UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-21731 | |||||

|

| ||||||

|

Nuveen Equity Premium Advantage Fund | ||||||

|

(Exact name of registrant as specified in charter) | ||||||

|

| ||||||

|

Nuveen Investments | ||||||

|

(Address of principal executive offices) (Zip code) | ||||||

|

| ||||||

|

Kevin J. McCarthy | ||||||

|

(Name and address of agent for service) | ||||||

|

| ||||||

|

Registrant’s telephone number, including area code: |

(312) 917-7700 |

| ||||

|

| ||||||

|

Date of fiscal year end: |

December 31 |

| ||||

|

| ||||||

|

Date of reporting period: |

December 31, 2012 |

| ||||

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

Nuveen Investments

Closed-End Funds

Seeks Attractive Quarterly Distributions from an Integrated Index Option and Equity Strategy

Annual Report

December 31, 2012

Nuveen Equity Premium Income Fund

JPZ

Nuveen Equity Premium Opportunity Fund

JSN

Nuveen Equity Premium Advantage Fund

JLA

Nuveen Equity Premium and Growth Fund

JPG

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you'll receive an e-mail as soon as your Nuveen Investments Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

Table of Contents

|

Chairman's Letter to Shareholders |

4 |

||||||

|

Portfolio Managers' Comments |

5 |

||||||

|

Share Distribution and Price Information |

10 |

||||||

|

Performance Overviews |

13 |

||||||

|

Report of Independent Registered Public Accounting Firm |

17 |

||||||

|

Portfolios of Investments |

18 |

||||||

|

Statement of Assets & Liabilities |

50 |

||||||

|

Statement of Operations |

51 |

||||||

|

Statement of Changes in Net Assets |

52 |

||||||

|

Financial Highlights |

54 |

||||||

|

Notes to Financial Statements |

56 |

||||||

|

Board Members & Officers |

68 |

||||||

|

Glossary of Terms Used in this Report |

73 |

||||||

|

Additional Fund Information |

75 |

||||||

Chairman's

Letter to Shareholders

Dear Shareholders,

Despite the global economy's ability to muddle through the many economic headwinds of 2012, investors continue to have good reasons to remain cautious. The European Central Bank's decisions to extend intermediate term financing to major European banks and to support sovereign debt markets have begun to show signs of a stabilized euro area financial market. The larger member states of the European Union (EU) are working diligently to strengthen the framework for a tighter financial and banking union and meaningful progress has been made by agreeing to centralize large bank regulation under the European Central Bank. However, economic conditions in the southern tier members are not improving and the pressures on their political leadership remain intense. The jury is out on whether the respective populations will support the continuing austerity measures that are needed to meet the EU fiscal targets.

In the U.S., the Fed remains committed to low interest rates into 2015 through its third program of Quantitative Easing (QE3). Inflation remains low but a growing number of economists are expressing concern about the economic distortions resulting from negative real interest rates. The highly partisan atmosphere in Congress led to a disappointingly modest solution for dealing with the end-of-year tax and spending issues. Early indications for the new Congressional term have not given much encouragement that the atmosphere for dealing with the sequestration legislation and the debt ceiling issues, let alone a more encompassing "grand bargain," will be any better than the last Congress. Over the longer term, there are some encouraging trends for the U.S. economy: house prices are beginning to recover, banks and corporations continue to strengthen their financial positions and incentives for capital investment in the U.S. by domestic and foreign corporations are increasing due to more competitive energy and labor costs.

During 2012 U.S. investors have benefited from strong returns in the domestic equity markets and solid returns in most fixed income markets. However, many of the macroeconomic risks of 2012 remain unresolved, including negotiating through the many U.S. fiscal issues, managing the risks of another year of abnormally low U.S. interest rates, sustaining the progress being made in the euro area and reducing the potential economic impact of geopolitical issues, particularly in the Middle East. In the face of these uncertainties, the experienced investment professionals at Nuveen Investments seek out investments that are enjoying positive economic conditions. At the same time they are always on the alert for risks in markets subject to excessive optimism or for opportunities in markets experiencing undue pessimism. Monitoring this process is a critical function for the Fund Board as it oversees your Nuveen Fund on your behalf.

As always, I encourage you to communicate with your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

February 22, 2013

Nuveen Investments

4

Portfolio Managers' Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Nuveen Equity Premium Income Fund (JPZ)

Nuveen Equity Premium Opportunity Fund (JSN)

Nuveen Equity Premium Advantage Fund (JLA)

Nuveen Equity Premium and Growth Fund (JPG)

These Funds feature portfolio management by Gateway Investment Advisers, LLC. J. Patrick Rogers, President, and Kenneth H. Toft, Vice President, serve as co-portfolio managers for JSN and JLA; Patrick and Michael T. Buckius, Senior Vice President, are co-portfolio managers for JPZ and JPG. Here they discuss the general market conditions, their management strategies and the performance of the Funds for the twelve-months ended December 31, 2012.

Effective February 21, 2013, Michael Buckius and Kenneth Toft, both of Gateway Investment Advisers, LLC, have been appointed co-portfolio managers of the Funds. J. Patrick Rogers no longer serves as a portfolio manager of the Funds. Each Fund's investment objectives and investment strategies remain unchanged.

What were the general market conditions and trends over the course of this reporting period?

During this period, the U.S. economy's progress toward recovery from recession continued at a moderate pace. The Federal Reserve (Fed) maintained its efforts to improve the overall economic environment by holding the benchmark fed funds rate at the record low level of zero to 0.25% that it established in December 2008. The central bank decided during its December 2012 meeting to keep the fed funds rate at "exceptionally low levels" until either the unemployment rate reaches 6.5% or expected inflation goes above 2.5%. The Fed also affirmed its decision, announced in September 2012, to purchase $40 billion of mortgage-backed securities each month in an effort to stimulate the housing market. In addition to this new, open-ended stimulus program, the Fed plans to continue its program to extend the average maturity of its holdings of U.S. Treasury securities through the end of December 2012. The goals of these actions, which together will increase the Fed's holdings of longer-term securities by approximately $85 billion a month through the end of the year, are to put downward pressure on longer-term interest rates, make broader financial conditions more accommodative and support a stronger economic recovery as well as continued progress toward the Fed's mandates of maximum employment and price stability.

In the fourth quarter 2012, the U.S. economy, as measured by the U.S. gross domestic product (GDP), decreased at an estimated annualized rate of 0.1%, down from a 3.1%

Nuveen Investments

5

increase in the third quarter. This slight decline was due to lower inventory investment, federal spending and net exports. The Consumer Price Index (CPI) rose 1.7% year-over-year as of December 2012, after a 3.0% increase in 2011. The core CPI (which excludes food and energy) increased 1.9% during the period, staying just within the Fed's unofficial objective of 2.0% or lower for this inflation measure. As of January 2013, the national unemployment rate was 7.9%, slightly higher than the 7.8% unemployment rate for December 2012 but below the 8.3% level recorded in January 2012. The housing market continued to show signs of improvement, with the average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rising 5.5% for the twelve months ended November 2012 (most recent data available at the time this report was prepared). This was the largest year-over-year price gain since August 2006. The outlook for the U.S. economy remained clouded by uncertainty about global financial markets and the continued negotiations by Congress regarding potential spending cuts and tax policy reform.

At the global level, all major markets skirted potentially serious economic disruption. Arguably, Europe was the most acute with multiple threats of sovereign defaults. The United States spent much of the year hoping to avoid a stalemated fiscal policy which would lead to an economic slowdown. In Asia, both China and Japan underwent regime changes with uncertainty in the background, particularly worrisome in China since it had been providing an important growth engine for the global economy. Countering these risks were substantial liquidity infusions in all three regions by central banking authorities, as monetary policy sought to compensate for the lack of fiscal stimulus.

Against this backdrop, it is hardly surprising that domestic equity investors took a risk-on/risk-off path during the year. After a strong first quarter, equity market optimism turned to apprehension as worldwide concerns clouded economic forecasts. Consequently, the S&P 500® Index ended the year up 16.00%, having earned 12.58% of this return in the risk-on first quarter. Paralleling the S&P 500® Index, the technology-laden, growth stock-oriented NASDAQ-100 Index exhibited a see-saw pattern of returns, posting a strong 21.24% in the first quarter, then playing defense the remainder of 2012 to finish the year at 18.33%.

Measures of market volatility, the Chicago Board Options Exchange Volatility Index (the "VIX"), which is reflective of S&P 500® Index option volatility, and the CBOE NASDAQ-100 Volatility Index (the "VXN"), which reflects volatility in NASDAQ-100 Index options, both declined during the year. Such declines have been related to large central bank liquidity infusions which occurred during the year.

What key strategies were used to manage the Funds during this reporting period?

Each Fund invests in an equity portfolio and writes (sells) index call options against all or a portion of the notional value of its stock portfolio. The premium generated by the index call options is intended to supplement the dividend yield on the underlying stock portfolio to support each Fund's distribution policy and provides the potential for growth in value in rising markets and/or risk mitigation in the event of market decline. These strategies remained consistent in each Fund throughout the period.

Nuveen Investments

6

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares.

For additional information, see the Performance Overview page for your Fund in this report.

* Since inception returns for JPZ and its comparative index are from 10/26/04; since inception returns for JSN and its comparative index are from 1/26/05; since inception returns for JLA and its comparative index are from 5/25/05; since inception returns for JPG and its comparative index are from 11/22/05.

** Refer to Glossary of Terms Used in this Report for definitions. Indexes are not available for direct investment.

For JPZ and JPG, the equity portfolio seeks to track the price movements of the S&P 500® Index. The JSN equity portfolio is invested to replicate the price performance of a custom index consisting of 75% S&P 500® Index and 25% NASDAQ-100 Index. JLA seeks to replicate a 50/50 blend of the S&P 500® Index and NASDAQ-100 Index. JPZ, JSN and JLA actively write (sell) listed index call options against their entire stock portfolios. JPG differs in that its index option hedging activity is applied to approximately 80% of the value of the equity portfolio.

The writing of call options on a broad equity index, while investing in a portfolio of equities, has the potential to enhance returns while exposing the Funds to less risk. Those portions of the Funds subject to the overwrite have their upside potential capped at the amount of premium received for the option. The downside is buffered by the amount of the cash flow premium received. In flat or declining markets, the option premium can enhance total returns relative to the comparative index. In rising markets, the options can hurt the Funds' total return relative to their comparative index. The reporting period was marked by rising markets, during the first and third quarters. This is one factor which contributed to the underperformance of each Fund during the period.

How did the Funds perform during this twelve-month period ended December 31, 2012?

The performance of the Funds, as well as for comparative indexes, is presented in the accompanying table.

Average Annual Total Returns on Net Asset Value

For periods ended 12/31/12

| Fund |

1-Year |

5-Year |

Since Inception* |

||||||||||||

|

JPZ |

10.43 |

% |

2.70 |

% |

4.62 |

% |

|||||||||

|

S&P 500® Index** |

16.00 |

% |

1.66 |

% |

5.27 |

% |

|||||||||

|

JSN |

9.62 |

% |

2.49 |

% |

4.71 |

% |

|||||||||

|

Comparative Index** |

16.63 |

% |

2.75 |

% |

5.57 |

% |

|||||||||

|

JLA |

9.54 |

% |

2.91 |

% |

4.81 |

% |

|||||||||

|

Comparative Index** |

17.23 |

% |

3.81 |

% |

6.47 |

% |

|||||||||

|

JPG |

11.03 |

% |

2.35 |

% |

4.19 |

% |

|||||||||

|

S&P 500® Index** |

16.00 |

% |

1.66 |

% |

3.92 |

% |

|||||||||

For the twelve-month period ended December 31, 2012, the Funds lagged their respective comparative unhedged equity indexes. During the first quarter and third quarters of 2012, when the S&P 500® Index and the NASDAQ 100 Index showed strong positive returns, the Funds performed as would be expected given the premium available from their call selling programs. As sellers of index call options, the Funds sell upside exposure to call buyers in return for option premium. As such, in a sharply rising market, call sellers tend to forego full participation in strong up-market moves. In the second and fourth quarter, when the comparative indexes declined, similar premium capture allowed each Fund to slightly outperform their comparative equity indexes. As compared to the

Nuveen Investments

7

S&P 500® Index, which earned the bulk of its annual return in the first quarter, and the NASDAQ-100 Index, which earned more than its annual return in the first quarter, all four Funds earned steady quarterly returns as is the nature of these hedged equity investments.

Throughout the period, the Funds' management team was able to benefit from the spikes in volatility that occurred by closing out near term (generally out-of-the-money) index option contracts and rewriting (rolling) closer-to-the-money longer-term contracts. This more conservative approach to adjusting strikes, lagging the more extreme market movements, benefited performance as the Funds suffered less from the whipsaws. When whipsaws occur during choppy markets, a security's price heads in one direction, but then is followed quickly by a movement in the opposite direction, which occurred during the choppy market.

Since the Funds follow a risk-managed investment discipline and strive to limit market volatility, the Funds will tend to post their most attractive relative returns in generally weak stock market environments: as noted above, all four Funds posted positive returns in the second quarter when the S&P 500® Index and NASDAQ-100 Index were down 2.75% and 4.79%, respectively. Conversely, when equity markets are generally strong, the call-writing portion of the Funds' strategy will tend to constrain relative performance. This was evident in the first quarter when the S&P 500® Index and NASDAQ-100 Index rose 12.59% and 21.24%, respectively. The range of the four Funds' net asset value (NAV) performance that quarter was from 5.26% to 6.46%.

We continue to maintain a cautious posture poised to benefit from market volatility through the sale of index call options. As we have seen over the last several years, especially within a whipsawing market that is driven more by liquidity infusions than economic growth, challenges facing investors appear more acute.

RISK CONSIDERATIONS

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. Shares of closed-end funds are subject to investment risks, including the possible loss of principal invested. Past performance is no guarantee of future results. Fund common shares are subject to a variety of risks including:

Investment, Market and Price Risk. An investment in common shares is subject to investment risk, including the possible loss of the entire principal amount that you invest. Your investment in common shares represents an indirect investment in the corporate securities owned by the Funds, which generally trade in the over-the-counter markets. Shares of closed-end investment companies like the Fund frequently trade at a discount to NAV. Your common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Tax Risk. The tax treatment of Fund distributions may be affected by new IRS interpretations of the Internal Revenue Code and future changes in tax laws and regulations. This is particularly true for funds employing a managed distribution program.

Nuveen Investments

8

Common Stock Risk. Common stock returns often have experienced significant volatility.

Call Option Risk. The value of call options sold (written) by the Funds will fluctuate. The Funds may not participate in any appreciation of its equity portfolio as fully as it would if the Funds did not sell call options. In addition, the Funds will continue to bear the risk of declines in the value of the equity portfolio.

Derivatives Strategy Risk. Derivative securities, such as calls, puts, warrants, swaps and forwards, carry risks different from, and possibly greater than, the risks associated with the underlying investments.

Index Call Option Risk. Because index options are settled in cash, sellers of index call options, such as the Funds, cannot provide in advance for their potential settlement obligations by acquiring and holding the underlying securities.

Reinvestment Risk. If market interest rates decline, income earned from a Fund's portfolio may be reinvested at rates below that of the original bond that generated the income.

Nuveen Investments

9

Share Distribution and

Price Information

Distribution Information

The following information regarding each Fund's distributions is current as of December 31, 2012, and likely will vary over time based on the Fund's investment activities and portfolio investment value changes.

During the current reporting period, each of the Funds maintained steady quarterly distributions. Some of the important factors affecting the amount and composition of these distributions are summarized below.

Each Fund has a managed distribution program. The goal of this program is to provide shareholders with relatively consistent and predictable cash flow by systematically converting the Fund's expected long-term return potential into regular distributions. As a result, regular distributions throughout the year are likely to include a portion of expected long-term gains (both realized and unrealized), along with net investment income.

Important points to understand about the managed distribution program are:

• Each Fund seeks to establish a relatively stable distribution rate that roughly corresponds to the projected total return from its investment strategy over an extended period of time. However, you should not draw any conclusions about a Fund's past or future investment performance from its current distribution rate.

• Actual returns will differ from projected long-term returns (and therefore a Fund's distribution rate), at least over shorter time periods. Over a specific timeframe, the difference between actual returns and total distributions will be reflected in an increasing (returns exceed distributions) or a decreasing (distributions exceed returns) Fund net asset value.

• Each distribution is expected to be paid from some or all of the following sources:

• net investment income (regular interest and dividends),

• realized capital gains, and

• unrealized gains, or, in certain cases, a return of principal (non-taxable distributions).

• A non-taxable distribution is a payment of a portion of a Fund's capital. When a Fund's returns exceed distributions, it may represent portfolio gains generated, but not realized as a taxable capital gain. In periods when a Fund's return falls short of distributions, the shortfall will represent a portion of your original principal, unless the shortfall is offset during other time periods over the life of your investment (previous or subsequent) when a Fund's total return exceeds distributions.

Nuveen Investments

10

• Because distribution source estimates are updated during the year based on a Fund's performance and forecast for its current fiscal year (which is the calendar year for each Fund), estimates on the nature of your distributions provided at the time distributions are paid may differ from both the tax information reported to you in your Fund's IRS Form 1099 statement provided at year end, as well as the ultimate economic sources of distributions over the life of your investment.

The following table provides estimated information regarding each Fund's distributions and total return performance for the year ended December 31, 2012. This information is intended to help you better understand whether the Funds' returns for the specified time period were sufficient to meet each Fund's distributions.

|

As of 12/31/12 |

JPZ |

JSN |

JLA |

JPG |

|||||||||||||||

|

Inception date |

10/26/04 |

1/26/05 |

5/25/05 |

11/22/05 |

|||||||||||||||

|

Fiscal year (calendar year) ended December 31, 2012: |

|||||||||||||||||||

|

Per share distribution: |

|||||||||||||||||||

|

From net investment income |

$ |

0.25 |

$ |

0.20 |

$ |

0.21 |

$ |

0.26 |

|||||||||||

|

From long-term capital gains |

0.00 |

0.00 |

0.00 |

0.00 |

|||||||||||||||

|

From short-term capital gains |

0.00 |

0.00 |

0.00 |

0.00 |

|||||||||||||||

|

Return of capital |

0.83 |

0.92 |

0.93 |

0.86 |

|||||||||||||||

|

Total per share distribution |

$ |

1.08 |

$ |

1.12 |

$ |

1.14 |

$ |

1.12 |

|||||||||||

|

Distribution rate on NAV |

8.23 |

% |

8.60 |

% |

8.55 |

% |

7.80 |

% |

|||||||||||

|

Average annual total returns: |

|||||||||||||||||||

| 1-Year on NAV |

10.43 |

% |

9.62 |

% |

9.54 |

% |

11.03 |

% |

|||||||||||

| 5-Year on NAV |

2.70 |

% |

2.49 |

% |

2.91 |

% |

2.35 |

% |

|||||||||||

|

Since inception on NAV |

4.62 |

% |

4.71 |

% |

4.81 |

% |

4.19 |

% |

|||||||||||

Share Repurchases and Price Information

During November 2012, the Nuveen Funds Board of Directors/Trustees reauthorized the Funds' open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of December 31, 2012, and since the inception of the Funds' repurchase programs, the Funds have cumulatively repurchased and retired their outstanding shares as shown in the accompanying table.

|

Fund |

Shares Repurchased and Retired |

% of Outstanding Shares |

|||||||||

|

JPZ |

460,238 |

1.2 |

% |

||||||||

|

JSN |

550,600 |

0.8 |

% |

||||||||

|

JLA |

462,633 |

1.8 |

% |

||||||||

|

JPG |

383,763 |

2.4 |

% |

||||||||

Nuveen Investments

11

During the current reporting period, the Funds repurchased and retired their shares at a weighted average price and a weighted average discount per share as shown in the accompanying table.

|

Fund |

Shares Repurchased and Retired |

Weighted Average Price Per Share Repurchased and Retired |

Weighted Average Discount Per Share Repurchased and Retired |

||||||||||||

|

JPZ |

17,662 |

$ |

11.50 |

19.37 |

% |

||||||||||

|

JSN |

4,700 |

$ |

11.31 |

12.12 |

% |

||||||||||

|

JLA |

75,394 |

$ |

11.83 |

12.36 |

% |

||||||||||

|

JPG |

13,800 |

$ |

12.60 |

11.72 |

% |

||||||||||

As of December 31, 2012, and during the twelve-month reporting period, the Funds' share prices were trading at (–) discounts relative to their NAVs as shown in the accompanying table.

|

Fund |

12/31/12 |

Twelve-Month Average |

|||||||||

|

JPZ |

(-) 9.90% |

(-) 9.25% |

|||||||||

|

JSN |

(-) 7.37% |

(-) 8.65% |

|||||||||

|

JLA |

(-) 10.73% |

(-) 10.77% |

|||||||||

|

JPG |

(-) 9.96% |

(-) 10.28% |

|||||||||

Nuveen Investments

12

JPZ

Performance

OVERVIEW

Nuveen Equity Premium Income Fund

as of December 31, 2012

Fund Allocation (as a % of total net assets)3

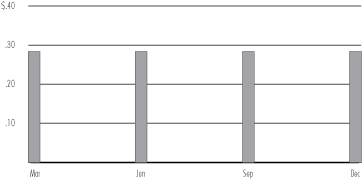

2012 Quarterly Distributions Per Share

Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized quarterly distribution divided by the Fund's current market price. The Fund's quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the calendar year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a return of capital for tax purposes.

2 Other assets less liabilities.

3 Holdings are subject to change.

4 Rounds to less than 0.1%.

Fund Snapshot

|

Share Price |

$ |

11.83 |

|||||

|

Net Asset Value (NAV) |

$ |

13.13 |

|||||

|

Premium/(Discount) to NAV |

-9.90 |

% |

|||||

|

Current Distribution Rate1 |

9.16 |

% |

|||||

|

Net Assets ($000) |

$ |

504,982 |

|||||

Average Annual Total Returns

(Inception 10/26/04)

|

On Share Price |

On NAV |

||||||||||

| 1-Year |

15.58 |

% |

10.43 |

% |

|||||||

| 5-Year |

3.65 |

% |

2.70 |

% |

|||||||

|

Since Inception |

3.31 |

% |

4.62 |

% |

|||||||

Portfolio Composition3

(as a % of total common stocks)

|

Oil, Gas & Consumable Fuels |

9.3 |

% |

|||||

|

Pharmaceuticals |

5.9 |

% |

|||||

|

Computers & Peripherals |

4.4 |

% |

|||||

|

Diversified Financial Services |

4.3 |

% |

|||||

|

IT Services |

3.7 |

% |

|||||

|

Software |

3.7 |

% |

|||||

|

Diversified Telecommunication Services |

3.4 |

% |

|||||

|

Media |

3.0 |

% |

|||||

|

Machinery |

2.7 |

% |

|||||

|

Aerospace & Defense |

2.7 |

% |

|||||

|

Commercial Banks |

2.7 |

% |

|||||

|

Real Estate Investment Trust |

2.6 |

% |

|||||

|

Industrial Conglomerates |

2.5 |

% |

|||||

|

Beverages |

2.5 |

% |

|||||

|

Specialty Retail |

2.4 |

% |

|||||

|

Internet Software & Services |

2.4 |

% |

|||||

|

Chemicals |

2.4 |

% |

|||||

|

Semiconductors & Equipment |

2.2 |

% |

|||||

|

Communications Equipment |

2.2 |

% |

|||||

|

Tobacco |

2.1 |

% |

|||||

|

Food & Staples Retailing |

2.1 |

% |

|||||

|

Energy Equipment & Services |

2.1 |

% |

|||||

|

Insurance |

2.1 |

% |

|||||

|

Household Products |

2.1 |

% |

|||||

|

Health Care Providers & Services |

2.0 |

% |

|||||

|

Capital Markets |

1.9 |

% |

|||||

|

Health Care Equipment & Supplies |

1.9 |

% |

|||||

|

Other |

18.7 |

% |

|||||

Nuveen Investments

13

Fund Snapshot

|

Share Price |

$ |

12.07 |

|||||

|

Net Asset Value (NAV) |

$ |

13.03 |

|||||

|

Premium/(Discount) to NAV |

-7.37 |

% |

|||||

|

Current Distribution Rate1 |

9.25 |

% |

|||||

|

Net Assets ($000) |

$ |

866,395 |

|||||

Average Annual Total Returns

(Inception 1/26/05)

|

On Share Price |

On NAV |

||||||||||

| 1-Year |

15.68 |

% |

9.62 |

% |

|||||||

| 5-Year |

4.41 |

% |

2.49 |

% |

|||||||

|

Since Inception |

3.70 |

% |

4.71 |

% |

|||||||

Portfolio Composition3

(as a % of total common stocks)

|

Computers & Peripherals |

8.5 |

% |

|||||

|

Software |

6.9 |

% |

|||||

|

Oil, Gas & Consumable Fuels |

6.4 |

% |

|||||

|

Pharmaceuticals |

5.0 |

% |

|||||

|

Internet Software & Services |

4.5 |

% |

|||||

|

Media |

3.7 |

% |

|||||

|

IT Services |

3.6 |

% |

|||||

|

Communications Equipment |

3.5 |

% |

|||||

|

Semiconductors & Equipment |

3.1 |

% |

|||||

|

Diversified Financial Services |

2.9 |

% |

|||||

|

Specialty Retail |

2.4 |

% |

|||||

|

Diversified Telecommunication Services |

2.3 |

% |

|||||

|

Insurance |

2.3 |

% |

|||||

|

Biotechnology |

2.2 |

% |

|||||

|

Internet & Catalog Retail |

2.1 |

% |

|||||

|

Commercial Banks |

2.1 |

% |

|||||

|

Beverages |

2.1 |

% |

|||||

|

Machinery |

2.1 |

% |

|||||

|

Health Care Providers & Services |

2.0 |

% |

|||||

|

Health Care Equipment & Supplies |

1.9 |

% |

|||||

|

Chemicals |

1.8 |

% |

|||||

|

Real Estate Investment Trust |

1.8 |

% |

|||||

|

Aerospace & Defense |

1.8 |

% |

|||||

|

Energy Equipment & Services |

1.8 |

% |

|||||

|

Food & Staples Retailing |

1.7 |

% |

|||||

|

Industrial Conglomerates |

1.7 |

% |

|||||

|

Other |

19.8 |

% |

|||||

JSN

Performance

OVERVIEW

Nuveen Equity Premium Opportunity Fund

as of December 31, 2012

Fund Allocation (as a % of total net assets)3

2012 Quarterly Distributions Per Share

Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized quarterly distribution divided by the Fund's current market price. The Fund's quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the calendar year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a return of capital for tax purposes.

2 Other assets less liabilities.

3 Holdings are subject to change.

4 Rounds to less than 0.1%.

Nuveen Investments

14

JLA

Performance

OVERVIEW

Nuveen Equity Premium Advantage Fund

as of December 31, 2012

Fund Allocation (as a % of total net assets)3

2012 Quarterly Distributions Per Share

Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized quarterly distribution divided by the Fund's current market price. The Fund's quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the calendar year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a return of capital for tax purposes.

2 Other assets less liabilities.

3 Holdings are subject to change.

4 Rounds to less than (0.1)%.

Fund Snapshot

|

Share Price |

$ |

11.90 |

|||||

|

Net Asset Value (NAV) |

$ |

13.33 |

|||||

|

Premium/(Discount) to NAV |

-10.73 |

% |

|||||

|

Current Distribution Rate1 |

9.55 |

% |

|||||

|

Net Assets ($000) |

$ |

342,191 |

|||||

Average Annual Total Returns

(Inception 5/25/05)

|

On Share Price |

On NAV |

||||||||||

| 1-Year |

13.89 |

% |

9.54 |

% |

|||||||

| 5-Year |

4.02 |

% |

2.91 |

% |

|||||||

|

Since Inception |

3.33 |

% |

4.81 |

% |

|||||||

Portfolio Composition3

(as a % of total common stocks)

|

Software |

10.6 |

% |

|||||

|

Computers & Peripherals |

10.4 |

% |

|||||

|

Internet Software & Services |

7.3 |

% |

|||||

|

Semiconductors & Equipment |

5.1 |

% |

|||||

|

Oil, Gas & Consumable Fuels |

4.8 |

% |

|||||

|

Communications Equipment |

4.7 |

% |

|||||

|

Media |

4.6 |

% |

|||||

|

Pharmaceuticals |

3.9 |

% |

|||||

|

Biotechnology |

3.3 |

% |

|||||

|

IT Services |

3.1 |

% |

|||||

|

Internet & Catalog Retail |

2.9 |

% |

|||||

|

Specialty Retail |

2.3 |

% |

|||||

|

Diversified Financial Services |

2.2 |

% |

|||||

|

Electrical Equipment |

2.1 |

% |

|||||

|

Hotels, Restaurants & Leisure |

1.9 |

% |

|||||

|

Health Care Equipment & Supplies |

1.8 |

% |

|||||

|

Insurance |

1.8 |

% |

|||||

|

Food & Staples Retailing |

1.7 |

% |

|||||

|

Diversified Telecommunication Services |

1.7 |

% |

|||||

|

Commercial Banks |

1.6 |

% |

|||||

|

Electric Utilities |

1.6 |

% |

|||||

|

Aerospace & Defense |

1.5 |

% |

|||||

|

Other |

19.1 |

% |

|||||

Nuveen Investments

15

Fund Snapshot

|

Share Price |

$ |

12.93 |

|||||

|

Net Asset Value (NAV) |

$ |

14.36 |

|||||

|

Premium/(Discount) to NAV |

-9.96 |

% |

|||||

|

Current Distribution Rate1 |

8.66 |

% |

|||||

|

Net Assets ($000) |

$ |

232,005 |

|||||

Average Annual Total Returns

(Inception 11/22/05)

|

On Share Price |

On NAV |

||||||||||

| 1-Year |

16.58 |

% |

11.03 |

% |

|||||||

| 5-Year |

3.53 |

% |

2.35 |

% |

|||||||

|

Since Inception |

2.76 |

% |

4.19 |

% |

|||||||

Portfolio Composition3

(as a % of total common stocks)

|

Oil, Gas & Consumable Fuels |

9.5 |

% |

|||||

|

Pharmaceuticals |

6.3 |

% |

|||||

|

Computers & Peripherals |

4.5 |

% |

|||||

|

Diversified Financial Services |

4.3 |

% |

|||||

|

IT Services |

3.9 |

% |

|||||

|

Software |

3.7 |

% |

|||||

|

Diversified Telecommunication Services |

3.5 |

% |

|||||

|

Insurance |

3.4 |

% |

|||||

|

Specialty Retail |

2.9 |

% |

|||||

|

Commercial Banks |

2.7 |

% |

|||||

|

Machinery |

2.7 |

% |

|||||

|

Internet Software & Services |

2.6 |

% |

|||||

|

Chemicals |

2.6 |

% |

|||||

|

Media |

2.6 |

% |

|||||

|

Real Estate Investment Trust |

2.4 |

% |

|||||

|

Aerospace & Defense |

2.4 |

% |

|||||

|

Beverages |

2.3 |

% |

|||||

|

Communications Equipment |

2.3 |

% |

|||||

|

Health Care Providers & Services |

2.2 |

% |

|||||

|

Semiconductors & Equipment |

2.1 |

% |

|||||

|

Energy Equipment & Services |

2.1 |

% |

|||||

|

Tobacco |

2.1 |

% |

|||||

|

Household Products |

2.0 |

% |

|||||

|

Multi-Utilities |

2.0 |

% |

|||||

|

Health Care Equipment & Supplies |

2.0 |

% |

|||||

|

Food & Staples Retailing |

1.9 |

% |

|||||

|

Other |

19.0 |

% |

|||||

JPG

Performance

OVERVIEW

Nuveen Equity Premium and Growth Fund

as of December 31, 2012

Fund Allocation (as a % of total net assets)3

2012 Quarterly Distributions Per Share

Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized quarterly distribution divided by the Fund's current market price. The Fund's quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the calendar year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a return of capital for tax purposes.

2 Other assets less liabilities.

3 Holdings are subject to change.

4 Rounds to less than 0.1%.

Nuveen Investments

16

Report of INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders of

Nuveen Equity Premium Income Fund

Nuveen Equity Premium Opportunity Fund

Nuveen Equity Premium Advantage Fund

Nuveen Equity Premium and Growth Fund:

In our opinion, the accompanying statements of assets and liabilities, including the portfolios of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Nuveen Equity Premium Income Fund, Nuveen Equity Premium Opportunity Fund, Nuveen Equity Premium Advantage Fund, and Nuveen Equity Premium and Growth Fund (hereinafter referred to as the "Funds") at December 31, 2012, the results of each of their operations for the year then ended, the changes in each of their net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Funds' management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2012 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Chicago, IL

February 28, 2013

Nuveen Investments

17

JPZ

Nuveen Equity Premium Income Fund

Portfolio of Investments

December 31, 2012

| Shares |

Description (1) |

Value |

|||||||||

|

Common Stocks – 99.1% (5) |

|||||||||||

|

Aerospace & Defense – 2.7% |

|||||||||||

| 44,366 |

Boeing Company |

$ |

3,343,422 |

||||||||

| 62,823 |

Honeywell International Inc. |

3,987,376 |

|||||||||

| 32,905 |

Raytheon Company |

1,894,012 |

|||||||||

| 52,443 |

United Technologies Corporation |

4,300,850 |

|||||||||

|

Total Aerospace & Defense |

13,525,660 |

||||||||||

|

Air Freight & Logistics – 0.9% |

|||||||||||

| 60,593 |

United Parcel Service, Inc., Class B |

4,467,522 |

|||||||||

|

Airlines – 0.0% |

|||||||||||

| 3,957 |

United Continental Holdings Inc., (2) |

92,515 |

|||||||||

|

Auto Components – 0.2% |

|||||||||||

| 30,296 |

Cooper Tire & Rubber |

768,307 |

|||||||||

|

Automobiles – 0.8% |

|||||||||||

| 195,811 |

Ford Motor Company |

2,535,752 |

|||||||||

| 32,461 |

Harley-Davidson, Inc. |

1,585,395 |

|||||||||

|

Total Automobiles |

4,121,147 |

||||||||||

|

Beverages – 2.5% |

|||||||||||

| 180,676 |

Coca-Cola Company |

6,549,505 |

|||||||||

| 14,723 |

Monster Beverage Corporation, (2) |

778,552 |

|||||||||

| 75,742 |

PepsiCo, Inc. |

5,183,025 |

|||||||||

|

Total Beverages |

12,511,082 |

||||||||||

|

Biotechnology – 1.4% |

|||||||||||

| 40,799 |

Amgen Inc. |

3,521,770 |

|||||||||

| 22,699 |

Celgene Corporation, (2) |

1,786,865 |

|||||||||

| 23,687 |

Gilead Sciences, Inc., (2) |

1,739,810 |

|||||||||

|

Total Biotechnology |

7,048,445 |

||||||||||

|

Building Products – 0.1% |

|||||||||||

| 42,748 |

Masco Corporation |

712,182 |

|||||||||

|

Capital Markets – 1.9% |

|||||||||||

| 109,476 |

Charles Schwab Corporation |

1,572,075 |

|||||||||

| 21,672 |

Goldman Sachs Group, Inc. |

2,764,480 |

|||||||||

| 48,534 |

Jefferies Group, Inc. |

901,276 |

|||||||||

| 40,593 |

Legg Mason, Inc. |

1,044,052 |

|||||||||

| 107,319 |

Morgan Stanley |

2,051,939 |

|||||||||

| 38,635 |

Waddell & Reed Financial, Inc., Class A |

1,345,271 |

|||||||||

|

Total Capital Markets |

9,679,093 |

||||||||||

Nuveen Investments

18

| Shares |

Description (1) |

Value |

|||||||||

|

Chemicals – 2.3% |

|||||||||||

| 53,348 |

Dow Chemical Company |

$ |

1,724,207 |

||||||||

| 54,215 |

E.I. Du Pont de Nemours and Company |

2,438,049 |

|||||||||

| 34,457 |

Eastman Chemical Company |

2,344,799 |

|||||||||

| 24,907 |

Monsanto Company |

2,357,448 |

|||||||||

| 53,293 |

Olin Corporation |

1,150,596 |

|||||||||

| 60,403 |

RPM International, Inc. |

1,773,432 |

|||||||||

|

Total Chemicals |

11,788,531 |

||||||||||

|

Commercial Banks – 2.7% |

|||||||||||

| 33,724 |

Comerica Incorporated |

1,023,186 |

|||||||||

| 16,998 |

HSBC Holdings PLC, Sponsored ADR |

902,084 |

|||||||||

| 17,184 |

PNC Financial Services Group, Inc. |

1,001,999 |

|||||||||

| 100,054 |

U.S. Bancorp |

3,195,725 |

|||||||||

| 213,264 |

Wells Fargo & Company |

7,289,364 |

|||||||||

|

Total Commercial Banks |

13,412,358 |

||||||||||

|

Commercial Services & Supplies – 0.7% |

|||||||||||

| 3,177 |

Avery Dennison Corporation |

110,941 |

|||||||||

| 56,149 |

Deluxe Corporation |

1,810,244 |

|||||||||

| 40,642 |

Pitney Bowes Inc. |

432,431 |

|||||||||

| 16,031 |

R.R. Donnelley & Sons Company |

144,279 |

|||||||||

| 35,497 |

Waste Management, Inc. |

1,197,669 |

|||||||||

|

Total Commercial Services & Supplies |

3,695,564 |

||||||||||

|

Communications Equipment – 2.2% |

|||||||||||

| 14,156 |

ADTRAN, Inc. |

276,608 |

|||||||||

| 3,408 |

Ciena Corporation, (2) |

53,506 |

|||||||||

| 230,385 |

Cisco Systems, Inc. |

4,527,065 |

|||||||||

| 11,034 |

JDS Uniphase Corporation, (2) |

149,400 |

|||||||||

| 25,703 |

Motorola Solutions Inc. |

1,431,143 |

|||||||||

| 71,809 |

QUALCOMM, Inc. |

4,453,594 |

|||||||||

|

Total Communications Equipment |

10,891,316 |

||||||||||

|

Computers & Peripherals – 4.3% |

|||||||||||

| 34,529 |

Apple, Inc. |

18,404,992 |

|||||||||

| 67,332 |

Dell Inc. |

682,073 |

|||||||||

| 108,453 |

EMC Corporation, (2) |

2,743,861 |

|||||||||

|

Total Computers & Peripherals |

21,830,926 |

||||||||||

|

Consumer Finance – 0.5% |

|||||||||||

| 23,246 |

American Express Company |

1,336,180 |

|||||||||

| 32,690 |

Discover Financial Services |

1,260,200 |

|||||||||

|

Total Consumer Finance |

2,596,380 |

||||||||||

|

Containers & Packaging – 0.4% |

|||||||||||

| 43,759 |

Packaging Corp. of America |

1,683,409 |

|||||||||

| 5,718 |

Sonoco Products Company |

169,996 |

|||||||||

|

Total Containers & Packaging |

1,853,405 |

||||||||||

|

Distributors – 0.4% |

|||||||||||

| 29,044 |

Genuine Parts Company |

1,846,618 |

|||||||||

|

Diversified Consumer Services – 0.0% |

|||||||||||

| 7,623 |

Apollo Group, Inc., Class A, (2) |

159,473 |

|||||||||

Nuveen Investments

19

JPZ

Nuveen Equity Premium Income Fund (continued)

Portfolio of Investments December 31, 2012

| Shares |

Description (1) |

Value |

|||||||||

|

Diversified Financial Services – 4.2% |

|||||||||||

| 414,679 |

Bank of America Corporation |

$ |

4,810,276 |

||||||||

| 118,386 |

Citigroup Inc. |

4,683,350 |

|||||||||

| 33,950 |

CME Group, Inc. |

1,721,605 |

|||||||||

| 194,835 |

JP Morgan Chase & Co. |

8,566,895 |

|||||||||

| 47,644 |

New York Stock Exchange Euronext |

1,502,692 |

|||||||||

|

Total Diversified Financial Services |

21,284,818 |

||||||||||

|

Diversified Telecommunication Services – 3.4% |

|||||||||||

| 262,347 |

AT&T Inc. |

8,843,717 |

|||||||||

| 29,237 |

CenturyLink Inc. |

1,143,751 |

|||||||||

| 250,097 |

Frontier Communications Corporation |

1,070,415 |

|||||||||

| 134,231 |

Verizon Communications Inc. |

5,808,175 |

|||||||||

| 18,198 |

Windstream Corporation |

150,679 |

|||||||||

|

Total Diversified Telecommunication Services |

17,016,737 |

||||||||||

|

Electric Utilities – 1.5% |

|||||||||||

| 55,280 |

Duke Energy Corporation |

3,526,864 |

|||||||||

| 27,323 |

Great Plains Energy Incorporated |

554,930 |

|||||||||

| 19,046 |

OGE Energy Corp. |

1,072,480 |

|||||||||

| 80,800 |

Pepco Holdings, Inc. |

1,584,488 |

|||||||||

| 20,004 |

Southern Company |

856,371 |

|||||||||

|

Total Electric Utilities |

7,595,133 |

||||||||||

|

Electrical Equipment – 0.7% |

|||||||||||

| 47,209 |

Emerson Electric Company |

2,500,189 |

|||||||||

| 14,553 |

Rockwell Automation, Inc. |

1,222,306 |

|||||||||

|

Total Electrical Equipment |

3,722,495 |

||||||||||

|

Electronic Equipment & Instruments – 0.3% |

|||||||||||

| 118,215 |

Corning Incorporated |

1,491,873 |

|||||||||

|

Energy Equipment & Services – 2.1% |

|||||||||||

| 6,964 |

Diamond Offshore Drilling, Inc. |

473,273 |

|||||||||

| 18,452 |

Ensco International PLC, Class A, Sponsored ADR |

1,093,835 |

|||||||||

| 83,720 |

Halliburton Company |

2,904,247 |

|||||||||

| 16,059 |

Patterson-UTI Energy, Inc. |

299,179 |

|||||||||

| 72,390 |

Schlumberger Limited |

5,015,903 |

|||||||||

| 16,157 |

Tidewater Inc. |

721,895 |

|||||||||

|

Total Energy Equipment & Services |

10,508,332 |

||||||||||

|

Food & Staples Retailing – 2.1% |

|||||||||||

| 97,386 |

CVS Caremark Corporation |

4,708,613 |

|||||||||

| 38,696 |

SUPERVALU INC., (2) |

95,579 |

|||||||||

| 84,905 |

Wal-Mart Stores, Inc. |

5,793,068 |

|||||||||

|

Total Food & Staples Retailing |

10,597,260 |

||||||||||

|

Food Products – 0.9% |

|||||||||||

| 37,375 |

Kraft Foods Inc., Class A |

1,699,441 |

|||||||||

| 112,127 |

Mondelez International Inc. |

2,855,875 |

|||||||||

|

Total Food Products |

4,555,316 |

||||||||||

|

Gas Utilities – 0.9% |

|||||||||||

| 36,031 |

AGL Resources Inc. |

1,440,159 |

|||||||||

| 12,516 |

Atmos Energy Corporation |

439,562 |

|||||||||

| 22,995 |

National Fuel Gas Company |

1,165,617 |

|||||||||

| 38,518 |

ONEOK, Inc. |

1,646,645 |

|||||||||

|

Total Gas Utilities |

4,691,983 |

||||||||||

Nuveen Investments

20

| Shares |

Description (1) |

Value |

|||||||||

|

Health Care Equipment & Supplies – 1.9% |

|||||||||||

| 72,041 |

Abbott Laboratories |

$ |

4,718,686 |

||||||||

| 4,460 |

Hologic Inc., (2) |

89,334 |

|||||||||

| 3,342 |

Intuitive Surgical, Inc., (2) |

1,638,817 |

|||||||||

| 78,706 |

Medtronic, Inc. |

3,228,520 |

|||||||||

|

Total Health Care Equipment & Supplies |

9,675,357 |

||||||||||

|

Health Care Providers & Services – 2.0% |

|||||||||||

| 6,901 |

Brookdale Senior Living Inc., (2) |

174,733 |

|||||||||

| 15,450 |

Coventry Health Care, Inc. |

692,624 |

|||||||||

| 48,093 |

Express Scripts, (2) |

2,597,022 |

|||||||||

| 17,609 |

HCA Holdings Inc. |

531,264 |

|||||||||

| 1,116 |

Henry Schein Inc., (2) |

89,793 |

|||||||||

| 39,267 |

Kindred Healthcare Inc., (2) |

424,869 |

|||||||||

| 71,299 |

UnitedHealth Group Incorporated |

3,867,258 |

|||||||||

| 25,221 |

Wellpoint Inc. |

1,536,463 |

|||||||||

|

Total Health Care Providers & Services |

9,914,026 |

||||||||||

|

Health Care Technology – 0.0% |

|||||||||||

| 114 |

Cerner Corporation, (2) |

8,851 |

|||||||||

|

Hotels, Restaurants & Leisure – 1.4% |

|||||||||||

| 22,200 |

Carnival Corporation |

816,294 |

|||||||||

| 42,761 |

International Game Technology |

605,923 |

|||||||||

| 2,272 |

Interval Leisure Group Inc. |

44,054 |

|||||||||

| 63,330 |

McDonald's Corporation |

5,586,339 |

|||||||||

|

Total Hotels, Restaurants & Leisure |

7,052,610 |

||||||||||

|

Household Durables – 0.7% |

|||||||||||

| 2,990 |

Garmin Limited |

122,052 |

|||||||||

| 64,653 |

Newell Rubbermaid Inc. |

1,439,822 |

|||||||||

| 13,864 |

Tupperware Corporation |

888,682 |

|||||||||

| 11,356 |

Whirlpool Corporation |

1,155,473 |

|||||||||

|

Total Household Durables |

3,606,029 |

||||||||||

|

Household Products – 2.0% |

|||||||||||

| 14,878 |

Colgate-Palmolive Company |

1,555,346 |

|||||||||

| 11,711 |

Kimberly-Clark Corporation |

988,760 |

|||||||||

| 114,328 |

Procter & Gamble Company |

7,761,728 |

|||||||||

|

Total Household Products |

10,305,834 |

||||||||||

|

Industrial Conglomerates – 2.5% |

|||||||||||

| 40,506 |

3M Co. |

3,760,982 |

|||||||||

| 421,001 |

General Electric Company |

8,836,811 |

|||||||||

| 57 |

Siemens AG, Sponsored ADR |

6,240 |

|||||||||

|

Total Industrial Conglomerates |

12,604,033 |

||||||||||

|

Insurance – 2.1% |

|||||||||||

| 47,749 |

Allstate Corporation |

1,918,077 |

|||||||||

| 8,871 |

Arthur J. Gallagher & Co. |

307,380 |

|||||||||

| 36,694 |

Fidelity National Title Group Inc., Class A |

864,144 |

|||||||||

| 26,683 |

Hartford Financial Services Group, Inc. |

598,767 |

|||||||||

| 13,665 |

Kemper Corporation |

403,118 |

|||||||||

| 60,781 |

Lincoln National Corporation |

1,574,228 |

|||||||||

| 63,707 |

Marsh & McLennan Companies, Inc. |

2,195,980 |

|||||||||

| 35,546 |

Travelers Companies, Inc. |

2,552,914 |

|||||||||

|

Total Insurance |

10,414,608 |

||||||||||

Nuveen Investments

21

JPZ

Nuveen Equity Premium Income Fund (continued)

Portfolio of Investments December 31, 2012

| Shares |

Description (1) |

Value |

|||||||||

|

Internet & Catalog Retail – 1.1% |

|||||||||||

| 14,883 |

Amazon.com, Inc., (2) |

$ |

3,737,717 |

||||||||

| 3,103 |

HSN, Inc. |

170,913 |

|||||||||

| 2,786 |

Priceline.com Incorporated, (2) |

1,730,663 |

|||||||||

|

Total Internet & Catalog Retail |

5,639,293 |

||||||||||

|

Internet Software & Services – 2.4% |

|||||||||||

| 10,937 |

Akamai Technologies, Inc., (2) |

447,433 |

|||||||||

| 49,259 |

eBay Inc., (2) |

2,513,194 |

|||||||||

| 9,760 |

Google Inc., Class A, (2) |

6,923,451 |

|||||||||

| 44,605 |

United Online, Inc. |

249,342 |

|||||||||

| 5,616 |

ValueClick, Inc., (2) |

109,007 |

|||||||||

| 10,002 |

VeriSign, Inc., (2) |

388,278 |

|||||||||

| 71,826 |

Yahoo! Inc., (2) |

1,429,337 |

|||||||||

|

Total Internet Software & Services |

12,060,042 |

||||||||||

|

IT Services – 3.7% |

|||||||||||

| 34,359 |

Automatic Data Processing, Inc. |

1,958,807 |

|||||||||

| 17,199 |

Cognizant Technology Solutions Corporation, Class A, (2) |

1,273,586 |

|||||||||

| 32,696 |

Fidelity National Information Services |

1,138,148 |

|||||||||

| 38,580 |

International Business Machines Corporation (IBM) |

7,389,999 |

|||||||||

| 3,197 |

Lender Processing Services Inc. |

78,710 |

|||||||||

| 5,819 |

MasterCard, Inc. |

2,858,758 |

|||||||||

| 42,671 |

Paychex, Inc. |

1,328,775 |

|||||||||

| 16,519 |

Visa Inc., Class A |

2,503,950 |

|||||||||

|

Total IT Services |

18,530,733 |

||||||||||

|

Leisure Equipment & Products – 0.3% |

|||||||||||

| 19,609 |

Polaris Industries Inc. |

1,650,097 |

|||||||||

|

Machinery – 2.7% |

|||||||||||

| 19,606 |

Caterpillar Inc. |

1,756,305 |

|||||||||

| 16,595 |

Cummins Inc. |

1,798,068 |

|||||||||

| 24,334 |

Deere & Company |

2,102,944 |

|||||||||

| 13,600 |

Graco Inc. |

700,264 |

|||||||||

| 13,107 |

Ingersoll Rand Company Limited, Class A |

628,612 |

|||||||||

| 16,893 |

Parker Hannifin Corporation |

1,436,919 |

|||||||||

| 11,767 |

Snap-on Incorporated |

929,475 |

|||||||||

| 22,597 |

SPX Corporation |

1,585,180 |

|||||||||

| 27,348 |

Stanley Black & Decker Inc. |

2,022,932 |

|||||||||

| 12,000 |

Timken Company |

573,960 |

|||||||||

|

Total Machinery |

13,534,659 |

||||||||||

|

Media – 3.0% |

|||||||||||

| 56,665 |

CBS Corporation, Class B |

2,156,103 |

|||||||||

| 114,249 |

Comcast Corporation, Class A |

4,270,628 |

|||||||||

| 39,613 |

New York Times, Class A, (2) |

337,899 |

|||||||||

| 35,396 |

Omnicom Group, Inc. |

1,768,384 |

|||||||||

| 114,479 |

Regal Entertainment Group, Class A |

1,596,982 |

|||||||||

| 96,590 |

Walt Disney Company |

4,809,216 |

|||||||||

|

Total Media |

14,939,212 |

||||||||||

|

Metals & Mining – 1.0% |

|||||||||||

| 88,284 |

Alcoa Inc. |

766,305 |

|||||||||

| 44,474 |

Freeport-McMoRan Copper & Gold, Inc. |

1,521,011 |

|||||||||

| 6,726 |

Newmont Mining Corporation |

312,355 |

|||||||||

| 28,148 |

Nucor Corporation |

1,215,431 |

|||||||||

| 32,749 |

Southern Copper Corporation |

1,239,877 |

|||||||||

|

Total Metals & Mining |

5,054,979 |

||||||||||

Nuveen Investments

22

|

Shares |

Description (1) |

Value |

|||||||||

|

Multiline Retail – 1.0% |

|||||||||||

|

4,000 |

Family Dollar Stores, Inc. |

$ |

253,640 |

||||||||

|

36,680 |

Macy's, Inc. |

1,431,254 |

|||||||||

|

25,718 |

Nordstrom, Inc. |

1,375,913 |

|||||||||

|

8,076 |

Sears Holding Corporation, (2) |

334,023 |

|||||||||

|

30,023 |

Target Corporation |

1,776,461 |

|||||||||

|

Total Multiline Retail |

5,171,291 |

||||||||||

|

Multi-Utilities – 1.6% |

|||||||||||

|

40,212 |

Ameren Corporation |

1,235,313 |

|||||||||

|

22,660 |

Consolidated Edison, Inc. |

1,258,536 |

|||||||||

|

63,324 |

Integrys Energy Group, Inc. |

3,306,779 |

|||||||||

|

15,734 |

Northwestern Corporation |

546,442 |

|||||||||

|

60,347 |

Public Service Enterprise Group Incorporated |

1,846,618 |

|||||||||

|

Total Multi-Utilities |

8,193,688 |

||||||||||

|

Oil, Gas & Consumable Fuels – 9.2% |

|||||||||||

|

9,051 |

Cenovus Energy Inc. |

303,571 |

|||||||||

|

88,783 |

Chevron Corporation |

9,600,994 |

|||||||||

|

74,346 |

ConocoPhillips |

4,311,325 |

|||||||||

|

39,168 |

CONSOL Energy Inc. |

1,257,293 |

|||||||||

|

22,581 |

Continental Resources Inc., (2) |

1,659,478 |

|||||||||

|

16,151 |

EnCana Corporation |

319,144 |

|||||||||

|

28,180 |

EOG Resources, Inc. |

3,403,862 |

|||||||||

|

201,503 |

Exxon Mobil Corporation |

17,440,085 |

|||||||||

|

45,954 |

Occidental Petroleum Corporation |

3,520,536 |

|||||||||

|

38,405 |

Phillips 66 |

2,039,306 |

|||||||||

|

4,626 |

Total SA, Sponsored ADR |

240,598 |

|||||||||

|

74,029 |

Valero Energy Corporation |

2,525,869 |

|||||||||

|

Total Oil, Gas & Consumable Fuels |

46,622,061 |

||||||||||

|

Pharmaceuticals – 5.9% |

|||||||||||

|

116,326 |

Bristol-Myers Squibb Company |

3,791,064 |

|||||||||

|

56,803 |

Eli Lilly and Company |

2,801,524 |

|||||||||

|

131,044 |

Johnson & Johnson |

9,186,184 |

|||||||||

|

152,239 |

Merck & Company Inc. |

6,232,665 |

|||||||||

|

308,278 |

Pfizer Inc. |

7,731,612 |

|||||||||

|

Total Pharmaceuticals |

29,743,049 |

||||||||||

|

Professional Services – 0.1% |

|||||||||||

|

3,665 |

Manpower Inc. |

155,543 |

|||||||||

|

6,949 |

Resources Connection, Inc. |

82,971 |

|||||||||

|

Total Professional Services |

238,514 |

||||||||||

|

Real Estate Investment Trust (REIT) – 2.6% |

|||||||||||

|

111,810 |

Annaly Capital Management Inc. |

1,569,812 |

|||||||||

|

39,521 |

Brandywine Realty Trust |

481,761 |

|||||||||

|

44,183 |

CapLease Inc. |

246,099 |

|||||||||

|

25,456 |

CommonWealth REIT |

403,223 |

|||||||||

|

55,131 |

CubeSmart |

803,259 |

|||||||||

|

15,432 |

Health Care REIT, Inc. |

945,827 |

|||||||||

|

47,225 |

Healthcare Realty Trust, Inc. |

1,133,872 |

|||||||||

|

45,684 |

Hospitality Properties Trust |

1,069,919 |

|||||||||

|

88,469 |

Lexington Corporate Properties Trust |

924,501 |

|||||||||

|

27,077 |

Liberty Property Trust |

968,544 |

|||||||||

|

17,263 |

Medical Properties Trust Inc. |

206,465 |

|||||||||

|

28,311 |

MFA Mortgage Investments, Inc. |

229,602 |

|||||||||

|

26,716 |

Senior Housing Properties Trust |

631,566 |

|||||||||

Nuveen Investments

23

JPZ

Nuveen Equity Premium Income Fund (continued)

Portfolio of Investments December 31, 2012

| Shares |

Description (1) |

Value |

|||||||||

| Real Estate Investment Trust (continued) | |||||||||||

| 11,215 |

Sun Communities Inc. |

$ |

447,366 |

||||||||

| 25,238 |

Ventas Inc. |

1,633,403 |

|||||||||

| 54,475 |

Weyerhaeuser Company |

1,515,495 |

|||||||||

|

Total Real Estate Investment Trust |

13,210,714 |

||||||||||

|

Road & Rail – 0.9% |

|||||||||||

| 17,765 |

Norfolk Southern Corporation |

1,098,588 |

|||||||||

| 25,475 |

Union Pacific Corporation |

3,202,717 |

|||||||||

|

Total Road & Rail |

4,301,305 |

||||||||||

|

Semiconductors & Equipment – 2.2% |

|||||||||||

| 25,275 |

Analog Devices, Inc. |

1,063,067 |

|||||||||

| 96,369 |

Applied Materials, Inc. |

1,102,461 |

|||||||||

| 21,444 |

Broadcom Corporation, Class A |

712,155 |

|||||||||

| 247,273 |

Intel Corporation |

5,101,242 |

|||||||||

| 12,846 |

Intersil Holding Corporation, Class A |

106,493 |

|||||||||

| 3,087 |

Lam Research Corporation, (2) |

111,533 |

|||||||||

| 24,776 |

Microchip Technology Incorporated |

807,450 |

|||||||||

| 27,856 |

NVIDIA Corporation |

342,350 |

|||||||||

| 51,579 |

Texas Instruments Incorporated |

1,595,854 |

|||||||||

|

Total Semiconductors & Equipment |

10,942,605 |

||||||||||

|

Software – 3.6% |

|||||||||||

| 23,572 |

Adobe Systems Incorporated, (2) |

888,193 |

|||||||||

| 18,599 |

Autodesk, Inc., (2) |

657,475 |

|||||||||

| 343,555 |

Microsoft Corporation |

9,183,225 |

|||||||||

| 181,687 |

Oracle Corporation |

6,053,811 |

|||||||||

| 9,475 |

Salesforce.com, Inc., (2) |

1,592,748 |

|||||||||

|

Total Software |

18,375,452 |

||||||||||

|

Specialty Retail – 2.4% |

|||||||||||

| 18,330 |

Abercrombie & Fitch Co., Class A |

879,290 |

|||||||||

| 41,497 |

American Eagle Outfitters, Inc. |

851,103 |

|||||||||

| 21,475 |

Best Buy Co., Inc. |

254,479 |

|||||||||

| 62,729 |

Home Depot, Inc. |

3,879,789 |

|||||||||

| 36,675 |

Limited Brands, Inc. |

1,725,926 |

|||||||||

| 71,238 |

Lowe's Companies, Inc. |

2,530,374 |

|||||||||

| 364 |

Orchard Supply Hardware Stores Corporation, (2) |

2,697 |

|||||||||

| 472 |

Ross Stores, Inc. |

25,559 |

|||||||||

| 13,465 |

Tiffany & Co. |

772,083 |

|||||||||

| 28,637 |

TJX Companies, Inc. |

1,215,641 |

|||||||||

|

Total Specialty Retail |

12,136,941 |

||||||||||

|

Textiles, Apparel & Luxury Goods – 0.4% |

|||||||||||

| 7,159 |

Cherokee Inc. |

98,150 |

|||||||||

| 14,066 |

VF Corporation |

2,123,544 |

|||||||||

|

Total Textiles, Apparel & Luxury Goods |

2,221,694 |

||||||||||

|

Thrifts & Mortgage Finance – 0.2% |

|||||||||||

| 36,703 |

Hudson City Bancorp, Inc. |

298,395 |

|||||||||

| 60,610 |

New York Community Bancorp Inc. |

793,991 |

|||||||||

|

Total Thrifts & Mortgage Finance |

1,092,386 |

||||||||||

Nuveen Investments

24

|

Shares |

Description (1) |

Value |

|||||||||

|

Tobacco – 2.1% |

|||||||||||

|

102,342 |

Altria Group, Inc. |

$ |

3,215,586 |

||||||||

|

77,216 |

Philip Morris International |

6,458,346 |

|||||||||

|

20,787 |

Reynolds American Inc. |

861,205 |

|||||||||

|

5,109 |

Vector Group Ltd. |

75,971 |

|||||||||

|

Total Tobacco |

10,611,108 |

||||||||||

|

Wireless Telecommunication Services – 0.0% |

|||||||||||

|

5,500 |

USA Mobility Inc. |

64,240 |

|||||||||

|

Total Common Stocks (cost $377,164,727) |

500,379,882 |

||||||||||

|

Principal Amount (000) |

Description (1) |

Coupon |

Maturity |

Value |

|||||||||||||||

|

Short-Term Investments – 3.6% |

|||||||||||||||||||

|

$ |

18,137 |

Repurchase Agreement with Fixed Income Clearing Corporation, dated 12/31/12, repurchase price $18,136,903, collateralized by $17,730,000 U.S. Treasury Notes, 1.750%, due 7/31/15, value $18,504,482 |

0.010 |

% |

1/02/13 |

$ |

18,136,893 |

||||||||||||

|

Total Short-Term Investments (cost $18,136,893) |

18,136,893 |

||||||||||||||||||

|

Total Investments (cost $395,301,620) – 102.7% |

518,516,775 |

||||||||||||||||||

|

Other Assets Less Liabilities – (2.7)% (3) |

(13,534,720 |

) |

|||||||||||||||||

|

Net Assets – 100% |

$ |

504,982,055 |

|||||||||||||||||

Investments in Derivatives as of December 31, 2012

Call Options Written outstanding:

|

Number of Contracts |

Type |

Notional Amount (4) |

Expiration Date |

Strike Price |

Value (3) |

||||||||||||||||||

|

Call Options Written – (2.7)% |

|||||||||||||||||||||||

| (399 |

) |

S&P 500 Index |

$ |

(53,865,000 |

) |

1/19/13 |

$ |

1,350 |

$ |

(3,273,795 |

) |

||||||||||||

| (406 |

) |

S&P 500 Index |

(55,825,000 |

) |

1/19/13 |

1,375 |

(2,419,760 |

) |

|||||||||||||||

| (668 |

) |

S&P 500 Index |

(93,520,000 |

) |

1/19/13 |

1,400 |

(2,655,300 |

) |

|||||||||||||||

| (436 |

) |

S&P 500 Index |

(62,130,000 |

) |

1/19/13 |

1,425 |

(996,260 |

) |

|||||||||||||||

| (648 |

) |

S&P 500 Index |

(93,960,000 |

) |

1/19/13 |

1,450 |

(592,920 |