UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal

year ended

or

For the transition period from ________ to ________

Commission file

number

(Exact name of registrant as specified in charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

People’s Republic of | ||

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate by check

mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check

mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check

mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | |

| Non-accelerated filer | ☐ | Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check

mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal

control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting

firm that prepared or issued its audit report.

If securities are

registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in

the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The aggregate

market value of voting and non-voting common stock held by non-affiliates of the registrant as of June 30, 2023, the last business day

of the registrant’s second fiscal quarter, was approximately $

The number of shares of common stock issued and

outstanding as of March 8, 2024 was 87,542,800 and

DOCUMENTS INCORPORATED BY REFERENCE:

None.

TABLE OF CONTENTS

i

SPECIAL NOTE REGARDING FORWARD -LOOKING STATEMENTS

This Annual Report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as “anticipate,” “expect,” intend,” “plan,” “will,” “we believe,” “our company believes,” management believes” and similar language. These forward-looking statements are based on our current expectations and are subject to certain risks, uncertainties and assumptions, including those set forth in the discussion under Item 1, “Business”, Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our actual results may differ materially from results anticipated in these forward-looking statements. We base our forward -looking statements on information currently available to us, and we assume no obligation to update them. In addition, our historical financial performance is not necessarily indicative of the results that may be expected in the future and we believe such comparisons cannot be relied upon as indicators of future performance.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

ii

PART I

Except as otherwise indicated in this Annual Report, references to

| ● | “China”, or “PRC” refers to the People’s Republic of China. |

| ● | “China Battery Exchange” refers to China Battery Exchange (Zhejiang) Technology Co., Ltd. |

| ● | “Continental” refers to Continental Development Limited |

| ● | “Fengsheng” refers to Fengsheng Automotive Technology Group Co., Ltd., formerly known as Zhejiang Kandi Electric Vehicles Co., Ltd. |

| ● | “Hengrun” refers to Hunan Hengrun Automobile Co., Ltd. |

| ● | “Hainan Kandi Holding” refers to Hainan Kandi Holding New Energy Technology Co., Ltd. |

| ● | “Jiangxi Huiyi” refers to Jiangxi Province Huiyi New Energy Co., Ltd. |

| ● | “Kandi BVI” refers to Kandi Technologies Group, Inc., a British Virgin Islands company. |

| ● | “Kandi Innovation” refers to Kandi Electric Innovation, Inc., a Nevada company. |

| ● | “Kandi Hainan” refers to Kandi Electric Vehicles (Hainan) Co., Ltd. |

| ● | “Kandi Canada” refers to Kandi Technologies Canada, Inc. |

| ● | “NGI” refers to Northern Group, Inc. |

| ● | “Kandi Investment” refers to Kandi America Investment, LLC. |

| ● | “Kandi New Energy” refers to Jinhua Kandi New Energy Vehicles Co., Ltd. |

| ● | “Kandi Technologies” refers to Kandi Technologies Group, Inc., a Delaware company. |

| ● | “Kandi Smart Battery Swap” refers to Zhejiang Kandi Smart Battery Swap Technology Co., Ltd., formerly known as Jinhua An Kao Power Technology Co., Ltd., or “Jinhua An Kao”. |

| ● | “PRC operating entities” refers to Kandi Technologies’ subsidiaries, including Zhejiang Kandi Technologies, China Battery Exchange, Kandi New Energy, Kandi Smart Battery Swap, Yongkang Scrou, Kandi Hainan, Jiangxi Huiyi, and Hainan Kandi Holdings New Energy Technology, Co., Ltd. |

| ● | “RMB” and “Renminbi” both refer to the legal currency of China. |

| ● | “Ruiheng” refers to Zhejiang Ruiheng Technology Co., Ltd. |

| ● | “SC Autosports” refers to SC AutoSports, LLC., formerly known as Sportsman Country, LLC |

| ● | “US$”, “U.S. dollars”, “$”, and dollars” all refer to the legal currency of the United States. |

| ● | “We,” “us,” “our,” “Kandi,” or the “Company” are to the combined businesses of Kandi Technologies Group, Inc. |

| ● | “Yongkang Scrou” refers to Yongkang Scrou Electric Co., Ltd. |

| ● | “Zhejiang Kandi Technologies” refers to Zhejiang Kandi Technologies Group, Co. Ltd., formerly known as Zhejiang Kandi Vehicles Co., Ltd., or “Kandi Vehicles”. |

Kandi Technologies use U.S. dollars as reporting currency in our financial statements and in this Annual Report. Monetary assets and liabilities denominated in Renminbi are translated into U.S. dollars at the rates of exchange as of the balance sheet date, equity accounts are translated at historical exchange rates, and revenues, expenses, gains and losses are translated using the average rate for the period. In other parts of this Annual Report, any Renminbi denominated amounts are accompanied by translations. We make no representation that the Renminbi or U.S. dollar amounts referred to in this Annual Report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. The PRC government restricts or prohibits the conversion of Renminbi into foreign currency and foreign currency into Renminbi for certain types of transactions.

1

Item 1. Business Introduction

Our Core Business

Kandi Technologies is a Delaware holding company, with its common stock being traded on the NASDAQ Global Select Market. As a holding company with no material operations of its own, a substantial majority of the operations are conducted through our wholly-owned subsidiaries established in the People’s Republic of China, or the PRC, including Zhejiang Kandi Technologies and its subsidiaries and U.S. wholly-owned subsidiaries SC Autosports and its subsidiary.

Originally, the Company’s primary business operations consist of designing, developing, manufacturing and commercializing electric vehicle (“EV”) products and EV parts. In recent years, some EV enterprises in China are seizing market share at the cost of huge losses. The Company realized that the EV market of China has not reached a healthy and orderly development stage. Therefore, the Company started to adjust the company’s development strategy after 2020. With the global trend of “fuel to electrification” of off-road vehicles becoming more and more obvious, the Company has been focusing on the production of pure electric off-road vehicles. Our goal is to achieve a leading position in the field of pure electric off-road vehicles within three years.

The Company does not believe that our major business is within the targeted areas of concern by the Chinese government. However, Kandi Technologies is a holding company in Delaware and our majority of business is conducted through the operations by Company’s subsidiaries and pre-existed VIE in the PRC. Therefore, there is a risk that the Chinese government may in the future seek to affect operations of any company with any level of operations in the PRC, including its ability to offer securities to investors, list its securities on a U.S. or other foreign exchange, conduct its business or accept foreign investment. Additionally, we are subject to certain legal and operational risks associated with our operations in China. PRC laws and regulations governing our current business operations are uncertain, and therefore, these risks may result in a material change in the Company’s operations, significant depreciation of the value of our common stock, or a complete hindrance of our ability to offer or continue to offer our securities to investors. Due to the fact that PRC does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States and many other countries and regions, direct recognition and enforcement in PRC of judgments of a court in any of these non-PRC jurisdictions in relation to any matter not subject to a binding arbitration provision may be difficult, time-consuming, costly or even impossible, the investors may even need to sue again in one of the courts under PRC jurisdiction. Therefore, our investors may experience difficulties in effecting service of legal process, enforcing judgements or bringing original actions based on United States or foreign laws against us or our management. Changes in currency conversion policies in China and fluctuation in exchange rates may also have a material adverse effect on our business and the value of our securities. During the previous few decades, the economy of China had experienced unprecedented growth. This growth has slowed in the recent years, and if the growth of the economy continues to slow or if the economy contracts, our financial condition may be materially and adversely affected. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact of such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange.

2

For a more detailed description of the risks regarding our business structure, please see “Risks Related to Doing Business in China” in pages 22-29. It is still unclear about the scope and the impact of these new regulations, however, these risks could result in a material change in the value of our securities or cause the value of our securities to significantly decline or be worthless.

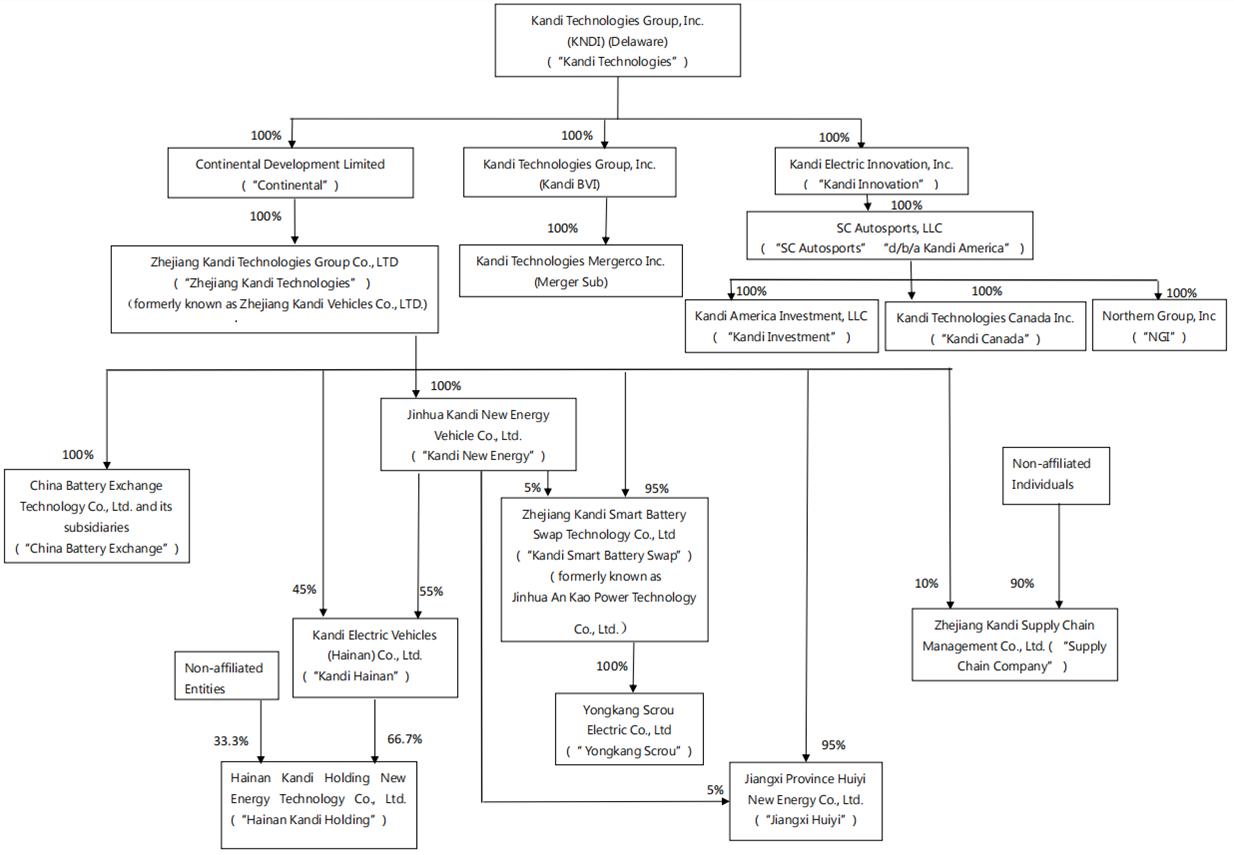

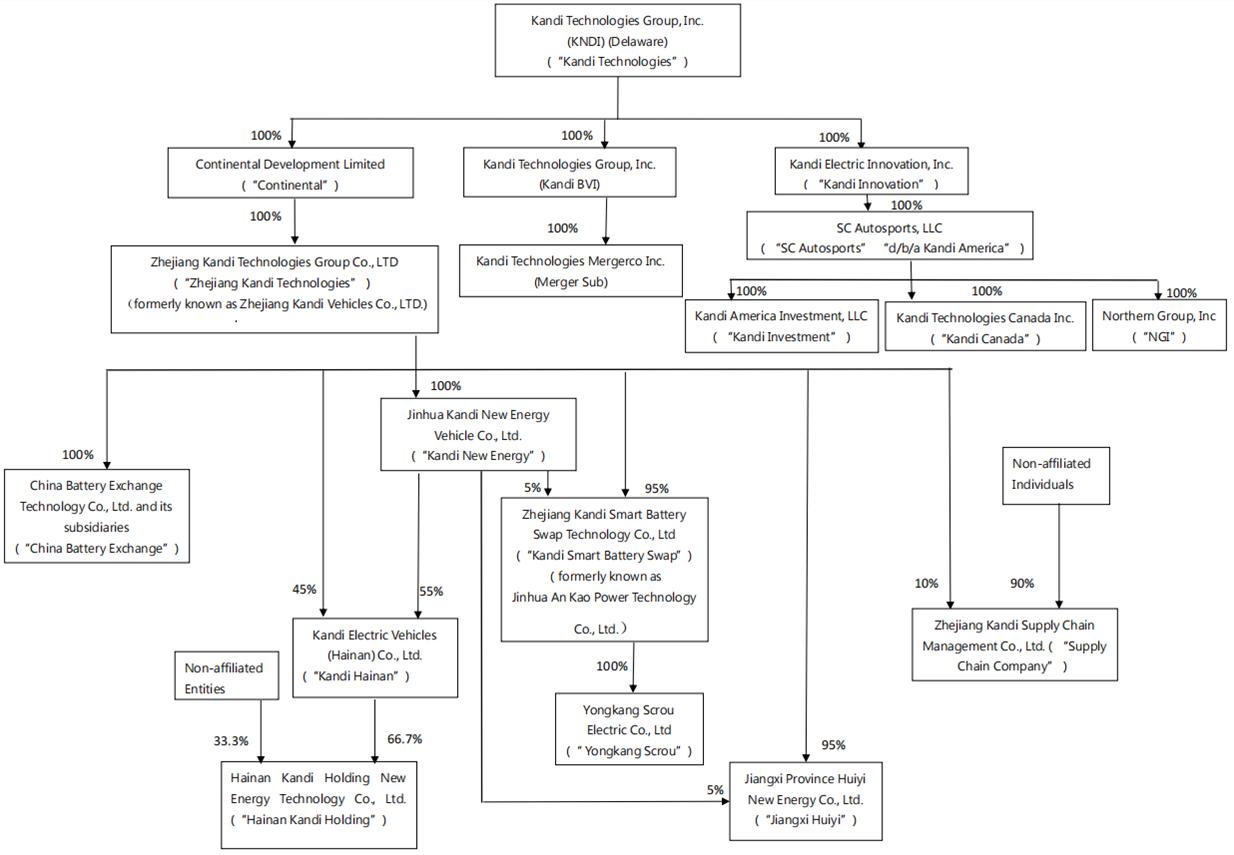

Our Organizational Structure

The Company’s organizational chart as of the date of this report is as follows:

Please refer to the discussion in NOTE 1 - ORGANIZATION AND PRINCIPAL ACTIVITIES of the Notes to the Consolidated Financial Statements under Item 8 of this Annual Report for a narrative of our organization structure and operating subsidiaries, including their dates of incorporation and history.

Reincorporation

On December 27, 2023, the shareholders of the Company approved the merger agreement and plan of merger, that the Company is to merge with and into Kandi BVI, with Kandi BVI as the surviving company upon the merger becoming effective in the second quarter of 2024 (the “Reincorporation”).

Industry Overview

Over the years, governments and the automobile manufacturers have reached a consensus on the importance of diversifying the automobile industry and utilizing various energy resources. China is one of the world’s largest automobile markets as China has relatively scarce fuel reserves but rich natural resources of electric power. As a result, the Chinese government has been implementing industrial policies of supporting new energy vehicles. The diversified market with the coexistence of traditional fuel vehicles, plug-in hybrid vehicles and pure electric vehicles has been initially formed. The Company believes China is a huge prospective market for pure electric vehicles. In recent years, some EV enterprises in China are seizing market share at the cost of huge losses. The Company realized that the EV market of China has not reached a healthy and orderly development stage. The Company also believes that in the global automobile industry, there is great development space for the Chinese electric vehicles and their core parts industry in the future. Meanwhile, with the global trend of “fuel to electrification” of off-road vehicles becoming more and more obvious and huge market demand, management believes this industry still has huge development space. A majority of the Company’s products are pure electric off-road vehicles include utility vehicles (UTVs), ATVs, golf carts, go karts, etc. The largest market of pure electric off-road vehicles is in the United States.

3

Competitive Landscape

In general, the EV and electric off-road vehicles business faces competition from two groups of competitors: traditional vehicle manufacturers and new market entrants.

In terms of competition with conventional fuel vehicle and off-road vehicles manufacturers, many of the conventional fuel vehicle manufacturers are much larger in terms of size, manufacturing capabilities, customer bases, financial, marketing and human resources than the electric vehicle and electric off-road vehicles manufacturers. However, the conventional fuel vehicles and off-road vehicles face many challenges, including but not limited to environmental pollution and energy scarcity, which in turn provide great opportunities for the rapid development of the EV and electric off-road vehicles industry.

Our Opportunities and Growth Strategy

Due to worsening air pollution and concerns about petroleum resource dependence, the new energy industry is developing vigorously. Given its technology innovation with integrated solutions and operation experience, Kandi has benefited from the development of EV and electric off-road vehicles industry.

The Company’s business strategy includes efforts to provide customers with high-quality products, to expand the footprint in new and existing markets, and to advance our profile and the market demand through the further innovations. The Company also provides products to end users through retail stores and our distributors.

As the largest market of pure electric off-road vehicles is in the United States, Kandi Technologies focus on the development of its wholly-owned subsidiary based in Dallas, SC Autosports, specialized in the sales in the United States. It has a seasoned management team with personnel over ten years of business experience, which has laid a good foundation for the sales of the Company’s products in the US market. On November 30, 2023, Kandi Technologies, through its wholly owned subsidiary, SC Autosports, acquired Northern Group, Inc. (“NGI”), a Wisconsin incorporated company that has extensive sales experience and sales channels in the United States rooted in wholesale, retail, supply chain and analytics solutions. The acquisition allows the expansion of the SC Autosports’ and the Company’s sales pipelines through vertical integration and thus enhance the growth of sales.

Our Products

General

For the years ended December 31, 2023 and 2022, our products primarily consist of EV parts, EV products, and off-road vehicles including All-Terrain Vehicles (“ATVs”), UTVs, go-karts, and electric scooters, electric self-balancing Scooters and associated parts, and Lithium-ion cells, etc. Based on our market research on consumer demand trends, the Company has adjusted our production line strategically and continue to develop and manufacture new products in an effort to meet market demand and better serve our customers.

4

The following table shows the breakdown of our net revenues:

| Year Ended December 31 | ||||||||

| 2023 | 2022 | |||||||

| Sales Revenue | Sales Revenue | |||||||

| Primary geographical markets | ||||||||

| U.S. and other countries/areas | $ | 93,979,363 | $ | 65,871,112 | ||||

| China | 29,619,869 | 51,941,937 | ||||||

| Total | $ | 123,599,232 | $ | 117,813,049 | ||||

| Major products and Services | ||||||||

| EV parts | $ | 5,807,973 | $ | 8,964,094 | ||||

| EV products | 1,214,786 | 7,926,233 | ||||||

| Off-road vehicles and associated parts | 106,983,891 | 70,622,278 | ||||||

| Electric Scooters, Electric Self-Balancing Scooters and associated parts | 683,952 | 4,616,683 | ||||||

| Battery exchange equipment and Battery exchange service | 674,927 | 1,691,486 | ||||||

| Lithium-ion cells | 7,994,227 | 23,992,275 | ||||||

| Commission income | 239,476 | - | ||||||

| Total | $ | 123,599,232 | $ | 117,813,049 | ||||

| Timing of revenue recognition | ||||||||

| Products transferred at a point in time | $ | 123,359,756 | $ | 117,813,049 | ||||

| Sales transactions completed at a point in time | 239,476 | - | ||||||

| Total | $ | 123,599,232 | $ | 117,813,049 | ||||

Sales and Distribution

Because our products are manufactured in China, there are two major sales modes of our products sold to the countries and regions other than China market: the first mode is indirect sales to Chinese import and export trading companies for sales to the countries and regions out of China, and the second is direct sales to retail stores and dealers of the countries and regions out of China. Our products sold in China are mainly through our sales department to sign sales contracts directly with customers.

5

The Company jointly manufactures the K23 model with Hunan Hengrun Automobile Co., Ltd. (“Hengrun”), whose manufacture license was granted in June 2022. This product is sold in the China market through our sales department by signing sales contracts directly with customers.

Customers

For the years ended December 31, 2023 and 2022, the major customers of our operating subsidiaries, in the aggregate, accounted for 55% and 26% of our sales. Our operating subsidiaries are working on developing new business partners and clients for our products to reduce our dependence on existing customers and is focusing our new business development efforts on pure electric off-road vehicle business.

For the year ended December 31, 2023 and 2022, the Company’s major customers, each of whom accounted for more than 10% of our consolidated revenue, were as follows:

| Sales | Trade Receivable | |||||||||||

| Year Ended | ||||||||||||

| December 31, | December 31, | December 31, | ||||||||||

| Major Customers | 2023 | 2023 | 2022 | |||||||||

| Customer A | 26 | % | 1 | % | 1 | % | ||||||

| Customer B | 19 | % | 4 | % | - | |||||||

| Customer C | 11 | % | 4 | % | - | |||||||

| Sales | Trade Receivable | |||||||||||

| Year Ended | ||||||||||||

| December 31, | December 31, | December 31, | ||||||||||

| Major Customers | 2022 | 2022 | 2021 | |||||||||

| Customer A | 26 | % | 1 | % | - | |||||||

6

Sources of Supply

All raw materials are purchased from suppliers. Our operating subsidiaries have developed close relationships with several key suppliers particularly in the procurement of certain key parts. While our operating subsidiaries obtain components from multiple third-party sources in some cases, the Company does not have, and do not anticipate to have, any difficulty in obtaining required materials from our suppliers. The Company believes that our operating subsidiaries have adequate supplies or sources of availability of the raw materials necessary to meet our manufacturing and supply requirements.

For the year ended December 31, 2023 and 2022, our operating subsidiaries’ material suppliers, each of whom accounted for more than 10% of our total purchases, were as follows:

| Purchases | Accounts Payable | |||||||||||

| Year Ended | ||||||||||||

| December 31, | December 31, | December 31, | ||||||||||

| Major Suppliers | 2023 | 2023 | 2022 | |||||||||

| Zhejiang Kandi Supply Chain Management Co., Ltd.(1) | 20 | % | 26 | % | 32 | % | ||||||

| Purchases | Accounts Payable | |||||||||||

| Year Ended | ||||||||||||

| December 31, | December 31, | December 31, | ||||||||||

| Major Suppliers | 2022 | 2022 | 2021 | |||||||||

| Zhejiang Kandi Supply Chain Management Co., Ltd.(1) | 22 | % | 32 | % | 11 | % | ||||||

| (1) | Zhejiang Kandi Technologies owns 10% equity interest of the supplier. |

Intellectual Property and Licenses

The Company’s success partially depends on our ability to protect our core technology and intellectual property. We rely on a combination of patents, patent applications, trademarks, copyrights and trade secret protection laws in China and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our intellectual property and our brand. As of December 31, 2023, Zhejiang Kandi Technologies had a total of 90 valid patents and 2 software copyrights, including 2 invention patent, 51 utility model patents and 37 appearance design patents. As of December 31, 2023, Kandi Smart Battery Swap had a total of 96 valid patents and 4 software copyrights, including 77 utility model patents, 12 appearance design patents and 7 invention patents. As of December 31, 2023, Kandi New Energy had a total of 6 valid patents, including 2 utility model patents and 4 appearance design patents. As of December 31, 2023, Yongkang Scrou had a total of 25 valid patents, including 11 utility model patents and 14 appearance design patents. As of December 31, 2023, Kandi Hainan had a total of 36 valid patents, including 33 utility model patents, 2 invention patent and 1 appearance design patents. As of December 31, 2023, China Battery Exchange and its subsidiaries had a total of 3 valid utility model patents and 10 software copyrights. As of December 31, 2023, Jiangxi Huiyi had a total of 51 valid patents, including 9 invention patents, 31 utility model patents and 11 appearance design patents. As of December 31, 2023, Hainan Kandi Holding had a total of 4 valid patents, including 3 utility model patents and 1 appearance design patents. Under Chinese patent law, the utility model patents and appearance design patents shall be valid until 10 years after the date of application. The invention patents shall be valid until 20 years after the date of application. Among the Company’s valid utility model patents, the earliest expiration date is January 2024 and the latest is February 2033. Among the Company’s valid appearance design patents, the earliest expiration date is September 2024 and the latest is September 2033. Among the Company’s valid invention patents, the earliest expiration date is November 2035 and the latest is April 2041. In addition, The Company is authorized to use the trademark “Kandi” in the PRC and the U.S. The Company intends to continue to file additional patent applications with respect to our technology.

7

Zhejiang Kandi Technologies, Kandi Smart Battery Swap, Kandi Hainan, and Jiangxi Huiyi are are recognized as a national High and New Technology Enterprises. The certification shall be renewed every three years. The status of being a national High and New Technology Enterprise qualifies for a preferred 15% income tax rate, as opposed to a standard corporate income tax rate at 25%.

Employees

As of December 31, 2023, excluding contractors and employees with the affiliate company, Kandi had a total of 840 full-time employees, as compared to 971 full-time employees as of December 31, 2022, of which 488 employees are production personnel, 44 employees are sales personnel, 88 employees are research and development personnel, and 220 employees are administrative personnel. None of our employees are covered by collective bargaining agreements. We consider our relationships with our employees to be good. We also employ consultants on an as-needed basis.

Environmental and Safety Regulation

Emissions

Our products are all subject to international laws and emissions related standards and regulations, including regulations and related standards established by China Environmental Protection Agency, the United States Environmental Protection Agency, the California Air Resources Board, and European and Canadian legislative bodies.

According to the management’s knowledge, the Company’s products have been designed and developed according to the environmental regulations of the target market since the research and development period, and have passed the corresponding tests before the products are put into production and sales, and obtained the compulsory product certification of the corresponding countries and regions.

If the standards and rules are modified, or interpreted differently, or the product certification certificate expires, the Company will evaluate the product and restart the corresponding product design improvement and product testing/certification procedures to continuously ensure the target market environment regulatory compliance. The Company cannot estimate the extent to which these changes, if any, will affect our operating costs in the future.

Product Safety and Regulation

Safety Regulation

The U.S. federal government and individual states have adopted, or are considering the adoption of, laws and regulations relating to the use and safety of Kandi’s products. The federal government is the primary regulator of product safety. The Consumer Product Safety Commission (“CPSC”) has federal oversight over product safety issues related to ATVs and off-road vehicles. The National Highway Transportation Safety Administration (“NHTSA”) has federal oversight over product safety issues related to off-road vehicles and regulates the safety of electric vehicles for road vehicles.

In August 2008, the Consumer Product Safety Improvement Act (the “Product Safety Act”) was passed. The Product Safety Act requires all manufacturers and distributors who import into or distribute ATVs within the United States to comply with the American National Standards Institute/Specialty Vehicle Institute of America (“ANSI/SVIA”) safety standard, which previously had been voluntary. The Product Safety Act also requires the same manufacturers and distributors to have ATV action plans filed with the CPSC that are substantially similar to the voluntary action plans that were previously in effect. Both Kandi and SC Autosports currently comply with the ANSI/SVIA standard.

Kandi’s off-road vehicles are subject to federal vehicle safety standards administered by NHTSA. Kandi’s off-road vehicles are also subject to various state vehicle safety standards. Kandi believes that its off-road vehicles comply with safety standards applicable to off-road vehicles.

Kandi’s off-road vehicles are also subject to international safety standards in places where it sells its products outside the United States. Kandi believes that its off-road vehicle products comply with applicable safety standards in the United States and internationally.

8

Permission and Approvals

The following table lists all the material permission and approvals the Company and its subsidiaries hold to operate business in PRC, as of December 31, 2023:

| Company | License/Permission | Issuing Authority | Validity | |||

| Zhejiang Kandi Technologies Group, Co. Ltd. | Business License | Market Supervision and Administration Bureau of Jinhua City | Until March 12, 2052 | |||

| Zhejiang Kandi Technologies Group, Co. Ltd. | Record Registration Form for Foreign Trade Business Operators | Eligible local foreign trade authorities appointed by the Ministry of Commerce | Long-term | |||

| Jinhua Kandi New Energy Vehicle Co., Ltd. | Business License | Market Supervision and Administration Bureau of Jinhua City | Until May 26, 2030 | |||

| Jinhua Kandi New Energy Vehicle Co., Ltd. | Record Registration Form for Foreign Trade Business Operators | Eligible local foreign trade authorities appointed by the Ministry of Commerce | Long-term | |||

| Zhejiang Kandi Smart Battery Swap Technology Co., Ltd | Business License | Market Supervision and Administration Bureau of Jinhua City | Long-term | |||

| Zhejiang Kandi Smart Battery Swap Technology Co., Ltd | Record Registration Form for Foreign Trade Business Operators | Eligible local foreign trade authorities appointed by the Ministry of Commerce | Long-term | |||

| Yongkang Scrou Electric Co, Ltd. | Business License | Market Supervision and Administration Bureau of Yongkang City | Until November 17, 2031 | |||

| Kandi Electric Vehicles (Hainan) Co., Ltd. | Business License | Market Supervision and Administration Bureau of Hainan Province | Long-term | |||

| Kandi Electric Vehicles (Hainan) Co., Ltd. | Record Registration Form for Foreign Trade Business Operators | Eligible local foreign trade authorities appointed by the Ministry of Commerce | Long-term | |||

| Kandi Electric Vehicles (Hainan) Co., Ltd. | Pollutant Discharge Permit | Haikou High-tech Zone | Until February 8, 2028 | |||

| China Battery Exchange (Zhejiang) Technology Co., Ltd. | Business License | Market Supervision and Administration Bureau of Xihu District, Hangzhou City | Until September 13, 2050 | |||

| China Battery Exchange (Hainan) Technology Co., Ltd. | Business License | Market Supervision and Administration Bureau of Hainan Province | Long-term | |||

| Jiangxi Province Huiyi New Energy Co., Ltd. | Business License | Market Supervision and Administration Bureau of Xinyu City High tech Zone | Long-term | |||

| Jiangxi Province Huiyi New Energy Co., Ltd. | Record Registration Form for Foreign Trade Business Operators | Eligible local foreign trade authorities appointed by the Ministry of Commerce | Long-term | |||

| Jiangxi Province Huiyi New Energy Co., Ltd. | Environmental impact assessment | Environmental Protection Bureau of Xinyu City | Long-term | |||

| Jiangxi Province Huiyi New Energy Co., Ltd. | Pollutant Discharge Permit | Xinyu High Tech Ecological Environment Bureau | Until July 18, 2027 | |||

| Hainan Kandi Holding New Energy Technology Co., Ltd. | Business License | Market Supervision and Administration Bureau of Hainan Province | Until February 18, 2042 |

9

Those listed above constitute all the requisite permissions or approvals the Company and its subsidiaries required to operate business in the PRC. The Company and its subsidiaries have never been denied any applications concerning any permissions or approvals. If the Company or its subsidiaries does not receive or maintain such permissions or approvals, or mistakenly conclude that such permissions or approvals are not required, our business may be adversely affected. In the scenario when the Company does get denied such permissions, the Company would either avoid such field of business, or collaborate with parties that can obtain such permissions. Currently the PRC legal system is under constant development and applicable laws, regulations, or interpretations are subject to substantial uncertainties. If relevant rules suddenly change, we will have to obtain such permissions or approvals, which may be costly, and may temporarily halt our operation of business, negatively affecting our revenues and our securities’ value.

CAC Review

The management believes that as of the date of this report: (i) the Company does not hold personal information of over one million users; (ii) the Company and its subsidiaries have not been informed by any PRC governmental authority of any requirement that it file for a cybersecurity review; and (iii) the Company and its subsidiaries have never disclosed any customer or supplier information within China (except when requested by related parties, the company and its subsidiaries tailor their customer or supplier information disclosures to the narrowest possible scope), therefore, the Company believes it is not required to pass cybersecurity review of CAC. We are also not aware that there are relevant laws or regulations in the PRC explicitly requiring us to seek approval from the China Securities Regulatory Commission for our overseas listing. Further, as of the date of this report, Kandi Technologies and its subsidiaries 1) did not collect any data that will or may negatively influence PRC’s national security; and 2) strictly follow the relevant PRC laws and regulations. Since these statements and regulatory actions are new, however, official guidance and related implementation rules have not been issued. It is highly uncertain what the potential impact such modified or new laws and regulations will have on the daily business operations of our subsidiaries, our ability to accept foreign investments, and our listing on a U.S. exchange. The PRC regulatory authorities may in the future promulgate laws, regulations, or implementing rules that require us, our subsidiaries to obtain regulatory approval from Chinese authorities for listing in the U.S. If we do not receive or maintain the approval, or inadvertently conclude that such approval is not required, or applicable laws, regulations, or interpretations change such that we are required to obtain approval in the future, we may be subject to an investigation by competent regulators, fines or penalties, or an order prohibiting us from conducting an offering, and these risks could result in a material adverse change in our operations and the value of our common stock, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless.

CSRC Filing Requirements

On December 24, 2021, the China Securities Regulatory Commission, or the “CSRC”, published draft regulations (the “Draft Rules”) on domestic enterprises issuing securities and being listed overseas. The Draft Rules lay out specific filing requirements for overseas listing and offering by PRC domestic companies and include unified regulation management and strengthening regulatory coordination. On February 17, 2023, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”), which took effect on March 31, 2023. The Trial Measures supersede the Draft Rules and clarified and emphasized several aspects, which include but are not limited to: (1) criteria to determine whether an issuer will be required to go through the filing procedures under the Trial Measures; (2) exemptions from immediate filing requirements for issuers including those that have already been listed or registered but not yet listed in foreign securities markets, including U.S. markets, prior to the effective date of the Trial Measures; (3) a negative list of types of issuers banned from listing or offering overseas, such as issuers whose affiliates have been recently convicted of bribery and corruption; (4) issuers’ compliance with web security, data security, and other national security laws and regulations; (5) issuers’ filing and reporting obligations, such as obligation to file with the CSRC after it submits an application for initial public offering to overseas regulators, and obligation after offering or listing overseas to report to the CSRC material events including change of control or voluntary or forced delisting of the issuer; and (6) the CSRC’s authority to fine both issuers and their shareholders for failure to comply with the Trial Measures, including failure to comply with filing obligations or committing fraud and misrepresentation. Because we are already publicly listed in the U.S., the Trial Measures do not impose additional regulatory burden on us beyond the obligation to report to the CSRC any future offerings of our securities, or material events such as a change of control or delisting. As the Trial Measures are newly issued, there remains uncertainty as to how it will be interpreted or implemented. Therefore, there is uncertainty that if we are subject to such filing requirements under the Trial Measures, we will be able to get clearance from the CSRC in a timely fashion.

10

Auditors’ Regulations

As auditors of companies that are traded publicly in the United States and a firm registered with the PCAOB, our auditor is required by the laws of the United States to undergo regular inspections by the PCAOB. However, to the extent that our auditor’s work papers become located in China, such work papers will not be subject to inspection by the PCAOB because the PCAOB is currently unable to conduct inspections without the approval of the Chinese authorities. Inspections of certain other firms that the PCAOB has conducted outside of China have identified deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. We are required by the Holding Foreign Companies Accountable Act (“HFCAA”) to have an auditor that is subject to the inspection by the PCAOB. Our present auditor is subject to the review of PCAOB and the PCAOB is able to conduct inspections on our present auditor, to the extent this status changes in the future and our auditor’s audit documentation related to their audit reports for our company becomes outside of the inspection by the PCAOB or if the PCAOB is unable to inspect or investigate completely our auditor because of a position taken by an authority in a foreign jurisdiction, trading in our common stock could be prohibited under the HFCAA, and as a result our common stock could be delisted from Nasdaq.

On May 13, 2021, the PCAOB proposed a new rule for implementing the HFCAA. Among other things, the proposed rule provides a framework for the PCAOB to use when determining, under the HFCAA, whether it is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. The proposed rule would also establish the manner of the PCAOB’s determinations; the factors the PCAOB will evaluate and the documents and information it will consider when assessing whether a determination is warranted; the form, public availability, effective date, and duration of such determinations; and the process by which the board of the PCAOB can modify or vacate its determinations. The proposed rule was adopted by the PCAOB on September 22, 2021 and approved by the SEC on November 5, 2021.

Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”), which, if enacted, would amend the HFCAA and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period for triggering the prohibition on trading. On December 29, 2022, the Consolidated Appropriations Act, 2023 (the “CAA”), which AHFCAA constituted a part, was signed into law, which officially reduced the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two, thus, reducing the time before an applicable issuer’s securities may be prohibited from trading or delisted.

While the HFCAA is not currently applicable to the Company because the Company’s current auditors are subject to PCAOB review, if this changes in the future for any reason, the Company may be subject to the HFCAA. The implications of this regulation if the Company were to become subject to it are uncertain. Such uncertainty could cause the market price of our common stock to be materially and adversely affected, and our securities could be delisted or prohibited from being traded on Nasdaq earlier than would be required by the HFCAA. If our common stock is unable to be listed on another securities exchange by then, such a delisting would substantially impair your ability to sell or purchase the common stock when you wish to do so, and the risk and uncertainty associated with a potential delisting would have a negative impact on the price of the common stock.

Principal Executive Offices

Our principal executive office is located in the Jinhua New Energy Vehicle Town in Jinhua, Zhejiang Province, PRC, 321016, and our telephone number is (86-579) 82239856.

Enforceability of civil liabilities against foreign persons

We have our principal executive office and substantially all of our operations in PRC. A majority of our directors and officers are nationals and/or residents of countries other than the United States. As a result, it may be difficult for our shareholders to effect service of process upon us or those persons inside PRC. The shareholders may have to rely on international treaties such as Hague Service Convention for service. In addition, PRC does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States and many other countries and regions. Therefore, direct recognition and enforcement in PRC of judgments of a court in any such non-PRC jurisdictions in relation to any matter not subject to a binding arbitration provision may be difficult, time-consuming, costly or even impossible.

11

Item 1A. Risk Factors.

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this Annual Report that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risk Factor Summary

The following are some material risks, any of which could have an adverse effect on our business financial condition, operating results, or prospects.

| ● | Risks Relating to Our Business |

| ○ | Our future growth is dependent upon market’s willingness to adopt our products and performance of our products in line with customers’ expectation; |

| ○ | Developments in alternative technologies or improvements in the internal combustion engine may materially adversely affect the demand for our products; |

| ○ | Our business depends substantially on the continuing efforts of our executive officers, and our business may be severely disrupted if we lose their services; |

| ○ | Our U.S. and PRC operating entities may be subject to product liability claims or recalls which could be expensive, damage our reputation or result in a diversion of management resources; |

| ○ | We and our PRC operating entities retain certain personal information about our customers and may be subject to various privacy and consumer protection laws; |

| ○ | If we are unable to protect our intellectual property rights from unauthorized use or infringement by third parties, defending and claiming our rights may be time-consuming and could cause us to incur substantial costs, our operating entities’ business may be adversely affected; |

| ○ | Our PRC operating entities’ products make use of lithium-ion battery cells, which may catch fire or vent smoke and flame. This may lead to additional concerns about batteries used in automotive applications; |

| ○ | Compliance with environmental regulations can be expensive, and noncompliance with these regulations may result in adverse publicity and potentially significant monetary damages and fines; |

| ○ | Our high concentration of sales to relatively few customers and supplies from relatively few suppliers may result in significant impact on our liquidity, business, results of operations and financial condition; |

| ○ | Our facilities or operations could be damaged or adversely affected as a result unpredictable events; |

| ○ | If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential shareholders could lose confidence in our financial reporting, which would harm our business and the trading price of our stock; |

12

| ● | Risks Related to Doing Business in China |

| ○ | Substantial uncertainties and restrictions on the political and economic policies of the PRC government, PRC laws and regulations which can change quickly with little advance notice, and Chinese government’s tendency to intervene or influence the Company’s operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers could have a significant impact upon the business that we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition; may restrict the level of legal protections to foreign investors and could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. For more detailed description, please refer to the discussion on P22 under such title; |

| ○ | Adverse regulatory developments in China may subject us to additional regulatory review, and additional disclosure requirements and regulatory scrutiny to be adopted by the SEC in response to risks related to recent regulatory developments in China may impose additional compliance requirements for companies like us with China-based operations, all of which could increase our compliance costs, subject us to additional disclosure requirements; |

| ○ | Compliance with China’s new Data Security Law, Measures on Cybersecurity Review, Personal Information Protection Law (second draft for consultation), regulations and guidelines relating to the multi-level protection scheme and any other future laws and regulations may entail significant expenses and could materially affect our business; The approval of the China Securities Regulatory Commission (“CSRC”) may be required in connection with future offering under a PRC regulation adopted in August 2006, and, if required, we cannot assure you that we will be able to obtain such approval; |

| ○ | It may be difficult for U.S. regulators, such as the Department of Justice, the SEC, and other authorities, to conduct investigation or collect evidence within China; |

| ○ | The economy of China had experienced unprecedented growth. This growth has slowed in the recent years, and if the growth of the economy continues to slow or if the economy contracts, our financial condition may be materially and adversely affected; |

| ○ | Changes in currency conversion policies in China and fluctuation in exchange rates may have a material adverse effect on our business and the value of our securities; |

| ○ | Investors may experience difficulties in effecting service of legal process, enforcing judgements or bringing original actions based on United States or foreign laws against us or our management; |

| ○ | Changes to the government’s subsidy support policies and further delays in subsidy payments may have negative impacts on our operations; |

| ● | Risks Associated With the Export of Kandi Electric Vehicles to and sale in the United States |

| ○ | Failures in our U.S. business may present a risk of significant losses to our business; |

| ○ | The United States has strict environmental laws and regulations which may cause us to expend significant sums to comply with such laws and regulations; |

| ○ | Our short-term financial performance may suffer due to our investment in expanding our presence and sales in the United States; |

| ○ | Lack of authorized dealers and absence of after-sales maintenance may adversely affect our business in the United States; |

13

| ● | Risks Relating to Ownership of Our Securities |

| ○ | Our stock price may be volatile, which may result in losses for our shareholders; |

| ○ | We do not anticipate paying cash dividends to our common shareholders; |

| ○ | Limited monetary liability against our directors, officers and employees under Delaware Law and the existence of statutory indemnification rights of our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees; |

| ○ | We may require additional capital, and the sale of additional shares or other equity securities could result in additional dilution to our shareholders; |

| ○ | Our business is subject to changing regulations related to corporate governance and public disclosure that may increase both our costs and the risk of noncompliance; |

| ○ | Techniques employed by manipulative short sellers in Chinese small cap stocks may drive down the market price of our common stock. |

| ● | Risks Relating to the Reincorporation |

| ○ | Your rights as a shareholder of Kandi will change as a result of the Reincorporation and you may not be afforded as many rights as a shareholder of Kandi BVI under applicable laws and the Kandi BVI memorandum and articles of association as you were as a shareholder of Kandi under applicable laws and the Kandi certificate of incorporation and bylaws. | |

| ○ | BVI companies may not be able to initiate shareholder derivative actions, thereby depriving shareholders of the ability to protect their interests. | |

| ○ | Kandi BVI’s Amended and Restated Articles of Association provide for the exclusive jurisdiction of the Courts of the British Virgin Islands for substantially all disputes between Kandi BVI and its shareholders, which could limit the shareholders’ ability to obtain a favorable judicial forum for disputes with Kandi BVI or its directors, officers, other employees or shareholders. | |

| ○ | As a foreign private issuer, Kandi BVI is permitted to, and Kandi BVI may in the future choose to follow certain corporate governance practices in accordance with British Virgin Island law in lieu of certain NASDAQ requirements applicable to U.S. issuers. As a result, Kandi BVI’s members may not have the protections afforded by these corporate governance requirements, which may make its ordinary shares less attractive to investors or otherwise harm the trading price or value of its ordinary shares. | |

| ○ | The expected benefits of the Reincorporation may not be realized. | |

| ○ | As a foreign private issuer, Kandi BVI will not be required to provide its shareholders with the same information as Kandi would if Kandi remained a U.S. public issuer and, as a result, you may not receive as much information about Kandi BVI as you did about Kandi and you may not be afforded the same level of protection as a shareholder of Kandi BVI under applicable laws and the Kandi BVI memorandum and articles of association as you were as a shareholder of Kandi under applicable laws and the Kandi certificate of incorporation and bylaws. |

Risks Relating to Our Business

Our future growth is dependent upon consumers’ willingness to adopt our products.

Our PRC operating entities’ growth is highly dependent upon the adoption by consumers of, and they are subject to a risk of any reduced demand for, alternative fuel vehicles in general and EVs and pure electric off-road vehicles in particular. The market for alternative fuel vehicles and pure electric off-road vehicles is relatively new and rapidly evolving, characterized by rapidly changing technologies, price competition, additional competitors, evolving government regulation and industry standards, frequent new vehicle announcements and changing consumer demands and behaviors. If the market for EVs and pure electric off-road vehicles in China does not develop as we expect or develops more slowly than we expect, our business, prospects, financial condition and operating results will be harmed.

Developments in alternative technologies or improvements in the internal combustion engine may materially adversely affect the demand for our products.

Significant developments in alternative technologies, such as advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements in the fuel economy of the internal combustion engine, may materially and adversely affect our business and prospects in ways we do not currently anticipate. Any failure by us to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay our development and introduction of new and enhanced EV products and Pure Electric off-road vehicles, which could result in the loss of competitiveness of our vehicles, decreased revenue and a loss of market share to competitors, which would materially and adversely affect our business, prospects, operating results and financial condition.

14

If our U.S. and PRC operating entities are unable to keep up with advances in electric vehicle and pure electric off-road vehicle technology, we may suffer a decline in our competitive position. Our research and development efforts may not be sufficient to adapt to changes in EV and pure electric off-road vehicle technology. As technologies change, our PRC operating entities plan to upgrade or adapt the vehicles and introduce new models in order to continue to provide vehicles with the latest technology, in particular battery cell technology. However, our PRC operating entities’ vehicles may not compete effectively with alternative vehicles and pure electric off-road vehicles if they are not able to source and integrate the latest technology into their vehicles. For example, our PRC operating entities do not manufacture battery cells, which makes them dependent upon other suppliers of battery cell technology for our battery packs.

Our business depends substantially on the continuing efforts of our executive officers, and our business may be severely disrupted if we lose their services.

Our future success depends substantially on the continued services of our executive officers, especially our CEO, Dr. Dong Xueqin and Chairman of the Board, Mr. Hu Xiaoming. We do not maintain key man life insurance on any of our executive officers. If any of our executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Therefore, our business may be severely disrupted, and we may incur additional expenses to recruit and retain new officers. In addition, if any of our executive officers joins a competitor or forms a competing company, we may lose some of our customers.

Our U.S. and PRC operating entities may be subject to product liability claims or recalls which could be expensive, damage our reputation or result in a diversion of management resources.

Our PRC and U.S. operating entities may be subject to lawsuits resulting from injuries or damages associated with the use of the vehicles that they sell or produce. We may incur losses relating to these claims or the defense of these claims. While our PRC and U.S. operating entities do maintain product liability insurance, there is a risk that claims or liabilities will exceed our insurance coverage. In addition, we cannot assure the insurance our PRC and U.S. operating entities currently maintain will continue to be available on commercially reasonable terms, therefore, we may be unable to retain adequate liability insurance in the future.

Our operating entities in PRC or in U.S. may also be involved in recalls of our vehicles. The vehicles we manufactured may prove to be defective, or our operating entities may voluntarily initiate a recall or make payments related to such claims as a result of various industry or business practices or the need to maintain good customer relationships. Such a recall would result in a diversion of resources, extra expenditure of the funds, or damage to our reputation. Any product liability claim brought against us could have a material adverse effect on the results of our operations.

We and our PRC operating entities retain certain personal information about our customers and may be subject to various privacy and consumer protection laws.

We and our PRC operating entities use the electronic systems of our vehicles to log information about each vehicle’s condition, performance and use in order to aid us in providing customer service, including vehicle diagnostics, repair and maintenance. Electronic systems are also used to help us collect data regarding our customers’ charging time, battery usage, mileage and efficiency habits to improve our vehicles. We also collect information about our customers through our website, at our stores and facilities, and via telephone.

15

Our customers may object to the processing of this data, which may negatively impact our ability to provide effective customer service and develop new vehicles and products. Collection and use of our customers’ personal information in conducting our business may be subject to national and local laws and regulations in China, and such laws and regulations may restrict our processing of such personal information and hinder our ability to attract new customers or market to existing customers. We may incur significant expenses to comply with privacy, consumer protection and security standards and protocols imposed by law, regulation, industry standards or contractual obligations. Although we take steps to protect the security of our customers’ personal information, we may be required to expend significant resources to comply with data breach requirements if third parties improperly obtain and use the personal information of our customers or we otherwise experience a data loss with respect to customers’ personal information. A major breach of our network security and systems could have serious negative consequences for our businesses and future prospects, including possible fines, penalties and damages, reduced customer demand for our vehicles, and harm to our reputation and brand.

Our PRC operating entities’ business will be adversely affected if we are unable to protect our intellectual property rights from unauthorized use or infringement by third parties.

Any failure to adequately protect our proprietary rights could result in the weakening or loss of such rights, which may allow our competitors to offer similar or identical products or use identical or confusingly similar branding, potentially resulting in the loss of some of our competitive advantage, a decrease in our revenue or an attribution of potentially lower quality products to us, which would adversely affect our business, prospects, financial condition and operating results. Our success depends, at least in part, on our ability to protect our core technology and intellectual property. To accomplish this, we rely on a combination of patents, patent applications, trade secrets (including know-how), employee and third-party nondisclosure agreements, copyright protection, trademarks, intellectual property licenses and other contractual rights to establish and protect our proprietary rights in our technology. We have also received from third parties patent licenses related to manufacturing our vehicles.

The protection provided by the patent laws is and will be important to our future opportunities. However, such patents and agreements and various other measures we take to protect our intellectual property from use by others may not be effective for various reasons, including the following:

| ● | our pending patent applications may not result in the issuance of patents; |

| ● | our patents, if issued, may not be broad enough to protect our commercial endeavors; |

| ● | the patents we have been granted may be challenged, invalidated or circumvented because of the pre-existence of similar patented or unpatented technology or for other reasons; |

| ● | the costs associated with obtaining and enforcing patents, confidentiality and invention agreements or other intellectual property rights may make aggressive enforcement impracticable; or |

| ● | current and future competitors may independently develop similar technology, duplicate our vehicles or design new vehicles in a way that circumvents our intellectual property. |

Existing trademark and trade secret laws and confidentiality agreements only afford limited protections. In addition, the laws of some countries, such as PRC, do not protect our proprietary rights to the same extent as do the laws of the United States, which can lead to more unauthorized use of our intellectual property.

16

We may need to defend ourselves against patent or trademark infringement claims, which may be time-consuming and could cause us to incur substantial costs.

Companies, organizations or individuals, including our competitors, may hold or obtain patents, trademarks or other proprietary rights that would prevent, limit or interfere with our ability to make, use, develop, sell or market our vehicles or components, which could make it more difficult for us to operate our business. From time to time, we may receive inquiries from holders of patents or trademarks regarding their proprietary rights. Companies holding patents or other intellectual property rights may bring suits alleging infringement of such rights or otherwise assert their rights and seek licenses. In addition, if we are determined to have infringed upon a third party’s intellectual property rights, we may be required to do one or more of the following:

| ● | cease selling, incorporating or using vehicles or offering goods or services that incorporate or use the challenged intellectual property; |

| ● | pay substantial damages; |

| ● | obtain a license from the holder of the infringed intellectual property right, which license may not be available on reasonable terms or at all; or |

| ● | redesign our vehicles or other goods or services. |

In the event of a successful claim of infringement against us and our failure or inability to obtain a license to the infringed technology or other intellectual property right, our business, prospects, operating results and financial condition could be materially adversely affected. In addition, any litigation or claims, whether or not valid, could result in substantial costs and diversion of resources and management attention.

We may also face claims that our use of technology licensed or otherwise obtained from a third party infringes the rights of others, under such case we may not be allowed to continue using such technology and selling our inventories containing such technology. In such cases, we may seek indemnification from our licensors/suppliers under our contracts with them. However, indemnification may be unavailable or insufficient to cover our costs and losses, depending on our use of the technology, whether we choose to retain control over conduct of the litigation, and other factors. In addition, we may have to find substitute to keep using similar technology to our products, which may be time-consuming and costly, if not impossible, upon such period our sales or manufacture of certain products may be negatively influenced.

Our PRC operating entities’ vehicles make use of lithium-ion battery cells, which have the potential to catch fire or vent smoke and flame. This may lead to additional concerns about batteries used in automotive applications.

The battery packs in our EV products and pure electric off-road vehicles make use of lithium-ion cells. Our PRC operating entities also currently intend to make use of lithium-ion cells in battery packs on any future vehicles we may produce. On rare occasions, lithium-ion cells can rapidly release the energy they contain by venting smoke and flames in a manner that can ignite nearby materials as well as other lithium-ion cells. Extremely rare incidents of laptop computers, cell phones and EV battery packs catching fire have focused consumer attention on the safety of these cells.

These events have raised concerns about batteries used in EV products and pure electric off-road vehicles applications. To address these questions and concerns, a number of battery cell manufacturers are pursuing alternative lithium-ion battery cell chemistries to improve safety. Our PRC operating entities may have to recall their vehicles or participate in a recall of a vehicle that contains their battery packs, or redesign their battery packs, which would be time consuming and expensive. Also, negative public perceptions regarding the suitability of lithium-ion cells for automotive applications or any future incident involving lithium-ion cells such as a vehicle or other fire, even if such incident does not involve us, could seriously harm our business.

In addition, our PRC operating entities store a significant number of lithium-ion cells at our manufacturing facility. Any mishandling of battery cells may cause disruption to the operation of our facilities. While our PRC operating entities have implemented safety procedures related to the handling of the cells, there can be no assurance that a safety issue or fire related to the cells would not disrupt our operations. Such damage or injury would likely lead to adverse publicity and potentially a safety recall. Moreover, any failure of a competitor’s EVs and pure electric off-road vehicles, may cause indirect adverse publicity for us and our EV products. Such adverse publicity would negatively affect our brand and harm our business, prospects, financial condition and operating results.

17

Compliance with environmental regulations can be expensive, and noncompliance with these regulations may result in adverse publicity and potentially significant monetary damages and fines.

The business operations of our PRC operating entities generate noise, waste water, gaseous byproduct and other industrial waste. Our PRC operating entities are required to comply with all national and local regulations regarding the protection of the environment. Our PRC operating entities are in compliance with current environmental protection requirements and have all necessary environmental permits to conduct our business. However, if more stringent regulations are adopted in the future, the costs of compliance with these new regulations could be substantial. Additionally, if our PRC operating entities fail to comply with present or future environmental regulations, they may be required to pay substantial fines, suspend production or cease operations. Any failure by our PRC operating entities to control the use of, or to adequately restrict the unauthorized discharge of, hazardous substances could subject us to potentially significant monetary damages and fines or suspensions to our business operations. Certain laws, ordinances and regulations could limit our ability to develop, use, or sell our products.

Our high concentration of sales to relatively few customers may result in significant impact on our liquidity, business, results of operations and financial condition.

As of December 31, 2023 and 2022, our operating subsidiaries’ major customers (above 10% of the total revenue), in the aggregate, accounted for 55% and 26%, respectively, of their sales. Due to the concentration of sales to relatively few customers, loss of one or more of these customers will have relatively high impact on their operational results.

Our business is subject to the risk of supplier concentrations.

Our PRC operating entities depend on a limited number of suppliers for the sourcing of major components and parts and principal raw materials. For the years ended December 31, 2023 and 2022, the major suppliers (above 10% of the total purchases) of our operating subsidiaries accounted for 20% and 22% of their purchases, respectively. As a result of this concentration in our supply chain, our operating subsidiaries’ business and operations would be negatively affected if any of their key suppliers were to experience significant disruption affecting the price, quality, availability or timely delivery of their products. The partial or complete loss of these suppliers, or a significant adverse change in our relationship with any of these suppliers, could result in lost revenue, added costs and distribution delays that could harm our business and customer relationships. Disputes with significant suppliers, logistics service providers or independent distributors, including disputes regarding pricing or performance, may also adversely affect our ability to manufacture and/or sell our products, as well as our business or financial results. In addition, concentration in our supply chain can exacerbate our exposure to risks associated with the termination by key suppliers of our distribution agreements or any adverse change in the terms of such agreements, which could have a negative impact on our revenues and profitability.

Our facilities or operations could be damaged or adversely affected as a result of disasters, epidemics or other unpredictable events.

The Company’s headquarters and facilities are located in several cities in China such as Jinhua, Yongkang and Haikou. If major disasters such as earthquakes, fires, floods, hurricanes, wars, terrorist attacks, computer viruses, pandemics or other events occur, or our information system or communications network breaks down or operates improperly, our headquarters and production facilities may be seriously damaged, or we may have to stop or delay production and shipment of our products. Any outbreak of contagious diseases, and other adverse public health developments, particularly in China, and failure to take adequate steps to mitigate the likelihood or potential impact of such events, or to effectively manage such events if they occur, may adversely affect our business or financial results. These could include port closures and other restrictions resulting from the outbreak; constrained global supply, which may cause the negative impact on our sale of off-road vehicles to the U.S.; disruptions or restrictions on our ability to travel or to distribute our products, as well as temporary closures of our facilities or the facilities of our suppliers, manufacturers or customers. Any disruption or delay of our operation and those of our suppliers, manufacturers or customers would adversely impact our sales and operating results. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of China and many other countries, resulting in an economic downturn that could affect demand for our products and we may incur expenses relating to such damages, which could have a material adverse impact on our business, operating results and financial condition.

18

Our EVs and pure electric off-road vehicles may not perform in line with customer expectations.

Our EVs and pure electric off-road vehicles may not perform in line with customers’ expectations. For example, our vehicles may not have the durability or longevity of other vehicles in the market, and may not be as easy and convenient to repair as other vehicles in the market. Any product defects or any other failure of our vehicles to perform as expected could harm our reputation and result in adverse publicity, lost revenue, delivery delays, product recalls, product liability claims, harm to our brand and reputation, and significant warranty and other expenses, and could have a material adverse impact on our business, financial condition, operating results and prospects.

In addition, the range of our vehicles on a single charge declines principally as a function of usage, time and charging patterns as well as other factors. For example, a customer’s use of his or her EVs and pure electric off-road vehicles as well as the frequency with which he or she charges the battery can result in additional deterioration of the battery’s ability to hold a charge.

Furthermore, our vehicles may contain defects in design and manufacture that may cause them not to perform as expected or that may require repair. While we have performed extensive internal testing on our vehicles’ software and hardware systems, we have a limited frame of reference by which to evaluate the long-term performance of our systems and vehicles. There can be no assurance that we will be able to detect and fix any defects in the vehicles prior to their sale to consumers. If any of our vehicles fail to perform as expected, we may need to delay deliveries, initiate product recalls and provide servicing or updates under warranty at our expense, which could adversely affect our brand in our target markets and could adversely affect our business, prospects and results of operations.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential shareholders could lose confidence in our financial reporting, which would harm our business and the trading price of our stock.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on our internal controls over financial reporting in their annual reports.

Although we continue to maintain and improve our internal control procedures, we cannot provide assurance that we will not fail to achieve and maintain an effective internal control environment on an ongoing basis, which may cause investors to lose confidence in our reported financial information and have a material adverse effect on the price of our common stock.

19

Risks Related to Doing Business in China

Substantial uncertainties and restrictions on the political and economic policies of the PRC government, PRC laws and regulations which can change quickly with little advance notice, and Chinese government’s tendency to intervene or influence your operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers could have a significant impact upon the business that we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition; may restrict the level of legal protections to foreign investors and could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless;