Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

LENSAR, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

LENSAR, Inc.

2800 Discovery Drive

Orlando, Florida 32826

June 20, 2023

Dear Fellow Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend a special meeting of stockholders (the “Special Meeting”) of LENSAR, Inc., which will be held on Tuesday, August 1, 2023, beginning at 1:00 p.m., Eastern Time. The Special Meeting will be a completely virtual meeting, which will be conducted via live webcast.

In accordance with the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their stockholders over the Internet, we have sent stockholders of record at the close of business on June 2, 2023 a Notice of Internet Availability of Proxy Materials. The notice contains instructions on how to access our Proxy Statement and vote online. If you would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the notice, as well as in the attached Proxy Statement.

Attached to this letter are a Notice of Special Meeting of Stockholders and Proxy Statement, which describe the business to be conducted at the meeting.

Your vote is important to us. Please act as soon as possible to vote your shares. It is important that your shares be represented at the meeting whether or not you plan to attend the Special Meeting via the Internet. Please vote electronically over the Internet, by telephone or, if you receive a paper copy of the proxy card by mail, by returning your signed proxy card in the envelope provided. You may also vote your shares online during the Special Meeting. Instructions on how to vote while participating at the meeting live via the Internet are posted at www.virtualshareholdermeeting.com/LNSR2023SM.

On behalf of the Board of Directors and management, it is my pleasure to express our appreciation for your continued support.

| /s/ William J. Link, PhD |

| William J. Link, PhD |

| Chairman of the Board |

Table of Contents

LENSAR, Inc.

2800 Discovery Drive

Orlando, Florida 32826

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 1, 2023

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders of LENSAR, Inc., a Delaware corporation, will be held on Tuesday, August 1, 2023, at 1:00 p.m., Eastern Time. The Special Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Special Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/LNSR2023SM. For instructions on how to attend and vote your shares at the Special Meeting, see the information in the accompanying Proxy Statement in the section titled “General Information about the Special Meeting and Voting—How can I attend and vote at the Special Meeting?”

The Special Meeting is being held:

| 1. | to approve, pursuant to Nasdaq Listing Rule 5635(b), the issuance of the Company’s common stock, par value $0.01 per share (the “Common Stock”), upon conversion of shares of Series A convertible preferred stock, par value $0.01 per share (the “Series A Convertible Preferred Stock”), and exercise of Class A and Class B common stock purchase warrants issued and sold to an affiliate of North Run Capital, LP; and |

| 2. | to transact such other business as may properly come before the Special Meeting or any continuation, postponement or adjournment thereof. |

These items of business are described in the Proxy Statement that follows this notice. Stockholders of record as of the close of business on June 2, 2023 (the “Record Date”) are entitled to notice of, and holders of record of Common Stock as of the close of business on the Record Date are entitled to vote at, the Special Meeting or any continuation, postponement or adjournment thereof.

Your vote is important. Voting your shares will ensure the presence of a quorum at the Special Meeting and will save us the expense of further solicitation. Please promptly vote your shares by following the instructions for voting on the Notice Regarding the Availability of Proxy Materials or, if you received a paper or electronic copy of our proxy materials, by completing, signing, dating and returning your proxy card or by Internet or telephone voting as described on your proxy card.

| By Order of the Board of Directors |

| /s/ Nicholas T. Curtis |

| Nicholas T. Curtis |

| Chief Executive Officer |

Orlando, Florida

June 20, 2023

This Notice of Special Meeting and Proxy Statement are first being distributed or made available, as the case may be, on or about June 20, 2023.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting:

This Proxy Statement is available free of charge at www.proxyvote.com.

Table of Contents

i

Table of Contents

LENSAR, Inc.

2800 Discovery Drive

Orlando, Florida 32826

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 1, 2023

This proxy statement (the “Proxy Statement”) is being furnished by and on behalf of the board of directors (the “Board” or “Board of Directors”) of LENSAR, Inc. (the “Company,” “LENSAR,” “we,” “us,” or “our”), in connection with a special meeting of stockholders (the “Special Meeting”). The Notice of Special Meeting and this Proxy Statement are first being distributed or made available, as the case may be, on or about June 20, 2023.

GENERAL INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

When and where will the Special Meeting be held?

The Special Meeting will be held on Tuesday, August 1, 2023 at 1:00 p.m., Eastern Time. The Special Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Special Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/LNSR2023SM and entering your 16-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials. If you lose your 16-digit control number, you may join the Special Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the as of the close of business on June 2, 2023 (the “Record Date”).

What is the purpose of the Special Meeting?

The purpose of the Special Meeting is to vote on the approval of the issuance of shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), issuable upon conversion of shares of Series A convertible preferred stock, par value $0.01 per share (the “Series A Convertible Preferred Stock”), and exercise of warrants designated as the Class A Common Stock Purchase Warrants and warrants designated as the Class B Common Stock Purchase Warrants (collectively, the “Warrants”) issued and sold to an affiliate of North Run Capital, LP (“North Run”) pursuant to Nasdaq Listing Rule 5635(b) as described further in this Proxy Statement (the “North Run Proposal”).

Are there any matters to be voted on at the Special Meeting that are not included in this Proxy Statement?

Our Second Amended and Restated Bylaws (the “Bylaws”) provide that no business may be transacted at any special meeting of stockholders other than the business specified in the notice of such meeting. Accordingly, no business other than the proposal set forth herein shall be conducted at the Special Meeting.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a paper copy of proxy materials?

The rules of the Securities and Exchange Commission (the “SEC”) permit us to furnish proxy materials, including this Proxy Statement, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Stockholders will not receive paper copies of the proxy materials unless they

1

Table of Contents

request them. Instead, the Notice of Internet Availability of Proxy Materials (the “Notice and Access Card”) provides instructions on how to access and review on the Internet all of the proxy materials. The Notice and Access Card also instructs you as to how to authorize via the Internet or telephone your proxy to vote your shares according to your voting instructions. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials described in the Notice and Access Card.

What does it mean if I receive more than one Notice and Access Card or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Notice and Access Card or set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

Can I vote my shares by filling out and returning the Notice and Access Card?

No. The Notice and Access Card identifies the item to be voted on at the Special Meeting, but you cannot vote by marking the Notice and Access Card and returning it. If you would like a paper proxy card, you should follow the instructions in the Notice and Access Card. The paper proxy card you receive will also provide instructions as to how to authorize via the Internet or telephone your proxy to vote your shares according to your voting instructions. Alternatively, you can mark the paper proxy card with how you would like your shares voted, sign and date the proxy card, and return it in the envelope provided.

Who is entitled to vote at the Special Meeting?

Holders of record of shares of Common Stock as of the close of business on the Record Date will be entitled to vote at the Special Meeting and any continuation, postponement or adjournment thereof.

At the close of business on the Record Date, there were 11,199,544 shares of Common Stock issued and outstanding and entitled to vote. As described in the North Run Proposal below, North Run and its affiliates are not currently permitted to vote any shares of Series A Convertible Preferred Stock they hold, or any shares of Common Stock they hold as a result of the conversion of Series A Convertible Preferred Stock or exercise of Warrants on the North Run Proposal.

The Company’s directors and executive officers as of the date of the Purchase Agreement, who have a combined voting power of 15.8% as of the Record Date, are each party to voting agreements with the Company pursuant to which, among other things, each such director or executive has agreed, solely in his or her capacity as a stockholder, to vote all of his or her shares of Common Stock in favor of the approval of the North Run Proposal.

You will need to obtain your own Internet access if you choose to attend the Special Meeting online and/or vote over the Internet. To attend and participate in the Special Meeting, you will need the 16-digit control number included in your Notice and Access Card, on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Special Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. The meeting webcast will begin promptly at 1:00 p.m., Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 12:45 p.m., Eastern Time, and you should allow ample time for the check-in procedures.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder (also called a “registered holder”) holds shares in his or her name. Shares held in “street name” means that shares are held in the name of a bank, broker or other nominee on the holder’s behalf.

2

Table of Contents

What do I do if my shares are held in “street name”?

If your shares are held in a brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in “street name.” The Notice and Access Card or the proxy materials, if you elected to receive a hard copy, has been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by following their instructions for voting. Please refer to information from your bank, broker or other nominee on how to submit your voting instructions.

How many shares must be present to hold the Special Meeting?

A quorum must be present at the Special Meeting for any business to be conducted. The holders of a majority in voting power of the Company’s capital stock issued and outstanding and entitled to vote, present electronically or represented by proxy, constitutes a quorum. If you sign and return your paper proxy card or authorize a proxy to vote electronically or telephonically, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote as indicated in the proxy materials.

Broker non-votes will also be considered present for the purpose of determining whether there is a quorum for the Special Meeting.

A “broker non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker lacks the authority to vote the shares at their discretion. The North Run Proposal is considered a non-discretionary matter, and a broker will lack the authority to vote uninstructed shares at their discretion on the North Run Proposal.

What if a quorum is not present at the Special Meeting?

If a quorum is not present or represented at the scheduled time of the Special Meeting, (i) the chairperson of the Special Meeting or (ii) a majority in voting power of the stockholders entitled to vote at the Special Meeting, present in person or by remote communication, if applicable, or represented by proxy, may recess the Special Meeting or adjourn the Special Meeting until a quorum is present or represented.

How do I vote my shares without attending the Special Meeting?

We recommend that stockholders vote by proxy even if they plan to attend the Special Meeting and vote electronically. If you are a stockholder of record, there are three ways to vote by proxy:

| • | by Internet—You can vote over the Internet at www.proxyvote.com by following the instructions on the Notice and Access Card or proxy card; |

| • | by Telephone—You can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card; or |

| • | by Mail—You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail. |

Internet and Telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on July 31, 2023.

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions on how to vote from the bank, broker or holder of record. You must follow the instructions of such bank, broker or holder of record in order for your shares to be voted.

3

Table of Contents

How can I attend and vote at the Special Meeting?

We will be hosting the Special Meeting live via audio webcast. Any stockholder can attend the Special Meeting live online at www.virtualshareholdermeeting.com/LNSR2023SM. If you were a stockholder as of the Record Date, or you hold a valid proxy for the Special Meeting, you can vote at the Special Meeting. A summary of the information you need to attend the Special Meeting online is provided below:

| • | Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/LNSR2023SM. |

| • | Assistance with questions regarding how to attend and participate via the Internet will be provided at www.virtualshareholdermeeting.com/LNSR2023SM on the day of the Special Meeting. |

| • | Webcast starts at 1:00 p.m., Eastern Time. |

| • | You will need your 16-Digit Control Number to enter the Special Meeting. |

| • | Stockholders may submit questions while attending the Special Meeting via the Internet. |

To attend and participate in the Special Meeting, you will need the 16-digit control number included in your Notice and Access Card, on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Special Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date.

Will there be a question and answer session during the Special Meeting?

As part of the Special Meeting, we will hold a live Question and Answer (“Q&A”) session, during which we intend to answer appropriate questions submitted online during or prior to the meeting that are pertinent to the meeting matters, as time permits. Only stockholders that have accessed the Special Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who can attend the Special Meeting?” will be permitted to submit questions during the Special Meeting. Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

| • | irrelevant to the business of the Special Meeting; |

| • | related to material non-public information of the Company, including the status or results of our business not included in our public disclosure; |

| • | related to any pending, threatened or ongoing litigation; |

| • | related to personal grievances; |

| • | derogatory references to individuals or that are otherwise in bad taste; |

| • | substantially repetitious of questions already made by another stockholder; |

| • | in furtherance of the stockholder’s personal or business interests; or |

| • | out of order or not otherwise suitable for the conduct of the Special Meeting as determined by the Chair or Secretary in their reasonable judgment. |

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Special Meeting webpage for stockholders that have accessed the Special Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above.

4

Table of Contents

What if during the check-in time or during the Special Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please contact technical support as directed on the virtual meeting website.

How does the Board recommend that I vote?

The Board recommends that you vote FOR the North Run Proposal.

How many votes are required to approve the North Run Proposal?

The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) is required to approve the North Run Proposal. A vote marked as an “Abstention” is not considered a vote cast and will, therefore, not affect the outcome of this proposal. As this proposal is not considered a discretionary matter, brokers lack authority to exercise their discretion to vote uninstructed shares on this proposal. Any broker non-votes will have no effect on the outcome of this proposal.

While holders of Series A Convertible Preferred Stock generally are entitled to vote on all matters on which holders of Common Stock are entitled to vote, on an as-converted-to-Common-Stock basis (not to exceed the Beneficial Ownership Limitation as described below), voting together as a single class with the Common Stock, North Run and its affiliates are not entitled to vote any shares of Series A Convertible Preferred Stock they hold, including on an as-converted-to-Common-Stock basis, on the North Run Proposal pursuant to the listing rules of The Nasdaq Stock Market LLC (the “Nasdaq Listing Rules”). North Run and its affiliates are entitled to vote their shares of Common Stock held as of the Record Date.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendation is set forth above, as well as with the description of the North Run Proposal in this Proxy Statement.

Representatives of Broadridge Investor Communications Services (“Broadridge”) will tabulate the votes, and a representative of Broadridge will act as inspector of election.

Can I revoke or change my vote after I submit my proxy?

Yes. Whether you have voted by Internet, telephone or mail, if you are a stockholder of record, you may change your vote and revoke your proxy by:

| • | sending a written statement to that effect to the attention of our Chief Financial Officer and Secretary at our corporate offices, provided such statement is received no later than July 31, 2023; |

| • | voting again by Internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m., Eastern Time, on July 31, 2023; |

| • | submitting a properly signed proxy card with a later date that is received no later than July 31, 2023; or |

| • | attending the Special Meeting, revoking your proxy and voting again. |

5

Table of Contents

If you hold shares in street name, you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your proxy online at the Special Meeting if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

Your most recent proxy card or telephone or Internet proxy is the one that is counted. Your attendance at the Special Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Company before your proxy is voted or you vote online at the Special Meeting.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees (for no additional compensation) in person or by telephone, electronic transmission and facsimile transmission. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses. We may also engage the services of a proxy solicitor to assist in the solicitation of proxies and provide related advice and informational support for a services fee and the reimbursement of customary disbursements that are not expected to exceed $15,000 in the aggregate.

6

Table of Contents

PROPOSAL NO. 1—APPROVAL OF THE NORTH RUN PROPOSAL

We are seeking stockholder approval for the issuance of shares of Common Stock issuable upon conversion of shares of Series A Convertible Preferred Stock and exercise of Warrants issued and sold to an affiliate of North Run in May 2023 (to the extent such conversion or exercise would result in North Run beneficially owning securities representing more than 19.99% of our outstanding Common Stock (the “Beneficial Ownership Limitation”)), as well as the ability of North Run to vote its shares of Series A Convertible Preferred Stock on an-as-converted-to-Common-Stock basis in excess of the Beneficial Ownership Limitation. Stockholder approval is required to permit such conversions, exercises and votes in excess of the Beneficial Ownership Limitation pursuant to Nasdaq Listing Rule 5635(b).

As disclosed in the Current Report on Form 8-K filed with the SEC on May 15, 2023 (the “Form 8-K”), on May 12, 2023, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with NR-GRI Partners, LP (the “Buyer”), a Delaware limited partnership and an affiliate of North Run, whereby it agreed to issue and sell to the Buyer, for an aggregate gross purchase price of $20.0 million, (i) an aggregate of 20,000 shares of Series A Convertible Preferred Stock (the “Preferred Shares”), a newly established series of preferred stock, which are initially convertible into 7,940,446 shares (the “Conversion Shares”) of Common Stock, and (ii) Warrants to purchase an aggregate of 4,367,246 shares of Common Stock (the “Warrant Shares”), subject in each case to the Beneficial Ownership Limitation (such transactions, collectively, the “Private Placement”). As of immediately prior to the Private Placement, North Run beneficially owned 1,100,592 shares, or approximately 9.9%, of our outstanding Common Stock.

On May 18, 2023, in connection with the closing of the Private Placement, the Company filed the Certificate of Designations, Preferences and Rights of Series A Convertible Preferred Stock (the “Certificate of Designations”) to its Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware, which established the designations, preferences, powers and rights of the Series A Convertible Preferred Stock, and issued to the Buyer 2,183,623 Warrants designated as Class A Common Stock Purchase Warrants and 2,183,623 Warrants designated as Class B Common Stock Purchase Warrants.

The Certificate of Designations and the Warrants each include provisions that prevent North Run and its affiliates, until stockholder approval is obtained in accordance with applicable Nasdaq Listing Rules, from converting the Preferred Shares, voting the Preferred Shares on an as-converted-to-Common-Stock basis or exercising its Warrants, as applicable, to the extent such action would result in North Run beneficially owning shares of Common Stock in excess of the Beneficial Ownership Limitation. A copy of the Certificate of Designations and form of Warrants are filed as exhibits to our Current Reports on Form 8-K that we filed with the SEC on May 15, 2023 and May 18, 2023.

The Purchase Agreement was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on May 15, 2023, and is incorporated herein by reference.

The Preferred Shares and Warrants were issued on May 18, 2023 (the “Closing”) pursuant to the Purchase Agreement. The Purchase Agreement contains representations, warranties, and covenants that are customary for financing transactions such as the Private Placement, including the following covenants:

| • | We agreed not to issue more than 10% of our outstanding shares of Common Stock as of the Closing (subject to exceptions for stock plans and acquisitions) or, within 120 days of the Closing, issue any equity securities (subject to exceptions for stock plans and acquisitions). |

| • | We agreed to increase the size of the Board from seven to nine directors, effective immediately following the 2023 Annual Meeting of Stockholders, to appoint two designees of North Run to the |

7

Table of Contents

| Board effective immediately following the 2023 Annual Meeting of Stockholders (“Board Designees”), and to provide North Run with continuing director designation rights based on North Run’s beneficial ownership of Common Stock on an as-converted basis. In accordance with this covenant, Thomas B. Ellis and Todd B. Hammer were appointed to the Board, effective as of May 25, 2023. |

| • | We agreed that, so long as North Run beneficially owns least 20% of the Conversion Shares and Warrant Shares underlying the Preferred Stock and Warrants issued pursuant to the Purchase Agreement, North Run will have a right to participate on a pro rata basis in equity financings or issuances of securities convertible, exercisable, or exchangeable into equity securities of the Company or any subsidiaries in capital-raising transactions (including debt securities with an equity component), subject to certain exceptions. |

| • | We agreed to call and hold, not later than 90 days after the Closing, a special meeting of stockholders to approve the removal of the Beneficial Ownership Limitation. The North Run Proposal is intended to fulfill this covenant. In addition, as a condition to the Closing, each director and executive officer of the Company executed and delivered to the Buyer a voting agreement under which the director or executive officer agreed to vote his or her shares of Common Stock in favor of removal of the Beneficial Ownership Limitation at the special meeting of stockholders. |

Series A Convertible Preferred Stock

The terms of the Preferred Shares are as set forth in the Certificate of Designations, which was filed with and became effective with the Secretary of State for the State of Delaware on May 18, 2023. The Certificate of Designations was filed as Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on May 18, 2023 and is incorporated herein by reference.

The Series A Convertible Preferred Stock ranks senior to the Common Stock, as to distributions and payments upon the liquidation, dissolution and winding up of the Company. Holders of Series A Convertible Preferred Stock participate with the holders of the Common Stock on an as-converted basis to the extent any dividends are declared on the Common Stock, although the Series A Convertible Preferred Stock will not accrue a fixed dividend.

The Series A Convertible Preferred Stock has a stated value of $1,000 per share (the “Liquidation Preference”). Each share of Series A Convertible Preferred Stock is convertible at the option of the holder from and after the original date of issuance into a number of shares of Common Stock based on the Liquidation Preference plus any declared and unpaid dividends divided by a conversion price of $2.51875, subject to customary adjustment in the event of stock splits, stock dividends, and similar events (the “Conversion Price”). In lieu of the Company issuing fractional shares upon the conversion of shares of Series A Convertible Preferred Stock, the Company will, at its election, either pay a cash adjustment based on the Conversion Price or round up to the next whole share.

The Series A Convertible Preferred Stock is subject to automatic redemption for cash upon a “Fundamental Transaction” (as defined in the Certificate of Designations) by the Company, which includes a merger, sale of all or substantially all the assets of the Company, recapitalization, or the sale by the Company of shares resulting in more than 50% ownership by a person or group. In such event, the redemption price would be equal to the greater of the stated value of the Series A Convertible Preferred Stock or the consideration per share of Common Stock in the Fundamental Transaction (or in the absence of such consideration, the volume-weighted average price of the Common Stock immediately preceding the closing of the Fundamental Transaction).

8

Table of Contents

Holders of Series A Convertible Preferred Stock generally are entitled to vote on an as-converted basis with the Company’s Common Stock, subject to the Beneficial Ownership Limitation, on all matters on which holders of Common Stock are entitled to vote, voting together with the Common Stock as a single class, and are otherwise entitled to such voting rights as required by applicable law. Pursuant to the Nasdaq Listing Rules, however, North Run and its affiliates are not currently permitted to vote any shares of Series A Convertible Preferred Stock they hold, or any shares of Common Stock they hold as a result of the conversion of Series A Convertible Preferred Stock or exercise of Warrants on the North Run Proposal.

For so long as North Run beneficially owns at least 20% of the Conversion Shares and Warrant Shares underlying the Preferred Shares and Warrants issued pursuant to the Purchase Agreement, we may not take any of the following actions without North Run’s consent:

| • | liquidate, dissolve, or wind up our affairs or effect a merger or sale of the Company or other Fundamental Transaction; |

| • | create, authorize, or issue shares of capital stock that are senior or pari passu to the Series A Convertible Preferred Stock; |

| • | complete an acquisition with consideration above $1.0 million; |

| • | incur debt in excess of $1.0 million; |

| • | change our line of business; or |

| • | enter into certain related-party transactions. |

Class A Common Stock Purchase Warrants and Class B Common Stock Purchase Warrants

The Class A Common Stock Purchase Warrants, representing 2,183,623 of the Warrants, have an exercise price equal to $2.45 per share, and the Class B Common Stock Purchase Warrants, representing 2,183,623 of the Warrants, have an exercise price equal to $3.0625 per share, subject in each instance to adjustments as provided under the terms of the Warrants. The Warrants are exercisable at any time up to and including May 18, 2028, subject to the Beneficial Ownership Limitation (as and to the extent applicable at that time). The Warrants may be exercised on a cashless basis at any time while the resale registration statement required by the Registration Rights Agreement described below is not effective and available for such holder’s Warrant Shares, and the Warrants will automatically be exercised on a cashless basis upon the expiration of the Warrants if not otherwise exercised prior thereto. In the event of a sale of the Company or other Fundamental Transaction (as defined in the Warrants) prior to the expiration or exercise of the Warrants, the holders of the Warrants may elect to have the Warrants redeemed by the Company for an amount in cash equal to the Black-Scholes value of the Warrants. The Warrants are subject to customary adjustments for corporate events such as stock dividends, splits, combinations and reclassifications.

In connection with our entry into the Purchase Agreement, on May 12, 2023, we entered into a registration rights agreement with North Run (the “Registration Rights Agreement”), pursuant to which we agreed to file a resale registration statement with respect to the resale of the Conversion Shares and the Warrant Shares not later than 45 calendar days following the execution of the Registration Rights Agreement, and to use our reasonable best efforts to cause such resale registration statement to be declared effective by the SEC as soon as practicable, but in no event later than 90 calendar days following the execution of the Registration Rights Agreement.

In connection with our entry into the Purchase Agreement, the Company’s directors and executive officers, who have a combined voting power of 15.8% as of the Record Date, each entered into a voting agreement with the

9

Table of Contents

Company pursuant to which, among other things, each such stockholder agreed, solely in his or her capacity as a stockholder, to vote all of his or her shares of Common Stock in favor of the approval of the North Run Proposal.

Reasons for Seeking Stockholder Approval

Our Common Stock is listed on the Nasdaq Capital Market, and as such, we are subject to the Nasdaq Listing Rules. In order to comply with the Nasdaq Listing Rules and to satisfy conditions under the Purchase Agreement, we are seeking stockholder approval of this proposal.

Under Nasdaq Listing Rule 5635(b), stockholder approval is required prior to the issuance of securities when the issuance or potential issuance will result in a change of control of a company. This rule does not specifically define when a change in control of a company may be deemed to occur for this purpose; however, Nasdaq suggests in its guidance that a change of control would occur, subject to certain limited exceptions, if after a transaction an investor (or a group of investors) would hold 20% or more of a company’s then-outstanding capital stock and such ownership or voting power would be the company’s largest ownership position. As of immediately prior to the Private Placement, North Run beneficially owned 1,100,592 shares, or approximately 9.9%, of our outstanding Common Stock. Based on shares outstanding as of June 2, 2023 (and assuming that all Warrants have been exercised solely for cash), the transactions contemplated by the Private Placement would result in North Run holding 57.0% of the voting power of the Company and 55.1% of the beneficial ownership of the Company. Accordingly, we are also seeking stockholder approval pursuant to Nasdaq Listing Rule 5635(b). Stockholders should note that a “change of control” as described under Rule 5635(b) applies only with respect to the application of such rule, and does not necessarily constitute a “change of control” for purposes of Delaware law or our organizational documents. Our Board of Directors determined that the Private Placement, the Purchase Agreement and the issuance of the securities thereunder were in the best interests of our company and its stockholders.

If the North Run Proposal is approved, all shares of Series A Convertible Preferred Stock held by North Run and its affiliates will, at the election of North Run, be convertible into an aggregate of 7,940,446 shares of our Common Stock and, prior to their conversion, can be voted on an as-converted-to-Common-Stock basis without restriction by the Beneficial Ownership Limitation. Additionally, if the North Run Proposal is approved, North Run will have the ability to acquire up to 4,367,246 shares of Common Stock by exercising the Warrants. If the North Run Proposal is approved, based on shares outstanding as of June 2, 2023 (and assuming that no Warrants have been exercised), North Run would hold, as of June 2, 2023, 47.2% of the voting power of the Company and 47.3% of the beneficial ownership of the Company, without any restriction of the Beneficial Ownership Limitation. If the North Run Proposal is approved, based on shares outstanding as of June 2, 2023 (and assuming that all Warrants have been exercised solely for cash), North Run would hold, as of June 2, 2023, 57.0% of the voting power of the Company and 57.0% of the beneficial ownership of the Company.

Consequences if Stockholder Approval Is Not Obtained

If our stockholders do not approve the North Run Proposal at the Special Meeting, North Run and its affiliates will not be able to vote or convert their shares of Series A Convertible Preferred Stock or exercise the Warrants in excess of the Beneficial Ownership Limitation on any matter brought for a stockholder vote. Additionally, if our stockholders do not approve this proposal by August 16, 2023, we would be obligated to include this proposal for stockholder approval again at our annual stockholder meeting held in 2024 and subsequent annual meetings until stockholder approval is obtained. The Company would bear the costs associated with including this proposal for stockholder approval at subsequent annual stockholder meetings.

Interests of Certain Persons in the North Run Proposal

Certain of our directors and existing stockholders may have interests that may be different from, or in addition to, the interests of other of our stockholders. In particular, North Run and directors Thomas B. Ellis and Todd B.

10

Table of Contents

Hammer, who are affiliates of the Buyer, beneficially owned more than 5% of our Common Stock as of immediately prior to the Closing and beneficially own securities of the Company held directly by the Buyer. The Buyer may be unable to convert all of the Preferred Shares and exercise all of the Warrants issued to it in connection with the Private Placement if this proposal is not approved by our stockholders.

The Board of Directors unanimously recommends a vote FOR the approval of the North Run Proposal.

11

Table of Contents

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information relating to the beneficial ownership of our Common Stock and Series A Convertible Preferred Stock as of June 2, 2023 by:

| • | each person, or group of affiliated persons, known by us to beneficially own more than 5% of the outstanding shares of any class of our outstanding voting securities; |

| • | each of our directors; |

| • | each of our named executive officers for 2022; and |

| • | all directors and executive officers as a group. |

The number of shares beneficially owned by each stockholder is determined under rules issued by the SEC. Under these rules, a person is deemed to be a “beneficial” owner of a security if that person has or shares voting power or investment power, which includes the power to dispose of or to direct the disposition of such security. Except as indicated in the footnotes below, we believe, based on the information furnished to us, that the individuals and entities named in the table below have sole voting and investment power with respect to all shares of Common Stock beneficially owned by them, subject to any applicable community property laws.

The number of shares of our Common Stock beneficially owned by our directors and executive officers includes shares that such persons have the right to acquire within 60 days of June 2, 2023, including through the exercise of stock options and warrants, the vesting of restricted stock units and the conversion of Series A Convertible Preferred Stock, as noted in the table footnotes.

| Shares Beneficially Owned Title or Class of Securities |

||||||||||||||||||||

| Common Stock(2) | Series A Convertible Preferred Stock(2) |

|||||||||||||||||||

| Name of Beneficial Owner(1) |

Number of Shares Beneficially Owned |

Percentage Beneficially Owned(3) |

Number of Shares Beneficially Owned |

Percentage Beneficially Owned |

Combined Voting Power(2) |

|||||||||||||||

| Holders of More Than 5% |

||||||||||||||||||||

| North Run and affiliates(4) |

2,523,160 | 19.99 | % | 20,000 | 100 | % | 19.99 | % | ||||||||||||

| Park West Asset Management LLC(5) |

1,080,599 | 9.65 | % | — | — | 8.56 | % | |||||||||||||

| Dimensional Fund Advisors LP(6) |

677,467 | 6.05 | % | — | — | 5.37 | % | |||||||||||||

| Madison Avenue International LP(7) |

669,046 | 5.97 | % | — | — | 5.30 | % | |||||||||||||

| Named Executive Officers and Directors |

||||||||||||||||||||

| Nicholas T. Curtis(8) |

843,071 | 7.46 | % | — | — | 5.93 | % | |||||||||||||

| Alan B. Connaughton(9) |

302,331 | 2.69 | % | — | — | 2.02 | % | |||||||||||||

| Thomas R. Staab, II(10) |

171,241 | 1.52 | % | — | — | * | ||||||||||||||

| Thomas B. Ellis(4) |

2,528,689 | 19.99 | % | 20,000 | 100 | % | 19.99 | % | ||||||||||||

| Todd B. Hammer(4) |

2,528,689 | 19.99 | % | 20,000 | 100 | % | 19.99 | % | ||||||||||||

| Richard L. Lindstrom, M.D.(11) |

249,740 | 2.22 | % | — | — | 1.65 | % | |||||||||||||

| William J. Link, Ph.D.(12) |

553,971 | 4.93 | % | — | — | 4.06 | % | |||||||||||||

| John P. McLaughlin(13) |

121,078 | 1.07 | % | — | — | * | ||||||||||||||

| Elizabeth G. O’Farrell(14) |

88,020 | * | — | — | * | |||||||||||||||

| Aimee S. Weisner(15) |

131,020 | 1.16 | % | — | — | * | ||||||||||||||

| Gary M. Winer(16) |

81,544 | * | — | — | * | |||||||||||||||

| All executive officers and directors as a group (11 persons)(17) |

5,076,234 | 38.52 | % | 20,000 | 100 | % | 35.81 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| * | Represents less than 1%. |

12

Table of Contents

| (1) | Unless otherwise indicated, the business address for each beneficial owner listed is 2800 Discovery Drive, Orlando, Florida 32826. |

| (2) | Each share of Common Stock is entitled to one vote, and each share of Series A Convertible Preferred Stock entitles its holder to a number of votes equal to the whole number of shares of Common Stock into which a share of Series A Convertible Preferred Stock can be converted, subject to the Beneficial Ownership Limitation. |

The beneficial ownership information shown in the table under “Common Stock” includes the number of shares of Common Stock held by such holder, as well as shares of our Common Stock such holder could acquire within 60 days of June 2, 2023, including by converting shares of Series A Convertible Preferred Stock, exercising warrants or options, or upon settlement of restricted stock units, subject to, in the case of North Run and its affiliates, the Beneficial Ownership Share Limitation. The beneficial ownership information shown in the table under “Series A Convertible Preferred Stock” reflects the maximum number of shares of Series A Convertible Preferred Stock that may be converted into Common Stock while the Beneficial Ownership Limitation remains in effect (assuming that no Warrants have been exercised). Each share of Series A Convertible Preferred Stock is currently convertible into a number of shares of Common Stock based on the stated value of such share and any declared and unpaid dividends divided by an initial conversion price of $2.51875, subject to, in the case of North Run and its affiliates, the Beneficial Ownership Limitation.

The percentage reported under “Combined Voting Power” represents the holder’s voting power with respect to all of our shares of Common Stock and Series A Convertible Preferred Stock outstanding as of June 2, 2023, voting as a single class, subject to, in the case of North Run and its affiliates, the Beneficial Ownership Limitation, and, as to each holder, without including any shares of Common Stock that such holder could acquire by exercising warrants or options or upon vesting of restricted stock units, as such securities confer no voting power until the issuance of Common Stock upon their exercise or settlement, as applicable and without taking into consideration the applicable restrictions on North Run and its affiliates’ ability to vote on the North Run Proposal.

See footnote (4) below regarding the Beneficial Ownership Limitation and restrictions on North Run and its affiliates’ ability to vote on the North Run Proposal.

| (3) | Percentages are based upon the 11,199,544 shares of our Common Stock that were outstanding on June 2, 2023. |

| (4) | Based on information reported on Schedule 13D filed on May 19, 2023 by (i) North Run, (ii) North Run Advisors, LLC (“North Run Advisors”), (iii) NR-GRI Partners, LP (“NR-GRI LP”), (iv) NR-GRI Partners GP, LLC (“NR-GRI GP”), (v) Todd B. Hammer and (vii) Thomas B. Ellis, as well as information known to us. Todd B. Hammer and Thomas B. Ellis are the principals and sole members of North Run Advisors and NR-GRI GP. North Run Advisors is the general partner of North Run and NRG-GRI GP is the general partner of NR-GRI LP. According to the filing, North Run is the investment manager of certain private pooled investment vehicles and directly beneficially owns 1,100,592 shares of Common Stock. North Run Advisors, as the general partner of North Run, may be deemed to beneficially own the 1,100,592 shares of Common Stock beneficially owned by North Run. NR-GRI LP directly beneficially owns 1,422,568 shares of Common Stock, which are issuable upon exercise of the Warrants and/or conversion of the Series A Convertible Preferred Stock, giving effect to the Beneficial Ownership Limitation. In addition, each of Mr. Hammer and Mr. Ellis may be deemed to beneficially own 5,529 shares of Common Stock issuable pursuant to options exercisable within 60 days of June 2, 2023. The reported beneficial ownership excludes an additional 10,885,124 shares of Common Stock that are issuable upon exercise of the Warrants and/or conversion of the Series A Convertible Preferred Stock but are not presently issuable due to the Beneficial Ownership Limitation. NR-GRI GP, as the general partner of NR-GRI LP, may be deemed to beneficially own the 1,422,568 shares of Common Stock beneficially owned by NR-GRI LP that are issuable upon exercise of the Warrants and/or conversion of the Series A Convertible Preferred Stock, giving effect to the Beneficial Ownership Limitation. Each of Mr. Hammer and Mr. Ellis, as the sole members of NR-GRI GP and North Run Advisors, may be deemed to beneficially own (i) the 1,100,592 shares of Common Stock |

13

Table of Contents

| beneficially owned by North Run, and (ii) the 1,422,568 shares of Common Stock beneficially owned by NR-GRI LP that are issuable upon exercise of the Warrants and/or conversion of the Series A Convertible Preferred Stock, giving effect to the Beneficial Ownership Limitation. The principal business office address for such stockholders is 867 Boylston St., 5th Floor #1361, Boston, MA 02116. |

Prior to the approval of the North Run Proposal, North Run and its affiliates are not currently permitted to vote shares of Series A Convertible Preferred Stock they hold to the extent such shares would result in North Run beneficially owning more than the Beneficial Ownership Limitation. However, for purposes of North Run’s and Messrs. Hammer’s and Ellis’s Class A beneficial ownership, all outstanding Series A Convertible Preferred Stock and all of the shares of Common Stock underlying such Series A Convertible Preferred Stock are deemed to be outstanding for such calculation, up to the Beneficial Ownership Limitation, and no unexercised Warrants to acquire shares of Common Stock are included.

The percentage reported under “Combined Voting Power” represents North Run’s voting power up to the Beneficial Ownership Limitation; however, North Run and its affiliates are not entitled to vote any shares of Series A Convertible Preferred Stock they hold, or any shares of Common Stock they hold as a result of the conversion of Series A Convertible Preferred Stock or the exercise of Warrants, on the North Run Proposal pursuant to the Nasdaq Listing Rules. North Run and its affiliates will be entitled to vote the other outstanding shares of Common Stock they hold as of the Record Date at the Special Meeting.

| (5) | Based solely on information reported on a Schedule 13G/A jointly filed on February 14, 2022 by (i) Park West Asset Management LLC (“PWAM”), (ii) Park West Investors Master Fund, Limited, (“PWIMF” and, together with PWAM, the “PW Funds”) and (iii) Peter S. Park. According to the filing, PWAM is the investment manager to PWIMF and Park West Partners International, Limited. Mr. Park, through one or more affiliated entities, is the controlling manager of PWAM. PWAM and Mr. Park have shared voting and dispositive power over 1,080,599 shares of our Common Stock and PWIMF has shared voting and dispositive power over 983,015 shares of our Common Stock. PWAM and Mr. Park may be deemed to beneficially own 1,080,599 shares of our Common Stock held in the aggregate by the PW Funds. The principal business office address for such stockholders is 900 Larkspur Landing Circle, Suite 165, Larkspur, California 94939. |

| (6) | Based solely on information reported on a Schedule 13G/A filed on February 10, 2023 by Dimensional Fund Advisors LP. Dimensional Fund Advisors LP furnishes investment advice to four investment companies and serves as investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”). In its role as investment advisor, sub-adviser and/or manager, Dimensional Fund Advisors LP or its subsidiaries (collectively, “Dimensional”) may possess voting and/or investment power over our securities that are owned by the Funds, and may be deemed to be the beneficial owner of the shares of our Common Stock held by the Funds. However, all securities reported in this table are owned by the Funds and Dimensional disclaims beneficial ownership of such securities. According to the filing, the Funds have sole voting power over 660,175 shares of our Common Stock and sole dispositive power over 677,467 shares of our Common Stock. To the knowledge of Dimensional, the interest of any one Fund does not exceed 5% of the class of securities. The principal business office address for such stockholders is 6300 Bee Cave Road, Building One, Austin, TX 78746. |

| (7) | Based solely on information reported on a Schedule 13G/A filed on February 14, 2023 by (i) Madison Avenue International LP, (ii) Madison Avenue Partners, LP, (iii) EMAI Management, LLC, (iv) Madison Avenue GP, LLC, (v) Caraway Jackson Investments LLC and (vi) Eli Samaha. According to the filing, Madison Avenue International LP, Madison Avenue Partners, LP, EMAI Management, LLC, Madison Avenue GP, LLC, Caraway Jackson Investments LLC and Eli Samaha have shared voting and dispositive power over 669,046 shares of our Common Stock. Madison Avenue Partners, LP and Madison Avenue GP, LLC as the investment manager and general partner of Madison Avenue International LP, respectively, may be deemed to be the beneficial owner of our Common Stock owned directly by Madison Avenue International LP. EMAI Management, LLC, as the general partner of Madison Avenue Partners, LP, may be |

14

Table of Contents

| deemed to be the beneficial owner of our Common Stock owned directly by Madison Avenue International LP. Caraway Jackson Investments LLC, as the owner of Madison Avenue GP, LLC, may be deemed to be the beneficial owner of our Common Stock owned directly by Madison Avenue International LP. Eli Samaha, as the non-member manager of Madison Avenue GP, LLC, the managing member of EMAI Management, LLC, and the majority owner of Caraway Jackson Investments LLC, may be deemed to be the beneficial owner of our Common Stock owned by Madison Avenue International LP. The principal business office address of Madison Avenue International LP is 150 East 58th Street, 14th Floor, New York, NY 10155. |

| (8) | Includes for Mr. Curtis 58,311 shares of unvested restricted stock that are subject to forfeiture, 86,247 shares of Common Stock issuable pursuant to vested but unexercised options and 8,474 shares of Common Stock issuable pursuant to options exercisable within 60 days of June 2, 2023. |

| (9) | Includes for Mr. Connaughton 19,597 shares of unvested restricted stock that are subject to forfeiture, 43,123 shares of Common Stock issuable pursuant to vested but unexercised options and 4,237 shares of Common Stock issuable pursuant to options exercisable within 60 days of June 2, 2023. |

| (10) | Includes for Mr. Staab 9,638 shares of unvested restricted stock that are subject to forfeiture, 43,123 shares of Common Stock issuable pursuant to vested but unexercised options and 4,237 shares of Common Stock issuable pursuant to options exercisable within 60 days of June 2, 2023. |

| (11) | Includes for Dr. Lindstrom 16,064 shares of unvested restricted stock that are subject to forfeiture, 36,463 shares of Common Stock issuable pursuant to vested but unexercised options and 5,529 shares of Common Stock issuable pursuant to options exercisable within 60 days of June 2, 2023. |

| (12) | Includes for Dr. Link 40,078 shares of unvested restricted stock that are subject to forfeiture, 36,463 shares of Common Stock issuable pursuant to vested but unexercised options and 5,529 shares of Common Stock issuable pursuant to options exercisable within 60 days of June 2, 2023. |

| (13) | Includes for Mr. McLaughlin 68,890 shares of Common Stock issuable pursuant to vested but unexercised options and 7,845 shares of Common Stock issuable pursuant to options exercisable within 60 days of June 2, 2023. |

| (14) | Includes for Ms. O’Farrell 68,890 shares of Common Stock issuable pursuant to vested but unexercised options and 7,845 shares of Common Stock issuable pursuant to options exercisable within 60 days of June 2, 2023. |

| (15) | Includes for Ms. Weisner 68,890 shares of Common Stock issuable pursuant to vested but unexercised options and 7,845 shares of Common Stock issuable pursuant to options exercisable within 60 days of June 2, 2023. |

| (16) | Includes for Mr. Winer 6,441 shares of unvested restricted stock that are subject to forfeiture, 36,463 shares of Common Stock issuable pursuant to vested but unexercised options and 5,529 shares of Common Stock issuable pursuant to options exercisable within 60 days of June 2, 2023. |

| (17) | Includes a total of 150,129 shares of unvested restricted stock held by our directors and executive officers that are subject to forfeiture, 488,552 shares of Common Stock issuable pursuant to vested but unexercised options and 68,128 shares of Common Stock issuable pursuant to options exercisable within 60 days of June 2, 2023. |

15

Table of Contents

Stockholder Proposals and Director Nominations

Stockholders who intend to have a proposal considered for inclusion in our proxy materials for presentation at our annual meeting of stockholders to be held in 2024 (the “2024 Annual Meeting”) pursuant to Rule 14a-8 under the Exchange Act must submit the proposal to our Secretary at our offices at 2800 Discovery Drive, Orlando, Florida 32826, in writing not later than December 14, 2023.

Stockholders intending to present a proposal at our 2024 Annual Meeting, but not to include the proposal in our proxy statement, or to nominate a person for election as a director (including director nominations pursuant to Rule 14a-19), must comply with the requirements set forth in our Bylaws. Our Bylaws require, among other things, that our Secretary receive written notice from the stockholder of record of their intent to present such proposal or nomination not earlier than the close of business on the 120th day and not later than the close of business on the 90th day prior to the first anniversary of the preceding year’s annual meeting of stockholders. Therefore, we must receive notice of such a proposal or nomination for the 2024 Annual Meeting no earlier than the close of business on January 26, 2024 and no later than the close of business on February 25, 2024. The notice must contain the information required by our Bylaws. In the event that the date of the 2024 Annual Meeting is more than 30 days before or more than 60 days after May 25, 2024, then our Secretary must receive such written notice not earlier than the close of business on the 120th day prior to the 2024 Annual Meeting and not later than the close of business of the 90th day prior to the 2024 Annual Meeting or, if later, the 10th day following the day on which public disclosure of the date of such meeting is first made by us. SEC rules permit management to vote proxies in its discretion in certain cases if the stockholder does not comply with this deadline and, in certain other cases notwithstanding the stockholder’s compliance with this deadline.

We reserve the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with these or other applicable requirements.

In addition to satisfying the foregoing requirements under our Bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees for the 2024 Annual Meeting must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act.

We intend to file a Proxy Statement and WHITE proxy card with the SEC in connection with the solicitation of proxies for our 2024 Annual Meeting. Stockholders may obtain our proxy statement (and any amendments and supplements thereto) and other documents as and when filed by us with the SEC without charge from the SEC’s website at: www.sec.gov.

Householding of Proxy Materials

SEC rules permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements and notices with respect to two or more stockholders sharing the same address by delivering a single proxy statement or a single notice addressed to those stockholders. This process, which is commonly referred to as “householding,” provides cost savings for companies and helps the environment by conserving natural resources. Some brokers household proxy materials, delivering a single proxy statement or notice to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement or notice, or if your household is receiving multiple copies of these documents and you wish to request that future deliveries be limited to a single copy, please notify your broker. You can also request prompt delivery of a copy of this Proxy Statement by contacting the Broadridge Financial Solutions, Inc. at (866) 540-7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

16

Table of Contents

WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING ELECTRONICALLY, WE URGE YOU TO SUBMIT A PROXY FOR YOUR SHARES VIA THE TOLL-FREE TELEPHONE NUMBER OR OVER THE INTERNET, OR BY SIGNING, DATING AND MAILING THE PROXY CARD IN THE ENCLOSED RETURN ENVELOPE.

| By Order of the Board of Directors |

| /s/ Nicholas T. Curtis |

| Nicholas T. Curtis |

| Chief Executive Officer |

Orlando, Florida

June 20, 2023

17

Table of Contents

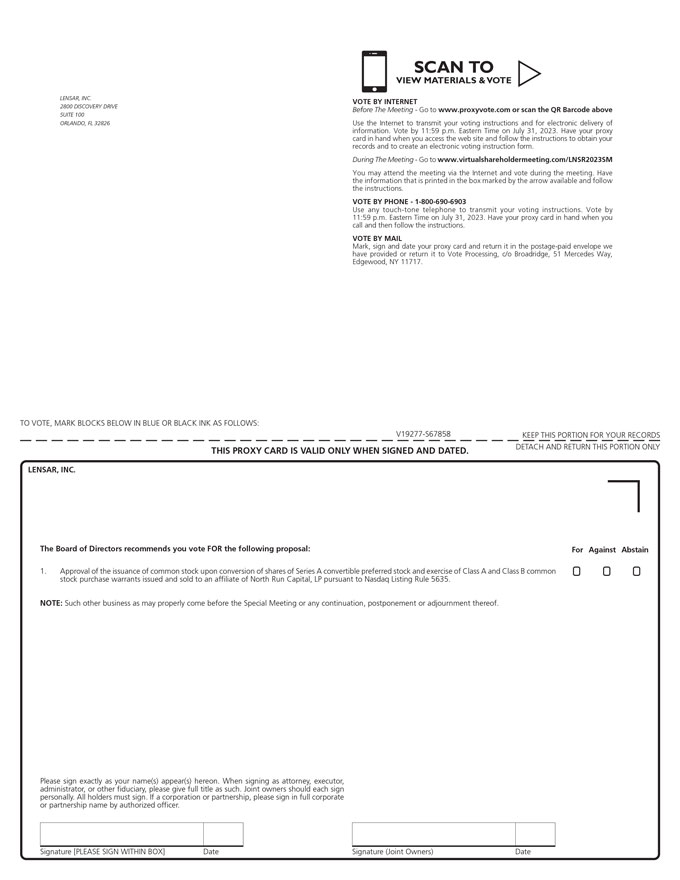

LENSAR, INC. 2800 DISCOVERY DRIVE SUITE 100 ORLANDO, FL 32826 SCAN TO VIEW MATERIALS & VOTE VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 p.m. Eastern Time on July 31, 2023. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/LNSR2023SM You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 p.m. Eastern Time on July 31, 2023. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: V19277-S67858 THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY LENSAR, INC. The Board of Directors recommends you vote FOR the following proposal: For Against Abstain 1. Approval of the issuance of common stock upon conversion of shares of Series A convertible preferred stock and exercise of Class A and Class B common stock purchase warrants issued and sold to an affiliate of North Run Capital, LP pursuant to Nasdaq Listing Rule 5635. NOTE: Such other business as may properly come before the Special Meeting or any continuation, postponement or adjournment thereof. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

Table of Contents

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Notice and Proxy Statement is available at www.proxyvote.com. V19278-S67858 LENSAR, INC. Special Meeting of Stockholders August 1, 2023, 1:00 P.M., Eastern Time This proxy is solicited by the Board of Directors The stockholder(s) hereby appoint(s) each of Nicholas T. Curtis and Thomas R. Staab, II, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorize(s) them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of common stock of LENSAR, Inc. that the stockholder(s) is/are entitled to vote at the Special Meeting of Stockholders to be held at 1:00 P.M., Eastern Time, on August 1, 2023 at www.virtualshareholdermeeting.com/LNSR2023SM, and any continuation, adjournment or postponement thereof. This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors’ recommendations as indicated on the reverse side, and in the discretion of the proxies with respect to such other matters as may properly come before the Special Meeting. Continued and to be signed on reverse side