Filed

with the Securities and Exchange Commission on September 4, 2009

1933 Act

Registration File No. 333-________

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

N-14

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933 [X]

|

[ ] Pre-Effective

Amendment No.

|

___

|

||

|

[ ]

Post-Effective Amendment

No.

|

___

|

(Check

appropriate box or boxes.)

INVESTMENT MANAGERS SERIES

TRUST

(Exact

Name of Registrant as Specified in Charter)

803 West

Michigan Street

Milwaukee,

WI 53233

(Address

of Principal Executive Offices, including Zip Code)

Registrant’s

Telephone Number, including Area Code: (414) 299-2295

Constance

Dye Shannon

UMB Fund

Services, Inc.

803 West

Michigan Street

Milwaukee,

WI 53233

(Name and

Address of Agent for Service)

Copy

to:

Michael

Glazer

Bingham

McCutchen LLP

355 South

Grand Avenue, Suite 4400

Los

Angeles, CA 90071

Approximate

Date of Proposed Public Offering: As soon as practicable after the Registration

Statement becomes effective under the Securities Act of 1933.

It is

proposed that this filing will become effective on ________ pursuant to Rule

488.

The

registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

An

indefinite number of Registrant’s shares of beneficial interest, par value $0.01

per share, has been registered pursuant to Rule 24f-2 under the Investment

Company Act of 1940. Accordingly, no filing fee is being paid at this

time.

W.P.

Stewart & Co. Growth Fund, Inc.

527

Madison Avenue

New

York, NY 10022

(212)

750-8585

___________________,

2009

Dear

Valued Stockholder:

A Special

Meeting of Stockholders of the W.P. Stewart & Co. Growth Fund, Inc. (the

“Target Fund”), has been scheduled for November 24, 2009 (the “Special

Meeting”), to vote on a proposal (the “Reorganization”) to reorganize the Target

Fund into the W.P. Stewart & Co. Growth Fund (the “Acquiring Fund”), a newly

created series of Investment Managers Series Trust (“IMST”) that is designed to

be similar from an investment perspective to the Target Fund. W.P.

Stewart & Co., Inc. (the “Advisor”) is the investment advisor for the Target

Fund and the Acquiring Fund.

The

reason for the Reorganization is to try to reduce the annual operating expenses

of the Target Fund. The Target Fund believes that by reorganizing

into a series of IMST, it may be possible to reduce certain

expenses. IMST, a multi-advisor, multi-fund complex, is larger than

the Target Fund, and certain operating expenses of the Acquiring Fund would be

shared across the larger pool of assets of the various funds comprised by

IMST.

The

investment objective, policies and strategies of the Acquiring Fund and Target

Fund are substantially similar, as further described in the attached Proxy

Statement/Prospectus. For the reasons discussed below and in the

attached Proxy Statement/Prospectus, based on the Advisor’s recommendation, the

Board of Directors of the Target Fund (the “Board”) has approved the

Reorganization and the solicitation of stockholders for their approval of the

Reorganization.

If the

Agreement and Plan of Reorganization between the Target Fund and IMST regarding

the proposed

Reorganization (the “Plan”) is approved by stockholders, each stockholder

of the Target Fund will receive a number of full and fractional shares of the

corresponding share class of the Acquiring Fund equal in number and dollar value

to the Target Fund shares that the stockholder owns at the time of the

Reorganization. In other words, your shares in the Target Fund would

in effect be converted into the shares of the Acquiring Fund of the same

value. The Acquiring Fund is a newly organized fund that will

commence operations upon consummation of the Reorganization. The

Target Fund would then be dissolved. The Reorganization is not

expected to have any federal or state tax consequences for the Target Fund or

its stockholders. No sales charges or

redemption fees will be imposed in connection with the Reorganization, and it is

not expected that the Acquiring Fund or its service providers will require

Target Fund stockholders to complete any additional forms or other documentation

in order to receive Acquiring Fund shares as part of the

Reorganization. The attached Proxy Statement/Prospectus is

designed to give you more information about the proposal.

If

stockholders of the Target Fund do not approve the Plan, then the Reorganization

will not be implemented.

If you

have any questions regarding the proposal to be voted on, please do not hesitate

to call (212) 750-8585. If you are a stockholder of record of the

Target Fund as of the close of business on October 7, 2009, the Record Date for

the Special Meeting, you are entitled to vote at the Special Meeting and at any

postponement or adjournment thereof. While you are, of course,

welcome to join us at the Special Meeting, we expect that most stockholders will

authorize a proxy and cast their votes by filling out and signing the enclosed

Proxy Card.

Whether

or not you are planning to attend the Special Meeting, we need your

vote. Please mark, sign and date the enclosed Proxy Card and promptly

return it in the enclosed, postage-paid envelope so that the maximum number of

shares may be voted. In the alternative, please call the toll-free

number on your proxy card to authorize a proxy to vote by

telephone. You should use the enclosed instructions to vote by

telephone. You can also authorize a proxy to vote on the Internet at

the website address listed on your proxy ballot. You may revoke your

proxy before it is exercised at the Special Meeting, either by writing to the

Secretary of the Target Fund at the address noted in the Proxy

Statement/Prospectus or in person at the time of the Special

Meeting. A prior proxy vote can also be revoked by submitting a proxy

at a later date through the toll-free number or the Internet address listed in

the enclosed voting instructions.

Thank you

for taking the time to consider this important proposal and for your continuing

investment in the W.P. Stewart & Co. Growth Fund, Inc.

Sincerely,

W.P.

Stewart & Co. Growth Fund, Inc.

|

By:

|

____________________________________________

|

|

|

Rocco

Macri

|

|

|

President

|

W.P.

Stewart & Co. Growth Fund, Inc.

527

Madison Avenue

New

York, NY 10022

(212)

750-8585

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD NOVEMBER 24, 2009.

W.P.

Stewart & Co. Growth Fund, Inc., a Maryland Corporation (the “Target Fund”),

will hold a Special Meeting of Stockholders (the “Special Meeting”) on November

24, 2009 at _________ a.m., Eastern time, at the offices of W.P. Stewart &

Co., Inc., 527 Madison Avenue, New York, NY 10022. At the Special

Meeting, you and the other stockholders of the Target Fund will be asked to

consider and vote upon:

An

Agreement and Plan of Reorganization providing for the transfer of all of the

assets of the Target Fund to the W.P. Stewart & Co. Growth Fund (the

“Acquiring Fund”), a newly created series of Investment Managers Series Trust,

in exchange for (a) the Acquiring Fund’s shares, which would be distributed

pro rata by the Target

Fund to the holders of its shares in complete liquidation of the Target Fund,

and (b) the Acquiring Fund’s assumption of all or substantially all of the

liabilities of the Target Fund.

Only

stockholders of record at the close of business on October 7, 2009, the record

date for this Special Meeting, will be entitled to notice of, and to vote at,

the Special Meeting or any postponements or adjournments thereof.

YOUR

VOTE IS IMPORTANT.

Please

return your Proxy Card promptly or authorize your proxy on the Internet or by

telephone using the website address and toll-free telephone number found on your

Proxy Card.

As a

stockholder, you are asked to attend the Special Meeting either in person or by

proxy. If you are unable to attend the Special Meeting in person, we

urge you to authorize proxies to cast your votes, commonly referred to as “proxy

voting”. Whether or not you expect to attend the Special Meeting,

please submit your vote by toll-free telephone or through the Internet according

to the enclosed voting instructions. You may also vote by completing,

dating and signing your proxy card and mailing it in the enclosed postage

prepaid envelope. Your prompt voting by proxy will help assure a

quorum at the Special Meeting. Voting by proxy will not prevent you

from voting your shares in person at the Special Meeting. You may

revoke your proxy before it is exercised at the Special Meeting, either by

writing to the Secretary of the Target Fund at the address noted in the Proxy

Statement/Prospectus or in person at the time of the Special

Meeting. A prior proxy can also be revoked by voting your proxy at a

later date through the toll-free number or Internet website address listed in

the enclosed voting instructions or submitting a later dated proxy

card.

By Order

of the Board of Directors of W.P. Stewart & Co. Growth Fund,

Inc.

Seth L.

Pearlstein

Secretary

W.P. Stewart & Co. Growth Fund,

Inc.

W.P.

Stewart & Co. Growth Fund, Inc.

527

Madison Avenue

New

York, NY 10022

(212)

750-8585

QUESTIONS

AND ANSWERS

YOUR

VOTE IS VERY IMPORTANT!

Dated:

______________________________, 2009

Question: What

is this document and why did you send it to me?

Answer: The

attached document is a proxy statement to solicit votes from stockholders of the

W.P Stewart & Co. Growth Fund, Inc. (the “Target Fund”) and a prospectus for

a new series of Investment Managers Series Trust (“IMST”), the W.P. Stewart

& Co. Growth Fund (the “Acquiring Fund”), together constituting a combined

proxy/prospectus (the “Proxy Statement”). The Proxy Statement is

being provided to you by the Target Fund and IMST in connection with the

solicitation of proxies to vote to approve the Agreement and Plan of

Reorganization between the Target Fund and IMST (the form of which is attached

as Appendix

A) (the

“Plan”) regarding the proposed reorganization of the Target Fund into the

Acquiring Fund (the “Reorganization”) at the special meeting of the Target

Fund’s stockholders (“Special Meeting”). The Proxy Statement contains

the information that stockholders of the Target Fund should know before voting

on the Plan.

Stockholder

approval is needed to proceed with the Reorganization, and the Special Meeting

will be held on November 24, 2009 to consider it. If stockholders of

the Target Fund do not approve the Plan, then the Reorganization will not be

implemented.

We are

sending this document to you for your use in deciding whether to approve the

Plan at the Special Meeting. This document includes a Notice of

Special Meeting of Stockholders, the Proxy Statement and a Proxy

Card.

Question: What

is the purpose of the Reorganization?

Answer: Operating the

Target Fund is relatively expensive in light of the current and anticipated size

of the Target Fund. In fact, the Advisor has been subsidizing the

costs of operating the Fund. It is uncertain whether the Advisor will

always continue to subsidize the Target Fund and, if it stopped doing so, the

expenses of the Target Fund could increase. The Board of Directors,

which recommends approving this Reorganization, believes that this

Reorganization may reduce the expenses of operating the Fund. As

further described in the Proxy Statement, the Acquiring Fund has substantially

similar investment objectives, policies and strategies, as well as the same

investment advisor, as the Target Fund.

Question: How

will the Reorganization work?

Answer: Subject to your approval,

pursuant to the Plan, the Target Fund will transfer all of its assets to

the Acquiring Fund in return for shares of the Acquiring Fund and the Acquiring

Fund’s assumption of all or substantially all of the Target Fund’s

liabilities. The Target Fund will then distribute the shares it

receives from the Acquiring Fund to its stockholders. Stockholders of

the Target Fund will become stockholders of the Acquiring Fund, and immediately

after the Reorganization each stockholder will hold the same number of shares in

the corresponding class of the Acquiring Fund with the same net asset value per

share as he or she held immediately prior to the

Reorganization. The total value of the

Acquiring Fund shares that you receive in the Reorganization will be the same as

the total value of the shares of the Target Fund that you held immediately

before the Reorganization. Subsequently, the Target Fund will be

liquidated and dissolved.

If the

Plan is carried out as proposed, we do not expect that the transaction will have

any federal or state tax consequences to the Target Fund or its

stockholders. Please refer to the Proxy Statement for a detailed

explanation of the proposal. If the Plan is approved by stockholders

of the Target Fund at the Special Meeting, the Reorganization currently is

expected to be effective on or about November 30, 2009.

Question: How

will this affect my investment?

Answer: Your

investment is not expected to be affected by the

Reorganization. Following the Reorganization, you will be a

stockholder of the Acquiring Fund, which has a substantially similar investment

objective and investment strategies, as well as the same investment advisor, as

the Target Fund. The Acquiring Fund’s investments will be managed in

the same way as the Target Fund. The primary differences between the

Funds will be (1) the identity of the service providers that provide third party

service arrangements (i.e., custody,

administrative, transfer agent and other general support services) to the

Acquiring Fund, (2) the Acquiring Fund will be under the IMST umbrella, and

(3) the Acquiring Fund’s board of trustees will be different than the

Target Fund’s board of directors. You will receive shares of the

Acquiring Fund equal in value as of the Reorganization closing date to shares of

the Target Fund you hold at the time of the Reorganization. The

Reorganization will not affect the value of your investment at the time of

Reorganization and your interest in the Target Fund will not be

diluted. The Reorganization is expected to be tax-free to the Target

Fund and its stockholders.

Question: How

will the proposed Reorganization affect the fees and expenses I pay as a

stockholder of the Target Fund?

Answer: Immediately

following the Reorganization, it is expected that the expenses of third party

service arrangements will decrease. However, because the Acquiring

Fund will be subject to the same expense cap as the Target Fund and fees and

expenses will still be above this expense cap, there will not be an initial

reduction in the net fees and expenses of the Acquiring

Fund. However, if the assets of the Acquiring Fund grow and its total

expenses fall below the current expense cap, then any reduction in the cost of

third party service arrangements (or other expenses) would reduce the net

expenses of the Acquiring Fund.

In addition, for stockholders that are

retirement accounts, we expect the maintenance fees for the fund-appointed

trustee acting for such accounts to be lower for the Acquiring

Fund. Currently such stockholders of the Target Fund pay a $120

annual fee which will be reduced to $15 per year. A redemption fee of $15 for

retirement accounts will still be charged; however, the current $75 fee to close

a retirement account will not be applicable for the Acquiring

Fund. While no changes to these fees are currently anticipated, they

are subject to change by the Acquiring Fund in the future.

Question: Will

I be charged a sales charge or contingent deferred sales charge (CDSC) as a

result of the Reorganization?

Answer: No

sales charge, CDSC or redemption fees will be imposed to any stockholders as a

result of the Reorganization.

Question: What

will happen if the Plan is not approved?

Answer: If

stockholders of the Target Fund fail to approve the Plan, the Target Fund will

not be reorganized into the Acquiring Fund.

Question: Why

do I need to vote?

Answer: Your

vote is needed to ensure that a quorum is present at the Special Meeting so that

the proposal can be acted upon. Your immediate response on the enclosed Proxy

Card will help prevent the need for any further solicitations for a stockholder

vote, which will result in additional expenses. Your vote is very

important to us regardless of the amount of shares you own.

Question: What

action has the Board of Directors taken?

Answer: After

careful consideration and upon the recommendation of the Advisor, the Board has

approved the Reorganization and authorized the solicitation of proxies “FOR” the Plan.

Question: Who

is paying for expenses related to the Special Meeting and the

Reorganization?

Answer: The

Advisor and an affiliate of IMST have agreed to pay (as apportioned between

themselves as they may agree) all costs relating to the proposed Reorganization,

including the costs relating to the Special Meeting and the Proxy

Statement. The Target Fund will not

incur any expenses in connection with the Reorganization.

Question: How

do I cast my vote?

Answer: You

may authorize your proxy to vote on the Internet at the website provided on your

Proxy Card or you may vote by telephone using the toll free number found on your

Proxy Card. You may also use the enclosed postage-paid envelope to

mail your Proxy Card. Please follow the enclosed instructions to use

these methods of authorization. We encourage you to

authorize your proxy to vote by telephone or via the Internet. Use of telephone

or Internet voting will reduce the time and costs associated with this proxy

solicitation.

Question: Whom

do I call if I have questions?

Answer: We

will be happy to answer your questions about the proxy

solicitation. Please contact the Advisor at (212)

750-8585.

COMBINED

PROXY STATEMENT AND PROSPECTUS

______________,

2009

FOR

THE REORGANIZATION OF

W.P.

Stewart & Co. Growth Fund, Inc.

527

Madison Avenue

New

York, NY 10022

(212)

750-8585

INTO

W.P.

Stewart & Co. Growth Fund,

a

series of Investment Managers Series Trust

803

West Michigan Street

Milwaukee,

WI 53233

[PHONE

NUMBER]

_________________________________________

This

Combined Proxy Statement and Prospectus (this “Proxy Statement”) is being sent

to you in connection with the solicitation of proxies by the Board of Directors

of W.P. Stewart & Co. Growth Fund, Inc. (the “Target Fund”), managed by W.P.

Stewart & Co., Inc. (the “Advisor”), for use at a Special Meeting of

Stockholders (the “Special Meeting”), to be held at the offices of the Advisor,

527 Madison Avenue, New York, New York 10022, on November 24, 2009 at ____ a.m.

Eastern time. At the Special Meeting, stockholders of the Target Fund

will be asked:

To

approve an Agreement and Plan of Reorganization providing for the transfer of

all of the assets of the Target Fund to the W.P. Stewart & Co. Growth Fund

(the “Acquiring Fund”), a newly created series of Investment Managers Series

Trust (“IMST”), in exchange for (a) the Acquiring Fund’s shares, which

would be distributed pro

rata by the Target Fund to the holders of its shares in complete

liquidation of the Target Fund, and (b) the Acquiring Fund’s assumption of

all or substantially all of the liabilities of the Target Fund (the

“Reorganization”).

Stockholders

who execute proxies may revoke them at any time before they are voted, either by

writing to the Target Fund, in person at the time of the Special Meeting, by

voting the proxy at a later date through the toll-free number or through the

Internet address listed in the enclosed voting instructions or by submitting a

later dated Proxy Card.

The

Target Fund is an open-end management investment company registered with the

Securities and Exchange Commission (the “SEC”) and organized as a Maryland

corporation. The Acquiring Fund is a newly created series of IMST,

also an open-end management investment company registered with the SEC and

organized as a Delaware statutory trust.

The

following Target Fund document has been filed with the SEC and is incorporated

by reference into this Proxy Statement (that means that this document is

considered legally to be part of this Proxy Statement):

|

|

●

|

Prospectus

of the Target Fund, dated April 30,

2009;

|

That

document, the Statement of Additional Information of the Target Fund, dated

April 30, 2009, the Annual Report to Stockholders of the Target Fund for the

fiscal year ended December 31, 2008, containing audited financial statements,

and the Semi-Annual Report to Stockholders of the Target Fund, dated June 30,

2009, containing unaudited interim financial statements, are available upon

request and without charge by writing to the Target Fund or by calling (212)

750-8585.

The

following Acquiring Fund documents have been filed with the SEC and are

incorporated by reference into this Proxy Statement (that means that these

documents are considered legally to be part of this Proxy

Statement):

|

|

●

|

Prospectus

and Statement of Additional Information of the Acquiring Fund, dated

___________________, 2009.

|

The

Acquiring Fund’s prospectus dated _____________, 2009 is included in the same

envelope as this combined proxy statement and prospectus. The

Acquiring Fund’s Statement of Additional Information dated ______________, 2009

is available upon request and without charge by writing to IMST or by calling

(xxx) xxx-xxxx. Because the Acquiring Fund has not yet commenced

operations as of the date of this Proxy Statement, no annual or semi-annual

report is available for the Acquiring Fund at this time.

This

Proxy Statement sets forth the basic information you should know before voting

on the proposal. You should read it and keep it for future

reference. Additional information is set forth in the Statement of

Additional Information dated ___________, 2009 relating to this Proxy Statement,

which is also incorporated by reference into this Proxy

Statement. The Statement of Additional Information is available upon

request and without charge by calling [phone number].

The

Target Fund expects that this Proxy Statement will be mailed to stockholders on

or about _______________, 2009.

Date:

____________________, 2009

THE

SEC HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES NOR HAS IT PASSED ON THE

ACCURACY OR ADEQUACY OF THIS COMBINED PROXY STATEMENT AND PROSPECTUS. ANY

REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The shares offered by this Combined

Proxy Statement and Prospectus are not deposits or obligations of any bank, and

are not insured or guaranteed by the Federal Deposit Insurance Corporation or

any other government agency. An investment in the Acquiring Fund

involves investment risk, including the possible loss of

principal.

TABLE

OF CONTENTS

|

A.

|

OVERVIEW

|

2

|

|

B.

|

COMPARISONFEE

TABLE AND EXAMPLES

|

3

|

|

C.

|

SUMMARYOF

FUND INVESTMENT OBJECTIVES, STRATEGIES, AND RISKS

|

4

|

|

D.

|

COMPARISONOF

DISTRIBUTION AND PURCHASE AND REDEMPTION PROCEDURES

|

7

|

|

E.

|

KEYINFORMATION

ABOUT THE PROPOSAL

|

7

|

|

1.

|

SUMMARY

OFTHE PROPOSED REORGANIZATION

|

7

|

|

2.

|

DESCRIPTION

OFTHE ACQUIRING FUND’S SHARES

|

8

|

|

3.

|

REASONS

FORTHE REORGANIZATION

|

9

|

|

4.

|

FEDERAL

INCOMETAX CONSEQUENCES

|

10

|

|

5.

|

COMPARISON

OFFORMS OF ORGANIZATION AND STOCKHOLDER RIGHTS

|

11

|

|

6.

|

CAPITALIZATION

|

12

|

|

F.

|

ADDITIONALINFORMATION

ABOUT THE FUNDS

|

12

|

|

1.

|

PAST

PERFORMANCEOF THE TARGET FUND

|

12

|

|

2.

|

SERVICE

PROVIDERS

|

12

|

|

II.

|

VOTINGINFORMATION

|

12

|

|

A.

|

GENERAL

INFORMATION

|

12

|

|

B.

|

METHODAND

COST OF SOLICITATION

|

12

|

|

C.

|

RIGHTOF

REVOCATION

|

12

|

|

D.

|

VOTINGSECURITIES

AND PRINCIPAL HOLDERS

|

12

|

|

E.

|

INTERESTOF

CERTAIN PERSONS IN THE TRANSACTION

|

12

|

|

III.

|

MISCELLANEOUSINFORMATION

|

12

|

|

A.

|

OTHERBUSINESS

|

12

|

|

B.

|

NEXTMEETING

OF STOCKHOLDERS

|

12

|

|

C.

|

LEGALMATTERS

|

12

|

|

D.

|

EXPERTS

|

12

|

|

E.

|

INFORMATIONFILED

WITH THE SEC

|

12

|

|

APPENDIX

A – Form of Agreement and Plan of Reorganization

|

A-1

|

|

|

I.

|

PROPOSAL

– TO APPROVE THE AGREEMENT AND PLAN OF

REORGANIZATION

|

|

|

A.

|

OVERVIEW

|

Based on

the Advisor’s recommendation, the Board of Directors of the Target Fund (the

“Board”) called the Special Meeting to ask stockholders to consider and vote on

the proposed reorganization of the Target Fund into the Acquiring Fund (each

sometimes referred to below as a “Fund”). The Board (including a

majority of the independent directors, meaning those directors who are not

“interested persons” of the Fund as that term is defined in the Investment

Company Act of 1940, as amended (the “1940 Act”)) believes that the

Reorganization is in the best interests of the Target Fund and its

stockholders. The Board considered the approval of the Reorganization

at Board meetings held on June 5, 2009 and September 1, 2009 and approved the

Reorganization at a Board meeting held on September 1, 2009, subject to the

approval of the Target Fund’s stockholders.

The

reason for the Reorganization is to try to reduce the annual operating expenses

of the Fund. The Target Fund believes that by reorganizing the Fund

into a series of Investment Managers Series Trust (“IMST”), it may be possible

to reduce certain expenses. The Advisor will continue to act as

investment adviser to the Acquiring Fund and its investment objective, policies

and strategies will be substantially similar to the Target

Fund’s. IMST, a multi-advisor, multi-fund complex, is larger than the

Target Fund, and certain operating expenses of the Acquiring Fund would be

shared across the larger pool of assets of the various funds comprised by

IMST.

In order

to reconstitute the Target Fund under the IMST umbrella, a substantially similar

fund, referred to as the “Acquiring Fund,” has been created as a new series of

IMST. If stockholders approve the Reorganization, then all of the

assets of the Target Fund will be acquired by the Acquiring Fund and your shares

of the Target Fund will be effectively converted into shares of the Acquiring

Fund. The investment objective, policies and strategies of the Target

Fund and Acquiring Fund are substantially similar. Third party

services such as administration, distribution, fund accounting, transfer agency

and custody (“Third Party Services Arrangements”) would then be provided to the

Acquiring Fund by Mutual Fund Administration Corporation (“MFAC”), UMB Fund

Services, Inc. (“UMBFS”) and its affiliates. The Advisor will not

change. Therefore, the Reorganization will not change the way your

investment assets are managed. The Board of Trustees of IMST,

however, is different from the Board.

The Target Fund believes that the

Reorganization will constitute a tax-free reorganization for federal income tax

purposes. The Target Fund and IMST will receive an opinion from tax

counsel to IMST to such effect. Assuming that the Reorganization

qualifies as a tax-free reorganization for federal tax purposes, stockholders

will not recognize any gain or loss on Target Fund shares for federal income tax

purposes as a result of the Reorganization. Furthermore, the Target Fund will

not pay for the costs of the Reorganization and the Special

Meeting. The Advisor and an affiliate of IMST will bear (as

apportioned between themselves as they may agree) the costs associated with the

Reorganization, Special Meeting, and solicitation of proxies, including the

expenses associated with preparing and filing the registration statement that

includes this Proxy Statement and the cost of copying, printing and mailing

proxy materials. In addition to solicitations by mail, the Advisor

also may solicit proxies, without special compensation, by telephone, facsimile

or otherwise.

The

Board, including a majority of the directors who are not interested persons of

the Target Fund, believes that the terms of the Reorganization are fair and

reasonable and that the interests of existing stockholders of the Target Fund

will not be diluted as a result of the proposed Reorganization. In

approving the Reorganization, the Board considered, among other things, that:

(1) the Reorganization was recommended by the Advisor; (2) the investment

objective, policies and strategies of the Acquiring Fund are substantially

similar to those of the Target Fund; (3) the Acquiring Fund will continue to be

managed by the Advisor; (4) the Target Fund will not bear the cost of the

Reorganization; (5) the stockholders of the Target Fund would likely not

experience any tax consequences as a result of the Reorganization and (6) the

operating expenses and stockholder fees and expenses of the Acquiring Fund are

not expected to be higher than those of the Target Fund and that the operating

expenses may be lower.

Based on

the Advisor’s recommendation, the Board approved the solicitation of the

stockholders of the Target Fund to vote “FOR” the approval of the

Agreement and Plan of Reorganization (the “Plan”), the form of which is attached

to this Proxy Statement in Appendix

A.

|

|

B.

|

COMPARISON

FEE TABLE AND EXAMPLES

|

The

following Summary of Target Fund Expenses shows the fees for the Target Fund

based on the Target Fund’s fiscal year ended December 31, 2008. As

the Acquiring Fund has not yet commenced operations as of the date of this Proxy

Statement, the Summary of Fund Expenses shown for the Acquiring Fund are

estimates.

|

Fees

and Expenses

|

W.P.

Stewart & Co.

Growth

Fund, Inc.

Target

Fund

|

W.P.

Stewart & Co.

Growth

Fund

Acquiring

Fund

(Pro

forma)

|

||||

|

Stockholder

Fees

(fees

paid directly from your investment)

|

||||||

|

Maximum

Sales Charge (Load)

Imposed

On Purchases

(as

a percentage of the offering price)

|

None

|

None

|

||||

|

Maximum

Deferred Sales Charge (Load) Imposed on Redemptions

(as

a percentage of the purchase or sale price, whichever is

less)

|

None

|

None

|

||||

|

Redemption

Fee(1)

(as

a percentage of amount redeemed)

|

1.00%

|

1.00%

|

||||

|

Annual

Fund Operating Expenses

(expenses

that are deducted from Fund assets)

|

||||||

|

Management

Fee

|

1.00%

|

1.00%

|

||||

|

Distribution

and/or Service (Rule 12b-1) Fees

|

None

|

None

|

||||

|

Other

Expenses(2)

|

1.19%

|

0.64%

|

||||

|

Total Annual Fund Operating

Expenses(2)

|

2.19%

|

1.64%

|

||||

|

Fee

Waiver and Expense Reimbursement(2)

|

(0.70%)

|

(0.15%)

|

||||

|

Net Expenses(2)

|

1.49%

|

1.49%

|

||||

(1)

The redemption fee is charged only if you redeem your shares within sixty days

after the date of purchase of such shares. The redemption fee does not apply to

shares that are acquired by reinvestment of dividends or other distributions of

the Fund. In addition, the Fund may waive such redemption fee where such shares

are purchased through or held in a vehicle where the vehicle sponsor has

demonstrated to the Fund that either (a) a similar type of fee is imposed or (b)

as determined by the Fund, short-term trading is otherwise adequately

prohibited, prevented or deterred.

(2)

Effective as of January 1, 2009 the Advisor has contractually agreed to pay or

reimburse the Target Fund for all operating expenses of the Target Fund so that

the ratio of net expenses to average net assets does not exceed 1.49% on an

annualized basis. Such agreement is effective until April 30, 2010, and may be

extended by mutual agreement of the Advisor and the Target Fund for successive

terms. Similarly, effective as of the closing of the Reorganization,

the Advisor has contractually agreed to pay or reimburse the Acquiring Fund for

all operating expenses of the Acquiring Fund so that the ratio of net expenses

to average net assets does not exceed 1.49% on an annualized basis. Such

agreement is effective until December 31, 2010, and may be extended by mutual

agreement of the Advisor and the Acquiring Fund for successive

terms.

Example

The

Example below is intended to help you compare the cost of investing in the

Target Fund with the estimated cost of investing in the Acquiring Fund on a pro

forma basis. The Example assumes that you invest $10,000 in each Fund

and then redeem all of your shares at the end of each period. The Example also

assumes that your investment has a 5% annual return, that the Fund’s Total

Annual Fund Operating Expenses and Net Expenses remain as stated in the previous

table and that distributions are reinvested. Although your actual costs may be

higher or lower, based on these assumptions, your costs would be as follows, if

you redeem your shares:

|

Estimated Cost

|

||||

|

One

Year

|

Three

Years

|

Five

Years

|

Ten

Years

|

|

|

Target

Fund

|

$153

|

$600

|

$1,098

|

$2,469

|

|

Acquiring

Fund (Pro

forma)

|

152

|

503

|

878

|

1,931

|

The

dollar amounts in the example above reflect the contractual expense

reimbursement agreement to limit the Target Fund’s Total Annual Fund Operating

Expenses through April 30, 2010 and the Acquiring Fund’s Total Annual Fund

Operating Expenses through December 31, 2010, as described above. The amount of

expenses you would pay would be the same whether or not you redeem your shares

at the end of the period.

C. SUMMARY

OF FUND INVESTMENT OBJECTIVES, STRATEGIES, AND RISKS

Comparison of Investment

Objectives, Strategies, and Risks

The Funds

have substantially similar investment objectives, strategies and

policies. The investment objective of each Fund is to earn capital

gains for stockholders. The Target Fund’s and the Acquiring Fund’s

investment objective is non-fundamental, which means it may be changed by a vote

of the Board or IMST’s board of trustees, respectively, without stockholder

approval upon a 60-day prior written notice to stockholders. There is

no current intention to change the Acquiring Fund’s investment

objective. Each Fund seeks to achieve its investment objective by

using the following strategies:

|

Target

Fund and Acquiring Fund

|

Investment

Strategy

|

|

W.P.

Stewart & Co.

Growth

Fund, Inc.

(Target

Fund)

and

W.P.

Stewart & Co.

Growth Fund, a series of

IMST

(Acquiring

Fund)

|

The

Fund’s investment objective is to earn capital gains for stockholders. The

Fund normally invests primarily in common stocks listed on the New York

Stock Exchange, but also invests, from time to time, in common stocks

listed on other U.S. stock exchanges, in common stocks traded through The

NASDAQ Stock Market Inc. (“NASDAQ”) and on international exchanges. The

Fund permits investors to participate in a professionally-managed

portfolio consisting primarily of stocks of growth businesses based in the

U.S.

The

Advisor employs an appraisal method which attempts to measure each

prospective company’s quality and growth rate by numerous criteria. Such

criteria include: the company’s record and projections of profit and

earnings growth, accuracy and availability of information with respect to

the company, success and experience of management, accessibility of

management to the Advisor, product lines and competitive position both in

the U.S. and abroad, lack of cyclicality, large market capitalization and

liquidity of the company’s securities. These results are compared to the

general stock markets to determine the relative attractiveness of each

company at a given moment. The Advisor weighs economic, political and

market factors in making investment

decisions;

this appraisal technique attempts to measure each investment candidate not

only against other stocks of the same industry group, but also against a

broad spectrum of investments. No method of fundamental or technical

analysis, including that employed by the Advisor, has been proven to

provide a guaranteed rate of return adjusted for investment

risk.

|

|

The

Fund invests in a relatively small number of individual stocks. To enable

it to do so, the Fund technically is classified as “non-diversified.” It

may invest more than 5% of the value of its assets in the securities of a

company and may acquire more than 10% of the voting securities of a

company (subject to certain limitations under the Internal Revenue

Code).

|

The

Acquiring Fund has substantially similar investment policies as the Target Fund,

except for the difference between the Funds’ respective non-fundamental policies

regarding investment in the securities of other investment companies, as

described below.

|

Target

Fund versus Acquiring Fund

|

Non-Fundamental

Policy Regarding Investment Company Investments

|

|

W.P.

Stewart & Co.

Growth

Fund, Inc.

(Target

Fund)

|

The

Fund does not intend to invest in the securities of other investment

companies.

|

|

W.P.

Stewart & Co.

Growth Fund, a series of

IMST

(Acquiring

Fund)

|

To

provide maximum flexibility for the management of the Fund’s cash

positions, the Fund may invest in securities of other investment companies

that invest primarily in securities of the type in which the Fund may

invest directly to the extent permitted in the 1940 Act. Under

the 1940 Act, a Fund may invest its assets in any investment company, as

long as the Fund and its affiliated persons own no more than 3% of the

outstanding voting stock of the acquired investment company and the Fund

complies with certain additional restrictions. This restriction

may not apply to the Fund’s investments in money market mutual funds and

affiliated funds (i.e. other series of

the Trust), if the Fund’s investments fall within the exceptions set forth

under the SEC rules. As a stockholder in an investment company,

a Fund will bear its ratable share of that investment company’s expenses

and would remain subject to payment of the Fund’s investment management

fees with respect to the assets so invested. Stockholders would

therefore be subject to duplicative expenses to the extent the Fund

invests in other investment companies. In addition, the

securities of other investment companies may be leveraged. The

NAV and market value of leveraged shares will be more volatile and the

yield to holders of common stock in such leveraged investment companies

will tend to fluctuate more than the yield generated by unleveraged

shares.

|

Investment

in the Acquiring Fund is subject to substantially similar principal investment

risks as investment in the Target Fund. As with all mutual funds, the

Acquiring Fund, like the Target Fund, may expose stockholders to certain market

risks that could cause stockholders to lose money, particularly a sudden decline

in a holding’s share price or market value or an overall decline in the stock or

bond markets or circumstances affecting the Fund. Each Fund is

subject to the following principal investment risks:

|

Target

Fund and Acquiring Fund

|

Principal

Investment Risks

|

|

W.P.

Stewart & Co.

Growth

Fund, Inc.

(Target

Fund)

and

|

The

price of the Fund’s shares may go up or down, and may be more volatile

than shares of a fund investing in fixed income or money market

securities. The prices of common stocks tend to rise and fall more

dramatically than other types of investments. These price movements may

result from economic, political, regulatory and other factors affecting

the issuer, the issuer’s geographic region, the issuer’s industry, stock

markets in general or particular sectors of stock markets. Large-cap

stocks, for example, can react differently than small- or mid-cap

stocks.

|

|

W.P.

Stewart & Co.

Growth Fund, a series of

IMST

(Acquiring

Fund)

|

The

price of growth stocks may be particularly volatile. Since the issuers of

such stocks usually reinvest a high portion of earnings in their own

businesses, they may lack the dividend yield associated with value stocks

that can cushion total return in a declining market. Also, growth stocks

tend to be more expensive relative to their earnings or assets, especially

compared to “value” stocks. Because investors buy growth stocks based on

their expected earnings growth, earnings disappointments often result in

sharp price declines.

Because

the Fund invests in a relatively small number of individual stocks, the

risks of investing in the Fund are greater than the risks of investing in

a more widely diversified fund. To the extent that the Fund invests a

relatively high percentage of its assets in securities of a limited number

of companies, the Fund may be more susceptible than would a more widely

diversified fund to any single economic, political or regulatory

occurrence or to changes in a particular company’s financial condition or

in the market’s assessment of the

company.

|

D. COMPARISON

OF DISTRIBUTION AND PURCHASE AND REDEMPTION PROCEDURES

The

Target Fund currently uses ALPS Distributors, Inc., as its exclusive agent for

distribution of shares. If stockholders approve the Reorganization,

the Acquiring Fund will use Grand Distribution Services as its Distributor (the

“Distributor”). The Distributor is obligated to sell the shares of

the Acquiring Fund on a best efforts basis only against purchase orders for the

shares. Shares of the Target Fund are, and shares of the Acquiring Fund will be,

offered to the public on a continuous basis at the relevant

NAVs. The Distributor is a registered broker-dealer and member

of the Financial Industry Regulatory Authority (“FINRA”).

The Funds

have similar purchase and redemption procedures. Shares of each Fund

are offered at the NAV per share of the Fund, computed after the purchase order

and monies are received by the Fund’s transfer agent or certain financial

intermediaries and their agents that have made arrangements with the Fund and

are authorized to buy and sell shares of the Fund (collectively, “Financial

Intermediaries”).

Shares of

each Fund are redeemed at a price equal to the NAV for the relevant class next

determined after the Fund’s transfer agent receives a redemption request in good

order less any applicable redemption fee. A redemption request cannot be

processed on days the New York Stock Exchange is closed. Each Fund may redeem

the shares in an account if the total value of the account falls below $2,500

(excluding qualified retirement accounts) due to redemptions after giving

stockholders at least 30 days’ prior written notice of this redemption to give

them an opportunity to increase the value of their account above this

minimum. Additionally, each Fund has also reserved the right to

redeem shares “in kind.”

Additional

stockholder account information for each Fund is available in its respective

prospectus, which is incorporated by reference.

E. KEY

INFORMATION ABOUT THE PROPOSAL

The

following is a summary of key information concerning the proposed

Reorganization. Keep in mind that more detailed information appears

in the Plan, a copy of the form of which is attached to this Proxy Statement in

Appendix A, and

in the prospectuses and statements of additional information incorporated by

reference into this Proxy Statement.

1. SUMMARY

OF THE PROPOSED REORGANIZATION

At the

Special Meeting, the stockholders of the Target Fund will be asked to approve

the Plan to reorganize the Target Fund into the Acquiring Fund. The

Acquiring Fund is a newly organized fund that will commence operations upon

consummation of the Reorganization. If the Plan is approved by the

stockholders of the Target Fund and the Reorganization is consummated, the

Target Fund will transfer all of its assets to the Acquiring Fund in exchange

for the number of full and fractional shares of each class of Acquiring Fund

shares equal to the number of full and fractional shares of each corresponding

class of Target Fund shares as of the close of business on the closing day of

the Reorganization (the “Closing”) and the Acquiring Fund will assume all or

substantially all of the Target Fund’s liabilities. Immediately

thereafter, the Target Fund will distribute the Acquiring Fund shares to its

stockholders, by IMST’s transfer agent’s establishing accounts on the Acquiring

Fund’s share records in the names of those stockholders and transferring those

Acquiring Fund shares to those accounts, in complete liquidation of the Target

Fund. As a result, each stockholder will receive shares of that class

of the Acquiring Fund that corresponds to the class of shares it owns in the

Target Fund. The value of the Acquiring Fund shares received by each

stockholder will have a value, immediately following the Closing, equal to the

value of such stockholder’s Target Fund shares immediately before the

Closing. The expenses associated with the Reorganization will not be

borne by the Target Fund. Certificates evidencing the Acquiring Fund

shares will not be issued to the Target Fund’s stockholders.

The

holding period for Target Fund shares will carry over to the corresponding

Acquiring Fund shares received by stockholders in the Reorganization for

purposes of determining the application of any applicable redemption

fees. Upon completion of the Reorganization, each stockholder of the

Target Fund will own that number of full and fractional shares of the

corresponding class of the Acquiring Fund equal to the number of such

stockholder’s shares held in the class of the Target Fund as of the

Closing.

Until the

Closing, stockholders of the Target Fund will continue to be able to redeem

their shares at the NAV next determined after receipt by the Target Fund’s

transfer agent of a redemption request in proper form. Redemption and

purchase requests received by the transfer agent after the Closing will be

treated as requests received for the redemption or purchase of shares of the

Acquiring Fund received by the stockholder in connection with the

Reorganization. After the Reorganization, all of the issued and

outstanding shares of the Target Fund will be canceled on the books of the

Target Fund and the transfer books of the Target Fund will be permanently

closed. If the Reorganization is consummated, stockholders will be

free to redeem the shares of the Acquiring Fund that they receive in the

transaction at the NAV next determined after receipt by the Acquiring Fund’s

transfer agent of a transfer request form in proper

form. Stockholders of the Target Fund may wish to consult their tax

advisors as to any different consequences of redeeming their shares prior to the

Reorganization or exchanging such shares for shares of the Acquiring Fund in the

Reorganization.

The

Reorganization is subject to a number of conditions, including, without

limitation, the approval of the Plan by the stockholders of the Target Fund and

the receipt of a legal opinion from counsel to IMST with respect to certain tax

issues. Assuming satisfaction of the conditions in the Plan, the Reorganization

is expected to be effective on or about November 30, 2009, or other date agreed

to by the Target Fund and IMST.

The

Advisor and an affiliate of IMST have agreed to pay (as apportioned between

themselves as they may agree) all costs relating to the proposed Reorganization,

including the costs relating to the Special Meeting and to preparing and filing

the registration statement that includes this Proxy Statement. They will also

incur the costs associated with the solicitation of proxies, including the cost

of copying, printing and mailing proxy materials.

The Plan

may be amended by the mutual consent of the Board and the Board of Trustees of

IMST, notwithstanding approval thereof by the Target Fund’s stockholders,

provided that no such amendment after such approval may have the effect of

changing the Plan to the detriment of such stockholders without their further

approval. In addition, the Plan may be terminated at any time prior

to the Closing with the mutual consent of the Board and the Board of Trustees of

IMST.

2. DESCRIPTION

OF THE ACQUIRING FUND’S SHARES

The

Acquiring Fund’s shares issued to the stockholders of the Target Fund pursuant

to the Reorganization will be duly authorized, validly issued, fully paid and

non-assessable when issued, and will be transferable without restriction and

will have no preemptive or conversion rights. The Acquiring Fund’s

shares will be sold and redeemed based upon the NAV of the Acquiring Fund next

determined after receipt of the purchase or redemption request, as described in

the Acquiring Fund’s Prospectus.

3. REASONS

FOR THE REORGANIZATION

Operating the Target Fund is

relatively expensive in light of the current and anticipated size of the

Fund. The Board has determined that reorganizing the Target Fund into

the Acquiring Fund could reduce the Target Fund's annual operating

expenses. The Board anticipates that it may be possible to reduce

these operating expenses because the Acquiring Fund will be able to share

certain operating expenses (namely counsel, trustees, chief compliance officer

and insurance expenses) across the larger pool of assets of the various funds

comprised by IMST (as of ___________, 2009, the assets of the Target Fund were

$__ million and the assets of IMST were $___ million). The Target

Fund will also be able to take advantage of economies of scale by using the same

auditors, administrator, transfer agent, fund accountant and custodian as many

of the other funds within the IMST. Further, the Board believes that

since the Target Fund and the Acquiring Fund will have the same investment

adviser, the transition to operating as a series of IMST should not have a

material impact on the Fund’s stockholders.

In

addition, the Board further considered that following the Reorganization, the

expenses of third party service arrangements are expected to decrease. Although

this would not result in an immediate reduction in the net fees and expenses of

the Acquiring Fund (because the fees and expenses would still be above the

current expense cap), if the assets of the Acquiring Fund grow and its total

expenses fall below the current expense cap, then any reduction in the cost of

third party service arrangements (or other expenses) would reduce the total

expenses of the Acquiring Fund. While the expenses of third party

service arrangements are expected to decrease, the Board considered that the

level of service provided by Acquiring Fund’s service providers (including the

co-administrators, transfer agent, fund accountant and custodian) are expected

to be the same or higher than that provided by the Target Fund’s corresponding

service providers. There will be no changes to the Advisor or

investment objective as a result of the Reorganization, and the Acquiring Fund’s

policies and strategies will be substantially similar to the Target

Fund’s.

In

considering the Reorganization, the Board further considered the terms of the

Plan; the material terms of the investment advisory agreement between the

Acquiring Fund and the Advisor; the experience and qualifications of the

trustees and officers of IMST; the compliance program and compliance history of

IMST; the stability, reputation, financial condition, resources and experience

of IMST; the past services and performance of the Advisor; the potential

benefits of the Reorganization to the Advisor, IMST and the Acquiring Fund; the

differences or similarities of the governing laws and organizational documents

of the Target Fund and the Acquiring Fund and IMST; the alternatives available

to the Target Fund. During their review of the proposed

Reorganization, the independent directors consulted with their independent

counsel regarding the legal considerations involved in the

Reorganization.

The Board

made its decision to approve the Agreement and Plan of Reorganization and the

Reorganization after considering various factors including those discussed above

and the following additional factors:

|

|

●

|

the

Reorganization was recommended by the

Advisor;

|

|

|

●

|

the

investment objective, policies and restrictions of the Target Fund are

substantially similar to the Acquiring

Fund;

|

|

|

●

|

the

Advisor will continue to manage the Acquiring

Fund;

|

|

|

●

|

the

cost of the Reorganization will not be borne by the Target Fund or its

stockholders;

|

|

|

●

|

counsel

to IMST will provide the Trust with an opinion to the effect that the

Reorganization will not have any federal tax consequences for the Target

Fund or its stockholders;

|

|

|

●

|

the

potential effects, including as discussed above, on annual fund operating

expenses and stockholder fees and

services.

|

Based on

these considerations and others, in approving the Agreement and Plan of

Reorganization and the Reorganization, the Board (including a majority of the

independent directors) determined that the Reorganization is in the best

interests of the Target Fund and its stockholders and that the interests of its

existing stockholders will not be diluted as a result of the

Reorganization.

If the

Plan is not approved by the Target Fund’s stockholders, then the Target Fund

will continue to operate as a separate Fund, or the Board may take any further

action as it deems to be in the best interests of the Target Fund and its

stockholders, subject to approval by Target Fund’s stockholders if required by

applicable law.

4. FEDERAL INCOME TAX

CONSEQUENCES

The Reorganization is

intended to qualify for federal income tax purposes as a tax-free reorganization

under Section 368(a) of the Code. As a condition to the Closing of

the Reorganization, the Target Fund will receive an opinion of counsel to

IMST to the effect that the Reorganization will qualify as a tax-free

reorganization for federal income tax purposes under the

Code. Accordingly, neither the Target Fund nor its stockholders nor

the Acquiring Fund are expected to recognize any gain or loss for federal income

tax purposes as a result of the Reorganization.

In

addition, the tax basis of, and the holding period for, the Acquiring Fund’s

shares received by each stockholder of the Target Fund in the Reorganization

will be the same as the tax basis of, and will include the holding period for

the Target Fund’s shares exchanged by such stockholder in the Reorganization

(provided that, with respect to the holding period for the Acquiring Fund’s

shares received, the Target Fund’s shares exchanged have been held as capital

assets by the stockholder).

Since its

inception, the Target Fund believes that it has qualified for treatment as a

“regulated investment company” under the Code. Accordingly, the Target Fund

believes that it has been, and expects to continue through the Closing to be,

relieved of any federal income tax liability on the taxable income and gains it

distributes to stockholders to the extent provided for in Subchapter M of the

Code.

Provided

that the Target Fund is so treated, the tax opinion mentioned above also will be

to the effect that for federal income tax purposes, generally:

|

|

●

|

The

Target Fund will not recognize any gain or loss as a result of the

Reorganization;

|

|

|

●

|

Each

Target Fund stockholder will not recognize any gain or loss as a result of

the receipt of Acquiring Fund shares in exchange for such stockholder’s

Target Fund shares pursuant to the

Reorganization;

|

|

|

●

|

The

tax basis and holding period for the Target Fund’s assets will effectively

be carried over when those assets are transferred to the Acquiring

Fund;

|

|

|

●

|

Each

Target Fund stockholder’s aggregate tax basis in the Acquiring Fund shares

received pursuant to the Reorganization will equal such stockholder’s

aggregate tax basis in the Target Fund shares held immediately before the

Reorganization;

|

|

|

●

|

Each

Target Fund stockholder’s holding period for the Acquiring Fund shares

received pursuant to the Reorganization will include, in each instance,

its holding period for those Target Fund shares, provided the stockholder

holds them as capital assets as of the time of the

Closing;

|

|

|

●

|

The

Acquiring Fund will recognize no gain or loss on its receipt of the Target

Fund’s assets in exchange solely for Acquiring Fund shares and its

assumption of the Target Fund’s liabilities;

and

|

|

|

●

|

For

purposes of section 381 of the Code, the Acquiring Fund will be treated

just as the Target Fund would have been treated if there had been no

Reorganization. Accordingly, the Reorganization will not result

in the termination of the Target Fund’s taxable year, the Target Fund’s

tax attributes enumerated in section 381(c) of the Code will be taken into

account by the Acquiring Fund as if there had been no Reorganization, and

the part of the Target Fund’s taxable year before the Reorganization will

be included in the Acquiring Fund’s taxable year after the

Reorganization.

|

Although

the Target Fund is not aware of any adverse state income tax consequences, the

Target Fund has not made any investigation as to those consequences for the

stockholders. Because each

stockholder may have unique tax issues, stockholders should consult their own

tax advisors.

5. COMPARISON

OF FORMS OF ORGANIZATION AND STOCKHOLDER RIGHTS

Set forth

below is a discussion of the material differences between the Funds and the

rights of their stockholders.

Governing

Law. The Target Fund

is a Maryland corporation. The Acquiring Fund is a separate series of

a Delaware statutory trust. As with Maryland law, Delaware law

contains provisions specifically designed for mutual funds that take into

account their unique structure and operations. Under Delaware law, funds are

able to simplify their operations by reducing administrative burdens, without

sacrificing the federal or state advantages of a mutual fund. Delaware law

allows greater flexibility in drafting a fund’s governing documents, which can

result in greater efficiencies of operation and savings for a fund and its

stockholders. For example, a fund organized as a Delaware statutory trust can

structure its governing documents to enable it to more easily obtain desired

board or stockholder approvals, and can potentially accomplish certain actions,

such as fund reorganizations or liquidations, without first seeking stockholder

approval. Furthermore, there is a well-established body of corporate legal

precedent that may be relevant in deciding issues pertaining to Delaware

statutory trusts. This could benefit the Trust by, for example, making

litigation involving the interpretation of provisions in the Trust’s governing

documents less likely or, if litigation should be initiated, less burdensome or

expensive. A comparison of Maryland corporate law and Delaware statutory trust

law is set forth below.

Directors

and trustees. The business

and affairs of the Target Fund are managed under the direction of a Board of

Directors elected by the stockholders. IMST is governed by a similar

board elected by its stockholders, called the Board of

Trustees. The Board of Trustees for IMST has five trustees,

two of whom are “interested persons” of IMST. For more information,

refer to the Statement of Additional Information dated ___________, 2009 for the

Acquiring Fund, which is incorporated by reference into this Proxy

Statement.

Series and

classes. The Target Fund’s governing instrument – its articles

of incorporation – authorizes the issuance of a specified number of shares of

capital stock and also authorizes the Board of Directors to classify or

reclassify any of the unissued shares into one or more classes of stock without

stockholder approval. IMST’s governing instrument – its

declaration of trust – allows it to issue an unlimited number of shares and to

classify shares into series, which represent interests in separate portfolios of

investments, without stockholder approval. In both cases, no series

is entitled to share in the assets of any other series or can be charged with

the expenses or liabilities of any other series.

Stockholder

liability. Stockholders of a Maryland corporation, such as the

Target Fund, generally have no personal liability for the corporation’s

obligations. The corporation laws of all other states have similar

provisions.

Stockholders

of a Delaware statutory trust, such as the Acquiring Fund, also are not

personally liable for obligations of a trust under Delaware

law. However, no similar statutory or other authority limiting

business trust stockholder liability exists in many other states. As

a result, to the extent that a trust or a stockholder of the trust is subject to

the jurisdiction of courts in such other states, those states might not apply

Delaware law and might subject the trust’s stockholders to

liability. To offset this risk, a trust’s declaration of trust: (i)

recites that its stockholders are not liable for its obligations, and requires

notice of this to be included in all trust contracts, and (ii) requires the

trust to indemnify any stockholder who is held personally liable for the

obligations of the trust. Thus the risk of a trust stockholder being

subject to liability beyond his or her investment is limited to the following

unusual circumstances in which all of the following factors are present: (1) a

court refuses to apply Delaware law; (2) the liability arises under tort law or,

if not, no contractual limitation of liability is in effect; and (3) a trust is

itself unable to meet its obligations. In light of Delaware law, the

nature of IMST’s business, and the nature of its assets, we believe that the

risk of personal liability to IMST’s stockholder is remote.

Stockholder

meetings and voting rights. Under Maryland law and the by-laws

of the Target Fund, the Target Fund is required to have an annual stockholder

meeting to elect directors and consider any other matters properly coming before

the meeting, except that that the Target Fund is not required to hold a meeting

in any year in which the election of directors is not required by the Investment

Company Act of 1940, as amended (the “Investment Company Act”). IMST

is not required to hold annual stockholder meetings, and does not intend to do

so unless required by the Investment Company Act.

6. CAPITALIZATION

The

capitalization of the Target Fund as of December 31, 2008 and the Acquiring

Fund’s pro forma combined capitalization as of that date after giving effect to

the proposed Reorganization are as follows:

|

Target

Fund

|

Pro

forma

Acquiring

Fund

|

|

|

Net

Assets

|

$28,723,551

|

$28,723,551

|

|

Shares

Outstanding

|

264,446

|

264,446

|

|

Net

Asset Value per Share

|

$108.62

|

$108.62

|

F. ADDITIONAL

INFORMATION ABOUT THE FUNDS

1. PAST

PERFORMANCE OF THE TARGET FUND

Performance

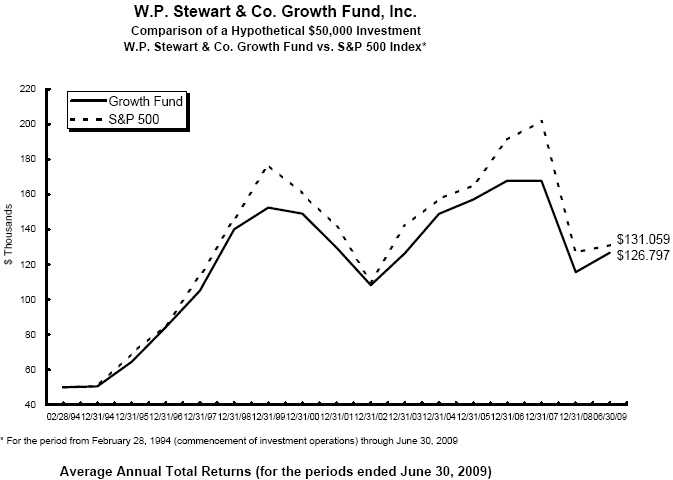

The following bar chart and table

illustrate the variability of the Target Fund’s return over the periods

indicated. The table below shows how the Target Fund’s performance compares to

relevant index information (which unlike the Target Fund, does not reflect fees

or expenses). All figures assume reinvestment of dividends and distributions (in

the case of after-tax returns, reinvested net of assumed tax rates). The returns

shown reflect any fee waiver/expense limitation applicable during the relevant

period.

After-tax returns are calculated using

the historical highest individual federal marginal income tax rates and do not

reflect the impact of state and local taxes. Actual after-tax returns depend on

an investor's tax situation and may differ from those shown, and after-tax

returns shown are not relevant to investors who hold their Target Fund shares

through tax-deferred arrangements, such as 401(k) plans or individual retirement

accounts.

Past performance is not indicative of

future performance.

If the Reorganization is approved, the

Acquiring Fund will assume the performance history of the Target

Fund.

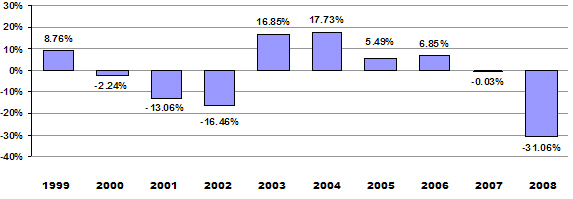

Annual Total Returns For

Target Fund

For each

calendar year at NAV

Annual

Total Returns*

*

Annual total returns do not include performance for the period from February 28,

1994 (inception date) through December 31, 1998. During the 10-year period shown

in the bar chart, the highest return for a quarter was 15.06% (quarter ended

December 31, 2004) and the lowest return for a quarter was -20.33% (quarter

ended December 31, 2008).

Target

Fund Average Annual Total Returns (as of the fiscal year ended December 31,

2008)

|

W.P.

Stewart & Co. Growth Fund, Inc.

|

One

Year

|

Five

Years

|

Ten

Years

|

Return

Since

Inception*

|

|

Return

Before Taxes

|

-31.06%

|

-1.77%

|

-1.90%

|

5.81%

|

|

Return

After Taxes on Distributions**

|

-31.63%

|

-2.95%

|

-2.68%

|

4.73%

|

|

Return

After Taxes on Distributions and Sale of Fund Shares** %

|

-19.30%

|

-1.16%

|

-1.44%

|

5.01%

|

|

S&P

500® Index (reflects no deduction for fees, expenses or

taxes)***

|

-37.00%

|

-2.19%

|

-1.38%

|

6.48%

|

*

Inception Date of Fund: February 28, 1994.

**

After-tax returns: (i) are estimated and based on calculations using the

historical highest individual federal marginal income tax rates and do not

reflect the impact of state and local taxes; actual after-tax returns depend on

an individual investor’s tax situation and are likely to differ from those

shown; and (ii) are not relevant to investors who hold Fund shares through

tax-deferred arrangements, such as 401(k) plans or individual retirement

accounts.

***

The S&P 500® Index is the Standard & Poor’s 500® Index, a widely

recognized, unmanaged index of common stock prices.

2. SERVICE

PROVIDERS

Investment Advisor and

Portfolio Managers

Each

Fund’s investment advisor is W.P. Stewart & Co., Inc., 527 Madison Avenue,

New York, NY 10022. As the Target Fund’s investment advisor, the Advisor is

responsible for the management of the Fund’s business affairs, including

providing investment research and analysis of investment opportunities and the

management of the Fund’s trading and investment transactions, subject to the

investment policies and restrictions described in the Prospectus. As

of June 30, 2009, the Advisor had $1.3 billion assets under management other

than the Target Fund.

For

providing services to the Target Fund, the Advisor receives an annual advisory

fee equal to 1.00% of average daily net assets of the Fund. A

discussion summarizing the basis of the Board’s approval of the investment

advisory agreement between the Target Fund and the Advisor is included in the

Target Fund’s annual report for the year ended December 31, 2008.

For the

fiscal year ended December 31, 2008, the Advisor earned the following fees for

its services with respect to the Target Fund. The Advisor did not

earn any fees with respect to the Acquiring Fund since it had not commenced

operations as of the date of this Proxy Statement.

|

Fiscal

Year Ended December 31, 2008

|

|||

|

Advisory

Fee Earned

|

Waiver/Reimbursement

|

Amount

Received After

Waiver/Reimbursement

|

|

|

Target

Fund

|

$436,338

|

($0)

|

$436,638

|

James Tierney is

the Advisor’s portfolio manager for the Target Fund and is primarily responsible

for the day-to-day management of the Target Fund’s portfolio. Mr.

Tierney is also a member of an investment research group of the Advisor which

identifies the group of prospective portfolio securities in which each account

managed by the Advisor, including the Target Fund, may invest. Mr.

Tierney selects securities from this group for investment by the Target

Fund. Although each account managed by the Advisor has individual

objectives and a unique portfolio, the Target Fund’s investments generally are

similar to investments made by the Advisor’s other managed accounts

Mr.

Tierney has served as a Portfolio Manager/Analyst and Senior Vice President of

the Target Fund’s Advisor since 2003 and has been a Portfolio Manager/Analyst of

the Adviser since 2000. Prior to joining the Advisor, Mr. Tierney was a Senior

Analyst at J.P. Morgan Investment Management following a succession of

industries including energy, transportation, media and entertainment from

1992-2000. Mr. Tierney left J.P. Morgan in 1990 to attend business school and

returned after completing his M.B.A. in 1992. Mr. Tierney was in the Equity

Research Department of J.P. Morgan Investment Management from 1988-1990

following the entertainment, healthcare and finance industries. Mr. Tierney