UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended March 31, 2018

or

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ______to______

Commission file number 001-33997

KANDI

TECHNOLOGIES GROUP, INC.

(Exact name of registrant as specified in charter)

| Delaware | 90-0363723 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

Jinhua

City Industrial Zone

Jinhua, Zhejiang Province

People’s Republic of China

Post Code 321016

(Address of principal executive offices)

(86

- 579) 82239856

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☒ |

| Non-accelerated filer ☐ | Smaller reporting company ☐ |

| (Do not check if a smaller reporting company) | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 4, 2018, the registrant had 53,969,212 shares of common stock issued and 51,009,375 shares of common stock outstanding, par value $0.001 per share.

TABLE OF CONTENTS

| Page | ||

| PART I — FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements | 1 |

| Condensed Consolidated Balance Sheets as of March 31, 2018 (unaudited) and December 31, 2017 | 1 | |

| Condensed Consolidated Statements of Income (Loss) and Comprehensive Income (Loss) (unaudited) – Three Months Ended March 31, 2018 and 2017 | 2 | |

| Condensed Consolidated Statements of Cash Flows (unaudited) –Three Months Ended March 31, 2018 and 2017 | 3 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 37 |

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk | 49 |

| Item 4. | Controls and Procedures | 50 |

| PART II — OTHER INFORMATION | ||

| Item 1. | Legal proceedings | 51 |

| Item 1A. | Risk Factors | 51 |

| Item 6. | Exhibits | 51 |

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements.

KANDI

TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET

| March

31, 2018 | December 31, 2017 | |||||||

| (Unaudited) | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 1,041,781 | $ | 4,891,808 | ||||

| Restricted cash | 7,491,324 | 11,218,688 | ||||||

| Accounts receivable(net of allowance for doubtful accounts of $382,108 and $133,930 as of March 31, 2018 and December 31, 2017, respectively) | 27,236,661 | 34,397,858 | ||||||

| Inventories (net of provision for slow moving inventory of $643,318 and $620,919 as of March 31, 2018 and December 31, 2017, respectively) | 17,439,458 | 15,979,794 | ||||||

| Notes receivable from JV Company and related party | 7,611,283 | 1,137,289 | ||||||

| Other receivables | 2,356,811 | 2,650,668 | ||||||

| Prepayments and prepaid expense | 6,744,641 | 6,536,839 | ||||||

| Due from employees | 6,847 | 7,070 | ||||||

| Advances to suppliers | 12,290,705 | 14,908,385 | ||||||

| Amount due from JV Company, net | 141,716,559 | 146,422,440 | ||||||

| Amount due from related party | 167,894 | 162,048 | ||||||

| TOTAL CURRENT ASSETS | 224,103,964 | 238,312,887 | ||||||

| LONG-TERM ASSETS | ||||||||

| Property, Plant and equipment, net | 14,091,019 | 12,000,971 | ||||||

| Land use rights, net | 13,133,595 | 12,666,047 | ||||||

| Construction in progress | 58,840,459 | 53,083,925 | ||||||

| Deferred taxes assets | 3,607,478 | 4,383,425 | ||||||

| Long Term Investment | 1,512,703 | 1,460,034 | ||||||

| Investment in JV Company | 74,035,495 | 70,681,013 | ||||||

| Goodwill | 25,344,151 | 322,591 | ||||||

| Intangible assets | 5,224,868 | 331,116 | ||||||

| Advances to suppliers | 22,371,860 | 21,592,918 | ||||||

| Other long term assets | 7,549,153 | 7,590,734 | ||||||

| Amount due from JV Company, net | 15,907,183 | 15,907,183 | ||||||

| TOTAL Long-Term Assets | 241,617,964 | 200,019,957 | ||||||

| TOTAL ASSETS | $ | 465,721,928 | $ | 438,332,844 | ||||

| CURRENT LIABILITIES | ||||||||

| Accounts payables | $ | 117,258,483 | $ | 111,595,540 | ||||

| Other payables and accrued expenses | 5,289,475 | 6,556,209 | ||||||

| Short-term loans | 34,234,851 | 33,042,864 | ||||||

| Customer deposits | 334,885 | 205,544 | ||||||

| Notes payable | 10,466,183 | 28,075,945 | ||||||

| Income tax payable | 2,421,168 | 2,902,699 | ||||||

| Due to employees | 11,699 | 35,041 | ||||||

| Deferred income | 3,960,698 | 2,191,143 | ||||||

| Total Current Liabilities | 173,977,442 | 184,604,985 | ||||||

| LONG-TERM LIABILITIES | ||||||||

| Long term bank loans | 31,846,373 | 30,737,547 | ||||||

| Contingent liability | 6,032,817 | - | ||||||

| Other long-term liability | 579,224 | - | ||||||

| Total Long-Term Liabilities | 38,458,414 | 30,737,547 | ||||||

| TOTAL LIABILITIES | 212,435,856 | 215,342,532 | ||||||

| STOCKHOLDER’S EQUITY | ||||||||

| Common stock, $0.001 par value; 100,000,000 shares authorized; 53,968,712 and 48,036,538 shares issued and 51,008,875 and 48,036,538 outstanding at March 31, 2018 and December 31, 2017, respectively | 51,009 | 48,037 | ||||||

| Additional paid-in capital | 252,154,904 | 233,055,348 | ||||||

| Retained earnings (the restricted portion is $4,422,033 and $4,422,033 at March 31, 2018 and December 31, 2017, respectively) | (74,318 | ) | (3,802,310 | ) | ||||

| Accumulated other comprehensive loss | 1,154,477 | (6,310,763 | ) | |||||

| TOTAL STOCKHOLDERS’ EQUITY | 253,286,072 | 222,990,312 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 465,721,928 | $ | 438,332,844 | ||||

See accompanying notes to condensed consolidated financial statements

| 1 |

KANDI

TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND

COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| Three Months Ended | ||||||||

| March 31, 2018 | March 31, 2017 | |||||||

| REVENUES FROM UNRELATED PARTY, NET | $ | 5,732,463 | $ | 2,962,931 | ||||

| REVENUES FROM JV COMPANY AND RELATED PARTY, NET | 2,603,444 | 1,311,642 | ||||||

| REVENUES, NET | 8,335,907 | 4,274,573 | ||||||

| COST OF GOODS SOLD | (6,989,956 | ) | (3,607,241 | ) | ||||

| GROSS PROFIT | 1,345,951 | 667,332 | ||||||

| OPERATING EXPENSES: | ||||||||

| Research and development | (757,298 | ) | (20,769,732 | ) | ||||

| Selling and marketing | (748,225 | ) | (358,309 | ) | ||||

| General and administrative | 398,171 | (8,319,294 | ) | |||||

| Total Operating Expenses | (1,107,352 | ) | (29,447,335 | ) | ||||

| INCOME (LOSS) FROM OPERATIONS | 238,599 | (28,780,003 | ) | |||||

| OTHER INCOME(EXPENSE): | ||||||||

| Interest income | 942,993 | 530,642 | ||||||

| Interest expense | (550,417 | ) | (614,453 | ) | ||||

| Change in fair value of contingent consideration | 2,680,179 | - | ||||||

| Government grants | 95,255 | 5,067,474 | ||||||

| Share of income (loss) after tax of JV | 795,055 | (5,161,713 | ) | |||||

| Other income, net | 22,977 | 28,621 | ||||||

| Total other income (expense), net | 3,986,042 | (149,429 | ) | |||||

| INCOME (LOSS) BEFORE INCOME TAXES | 4,224,641 | (28,929,432 | ) | |||||

| INCOME TAX (EXPENSE) BENEFIT | (496,646 | ) | 4,775,997 | |||||

| NET INCOME (LOSS) | 3,727,995 | (24,153,435 | ) | |||||

| OTHER COMPREHENSIVE INCOME (LOSS) | ||||||||

| Foreign currency translation | 7,465,240 | 1,791,816 | ||||||

| COMPREHENSIVE INCOME (LOSS) | $ | 11,193,235 | $ | (22,361,619 | ) | |||

| WEIGHTED AVERAGE SHARES OUTSTANDING BASIC | 50,643,423 | 47,732,388 | ||||||

| WEIGHTED AVERAGE SHARES OUTSTANDING DILUTED | 50,643,423 | 47,732,388 | ||||||

| NET INCOME (LOSS) PER SHARE, BASIC | $ | 0.07 | $ | (0.51 | ) | |||

| NET INCOME (LOSS) PER SHARE, DILUTED | $ | 0.07 | $ | (0.51 | ) | |||

See accompanying notes to condensed consolidated financial statements

| 2 |

KANDI

TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| Three Months Ended | ||||||||

| March

31, 2018 | March

31, 2017 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net income (loss) | $ | 3,727,995 | $ | (24,153,435 | ) | |||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||

| Depreciation and amortization | 875,463 | 1,162,795 | ||||||

| Assets impairments | - | 45,831 | ||||||

| Allowance for doubtful accounts | 240,419 | - | ||||||

| Deferred taxes | (308,406 | ) | (4,775,997 | ) | ||||

| Share of income after tax of JV Company | (795,055 | ) | 5,161,713 | |||||

| Change in fair value of contingent consideration | (2,680,179 | ) | - | |||||

| Stock compensation cost | (1,615,706 | ) | 2,476,519 | |||||

| Changes in operating assets and liabilities, net of effects of acquisition: | ||||||||

| (Increase) Decrease In: | ||||||||

| Accounts receivable | 12,343,813 | (1,399,372 | ) | |||||

| Deferred taxes assets | (53,414 | ) | - | |||||

| Notes receivable from JV Company and related party | (5,015,238 | ) | 3,704,957 | |||||

| Inventories | 265,800 | (2,779,644 | ) | |||||

| Other receivables and other assets | 752,017 | (210,503 | ) | |||||

| Due from employee | (23,838 | ) | (46,692 | ) | ||||

| Advances to supplier and prepayments and prepaid expenses | 3,144,325 | 21,948,470 | ||||||

| Advances to suppliers-long term | (3,712,576 | ) | (5,682,460 | ) | ||||

| Amount due from JV Company | (9,902,514 | ) | (15,542,072 | ) | ||||

| Due from related party | - | (300,000 | ) | |||||

| Increase (Decrease) In: | ||||||||

| Accounts payable | 19,319,570 | 9,986,016 | ||||||

| Other payables and accrued liabilities | (2,503,830 | ) | (297,408 | ) | ||||

| Notes payable | (16,117,038 | ) | (1,855,353 | ) | ||||

| Customer deposits | 120,458 | 127,216 | ||||||

| Income tax payable | (819,372 | ) | (789,661 | ) | ||||

| Deferred income | 1,670,173 | (5,067,474 | ) | |||||

| Loss contingency-litigation | - | 4,622,066 | ||||||

| Net cash used in operating activities | $ | (1,087,133 | ) | $ | (13,664,488 | ) | ||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchases of property, plant and equipment, net | (109,160 | ) | (23,492 | ) | ||||

| Purchases of land use rights and other intangible assets | (99,404 | ) | - | |||||

| Acquisition of Jinhua An Kao (net of cash received) | (3,699,801 | ) | - | |||||

| Purchases of construction in progress | (82,792 | ) | (1,488,409 | ) | ||||

| Short term investment | - | 4,418,065 | ||||||

| Net cash (used in) provided by investing activities | $ | (3,991,157 | ) | $ | 2,906,164 | |||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from short-term bank loans | 3,775,587 | 3,629,407 | ||||||

| Repayments of short-term bank loans | (3,775,587 | ) | (5,661,875 | ) | ||||

| Proceeds from notes payable | 25,539,803 | 3,669,853 | ||||||

| Repayment of notes payable | (28,607,869 | ) | - | |||||

| Net cash (used in) provided by financing activities | $ | (3,068,066 | ) | $ | 1,637,385 | |||

| NET DECREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | (8,146,356 | ) | (9,120,939 | ) | ||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 568,965 | 194,084 | ||||||

| Cash, cash equivalents and restricted cash at beginning of year | 16,110,496 | 25,193,298 | ||||||

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | 8,533,105 | 16,266,443 | ||||||

| SUPPLEMENTARY CASH FLOW INFORMATION | ||||||||

| Income taxes paid | 1,466,761 | 786,172 | ||||||

| Interest paid | 414,319 | 386,973 | ||||||

| SUPPLEMENTAL NON-CASH DISCLOSURES: | ||||||||

| Advances to suppliers-long term transferred to Construction in progress | 3,712,576 | 8,023,030 | ||||||

| Purchase of construction in progress in accounts payable | - | 980,292 | ||||||

| Settlement of due from JV Company and related parties with notes receivable | 20,337,201 | 22,713,442 | ||||||

| Settlement of accounts receivables with notes receivable from unrelated parties | 7,866 | - | ||||||

| Assignment of notes receivable from unrelated parties to supplier to settle accounts payable | 7,866 | - | ||||||

| Assignment of notes receivable from JV Company and related parties to supplier to settle accounts payable | 18,996,867 | 18,082,140 | ||||||

| Settlement of accounts payable with notes payables | 786,581 | 2,032,468 | ||||||

| Deferred tax changed to other comprehensive income | 42,528 | - | ||||||

See accompanying notes to condensed consolidated financial statements

| 3 |

NOTE 1 - ORGANIZATION AND PRINCIPAL ACTIVITIES

Kandi Technologies Group, Inc. (“Kandi Technologies”) was incorporated under the laws of the State of Delaware on March 31, 2004. Kandi Technologies changed its name from Stone Mountain Resources, Inc. to Kandi Technologies, Corp. on August 13, 2007, and on December 21, 2012, Kandi Technologies changed its name to Kandi Technologies Group, Inc. As used herein, the term the “Company” means Kandi Technologies and its operating subsidiaries, as described below.

Headquartered in Jinhua City, Zhejiang Province, People’s Republic of China, the Company is one of the People’s Republic of China’s (“China”) leading producers and manufacturers of electric vehicle (“EV”) products, EV parts, and off-road vehicles for sale in China and global markets. The Company conducts its primary business operations through its wholly-owned subsidiary, Zhejiang Kandi Vehicles Co., Ltd. (“Kandi Vehicles”), and the partially and wholly-owned subsidiaries of Kandi Vehicles.

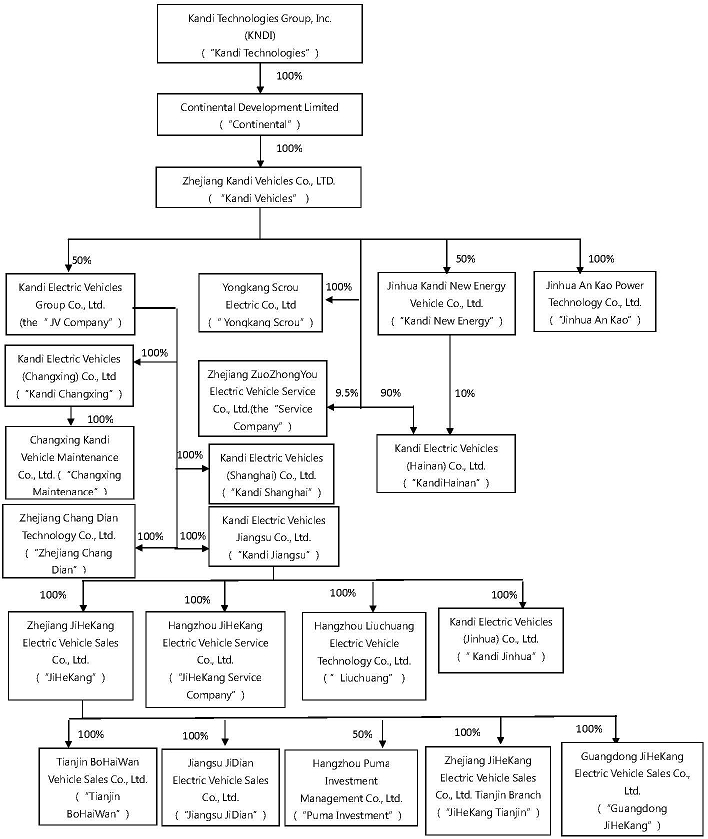

The Company’s organizational chart as of May 3, 2018 is as follows:

| 4 |

Operating Subsidiaries:

Pursuant to the agreements executed in January 2011, Kandi Vehicles is entitled to 100% of the economic benefits, voting rights and residual interests (100% of profits and losses) of Jinhua Kandi New Energy Vehicles Co., Ltd. (“Kandi New Energy”). Kandi New Energy currently holds battery pack production licensing rights and supplies battery packs to the JV Company (as such term is defined below). In April 2012, pursuant to the agreement, the Company acquired 100% of Yongkang Scrou Electric Co, Ltd. (“Yongkang Scrou”), a manufacturer of automobile and EV parts. Yongkang Scrou currently manufactures and sells EV drive motors, EV controllers, air conditioners and other electric products to the JV Company.

In March 2013, pursuant to a joint venture agreement (the “JV Agreement”) entered into by Kandi Vehicles and Shanghai Maple Guorun Automobile Co., Ltd. (“Shanghai Guorun”), a 99%-owned subsidiary of Geely Automobile Holdings Ltd. (“Geely”), the parties established Zhejiang Kandi Electric Vehicles Co., Ltd. (the “JV Company”) to develop, manufacture and sell EV products and related auto parts. Each of Kandi Vehicles and Shanghai Guorun has 50% ownership interest in the JV Company. In March 2014, the JV Company changed its name to Kandi Electric Vehicles Group Co., Ltd. At present, the JV Company is a holding company and all products are manufactured by its subsidiaries. In an effort to improve the JV Company’s development, Zhejiang Geely Holding Group, the parent company of Geely, became the JV Company’s -shareholder on October 26, 2016, through its purchase of the 50% equity of the JV Company held by Shanghai Guorun at a premium price (a price exceeding the cash amount of the aggregate of the original investment and the shared profits over the years). On May 19, 2017, due to business development, Geely Holding entrusted Hu Xiaoming, Chairman of the Board of the JV Company, to hold 19% equity of the JV Company from its 50% holding of the JV Company on behalf of Geely Holding as a nominal holder. On the same day, Geely Holding transferred its remaining 31% equity in the JV Company to Geely Group (Ningbo) Ltd., a company wholly owned by Li Shufu, Chairman of the Board of Geely Holding. On May 25, 2017, Mr. Hu pledged his 19% equity in the JV Company held on behalf of Geely Holding to Geely Holding. On June 30, 2017, due to the JV Company’s operational needs, Kandi Vehicles pledged its 50% equity in the JV Company to Geely Holding as counter-guarantee, because Geely Holding provides a 100% guarantee on the JV Company’s borrowings. Notwithstanding the pledge, guarantee and counter-guarantee arrangements stated above, there has been no change in control with respect to the 50% ownership held by each shareholder of the JV Company. In order to streamline the equity structure, on October 24, 2017, Mr. Hu transferred the 19% equity of the JV Company to Geely Group (Ningbo) Ltd. Now, Kandi Vehicles and Geely Group (Ningbo) Ltd. each owns 50% of equity of the JV Company.

In March 2013, Kandi Vehicles formed Kandi Electric Vehicles (Changxing) Co., Ltd. (“Kandi Changxing”) in the Changxing (National) Economic and Technological Development Zone. Kandi Changxing is engaged in the production of EV products. In the fourth quarter of 2013, Kandi Vehicles entered into an ownership transfer agreement with the JV Company pursuant to which Kandi Vehicles transferred 100% of its ownership in Kandi Changxing to the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Kandi Changxing.

In July 2013, Zhejiang ZuoZhongYou Electric Vehicle Service Co., Ltd. (the “Service Company”) was formed. The Service Company is engaged in various pure EV leasing businesses, generally referred to as the Micro Public Transportation (“MPT”) program. The Company, through Kandi Vehicle, has a 9.5% ownership interest in the Service Company.

In November 2013, Kandi Electric Vehicles Jinhua Co., Ltd. (“KandiJinhua”) was formed by the JV Company. The JV Company has a 100% ownership interest in KandiJinhua, and the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in KandiJinhua. In April 2017, KandiJinhua was reorganized to be owned directly by Kandi Jiangsu, which is 100% directly owned by the JV Company.

In November 2013, Zhejiang JiHeKang Electric Vehicle Sales Co., Ltd. (“JiHeKang”) was formed by the JV Company. JiHeKang is engaged in the car sales business. The JV Company has a 100% ownership interest in JiHeKang, and the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in JiHeKang. In April 2017, JiHeKang was reorganized to be owned directly by Kandi Jiangsu, which is 100% directly owned by the JV Company.

In December 2013, the JV Company entered into an ownership transfer agreement with Shanghai Guorun, pursuant to which the JV Company acquired a 100% ownership interest in Kandi Electric Vehicles (Shanghai) Co., Ltd. (“Kandi Shanghai”). As a result, Kandi Shanghai is a wholly-owned subsidiary of the JV Company, and the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Kandi Shanghai.

In January 2014, KandiElectric Vehicles Jiangsu Co., Ltd. (“Kandi Jiangsu”) was formed by the JV Company. The JV Company has a 100% ownership interest in Kandi Jiangsu, and the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Kandi Jiangsu. Kandi Jiangsu is mainly engaged in EV research and development, manufacturing, and sales. As of the date of this report, Kandi Jiangsu directly owns 100% of JiHeKang, JiHeKang Service Company, Liuchuang and KandiJinhua.

In November 2015, Hangzhou Puma Investment Management Co., Ltd. (“Puma Investment”) was formed by the JV Company. Puma Investment provides investment and consulting services. The JV Company has a 50% ownership interest in Puma Investment (the other 50% is owned by Zuozhongyou Electric Vehicles Service (Hangzhou) Co., Ltd., a subsidiary of the Service Company), and the Company, indirectly through the JV Company, has a 25% economic interest in Puma Investment. In addition, Kandi Vehicle has a 9.5% ownership interest in Zuozhongyou Electric Vehicles Service (Hangzhou) Co., Ltd. The Company, indirectly through its 100% ownership interest in Kandi Vehicle, also has a 4.75% economic interest in Puma Investment. Therefore, the Company has a total of 29.75% of economic interest in Puma Investment.

| 5 |

In November 2015, Hangzhou JiHeKang Electric Vehicle Service Co., Ltd. (the “JiHeKang Service Company”) was formed by the JV Company. The JiHeKang Service Company focuses on after-market services for EV products. In April 2017, JiHeKang Service Company was reorganized to be owned directly by Kandi Jiangsu, which is 100% directly owned by the JV Company. The JV Company has a 100% ownership interest in the JiHeKang Service Company, and the Company, indirectly through the JV Company, has a 50% economic interest in the JiHeKang Service Company.

In December 2015, Zhejiang JiHeKang Electric Vehicle Sales Co., Ltd. Tianjin Branch (“JiHeKang Tianjin”) was formed by JiHeKang. JiHeKang Tianjin is engaged in the car sales business. Since JiHeKangis 100% owned by the JV Company, the JV Company has a 100% ownership interest in JiHeKang Tianjin, and the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in JiHeKang Tianjin.

In January 2016, Kandi Electric Vehicles (Wanning) Co., Ltd. was renamed Kandi Electric Vehicles (Hainan) Co., Ltd. (“Kandi Hainan”). Kandi Hainan was originally formed in Wanning City in Hainan Province by Kandi Vehicles and Kandi New Energy in April 2013, and was transferred to Haikou City in January 2016. Kandi Vehicles has a 90% ownership interest in Kandi Hainan, and Kandi New Energy has the remaining 10% ownership interest. In fact, Kandi Vehicles is, effectively, entitled to 100% of the economic benefits, voting rights and residual interests (100% of the profits and losses) of Kandi Hainan as Kandi Vehicles is entitled to 100% of the economic benefits, voting rights and residual interests of Kandi New Energy.

In August 2016, Jiangsu JiDian Electric Vehicle Sales Co., Ltd. (“Jiangsu JiDian”) was formed by JiHeKang. Jiangsu JiDian is engaged in the car sales business. Since JiHeKang is 100% owned by the JV Company, the JV Company has a 100% ownership interest in Jiangsu JiDian, and the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Jiangsu JiDian.

In October 2016, JiHeKang acquired Tianjin BoHaiWan Vehicle Sales Co., Ltd. (“Tianjin BoHaiWan”), which is engaged in the car sales business. Since JiHeKang is 100% owned by the JV Company, the JV Company has a 100% ownership interest in Tianjin BoHaiWan, and the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Tianjin BoHaiWan.

In November 2016, Changxing Kandi Vehicle Maintenance Co., Ltd. (“Changxing Maintenance”) was formed by KandiChangxing. Changxing Maintenance is engaged in the car repair and maintenance business. In December 2017, the Service Company entered an agreement with the JV Company to acquire 100% of Changxing Maintenance for RMB 1,089,887 or approximately $167,501. As of March 31, 2018, the transaction was not closed. Since Kandi Changxing is 100% owned by the JV Company, the JV Company has a 100% ownership interest in Changxing Maintenance, and the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Changxing Maintenance.

In November 2016, Guangdong JiHeKang Electric Vehicle Sales Co., Ltd. (“Guangdong JiHeKang”) was formed by JiHeKang. Guangdong JiHeKang is engaged in the car sales business. Since JiHeKangis 100% owned by the JV Company, the JV Company has a 100% ownership interest in Guangdong JiHeKang, and the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Guangdong JiHeKang.

In March 2017, Hangzhou Liuchuang Electric Vehicle Technology Co., Ltd. (“Liuchuang”) was formed by Kandi Jiangsu. Since Kandi Jiangsu is 100% owned by the JV Company, the JV Company has a 100% ownership interest in Liuchuang, and the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Liuchuang.

In April 2017, in order to promote business development, KandiJinhua, JiHeKang, and the JiHeKang Service Company were reorganized to become subsidiaries of Kandi Jiangsu. As the JV Company has a 100% ownership interest in Kandi Jiangsu, the JV Company has 100% ownership interests in KandiJinhua, JiHeKang, and the JiHeKang Service Company;the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in KandiJinhua, JiHeKang, and the JiHeKang Service Company.

| 6 |

In December 2017, Zhejiang Chang Dian Technology Co., Ltd. (“Zhejiang Chang Dian”) was formed by the JV Company. Zhejiang Chang Dian is primarily engaged in the battery replacement business. Since Zhejiang Chang Dian is 100% owned by the JV Company, and the Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Zhejiang Chang Dian.

On December 18, 2017, Kandi Vehicles and the sole shareholder of Jinhua An Kao Power Technology Co., Ltd. (“JinhuaAn Kao”) entered into a Share Transfer Agreement and a Supplementary Agreement, pursuant to which Kandi Vehicles acquired JinhuaAn Kao. The two agreements were signed on December 12, 2017 and the closing took place on January 3, 2018. Kandi Vehicles acquired 100% of the equity interests of Jinhua An Kao for a purchase price of approximately RMB 25.93 million (approximately $3.9 million) in cash. In addition, pursuant to the Supplementary Agreement by and between the two parties, the Company issued a total of 2,959,837 shares of restrictive stock, or 6.2% of the Company’s total outstanding shares of the common stock to the shareholder of Jinhua An Kao. An additional 2,959,837 shares are placed as make good shares for the undertaking of Jinhua An Kao to achieve no less than a total of RMB 120,000,000 (approximately $18.1 million) net income over the course of the following three years. The Supplementary Agreement sets forth the terms and conditions of the issuance of these shares, including that the Company has the voting rights of the make good shares until conditions for vesting those shares are satisfied.

The Company’s primary business operations are designing, developing, manufacturing and commercializing EV products, EV parts and off-road vehicles. As part of its strategic objective of becoming a leading manufacturer of EV products (through the JV Company) and related services, the Company has increased its focus on pure EV-related products, with a particular emphasis on expanding its market share in China.

NOTE 2 – LIQUIDITY

The Company had a working capital surplus of $ 50,126,522 as of March 31, 2018, a decrease of $3,581,380 from a working capital surplus of $53,707,902 as of December 31, 2017.

As of March 31, 2018, the Company had credit lines available from commercial banks of $34,234,851. Although the Company expects that most of its outstanding trade receivables from customers will be collected in the next twelve months, there are uncertainties about the timing in collecting these receivables, especially the receivables due from the JV Company, because most of them are indirectly impacted by the timely receipt of government subsidies. Since the amount due from the JV Company accounts for the majority of the Company’s outstanding receivables, and since the Company cannot control the timing of the receipt of government subsidies, the Company believes that its internally-generated cash flows may not be sufficient to support the growth of future operations and to repay short-term bank loans for the next twelve months. However, the Company believes its access to existing financing sources and its good credit will enable it to meet its obligations and fund its ongoing operations for the next 12 months. The Company expects to approximately maintain the current debt level for the next twelve months given the Company’s current financial position and business development needs.

The Company’s primary need for liquidity is to fund working capital requirements of the Company’s businesses, capital expenditures and for general operational purposes, including debt repayment. The Company has incurred losses and experienced negative operating cash flows for the past years, and accordingly, the Company has taken a number of actions to continue to support its operations and meet its obligations. The Company has historically financed its operations through short-term commercial bank loans from Chinese banks. The term of these loans is typically for one year, and upon the payment of all outstanding principal and interest on a particular loan, the banks have typically rolled over the loan for an additional one-year term, with adjustments made to the interest rate to reflect prevailing market rates. This practice has been ongoing year after year and the Company believes that short-term bank loans will remain available on normal trade terms if needed. As the misunderstanding surrounding the exchange battery model of the JV Company has been cleared up and the financial institutions’ confidence in Kandi has been restored, the relevant Chinese banks are expected to further increase the credit to the Company. During the second half of 2017, the Company gradually resumed normal production and turned losses in the first six months in 2017 to profits generated in the second six months in 2017. During the first quarter of 2018, the Company continued its operation profitable. For the remainder of 2018, the management will take measures to grow the business and further improve the Company’s liquidity. The Company acknowledges that it continues to face a challenging competitive environment and expects to take actions that will enhance the Company’s liquidity and financial flexibility to support the Company’s operation needs.

| 7 |

We finance our ongoing operating activities by using funds from our operations and external credit or financing arrangements. We routinely monitor current and expected operational requirements and financial market conditions to evaluate the use of available financing sources. Considering our existing working capital position and our ability to access debt funding sources, we believe that our operations and borrowing resources are sufficient to provide for our current and foreseeable capital requirements to support our ongoing operations for the next twelve months.

NOTE 3 – BASIS OF PRESENTATION

The Company maintains its general ledger and journals using the accrual method of accounting for financial reporting purposes. The Company’s financial statements and notes are the representations of the Company’s management. Accounting policies adopted by the Company conform to generally accepted accounting principles in the United States and have been consistently applied in the Company’s presentation of its financial statements.

NOTE 4 – PRINCIPLES OF CONSOLIDATION

The Company’s consolidated financial statements reflect the accounts of the Company and its ownership interests in the following subsidiaries:

| (1) | Continental Development Limited (“Continental”), a wholly-owned subsidiary of the Company incorporated under the laws of Hong Kong; |

| (2) | Kandi Vehicles, a wholly-owned subsidiary of Continental; |

| (3) | Kandi New Energy, a 50%-owned subsidiary of Kandi Vehicles (Mr. Hu Xiaoming owns the other 50%). Pursuant to agreements executed in January 2011, Mr. Hu Xiaoming contracted with Kandi Vehicles for the operation and management of Kandi New Energy and put his shares of Kandi New Energy into escrow. As a result, Kandi Vehicles is entitled to 100% of the economic benefits, voting rights and residual interests of Kandi New Energy; |

| (4) | YongkangScrou, a wholly-owned subsidiary of Kandi Vehicles; |

(5)

(6) |

Kandi Hainan, a subsidiary, 10% owned by Kandi New Energy and 90% owned by Kandi Vehicles; and

Jinhua An Kao, a wholly-owned subsidiary of Kandi Vehicles. |

Equity Method Investees

The Company’s consolidated net income also includes the Company’s proportionate share of the net income or loss of its equity method investees as follows:

(1) The JV Company, a 50% owned subsidiary of Kandi Vehicles;

(2) KandiChangxing, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in KandiChangxing;

(3) KandiJinhua, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in KandiJinhua;

(4) JiHeKang, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in JiHeKang;

(5) Kandi Shanghai, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Kandi Shanghai;

| 8 |

(6) Kandi Jiangsu, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Kandi Jiangsu;

(7) The JiHeKang Service Company, a wholly-owned direct subsidiary of Kandi Jiangsu, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in the JiHeKang Service Company.

(8) Tianjin BoHaiWan, a wholly-owned direct subsidiary of JiHeKang, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Tianjin BoHaiWan;

(9) Changxing Maintenance, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Changxing Maintenance;

(10) Liuchuang, a wholly-owned direct subsidiary of Kandi Jiangsu, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Liuchuang;

(11) Jiangsu JiDian, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Jiangsu JiDian;

(12) JiHeKang Tianjin, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in JiHeKang Tianjin;

(13) Guangdong JiHeKang, a wholly-owned direct subsidiary of JiHeKang, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Guangdong JiHeKang; and

(14) Zhejiang Chang Dian, a wholly-owned direct subsidiary of JiHeKang, a wholly-owned subsidiary of the JV Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 50% economic interest in Zhejiang Chang Dian.

All intra-entity profits and losses with regards to the Company’s equity method investees have been eliminated.

NOTE 5 – USE OF ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles in the United States requires the Company’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. Management makes these estimates using the best information available at the time the estimates are made; however actual results when ultimately realized could differ from those estimates.

NOTE 6 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Economic and Political Risks

The Company’s operations are conducted in China. As a result, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in China, and by the general state of the Chinese economy. In addition, the Company’s earnings are subject to movements in foreign currency exchange rates when transactions are denominated in Renminbi (“RMB”), which is the Company’s functional currency. Accordingly, the Company’s operating results are affected by changes in the exchange rate between the U.S. dollar and the RMB.

The Company’s operations in China are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange restrictions. The Company’s performance may be adversely affected by changes in the political and social conditions in China, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

| 9 |

(b) Fair Value of Financial Instruments

ASC 820 establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. The hierarchy prioritizes the inputs into three levels based on the extent to which inputs used in measuring fair value are observable in the market.

These tiers include:

Level 1—defined as observable inputs such as quoted prices in active markets;

Level 2—defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and

Level 3—defined as unobservable inputs for which little or no market data exists, therefore requiring an entity to develop its own assumptions.

The Company’s financial instruments primarily consist of cash and cash equivalents, restricted cash, accounts receivable, notes receivable, other receivables, accounts payable, other payables and accrued liabilities, short-term bank loans, notes payable, and warrants.

The carrying value of cash and cash equivalents, restricted cash, accounts receivable, notes receivable, other receivables, accounts payable, other payables and accrued liabilities, and notes payable approximate fair value because of the short-term nature of these items. The estimated fair values of short-term bank loans were not materially different from their carrying value as presented due to the brief maturities and because the interest rates on these borrowings approximate those that would have been available for loans of similar remaining maturities and risk profiles. As the carrying amounts are reasonable estimates of fair value, these financial instruments are classified within Level 1 of the fair value hierarchy. The Company identified notes payable as Level 2 instruments due to the fact that the inputs to valuation are primarily based upon readily observable pricing information. The balance of notes payable, which was measured and disclosed at fair value, was $10,466,183 and $28,075,945 at March 31, 2018 and December 31, 2017, respectively.

Contingent consideration related to the acquisition of Jinhua An Kao, which is accounted for as liabilities, are measured at each reporting date for their fair value using Level 3 inputs. The fair value of contingent consideration was $6,032,817 and $0 at March 31, 2018 and December 31, 2017, respectively. Also see Note 26.

(c) Cash and Cash Equivalents

The Company considers highly-liquid investments purchased with original maturities of three months or less to be cash equivalents.

As of March 31, 2018, and December 31, 2017, the Company’s restricted cash was $7,491,324 and $11,218,688, respectively.

(d) Inventories

Inventories are stated at the lower of cost or net realizable value (market value). The cost of raw materials is determined on the basis of weighted average. The cost of finished goods is determined on the basis of weighted average and comprises direct materials, direct labor and an appropriate proportion of overhead.

Net realizable value is based on estimated selling prices less selling expenses and any further costs expected to be incurred for completion. Adjustments to reduce the cost of inventory to net realizable value are made, if required, for estimated excess, obsolescence, or impaired balances.

| 10 |

(e) Accounts Receivable

Accounts receivable are recognized and carried at net realizable value. An allowance for doubtful accounts is recorded for periods in which the Company determines a loss is probable, based on its assessment of specific factors, such as troubled collections, historical experience, accounts aging, ongoing business relations and other factors. Accounts are written off after exhaustive collection efforts. If accounts receivable are to be provided for, or written off, they are recognized in the consolidated statement of operations within the operating expenses line item. If accounts receivable previously written off is recovered in later period or when facts subsequently become available to indicate that the amount provided as an allowance for doubtful accounts was incorrect, an adjustment is made to restate allowance for doubtful accounts.

As of March 31, 2018 and December 31, 2017, credit terms with the Company’s customers were typically 180 to 360 days after delivery. Because of the industry-wide subsidy review in 2016, the Chinese government temporarily delayed the processing of subsidy payments for the EVs sold in 2015 and 2016, which negatively impacted the JV Company’s cash flow position and caused its delay in repaying the Company. According to the government’s subsidy policies, the EVs sold in 2015 and 2016 by the JV Company are eligible for receiving subsidies. As of March 31, 2018 and December 31, 2017, the Company had a $382,108 and $133,930 allowance for doubtful accounts, as per the Company management’s judgment based on their best knowledge. The Company conducts quarterly assessments of the state of the Company’s outstanding receivables and reserves any allowance for doubtful accounts if it becomes necessary. As of March 31, 2018, based on the Company management’s collection experience, approximately $15.9 million of amount due from the JV Company in the current assets was reclassified to amount due from the JV Company in the long-term assets due to the reason mentioned above.

(f) Notes receivable

Notes receivable represent short-term loans to third parties with maximum terms of six months. Interest income is recognized according to each agreement between a borrower and the Company on an accrual basis. For notes receivable with banks, the interest rates are determined by banks. For notes receivable with other parties, the interest rates are based on agreements between the parties. If notes receivable are paid back, that transaction will be recognized in the relevant year. If notes receivable are not paid back, or are written off, that transaction will be recognized in the relevant year if default is probable, reasonably assured, and the loss can be reasonably estimated. The Company will recognize income if the written-off loan is recovered at a future date. In case of any foreclosure proceedings or legal actions, the Company provides an accrual for the related foreclosure and litigation expenses. The Company also receives notes receivable from the JV Company and other parties to settle accounts receivable. If the Company decides to discount notes receivable for the purpose of receiving immediate cash, the current discount rate is approximately in the range of 4.80% to 5.00% annually. As of March 31, 2018 and December 31, 2017, the Company had notes receivable from JV Company and other related parties of $7,611,283 and $1,137,289, respectively, which notes receivable typically mature within six months.

(g) Advances to Suppliers

Advances to suppliers represent cash paid in advance to suppliers, and include advances to raw material suppliers, mold manufacturers, and equipment suppliers.

As of March 31, 2018, the Company had made a total advance payments of RMB 744 million (approximately $118 million) to Nanjing Shangtong Auto Technologies Co., Ltd. (“Nanjing Shangtong”) as an advance to purchase a production line and develop a new EV model for Kandi Hainan. Nanjing Shangtong is a total solutions contractor for Kandi Hainan and provides all the equipment and EV product design and research services used by Kandi Hainan. After part of such advances were transferred to construction in progress and expensed for R&D purposes, the Company had $12,171,480 left in Advance to Suppliers in current assets and $12,782,016 left in Advance to Suppliers in long-term assets related to the purchases from Nanjing Shangtong as of March 31, 2018.

Advances for raw material purchases are typically settled within two months of the Company’s receipt of the raw materials. Prepayment is offset against the purchase price after the equipment or materials are delivered.

| 11 |

(h) Property, Plants and Equipment

Property, plants and equipment are carried at cost less accumulated depreciation. Depreciation is calculated over the asset’s estimated useful life using the straight-line method. Leasehold improvements are amortized over the life of the asset or the term of the lease, whichever is shorter. Estimated useful lives are as follows:

| Buildings | 30 years | |||

| Machinery and equipment | 10 years | |||

| Office equipment | 5 years | |||

| Motor vehicles | 5 years | |||

| Molds | 5 years |

The costs and related accumulated depreciation of assets sold or otherwise retired are eliminated from the Company’s accounts and any gain or loss is included in the statements of income. The cost of maintenance and repairs is charged to expenses as incurred, whereas significant renewals and betterments are capitalized.

(i) Construction in Progress

Construction in progress (“CIP”) represents the direct costs of construction, and the acquisition costs of buildings or machinery. Capitalization of these costs ceases, and construction in progress is transferred to plants and equipment, when substantially all the activities necessary to prepare the assets for their intended use are completed. No depreciation is provided for until the assets are completed and ready for their intended use. $2,854,673 of interest expenses had been capitalized for CIP as of March 31, 2018.

(j) Land Use Rights

Land in China is owned by the government and land ownership rights cannot be sold to an individual or to a private company. However, the Chinese government grants the user a “land use right” to use the land. The land use rights granted to the Company are amortized using the straight-line method over a term of fifty years.

(k) Accounting for the Impairment of Long-Lived Assets

The Company periodically evaluates the carrying value of long-lived assets to be held and used, including intangible assets subject to amortization, when events and circumstances warrant such a review, pursuant to the guidelines established in Statement of Financial Accounting Standards (“SFAS”) No. 144 (now known as “ASC 360”). The carrying value of a long-lived asset is considered impaired when the anticipated undiscounted cash flow from such asset is separately identifiable and is less than its carrying value. In that event, a loss is recognized based on the amount by which the carrying value exceeds the fair market value of the long-lived asset. Fair market value is determined primarily using the anticipated cash flows discounted at a rate commensurate with the risk involved. Losses on long-lived assets to be disposed of are determined in a similar manner, except that fair market values are reduced for disposal costs.

The Company recognized no impairment loss during the reporting period.

(l) Revenue Recognition

The Company adopted ASC Topic 606 Revenue from Contracts with Customers with a date of the initial application of January 1, 2018 using the modified retrospective method. As a result, the Company has changed its accounting policy for revenue recognition. The impact of the adoption of ASC Topic 606 on the Company’s condensed consolidated financial statements is not material.

The Company recognizes revenue when goods or services are transferred to customers in an amount that reflects the consideration which it expects to receive in exchange for those goods or services. In determining when and how revenue is recognized from contracts with customers, the Company performs the following five-step analysis: (i) identification of contract with customer; (ii) determination of performance obligations; (iii) measurement of the transaction price; (iv) allocation of the transaction price to the performance obligations; and (v) recognition of revenue when (or as) the Company satisfies each performance obligation.

| 12 |

The Company generates revenue through the sale of EV products, EV parts and off-road vehicles. The revenue is recognized at a point in time once the Company has determined that the customer has obtained control over the product. Control is typically deemed to have been transferred to the customer when the performance obligation is fulfilled, usually at the time of delivery, at the net sales price (transaction price). Estimates of variable consideration, such as volume discounts and rebates, are determined, reviewed and revised periodically by management. Revenue is recognized net of any taxes collected from customers, which are subsequently remitted to governmental authorities. Shipping and handling costs for product shipments occur prior to the customer obtaining control of the goods are accounted for as fulfillment costs rather than separate performance obligations and recorded as sales and marketing expenses.

The Company’s contracts are predominantly short-term in nature with a contract term of one year or less. For those contracts, the Company has utilized the practical expedient in ASC Topic 606 exempting the Company from disclosure of the transaction price allocated to remaining performance obligations if the performance obligation is part of a contract that has an original expected duration of one year or less.

Receivables are recorded when the Company has an unconditional right to consideration.

See Note 24 “Segment Reporting” for disaggregation of revenue by reporting segments. The Company believes this disaggregation best depicts how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors.

(m) Research and Development

Expenditures relating to the development of new products and processes, including improvements to existing products, are expensed as incurred. Research and development expenses were $757,298 and $20,769,732 for the three months ended March 31, 2018, and March 31, 2017, respectively.

(n) Government Grants

Grants and subsidies received from the Chinese government are recognized when the proceeds are received or collectible and related milestones have been reached and all contingencies have been resolved.

For the three months ended March 31, 2018 and March 31, 2017, $95,255 and $5,067,474, respectively, were received by the Company’s subsidiaries from the Chinese government.

(o) Income Taxes

The Company accounts for income tax using an asset and liability approach, which allows for the recognition of deferred tax benefits in future years. Under the asset and liability approach, deferred taxes are provided for the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The accounting for deferred tax calculation represents the Company management’s best estimate of the most likely future tax consequences of events that have been recognized in our financial statements or tax returns and related future anticipation. A valuation allowance is provided for deferred tax assets if it is more likely than not these items will either expire before the Company is able to realize their benefits, or that future realization will be uncertain.

(p) Foreign Currency Translation

The accompanying consolidated financial statements are presented in United States dollars. The functional currency of the Company is the Renminbi (RMB). Capital accounts of the consolidated financial statements are translated into United States dollars from RMB at their historical exchange rates when the capital transactions occurred.

Assets and liabilities are translated at the exchange rates as of balance sheet date. Income and expenditures are translated at the average exchange rate of the reporting period, which rates are obtained from the website: http://www.oanda.com

| March 31, | December 31, | March 31, | ||||||||||

| 2018 | 2017 | 2017 | ||||||||||

| Period end RMB : USD exchange rate | 6.28015 | 6.5067 | 6.890530 | |||||||||

| Average RMB : USD exchange rate | 6.356627 | 6.7568 | 6.888178 | |||||||||

| 13 |

(q) Comprehensive Income

Comprehensive income is defined to include all changes in equity except those resulting from investments by owners and distributions to owners. Among other disclosures, all items that are required to be recognized under current accounting standards as components of comprehensive income are required to be reported in a financial statement that is presented with the same prominence as other financial statements. Comprehensive income includes net income and the foreign currency translation changes.

(r) Segments

In accordance with ASC 280-10, Segment Reporting, the Company’s chief operating decision makers rely upon the consolidated results of operations when making decisions about allocating resources and assessing the performance of the Company. As a result of the assessment made by the Company’s chief operating decision makers, the Company has only one operating segment. The Company does not distinguish between markets or segments for the purpose of internal reporting.

(s) Stock Option Expenses

The Company’s stock option expenses are recorded in accordance with ASC 718 and ASC 505.

The fair value of stock options is estimated using the Black-Scholes-Merton model. The Company’s expected volatility assumption is based on the historical volatility of the Company’s common stock. The expected life assumption is primarily based on the expiration date of the option. The risk-free interest rate for the expected term of the option is based on the U.S. Treasury yield curve in effect at the time of grant.

The recognition of stock option expenses is based on awards expected to vest. ASC standards require forfeitures to be estimated at the time of grant and revised in subsequent periods, if necessary, if actual forfeitures differ from those estimates.

The stock-based option expenses for the three months ended March 31, 2018 and March 31, 2017, were $997,496 net of a reversal for forfeited stock option of $2,644,877 and $1,133,519, respectively. See Note 19. There were no forfeitures estimated during the reporting period.

(t) Goodwill

The Company allocates goodwill from business combinations to reporting units based on the expectation that the reporting unit is to benefit from the business combination. The Company evaluates its reporting units on an annual basis and, if necessary, reassigns goodwill using a relative fair value allocation approach. Goodwill is tested for impairment at the reporting unit level on an annual basis and between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying value. These events or circumstances could include a significant change in the business climate, legal factors, operating performance indicators, competition, or sale or disposition of a significant portion of a reporting unit.

Application of the goodwill impairment test requires judgments, including the identification of reporting units, assignment of assets and liabilities to reporting units, assignment of goodwill to reporting units, and the determination of the fair value of each reporting unit. The Company first assesses qualitative factors to determine whether it is more likely than not that goodwill is impaired. If the more likely than not threshold is met, the Company performs a quantitative impairment test.

As of March 31, 2018 and March 31, 2017, the Company determined that its goodwill was not impaired.

| 14 |

(u) Intangible assets

Intangible assets consist of patent, trade names and customer relations associated with the purchase price from the allocation of YongkangScrou and JinhuaAn Kao. Such assets are being amortized over their estimated useful lives. Intangible assets are amortized as of March 31, 2018. The amortization expenses for intangible assets were $169,821 and $20,524 for the three months ended March 31, 2018 and March 31, 2017, respectively.

(v) Accounting for Sale of Common Stock and Warrants

Gross proceeds are first allocated according to the initial fair value of the freestanding derivative instruments (i.e. the warrants issued to the Company’s investors in its previous offerings, or the “Investor Warrants”). The remaining proceeds are allocated to common stock. The related issuance expenses, including the placement agent cash fees, legal fees, the initial fair value of the warrants issued to the placement agent and others were allocated between the common stock and the Investor Warrants based on how the proceeds are allocated to these instruments. Expenses related to the issuance of common stock were charged to paid-in capital. Expenses related to the issuance of derivative instruments were expensed upon issuance.

(w) Consolidation of variable interest entities

In accordance with accounting standards regarding consolidation of variable interest entities, or VIEs, VIEs are generally entities that lack sufficient equity to finance their activities without additional financial support from other parties or whose equity holders lack adequate decision making ability. All VIEs with which the Company is involved must be evaluated to determine the primary beneficiary of the risks and rewards of the VIE. The primary beneficiary is required to consolidate the VIE for financial reporting purposes.

The Company has concluded, based on the contractual arrangements, that Kandi New Energy is a VIE and that the Company’s wholly-owned subsidiary, Kandi Vehicles, absorbs a majority of the risk of loss from the activities of this company, thereby enabling the Company, through Kandi Vehicles, to receive a majority of its respective expected residual returns.

Additionally, because Kandi New Energy is under common control with other entities, the consolidated financial statements have been prepared as if the transactions had occurred retroactively as to the beginning of the reporting period of these consolidated financial statements.

Control and common control are defined under the accounting standards as “an individual, enterprise, or immediate family members who hold more than 50 percent of the voting ownership interest of each entity.” Because the owners collectively own 100% of Kandi New Energy, and have agreed to vote their interests in concert since the establishment of each of these three companies as memorialized the Voting Rights Proxy Agreement, the Company believes that the owners collectively have control and common control of Kandi New Energy. Accordingly, the Company believes that Kandi New Energy was constructively held under common control by Kandi Vehicles as of the time the contractual agreements were entered into, establishing Kandi Vehicles as their primary beneficiary. Kandi Vehicles, in turn, is owned by Continental, which is owned by the Company.

(x) Reclassification

The Company adopted ASU 2016-18, “Statement of Cash Flows (Topic 230) - Restricted Cash” in the first quarter of 2018. Certain amounts included in the 2017 condensed consolidated statement of cash flows have been reclassified to conform to the 2018 financial statement presentation as follows:

The Company has included restricted cash of $12,957,377 and $14,222,418, respectively, with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows for the three months ended March 31, 2017. As a result, total amount at beginning of period on the statement of cash flows for the three months ended March 31, 2017 has changed from $12,235,921 to $25,193,298; and total amount at end of period on the statement of cash flows for the three months ended March 31, 2017 has changed from $2,044,025 to $16,266,443.

The Company has eliminated the line item of restricted cash of $(1,161,410) from the section of financing activities on the statement of cash flows for three months ended March 31, 2017. As a result, net cash provided by financing activities on the statement of cash flows for the three months ended March 31, 2017 has changed from $475,975 to $1,637,385.

NOTE 7 – NEW ACCOUNTING PRONOUNCEMENTS

Recent accounting pronouncements that the Company has adopted or may be required to adopt in the future are summarized below:

In May 2014, the FASB issued a new standard on revenue recognition related to contracts with customers. This standard supersedes nearly all existing revenue recognition guidance and involves a five-step principles-based approach to recognizing revenue. The new model requires revenue recognition to depict the transfer of promised goods or services to customers in an amount that reflects the consideration a company expects to receive. The new standard also require additional qualitative and quantitative about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments made in applying the revenue guidance, and assets recognized from the costs to obtain or fulfill a contract. The Company adopted this standard in the first quarter of 2018 using the modified retrospective approach. The impact of adoption on its Condensed Consolidated Balance Sheet, and cash provided by or used in operations for any period presented is not material.

| 15 |

In November 2015, the Financial Accounting Standards Board (“FASB”) issued ASU 2015-17, “Balance Sheet Classification of Deferred Taxes.” This ASU amends existing guidance to require that deferred income tax assets and liabilities be classified as non-current in a classified balance sheet, and eliminates the prior guidance which required an entity to separate deferred tax assets and liabilities into a current amount and a non-current amount in a classified balance sheet. The Company adopted this standard prospectively in the first quarter of 2018. The impact of adoption on its Condensed Consolidated Balance Sheet, and cash provided by or used in operations for any period presented is not material.

In November 2016, the FASB issued ASU 2016-18, “Statement of Cash Flows (Topic 230) - Restricted Cash,” (“ASU 2016-18”). This ASU requires a statement of cash flows to explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. Amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. The Company adopted this standard in the first quarter of 2018. The impact of adoption on its Condensed Consolidated Balance Sheet, and cash provided by or used in operations for any period presented is not material.

In February 2018, the FASB released ASU 2018-2, “Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income.” This standard update addresses a specific consequence of the Tax Cuts and Jobs Act (“U.S tax reform”) and allows a reclassification from accumulated other comprehensive income to retained earnings for the stranded tax effects resulting from U.S. tax reform. Consequently, the update eliminates the stranded tax effects that were created as a result of the historical U.S. federal corporate income tax rate to the newly enacted U.S. federal corporate income tax rate. The Company is required to adopt this standard in the first quarter of fiscal year 2020, with early adoption permitted. The amendments in this update should be applied either in the period of adoption or retrospectively to each period in which the effect of the change in the U.S federal corporate income tax rate in the Tax Cuts and Jobs Act is recognized. The Company is currently in the process of evaluating the impact of adoption on its Condensed Consolidated Financial Statements.

NOTE 8 – CONCENTRATIONS

(a) Customers

For the three-month periods ended March 31, 2018 and March 31, 2017, the Company’s major customers, each of whom accounted for more than 10% of the Company’s consolidated revenue, were as follows:

| Sales | Trade Receivable | |||||||||||||||

| Three Months | Three Months | |||||||||||||||

| Ended | Ended | |||||||||||||||

| March 31, | March 31, | March 31, | December 31, | |||||||||||||

| Major Customers | 2018 | 2017 | 2018 | 2017 | ||||||||||||

| Zhejiang Shikong Energy Technology Co., Ltd. | 45 | % | - | 4 | % | - | ||||||||||

| Kandi Electric Vehicles Group Co., Ltd. | 29 | % | 31 | % | 68 | % | 71 | % | ||||||||

| Zhejiang Kuke Sports Technology Co., Ltd. | 21 | % | 32 | % | 2 | % | - | |||||||||

| Jinhua Chaoneng Automobile Sales Co. Ltd. | - | 32 | % | 17 | % | - | ||||||||||

| 16 |

(b) Suppliers

For the three-month periods ended March 31, 2018 and March 31, 2017, the Company’s material suppliers, each of whom accounted for more than 10% of the Company’s total purchases, were as follows:

| Purchases | Accounts Payable | |||||||||||||||

| Three Months | Three Months | |||||||||||||||

| Ended | Ended | |||||||||||||||

| March 31, | March 31, | March 31, | December 31, | |||||||||||||

| Major Suppliers | 2018 | 2017 | 2018 | 2017 | ||||||||||||

| Shanghai de Lang Power Battery Co., Ltd. | 50 | % | - | 3 | % | - | ||||||||||

| Dongguan Chuangming Battery Technology Co., Ltd. | - | 38 | % | 19 | % | 19 | % | |||||||||

| Zhejiang Tianneng Energy Technology Co., Ltd. | - | 20 | % | 1 | % | 11 | % | |||||||||

NOTE 9 – EARNINGS PER SHARE

The Company calculates earnings per share in accordance with ASC 260, Earnings Per Share, which requires a dual presentation of basic and diluted earnings per share. Basic earnings per share are computed using the weighted average number of shares outstanding during the reporting period. Diluted earnings per share represents basic earnings per share adjusted to include the potentially dilutive effect of outstanding stock options, warrants and convertible notes (using the if-converted method). For the three months ended March 31, 2018 and March 31, 2017, the average number of potentially dilutive common share was zero. The potential dilutive common shares as at the three months ended March 31, 2018 and March 31, 2017, were 3,900,000 and 4,400,000 shares respectively.

The following is the calculation of earnings per share:

| For three months ended | ||||||||

| March 31, | ||||||||

| 2018 | 2017 | |||||||

| Net income (loss) | $ | 3,727,995 | $ | (24,153,435 | ) | |||

| Weighted average shares used in basic computation | 50,643,423 | 47,732,388 | ||||||

| Dilutive shares | - | - | ||||||

| Weighted average shares used in diluted computation | $ | 50,643,423 | $ | 47,732,388 | ||||

| Earnings per share: | ||||||||

| Basic | $ | 0.07 | $ | (0.51 | ) | |||

| Diluted | $ | 0.07 | $ | (0.51 | ) | |||

| 17 |

NOTE 10 – ACCOUNTS RECEIVABLE

Accounts receivable are summarized as follows:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Accounts receivable | $ | 27,618,769 | $ | 34,531,788 | ||||

| Less: allowance for doubtful accounts | (382,108 | ) | (133,930 | ) | ||||

| Accounts receivable, net | $ | 27,236,661 | $ | 34,397,858 | ||||

NOTE 11 – INVENTORIES

Inventories are summarized as follows:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Raw material | $ | 5,136,566 | $ | 7,256,498 | ||||

| Work-in-progress | 2,552,452 | 2,831,678 | ||||||

| Finished goods | 10,393,758 | 6,512,537 | ||||||

| Total inventories | 18,082,776 | 16,600,713 | ||||||

| Less: provision for slowing moving inventories | (643,318 | ) | (620,919 | ) | ||||

| Inventories, net | $ | 17,439,458 | $ | 15,979,794 | ||||

NOTE 12 – NOTES RECEIVABLE

As of March 31, 2018 and December 31, 2017, there is no notes receivable from an unrelated party.

Notes receivable from the JV Company and related parties as of March 31, 2018, and December 31, 2017, are summarized as follows:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Notes receivable as below: | ||||||||

| Bank acceptance notes | $ | 7,611,283 | $ | 1,137,289 | ||||

| Notes receivable | $ | 7,611,283 | $ | 1,137,289 | ||||

Details of notes receivable from the JV Company and related parties as of March 31, 2018, are as set forth below:

| Index | Amount ($) | Counter party | Relationship | Nature | Manner of settlement | ||||||||

| 1 | 7,611,283 | Kandi Electric Vehicles Group Co., Ltd. | Joint Venture of the Company | Payments for sales | Not due | ||||||||

| 18 |

Details of notes receivable from the JV Company and related parties as of December 31, 2017, are as set forth below:

| Index | Amount ($) | Counter party | Relationship | Nature | Manner of settlement | ||||||||

| 1 | 922,126 | Kandi Electric Vehicles Group Co., Ltd. | Joint Venture of the Company | Payments for sales | Not due | ||||||||

| 2 | 153,688 | Kandi Jiangsu | Subsidiary of the JV Company | Payments for sales | Not due | ||||||||

| 3 | 61,475 | KandiChangxing | Subsidiary of the JV Company | Payments for sales | Not due | ||||||||

NOTE 13 – PROPERTY, PLANT AND EQUIPMENT

Property, plants and equipment as of March 31, 2018 and December 31, 2017, consisted of the following:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| At cost: | ||||||||

| Buildings | $ | 14,353,933 | $ | 13,853,340 | ||||

| Machinery and equipment | 10,338,034 | 7,916,562 | ||||||

| Office equipment | 673,365 | 532,774 | ||||||

| Motor vehicles and other transport equipment | 421,677 | 382,866 | ||||||

| Moulds and others | 29,693,584 | 28,659,714 | ||||||

| $ | 55,480,593 | $ | 51,345,256 | |||||

| Less : Accumulated depreciation | ||||||||

| Buildings | $ | (4,973,076 | ) | $ | (4,683,040 | ) | ||

| Machinery and equipment | (7,546,513 | ) | (7,216,464 | ) | ||||

| Office equipment | (337,503 | ) | (305,367 | ) | ||||

| Motor vehicles and other transport equipment | (331,698 | ) | (310,631 | ) | ||||

| Moulds and others | (27,659,460 | ) | (26,306,306 | ) | ||||

| (40,848,250 | ) | (38,821,808 | ) | |||||

| Less: provision for impairment for fixed assets | (541,324 | ) | (522,477 | ) | ||||

| Property, Plant and equipment, net | $ | 14,091,019 | $ | 12,000,971 | ||||

As of March 31, 2018 and December 31, 2017, the net book value of plants and equipment pledged as collateral for bank loans was $9,227,776 and $9,019,993, respectively.

Depreciation expenses for the three months ended March 31, 2018 and March 31, 2017 were $618,540 and $1,064,568, respectively.

| 19 |

NOTE 14 – LAND USE RIGHTS

The Company’s land use rights consist of the following:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Cost of land use rights | $ | 16,342,577 | $ | 15,676,450 | ||||

| Less: Accumulated amortization | (3,208,982 | ) | (3,010,403 | ) | ||||

| Land use rights, net | $ | 13,133,595 | $ | 12,666,047 | ||||

As of March 31, 2018, and December 31, 2017, the net book value of land use rights pledged as collateral for the Company’s bank loans was $9,253,431 and $8,993,913, respectively. Also see Note 16.

The amortization expenses for the three months ended March 31, 2018 and March 31, 2017, were $88,899 and $79,538, respectively. Amortization expenses for the next five years and thereafter is as follows:

| 2018 (Nine Months) | $ | 266,697 | ||

| 2019 | 355,596 | |||

| 2020 | 355,596 | |||

| 2021 | 355,596 | |||

| 2022 | 355,596 | |||

| Thereafter | 11,444,514 | |||

| Total | $ | 13,133,595 |

NOTE 15 – CONSTRUCTION-IN-PROGRESS

Hainan Facility

In April 2013, the Company signed an agreement with the Wanning city government in Hainan Province to invest a total of RMB 1 billion to establish a factory in Wanning to manufacture 100,000 EVs annually. In January 2016, the Hainan Province government implemented a development plan to centralize manufacturing in certain designated industry parks. As a result, the Wanning facility was relocated from Wanning city to the Haikou city high-tech zone. Based on the agreement with the government, all the expenses and lost assets resulting from the relocation were compensated for by the local government. As a result of the relocation, the contracts to build the manufacturing facility had to be revised in terms of total contract amount, technical requirements, completion milestones and others for the new construction site in Haikou. Currently, the Hainan facility is progressing well. The first batch of products was off the assembly line on March 28, 2018. The prototype is currently under the inspection by the government designated inspection authorities. The Company expects the inspection will be completed by the end of June and the products will be put on the market thereafter.

| 20 |

No depreciation is provided for CIP until such time as the facility is completed and placed into operation.

The contractual obligations under CIP of the Company as of March 31, 2018 are as follows:

| Total in CIP as of | Total | |||||||||||

| March 31, | Estimate to | contract | ||||||||||

| Project | 2018 | complete | amount | |||||||||

| Kandi Hainan facility | $ | 58,840,459 | $ | 31,139,268 | $ | 89,979,727 | ||||||

| Total | $ | 58,840,459 | $ | 31,139,268 | $ | 89,979,727 | ||||||

As of March 31, 2018, and December 31, 2017, the Company had CIP amounting to $58,840,459 and $53,083,925, respectively.

$673,161 and $507,944 of interest expense has been capitalized for CIP for three months ended March 31, 2018 and 2017, respectively.

NOTE 16 – SHORT -TERM AND LONG-TERM BANK LOANS

Short-term loans are summarized as follows:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Loans from China Ever-bright Bank | ||||||||

| Interest rate 5.22% per annum, paid off on April 25, 2018, secured by the assets of Kandi Vehicle, guaranteed by Mr. Hu Xiaoming and his wife, also guaranteed by Company’s subsidiaries. Also see Note 13 and Note 14. | $ | 11,146,230 | $ | 10,758,141 | ||||

| Loans from Hangzhou Bank | ||||||||

| Interest rate 4.79% per annum, due on October 16, 2018, secured by the assets of Kandi Vehicle. Also see Note 13 and Note 14. | 7,770,515 | 7,499,962 | ||||||

| Interest rate 4.79% per annum, due on July 4, 2018, secured by the assets of Kandi Vehicle. Also see Note 13 and Note 14. | 11,496,541 | 11,096,255 | ||||||

| Interest rate 4.35% per annum, paid off on March 26, 2018, secured by the assets of Kandi Vehicle. Also see Note 13 and Note 14. | - | 3,688,506 | ||||||

| Interest rate 5.66% per annum, due March 25, 2019, secured by the assets of Kandi Vehicle. Also see Note 13 and Note 14. | 3,821,565 | - | ||||||

| $ | 34,234,851 | $ | 33,042,864 | |||||

Long-term loans are summarized as follows:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||