|

By:

|

/s/Stacey E.

Hong

|

|

|

Stacey

E. Hong

|

|

|

President

|

|

|

|

|

|

Forum Funds (Target Fund)

|

IMST (Acquiring Fund)

|

|

|

Liberty Street Horizon Fund – A

Shares

|

Liberty Street Horizon Fund – A

Shares

|

|

|

Liberty Street Horizon Fund – C

Shares

|

Liberty Street Horizon Fund – C

Shares

|

|

|

Liberty Street Horizon Fund – Institutional

Shares

|

Liberty Street Horizon Fund – Institutional

Shares

|

|

|

·

|

Prospectus and Statement of

Additional Information of the Target Fund, dated September 1,

2008;

|

|

|

·

|

Semi-Annual Report to

Shareholders of the Target Fund, dated October 31, 2008 and Annual Report

to Shareholders of the Target Fund, dated April 30,

2009.

|

|

|

·

|

Prospectus and Statement of

Additional Information of the Acquiring Fund, dated August 14,

2009.

|

|

A.

|

OVERVIEW

|

4

|

|

B.

|

COMPARISON

FEE TABLE AND EXAMPLES

|

5

|

|

C.

|

SUMMARY

OF FUND INVESTMENT OBJECTIVES, STRATEGIES, AND RISKS

|

7

|

|

D.

|

COMPARISON

OF DISTRIBUTION AND PURCHASE AND REDEMPTION PROCEDURES

|

16

|

|

E.

|

KEY

INFORMATION ABOUT THE PROPOSAL

|

16

|

| 1. SUMMARY OF THE PROPOSED REORGANIZATION |

16

|

|

| 2. DESCRIPTION OF THE ACQUIRING FUND’S SHARES |

17

|

|

| 3. REASONS FOR THE REORGANIZATION |

17

|

|

| 4. FEDERAL INCOME TAX CONSEQUENCES |

18

|

|

| 5. COMPARISON OF FORMS OF ORGANIZATION AND SHAREHOLDER RIGHTS |

19

|

|

| 6. CAPITALIZATION |

20

|

|

|

F.

|

ADDITIONAL

INFORMATION ABOUT THE FUNDS

|

21

|

| 1. PAST PERFORMANCE OF THE TARGET FUND |

21

|

|

| 2. SERVICE PROVIDERS |

22

|

|

|

II.

|

VOTING

INFORMATION

|

24

|

|

A.

|

GENERAL

INFORMATION

|

24

|

|

B.

|

METHOD

AND COST OF SOLICITATION

|

25

|

|

C.

|

RIGHT

OF REVOCATION

|

26

|

|

D.

|

VOTING

SECURITIES AND PRINCIPAL HOLDERS

|

26

|

|

E.

|

INTEREST

OF CERTAIN PERSONS IN THE TRANSACTION

|

27

|

|

III.

|

MISCELLANEOUS

INFORMATION

|

27

|

|

A.

|

OTHER

BUSINESS

|

27

|

|

B.

|

NEXT

MEETING OF SHAREHOLDERS

|

27

|

|

C.

|

LEGAL

MATTERS

|

27

|

|

D.

|

EXPERTS

|

28

|

|

E.

|

INFORMATION

FILED WITH THE SEC

|

28

|

| APPENDIX A – Form of Agreement and Plan of Reorganization | A-1 | |

|

I.

|

PROPOSAL

– TO APPROVE THE AGREEMENT AND PLAN OF

REORGANIZATION

|

|

|

A.

|

OVERVIEW

|

|

Liberty Street Horizon

Fund

|

||||||

|

Fees and

Expenses

|

||||||

|

Target

Fund

|

Acquiring

Fund

(Pro

forma)

|

Target

Fund

|

Acquiring

Fund

(Pro

forma)

|

Target

Fund

|

Acquiring

Fund

(Pro

forma)

|

|

|

Share

Class

|

Class

A

|

Class

A

|

Class

C

|

Class

C

|

Institutional

Class

|

Institutional

Class

|

|

Shareholder

Fees

|

||||||

|

(fees paid directly from your

investment)

|

||||||

|

Maximum Sales Charge

(Load)

|

4.75%(1)

|

4.75%(1)

|

None

|

None

|

None

|

None

|

|

Imposed On

Purchases

|

||||||

|

(as a percentage of the

offering price)

|

||||||

|

Maximum Deferred Sales Charge

(Load) Imposed on Redemptions

|

1.00%(2)

|

1.00%(2)

|

0.75%(3)

|

0.75%(3)

|

None

|

None

|

|

(as a percentage of the

purchase or sale price, whichever is less)

|

||||||

|

Redemption

Fee

|

1.00%(4)

|

1.00%(4)

|

1.00%(4)

|

1.00%(4)

|

1.00%(4)

|

1.00%(4)

|

|

(as a percentage of amount

redeemed)

|

||||||

|

Annual Fund Operating

Expenses(5)

|

||||||

|

(expenses that are deducted

from Fund assets)

|

||||||

|

Management

Fee

|

1.00%

|

1.00%

|

1.00%

|

1.00%

|

1.00%

|

1.00%

|

|

Distribution and/or Service

(Rule 12b-1) Fees

|

0.25%

|

0.25%

|

0.75%

|

0.75%

|

None

|

None

|

|

Other Expenses(6)

|

0.66%

|

0.41%

|

0.75%

|

0.41%

|

0.68%

|

0.41%

|

|

Total Annual Fund

Operating

|

1.91%

|

1.66%

|

2.50%

|

2.16%

|

1.68%

|

1.41%

|

|

Expenses

|

||||||

|

Fee Waiver and

Expense

|

(0.41%)

|

(0.16%)

|

(0.50%)

|

(0.16%)

|

(0.43%)

|

(0.16%)

|

|

Reimbursement

|

||||||

|

Net Expenses(7)(8)

|

1.50%

|

1.50%

|

2.00%

|

2.00%

|

1.25%

|

1.25%

|

|

One

Year

|

Three

Years

|

Five

Years

|

Ten

Years

|

|

|

Liberty

Street Horizon Fund (A Shares)

|

||||

|

Target

Fund

|

$620

|

$1,009

|

$1,421

|

$2,570

|

|

Acquiring

Fund (Pro

forma)

|

620

|

959

|

1,320

|

2,334

|

|

Liberty

Street Horizon Fund (C Shares)

|

||||

|

Target

Fund

|

$278

|

$731

|

$1,286

|

$2,798

|

|

Acquiring

Fund (Pro

forma)

|

278

|

661

|

1,145

|

2,480

|

|

Liberty

Street Horizon Fund (Institutional Shares)

|

||||

|

Target

Fund

|

$127

|

$488

|

$872

|

$1,951

|

|

Acquiring

Fund (Pro

forma)

|

127

|

431

|

756

|

1,677

|

|

One

Year

|

Three

Years

|

Five

Years

|

Ten

Years

|

|

|

Liberty

Street Horizon Fund (A Shares)

|

||||

|

Target

Fund

|

$620

|

$1,009

|

$1,421

|

$2,570

|

|

Acquiring

Fund (Pro

forma)

|

620

|

959

|

1,320

|

2,334

|

|

Liberty

Street Horizon Fund (C Shares)

|

||||

|

Target

Fund

|

$278

|

$731

|

$1,286

|

$2,798

|

|

Acquiring

Fund (Pro

forma)

|

278

|

661

|

1,145

|

2,480

|

|

Liberty

Street Horizon Fund (Institutional Shares)

|

||||

|

Target

Fund

|

$127

|

$488

|

$872

|

$1,951

|

|

Acquiring

Fund (Pro

forma)

|

127

|

431

|

756

|

1,677

|

|

|

C.

|

SUMMARY

OF FUND INVESTMENT OBJECTIVES, STRATEGIES, AND

RISKS

|

|

Target

Fund and Acquiring Fund

|

Investment

Strategy

|

|

Liberty

Street Horizon Fund,

a

series of Forum Funds

and

Liberty

Street Horizon Fund,

a

series of IMST

|

The

Fund pursues its investment objective by primarily investing in U.S. and

foreign equity stocks. The Fund’s equity investments may include common

stock, preferred stock, securities convertible into common stock,

warrants, rights and other equity securities having the characteristics of

common stock (such as depositary receipts). The Fund may invest in any

size company, including small- and medium-sized companies, and further may

invest in companies which are financially distressed. In addition, under

certain market conditions, the Fund may invest in companies at the time of

their initial public offering (“IPO”). The Fund’s investments in foreign

equity stocks will primarily be purchased in developed markets, although

it may also purchase foreign equity stocks in emerging markets pursuant to

its investment strategy.

The

Fund may also invest up to 20% of its assets in fixed income securities

with maturities typically between one year and ten years, which may

include debt securities that are rated below investment grade, or unrated

securities that Horizon, the Fund’s sub-advisor, deems to be of comparable

quality.

The

Fund may use certain derivative instruments, such as writing and selling

options, for risk management purposes or as part of the Fund’s investment

strategies. Generally, derivatives are financial contracts the

values of which depend upon, or are derived from, the value of an

underlying asset, reference rate, or index, and may relate to stocks,

bonds, interest rates, currencies or currency exchange rates, and related

indices. The Fund may also lend its portfolio securities to generate

additional income.

The

Sub-Advisor’s Process

Horizon’s

general investment philosophy begins with the acknowledgement that the

greatest determining factor of a portfolio’s long-term, successful

performance is the reduction of risk. Many investment professionals

measure risk in degrees of prior volatility; Horizon assesses risk in

terms of the probability of permanent capital loss. It is generally

understood that equity investing is an inherently risky exercise; yet it

is less understood that investment returns are asymmetrical, meaning that

negative returns require larger off-setting positive returns just to break

even. Horizon’s investment process uses in-house research as well as a

dynamic approach to portfolio construction to identify and select what

Horizon believes are securities with asymmetrically favorable return

properties – those for which reward potential exceeds downside risk.

Horizon invests in opportunities in the full spectrum of available

securities that it believes have the most favorable risk/reward

characteristics. Where appropriate, Horizon may employ periodic hedging

and other risk reduction techniques, including the use of fixed income

securities where the risk/reward attributes are

favorable.

|

|

The

majority of the Fund’s assets are managed using Horizon’s core value

strategy, as described below. In addition, portions of the Fund’s assets

are managed by Horizon using its research strategy, and also may be

invested in specialty stocks that Horizon believes maintain the most

favorable risk/reward characteristics. Horizon may allocate assets of the

Fund across the above strategies in order to best implement its investment

philosophy.

Horizon’s Core Value

Strategy. Horizon’s core value strategy relies on its

in-house research to identify companies possessing very particular, often

distinctive and under-appreciated business models. The strategy focuses on

businesses that tend to be relatively protected from severe price

competition or technological obsolescence which, as a consequence, Horizon

believes can sustain high returns on equity.

Horizon

does not screen for quantitative value measures. Horizon often invests in

out-of-favor companies, applying its research capabilities to distinguish

between permanent and transitory problems, and exercises the patience to

await the resolution of the latter. Selections are not constrained by

arbitrary or non-investment considerations and therefore will include a

variety of market capitalizations as well as companies outside the U.S.,

though typically the majority of stocks held by the Fund will tend to be

larger U.S. companies. Core value holdings will not ordinarily include

shares that rely on a catalyst, thereby avoiding what is often referred to

as the “value trap.” Rather, holdings reflect a focus on a company’s

ability to continue to compound earnings as the result of its core

business.

Horizon’s

security selection is based upon a strategic and financial, or “bottom up”

analysis of each company. However, as unusually favorable

risk/reward opportunities are often the product of dislocation in a

particular sector, weightings can reflect businesses subject to similar

conditions. Thus, core value holdings frequently contain themes, with

allocations of 25% or more in one area. This presents an opportunity to

own shares below what Horizon considers to be intrinsic value and can

represent a second margin of safety in addition to the compounding

manifested by the superior business model.

Horizon’s Research

Strategy. In utilizing its research strategy, Horizon

selects a wide variety of investments in the areas of catalyst driven and

event driven opportunities, distressed securities, companies that it

believes have certain assets whose true values are not fully reflected on

the balance sheets, and securities with pricing anomalies and other areas

of inefficiency.

Unlike

Horizon’s core value strategy which typically requires a proven history of

high and sustainable returns on invested capital, Horizon’s research

strategy has a higher tolerance for companies that may not have as

extensive operating histories. Horizon considers not only a company’s

current ability to produce high sustainable returns on invested capital

but also the company’s future potential to increase that rate of return.

In many instances, the Fund’s research strategy portfolio will invest in

less mature companies in the process of developing a superior product or

market niche. These companies can be smaller in size and may employ

leverage to assist in rapid expansion opportunities or enhance returns on

invested capital. In many cases, the portfolio may invest in companies

that are the subject of significant questions by Wall Street surrounding

the companies’ going concern status. In rare instances, companies emerging

from bankruptcy may also be purchased in this strategy. Appropriately, the

holdings in the research strategy will tend to be more volatile while

offering higher return potential given their earlier stage in the business

cycle.

|

|

Horizon’s Sell

Discipline. For each strategy, Horizon evaluates

securities for sale as fundamentally as it does for purchase. Its primary

reasons for selling a security are as follows:

•

expectations have been met or exceeded and it becomes appropriate to

realize gains;

•

the risk/reward characteristics have changed and no longer meet the Fund’s

investment guidelines;

• an

additional investment idea, with more favorable risk/reward

characteristics, has been identified creating a need for cash;

or

• Horizon

has misjudged or otherwise found an omission in its original

analysis.

Cash and Temporary Defensive

Positions. The Fund intends to hold some cash or high quality,

short-term debt obligations and money market instruments for reserves to

cover redemptions and unanticipated expenses. In addition, when the

risk/reward profile for common stocks or fixed income instruments appears

unfavorable, or when price valuations are not attractive, Horizon will

allow the Fund’s cash position to increase rather than purchase stocks

that fail to meet its investment criteria. In addition, there may be times

when Horizon may respond to adverse market, economic, political or other

considerations by investing up to 100% of the Fund’s assets in high

quality, short-term debt securities or other defensive investments for

temporary defensive purposes. During those times, the Fund may not achieve

its investment objective and, instead, will focus on preserving its

assets. To the extent the Fund uses a money market fund for investment of

cash, there will be some duplication of expenses because the Fund would

bear its pro rata portion of such money market fund’s advisory fees and

operational expenses.

|

|

Target Fund and Acquiring

Fund

|

Principal Investment

Risks

|

|

Liberty

Street Horizon Fund,

a

series of Forum Funds

and

Liberty

Street Horizon Fund,

a

series of IMST

|

Management Risk. The

Fund’s success depends largely on Horizon’s ability to select favorable

investments. Different types of investments shift in and out of favor

depending on market and economic conditions. For example, at various times

equity securities will be more or less favorable than debt securities and

small company stocks will be more or less favorable than large company

stocks. Because of this, the Fund will perform better or worse than other

types of Fund depending on what is in “favor.” In addition, there is the

risk that the strategies, research or analytical techniques used by the

Fund’s portfolio managers and/or their security selection may fail to

produce the intended result.

|

|

General Market Risk. In

general, a company’s stock value is affected by activities specific to the

company as well as general market, economic and political conditions. The

net asset value per share (“NAV”) and investment return of the Fund will

fluctuate based upon changes in the value of its portfolio securities. The

market value of securities in which the Fund invests is based upon the

market’s perception of value and is not necessarily an objective measure

of the securities’ value. There is no assurance that the Fund will achieve

its investment objective, and an investment in the Fund is not by itself a

complete or balanced investment program. You could lose money on your

investment in the Fund or the Fund could underperform other investments.

Other general market risks include:

• The

market may not recognize what Horizon believes to be the true value

potential of the stocks held by the Fund;

• The

earnings of the companies in which the Fund invests may not continue to

grow at expected rates, thus causing the price of the underlying stocks to

decline;

• Horizon’s

judgment as to the growth potential or value of a stock may prove to be

wrong; and

• A

decline in investor demand for the stocks held by the Fund also may

adversely affect the value of the securities.

Small- and Medium-Sized

Companies Risk. The Fund may invest in any size company, including

small- and medium-sized companies. Investments in smaller capitalized

companies may involve greater risks than larger-capitalized companies,

such as limited product lines, markets and financial or managerial

resources. Investments in small- and medium-sized companies may

be more volatile than investments in larger companies because short-term

changes in the demand for the securities of smaller companies may have a

disproportionate effect on their market price, tending to make prices of

these securities fall more in response to selling pressure. The smaller

the company, the greater effect these risks may have on that company’s

performance. As a result, an investment in the Fund may exhibit a higher

degree of volatility than the general domestic securities

market.

Initial Public Offerings

Risk. The Fund may purchase securities of companies in initial

public offerings. Special risks associated with these securities may

include limited numbers of shares available for trading, unseasoned

trading, lack of investor knowledge of the companies and the companies’

limited operating histories. These factors may contribute to substantial

price volatility for the shares of these companies. The limited number of

shares available for trading in some initial public offerings may make it

more difficult for the Fund to buy or sell significant amounts of shares

without an unfavorable impact on prevailing market prices. Some companies

whose shares are sold through initial public offerings are involved in

relatively new industries or lines of business, which may not be widely

understood by investors. Some of these companies may be undercapitalized

or regarded as developmental stage companies without revenues or operating

income, or the near-term prospects of achieving

them.

|

|

Distressed Securities

Risk. Financially distressed securities involve considerable risk

that can result in substantial or even total loss of the Fund’s

investment. It is often difficult to obtain information as to the true

condition of financially distressed securities. These securities are often

subject to litigation among the participants in bankruptcy or

reorganization proceedings. Such investments may also be adversely

affected by federal and state laws relating to, among other things,

fraudulent transfers and other voidable transfers or payments, lender

liability and a bankruptcy court’s power to disallow, reduce, subordinate

or disenfranchise particular claims. These and other factors contribute to

above-average price volatility and abrupt and erratic movements of the

market prices of these securities. In addition, the spread between the bid

and asked prices of such securities may be greater than normally expected

and it may take a number of years for the market prices of such securities

to reflect their intrinsic values.

Foreign Securities Risk.

The Fund’s investments in foreign securities will have the following

additional risks:

• Foreign

securities may be subject to greater fluctuations in price than securities

of U.S. companies because foreign markets may be smaller and less liquid

than U.S. markets;

• Changes

in foreign tax laws, exchange controls, investment regulations and

policies on nationalization and expropriation as well as political

instability may affect the operations of foreign companies and the value

of their securities;

• Fluctuations

in currency exchange rates and currency transfer restrictions may

adversely affect the value of the Fund’s investments in foreign

securities, which are denominated or quoted in currencies other than the

U.S. dollar;

• Foreign

securities and their issuers are not subject to the same degree of

regulation as U.S. issuers regarding information disclosure, insider

trading and market manipulation. There may be less publicly available

information on foreign companies and foreign companies may not be subject

to uniform accounting, auditing, and financial standards as are U.S.

companies;

• Foreign

securities registration, custody and settlements may be subject to delays

or other operational and administrative problems;

• Certain

foreign brokerage commissions and custody fees may be higher than those in

the U.S.; and

• Dividends

payable on the foreign securities contained in the Fund’s portfolio may be

subject to foreign withholding taxes, thus reducing the income available

for distribution to the Fund’s

shareholders.

|

|

Foreign

securities may trade on U.S. or European exchanges in the form of

American, European or International depositary receipts. Although

depositary receipts have similar risks to the securities they represent,

they may also involve higher expenses and be less liquid than the

underlying securities listed on an exchange. In addition, depositary

receipts may not pass through voting and other shareholder

rights.

|

|

|

Emerging Markets Risk.

To the extent that the Fund invests in emerging markets, an investment in

the Fund may have the following additional risks:

• Information

about the companies in these countries is not always readily

available;

• Stocks

of companies traded in these countries may be less liquid and the prices

of these stocks may be more volatile than the prices of the stocks in more

established markets;

• Greater

political and economic uncertainties exist in emerging markets than in

developed foreign markets;

• The

securities markets and legal systems in emerging markets may not be well

developed and may not provide the protections and advantages of the

markets and systems available in more developed countries;

and

• Very

high inflation rates may exist in emerging markets and could negatively

impact a country’s economy and securities markets.

For

these and other reasons, the prices of securities in emerging markets can

fluctuate more significantly than the prices of securities of companies in

developed countries. The less developed the country, the greater effect

these risks may have on your investment in the Fund. As a result, an

investment in the Fund may exhibit a higher degree of volatility than

either the general domestic securities market or the securities markets of

developed foreign countries.

Derivatives Risk.

Derivatives can be volatile and involve various types and degrees of

risks, including leverage, credit and liquidity risk. The Fund could

experience a significant loss if derivatives do not perform as

anticipated, or are not correlated with the performance of other

investments which they are used to hedge or if the Fund is unable to

liquidate a position because of an illiquid secondary market.

Interest Rate Risk. The

value of your investment in the Fund may change in response to changes in

interest rates. An increase in interest rates typically causes a fall in

the value of the debt securities that the Fund holds. The effect is

usually more pronounced for debt securities with longer dates to

maturity.

Credit Risk. The

financial condition of an issuer of a debt security may cause it to

default or become unable to pay interest or principal due on the security.

If an issuer defaults, the affected security could lose all of its value,

be renegotiated at a lower interest rate or principal amount, or become

illiquid. The Fund may invest in debt securities that are issued by U.S.

Government sponsored entities. Securities issued by agencies and

instrumentalities of the U.S. Government that are supported by the full

faith and credit of the United States, such as the Federal Housing

Administration and Government National Mortgage Association, present

little credit risk. Other securities issued by agencies and

instrumentalities sponsored by the U.S. Government that are supported only

by the issuer’s right to borrow from the U.S. Treasury, subject to certain

limitations, such as securities issued by Federal Home Loan Banks, and

securities issued by agencies and instrumentalities sponsored by the U.S.

Government that are supported only by the credit of the issuing agencies,

such as Federal Home Loan Mortgage Corporation and Federal National

Mortgage Association, are subject to a greater degree of credit risk as

they are not backed by the full faith and credit of the U.S.

Government.

|

|

As

of September 7, 2008, the Federal Housing Finance Agency (“FHFA”) was

appointed as the conservator of Federal Home Loan Mortgage Corporation

(“FHLMC”) and Federal National Mortgage Association (“FNMA”) for an

indefinite period. In accordance with the Federal Housing

Finance Regulatory Reform Act of 2008 and the Federal Housing Enterprises

Financial Safety and Soundness Act of 1992, as conservator, the FHFA will

control and oversee these entities until the FHFA deems them financially

sound and solvent. During the conservatorship, each entity's

obligations are expected to be paid in the normal course of

business. Although no express guarantee exists for the debt or

mortgage-backed securities issued by these entities, the U.S. Department

of Treasury, through a secured lending credit facility and a senior

preferred stock purchase agreement, has attempted to enhance the ability

of the entities to meet their obligations.

Prepayment or Call Risk.

Issuers may prepay fixed rate obligations when interest rates fall,

forcing the Fund to reinvest in obligations with lower interest rates than

the original obligations.

Lower-Rated Securities

Risk. Debt securities rated below investment grade (often called

“junk bonds”) generally have greater credit risk than higher-rated

securities. Companies issuing high yield, fixed-income securities are less

financially strong, are more likely to encounter financial difficulties

and are more vulnerable to changes in the economy than those companies

with higher credit ratings. These factors could affect such companies’

abilities to make interest and principal payments and ultimately could

cause the issuer to stop making interest and/or principal payments. In

such cases, payments on the securities may never resume, which would

result in the securities owned by the Fund becoming

worthless.

The

prices of high yield, fixed-income securities may fluctuate more than

higher-quality securities, which could subject the Fund to a greater risk

of loss. Such securities are more sensitive to developments affecting the

company’s business and are more closely linked with the company’s stock

prices than higher-quality securities. In addition, high yield securities

generally may also be less liquid than higher-quality securities. The Fund

may have difficulty selling these securities promptly at acceptable

prices.

Diversification Risk.

The Fund is classified as non-diversified and may focus its investments in

the securities of a comparatively small number of issuers. Investment in

securities of a limited number of issuers exposes the Fund to greater

market risk and potential losses than if its assets were diversified among

the securities of a greater number of issuers. However, the Fund will

comply with certain diversification requirements imposed by the Internal

Revenue Code.

|

|

Securities Lending Risk.

The Fund may lend its portfolio securities to broker-dealers by entering

directly into lending arrangements with such broker-dealers or indirectly

through a securities lending arrangement, in an amount no more than

33

1/3% of the total assets of the Fund (including any collateral

posted) or 50% of the total assets of the Fund (excluding any collateral

posted). Securities lending transactions will be fully collateralized at

all times with cash and/or short-term obligations. These transactions

involve some risk to the Fund if the other party should default on its

obligation and the Fund is delayed or prevented from recovering the

collateral. In the event the original seller defaults on its obligation to

repurchase, the Fund will seek to sell the collateral, which could involve

costs or delays. To the extent the proceeds from the sale of the

collateral are less than the repurchase price, the Fund would suffer a

loss if forced to sell such collateral in this manner.

|

|

|

|

·

|

the Reorganization was

recommended by the Advisor;

|

|

|

·

|

the investment objective,

policies and restrictions of the Target Fund are substantially identical

to the Acquiring Fund;

|

|

|

·

|

the Advisor and Horizon will

continue to manage the Acquiring

Fund;

|

|

|

·

|

the cost of the Reorganization

will not be borne by the Target Fund or its shareholders;

and

|

|

|

·

|

counsel to IMST will provide the

Trust with an opinion to the effect that the Reorganization will not have

any federal or state tax consequences for the Target Fund or its

shareholders.

|

|

|

·

|

The Target Fund will not

recognize any gain or loss as a result of the

Reorganization;

|

|

|

·

|

Each Target Fund shareholder will

not recognize any gain or loss as a result of the receipt of Acquiring

Fund shares in exchange for such shareholder’s Target Fund shares pursuant

to the Reorganization;

|

|

|

·

|

The tax basis and holding period

for the Target Fund’s assets will effectively be carried over when those

assets are transferred to the Acquiring

Fund;

|

|

|

·

|

Each Target Fund shareholder’s

aggregate tax basis in the Acquiring Fund shares received pursuant to the

Reorganization will equal such shareholder’s aggregate tax basis in the

Target Fund shares held immediately before the Reorganization, and its

holding period for those Acquiring Fund shares will include, in each

instance, its holding period for those Target Fund shares, provided the

shareholder holds them as capital assets as of the time of the

Closing;

|

|

|

·

|

The Acquiring Fund will recognize

no gain or loss on its receipt of the Target Fund’s assets in exchange

solely for Acquiring Fund shares and its assumption of the Target Fund’s

liabilities; and

|

|

|

·

|

For purposes of section 381 of

the Code, the Acquiring Fund will be treated just as the Target Fund would

have been treated if there had been no

Reorganization. Accordingly, the Reorganization will not result

in the termination of the Target Fund’s taxable year, the Target Fund’s

tax attributes enumerated in section 381(c) of the Code will be taken into

account by the Acquiring Fund as if there had been no Reorganization, and

the part of the Target Fund’s taxable year before the Reorganization will

be included in the Acquiring Fund’s taxable year after the

Reorganization.

|

|

(unaudited)

|

Target

Fund

|

Pro

forma

Acquiring

Fund

|

|

Net

Assets

|

||

|

Class

A

|

$19,383,588

|

$19,383,588

|

|

Class

C

|

10,063,814

|

10,063,814

|

|

Institutional

Class

|

60,434,028

|

60,434,028

|

|

Total

|

$89,881,430

|

$89,881,430

|

|

Shares

Outstanding

|

||

|

Class

A

|

4,038,556

|

4,038,556

|

|

Class

C

|

2,117,741

|

2,117,741

|

|

Institutional

Class

|

12,660,307

|

12,660,307

|

|

Total

|

18,816,604

|

18,816,604

|

|

Net

Asset Value per Share

|

||

|

Class

A

|

$4.80

|

$4.80

|

|

Class

C

|

$4.75

|

$4.75

|

|

Institutional

Class

|

$4.77

|

$4.77

|

|

|

F.

|

ADDITIONAL

INFORMATION ABOUT THE FUNDS

|

|

Institutional

Class

|

||

|

Highest

Calendar Qtr Return at NAV (non-annualized):

|

(1.38)%

|

Quarter

Ended 6/30/08

|

|

Lowest

Calendar Qtr Return at NAV (non-annualized):

|

(29.16)%

|

Quarter

Ended 12/31/08

|

|

1

Year

|

Since

Inception

|

|

|

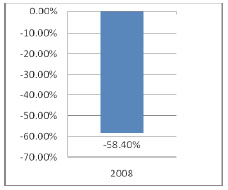

Institutional

Shares — Return Before

Taxes

|

(58.40)%

|

(43.17)% (1)

|

|

Institutional

Shares — Return After Taxes on

Distributions

|

(58.44)%

|

(43.23)% (1)

|

|

Institutional

Shares — Return After Taxes on

Distributions and Sale of Fund

Shares

|

(37.92)%

|

(35.83)% (1)

|

|

A Shares

— Return Before

Taxes

|

(60.37)%

|

(38.41)%

(2)

|

|

C

Shares — Return Before

Taxes

|

(58.99)%

|

(38.15)%

(2)

|

|

S&P 500 Index (reflects no

deduction for fees, expenses or taxes)

|

(37.00)%

|

(28.12)%(3)

|

|

Fiscal

Year Ended April 30, 2009

|

|||

|

Advisory

Fee Earned

|

Waiver/Reimbursement

|

Amount

Received After

Waiver/Reimbursement

|

|

|

Liberty

Street Horizon Fund

|

$702,332

|

($305,285)

|

$397,047

|

|

II.

|

VOTING

INFORMATION

|

|

|

•

|

complete and sign the enclosed

proxy ballot and mail it to us in the prepaid return envelope (if mailed

in the United States);

|

|

|

•

|

vote on the Internet at the

website address listed on your proxy ballot;

or

|

|

|

•

|

call the toll-free number printed

on your proxy ballot.

|

|

Target Fund Class

|

Shares

Outstanding &

Entitled

to Vote

(unaudited)

|

|

Class

A

|

4,104,993.191

|

|

Class

C

|

2,158,334.681

|

|

Institutional

Class

|

13,214,461.718

|

|

Name and

Address

|

Class

|

No.

of Shares

Owned

|

%

of Shares

|

|

UBS

Financial Services, Inc.

FBO

Richard E. Workman Living Trust

5180

Vardon Drive

Windermere,

FL 34786-8960

|

A

|

586,643.165

|

14.29%

|

|

UBS

Financial Services, Inc.

FBO

William H. Stender Jr. Living Trust

1720

Buck Island Drive

Guntersville,

AL 35976-8548

|

A

|

248,249.884

|

6.05%

|

|

UBS

Financial Services, Inc.

FBO

Fredric H. Clark

Rinda

K. Clark JTWROS

11

Fred Clark Lane

Fayetteville,

TN 37334-6180

|

C

|

153,601.695

|

7.12%

|

|

UBS

Financial Services, Inc.

FBO

Diversified Holdings LLC

Horizon

Large Cap

303

Middle Collision Road

Mount

Lookout, WV 26678-9347

|

C

|

152,865.127

|

7.08%

|

|

Charles

Schwab & Co, Inc.

101

Montgomery Street

San

Francisco, CA 94104

|

I

|

8,428,134.374

|

63.78%

|

|

Name

|

Relationship

to Liberty Street Advisors, Inc.

|

|

|

Raymond

A. Hill III, Timothy Reick, Victor J. Fontana

and

Scott Daniels

|

Shareholders

|

|

III.

|

MISCELLANEOUS

INFORMATION

|

|

1.

|

The

Statement of Additional Information of the Target Fund dated September 1,

2008;

|

|

2.

|

The

Statement of Additional Information of the Acquiring Fund dated August 14,

2009;

|

|

3.

|

The

Semi-Annual Report to Shareholders of the Target Fund dated October 31,

2008; and

|

|

4.

|

The

Annual Report to Shareholders of the Target Fund dated April 30,

2009.

|

|

|

1.

|

Amended and Restated Agreement

and Declaration of Trust is herein incorporated by reference from

Registrant’s Post-Effective Amendment No. 29 to Registrant’s Registration

Statement on form N-1A (333-122901) filed with the Commission on December

5, 2007.

|

|

|

2.

|

Amended and Restated By-Laws are

herein incorporated by reference from Registrant’s Post-Effective

Amendment No. 30 to Registrant’s Registration Statement on form N-1A

(333-122901) filed with the Commission on January 16,

2008.

|

|

|

3.

|

Not

Applicable.

|

|

|

4.

|

Form of Agreement and Plan of

Reorganization – filed

herewith.

|

|

|

5.

|

Instruments Defining Rights of

Security Holders are herein incorporated by reference from the Trust’s

Declaration of Trust and

By-Laws.

|

|

6.

(a)

|

Form of Investment Advisory

Agreement between the Trust and Liberty Street Advisors, Inc. is herein

incorporated by reference from Registrant’s Post-Effective Amendment No.

67 to Registrant’s Registration Statement on Form N-1A (333-122901) filed

with the Commission on August 14,

2009.

|

|

|

(b)

|

Form of Investment Sub-Advisor

Agreement between Horizon Asset Management, Inc. and Liberty Street

Advisors, Inc. is herein incorporated by reference from Registrant’s

Post-Effective Amendment No. 67 to Registrant’s Registration Statement on

Form N-1A (333-122901) filed with the Commission on August 14,

2009.

|

|

|

7.

|

Form of Distribution Agreement

between Foreside Fund Services, LLC and IMST on behalf of the Liberty

Street Horizon Fund is herein incorporated by reference from Registrant’s

Post-Effective Amendment No. 67 to Registrant’s Registration Statement on

Form N-1A (333-122901) filed with the Commission on August 14,

2009.

|

|

|

8.

|

Not

Applicable.

|

|

|

9.

|

Custodian

Agreement dated January 14, 2008 between the Trust and UMB Bank, n.a. is

herein incorporated by reference from Registrant’s Post-Effective

Amendment No. 31 to Registrant’s Registration Statement on form N-1A

(333-122901) filed with the Commission on February 1,

2008.

|

|

10.

(a)

|

Distribution

and Service Plan for A Class and C Class shares is herein incorporated by

reference from Registrant’s Post-Effective Amendment No. 67 to

Registrant’s Registration Statement on form N-1A (333-122901) filed with

the Commission on August 14,

2009.

|

|

|

(b)

|

Multiple

Class Plan pursuant to Rule 18f-3 is herein incorporated by reference from

Registrant’s Post-Effective Amendment No. 67 to Registrant’s Registration

Statement on Form N-1A (333-122901) filed with the Commission on August

14, 2009.

|

|

|

11.

|

Opinion of Counsel regarding

legality of issuance of shares and other matters – filed

herewith.

|

|

|

12.

|

Opinion

of Counsel as to Tax Matters – filed

herewith.

|

|

|

13.

|

Other

Material Contracts

|

|

|

(a)

|

Co-Administration Agreement dated

March 25, 2009 between the Trust and UMB Fund Services, Inc. and Mutual

Fund Administration Corporation is herein incorporated by reference from

Registrant’s Post-Effective Amendment No. 56 to Registrant’s Registration

Statement on form N-1A (333-122901) filed with the Commission on April 1,

2009.

|

|

|

(b)

|

Fund Accounting Servicing

Agreement dated March 25, 2009 between the Trust and UMB Fund Services,

Inc. is herein incorporated by reference from Registrant’s Post-Effective

Amendment No. 56 to Registrant’s Registration Statement on form N-1A

(333-122901) filed with the Commission on April 1,

2009.

|

|

|

(c)

|

Transfer Agency Agreement dated

March 25, 2009 between the Trust and UMB Fund Services, Inc. is herein

incorporated by reference from Registrant’s Post-Effective Amendment No.

56 to Registrant’s Registration Statement on form N-1A (333-122901) filed

with the Commission on April 1, 2009.

|

|

|

(d)

|

Operating Expense Limitation

Agreement between Liberty Street Advisors, Inc. and the Trust on behalf of

the Liberty Street Horizon Fund is herein incorporated by reference from

Registrant’s Post-Effective Amendment No. 67 to Registrant’s Registration

Statement on form N-1A (333-122901) filed with the Commission on August

14, 2009.

|

|

|

14.

|

Consent of Independent Registered

Public Accounting Firm

|

|

|

(a)

|

From

Briggs, Bunting & Dougherty, LLP – filed

herewith.

|

|

|

(b)

|

From

Tait, Weller & Baker, LLP – filed

herewith.

|

|

|

15.

|

Not

Applicable.

|

|

|

16.

|

Powers

of Attorney

|

|

|

(a)

|

Power of Attorney for Charles H.

Miller dated June 24, 2009 (1)

|

|

|

(b)

|

Power of Attorney for Ashley T.

Rabun dated June 24, 2009 (1)

|

|

|

(c)

|

Power

of Attorney for William H. Young dated June 24, 2009 (1)

|

|

|

(d)

|

Power of Attorney for Eric M.

Banhazl dated June 24, 2009 (1)

|

|

|

17.

|

(a)

|

Proxy

Card -

filed herewith

|

|

|

(b)

|

Statement

of Additional Information of the Target Fund dated September 1, 2008 (1)

|

|

|

(c)

|

Semi-Annual

Report to Shareholders of the Target Fund dated October 31, 2008 (1)

|

|

|

(d)

|

Annual Report to Shareholders of

the Target Fund dated April 30, 2009 (1)

|

|

Signature

|

Title

|

|

|

*

|

||

|

Ashley

T. Rabun

|

Trustee

|

|

|

*

|

||

|

William

H. Young

|

Trustee

|

|

|

*

|

||

|

Charles

H. Miller

|

Trustee

|

|

|

/s/ John P. Zader

|

||

|

John

P. Zader

|

Trustee

and President

|

|

|

*

|

||

|

Eric

M. Banhazl

|

Trustee

and Vice President

|

|

|

/s/ Rita Dam

|

||

|

Rita

Dam

|

Treasurer

and Principal Financial and Accounting

Officer

|

|

Exhibit

|

Exhibit

No.

|

|

Form

of Agreement and Plan of Reorganization

|

EX.4

|

|

Opinion

and Consent of Counsel

|

EX.11

|

|

Opinion

of Counsel as to Tax Matters.

|

EX.12

|

|

Consent

of Independent Registered Public Accounting Firm from Briggs, Bunting

& Dougherty, LLP

|

EX.14.a

|

|

Consent

of Independent Registered Public Accounting Firm from Tait, Weller &

Baker, LLP

|

EX.14.b

|

|

Proxy

Card

|

EX.

17.a

|