Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21732

Mercer Funds

(Exact Name of Registrant as Specified in Charter)

99 High Street

Boston, MA 02110

(Address of Principal Executive Offices)(Zip Code)

Colin J. Dean, Esq.

Mercer Investments LLC

99 High Street

Boston, MA 02110

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: (617) 747-9500

Date of Fiscal Year End: March 31, 2022

Date of Reporting Period: March 31, 2022

Table of Contents

| Item 1. | Reports to Stockholders. |

(a) The Report to Shareholders is attached herewith.

Table of Contents

Mercer FundsTM

Annual Report

Mercer US Large Cap Equity Fund

Mercer US Small/Mid Cap Equity Fund

Mercer Non-US Core Equity Fund

Mercer Core Fixed Income Fund

Mercer Opportunistic Fixed Income Fund

Mercer Emerging Markets Equity Fund

Mercer Global Low Volatility Equity Fund

This report has been prepared for Mercer Funds shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Mercer Funds prospectus. The prospectus contains more complete information about the Funds’ investment objectives, risks, and expenses. Investors are reminded to read the prospectus carefully before investing.

March 31, 2022

Table of Contents

MERCER FUNDS

| Page | ||

| 1 | ||

| 27 | ||

| 29 | ||

| 201 | ||

| 205 | ||

| 207 | ||

| 211 | ||

| 220 | ||

| 258 | ||

| 259 | ||

| 264 | ||

| 267 | ||

Table of Contents

Mercer US Large Cap Equity Fund

Investment Objective and Benchmark

The investment objective of the Fund is long-term total return, which includes capital appreciation and income. The benchmark for the Fund is the Russell 1000® Index1.

Investment Strategy

The Fund invests principally in equity securities (such as common stock) issued by large capitalization U.S. companies. The Fund employs a “core equity” investment strategy by investing in both growth and value oriented equity securities. The Fund may invest in derivative instruments to gain market exposure on cash balances or to reduce market exposure in anticipation of liquidity needs.

Performance

For the fiscal year ended March 31, 2022, the Fund’s Y-3 share class performance was 8.62% compared to its benchmark, the Russell 1000® Index, return of 13.27%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2022, the Fund employed six sub-advisors: Brandywine Global Investment Management LLC (Brandywine), O’Shaughnessy Asset Management LLC (OSAM), Polen Capital Management LLC (Polen), Jennison Associates LLC (Jennison), Delaware Investments Fund Advisers, a series of Macquarie Investment Management Business Trust (Macquarie), and Parametric Portfolio Associates LLC (Parametric).

Brandywine, a deep value manager, focuses on cheap stocks that trade at a significant discount to intrinsic value, with strong free cash flows and quality balance sheets.

OSAM is a yield focused quantitative value manager that seeks stocks that rank high based on valuation, quality and shareholder yield.

Polen is a concentrated quality growth manager, focused on finding high quality companies, with sustainable, above-average earnings growth.

Jennison is a growth manager who selects stocks with long-term competitive advantages that are growing earnings faster or longer than the broad market.

Macquarie is a quality value manager who invests in strong, high quality businesses with sound balance sheets and free cash flow generation.

Parametric utilizes exchange-traded futures to generate market exposure corresponding to the Fund’s benchmark.

Market Commentary and Fund Performance

The US equity rally from pandemic lows continued in the first three quarters of the 2021 fiscal year. It was largely driven by strong economic recovery, robust corporate earnings and loose financial conditions. The environment also presented its challenges with virus variants, a slowdown in China, continuing supply chain disruptions and towards the second half of the year rising commodity prices, soaring inflation, and increasingly hawkish Federal Reserve. With inflation prints reaching 40-year highs and the Federal Reserve signaling its resolve to temper rising prices through monetary tightening, last quarter of the fiscal 2021 year saw US equities closing lower. The Russian invasion of Ukraine at the end of February and subsequent sanctions on Russian economy led to more disruptions in supply chains and created more pressure for energy, food and other commodity prices to move higher.

1

Table of Contents

Mercer US Large Cap Equity Fund

The environment led to significant divergences in performance across different sectors and styles of investing. Energy and metals & mining industries, for example, had greater than 50% returns for the year. On the other hand, the rising rate environment traditionally put more pressure on valuations of companies with high earnings growth characteristics. With rich valuations from exceptional performance from the prior year, these types of stocks entered a challenging environment and significantly lagged stocks with lower valuations.

Within the Russell 1000® Index, the Fund’s benchmark, the best performing sectors for the fiscal year were Energy (65.2%), Real Estate (22.7%), and Utilities (19.3%). The worst performing sectors were Communication Services (-3.2%), Industrials (3.6%) and Consumer Discretionary (5.9%). Information Technology, the largest sector in Russell 1000® Index returned 17.2%. However, excluding the impact of Apple and Microsoft, which combined constitute above 35% of the sector, IT returns were in single digits.

The Mercer US Large Cap Equity Fund lagged the Russell 1000® Index for the period, with value oriented managers, Brandywine, OSAM, and Macquarie outperforming, and growth and higher quality managers, Jennison and Polen underperforming their benchmarks.

Jennison lagged the Russell 1000® Growth Index by 12.38%. In contrast to 2020 when stocks with higher earnings growth characteristics had an exceptionally strong performance, 2021 was marked by change of investor sentiment and sharp decline in stock prices of higher growth, expensively priced businesses. The environment was a major headwind for Jennison. Majority of underperformance came from security selection in Information Technology and Communication Services sectors. Overweight positions to Shopify, Block, Twilio and Match were among largest negative contributors to performance.

Polen lagged the Russell 1000® Growth Index by 8.99%. Significant underperformance of higher growth, more expensively priced stocks was a headwind. Polen’s underperformance in most part came from security selection within Information Technology Sector. Overweight positions to Autodesk, Meta, Paypal and Netflix were among largest negative contributors to performance.

Macquarie outperformed the Russell 1000® Value Index by 1.83%. Macquarie’s outperformance was driven by security selection in a number of sectors such as Information Technology, Consumer Discretionary, Industrials and Consumer Staples. Being underweight to Energy and weaker security selection in Communication Services detracted. The investment environment was favorable as less expensively priced companies with relatively strong balance sheets and earnings tended to outperform.

OSAM outperformed the Russell 1000® Value Index by 0.95%. Security selection across a number of sectors such as Industrials, Information Technology, Consumer Staples and Health Care led to outperformance. Security selection in Materials and Financials detracted. OSAM’s higher than index exposure to inexpensive businesses was a tailwind as companies with value characteristics tended to outperform during the period.

Brandywine outperformed the Russell 1000® Value Index by 0.98%. Investments in Information Technology, Materials and Industrials both from allocation as well security selection perspectives were main contributors to returns. Security selection in Financials and Consumer Discretionary detracted. Brandywine’s higher than index exposure to inexpensive businesses was a tailwind as companies with value characteristics tended to outperform during the period.

Parametric utilizes exchange-traded futures replicating the Fund’s benchmark, aiming to provide broad, passive, equity market exposure to the Fund’s liquidity sleeve, and seeking to create positive returns on assets that would have otherwise been earning cash or cash equivalent returns. Performance differences versus the benchmark are largely a result of cash flow effects related to daily subscription/redemption activity and through financing costs of futures relative to interest earned on cash.

2

Table of Contents

Mercer US Large Cap Equity Fund

Risk Considerations

The Fund invests in both growth stocks and value stocks. Growth stocks may be particularly sensitive to market conditions. Investing in value stocks involves the risk that an investment made in undervalued securities may not appreciate in value as anticipated or remain undervalued for long periods of time. The Fund may invest in derivative instruments such as exchange-listed equity futures contracts, which may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains.

3

Table of Contents

Mercer US Large Cap Equity Fund

March 31, 2022

Comparison of Change in Value of a $10,000 Investment in

Mercer US Large Cap Equity Shares vs. the

Russell 1000® Index

As of March 31, 2022

| 1 | Russell 1000® Index measures the performance of the large cap segment of the U.S. equity universe. The index is unmanaged and cannot be invested in directly |

This graph shows the performance of the Mercer US Large Cap Equity Fund Class Y-3 shares versus the Russell 1000® Index from April 1, 2012 through March 31, 2022. The performance of other classes, when launched, will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-888-887-0619 or visit the Trust’s web site at https://www.mercer.us/what-we-do/wealth-and-investments/delegated-solutions-us.html for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Please see the Schedule of Investments for a complete list of Fund holdings.

4

Table of Contents

Mercer US Small/Mid Cap Equity Fund

Investment Objective and Benchmark

The investment objective of the Fund is to provide long-term total return, comprised primarily of capital appreciation. The benchmark for the Fund is the Russell 2500® Index1.

Investment Strategy

The Fund invests principally in equity securities issued by small-to-medium capitalization U.S. companies. The Fund employs a “core equity” investment strategy by investing in both growth and value oriented equity securities. The Fund may invest in derivative instruments to gain market exposure on cash balances or to reduce market exposure in anticipation of liquidity needs.

Performance

For the fiscal year ended March 31, 2022, the Fund’s Y-3 share class performance was 3.45% compared to its benchmark, the Russell 2500® Index, return of 0.34%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2022, the Fund employed six sub-advisors: Westfield Capital Management Company (Westfield), GW&K Investment Management LLC (GW&K), Loomis, Sayles & Company, LP (Loomis), LSV Asset Management (LSV), River Road Asset Management (River Road) and Parametric Portfolio Associates LLC (Parametric).

Westfield, a traditional growth manager, employs a fundamental, bottom-up approach, which seeks to identify reasonably priced stocks with high earnings growth potential. A bottom-up approach focuses on the analysis of individual stocks and de-emphasizes the significance of macroeconomic and market cycles with the assumption individual companies can do well even in an industry that is not performing, at least on a relative basis.

GW&K uses a bottom-up fundamental research process in order to identify high quality companies with sustainable long-term earnings growth rates.

Loomis looks to provide a lower volatility approach to high growth investing by seeking companies with high quality business models that have differentiated and sustainable growth opportunities.

LSV, a quantitative value manager, using mathematical and statistical methods, seeks deep value, out-of-favor companies with recent momentum. LSV avoids introducing any judgmental biases or behavioral weaknesses into their investment process.

River Road, a fundamental absolute value manager, seeks to buy stocks at a discount to their fair value and sell them at or in excess of that value, and focuses on purchasing companies that are priced at a modest discount to their absolute value and possess superior fundamental business characteristics.

Parametric utilizes exchange-traded futures to generate market exposure corresponding to the Fund’s benchmark.

Market Commentary and Fund Performance

The U.S. equity rally from pandemic lows continued in the first three quarters of the 2021 fiscal year. It was largely driven by strong economic recovery, robust corporate earnings and loose financial conditions. The environment also presented its challenges with virus variants, a slowdown in China, continuing supply chain disruptions and towards the second half of the year rising commodity prices, soaring inflation, and increasingly hawkish Federal Reserve. With inflation prints reaching 40-year highs and the Federal Reserve signaling its

5

Table of Contents

Mercer US Small/Mid Cap Equity Fund

resolve to temper rising prices through monetary tightening, last quarter of the fiscal 2021 year saw US equities closing lower. The Russian invasion of Ukraine at the end of February and subsequent sanctions on Russian economy led to more disruptions in supply chains and created more pressure for energy, food and other commodity prices to move higher.

The environment led to significant divergences in performance across different sectors and styles of investing. Energy and metals & mining industries, for example, had greater than 50% returns for the year. On the other hand, the rising rate environment traditionally put more pressure on valuations of companies with high earnings growth characteristics. With rich valuations from exceptional performance from the prior year, these types of stocks entered a challenging environment and significantly lagged stocks with lower valuations.

Within the Russell 2500® Index, the Fund’s benchmark, the best performing sectors for the fiscal year were Energy and Materials with returns of 84.05% and 21.21%, respectively. Underperforming sectors for the fiscal year were Health Care and Consumer Discretionary, with returns of -19.74% and -15.98%, respectively. The top performing industries for the fiscal year were Industrial Conglomerates and Metals & Mining with returns of 51.53% and 42.26%, respectively. The underperforming industries for the fiscal year were Biotechnology and Beverages with returns of -37.00% and -33.81%, respectively.

The Mercer US Small/Mid Cap Equity Fund outperformed the Russell 2500® Index for the period. The Fund’s exposure to quality, value, size from a market capitalization standpoint as well as its lower beta profile were tailwinds towards performance for the year. Security selection, particularly in the health care, consumer staples and consumer discretionary sectors contributed towards performance while selection in the materials and energy sectors detracted from performance for the fiscal year. From an allocation standpoint, the Fund’s overweight position in the information technology sector contributed towards performance while the Fund’s underweight positions in the energy and real estate sectors detracted from performance.

Westfield outperformed the Russell 2500® Growth Index for the fiscal year. The relative outperformance was driven by their valuation bias as well as their exposure to size from a weighted average market capitalization standpoint. In addition, their strong security selection in the health care and financials sectors contributed towards performance for the fiscal year. From an allocation standpoint, their underweight positioning in the consumer discretionary and consumer staples sectors coupled with their overweight positioning in the industrials sector contributed towards performance. Westfield’s underweight positioning in the energy sector detracted from performance for the fiscal year.

Loomis’ exposure to high quality growth coupled with their size exposure from a market capitalization standpoint were tailwinds towards performance versus the Russell 2500® Growth Index. In addition, their strong security selection within the biotechnology and life sciences tools & services industries within the health care sector coupled with their selection in the technology hardware, storage & peripherals, IT services and communications equipment industries within the information technology sector as well as the aerospace & defense industry within the industrials sector contributed towards performance for the fiscal year.

GW&K’s outperformance can be attributed to its exposure to higher quality and size from a market capitalization standpoint. In addition, their strong security selection in the biotechnology industry within the health care sector along with strong selection in the IT services and software industries within the information technology sector drove their performance for the fiscal year.

LSV’s underperformance versus the Russell 2500® Value Index for the period was driven by their allocation decisions being underweight to energy and overweight to the consumer discretionary sector despite their deep value style being in favor, which is evident with its security selection in multiple sectors to include financials, consumer staples, health care, real estate, information technology, consumer discretionary and utilities all contributing towards performance.

6

Table of Contents

Mercer US Small/Mid Cap Equity Fund

River Road’s underperformance versus the Russell 2500® Value Index for the period was attributed to their underweight exposure to materials, energy and real estate despite their strong security selection within the consumer discretionary and staples sectors for the fiscal year.

Parametric utilizes exchange-traded futures replicating the Fund’s benchmark to provide broad, passive, equity market exposure to the Fund’s liquidity sleeve, creating positive returns on assets that would have otherwise been earning cash or cash equivalent returns. Performance differences versus the benchmark are largely a result of cash flow effects related to daily subscription/redemption activity and through financing costs of futures relative to interest earned on cash.

Risk Considerations

The Fund invests in both growth stocks and value stocks. Growth stocks may be particularly sensitive to market conditions. Investing in value stocks involves the risk that an investment made in undervalued securities may not appreciate in value as anticipated or remain undervalued for long periods of time. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. The Fund may invest in derivative instruments such as exchange-listed equity futures contracts, which may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains.

7

Table of Contents

Mercer US Small/Mid Cap Equity Fund

March 31, 2022

Comparison of Change in Value of a $10,000 Investment in

Mercer US Small/Mid Cap Equity Shares vs. the

Russell 2500® Index

As of March 31, 2022

| 1 | Russell 2500® Index measures the performance of the small-to mid-cap segment of the U.S. equity universe. The Russell 2500® Index is a subset of the Russell 3000® Index. It includes approximately 2,500 of the smallest securities based on a combination of their market cap and current index membership. The index is unmanaged and cannot be invested in directly. |

This graph shows the performance of the Mercer US Small/Mid Cap Equity Fund Class Y-3 shares versus the Russell 2500® Index from April 1, 2012 through March 31, 2022. The performance of other classes, when launched, will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-888-887-0619 or visit the Trust’s web site at https://www.mercer.us/what-we-do/wealth-and-investments/delegated-solutions-us.html for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Please see the Schedule of Investments for a complete list of Fund holdings.

8

Table of Contents

Mercer Non-US Core Equity Fund

Investment Objective and Benchmark

The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income. The benchmark for the Fund is the MSCI EAFE® Index1.

Investment Strategy

The Fund invests principally in equity securities issued by non-U.S. companies of any capitalization, located in the world’s developed and emerging capital markets. The Fund employs a “core equity” investment strategy that seeks to meet the Fund’s investment objective by investing in both growth- and value-oriented equity securities.

Performance

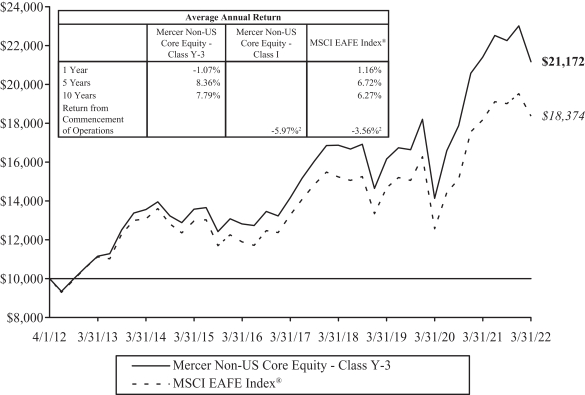

For the fiscal year ended March 31, 2022, the Fund’s Y-3 share class performance was -1.07% and the I share class performance was -5.97% compared to its benchmark return of 1.16%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2022, the Fund employed five sub-advisors: Arrowstreet Capital, Limited Partnership (Arrowstreet), American Century Investment Management, Inc. (American Century), MFS Investment Management (MFS), LSV Asset Management (LSV) and Parametric Portfolio Associates LLC (Parametric).

Arrowstreet’s strategy seeks to outperform international equity benchmarks through a risk-controlled core approach. Arrowstreet combines sound investment intuition and research with rigorous quantitative tools to identify mispriced stocks around the world. Arrowstreet believes that the key to generating return in excess of the benchmark involves evaluating the prospects of a security considering both the characteristics of the stock itself (direct effects) as well as the characteristics of other related stocks (indirect effects).

American Century manages its portfolio based on an investment philosophy that companies exhibiting improving or accelerating growth will outperform the market over time. American Century constructs its portfolio through a bottom-up stock selection, which focuses on individual stock selection rather than macroeconomic and market cycles, within a risk aware framework. American Century’s thorough research process seeks to identify companies that are exhibiting an improvement or acceleration in growth where it believes that growth is sustainable but that the earnings power of the company is generally underestimated. American Century can opportunistically invest in emerging market stocks.

MFS’s investment process is based on a fundamental, bottom-up stock selection of high quality companies whose long-term value MFS believes is not adequately reflected in the stock price.

LSV utilizes a quantitative approach, which uses mathematical and statistical methods and seeks deep value stocks that have fallen out of favor with the market, but have recent momentum, either in terms of price or earnings. LSV believes that long-term results are achieved through systematic exploitation of judgmental biases and behavioral weaknesses that influence investor decisions. LSV aims to exploit these biases through the disciplined application of quantitative techniques to drive bottom-up security selection.

Parametric utilizes exchange-traded futures to generate market exposure corresponding to the Fund’s benchmark.

Market Commentary and Fund Performance

During the first three quarters of fiscal year 2021 equities of developed economies continued to move higher supported by robust economic recovery, strong corporate earnings and relatively loose financials conditions.

9

Table of Contents

Mercer Non-US Core Equity Fund

In contrast, emerging market equities appeared under significant pressure starting from the second quarter. Chinese government’s tougher regulations towards a number of industries, including mega-cap technology and education stocks, sent Chinese equities, which constitute more than the third of the MSCI Emerging Markets® Index, sharply lower. In addition, Chinese equities have been under pressure from economic slowdown, which was exasperated by lock-downs as the government continued to pursue Covid-19 zero tolerance policies, as well as government’s attempts to manage soft landing for the overvalued Chinese real estate market.

During the year both developed and emerging markets had to grapple with a number of challenges such as virus variants, continuing supply chain disruptions and rising commodity prices and inflation rates. As it became increasingly clear that inflation pressures were not transitionary in nature, many Central Banks, including Federal Reserve, turned hawkish and began implementing or announcing monetary tightening policies. With multi-decade high inflation prints and hawkish Central banks around the world, equities declined in the last quarter of fiscal year 2021. Russian invasion of Ukraine at the end of February and subsequent sanctions on Russian economy led to more disruptions in supply chains and created more pressure for Energy, food and other commodity prices to move higher.

For the year ended March 31, 2022. U.S. equities — measured using the Russell 1000® Index — increased by 13.27%. Compared to the U.S., international developed markets lagged, with the MSCI EAFE® Index (the Fund’s benchmark) returning 1.16% over the period. The MSCI Emerging Markets® Index declined by 11.37% for the 12-month period ended March 31, 2022. In local currency terms MSCI EAFE® Index and MSCI Emerging Markets® Index posted higher returns, as US dollar significantly appreciated compared to other major currencies.

With rising commodity prices, commodity-producing countries such as Canada, Australia and UK in the developed world and Brazil, Mexico South Africa and Saudi Arabia in the emerging world posted strong returns. US and Switzerland in the developed world and India among emerging countries also registered strong returns for the year. Germany was the worst performing major developed economy, followed by Japan. In Emerging markets, Russia, China and Korea were the worst performers. Russian stocks, which at the end of January 2022 constituted 3.4% of the MSCI Emerging Markets® Index and were predominantly in Energy, Materials and Financial sectors, as a consequence of crises around Ukraine became illiquid and lost most their value. As of end of March, Russian stocks were removed from the MSCI Emerging Markets® Index.

The year witnessed major performance divergences across different sectors, styles of investing and regions. Commodity producing companies posted very strong returns. On the other hand, the rising rate environment traditionally put more pressure on valuations of companies with high earnings growth characteristics. With rich valuations from prior year’s exceptional performance, these types of stocks entered a challenging environment and significantly lagged value stocks. Companies with higher profitability and lower indebtedness levels also tended to lag in performance in part due to richer valuations. In the developed world, smaller market capitalization companies were under more pressure compared to mega and larger market capitalization companies. In contrast, in Emerging markets larger market cap stocks lagged, in large part stemming from significant underperformance of Chinese and Korean mega-cap names such as Tencent, Meituan and Samsung.

For the fiscal year, in EAFE markets Energy (30.8%), Health Care (9.3%) and Materials (8.7%) were the best performing sectors while Communication Services (-9.8%), Consumer Discretionary (-9.5%) and Industrials (-3.5%) were the worst performers.

Arrowstreet lagged the Fund’s benchmark by 0.32%. Largest detractors from performance were weaker security selection within Consumer Discretionary, Energy and Consumer Staples sectors; stronger security selection in Industrials, Financials and Information Technology sectors accounted for largest positive contributions. Arrowstreet’s tilt towards lower market capitalization stocks was a headwind; higher than benchmark exposure to cheaper priced stocks was a tailwind.

10

Table of Contents

Mercer Non-US Core Equity Fund

American Century lagged the Fund’s benchmark by 6.61%. While 2020 marked a year with exceptionally strong returns for companies with high and accelerating earnings growth characteristics, 2021 saw a reversal of investor sentiment and a significant sell-off for these types of stocks. This environment was a major headwind for American Century. Majority of underperformance came from security selection within Information Technology, Consumer Discretionary, Materials and Financials.

MFS underperformed the Fund’s benchmark by 2.79%. During 2021 more expensively priced businesses with high quality characteristics such as higher return on equity and lower indebtedness tended to underperform companies with lower valuations. This environment was a headwind for MFS. Largest detractors to performance came from security selection within Information Technology and Consumer Staples as well as being underweight to Health Care and Energy sectors.

LSV outperformed the Fund’s benchmark by 0.26%. Stronger security selection in Communication Services, Financials and Consumer Staples were largest positive contributors to returns. Weaker security selection in Energy, Materials and Information Technology were largest negative detractors. LSV’s tilt towards lower market capitalization stocks was a headwind; higher than benchmark exposure to cheaper priced stocks was a tailwind.

Parametric utilizes exchange-traded futures replicating the Fund’s benchmark, aiming to provide broad, passive, equity market exposure to the Fund’s liquidity sleeve, and seeking to create positive returns on assets that would have otherwise been earning cash or cash equivalent returns. Performance differences versus the benchmark are largely a result of cash flow effects related to daily subscription/redemption activity and through financing costs of futures relative to interest earned on cash.

Risk Considerations

The Fund invests in foreign and emerging market securities which involves certain risks such as currency volatility, political and social instability and reduced market liquidity. Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. The Fund may invest in derivative instruments such as exchange-listed equity futures contracts, which may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains.

11

Table of Contents

Mercer Non-US Core Equity Fund

March 31, 2022

Comparison of Change in Value of a $10,000 Investment in

Mercer Non-US Core Equity Shares vs. the

MSCI EAFE Index®

As of March 31, 2022

| 1 | MSCI EAFE® Index measures the performance of equity securities in developed markets outside of North America, including Europe, Australasia, and the Far East. The index is unmanaged and cannot be invested in directly. |

| 2 | Class I return is from commencement date July 22, 2021 through March 31, 2022. MSCI EAFE® Index return reflects the same time period. |

This graph shows the performance of the Mercer Non-US Core Equity Fund Class Y-3 shares versus the MSCI EAFE Index® from April 1, 2012 through March 31, 2022. The performance of other classes will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-888-887-0619 or visit the Trust’s web site at https://www.mercer.us/what-we-do/wealth-and-investments/delegated-solutions-us.html for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Please see the Schedule of Investments for a complete list of Fund holdings.

12

Table of Contents

Mercer Core Fixed Income Fund

Investment Objective and Benchmark

The investment objective of the Fund is to provide total return, consisting of both current income and capital appreciation. The benchmark for the Fund is the Bloomberg U.S. Aggregate Bond™ Index1.

Investment Strategy

The Fund invests principally in investment grade fixed income securities, including government securities, corporate bonds and securitized bonds, such as mortgage and asset-backed securities. The Fund may also invest in non-investment grade bonds (sometimes called high yield or junk bonds), non-U.S. dollar denominated bonds, and bonds issued by issuers located in emerging capital markets. The Fund may also invest in certain derivative instruments, such as options, futures, and swap agreements. The Fund may engage in transactions in derivatives for a variety of purposes, including changing the investment characteristics of its portfolio, enhancing total returns or as a substitute for taking a position in an underlying asset.

Performance

For the fiscal year ended March 31, 2022, the Fund’s Y-3 share class performance was -4.01% compared to its benchmark return of -6.14%. For the fiscal year ended March 31, 2022, the Fund’s I share class performance was -4.29% compared to its benchmark return of -4.15%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2022, the Fund employed three sub-advisors: Manulife Asset Management (Manulife), Income Research & Management (IR&M) and PGIM Fixed Income, a business unit of PGIM, Inc. (Prudential).

Manulife manages its allocated portion of the Fund by seeking to produce superior results by anticipating shifts in the business cycle and moderating risk relative to the direction of interest rates. The investment team capitalizes on these shifts by using a research-driven process to identify attractive sectors as well as mispriced securities within those sectors.

IR&M manages its allocated portion of the Fund based on the belief that careful security selection and higher portfolio income provide superior returns over the long term. Portfolios are constructed using a disciplined, bottom-up investment approach to select attractive securities from the U.S. fixed income universe. A bottom-up approach focuses on the analysis of individual stocks and de-emphasizes the significance of macroeconomic and market cycles with the assumption individual companies can do well even in an industry that is not performing, at least on a relative basis.

Prudential manages its allocated portion of the Fund by seeking to maximize excess return opportunities from sustainable alpha sources, such as sector allocation and bottom-up security selection. This process is coupled with a diligent daily portfolio risk evaluation and monitoring process. Research-based security selection is a major source of added value and incorporates both fundamental analysis, by measuring a security’s intrinsic value to determine if undervalued or overvalued, as well as proprietary models, by using software and other means of analysis to gain a competitive edge, which identify relative value and detailed technical review of issuers across both benchmark and non-benchmark sectors, with an emphasis on credit-oriented sectors.

Market Commentary and Fund Performance

For the 12-month period ended March 31, 2022, U.S. fixed income market returns, as measured by the Bloomberg U.S. Aggregate Bond™ Index, were negative, stemming from a move higher in rates in early 2022.

13

Table of Contents

Mercer Core Fixed Income Fund

Rising consumer prices as measured by the Consumer Price Index and the Federal Reserve’s (Fed) preferred gauge of the Core Personal Consumption Expenditures Price Index were a recurring theme throughout the period. During the December 2021 Federal Open Market Committee (FOMC) press conference, Chair Powell announced that data collected during fall signals inflation is higher and more persistent, with elevated risk of remaining higher for longer. Subsequently, the FOMC expedited the reduction of monthly asset purchases for U.S. Treasuries and Agency mortgage-backed securities in a move to end the purchasing program in March and put the Fed in position to raise the target federal funds rate if appropriate. Investment grade credit spreads ended the period at 116 basis points (1.16%), widening from their March 2020 level of 91 basis points (0.91%). Rates remained anchored at the front end for the majority of the period, until rising in Q4 in reaction to the Fed’s foreshadowing of rate hikes. Following expectations, the FOMC raised the Fed Funds target range by 25 bps during their March 2022 meeting to a new target range of 25-50 bps, citing strong job gains, a falling unemployment rate and elevated inflation as motivation. The 10-year Treasury ended the period at a rate of 2.32%, 58 basis points higher than its March 2021 level of 1.74%.

The Fund’s return was positive in relative terms as it outperformed in relation to the Bloomberg U.S. Aggregate Bond™ Index for the fiscal year ended March 31, 2022. The majority of outperformance was due to the Fund’s strategic overweight to spread sectors.

The respective performance results of each Sub-advisor was in line with expectations based on risk posture. Manulife has the largest share of the risk-allocation within the Fund. Manulife’s bias towards corporate credit and allocation to “higher quality” high yield bonds led the manager to outperform for the fiscal year. Manulife maintained a significant underweight to treasuries, with an unfavorable risk to reward view of the sector in anticipation of rate hikes.

Prudential had a marginally less aggressive allocation to spread sectors relative to Manulife, but was still overweight relative to the Fund’s benchmark. The majority of outperformance relative to the benchmark was due to their continued overweight allocations to securitized sectors such as CLOs and CMBS. An underweight allocation to Treasuries also contributed positively to the Fund’s returns.

IR&M also outperformed the Fund’s benchmark over the trailing 12-month period. The bias towards higher quality corporate bonds as well as their tactical rotation of spread exposure led them to outperform. Their slightly lower risk posture coming into the fiscal year allowed them to deploy more capital into market dislocations which benefited their overall performance as spreads tightened at a historic pace.

Risk Considerations

The Fund is subject to the risks that the underlying bonds in its portfolio are subject to, including credit, prepayment, call and interest rate risk. As interest rates rise, the value of bond prices will decline. The Fund may invest in foreign securities, which may expose the Fund to currency and exchange rate fluctuations, derivatives (such as futures, options, or swaps) and high yield bonds (also known as “junk” bonds). These investments may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may also experience high portfolio turnover, which may result in higher transaction costs and capital gains.

14

Table of Contents

Mercer Core Fixed Income Fund

March 31, 2022

Comparison of Change in Value of a $10,000 Investment in

Mercer Core Fixed Income Shares vs. the

Bloomberg U.S. Aggregate Bond™ Index

As of March 31, 2022

| 1 | Bloomberg U.S. Aggregate Bond Index is an index that measures the performance of securities from the Bloomberg U.S. Government/Corporate Bond Index, Mortgage-Backed Securities Index, Asset-Backed Securities Index, and Commercial Mortgage-Backed Securities Index. The Bloomberg U.S. Aggregate BondTM Index is a broad representation of the investment-grade fixed-income market in the United States and includes U.S. government and corporate debt securities, mortgage- and asset-backed securities, and international U.S. dollar-denominated bonds. All securities contained in the Bloomberg U.S. Aggregate BondTM Index have a minimum term to maturity of one year. The index is unmanaged and cannot be invested in directly. |

| 2 | Class I return is from commencement date December 27, 2021 through March 31, 2022. Bloomberg U.S. Aggregate BondTM Index return reflects the same time period. |

This graph shows the performance of the Mercer Core Fixed Income Fund Class Y-3 shares versus the Bloomberg U.S. Aggregate Bond™ Index from April 1, 2012 through March 31, 2022. The performance of other classes will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-888-887-0619 or visit the Trust’s web site at https://www.mercer.us/what-we-do/wealth-and-investments/delegated-solutions-us.html for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Please see the Schedule of Investments for a complete list of Fund holdings.

15

Table of Contents

Mercer Opportunistic Fixed Income Fund

Investment Objective and Benchmark

The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income. The Fund’s primary benchmark is the ICE Bank of America Merrill Lynch Global High Yield 2% Constrained Index Unhedged1. The Fund’s secondary benchmark is a blended benchmark consisting of 35% Bloomberg Global Aggregate Corporate Total Return Index Hedged, 17.5% Bloomberg Global High Yield Index, 10.5% JP Morgan CEMBI Broad Diversified Core Index, 7% S&P/LSTA Leveraged Loan Index, and 30% JP Morgan GBI-EM Diversified Index2.

Investment Strategy

The Fund invests principally in fixed income securities of U.S. and non-U.S. issuers, including those in emerging and frontier markets. The Fund invests in various strategic and tactical global bond market opportunities without limitations in geography, issuer type, quality and currency denomination. The Fund may invest in derivatives such as futures (including among others, interest rate futures), swaps (currency, interest rate, credit default and total return), forwards, options, and credit-linked notes. The Fund may engage in transactions in derivatives for a variety of purposes, including hedging, risk management, efficient portfolio management, enhance total returns, or as a substitute for taking position in the underlying asset.

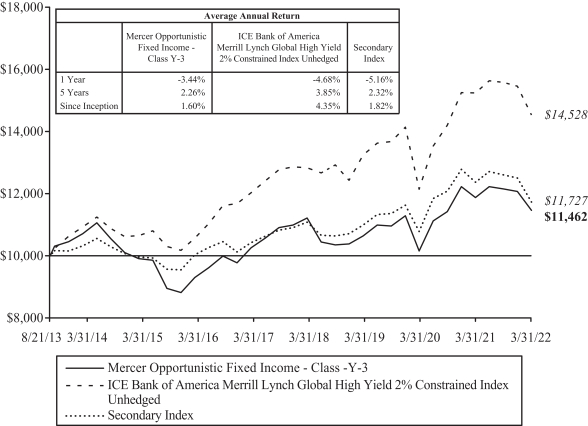

Performance

For the fiscal year ended March 31, 2022, the Fund’s Y-3 share class performance was -3.44% compared to its primary benchmark return of -4.68% and secondary benchmark return of -5.16%, Performance of the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2022, the Fund employed four sub-advisors and a sub-subadvisor, Western Asset Management Company and Western Asset Management Company Limited (as sub-subadvisor) (together referred to as WAMCO), Loomis, Sayles & Company, LP (Loomis), BlackRock International Limited (BlackRock), and Colchester Global Investors Limited (Colchester).

In managing its allocated portion of the Fund’s portfolio, Loomis invests in debt of issuers globally. Loomis produces country and credit cycle views as inputs to portfolio construction. Security selection is then carried out by a team of credit analysts who maintain a comprehensive database of internal ratings. The team will also engage in active duration positioning although security and sector selection are identified as main drivers of performance.

In managing its allocated portion of the Fund’s portfolio, WAMCO invests in credit securities across sectors and geographies. The strategy focuses on global valuations in credit and volatility conditions. The strategy seeks a blend of income and capital appreciation by dynamically rotating across sectors such as global corporates, emerging markets, and structured credit, and tactically managing overall portfolio duration.

In managing its allocated portion of the Fund’s portfolio, Colchester invests in sovereign debt issued by emerging market borrowers and those denominated in local emerging market currencies. Colchester’s portfolio

construction process is based on a quantitative model, using mathematical and statistical methods, that promotes allocation to countries and currencies identified based on attractive real yields and sound financial characteristics.

In managing its allocated portion of the Fund’s portfolio, BlackRock invests in emerging market debt securities denominated in local currency. BlackRock’s portfolio construction process implements a top down philosophy focused on identifying economic or market themes that impact asset prices. The themes inform the team’s market views and portfolios are positioned to benefit from directional moves in the market.

16

Table of Contents

Mercer Opportunistic Fixed Income Fund

Market Commentary and Fund Performance

For the 12-month period ended March 31, 2022, U.S. fixed income market returns, as measured by the Bloomberg U.S. Aggregate Bond™ Index, were negative, stemming from a move higher in rates in early 2022. Rising consumer prices as measured by the Consumer Price Index and the Federal Reserve’s (Fed) preferred gauge of the Core Personal Consumption Expenditures Price Index were a recurring theme throughout the period. During the December 2021 Federal Open Market Committee (FOMC) press conference, Chair Powell announced that data collected during fall signals inflation is higher and more persistent, with elevated risk of remaining higher for longer. Subsequently, the FOMC expedited the reduction of monthly asset purchases for U.S. Treasuries and Agency mortgage-backed securities in a move to end the purchasing program in March and put the Fed in position to raise the target federal funds rate if appropriate. Investment grade credit spreads ended the period at 116 basis points (1.16%), widening from their March 2020 level of 91 basis points (0.91%). Rates remained anchored at the front end for the majority of the period, until rising in Q4 in reaction to the Fed’s foreshadowing of rate hikes. Following expectations, the FOMC raised the Fed Funds target range by 25 bps during their March 2022 meeting to a new target range of 25-50 bps, citing strong job gains, a falling unemployment rate and elevated inflation as motivation. The 10-year Treasury ended the period at a rate of 2.32%, 58 basis points higher than its March 2021 level of 1.74%.

JPM GBI-EM Global Diversified Index of local currency Emerging Market government returned -8.53% in U.S. dollar terms over the 12-month period ending March 2022. Rates had a big impact on performance over the year and in March 2022 the index removed Russia as a response to the Russia invasion of Ukraine.

During the period, WAMCO and Loomis outperformed their component of the Fund’s secondary benchmark. The managers continued to tactically capitalize on opportunistic sector exposures. Western took advantage of CLO and bank loan risk exposure along while Loomis gained value in securitized assets and convertible bonds.

During the period, each of Blackrock and Colchester outperformed its component of the Fund’s secondary benchmark, the JPM GBI-EM Global Diversified Index government bond benchmark, for its strategy. BlackRock’s macro regime shifting investment approach helped to take advantage of broad market correlation shifts and idiosyncratic opportunities while increasing their exposure in commodity exporters against the US Dollar in 2022. Colchester benefitted from continuing their fundamental real-yield valuation approach

Risk Considerations

The Fund invests in non-investment grade and emerging market fixed income securities which involves certain risks such as higher volatility, currency fluctuation, political and social instability and reduced market liquidity. The Fund is subject to the risks that the underlying bonds in its portfolio are subject to, including credit, prepayment, call and interest rate risk. As interest rates rise, the value of bond prices will decline. The Fund may invest in foreign securities, which may expose the Fund to currency and exchange rate fluctuations, derivatives (such as futures, options and swaps) and high yield bonds (also known as “junk” bonds). These investments may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains

17

Table of Contents

Mercer Opportunistic Fixed Income Fund

March 31, 2022

Comparison of Change in Value of a $10,000 Investment in

Mercer Opportunistic Fixed Income Shares vs. the

ICE Bank of America Merrill Lynch Global High Yield 2% Constrained Index Unhedged, the Fund’s Secondary Index

As of March 31, 2022

| 1 | ICE Bank of America Merrill Lynch Global High Yield 2.0% Constrained Index Unhedged contains all securities in The Bank of America Merrill Lynch Global High Yield Index but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on a pro-rata basis. |

| 2 | The Fund’s secondary benchmark is a blended benchmark consisting of 35% Bloomberg Global Aggregate Corporate Total Return Index Hedged, 17.5% Bloomberg Global High Yield Index, 10.5% JP Morgan CEMBI Broad Diversified Core Index, 7% S&P/LSTA Leveraged Loan Index, and 30% JP Morgan GBI-EM Diversified Index. |

This graph shows the performance of the Mercer Opportunistic Fixed Income Fund Class Y-3 shares versus the ICE Bank of America Merrill Lynch Global High Yield 2% Constrained Index Unhedged and the Fund’s Secondary Index from August 21, 2013, which is the inception date of the Fund, through March 31, 2022. The performance of other classes, when launched, will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-888-887-0619 or visit the Trust’s web site at https://www.mercer.us/what-we-do/wealth-and-investments/delegated-solutions-us.html for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Please see the Schedule of Investments for a complete list of Fund holdings.

18

Table of Contents

Mercer Emerging Markets Equity Fund

Investment Objective and Benchmark

The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income. The benchmark for the Fund is the MSCI Emerging Markets® Index1.

Investment Strategy

The Fund invests principally in equity securities of large, medium and small capitalization companies, located in emerging markets, other investments that are tied economically to emerging markets, as well as in American, European and Global Depositary receipts. Stock index futures and various types of swaps may be used to implement the country selection component of the Fund’s investment strategy. Currency forwards may be used to make stock-selection and country allocation decisions independently of the underlying currency.

Performance

For the fiscal year ended March 31, 2022, the Fund’s Y-3 share class performance was -15.35% compared to its benchmark return of -11.4%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2022, the Fund employed six sub-advisors and one sub-subadvisor: William Blair Investment Management LLC (William Blair), Origin Asset Management LLP (Origin), Grantham, Mayo, Van Otterloo & Co. LLC (GMO), Bennbridge (U.S.) LLC, which utilizes certain personnel of Skerryvore Asset Management LLP (together referred to as Bennbridge/Skerryvore), Schroder Investment Management North America Inc. and Schroder Investment Management North America Limited (as sub-subadvisor) (together, referred to as Schroders) and Parametric Portfolio Associates LLC (Parametric).

William Blair has a quality growth philosophy and process focused on finding those companies that can achieve a higher growth rate for a longer period of time than the market expects. William Blair looks for companies with experienced and motivated management teams, unique business models and attractive financial characteristics.

Origin’s portfolio is managed using a quantitative process focused on companies with high and improving cash flow return on investment, selling at discounted valuations of expected future growth versus historical growth and that also display fundamental and price momentum. The portfolio is managed to have a higher tracking error and high active share.

GMO manages a quantitative strategy that combines both top down country and sector models, with bottom up stock selection models. These models combine elements of value, quality, and sentiment to help identify attractively valued countries and assets within those countries to purchase. The process is risk controlled and highly diversified.

Bennbridge/Skerryvore manages a high quality, concentrated equity strategy with an emphasis on preservation of capital, and sustainability of the businesses in which they invest. The strategy is low turnover, and concentrated, roughly 30-60 names.

Schroders manages a dedicated China allocation for the Fund to exploit alpha opportunities within the country. The strategy is a bottom up, fundamental strategy, relying on a team of experienced analysts and PMs to source and evaluate potential investments. The strategy is based on the belief that investing in quality businesses, with sustainable competitive advantages, and focus on shareholder value, trading at reasonable valuations will outperform over time.

19

Table of Contents

Mercer Emerging Markets Equity Fund

Parametric utilizes exchange-traded futures to generate market exposure corresponding to the Fund’s benchmark.

Market Commentary and Fund Performance

Over the 12 months ending 3/31/22, emerging market equities significantly lagged global developed equities, returning -11.4% vs 10.1% for the MSCI World Index®. A number of factors, including an uneven response to COVID 19, increasing regulation, tightening monetary policy, and geopolitical events drove this underperformance.

Throughout 2021, emerging market performance was choppy, with Chinese regulation and surging COVID rates in South American and India impacting markets. Within China, increased government regulations on technology and private education caused significant selling pressure in internet and ecommerce stocks. Alongside regulatory concerns, Evergrande, a highly leveraged Chinese property developer, caught headlines as it teetered on the brink of solvency bringing down the entire property sector on risks of contagion. China was also negatively impacted by tightening monetary policy and a surge in COVID 19 towards the end of 2021 and into early 2022. This surge, combined with China’s continued “zero-COVID” approach put significant pressure on future growth prospects for the country.

There were bright spots in EM, with India, Brazil, Saudi Arabia and Taiwan all outperforming. During 2021 an improving COVID situation in India, and flight of capital from China boosted Indian shares dramatically. In Taiwan, a global supply shortage of semiconductors created strong demand and growth for their dominant companies like TSMC.

Going into 2022, the pictured for emerging markets change dramatically, as Russia invaded neighboring Ukraine, shocking the world and markets. In the days following the invasion, strong sanctions from Western governments cut off Russia from the global economy, removing their banks from the SWIFT network and cutting access to Russia’s vast foreign reserves. The impact of this was a severe decline in the Ruble and devaluation of Russian shares. In early March, MSCI removed Russia from its flagship Emerging Markets index. The ripple effects of the invasion were dramatic increases in energy and commodity prices, which benefitted other commodity exporters like Brazil, South Africa, and Middle Eastern countries.

For the fiscal year, financials, utilities and materials were the best performing sectors while consumer discretionary, real estate and health care were the worst performers. From a country perspective, South American and Middle Eastern countries outperformed while Russia, China and Korea were among the laggards.

For the 12-month period ending March 31, 2022, the Mercer Emerging Markets Equity Fund lagged the MSCI Emerging Markets Index by approximately 3.4%. The Fund’s underperformance was driven in large part by an overweight allocation to Russia, which fell dramatically after the Ukraine invasion. Underweight allocations to other commodity exporters (ex Russia) including Brazil and the middle east also detracted. From a sector perspective underweight allocations and selection within financials, materials and energy were the largest detractors.

The William Blair Emerging Markets strategy underperformed the MSCI Emerging Markets® Index over the trailing 12-month period ending March 31st. Underperformance was driven by stock selection within China, particularly a holding in Tal Education whose shares fell after China severely regulated the after school tutoring industry. Other laggards included Ping An, a large Chinese insurer, along with Alibaba Group, an e-commerce company, and Tencent Music, an online music entertainment platform. Outside of China, holdings in Russia along with a relative lack of exposure to the Middle East also detracted. On the positive side, Mexican holdings, including a position in Grupo Aeroport Del Pacific was positive as was the strategy’s overweight to India

Origin underperformed the MSCI Emerging Markets® Index by 2.4%. Style exposure was a tailwind, with momentum, valuation and profitability all contributing. Underperformance was largely the result of South

20

Table of Contents

Mercer Emerging Markets Equity Fund

African mining holdings lagging and a lack of exposure to energy companies in the middle east. Exposure to Russia was also a large detractor for the strategy. On the positive side holdings in China and Korea were positive, particularly Chinese energy and financials.

GMO underperformed the MSCI Emerging Markets® Index by 11.1% for the fund’s fiscal year. The majority of the underperformance for the period is attributable to large holdings in Russia. GMO is a value oriented manager, and prior to the invasion felt comfortable holding significant Russian assets due to its low valuations and its strong economic fundamentals from a country standpoint, including their large foreign currency reserves and current account balance. Other detractors included being underweight other commodity exporters like Brazil and the Middle East. Offsetting losses slightly was strong sector selection within China, particularly an underweight in Consumer Discretionary.

Bennbridge outperformed by 9.6% for the year ending 3/31/22. The portfolio’s higher quality positioning was beneficial during a volatile period for emerging markets. Results were driven by strong performance from Indian domiciled business, and a relative lack of holdings in China, which continued to struggle due to increasing regulation and COVID lockdowns. Holding no exposure to Russia was also a strong contributor.

Schroders, the dedicated China manger within the fund outperformed for the year. Among the largest contributors were holdings in gold miners, which performed strongly during a volatile year for China. Our holdings in select Hong Kong banks were also helpful as they rose higher on faster rate hike expectation. The investment in electric vehicle names contributed as overall sentiment for the EV sector remained robust on the back of strong EV sales last year. A general underweight to Chinese internet names and lack of exposure to after school tutoring companies also contributed as these industries came under heavy regulatory pressure.

Parametric utilizes exchange-traded futures to replicate the Fund’s benchmark, aiming to provide broad, passive, equity market exposure to the Fund’s liquidity sleeve and seeking to create positive returns on assets that would have otherwise been earning cash or cash equivalent returns. Performance differences versus the benchmark are largely a result of cash flow effects related to daily subscription/redemption activity and through financing costs of futures relative to interest earned on cash.

Risk Considerations

The Fund invests in emerging market securities which involves certain risks such as currency volatility, political and social instability and reduced market liquidity. Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. The Fund may invest in derivatives (such as futures, forwards, options, or swaps), which may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains.

21

Table of Contents

Mercer Emerging Markets Equity Fund

March 31, 2022

Comparison of Change in Value of a $10,000 Investment in

Mercer Emerging Markets Equity Shares vs. the

MSCI Emerging Markets Index®

As of March 31, 2022

| 1 | MSCI Emerging Markets® Index measures the performance of equity securities in global emerging markets. The index is unmanaged and cannot be invested in directly. |

This graph shows the performance of the Mercer Emerging Markets Equity Fund Class Y-3 shares versus the MSCI Emerging Markets Index® from May 1, 2012, which is the inception date of the Fund, through March 31, 2022. The performance of other classes, when launched, will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-888-887-0619 or visit the Trust’s web site at https://www.mercer.us/what-we-do/wealth-and-investments/delegated-solutions-us.html for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Please see the Schedule of Investments for a complete list of Fund holdings.

22

Table of Contents

Mercer Global Low Volatility Equity Fund

Investment Objective and Benchmark

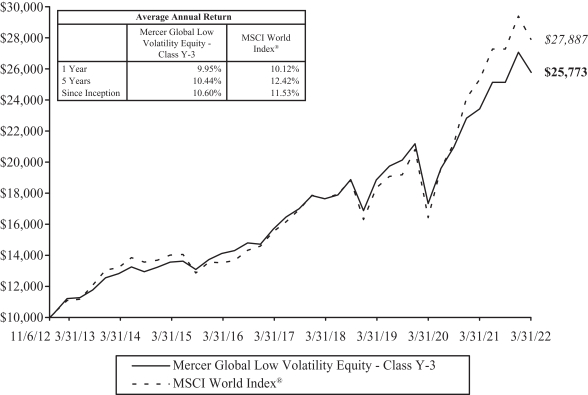

The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income. The benchmark for the Fund is the MSCI World® Index1.

Investment Strategy

The Fund invests principally in equity securities of U.S. and foreign issuers, of large, medium and small capitalization companies. Stock index futures and various types of swaps may be used to implement the equity security selection component of the Fund’s investment strategy. Currency forwards may be used to make stock- selection and country allocation decisions independently of the underlying currency.

Performance

For the fiscal year ended March 31, 2022, the Fund’s Y-3 share class performance was 9.95% compared to its benchmark return of 10.1%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2022, the Fund employed five sub-advisors, Acadian Asset Management LLC (Acadian), Martingale Asset Management, LP (Martingale), Ninety One Investment Management (Ninety One), Veritas Asset Management LLC (Veritas) and Parametric Portfolio Associates LLC (Parametric). Ninety One replaced Wellington Management Company in April, 2021.

Acadian is the Fund’s dedicated minimum variance manager for developed economies outside the U.S. The strategy applies a quantitative investment process, using mathematical and statistical methods, to the EAFE + Canada universe of securities and emphasizes low-volatility securities, low correlations between securities and a high degree of portfolio diversification with the goal of constructing a portfolio with lower levels of absolute volatility compared to the benchmark. Additionally, the strategy applies Acadian’s stock forecast and top-down alpha model, which measures the active return on an investment for performance as compared with a suitable market index, in order to enhance the returns. The portfolio does not employ tight constraints vs the benchmark across capitalization and/or sectors, enhancing its ability to more effectively manage portfolio volatility.

Martingale is the Fund’s dedicated minimum variance manager for the U.S. region. The strategy uses a systematic process of investing in stocks with lower stock price volatility and attractive fundamental factors such as value, quality and momentum. The portfolio aims to deliver equity-like market returns with lower volatility and less downside risk than the market index. Martingale’s core process includes reconstituting the Russell 1000 Index® into a proprietary “Stability Index”, which Martingale believes more accurately reflects stock risk properties based on longer-term company fundamentals as well as high frequency short-term risk signals. The strategy is managed against the derived Stability Index, which measures the degree of change (or stability) of the market, by applying stock and industry alpha forecasting models and optimizing to minimize the portfolio’s absolute volatility.

Ninety One manages a cconcentrated portfolio of exceptionally high-quality companies, operating in stable or growing industries with high barriers to entry and low capital intensity. The team uses bottom up fundamental analysis to select businesses that display the best combination of high quality, sustainable growth and compelling valuations. Fundamental analysis focuses on companies with “franchise” characteristics and competitive advantages. Their evidence suggests that dominant intangible assets (low capital intensity) such as high customer loyalty, brands, patents, licenses, copyrights, and distribution networks are difficult to create and more difficult for competitors to duplicate. Enduring franchises consistently generate high returns on capital and compound shareholder wealth. Companies will have high ROIC, high gross margins, low leverage, low capital intensity, above average growth and stable cash flow generation.

23

Table of Contents

Mercer Global Low Volatility Equity Fund

Veritas uses an unconstrained, fundamentally driven, rigorous research process with a long-term horizon. Veritas believes that companies with sustainable competitive advantage and benefitting from long-term drivers of growth, purchased at attractive valuations, will deliver performance in excess of the benchmark over time. The strategy may hold up to 20% cash.

Parametric utilizes exchange-traded futures to generate market exposure corresponding to the Fund’s benchmark.

Market Commentary and Fund Performance

During the first three quarters of fiscal year 2021 equities of developed economies continued to move higher supported by robust economic recovery, strong corporate earnings and relatively loose financials conditions. In contrast, emerging market equities appeared under significant pressure starting from the second quarter. Chinese government’s tougher regulations towards a number of industries, including mega-cap technology and education stocks, sent Chinese equities, which constitute more than the third of the MSCI EAFE Emerging Markets® Index, sharply lower. In addition, Chinese equities have been under pressure from economic slowdown, which was exasperated by lock-downs as the government continued to pursue Covid-19 zero tolerance policies, as well as government’s attempts to manage soft landing for the overvalued Chinese real estate market.

During the year both developed and emerging markets had to grapple with a number of challenges such as virus variants, continuing supply chain disruptions and rising commodity prices and inflation rates. As it became increasingly clear that inflation pressures were not transitionary in nature, many Central Banks, including Federal Reserve, turned hawkish and began implementing or announcing monetary tightening policies. With multi-decade high inflation prints and hawkish Central banks around the world, equities declined in the last quarter of fiscal year 2021. Russian invasion of Ukraine at the end of February and subsequent sanctions on Russian economy led to more disruptions in supply chains and created more pressure for Energy, food and other commodity prices to move higher.

For the year ended March 31, 2022. U.S. equities — measured using the Russell 1000® Index — increased by 13.27%. Compared to the U.S., international developed markets lagged, with the MSCI EAFE® Index (the Fund’s benchmark) returning 1.16% over the period. The MSCI Emerging Markets® Index declined by 11.37% for the 12-month period ended March 31, 2022. In local currency terms MSCI EAFE® Index and MSCI EAFE Emerging Markets® Index posted higher returns, as US dollar significantly appreciated compared to other major currencies.

With rising commodity prices, commodity-producing countries such as Canada, Australia and UK in the developed world and Brazil, Mexico South Africa and Saudi Arabia in the emerging world posted strong returns. US and Switzerland in the developed world and India among emerging countries also registered strong returns for the year. Germany was the worst performing major developed economy, followed by Japan. In Emerging markets, Russia, China and Korea were the worst performers. Russian stocks, which at the end of January 2022 constituted 3.4% of the MSCI Emerging Markets’ Index and were predominantly in Energy, Materials and Financial sectors, as a consequence of crises around Ukraine became illiquid and lost most their value. As of end of March, Russian stocks were removed from the MSCI EAFE Emerging Markets® Index.

The year witnessed major performance divergences across different sectors, styles of investing and regions. Commodity producing companies posted very strong returns. On the other hand, the rising rate environment traditionally put more pressure on valuations of companies with high earnings growth characteristics. With rich valuations from prior year’s exceptional performance, these types of stocks entered a challenging environment and significantly lagged value stocks. Companies with higher profitability and lower indebtedness levels also tended to lag in performance in part due to richer valuations. In the developed world, smaller market capitalization companies were under more pressure compared to mega and larger market capitalization