UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4300 Shawnee Mission Parkway, Suite 100, Fairway, KS | 66205 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company

Corporation Trust Center

1209 Orange St.

Wilmington, DE 19801

(Name and address of agent for service)

With Copies To:

Bo J. Howell

Strauss Troy Co., LPA

Federal Reserve Building

150 E. 4th Street, 4th Floor

Cincinnati, OH 45202-4018

Registrant’s telephone number, including area code: 877-244-6235

Date of fiscal year end: 09/30/2020

Date of reporting period: 09/30/2020

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the Midwood Long/Short Equity Fund (the “Long/Short Fund”), a series of the 360 Funds (the “registrant”), for the period ended September 30, 2020 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”) (17 CFR 270.30e-1), as amended, is filed herewith.

|

Midwood Long/Short Equity Fund

Institutional Class Shares (Ticker Symbol: MDWDX) Investor Class Shares *

A Series of the 360 Funds |

ANNUAL REPORT

September 30, 2020

Investment Adviser:

Midwood Capital Management LLC

280 Summer Street, Suite M1

Boston, MA 02210

1-877-244-6235

Distributed by Matrix 360 Distributors, LLC

Member FINRA

This report is authorized for distribution only to shareholders and to others who have received a copy of the Fund’s prospectus.

IMPORTANT NOTE: Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the Midwood Long/Short Equity Fund’s (the “Fund”) shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling or sending an e-mail request.

* Shares not currently offered for sale.

TABLE OF CONTENTS

| 280 Summer Street | |

| Suite M1 | |

| Boston, MA 02210 | |

| (617) 912-4972 | |

| (617) 875-6644 (cell) |

November 2020

Midwood Long/Short Equity Fund Letter to Shareholders

Dear Shareholder:

I know am I not alone in describing 2020 as a challenging year on many levels. The Midwood Long/Short Equity Fund (the “Fund” or “Midwood”) began operations on January 2, 2020 after converting from a private limited partnership. The Fund got off to a slow start during the first two months of the calendar year as small-cap stocks struggled, but did preserve capital better than the Russell 2000 Small-Cap Total Return Index (“R2000 Small-Cap”) (-5.9% for Midwood vs. -11.3% for R2000 Small-Cap) for the period ended February 29, 2020. The equity markets deteriorated dramatically in March as investors reacted with panic to the pandemic arriving in the U.S. with full force. Having few points of reference regarding the economic impacts of a pandemic like we were experiencing, equity market investors priced in a worst-case scenario for virtually all companies. At its late-March trough, the R2000 Small-Cap, for example, had declined 40% from the beginning of the year.

Aggressive Fed intervention in the capital markets, significant (albeit arguably insufficient and ephemeral) fiscal stimulus, and the realization that the pandemic would actually provide a tailwind to certain businesses (e.g., Amazon, housing), led to a swift rebound in certain segments of the equity markets. Growth stocks – large-cap growth in particular – were propelled higher by the above factors as well as the participation of retail investors taking advantage of new mechanisms to invest in the market.

Unfortunately, Midwood’s longstanding strategy of investing in a concentrated portfolio of small-cap value stocks was at a disadvantage in this market environment. The divergence in returns between value and growth strategies has been stark this year: for example, the Russell 2000 Value Total Return Index (RUJ) was down nearly 22% year-to-date through September 30, 2020 compared to the Russell 2000 Growth Total Return Index (RUO) being up roughly 4%. Such a disparity in performance – a 25-percentage point delta – between small-cap value and growth has been rare in our experience.

The Fund’s short book did provide some ballast against the market’s initial downturn, but obviously not enough given our concentration and value orientation on the long side. In addition, with our short portfolio weighted towards growthier names with high expectations (e.g., Boston Beer Company, Inc. (SAM), Freshpet, Inc. (FRPT)), the market’s snapback and appetite for pandemic beneficiaries created headwinds for our shorts. The Fund did experience some recovery from its late March trough, rebounding 20% by September 30. Even with this recovery, however, the Fund was down approximately 22% through September 30.

We did incur some self-inflicted wounds during the year independent of the pandemic-driven market decline. One of our top five positions entering 2020 was Recro Pharma, Inc. (REPH), a leading contract development and manufacturing organization to the pharmaceutical industry. The company performed exceptionally well during 2019, experiencing revenue and adjusted EBITDA growth of 28% and 52%, respectively. This drove a return of 188% for the stock in 2019. We entered 2020 with a strong belief in the company’s business model and momentum. However, management failed to explain the non-recurring nature of 2019’s gains and the nearer-term headwinds facing the company until giving 2020 guidance in early March. The stock was crushed on its Q4 2019 earnings release and the following two earnings results and lost nearly 90% of its value by September 30. We ultimately lost faith in management and sold the stock, but not soon enough to avoid a significant loss.

1

Nexstar Media Group, Inc. (NXST) is another top five position that materially impacted the Fund’s performance. The stock actually began 2020 on a strong note, climbing nearly 12% by mid-January. However, as a largely fixed cost business (local TV stations) with approximately half of its revenue coming from advertising, combined with a considerable (although manageable) amount of leverage, investors rushed to the exits as the pandemic hit. The stock lost 65% of its value from its mid-January high to its late March low. While some investor concerns were merited – advertising is a discretionary expense that companies certainly curtailed as the pandemic hit – we believe the market reaction was excessive and failed to discount the company’s near-term strengths such as its very strong free cash flow generation and the record-setting political advertising planned for this election cycle. We stuck with the position, and the stock nearly doubled off its low. However, the stock’s 20% year-to-date decline through September 30 dragged on the Fund’s performance.

One meaningful positive contributor to the Fund’s performance was R1 RCM, Inc. (RCM). This outsourced provider of revenue cycle management services to healthcare providers was our largest position during the year. The pandemic did cause some concerns about revenue declines at its acute care hospital customers, but the company’s performance has held up admirably during 2020 with first half revenue growth of over 11% thanks to its high visibility business model. The second half of 2020 is likely to deliver slower growth, but the long-term opportunity for the company remains unchanged. The stock appreciated 35% through September 30.

The rapid, broad market decline in March did afford us the opportunity to purchase some high quality businesses at compelling prices. For example, the Fund purchased industrial names such as Advanced Drainage Systems (WMS), Middleby (MIDD), and JBT Corporation (JBT). The Fund also made opportunistic purchases of leading companies in casual dining (Cheesecake Factory – CAKE), temporary healthcare staffing (AMN Healthcare Services – AMN), and casual footwear (Crocs – CROX) whose stocks experienced significant declines. The recovery paths differ across these businesses, but our entry points provided us with a substantial margin of safety.

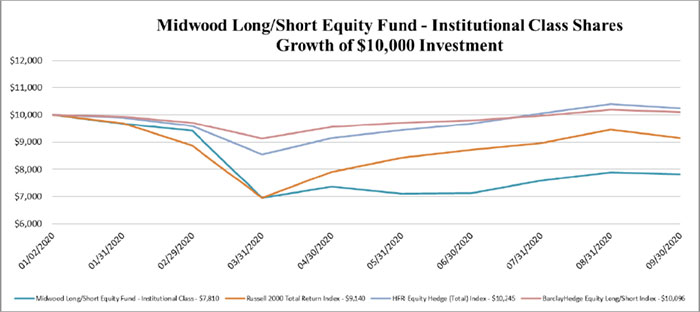

The Fund’s -21.9% return through September 30, 2020 compared unfavorably to the Russell 2000 Total Return Index (“R2000”) of small-cap stocks (-8.6% YTD) and to long/short indices such as HFRI Equity Hedge (Total) Index (“HFRI”) (+2.5% YTD) and BarclayHedge Equity Long/Short Index (“BarclayHedge”) (+1.0% YTD). In the case of the R2000, as mentioned above, there was a large divergence between the value and growth components of the R2000. In the case of the HFRI and BarclayHedge, they include funds with myriad equity strategies outside of small-cap stocks. With the S&P 500 Index of large-cap stocks up 4.7% and the NASDAQ Composite Index returning 23.8%, exposure to sectors other than small-cap value were highly beneficial to equity returns.

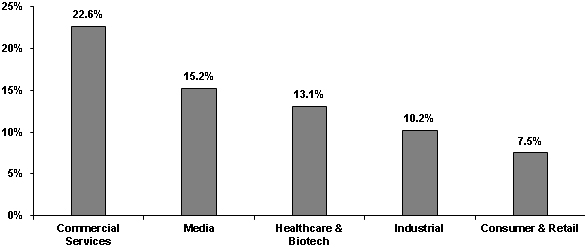

All of the Fund’s investments at September 30, 2020 were in U.S.-based and U.S-listed companies. Our top industry weightings (net) are illustrated below:

The Fund also held 27% of its assets in cash and a small-cap index short position of -18% at September 30, 2020.

2

We have generally managed the portfolio with a heightened sensitivity to downside risk since the market recovery this spring. While some businesses have actually seen positive impacts from the economic effects of the pandemic, we believe that many are likely to see depressed operating performance for some time because the path of the COVID-19 virus will not allow for a return to normalcy in the purchasing behavior of consumers and businesses for certain goods and services. Some market observers have described this as a “K”-shaped recovery, which we think is apt. Yet the prices of many stocks in our opinion do not adequately discount the risk of less favorable outcomes. With certain stocks driving the marquee market indices higher, plus a Federal Reserve ready to step in to protect asset prices, there is in our minds a dangerous disconnect between stock prices and the real economy. Worsening virus numbers plus the prospect of a contested election have the potential to take away the punch bowl for equity investors in the near term.

In light of the Fund’s 2020 performance, limited potential to grow assets under management, and the high operating costs at the Fund’s current size, we recommended to the Board that it was in the best interests of the Fund’s shareholders for the Fund to be liquidated. The Board agreed and approved a Plan of Liquidation, which became effective on October 28, 2020. The Fund is expected to liquidate on or about December 23, 2020. At any time before the liquidation date, shareholders may redeem their shares of the Fund.

We have greatly appreciated the trust that investors have placed in us over these many years as a private fund and now a registered fund. Stay safe.

Sincerely,

Midwood Capital Management LLC

David E. Cohen

Portfolio Manager and Managing Member

3

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

September 30, 2020 (Unaudited)

(1) The minimum initial investment for the Institutional Class is $10,000.

|

Institutional Class Returns as of September 30, 2020 |

|

Commencement of Operations through September 30, 2020* |

|

| Midwood Long/Short Equity Fund Institutional Class | (21.90)% | ||

| Russell 2000 Total Return Index | (8.60)% | ||

| HFRI Equity Hedge (Total) Index | 2.45% | ||

| BarclayHedge Equity Long/Short Index | 0.96% |

* The Midwood Long/Short Equity Fund (the “Fund”) Institutional Class shares commenced operations on January 2, 2020.

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Fund versus the Russell 2000 Total Return Index (“Russell 2000”), the HFRI Equity Hedge (Total) Index (“HFRI Index”) and the BarclayHedge Equity Long/Short Index (“BarclayHedge Index”). The Russell 2000 is a small-cap stock market index of the bottom 2,000 stocks in the Russell 3000 Index. The HFRI Index is an index of multi-strategy hedge fund investment managers who maintains positions both long and short in primarily equity and equity derivative securities. The BarclayHedge Index is a directional strategy involving equity-oriented investing on both the long and short sides of the market. Index returns assume reinvestment of dividends. Investors may not invest in the indexes directly; unlike the Fund’s returns, the indexes do not reflect any fees or expenses. Index returns assume reinvestment of dividends. Investors may not invest in any index directly; unlike the Fund’s returns, each Index does not reflect any fees or expenses. The Fund will generally not invest in all the securities comprising each index.

4

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

September 30, 2020 (Unaudited)

The investment objective of the Fund is to achieve long-term capital appreciation. Midwood Capital Management LLC (the “Adviser”) serves as Investment Adviser to the Fund. As the Fund’s investment adviser, the Adviser reviews, supervises and administers the Fund’s investment program and also ensures compliance with the Fund’s investment policies and guidelines.

The Fund employs a long-short investment strategy to attempt to achieve capital appreciation and manage risk by purchasing small-capitalization stocks believed to be undervalued and selling short small-capitalization stocks believed to be overvalued. The Fund generally maintains a net long bias; however, it is anticipated that the Fund will have at least some short exposure at all times with a maximum of 75% of the Fund’s assets being shorted under normal market conditions.

A fundamental element of the Fund’s strategy is its focus generally on areas of the U.S. equities market with the greatest inefficiencies where extensive research and analysis can seek to generate superior long-run performance with an emphasis on small-capitalization companies. Small-capitalization stocks are those companies with market capitalizations similar to companies in the Russell 2000. The size of the companies in the Index changes with market conditions and the composition of the Index. The Adviser generally defines small-capitalization as between $152 million and $5 billion at the time of purchase. The Adviser believes that the small-cap segment of the U.S. equities market is subject to structural inefficiencies and that its value oriented, fundamental research driven approach can yield proprietary information and insights about these small companies, which can lead to attractive long-term investment returns for the Fund. Notwithstanding the Fund’s intent to focus primarily on small-cap stocks, the Fund may from time to time also take advantage of investment opportunities in mid-cap and large-cap companies. The Adviser will seek to build a focused portfolio consistent with its intensive investment process. The Fund expects to hold a total of approximately 40 to 65 long and short positions, of which 10 to 15 will likely represent core long holdings.

Under normal market conditions, the Fund will invest at least 80% of its net assets (plus borrowings for investment purposes) in long and short positions of domestic equity securities. As part of meeting the 80% test, the Fund’s Adviser may sell or hold the equity securities received incidental to these investments for a period of time depending on market conditions. Similarly, as part of meeting the 80% test, the Fund may also invest in derivatives, such as options, and in other investment companies, including exchange traded funds (“ETFs”) that focus their investments on equity securities. This 80% test is a non-fundamental policy of the Fund and may be changed upon 60 days’ notice to shareholders of the Fund. The Fund may also invest in convertible debt, fixed income, and debt securities, both in United States and foreign securities markets.

Allocation of Portfolio Holdings

| Industry Sector | Percentage of Net Assets* | Industry Sector | Percentage of Net Assets* | |||

| Apparel | 4.41% | Home Furnishings | (2.24)% | |||

| Biotechnology | 7.74% | Machinery-Diversified | 4.62% | |||

| Building Materials | 0.77% | Media | 9.86% | |||

| Chemical | 1.76% | Metal Fabricate & Hardware | 3.08% | |||

| Commercial Services | 20.68% | Office Furnishings | 3.30% | |||

| Distribution & Wholesale | 3.41% | Real Estate Investment Trusts | 5.39% | |||

| Electronics | 1.73% | Retail | 3.09% | |||

| Engineering & Construction | 0.66% | Software | 0.01% | |||

| Food Service | 1.93% | Exchange-Traded Funds | (18.15)% | |||

| Healthcare – Products | 5.33% | Cash, Cash Equivalents & Other Assets in Excess of Liabilities, net | 42.62% | |||

| Total | 100.00% |

* The percentages in the above table are based on the portfolio holdings of the Fund as of September 30, 2020 and are subject to change.

For a detailed break-out of holdings by industry and investment type, please refer to the Schedule of Investments.

5

6

| Midwood Long/Short Equity Fund | ||||||||

| SCHEDULE OF INVESTMENTS | ||||||||

| September 30, 2020 | ANNUAL REPORT | |||||||

| COMMON STOCK - 83.36% (continued) | Shares | Value | ||||||

| Real Estate Investment Trusts - 5.39% | ||||||||

| Outfront Media, Inc. (c) | 82,500 | $ | 1,200,375 | |||||

| Retail - 4.92% | ||||||||

| Cheesecake Factory, Inc. | 20,000 | 554,800 | ||||||

| Designer Brands, Inc. (c) | 99,500 | 540,285 | ||||||

| 1,095,085 | ||||||||

| Software - 0.01% | ||||||||

| Actua Corp. (a) (c ) (d) | 60,003 | 3,000 | ||||||

| TOTAL COMMON STOCK (Cost $14,041,494) | 18,570,025 | |||||||

| SHORT-TERM INVESTMENTS - 27.38% | ||||||||

| Federated Hermes Government Obligations Fund - Institutional Shares, 0.01% (b) (c) | 6,099,321 | 6,099,321 | ||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $6,099,321) | 6,099,321 | |||||||

| TOTAL INVESTMENTS, AT VALUE (Cost $20,140,815) – 110.74% | $ | 24,669,346 | ||||||

| SECURITIES SOLD SHORT (Proceeds $5,437,180) - (25.98%) | (5,788,632 | ) | ||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 15.24% | 3,397,352 | |||||||

| NET ASSETS - 100% | $ | 22,278,066 | ||||||

(a) Non-income producing security.

(b) Rate shown represents the 7-day effective yield at September 30, 2020, is subject to change and resets daily.

(c) All or a portion of the security is segregated as collateral for short positions.

(d) This security is currently valued by the Adviser using fair valuation procedures approved by the Board of Trustees under the oversight of the Fair Valuation Committee.

The accompanying notes are an integral part of these financial statements.

7

| Midwood Long/Short Equity Fund | ||||||||

| SCHEDULE OF INVESTMENTS - SECURITIES SOLD SHORT | ||||||||

| September 30, 2020 | ANNUAL REPORT | |||||||

| SECURITIES SOLD SHORT - (25.98)% | Shares | Value | ||||||

| COMMON STOCK - (7.83)% | ||||||||

| Home Furnishings - (2.24)% | ||||||||

| VOXX International Corp. | 65,000 | $ | (499,850 | ) | ||||

| Machinery-Diversified - (1.51)% | ||||||||

| Welbilt, Inc. | 54,500 | (335,720 | ) | |||||

| Media - (2.25)% | ||||||||

| Sinclair Broadcast Group, Inc. | 26,000 | (499,980 | ) | |||||

| Retail - (1.83)% | ||||||||

| Pier 1 Imports, Inc. | 103,103 | (21,652 | ) | |||||

| Ruth’s Hospitality Group, Inc. | 35,000 | (387,100 | ) | |||||

| (408,752 | ) | |||||||

| TOTAL COMMON STOCK (Proceeds $1,437,580) | (1,744,302 | ) | ||||||

| EXCHANGED TRADED FUNDS - (18.15)% | ||||||||

| iShares Russell 2000 - ETF | 27,000 | (4,044,330 | ) | |||||

| TOTAL EXCHANGE TRADED FUNDS (Proceeds $3,999,600) | (4,044,330 | ) | ||||||

| TOTAL SECURITIES SOLD SHORT (Proceeds $5,437,180) | $ | (5,788,632 | ) | |||||

| ETF - Exchange Traded Fund |

The accompanying notes are an integral part of these financial statements.

8

| Midwood Long/Short Equity Fund | |

| Statement of Assets and Liabilities | |

| September 30, 2020 | ANNUAL REPORT |

| Assets: | ||||

| Investment securities: | ||||

| At cost | $ | 20,140,815 | ||

| At value | 24,669,346 | |||

| Deposits at broker | 3,053,412 | |||

| Due from adviser | 3,180 | |||

| Receivables: | ||||

| Interest | 59 | |||

| Investment securities sold | 357,168 | |||

| Prepaid expenses | 14,631 | |||

| Total assets | 28,097,796 | |||

| Liabilities: | ||||

| Securities sold short: | ||||

| Proceeds from securities sold short | 5,437,180 | |||

| Securities sold short at value | 5,788,632 | |||

| Payables: | ||||

| Due to administrator | 10,693 | |||

| Accrued expenses | 20,405 | |||

| Total liabilities | 5,819,730 | |||

| Net Assets | $ | 22,278,066 | ||

| Sources of Net Assets: | ||||

| Paid-in capital | $ | 20,170,071 | ||

| Total distributable earnings | 2,107,995 | |||

| Total Net Assets | $ | 22,278,066 | ||

| Institutional Class Shares: | ||||

| Net assets | $ | 22,278,066 | ||

| Shares Outstanding (Unlimited shares of beneficial interest authorized) | 2,853,748 | |||

| Net Asset Value and Offering Price Per Share | $ | 7.81 | ||

| Minimum Redemption Price Per Share (a) | $ | 7.65 | ||

(a) A 2.00% redemption fee is imposed on shares redeemed within 30 days from the date of purchase.

The accompanying notes are an integral part of these financial statements.

9

| Midwood Long/Short Equity Fund | ||

| Statement of Operations | ANNUAL REPORT |

| For the | ||||

| Period Ended | ||||

| September 30, 2020 (a) | ||||

| Investment income: | ||||

| Dividends | $ | 93,337 | ||

| Interest | 6,553 | |||

| Total investment income | 99,890 | |||

| Expenses: | ||||

| Advisory fees (Note 6) | 216,869 | |||

| Interest expense | 132,824 | |||

| Accounting and transfer agent fees and expenses | 89,831 | |||

| Dividend expense | 84,284 | |||

| Organizational and offering costs | 50,498 | |||

| Professional fees | 28,499 | |||

| Liquidity Rule Fees | 14,406 | |||

| Compliance officer fees | 11,250 | |||

| Trustee fees and expenses | 10,119 | |||

| Printing & Mailing | 9,799 | |||

| Miscellaneous | 7,299 | |||

| Custodian fees | 6,109 | |||

| Non 12b-1 shareholder servicing fees | 5,224 | |||

| Pricing fees | 3,622 | |||

| Registration and filing fees | 2,121 | |||

| Total expenses | 672,754 | |||

| Less expense reimbursement: | ||||

| Fees waived by Adviser (Note 6) | (65,272 | ) | ||

| Net expenses | 607,482 | |||

| Net investment loss | (507,592 | ) | ||

| Realized and unrealized gain (loss): | ||||

| Net realized gain (loss) on: | ||||

| Investments | 835,839 | |||

| Securities sold short | (2,393,054 | ) | ||

| Foreign currency transactions | (4,277 | ) | ||

| Net realized loss on investments, securities sold short and foreign currency transactions | (1,561,492 | ) | ||

| Net change in unrealized appreciation (depreciation) on: | ||||

| Investments | (5,695,205 | ) | ||

| Securities sold short | 1,196,256 | |||

| Net change in unrealized depreciation on investments and securities sold short | (4,498,949 | ) | ||

| Net loss on investments, securities sold short and foreign currency transactions | (6,060,441 | ) | ||

| Net decrease in net assets resulting from operations | $ | (6,568,033 | ) | |

(a) The Fund commenced operations on January 2, 2020.

The accompanying notes are an integral part of these financial statements.

10

| Midwood Long/Short Equity Fund | ||

| Statement of Changes in Net Assets | ANNUAL REPORT |

| For the | ||||

| Period Ended | ||||

| September 30, 2020 (a) | ||||

| Increase (decrease) in net assets from: | ||||

| Operations: | ||||

| Net investment loss | $ | (507,592 | ) | |

| Net realized loss on investments, securities sold short and foreign currency transactions | (1,561,492 | ) | ||

| Net change in unrealized depreciation on investments and securities sold short | (4,498,949 | ) | ||

| Net decrease in net assets resulting from operations | (6,568,033 | ) | ||

| Transactions in shares of beneficial interest: | ||||

| Proceeds from transfer-in-kind: | ||||

| Institutional Class | 28,174,662 | |||

| Proceeds from shares sold: | ||||

| Institutional Class | 2,217,785 | |||

| Payments for shares redeemed: | ||||

| Institutional Class (b) | (1,546,348 | ) | ||

| Increase in net assets from transactions in shares of beneficial interest | 28,846,099 | |||

| Increase in net assets | 22,278,066 | |||

| Net Assets: | ||||

| Beginning of period | — | |||

| End of period | $ | 22,278,066 | ||

| Share activity: | ||||

| Institutional Class: | ||||

| Shares issued in connection with transfer-in-kind | 2,817,466 | |||

| Shares sold | 246,508 | |||

| Shares redeemed | (210,226 | ) | ||

| Net increase in shares of beneficial interest | 2,853,748 | |||

| (a) The Fund commenced operations on January 2, 2020. |

| (b) Payments for shares redeemed include redemption fees of $117. |

The accompanying notes are an integral part of these financial statements.

11

| Midwood Long/Short Equity Fund | |||

| Financial Highlights | ANNUAL REPORT |

The following table sets forth the per share operating performance data for a share of beneficial interest outstanding, total return, ratios to average net assets and other supplemental data for the period indicated.

| Institutional Class | ||||

| For the | ||||

| Period Ended | ||||

| September 30, 2020(a) | ||||

| Net Asset Value, Beginning of Period | $ | 10.00 | ||

| Investment Operations: | ||||

| Net investment loss (b) | (0.17 | ) | ||

| Net realized and unrealized loss on investments | (2.02 | ) | ||

| Total from investment operations | (2.19 | ) | ||

| Paid in capital from redemption fees | 0.00 | (g) | ||

| Net Asset Value, End of Period | $ | 7.81 | ||

| Total Return (c) | (21.90 | )%(e) | ||

| Ratios/Supplemental Data | ||||

| Net assets, end of period (in 000’s) | $ | 22,278 | ||

| Ratios of expenses to average net assets: | ||||

| Before fees waived and expenses reimbursed (d) | 3.88 | %(f) | ||

| After fees waived and expenses reimbursed | 3.50 | %(f) | ||

| Ratios of expenses to average net assets (excluding dividends and interest on margin account): | ||||

| Before fees waived and expenses reimbursed (d) | 2.63 | %(f) | ||

| After fees waived and expenses reimbursed | 2.25 | %(f) | ||

| Ratios of net investment loss to average net assets | (2.92 | )%(f) | ||

| Portfolio turnover rate | 75 | %(e) | ||

| (a) | The Fund commenced operations on January 2, 2020. | ||||

| (b) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. | ||||

| (c) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. | ||||

| (d) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the Adviser. | ||||

| (e) | Not annualized | ||||

| (f) | Annualized | ||||

| (g) | Redemption fees were less than $0.005 per share. | ||||

The accompanying notes are an integral part of these financial statements.

12

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2020

| 1. | ORGANIZATION |

The Midwood Long/Short Equity Fund (the “Fund”) was organized on January 2, 2020 as a non-diversified series of 360 Funds (the “Trust”). As a non-diversified Fund, it may invest a significant portion of its assets in a small number of companies. The Fund commenced operations on January 2, 2020. The Trust was organized on February 24, 2005, as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund’s investment objective is to achieve long-term capital appreciation. The Fund’s investment adviser is Midwood Capital Management LLC (the “Adviser” or “Former Sub-Adviser”). The Fund has two classes of shares, Institutional Class and Investor Class, but currently offers only the Institutional Class.

Effective as of the close of business on January 2, 2020, pursuant to an Agreement and Plan of Reorganization (the “Reorganization”), the Fund received all of the assets and liabilities of Midwood Capital Partners, L.P. (the “Predecessor Fund”). The partners of the Predecessor Fund received 2,817,466 shares of the Fund, valued at $10.00 per share, with aggregate net asset value of $28,174,662, which included $8,676,028 of unrealized appreciation, immediately prior to the Reorganization. The Predecessor Fund’s investment objectives, policies and limitations were substantially identical to those of the Fund, which had no operations prior to the Reorganization. The Reorganization was treated as a tax-free reorganization for federal income tax purposes and, accordingly, the basis of the assets of the Fund reflect the historical basis of the assets of the Predecessor Fund as of the date of the Reorganization. The Reorganization is also considered tax-free based on accounting principles generally accepted in the United States of America (“GAAP”).

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is an investment company that follows the accounting and reporting guidance of Accounting Standards Codification Topic 946 applicable to investment companies.

a) Security Valuation – All investments in securities are recorded at their estimated fair value, as described in note 2.

b) Investment Companies – The Fund may invest in investment companies such as open-end funds (mutual funds), exchange traded funds (“ETFs”) and closed-end funds (also referred to as “Underlying Funds”) subject to limitations as defined in the Investment Company Act of 1940. Your cost of investing in the Fund will generally be higher than the cost of investing directly in the Underlying Funds. By investing in the Fund, you will indirectly bear fees and expenses charged by the Underlying Funds in which the Fund invests in addition to the Fund’s direct fees and expenses. Also, with respect to dividends paid by the Underlying Funds, it is possible for these dividends to exceed the underlying investments' taxable earnings and profits resulting in the excess portion of such dividends being designated as a return of capital. Distributions received from investments in securities that represent a return of capital or capital gains are recorded as a reduction of the cost of investments or as a realized gain, respectively.

The Fund may invest a significant portion of its assets in shares of one or more Investment Companies (i.e., ETF’s). From time to time, the Fund may invest greater than 25% of its net assets in one security. As of September 30, 2020, the Federated Hermes Government Obligations Fund - Institutional Shares represented 27.38% of the Fund’s net assets; the security is a money market fund that invests in securities of the U.S. treasury and government agencies. Additional information for this security, including its financial statements, is available from the U.S. Securities and Exchange Commission’s website at www.sec.gov.

c) Federal Income Taxes – The Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. Therefore, no federal income tax or excise provision is required.

As of and during the period from January 2, 2020 (commencement of operations) through September 30, 2020 (the “period”), the Fund did not have a liability for any unrecognized tax expenses. The Fund recognizes interest and penalties, if any, related to unrecognized tax liability as income tax expense in the statement of operations. During the period ended September 30, 2020, the Fund did not incur any interest or penalties. The Fund identifies its major tax jurisdictions as U.S. Federal and Delaware state.

13

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2020

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

In addition, GAAP requires management of the Fund to analyze all open tax years, as defined by IRS statute of limitations for all major industries, including federal tax authorities and certain state tax authorities. Management has reviewed the Fund’s tax positions to be taken on federal income tax returns for the open tax period ending September 30, 2020 and has determined that the Fund does not have a liability for uncertain tax positions. The Fund has no examinations in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

d) Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. GAAP requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in capital or net realized gains.

e) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

f) Short Sales – The Fund may make short sales of securities consistent with its strategies. A short sale is a transaction in which the Fund sells a security it does not own in anticipation that the market price of that security will decline.

When the Fund makes a short sale, it must borrow the security sold short and deliver a security equal in value to the security sold short to the broker-dealer through which it made the short sale as collateral for its obligation to deliver the security upon conclusion of the sale. The Fund may have to pay a fee to borrow particular securities and is often obligated to pay over any accrued interest and dividends on such borrowed securities.

If the price of the security sold short increases between the time of the short sale and the time that the Fund replaces the borrowed security, the Fund will incur a loss; conversely, if the price declines, the Fund will realize a capital gain. Any gain will be decreased, and any loss increased, by the transaction costs described above. The successful use of short selling may be adversely affected by imperfect correlation between movements in the price of the security sold short and the securities being hedged.

To the extent that the Fund engages in short sales, it will provide collateral to the broker-dealer and (except in the case of short sales “against the box”) will maintain additional asset coverage in the form of segregated or “earmarked” assets that the Adviser determines to be liquid in accordance with procedures established by the Trust’s Board of Trustees (the “Board”) and that is equal to the current market value of the securities sold short until the Fund replaces the borrowed security. A short sale is “against the box” to the extent that the Fund contemporaneously owns, or has the right to obtain at no added cost, securities identical to those sold short. The Fund may engage in short selling to the extent permitted by the federal securities laws and rules and interpretations thereunder. To the extent the Fund engages in short selling in foreign (non-U.S.) jurisdictions, the Fund will do so to the extent permitted by the laws and regulations of such jurisdiction. As of September 30, 2020, portfolio securities valued at $12,382,738 were held in escrow by the custodian as collateral for securities sold short by the Fund.

g) Non-Diversified Fund – The Fund is a non-diversified fund. In general, a non-diversified fund may invest a greater percentage of its assets in a particular issue and may own fewer securities than other mutual funds. Accordingly, a non-diversified fund is generally subject to the risk that a large loss in an individual issue will cause a greater loss for the Fund than it would if the fund was required to hold a larger number of securities or smaller positions.

h) Foreign Currency Translation – Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities and income items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments. Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest and foreign withholding taxes, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains or losses arise from changes in foreign exchange rates on foreign currency denominated assets and liabilities other than investments in securities held at the end of the reporting period.

14

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2020

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

i) Other – Investment and shareholder transactions are recorded on trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds. Dividend income and expenses are recognized on the ex-dividend date or as soon as information is available to the Fund and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

| 3. | SECURITIES VALUATIONS |

Processes and Structure

The Fund’s Board has adopted guidelines for valuing securities and other derivative instruments including in circumstances in which market quotes are not readily available, and has delegated authority to the Adviser to apply those guidelines in determining fair value prices, subject to review by the Board.

Hierarchy of Fair Value Inputs

The Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| • | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| • | Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| • | Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Fair Value Measurements

A description of the valuation techniques applied to the Trust’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stock and ETFs) – Securities traded on a national securities exchange (or reported on the NASDAQ national market) are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in level 1 of the fair value hierarchy. Certain foreign securities may be fair valued using a pricing service that considers the correlation of the trading patterns of the foreign security to the intraday trading in the U.S. markets for investments such as American Depositary Receipts, financial futures, Exchange Traded Funds, and the movement of the certain indexes of securities based on a statistical analysis of the historical relationship and that are categorized in level 2. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are also categorized in level 2.

Money market funds – Money market funds are valued at their net asset value of $1.00 per share and are categorized as level 1.

15

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2020

| 3. | SECURITIES VALUATIONS (continued) |

Derivative instruments – Listed derivatives, including options, that are actively traded, are valued based on quoted prices from the exchange and categorized in level 1 of the fair value hierarchy. Options held by the Fund for which no current quotations are readily available and which are not traded on the valuation date are valued at the mean price and are categorized within level 2 of the fair value hierarchy. Over-the-counter (OTC) derivative contracts include forward, swap, and option contracts related to interest rates; foreign currencies; credit standing of reference entities; equity prices; or commodity prices, and warrants on exchange-traded securities. Depending on the product and terms of the transaction, the fair value of the OTC derivative products can be modeled taking into account the counterparties' creditworthiness and using a series of techniques, including simulation models. Many pricing models do not entail material subjectivity because the methodologies employed do not necessitate significant judgments, and the pricing inputs are observed from actively quoted markets, as is the case of interest rate swap and option contracts. OTC derivative products valued using pricing models are categorized within level 2 of the fair value hierarchy.

In accordance with the Trust’s good faith pricing guidelines, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Adviser would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations. Good faith pricing may also be used in instances when the bonds in which the Fund invests may default or otherwise cease to have market quotations readily available.

The Trustees of the Trust adopted the M3Sixty Consolidated Valuation Procedures, which established a Valuation Committee to work with the Adviser and report to the Board on securities being fair valued or manually priced. The Independent Chairman and Trustee of the Trust, along with the Trust’s Principal Financial Officer and Chief Compliance Officer and other officers of the Trust are members of the Valuation Committee which meets at least monthly or, as required, to review the interim actions and coordination with the Adviser in pricing fair valued securities, and consideration of any unresolved valuation issue or a request to change the methodology for manually pricing a security. In turn, the Independent Chairman provides updates to the Board at the regularly scheduled board meetings as well as interim updates to the board members on substantive changes in a daily valuation or methodology issue.

If the Adviser decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when certain restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Adviser, in conformity with guidelines adopted by and subject to review of the Board and the Fair Valuation Committee. These securities will be categorized as level 3 securities.

The following tables summarize the inputs used to value the Fund’s assets and liabilities measured at fair value as of September 30, 2020.

| Financial Instruments – Assets | ||||||||||||||||

| Security Classification | Level 1 | Level 2 | Level 3 | Totals | ||||||||||||

| Common Stock (1) | $ | 18,567,025 | $ | — | $ | 3,000 | $ | 18,570,025 | ||||||||

| Short-Term Investments | 6,099,321 | — | — | 6,099,321 | ||||||||||||

| Total Assets | $ | 24,666,346 | $ | — | $ | 3,000 | $ | 24,669,346 | ||||||||

16

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2020

| 3. | SECURITY VALUATIONS (continued) |

| Financial Instruments – Liabilities | ||||||||||||||||

| Security Classification | Level 1 | Level 2 | Level 3 | Totals | ||||||||||||

| Common Stock (1) | $ | 1,744,302 | $ | — | $ | — | $ | 1,744,302 | ||||||||

| Exchange-Traded Funds | 4,044,330 | — | — | 4,044,330 | ||||||||||||

| Total Assets | $ | 5,788,632 | $ | — | $ | — | $ | 5,788,632 | ||||||||

(1) For a detailed break-out of common stock by industry, please refer to the Schedule of Investments.

Following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value for the Fund:

|

Balance as of Jan. 2, 2020 |

Realized gain (loss) |

Change in unrealized depreciation |

Purchases | Sales |

Transfers into Level 3 |

Transfers out of

Level 3 |

Balance as of September 30, 2020 |

|||||||||||||||||||||||||

| Common Stock | $ | — | $ | — | $ | (13,801 | ) | $ | 16,801 | $ | — | $ | — | $ | — | $ | 3,000 | |||||||||||||||

| Total | $ | — | $ | — | $ | (13,801 | ) | $ | 16,801 | $ | — | $ | — | $ | — | $ | 3,000 | |||||||||||||||

The net change in unrealized depreciation attributable to Level 3 investments still held at September 30, 2020 was $(13,801) as shown below.

|

Total Change in Unrealized Depreciation |

||||

| Common Stock | $ | (13,801 | ) | |

| Total | $ | (13,801 | ) | |

| 4. | DERIVATIVES TRANSACTIONS |

Realized and unrealized gains and losses on options purchased by the Fund during the period ended September 30, 2020 are recorded in the following locations in the Statement of Operations:

| Net realized gain (loss) on: | Location | Equity Contracts | ||||||

| Put options purchased | Investments | $ | 21,595 | |||||

| Warrants | Investments | 650 | ||||||

| $ | 22,245 | |||||||

There were no open derivative contracts for the Fund at September 30, 2020.

| 5. | INVESTMENT TRANSACTIONS |

For the period ended September 30, 2020, aggregate purchases and sales of investment securities (excluding short-term investments) for the Fund were as follows:

| Purchases | Sales | |||||

| $ | 16,461,240 | $ | 18,527,696 | |||

There were no Government securities purchased or sold during the period.

17

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2020

| 6. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

The Fund had entered into an Investment Advisory Agreement (the “Former Advisory Agreement”) with Crow Point Partners, LLC (the “Former Adviser”). As the Fund’s investment adviser, the Former Adviser reviewed, supervised and administered the Fund’s investment program and also ensured compliance with the Fund’s investment policies and guidelines.

The Former Adviser was responsible for selecting the Fund’s sub-adviser(s), subject to approval by the Board. The Adviser selected a sub-adviser that had shown good investment performance in its areas of expertise. The Former Adviser considered various factors in evaluating a sub-adviser, including: (i) level of knowledge and skill; (ii) performance as compared to its peers or benchmark; (iii) level of compliance with investment rules and strategies; (iv) employees’ facilities and financial strength; and (v) quality of service.

The Former Adviser had entered into an Investment Sub-Advisory Agreement with the Former Sub-Adviser. The Former Adviser also continually monitored the Former Sub-Adviser’s performance through various analyses and through in person, telephone, and written consultations with the Former Sub-Adviser. The Former Adviser discussed its expectations for performance with the Former Sub-Adviser and provided evaluations and recommendations to the Board, including whether or not the Former Sub-Adviser’s contract should be renewed, modified, or terminated.

The Former Adviser was also responsible for running all of the operations of the Fund, except those that were subcontracted to the Former Sub-Adviser, custodian, transfer agent, administrative agent, or other parties. For its services, the Former Adviser was entitled to receive an investment advisory fee from the Fund at an annualized rate of 1.25%, based on the average daily net assets of the Fund. The Former Adviser paid sub-advisory fee to the Former Sub-Adviser from its advisory fee. For the period from January 2, 2020 through June 9, 2020, the Former Adviser earned $133,244 of advisory fees.

Effective June 10, 2020, the Former Adviser resigned and was replaced by the Adviser via a new Investment Advisory Agreement (the “New Advisory Agreement”) and the Investment Sub-Advisory Agreement was terminated. The New Advisory Agreement was approved by the Board at a meeting held on April 30, 2020, and then approved by shareholders at a meeting held on June 10, 2020. The Adviser is responsible for running all of the operations of the Fund, except those that were subcontracted to the custodian, transfer agent, administrative agent, or other parties. For its services, the Adviser is entitled to receive an investment advisory fee from the Fund at an annualized rate of 1.25%, based on the average daily net assets of the Fund. For the period from June 10, 2020 through September 30, 2020, the Adviser earned $83,625 of advisory fees.

The Former Adviser had entered into a written expense limitation agreement, through at least January 31, 2022, under which it had agreed to limit the total expenses of the Fund (excluding interest, taxes, brokerage fees and commissions, other expenditures that are capitalized in accordance with generally accepted accounting principles, acquired fund fees and expenses, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, interest and dividend expense on securities sold short, and amounts, if any payable pursuant to a plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940, as amended (the “1940 Act”)) to an annual rate of 2.25% of the average daily net assets of each class of shares of the Fund. This expense limitation agreement was terminated effective June 10, 2020.

For the period from January 2, 2020 through June 9, 2020, the Former Adviser waived advisory fees of $22,018 and did not reimburse any expenses.

Effective June 10, 2020, the Adviser has entered into a written expense limitation agreement, through at least January 31, 2022, under which it has agreed to limit the total expenses of the Fund (excluding interest, taxes, brokerage fees and commissions, other expenditures that are capitalized in accordance with generally accepted accounting principles, acquired fund fees and expenses, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, interest and dividend expense on securities sold short, and amounts, if any payable pursuant to a plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940, as amended (the “1940 Act”)) to an annual rate of 2.25% of the average daily net assets of each class of shares of the Fund. This expense cap agreement may be terminated by either party upon 90 days’ written notice provided that, in the case of termination by the Adviser, such action shall be authorized by resolution of a majority of the Independent Trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund.

18

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2020

| 6. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS (continued) |

For the period from June 10, 2020 through September 30, 2020, the Adviser waived advisory fees of $43,254 and did not reimburse any expenses.

Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within three years from the date in which the expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. As of September 30, 2020, the total amount of expenses waived/reimbursed subject to recapture and their expiration dates, pursuant to the waiver agreements, was as follows:

| Amount Subject to Recoupment* | Expiration Dates | |||

| $ | 43,254 | September 30, 2023 | ||

* Amounts waived by the Former Adviser are no longer subject to recoupment.

The Fund has entered into an Investment Company Services Agreement (“ICSA”) with M3Sixty Administration, LLC (“M3Sixty”). Pursuant to the ICSA, M3Sixty is responsible for a wide variety of functions, including but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Fund’s portfolio securities; (d) pricing the Fund’s shares; (e) assistance in preparing tax returns; (f) preparation and filing of required regulatory reports; (g) communications with shareholders; (h) coordination of Board and shareholder meetings; (i) monitoring the Fund’s legal compliance; and (j) maintaining shareholder account records.

For the period ended September 30, 2020, M3Sixty earned $89,831, including out of pocket expenses.

The Fund has also entered into a Chief Compliance Officer Service Agreement (“CCO Agreement”) with M3Sixty. Pursuant to the CCO Agreement, M3Sixty agrees to provide a Chief Compliance Officer (“CCO”), as described in Rule 38a-l of the 1940 Act, to the Fund for the period and on the terms and conditions set forth in the CCO Agreement. Pursuant to the CCO Agreement, M3Sixty earned $11,250 during the period ended September 30, 2020.

Certain officers and an interested Trustee of the Trust are also employees or officers of M3Sixty.

Matrix 360 Distributors, LLC (the “Distributor”) acts as the principal underwriter and distributor of the Fund’s shares for the purpose of facilitating the registration of shares of the Fund under state securities laws and to assist in sales of the Fund’s shares pursuant to a Distribution Agreement (the “Distribution Agreement”) approved by the Trustees. The Distribution Agreement between the Fund and the Distributor requires the Distributor to use all reasonable efforts in connection with the distribution of the Fund’s shares. However, the Distributor has no obligation to sell any specific number of shares and will only sell shares for orders it receives.

The Distributor is an affiliate of M3Sixty.

| 7. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX MATTERS |

During the period ended September 30, 2020, the Fund did not pay any distributions.

The tax character of distributable earnings (deficit) at September 30, 2020, was as follows:

|

Undistributed Ordinary Income |

Post-October Loss and Late Year Loss |

Capital Loss Carry Forwards |

Other Book/Tax Differences |

Unrealized Appreciation/ (Depreciation) |

Total Distributable Earnings |

|||||||||||||||||

| $ | — | $ | (1,125,646 | ) | $ | — | $ | (57,487 | ) | $ | 3,291,128 | $ | 2,107,995 | |||||||||

The difference between book basis and tax basis undistributed net investment income (loss), accumulated net realized loss, and unrealized appreciation from investments is primarily attributable to the tax deferral of losses on wash sales. In addition, the amount listed under other book/tax differences for the Fund is primarily attributable to the tax deferral of organizational and offering costs.

19

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2020

| 7. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX MATTERS (continued) |

Capital losses incurred after October 31 and ordinary losses incurred after December 31within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes. At September 30, 2020, the Fund deferred capital and ordinary losses as follows:

| Post-October Capital Losses | Late Year Ordinary Losses | |||||

| $ | 722,282 | $ | 403,364 | |||

At September 30, 2020, the Fund did not have any capital loss carry forwards for federal income tax purposes available to offset future capital gains.

In accordance with GAAP, the Fund may record reclassifications in the capital accounts. These reclassifications have no impact on the net asset value of the Fund and are designed generally to present total distributable earnings and paid-in capital on a tax basis which is considered to be more informative to the shareholder. There were no reclassifications necessary for the period ended September 30, 2020.

For U.S. Federal income tax purposes, the cost of securities owned, gross appreciation, gross depreciation, and net unrealized appreciation/(depreciation) of investments at September 30, 2020, were as follows:

| Cost | Gross Appreciation | Gross Depreciation | Net Appreciation | |||||||||||

| $ | 15,589,586 | $ | 5,316,397 | $ | (2,025,269 | ) | $ | 3,291,128 | ||||||

| 8. | COMMITMENTS AND CONTINGENCIES |

In the normal course of business, the Trust may enter into contracts that may contain a variety of representations and warranties and provide general indemnifications. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, management considers the risk of loss from such claims to be remote.

| 9. | SUBSEQUENT EVENTS |

The Board has approved a Plan of Liquidation (the “Plan”) for the Fund, which became effective on October 28, 2020. The Adviser recommended that the Board approve the Plan due to limited growth in Fund assets and high operating costs at the Fund’s current size. As a result, the Board concluded that it is in the best interest of the Fund’s shareholders to liquidate the Fund. The Fund is expected to liquidate on or about December 23, 2020 (the “Liquidation Date”). Effective October 28, 2020, the Fund is closed to new and subsequent investments. At any time before the Liquidation Date, shareholders may redeem their shares of the Fund.

In accordance with GAAP, Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued, and has determined that there were no other subsequent events requiring recognition or disclosure in the financial statements.

20

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of 360 Funds

and the Shareholders of Midwood Long/Short Equity Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Midwood Long/Short Equity Fund, a series of shares of beneficial interest in 360 Funds (the “Fund”), including the schedule of investments, as of September 30, 2020, and the related statement of operations, the statement of changes in net assets and the financial highlights for the period from January 2, 2020 (commencement of operations) through September 30, 2020, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2020, and the results of its operations, the changes in its net assets and its financial highlights for the period from January 2, 2020 through September 30, 2020, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

21

Our audit included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2020 by correspondence with the custodian and brokers. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the 360 Funds since 2018.

Philadelphia, Pennsylvania

December 7, 2020

22

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

September 30, 2020 (Unaudited)

The Trust, on behalf of the Fund, files a complete schedule of investments with the U.S. Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its report on Form N-PORT. Shareholders may view the filed Form N-PORT by visiting the Commission’s website at http://www.sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

Shareholder Tax Information - The Fund is required to advise you within 60 days of the Fund’s fiscal year end regarding the federal tax status of distributions received by shareholders during the fiscal year. The Fund did not pay any distributions during the fiscal year ended September 30, 2020.

Tax information is reported from the Fund’s fiscal year and not calendar year, therefore, shareholders should refer to their Form 1099-DIV or other tax information which will be mailed in 2021 to determine the calendar year amounts to be included on their 2020 tax returns. Shareholders should consult their own tax advisors.

On June 10, 2020, a Special Meeting of Shareholders (the “Special Meeting”) of the Fund was held for the purpose of voting on the following proposals:

Proposal 1: Approve a new investment advisory agreement between the Fund and the Adviser.

The total number of shares of the Fund present in person or by proxy represented approximately 79.41% of the Fund’s shares entitled to vote at the Special Meeting. The shareholders of the Fund voted to approve Proposal 1. The votes cast by the Fund’s shareholders with respect to Proposal 1 were as follows:

| For | Against | Abstain | |

| Proposal 1 | 2,379,155 | — | — |

23

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

ADDITIONAL INFORMATION

September 30, 2020

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited)

The Trustees are responsible for the management and supervision of the Fund. The Trustees approve all significant agreements between the Trust, on behalf of the Fund, and those companies that furnish services to the Fund; review performance of the Fund; and oversee activities of the Fund. The Statement of Additional Information of the Trust includes additional information about the Fund’s Trustees and is available upon request, without charge, by calling (877) 244-6235.

Trustees and Officers. Following are the Trustees and Officers of the Trust, their age and address, their present position with the Trust or the Fund, and their principal occupation during the past five years. Each of the Trustees of the Trust will generally hold office indefinitely. The Officers of the Trust will hold office indefinitely, except that: (1) any Officer may resign or retire and (2) any Officer may be removed any time by written instrument signed by at least two-thirds of the number of Trustees prior to such removal. In case a vacancy or an anticipated vacancy on the Board of Trustees shall for any reason exist, the vacancy shall be filled by the affirmative vote of a majority of the remaining Trustees, subject to certain restrictions under the 1940 Act. Those Trustees who are “interested persons” (as defined in the 1940 Act) by virtue of their affiliation with either the Trust or the Adviser, are indicated in the table. The address of each trustee and officer is 4300 Shawnee Mission Parkway, Suite 100, Fairway, KS 66205.

|

Name, Address and Year of Birth (“YOB”) |

Position(s) Held with Trust |

Length of Service |

Principal Occupation(s) During Past 5 Years |

Number of Series Overseen |

Other Directorships During Past 5 Years |

| Independent Trustees | |||||

|

Arthur Q. Falk YOB : 1937 |

Trustee | Since 2011 | Retired. | Seven | None |

|

Tom M. Wirtshafter YOB : 1954 |

Trustee | Since 2011 | Senior Vice President, American Portfolios Financial Services, (broker-dealer), American Portfolios Advisors (investment adviser) (2009-Present). | Seven | None |

|

Gary W. DiCenzo YOB: 1962 |

Trustee and Independent Chairman |

Since 2014

Since 2019 |

Partner, Cognios Capital (investment management firm) (2015-2020) Chief Executive officer 2015-2019; President and CEO, IMC Group, LLC (asset management firm consultant) (2010-2015). | Seven | None |

|

Steven D. Poppen YOB : 1968 |

Trustee | Since 2018 | Executive Vice President and Chief Financial Officer, Minnesota Vikings (professional sports organization) (1999-present). | Seven | M3Sixty Funds Trust (3 portfolios) (2015 – present) |

|

Thomas J. Schmidt YOB: 1963 |

Trustee | Since 2018 | Principal, Tom Schmidt & Associates Consulting, LLC (2015-Present). | Seven | None |

| Interested Trustee* | Seven | ||||

|

Randall K. Linscott YOB: 1971 |

President | Since 2013 | Chief Executive Officer, M3Sixty Administration, LLC (2013 – present). | Seven | M3Sixty Funds Trust (3 portfolios) (2015 – present) |

* The Interested Trustee is an Interested Trustee because he is an officer and principal owner of the Administrator.

24

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

ADDITIONAL INFORMATION

September 30, 2020

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited) (continued)

|

Name, Address and Year of Birth (“YOB”) |

Position(s) Held with Trust |

Length of Service |

Principal Occupation(s) During Past 5 Years |

Number of Series Overseen |

Other Directorships During Past 5 Years |

|

Officers |

|||||

|

Andras P. Teleki YOB: 1971 |

Chief Compliance Officer and Secretary |

Since 2015 | Chief Legal Officer, M3Sixty Administration, LLC, M3Sixty Holdings, LLC, Matrix 360 Distributors, LLC and M3Sixty Advisors, LLC (2015-present); Chief Compliance Officer and Secretary, M3Sixty Funds Trust (2016-present); Chief Compliance Officer and Secretary, WP Trust (2016-present); Secretary and Assistant Treasurer, Capital Management Investment Trust (2015); Partner, K&L Gates (2009-2015). | N/A | N/A |

|

Brandon J. Byrd YOB: 1981 |

Assistant Secretary and Anti-Money Laundering Officer

Vice President |

Since 2013

Since 2018 |

Chief Operating Officer, M3Sixty Administration, LLC (2013-present); Anti-Money Laundering Compliance Officer, Monteagle Funds (2015-2016). | N/A | N/A |

|

Larry E. Beaver, Jr.** YOB: 1969 |

Assistant Treasurer | Since 2017 | Fund Accounting, Administration and Tax Officer, M3Sixty Administration, LLC (2017-Present); Director of Fund Accounting & Administration, M3Sixty Administration, LLC (2005-2017); Chief Accounting Officer, Amidex Funds, Inc. (2003-2020); Assistant Treasurer, Capital Management Investment Trust (July 2017-July 2019); Assistant Treasurer, M3Sixty Funds Trust (July 2017-Present; Assistant Treasurer, WP Trust (July 2017-Present); Treasurer and Assistant Secretary, Capital Management Investment Trust (2008-July 2017); Treasurer, 360 Funds Trust (2007-2017); Treasurer, M3Sixty Funds Trust (2015-July 2017); Treasurer, WP Trust (2015-July 2017); Treasurer and Chief Financial Officer, Monteagle Funds (2008-2016). | N/A | N/A |

|

Bo J. Howell YOB: 1981 |

Assistant Secretary | Since 2020 | Shareholder, Strauss Troy Co., LPA (2020-present); Partner, Practus LLP (2018-2020); CEO, Joot (2018-present); Director of Fund Administration, Ultimus Fund Services, LLC (2014-2018). | N/A | N/A |

|

Ted L. Akins YOB: 1974 |

Assistant Secretary | Since 2018 | Vice President of Operations, M3Sixty Administration, LLC (2012-present). | N/A | N/A |

** Effective December 28, 2018, Larry E. Beaver, Jr. was assigned as Interim Treasurer until a new Treasurer is appointed by the Board.

25

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

ADDITIONAL INFORMATION

September 30, 2020

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited) (continued)

Remuneration Paid to Trustees and Officers - Officers of the Trust and Trustees who are “interested persons” of the Trust or the Adviser will receive no salary or fees from the Trust. Officers of the Trust and interested Trustees do receive compensation directly from certain service providers to the Trust, including Matrix 360 Distributors, LLC and M3Sixty Administration, LLC. Each Trustee who is not an “interested person” (an “Independent Trustee”) receives a $5,000 annual retainer (paid quarterly). In addition, each Independent Trustee receives, on a per fund basis: (i) a fee of $1,500 per fund each year (paid quarterly); (ii) a fee of $200 per Board meeting attended; and (iii) a fee of $200 per committee meeting attended. The Trust will also reimburse each Trustee for travel and other expenses incurred in connection with, and/or related to, the performance of their obligations as a Trustee. Officers of the Trust will also be reimbursed for travel and other expenses relating to their attendance at Board meetings.

| Name of Trustee1 |

Aggregate

|

Pension or Retirement

Benefits Accrued As Part of Portfolio Expenses |

Estimated

Annual Benefits Upon Retirement |

Total Compensation

|

||||||||

| Independent Trustees | ||||||||||||

| Arthur Q. Falk | $ | 1,970 | None | None | $ | 1,970 | ||||||

| Tom M. Wirtshafter | $ | 1,570 | None | None | $ | 1,570 | ||||||

| Gary W. DiCenzo | $ | 1,970 | None | None | $ | 1,970 | ||||||

| Steven D. Poppen | $ | 1,570 | None | None | $ | 1,570 | ||||||

| Thomas J. Schmidt | $ | 1,970 | None | None | $ | 1,970 | ||||||

| Interested Trustees and Officers | ||||||||||||

| Randall K. Linscott | None | Not Applicable | Not Applicable | None | ||||||||

1 Each of the Trustees serves as a Trustee to each Series of the Trust. The Trust currently offers seven (7) series of shares.

2 Figures are for the period ended September 30, 2020.

26

| Midwood Long/Short Equity Fund | ANNUAL REPORT |

Information About Your Fund’s Expenses (Unaudited)