UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the quarterly period ended

or

For the transition period from ______to______

Commission File Number

(Exact name of registrant as specified in charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

People’s Republic of | ||

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Jinhua City Industrial Zone, Jinhua, Zhejiang Province, People’s Republic of China 321016

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§

232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | |

| Non-accelerated filer | ☐ | Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of August 4, 2022, the registrant had 77,658,730

shares of common stock issued and

TABLE OF CONTENTS

i

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements.

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| June 30, 2022 | December 31, 2021 | |||||||

| (Unaudited) | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Restricted cash | ||||||||

| Certificate of deposit | ||||||||

| Accounts receivable (net of allowance for doubtful accounts of $ | ||||||||

| Inventories | ||||||||

| Notes receivable | ||||||||

| Other receivables | ||||||||

| Prepayments and prepaid expense | ||||||||

| Advances to suppliers | ||||||||

| TOTAL CURRENT ASSETS | ||||||||

| NON-CURRENT ASSETS | ||||||||

| Property, plant and equipment, net | ||||||||

| Intangible assets, net | ||||||||

| Land use rights, net | ||||||||

| Construction in progress | ||||||||

| Deferred tax assets | ||||||||

| Long-term investment | ||||||||

| Goodwill | ||||||||

| Other long-term assets | ||||||||

| TOTAL NON-CURRENT ASSETS | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | $ | ||||||

| Other payables and accrued expenses | ||||||||

| Short-term loans | ||||||||

| Notes payable | ||||||||

| Income tax payable | ||||||||

| Other current liabilities | ||||||||

| TOTAL CURRENT LIABILITIES | ||||||||

| NON-CURRENT LIABILITIES | ||||||||

| Long-term loans | ||||||||

| Deferred taxes liability | ||||||||

| Contingent consideration liability | ||||||||

| Other long-term liabilities | ||||||||

| TOTAL NON-CURRENT LIABILITIES | ||||||||

| TOTAL LIABILITIES | ||||||||

| STOCKHOLDER'S EQUITY | ||||||||

| Common stock, $ | ||||||||

| Less: Treasury stock ( | ( | ) | ( | ) | ||||

| Additional paid-in capital | ||||||||

| Accumulated deficit (the restricted portion is $ | ( | ) | ( | ) | ||||

| Accumulated other comprehensive loss | ( | ) | ||||||

| TOTAL KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS' EQUITY | ||||||||

| Non-controlling interests | ||||||||

| TOTAL STOCKHOLDERS' EQUITY | ||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | $ | ||||||

See accompanying notes to condensed consolidated financial statements

1

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2022 | June 30, 2021 | June 30, 2022 | June 30, 2021 | |||||||||||||

| REVENUES FROM UNRELATED PARTIES, NET | $ | $ | $ | $ | ||||||||||||

| REVENUES FROM THE FORMER AFFILIATE COMPANY AND RELATED PARTIES, NET | ||||||||||||||||

| REVENUES, NET | ||||||||||||||||

| COST OF GOODS SOLD | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| GROSS PROFIT | ||||||||||||||||

| OPERATING INCOME (EXPENSE): | ||||||||||||||||

| Research and development | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Selling and marketing | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| General and administrative | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Gain on disposal of long-lived assets | ||||||||||||||||

| TOTAL OPERATING (EXPENSE) INCOME | ( | ) | ( | ) | ||||||||||||

| (LOSS) INCOME FROM OPERATIONS | ( | ) | ( | ) | ||||||||||||

| OTHER INCOME (EXPENSE): | ||||||||||||||||

| Interest income | ||||||||||||||||

| Interest expense | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Change in fair value of contingent consideration | ( | ) | ( | ) | ||||||||||||

| Government grants | ||||||||||||||||

| Gain from sale of equity in the Former Affiliate Company | ||||||||||||||||

| Share of loss after tax of the Former Affiliate Company | ( | ) | ( | ) | ||||||||||||

| Other income, net | ||||||||||||||||

| TOTAL OTHER INCOME , NET | ||||||||||||||||

| (LOSS) INCOME BEFORE INCOME TAXES | ( | ) | ( | ) | ||||||||||||

| INCOME TAX BENEFIT (EXPENSE) | ( | ) | ( | ) | ||||||||||||

| NET (LOSS) INCOME | ( | ) | ( | ) | ||||||||||||

| LESS: NET INCOME (LOSS) ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | ||||||||||||||||

| NET (LOSS) INCOME ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS | ( | ) | ( | ) | ||||||||||||

| OTHER COMPREHENSIVE INCOME (LOSS) | ||||||||||||||||

| Foreign currency translation adjustment | ( | ) | ( | ) | ||||||||||||

| COMPREHENSIVE (LOSS) INCOME | $ | ( | ) | $ | $ | ( | ) | $ | ||||||||

| WEIGHTED AVERAGE SHARES OUTSTANDING BASIC AND DILUTED | ||||||||||||||||

| NET (LOSS) INCOME PER SHARE, BASIC AND DILUTED | $ | ( | ) | $ | $ | ( | ) | $ | ||||||||

See accompanying notes to condensed consolidated financial statements

2

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(UNAUDITED)

| Number of Outstanding Shares | Common Stock | Treasury Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Loss | Non-controlling interests | Total | |||||||||||||||||||||||||

| Balance, December 31, 2020 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | |||||||||||||||||||||

| Stock issuance and award | ||||||||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||||||||||||||

| Foreign currency translation | - | ( | ) | ( | ) | |||||||||||||||||||||||||||

| Reversal of reduction in the Former Affiliate Company’s equity (net of tax effect of $ | - | |||||||||||||||||||||||||||||||

| Balance, March 31, 2021 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | |||||||||||||||||||||

| Stock issuance and award | ||||||||||||||||||||||||||||||||

| Net income | - | |||||||||||||||||||||||||||||||

| Foreign currency translation | - | |||||||||||||||||||||||||||||||

| Balance, June 30, 2021 | $ | $ | $ | $ | $ | ( | ) | $ | $ | |||||||||||||||||||||||

| Number of Outstanding Shares | Common Stock | Treasury Stock | Additional Paid-in Capital | Accumulated Earning (Deficit) | Accumulated Other Comprehensive Income | Non-controlling interests | Total | |||||||||||||||||||||||||

| Balance, December 31, 2021 | $ | $ | ( | ) | $ | $ | ( | ) | $ | $ | $ | |||||||||||||||||||||

| Stock issuance and award | ||||||||||||||||||||||||||||||||

| Stock buyback | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Capital contribution from shareholder | - | |||||||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Foreign currency translation | - | |||||||||||||||||||||||||||||||

| Balance, March 31, 2022 | $ | $ | ( | ) | $ | $ | ( | ) | $ | $ | $ | |||||||||||||||||||||

| Stock issuance and award | ||||||||||||||||||||||||||||||||

| Stock buyback | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Net income (loss) | - | ( | ) | ( | ) | |||||||||||||||||||||||||||

| Foreign currency translation | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Balance, June 30, 2022 | $ | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

3

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| Six Months Ended | ||||||||

| June 30, 2022 | June 30, 2021 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||

| Depreciation and amortization | ||||||||

| Provision (reversal) of allowance for doubtful accounts | ||||||||

| Deferred taxes | ( | ) | ( | ) | ||||

| Share of loss after tax of the Former Affiliate Company | ||||||||

| Gain from equity sale in the Former Affiliate Company | ( | ) | ||||||

| Gain on disposal of long-lived assets | ( | ) | ||||||

| Change in fair value of contingent consideration | ( | ) | ||||||

| Stock based compensation expense | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | ( | ) | ||||||

| Notes receivable | ||||||||

| Inventories | ( | ) | ( | ) | ||||

| Other receivables and other assets | ( | ) | ( | ) | ||||

| Advances to supplier and prepayments and prepaid expenses | ||||||||

| Increase (Decrease) In: | ||||||||

| Accounts payable | ( | ) | ||||||

| Other payables and accrued liabilities | ( | ) | ||||||

| Notes payable | ( | ) | ( | ) | ||||

| Income tax payable | ( | ) | ||||||

| Net cash provided by (used in) operating activities | $ | $ | ( | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchases of property, plant and equipment, net | ( | ) | ( | ) | ||||

| Payment for construction in progress | ( | ) | ( | ) | ||||

| Proceeds from disposal of long-lived assets | - | |||||||

| Repayment from (loan to) third party | ||||||||

| Certificate of deposit | ( | ) | ( | ) | ||||

| Proceeds from sales of equity in the Former Affiliate Company | ||||||||

| Long-term Investment | ( | ) | ||||||

| Net cash (used in) provided by investing activities | $ | ( | ) | $ | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from short-term loans | ||||||||

| Repayments of short-term loans | ( | ) | - | |||||

| Contribution from non-controlling shareholder | ||||||||

| Purchase of treasury stock | ( | ) | ||||||

| Net cash (used in) provided by financing activities | $ | ( | ) | $ | ||||

| NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH | $ | ( | ) | $ | ||||

| Effect of exchange rate changes | $ | ( | ) | $ | ||||

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF YEAR | $ | $ | ||||||

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | $ | $ | ||||||

| -CASH AND CASH EQUIVALENTS AT END OF PERIOD | ||||||||

| -RESTRICTED CASH AT END OF PERIOD | ||||||||

| SUPPLEMENTARY CASH FLOW INFORMATION | ||||||||

| Income taxes paid | $ | |||||||

| Interest paid | $ | |||||||

| SUPPLEMENTAL NON-CASH DISCLOSURES: | ||||||||

| Reversal of decrease in investment in the Former Affiliate Company due to change in its equity (net of tax effect of $ | ||||||||

| Increase of other receivable for equity transfer payment of the Former Affiliate Company | ||||||||

| Contribution from non-controlling shareholder by inventories and fix assets | ||||||||

See accompanying notes to condensed consolidated financial statements

4

NOTE 1 - ORGANIZATION AND PRINCIPAL ACTIVITIES

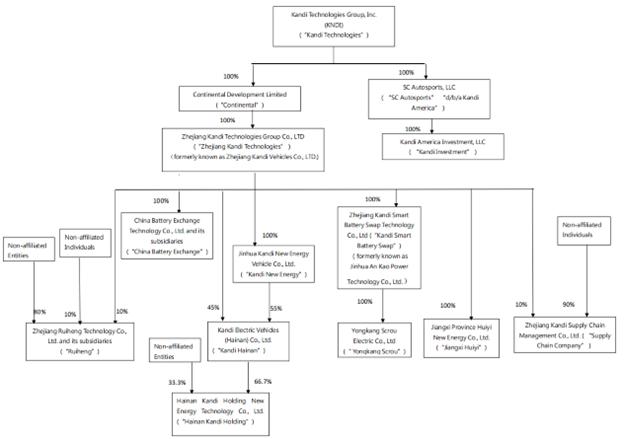

Kandi Technologies Group, Inc. (“Kandi Technologies”) was incorporated under the laws of the State of Delaware on March 31, 2004. As used herein, the terms “Company” or “Kandi” refer to Kandi Technologies and its operating subsidiaries, as described below.

Headquartered in Jinhua City, Zhejiang Province, People’s Republic of China (“China” or “PRC”), the Company is one of China’s leading producers and manufacturers of electric vehicle (“EV”) products, EV parts, and off-road vehicles for sale in the Chinese and the global markets. The Company conducts its primary business operations through its wholly-owned subsidiaries, Zhejiang Kandi Vehicles Co., Ltd. (“Kandi Vehicles”), Kandi Vehicles’ wholly and partially-owned subsidiaries, and SC Autosports, LLC (“SC Autosports”, d/b/a Kandi America) and its wholly-owned subsidiary, Kandi America Investment, LLC (“Kandi Investment”). In March 2021, Zhejiang Kandi Vehicles Co., Ltd. changed its name to Zhejiang Kandi Technologies Group Co., Ltd. (“Zhejiang Kandi Technologies”).

The Company’s organizational chart as of the date of this report is as follows:

On February 15, 2022,

Kandi Hainan and Jiangsu Xingchi Electric Technology Co., Ltd. (“Jiangsu Xingchi”) signed a joint venture agreement, pursuant

to which the two parties jointly invested RMB

5

NOTE 2 - LIQUIDITY

The Company had working capital of $

Although the Company expects that most of its outstanding trade receivables from customers will be collected in the next twelve months, there are uncertainties with respect to the timing in collecting these receivables.

The Company’s primary need for liquidity

stems from its need to fund working capital requirements of the Company’s businesses, its capital expenditures and its general operations,

including debt repayment. The Company has historically financed its operations through short-term commercial bank loans from Chinese banks,

as well as its ongoing operating activities by using funds from operations, external credit or financing arrangements. Currently

the Company has sufficient cash in hand to meet the existing operational needs, but the credit line is retained and can be utilized

timely when the Company has special capital needs. The PRC subsidiaries do not have any short-term bank loans and the US subsidiaries

have $

NOTE 3 - BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim information, and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X promulgated by the Securities and Exchange Commission (“SEC”). Accordingly, they do not include all of the information and notes required by U.S. GAAP for annual financial statements. In management’s opinion, the interim financial statements reflect all normal adjustments that are necessary to provide a fair presentation of the financial results for the interim periods presented. Operating results for interim periods are not necessarily indicative of results that may be expected for an entire fiscal year. The condensed consolidated balance sheet as of December 31, 2021 has been derived from the audited consolidated financial statements as of such date. For a more complete understanding of the Company’s business, financial position, operating results, cash flows, risk factors and other matters, please refer to its Amendment No.1 to the Annual Report on Form 10-K/A for the fiscal year ended December 31, 2021 (the “2021 Form 10-K/A”).

NOTE 4 - PRINCIPLES OF CONSOLIDATION

The Company’s unaudited condensed consolidated financial statements reflect the accounts of the Company and its ownership interests in the following subsidiaries:

| (1) | Continental Development Limited (“Continental”), a wholly-owned subsidiary of the Company, incorporated under the laws of Hong Kong; |

| (2) | Zhejiang Kandi Technologies, a wholly-owned subsidiary of Continental, incorporated under the laws of the PRC; |

6

| (3) | Kandi New Energy Vehicle Co. Ltd. (“Kandi New Energy”), formerly, a |

| (4) | Kandi Electric Vehicles (Hainan) Co., Ltd. (“Kandi Hainan”), a subsidiary |

| (5) | Zhejiang Kandi Smart Battery Swap Technology Co., Ltd (“Kandi Smart Battery Swap”), a wholly-owned subsidiary of Zhejiang Kandi Technologies, incorporated under the laws of the PRC; |

| (6) | Yongkang Scrou Electric Co, Ltd. (“Yongkang Scrou”), a wholly-owned subsidiary of Kandi Smart Battery Swap, incorporated under the laws of the PRC; |

| (7) | SC Autosports (d/b/a Kandi America), a wholly-owned subsidiary of the Company formed under the laws of the State of Texas. |

| (8) | China Battery Exchange (Zhejiang) Technology Co., Ltd. (“China Battery Exchange”), a wholly-owned subsidiary of Zhejiang Kandi Technologies, and its subsidiaries, incorporated under the laws of the PRC; |

| (9) | Kandi America Investment, LLC (“Kandi Investment”), a wholly-owned subsidiary of SC Autosports formed under the laws of the State of Texas, USA; |

| (10) | Jiangxi Province Huiyi New Energy Co., Ltd. (“Jiangxi Huiyi”) and its subsidiaries, a wholly-owned subsidiary of Zhejiang Kandi Technologies, incorporated under the laws of the PRC; and | |

| (11) | Hainan Kandi Holding New Energy Technology Co., Ltd. (“Hainan

Kandi Holding”), a subsidiary of Kandi Hainan, incorporated under the laws of the PRC; Kandi Hainan owns |

Equity Method Investees

The Company’s consolidated net income also

includes the Company’s proportionate share of the net income or loss of its equity method investment in Fengsheng Automotive Technology

Group Co., Ltd. (“Former Affiliate Company”), in which the Company owned

On February 18, 2021, Zhejiang Kandi Technologies

signed an Equity Transfer Agreement with Geely to transfer all of its remaining

All intra-entity profits and losses with regard to the Company’s equity method investees have been eliminated.

7

NOTE 5 - USE OF ESTIMATES

The preparation of the unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and related disclosures of contingent assets and liabilities at the balance sheet date, and the reported revenues and expenses during the reported period in the unaudited condensed consolidated financial statements and accompanying notes. Significant accounting estimates reflected in the Company’s unaudited condensed consolidated financial statements primarily include, but are not limited to, allowances for doubtful accounts, lower of cost and net realizable value of inventory, assessment for impairment of long-lived assets and intangible assets, valuation of deferred tax assets, change in fair value of contingent consideration, determination of share-based compensation expenses as well as fair value of stock warrants.

Management bases the estimates on historical experience and on various other assumptions that are believed to be reasonable, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Actual results could differ from these estimates.

NOTE 6 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Our significant accounting policies are detailed in “Note 6 - Summary of Significant Accounting Policies” of the Company’s 2021 Form 10-K/A.

NOTE 7 - NEW ACCOUNTING PRONOUNCEMENTS

Accounting Pronouncements Not Yet Adopted

In October 2021, the FASB issued ASU 2021-08, “Business Combinations (Topic 805) – Accounting for Contract Assets and Contract Liabilities from Contracts with Customers”, which requires that an acquirer recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with Topic 606, as if it had originated the contracts. Prior to this ASU, an acquirer generally recognizes contract assets acquired and contract liabilities assumed that arose from contracts with customers at fair value on the acquisition date. The ASU is effective for fiscal years beginning after December 15, 2022, with early adoption permitted. The ASU is to be applied prospectively to business combinations occurring on or after the effective date of the amendment (or if adopted early as of an interim period, as of the beginning of the fiscal year that includes the interim period of early application). The Company is currently assessing this standard’s impact on its consolidated financial statements.

NOTE 8 - CONCENTRATIONS

(a) Customers

For the three-month period ended June 30, 2022

and 2021, the Company’s major customers, each of whom accounted for more than

| Sales | Trade Receivable | |||||||||||

| Three Months | ||||||||||||

| Ended | ||||||||||||

| June 30, | June 30, | December 31, | ||||||||||

| Major Customers | 2022 | 2022 | 2021 | |||||||||

| Customer A | % | % | ||||||||||

8

| Sales | Trade Receivable | |||||||||||

| Three Months | ||||||||||||

| Ended | ||||||||||||

| June 30, | June 30, | December 31, | ||||||||||

| Major Customers | 2021 | 2021 | 2020 | |||||||||

| Customer B | % | % | % | |||||||||

| Customer C | % | % | % | |||||||||

| Customer D | % | % | % | |||||||||

| Customer E | % | % | - | |||||||||

For the six-month period ended June 30, 2022,

there were no customers that accounted for more than

| Sales | Trade Receivable | |||||||||||

| Six Months | ||||||||||||

| Ended | ||||||||||||

| June 30, | June 30, | December 31, | ||||||||||

| Major Customers | 2021 | 2021 | 2020 | |||||||||

| Customer B | % | % | % | |||||||||

| Customer C | % | % | % | |||||||||

(b) Suppliers

For the three-month period ended June 30, 2022,

there were no suppliers that accounted for more than

| Purchases | Accounts Payable | |||||||||||

| Three Months | ||||||||||||

| Ended | ||||||||||||

| June 30, | June 30, | December 31, | ||||||||||

| Major Suppliers | 2021 | 2021 | 2020 | |||||||||

| Zhejiang Kandi Supply Chain Management Co., Ltd. | % | % | % | |||||||||

9

For the six-month period ended June 30, 2022 and

2021, the Company’s material suppliers, each of whom accounted for more than

| Purchases | Accounts Payable | |||||||||||

| Six Months | ||||||||||||

| Ended | ||||||||||||

| June 30, | June 30, | December 31, | ||||||||||

| Major Suppliers | 2022 | 2022 | 2021 | |||||||||

| ODES USA, Inc. | % | % | ||||||||||

| Purchases | Accounts Payable | |||||||||||

| Six Months | ||||||||||||

| Ended | ||||||||||||

| June 30, | June 30, | December 31, | ||||||||||

| Major Suppliers | 2021 | 2021 | 2020 | |||||||||

| Zhejiang Kandi Supply Chain Management Co., Ltd. | % | % | % | |||||||||

| Massimo Motor Sports, LLC | % | % | % | |||||||||

NOTE 9 - EARNINGS PER SHARE

The Company calculates earnings (loss) per share

in accordance with ASC 260, Earnings Per Share, which requires a dual presentation of basic and diluted earnings (loss) per share. Basic

earnings (loss) per share is computed using the weighted average number of shares outstanding during the reporting period. Diluted earnings

(loss) per share represents basic earnings (loss) per share adjusted to include the potentially dilutive effect of outstanding stock options

and warrants (using treasury stock method). Due to the average market price of the common stock during the period being below the exercise

price of the options, approximately

NOTE 10 - ACCOUNTS RECEIVABLE

Accounts receivable are summarized as follows:

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Accounts receivable | $ | $ | ||||||

| Less: allowance for doubtful accounts | ( | ) | ( | ) | ||||

| Accounts receivable, net | $ | $ | ||||||

10

The following table sets forth the movement of provision for doubtful accounts:

| Allowance for Doubtful Accounts | ||||

| BALANCE AT DECEMBER 31, 2020 | $ | |||

| Provision | ||||

| Addition of allowance resulted from acquisition of Jiangxi Huiyi | ||||

| Exchange rate difference | ||||

| BALANCE AT DECEMBER 31, 2021 | $ | |||

| Provision | ||||

| Exchange rate difference | ( | ) | ||

| BALANCE AT JUNE 30, 2022 | $ | |||

In May 2022, Zhejiang Kandi Technologies, Yongkang

Scrou, and Kandi New Energy jointly filed a lawsuit against Former Affiliate Company and its affiliates and related parties, for the collection

of the overdue accounts receivable in the amount of approximately $

NOTE 11 - INVENTORIES

Inventories are summarized as follows:

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Raw material | $ | $ | ||||||

| Work-in-progress | ||||||||

| Finished goods * | ||||||||

| Inventories | $ | $ | ||||||

| * |

NOTE 12 - PROPERTY, PLANT AND EQUIPMENT, NET

Property, plants and equipment as of June 30, 2022 and December 31, 2021, consisted of the following:

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| At cost: | ||||||||

| Buildings | $ | $ | ||||||

| Machinery and equipment | ||||||||

| Office equipment | ||||||||

| Motor vehicles and other transport equipment | ||||||||

| Molds and others | ||||||||

| Less : Accumulated depreciation | ( | ) | ( | ) | ||||

| Property, plant and equipment, net | $ | $ | ||||||

11

The Company’s Jinhua factory completed the

relocation to a new industrial park in April 2021. The new location covers an area of more than

Depreciation expenses for the three months ended

June 30, 2022 and 2021 were $

NOTE 13 - INTANGIBLE ASSETS

Intangible assets include acquired other intangibles of patent and technology recorded at estimated fair values in accordance with purchase accounting guidelines for acquisitions.

The following table provides the gross carrying value and accumulated amortization for each major class of our intangible assets, other than goodwill:

| Remaining useful life | June 30, 2022 | December 31, 2021 | ||||||||

| Gross carrying amount: | ||||||||||

| Trade name | $ | $ | ||||||||

| Customer relations | ||||||||||

| Patent | $ | |||||||||

| Technology | ||||||||||

| Less : Accumulated amortization | ||||||||||

| Trade name | $ | ( | ) | $ | ( | ) | ||||

| Customer relations | ( | ) | ( | ) | ||||||

| Patent | $ | ( | ) | ( | ) | |||||

| Technology | ( | ) | ( | ) | ||||||

| ( | ) | ( | ) | |||||||

| Intangible assets, net | $ | $ | ||||||||

The aggregate amortization expenses for those

intangible assets were $

12

Amortization expenses for the next five years and thereafter are as follows:

| Six months ended December 31, 2022 | $ | |||

| Years ended December 31, | ||||

| 2023 | ||||

| 2024 | ||||

| 2025 | ||||

| 2026 | ||||

| Thereafter | ||||

| Total | $ |

NOTE 14 - LAND USE RIGHTS, NET

The Company’s land use rights consist of the following:

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Cost of land use rights | $ | $ | ||||||

| Less: Accumulated amortization | ( | ) | ( | ) | ||||

| Land use rights, net | $ | $ | ||||||

The amortization expenses for the three months

ended June 30, 2022 and 2021, were $

| Six months ended December 31, 2022 | $ | |||

| Years ended December 31, | ||||

| 2023 | ||||

| 2024 | ||||

| 2025 | ||||

| 2026 | ||||

| Thereafter | ||||

| Total | $ |

13

NOTE 15 - OTHER LONG TERM ASSETS

Other long term assets as of June 30, 2022 and December 31, 2021, consisted of the following:

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Prepayments for land use right (i) | $ | |||||||

| Right - of - use asset (ii) | ||||||||

| Others | ||||||||

| Total other long-term asset | $ | $ | ||||||

| (i) |

| (ii) |

14

NOTE 16 - TAXES

(a) Corporation Income Tax

Pursuant to the tax laws and regulations of the

PRC, the Company’s applicable corporate income tax (“CIT”) rate is

The Company’s provision or benefit from

income taxes for interim periods is determined using an estimate of the Company’s annual effective tax rate, adjusted for discrete

items, if any, that are taken into account in the relevant period. Each quarter the Company updates its estimate of the annual effective

tax rate, and if its estimated tax rate changes, management makes a cumulative adjustment. For 2022, the Company’s effective tax

rate is favorably affected by a super-deduction for qualified research and development costs and adversely affected by non-deductible

expenses such as stock rewards for non-US employees, and part of entertainment expenses. The Company records valuation allowances against

the deferred tax assets associated with losses and other timing differences for which we may not realize a related tax benefit.

The quarterly tax provision, and the quarterly

estimate of the Company’s annual effective tax rate, is subject to significant variation due to several factors, including variability

in accurately predicting the Company’s pre-tax and taxable income and loss, acquisitions (including integrations) and investments,

changes in its stock price, changes in its deferred tax assets and liabilities and their valuation, return to provision true-up, foreign

currency gains (losses), changes in regulations and interpretations related to tax, accounting, and other areas. Additionally, the Company’s

effective tax rate can be volatile based on the amount of pre-tax income or loss. The income tax provision for the six months ended June

30, 2022 and 2021 was tax benefit of $

Under ASC 740 guidance relating to uncertain tax positions, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. As of June 30, 2022, the Company did not have any liability for unrecognized tax benefits. The Company files income tax returns with the U.S. Internal Revenue Services (“IRS”) and those states where the Company has operations. The Company is subject to U.S. federal or state income tax examinations by the IRS and relevant state tax authorities. During the periods open to examination, the Company has net operating loss carry forwards (“NOLs”) for U.S. federal and state tax purposes that have attributes from closed periods. Since these NOLs may be utilized in future periods, they remain subject to examination. The Company also files certain tax returns in the PRC. As of June 30, 2022, the Company was not aware of any pending income tax examinations by U.S. or PRC tax authorities. The Company records interest and penalties on uncertain tax provisions as income tax expense. As of June 30, 2022, 2022, the Company has no accrued interest or penalties related to uncertain tax positions.

The tax effected aggregate Net Operating Loss

(“NOL”) was $

15

(b) Tax Holiday Effect

For the

The combined effects of income tax expense exemptions and reductions available to the Company for the six months ended June 30, 2021 and 2021 are as follows:

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2022 | 2021 | |||||||

| Tax benefit (holiday) credit | $ | $ | ||||||

| Basic net income per share effect | $ | $ | ||||||

NOTE 17 - LEASES AND RIGHT-OF-USE-ASSETS

The Company previously renewed its corporate office

leases for SC Autosports, with a term of

During October 2020, land use right of gross value

of $

The Company has entered into a lease for Hangzhou office, with a term of 48 months from January 1, 2022 to December 31, 2025. The Company recorded operating lease assets and operating lease liabilities on January 1, 2022, with a remaining lease term of 48 months and discount rate of 3.70%. The annual lease payment for 2022 was prepaid as of January 1, 2022. The Company has prepaid the first year of lease amount of $262,449.

As of June 30, 2022, the Company’s operating

lease right-of-use assets (grouped in other long-term assets on the balance sheet) was $

Supplemental information related to operating leases was as follows:

| Six months ended | ||||||||

| June 30, | ||||||||

| 2022 | 2021 | |||||||

| Cash payments for operating leases | $ | $ | ||||||

Maturities of lease liabilities as of June 30, 2022 were as follow:

| Maturity of Lease Liabilities: | Lease payable | |||

| Years ended December 31, | $ | |||

| 2023 | ||||

| 2024 | ||||

| 2025 | ||||

16

NOTE 18 - CONTINGENT CONSIDERATION LIABILITY

On January 3, 2018,

As the outbreak of COVID-19 in 2020 affected Kandi Smart Battery Swap’s operation and business, on July 7, 2020, the Company and the KSBS Shareholders made the following supplements to Condition III of the original Supplementary Agreement: The KSBS Shareholders have the right to receive an aggregate of 20.83% of the total equity consideration (i.e., 5,919,674 total shares), provided that Kandi Smart Battery Swap realizes a net profit of RMB50 million (approximately $8 million) or more for the period from January 1, 2020 to June 30, 2021 (as opposed to be the originally stated “December 31, 2020”), and such profit is audited or reviewed and Kandi Smart Battery Swap gets annual or quarterly financial report issued under US GAAP. For the period from January 1, 2020 to June 30, 2021, Kandi Smart Battery Swap achieved its net profit target. Accordingly, the KSBS Shareholders received 1,233,068 shares of Kandi’s restrictive common stock or 20.83% of the total equity consideration (i.e., 5,919,674 total shares) as part of the purchase price. All the escrowed shares have been included in the Company’s registration statement on Form S-3 declared effective by the SEC on April 5, 2019.

On October 31, 2021, the Company completed

the acquisition of

17

The Company recorded contingent consideration liability of the estimated fair value of the contingent consideration the Company currently expects to pay to the KSBS Shareholders and Jiangxi Huiyi’s former members upon the achievement of certain milestones. The fair value of the contingent consideration liability associated with remaining shares of restrictive common stock was estimated by using the Monte Carlo simulation method, which took into account all possible scenarios. This fair value measurement is classified as Level 3 within the fair value hierarchy prescribed by ASC Topic 820, Fair Value Measurement and Disclosures. In accordance with ASC Topic 805, Business Combinations, the Company will re-measure this liability each reporting period and record changes in the fair value through a separate line item within the Company’s consolidated statements of income.

As of June 30, 2022 and December 31, 2021,

the Company’s contingent consideration liability to former members of Jiangxi Huiyi was $

NOTE 19 - STOCK AWARD

In connection with the appointment of Mr. Henry

Yu as a member of the Board of Directors (the “Board”), the Board authorized the Company to compensate Mr. Henry Yu with

As compensation for Mr. Jerry Lewin’s services

as a member of the Board, the Board authorized the Company to compensate Mr. Jerry Lewin with

As compensation for Ms. Kewa Luo’s services

as the Company’s investor relation officer, the Board authorized the Company to compensate Ms. Kewa Luo with

On May 15, 2020, the Board appointed Mr. Jehn

Ming Lim as the Chief Financial Officer. Mr. Lim was entitled to receive

The fair value of stock awards with service condition is determined based on the closing price of the common stock on the date the shares are granted. The compensation costs for awards of common stock are recognized over the requisite service period.

On December 30, 2013, the Board approved a proposal

(as submitted by the Compensation Committee) of an award (the “Board’s Pre-Approved Award Grant Sub-Plan under the 2008 Plan”)

for certain executives and other key employees. The fair value of each award granted under the 2008 Plan is determined based on the closing

price of the Company’s stock on the date of grant of such award. On September 26, 2016, the Board approved to terminate the previous

Board’s Pre-Approved Award Grant Sub-Plan under the 2008 Plan and adopted a new plan to grant the total number of shares of common

stock of the stock award for selected executives and key employees

For the three months ended June 30, 2022 and 2021,

the Company recognized $

18

NOTE 20 - SUMMARIZED INFORMATION OF EQUITY METHOD INVESTMENT IN THE FORMER AFFILIATE COMPANY

The Company’s consolidated net income (loss) includes the Company’s proportionate share of the net income or loss of the Company’s equity method investees. When the Company records its proportionate share of net income in such investees, it increases equity income (loss) – net in the Company’s consolidated statements of income (loss) and the Company’s carrying value in that investment. Conversely, when the Company records its proportionate share of net loss in such investees, it decreases equity income (loss) – net in the Company’s consolidated statements of income (loss) and the Company’s carrying value in that investment. All intra-entity profits and losses with the Company’s equity method investees have been eliminated.

On February 18, 2021, Zhejiang Kandi Technologies

signed an Equity Transfer Agreement with Geely to transfer all of its remaining

The Company accounted for its investments in the

Former Affiliate Company under the equity method of accounting. As the equity transfer was completed on March 9, 2021, the Company recorded

The Company’s equity method investments in the Former Affiliate Company for the six months ended June 30, 2022 and 2021 are as follows:

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2022 | 2021 | |||||||

| Investment in the Former Affiliate Company, beginning of the period, | $ | $ | ||||||

| Investment decreased in 2021 | ( | ) | ||||||

| Gain from equity sale | ||||||||

| Reversal of prior year reduction in the equity of the Former Affiliate Company | ||||||||

| Share of loss: | ||||||||

| Company’s share in net loss of Former Affiliate based on | ( | ) | ||||||

| Non-controlling interest | ||||||||

| Subtotal | ( | ) | ||||||

| Exchange difference | ||||||||

| Investment in Former Affiliate Company, end of the period | $ | $ | ||||||

NOTE 21 - COMMITMENTS AND CONTINGENCIES

Guarantees and pledged collateral for bank loans to other parties

(1) Guarantees for bank loans

On March 15, 2013,

(2) Pledged collateral for bank loans for which the parties other than the Company are the borrowers.

As of June 30, 2022 and December 31, 2021, none of the Company’s land use rights or plants and equipment were pledged as collateral securing bank loans for which the parties other than the Company are the borrowers.

19

Litigation

Beginning in March 2017, putative shareholder class actions were filed against Kandi Technologies and certain of its current and former directors and officers in the United States District Court for the Central District of California and the United States District Court for the Southern District of New York. The complaints generally alleged violations of the federal securities laws based on Kandi’s disclosure in March 2017 that its financial statements for the years 2014, 2015 and the first three quarters of 2016 would need to be restated, and sought damages on behalf of putative classes of shareholders who purchased or acquired Kandi Technologies’ securities prior to March 13, 2017. Kandi Technologies moved to dismiss the remaining cases, all of which were pending in the New York federal court, that motion was granted in September 2019, and the time to appeal has run. In June 2020, a similar but separate putative securities class action was filed against Kandi Technologies and certain of its current and former directors and officers in California federal court. This action was transferred to the New York federal court in September 2020, Kandi Technologies moved to dismiss in March 2021, and that motion was granted in October 2021. The plaintiff in this case subsequently filed an amended complaint, Kandi Technologies moved to dismiss that complaint in January 2022, and the motion remains pending.

Beginning in May 2017, purported shareholder derivative actions based on the same underlying events described above were filed against certain current and former directors of Kandi Technologies in the United States District Court for the Southern District of New York. The New York federal court confirmed the voluntary dismissal of these actions in April 2019.

In October 2017, a shareholder filed a books and records action against the Company in the Delaware Court of Chancery pursuant to 8 Del. C. Section 220 seeking the production of certain documents generally relating to the same underlying items described above as well as attorney’s fees (the “Section 220 Litigation”). On September 28, 2018, the parties, through their respective counsel, agreed to dismiss the Section 220 Litigation with prejudice and with each party bearing its own attorney’s fees, costs, and expenses, thereby concluding the action. In February 2019, this same shareholder commenced a derivative action against certain current and former directors of Kandi Technologies in the Delaware Court of Chancery. A motion to dismiss this derivative action was filed in May 2019 and that motion was denied on April 27, 2020. Discovery is ongoing.

Separately, in connection with allegations of misconduct identified in pre-suit demands made by putative shareholders of Kandi Technologies, Kandi Technologies formed a Special Litigation Committee (“SLC”) and retained a Delaware law firm as independent counsel to the SLC to aid in the SLC’s investigation of, and to ultimately report on, the allegations of misconduct set forth in the pre-suit demands. The SLC recommended to Kandi Technologies’ board of directors in June 2020 that the SLC be dissolved in light of the ongoing derivative action pending in the Delaware Court of Chancery, and this recommendation was adopted by the board in August 2020.

In December 2020, a putative securities class action was filed against Kandi Technologies and certain of its current officers in the United States District Court for the Eastern District of New York. The complaint generally alleges violations of the federal securities laws based on claims made in a report issued by Hindenburg Research in November 2020, and seeks damages on behalf of a putative class of shareholders who purchased or acquired Kandi Technologies’ securities prior to March 15, 2019. Kandi moved to dismiss this action in January 2022, and that motion remains pending.

While the Company believes that the claims in these litigations are without merit and will defend itself vigorously, the Company is unable to estimate the possible loss, if any, associated with these litigations. The ultimate outcome of any litigation is uncertain and the outcome of these matters, whether favorable or unfavorable, could have a negative impact on the Company’s financial condition or results of operations due to defense costs, diversion of management resources and other factors. Defending litigation can be costly, and adverse results in the litigations could result in substantial monetary judgments. No assurance can be made that litigation will not have a material adverse effect on the Company’s future financial position.

20

NOTE 22 - SEGMENT REPORTING

The Company has

The following table sets forth disaggregation of revenue:

| Three Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

| Sales Revenue | Sales Revenue | |||||||

| Primary geographical markets | ||||||||

| Overseas | $ | $ | ||||||

| China | ||||||||

| Total | $ | $ | ||||||

| Major products | ||||||||

| EV parts | $ | $ | ||||||

| EV products | ||||||||

| Off-road vehicles | ||||||||

| Electric Scooters, Electric Self-Balancing Scooters and associated parts | ||||||||

| Battery exchange equipment and Battery exchange service | ||||||||

| Lithium-ion cells | ||||||||

| Total | $ | $ | ||||||

| Timing of revenue recognition | ||||||||

| Products transferred at a point in time | $ | $ | ||||||

| Total | $ | $ | ||||||

| Six Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

| Sales Revenue | Sales Revenue | |||||||

| Primary geographical markets | ||||||||

| Overseas | $ | $ | ||||||

| China | ||||||||

| Total | $ | $ | ||||||

| Major products | ||||||||

| EV parts | $ | $ | ||||||

| EV products | ||||||||

| Off-road vehicles | ||||||||

| Electric Scooters, Electric Self-Balancing Scooters and associated parts | ||||||||

| Battery exchange equipment and Battery exchange service | ||||||||

| Lithium-ion cells | ||||||||

| Total | $ | $ | ||||||

| Timing of revenue recognition | ||||||||

| Products transferred at a point in time | $ | $ | ||||||

| Total | $ | $ | ||||||

21

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This report contains forward-looking statements within the meaning of the federal securities laws that relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminologies, such as “may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “intend,” “potential” or “continue” or the negative of such terms or other comparable terminologies, although not all forward-looking statements contain such terms.

In addition, these forward-looking statements include, but are not limited to, statements regarding implementing our business strategy; development and marketing of our products; our estimates of future revenue and profitability; our expectations regarding future expenses, including research and development, sales and marketing, manufacturing and general and administrative expenses; difficulty or inability to raise additional financing, if needed, on terms acceptable to us; our estimates regarding our capital requirements and our needs for additional financing; attracting and retaining customers and employees; sources of revenue and anticipated revenue; and competition in our market.

Forward-looking statements are only predictions. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. All of our forward-looking information is subject to risks and uncertainties that could cause actual results to differ materially from the results expected. Although it is not possible to identify all factors, these risks and uncertainties include the risk factors and the timing of any of those risk factors described in the 2021 Form 10-K/A and those set forth from time to time in our other filings with the SEC. These documents are available on the SEC’s Electronic Data Gathering and Analysis Retrieval System at http://www.sec.gov.

Critical Accounting Policies and Estimates

The preparation of the unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities, as of the date of the financial statements, and the reported amounts of revenue and expenses during the reported period. If these estimates differ significantly from actual results, the impact to the condensed consolidated financial statements may be material. There have been no material changes in our critical accounting policies and estimates from those disclosed in on the 2021 Form 10-K/A. Please refer to Part II, Item 7 of such a report for a discussion of our critical accounting policies and estimates.

Overview

For the six months ended June 30, 2022, we recognized total revenue of $45,732,587 as compared to $45,853,589 for the same period of 2021, a decrease of $121,002 or 0.3%. For the six months ended June 30, 2022, we recorded $5,106,030 of gross profit, a decrease of 51.1% from the same period of 2021. Gross margin for the six months ended June 30, 2022 was 11.2%, compared to 22.8% for the same period of 2021. We recorded a net loss of $3,494,665 for the six months ended June 30, 2022, compared to a net income of $34,526,754 in the same period of 2021, a decrease of $38,021,419 or 110.1% from the same period of 2021.

Thanks to our business strategy adjustment, our business has made some progress, despite the resurgences of COVID-19, which has been causing frequent lockdowns in many cities and severe disruption of supply chain. Especially in the field of the pure electric off-road vehicles, we have achieved steady growth. In the first half of this year, we developed a number of pure electric off-road vehicles, including UTV, ATV, crossover golf carts and crossover go-karts. The number of crossover golf carts delivered from factory has increased from dozens in March 2022 to more than 2,000 per month. In the second half of the year, we will continue launching new models one after another, as we are optimistic with the potential of pure electric off-road vehicles’ market to be over $ 2.2 billion by 2028, with a healthy CAGR of 19% from this year. Our various newly launched off-road vehicles, such as golf karts and ATVs are getting recognized in the market. In this regard, we are confident to achieve sustained growth in the field of the pure electric off-road vehicles. As for our EV business, due to the persisting COVID-19 situation in China and the fact that the Chinese EV market has not entered a healthy and orderly development stage, currently the Company will continue to operate in small-scale, and expedite the progress when the EV market of China entered a healthy and orderly development stage.

22

Results of Operations

Comparison of the Three Months Ended June 30, 2022 and 2021

The following table sets forth the amounts and percentage to revenue of certain items in our condensed consolidated statements of operations and comprehensive income (loss) for the three months ended June 30, 2022 and 2021.

| Three Months Ended | ||||||||||||||||||||||||

| June 30, 2022 | % of Revenue | June 30, 2021 | % of Revenue | Change in Amount | Change in % | |||||||||||||||||||

| REVENUES FROM UNRELATED PARTIES, NET | $ | 20,841,183 | 100.0 | % | $ | 29,875,835 | 100.0 | % | (9,034,652 | ) | (30.2 | %) | ||||||||||||

| REVENUES FROM THE FORMER AFFILIATE COMPANY AND RELATED PARTIES, NET | - | 0.0 | % | - | 0.0 | % | - | - | ||||||||||||||||

| REVENUES, NET | 20,841,183 | 29,875,835 | (9,034,652 | ) | (30.2 | %) | ||||||||||||||||||

| COST OF GOODS SOLD | (18,122,316 | ) | (87.0 | %) | (23,778,053 | ) | (79.6 | %) | 5,655,737 | (23.8 | %) | |||||||||||||

| GROSS PROFIT | 2,718,867 | 13.0 | % | 6,097,782 | 20.4 | % | (3,378,915 | ) | (55.4 | %) | ||||||||||||||

| OPERATING INCOME (EXPENSE): | ||||||||||||||||||||||||

| Research and development | (1,253,843 | ) | (6.0 | %) | (3,564,905 | ) | (11.9 | %) | 2,311,062 | (64.8 | %) | |||||||||||||

| Selling and marketing | (1,172,528 | ) | (5.6 | %) | (1,057,517 | ) | (3.5 | %) | (115,011 | ) | 10.9 | % | ||||||||||||

| General and administrative | (6,574,079 | ) | (31.5 | %) | (5,359,572 | ) | (17.9 | %) | (1,214,507 | ) | 22.7 | % | ||||||||||||

| Gain on disposal of long-lived assets | - | 0.0 | % | 48,253,667 | 161.5 | % | (48,253,667 | ) | (100.0 | %) | ||||||||||||||

| TOTAL OPERATING (EXPENSE) INCOME | (9,000,450 | ) | (43.2 | %) | 38,271,673 | 128.1 | % | (47,272,123 | ) | (123.5 | %) | |||||||||||||

| (LOSS) INCOME FROM OPERATIONS | (6,281,583 | ) | (30.1 | %) | 44,369,455 | 148.5 | % | (50,651,038 | ) | (114.2 | %) | |||||||||||||

| OTHER INCOME (EXPENSE): | ||||||||||||||||||||||||

| Interest income | 1,378,774 | 6.6 | % | 974,105 | 3.3 | % | 404,669 | 41.5 | % | |||||||||||||||

| Interest expense | (138,433 | ) | (0.7 | %) | (78,069 | ) | (0.3 | %) | (60,364 | ) | 77.3 | % | ||||||||||||

| Change in fair value of contingent consideration | (391,000 | ) | (1.9 | %) | (357,000 | ) | (1.2 | %) | (34,000 | ) | 9.5 | % | ||||||||||||

| Government grants | 463,219 | 2.2 | % | 114,402 | 0.4 | % | 348,817 | 304.9 | % | |||||||||||||||

| Gain from sale of equity in the Former Affiliate Company | - | 0.0 | % | 33,651 | 0.1 | % | (33,651 | ) | (100.0 | %) | ||||||||||||||

| Share of loss after tax of the Former Affiliate Company | - | 0.0 | % | (4,904 | ) | (0.0 | %) | 4,904 | (100.0 | %) | ||||||||||||||

| Other income, net | 2,373,528 | 11.4 | % | 3,827,089 | 12.8 | % | (1,453,561 | ) | (38.0 | %) | ||||||||||||||

| TOTAL OTHER INCOME, NET | 3,686,088 | 17.7 | % | 4,509,274 | 15.1 | % | (823,186 | ) | (18.3 | %) | ||||||||||||||

| (LOSS) INCOME BEFORE INCOME TAXES | (2,595,495 | ) | (12.5 | %) | 48,878,729 | 163.6 | % | (51,474,224 | ) | (105.3 | %) | |||||||||||||

| INCOME TAX BENEFIT (EXPENSE) | 719,843 | 3.5 | % | (7,949,255 | ) | (26.6 | %) | 8,669,098 | (109.1 | %) | ||||||||||||||

| NET (LOSS) INCOME | (1,875,652 | ) | (9.0 | %) | 40,929,474 | 137.0 | % | (42,805,126 | ) | (104.6 | %) | |||||||||||||

| LESS: NET INCOME (LOSS) ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | 61,619 | 0.3 | % | - | 0.0 | % | 61,619 | - | ||||||||||||||||

| NET (LOSS) INCOME ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS | (1,937,271 | ) | (9.3 | %) | 40,929,474 | 137.0 | % | (42,866,745 | ) | (104.7 | %) | |||||||||||||

23

(a) Revenue

For the three months ended June 30, 2022, Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ revenue was $20,841,183 compared to $29,875,835 for the same period of 2021, representing a decrease of $9,034,652 or 30.2%. The decrease in revenue was mainly due to the decrease in the sales volume of Electric Scooters, Electric Self-Balancing Scooters and associated parts and EV parts.

The following table summarizes Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ revenues by product types for the three months ended June 30, 2022 and 2021:

| Three Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

| Sales | Sales | |||||||

| EV parts | $ | 588,775 | $ | 6,680,515 | ||||

| EV products | 2,486,558 | 610,812 | ||||||

| Off-road vehicles | 10,092,141 | 5,473,195 | ||||||

| Electric Scooters, Electric Self-Balancing Scooters and associated parts | 1,217,074 | 16,526,436 | ||||||

| Battery exchange equipment and Battery exchange service | 83,153 | 584,877 | ||||||

| Lithium-ion cells | 6,373,482 | - | ||||||

| Total | $ | 20,841,183 | $ | 29,875,835 | ||||

EV Parts

During the three months ended June 30, 2022, Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ revenues from the sales of EV parts were $588,775, representing a decrease of $6,091,740 or 91.2% from $6,680,515 for the same quarter of 2021. The decrease was primarily due to the reduced demand from the market during the three months ended June 30, 2022.

Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ revenue for the three months ended June 30, 2022 primarily consisted of revenue from the sales of battery packs, body parts, EV controllers, air conditioning units and other auto parts for use in the manufacturing of EV products. These sales accounted for 2.8% of total sales.

EV Products

During the three months ended June 30, 2022, Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ revenue from the sale of EV Products was $2,486,558, representing an increase of $1,875,746 or 307.1% from $610,812 for the same quarter of 2021. The increase was mainly due to the sales of EV K23 to car hailing platform in China market during the three months ended June 30, 2022.

Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ EV Products business line accounted for approximately 11.9% of the total net revenue for the three months ended June 30, 2022.

Off-Road Vehicles

During the three months ended June 30, 2022, Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ revenue from the sales of off-road vehicles, including go karts, all-terrain vehicles (“ATVs”) and others, were $10,092,141, representing an increase of $4,618,946 or 84.4% from $5,473,195, for the same quarter of 2021. The increase was because a new brand of off-road vehicle was introduced to the US market with aggressive price in order to promote its sales during the current period, as well as our new model of crossover golf carts which were sold in US market in the second quarter of this year.

Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ off-road vehicles business line accounted for approximately 48.4% of the total net revenue for the three months ended June 30, 2022.

Electric Scooters, Electric Self-Balancing Scooters and associated parts

During the three months ended June 30, 2022, Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ revenue from the sales of electric scooters, electric self-balancing scooters and associated parts, were $1,217,074, representing a decrease of $15,309,362 or 92.6% from $16,526,436, for the same quarter of 2021. During the prior period in 2021, we sold electric scooters manufactured by ourselves. However, during the current period, we only manufactured motors and certain parts as one of our business partners began producing these electric scooters and scooter related products on their own.

Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ electric scooters, electric self-balancing scooters and associated parts business line accounted for approximately 5.8% of the total net revenue for the three months ended June 30, 2022.

Lithium-ion cells

During the three months ended June 30, 2022, Zhejiang Kandi Technologies and its subsidiaries’ revenue from the sale of Lithium-ion cells was $6,373,482, there was no such sales for the same period of 2021 since the related entity Jiangxi Huiyi was acquired by the Company in October 2021.

Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ Lithium-ion cell business line accounted for approximately 30.6% of the total net revenue for the three months ended June 30, 2022.

24

The following table shows the breakdown of Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ net revenues:

| Three Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

| Sales Revenue | Sales Revenue | |||||||

| Primary geographical markets | ||||||||

| Overseas | $ | 10,446,475 | $ | 6,180,582 | ||||

| China | 10,394,708 | 23,695,253 | ||||||

| Total | $ | 20,841,183 | $ | 29,875,835 | ||||

| Major products | ||||||||

| EV parts | $ | 588,775 | $ | 6,680,515 | ||||

| EV products | 2,486,558 | 610,812 | ||||||

| Off-road vehicles | 10,092,141 | 5,473,195 | ||||||

| Electric Scooters, Electric Self-Balancing Scooters and associated parts | 1,217,074 | 16,526,436 | ||||||

| Battery exchange equipment and Battery exchange service | 83,153 | 584,877 | ||||||

| Lithium-ion cells | 6,373,482 | - | ||||||

| Total | $ | 20,841,183 | $ | 29,875,835 | ||||

| Timing of revenue recognition | ||||||||

| Products transferred at a point in time | $ | 20,841,183 | $ | 29,875,835 | ||||

| Total | $ | 20,841,183 | $ | 29,875,835 | ||||

(b) Cost of goods sold

Cost of goods sold was $18,122,316 during the three months ended June 30, 2022, representing a decrease of $5,655,737, or 23.8%, compared to $23,778,053 for the same period of 2021. The decrease was primarily due to the corresponding decrease in sales. Please refer to the Gross Profit section below for product margin analysis.

(c) Gross profit

Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ margins by product for the three months ended June 30, 2022 and 2021 are as set forth below:

| Three Months Ended June 30, | ||||||||||||||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||||||||

| Sales | Cost | Gross Profit | Margin % | Sales | Cost | Gross Profit | Margin % | |||||||||||||||||||||||||

| EV parts | $ | 588,775 | 492,049 | 96,726 | 16.4 | % | $ | 6,680,515 | 5,608,759 | 1,071,756 | 16.0 | % | ||||||||||||||||||||

| EV products | 2,486,558 | 2,337,473 | 149,085 | 6.0 | % | 610,812 | 542,121 | 68,691 | 11.2 | % | ||||||||||||||||||||||

| Off-road vehicles | 10,092,141 | 8,210,368 | 1,881,773 | 18.6 | % | 5,473,195 | 4,098,401 | 1,374,794 | 25.1 | % | ||||||||||||||||||||||

| Electric Scooters, Electric Self-Balancing Scooters and associated parts | 1,217,074 | 1,139,335 | 77,739 | 6.4 | % | 16,526,436 | 12,999,612 | 3,526,824 | 21.3 | % | ||||||||||||||||||||||

| Battery exchange equipment and Battery exchange service | 83,153 | 101,775 | (18,622 | ) | -22.4 | % | 584,877 | 529,160 | 55,717 | 9.5 | % | |||||||||||||||||||||

| Lithium-ion cells | 6,373,482 | 5,841,316 | 532,166 | 8.3 | % | - | - | - | - | |||||||||||||||||||||||

| Total | $ | 20,841,183 | 18,122,316 | 2,718,867 | 13.0 | % | $ | 29,875,835 | 23,778,053 | 6,097,782 | 20.4 | % | ||||||||||||||||||||

25

Gross profit for the second quarter of 2022 decreased 55.4% to $2,718,867, compared to $6,097,782 for the same period last year. This was primarily attributable to the product mixing with higher concentration of products with lower gross margin being sold during the current period. Our gross margin decreased to 13.0% compared to 20.4% for the same period of 2021. The decrease in our gross margin was mainly due to the higher concentration of sales from the products with lower gross margin such as lithium-ion cells which was not sold in second quarter of 2021, and less concentration of the sales of products with higher gross margin such as Electric Scooters, Electric Self-Balancing Scooters as well as EV parts. Besides, we have brought in a new brand of off-road vehicle to the US market, and we have sold at a more aggressive price in order to promote its sales.

(d) Research and development

Research and development expenses, including materials, labor, equipment depreciation, design, testing, inspection, and other related expenses, totaled $1,253,843 for the second quarter of 2022, a decrease of $2,311,062 or 64.8% compared to $3,564,905 for the same period in 2021. The decrease was mainly due to the completion of Company’s R&D expenditure in the same period of 2021 for new product.

(e) Sales and marketing

Selling and distribution expenses were $1,172,528 for the second quarter of 2022, compared to $1,057,517 for the same period in 2021, representing an increase of $115,011 or 10.9%. The increase was mainly due to the increased customs clearing charges.

(f) General and administrative expenses

General and administrative expenses were $6,574,079 for the second quarter of 2022, compared to $5,359,572 for the same period in 2021, representing an increase of $1,214,507 or 22.7%. For the three months ended June 30, 2022, general and administrative expenses included $616,765 as expenses for common stock awards and stock options to employees and Board members, compared to $1,406,531 of common stock awards and stock options expenses for the same period in 2021. Besides stock compensation expense, our net general and administrative expenses for the three months ended June 30, 2022 were $5,957,314, representing an increase of $2,004,273, from $3,953,041 for the same period in 2021, which was largely due to increase in depreciation expense and amortization expense compared to the same period in 2021.

(g) Gain on disposal of long-live assets

Gain on disposal of long-live assets was $0 for the second quarter of 2022, compared to $48,253,667 for the same period last year, which was related to the real estate repurchase agreement of our Jinhua Facility’s relocation. In June 2020, 73,333 square meters of land use right was transferred to the local government, and the related gain was recognized in the second quarter of 2020. The Company’s Jinhua facility moved out of the old location and completed the relocation process in April 2021. The relevant Economic Zone authorities inspected the vacated land and determined that it met all stipulated conditions. The remaining related gain on disposal of long-live asset was recognized in the second quarter of 2021.

(h) Interest income

Interest income was $1,378,774 for the second quarter of 2022, representing an increase of $404,669 or 41.5% compared to $974,105 for the same period of last year. The increase was primarily attributable to the increased interest earned on increased certificate of deposit compared to the same period in 2021.

(i) Interest expenses

Interest expenses were $138,433 in the second quarter of 2022, representing an increase of $60,364 or 77.3% compared to $78,069 for the same period of last year. The increase was primarily due to interest expenses related to increased short-term and long-term debt of the Company compared to the same period in 2021.

(j) Change in fair value of contingent consideration

For the second quarter of 2022, the loss related to changes in the fair value of contingent consideration was $391,000, an increased loss of $34,000 or 9.5% compared to loss related to changes in the fair value of contingent consideration of $357,000 for the same period in 2021, which was mainly due to the adjustment of the fair value of the contingent consideration liability associated with the remaining shares of restrictive common stock (Please refer to NOTE 18 – CONTINGENT CONSIDERATION LIABILITY). The fair value of the contingent consideration liability was estimated at each reporting date by using the Monte Carlo simulation method, which took into account all possible scenarios.

26

(k) Government grants

Government grants were $463,219 for the second quarter of 2022, compared to $114,402 for the same quarter last year, representing an increase of $348,817, or 304.9%, which was largely attributable to the award for our research and development granted by Jinhua local government in the second quarter of 2022.

(l) Gain from equity sale in the Former Affiliate Company

Gain from equity sale was $0 for the second quarter of 2022, compared to $33,651 for the same quarter last year, which was due to the Affiliate Equity Transfer. On February 18, 2021, Zhejiang Kandi Technologies signed an Equity Transfer Agreement with Geely to transfer all of its remaining 22% equity interests in the Former Affiliate Company to Geely for a total consideration of RMB 308 million (approximately $48 million). Zhejiang Provincial Administration for Market Regulation recorded the update of the ownership of Former Affiliate Company on March 9, 2021. On March 16, 2021, the Company received the first half of the equity transfer payment of RMB 154,000,000 (approximately $24 million). As of March 9, 2021, the equity transfer had been completed. Therefore, in the second quarter of 2021, the Company has recognized the gain from equity sale. On September 10, 2021, the Company received the second half of the equity transfer payment of RMB 154,000,000 (approximately $24 million).

(m) Share of loss after tax of the Former Affiliate Company

For the second quarter of 2022, our share of loss of the Former Affiliate Company was $0 as compared to share of loss of $4,904 for the same period in 2021. On February 18, 2021, Zhejiang Kandi Technologies signed an Equity Transfer Agreement with Geely to transfer all of its remaining 22% equity interests in the Former Affiliate Company to Geely for a total consideration of RMB 308 million (approximately $48 million). Zhejiang Provincial Administration for Market Regulation recorded the update of the ownership of Former Affiliate Company on March 9, 2021. On March 16, 2021, the Company received the first half of the equity transfer payment of RMB 154,000,000 (approximately $24 million). As of March 9, 2021, the equity transfer had been completed. On September 10, 2021, the Company received the second half of the equity transfer payment of RMB 154,000,000 (approximately $24 million).

(n) Other income, net

Net other income was $2,373,528 for the second quarter of 2022, representing a decrease of $1,453,561 or 38.0% compared to net other income of $3,827,089 for the same period of last year, which was largely due to the income from the discount of accounts payable after negotiation with supplier in the same period of last year.

(o) Income Taxes

In accordance with the relevant Chinese tax laws and regulations, the applicable corporate income tax rate of our Chinese subsidiaries is 25%. However, four of our subsidiaries, including Zhejiang Kandi Technologies, Kandi Smart Battery Swap, Kandi Hainan and Jiangxi Huiyi are qualified as high technology companies in China and are therefore entitled to a reduced corporate income tax rate of 15%. Additionally, Hainan Kandi Holding also has an income tax rate of 15% due to its local preferred tax rate in Hainan Free Trade Port.

Each of our other subsidiaries, Kandi New Energy, Yongkang Scrou, China Battery Exchange and its subsidiaries has an applicable corporate income tax rate of 25%.

Our actual effective income tax rate for the second quarter of 2022 was a tax benefit of 27.73% on a reported loss before taxes of approximately $2.6 million, compared to a tax expense of 16.26% on a reported income before taxes of approximately $48.9 million for the same period of last year.

(p) Net loss

Net loss was $1,875,652 for the second quarter of 2022, representing a decrease of $42,805,126 compared to net income of $40,929,474 for the same period in 2021. The decrease was primarily attributable to the gain on disposal of long-lived assets with $48,253,667 that was recorded during the second quarter of 2021, whereas there was none of such gain during second quarter of 2022.

27

Comparison of the Six Months Ended June 30, 2022 and 2021

The following table sets forth the amounts and percentage to revenue of certain items in our condensed consolidated statements of operations and comprehensive income (loss) for the six months ended June 30, 2022 and 2021.

| Six Months Ended | ||||||||||||||||||||||||

| June

30, 2022 | % of Revenue | June

30, 2021 | % of Revenue | Change

in Amount | Change

in % | |||||||||||||||||||

| REVENUES FROM UNRELATED PARTIES, NET | $ | 45,732,587 | 100.0 | % | $ | 45,852,002 | 100.0 | % | (119,415 | ) | (0.3 | %) | ||||||||||||

| REVENUES FROM THE FORMER AFFILIATE COMPANY AND RELATED PARTIES, NET | - | 0.0 | % | 1,587 | 0.0 | % | (1,587 | ) | (100.0 | %) | ||||||||||||||

| REVENUES, NET | 45,732,587 | 100.0 | % | 45,853,589 | 100.0 | % | (121,002 | ) | (0.3 | %) | ||||||||||||||

| COST OF GOODS SOLD | (40,626,557 | ) | (88.8 | %) | (35,401,456 | ) | (77.2 | %) | (5,225,101 | ) | 14.8 | % | ||||||||||||

| GROSS PROFIT | 5,106,030 | 11.2 | % | 10,452,133 | 22.8 | % | (5,346,103 | ) | (51.1 | %) | ||||||||||||||

| OPERATING INCOME (EXPENSE): | ||||||||||||||||||||||||

| Research and development | (2,394,429 | ) | (5.2 | %) | (25,189,502 | ) | (54.9 | %) | 22,795,073 | (90.5 | %) | |||||||||||||

| Selling and marketing | (2,366,227 | ) | (5.2 | %) | (2,204,383 | ) | (4.8 | %) | (161,844 | ) | 7.3 | % | ||||||||||||

| General and administrative | (12,330,610 | ) | (27.0 | %) | (9,789,695 | ) | (21.3 | %) | (2,540,915 | ) | 26.0 | % | ||||||||||||

| Gain on disposal of long-lived assets | - | 0.0 | % | 48,253,667 | 105.2 | % | (48,253,667 | ) | (100.0 | %) | ||||||||||||||

| TOTAL OPERATING (EXPENSE) INCOME | (17,091,266 | ) | (37.4 | %) | 11,070,087 | 24.1 | % | (28,161,353 | ) | (254.4 | %) | |||||||||||||

| (LOSS) INCOME FROM OPERATIONS | (11,985,236 | ) | (26.2 | %) | 21,522,220 | 46.9 | % | (33,507,456 | ) | (155.7 | %) | |||||||||||||

| OTHER INCOME (EXPENSE): | ||||||||||||||||||||||||

| Interest income | 2,601,078 | 5.7 | % | 1,502,697 | 3.3 | % | 1,098,381 | 73.1 | % | |||||||||||||||

| Interest expense | (286,577 | ) | (0.6 | %) | (204,417 | ) | (0.4 | %) | (82,160 | ) | 40.2 | % | ||||||||||||

| Change in fair value of contingent consideration | 2,299,000 | 5.0 | % | - | 0.0 | % | 2,299,000 | - | ||||||||||||||||

| Government grants | 707,317 | 1.5 | % | 349,195 | 0.8 | % | 358,122 | 102.6 | % | |||||||||||||||

| Gain from sale of equity in the Former Affiliate Company | - | 0.0 | % | 17,733,911 | 38.7 | % | (17,733,911 | ) | (100.0 | %) | ||||||||||||||

| Share of loss after tax of the Former Affiliate Company | - | 0.0 | % | (2,584,401 | ) | (5.6 | %) | 2,584,401 | (100.0 | %) | ||||||||||||||

| Other income, net | 2,417,310 | 5.3 | % | 4,325,990 | 9.4 | % | (1,908,680 | ) | (44.1 | %) | ||||||||||||||

| TOTAL OTHER INCOME , NET | 7,738,128 | 16.9 | % | 21,122,975 | 46.1 | % | (13,384,847 | ) | (63.4 | %) | ||||||||||||||

| (LOSS) INCOME BEFORE INCOME TAXES | (4,247,108 | ) | (9.3 | %) | 42,645,195 | 93.0 | % | (46,892,303 | ) | (110.0 | %) | |||||||||||||

| INCOME TAX BENEFIT (EXPENSE) | 752,443 | 1.6 | % | (8,118,441 | ) | (17.7 | %) | 8,870,884 | (109.3 | %) | ||||||||||||||

| NET (LOSS) INCOME | (3,494,665 | ) | (7.6 | %) | 34,526,754 | 75.3 | % | (38,021,419 | ) | (110.1 | %) | |||||||||||||

| LESS: NET INCOME (LOSS) ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | 58,662 | 0.1 | % | - | 0.0 | % | 58,662 | - | ||||||||||||||||

| NET (LOSS) INCOME ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS | (3,553,327 | ) | (7.8 | %) | 34,526,754 | 75.3 | % | (38,080,081 | ) | (110.3 | %) | |||||||||||||

(a) Revenue

For the six months ended June 30, 2022, Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ revenue was $45,732,587 compared to $45,853,589 for the same period of 2021, representing a decrease of $121,002 or 0.3%, which was comparable.

28

The following table summarizes Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ revenues by product types for the six months ended June 30, 2022 and 2021:

| 2022 | 2021 | |||||||

| Sales | Sales | |||||||

| EV parts | $ | 4,256,553 | $ | 13,048,846 | ||||

| EV products | 2,826,513 | 732,306 | ||||||

| Off-road vehicles | 20,805,882 | 11,092,199 | ||||||

| Electric Scooters, Electric Self-Balancing Scooters and associated parts | 3,344,439 | 20,395,361 | ||||||

| Battery exchange equipment and Battery exchange service | 108,664 | 584,877 | ||||||

| Lithium-ion cells | 14,390,536 | - | ||||||

| Total | $ | 45,732,587 | $ | 45,853,589 | ||||

EV Parts

During the six months ended June 30, 2022, Zhejiang Kandi Technologies, its subsidiaries and SC Autosports’ revenues from the sales of EV parts were $4,256,553, representing a decrease of $8,792,293 or 67.4% from $13,048,846 for the same period of 2021. The decrease was primarily due to less demand from the market during the six months ended June 30, 2022.