OMB APPROVAL

OMB Number: 3235-0570

Expires: January 31, 2014

Estimated average burden hours per response...20.6

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21713

Madison Strategic Sector Premium Fund

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

Pamela M. Krill

Madison Legal and Compliance Department

550 Science Drive

Madison, WI 53711

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: December 31

Date of reporting period: December 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a

currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

ANNUAL REPORT

December 31, 2013

Madison Strategic Sector

Premium Fund (MSP)

Active Equity Management combined with a Covered Call Option Strategy

Madison

www.madisonfunds.com

MSP | Madison Strategic Sector Premium Fund

Table of Contents

Management’s Discussion of Fund Performance | 2 |

Portfolio of Investments | 7 |

Statement of Assets and Liabilities | 11 |

Statement of Operations | 12 |

Statements of Changes in Net Assets | 13 |

Financial Highlights for a Share of Beneficial Interest Outstanding | 14 |

Notes to Financial Statements | 15 |

Report of Independent Registered Public Accounting Firm | 22 |

Other Information | 23 |

Trustees and Officers | 27 |

Dividend Reinvestment Plan | 31 |

1

MSP | Madison Strategic Sector Premium Fund

Management’s Discussion of Fund Performance

What happened in the market during 2013?

Despite modest economic growth, U.S. equities had one of the best years in history and led the world’s stock markets, as the S&P 500 advanced 32.39% in 2013. Domestic mid-cap and small-cap indices showed even stronger returns, with the Russell Midcap® Index up 34.76% and the Russell 2000® Index of small-cap stocks up 38.82%. Developed international markets were also robust, as the broad MSCI EAFE Net Index advanced 22.78%. Emerging markets, on the other hand, lagged the developed world badly, with the Russell Emerging Market Index barely positive with a 0.2% return.

Despite an array of challenges, the resilient U.S. economy grew by nearly 2% in 2013, with the rate of this growth appearing to accelerate through the final quarters. Europe seemed to be working through the worst of its problems, while emerging markets showed signs of slowing growth, putting selling pressure on what had been an investor favorite for much of the past decade.

Returns for bond investors were not as satisfying, as the broad Barclays U.S. Aggregate Bond Index dropped -2.02%. During the final quarter of 2013, fixed income investors continued to focus on the timing of a much awaited shift in monetary policy from the Federal Reserve (the “Fed”). Throughout 2013 strengthening economic fundamentals and hints from the Fed created expectations for a tapering in Fed open-market bond purchasing. These expectations for what was widely viewed as the first stage towards monetary tightening put steady pressure on interest rates. The yield on the bellwether 10-year Treasury began the year below 2% and climbed close to 3% in early September before drifting back to 2.6% at the end of the third quarter. At year’s end the 10-year yield was just over 3%, marking its highest level for 2013.

How did the fund perform given the marketplace conditions during 2013?

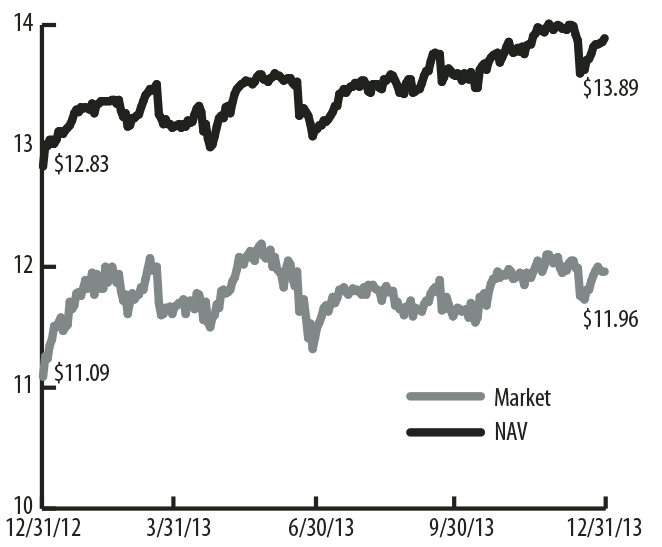

For the year ending December 31, 2013, on a Net Asset Value (NAV) basis, Madison Strategic Sector Premium Fund (“MSP” or the “Fund”) rose 16.8%, compared to the 13.3% return of the CBOE S&P BuyWrite Index (BXM), the Fund‘s primary index. The BXM represents the passive version of a covered call equity strategy. On a share price basis, MSP advanced 17.7%. The fund’s share price discount to the NAV widened slightly throughout the year, starting at a 13.5% discount and ending the year at a 13.8% discount. In mid-February, the discount was at its narrowest level at 10.2%. MSP distributed $1.04 per share for the full year, on par with the 2012 distribution level. We earned $2.09 from investment operations as our NAV increased from $12.83

to $13.88. Using year-end values, the Fund’s yield was 7.5% on NAV or 8.7% on market price.

SHARE PRICE AND NAV PERFORMANCE FOR

MADISON STRATEGIC SECTOR PREMIUM FUND

MADISON STRATEGIC SECTOR PREMIUM FUND

However, MSP outperformed the BXM by over 350 basis points on a NAV basis. The Fund was positively impacted by stock selection and sector allocation that were stronger than the S&P 500, which is the underlying asset in the BXM. In addition, the Fund’s equity exposure was not fully “covered’ by call options during the year which resulted in the Fund being less hedged relative to the BXM which is fully covered at all times. Being less hedged in a rising market environment allowed the Fund to participate in the positive market move to a greater extent. Partially offsetting these positive attributes was the impact of the Fund’s cash exposure which detracted from performance in a rising market relative to the BXM, which has no cash exposure. The impacts of stock selection, sector allocation and cash holdings is discussed below.

2

MSP | Madison Strategic Sector Premium Fund | Management’s Discussion of Fund Performance - continued

Typically, a covered call strategy will lag the overall market during periods of strong upward movement in stock prices as the sale of call options against stock positions limits full participation in favor of higher income potential and downside protection. This certainly impacted the Fund’s ability to keep up with the strong returns of the S&P 500 over the past 12 months.

The strong full year performance of the S&P 500 was broad-based and led by lower-quality, higher-risk companies. From a sector perspective, the Consumer Discretionary, Health Care and Industrial sectors were the top performers for the Fund. The Fund benefited from its overweighted positioning in consumer companies with particularly strong performance coming from Best Buy, Advance Auto Parts and Amazon, only minimally offset by weakness in a few mid-cap companies such as Lululemon and Panera Bread Company. The Fund had a neutral weight in Health Care stocks, although the positioning declined throughout the year as individual holdings were trimmed or sold due to strong performance. Biotechnology companies were the best of breed performers with this sector, and the Fund benefitted from owning Celgene and Allergan. Generic drug manufacturers were mixed with Mylan Labs’ strong performance offset by weakness in Teva Pharmaceuticals. The Industrials sector was under-represented in the Fund and individual stocks underperformed led by weakness in C. H. Robinson and Expeditors International. Strength in United Technologies partially offset weakness elsewhere. The weakest sectors during the year were the relatively small Telecom and Utilities sectors in which the Fund had no exposure. The Information Technology sector was up over 26% but technically underperformed the overall market. The Fund has had a consistent overweighted position in this sector so this hindered relative performance to a small degree. The Fund’s individual technology holdings fared well during the year with particularly strong contribution coming from Microsoft, Linear Technology, Applied Materials, Symantec and Cisco Systems. Weaker performance came from Broadcom, Altera, Nuance Communications and eBay.

With respect to cash levels, a rising stock market typically results in a high level of stock assignments, which can occur when a holding’s market price moves above the call option’s strike price. A high level of assignments will lead to higher cash levels until the cash is reinvested into other appropriate equity holdings. During 2013, assignment activity was very high given the stock market’s strong advance, and cash levels were consistently elevated as the fund managers prudently awaited reinvestment opportunities without the benefit of meaningful market pullbacks. The higher than normal cash levels were a hindrance to performance given the market’s strong advance. At year end, cash levels were at 10.5%.

Describe the Fund’s portfolio equity and option structure.

As of December 31, 2013, the Fund held 45 equity securities, and unexpired covered call options had been written against 86.5% of the Fund’s stock holdings. It is the strategy of the fund to write “out-of-the-money” call options, yet, as of December 31, only 26% of the Fund’s call options (17 of 65 different options) remained “out-of-the-money.” The sharp market rally late in the year caused many options to move into the money although they were originally written out-of-the-money. (Out-of-the-money means the stock price is below the strike price at which the shares could be called away by the option holder.) Given concerns that the overall market had moved ahead of fundamentals, in mid-year, the Fund’s managers began writing options “closer-to-the-money” in order to capture higher premium income and provide the Fund added protection from a reversal in the market’s most recent upward trend. With a very high percentage of the equity holdings covered by options written closer-to-the-money, the Fund took on a greater “hedged” posture as the year wound down. Clearly, as the market continued to move higher, this was a drag on relative performance.

Which sectors are prevalent in the Fund?

From a sector perspective, MSP’s largest exposure as of December 31, 2013 was to the Information Technology (and technology related) sector, followed by Consumer Discretionary, Health Care and Industrials. The Fund had no representation in the Telecommunication Services and Utilities sectors as of year-end.

3

MSP | Madison Strategic Sector Premium Fund | Management’s Discussion of Fund Performance - continued

ALLOCATION AS A PERCENTAGE OF TOTAL INVESTMENTS AS OF 12/31/13 | ||

Consumer Discretionary | 16.5 | % |

Consumer Staples | 4.5 | % |

Energy | 7.1 | % |

Financials | 6.1 | % |

Health Care | 8.5 | % |

Industrials | 8.4 | % |

Information Technology† | 26.3 | % |

Materials | 5.0 | % |

Short-Term Investments | 0.4 | % |

Exchange Traded Funds | 6.7 | % |

U.S. Government and Agency Obligations | 10.5 | % |

†Information Technology includes securities in the following industries: Communications Equipment; Computers and Peripherals; Internet Software & Services; IT services; Semiconductors & Semiconductor Equipment; and Software. | ||

Discuss the Fund’s security and option selection process.

The Fund is managed by primarily focusing on active stock selection before adding the call option overlay utilizing individual equity call options rather than index options. We use fundamental analysis to select solid companies with good growth prospects and attractive valuations. We then seek attractive call options to write on those stocks. It is our belief that this partnership of active management of the equity and option strategies provides investors with an innovative, risk-moderated approach to equity investing. The Fund’s portfolio managers seek to invest in a portfolio of common stocks that have favorable “PEG” ratios (Price/Earnings Ratio to Growth Rate) as well as financial strength and industry leadership. As bottom-up investors, we

focus on the fundamental businesses of our companies. Our stock selection philosophy strays away from the “beat the street” mentality, as we seek companies that have sustainable competitive advantages, predictable cash flows, solid balance sheets and high-quality management teams. By concentrating on long-term prospects and circumventing the “instant gratification” school of thought, we believe we bring elements of consistency, stability and predictability to our shareholders.

Once we have selected attractive and solid names for the fund, we employ our call writing strategy. This procedure entails selling calls that are primarily out-of the-money, meaning that the strike price is higher than the common stock price, so that the Fund can participate in some stock appreciation. By receiving option premiums, the Fund receives a high level of investment income and adds an element of downside protection. Call options may be written over a number of time periods and at differing strike prices in an effort to maximize the protective value to the strategy and spread income evenly throughout the year.

Discuss how risk is managed through the Fund’s investment process.

Risk management is a critical component of the investment manager’s overall philosophy and investment process. The primary means for managing risk are as follows:

1. Focus on the underlying security. The manager’s bottom-up stock selection process is geared toward investing in companies with very strong fundamentals including market leadership, balance sheet strength, attractive growth prospects, sustainable competitive advantages, predictable cash flows, and high-quality management teams. Purchasing such companies at attractive valuations is vital to providing an added margin of safety and the manager’s “growth-at-a-reasonable-price” (GARP) philosophy is specifically tuned to such valuation discipline.

2. Active covered call writing. The manager actively sells (writes) individual equity call options on equities that are owned by the fund. The specific characteristics of the call options (strike price, expiration, degree of coverage) are dependent on the manager’s outlook on the underlying equity and/or general market conditions. If equity prices appear over-valued due to individual company strength or surging markets, the manager may choose to become more defensive with the fund’s option strategy by selling call options that are closer to the current equity market price, generating larger option premiums which would help defend against a market reversal. The manager may also sell call options on a greater percentage of the portfolio in an effort to provide for more downside protection. Following a market downturn, the manager may sell options further out of the money in order to allow the Fund to

benefit from a market recovery. In such an environment, the manager may also determine that a

4

MSP | Madison Strategic Sector Premium Fund | Management’s Discussion of Fund Performance - continued

lesser percentage of the portfolio should be covered by call options in order to more fully participate in market upside.

3. Cash management and timing. Generally, the manager believes that the Fund should be fully invested under normal market conditions. A covered call strategy is rather unique relative to most equity portfolios, as the short term nature of call options can lead to the assignment or sale of underlying stock positions on a fairly regular basis. As a result, the Fund’s cash levels are likely to frequently fluctuate based on the characteristics of the call options and the market conditions. The thoughtful reinvestment of cash levels adds a layer of risk management to the investment process. This is most evident following a strong surge in equity prices above the strike prices of call options written against individual stocks in the Fund (call options move in-the-money). This could lead to a larger than normal wave of stock sales via call option assignment, which would increase the fund’s cash position following a period of very strong stock growth. Given the manager’s disciplined focus on purchasing underlying securities at appropriate valuation levels, the immediate reinvestment of cash may be delayed until market conditions and valuations become more attractive. If market conditions continue to surge for a period of time, the fund may underperform due to higher than normal cash levels; however, it is the manager’s belief that maintaining a strong valuation discipline will provide greater downside protection over a full market cycle.

What is management’s outlook for the market and Fund in 2014?

In our view, the slow but steady improvement in the U.S. real economy bodes well for 2014. Our cautiously upbeat outlook is largely based on an improving fiscal backdrop, with 2013’s federal government headwind expected to recede in 2014. Relative to other countries, the U.S. enjoys favorable demographics, has strong energy and agricultural resources, and a robust consumer base. In addition, the U.S. federal budget deficit has declined from 10% to near 4% of GDP over the past four years. We remain watchful regarding still-high debt levels with governmental entities and consumers, lower labor force participation, unclear long-term fiscal and monetary policies, and lower levels of capital investments by businesses. On balance, though, the U.S. looks strong compared to the rest of the world.

In terms of the equity markets, following an incredibly strong performance in 2013, U.S. equity markets are more susceptible to short term volatility stemming from some wavering in the emerging markets and/or the negative impact from severe winter weather. There are also growing signs of complacency and greed with investors, so we would view the short term risk/reward environment as skewed toward risk. This has

been evident in the growing “hedged” positioning of the Fund in late 2013. However, looking beyond some potential near-term uncertainty, we view corporate America as being in relatively solid health with good balance sheets, excessive cash, and low but positive earnings growth. Given the recent run-up in equities, valuations have become somewhat extended but not excessive. We expect that volatility will be higher in 2014, and this should provide an improved premium environment for selling call options.

TOP TEN HOLDINGS AS OF 12/31/13 | ||

% of net assets | ||

Apple Inc. | 3.8 | % |

Apache Corp. | 3.4 | % |

eBay Inc. | 3.4 | % |

DIRECTV | 3.3 | % |

Powershares QQQ Trust Series 1 ETF | 3.3 | % |

Oracle Corp. | 2.9 | % |

T. Rowe Price Group Inc. | 2.8 | % |

Accenture PLC, Class A | 2.8 | % |

Advance Auto Parts Inc. | 2.8 | % |

SPDR S&P 500 ETF Trust | 2.7 | % |

5

MSP | Madison Strategic Sector Premium Fund | Management’s Discussion of Fund Performance - concluded

INDEX DEFINITIONS

Indices are unmanaged, reflect no expenses and it is not possible to invest directly in an index.

The S&P 500 Index is an unmanaged, capitalization weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Chicago Board Options Exchange (CBOE) Market Volatility Index, often referred to as the VIX (its ticker symbol), the fear index or the fear gauge, is a measure of the implied volatility of S&P 500 Index options. It represents a measure of the market’s expectation of stock market volatility over the next 30-day period. Quoted in percentage points, the VIX represents the expected daily movement in the S&P 500 Index over the next 30-day period, which is then annualized.

The CBOE S&P 500 Buy/Write Index (BXM) is a benchmark index designed to show the hypothetical performance of a portfolio that purchases all the constituents of the S&P 500 Index and then sells at-the-money (meaning same as purchase price) call options of one-month duration against those positions.

6

MSP | Madison Strategic Sector Premium Fund | December 31, 2013

Portfolio of Investments

Shares | Value | |||

COMMON STOCKS - 87.2% | ||||

Consumer Discretionary - 17.5% | ||||

Advance Auto Parts Inc. (A) | 20,000 | $ 2,213,600 | ||

Amazon.com Inc. * (A) | 4,000 | 1,595,160 | ||

CBS Corp., Class B (A) | 15,000 | 956,100 | ||

DIRECTV * (A) | 39,000 | 2,694,510 | ||

Discovery Communications Inc., Class C * (A) | 17,000 | 1,425,620 | ||

Home Depot Inc./The (A) | 23,000 | 1,893,820 | ||

Lululemon Athletica Inc. * (A) | 27,000 | 1,593,810 | ||

Panera Bread Co., Class A * (A) | 9,500 | 1,678,555 | ||

14,051,175 | ||||

Consumer Staples - 4.8% | ||||

Costco Wholesale Corp. (A) | 15,000 | 1,785,150 | ||

CVS Caremark Corp. (A) | 29,000 | 2,075,530 | ||

3,860,680 | ||||

Energy - 7.5% | ||||

Apache Corp. (A) | 32,000 | 2,750,080 | ||

Canadian Natural Resources Ltd. (A) | 35,000 | 1,184,400 | ||

Petroleo Brasileiro S.A., ADR | 60,000 | 826,800 | ||

Schlumberger Ltd. (A) | 14,000 | 1,261,540 | ||

6,022,820 | ||||

Financials - 6.4% | ||||

BB&T Corp. (A) | 45,000 | 1,679,400 | ||

Morgan Stanley (A) | 40,000 | 1,254,400 | ||

T. Rowe Price Group Inc. (A) | 27,000 | 2,261,790 | ||

5,195,590 | ||||

Health Care - 8.9% | ||||

Allergan Inc. (A) | 16,000 | 1,777,280 | ||

Baxter International Inc. (A) | 27,000 | 1,877,850 | ||

Mylan Inc. * (A) | 12,000 | 520,800 | ||

Teva Pharmaceutical Industries Ltd., ADR (A) | 35,000 | 1,402,800 | ||

Varian Medical Systems Inc. * (A) | 21,000 | 1,631,490 | ||

7,210,220 | ||||

Industrials - 8.9% | ||||

C.H. Robinson Worldwide Inc. (A) | 20,000 | 1,166,800 | ||

Expeditors International of Washington Inc. (A) | 31,000 | 1,371,750 | ||

Rockwell Collins Inc. (A) | 23,000 | 1,700,160 | ||

Stericycle Inc. * (A) | 10,500 | 1,219,785 | ||

United Technologies Corp. (A) | 15,000 | 1,707,000 | ||

7,165,495 | ||||

Information Technology - 27.9% | ||||

Communications Equipment - 2.7% | ||||

QUALCOMM Inc. (A) | 29,000 | 2,153,250 | ||

Shares | Value | |||

Computers & Peripherals - 5.6% | ||||

Apple Inc. (A) | 5,500 | $ 3,086,105 | ||

EMC Corp. (A) | 55,000 | 1,383,250 | ||

4,469,355 | ||||

Internet Software & Services - 3.4% | ||||

eBay Inc. * (A) | 50,000 | 2,744,500 | ||

IT Services - 3.3% | ||||

Accenture PLC, Class A (A) | 27,000 | 2,219,940 | ||

Visa Inc., Class A (A) | 2,000 | 445,360 | ||

2,665,300 | ||||

Semiconductors & Semiconductor Equipment - 6.8% | ||||

Altera Corp. | 50,000 | 1,626,500 | ||

Broadcom Corp., Class A (A) | 60,000 | 1,779,000 | ||

Linear Technology Corp. (A) | 46,000 | 2,095,300 | ||

5,500,800 | ||||

Software - 6.1% | ||||

Microsoft Corp. (A) | 42,000 | 1,572,060 | ||

Nuance Communications Inc. * (A) | 65,000 | 988,000 | ||

Oracle Corp. (A) | 61,000 | 2,333,860 | ||

4,893,920 | ||||

22,427,125 | ||||

Materials - 5.3% | ||||

Freeport-McMoRan Copper & Gold Inc. (A) | 25,000 | 943,500 | ||

Monsanto Co. (A) | 12,000 | 1,398,600 | ||

Mosaic Co./The (A) | 40,000 | 1,890,800 | ||

4,232,900 | ||||

Total Common Stocks ( Cost $66,368,041 ) | 70,166,005 | |||

INVESTMENT COMPANIES - 7.1% | ||||

Powershares QQQ Trust Series 1 ETF (A) | 30,000 | 2,638,800 | ||

SPDR S&P 500 ETF Trust (A) | 11,900 | 2,197,573 | ||

SPDR S&P MidCap 400 ETF Trust (A) | 3,500 | 854,700 | ||

Total Investment Companies ( Cost $5,352,579 ) | 5,691,073 | |||

Par Value | ||||

U.S. GOVERNMENT AND AGENCY OBLIGATIONS - 11.1% | ||||

U.S. Treasury Bills (B) (C) - 11.1% | ||||

0.018%, 1/30/14 | $4,000,000 | 3,999,944 | ||

0.038%, 2/6/14 | 5,000,000 | 4,999,812 | ||

8,999,756 | ||||

Total U.S. Government and Agency Obligations ( Cost $8,999,756 ) | 8,999,756 | |||

See accompanying Notes to Financial Statements.

7

MSP | Madison Strategic Sector Premium Fund | Portfolio of Investments - continued | December 31, 2013

Shares | Value | |||

SHORT-TERM INVESTMENTS - 0.5% | ||||

State Street Institutional U.S. Government Money Market Fund | 367,732 | $ 367,732 | ||

Total Short-Term Investments ( Cost $367,732 ) | 367,732 | |||

TOTAL INVESTMENTS - 105.9% ( Cost $81,088,108** ) | 85,224,566 | |||

NET OTHER ASSETS AND LIABILITIES - (0.1%) | (54,797) | |||

TOTAL CALL & PUT OPTIONS WRITTEN - (5.8%) | (4,695,883) | |||

TOTAL NET ASSETS - 100.0% | $80,473,886 | |||

* | Non-income producing. |

** | Aggregate cost for Federal tax purposes was $81,209,226. |

(A) | All or a portion of these securities’ positions represent covers (directly or through conversion rights) for outstanding options written. |

(B) | All or a portion of these securities are segregated as collateral for put options written. As of December 31, 2013, the total amount segregated was $8,999,756. |

(C) | Rate noted represents annualized yield at time of purchase. |

ADR | American Depository Receipt |

ETF | Exchange Traded Fund |

PLC | Public Limited Company |

See accompanying Notes to Financial Statements.

8

MSP | Madison Strategic Sector Premium Fund | Portfolio of Investments - continued | December 31, 2013

Call Options Written | Contracts (100 Shares Per Contract) | Expiration Date | Strike Price | Value (Note 2) | ||

Accenture PLC, Class A | 270 | January 2014 | $ 75.00 | $195,750 | ||

Advance Auto Parts Inc. | 200 | January 2014 | 85.00 | 513,000 | ||

Allergan Inc. | 160 | January 2014 | 95.00 | 260,800 | ||

Amazon.com Inc. | 40 | January 2014 | 315.00 | 335,900 | ||

Apache Corp. | 120 | January 2014 | 90.00 | 2,760 | ||

Apache Corp. | 200 | January 2014 | 92.50 | 1,300 | ||

Apple Inc. | 15 | January 2014 | 550.00 | 26,362 | ||

Apple Inc. | 40 | February 2014 | 565.00 | 88,600 | ||

Baxter International Inc. | 135 | February 2014 | 70.00 | 20,250 | ||

BB&T Corp. | 450 | January 2014 | 35.00 | 109,350 | ||

Broadcom Corp., Class A | 300 | January 2014 | 28.00 | 53,700 | ||

Broadcom Corp., Class A | 300 | February 2014 | 28.00 | 70,200 | ||

C.H. Robinson Worldwide Inc. | 100 | January 2014 | 60.00 | 2,500 | ||

C.H. Robinson Worldwide Inc. | 100 | February 2014 | 57.50 | 24,750 | ||

Canadian Natural Resources Ltd. | 350 | January 2014 | 33.00 | 40,250 | ||

CBS Corp., Class B | 75 | January 2014 | 55.00 | 65,625 | ||

CBS Corp., Class B | 75 | January 2014 | 60.00 | 29,250 | ||

Costco Wholesale Corp. | 120 | January 2014 | 118.00 | 25,080 | ||

Costco Wholesale Corp. | 30 | January 2014 | 120.00 | 3,030 | ||

CVS Caremark Corp. | 290 | January 2014 | 62.50 | 265,350 | ||

DIRECTV | 100 | January 2014 | 62.50 | 66,250 | ||

DIRECTV | 215 | January 2014 | 65.00 | 91,375 | ||

Discovery Communications Inc., Class C | 170 | March 2014 | 80.00 | 97,750 | ||

eBay Inc. | 300 | January 2014 | 52.50 | 84,300 | ||

eBay Inc. | 200 | January 2014 | 55.00 | 23,800 | ||

EMC Corp. | 250 | January 2014 | 26.00 | 2,500 | ||

EMC Corp. | 300 | February 2014 | 25.00 | 26,700 | ||

Expeditors International of Washington Inc. | 180 | January 2014 | 45.00 | 6,750 | ||

Expeditors International of Washington Inc. | 130 | February 2014 | 45.00 | 12,350 | ||

Freeport-McMoRan Copper & Gold Inc. | 250 | January 2014 | 35.00 | 70,375 | ||

Home Depot Inc./The | 190 | January 2014 | 75.00 | 140,125 | ||

Home Depot Inc./The | 40 | January 2014 | 77.50 | 19,800 | ||

Linear Technology Corp. | 260 | January 2014 | 40.00 | 144,300 | ||

Linear Technology Corp. | 200 | February 2014 | 41.00 | 93,000 | ||

Lululemon Athletica Inc. | 135 | March 2014 | 62.50 | 30,713 | ||

Microsoft Corp. | 270 | January 2014 | 35.00 | 68,580 | ||

Microsoft Corp. | 150 | February 2014 | 36.00 | 32,700 | ||

Monsanto Co. | 120 | January 2014 | 110.00 | 81,600 | ||

Morgan Stanley | 200 | January 2014 | 29.00 | 50,100 | ||

Morgan Stanley | 200 | January 2014 | 30.00 | 33,200 | ||

Mosaic Co./The | 200 | January 2014 | 47.50 | 17,200 | ||

Mosaic Co./The | 200 | January 2014 | 50.00 | 3,800 | ||

Mylan Inc. | 120 | January 2014 | 39.00 | 54,000 | ||

Nuance Communications Inc. | 300 | February 2014 | 16.00 | 24,000 | ||

Oracle Corp. | 310 | January 2014 | 34.00 | 131,750 | ||

Oracle Corp. | 300 | March 2014 | 35.00 | 110,250 | ||

Panera Bread Co., Class A | 25 | January 2014 | 165.00 | 30,250 | ||

Panera Bread Co., Class A | 70 | January 2014 | 170.00 | 53,550 | ||

See accompanying Notes to Financial Statements.

9

MSP | Madison Strategic Sector Premium Fund | Portfolio of Investments - concluded | December 31, 2013

Call Options Written | Contracts (100 Shares Per Contract) | Expiration Date | Strike Price | Value (Note 2) | ||

Powershares QQQ Trust Series 1 | 300 | January 2014 | $ 82.00 | $ 185,550 | ||

QUALCOMM Inc. | 190 | January 2014 | 70.00 | 82,650 | ||

QUALCOMM Inc. | 100 | January 2014 | 72.50 | 21,200 | ||

Rockwell Collins Inc. | 180 | January 2014 | 70.00 | 75,600 | ||

Schlumberger Ltd. | 140 | February 2014 | 90.00 | 39,620 | ||

SPDR S&P 500 ETF Trust | 119 | January 2014 | 175.00 | 120,428 | ||

SPDR S&P MidCap 400 ETF Trust | 35 | January 2014 | 235.00 | 34,125 | ||

Stericycle Inc. | 55 | February 2014 | 115.00 | 19,525 | ||

T. Rowe Price Group Inc. | 180 | January 2014 | 75.00 | 156,600 | ||

T. Rowe Price Group Inc. | 90 | January 2014 | 80.00 | 35,550 | ||

Teva Pharmaceutical Industries Ltd. | 200 | January 2014 | 42.50 | 3,800 | ||

United Technologies Corp. | 100 | January 2014 | 110.00 | 41,500 | ||

United Technologies Corp. | 50 | February 2014 | 110.00 | 25,625 | ||

Varian Medical Systems Inc. | 50 | February 2014 | 75.00 | 21,500 | ||

Varian Medical Systems Inc. | 160 | May 2014 | 80.00 | 51,200 | ||

Visa Inc., Class A | 20 | January 2014 | 200.00 | 45,500 | ||

Total Call Options Written (Premiums received $2,186,508) | $4,694,848 | |||||

Put Options Written | ||||||

Monsanto Co. | 90 | January 2014 | 97.50 | 1,035 | ||

Total Put Options Written (Premiums received $22,140) | $ 1,035 | |||||

Total Options Written, at Value (Premiums received $2,208,648) | $4,695,883 | |||||

See accompanying Notes to Financial Statements.

10

MSP | Madison Strategic Sector Premium Fund

Statement of Assets and Liabilities as of December 31, 2013

Assets: | |

Investments in securities, at cost | |

Unaffiliated issuers | $ 81,088,108 |

Net unrealized appreciation | |

Unaffiliated issuers | 4,136,458 |

Total investments at value | 85,224,566 |

Receivables: | |

Dividends and interest | 31,571 |

Total assets | 85,256,137 |

Liabilities: | |

Payables: | |

Advisory agreement fees | 54,586 |

Service agreement fees | 31,782 |

Options written, at value (premiums received $2,208,648) (Note 6) | 4,695,883 |

Total liabilities | 4,782,251 |

Net Assets | $ 80,473,886 |

Net assets consist of: | |

Paid-in capital | $ 86,506,142 |

Accumulated undistributed net investment income | – |

Accumulated net realized loss on investments sold, options and foreign currency related transactions | (7,681,473) |

Net unrealized appreciation of investments (including appreciation (depreciation) of options and foreign currency related transactions) | 1,649,217 |

Net Assets | $ 80,473,886 |

Capital Shares Issued and Outstanding (Note 7) | 5,798,291 |

Net Asset Value per share | $ 13.88 |

See accompanying Notes to Financial Statements.

11

MSP | Madison Strategic Sector Premium Fund

Statement of Operations For the Year Ended December 31, 2013

Investment Income: | |

Interest | $ 4,948 |

Dividends | |

Unaffiliated issuers | 845,288 |

Less: Foreign taxes withheld | (13,108) |

Total investment income | 837,128 |

Expenses: | |

Advisory agreement fees | 625,375 |

Service agreement fees | 140,710 |

Other expenses | 137 |

Total expenses | 766,222 |

Net Investment Income | 70,906 |

Net Realized and Unrealized Gain (Loss) on Investments | |

Net realized gain on investments (including net realized gain (loss) on foreign currency related transactions) | |

Options | 4,651,127 |

Unaffiliated issuers | 4,403,536 |

Net change in unrealized appreciation (depreciation) on investments (including net unrealized appreciation (depreciation) on foreign currency related transactions) | |

Options | (2,136,567) |

Unaffiliated issuers | 5,097,767 |

Net Realized and Unrealized Gain on Investments and Option Transactions | 12,015,863 |

Net Increase in Net Assets from Operations | $ 12,086,769 |

See accompanying Notes to Financial Statements.

12

MSP | Madison Strategic Sector Premium Fund | December 31, 2013

Statements of Changes in Net Assets

Year Ended December 31, | |||

2013 | 2012 | ||

Net Assets at beginning of period | $ 74,417,340 | $ 73,212,098 | |

Increase in net assets from operations: | |||

Net investment income | 70,906 | 166,882 | |

Net realized gain on investment transactions | 9,054,663 | 32,352 | |

Net change in unrealized appreciation on investment transactions | 2,961,200 | 7,036,231 | |

Net increase in net assets from operations | 12,086,769 | 7,235,465 | |

Distributions to shareholders: | |||

From net investment income | (70,906) | (166,882) | |

From net capital gains | (5,959,317) | (23,748) | |

From return of capital | – | (5,839,593) | |

Total distributions | (6,030,223) | (6,030,223) | |

Total increase in net assets | 6,056,546 | 1,205,242 | |

Net Assets at end of period | $ 80,473,886 | $ 74,417,340 | |

Undistributed net investment income included in net assets | $ – | $ – | |

See accompanying Notes to Financial Statements.

13

MSP | Madison Strategic Sector Premium Fund | December 31, 2013

Financial Highlights for a Share of

Beneficial Interest Outstanding

Beneficial Interest Outstanding

Year Ended December 31, | ||||||

2013 | 2012 | 2011 | 2010 | 2009 | ||

Net Asset Value at beginning of period | $12.83 | $12.63 | $14.07 | $13.83 | $10.75 | |

Income from investment operations: | ||||||

Net investment income (loss)1 | 0.01 | 0.03 | 0.002 | (0.030) | (0.030) | |

Net realized and unrealized gain (loss) on investments | 2.08 | 1.21 | (0.400) | 1.31 | 4.26 | |

Total from investment operations | 2.09 | 1.24 | (0.400) | 1.28 | 4.23 | |

Less Distributions: | ||||||

From net investment income | (0.010) | (0.030) | (0.00)2 | – | – | |

From capital gains | (1.030) | (0.00)2 | (0.940) | – | (1.150) | |

From return of capital | – | (1.010) | (0.100) | (1.040) | – | |

Total distributions | (1.040) | (1.040) | (1.040) | (1.040) | (1.150) | |

Net increase (decrease) in net asset value | 1.05 | 0.20 | (1.440) | 0.24 | 3.08 | |

Net Asset Value at end of period | $13.88 | $12.83 | $12.63 | $14.07 | $13.83 | |

Market Value at end of period | $11.96 | $11.09 | $10.64 | $12.82 | $12.23 | |

Total Return | ||||||

Net asset value (%) | 16.81 | 9.92 | (2.800) | 9.79 | 41.21 | |

Market value (%) | 17.71 | 13.97 | (9.240) | 14.01 | 55.81 | |

Ratios/Supplemental Data | ||||||

Net Assets at end of period (in 000’s) | $80,474 | $74,417 | $73,212 | $81,572 | $80,178 | |

Ratios of expenses to average net assets: | ||||||

Total expenses, excluding interest expense (%) | 0.98 | 0.98 | 0.98 | 0.98 | 1.04 | |

Total expenses, including interest expense (%) | 0.98 | 0.98 | 0.98 | 0.98 | 1.23 | |

Ratio of net investment income to average net assets(%) | 0.09 | 0.22 | 0.01 | (0.200) | (0.270) | |

Portfolio turnover (%) | 153 | 53 | 83 | 61 | 25 | |

1Based on average shares outstanding during the year.

2Amount represents less than $0.005 per share.

See accompanying Notes to Financial Statements.

14

MSP | Madison Strategic Sector Premium Fund

Notes to Financial Statements

1. ORGANIZATION

Madison Strategic Sector Premium Fund (the “Fund”) was organized as a Delaware statutory trust on February 4, 2005. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended, and the Securities Act of 1933, as amended. The Fund commenced operations on April 27, 2005.

The Fund’s primary investment objective is to provide a high level of current income and current gains, with a secondary objective of long-term capital appreciation. The Fund will pursue its investment objectives by investing in a portfolio consisting primarily of common stocks of large and mid-capitalization issuers that are, in the view of Madison Asset Management, LLC, the Fund’s investment adviser (the “Adviser”), selling at a reasonable price in relation to their long-term earnings growth rates. Under normal market conditions, the Fund will seek to generate current earnings from option premiums by writing (selling) covered call options on a substantial portion of its portfolio securities. There can be no assurance that the Fund will achieve its investment objectives. The Fund’s investment objectives are considered fundamental and may not be changed without shareholder approval.

2. SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation. Securities traded on a national securities exchange are valued at their closing sale price, except for securities traded on NASDAQ, which are valued at the NASDAQ official closing price (“NOCP”), and options which are valued at the mean between the best bid and best ask price across all option exchanges. Debt securities having maturities of 60 days or less are valued at amortized cost, which approximates market value. Debt securities having longer maturities, are valued on the basis of last available bid prices or current market quotations provided by dealers or pricing services approved by the Fund. Mutual funds are valued at their Net Asset Value. Securities for which market quotations are not readily available are valued at

their fair value as determined in good faith under procedures approved by the Board of Trustees.

At times, the Fund maintains cash balances at financial institutions in excess of federally insured limits. The Fund monitors this credit risk and has not experienced any losses related to this risk.

The Fund has adopted Financial Accounting Standards Board (“FASB”) applicable guidance on fair value measurements. Fair value is defined as the price that each fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data “inputs,” minimize the use of unobservable “inputs” and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable.

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

Level 1 – unadjusted quoted prices in active markets for identical investments

15

MSP | Madison Strategic Sector Premium Fund | Notes to Financial Statements - continued

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rate volatilities, prepayment speeds, credit risk, benchmark yields, transactions, bids, offers, new issues, spreads and other relationships observed in the markets among comparable securities, underlying equity of the issuer; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)The valuation techniques used by the Fund to measure fair value for the period ended December 31, 2013 maximized the use of observable inputs and minimized the use of unobservable inputs.

There were no transfers between classification levels during the year ended December 31, 2013. As of and during the year ended December 31, 2013, the Fund did not hold securities deemed as a Level 3.

The following table represents the Fund’s investments carried on the Statement of Assets and Liabilities by caption and by level within the fair value hierarchy as of December 31, 2013:

Description | Level 1 | Level 2 | Level 3 | Value at 12/31/13 | ||||

Assets: | ||||||||

Common Stocks | $70,166,005 | $ – | $ – | $70,166,005 | ||||

Investment Companies | 5,691,073 | – | – | 5,691,073 | ||||

U.S. Government and Agency Obligations | – | 8,999,756 | – | 8,999,756 | ||||

Short-Term Investments | 367,732 | – | – | 367,732 | ||||

$76,224,810 | $ 8,999,756 | $ – | $85,224,566 | |||||

Liabilities: | ||||||||

Written options | $ 4,695,883 | $ – | $ – | $ 4,695,883 | ||||

The following table presents the types of derivatives in the Fund and their effect:

Statement of Asset & Liability Presentation of Fair Values of Derivative Instruments | ||||

Asset Derivatives | Liability Derivatives | |||

Derivatives not accounted for as hedging instruments | Statement of Assets and Liabilities Location | Fair Value | Statement of Assets and Liabilities Location | Fair Value |

Equity contracts | – | $ – | Options written | $4,695,883 |

The following table presents the effect of derivative instruments on the Statement of Operations for the year ended December 31, 2013:

Derivatives not accounted for as hedging instruments | Realized Gain on Derivatives | Change in Unrealized Depreciation on Derivatives |

Equity contracts | $4,651,127 | $(2,136,567) |

16

MSP | Madison Strategic Sector Premium Fund | Notes to Financial Statements - continued

In June 2013, FASB issued an update (“ASU 2013-08”) to ASC Topic 946, Financial Services – Investment Companies (“Topic 946”). ASU 2013-08 amends the guidance in Topic 946 for determining whether an entity qualifies as an investment company and requires certain additional disclosures. ASU 2013-08 is effective for interim and annual reporting periods in fiscal years that begin after December 15, 2013. Management is currently evaluating the impact, if any, of ASU 2013-08 on the Funds’ financial statements.

Investment Transactions and Investment Income. Investment transactions are recorded on a trade date basis. The cost of investments sold is determined on the identified cost basis for financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis.

Distributions to Shareholders. The Fund declares and pays quarterly distributions to shareholders. Distributions to shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. These dividends consist of investment company taxable income, which generally includes qualified dividend income, ordinary income and short-term capital gains, including premiums received on written options. Distributions may also include a return of capital. Any net realized long-term capital gains are distributed annually to shareholders.

Clarification of Investment Strategy. The Fund may invest up to 15% of its net assets in foreign securities. Foreign securities are defined as securities that are: (i) issued by companies organized outside the U.S. or whose principal operations are outside the U.S., or issued by foreign governments or their agencies or instrumentalities (“foreign issuers”); (ii) principally traded outside of the U.S.; and (iii) quoted or denominated in a foreign currency (“non-dollar securities”). The Fund did not hold any foreign securities during the period.

3. INVESTMENT ADVISORY AGREEMENT AND SERVICES AGREEMENT

Pursuant to an Investment Advisory Agreement between the Fund and the Adviser, the Adviser, under the supervision of the Fund’s Board of Trustees, provides a continuous investment program for the Fund’s portfolio; provides investment research and makes and executes recommendations for the purchase and sale of securities; and provides certain facilities and personnel, including officers required for the Fund’s administrative management and compensation of all officers and trustees of the Fund who are its affiliates. For these services, the Fund pays the Adviser a fee, payable monthly, in an amount equal to an annualized rate of 0.80% of the Fund’s average

daily managed assets on the first $500 million of assets, and 0.60% of the Fund’s average daily managed assets on assets in excess of $500 million.

Under a separate Services Agreement, the Adviser also provides or arranges to have a third party provide the Fund with such services as it may require in the ordinary conduct of its business, to the extent that the Adviser (or any other person acting as the Fund’s investment adviser) has not undertaken to provide such services. In this regard, the Adviser shall provide, or arrange to have a third party provide, among other things, the following services to the Fund: compliance services, transfer agent services, custodial services, fund administration services, fund accounting services, and such other services necessary to the conduct of the Fund’s business. In addition, the Adviser shall arrange and pay for independent public accounting services for audit and tax purposes, legal services, the services of independent trustees of the Fund, a fidelity bond, and directors and officers/errors and omissions insurance. In exchange for these services, the Fund pays the Adviser a service fee, payable monthly, equal to 0.18% of the Fund’s average daily managed assets. Not included in this service fee (and, therefore, the responsibility of the Fund) are “excluded expenses.” Excluded expenses consist of (i) any fees and expenses relating to portfolio holdings (e.g., brokerage commissions, interest on loans, etc.); (ii) extraordinary and non-recurring fees and expenses (e.g., costs relating to any borrowing costs or taxes the Fund may owe, etc.); and (iii) the costs associated with investment by the Fund in other investment companies (i.e., acquired fund fees and expenses).

Other Expenses. Certain officers and trustees of the Fund may also be officers, directors and/or employees of the Investment Adviser or its affiliates. The Fund does not compensate its officers or trustees who are officers,

17

MSP | Madison Strategic Sector Premium Fund | Notes to Financial Statements - continued

directors and/or employees of the Investment Adviser or its affiliates. The fees for the independent trustees are paid out of the Services Agreement fee and totaled $18,000 for the year ended December 31, 2013.

4. FEDERAL INCOME TAXES

No provision is made for federal income taxes since it is the intention of the Fund to comply with the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, available to investment companies and to make the requisite distribution to shareholders of taxable income, which will be sufficient to relieve the Fund from all or substantially all federal income taxes.

Due to inherent differences in the recognition of income, expenses, and realized gains/losses under GAAP and federal income tax purposes, permanent differences between book and tax basis reporting have been identified and appropriately reclassified on the Statement of Assets and Liabilities. At December 31, 2013, $5,959,317 was reclassified from accumulated net Investment loss, and $135 was reclassified from accumulated net realized loss into the paid in capital account of the Fund, to reflect permanent book and tax differences relating to a net operating loss.

As of December 31, 2013, for federal income tax purposes, the Fund utilized $8,910,231 of capital loss carryforwards (“CLCF”). The Fund had a remaining CLCF of $7,560,357, which can be used to offset future capital gains. These CLCF’s will expire on December 31, 2018. Per the RIC Modernization Act , CLCFs generated in taxable years beginning after December 22, 2010 must be fully used before CLCFs generated in taxable years prior to December 22, 2010: therefore, CLCFs available as of the report date may expire unused.

Information on the tax components of investments, excluding option contracts, as of December 31, 2013, is as follows:

Cost | $81,209,226 |

Gross appreciation | 5,907,865 |

Gross depreciation | (1,892,525) |

Net appreciation | $ 4,015,340 |

Net realized gains or losses may differ for financial reporting and tax purposes primarily as a result of the deferral of losses relating to wash sale transactions and post-October transactions.

For the years ended December 31, 2013 and 2012, the tax character of distributions paid to shareholders was $6,030,223 ordinary income for 2013 and $190,630 ordinary income and $5,839,593 return of capital for 2012.

As of December 31, 2013, the components of distributable earnings on a tax basis were as follows:

Undistributed Long-Term Capital Gains | $ – |

Undistributed Ordinary Income | $ – |

For all open tax years and all major jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Uncertain tax positions are tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns that would not meet a more-likely-than not threshold of being sustained by the applicable tax authority and would be recorded as a tax expense in the current year. Open tax years are those that are open for examination by taxing authorities (i.e., generally the last four tax year ends). Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. It is the Fund’s policy to recognize accrued interest and penalties related to uncertain tax benefits in income taxes, as appropriate.

5. INVESTMENT TRANSACTIONS

During the year ended December 31, 2013, the cost of purchases and proceeds from sales of investments, excluding short-term investments, were $101,634,478 and $98,856,170, respectively. No long-term U.S. Government securities were purchased or sold during the period.

6. COVERED CALL AND PUT OPTIONS

An option on a security is a contract that gives the holder of the option, in return for a premium, the right to buy from (in the case of a call) or sell to (in the case of a put) the writer of the option the security underlying the option at a specified exercise or “strike” price. The writer of an option on a security has an obligation upon exercise of the option to deliver the underlying security upon payment of the exercise price (in

18

MSP | Madison Strategic Sector Premium Fund | Notes to Financial Statements - continued

the case of a call) or pay the exercise price upon delivery of the underlying security (in the case of a put).

The number of call options the Fund can write (sell) is limited by the amount of equity securities the Fund holds in its portfolio. The Fund will not write (sell) “naked” or uncovered call options. The Fund seeks to produce a high level of current income and gains generated from option writing premiums and, to a lesser extent, from dividends.

When an option is written, a liability is recorded equal to the premium received. This liability for options written and is subsequently marked-to-market to reflect the current market value of the option written. These liabilities are reflected as options written in the Statement of Assets and Liabilities. Premiums received from writing options that expire unexercised are recorded on the expiration date as a realized gain. The difference between the premium received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transactions, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether there has been a realized gain or loss.

Transactions in written option contracts during the year ended December 31, 2013 were as follows:

Number of Contracts | Premiums Received | |||

Options outstanding beginning of period | 12,272 | $2,555,680 | ||

Options written during the period | 42,035 | 7,459,102 | ||

Options closed during the period | (12,256) | (2,170,695) | ||

Options exercised during the period | (19,712) | (3,459,781) | ||

Options expired during the period | (11,525) | (2,175,658) | ||

Options outstanding end of period | 10,814 | $2,208,648 | ||

Purchased call option activity was not significant for the year ended December 31, 2013 and no purchased options were outstanding as of December 31, 2013.

7. CAPITAL

The Fund has an unlimited amount of common shares, $0.01 par value, authorized and 5,798,291 shares issued and outstanding as of December 31, 2013. Additionally, no capital stock activity occurred for the years ended December 31, 2013 and 2012, respectively. In connection with the Fund’s dividend reinvestment plan, there were no shares reinvested for the years ended December 31, 2013 and 2012, respectively.

8. INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent upon claims that may be made against the Fund in the future and, therefore cannot be estimated; however, the risk of material loss from such claims is considered remote.

9. DISCUSSION OF RISKS

Please see the Fund’s prospectus for a complete discussion of risks associated with investing in the Fund.

Equity Risk. The value of the securities held by the Fund may decline due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by the Fund participate, or factors relating to specific companies in which the Fund invests.

Option Risk. There are several risks associated with transactions in options on securities. For example, there are significant differences between the securities and options markets that could result in an imperfect correlation between these markets, causing a given transaction not to achieve its objectives. A decision as to whether, when and how to use options involves the exercise of skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events.

As the writer of a covered call option, the Fund forgoes, during the option’s life, the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call, but retains the risk of loss should the price of the underlying security decline. The writer of an option has no control over the time when it may be required to fulfill its obligation as a writer of the option. Once an option writer has received an exercise notice, it cannot effect a closing purchase transaction in order to terminate its obligation under the option and must deliver the underlying security at the exercise price.

19

MSP | Madison Strategic Sector Premium Fund | Notes to Financial Statements - continued

When the Fund writes covered put options, it bears the risk of loss if the value of the underlying stock declines below the exercise price. If the option is exercised, the Fund could incur a loss if it is required to purchase the stock underlying the put option at a price greater than the market price of the stock at the time of exercise. While the Fund’s potential gain in writing a covered put option is limited to the interest earned on the liquid assets securing the put option plus the premium received from the purchaser of the put option, the Fund risks a loss equal to the entire value of the stock.

Foreign Investment Risk. Investing in non-U.S. issuers may involve unique risks such as currency, political, and economic risks, as well as lower market liquidity, generally greater market volatility, and less complete financial information than for U.S. issuers.

Mid Cap Company Risk. Mid-cap companies often are newer or less established than larger companies. Investments in mid-cap companies carry additional risks because the earnings of these companies tend to be less predictable; they often have limited product lines, markets, distribution channels or financial resources; and the management of such companies may be dependent upon one or a few key people. The market movements of equity securities of mid-cap companies may be more abrupt or erratic than the market movements of equity securities of larger, more established companies or the stock market in general.

Industry Concentration Risk. To the extent that the Fund makes substantial investments in a single industry, the Fund will be more susceptible to adverse economic or regulatory occurrences affecting those sectors.

Fund Distribution Risk. In order to make regular quarterly distributions on its common shares, the Fund may have to sell a portion of its investment portfolio at a time when independent investment judgment may not dictate such action. In addition, the Fund’s ability to make distributions more frequently than annually from any net realized capital gains by the Fund is subject to the Fund obtaining exemptive relief from the Securities and Exchange Commission, which cannot be assured. To the extent the total quarterly distributions for a year exceed the Fund’s net investment company income and net realized capital gain for that year, the excess will generally constitute a return of the Fund’s capital to its common shareholders. Such return of capital distributions generally are tax-free up to the amount of a common shareholder’s tax basis in the common shares (generally, the amount paid for the common shares). In addition, such excess distributions will decrease the Fund’s total assets and may increase the Fund’s expense ratio.

Financial Leverage Risk. The Fund is authorized to utilize leverage through the issuance of preferred shares and/or the Fund may borrow or issue debt securities for

financial leveraging purposes and for temporary purposes such as settlement of transactions. Although the use of any financial leverage by the Fund may create an opportunity for increased net income, gains and capital appreciation for common shares, it also results in additional risks and can magnify the effect of any losses. If the income and gains earned on securities purchased with financial leverage proceeds are greater than the cost of financial leverage, the Fund’s return will be greater than if financial leverage had not been used. Conversely, if the income or gain from the securities purchased with such proceeds does not cover the cost of financial leverage, the return to the Fund will be less than if financial leverage had not been used. Financial leverage also increases the likelihood of greater volatility of net asset value and market price of, and dividends on, the common shares than a comparable portfolio without leverage.

Recent Market Developments Risk. Global and domestic financial markets have experienced periods of unprecedented turmoil. Recently, markets have witnessed more stabilized economic activity as expectations for an economic recovery increased. However, risks to a robust resumption of growth persist. Continuing uncertainty as to the status of the euro and the European Monetary Union has created significant volatility in currency and financial markets generally. A return to unfavorable economic conditions or sustained economic slowdown could adversely impact the Fund’s portfolio. Financial market conditions, as well as various social and political tensions in the United States and around the world, have contributed to increased market volatility and may have long-term effects on the United States and worldwide financial markets and cause further economic uncertainties or deterioration in the United States and worldwide. The

20

MSP | Madison Strategic Sector Premium Fund | Notes to Financial Statements - concluded

Investment Adviser does not know how long the financial markets will continue to be affected by these events and cannot predict the effects of these or similar events in the future on the United States and global economies and securities markets.

10. SUBSEQUENT EVENTS

Management has evaluated all subsequent events through the date the financial statements were available for issue. No events have taken place that meet the definition of a subsequent event that requires adjustment to, or disclosure in, the financial statements.

21

MSP | Madison Strategic Sector Premium Fund

Report of Independent

Registered Public Accounting Firm

Registered Public Accounting Firm

To the Shareholders and Board of Trustees of Madison Strategic Sector Premium Fund:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of the Madison Strategic Sector Premium Fund (the “Fund”), as of December 31, 2013, and the related statement of operations, statement of changes in net assets, and financial highlights for the year then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit. The statement of changes in net assets for the year ended December 31, 2012 and the financial highlights for the periods ended prior to January 1, 2013 were audited by other auditors, whose report, dated February 26, 2013, expressed an unqualified opinion on this statement of changes in net assets and financial highlights.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2013, by correspondence with the custodian and brokers. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of December 31, 2013, the results of operations, the changes net assets, and the financial

highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche, LLP

(signature)

Milwaukee, WI

February 21, 2014

February 21, 2014

22

MSP | Madison Strategic Sector Premium Fund

Other Information (unaudited)

Federal Income Tax Information. The Fund recognized qualified dividend income of $823,789 during the fiscal year ended December 31, 2013. The Fund intends to designate the maximum amount of dividends that qualify for the reduced tax rate pursuant to the Jobs and Growth Tax Relief Reconciliation Act of 2003. For corporate shareholders, 11.26% of the dividends paid by the Fund qualifies for the dividends-received deduction.

Complete information regarding the federal tax status of the distributions received during calendar year 2013 will be reported in conjunction with Form 1099-DIV.

Results of Shareholder Vote. The Annual Meeting of shareholders of the Fund was held on July 31, 2013. At the meeting, shareholders voted on the election of two trustees, Katherine L. Frank and James R. Imhoff, Jr. The votes cast in favor of election for Ms. Frank were 4,536,219 with 370,232 withheld, and in favor of election for

Mr. Imhoff were 4,519,838 with 386,613 withheld. The other trustees of the Fund, whose terms did not expire

in 2013, are Philip E. Blake, Frank E. Burgess and Lorence D. Wheeler.

Mr. Imhoff were 4,519,838 with 386,613 withheld. The other trustees of the Fund, whose terms did not expire

in 2013, are Philip E. Blake, Frank E. Burgess and Lorence D. Wheeler.

Additional Information. Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940 that from time to time, the Fund may purchase shares of its common stock in the open market at prevailing market prices.

This report is sent to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or any securities mentioned in the report.

Other Considerations. The views expressed in this report reflect those of the Investment Adviser only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value.

While investments in securities have been keystones in wealth building and management for a hundred years, at times they’ve produced surprises for even the savviest investors. Those who enjoyed growth and income of their investments were

rewarded for the risks they took by investing in the securities markets. When calamity strikes, the word “security” itself seems a misnomer. Although the Adviser seeks to appropriately address and manage the risks identified and disclosed to you in connection with the management of the securities in the Fund, you should understand that the very nature of the securities markets includes the possibility that there are additional risks that we did not contemplate for any number of reasons. We seek to identify all applicable risks and then appropriately address them, take appropriate action to reasonably manage them and, of course, to make you aware of them so you can determine if they exceed your risk tolerance. Nevertheless, the often volatile nature of the securities markets and the global economy in which we work suggests that the risk of the unknown is something you must consider in connection with your investments in securities. Unforeseen events have the potential to upset the best laid plans, and could, under certain circumstances produce a material loss of the value of some or all of the securities we manage for you in the Fund.

One of our most important responsibilities as investment company managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “will,” “expect,” “believe,” “plan” and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

23

MSP | Madison Strategic Sector Premium Fund | Other Information (unaudited) - continued

Proxy Voting Information. The Fund adopted policies that provide guidance and set forth parameters for the voting of proxies relating to securities held in the Fund’s portfolios. Additionally, information regarding how the Fund voted proxies related to portfolio securities, if applicable, during the period ended June 30, 2013, is available upon request and free of charge, by writing to Madison Strategic Sector Premium Fund, 550 Science Drive, Madison, WI 53711 or by calling toll-free at 1-800-368-3195. The Fund’s proxy voting policies and voting information may also be obtained by visiting the Securities and Exchange Commission (“SEC”) web site at www.sec.gov.

N-Q Disclosure. The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information about the operation of the Public Reference Room may be obtained by calling the SEC at 1-202-551-8090. Form N-Q and other information about the Fund are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. Copies of this information may also be obtained, upon payment of a duplicating fee, by electronic request at the following email address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, Washington, DC 20549-0102. Finally, you may call the Fund at 800-368-3195 if you would like a copy of Form N-Q and we will mail one to you at no charge.

Summary of Board’s Annual Approval Process and Considerations. The Board reviewed a variety of matters in connection with the Fund’s investment advisory contract with the Adviser.

With regard to the nature, extent and quality of the services to be provided by the Adviser, the Board reviewed the biographies and tenure of the personnel involved in Fund management and the experience of the Adviser and its affiliates as investment manager to other investment companies with similar investment strategies or to individual clients or institutions with similar investment strategies. They recognized the wide array of investment professionals employed by the respective firm or firms. Representatives of the Adviser discussed the firm’s ongoing investment philosophies and strategies intended to provide performance consistent with the Fund’s investment objectives under various market scenarios. The Trustees also noted their familiarity with the Adviser and its affiliates due to the Adviser’s history of providing advisory services to its proprietary investment company clients.

The Board also discussed the quality of services provided to the Fund by its applicable transfer agent, fund administrator and custodian as well as the various administrative

services provided directly by the Adviser. Such services included arranging for third party service providers to provide all necessary administration.

With regard to the investment performance of the Fund and the investment adviser, the Board reviewed current performance information provided in the written Board materials. They discussed the reasons for both outperformance and underperformance compared with peer groups and applicable indices and benchmarks. They reviewed both long-term and short-term performance. They also considered whether any relative underperformance was appropriate in view of the Adviser’s conservative investment philosophy. In connection with the review of performance, the Board engaged in a comprehensive discussion of market conditions and discussed the reasons for Fund performance under such conditions. Representatives of the Adviser discussed with the Board the methodology for arriving at peer groups and indices used for performance comparisons.

With regard to the costs of the services to be provided and the profits to be realized by the investment adviser and its affiliates from the relationship with the Fund, the Board reviewed the expense ratios for a variety of other funds in the Fund’s peer group with similar investment objectives.

The Board noted that the Adviser or its affiliates provided investment management services to other investment company and/or non-investment company clients and considered the fees charged by the Adviser to such funds and clients for purposes of determining whether the given advisory fee was disproportionately large under the so-called Gartenberg standard traditionally used by investment company boards in connection with contract renewal considerations. The Board took those fees into account and considered the differences in services and time required by the various types of funds and clients to

24

MSP | Madison Strategic Sector Premium Fund | Other Information (unaudited) - continued

which the Adviser provided services. The Board recognized that significant differences may exist between the services provided to one type of fund or client and those provided to others. The Board gave such comparisons the weight that they merit in light of the similarities and differences between the services that the Fund requires and were wary of “inapt comparisons.” They considered that, if the services rendered by the Adviser to one type of fund or client differed significantly from others, then the comparison should not be used. In the case of non-investment company clients for which the Adviser may act as either investment adviser or subadviser, the Board noted that the fee may be lower than the fee charged to the Fund. The Board noted too the various administrative, operational, compliance, legal and corporate communication services required to be handled by the Adviser which are performed for investment company clients but are not performed for other institutional clients.

The Trustees reviewed the Fund’s fee structure based on total Fund expense ratio as well as by comparing advisory fees to other advisory fees. The Board noted the simple expense structure maintained by the Fund: an advisory fee and a capped administrative “services” expense. The Board reviewed total expense ratios paid by other funds with similar investment objectives, recognizing that such a comparison, while not dispositive, was an important consideration.

The Trustees sought to ensure that fees paid by the Fund were appropriate. The Board reviewed materials demonstrating that although the Adviser is compensated for a variety of the administrative services it provides or arranges to provide to the Fund pursuant to its administrative services agreements with the Fund, such compensation does not always cover all costs due to the cap on administrative expenses. Administrative, operational, regulatory and compliance fees and costs in excess of the Services Agreement fees are paid by the Adviser from the investment advisory fees earned. In this regard, the Trustees noted that examination of the Fund’s total expense ratio compared to those of other investment companies was more meaningful than a simple comparison of basic “investment management only” fee schedules.