cps-20231231false2023FYCPS000132046112-31770.0010.00110,000,00010,000,00000000.0010.001190,000,000190,000,00019,263,28819,173,83817,197,47917,108,029154,801186,875248,0107,2444,6509611,0161,2822,157163,061192,807251,128P3Y10105254010http://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligations91,00024,000166,000P1Yhttp://fasb.org/us-gaap/2023#GainLossOnSaleOfBusiness00013204612023-01-012023-12-310001320461us-gaap:CommonStockMember2023-01-012023-12-310001320461us-gaap:PreferredStockMember2023-01-012023-12-3100013204612021-06-30iso4217:USD00013204612024-02-09xbrli:shares00013204612022-01-012022-12-3100013204612021-01-012021-12-31iso4217:USDxbrli:shares00013204612023-12-3100013204612022-12-31xbrli:pure0001320461us-gaap:CommonStockMember2020-12-310001320461us-gaap:AdditionalPaidInCapitalMember2020-12-310001320461us-gaap:RetainedEarningsMember2020-12-310001320461us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001320461cps:CooperStandardHoldingsIncEquityDeficitMember2020-12-310001320461us-gaap:NoncontrollingInterestMember2020-12-3100013204612020-12-310001320461us-gaap:CommonStockMember2021-01-012021-12-310001320461us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001320461us-gaap:RetainedEarningsMember2021-01-012021-12-310001320461cps:CooperStandardHoldingsIncEquityDeficitMember2021-01-012021-12-310001320461us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001320461us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001320461us-gaap:CommonStockMember2021-12-310001320461us-gaap:AdditionalPaidInCapitalMember2021-12-310001320461us-gaap:RetainedEarningsMember2021-12-310001320461us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001320461cps:CooperStandardHoldingsIncEquityDeficitMember2021-12-310001320461us-gaap:NoncontrollingInterestMember2021-12-3100013204612021-12-310001320461us-gaap:CommonStockMember2022-01-012022-12-310001320461us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001320461cps:CooperStandardHoldingsIncEquityDeficitMember2022-01-012022-12-310001320461us-gaap:RetainedEarningsMember2022-01-012022-12-310001320461us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001320461us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001320461us-gaap:CommonStockMember2022-12-310001320461us-gaap:AdditionalPaidInCapitalMember2022-12-310001320461us-gaap:RetainedEarningsMember2022-12-310001320461us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001320461cps:CooperStandardHoldingsIncEquityDeficitMember2022-12-310001320461us-gaap:NoncontrollingInterestMember2022-12-310001320461us-gaap:CommonStockMember2023-01-012023-12-310001320461us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001320461cps:CooperStandardHoldingsIncEquityDeficitMember2023-01-012023-12-310001320461us-gaap:RetainedEarningsMember2023-01-012023-12-310001320461us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001320461us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001320461us-gaap:CommonStockMember2023-12-310001320461us-gaap:AdditionalPaidInCapitalMember2023-12-310001320461us-gaap:RetainedEarningsMember2023-12-310001320461us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001320461cps:CooperStandardHoldingsIncEquityDeficitMember2023-12-310001320461us-gaap:NoncontrollingInterestMember2023-12-31cps:Locationcps:Country0001320461us-gaap:PropertyPlantAndEquipmentOtherTypesMember2023-12-310001320461cps:PreviouslyConsolidatedJointVentureMember2023-03-310001320461cps:AutomotiveMembersrt:NorthAmericaMember2023-01-012023-12-310001320461cps:AutomotiveMembersrt:EuropeMember2023-01-012023-12-310001320461cps:AutomotiveMembersrt:AsiaPacificMember2023-01-012023-12-310001320461cps:AutomotiveMembersrt:SouthAmericaMember2023-01-012023-12-310001320461cps:AutomotiveMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310001320461cps:AutomotiveMember2023-01-012023-12-310001320461srt:NorthAmericaMembercps:CommercialMember2023-01-012023-12-310001320461srt:EuropeMembercps:CommercialMember2023-01-012023-12-310001320461srt:AsiaPacificMembercps:CommercialMember2023-01-012023-12-310001320461srt:SouthAmericaMembercps:CommercialMember2023-01-012023-12-310001320461us-gaap:CorporateAndOtherMembercps:CommercialMember2023-01-012023-12-310001320461cps:CommercialMember2023-01-012023-12-310001320461srt:NorthAmericaMembercps:OtherCustomersMember2023-01-012023-12-310001320461cps:OtherCustomersMembersrt:EuropeMember2023-01-012023-12-310001320461srt:AsiaPacificMembercps:OtherCustomersMember2023-01-012023-12-310001320461cps:OtherCustomersMembersrt:SouthAmericaMember2023-01-012023-12-310001320461us-gaap:CorporateAndOtherMembercps:OtherCustomersMember2023-01-012023-12-310001320461cps:OtherCustomersMember2023-01-012023-12-310001320461srt:NorthAmericaMember2023-01-012023-12-310001320461srt:EuropeMember2023-01-012023-12-310001320461srt:AsiaPacificMember2023-01-012023-12-310001320461srt:SouthAmericaMember2023-01-012023-12-310001320461us-gaap:CorporateAndOtherMember2023-01-012023-12-310001320461cps:AutomotiveMembersrt:NorthAmericaMember2022-01-012022-12-310001320461cps:AutomotiveMembersrt:EuropeMember2022-01-012022-12-310001320461cps:AutomotiveMembersrt:AsiaPacificMember2022-01-012022-12-310001320461cps:AutomotiveMembersrt:SouthAmericaMember2022-01-012022-12-310001320461cps:AutomotiveMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310001320461cps:AutomotiveMember2022-01-012022-12-310001320461srt:NorthAmericaMembercps:CommercialMember2022-01-012022-12-310001320461srt:EuropeMembercps:CommercialMember2022-01-012022-12-310001320461srt:AsiaPacificMembercps:CommercialMember2022-01-012022-12-310001320461srt:SouthAmericaMembercps:CommercialMember2022-01-012022-12-310001320461us-gaap:CorporateAndOtherMembercps:CommercialMember2022-01-012022-12-310001320461cps:CommercialMember2022-01-012022-12-310001320461srt:NorthAmericaMembercps:OtherCustomersMember2022-01-012022-12-310001320461cps:OtherCustomersMembersrt:EuropeMember2022-01-012022-12-310001320461srt:AsiaPacificMembercps:OtherCustomersMember2022-01-012022-12-310001320461cps:OtherCustomersMembersrt:SouthAmericaMember2022-01-012022-12-310001320461us-gaap:CorporateAndOtherMembercps:OtherCustomersMember2022-01-012022-12-310001320461cps:OtherCustomersMember2022-01-012022-12-310001320461srt:NorthAmericaMember2022-01-012022-12-310001320461srt:EuropeMember2022-01-012022-12-310001320461srt:AsiaPacificMember2022-01-012022-12-310001320461srt:SouthAmericaMember2022-01-012022-12-310001320461us-gaap:CorporateAndOtherMember2022-01-012022-12-310001320461cps:AutomotiveMembersrt:NorthAmericaMember2021-01-012021-12-310001320461cps:AutomotiveMembersrt:EuropeMember2021-01-012021-12-310001320461cps:AutomotiveMembersrt:AsiaPacificMember2021-01-012021-12-310001320461cps:AutomotiveMembersrt:SouthAmericaMember2021-01-012021-12-310001320461cps:AutomotiveMemberus-gaap:CorporateAndOtherMember2021-01-012021-12-310001320461cps:AutomotiveMember2021-01-012021-12-310001320461srt:NorthAmericaMembercps:CommercialMember2021-01-012021-12-310001320461srt:EuropeMembercps:CommercialMember2021-01-012021-12-310001320461srt:AsiaPacificMembercps:CommercialMember2021-01-012021-12-310001320461srt:SouthAmericaMembercps:CommercialMember2021-01-012021-12-310001320461us-gaap:CorporateAndOtherMembercps:CommercialMember2021-01-012021-12-310001320461cps:CommercialMember2021-01-012021-12-310001320461srt:NorthAmericaMembercps:OtherCustomersMember2021-01-012021-12-310001320461cps:OtherCustomersMembersrt:EuropeMember2021-01-012021-12-310001320461srt:AsiaPacificMembercps:OtherCustomersMember2021-01-012021-12-310001320461cps:OtherCustomersMembersrt:SouthAmericaMember2021-01-012021-12-310001320461us-gaap:CorporateAndOtherMembercps:OtherCustomersMember2021-01-012021-12-310001320461cps:OtherCustomersMember2021-01-012021-12-310001320461srt:NorthAmericaMember2021-01-012021-12-310001320461srt:EuropeMember2021-01-012021-12-310001320461srt:AsiaPacificMember2021-01-012021-12-310001320461srt:SouthAmericaMember2021-01-012021-12-310001320461us-gaap:CorporateAndOtherMember2021-01-012021-12-310001320461cps:SealingsystemsMembersrt:NorthAmericaMember2023-01-012023-12-310001320461cps:SealingsystemsMembersrt:EuropeMember2023-01-012023-12-310001320461cps:SealingsystemsMembersrt:AsiaPacificMember2023-01-012023-12-310001320461cps:SealingsystemsMembersrt:SouthAmericaMember2023-01-012023-12-310001320461cps:SealingsystemsMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310001320461cps:SealingsystemsMember2023-01-012023-12-310001320461srt:NorthAmericaMembercps:FuelandbrakedeliverysystemsMember2023-01-012023-12-310001320461srt:EuropeMembercps:FuelandbrakedeliverysystemsMember2023-01-012023-12-310001320461srt:AsiaPacificMembercps:FuelandbrakedeliverysystemsMember2023-01-012023-12-310001320461srt:SouthAmericaMembercps:FuelandbrakedeliverysystemsMember2023-01-012023-12-310001320461us-gaap:CorporateAndOtherMembercps:FuelandbrakedeliverysystemsMember2023-01-012023-12-310001320461cps:FuelandbrakedeliverysystemsMember2023-01-012023-12-310001320461cps:FluidtransfersystemsMembersrt:NorthAmericaMember2023-01-012023-12-310001320461cps:FluidtransfersystemsMembersrt:EuropeMember2023-01-012023-12-310001320461cps:FluidtransfersystemsMembersrt:AsiaPacificMember2023-01-012023-12-310001320461cps:FluidtransfersystemsMembersrt:SouthAmericaMember2023-01-012023-12-310001320461cps:FluidtransfersystemsMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310001320461cps:FluidtransfersystemsMember2023-01-012023-12-310001320461srt:NorthAmericaMembercps:TotalFluidHandlingMember2023-01-012023-12-310001320461srt:EuropeMembercps:TotalFluidHandlingMember2023-01-012023-12-310001320461srt:AsiaPacificMembercps:TotalFluidHandlingMember2023-01-012023-12-310001320461srt:SouthAmericaMembercps:TotalFluidHandlingMember2023-01-012023-12-310001320461us-gaap:CorporateAndOtherMembercps:TotalFluidHandlingMember2023-01-012023-12-310001320461cps:TotalFluidHandlingMember2023-01-012023-12-310001320461srt:NorthAmericaMembercps:OtherproductsMember2023-01-012023-12-310001320461srt:EuropeMembercps:OtherproductsMember2023-01-012023-12-310001320461srt:AsiaPacificMembercps:OtherproductsMember2023-01-012023-12-310001320461srt:SouthAmericaMembercps:OtherproductsMember2023-01-012023-12-310001320461us-gaap:CorporateAndOtherMembercps:OtherproductsMember2023-01-012023-12-310001320461cps:OtherproductsMember2023-01-012023-12-310001320461cps:SealingsystemsMembersrt:NorthAmericaMember2022-01-012022-12-310001320461cps:SealingsystemsMembersrt:EuropeMember2022-01-012022-12-310001320461cps:SealingsystemsMembersrt:AsiaPacificMember2022-01-012022-12-310001320461cps:SealingsystemsMembersrt:SouthAmericaMember2022-01-012022-12-310001320461cps:SealingsystemsMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310001320461cps:SealingsystemsMember2022-01-012022-12-310001320461srt:NorthAmericaMembercps:FuelandbrakedeliverysystemsMember2022-01-012022-12-310001320461srt:EuropeMembercps:FuelandbrakedeliverysystemsMember2022-01-012022-12-310001320461srt:AsiaPacificMembercps:FuelandbrakedeliverysystemsMember2022-01-012022-12-310001320461srt:SouthAmericaMembercps:FuelandbrakedeliverysystemsMember2022-01-012022-12-310001320461us-gaap:CorporateAndOtherMembercps:FuelandbrakedeliverysystemsMember2022-01-012022-12-310001320461cps:FuelandbrakedeliverysystemsMember2022-01-012022-12-310001320461cps:FluidtransfersystemsMembersrt:NorthAmericaMember2022-01-012022-12-310001320461cps:FluidtransfersystemsMembersrt:EuropeMember2022-01-012022-12-310001320461cps:FluidtransfersystemsMembersrt:AsiaPacificMember2022-01-012022-12-310001320461cps:FluidtransfersystemsMembersrt:SouthAmericaMember2022-01-012022-12-310001320461cps:FluidtransfersystemsMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310001320461cps:FluidtransfersystemsMember2022-01-012022-12-310001320461srt:NorthAmericaMembercps:TotalFluidHandlingMember2022-01-012022-12-310001320461srt:EuropeMembercps:TotalFluidHandlingMember2022-01-012022-12-310001320461srt:AsiaPacificMembercps:TotalFluidHandlingMember2022-01-012022-12-310001320461srt:SouthAmericaMembercps:TotalFluidHandlingMember2022-01-012022-12-310001320461us-gaap:CorporateAndOtherMembercps:TotalFluidHandlingMember2022-01-012022-12-310001320461cps:TotalFluidHandlingMember2022-01-012022-12-310001320461srt:NorthAmericaMembercps:OtherproductsMember2022-01-012022-12-310001320461srt:EuropeMembercps:OtherproductsMember2022-01-012022-12-310001320461srt:AsiaPacificMembercps:OtherproductsMember2022-01-012022-12-310001320461srt:SouthAmericaMembercps:OtherproductsMember2022-01-012022-12-310001320461us-gaap:CorporateAndOtherMembercps:OtherproductsMember2022-01-012022-12-310001320461cps:OtherproductsMember2022-01-012022-12-310001320461cps:SealingsystemsMembersrt:NorthAmericaMember2021-01-012021-12-310001320461cps:SealingsystemsMembersrt:EuropeMember2021-01-012021-12-310001320461cps:SealingsystemsMembersrt:AsiaPacificMember2021-01-012021-12-310001320461cps:SealingsystemsMembersrt:SouthAmericaMember2021-01-012021-12-310001320461cps:SealingsystemsMemberus-gaap:CorporateAndOtherMember2021-01-012021-12-310001320461cps:SealingsystemsMember2021-01-012021-12-310001320461srt:NorthAmericaMembercps:FuelandbrakedeliverysystemsMember2021-01-012021-12-310001320461srt:EuropeMembercps:FuelandbrakedeliverysystemsMember2021-01-012021-12-310001320461srt:AsiaPacificMembercps:FuelandbrakedeliverysystemsMember2021-01-012021-12-310001320461srt:SouthAmericaMembercps:FuelandbrakedeliverysystemsMember2021-01-012021-12-310001320461us-gaap:CorporateAndOtherMembercps:FuelandbrakedeliverysystemsMember2021-01-012021-12-310001320461cps:FuelandbrakedeliverysystemsMember2021-01-012021-12-310001320461cps:FluidtransfersystemsMembersrt:NorthAmericaMember2021-01-012021-12-310001320461cps:FluidtransfersystemsMembersrt:EuropeMember2021-01-012021-12-310001320461cps:FluidtransfersystemsMembersrt:AsiaPacificMember2021-01-012021-12-310001320461cps:FluidtransfersystemsMembersrt:SouthAmericaMember2021-01-012021-12-310001320461cps:FluidtransfersystemsMemberus-gaap:CorporateAndOtherMember2021-01-012021-12-310001320461cps:FluidtransfersystemsMember2021-01-012021-12-310001320461srt:NorthAmericaMembercps:TotalFluidHandlingMember2021-01-012021-12-310001320461srt:EuropeMembercps:TotalFluidHandlingMember2021-01-012021-12-310001320461srt:AsiaPacificMembercps:TotalFluidHandlingMember2021-01-012021-12-310001320461srt:SouthAmericaMembercps:TotalFluidHandlingMember2021-01-012021-12-310001320461us-gaap:CorporateAndOtherMembercps:TotalFluidHandlingMember2021-01-012021-12-310001320461cps:TotalFluidHandlingMember2021-01-012021-12-310001320461srt:NorthAmericaMembercps:OtherproductsMember2021-01-012021-12-310001320461srt:EuropeMembercps:OtherproductsMember2021-01-012021-12-310001320461srt:AsiaPacificMembercps:OtherproductsMember2021-01-012021-12-310001320461srt:SouthAmericaMembercps:OtherproductsMember2021-01-012021-12-310001320461us-gaap:CorporateAndOtherMembercps:OtherproductsMember2021-01-012021-12-310001320461cps:OtherproductsMember2021-01-012021-12-310001320461us-gaap:ShortTermContractWithCustomerMember2023-12-310001320461us-gaap:ShortTermContractWithCustomerMember2022-12-310001320461us-gaap:LongTermContractWithCustomerMember2023-12-310001320461us-gaap:LongTermContractWithCustomerMember2022-12-310001320461srt:NorthAmericaMembersrt:ReportableGeographicalComponentsMember2023-01-012023-12-310001320461srt:NorthAmericaMembersrt:ReportableGeographicalComponentsMember2022-01-012022-12-310001320461srt:NorthAmericaMembersrt:ReportableGeographicalComponentsMember2021-01-012021-12-310001320461srt:EuropeMembersrt:ReportableGeographicalComponentsMember2023-01-012023-12-310001320461srt:EuropeMembersrt:ReportableGeographicalComponentsMember2022-01-012022-12-310001320461srt:EuropeMembersrt:ReportableGeographicalComponentsMember2021-01-012021-12-310001320461srt:AsiaPacificMembersrt:ReportableGeographicalComponentsMember2023-01-012023-12-310001320461srt:AsiaPacificMembersrt:ReportableGeographicalComponentsMember2022-01-012022-12-310001320461srt:AsiaPacificMembersrt:ReportableGeographicalComponentsMember2021-01-012021-12-310001320461srt:SouthAmericaMembersrt:ReportableGeographicalComponentsMember2023-01-012023-12-310001320461srt:SouthAmericaMembersrt:ReportableGeographicalComponentsMember2022-01-012022-12-310001320461srt:SouthAmericaMembersrt:ReportableGeographicalComponentsMember2021-01-012021-12-310001320461cps:AutomotiveMember2023-01-012023-12-310001320461cps:AutomotiveMember2022-01-012022-12-310001320461cps:AutomotiveMember2021-01-012021-12-310001320461us-gaap:CorporateAndOtherMember2023-01-012023-12-310001320461us-gaap:CorporateAndOtherMember2022-01-012022-12-310001320461us-gaap:CorporateAndOtherMember2021-01-012021-12-310001320461us-gaap:EmployeeSeveranceMember2021-12-310001320461us-gaap:OtherRestructuringMember2021-12-310001320461us-gaap:EmployeeSeveranceMember2022-01-012022-12-310001320461us-gaap:OtherRestructuringMember2022-01-012022-12-310001320461us-gaap:EmployeeSeveranceMember2022-12-310001320461us-gaap:OtherRestructuringMember2022-12-310001320461us-gaap:EmployeeSeveranceMember2023-01-012023-12-310001320461us-gaap:OtherRestructuringMember2023-01-012023-12-310001320461us-gaap:EmployeeSeveranceMember2023-12-310001320461us-gaap:OtherRestructuringMember2023-12-310001320461cps:OperatingLeasesMember2023-12-310001320461cps:FinanceLeasesMember2023-12-310001320461cps:OperatingLeasesMember2022-12-310001320461cps:FinanceLeasesMember2022-12-310001320461us-gaap:LandAndLandImprovementsMember2023-12-310001320461us-gaap:LandAndLandImprovementsMember2022-12-310001320461us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001320461us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001320461us-gaap:MachineryAndEquipmentMember2023-12-310001320461us-gaap:MachineryAndEquipmentMember2022-12-310001320461us-gaap:ConstructionInProgressMember2023-12-310001320461us-gaap:ConstructionInProgressMember2022-12-310001320461us-gaap:PropertyPlantAndEquipmentMember2023-01-012023-12-310001320461us-gaap:PropertyPlantAndEquipmentMember2022-01-012022-12-310001320461us-gaap:PropertyPlantAndEquipmentMember2021-01-012021-12-310001320461us-gaap:MachineryAndEquipmentMember2023-01-012023-12-310001320461us-gaap:MachineryAndEquipmentMember2022-01-012022-12-310001320461us-gaap:MachineryAndEquipmentMember2021-01-012021-12-310001320461cps:EuropeReportingUnitMember2022-01-012022-12-310001320461us-gaap:LandAndLandImprovementsMembersrt:MinimumMember2023-12-310001320461us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2023-12-310001320461us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2023-12-310001320461srt:MaximumMemberus-gaap:LandAndLandImprovementsMember2023-12-310001320461srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001320461srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2023-12-310001320461srt:NorthAmericaMember2021-12-310001320461cps:IndustrialSpecialtyGroupMember2021-12-310001320461cps:IndustrialSpecialtyGroupMember2022-01-012022-12-310001320461srt:NorthAmericaMember2022-12-310001320461cps:IndustrialSpecialtyGroupMember2022-12-310001320461cps:IndustrialSpecialtyGroupMember2023-01-012023-12-310001320461srt:NorthAmericaMember2023-12-310001320461cps:IndustrialSpecialtyGroupMember2023-12-310001320461us-gaap:CustomerRelationshipsMember2023-12-310001320461us-gaap:OtherIntangibleAssetsMember2023-12-310001320461us-gaap:CustomerRelationshipsMember2022-12-310001320461us-gaap:OtherIntangibleAssetsMember2022-12-310001320461us-gaap:SecuredDebtMember2023-12-310001320461us-gaap:SecuredDebtMember2022-12-310001320461us-gaap:SeniorNotesMember2023-01-272023-01-270001320461us-gaap:SeniorNotesMembercps:FirstLienNotesMember2023-01-270001320461us-gaap:SeniorNotesMembercps:ThirdLienNotesMember2023-01-270001320461us-gaap:SeniorNotesMember2016-11-020001320461us-gaap:SeniorNotesMember2023-01-270001320461us-gaap:SeniorNotesMember2018-12-310001320461us-gaap:SeniorNotesMember2023-12-310001320461us-gaap:SeniorNotesMember2022-12-310001320461us-gaap:SecuredDebtMember2020-05-290001320461cps:AmendedSeniorAblFacilityMember2022-03-310001320461cps:AmendedSeniorAblFacilityMember2016-11-020001320461cps:AmendedSeniorAblFacilityMember2023-01-012023-12-310001320461cps:CooperStandardAutomotiveIncUsMembercps:SeniorAblFacilityMember2023-12-310001320461cps:CooperStandardAutomotiveIncCanadaMembercps:SeniorAblFacilityMember2023-12-310001320461cps:AmendedSeniorAblFacilityMember2023-12-310001320461cps:AmendedSeniorAblFacilityMember2022-12-310001320461us-gaap:MediumTermNotesMember2016-11-020001320461us-gaap:MediumTermNotesMember2023-01-012023-12-310001320461us-gaap:MediumTermNotesMember2022-12-310001320461us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001320461us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001320461us-gaap:FairValueInputsLevel2Memberus-gaap:AccruedLiabilitiesMember2023-12-310001320461us-gaap:FairValueInputsLevel2Memberus-gaap:AccruedLiabilitiesMember2022-12-310001320461us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2023-12-310001320461us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2022-12-310001320461us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001320461country:USus-gaap:PensionPlansDefinedBenefitMember2022-12-310001320461us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001320461country:USus-gaap:PensionPlansDefinedBenefitMember2021-12-310001320461us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001320461country:USus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001320461us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001320461country:USus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001320461us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001320461country:USus-gaap:PensionPlansDefinedBenefitMember2023-12-310001320461us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001320461country:USus-gaap:OtherAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001320461us-gaap:ForeignPlanMemberus-gaap:OtherAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001320461country:USus-gaap:OtherAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001320461us-gaap:ForeignPlanMemberus-gaap:OtherAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001320461country:USus-gaap:AccruedLiabilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001320461us-gaap:ForeignPlanMemberus-gaap:AccruedLiabilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001320461country:USus-gaap:AccruedLiabilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001320461us-gaap:ForeignPlanMemberus-gaap:AccruedLiabilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001320461country:UScps:PensionBenefitsLongTermMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001320461us-gaap:ForeignPlanMembercps:PensionBenefitsLongTermMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001320461country:UScps:PensionBenefitsLongTermMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001320461us-gaap:ForeignPlanMembercps:PensionBenefitsLongTermMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001320461country:USus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001320461us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001320461us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2023-12-310001320461us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001320461us-gaap:EquitySecuritiesMember2023-12-310001320461us-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMember2023-12-310001320461us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001320461us-gaap:DebtSecuritiesMember2023-12-310001320461cps:DebtSecuritiesMeasuredAtNetAssetValueMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310001320461cps:DebtSecuritiesMeasuredAtNetAssetValueMember2023-12-310001320461us-gaap:RealEstateMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310001320461us-gaap:RealEstateMember2023-12-310001320461us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2023-12-310001320461us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001320461us-gaap:CashAndCashEquivalentsMember2023-12-310001320461us-gaap:FairValueInputsLevel1Member2023-12-310001320461us-gaap:FairValueInputsLevel2Member2023-12-310001320461us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310001320461us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2022-12-310001320461us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001320461us-gaap:EquitySecuritiesMember2022-12-310001320461us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercps:EquitySecuritiesMeasuredAtNetAssetValueMember2022-12-310001320461cps:EquitySecuritiesMeasuredAtNetAssetValueMember2022-12-310001320461us-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMember2022-12-310001320461us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001320461us-gaap:DebtSecuritiesMember2022-12-310001320461cps:DebtSecuritiesMeasuredAtNetAssetValueMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310001320461cps:DebtSecuritiesMeasuredAtNetAssetValueMember2022-12-310001320461us-gaap:RealEstateMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310001320461us-gaap:RealEstateMember2022-12-310001320461us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2022-12-310001320461us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001320461us-gaap:CashAndCashEquivalentsMember2022-12-310001320461us-gaap:FairValueInputsLevel1Member2022-12-310001320461us-gaap:FairValueInputsLevel2Member2022-12-310001320461us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310001320461us-gaap:PensionPlansDefinedBenefitMember2023-12-310001320461country:US2023-12-310001320461us-gaap:ForeignPlanMember2023-12-310001320461us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310001320461country:US2022-12-310001320461us-gaap:ForeignPlanMember2022-12-310001320461country:US2021-12-310001320461us-gaap:ForeignPlanMember2021-12-310001320461country:US2023-01-012023-12-310001320461us-gaap:ForeignPlanMember2023-01-012023-12-310001320461country:US2022-01-012022-12-310001320461us-gaap:ForeignPlanMember2022-01-012022-12-310001320461country:USus-gaap:AccruedLiabilitiesMember2023-12-310001320461us-gaap:ForeignPlanMemberus-gaap:AccruedLiabilitiesMember2023-12-310001320461country:USus-gaap:AccruedLiabilitiesMember2022-12-310001320461us-gaap:ForeignPlanMemberus-gaap:AccruedLiabilitiesMember2022-12-310001320461country:UScps:PensionBenefitsLongTermMember2023-12-310001320461us-gaap:ForeignPlanMembercps:PensionBenefitsLongTermMember2023-12-310001320461country:UScps:PensionBenefitsLongTermMember2022-12-310001320461us-gaap:ForeignPlanMembercps:PensionBenefitsLongTermMember2022-12-310001320461country:US2021-01-012021-12-310001320461us-gaap:ForeignPlanMember2021-01-012021-12-310001320461us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001320461us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001320461cps:OtherlegislationMember2023-01-012023-12-310001320461cps:OtherlegislationMember2022-01-012022-12-310001320461cps:OtherlegislationMember2021-01-012021-12-310001320461cps:U.S.TaxandJobsActMember2023-01-012023-12-310001320461cps:U.S.TaxandJobsActMember2022-01-012022-12-310001320461cps:U.S.TaxandJobsActMember2021-01-012021-12-310001320461cps:OutsideBasisDifferenceMember2023-01-012023-12-310001320461cps:OutsideBasisDifferenceMember2022-01-012022-12-310001320461cps:OutsideBasisDifferenceMember2021-01-012021-12-310001320461cps:OtherAdjustmentsMember2023-01-012023-12-310001320461cps:OtherAdjustmentsMember2022-01-012022-12-310001320461cps:OtherAdjustmentsMember2021-01-012021-12-310001320461cps:SegmentGeographicalGroupOfCountriesGroupOneMember2023-12-310001320461cps:SegmentGeographicalGroupOfCountriesGroupOneMember2023-01-012023-12-310001320461cps:SegmentGeographicalGroupOfCountriesGroupTwoMember2023-12-310001320461us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001320461us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001320461us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-12-310001320461us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001320461us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001320461us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-01-012022-12-310001320461us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001320461us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001320461us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-12-310001320461us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001320461us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001320461us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-01-012023-12-310001320461us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001320461us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001320461us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-12-310001320461cps:SettlementMember2022-01-012022-12-310001320461cps:SettlementMember2023-01-012023-12-31cps:commonStockNumberOfVotePerShare0001320461cps:A2018ProgramMember2023-12-310001320461us-gaap:PerformanceSharesMember2023-01-012023-12-310001320461us-gaap:PerformanceSharesMember2022-01-012022-12-310001320461us-gaap:PerformanceSharesMember2021-01-012021-12-310001320461us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001320461us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001320461us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001320461us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001320461us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001320461us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001320461us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-01-012023-12-310001320461us-gaap:EmployeeStockOptionMember2023-12-310001320461us-gaap:StockOptionMember2022-01-012022-12-310001320461cps:RestrictedCommonStockMember2023-01-012023-12-310001320461cps:RestrictedStockAndUnitsMember2022-12-310001320461cps:RestrictedStockAndUnitsMember2023-01-012023-12-310001320461cps:RestrictedStockAndUnitsMember2023-12-310001320461cps:RestrictedCommonStockMember2022-01-012022-12-310001320461cps:RestrictedCommonStockMember2021-01-012021-12-310001320461cps:RestrictedCommonStockMember2023-12-310001320461us-gaap:PerformanceSharesMember2022-12-310001320461cps:PerformanceSharesCashSettledMember2022-12-310001320461cps:PerformanceSharesCashSettledMember2023-01-012023-12-310001320461us-gaap:PerformanceSharesMember2023-12-310001320461cps:PerformanceSharesCashSettledMember2023-12-310001320461us-gaap:ParentMember2023-01-012023-12-310001320461us-gaap:ParentMember2022-01-012022-12-310001320461us-gaap:ParentMember2021-01-012021-12-310001320461srt:NorthAmericaMembersrt:ReportableGeographicalComponentsMember2023-12-310001320461srt:NorthAmericaMembersrt:ReportableGeographicalComponentsMember2022-12-310001320461srt:EuropeMembersrt:ReportableGeographicalComponentsMember2023-12-310001320461srt:EuropeMembersrt:ReportableGeographicalComponentsMember2022-12-310001320461srt:AsiaPacificMembersrt:ReportableGeographicalComponentsMember2023-12-310001320461srt:AsiaPacificMembersrt:ReportableGeographicalComponentsMember2022-12-310001320461srt:SouthAmericaMembersrt:ReportableGeographicalComponentsMember2023-12-310001320461srt:SouthAmericaMembersrt:ReportableGeographicalComponentsMember2022-12-310001320461cps:AutomotiveMember2023-12-310001320461cps:AutomotiveMember2022-12-310001320461us-gaap:CorporateAndOtherMember2023-12-310001320461us-gaap:CorporateAndOtherMember2022-12-310001320461country:MX2023-01-012023-12-310001320461country:MX2022-01-012022-12-310001320461country:MX2021-01-012021-12-310001320461country:US2023-01-012023-12-310001320461country:US2022-01-012022-12-310001320461country:US2021-01-012021-12-310001320461country:CN2023-01-012023-12-310001320461country:CN2022-01-012022-12-310001320461country:CN2021-01-012021-12-310001320461country:PL2023-01-012023-12-310001320461country:PL2022-01-012022-12-310001320461country:PL2021-01-012021-12-310001320461country:CA2023-01-012023-12-310001320461country:CA2022-01-012022-12-310001320461country:CA2021-01-012021-12-310001320461country:DE2023-01-012023-12-310001320461country:DE2022-01-012022-12-310001320461country:DE2021-01-012021-12-310001320461country:FR2023-01-012023-12-310001320461country:FR2022-01-012022-12-310001320461country:FR2021-01-012021-12-310001320461cps:OtherInternationalMember2023-01-012023-12-310001320461cps:OtherInternationalMember2022-01-012022-12-310001320461cps:OtherInternationalMember2021-01-012021-12-310001320461country:US2023-12-310001320461country:US2022-12-310001320461country:MX2023-12-310001320461country:MX2022-12-310001320461country:CN2023-12-310001320461country:CN2022-12-310001320461country:CA2023-12-310001320461country:CA2022-12-310001320461country:FR2023-12-310001320461country:FR2022-12-310001320461country:PL2023-12-310001320461country:PL2022-12-310001320461country:DE2023-12-310001320461country:DE2022-12-310001320461cps:OtherInternationalMember2023-12-310001320461cps:OtherInternationalMember2022-12-310001320461cps:FordMember2023-01-012023-12-310001320461cps:FordMember2022-01-012022-12-310001320461cps:FordMember2021-01-012021-12-310001320461cps:GeneralMotorsMember2023-01-012023-12-310001320461cps:GeneralMotorsMember2022-01-012022-12-310001320461cps:GeneralMotorsMember2021-01-012021-12-310001320461cps:StellantisMember2023-01-012023-12-310001320461cps:StellantisMember2022-01-012022-12-310001320461cps:StellantisMember2021-01-012021-12-310001320461us-gaap:AllowanceForCreditLossMember2022-12-310001320461us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310001320461us-gaap:AllowanceForCreditLossMember2023-12-310001320461us-gaap:AllowanceForCreditLossMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2021-12-310001320461us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310001320461us-gaap:AllowanceForCreditLossMember2020-12-310001320461us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310001320461us-gaap:AllowanceForCreditLossMember2021-12-3100013204612023-07-012023-09-300001320461cps:TaxValuationAllowanceMember2022-12-310001320461cps:TaxValuationAllowanceMember2023-01-012023-12-310001320461cps:TaxValuationAllowanceMember2023-12-310001320461cps:TaxValuationAllowanceMember2021-12-310001320461cps:TaxValuationAllowanceMember2022-01-012022-12-310001320461cps:TaxValuationAllowanceMember2020-12-310001320461cps:TaxValuationAllowanceMember2021-01-012021-12-3100013204612023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-36127

COOPER-STANDARD HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 20-1945088 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

40300 Traditions Drive

Northville, Michigan 48168

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (248) 596-5900

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | CPS | | New York Stock Exchange |

| Preferred Stock Purchase Rights | | - | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting and non-voting common stock held by non-affiliates as of June 30, 2023 was $192,207,617.

The number of the registrant’s shares of common stock, $0.001 par value per share, outstanding as of February 9, 2024 was 17,197,479 shares.

Documents Incorporated by Reference

Certain portions, as expressly described in this report, of the Registrant’s Proxy Statement for the 2024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS | | | | | | | | |

| | | Page |

| PART I |

| | |

| Item 1. | Business | |

| Item 1A. | Risk Factors | |

| Item 1B. | Unresolved Staff Comments | |

| Item 1C. | Cybersecurity | |

| Item 2. | Properties | |

| Item 3. | Legal Proceedings | |

| Item 4. | Mine Safety Disclosures | |

|

| PART II |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| Item 6. | [Reserved] | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 8. | Financial Statements and Supplementary Data | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| Item 9A. | Controls and Procedures | |

| Item 9B. | Other Information | |

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

|

| PART III |

| Item 10. | Directors, Executive Officers and Corporate Governance | |

| Item 11. | Executive Compensation | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

| Item 14. | Principal Accounting Fees and Services | |

|

| PART IV |

| Item 15. | Exhibits and Financial Statement Schedules | |

| Signatures | |

PART I

Item 1. Business

Cooper-Standard Holdings Inc. (together with its consolidated subsidiaries, the “Company,” “Cooper Standard,” “we,” “our” or “us”) is a leading manufacturer of sealing and fluid handling systems (consisting of fuel and brake delivery and fluid transfer systems). Our products are primarily for use in passenger vehicles and light trucks that are manufactured by global automotive original equipment manufacturers (“OEMs”) and replacement markets. We conduct substantially all of our activities through our subsidiaries.

Cooper Standard is listed on the New York Stock Exchange (“NYSE”) under the ticker symbol “CPS.” The Company has approximately 23,000 employees, including 3,000 contingent workers, with 128 facilities in 21 countries. We believe that we are the largest global producer of sealing systems, the second largest global producer of the types of fuel and brake delivery products that we manufacture and the third largest global producer of the types of fluid transfer systems that we manufacture. We design and manufacture our products in each major region of the world through a disciplined and sustained approach to engineering and operational excellence. We operate in 78 manufacturing locations and 50 design, engineering, administrative and logistics locations.

Approximately 84% of our sales in 2023 were to OEMs, including Ford Motor Company (“Ford”), General Motors Company (“GM”), Stellantis, Volkswagen Group, Daimler, Renault-Nissan, BMW, Toyota, Volvo, Jaguar/Land Rover, Honda and various other OEMs based in China. The remaining 16% of our 2023 sales were primarily to Tier I and Tier II automotive suppliers, non-automotive customers, and replacement market distributors. The Company’s products can be found on over 440 nameplates globally.

Our organizational structure primarily consists of a global automotive business (“Automotive”) and the Industrial and Specialty Group (“ISG”). For the periods presented herein, our business was organized in the following reportable segments: North America, Europe, Asia Pacific and South America. ISG and all other business activities were reported in Corporate, eliminations and other. This operating structure allowed us to offer our full portfolio of products and support our global and regional customers with complete engineering and manufacturing expertise in all major regions of the world. On an ongoing basis, we undertake restructuring, expansion and cost reduction initiatives to improve competitiveness.

Consistent with our strategy to drive future profitable growth, the Company has increased and intensified management focus on its two global automotive product line businesses. Effective January 1, 2024, the Company appointed a senior executive to lead each of our sealing and fluid handling systems businesses, and the chief operating decision maker will prospectively begin to assess operating performance by product line rather than geography. As a result, beginning with the first quarter of 2024, the Company expects to report its financial results in two reportable segments based on product line: Sealing Systems and Fluid Handling Systems.

Corporate History and Business Developments

Cooper-Standard Holdings Inc. was established in 2004 as a Delaware corporation and began operating on December 23, 2004 when it acquired the automotive segment of Cooper Tire & Rubber Company. Cooper-Standard Holdings Inc. operates the business primarily through its principal operating subsidiary, Cooper-Standard Automotive Inc. (“CSA U.S.”). Since the 2004 acquisition, the Company has expanded and diversified its customer base through a combination of organic growth and strategic acquisitions.

Our ISG business accelerates and maximizes the value stream of Cooper Standard’s materials science and manufacturing expertise in industrial and specialty markets. We furthered the expansion of our ISG business through the acquisition of Lauren Manufacturing and Lauren Plastics in 2018.

Cooper Standard signed multiple joint development agreements for our Fortrex™ chemistry platform throughout 2018 to 2021. In 2021, the Company reached a long-term commercial agreement to license its Fortrex™ technology to NIKE, Inc., with the footwear manufacturer launching the first related mass production programs in 2023.

In 2023, we finalized the divestiture of our European technical rubber products business and sold the Company’s entire controlling equity interest in a joint venture in the Asia Pacific region.

Business Strategy

Cooper Standard’s Purpose statement - Creating Sustainable Solutions Together - represents the Company’s focus on creating solutions for the long-term health of the business as a whole and the sustained value that we work each day to deliver to our stakeholders (customers, investors, employees, suppliers and communities). Our key strategic imperatives are defined as:

| | | | | |

| Financial Strength: | Execute our business plans achieving and sustaining double-digit EBITDA margins, ROIC and strong free cash flow generation. |

| |

| World-Class Execution: | Attain world-class results across all our business allowing the Company to Be the First Choice of the Stakeholders We Serve. |

| |

| Profitable Growth Driven by Innovation: | Leverage our materials science and product knowledge, innovation and manufacturing expertise across our product groups in the pursuit of organic and inorganic growth. |

| |

| Corporate Responsibility: | Deliver value to all our stakeholders through our environmental, social and governance initiatives to ensure the long-term sustainability of the Company. |

Cooper Standard’s global alignment around these imperatives continues to drive further value in many areas of the business.

Operational and Strategic Initiatives

As part of Cooper Standard’s world-class operations, the Company relies upon its CSOS (Cooper Standard Operating System) to fully position the Company for growth and ensure global consistency in engineering design, program management, manufacturing process, purchasing and IT systems. Standardization across all regions is especially critical in support of customers’ global platforms that require the same design, quality and delivery standards everywhere across the world. As a result of these initiatives, the Company has leveraged CSOS to drive an average savings from improved operating efficiency of approximately $60 million each of the past five years.

In addition, as part of our continued focus on sustainability and corporate responsibility, the Company’s Global Sustainability Council provides executive level oversight for the Company’s sustainability strategy to help ensure alignment and integration with business goals and stakeholder priorities. The council maintains a holistic look at the Company’s ESG (environmental, social and governance) initiatives, tracks rapidly-evolving best practices and further develops long-term goals as the Company strives for ESG excellence.

Cooper Standard continues to progress its diversification strategy through its ISG business, which is charged with accelerating and maximizing expertise in the Company’s core product types for applications in the industrial and specialty markets. Cooper Standard also drives growth and diversification through the Company’s applied materials science offerings, which include the Fortrex™ chemistry platform that provides performance advantages over many other materials, as well as a significantly reduced carbon footprint.

Leveraging Technology and Materials Science for Innovative Solutions

We use our technical and materials science expertise to provide customers with innovative and sustainable product solutions. Our engineers use the results of advanced computational simulations and incorporate a broad understanding of materials science to design products which meet or exceed our customers’ stringent requirements. We believe our reputation for successful innovation in product design and materials is the reason our customers consult us early in the development and design process of their next-generation vehicles or products.

The Company’s CS Open Innovation is an initiative that aims to position Cooper Standard as the partner of choice for start-ups, universities and other suppliers through a proactive outreach program. The initiative is focused in the areas of materials science, manufacturing and process technology, digital/artificial intelligence and advanced product technology.

Cooper Standard uses its i3 Innovation Process (Imagine, Initiate and Innovate) and CS Open Innovation as mechanisms to capture novel ideas while promoting a culture of innovation. Ideas are carefully evaluated by our global product line teams and Global Technology Council, and those that are selected are put on an accelerated development cycle. We are developing innovative technologies based on materials expertise, process know-how, and application vision, which may drive future product direction. An example is Fortrex™, the Company’s synthetic elastomer chemistry platform, offering reduced weight while delivering superior material performance and aesthetics. We have also developed several other significant technologies,

especially related to advanced materials, processing and weight reduction. These include: FlushSeal™, an advanced integrated solution for frame under glass static sealing systems offering better appearance, improved aerodynamics, quieter ride and reduced weight; TPV body seal, a next generation body seal that replaces traditionally less sustainable EPDM and metal with recyclable thermoplastic materials which save significant component weight; MagAlloy™, a processing technology for brake lines that increases long term durability through superior corrosion resistance; and Easy-Lock™, a small package coolant and fuel vapor quick connect. Given the trajectory and anticipated future growth of electric vehicles, Cooper Standard has developed innovations to provide lightweight plastic tubing with our PlastiCool® 2000 multilayer tubing, smooth and clear vinyl tubing (“CVT”) mid-temperature multilayer tubing, and our next-generation Ergo-Lock™ and Ergo-Lock™ + VDA quick connectors for glycol thermal management needs.

Cooper Standard is strategically integrating digital tools and advanced analysis to help deliver the best solutions. We offer advanced computer-aided engineering and digital simulations for engineered solutions. In addition, our team of experts has developed digital tools that enable them to conduct prototype testing without the need for physical samples, resulting in sustainability benefits. We can provide up to 100% virtual testing for certain products.

Among our newer technologies is Cooper Standard’s artificial intelligence (A.I.)-enhanced development cycle for polymer compounds that has shortened material development times while realizing rapid discovery of new compounds that offer superior performance properties, which yield superior products. We have also developed proprietary technology for A.I. automated processes control improvements, called Liveline Technologies, a wholly owned subsidiary of Cooper Standard. This technology enables full automation of polymer extrusion and other complex continuous processes, reducing process variation (a top driver of scrap), increasing product quality, improving operational metrics and reducing our carbon footprint. In addition, the Company is piloting multiple A.I. applications to help drive efficiencies in various functions.

Our innovations are receiving industry recognition. Cooper Standard earned an Environment + Energy Leader Award in 2022 for our Fortrex™ chemistry platform, in addition to being named a General Motors Overdrive Award winner in the category of ‘Sustainability’ in 2021, a 2018 Automotive News PACE Award winner, and a 2018, 2019, and 2023 Society of Plastics Engineers Innovation Award finalist. Also, Cooper Standard’s artificial intelligence-enhanced development cycle for polymer compound development was named a finalist for the 2019 Automotive News PACE Awards.

Cooper Standard’s fluid handling products were selected as the Society of Plastics Engineers 2022 Automotive Innovation Award winner for the Material category for our innovative battery electric vehicle thermoplastic thermal management solution utilizing PlastiCool® 2000 multilayer tube and Ergo-Lock® connectors.

Industry

The automotive industry is one of the world’s largest and most competitive markets. Consumer demand for new vehicles largely determines sales and production volumes of global OEMs. The business and commercial environment in each region also plays a role in vehicle demand as it relates to fleet vehicle sales and industrial-use vehicles such as light and heavy trucks.

OEMs compete for market share in a variety of ways including pricing and incentives, the development of new, more attractive models, branding and advertising, and the ability to customize vehicle features and options to meet specific consumer needs or demands. They rely heavily on thousands of specialized suppliers to provide the many distinct components and systems that comprise the modern vehicle. They also rely on these automotive suppliers to develop technological innovations that will help them meet internal and consumer demands as well as regulatory requirements.

The supplier industry is a highly competitive industry and is generally characterized by high barriers to entry, significant start-up costs and long-standing customer relationships. The criteria by which OEMs judge automotive suppliers include quality, price, service, launch performance, design and engineering capabilities, innovation, timely delivery, financial stability and global footprint. Over the last decade, suppliers that have been able to achieve manufacturing scale globally, reduce structural costs, diversify their customer base and provide innovative, value-added technologies have been the most successful.

The technology of today’s vehicles is evolving rapidly. This evolution is being driven by many factors including consumer preferences and social behaviors, a competitive drive for differentiation, regulatory requirements and environmental impact and safety. Cooper Standard supports these trends by providing innovations that reduce weight, increase life-cycle and durability, reduce interior noise, enhance exterior appearance, simplify the manufacturing and assembly process, and help reduce a vehicle’s environmental impact. These are innovations that can be applicable and valuable to virtually any vehicle (including internal combustion, hybrid or battery electric powertrains) or vehicle manufacturer and, in many cases, can also be transferred to non-automotive applications in adjacent markets. Cooper Standard remains closely aligned with our customers and is prepared to meet their evolving needs as they shift their fleets and offer more electric vehicle (“EV”) options. We are focused on growing

our business in the EV segment by leveraging our technology and innovation to provide value-add solutions for increasingly specialized technical requirements.

Markets Served

Our automotive business is focused on the passenger car and light truck market, up to and including Class 3 full-size, full-frame trucks, better known as the global light vehicle market. This is our largest market and accounts for approximately 94% of our global sales.

Customers

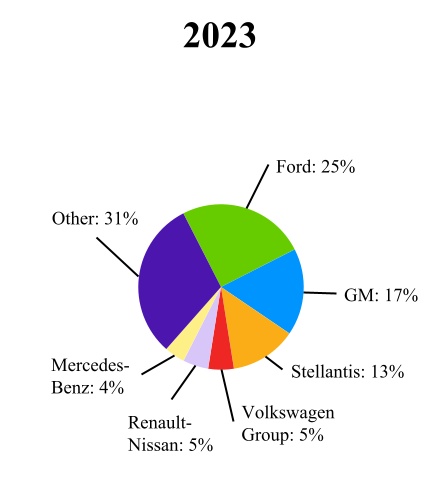

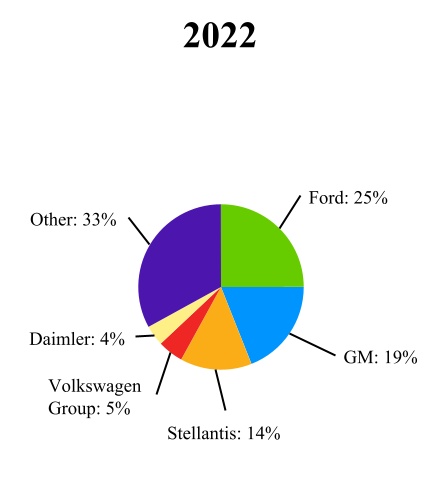

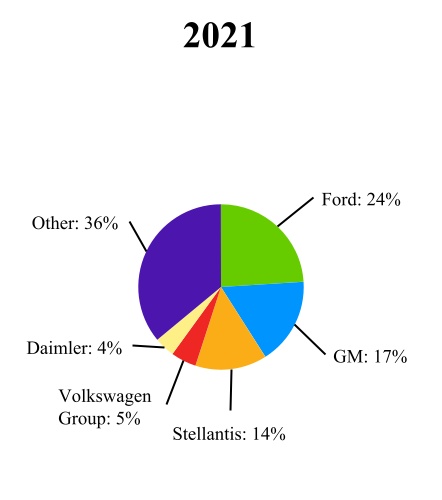

We are a leading supplier to the following OEMs and are increasing our presence with major OEMs throughout the world. The following charts show the percentage of sales to our top customers for the years ended December 31, 2023, 2022 and 2021:

Our other customers include OEMs such as BMW, Toyota, Volvo, Jaguar/Land Rover, Honda and various other OEMs based in China. Our business with any given customer is typically split among several contracts for different parts on a number of platforms.

Products

Our product lines include sealing systems and fluid handling systems (consisting of fuel and brake delivery and fluid transfer systems). These products are produced and supplied globally to a broad range of customers in multiple markets.

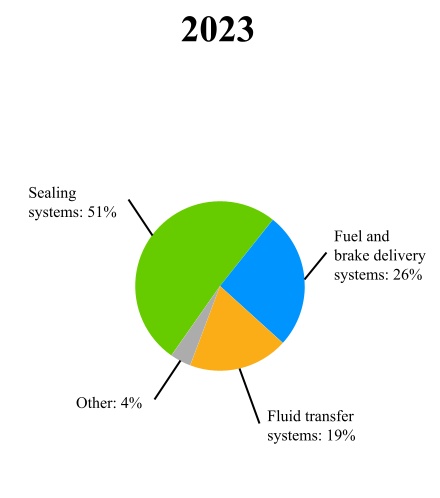

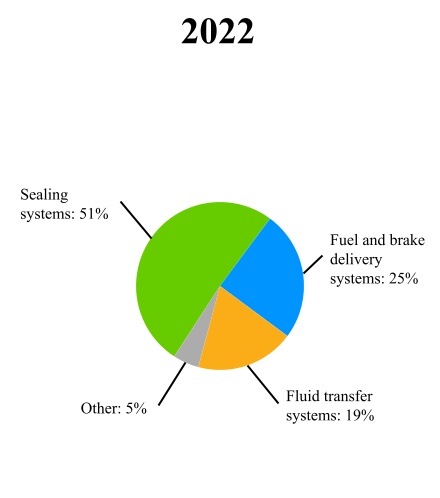

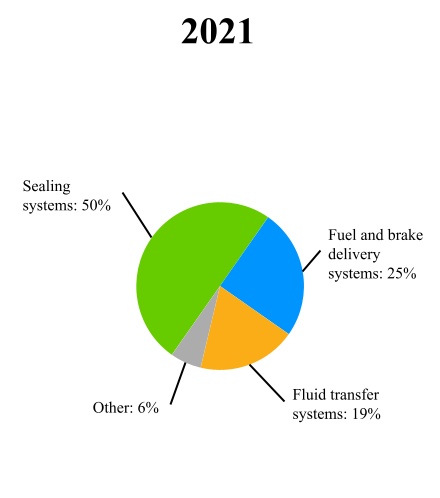

In addition to these product lines, we also sell our core products into other adjacent markets. The percentage of sales by product line and other markets for the years ended December 31, 2023, 2022 and 2021 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Product Lines | | | | | | | Market Position |

| SEALING SYSTEMS | | Protect vehicle interiors from weather, dust and noise intrusion for improved driving experience; provide aesthetic and functional class-A exterior surface treatment | | Global leader |

| | Products: | | | | |

| | – | Fortrex® | – | FlushSeal™ systems | | |

| | – | Dynamic seals | – | Variable extrusion | | |

| | – | Static seals | – | Specialty sealing products | | |

| | – | Encapsulated glass | – | Stainless steel trim | | |

| | – | Tex-A-Fib (Textured Surface with Cloth Appearance) | – | Frameless Systems | | |

| | – | Obstacle detection sensor system | | | | |

| | | | | |

| FUEL & BRAKE DELIVERY SYSTEMS | | Sense, deliver and control fluid and fluid vapors for fuel and brake systems | | Top 2 globally |

| | Products: | | | | |

| | – | Chassis and tank fuel lines and bundles (fuel lines, vapor lines and bundles) | – | Direct injection & port fuel rails (fuel rails and fuel charging assemblies) | | |

| | – | Metallic brake lines and bundles | – | MagAlloy™ break tube coating | | |

| | – | Quick connects | – | ArmorTube™ brake tube coating | | |

| | – | Low oligomer multi-layer convoluted tube | – | Series 300 and S300LT (low temperature) quick connects | | |

| | – | Brake jounce lines | – | Gen III Posi-Lock® quick connects | | |

| | | | | |

| FLUID TRANSFER SYSTEMS | | Sense, deliver, connect and control fluid delivery for optimal thermal management, powertrain & HVAC operation | | Top 3 globally |

| | Products: | | | | |

| | – | Heater/coolant hoses | – | Turbo charger hoses | | |

| | – | Quick connects (SAE and VDA) | – | Charged air cooler ducts/assemblies | | |

| | – | Diesel particulate filter (DPF) lines | – | Secondary air hoses | | |

| | – | Degas tanks and deaerators | – | Brake and clutch hoses | | |

| | – | Charged air cooling (air intake and discharge) | – | Easy-Lock™ quick connect | | |

| | – | Transmission oil cooling hoses | – | Ergo-Lock™ VDA quick connect | | |

| | – | Multilayer tubing for glycol thermal management | – | Ergo-Lock™ + VDA quick connect | | |

| | – | PlastiCool® 5000 high temperature MLT | – | PlastiCool® 2000 multi-layer tubing for glycol thermal management | | |

| | | | | |

Competition

We believe that the principal competitive factors in our industry are quality, price, service, launch performance, design and engineering capabilities, innovation, timely delivery, financial stability and global footprint. We believe that our capabilities in these core competencies are integral to our position as a market leader in each of our product lines. Our sealing systems products compete with Toyoda Gosei, Henniges, Hutchinson Standard Profil, HSR&A, SaarGummi and JianXin, among others. Our fuel and brake delivery products compete with TI Automotive, Sanoh, Martinrea, Maruyasu and SeAH, among others. Our fluid transfer products compete with Conti-Tech, Hutchinson, Teklas, Tristone, Akwel and Fränkische, among others.

Joint Ventures and Strategic Alliances

Joint ventures represent an important part of our business, both operationally and strategically. We have utilized joint ventures to enter and expand in geographic markets such as China, India and Thailand, to acquire new customers and to develop new technologies. When entering new geographic markets, teaming with a local partner can reduce capital investment by leveraging pre-existing infrastructure. In addition, local partners in these markets can provide knowledge and insight into local practices and access to local suppliers of raw materials and components.

The following table shows our significant unconsolidated joint ventures as of December 31, 2023:

| | | | | | | | | | | |

| Country | Name | Product Line | Ownership Percentage |

| Thailand | Nishikawa Tachaplalert Cooper Ltd. | Sealing systems | 20% |

| India | Polyrub Cooper Standard FTS Private Limited | Fluid transfer systems | 35% |

| United States | Nishikawa Cooper LLC | Sealing systems | 40% |

| China | Yantai Leading Solutions Auto Parts Co., Ltd. | Fuel and brake delivery systems | 50% |

| China | Shenya Sealing (Guangzhou) Company Limited | Sealing and fluid transfer systems | 51% |

Research and Development

We have a dedicated team of technical and engineering resources for each product line, some of which are located at our customers’ facilities. We utilize simulation, digital tools, best practices, standardization and track key process indicators to drive efficiency in execution with an emphasis on manufacturability and quality. Our development teams work closely with our customers to design and deliver innovative solutions, unique for their applications. Amounts spent on engineering, research and development, and program management were as follows:

| | | | | | | | | | | | | | |

| Year | | Amount | | Percentage of Sales |

| (Dollar amounts in millions) |

| 2023 | | $84.1 | | 3.0% |

| 2022 | | $80.5 | | 3.2% |

| 2021 | | $90.0 | | 3.9% |

Intellectual Property

We believe that one of our key competitive advantages is our ability to translate customer needs and our ideas into innovation through the development of intellectual property. We hold a significant number of patents and trademarks worldwide.

Our patents are grouped into two major categories: (1) specific product invention claims and (2) specific manufacturing processes that are used for producing products. The vast majority of our patents fall within the product invention category. We consider these patents to be of value and seek to protect our rights throughout the world against infringement. While in the aggregate these patents are important to our business, we do not believe that the loss or expiration of any one patent would materially affect our Company. We continue to seek patent protection for our new products and we develop significant technologies that we treat as trade secrets and choose not to disclose to the public through the patent process. These technologies nonetheless provide significant competitive advantages and contribute to our global leadership position in various markets. We believe that our trademarks, including FlushSeal™, Gen III Posi-Lock®, Easy-Lock®, MagAlloy®, Ergo-Lock® +, PlastiCool® and Fortrex™, help differentiate us and lead customers to seek our partnership.

We also have technology sharing and licensing agreements with various third parties, including Nishikawa Rubber Company, one of our joint venture partners in sealing products. We have mutual agreements with Nishikawa Rubber Company for sales, marketing and engineering services on certain sealing products. Under those agreements, each party pays for services provided by the other and royalties on certain products for which the other party provides design or development services. We also have licensing and joint development agreements for commercial applications of our Fortrex™ chemistry platform in non-automotive industries. A joint development agreement has also been put in place for the collaborative creation of novel dynamic fluid control products and systems.

Innovation, Materials, and Product Lifecycle

The international response to risks and opportunities of climate change is transforming our global economy. Our most significant opportunity to contribute to this low-carbon and circular economy is through reducing the environmental impact of our products and manufacturing processes. We purposefully apply sustainable principles in the design and production of our

products, reducing the environmental impact from sourcing through end-of-life. These efforts also enable our customers to reduce their environmental impacts.

When obtaining or innovating materials for our products, we seek to sustainably source raw materials, increase the use of recycled content or recyclable material where feasible, decrease our use of hazardous chemicals where possible, and properly disclose restricted materials to customers and regulators. We believe our culture of innovation is a key differentiator, allowing us to compete and succeed within our dynamic global markets.

Supplies and Raw Materials

Cooper Standard is committed to building strong relationships with our supply partners. We recognize the importance of engaging with suppliers to create value for our customers.

The principal raw materials for our business include synthetic and natural rubber, carbon black, process oils, and plastic resins. Principal procured components are primarily made from plastic, carbon steel, aluminum and stainless steel. We manage the procurement of our direct and indirect materials to assure supply continuity and to obtain the most favorable total cost. Procurement arrangements include short-term and long-term supply agreements that may contain formula-based pricing based on commodity indices. These arrangements provide quantities needed to satisfy normal manufacturing demands. We believe we have adequate sources for the supply of raw materials and components for our products with suppliers located around the world.

Raw material prices are susceptible to fluctuations which may place operational and profitability burdens on the entire supply chain. Following the pandemic, market prices for key raw materials, such as steel, aluminum, and oil-derived

commodities, experienced a period of extreme volatility, which led to significant cost increases for our business in 2021 and

2022. In response, we worked with our customers throughout 2022 and 2023 to implement or expand index-based commercial

agreements that have enabled us to partially recover incremental material costs incurred and significantly reduced our exposure

and risk related to commodity price fluctuations going forward. Global commodity markets and pricing have stabilized to a

large degree in 2023 and into the beginning of 2024.

Seasonality

Within the automotive industry, sales to OEMs are lowest during the months prior to model changeovers or during assembly plant shutdowns. Automotive production is traditionally reduced during July, August and year-end holidays, and our quarterly results may reflect these trends. However, economic conditions and consumer demand may change the traditional seasonality of the industry. In recent years, for example, global light vehicle production, inventory and consumer demand all experienced extreme dislocations from historic norms due to the global COVID-19 pandemic and related restrictions on production and consumer activity. Post-pandemic, global light vehicle production continued to be negatively impacted by widespread supply chain disruptions, limiting the global automotive OEM’s ability to rebuild inventory and meet pent-up consumer demand.

Backlog

Our OEM sales are generally based upon purchase orders issued by the OEMs, with updated releases for volume adjustments. As such, we typically do not have a firm and definitive backlog of orders at any point in time. Once selected to supply products for a particular platform, we typically supply those products for the platform life, which is normally five to eight years, although there is no guarantee that this will occur. In addition, when we are the incumbent supplier to a given platform, we believe we have a competitive advantage in winning the redesign or replacement platform, although there is no guarantee that this will occur.

Human Capital and Safety

As of December 31, 2023, we had approximately 23,000 employees, including 3,000 contingent workers. We maintain good relations with both our union and non-union employees and, in the past ten years, have not experienced any major work stoppages.

Our people have always been the driving force of value at Cooper Standard. We continue to embrace new ways of working, a growing international movement for civil rights, and our unwavering dedication to keeping our employees healthy and safe has only made them more critical to our success. We accomplish this by developing the capabilities of our employees through continuous learning and performance management processes. Additionally, building an internal talent pipeline supports the achievement of this priority. In 2023, our internal fill rate was approximately 36%. This metric, which is based on salaried, director-level positions and above, helps us to understand where employees are advancing in their careers and the effectiveness of our internal development programs. For 2023, our voluntary employee turnover rate was approximately 15%. We believe that our culture and continued effort to provide our employees with growth opportunities contributes to retaining our strong talent.

In addition, we aim to diversify our workforce because we recognize the value of engaging different opinions and backgrounds in a global company. We are committed to recruiting, developing and retaining a high-performing and diverse workforce. A global measurement for our diversity is women in the company and women in leadership. In 2023, women made up approximately 40% of our workforce. Of our leadership positions, defined as vice president positions and above, women held approximately 24% of such roles.

Safety continues to be a top priority and primary focus of management. An emphasis on reducing workplace incidents helps Cooper Standard to maintain a safe workforce and continue to deliver world class results for product quality. In 2023, our total incident rate (“TIR”) was 0.32, which represents an Occupational Safety and Health Administration measurement of on-the-job injuries in relation to total hours worked. Based on our review of industry peer sustainability reports, we have a lower TIR relative to our peer group. Additionally, throughout the COVID-19 pandemic, we have remained focused on protecting the health and safety of our employees while meeting the needs of our customers.

Community Involvement

Supported by the Cooper Standard Foundation, our employees are highly engaged in their local communities. The Foundation’s mission is to strengthen the communities where Cooper Standard employees work and live through the passionate support of children’s charities, education, health and wellness, and community revitalization. The Cooper Standard Foundation is a 501(c)(3) organization with oversight by its Board of Directors, Board of Trustees and Philanthropic Committee. For more information on the Company’s community involvement, please visit our Corporate Responsibility Report located on the Cooper Standard website.

Environmental, Social and Governance (ESG)

In 2023, the Company was named to Newsweek’s list of America’s Most Responsible Companies for the fifth consecutive year and achieved Ecovadis Silver Status for sustainability efforts that also earned the Company recognition from Nissan for sustainability and social responsible practices. These awards are a further testament to Cooper Standard’s commitment to ESG topics, including our core value of integrity.

Cooper Standard considers itself a steward of the environment, and we monitor the environmental impact of our business and products. We prioritize our environmental management as a means of driving and sustaining excellence. We are subject to a broad range of federal, state, and local environmental and occupational safety and health laws and regulations in the United States and other countries, including regulations governing: emissions to air, discharges to water, noise and odor emissions; the generation, handling, storage, transportation, treatment, reclamation and disposal of chemicals and waste materials; the cleanup of contaminated properties; and human health and safety. We have made, and will continue to make, expenditures to comply with environmental requirements. While our costs to defend and settle known claims arising under environmental laws have not been material in the past and are not currently estimated to have a material adverse effect on our financial condition, such costs could be material to our financial statements in the future. Further details regarding our commitments and contingencies are provided in Note 20. “Contingent Liabilities” to the consolidated financial statements included in Item 8. “Financial Statements and Supplementary Data” of this Annual Report on Form 10-K (the “Report”).

Market Data

Certain market data and other statistical information used throughout this Annual Report on Form 10-K is based on data from independent firms such as S&P Global. Other data is based on good faith estimates, which are derived from our review of internal analyses, as well as third-party sources. Although we believe these third-party sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. To the extent that we have been unable to obtain information from third-party sources, we have expressed our belief on the basis of our own internal analyses of our products and capabilities in comparison to our competitors.

Available Information

We make available free of charge on our website (www.cooperstandard.com) our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (“SEC”). Our reports filed with the SEC also may be found on the SEC’s website at www.sec.gov. We may also use our website as a distribution channel of material company information. Neither the information on our website nor the information on the SEC’s website is incorporated by reference into this Report unless expressly noted.

Forward-Looking Statements