10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-54305

COOPER-STANDARD HOLDINGS INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 20-1945088 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

39550 Orchard Hill Place Drive

Novi, Michigan 48375

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (248) 596-5900

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Exchange on Which Registered |

Common Stock, par value $0.001 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ¨ | Accelerated filer | x |

Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of voting and non-voting common stock held by non-affiliates as of June 30, 2015 was $403,150,257.

The number of the registrant’s shares of common stock, $0.001 par value per share, outstanding as of February 17, 2016 was 17,532,935 shares.

Documents Incorporated by Reference

Certain portions, as expressly described in this report, of the Registrant’s Proxy Statement for the 2016 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

|

| | |

| | Page |

PART I |

| | |

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

|

PART II |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Item 6. | Selected Financial Data | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A. | Controls and Procedures | |

Item 9B. | Other Information | |

|

PART III |

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accountant Fees and Services | |

|

PART IV |

Item 15. | Exhibits and Financial Statement Schedules | |

Signatures | |

PART I

Item 1. Business

Cooper-Standard Holdings Inc. (together with its consolidated subsidiaries, the “Company,” “Cooper Standard,” “we,” “our” or “us”) is a leading manufacturer of sealing, fuel and brake delivery, fluid transfer and anti-vibration systems. Our products are primarily for use in passenger vehicles and light trucks that are manufactured by global automotive original equipment manufacturers (“OEMs”) and replacement markets. We conduct substantially all of our activities through our subsidiaries.

Cooper Standard is a New York Stock Exchange (“NYSE”) listed company under the ticker symbol “CPS”. The Company has more than 29,000 employees with 98 facilities in 20 countries. We believe we are the largest global producer of sealing systems, the second largest global producer of the types of fuel and brake delivery products that we manufacture, the third largest global producer of fluid transfer systems, and one of the largest North American producers of anti-vibration systems. We design and manufacture our products in each major region of the world through a disciplined and sustained approach to engineering and operational excellence. We operate in 79 manufacturing locations and 19 design, engineering, and administrative locations.

The Company has four operating segments: North America, Europe, Asia Pacific and South America. This operating structure allows us to offer our full portfolio of products and support our regional and global customers with complete engineering and manufacturing expertise in all major regions of the world. We have implemented a number of operational restructuring and expansion initiatives this year and in recent years to improve competitiveness, primarily related to footprint optimization in Europe and expansion in Asia and Mexico. See “Segment Results of Operations” under Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 19. “Business Segments” to our consolidated financial statements included under Item 8. “Financial Statements and Supplementary Data” of this Annual Report on Form 10-K for further information on our segments.

Approximately 82% of our sales in 2015 were to OEMs, including Ford Motor Company (“Ford”), General Motors Company (“GM”), Fiat Chrysler Automobiles (“FCA”), PSA Peugeot Citroën, Volkswagen Group, Daimler, Renault-Nissan, BMW, Toyota, Volvo, Jaguar/Land Rover, Honda and various other OEMs based in India and China. The remaining 18% of our 2015 sales were primarily to Tier I and Tier II automotive suppliers, non-automotive manufacturers, and replacement market distributors.

Corporate History and Business Developments

Cooper-Standard Holdings Inc. was established in 2004 as a Delaware corporation and began operating on December 23, 2004 when it acquired the automotive segment of Cooper Tire & Rubber Company (the “2004 Acquisition”). Cooper-Standard Holdings Inc. operates the business primarily through its principal operating subsidiary, Cooper-Standard Automotive Inc. (“CSA U.S.”). Since the 2004 Acquisition, the Company has expanded and diversified its customer base through a combination of organic growth and strategic acquisitions.

In August 2009, following the onset of the financial crisis and economic downturn that severely impacted the global

automotive industry, Cooper-Standard Holdings Inc. and its wholly-owned subsidiaries in the United States and Canada commenced reorganization proceedings in the United States (the “Chapter 11 proceedings”) and Canada. In May 2010, the Company consummated its reorganization pursuant to a court-confirmed plan of reorganization and emerged from the Chapter 11 proceedings and the Canadian proceedings.

In October 2013, Cooper Standard’s common stock was listed on the NYSE and began trading under the ticker symbol “CPS.” Prior to the NYSE listing, the Company’s common stock was traded on the Over-the-Counter (“OTC”) Bulletin Board under the symbol “COSH.”

From 2006 to 2013, the Company accelerated its growth through a number of strategic acquisitions including the Fluid Handling Systems Operations in North America, Europe and China (collectively, “FHS”) from ITT Industries, Inc.; Metzeler Automotive Profile Systems; a hose manufacturing operation in Mexico from the Gates Corporation; USi, Inc.; the sealing business of Sigit S.p.A.; a joint venture with Fonds de Modernisation des Equipementiers Automobiles (“FMEA”); and Jyco Sealing Technology.

We continued strategic acquisitions and partnerships in 2014 and 2015 with the acquisition of Cikautxo Borja, S.L.U. in Spain, a manufacturer of heating and cooling hoses; the purchase of an additional 47.5% of Huayu-Cooper Standard Sealing Systems Co. (“Shenya”), increasing our equity ownership to 95% and positioning the Company as a leader in sealing systems in the Chinese automotive market; the formation of a joint venture with Polyrub Extrusions (India) Private Limited to grow the

Company’s fluid transfer systems business in Asia; and a joint venture with INOAC Corporation of Japan accelerating our fluid transfer systems strategy in Asia.

In 2014 and 2015, the Company divested its thermal and emissions product line and hard coat plastic exterior trim business, respectively, to focus on the product lines where Cooper Standard holds leading market positions.

Business Strategy

Cooper Standard has a well-defined and broadly communicated corporate vision: to drive for profitable growth and become one of the thirty largest global automotive suppliers in terms of sales, and among the top 5% in terms of return on invested capital (Top 30 / Top 5). The Company’s strategic plan is geared to realize this vision by matching our priorities and strengths to the emerging global industry environment. To this end, we continue to:

| |

• | Focus on our core product lines; |

| |

• | Produce superior products as a recognized innovation leader; |

| |

• | Create an advantaged global manufacturing footprint to support customers; and |

| |

• | Commonize and standardize world-class engineering and manufacturing operations. |

As the Company continues to grow, we will look to further evolve our strategy to create additional opportunities to drive shareholder value.

Operational and Strategic Initiatives

As part of its profitable growth strategy, the Company implemented the Cooper Standard Operating System (“CSOS”) to fully position the Company for growth and ensure global consistency in engineering design, program management, manufacturing process, purchasing and IT systems. Standardization across all regions is especially critical in support of customers’ global platforms that require the same design, quality and delivery standards everywhere across the world.

The CSOS consists of the following areas, with a strategic focus that aligns with the Company’s growth strategy:

|

| |

CSOS Function | Strategic Focus |

World-Class Safety | Implement globally consistent measurement system with zero incidents goal. |

World-Class Operations | Optimize global performance by implementing best business practices across the organization. |

Continuous Improvement | Implement lean manufacturing tools across all facilities to achieve cost savings and increased performance. |

Global Purchasing | Develop an advantaged supply base to effectively leverage scale and optimize supplier quality. |

Innovation Management | Focused innovation processes to create breakthrough technologies for market differentiation. |

Global Program Management | Ensure consistent and flawless product launch process across all regions. |

IT Systems | Implement common systems to effectively communicate information throughout the business. |

Leverage Technology for Innovative Solutions

We utilize our technical expertise to provide customers with innovative solutions. Our engineers combine product design with a broad understanding of material characteristics for enhanced vehicle performance. We believe our reputation for successful innovation in product design and materials is the reason our customers consult us early in their vehicle development and design process of their next generation vehicles.

Cooper Standard has evolved and further energized its approach to innovation with its i3 Innovation Process (Imagine, Initiate, Innovate). This approach is used as a mechanism to capture ideas from across our Company and supply partners while promoting a culture of innovation.

Ideas are carefully evaluated by a Global Technology Council and those that are selected are put on an accelerated development cycle with a dedicated innovation team focused on breakthrough ideas. This team is developing game-changing technologies based on materials expertise, process know-how, and application vision, which will drive future product direction. Among recently announced technologies is ArmorHose™, a breakthrough technology which results in significantly more durable coolant hoses and eliminates the need for separate abrasion sleeves on under-hood hose assemblies. Several other significant technologies, especially related to advanced materials, processing and weight reduction, have recently been realized. These include: Fortrex™, a revolutionary material that provides higher performance and lower weight to weather seals; and MagAlloy™, a new processing technology for brake lines that increases long term durability through superior corrosion resistance.

Continued Emphasis on Global Platforms

We believe global platforms, which require the same design, quality and delivery standards globally, will drive increased growth for capable global suppliers. It is predicted that the top ten global platforms produced by automakers will account for about 30% of the world’s light vehicle volume by 2021, highlighting the importance of being well-positioned to participate in these high volume global programs. Based on our 2015 revenue, six of the top ten vehicle platforms on which we provide content are global platforms, which demonstrates that customers already look to us to support global platforms. Our global presence and technological capabilities ideally position us to continue to win business on global platforms.

Pursue Acquisitions and Alliances to Enhance Capabilities and Accelerate Growth

We intend to continue to selectively pursue complementary acquisitions and joint ventures to enhance our customer base, geographic penetration, scale and technology. Consolidation is an industry trend and is encouraged by the OEMs desire for global automotive suppliers. We believe we have a strong platform for growth through acquisitions based on our past integration successes, experienced management team, global presence and operational excellence. Our operations currently include several successful joint ventures.

Industry

The automotive industry is one of the world’s largest and most competitive. Consumer demand for new vehicles largely determines sales and production volumes of global OEMs.

The automotive supplier industry is generally characterized by high barriers to entry, significant start-up costs and long-standing customer relationships. The criteria by which OEMs judge automotive suppliers include quality, price, service, performance, design and engineering capabilities, innovation, timely delivery, financial stability and global footprint. Over the last decade, suppliers that have been able to achieve manufacturing scale, reduce structural costs, diversify their customer base and establish a global manufacturing footprint have been successful.

Markets Served

The passenger car and light truck market, better known as the light vehicle market, is our largest market and accounts for approximately 95% of our global sales. The focus of this market is on passenger cars and light trucks, up to and including Class 3 Full Size Frame trucks.

In addition to the global team focused on the light vehicle market, we also established dedicated sales and engineering teams in North America and Europe to leverage core product technology into adjacent markets to profitably grow Cooper Standard. The adjacent markets include: commercial vehicle (on-highway and off-highway), specialty markets and technical rubber.

Customers

We are a leading supplier to the following OEMs and are increasing our presence with major OEMs throughout the world. The following table shows the approximate percentage of sales to our top customers for the years ended December 31, 2015 and 2014:

|

| | | | |

Customer | | 2015 | | 2014 |

Ford | | 26% | | 24% |

GM | | 16% | | 16% |

FCA | | 12% | | 13% |

PSA Peugeot Citroën | | 5% | | 6% |

Volkswagen Group | | 5% | | 5% |

Our other customers include OEMs such as Daimler, Renault-Nissan, BMW, Toyota, Volvo, Jaguar/Land Rover, Honda and various other OEMs based in India and China. Our business with any given customer is typically split among several contracts for different parts on a number of platforms.

Segment Information

See Note 19. “Business Segments” to the consolidated financial statements for segment information.

Products

We have four distinct product lines. These products are produced and supplied globally to a broad range of customers in multiple markets. The percentage of sales by product for the years ended December 31, 2015, 2014 and 2013 are as follows:

|

| | | | | | |

| | Percentage of Sales |

Product Lines | | 2015 | | 2014 | | 2013 |

Sealing systems | | 53% | | 52% | | 51% |

Fuel and brake delivery systems | | 20% | | 20% | | 23% |

Fluid transfer systems | | 14% | | 14% | | 13% |

Anti-vibration systems | | 8% | | 8% | | 9% |

In addition to these product lines, we also have sales to other adjacent markets.

|

| | | | | | | |

Product Lines | | | | | | | Market Position* |

SEALING SYSTEMS | | Protect vehicle interiors from weather, dust and noise intrusion for improved driving experience; provide aesthetic and functional class-A exterior surface treatment | | Global leader |

| | Products: | | | | |

| | – | Fortrex™ | – | Stainless steel trim | | |

| | – | Dynamic seals | – | Flush glass systems | | |

| | – | Static seals | – | Variable extrusion

| | |

| | – | Encapsulated glass | – | Specialty sealing products | | |

| | | | | |

FUEL & BRAKE DELIVERY SYSTEMS | | Sense, deliver and control fluids to fuel and brake systems | | Top 2 globally |

| Products: | | | | |

| | – | Chassis and tank fuel lines and bundles (fuel lines, vapor lines and bundles) | – | Direct injection & port fuel rails (fuel rails and fuel charging assemblies) | | |

| | – | Metallic brake lines and bundles | – | Quick connects | | |

| | | | | |

FLUID TRANSFER SYSTEMS | | Sense, deliver and control fluid and vapors for optimal powertrain & HVAC operation | | Top 3 globally |

| | Products: | | | | |

| | – | Heater/coolant hoses | – | Turbo charger hoses | | |

| | – | Quick connects | – | Secondary air hoses | | |

| | – | DPF and SCR emission lines | – | Brake and clutch hoses | | |

| | – | Degas tanks | – | ArmorHose™ | | |

| | – | Air intake and charge | – | ArmorHose™ II | | |

| | – | Transmission Oil Cooling Hoses | – | ArmorHose™ TPV | | |

| | | | | |

ANTI-VIBRATION SYSTEMS | | Control and isolate vibration and noise in the vehicle to improve ride and handling | | North America Leader |

| | Products: | | | | |

| | – | Powertrain Mount Systems: (Multi-state Vacuum Switchable Hydraulic Engine Mounts, Bi-state Electric Switchable Hydraulic Engine Mounts, Conventional Hydraulic Mounts, Elastomeric Mounts) | | |

| | – | Suspension Mounts: (Conventional & Hydraulic Bushings, Strut Mounts, Spring Seats & Bumpers, Mass Dampers, Dual Durometer (Bi-compound) Bushings) | | |

* Market position study conducted by Booz & Co. (2013) and Boston Consulting Group (2016)

Competition

We believe that the principal competitive factors in our industry are quality, price, service, performance, design and engineering capabilities, innovation, timely delivery, financial stability and global footprint. We believe that our capabilities in these core competencies are integral to our position as a market leader in each of our product lines. Our sealing systems products compete with Toyoda Gosei, Hutchinson, Henniges and Standard Profil, among others. Our fuel and brake delivery products compete with TI Automotive, Sanoh, Martinrea, Maruyasu and Usui. Our fluid transfer products compete with Conti-Tech, Hutchinson, Teklas, Tristone and Hwaseung R&A. Our anti-vibration systems compete with Trelleborg/Vibracoustic, Hutchinson, Tokai Rubber, Bridgestone and ContiTech.

Joint Ventures and Strategic Alliances

Joint ventures represent an important part of our business, both operationally and strategically. We have utilized joint ventures to enter into new geographic markets such as China, India and Thailand, to acquire new customers and to develop new technologies. In entering new geographic markets, teaming with a local partner can reduce capital investment by leveraging pre-existing infrastructure. In addition, local partners in these markets can provide knowledge and insight into local practices and access to local suppliers of raw materials and components.

The following table shows our significant unconsolidated joint ventures:

|

| | | | |

Country | | Name | | Ownership Percentage |

China | | Shenya Sealing (Guangzhou) Company Limited | | 51% |

India | | Sujan Cooper Standard AVS Private Limited | | 50% |

United States | | Nishikawa Cooper LLC | | 40% |

India | | Polyrub Cooper Standard FTS Private Limited | | 35% |

Thailand | | Nishikawa Tachaplalert Cooper Ltd. | | 20% |

Research and Development

We have a dedicated team of technical and engineering resources in each global region, some of which are located at our customers' facilities. We utilize Design for Six Sigma and other methodologies that emphasize manufacturability and quality. Our development teams work closely with our customers to design and deliver innovative solutions. We continue to add technical resources throughout the world as required to support our customers, including a technical center in Shanghai, China and, with the Sujan Cooper Standard joint venture, in Maharashtra, India. We spent $108.8 million, $102.0 million, and $103.5 million in 2015, 2014 and 2013, respectively, on engineering, research and development.

Patents and Trademarks

We believe that one of our key competitive advantages is our ability to translate customer need into innovative solutions through the development of intellectual property. We hold a significant number of patents and trademarks worldwide. Our patents relate to our product lines and are grouped into two major categories: (1) specific product invention claims and (2) specific manufacturing processes that are used for producing products. The vast majority of our patents fall within the product invention category. We consider these patents to be of value and seek to protect our rights throughout the world against infringement. While in the aggregate these patents are important to our business, we do not believe that the loss or expiration of any one patent would materially affect our Company. We continue to seek patent protection for our new products and have an incentive program to recognize employees whose inventions are patented. Additionally, we develop significant technologies that we treat as trade secrets and choose not to disclose to the public through the patent process, but which nonetheless provide significant competitive advantages and contribute to our global leadership position in various markets. We believe that our trademarks, including ArmorHose™, Ultra Pro Coat™, MagAlloy™ and Fortrex™, help differentiate us and lead customers to seek our partnership.

We also have technology sharing and licensing agreements with various third parties, including Nishikawa Rubber Company, one of our joint venture partners in sealing products. We have mutual agreements with Nishikawa Rubber Company for sales, marketing and engineering services on certain sealing products. Under those agreements, each party pays for services provided by the other and royalties on certain products for which the other party provides design or development services.

Supplies and Raw Materials

The principal raw materials for our business include ethylene propylene diene monomer M-Class rubber (“EPDM”) and synthetic rubber, components manufactured from carbon steel, plastic resins and components, carbon black, process oils,

components manufactured from aluminum and natural rubber. Raw material prices have fluctuated greatly in recent years. We have implemented strategies with both our suppliers and our customers to help manage fluctuations in raw material prices. These actions include material substitutions and leveraging global purchases. Global supply chain optimization includes using benchmarks and selective sourcing from low cost regions. We have also made process improvements to ensure the efficient use of materials through scrap reduction, as well as standardization of material specifications to maximize leverage over higher volume purchases. With some customers, on certain raw materials, we have implemented indexes that allow price changes as underlying material costs fluctuate.

Geographic Information

See Note 19. “Business Segments” to the consolidated financial statements for geographic information.

Seasonality

Historically, sales to automotive customers are lowest during the months prior to model changeovers and during assembly plant shutdowns. However, economic conditions and consumer demand may change the traditional seasonality of the industry and lower production may prevail without the impact of seasonality. In the past, model changeover periods have typically resulted in lower sales volumes during July, August and December. During these periods of lower sales volumes, profit may decline but working capital often improves due to the continued collection of accounts receivable.

Backlog

Our OEM sales are generally based upon purchase orders issued by the OEMs, with updated releases for volume adjustments, and as such we typically do not have a backlog of orders at any point in time. Once selected to supply products for a particular platform, we typically supply those products for the platform life, which is normally three to five years, although there is no guarantee that this will occur. In addition, when we are the incumbent supplier to a given platform, we believe we have a competitive advantage in winning the redesign or replacement platform.

Employees

As of December 31, 2015, we had more than 29,000 full-time and temporary employees. We maintain good relations with both our union and non-union employees and, in the past ten years, have not experienced any major work stoppages. We renegotiated some of our domestic and non-domestic union agreements in 2015 and have several contracts set to expire in the next twelve months. As of December 31, 2015, approximately 28% of our employees were represented by unions, and approximately 9% of the unionized employees were located in the United States.

Environmental

We are subject to a broad range of federal, state, and local environmental and occupational safety and health laws and regulations in the United States and other countries, including regulations governing: emissions to air, discharges to water, noise and odor emissions; the generation, handling, storage, transportation, treatment, reclamation and disposal of chemicals and waste materials; the cleanup of contaminated properties; and human health and safety. We have made and will continue to make expenditures to comply with environmental requirements. While our costs to defend and settle known claims arising under environmental laws are not currently estimated to be material, such costs may be material in the future.

Market Data

Some market data and other statistical information used throughout this Annual Report on Form 10-K is based on data from independent firms such as IHS Automotive and Booz & Co. Other data is based on good faith estimates, which are derived from our review of internal analyses, as well as third party sources. Although we believe these third party sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. To the extent that we have been unable to obtain information from third party sources, we have expressed our belief on the basis of our own internal analyses of our products and capabilities in comparison to our competitors.

Available Information

We make available free of charge on or through our website (www.cooperstandard.com) our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (“SEC”).

Executive Officers

Set forth below is certain information with respect to the current executive officers of the Company.

|

| | | | |

Name | | Age | | Position |

Jeffrey S. Edwards | | 53 | | Chairman and Chief Executive Officer |

Matthew W. Hardt | | 48 | | Executive Vice President and Chief Financial Officer |

Keith D. Stephenson | | 55 | | Executive Vice President and Chief Operating Officer |

Juan Fernando de Miguel Posada | | 58 | | Corporate Senior Vice President and President, Europe and South America |

Song Min Lee | | 56 | | Corporate Senior Vice President and President, Asia Pacific |

D. William Pumphrey, Jr. | | 56 | | Corporate Senior Vice President and President, North America |

Aleksandra A. Miziolek | | 59 | | Senior Vice President, General Counsel and Secretary |

Larry E. Ott | | 56 | | Senior Vice President and Chief Human Resources Officer |

Jonathan P. Banas | | 45 | | Vice President, Controller and Chief Accounting Officer |

Sharon S. Wenzl | | 56 | | Senior Vice President, Corporate Communications and Community Affairs |

Jeffrey S. Edwards is our Chairman and Chief Executive Officer, a position he has held since May 2013, previously serving as Chief Executive Officer and member of the Board of Directors of the Company since October 2012. Prior to joining the Company, Mr. Edwards gained more than 28 years of automotive industry experience through various positions of increasing responsibility at Johnson Controls, Inc. He led the Automotive Experience Asia Group, serving as Corporate Vice President, Group Vice President and General Manager from 2004 to 2012. Prior to this, he served as Group Vice President and General Manager for Automotive Experience North America from 2002 to 2004. Mr. Edwards completed an executive training program at INSEAD and earned a BS from Clarion University. Mr. Edwards is a member of the Executive Committee of the National Association of Manufacturers and a member of Board of Directors since April 2013. He has also served on the Board of Directors of Standex International Corp. since October 2014.

Matthew W. Hardt is our Executive Vice President and Chief Financial Officer, a position he has held since March 2015. Prior to joining the Company, Mr. Hardt served as Senior Vice President, Finance, Industrial Solutions from 2012 to 2014 and Consumer and Industrial Solutions from 2010 to 2012 at TE Connectivity LTD (previously Tyco Electronics). Mr. Hardt served as Vice President, Finance for TE Connectivity LTD’s Specialty Products Group from 2009 to 2010. He previously served in multiple finance and audit roles of increasing responsibility at General Electric Co., including Chief Financial Officer for a number of the company’s global divisions. Mr. Hardt earned a Bachelor of Science degree in finance from Siena College.

Keith D. Stephenson is our Executive Vice President and Chief Operating Officer, a position he has held since January 2014, previously serving as Chief Operating Officer since December 2010. He served as President, International from March 2009 to December 2010. He served as President, Global Body & Chassis Systems from June 2007 to March 2009. Mr. Stephenson was Chief Development Officer at Boler Company from January 2004 until October 2006. From 1985 to January 2004, he held various senior positions at Hendrickson, a division of Boler Company, including President of International Operations, Senior Vice President of Global Business Operations and President of the Truck Systems Group.

Juan Fernando de Miguel Posada is our Corporate Senior Vice President and President, Europe and South America, a position he has held since January 2014, previously serving as President, Europe since March 2013. Mr. de Miguel served as western European Chief Executive Officer of Avincis Emergency Services from September 2012 until joining the Company. From May 2011 to September 2012, he served as Consulting President for Europe for Argo Consulting. Mr. de Miguel served as managing director of the Paper Division of SAICA in Spain from 2009 to 2011. From 2007 to 2009, he served as President of the Protective Packaging division of Pregis in Belgium. Mr. de Miguel served as Senior Vice President of Northern Europe for Alstom Transport in France from 2006 to 2007. Previously, Mr. de Miguel held numerous senior level positions at Johnson Controls, Inc., beginning in 1988, ultimately serving as Group Vice President and General Manager, Electronics, Europe and International. Mr. de Miguel received an electrical engineering degree and a Master’s Degree in industrial engineering from Universidad Politecnica de Barcelona, as well as an Executive Master’s degree in Business Administration from the IESE Business School – University of Navarra in Spain.

Song Min Lee is our Corporate Senior Vice President and President, Asia Pacific, a position he has held since January 2014, previously serving as President, Asia Pacific since January 2013. Prior to joining the Company, Mr. Lee served as Vice President and General Manager of Johnson Controls, Inc. from 2007 to 2012. From 2006 to 2007, Mr. Lee served as Vice President and President, Korea, for Autoliv, Inc. Mr. Lee served as Plant Manager for Lear Corporation from 2004 to 2006 and held various engineering positions at Ford Motor Company from 1994 to 2004. Mr. Lee completed the Advanced Management

Program at Seoul National University. Mr. Lee also earned a Masters of Science in Management Technology from Rensselaer Polytechnic Institute and a Bachelor of Science in Chemistry from Washburn University.

D. William Pumphrey, Jr. is our Corporate Senior Vice President and President, North America, a position he has held since January 2014, previously serving as President, North America since August 2011. Mr. Pumphrey served as President, Americas for Tower Automotive from 2008 through August 2011. From 2005 to 2008, he served as President of Tower’s North America operations. From 1999 to 2004, Mr. Pumphrey held various positions at Lear Corporation in Southfield, Michigan, ultimately serving as President of the company’s Asia Pacific operations. Mr. Pumphrey earned an MBA from the University of Michigan and a Bachelor of Arts from Kenyon College.

Aleksandra A. Miziolek is our Senior Vice President, General Counsel and Secretary, a position she has held since February 2014. Previously, Ms. Miziolek was the Director of the Automotive Industry Group of Dykema Gossett, PLLC, a national law firm, from 2010. From 2003 to 2010, Ms. Miziolek served on Dykema’s Executive Board and as the Director of its Business Services Department. Ms. Miziolek joined Dykema in 1982 after serving as a law clerk for the Honorable James P. Churchill in the U.S. District Court, Eastern District of Michigan, Southern Division. Ms. Miziolek received her JD from Wayne State University Law School.

Larry E. Ott is our Senior Vice President and Chief Human Resources Officer, a position he has held since January 2014, previously serving as Vice President, Global Human Resources since August 2013. Prior to joining the Company, Mr. Ott served as Senior Vice President, Human Resources for Meritor, Inc. from 2010 until 2013. Prior to this, he held a similar position at Ally Financial Inc. from 2006 until July 2010. Mr. Ott spent 20 years at General Motors in a variety of progressive human resources functions. Mr. Ott earned an MBA with a concentration in Organizational Behavior and Industrial Relations from the University of Michigan and a Bachelor of Science degree in Business Administration and English from the University of Wisconsin at Stevens Point.

Jonathan P. Banas is our Vice President, Controller and Chief Accounting Officer, a position he has held since September 2015. Prior to joining Cooper Standard, Mr. Banas served as Director, Financial Reporting of ZF TRW Automotive Holdings Corp. (formerly TRW Automotive Holdings Corp.) from 2010 to 2015. Prior to this role, Mr. Banas served as Senior Manager of Financial Planning and Analysis from 2007 to 2010 and of Financial Reporting and Technical Accounting from 2004 to 2007 at TRW Automotive Holdings Corp. Previously, Mr. Banas held corporate accounting and financial reporting roles with Hayes Lemmerz International, Inc. from 2003 to 2004, was President of 664 Consulting Group, PC from 2000 to 2003 and was Manager, Audit and Assurance at KPMG LLP from 1994 to 1999. Mr. Banas is a certified public accountant and earned an MBA with a concentration in Finance and Accounting from the University of Michigan and a Bachelor of Business Administration degree in Accounting from Wayne State University.

Sharon S. Wenzl is our Senior Vice President, Corporate Communications and Community Affairs, a position she has held since January 2016. Previously, she was Vice President Corporate Communications, a position she held since joining the company in 2007. Prior to joining Cooper Standard, from 2006 to 2007, Ms. Wenzl was the Principal / Owner of Laramie Group. From 2004 to 2006, she served as Senior Vice President, Global Human Resources and Communications for Tower Automotive. From 1990 to 2004, she held various positions of increasing responsibility at Freudenberg-NOK, most recently serving as Vice President, Human Resources and Corporate Relations. Ms. Wenzl earned a Bachelor of Arts degree in Communications from Michigan State University and a Master of Arts degree in Communications from Eastern Michigan University. She also attended Boston University’s Public Communications Institute as part of her post graduate work.

Forward-Looking Statements

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of U.S. federal securities laws, and we intend that such forward-looking statements be subject to the safe harbor created thereby. We make forward-looking statements in this Annual Report on Form 10-K and may make such statements in future filings with the SEC. We may also make forward-looking statements in our press releases or other public or stockholder communications. These forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions, business trends, and other information that is not historical information and, in particular, appear under “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” When used in this report, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, management’s examination of historical operating trends and data are based upon our current expectations and various assumptions. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, we cannot assure you that these expectations, beliefs and projections will be achieved. Forward-looking statements are not guarantees of future performance and

are subject to significant risks and uncertainties that may cause actual results or achievements to be materially different from the future results or achievements expressed or implied by the forward-looking statements.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in this Annual Report on Form 10-K. Important factors that could cause our actual results to differ materially from the forward-looking statements we make in this report are set forth in this Annual Report on Form 10-K, including under Item 1A. “Risk Factors.”

There may be other factors beyond the factors set forth in this Annual Report on Form 10-K, including under Item 1A. “Risk Factors,” that may cause our actual results to differ materially from the forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf apply only as of the date of this Annual Report on Form 10-K or other reports we file with the SEC, as applicable, and are expressly qualified in their entirety by the cautionary statements included herein and therein. We undertake no obligation to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

Item 1A. Risk Factors

Our business and financial condition can be impacted by a number of factors, including the risks described below and elsewhere in this Annual Report on Form 10-K. Any of these risks could cause our actual results to vary materially from recent or anticipated results and could materially and adversely affect our business, results of operations and financial condition.

We are highly dependent on the automotive industry. A prolonged or material contraction in automotive sales and production volumes could adversely affect our business, results of operations and financial condition.

Automotive sales and production are cyclical and depend on, among other things, general economic conditions and consumer spending, vehicle demand and preferences (which can be affected by a number of factors, including fuel costs, employment levels and the availability of consumer financing). As the volume of automotive production fluctuates, the demand for our products also fluctuates. Prolonged or material contraction in automotive sales and production volume could cause our customers to reduce orders of our products, which could adversely affect our business, results of operations and financial condition.

In addition, our liquidity could be adversely impacted if our customers were to extend their normal payment terms. Likewise, if our suppliers were to reduce normal trade credit terms, our liquidity could be adversely impacted. If either of these situations occurs, we may need to rely on other sources of funding to bridge the additional gap between the time we pay our suppliers and the time we receive corresponding payments from our customers.

Escalating pricing pressures may adversely affect our business.

Pricing pressure in the automotive supply industry has been substantial and is likely to continue. Nearly all vehicle manufacturers seek price reductions in both the initial bidding process and during the term of the contract. Price reductions have adversely impacted our sales and profit margins and are expected to do so in the future. If we are not able to offset continued price reductions through improved operating efficiencies and reduced expenditures, those price reductions may have a negative impact on our financial condition.

Our business could be adversely affected if we lose any of our largest customers or significant platforms.

While we provide parts to virtually every major global OEM for use on a multitude of different platforms, sales to our three largest customers, Ford, GM and FCA, on a worldwide basis represented approximately 54% of our sales for the year ended December 31, 2015. Our ability to reduce the risks inherent in certain concentrations of business will depend, in part, on our ability to continue to diversify our sales on a customer, product, platform and geographic basis. Although business with each customer is typically split among numerous contracts, the loss of a major customer, significant reduction in purchases of our products by such customer, or any discontinuance or resourcing of a significant platform could adversely affect our business, results of operations and financial condition.

We operate in a highly competitive industry and efforts by our competitors to gain market share could adversely affect our financial performance.

The automotive parts industry is highly competitive. We face numerous competitors in each of our product lines. In general, there are three or more significant competitors and numerous smaller competitors for most of the products we offer. We also face competition for certain of our products from suppliers producing in lower-cost regions such as Asia and Eastern Europe. Our competitors’ efforts to grow market share could exert downward pressure on the pricing of our products and our margins.

Increases in the costs, or reduced availability of, raw materials and manufactured components may adversely affect our profitability.

Raw material costs can be volatile. The principal raw materials we purchase include EPDM and synthetic rubber, components manufactured from carbon steel, plastic resins, carbon black, process oils, components manufactured from aluminum and natural rubber. Raw materials are the largest component of our costs, representing approximately 50% of our total cost of products sold in 2015. The availability of raw materials and manufactured components can fluctuate due to factors beyond our control. A significant increase in the price of these items, or a restriction in their availability, could materially increase our operating costs and adversely affect our profitability because it is generally difficult to pass through these increased costs to our customers.

Disruptions in the supply chain could have an adverse effect on our business, financial condition, results of operations and cash flows.

We obtain components and other products and services from numerous suppliers and other vendors throughout the world. We are responsible for managing our supply chain, including suppliers that may be the sole sources of products that we require, that our customers direct us to use or that have unique capabilities that would make it difficult and/or expensive to re-source. In certain instances, entire industries may experience short-term capacity constraints. Any significant disruption could adversely affect our financial performance. Furthermore, unfavorable economic or industry conditions could result in financial distress within our supply base, thereby increasing the risk of supply disruption. Although market conditions generally have improved in recent years, uncertainty remains, and another economic downturn or other unfavorable industry conditions in one or more of the regions in which we operate could cause a supply disruption and thereby adversely affect our financial condition, operating results and cash flows.

If a customer experiences a material supply shortage, either directly or as a result of a supply shortage at another supplier, that customer may halt or limit the purchase of our products, which could adversely affect our business, results of operations and financial condition.

We are subject to other risks associated with our international operations.

We have significant manufacturing operations outside the United States, including joint ventures and other alliances. Our operations are located in 20 countries, and we export to several other countries. In 2015, approximately 73% of our sales were attributable to products manufactured outside the United States. Risks inherent in our international operations include:

| |

• | currency exchange rate fluctuations, currency controls and restrictions, and the ability to hedge currencies; |

| |

• | changes in local economic conditions; |

| |

• | repatriation restrictions or requirements, including tax increases on remittances and other payments by our foreign subsidiaries; |

| |

• | global sovereign fiscal uncertainty and hyperinflation in certain foreign countries; |

| |

• | changes in laws and regulations, including export and import restrictions and the imposition of embargos; |

| |

• | exposure to possible expropriation or other government actions; and |

| |

• | exposure to local political or social unrest including resultant acts of war, terrorism, or similar events. |

Expanding our sales and manufacturing operations in the Asia Pacific region, particularly in China, is an integral part of our strategy, and, as a result, our exposure to the risks described above is substantial. The occurrence of any of these risks may adversely affect the results of operations and financial condition of our international operations and our business as a whole.

Foreign currency exchange rate fluctuations could materially impact our operating results.

Our sales and manufacturing operations outside the United States expose us to currency risks. Our sales and earnings denominated in foreign currencies are translated into U.S. dollars for our consolidated financial statements. This translation is calculated based on average exchange rates during the reporting period. Our reported international sales and earnings could be adversely impacted in periods of a strengthening U.S. dollar.

Although we generally produce in the same geographic region as our products are sold, we also produce in countries that predominately sell in another currency. Some of our commodities are purchased in or tied to the U.S. dollar; therefore our earnings could be adversely impacted during the periods of a strengthening U.S. dollar relative to other foreign currencies. We employ financial instruments to hedge certain portions of our foreign currency exposures. However, this will not completely insulate us from the effects of currency fluctuation.

A portion of our operations are conducted by joint ventures which have unique risks.

Certain of our operations are carried on by joint ventures. In joint ventures, we share the management of the company with one or more partners who may not have the same goals, resources or priorities as we do. The operations of our joint

ventures are subject to agreements with our partners, which typically include additional organizational formalities as well as requirements to share information and decision making, and may also limit our ability to sell our interest. Additional risks include one or more partners failing to satisfy contractual obligations, a change in ownership of any of our partners and our limited ability to control our partners’ compliance with applicable laws, including the Foreign Corrupt Practices Act. Any such occurrences could adversely affect our financial condition, operating results, cash flow or reputation.

Our capital structure includes a substantial amount of indebtedness, which imposes demands on our liquidity that could have an adverse effect on our financial condition or on our ability to obtain financing in the future.

As of December 31, 2015, we had approximately $777.9 million of outstanding indebtedness, including our $750 million senior term loan facility (the “Term Loan Facility”), our $180 million senior asset-based revolving credit facility ("Senior ABL Facility") and the debt of certain foreign subsidiaries, which requires principal and interest payments. We are permitted by the terms of the Term Loan Facility and our Senior ABL Facility to incur additional indebtedness, subject to the restrictions therein, which could:

| |

• | make it more difficult for us to satisfy our obligations under the Term Loan Facility and the Senior ABL facility; |

| |

• | increase our vulnerability to adverse economic and general industry conditions, including interest rate fluctuations, since the majority of our borrowings are at variable rates of interest; and |

| |

• | increase our cost of borrowing. |

Our ability to make scheduled payments on our debt or to refinance these obligations depends on our financial condition and operating performance. If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, sell material assets, seek additional capital or restructure or refinance our indebtedness, which could have an adverse effect on our business, results of operations and financial condition.

The Term Loan Facility and the Senior ABL Facility impose significant operating and financial restrictions on us and our subsidiaries.

The Term Loan Facility and the Senior ABL Facility limit our ability, among other things, to:

•incur additional indebtedness or issue certain disqualified stock and preferred stock;

•pay dividends or certain other distributions on our capital stock or repurchase our capital stock;

•make certain investments or other restricted payments;

•enter into certain restrictive agreements;

•engage in transactions with affiliates;

•sell certain assets or merge with or into other companies;

•guarantee indebtedness; and

•permit liens.

Moreover, our Senior ABL Facility provides the agent considerable discretion to impose reserves, which could materially reduce the amount of borrowings that would otherwise be available to us.

As a result of these covenants and restrictions (including borrowing base availability), we are limited in how we conduct our business, and we may be unable to raise additional debt or equity financing to compete effectively or to take advantage of new business opportunities or acquisitions. A breach of any of these covenants could result in a default under the Senior ABL Facility and under the Term Loan Facility. The terms of any future indebtedness we may incur could include more restrictive covenants. We cannot assure that we will be able to maintain compliance with these covenants in the future and, if we fail to do so, that we will be able to obtain waivers from the lenders under the Senior ABL Facility and the Term Loan Facility and/or amend the covenants in such agreements.

Our pension plans are currently underfunded, and we may have to make cash payments to the plans, reducing the cash available for our business.

We sponsor various pension plans worldwide that are underfunded and will require cash payments. Additionally, if the performance of the assets in our pension plans does not meet our expectations, or if other actuarial assumptions are modified, our required contributions may be higher than we expect. As of December 31, 2015, our net underfunded status was $173.3 million. If our cash flow from operations is insufficient to fund our worldwide pension liabilities, it could have an adverse effect on our financial condition and results of operations.

Significant changes in discount rates, the actual return on pension assets and other factors could adversely affect our liquidity, results of operations and financial condition.

Our earnings may be positively or negatively impacted by the amount of income or expense recorded related to our pension plans. Generally accepted accounting principles in the United States (“U.S. GAAP”) require that income or expense related to the pension plans be calculated at the annual measurement date using actuarial calculations, which reflect certain assumptions. Because these assumptions have fluctuated and will continue to fluctuate in response to changing market conditions, the amount of gains or losses that will be recognized in subsequent periods, the impact on the funded status of the pension plans and the future minimum required contributions, if any, could adversely affect our liquidity, results of operations and financial condition.

The benefits of our continuous improvement program and other cost savings plans may not be fully realized.

Our operations strategy includes continuous improvement programs and implementation of lean manufacturing tools across all facilities to achieve cost savings and increased performance. We have and may continue to initiate restructuring actions designed to improve future profitability and competitiveness. The cost savings that we anticipate from these initiatives may not be achieved on schedule or at the level we anticipate. If we are unable to realize these anticipated savings, our operating results and financial condition may be adversely affected.

We may incur significant costs related to manufacturing facility closings or consolidation which could have an adverse effect on our financial condition.

If we must close or consolidate manufacturing locations, the exit costs associated with such closure or consolidation, including employee termination costs, may be significant. Such costs could negatively affect our cash flows, results of operations and financial condition.

Our inability to effectively manage the timing, quality and costs of new program launches could adversely affect our financial performance.

In connection with the award of new business, we may obligate ourselves to deliver new products that are subject to our customers’ timing, performance and quality standards. Given the number and complexity of new program launches, we may experience difficulties managing product quality, timeliness and associated costs. In addition, new program launches require a significant ramp up of costs. However, our sales related to these new programs generally are dependent upon the timing and success of our customers’ introduction of new vehicles. Our inability to effectively manage the timing, quality and costs of these new program launches could adversely affect our financial condition, operating results and cash flows.

Our success depends in part on our development of improved products, and our efforts may fail to meet the needs of customers on a timely or cost-effective basis.

Our continued success depends on our ability to maintain advanced technological capabilities and knowledge necessary to adapt to changing market demands as well as to develop and commercialize innovative products. We may be unable to develop new products successfully or to keep pace with technological developments by our competitors and the industry in general. In addition, we may develop specific technologies and capabilities in anticipation of customers’ demands for new innovations and technologies. If such demand does not materialize, we may be unable to recover the costs incurred in such programs. If we are unable to recover these costs or if any such programs do not progress as expected, our business, results of operations and financial condition could be adversely affected.

Any acquisitions or divestitures we make may be unsuccessful, may take longer than anticipated or may negatively impact our business, financial condition, results of operations and cash flows.

We may pursue acquisitions or divestitures in the future as part of our strategy. Acquisitions and divestitures involve numerous risks, including identifying attractive target acquisitions, undisclosed risks affecting the target, difficulties integrating acquired businesses, the assumption of unknown liabilities, potential adverse effects on existing customer or supplier relationships, and the diversion of management’s attention from day-to-day business. We may not have, or be able to raise on acceptable terms, sufficient financial resources to make acquisitions. Our ability to make investments may also be limited by the terms of our existing or future financing arrangements. Any acquisitions or divestitures we pursue may not be successful or prove to be beneficial to our operations and cash flow.

We may incur material losses and costs as a result of product liability and warranty and recall claims that may be brought against us.

We may be exposed to product liability and warranty claims in the event that our products actually or allegedly fail to perform as expected or the use of our products results, or is alleged to result, in bodily injury and/or property damage.

Accordingly, we could experience material warranty or product liability expenses in the future and incur significant costs to defend against these claims. In addition, if any of our products are, or are alleged to be, defective, we may be required to participate in a recall of that product if the defect or the alleged defect relates to automotive safety. Product recalls could cause us to incur material costs and could harm our reputation or cause us to lose customers, particularly if any such recall causes customers to question the safety or reliability of our products. Also, while we possess considerable historical warranty and recall data with respect to the products we currently produce, we do not have such data relating to new products, assembly programs or technologies, including any new fuel and emissions technology and systems being brought into production, to allow us to accurately estimate future warranty or recall costs.

In addition, the increased focus on systems integration platforms utilizing fuel and emissions technology with more sophisticated components from multiple sources could result in an increased risk of component warranty costs over which we have little or no control and for which we may be subject to an increasing share of liability to the extent any of the other component suppliers are in financial distress or are otherwise incapable of fulfilling their warranty or product recall obligations. Our costs associated with providing product warranties and responding to product recall claims could be material, and we do not have insurance covering product recalls. Product liability, warranty and recall costs may adversely affect our business, results of operations and financial condition.

We are subject to a broad range of environmental, health and safety laws and regulations which could adversely affect our business and results of operations.

We are subject to a broad range of laws and regulations governing emissions to air; discharges to water; noise and odor emissions; the generation, handling, storage, transportation, treatment, reclamation and disposal of chemicals and waste materials; the cleanup of contaminated properties; and health and safety. We may incur substantial costs in complying with these laws and regulations. Many of our current and former facilities have been subject to certain environmental investigations and remediation activities, and we maintain environmental reserves for certain of these sites. Through various acquisitions, we have acquired a number of manufacturing facilities, and we cannot assure that we will not incur material costs or liabilities relating to activities that predate our ownership. Material future expenditures may be necessary if compliance standards change or material unknown conditions that require remediation are discovered. Environmental laws could also restrict our ability to expand our facilities or could require us to acquire costly equipment or to incur other significant expenses. If we fail to comply with present and future environmental laws and regulations, we could be subject to future liabilities, which could adversely affect our financial condition, operating results and cash flows.

Work stoppages or similar difficulties could disrupt our operations and negatively affect our operations and financial performance.

We may be subject to work stoppages and may be affected by other labor disputes. A number of our collective bargaining agreements expire in any given year. There is no certainty that we will be successful in negotiating new agreements with these unions that extend beyond the current expiration dates or that these new agreements will be on terms as favorable to us as past labor agreements. Failure to renew these agreements when they expire or to establish new collective bargaining agreements on terms acceptable to us and the unions could result in work stoppages or other labor disruptions which may have an adverse effect on our operations, customer relationships and financial results. Additionally, a work stoppage at one or more of our suppliers or our customers’ suppliers could adversely affect our operations if an alternative source of supply were not readily available. Work stoppages by our customers’ employees could result in reduced demand for our products and could have an adverse effect on our business. As of December 31, 2015, approximately 28% of our employees were represented by unions, and approximately 9% of the unionized employees were located in the U.S. In addition, it is possible that our workforce will become more unionized in the future. Unionization activities could increase our costs, which could negatively affect our profitability.

If we are unable to protect our intellectual property or if a third party challenges our intellectual property rights, our business could be adversely affected.

We own or have rights to proprietary technology that is important to our business. We rely on intellectual property laws, patents, trademarks and trade secrets to protect such technology. Such protections, however, vary among the countries in which we market and sell our products, and as a result, we may be unable to prevent third parties from using our intellectual property without authorization. Any infringement or misappropriation of our technology could have an adverse effect on our business and results of operations. We also face exposure to claims by others for infringement of intellectual property rights and could incur significant costs or losses related to such claims. In addition, many of our supply agreements require us to indemnify our customers from third-party infringement claims. These claims, regardless of their merit or resolution, are frequently costly to prosecute, defend or settle and divert the efforts and attention of our management and employees. If any such claim were to result in an adverse outcome, we could be required to take actions which may include: ceasing the manufacture, use or sale of the infringing products; paying substantial damages to third parties, including to customers to compensate them for the

discontinued use of a product or to replace infringing technology with non-infringing technology; or expending significant resources to develop or license non-infringing products, any of which could adversely affect our operations, business and financial condition.

A disruption in, or the inability to successfully implement upgrades to, our information technology systems, including disruptions relating to cybersecurity, could adversely affect our business and financial performance.

We rely upon information technology networks, systems and processes to manage and support our business. We have implemented a number of procedures and practices designed to protect against breaches or failures of our systems. Despite the security measures that we have implemented, including those measures to prevent cyber-attacks, our systems could be breached or damaged by computer viruses or unauthorized physical or electronic access. A breach of our information technology systems could result in theft of our intellectual property, disruption to business or unauthorized access to customer or personal information. Such a breach could adversely impact our operations and/or our reputation and may cause us to incur significant time and expense to cure or remediate the breach.

Further, we continually update and expand our information technology systems to enable us to more efficiently run our business. If these systems are not implemented successfully, our operations and business could be disrupted and our ability to report accurate and timely financial results could be adversely effected.

Our expected annual effective tax rate could be volatile and could materially change as a result of changes in many items including mix of earnings, debt and capital structure and other factors.

Many items could impact our effective tax rate including changes in our debt and capital structure, mix of earnings and many other factors. Our overall effective tax rate is based upon the consolidated tax expense as a percentage of consolidated earnings before tax. However, tax expenses and benefits are not recognized on a consolidated or global basis, but rather on a jurisdictional, legal entity basis. Further, certain jurisdictions in which we operate generate losses where no current financial statement benefit is realized. In addition, certain jurisdictions have statutory rates greater than or less than the United States statutory rate. As such, changes in the mix and source of earnings between jurisdictions could have a significant impact on our overall effective tax rate in future years. Changes in rules related to accounting for income taxes, changes in tax laws and rates or adverse outcomes from tax audits that occur regularly in any of our jurisdictions could also have a significant impact on our overall effective tax rate in future periods.

Impairment charges relating to our goodwill, long-lived assets or intangible assets could adversely affect our results of operations.

We regularly monitor our goodwill, long-lived assets and intangible assets for impairment indicators. In conducting our goodwill impairment testing, we compare the fair value of each of our reporting units to the related net book value. In conducting our impairment analysis of long-lived and intangible assets, we compare the undiscounted cash flows expected to be generated from the long-lived or intangible assets to the related net book values. Changes in economic or operating conditions impacting our estimates and assumptions could result in the impairment of our goodwill, long-lived assets or intangible assets. In the event that we determine that our goodwill, long-lived assets or intangible assets are impaired, we may be required to record a significant charge to earnings, which could adversely affect our results of operations.

A substantial portion of our total outstanding shares are held by a small number of investors who may, individually or collectively, exert significant control over us, and whose shares may be sold in the future.

Certain stockholders own a substantial portion of our outstanding common stock. As long as such major stockholders (whether or not acting in a coordinated manner) and any other substantial stockholder own, directly or indirectly, a substantial portion of our outstanding shares, they will be able to exert significant influence over matters requiring stockholder approval, including the composition of our Board of Directors. Further, to the extent that the substantial stockholders were to act in concert, they could potentially control any action taken by our stockholders.

The concentration of ownership of our outstanding equity in such major stockholders may make some transactions more difficult or impossible without the support of such stockholders or more likely with the support of such stockholders. The interests of any of such stockholders, any other substantial stockholder or any of their respective affiliates could conflict with or differ from the interests of our other stockholders.

Furthermore, some of our large shareholders may determine to sell their shares in the future. The market price of our common stock could decline as a result of sales of shares of our common stock in the market in the future, and the perception that these sales could occur may also depress the market price of our common stock.

We operate as a holding company and depend on our subsidiaries for cash to satisfy the obligations of the holding company.

Cooper-Standard Holdings Inc. is a holding company. Our subsidiaries conduct all of our operations and own substantially all of our assets. Our cash flow and our ability to meet our obligations depend on the cash flow of our subsidiaries. In addition, the payment of funds in the form of dividends, intercompany payments, tax sharing payments and otherwise may be subject to restrictions under the laws of the countries of incorporation of our subsidiaries or the by-laws of the subsidiary.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

As of December 31, 2015, our operations were conducted through 98 wholly-owned, leased and joint venture facilities in 20 countries (North America: Canada, Mexico, United States; Asia Pacific: China, India, Japan, South Korea, Thailand; Europe: Czech Republic, France, Germany, Italy, Netherlands, Poland, Romania, Serbia, Spain, Sweden, United Kingdom; South America: Brazil), of which 79 are predominantly manufacturing facilities and 19 have design, engineering, administrative or logistics designation(s). Our corporate headquarters are located in Novi, Michigan. Our manufacturing facilities are located in North America, Europe, Asia and South America. We believe that substantially all of our properties are in generally good condition and there is sufficient capacity to meet current and projected manufacturing, product development and logistics requirements. The following table summarizes our key property holdings by geographic region:

|

| | | | | | | | |

Region | | Type | | Total Facilities* | | Owned Facilities |

North America | | Manufacturing(a) | | 30 |

| | 23 |

|

| | Other(b) | | 7 |

| | 1 |

|

Asia Pacific | | Manufacturing | | 23 |

| | 12 |

|

| | Other(b) | | 4 |

| | — |

|

Europe | | Manufacturing(a) | | 22 |

| | 18 |

|

| | Other(b) | | 7 |

| | 3 |

|

South America | | Manufacturing | | 4 |

| | 1 |

|

| | Other(b) | | 1 |

| | — |

|

| |

(a) | Includes multi-activity sites which are predominantly manufacturing. |

| |

(b) | Includes design, engineering, administrative and logistics locations. |

(*) Excludes 6 unutilized (owned) facilities: (2) Europe; (4) North America

Item 3. Legal Proceedings

We are periodically involved in claims, litigation and various legal matters that arise in the ordinary course of business. In addition, we conduct and monitor environmental investigations and remedial actions at certain locations. Each of these matters is subject to various uncertainties, and some of these matters may be resolved unfavorably for us. If appropriate, we establish a reserve estimate for each matter and update such estimates as additional information becomes available. We do not believe that the ultimate resolution of any of these matters will have a material adverse effect on our business, financial condition or results of operations.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities

Market Information

Our common stock has been traded on the NYSE since October 17, 2013, under the symbol “CPS” and our warrants have been traded on the OTC Bulletin Board since June 4, 2010, under the symbol “COSHW.” Prior to its listing on the NYSE, our common stock was traded on the OTC Bulletin Board under the symbol “COSH.”

The following chart lists the high and low sale prices for shares of our common stock and warrants for the fiscal quarters indicated through December 31, 2015 and 2014. With respect to our warrants, these prices are between dealers and do not include retail markups, markdowns or other fees and commissions and may not represent actual transactions:

|

| | | | | | | | | | | | | | | | |

| | Common Stock | | Warrants |

2015 | | High | | Low | | High | | Low |

March 31, 2015 | | $ | 59.20 |

| | $ | 50.96 |

| | $ | 32.44 |

| | $ | 25.67 |

|

June 30, 2015 | | 64.24 |

| | 58.83 |

| | 36.70 |

| | 32.45 |

|

September 30, 2015 | | 64.79 |

| | 55.00 |

| | 39.13 |

| | 29.00 |

|

December 31, 2015 | | 80.15 |

| | 58.10 |

| | 49.80 |

| | 33.59 |

|

|

| | | | | | | | | | | | | | | | |

| | Common Stock | | Warrants |

2014 | | High | | Low | | High | | Low |

March 31, 2014 | | $ | 70.65 |

| | $ | 48.10 |

| | $ | 44.00 |

| | $ | 23.03 |

|

June 30, 2014 | | 70.20 |

| | 61.24 |

| | 44.25 |

| | 34.00 |

|

September 30, 2014 | | 65.87 |

| | 60.92 |

| | 39.30 |

| | 34.45 |

|

December 31, 2014 | | 59.77 |

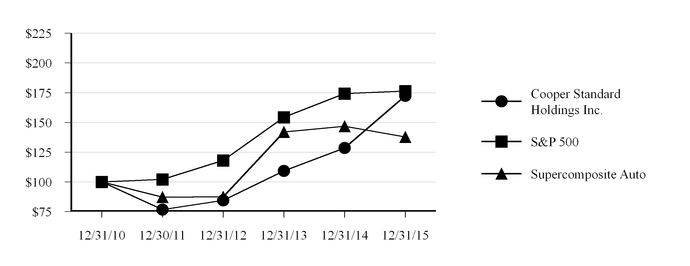

| | 50.99 |