpenseNetMember

2020-01-01

2020-03-31

0001320695

us-gaap:ForeignExchangeContractMember

us-gaap:CostOfSalesMember

2020-01-01

2020-03-31

0001320695

us-gaap:ForeignExchangeContractMember

us-gaap:CostOfSalesMember

2019-01-01

2019-03-31

0001320695

us-gaap:InterestRateSwapMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2020-03-31

0001320695

srt:ScenarioForecastMember

us-gaap:InterestRateSwapMember

2025-12-31

0001320695

us-gaap:ForeignExchangeContractMember

2020-01-01

2020-03-31

0001320695

ths:DieselFuelContractsMember

2020-01-01

2020-03-31

0001320695

ths:ResinContractMember

2020-01-01

2020-03-31

0001320695

ths:CornContractMember

2020-01-01

2020-03-31

0001320695

us-gaap:ForeignExchangeContractMember

2020-03-31

0001320695

ths:ElectricityContractMember

2020-03-31

0001320695

ths:CoffeeContractMember

2020-01-01

2020-03-31

0001320695

ths:NaturalGasContractsMember

2020-03-31

0001320695

srt:ScenarioForecastMember

us-gaap:InterestRateSwapMember

2020-12-31

0001320695

ths:ElectricityContractMember

2020-01-01

2020-03-31

0001320695

ths:NaturalGasContractsMember

2020-01-01

2020-03-31

0001320695

us-gaap:InterestRateSwapMember

2019-12-31

0001320695

us-gaap:InterestRateSwapMember

2020-03-31

0001320695

us-gaap:ForeignExchangeContractMember

2019-12-31

0001320695

us-gaap:CommodityContractMember

2020-03-31

0001320695

us-gaap:CommodityContractMember

2019-12-31

0001320695

ths:RetailGroceryCustomersMember

2019-01-01

2019-03-31

0001320695

ths:FoodserviceMember

2020-01-01

2020-03-31

0001320695

ths:IndustrialComanufacturingandOtherMember

2020-01-01

2020-03-31

0001320695

ths:FoodserviceMember

2019-01-01

2019-03-31

0001320695

ths:RetailGroceryCustomersMember

2020-01-01

2020-03-31

0001320695

ths:IndustrialComanufacturingandOtherMember

2019-01-01

2019-03-31

0001320695

ths:MealPreparationMember

2019-01-01

2019-03-31

0001320695

ths:CenterStoreGroceryMember

ths:MealPreparationMember

2020-01-01

2020-03-31

0001320695

ths:MainCourseMember

ths:MealPreparationMember

2019-01-01

2019-03-31

0001320695

ths:SnackingandBeveragesMember

2019-01-01

2019-03-31

0001320695

ths:SweetSavorySnacksMember

ths:SnackingandBeveragesMember

2020-01-01

2020-03-31

0001320695

ths:BeveragesandDrinkMixesMember

ths:SnackingandBeveragesMember

2020-01-01

2020-03-31

0001320695

ths:MainCourseMember

ths:MealPreparationMember

2020-01-01

2020-03-31

0001320695

ths:BeveragesandDrinkMixesMember

ths:SnackingandBeveragesMember

2019-01-01

2019-03-31

0001320695

ths:SweetSavorySnacksMember

ths:SnackingandBeveragesMember

2019-01-01

2019-03-31

0001320695

ths:CenterStoreGroceryMember

ths:MealPreparationMember

2019-01-01

2019-03-31

0001320695

us-gaap:OperatingSegmentsMember

ths:MealPreparationMember

2020-01-01

2020-03-31

0001320695

us-gaap:MaterialReconcilingItemsMember

2020-01-01

2020-03-31

0001320695

us-gaap:OperatingSegmentsMember

ths:SnackingandBeveragesMember

2020-01-01

2020-03-31

0001320695

us-gaap:OperatingSegmentsMember

ths:SnackingandBeveragesMember

2019-01-01

2019-03-31

0001320695

us-gaap:MaterialReconcilingItemsMember

2019-01-01

2019-03-31

0001320695

us-gaap:OperatingSegmentsMember

ths:MealPreparationMember

2019-01-01

2019-03-31

utreg:MW

xbrli:shares

ths:DTH

ths:case

iso4217:USD

ths:state

ths:agreement

utreg:gal

xbrli:pure

ths:complaint

ths:segment

utreg:lb

ths:installment

iso4217:USD

xbrli:shares

ths:performance_period

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

|

| | |

| ☒ | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Quarterly Period Ended March 31, 2020.

or

|

| | |

| ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition Period from to

Commission File Number 001-32504

TreeHouse Foods, Inc.

(Exact name of the registrant as specified in its charter)

|

| | | |

Delaware | | | 20-2311383 |

(State or other jurisdiction of incorporation or organization) | | | (I.R.S. employer identification no.) |

| | | |

2021 Spring Road, Suite 600 | Oak Brook | IL | 60523 |

(Address of principal executive offices) | | | (Zip Code) |

(Registrant’s telephone number, including area code) (708) 483-1300

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 par value | THS | NYSE |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

| | | |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

(Do not check if a smaller reporting company) | | |

| | | |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Number of shares of Common Stock, $0.01 par value, outstanding as of May 1, 2020: 56,434,444.

Table of Contents

Part I — Financial Information

Item 1. Financial Statements

TREEHOUSE FOODS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, in millions, except per share data)

|

| | | | | | | | |

| | March 31, 2020 | | December 31, 2019 |

Assets | | |

| | |

|

Current assets: | | |

| | |

|

Cash and cash equivalents | | $ | 330.4 |

| | $ | 202.3 |

|

Receivables, net | | 292.8 |

| | 270.6 |

|

Inventories | | 537.8 |

| | 544.0 |

|

Prepaid expenses and other current assets | | 97.5 |

| | 44.5 |

|

Assets held for sale | | 26.3 |

| | 27.0 |

|

Assets of discontinued operations | | 128.3 |

| | 131.1 |

|

Total current assets | | 1,413.1 |

|

| 1,219.5 |

|

Property, plant, and equipment, net | | 1,022.3 |

| | 1,045.2 |

|

Operating lease right-of-use assets | | 166.0 |

| | 175.3 |

|

Goodwill | | 2,097.9 |

| | 2,107.3 |

|

Intangible assets, net | | 536.9 |

| | 554.7 |

|

Other assets, net | | 34.8 |

| | 37.4 |

|

Total assets | | $ | 5,271.0 |

|

| $ | 5,139.4 |

|

Liabilities and Stockholders’ Equity | | |

| | |

|

Current liabilities: | | |

| | |

|

Accounts payable | | $ | 539.1 |

| | $ | 508.4 |

|

Accrued expenses | | 331.2 |

| | 273.2 |

|

Current portion of long-term debt | | 15.3 |

| | 15.3 |

|

Liabilities of discontinued operations | | 8.1 |

| | 16.5 |

|

Total current liabilities | | 893.7 |

|

| 813.4 |

|

Long-term debt | | 2,189.5 |

| | 2,091.7 |

|

Operating lease liabilities | | 151.2 |

| | 158.5 |

|

Deferred income taxes | | 114.8 |

| | 101.5 |

|

Other long-term liabilities | | 133.7 |

| | 143.4 |

|

Total liabilities | | 3,482.9 |

|

| 3,308.5 |

|

Commitments and contingencies (Note 14) | |

|

| |

|

|

Stockholders’ equity: | | |

| | |

|

Preferred stock, par value $0.01 per share, 10.0 shares authorized, none issued | | — |

| | — |

|

Common stock, par value $0.01 per share, 90.0 shares authorized, 56.4 and 56.2 shares issued and outstanding, respectively | | 0.6 |

| | 0.6 |

|

Treasury stock | | (83.3 | ) | | (83.3 | ) |

Additional paid-in capital | | 2,158.8 |

| | 2,154.6 |

|

Accumulated deficit | | (188.2 | ) | | (157.0 | ) |

Accumulated other comprehensive loss | | (99.8 | ) | | (84.0 | ) |

Total stockholders’ equity | | 1,788.1 |

|

| 1,830.9 |

|

Total liabilities and stockholders’ equity | | $ | 5,271.0 |

|

| $ | 5,139.4 |

|

See Notes to Condensed Consolidated Financial Statements.

TREEHOUSE FOODS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in millions, except per share data)

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

Net sales | | $ | 1,084.9 |

| | $ | 1,066.8 |

|

Cost of sales | | 890.0 |

| | 870.6 |

|

Gross profit |

| 194.9 |

|

| 196.2 |

|

Operating expenses: | | | | |

Selling and distribution | | 65.1 |

| | 70.2 |

|

General and administrative | | 63.6 |

| | 62.3 |

|

Amortization expense | | 17.5 |

|

| 20.1 |

|

Other operating expense, net | | 18.5 |

| | 28.1 |

|

Total operating expenses |

| 164.7 |

|

| 180.7 |

|

Operating income |

| 30.2 |

|

| 15.5 |

|

Other expense: | | | | |

Interest expense | | 24.8 |

| | 25.1 |

|

Loss (gain) on foreign currency exchange | | 14.4 |

| | (0.4 | ) |

Other expense, net | | 64.0 |

| | 12.2 |

|

Total other expense |

| 103.2 |

|

| 36.9 |

|

Loss before income taxes | | (73.0 | ) | | (21.4 | ) |

Income tax benefit | | (40.2 | ) | | (6.9 | ) |

Net loss from continuing operations | | (32.8 | ) | | (14.5 | ) |

Net income (loss) from discontinued operations | | 1.6 |

| | (12.4 | ) |

Net loss |

| $ | (31.2 | ) |

| $ | (26.9 | ) |

| | | | |

Earnings (loss) per common share - basic: | | | | |

Continuing operations | | $ | (0.58 | ) | | $ | (0.26 | ) |

Discontinued operations | | 0.03 |

| | (0.22 | ) |

Net loss per share basic (1) | | $ | (0.55 | ) | | $ | (0.48 | ) |

| | | | |

Earnings (loss) per common share - diluted: | | | | |

Continuing operations | | $ | (0.58 | ) | | $ | (0.26 | ) |

Discontinued operations | | 0.03 |

| | (0.22 | ) |

Net loss per share diluted (1) | | $ | (0.55 | ) | | $ | (0.48 | ) |

| | | | |

Weighted average common shares: | | | | |

Basic | | 56.3 |

| | 56.1 |

|

Diluted | | 56.3 |

| | 56.1 |

|

See Notes to Condensed Consolidated Financial Statements.

TREEHOUSE FOODS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited, in millions)

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

Net loss | | $ | (31.2 | ) | | $ | (26.9 | ) |

| | | | |

Other comprehensive (loss) income: | | | | |

Foreign currency translation adjustments | | (15.9 | ) | | 6.8 |

|

Pension and postretirement reclassification adjustment | | 0.1 |

| | 0.1 |

|

Other comprehensive (loss) income | | (15.8 | ) | | 6.9 |

|

Comprehensive loss | | $ | (47.0 | ) |

| $ | (20.0 | ) |

See Notes to Condensed Consolidated Financial Statements.

TREEHOUSE FOODS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(Unaudited, in millions)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Retained | | | | | | Accumulated | | |

| | | | | | Additional | | Earnings | | | | Other | | |

| | Common Stock | | Paid-In | | (Accumulated | | Treasury Stock | | Comprehensive | | Total |

| | Shares | | Amount | | Capital | | Deficit) | | Shares | | Amount | | Loss | | Equity |

Balance, January 1, 2019 | | 57.8 |

| | $ | 0.6 |

| | $ | 2,135.8 |

| | $ | 204.0 |

| | (1.8 | ) | | $ | (83.3 | ) | | $ | (97.1 | ) | | $ | 2,160.0 |

|

Net loss | | — |

| | — |

| | — |

| | (26.9 | ) | | — |

| | — |

| | — |

| | (26.9 | ) |

Other comprehensive income | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 6.9 |

| | 6.9 |

|

Equity awards exercised | | 0.2 |

| | — |

| | (4.4 | ) | | — |

| | — |

| | — |

| | — |

| | (4.4 | ) |

Stock-based compensation | | — |

| | — |

| | 6.1 |

| | — |

| | — |

| | — |

| | — |

| | 6.1 |

|

Balance, March 31, 2019 | | 58.0 |

| | $ | 0.6 |

| | $ | 2,137.5 |

| | $ | 177.1 |

| | (1.8 | ) | | $ | (83.3 | ) | | $ | (90.2 | ) | | $ | 2,141.7 |

|

| | | | | | | | | | | | | | | | |

Balance, January 1, 2020 | | 58.0 |

| | $ | 0.6 |

| | $ | 2,154.6 |

| | $ | (157.0 | ) | | (1.8 | ) | | $ | (83.3 | ) | | $ | (84.0 | ) | | $ | 1,830.9 |

|

Net loss | | — |

| | — |

| | — |

| | (31.2 | ) | | — |

| | — |

| | — |

| | (31.2 | ) |

Other comprehensive loss | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (15.8 | ) | | (15.8 | ) |

Equity awards exercised | | 0.2 |

| | — |

| | (3.9 | ) | | — |

| | — |

| | — |

| | — |

| | (3.9 | ) |

Stock-based compensation | | — |

| | — |

| | 8.1 |

| | — |

| | — |

| | — |

| | — |

| | 8.1 |

|

Balance, March 31, 2020 | | 58.2 |

| | $ | 0.6 |

| | $ | 2,158.8 |

| | $ | (188.2 | ) | | (1.8 | ) | | $ | (83.3 | ) | | $ | (99.8 | ) | | $ | 1,788.1 |

|

See Notes to Condensed Consolidated Financial Statements.

TREEHOUSE FOODS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in millions)

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| | | | |

Cash flows from operating activities: | | | | |

Net loss | | $ | (31.2 | ) | | $ | (26.9 | ) |

Net income (loss) from discontinued operations | | 1.6 |

| | (12.4 | ) |

Net loss from continuing operations | | (32.8 | ) | | (14.5 | ) |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | |

Depreciation and amortization | | 49.8 |

| | 55.0 |

|

Stock-based compensation | | 7.9 |

| | 5.7 |

|

Unrealized loss on derivative contracts | | 64.1 |

| | 15.9 |

|

Deferred income taxes | | 15.0 |

| | 0.7 |

|

Other | | 19.2 |

| | — |

|

Changes in operating assets and liabilities: | | | | |

Receivables | | (24.0 | ) | | (16.4 | ) |

Inventories | | 1.1 |

| | (46.6 | ) |

Prepaid expenses and other assets | | (60.4 | ) | | (14.9 | ) |

Accounts payable | | 39.7 |

| | 11.9 |

|

Accrued expenses and other liabilities | | (11.1 | ) | | (62.2 | ) |

Net cash provided by (used in) operating activities - continuing operations | | 68.5 |

| | (65.4 | ) |

Net cash (used in) provided by operating activities - discontinued operations | | (6.0 | ) | | 27.5 |

|

Net cash provided by (used in) operating activities | | 62.5 |

| | (37.9 | ) |

Cash flows from investing activities: | | | | |

Additions to property, plant, and equipment | | (27.3 | ) | | (28.8 | ) |

Additions to intangible assets | | (3.8 | ) | | (6.5 | ) |

Proceeds from sale of fixed assets | | 5.1 |

| | — |

|

Other | | — |

| | (0.1 | ) |

Net cash used in investing activities - continuing operations | | (26.0 | ) | | (35.4 | ) |

Net cash used in investing activities - discontinued operations | | (0.3 | ) | | (1.1 | ) |

Net cash used in investing activities | | (26.3 | ) | | (36.5 | ) |

Cash flows from financing activities: | | | | |

Borrowings under Revolving Credit Facility | | 100.0 |

| | 14.0 |

|

Payments under Revolving Credit Facility | | — |

| | (14.0 | ) |

Payments on financing lease obligations | | (0.4 | ) | | (0.4 | ) |

Payments on Term Loans | | (3.5 | ) | | (10.0 | ) |

Receipts related to stock-based award activities | | — |

| | 0.2 |

|

Payments related to stock-based award activities | | (3.8 | ) | | (4.6 | ) |

Net cash provided by (used in) financing activities - continuing operations | | 92.3 |

| | (14.8 | ) |

Net cash used in financing activities - discontinued operations | | — |

| | — |

|

Net cash provided by (used in) financing activities | | 92.3 |

| | (14.8 | ) |

Effect of exchange rate changes on cash and cash equivalents | | (0.4 | ) | | 3.9 |

|

Net increase (decrease) in cash and cash equivalents | | 128.1 |

| | (85.3 | ) |

Cash and cash equivalents, beginning of period | | 202.3 |

| | 164.3 |

|

Cash and cash equivalents, end of period | | $ | 330.4 |

| | $ | 79.0 |

|

| | | | |

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

Supplemental cash flow disclosures | | | | |

Interest paid | | $ | 37.8 |

| | $ | 41.8 |

|

Net income tax paid | | 5.0 |

| | 4.7 |

|

| | | | |

Non-cash investing activities: | | | | |

Accrued purchase of property and equipment | | $ | 21.1 |

| | $ | 18.9 |

|

Accrued other intangible assets | | 2.9 |

| | 7.3 |

|

Right-of-use assets and operating lease obligations recognized at ASU 2016-02 transition | | — |

| | 252.5 |

|

Right-of-use assets and operating lease obligations recognized after ASU 2016-02 transition | | 1.7 |

| | 6.1 |

|

See Notes to Condensed Consolidated Financial Statements.

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

As of and for the three months ended March 31, 2020

(Unaudited)

1. BASIS OF PRESENTATION

The unaudited Condensed Consolidated Financial Statements included herein have been prepared by TreeHouse Foods, Inc. and its consolidated subsidiaries (the "Company," "TreeHouse," "we," "us," or "our"), pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC") applicable to quarterly reporting on Form 10-Q. In our opinion, these statements include all adjustments necessary for a fair presentation of the results of all interim periods reported herein. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP") have been condensed or omitted as permitted by such rules and regulations. The Condensed Consolidated Financial Statements and related notes should be read in conjunction with the Consolidated Financial Statements and related notes included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019. Results of operations for interim periods are not necessarily indicative of annual results.

The preparation of our Condensed Consolidated Financial Statements in conformity with GAAP requires us to use our judgment to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosures of contingent assets and liabilities at the date of the Condensed Consolidated Financial Statements, and the reported amounts of net sales and expenses during the reporting period. Actual results could differ from these estimates.

A detailed description of the Company’s significant accounting policies can be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

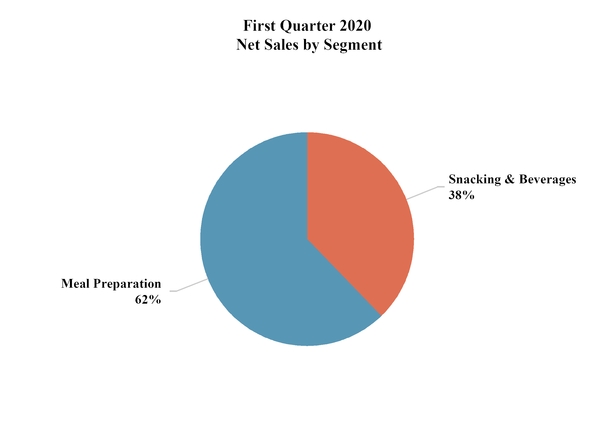

Change in Segments

In the first quarter of 2020, the Company changed how it manages its business, allocates resources, and goes to market, which resulted in modifications to its organizational and segment structure. All prior period information has been recast to reflect this change in reportable segments. Refer to Note 16 for additional information.

2. RECENT ACCOUNTING PRONOUNCEMENTS

Adopted

In March 2020, the SEC amended Rules 3-10 and 3-16 of Regulation S-X regarding financial disclosure requirements for registered debt offerings involving subsidiaries as either issuers or guarantors and affiliates whose securities are pledged as collateral. This new guidance narrows the circumstances that require separate financial statements of subsidiary issuers and guarantors and streamlines the alternative disclosures required in lieu of those statements. The final rule also allows for the simplified disclosure to be included within Management’s Discussion and Analysis of Financial Condition and Results of Operations. This rule is effective January 4, 2021 with earlier adoption permitted. The Company early adopted this new rule during the three months ended March 31, 2020.

In December 2019, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2019-12, Simplifying the Accounting for Income Taxes (Topic 740), which removes certain exceptions to the general principles in Topic 740 and improves consistent application of and simplifies GAAP for other areas of Topic 740 by clarifying and amending existing guidance. This guidance is effective for fiscal years and interim periods within those years beginning after December 15, 2020 with early adoption permitted. Amendments are to be applied prospectively, except for certain amendments that are to be applied either retrospectively or with a modified retrospective approach through a cumulative effect adjustment recorded to retained earnings. The Company early adopted this guidance during the three months ended March 31, 2020. The adoption will not have a material impact on our annual consolidated financial statements.

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Not yet adopted

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting, which provides temporary optional guidance to ease the potential burden in accounting for reference rate reform. The new guidance provides optional expedients and exceptions for applying generally accepted accounting principles to transactions affected by reference rate reform if certain criteria are met. These transactions include: contract modifications, hedging relationships, and the sale or transfer of debt securities classified as held-to-maturity. Entities may apply the ASU from March 12, 2020 through December 31, 2022. The Company is currently evaluating the impact of this new ASU on its consolidated financial statements and related disclosures.

3. RESTRUCTURING PROGRAMS

The Company’s restructuring and margin improvement activities are part of an enterprise-wide transformation to improve long-term profitability of the Company. These activities are aggregated into two categories: (1) TreeHouse 2020 – a long-term growth and margin improvement strategy and (2) Structure to Win – an operating expenses improvement program (collectively the "Restructuring Programs").

The costs by activity for the Restructuring Programs are outlined below:

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| (In millions) |

TreeHouse 2020 | | $ | 12.1 |

| | $ | 26.4 |

|

Structure to Win | | 7.8 |

| | 5.6 |

|

Total Restructuring Programs | | $ | 19.9 |

| | $ | 32.0 |

|

Expenses associated with these programs are recognized in Cost of sales, General and administrative, and Other operating expense, net in the Condensed Consolidated Statements of Operations. The Company does not allocate costs associated with Restructuring Programs to reportable segments when evaluating the performance of its segments. As a result, costs associated with Restructuring Programs are not presented by reportable segment. Refer to Note 16 for more information.

Below is a summary of costs by line item for the Restructuring Programs:

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| (In millions) |

Cost of sales | | $ | 0.7 |

| | $ | 3.0 |

|

General and administrative | | 0.7 |

| | 0.8 |

|

Other operating expense, net | | 18.5 |

| | 28.2 |

|

Total | | $ | 19.9 |

| | $ | 32.0 |

|

The table below presents the exit cost liability activity as of March 31, 2020:

|

| | | | |

| | Severance |

| | (In millions) |

Balance as of December 31, 2019 | | $ | 5.6 |

|

Expenses recognized | | 3.5 |

|

Cash payments | | (2.2 | ) |

Balance as of March 31, 2020 | | $ | 6.9 |

|

Liabilities as of March 31, 2020 associated with total exit cost reserves relate to severance. The severance liability is included in Accrued expenses in the Condensed Consolidated Balance Sheets.

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(1) TreeHouse 2020

In the third quarter of 2017, the Company announced TreeHouse 2020, a program intended to accelerate long-term growth through optimization of our manufacturing network, transformation of our mixing centers and warehouse footprint, and leveraging of systems and processes to drive performance. The Company’s workstreams related to these activities and selling, general, and administrative cost reductions will increase our capacity utilization, expand operating margins, and streamline our plant structure to optimize our supply chain. This program will be executed through 2020.

Below is a summary of the overall TreeHouse 2020 program costs by type:

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31, | | Cumulative Costs To Date | | Total Expected Costs |

| | 2020 | | 2019 | | |

| (In millions) |

Asset-related | | $ | — |

| | $ | 2.4 |

| | $ | 45.1 |

| | $ | 45.5 |

|

Employee-related | | 0.7 |

| | 4.1 |

| | 56.8 |

| | 59.2 |

|

Other costs | | 11.4 |

| | 19.9 |

| | 169.5 |

| | 190.4 |

|

Total | | $ | 12.1 |

| | $ | 26.4 |

| | $ | 271.4 |

| | $ | 295.1 |

|

For the three months ended March 31, 2020 and 2019, asset-related costs primarily consisted of accelerated depreciation; employee-related costs primarily consisted of dedicated project employee cost and severance; and other costs primarily consisted of consulting costs. Asset-related costs were recognized in Cost of sales while employee-related and other costs were primarily recognized in Other operating expense, net of the Condensed Consolidated Statement of Operations.

(2) Structure to Win

In the first quarter of 2018, the Company announced an operating expenses improvement program ("Structure to Win") designed to align our organization structure with strategic priorities. The program is intended to drive operational effectiveness, cost reduction, and position the Company for growth with a focus on a lean customer focused go-to-market team, centralized supply chain, and streamlined administrative functions.

Below is a summary of costs by type associated with the Structure to Win program:

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31, | | Cumulative Costs To Date | | Total Expected Costs |

| | 2020 | | 2019 | | |

| (In millions) |

Asset-related | | $ | — |

| | $ | 0.8 |

| | $ | 4.0 |

| | $ | 4.0 |

|

Employee-related | | 4.1 |

| | 1.3 |

| | 30.2 |

| | 39.4 |

|

Other costs | | 3.7 |

| | 3.5 |

| | 33.4 |

| | 36.9 |

|

Total | | $ | 7.8 |

| | $ | 5.6 |

| | $ | 67.6 |

| | $ | 80.3 |

|

In the first quarter of 2020, the Company changed how it manages its business, allocates resources, and goes to market, which resulted in modifications to its organizational and segment structure. Transition expenses related to the reorganization, which primarily relate to dedicated employee cost, severance, and consulting are included within Structure to Win. In connection with this reorganization, the Company increased the total expected costs for the Structure to Win program from $60.4 million to $80.3 million during the three months ended March 31, 2020.

For the three months ended March 31, 2020 and 2019, asset-related costs primarily consisted of accelerated depreciation; employee-related costs primarily consisted of severance; and other costs primarily consisted of consulting services. Asset-related costs are included in General and administrative expense and the employee-related and other costs are included in Other operating expense, net of the Condensed Consolidated Statements of Operations.

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

4. RECEIVABLES SALES PROGRAM

In December 2017 and June 2019, the Company entered into agreements to sell certain trade accounts receivable to two unrelated, third-party financial institutions (collectively, "the Receivables Sales Program"). The agreements can be terminated by either party with 60 days' notice. The Company has no retained interest in the receivables sold under the Receivables Sales Program; however, under the agreements the Company does have collection and administrative responsibilities for the sold receivables. Under the Receivables Sales Program, the maximum amount of receivables that may be sold at any time is $300.0 million.

Receivables sold under the Receivables Sales Program are de-recognized from the Company's Condensed Consolidated Balance Sheet at the time of the sale and the proceeds from such sales are reflected as a component of the change in receivables in the operating activities section of the Condensed Consolidated Statements of Cash Flows. The outstanding amount of accounts receivable sold under the Receivables Sales Program was $229.8 million and $243.0 million as of March 31, 2020 and December 31, 2019, respectively.

The loss on sale of receivables was $0.9 million for both the three months ended March 31, 2020 and 2019, and is included in Other expense, net in the Condensed Consolidated Statements of Operations. The Company has not recognized any servicing assets or liabilities as of March 31, 2020 or December 31, 2019, as the fair value of the servicing arrangement as well as the fees earned were not material to the financial statements.

As of March 31, 2020 and December 31, 2019, the Company had collected but not yet remitted to the financial institutions $106.7 million and $158.3 million, respectively. These amounts were included in Accounts payable in the Condensed Consolidated Balance Sheets.

5. INVENTORIES |

| | | | | | | | |

| | March 31, 2020 | | December 31, 2019 |

| | (In millions) |

Raw materials and supplies | | $ | 213.0 |

| | $ | 205.5 |

|

Finished goods | | 324.8 |

| | 338.5 |

|

Total inventories | | $ | 537.8 |

| | $ | 544.0 |

|

6. DISCONTINUED OPERATIONS AND OTHER DIVESTITURES

Snacks

On August 1, 2019, the Company completed the sale of its Snacks division to Atlas Holdings, LLC. ("Atlas") for $90 million in cash, subject to customary purchase price adjustments. The Snacks division operated three plants located in Robersonville, North Carolina; El Paso, Texas; and Dothan, Alabama. A fourth plant in Minneapolis, Minnesota was not included with the sale and closed during the third quarter of 2019.

The Company entered into a Transition Services Agreement ("TSA") with Atlas, which is designed to ensure and facilitate an orderly transfer of business operations. The services provided under the TSA terminated or will terminate at various times between January 1, 2020 and August 1, 2020 and can be renewed with a maximum of an additional twelve-month period for certain services. The income received under the TSA was not material for the three months ended March 31, 2020 and is primarily classified within General and administrative expenses or Cost of sales in the Company's Condensed Consolidated Statements of Operations depending on the functions being supported by the Company. Except for transition services, the Company has no continuing involvement with Atlas subsequent to the completion of the sale.

Ready-to-eat Cereal

On May 1, 2019, the Company entered into a definitive agreement to sell its RTE Cereal business, which until that time had been a component of the Meal Preparation reporting segment. The sale of this business is part of the Company's strategy to pursue portfolio optimization. On December 19, 2019, the Federal Trade Commission objected to the sale to Post. On January 13, 2020, the sale to Post was terminated and the Company announced its intention to pursue a sale of the RTE business to an alternative buyer. The Company continues to pursue this sale but has had to postpone certain activities during the quarter as a

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

result of the COVID-19 pandemic and associated shelter-in-place orders. The Company expects to continue sale activities as soon as practicable.

The Company continues to classify the RTE Cereal business as a discontinued operation as of March 31, 2020. The expected disposal loss for the RTE Cereal business is remeasured each quarter at the lower of carrying value or estimated fair value less costs to sell and is included in the valuation allowance in the balance sheet. The Company recognized adjustments to the expected disposal loss of $0.3 million during the three months ended March 31, 2020. These adjustments are classified as a component of Net income (loss) from discontinued operations in the Condensed Consolidated Statements of Operations. Completion of the sale may be for amounts that could be significantly different from the current fair value estimate. The Company's estimate of fair value will be evaluated and recognized each reporting period until the divestiture is complete.

The Company has reflected the Snacks division (through the date of sale) and RTE Cereal business as discontinued operations for all periods presented. Unless otherwise noted, amounts and disclosures throughout these Notes to Condensed Consolidated Financial Statements relate to the Company's continuing operations.

Results of discontinued operations were as follows:

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| | (in millions) |

Net sales | | $ | 56.8 |

| | $ | 235.0 |

|

Cost of sales | | 47.9 |

| | 236.1 |

|

Selling, general, administrative and other operating expenses | | 4.9 |

| | 12.6 |

|

Amortization expense | | — |

| | 1.5 |

|

Other operating expense, net | | 0.5 |

| | 0.7 |

|

Operating income (loss) from discontinued operations | | 3.5 |

| | (15.9 | ) |

Interest and other expense | | 1.3 |

| | 1.8 |

|

Income tax expense (benefit) | | 0.6 |

| | (5.3 | ) |

Net income (loss) from discontinued operations | | $ | 1.6 |

| | $ | (12.4 | ) |

Assets and liabilities of discontinued operations presented in the Condensed Consolidated Balance Sheets as of March 31, 2020 and December 31, 2019 include the following:

|

| | | | | | | | |

| | March 31, 2020 | | December 31, 2019 |

| | (in millions) |

Inventories | | $ | 39.5 |

| | $ | 41.6 |

|

Property, plant, and equipment, net | | 64.2 |

| | 64.4 |

|

Operating lease right-of-use assets | | 6.7 |

| | 7.5 |

|

Goodwill | | 53.5 |

| | 53.5 |

|

Intangible assets, net | | 38.6 |

| | 38.6 |

|

Valuation allowance | | (74.2 | ) | | (74.5 | ) |

Total assets of discontinued operations | | $ | 128.3 |

| | $ | 131.1 |

|

| | | | |

Accrued expenses and other liabilities | | $ | 0.9 |

| | $ | 8.3 |

|

Operating lease liabilities | | 7.2 |

| | 8.2 |

|

Total liabilities of discontinued operations | | $ | 8.1 |

| | $ | 16.5 |

|

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Other Divestitures

In-Store Bakery Facilities

During the fourth quarter of 2019, the Company reached the decision to sell two of its In-Store Bakery facilities located in Fridley, Minnesota and Lodi, California, which manufacture breads, rolls, and cakes for in-store retail bakeries and foodservice customers. These two facilities are included within the Snacking & Beverages reporting segment. On January 10, 2020, the Company entered into a definitive agreement to sell these facilities. On April 17, 2020, the Company completed the sale of these facilities. The Company determined the associated assets met the held for sale accounting criteria as of March 31, 2020 and December 31, 2019 and were classified accordingly in the Condensed Consolidated Balance Sheets. These two facilities did not meet the criteria to be presented as a discontinued operation.

The expected disposal loss for these facilities is remeasured each quarter at the lower of carrying value or estimated fair value less costs to sell and is included in the valuation allowance in the balance sheet. There were no adjustments to the expected disposal loss recognized by the Company during the three months ended March 31, 2020.

The following table represents detail of assets held for sale as of March 31, 2020 and December 31, 2019:

|

| | | | | | | | |

| | March 31, 2020 | | December 31, 2019 |

| | (in millions) |

Inventories | | $ | 11.9 |

| | $ | 9.4 |

|

Property, plant, and equipment, net | | 40.4 |

| | 40.9 |

|

Goodwill | | 5.7 |

| | 5.7 |

|

Intangible assets, net | | 9.4 |

| | 9.4 |

|

Valuation allowance | | (41.1 | ) | | (41.1 | ) |

Total assets held for sale | | $ | 26.3 |

| | $ | 24.3 |

|

The Company also had $2.7 million of assets classified as held for sale as of December 31, 2019 related to the closure of the Minneapolis, Minnesota facility. The sale of these assets was completed during the first quarter of 2020.

7. GOODWILL AND INTANGIBLE ASSETS

As a result of the changes in organizational structure completed in the first quarter of 2020, the Company now has the following two reportable segments: Meal Preparation and Snacking & Beverages. See Note 16 for more information regarding the change in segment structure.

In connection with the change in organizational structure completed in the first quarter of 2020, the Company allocated goodwill and accumulated impairment loss balances as of January 1, 2020 between reporting units using a relative fair value allocation approach. The change was considered a triggering event indicating a test for goodwill impairment was required as of January 1, 2020. The Company performed the impairment test, which did not result in the identification of any impairment losses.

Changes in the carrying amount of goodwill for the three months ended March 31, 2020 are as follows:

|

| | | | | | | | | | | | |

| | Meal Preparation | | Snacking & Beverages | | Total |

| | (In millions) |

Balance at January 1, 2020, before accumulated impairment losses | | $ | 1,264.5 |

| | $ | 887.3 |

| | $ | 2,151.8 |

|

Accumulated impairment losses | | (11.5 | ) | | (33.0 | ) | | (44.5 | ) |

Balance at January 1, 2020 | | 1,253.0 |

| | 854.3 |

| | 2,107.3 |

|

Foreign currency exchange adjustments | | (5.5 | ) | | (3.9 | ) | | (9.4 | ) |

Balance at March 31, 2020 | | $ | 1,247.5 |

| | $ | 850.4 |

| | $ | 2,097.9 |

|

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Indefinite Lived Intangible Assets

The Company has $20.8 million and $22.0 million of trademarks with indefinite lives as of March 31, 2020 and December 31, 2019, respectively.

Finite Lived Intangible Assets

The gross carrying amounts and accumulated amortization of intangible assets with finite lives as of March 31, 2020 and December 31, 2019 are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2020 | | December 31, 2019 |

| | Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount | | Gross Carrying Amount | | Accumulated Amortization | | | Net Carrying Amount |

| | (In millions) |

Intangible assets with finite lives: | | |

| | |

| | |

| | |

| | |

| | | |

|

Customer-related | | $ | 770.9 |

| | $ | (362.8 | ) | | $ | 408.1 |

| | $ | 778.1 |

| | $ | (355.2 | ) | | | $ | 422.9 |

|

Contractual agreements | | 0.5 |

| | (0.5 | ) | | — |

| | 0.5 |

| | (0.5 | ) | | | — |

|

Trademarks | | 52.5 |

| | (27.7 | ) | | 24.8 |

| | 53.0 |

| | (27.1 | ) | | | 25.9 |

|

Formulas/recipes | | 22.1 |

| | (19.8 | ) | | 2.3 |

| | 22.1 |

| | (19.2 | ) | | | 2.9 |

|

Computer software | | 182.4 |

| | (101.5 | ) | | 80.9 |

| | 179.0 |

| | (98.0 | ) | | | 81.0 |

|

Total finite lived intangibles | | $ | 1,028.4 |

| | $ | (512.3 | ) | | $ | 516.1 |

| | $ | 1,032.7 |

|

| $ | (500.0 | ) | | | $ | 532.7 |

|

8. INCOME TAXES

Income tax benefit was recognized at an effective rate of 55.1% and 32.2% for the three months ended March 31, 2020 and 2019, respectively. The change in the Company's effective tax rate for the three months ended March 31, 2020 compared to 2019 is primarily the result of a benefit recognized in 2020 due to the enactment of the CARES Act, a change in the amount of valuation allowance recorded against certain deferred tax assets, and a decrease in the amount of tax deductible stock based compensation. Our effective tax rate may change from period to period based on recurring and non-recurring factors including the jurisdictional mix of earnings, enacted tax legislation, state income taxes, settlement of tax audits, and the expiration of the statute of limitations in relation to unrecognized tax benefits.

Management estimates that it is reasonably possible that the total amount of unrecognized tax benefits could decrease by as much as $4.4 million within the next 12 months, primarily as a result of the resolution of audits currently in progress and the lapsing of statutes of limitations. As much as $0.4 million of the $4.4 million could affect net income when settled.

On March 27, 2020, President Trump signed the “Coronavirus Aid, Relief, and Economic Security Act” (the CARES Act), which features several tax provisions and other measures that assist businesses impacted by the economic effects of the COVID-19 pandemic. The significant tax provisions include an increase in the limitation of the tax deduction for interest expense from 30% to 50% of adjusted earnings in 2019 and 2020, a five-year carryback allowance for net operating losses generated in tax years 2018-2020, increased charitable contribution limitations to 25% of taxable income in 2020, and a retroactive technical correction to the 2017 Tax Cuts and Jobs Act that makes qualified improvement property placed in service after December 31, 2017 eligible for bonus depreciation. The Company has recorded a $6.0 million income tax benefit related to the net operating loss carryback provisions of the CARES Act for the three months ended March 31, 2020.

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

9. LONG-TERM DEBT

|

| | | | | | | | |

| | March 31, 2020 | | December 31, 2019 |

| | (In millions) |

Revolving Credit Facility | | $ | 100.0 |

| | $ | — |

|

Term Loan A | | 457.1 |

| | 458.4 |

|

Term Loan A-1 | | 679.4 |

| | 681.6 |

|

2022 Notes | | 375.9 |

| | 375.9 |

|

2024 Notes | | 602.9 |

| | 602.9 |

|

Finance leases | | 4.2 |

| | 3.9 |

|

Total outstanding debt | | 2,219.5 |

| | 2,122.7 |

|

Deferred financing costs | | (14.7 | ) | | (15.7 | ) |

Less current portion | | (15.3 | ) | | (15.3 | ) |

Total long-term debt | | $ | 2,189.5 |

| | $ | 2,091.7 |

|

The Company’s average interest rate on debt outstanding under its Credit Agreement for the three months ended March 31, 2020 was 3.37%. Including the impact of interest rate swap agreements in effect as of March 31, 2020, the average rate increased to 3.65%.

Revolving Credit Facility — During the three months ended March 31, 2020, the Company drew $100.0 million from its $750.0 million Revolving Credit Facility as a precautionary measure to maximize its financial flexibility and increase cash on hand. As of March 31, 2020, the Company had remaining availability of $623.9 million under the Revolving Credit Facility. The Revolving Credit Facility matures on February 1, 2023. In addition, as of March 31, 2020, there were $26.1 million in letters of credit under the Revolving Credit Facility that were issued but undrawn, which have been included as a reduction to the calculation of available credit.

Fair Value - At March 31, 2020, the aggregate fair value of the Company's total debt was $2,212.8 million and its carrying value was $2,215.3 million. At December 31, 2019, the aggregate fair value of the Company's total debt was $2,146.1 million and its carrying value was $2,118.8 million. The fair values of the Revolving Credit Facility, Term Loan A, and Term Loan A-1 were estimated using present value techniques and market-based interest rates and credit spreads. The fair values of the Company's 2022 Notes and 2024 Notes were estimated based on quoted market prices for similar instruments due to their infrequent trading volume. Accordingly, the fair value of the Company's debt is classified as Level 2 within the valuation hierarchy.

10. EARNINGS PER SHARE

The following table summarizes the effect of the share-based compensation awards on the weighted average number of shares outstanding used in calculating diluted loss per share:

|

| | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| (In millions, except per share data) |

Weighted average common shares outstanding | | 56.3 |

| | 56.1 |

|

Assumed exercise/vesting of equity awards (1) | | — |

| | — |

|

Weighted average diluted common shares outstanding | | 56.3 |

| | 56.1 |

|

| |

(1) | For the three months ended March 31, 2020 and 2019, the weighted average common shares outstanding is the same for the computations of both basic and diluted shares outstanding because including incremental shares would have been anti-dilutive. Equity awards excluded from our computation of diluted earnings per share because they were anti-dilutive, were 2.1 million and 1.7 million for the three months ended March 31, 2020 and 2019, respectively. |

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

11. STOCK-BASED COMPENSATION

The Board of Directors adopted, and the Company's Stockholders approved, the "TreeHouse Foods, Inc. Equity and Incentive Plan" (the "Plan"). Under the Plan, the Compensation Committee may grant awards of various types of compensation, including stock options, restricted stock, restricted stock units, performance shares, performance units, other types of stock-based awards, and other cash-based compensation. The maximum number of shares available to be awarded under the Plan is approximately 17.5 million, of which approximately 3.9 million remained available at March 31, 2020.

Total compensation expense related to stock-based payments and the related income tax benefit recognized in Net loss from continuing operations was as follows:

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| | (In millions) |

Compensation expense related to stock-based payments | | $ | 7.9 |

| | $ | 5.7 |

|

Related income tax benefit | | 2.1 |

| | 1.5 |

|

All amounts below include continuing and discontinued operations.

Stock Options — The following table summarizes stock option activity during the three months ended March 31, 2020. Stock options generally vest in approximately three equal installments on each of the first three anniversaries of the grant date and expire ten years from the grant date.

|

| | | | | | | | | | | | | |

| | Employee Options | | Weighted Average Exercise Price | | Weighted Average Remaining Contractual Term (yrs) | | Aggregate Intrinsic Value |

| | (In thousands) | | | | | | (In millions) |

Outstanding, at December 31, 2019 | | 1,528 |

| | $ | 74.58 |

| | 3.7 | | $ | 0.8 |

|

Forfeited | | (7 | ) | | 85.98 |

| | | | |

Expired | | (24 | ) | | 80.62 |

| | | | |

Outstanding, at March 31, 2020 | | 1,497 |

| | 74.43 |

| | 3.4 | | 0.5 |

|

Vested/expected to vest, at March 31, 2020 | | 1,496 |

| | 74.43 |

| | 3.4 | | 0.5 |

|

Exercisable, at March 31, 2020 | | 1,494 |

| | 74.44 |

| | 3.4 | | 0.5 |

|

Future compensation costs related to unvested options totaled less than $0.1 million at March 31, 2020 and will be recognized over the remaining vesting period of the grants, which averages 0.6 years.

Restricted Stock Units — Employee restricted stock unit awards generally vest based on the passage of time. These awards generally vest in approximately three equal installments on each of the first three anniversaries of the grant date. Director restricted stock units generally vest on the first anniversary of the grant date. Certain directors have deferred receipt of their awards until either their departure from the Board of Directors or a specified date. As of March 31, 2020, director restricted stock units that have been earned and deferred totaled approximately 91,660.

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The following table summarizes the restricted stock unit activity during the three months ended March 31, 2020:

|

| | | | | | | | | | | | | | |

| | Employee Restricted Stock Units | | Weighted Average Grant Date Fair Value | | Director Restricted Stock Units | | Weighted Average Grant Date Fair Value |

| | (In thousands) | | | | (In thousands) | | |

Outstanding, at December 31, 2019 | | 615 |

| | $ | 54.58 |

| | 116 |

| | $ | 58.30 |

|

Granted | | 416 |

| | 44.16 |

| | — |

| | — |

|

Vested | | (208 | ) | | 54.65 |

| | — |

| | — |

|

Forfeited | | (42 | ) | | 61.65 |

| | — |

| | — |

|

Outstanding, at March 31, 2020 | | 781 |

| | 48.63 |

| | 116 |

| | 58.30 |

|

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| | (In millions) |

Fair value of vested restricted stock units | | $ | 8.4 |

| | $ | 15.2 |

|

Tax benefit recognized from vested restricted stock units | | 1.4 |

| | 2.6 |

|

Future compensation costs related to restricted stock units are approximately $30.6 million as of March 31, 2020 and will be recognized on a weighted average basis over the next 2.4 years. The grant date fair value of the awards is equal to the Company’s closing stock price on the grant date.

Performance Units — Performance unit awards are granted to certain members of management. These awards contain service and performance conditions. For each of the three performance periods, one-third of the units will accrue, multiplied by a predefined percentage generally between 0% and 200%, depending on the achievement of certain operating performance measures. Additionally, for the cumulative performance period, a number of units will accrue, equal to the number of units granted multiplied by a predefined percentage generally between 0% and 200%, depending on the achievement of certain operating performance measures, less any units previously accrued. Accrued units will be converted to stock or cash, at the discretion of the Compensation Committee, generally, on the third anniversary of the grant date. The Company intends to settle these awards in stock and has the shares available to do so.

The following table summarizes the performance unit activity during the three months ended March 31, 2020:

|

| | | | | | | |

| | Performance Units | | Weighted Average Grant Date Fair Value |

| | (In thousands) | | |

Unvested, at December 31, 2019 | | 482 |

| | $ | 61.28 |

|

Granted | | 221 |

| | 44.19 |

|

Vested | | (75 | ) | | 60.12 |

|

Forfeited | | (67 | ) | | 80.30 |

|

Unvested, at March 31, 2020 | | 561 |

| | 52.43 |

|

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| | (In millions) |

Fair value of vested performance units | | $ | 3.3 |

| | $ | — |

|

Tax benefit recognized from performance units vested | | 0.6 |

| | — |

|

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Future compensation costs related to the performance units are estimated to be approximately $15.3 million as of March 31, 2020 and are expected to be recognized over the next 1.6 years. The grant date fair value of the awards is equal to the Company’s closing stock price on the date of grant.

12. ACCUMULATED OTHER COMPREHENSIVE LOSS

Accumulated other comprehensive loss consists of the following components, all of which are net of tax:

|

| | | | | | | | | | | | |

| | Foreign Currency Translation (1) | | Unrecognized Pension and Postretirement Benefits (1) | | Accumulated Other Comprehensive Loss |

| | (In millions) |

Balance at December 31, 2018 | | $ | (91.7 | ) | | $ | (5.4 | ) | | $ | (97.1 | ) |

Other comprehensive income | | 6.8 |

| | — |

| | 6.8 |

|

Reclassifications from accumulated other comprehensive loss (2) | | — |

| | 0.1 |

| | 0.1 |

|

Other comprehensive income | | 6.8 |

| | 0.1 |

| | 6.9 |

|

Balance at March 31, 2019 | | $ | (84.9 | ) | | $ | (5.3 | ) | | $ | (90.2 | ) |

| | | | | | |

Balance at December 31, 2019 | | $ | (79.4 | ) | | $ | (4.6 | ) | | $ | (84.0 | ) |

Other comprehensive loss | | (15.9 | ) | | — |

| | (15.9 | ) |

Reclassifications from accumulated other comprehensive loss (2) | | — |

| | 0.1 |

| | 0.1 |

|

Other comprehensive (loss) income | | (15.9 | ) | | 0.1 |

| | (15.8 | ) |

Balance at March 31, 2020 | | $ | (95.3 | ) | | $ | (4.5 | ) | | $ | (99.8 | ) |

| |

(1) | The tax impact of the foreign currency translation adjustment and the unrecognized pension and postretirement benefits reclassification was insignificant for the three months ended March 31, 2020 and 2019. |

| |

(2) | Refer to Note 13 for additional information regarding these reclassifications. |

13. EMPLOYEE RETIREMENT AND POSTRETIREMENT BENEFITS

Pension, Profit Sharing, and Postretirement Benefits — Certain employees and retirees participate in pension and other postretirement benefit plans. Employee benefit plan obligations and expenses included in the Condensed Consolidated Financial Statements are determined based on plan assumptions, employee demographic data, including years of service and compensation, benefits and claims paid, and employer contributions. The information below includes the activities of the Company's continuing and discontinued operations.

Components of net periodic pension benefit are as follows:

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| | (In millions) |

Service cost | | $ | 0.4 |

| | $ | 0.5 |

|

Interest cost | | 2.7 |

| | 3.2 |

|

Expected return on plan assets | | (3.6 | ) | | (3.8 | ) |

Amortization of unrecognized net loss | | 0.1 |

| | 0.1 |

|

Net periodic pension benefit | | $ | (0.4 | ) | | $ | — |

|

TREEHOUSE FOODS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Components of net periodic postretirement cost are as follows:

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| | (In millions) |

Interest cost | | $ | 0.2 |

| | $ | 0.3 |

|

Net periodic postretirement cost | | $ | 0.2 |

| | $ | 0.3 |

|

The service cost components of net periodic pension and postretirement costs were recognized in Cost of sales and the other components were recognized in Other expense, net of the Condensed Consolidated Statements of Operations.

14. COMMITMENTS AND CONTINGENCIES