Q1 2023 Update 1 Exhibit 99.1

Highlights 03 Financial Summary 04 Operational Summary 06 Vehicle Capacity 07 Core Technology 08 Other Highlights 09 Outlook 10 Photos & Charts 11 Key Metrics 19 Financial Statements 22 Additional Information 28

S U M M A R Y H I G H L I G H T S (1) Excludes SBC (stock-based compensation). (2) Free cash flow = operating cash flow less capex. (3) Includes cash, cash equivalents and investments.

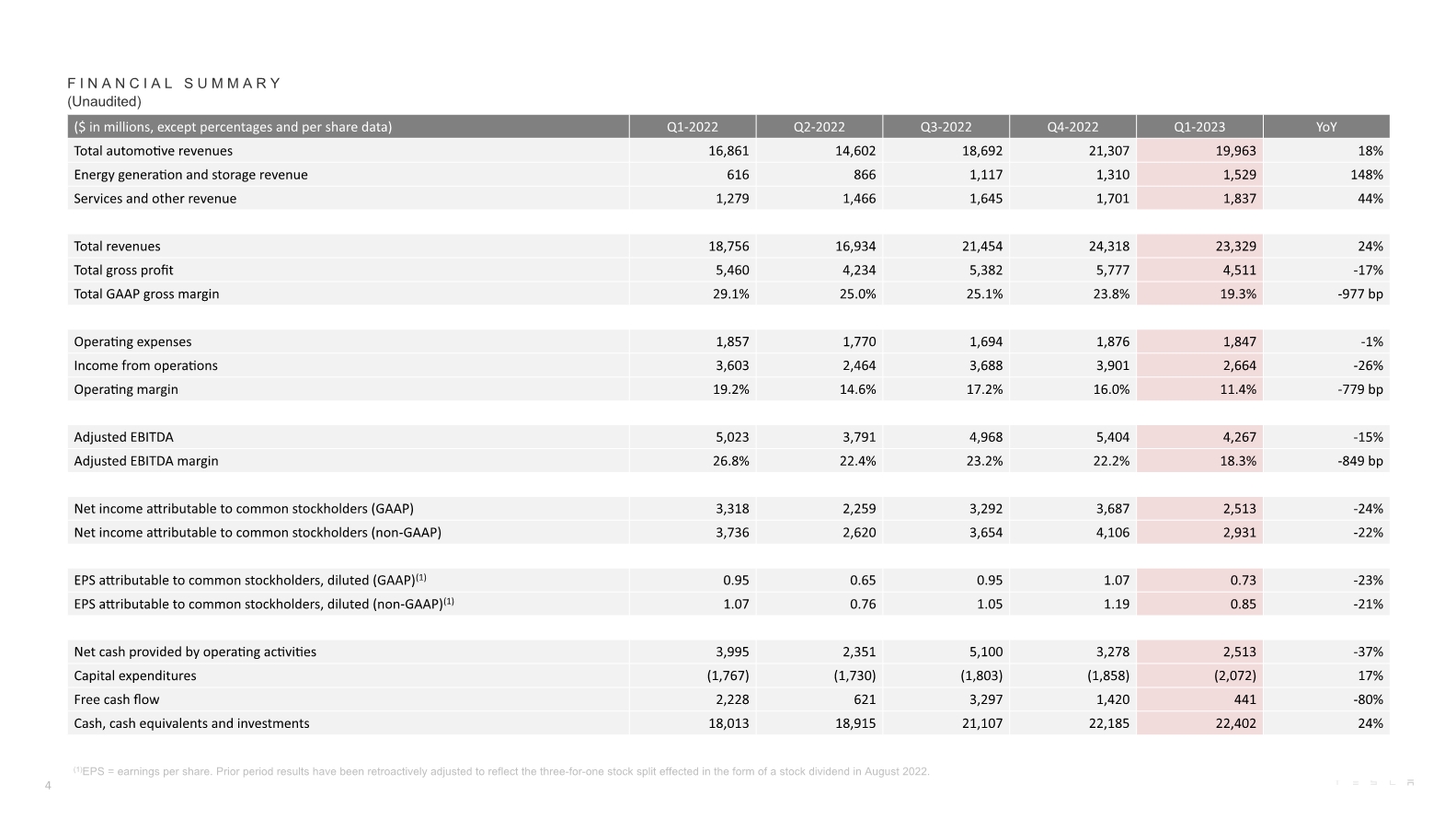

F I N A N C I A L S U M M A R Y (Unaudited) (1)EPS = earnings per share. Prior period results have been retroactively adjusted to reflect the three-for-one stock split effected in the form of a stock dividend in August 2022. 4

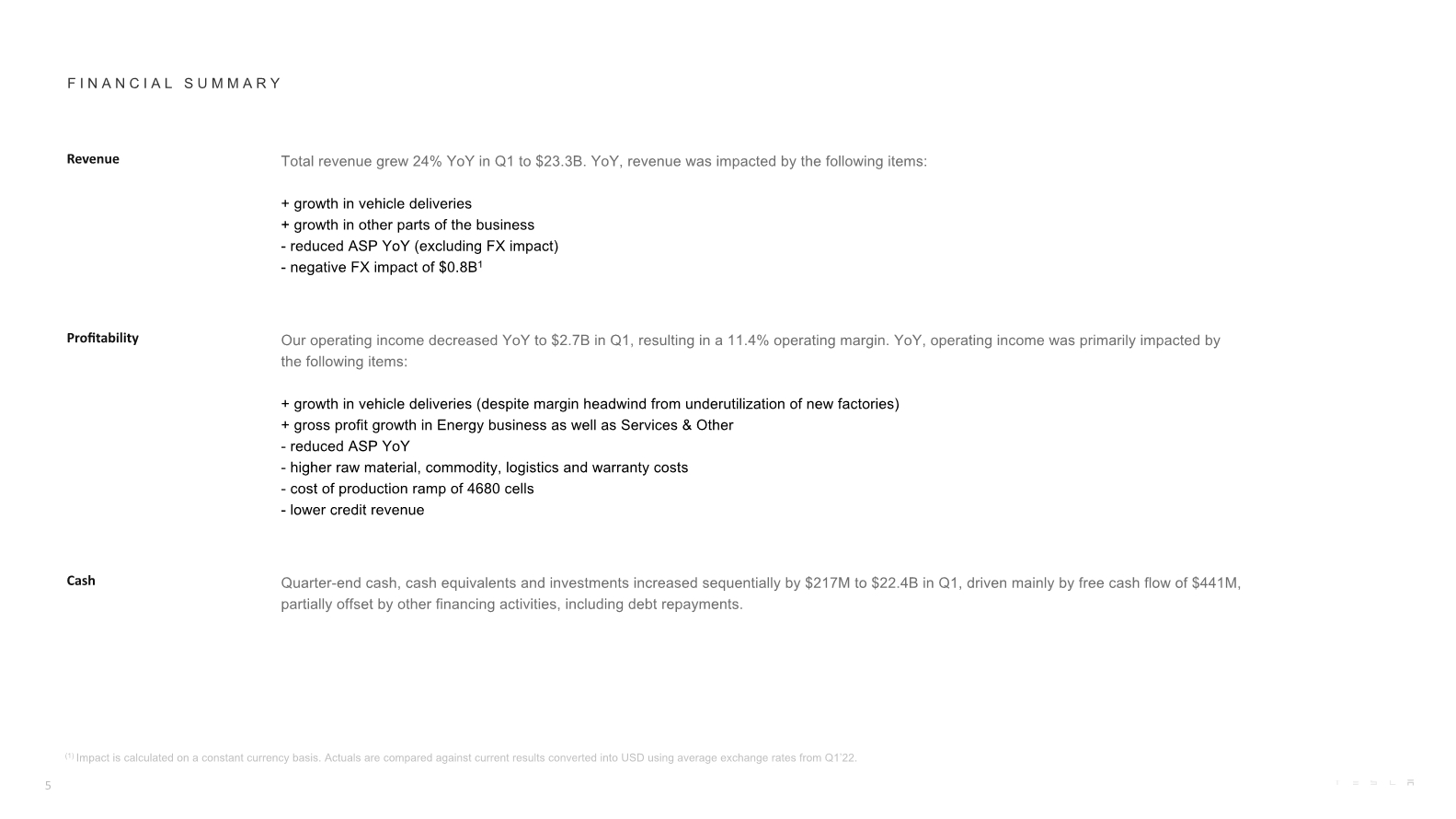

F I N A N C I A L S U M M A R Y 5 (1) Impact is calculated on a constant currency basis. Actuals are compared against current results converted into USD using average exchange rates from Q1’22.

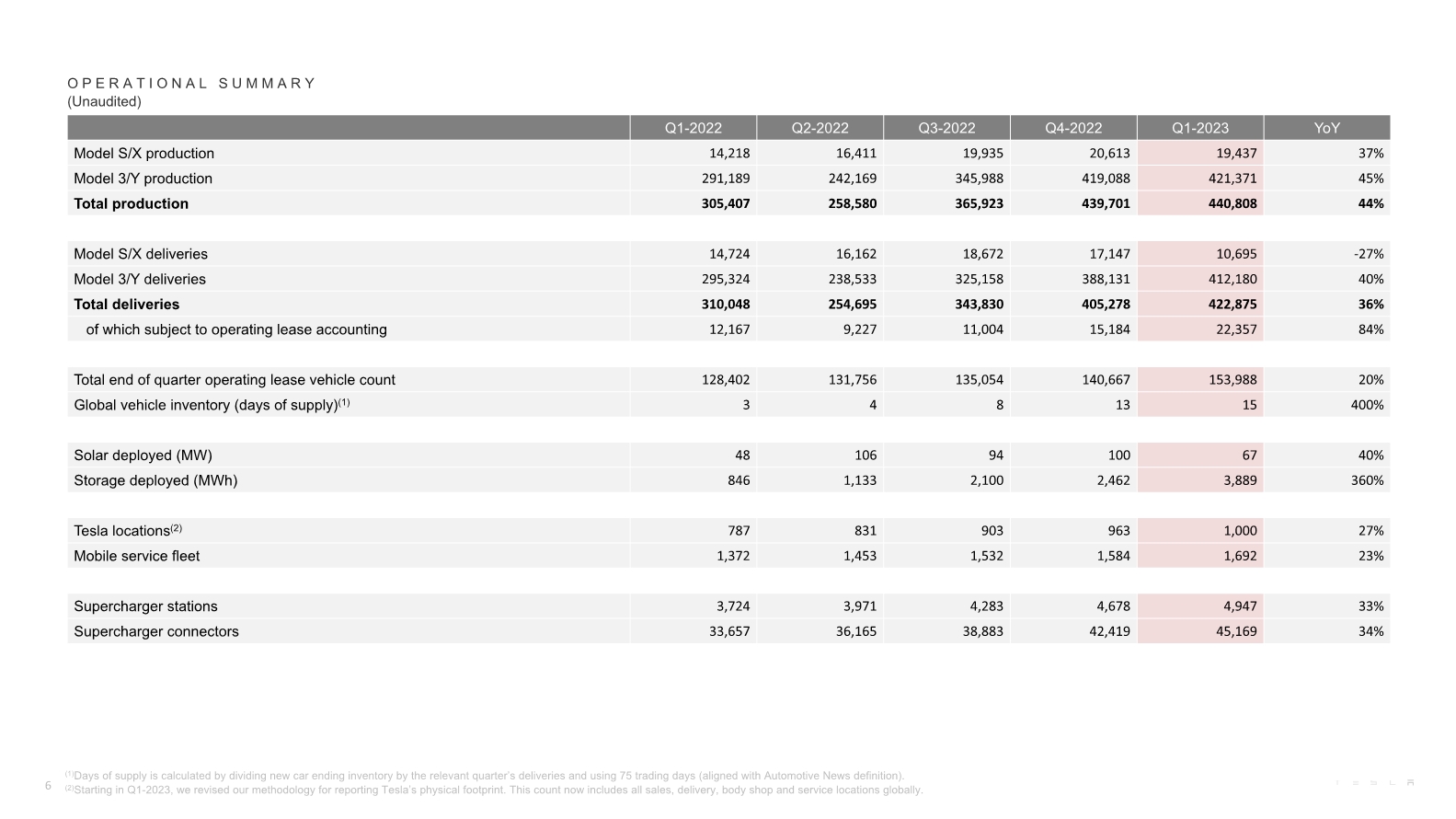

(1)Days of supply is calculated by dividing new car ending inventory by the relevant quarter’s deliveries and using 75 trading days (aligned with Automotive News definition). (2)Starting in Q1-2023, we revised our methodology for reporting Tesla’s physical footprint. This count now includes all sales, delivery, body shop and service locations globally. O P E R A T I O N A L S U M M A R Y (Unaudited) 6

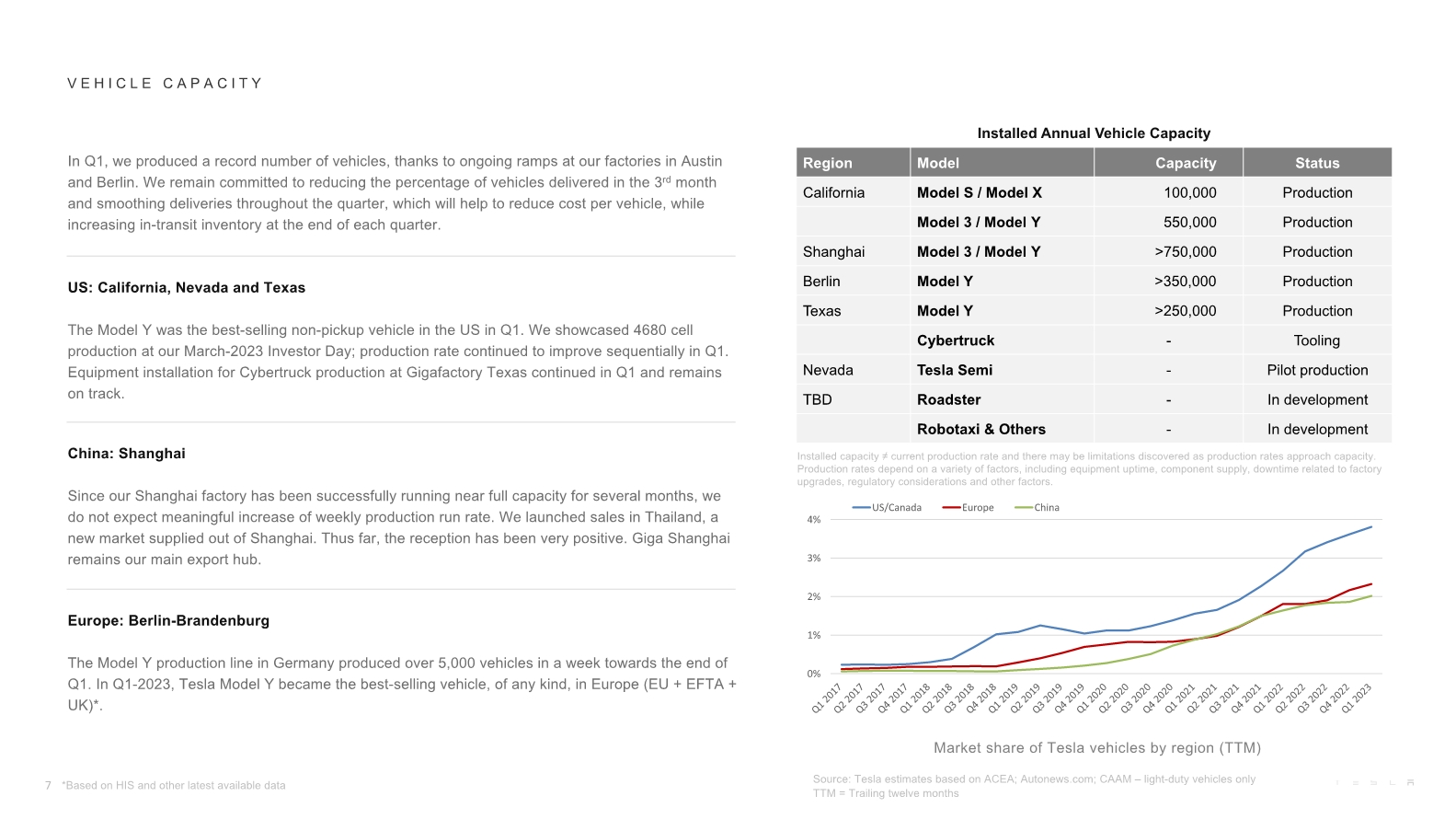

V E H I C L E C A P A C I T Y Installed capacity ≠ current production rate and there may be limitations discovered as production rates approach capacity. Production rates depend on a variety of factors, including equipment uptime, component supply, downtime related to factory upgrades, regulatory considerations and other factors. Market share of Tesla vehicles by region (TTM) Source: Tesla estimates based on ACEA; Autonews.com; CAAM – light-duty vehicles only TTM = Trailing twelve months 7 *Based on HIS and other latest available data

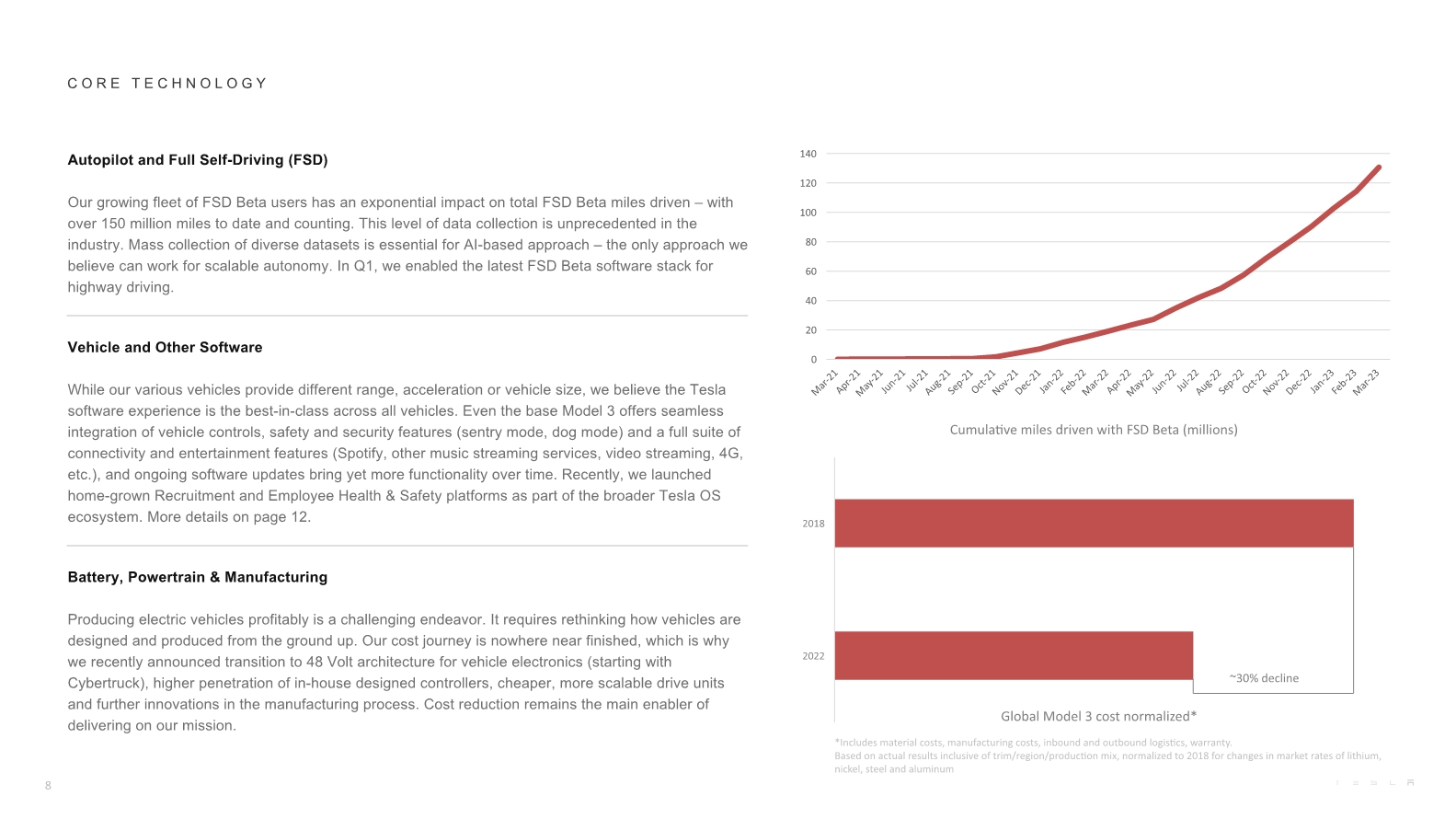

C O R E T E C H N O L O G Y Cumulative miles driven with FSD Beta (millions) 8 Global Model 3 cost normalized* ~30% decline *Includes material costs, manufacturing costs, inbound and outbound logistics, warranty. Based on actual results inclusive of trim/region/production mix, normalized to 2018 for changes in market rates of lithium, nickel, steel and aluminum

O T H E R H I G H L I G H T S 9 Services & Other gross margin Energy Storage deployments (GWh)

O U T L O O K 10

P H O T O S & C H A R T S

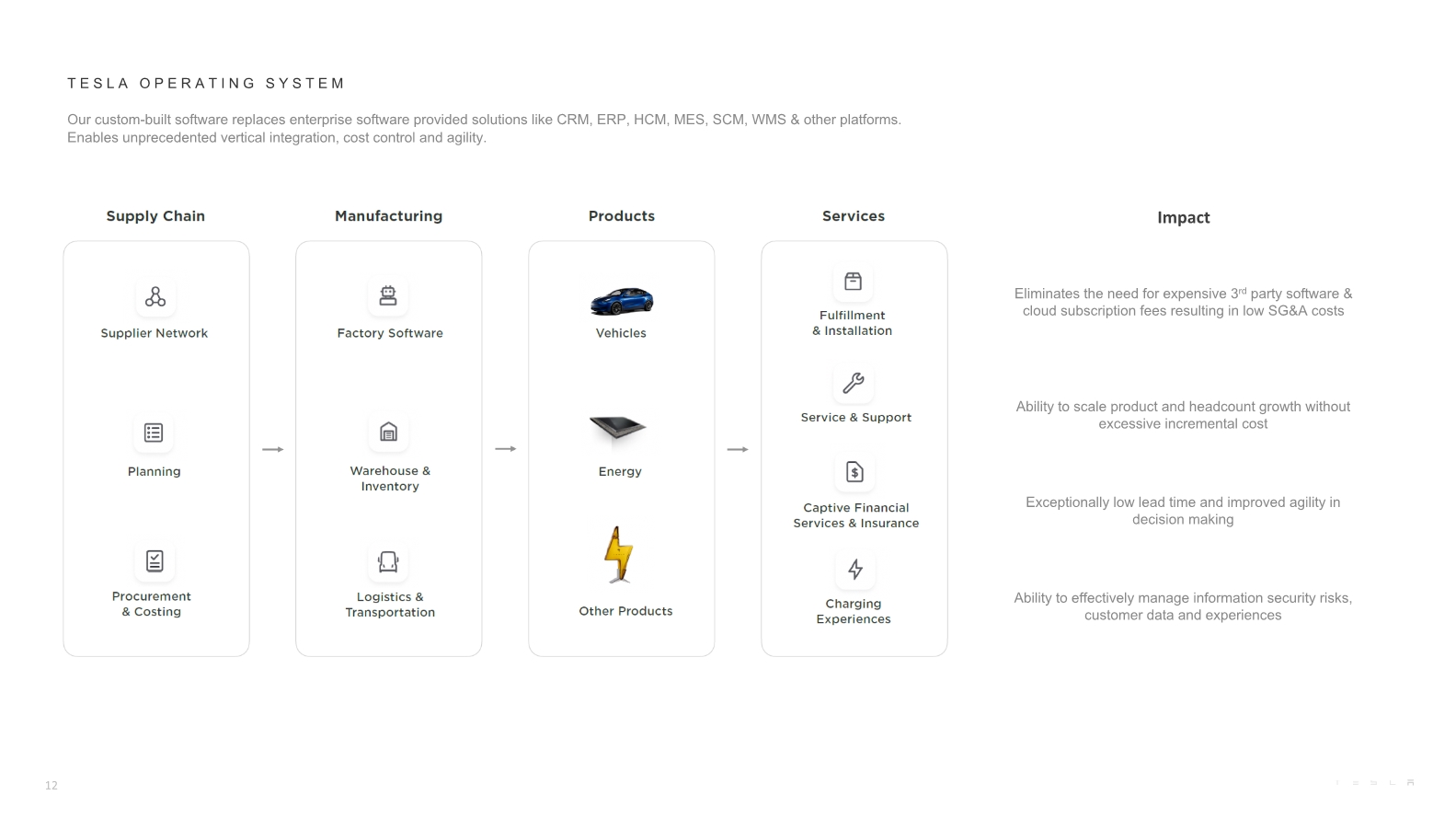

T E S L A O P E R A T I N G S Y S T E M Our custom-built software replaces enterprise software provided solutions like CRM, ERP, HCM, MES, SCM, WMS & other platforms. Enables unprecedented vertical integration, cost control and agility. 12 Eliminates the need for expensive 3rd party software & cloud subscription fees resulting in low SG&A costs Ability to scale product and headcount growth without excessive incremental cost Exceptionally low lead time and improved agility in decision making Ability to effectively manage information security risks, customer data and experiences Impact

C Y B E R T R U C K P I L O T L I N E 13

C Y B E R T R U C K P I L O T L I N E 14

G I G A F A C T O R Y T E X A S — T O O L I N G F O R C Y B E R T R U C K P R O D U C T I O N L I N E 15

C Y B E R T R U C K W I N T E R T E S T I N G 16

M E G A F A C T O R Y L A T H R O P , C A — M E G A P A C K B O D Y L I N E 17

G I G A F A C T O R Y T E X A S — 4 6 8 0 C E L L P R O D U C T I O N 18

Vehicle Deliveries (millions of units) K E Y M E T R I C S Q U A R T E R L Y (Unaudited) Operating Cash Flow ($B) Free Cash Flow ($B) Net Income ($B) Adjusted EBITDA ($B) 19

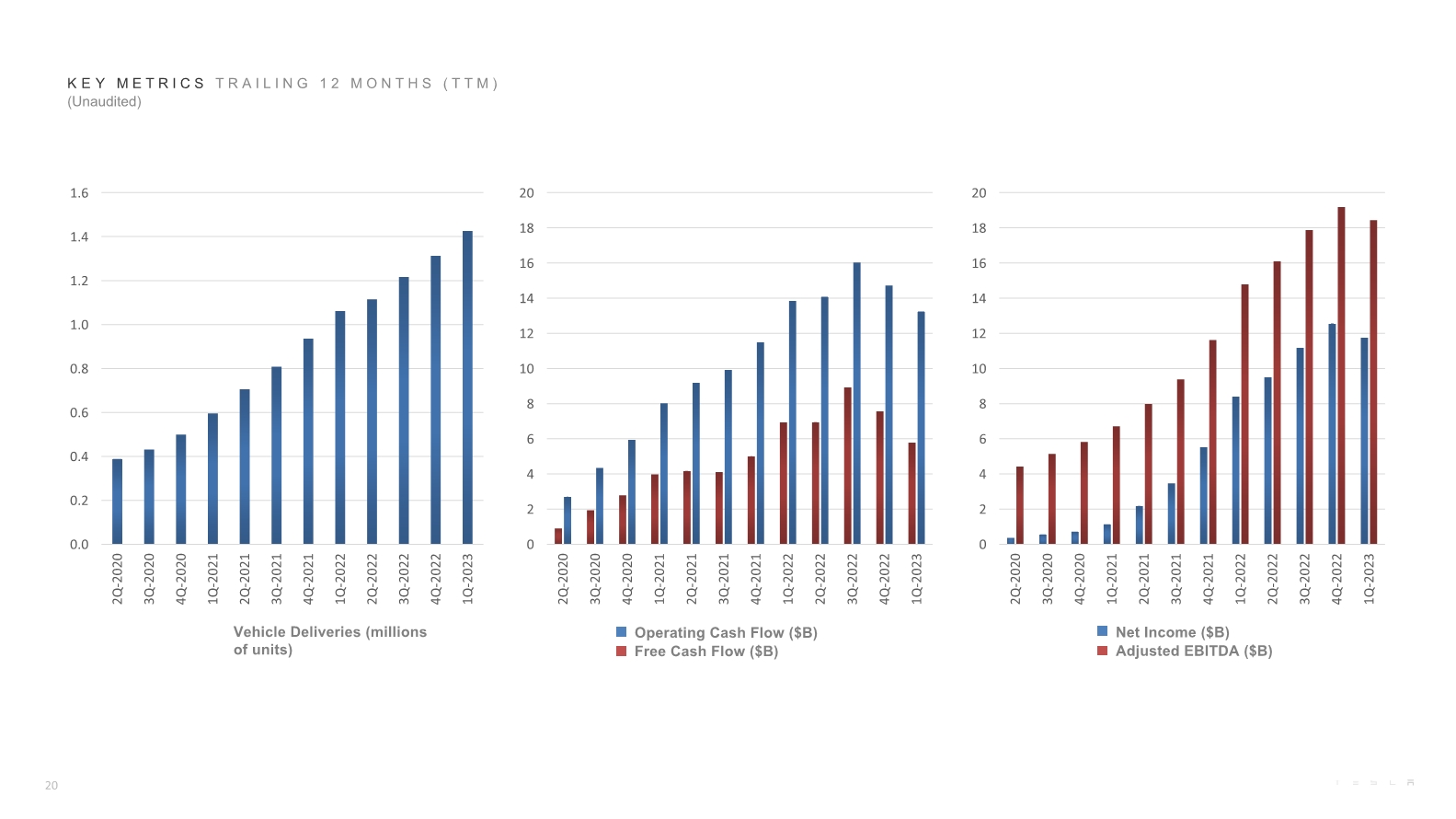

Operating Cash Flow ($B) Free Cash Flow ($B) K E Y M E T R I C S T R A I L I N G 1 2 M O N T H S ( T T M ) (Unaudited) Net Income ($B) Adjusted EBITDA ($B) 20 Vehicle Deliveries (millions of units)

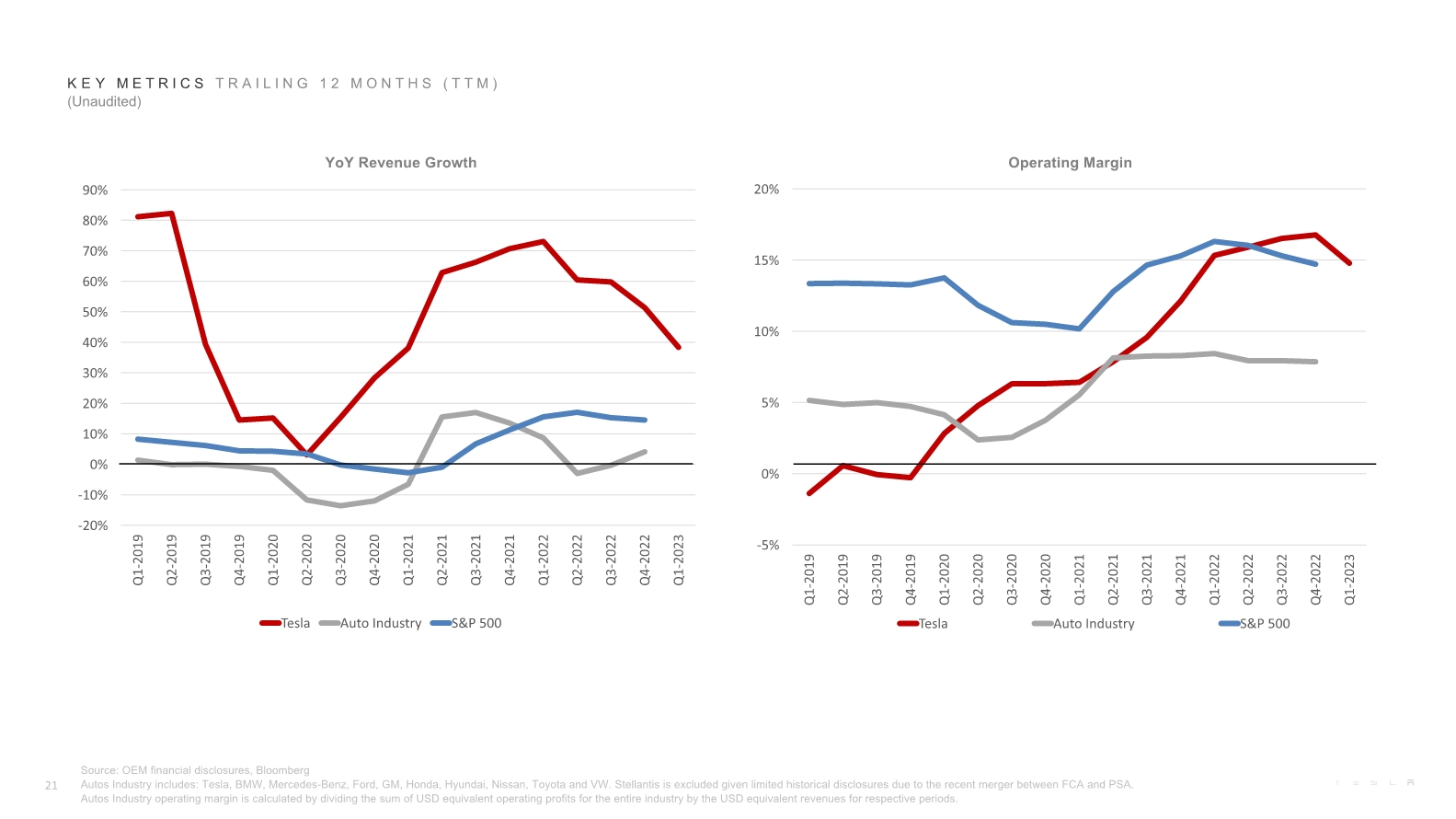

K E Y M E T R I C S T R A I L I N G 1 2 M O N T H S ( T T M ) (Unaudited) 21 YoY Revenue Growth Operating Margin Source: OEM financial disclosures, Bloomberg Autos Industry includes: Tesla, BMW, Mercedes-Benz, Ford, GM, Honda, Hyundai, Nissan, Toyota and VW. Stellantis is excluded given limited historical disclosures due to the recent merger between FCA and PSA. Autos Industry operating margin is calculated by dividing the sum of USD equivalent operating profits for the entire industry by the USD equivalent revenues for respective periods.

F I N A N C I A L S T A T E M E N T S

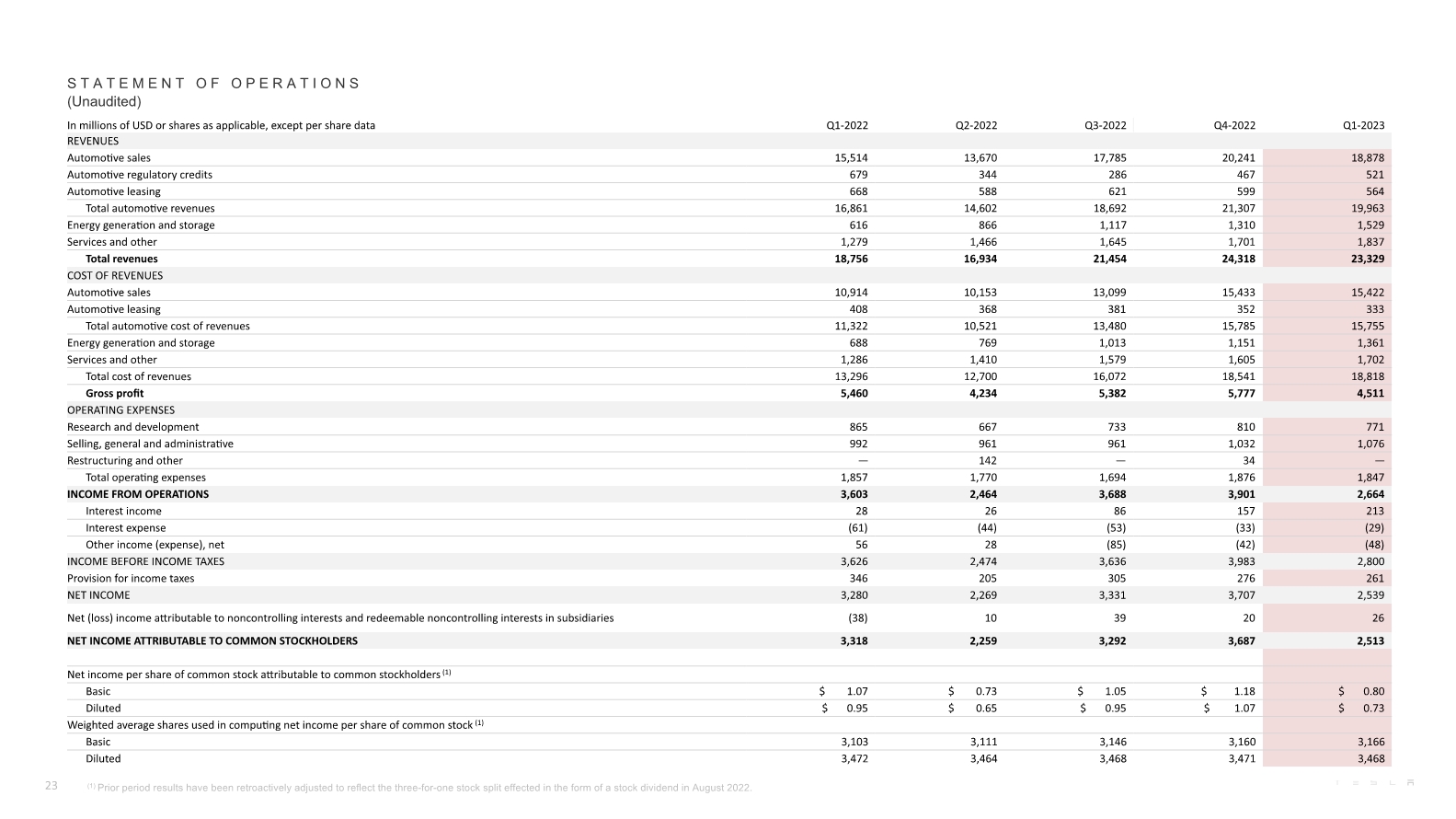

S T A T E M E N T O F O P E R A T I O N S (Unaudited) 23 (1) Prior period results have been retroactively adjusted to reflect the three-for-one stock split effected in the form of a stock dividend in August 2022.

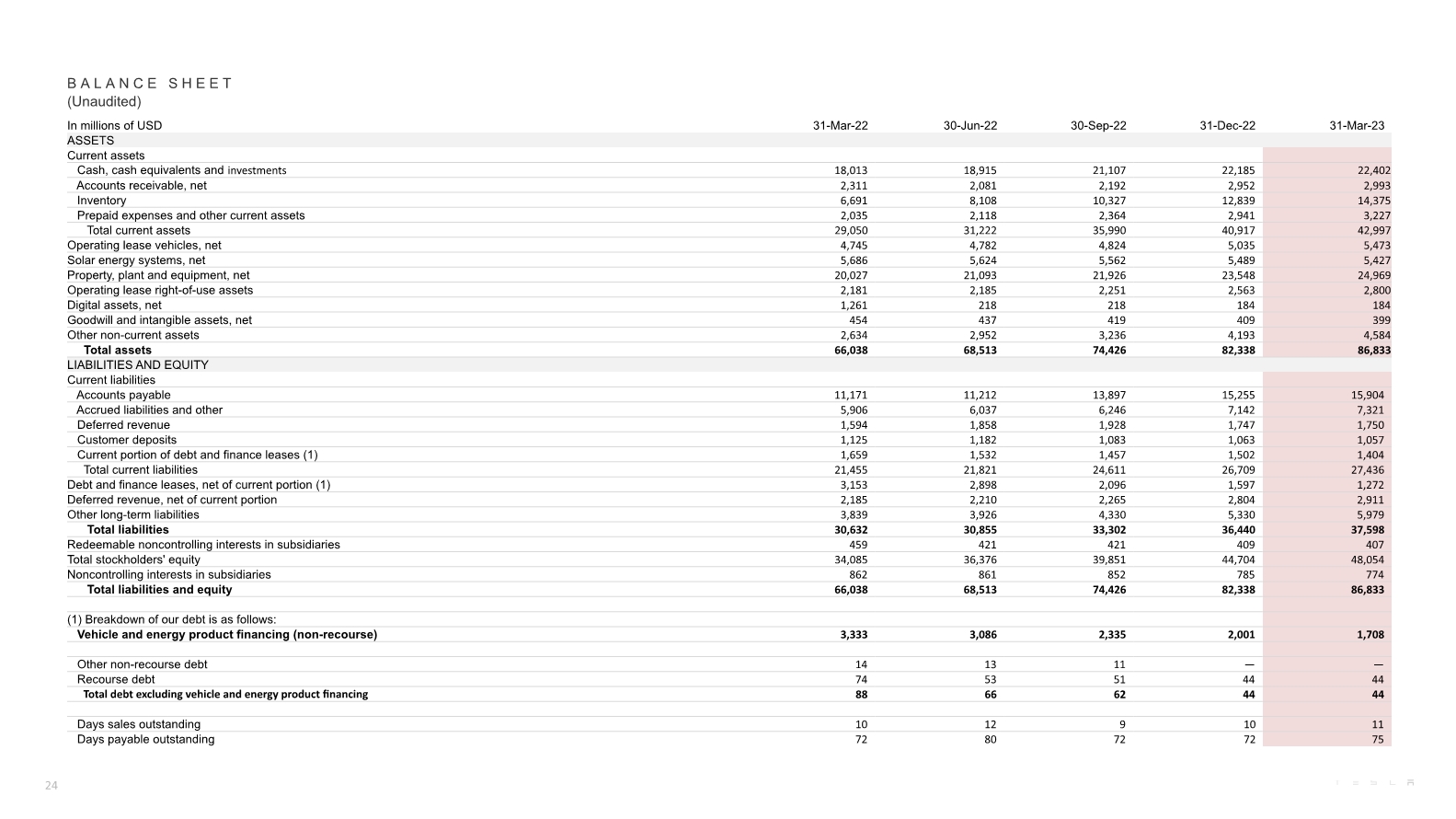

B A L A N C E S H E E T (Unaudited) 24

S T A T E M E N T O F C A S H F L O W S (Unaudited) 25

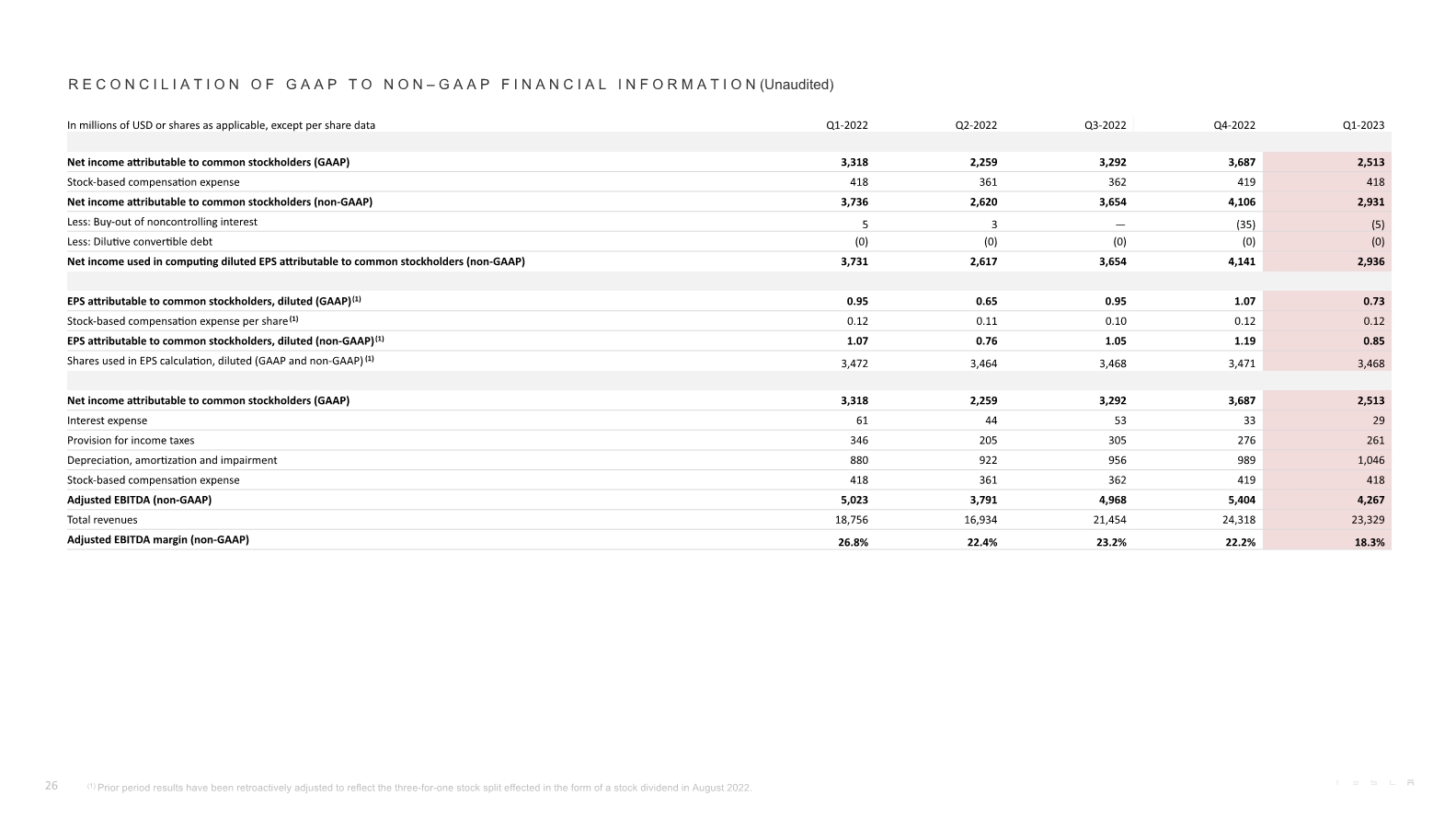

R e c o n c I l I a t I o n o f G A A P t o N o n – G A A P F I n a n c I a l I n f o r m a t I o n (Unaudited) 26 (1) Prior period results have been retroactively adjusted to reflect the three-for-one stock split effected in the form of a stock dividend in August 2022.

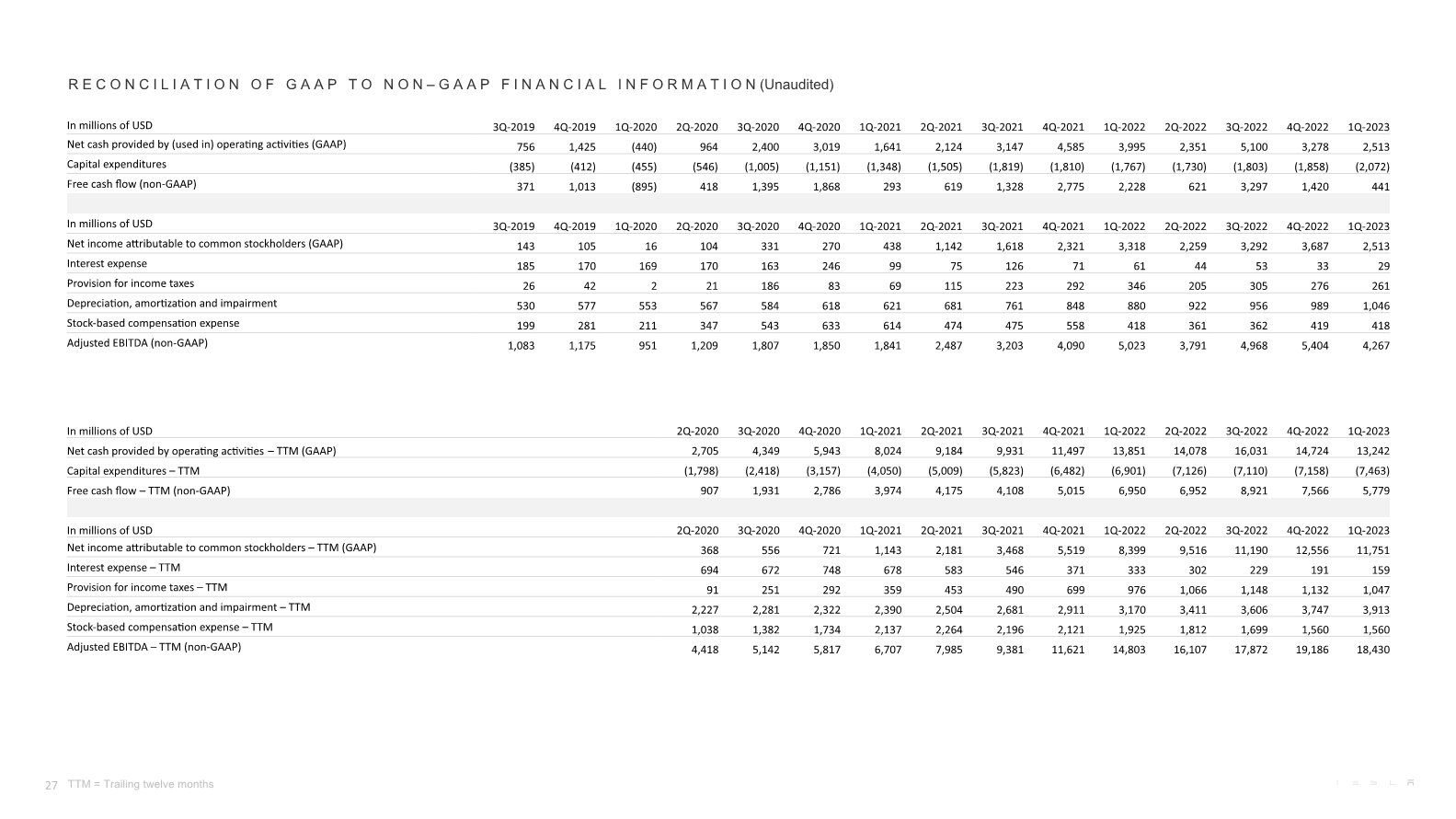

R e c o n c I l I a t I o n o f G A A P t o N o n – G A A P F I n a n c I a l I n f o r m a t I o n (Unaudited) TTM = Trailing twelve months 27

A D D I T I O N A L I N F O R M A T I O N WEBCAST INFORMATION Tesla will provide a live webcast of its first quarter 2023 financial results conference call beginning at 4:30 p.m. CT on April 19, 2023 at ir.tesla.com. This webcast will also be available for replay for approximately one year thereafter. CERTAIN TERMS When used in this update, certain terms have the following meanings. Our vehicle deliveries include only vehicles that have been transferred to end customers with all paperwork correctly completed. Our energy product deployment volume includes both customer units installed and equipment sales; we report installations at time of commissioning for storage projects or inspection for solar projects, and equipment sales at time of delivery. "Adjusted EBITDA" is equal to (i) net income (loss) attributable to common stockholders before (ii)(a) interest expense, (b) provision for income taxes, (c) depreciation, amortization and impairment and (d) stock-based compensation expense, which is the same measurement for this term pursuant to the performance-based stock option award granted to our CEO in 2018. "Free cash flow" is operating cash flow less capital expenditures. Average cost per vehicle is cost of automotive sales divided by new vehicle deliveries (excluding leases). “Days sales outstanding” is equal to (i) average accounts receivable, net for the period divided by (ii) total revenues and multiplied by (iii) the number of days in the period. “Days payable outstanding” is equal to (i) average accounts payable for the period divided by (ii) total cost of revenues and multiplied by (iii) the number of days in the period. “Days of supply” is calculated by dividing new car ending inventory by the relevant quarter’s deliveries and using 75 trading days. Constant currency impacts are calculated by comparing actuals against current results converted into USD using average exchange rates from the prior period. NON-GAAP FINANCIAL INFORMATION Consolidated financial information has been presented in accordance with GAAP as well as on a non-GAAP basis to supplement our consolidated financial results. Our non-GAAP financial measures include non-GAAP net income (loss) attributable to common stockholders, non-GAAP net income (loss) attributable to common stockholders on a diluted per share basis (calculated using weighted average shares for GAAP diluted net income (loss) attributable to common stockholders), Adjusted EBITDA, Adjusted EBITDA margin and free cash flow. These non-GAAP financial measures also facilitate management’s internal comparisons to Tesla’s historical performance as well as comparisons to the operating results of other companies. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial planning purposes. Management also believes that presentation of the non-GAAP financial measures provides useful information to our investors regarding our financial condition and results of operations, so that investors can see through the eyes of Tesla management regarding important financial metrics that Tesla uses to run the business and allowing investors to better understand Tesla’s performance. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Tesla’s operating performance. A reconciliation between GAAP and non-GAAP financial information is provided above. FORWARD-LOOKING STATEMENTS Certain statements in this update, including statements in the “Outlook” section; statements relating to the future development, ramp, production capacity, efficiency and output rates, supply chain, demand and market growth, cost, pricing and profitability, deliveries, deployment, availability and other features and improvements and timing of existing and future Tesla products and technologies such as Model 3, Model Y, Model X, Model S, Cybertruck, Tesla Semi, our next generation vehicle platform, our Autopilot, Full Self-Driving and other vehicle software and AI enabled products, our battery cells, our Supercharging network and our energy storage and solar products; statements regarding operating margin, operating profits, spending and liquidity; and statements regarding expansion, improvements and/or ramp and related timing at our factories are “forward-looking statements” that are subject to risks and uncertainties. These forward-looking statements are based on management’s current expectations, and as a result of certain risks and uncertainties, actual results may differ materially from those projected. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: uncertainties in future macroeconomic and regulatory conditions arising from the current global pandemic; the risk of delays in launching and manufacturing our products and features cost-effectively; our ability to grow our sales, delivery, installation, servicing and charging capabilities and effectively manage this growth; consumers’ demand for electric vehicles generally and our vehicles specifically; the ability of suppliers to deliver components according to schedules, prices, quality and volumes acceptable to us, and our ability to manage such components effectively; any issues with lithium-ion cells or other components manufactured at our factories; our ability to ramp our factories in accordance with our plans; our ability to procure supply of battery cells, including through our own manufacturing; risks relating to international expansion; any failures by Tesla products to perform as expected or if product recalls occur; the risk of product liability claims; competition in the automotive and energy product markets; our ability to maintain public credibility and confidence in our long-term business prospects; our ability to manage risks relating to our various product financing programs; the status of government and economic incentives for electric vehicles and energy products; our ability to attract, hire and retain key employees and qualified personnel and ramp our installation teams; our ability to maintain the security of our information and production and product systems; our compliance with various regulations and laws applicable to our operations and products, which may evolve from time to time; risks relating to our indebtedness and financing strategies; and adverse foreign exchange movements. More information on potential factors that could affect our financial results is included from time to time in our Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in our annual report on Form 10-K filed with the SEC on January 31, 2023. Tesla disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events or otherwise. 28