Exhibit

PARKE BANCORP, INC.

2017 ANNUAL REPORT TO SHAREHOLDERS

PARKE BANCORP, INC.

2017 ANNUAL REPORT TO SHAREHOLDERS

|

| | | |

TABLE OF CONTENTS |

| |

| Page |

Section One | |

| |

Letter to Shareholders................................................................................................................................ | |

| |

Selected Financial Data.............................................................................................................................. | |

| |

Management’s Discussion and Analysis of Financial Condition and Results of Operations...................... | |

| |

Market Prices and Dividends...................................................................................................................... | |

| |

Section Two | |

| |

Management’s Report on Internal Control Over Financial Reporting......................................................... | |

| |

Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting | |

| |

Report of Independent Registered Public Accounting Firm on the Consolidated Financial Statements.... | |

| |

Consolidated Financial Statements............................................................................................................ | |

| |

Notes to Consolidated Financial Statements.............................................................................................. | |

| |

Officers and Corporate Information............................................................................................................ | |

| | |

| | |

To Our Shareholders:

It is sometimes difficult to believe that we are starting our 20th year in business. Many of you were right there with us investing in our Company when all we could present to you was our business plan and goals to build a quality bank in the Delaware Valley region. Our initial investors provided $8 million dollars to start our de novo bank in a little bank trailer in Washington Township, NJ. Thanks to that investment, and our Board of Directors and staff, our Bank became profitable in our 13th month of operation, which at that time was a record for a de novo bank in New Jersey. Our Bank continued to grow and maintained profitability which supported our going public in 2002, raising an additional $8.5 million in capital. We continued to grow and generate strong profits, which provided the financial strength to open new branches in the region. Today we have seven branches stretching from the shore to Philadelphia and, as of the end of 2017, we are over $1 billion dollars in assets with shareholders’ equity of close to $135 million. Our Board of Directors focused on shareholder value, approving ten stock dividends since going public and cash dividends beginning in July of 2014. We have increased our cash dividend five times since first beginning to pay a cash dividend. Today we are paying 12 cents per share per quarter, up from our initial cash dividend of 5 cents per share per quarter. Our Board of Directors also issued a 10% stock dividend in 2017, again enhancing shareholder value. Our company’s growth in assets, loans, deposits and profitability continued through the most challenging recession, which started in 2007, since the Great Depression. Over the last five years our stock has outperformed the NASDAQ, S&P and DOW averages.

Strong operating profits continued in 2017 with Net Income of $10.8 million, after taking the non-recurring deferred tax asset charge of $3.2 million, due to the new tax law that was passed in December 2017. The new tax law dampened our earnings in 2017, due to the lowering of the corporate tax rate from 35% to 21%. Based on our Company’s past performance, we believe the new tax rate will support the charge being recovered by year-end 2018. The deferred tax asset charge reduced our ROAA from 1.43% to 1.13% and our ROAE from 12.19% to 9.40% in 2017. Our Company’s strong operating income was supported by our loan portfolio growing to over $1 billion by the end of 2017, close to a 20% increase from the end of 2016. Our deposits grew to $866 million at year-end, a 10% increase from the end of 2016, which helped support the growth of our loan portfolio. We maintained very tight controls on our Company’s expenses ending the year with a cost efficiency ratio of 36.39%, which again makes us one of the leaders in controlling expenses in our peer group.

We have an unwavering commitment to reducing our non-performing assets (“NPAs”). Our non-performing loans decreased 60% in 2017 to $4.5 million, a decrease of $6.8 million from the end of 2016. OREO decreased to $7.2 million, a 31% reduction from $10.5 million at the end of 2016. The Company’s NPAs to total assets ratio is 1.04%, down from 2.15% at the end of 2016. Our focus continues to be on reducing our NPAs through aggressive workouts of these assets rather than selling them at a deep discount, preserving shareholder value.

Last year we discussed the possibility of the business environment improving due to promised changes in regulations and the anticipation of a new tax bill being passed. There have been many regulations removed or amended to assist various industries with growth and employment. There also was a new tax law passed in December of 2017. The new tax bill did not have a direct effect on the country’s 2017 economy, however, the GDP experienced strong growth.

When the new tax law was passed, many companies announced moving their operations and cash back to the United States, while other companies announced the expansion of their existing operation, with some announcing construction of new plants in the US, which will support additional growth.

Several companies, including Parke Bank, increased the starting salaries of entry-level employees while others issued special bonuses to their employees. Employee wages increased and 200,000 new jobs were added in January of 2018. All good news, right? Not so fast, alarms sounded that the economy would be overheating and increased wages will spike inflation which may force the Fed to accelerate their plans to raise interest rates. A volatile and uncertain economy is certainly nothing new. However, we believe our Company is well positioned to take advantage of opportunities in the market.

Parke Bancorp’s Board, Management and Staff will be working hard in what looks to be another exciting year in 2018. We are currently working on the potential of opening two new Loan Production Offices, which could help the strong

loan growth that we enjoyed in 2017. We are also working on new products including offering credit cards and upgrading our debit card process, in addition to new loan products. Thanks to you, our shareholders, we have the capital to expand our market share, increase lending and grow the profitability of our Company.

|

| | |

/s/ C.R. Pennoni | | /s/ Vito S. Pantilione |

C.R. “Chuck” Pennoni | | Vito S. Pantilione |

Chairman | | President and Chief Executive Officer |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | | | | | | | | | | | | | | | | | | |

| Selected Financial Data At or for the Year Ended December, 31 |

| 2017 | | 2016 | | 2015 | | 2014 | | 2013 |

Balance Sheet Data: (in thousands) | | | | | | | | | |

Assets | $ | 1,137,452 |

| | $ | 1,016,185 |

| | $ | 885,124 |

| | $ | 821,706 |

| | $ | 794,943 |

|

Loans, Net | $ | 995,184 |

| | $ | 836,373 |

| | $ | 742,365 |

| | $ | 695,018 |

| | $ | 635,981 |

|

Securities Available for Sale | $ | 37,991 |

| | $ | 44,854 |

| | $ | 42,567 |

| | $ | 28,208 |

| | $ | 35,695 |

|

Securities Held to Maturity | $ | 2,268 |

| | $ | 2,224 |

| | $ | 2,181 |

| | $ | 2,141 |

| | $ | 2,103 |

|

Cash and Cash Equivalents | $ | 42,113 |

| | $ | 70,720 |

| | $ | 27,429 |

| | $ | 36,238 |

| | $ | 45,661 |

|

OREO | $ | 7,248 |

| | $ | 10,528 |

| | $ | 16,629 |

| | $ | 20,931 |

| | $ | 28,910 |

|

Deposits | $ | 866,383 |

| | $ | 788,694 |

| | $ | 665,210 |

| | $ | 647,933 |

| | $ | 626,768 |

|

Borrowings | $ | 128,053 |

| | $ | 93,053 |

| | $ | 98,053 |

| | $ | 62,755 |

| | $ | 68,683 |

|

Shareholders' Equity | $ | 134,780 |

| | $ | 127,134 |

| | $ | 112,040 |

| | $ | 102,905 |

| | $ | 93,716 |

|

Operational Data: (in thousands) | | | | | | | | | |

Interest Income | $ | 48,655 |

| | $ | 42,202 |

| | $ | 39,410 |

| | $ | 38,132 |

| | $ | 36,784 |

|

Interest Expense | 8,280 |

| | 6,764 |

| | 5,812 |

| | 5,579 |

| | 5,795 |

|

Net Interest Income | 40,375 |

| | 35,438 |

| | 33,598 |

| | 32,553 |

| | 30,989 |

|

Provision for Loan Losses | 2,500 |

| | 1,462 |

| | 3,040 |

| | 3,250 |

| | 2,700 |

|

Net Interest Income after Provision for Loan Losses | 37,875 |

| | 33,976 |

| | 30,558 |

| | 29,303 |

| | 28,289 |

|

Noninterest Income | 1,645 |

| | 10,290 |

| | 5,080 |

| | 7,631 |

| | 3,426 |

|

Noninterest Expense | 15,293 |

| | 16,628 |

| | 16,852 |

| | 18,911 |

| | 18,852 |

|

Income Before Income Tax Expense | 24,227 |

| | 27,638 |

| | 18,786 |

| | 18,023 |

| | 12,863 |

|

Income Tax Expense | 12,389 |

| | 8,695 |

| | 6,843 |

| | 5,711 |

| | 5,024 |

|

Net Income Attributable to Company and Noncontrolling Interest | 11,838 |

| | 18,943 |

| | 11,943 |

| | 12,312 |

| | 7,839 |

|

Net Income Attributable to Noncontrolling Interest | 32 |

| | (433 | ) | | (1,246 | ) | | (1,839 | ) | | (268 | ) |

Discount on Retirement of Preferred Shares | — |

| | — |

| | — |

| | — |

| | 1,948 |

|

Preferred Stock Dividend and Discount Accretion | 1,119 |

| | 1,200 |

| | 1,200 |

| | 1,200 |

| | 1,058 |

|

Net Income Available to Common Shareholders | $ | 10,751 |

| | $ | 17,310 |

| | $ | 9,497 |

| | $ | 9,273 |

| | $ | 8,461 |

|

Per Share Data: 1 | | | | | | | | | |

Basic Earnings per Common Share | $ | 1.40 |

| | $ | 2.31 |

| | $ | 1.56 |

| | $ | 1.41 |

| | $ | 1.29 |

|

Diluted Earnings per Common Share | $ | 1.24 |

| | $ | 1.92 |

| | $ | 1.34 |

| | $ | 1.06 |

| | $ | 1.29 |

|

Book Value per Common Share | $ | 14.96 |

| | $ | 14.39 |

| | $ | 12.52 |

| | $ | 11.72 |

| | $ | 10.47 |

|

Performance Ratios: | | | | | | | | | |

Return on Average Assets | 1.13 | % | | 1.97 | % | | 1.25 | % | | 1.30 | % | | 1.01 | % |

Return on Average Common Equity | 9.40 | % | | 17.04 | % | | 10.82 | % | | 11.77 | % | | 12.04 | % |

Net Interest Margin | 4.01 | % | | 3.96 | % | | 4.14 | % | | 4.33 | % | | 4.36 | % |

Efficiency Ratio | 36.39 | % | | 45.64 | % | | 43.57 | % | | 47.06 | % | | 54.78 | % |

Capital Ratios: | | | | | | | | | |

Equity to Assets | 11.85 | % | | 12.51 | % | | 12.68 | % | | 12.53 | % | | 11.64 | % |

Dividend Payout | 34.29 | % | | 13.44 | % | | 16.90 | % | | — | % | | — | % |

Tier 1 Risk-based Capital2 | 15.56 | % | | 16.67 | % | | 15.87 | % | | 15.97 | % | | 15.65 | % |

Total Risk-based Capital2 | 16.81 | % | | 17.93 | % | | 17.13 | % | | 17.22 | % | | 16.92 | % |

Asset Quality Ratios: | | | | | | | | | |

Nonperforming Loans/Total Loans | 0.45 | % | | 1.30 | % | | 1.79 | % | | 3.77 | % | | 5.49 | % |

Allowance for Loan Losses/Total Loans | 1.63 | % | | 1.83 | % | | 2.13 | % | | 2.53 | % | | 2.84 | % |

Allowance for Loan Losses/Non-performing Loans | 364.68 | % | | 137.90 | % | | 119.01 | % | | 67.09 | % | | 51.62 | % |

1 Per share computations give retroactive effect to stock dividends declared in each of 2013, 2016 and 2017 |

2 Capital ratios for Parke Bank |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

Forward Looking Statements

Parke Bancorp, Inc. (the “Company”) may from time to time make written or oral "forward‑looking statements", including statements contained in the Company's filings with the Securities and Exchange Commission (including the Proxy Statement and the Annual Report on Form 10‑K, including the exhibits), in its reports to stockholders and in other communications by the Company, which are made in good faith by the Company.

These forward‑looking statements involve risks and uncertainties, such as statements of the Company's plans, objectives, expectations, estimates and intentions, which are subject to change based on various important factors (some of which are beyond the Company's control). The following factors, among others, could cause the Company's financial performance to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward‑looking statements: the strength of the United States economy in general and the strength of the local economies in which Parke Bank (the “Bank”) conducts operations; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rates, market and monetary fluctuations; the timely development of and acceptance of new products and services of the Bank and the perceived overall value of these products and services by users, including the features, pricing and quality compared to competitors' products and services; the impact of changes in financial services' laws and regulations (including laws concerning taxes, banking, securities and insurance); technological changes; changes in consumer spending and saving habits; and the success of the Bank at managing the risks resulting from these factors. The Company cautions that the listed factors are not exclusive.

Overview

The Company's results of operations are dependent primarily on the its net interest income, which is the difference between the interest income earned on its interest‑earning assets, such as loans and securities, and the interest expense paid on its interest‑bearing liabilities, such as deposits and borrowings. The Company also generates noninterest income such as service charges, Bank Owned Life Insurance (“BOLI”) income, gains on sales of loans guaranteed by the Small Business Administration (“SBA”) and other fees. The Company's noninterest expenses primarily consist of employee compensation and benefits, occupancy expenses, marketing expenses, professional services, FDIC insurance assessments, data processing costs and other operating expenses. The Company is also subject to losses from its loan portfolio if borrowers fail to meet their obligations. The Company's results of operations are also significantly affected by general economic and competitive conditions, particularly changes in market interest rates, government policies and actions of regulatory agencies.

Results of Operation

The Company recorded net income available to common shareholders of $10.8 million, or $1.24 per diluted common share, $17.3 million, or $1.92 per diluted common share and $9.5 million, or $1.12 per diluted common share, for 2017, 2016 and 2015, respectively. Pre-tax earnings amounted to $24.2 million for 2017, $27.6 million for 2016 and $18.8 million for 2015.

As a result of the enactment of the Tax Cuts and Jobs Act on December 22, 2017, the Company was required to re-value its net deferred tax asset (“DTA”). The DTA was written down by $3.2 million, due to the reduced tax rate, through a non-recurring charge to provision for income taxes. The Company expects to benefit prospectively from the reduced corporate tax rate and should recover this charge in less than one year.

On April 29, 2016, the Bank and its majority-owned subsidiary, 44 Business Capital, LLC ("44BC") completed the sale transaction of the assets of 44BC and certain related assets held by the Bank to Berkshire Bank ("Berkshire"). Under the transaction, Berkshire purchased the assets of 44BC. In addition, Berkshire purchased the Bank's SBA loan portfolio, totaling $42.6 million, and related servicing rights held by the Bank. The after-tax gain to the Bank was approximately $5.9 million.

Total assets of $1.1 billion at December 31, 2017, represented an increase of $121.3 million, or 11.9%, from December 31, 2016. Total gross loans amounted to $1.0 billion at year end 2017 for an increase of $159.8 million, or 18.8% from December 31, 2016. Deposits increased by $77.7 million, an increase of 9.9%. Total shareholders’ equity at December 31, 2017 amounted to $134.8 million an increase of $7.7 million, or 6.0%, during the past year.

The principal objective of this financial review is to provide a discussion and an overview of our consolidated financial condition and results of operations. This discussion should be read in conjunction with the accompanying financial statements and related notes thereto.

Comparative Average Balances, Yields and Rates. The following table sets forth average balance sheets, average yields and costs, and certain other information for the periods indicated. Interest rate spread is the difference between the average yield earned on interest-earning assets and the average rate paid on interest-bearing liabilities. Net interest margin is net interest income divided by average earning assets. All average balances are daily average balances. Non-accrual loans were included in the computation of average balances and have been reflected in the table as loans carrying a zero yield. The yields set forth below include the effect of deferred fees, discounts and premiums that are amortized or accreted to interest income or expense.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Years Ended December 31, |

| 2017 | | 2016 | | 2015 |

| Average Balance | Interest Income/ Expense | Yield/ Cost | | Average Balance | Interest Income/ Expense | Yield/ Cost | | Average

Balance | Interest

Income/

Expense | Yield/

Cost |

| (Amounts in thousands except Yield/ Cost data) |

Assets | | | | | | | | | | | |

Loans | $ | 923,271 |

| $ | 46,847 |

| 5.07 | % | | $ | 800,677 |

| $ | 40,740 |

| 5.09 | % | | $ | 731,032 |

| $ | 38,035 |

| 5.20 | % |

Investment securities | 49,329 |

| 1,429 |

| 2.90 | % | | 46,782 |

| 1,245 |

| 2.66 | % | | 47,323 |

| 1,296 |

| 2.74 | % |

Federal funds sold and cash equivalents | 35,274 |

| 379 |

| 1.07 | % | | 46,791 |

| 217 |

| 0.46 | % | | 33,184 |

| 79 |

| 0.24 | % |

Total interest-earning assets | 1,007,874 |

| $ | 48,655 |

| 4.83 | % | | 894,250 |

| $ | 42,202 |

| 4.72 | % | | 811,539 |

| $ | 39,410 |

| 4.86 | % |

Non-interest earning assets | 62,622 |

| |

| |

| | 61,735 |

| |

| |

| | 59,545 |

| | |

|

Allowance for loan losses | (16,052 | ) | |

| |

| | (15,534 | ) | |

| |

| | (17,243 | ) | | |

|

Total assets | $ | 1,054,444 |

| |

| |

| | $ | 940,451 |

| |

| |

| | $ | 853,841 |

| | |

|

Liabilities and Equity | |

| |

| |

| | |

| |

| |

| | | | |

|

Interest bearing deposits | |

| |

| |

| | |

| |

| |

| | | | |

|

NOWs | $ | 42,582 |

| $ | 209 |

| 0.49 | % | | $ | 32,499 |

| $ | 163 |

| 0.50 | % | | $ | 31,318 |

| $ | 154 |

| 0.49 | % |

Money markets | 138,084 |

| 1,071 |

| 0.78 | % | | 123,017 |

| 625 |

| 0.51 | % | | 112,180 |

| 559 |

| 0.50 | % |

Savings | 180,908 |

| 960 |

| 0.53 | % | | 175,163 |

| 931 |

| 0.53 | % | | 188,392 |

| 1,006 |

| 0.53 | % |

Time deposits | 288,617 |

| 3,373 |

| 1.17 | % | | 284,018 |

| 3,319 |

| 1.17 | % | | 251,816 |

| 2,836 |

| 1.13 | % |

Brokered certificates of deposit | 74,357 |

| 865 |

| 1.16 | % | | 45,961 |

| 380 |

| 0.83 | % | | 30,337 |

| 189 |

| 0.62 | % |

Total interest-bearing deposits | 724,548 |

| 6,478 |

| 0.89 | % | | 660,658 |

| 5,418 |

| 0.82 | % | | 614,043 |

| 4,744 |

| 0.77 | % |

Borrowings | 105,108 |

| 1,802 |

| 1.71 | % | | 90,048 |

| 1,346 |

| 1.49 | % | | 80,729 |

| 1,068 |

| 1.32 | % |

Total interest-bearing liabilities | 829,656 |

| $ | 8,280 |

| 1.00 | % | | 750,706 |

| $ | 6,764 |

| 0.90 | % | | 694,772 |

| $ | 5,812 |

| 0.84 | % |

Non-interest bearing deposits | 84,758 |

| |

| |

| | 62,483 |

| |

| |

| | 45,656 |

| | |

|

Other liabilities | 6,358 |

| |

| |

| | 5,656 |

| |

| |

| | 5,319 |

| | |

|

Total liabilities | 920,772 |

| |

| |

| | 818,845 |

| |

| |

| | 745,747 |

| | |

|

Equity | 133,672 |

| |

| |

| | 121,606 |

| |

| |

| | 108,094 |

| | |

|

Total liabilities and equity | $ | 1,054,444 |

| |

| |

| | $ | 940,451 |

| |

| |

| | $ | 853,841 |

| | |

|

Net interest income | |

| $ | 40,375 |

| |

| | |

| $ | 35,438 |

| |

| | | $ | 33,598 |

| |

|

Interest rate spread | |

| |

| 3.83 | % | | |

| |

| 3.82 | % | | | | 4.02 | % |

Net interest margin | |

| |

| 4.01 | % | | |

| |

| 3.96 | % | | | | 4.14 | % |

Rate/Volume Analysis. For each category of interest-earning assets and interest-bearing liabilities, information is provided on changes attributable to (i) changes in volume (i.e., changes in volume multiplied by the previous rate) and (ii) changes in rate (i.e., changes in rate multiplied by old volume). For purposes of this table, changes attributable to both rate and volume, which cannot be segregated, have been allocated proportionately to the change due to volume and the change due to rate.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Years ended December 31, |

| 2017 vs 2016 | | 2016 vs 2015 |

| Variance due to change in | | Variance due to change in |

| Average Volume | | Average Rate | | Net Increase/ (Decrease) | | Average Volume | | Average Rate | | Net Increase/ (Decrease) |

| (Amounts in thousands) |

Interest Income: | | | | | | | | | | | |

Loans (net of deferred costs/fees) | $ | 6,221 |

| | $ | (114 | ) | | $ | 6,107 |

| | $ | 3,559 |

| | $ | (854 | ) | | $ | 2,705 |

|

Investment securities | 70 |

| | 114 |

| | 184 |

| | (15 | ) | | (36 | ) | | (51 | ) |

Federal funds sold | (42 | ) | | 204 |

| | 162 |

| | 41 |

| | 97 |

| | 138 |

|

Total interest income | 6,249 |

| | 204 |

| | 6,453 |

| | 3,585 |

| | (793 | ) | | 2,792 |

|

Interest Expense: | |

| | |

| | |

| | |

| | |

| | |

|

Deposits | 500 |

| | 560 |

| | 1,060 |

| | 348 |

| | 326 |

| | 674 |

|

Borrowed funds | 243 |

| | 213 |

| | 456 |

| | 130 |

| | 148 |

| | 278 |

|

Total interest expense | 743 |

| | 773 |

| | 1,516 |

| | 478 |

| | 474 |

| | 952 |

|

Net interest income | $ | 5,506 |

| | $ | (569 | ) | | $ | 4,937 |

| | $ | 3,107 |

| | $ | (1,267 | ) | | $ | 1,840 |

|

Quarterly Financial Data (unaudited)

The following represents summarized unaudited quarterly financial data of the Company which, in the opinion of management, reflects adjustments (comprised only of normal recurring accruals) necessary for fair presentation.

|

| | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, | | September 30, | | June 30, | | March 31, |

| (Amounts in thousands, except per share amounts) |

2017 | | | | | | | |

Interest income | $ | 12,953 |

| | $ | 12,838 |

| | $ | 11,769 |

| | $ | 11,095 |

|

Interest expense | 2,325 |

| | 2,147 |

| | 1,967 |

| | 1,841 |

|

Net interest income | 10,628 |

| | 10,691 |

| | 9,802 |

| | 9,254 |

|

Provision for loan losses | 500 |

| | 500 |

| | 1,000 |

| | 500 |

|

Income before income tax expense | 6,340 |

| | 6,593 |

| | 5,833 |

| | 5,461 |

|

Income tax expense | 5,799 |

| | 2,435 |

| | 2,151 |

| | 2,004 |

|

Net income | 551 |

| | 4,161 |

| | 3,699 |

| | 3,459 |

|

Preferred stock dividends | 226 |

| | 297 |

| | 297 |

| | 299 |

|

Net income available to common shareholders | 325 |

| | 3,864 |

| | 3,402 |

| | 3,160 |

|

Net income per common share: | | | | | | | |

Basic | $ | 0.04 |

| | $ | 0.50 |

| | $ | 0.42 |

| | $ | 0.44 |

|

Diluted | $ | 0.06 |

| | $ | 0.42 |

| | $ | 0.37 |

| | $ | 0.39 |

|

|

| | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, | | September 30, | | June 30, | | March 31, |

| (Amounts in thousands, except per share amounts) |

2016 | |

| | |

| | |

| | |

|

Interest income | $ | 11,017 |

| | $ | 10,371 |

| | $ | 10,471 |

| | $ | 10,343 |

|

Interest expense | 1,762 |

| | 1,697 |

| | 1,714 |

| | 1,591 |

|

Net interest income | 9,255 |

| | 8,674 |

| | 8,757 |

| | 8,752 |

|

Provision for loan losses | 700 |

| | 700 |

| | (638 | ) | | 700 |

|

Income before income tax expense | 5,302 |

| | 3,927 |

| | 13,874 |

| | 4,535 |

|

Income tax expense | 1,944 |

| | 51 |

| | 5,154 |

| | 1,546 |

|

Net income | 3,377 |

| | 3,876 |

| | 8,648 |

| | 2,609 |

|

Preferred stock dividends | 300 |

| | 300 |

| | 300 |

| | 300 |

|

Net income available to common shareholders | 3,077 |

| | 3,576 |

| | 8,348 |

| | 2,309 |

|

Net income per common share: | | | | | | | |

Basic | $ | 0.45 |

| | $ | 0.52 |

| | $ | 1.20 |

| | $ | 0.36 |

|

Diluted | $ | 0.38 |

| | $ | 0.43 |

| | $ | 0.95 |

| | $ | 0.31 |

|

|

| | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, | | September 30, | | June 30, | | March 31, |

| (Amounts in thousands, except per share amounts) |

2015 | | | | | | | |

Interest income | $ | 10,159 |

| | $ | 9,918 |

| | $ | 9,933 |

| | $ | 9,400 |

|

Interest expense | 1,493 |

| | 1,501 |

| | 1,474 |

| | 1,344 |

|

Net interest income | 8,666 |

| | 8,417 |

| | 8,459 |

| | 8,056 |

|

Provision for loan losses | — |

| | 1,450 |

| | 750 |

| | 840 |

|

Income before income tax expense | 5,698 |

| | 4,658 |

| | 4,303 |

| | 4,127 |

|

Income tax expense | 2,204 |

| | 1,730 |

| | 1,388 |

| | 1,521 |

|

Net income | 3,246 |

| | 2,430 |

| | 2,522 |

| | 2,499 |

|

Preferred stock dividends | 300 |

| | 300 |

| | 300 |

| | 300 |

|

Net income available to common shareholders | 2,946 |

| | 2,130 |

| | 2,222 |

| | 2,199 |

|

Net income per common share: | | | | | | | |

Basic | $ | 0.48 |

| | $ | 0.35 |

| | $ | 0.37 |

| | $ | 0.37 |

|

Diluted | $ | 0.40 |

| | $ | 0.30 |

| | $ | 0.32 |

| | $ | 0.31 |

|

Critical Accounting Policies and Estimates

Allowance for Losses on Loans. The allowance for loan losses is established as losses are estimated to have occurred through a provision for loan losses. Loans that are determined to be uncollectible are charged against the allowance account, and subsequent recoveries, if any, are credited to the allowance. When evaluating the adequacy of the allowance, an assessment of the loan portfolio will typically include changes in the composition and volume of the loan portfolio, overall portfolio quality and past loss experience, review of specific problem loans, current economic conditions which may affect borrowers' ability to repay, and other factors which may warrant current recognition. Such periodic assessments may, in management's judgment, require the Company to recognize additions or reductions to the allowance.

Various regulatory agencies periodically review the adequacy of the Company’s allowance for loan losses as an integral part of their examination process. Such agencies may require the Company to recognize additions or reductions to the allowance based on their evaluation of information available to them at the time of their examination. It is reasonably possible that the above factors may change significantly and, therefore, affect management’s determination of the allowance for loan losses in the near term.

Valuation of Investment Securities. Available for sale securities are reported at fair market value with unrealized gains and losses reported, net of deferred taxes, as comprehensive income, a component of shareholders’ equity. The held to maturity securities portfolio, consisting of debt securities for which there is a positive intent and ability to hold to maturity, is carried at amortized cost. Management conducts a quarterly review and evaluation of the securities portfolio to determine if the value of any security has declined below its cost or amortized cost, and whether such decline is other than temporary. If such decline is deemed other than temporary, the cost basis of the security is adjusted by writing down the security to estimated fair market value through a charge to current period earnings to the extent that such decline is credit related.

Other Real Estate Owned (“OREO”). OREO consists of real estate properties which are recorded at fair value. All properties have an independent third-party full appraisal to determine the value, less cost to sell (a range of 5% to 10%) and other costs. The appraisal is based on an "as-is" valuation and will follow a reasonable valuation method that addresses the direct sales comparison, income, and cost approaches to market value, reconciles those approaches, and explains the elimination of each approach not used. Appraisals are updated every 12 months or sooner if we have identified possible further deterioration in value.

Income Taxes. Deferred taxes are provided on a liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss carry forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the difference between the reported amounts of assets and liabilities and their tax basis. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion, or all of the deferred tax assets, will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. Realization of deferred tax assets is dependent on generating sufficient taxable income in the future.

When tax returns are filed, it is highly certain that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that ultimately would be sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. The evaluation of a tax position taken is considered by itself and not offset or aggregated with other positions. Tax positions that meet the more likely than not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of benefits associated with tax positions taken that exceeds the amount measured, as described above, is reflected as a liability for unrecognized tax benefits in the accompanying balance sheet along with any associated interest and penalties that would be payable to the taxing authorities upon examination.

Operating Results for the Years Ended December 31, 2017 and 2016

Net Interest Income. The Company’s primary source of earnings is net interest income, which is the difference between income earned on interest-earning assets, such as loans and investment securities, and interest expense incurred on interest-bearing liabilities, such as deposits and borrowings. The level of net interest income is determined primarily by the average level of balances (“volume”) and the market rates associated with the interest-earning assets and interest-bearing liabilities.

Net interest income increased $4.9 million, or 13.9%, to $40.4 million for 2017, from $35.4 million for 2016. We experienced an increase in our interest rate spread of one basis point, to 3.83% for 2017, from 3.82% for 2016. Our net interest margin increased five basis points, to 4.01% for 2017, from 3.96% for 2016. The increase in net interest income is attributable to an increase in the average balance of loans partially offset by increases in the average balance of interest bearing liabilities as well as an increase in the average rate paid on such liabilities.

Interest income increased $6.5 million, or 15.3%, to $48.7 million for 2017, from $42.2 million for 2016. The increase is primarily attributable to higher loan volumes, partially offset by a slight decrease of yields on loans. Average loans for the year were $923.3 million, compared to $800.7 million for 2016, while average loan yields were 5.07% for 2017, compared to 5.09% for 2016.

Interest expense increased $1.5 million, or 22.4%, to $8.3 million for 2017, from $6.8 million for 2016. The increase is primarily attributable to higher deposit and borrowing volumes and an increase in the cost of funds. Average interest bearing deposits for 2017 were $724.5 million, compared to $660.7 million for 2016, while average deposit rates were 0.89% for 2017, compared to 0.82% for 2016. Average borrowings outstanding increased $15.1 million to $105.1

million in 2017, compared to $90.0 million in 2016. The average rate paid on these borrowings increased to 1.71%, from 1.49% in 2016.

Non-interest Income. Non-interest income is principally derived from service fees on deposit accounts, fee income from loan services, and BOLI income. Non-interest income totaled $1.6 million in 2017, versus $10.3 million in 2016. Included in 2016 was a $7.6 million gain on the sale of SBA related assets.

The Company recognized $477,000 in gains from the sale of the guaranteed portion of SBA loans in 2017, compared to a gain of $1.8 million in 2016. The decrease is attributable to the sale of certain of the Company’s SBA related assets in April of 2016.

Loan fees were $654,000 in 2017, a decrease from $777,000 in 2016. Loan fees consist primarily of prepayment fees. These loan fees are variable in nature and are dependent upon the borrowers’ course of action.

The loss on the sale and write down of OREO for 2017 was $1.4 million, compared to a loss of $1.8 million in 2016.

BOLI income was $652,000 in 2017, a decrease from $722,000 in 2016. The decrease is attributable to lower rates in 2017.

Other non-interest income, which includes ATM fees, debit card fees, early CD withdrawal penalties, rental income and other miscellaneous income, amounted to $911,000 in 2017 and $876,000 in 2016.

Non-interest Expense. Non-interest expense for 2017 was $15.3 million, a decrease of $1.3 million from 2016.

Compensation and benefits expense for 2017 was $7.4 million, an increase of $40,000 over 2016. The increase was attributable to a combination of routine salary increases and increased staffing.

Occupancy and equipment and data processing expenses increased by $232,000 from 2016. The increase was primarily due to the opening of two new retail branches in the fourth quarter of 2016.

OREO expenses decreased to $625,000 in 2017, from $1.0 million in 2016. The expenses are related to the carrying costs of OREO, including property taxes, insurance, and maintenance. The decrease is attributable to the reduction in the balance of OREO.

Other operating expense decreased to $3.3 million in 2017, from $4.1 million in 2016. Other operating expense is primarily related to nonperforming loans, including force-placed insurance and payment of real estate taxes to protect the Bank’s lien position. The reduction was primarily related to a decrease in nonperforming loans.

Income Taxes. Income tax expense amounted to $12.4 million for 2017, compared to $8.7 million for 2016, resulting in effective tax rates of 51.1% and 31.5% for the respective years. The increase in the effective rate in 2017 was a result of the enactment of the Tax Cuts and Jobs Act on December 22, 2017. Parke Bancorp was required to re-value its net deferred tax asset (“DTA”). The DTA was written down by $3.2 million, due to the reduced tax rate, a non-recurring charge to provision for income taxes.

Operating Results for the Years Ended December 31, 2016 and 2015

Net Interest Income. The Company’s primary source of earnings is net interest income, which is the difference between income earned on interest-earning assets, such as loans and investment securities, and interest expense incurred on interest-bearing liabilities, such as deposits and borrowings. The level of net interest income is determined primarily by the average level of balances (“volume”) and the market rates associated with the interest-earning assets and interest-bearing liabilities.

Net interest income increased $1.8 million, or 5.5%, to $35.4 million for 2016, from $33.6 million for 2015. We experienced a decrease in our interest rate spread of 20 basis points, to 3.82% for 2016, from 4.02% for 2015. Our net interest margin decreased 18 basis points, to 3.96% for 2016, from 4.14% for 2015. The increase in net interest income is primarily attributable to the combined effects of an increase in the average balance of loans, partially offset by lower yields on loans.

Interest income increased $2.8 million, or 7.1%, to $42.2 million for 2016, from $39.4 million for 2015. The increase is primarily attributable to higher loan volumes partially offset by lower yields on loans. Average loans for the year were $800.7 million compared to $731.0 million for 2015, while average loan yields were 5.09% for 2016 compared to 5.20% for 2015.

Interest expense increased $952,000, or 16.4%, to $6.8 million for 2016, from $5.8 million for 2015. The increase is primarily attributable to higher deposit and borrowing volumes and an increase in the cost of funds. Average deposits for 2016 were $660.7 million compared to $614.0 million for 2015, while average deposit rates were 0.82% for 2016 compared to 0.77% for 2015. Average borrowings outstanding increased $9.3 million to $90.0 million in 2016 as compared to $80.7 million in 2015. The average rate paid on these borrowings increased to 1.49% from 1.32% in 2015.

Non-interest Income. Non-interest income is principally derived from gains on the sale of SBA loans, service fees on deposit accounts, fee income from loan services and BOLI income. Non-interest income totaled $10.3 million in 2016 versus $5.1 million in 2015. Included in non-interest income is the $7.6 million gain on sale of SBA related assets discussed previously.

The Company recognized $1.8 million in gains from the sale of the guaranteed portion of SBA loans in 2016, compared to a gain of $4.1 million in 2015. The decrease is attributable to the sale of the Company’s SBA related assets in April of 2016.

Loan fees were $777,000 in 2016, a decrease from $1.4 million in 2015. Loan fees consist primarily of prepayment fees. These loan fees are variable in nature and are dependent upon the borrowers’ course of action.

The loss on the sale and write down of OREO for 2016 was $1.8 million, compared to a loss of $2.0 million in 2015.

BOLI income was $722,000 in 2016, an increase from $357,000 in 2015. The increase is attributable to an additional BOLI purchase in December of 2015.

Other non-interest income, which includes ATM fees, debit card fees, early CD withdrawal penalties, rental income and other miscellaneous income, amounted to $876,000 in 2016 and $918,000 in 2015.

Non-interest Expense. Non-interest expense for 2016 was $16.6 million, a decrease of $224,000 from 2015.

Compensation and benefits expense for 2016 was $7.3 million, a decrease of $395,000 over 2015. The decrease is attributable to the sale of the Company’s SBA related assets in April of 2016, partially offset by routine salary increases, higher benefits expense and increased staffing in other areas.

Occupancy and equipment and data processing expenses increased by $164,000 from 2015. The increase was due to the opening of two new retail branches in the second half of 2016.

OREO expenses decreased to $1.0 million in 2016, from $1.6 million in 2015. The expenses are related to the carrying costs of OREO including property taxes, insurance and maintenance. The decrease is attributable to the reduction in the balance of OREO.

Other operating expense increased to $4.1 million in 2016, from $3.4 million in 2015. Other operating expense is primarily related to nonperforming loans, including force-placed insurance and payment of real estate taxes to protect the Bank’s lien position.

Income Taxes. Income tax expense amounted to $8.7 million for 2016, compared to $6.8 million for 2015, resulting in effective tax rates of 31.5% and 36.4% for the respective years. The decrease in the effective rate in 2016 is due to the Company utilizing a $1.5 million Historic Tax Credit which reduced its income tax expense.

Financial Condition at December 31, 2017 and December 31, 2016

At December 31, 2017, the Company’s total assets increased to $1.1 billion, from $1.0 billion at December 31, 2016, an increase of $121.3 million, or 11.9%.

Cash and cash equivalents decreased $28.6 million to $42.1 million at December 31, 2017, from $70.7 million at December 31, 2016. The decrease was primarily attributable to growth of the loan portfolio.

The Company's total investment securities portfolio decreased to $40.3 million at December 31, 2017, from $47.1 million at December 31, 2016, a decrease of $6.8 million, or 14.5%. The decrease was attributable to normal principal payments and the sale of an impaired collateralized debt obligation security (TRUP) with a carrying value of $705,000.

Total gross loans increased to $1.0 billion at December 31, 2017, from $852.0 million at December 31, 2016, an increase of $159.8 million, or 18.8%.

OREO at December 31, 2017 was $7.2 million, compared to $10.5 million at December 31, 2016, a decrease of $3.3 million. OREO consisted of 11 properties, the largest being a condominium development in Absecon. The decrease was primarily due to the sale of OREO property carried at $2.3 million, and write-downs of other properties totaling $1.6 million.

At December 31, 2017, the Bank’s total deposits increased to $866.4 million, from $788.7 million at December 31, 2016, an increase of $77.7 million, or 9.9%. Non-interest bearing deposits increased $31.8 million, or 34.4%, to $124.4 million at December 31, 2017, from $92.5 million at December 31, 2016. Interest-bearing deposits increased to $742.0 million, from $696.2 million, an increase of $45.8 million, or 6.6%. The increase in deposits is attributable to the opening of two new retail branches in the last quarter of 2016 and a successful new deposit account promotion.

Borrowings increased to $128.1 million at December 31, 2017, from $93.1 million at December 31, 2016, an increase of $35.0 million, or 37.6%, utilized to fund loan growth.

Total shareholders’ equity increased to $134.8 million at December 31, 2017, from $127.1 million at December 31, 2016, an increase of $7.7 million, or 6.0%, primarily due to the retention of earnings.

Asset Quality

The Company attempts to manage the risk characteristics of its loan portfolio through various control processes, such as credit evaluations of borrowers, establishment of lending limits and application of lending procedures, including the holding of adequate collateral and the maintenance of compensating balances. However, the Company seeks to rely primarily on the cash flow of its borrowers as the principal source of repayment. Although credit policies are designed to minimize risk, management recognizes that loan losses will occur and the amount of these losses will fluctuate depending on the risk characteristics of the loan portfolio as well as general and regional economic conditions.

The allowance for loan losses represents a reserve for losses inherent in the loan portfolio. The adequacy of the allowance for loan losses is evaluated periodically based on a review of all significant loans, with a particular emphasis on nonaccrual loans, past due and other loans that management believes require special attention.

For significant problem loans, management's review consists of an evaluation of the financial strengths of the borrower and the guarantor, the related collateral, and the effects of economic conditions. A loan is considered impaired when, based on current information and events, it is probable that the Company will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Impaired loans include loans identified as troubled debt restructurings (TDRs). Impairment is measured on a loan by loan basis for commercial loans in order to establish specific reserves by either the present value of expected future cash flows discounted at the loan’s effective interest rate, the loan’s obtainable market price, or the fair value of the collateral if the loan is collateral dependent. General reserves against the remaining loan portfolio are based on an analysis of historical loan loss ratios, changes in the composition and volume of the loan portfolio, overall portfolio quality, current national and local economic conditions which may affect borrowers' ability to repay, and other factors which may warrant current recognition.

Delinquent loans decreased $7.6 million to $5.0 million, or 0.49% of total loans, at December 31, 2017, from $12.6 million, or 1.5% of total loans, at December 31, 2016. Delinquent loan balances by number of days delinquent at December 31, 2017 were: 31 to 89 days --- $444,000 and 90 days and greater --- $4.5 million. Loans 90 days and more past due are no longer accruing interest. December 31, 2016, delinquent loan balances by number of days were: 31 to 89 days --- $1.3 million and 90 days and greater --- $11.3 million.

At December 31, 2017, the Company had $4.5 million in nonperforming loans, or 0.45% of total loans, a decrease from $11.3 million, or 1.3% of total loans, at December 31, 2016. The three largest relationships in nonperforming loans are a $1.4 million land development loan, a $565,000 commercial real estate loan and a $497,000 residential loan.

At December 31, 2017, the Company had $11.8 million in nonperforming assets, which includes $4.5 million of nonperforming loans and $7.3 million of OREO, or 1.04% of total assets, a decrease from $21.8 million, or 2.2% of total assets at December 31, 2016.

At December 31, 2017, the Company had $25.5 million in loans deemed impaired, a decrease from $36.4 million at December 31, 2016. Included in impaired loans are TDRs that were in compliance with their modified terms and therefore are accruing, totaling $20.9 million and $25.1 million at December 31, 2017 and December 31, 2016, respectively.

The provision for loan losses is a charge to earnings in the current year to maintain the allowance at a level management has determined to be adequate based upon the factors noted above. The provision for loan losses amounted to $2.5 million for 2017, compared to $1.5 million for 2016 and $3.0 million for 2015. The provision in 2016 was impacted by the sale of the Bank's SBA loan portfolio, which had a one-time effect of relieving the allowance for loan losses by $1.7 million. Net loan charge-offs/recoveries were $1.5 million in 2017, and $2.0 million in 2016.

At December 31, 2017, the Company’s allowance for loan losses increased to $16.5 million, from $15.6 million at December 31, 2016, a increase of $953,000 or 6.1%. The ratio of the allowance for loan loss to total loans decreased to 1.6% of loans at December 31, 2017, from 1.8% of loans at December 31, 2016, due to improving credit conditions. The allowance for loan losses to nonperforming loans coverage ratio increased to 364.7% at December 31, 2017, from 137.9% at December 31, 2016.

We believe we have appropriately established adequate loss reserves on problem loans that we have identified and to cover credit risks that are inherent in the portfolio as of December 31, 2017. We continue to aggressively manage all loan relationships. Credit monitoring and tracking systems are established. Updated appraisals are being obtained, where appropriate, to ensure that collateral values are sufficient to cover outstanding loan balances. Where necessary, we will apply our loan work-out experience to protect our collateral position and actively negotiate with borrowers to resolve these nonperforming loans.

Interest Rate Sensitivity and Liquidity

Interest rate sensitivity is an important factor in the management of the composition and maturity configurations of earning assets and funding sources. The primary objective of asset/liability management is to ensure the steady growth of our primary earnings component, net interest income. Net interest income can fluctuate with significant interest rate movements. To lessen the impact of interest rate movements, management endeavors to structure the balance sheet so that repricing opportunities exist for both assets and liabilities in roughly equivalent amounts at approximately the same time intervals. Imbalances in these repricing opportunities at any point in time constitute interest rate sensitivity.

The measurement of our interest rate sensitivity, or "gap," is one of the principal techniques used in asset/liability management. Interest sensitive gap is the dollar difference between assets and liabilities that are subject to interest-rate pricing within a given time period, including both floating rate or adjustable rate instruments and instruments that are approaching maturity.

Our management and the Board of Directors oversee the asset/liability management function through the asset/liability committee of the Board that meets periodically to monitor and manage the balance sheet, control interest rate exposure, and evaluate our pricing strategies. The asset mix of the balance sheet is continually evaluated in terms of several variables: yield, credit quality, appropriate funding sources and liquidity. Management of the liability mix of the balance sheet focuses on expanding the various funding sources.

In theory, interest rate risk can be diminished by maintaining a nominal level of interest rate sensitivity. In practice, this is made difficult by a number of factors, including cyclical variation in loan demand, different impacts on interest-sensitive assets and liabilities when interest rates change, and the availability of funding sources. Accordingly, we undertake to manage the interest-rate sensitivity gap by adjusting the maturity of and establishing rates on the earning asset portfolio and certain interest-bearing liabilities commensurate with management's expectations relative to market

interest rates. Management generally attempts to maintain a balance between rate-sensitive assets and liabilities as the exposure period is lengthened to minimize our overall interest rate risk.

Rate Sensitivity Analysis. The interest rate sensitivity position as of December 31, 2017, is presented in the following table. Assets and liabilities are scheduled based on maturity or re-pricing data except for mortgage loans and mortgage-backed securities, which are based on prevailing prepayment assumptions and expected maturities and deposits which are based on recent retention experience of core deposits. The difference between rate-sensitive assets and rate-sensitive liabilities, or the interest rate sensitivity gap, is shown at the bottom of the table. As of December 31, 2017, our interest sensitive liabilities exceeded interest sensitive assets within a one-year period by $98.4 million, or 49.6%, of total assets.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2017 |

| 3 Months or Less | | Over 3 Months Through 12 Months | | Over 1 Year Through 3 Years | | Over 3 Years Through 5 Years | | Over 5 Years Through 10 Years | | Total |

| (Amounts in thousands) |

Interest-earning assets: | | | | | | | | | | | |

Loans | $ | 163,260 |

| | $ | 157,151 |

| | $ | 307,901 |

| | $ | 270,254 |

| | $ | 110,616 |

| | $ | 1,009,182 |

|

Investment securities | 3,128 |

| | 4,367 |

| | 9,949 |

| | 8,834 |

| | 13,981 |

| | 40,259 |

|

Federal funds sold and cash equivalents | 37,635 |

| | — |

| | — |

| | — |

| | — |

| | 37,635 |

|

Total interest-earning assets | $ | 204,023 |

| | $ | 161,518 |

| | $ | 317,850 |

| | $ | 279,088 |

| | $ | 124,597 |

| | $ | 1,087,076 |

|

Interest-bearing liabilities: | |

| | |

| | |

| | |

| | |

| | |

|

Regular savings deposits | $ | 8,401 |

| | $ | 25,203 |

| | $ | 67,208 |

| | $ | 57,937 |

| | $ | 13,695 |

| | $ | 172,444 |

|

NOW and money market deposits | 12,041 |

| | 36,125 |

| | 96,334 |

| | 54,043 |

| | 3,124 |

| | 201,667 |

|

Retail time deposits | 42,579 |

| | 157,958 |

| | 69,501 |

| | 14,306 |

| | — |

| | 284,344 |

|

Brokered time deposits | 36,393 |

| | 47,124 |

| | — |

| | — |

| | — |

| | 83,517 |

|

Borrowed funds | 39,000 |

| | 59,150 |

| | 16,500 |

| | — |

| | — |

| | 114,650 |

|

Total interest-bearing liabilities | $ | 138,414 |

| | $ | 325,560 |

| | $ | 249,543 |

| | $ | 126,286 |

| | $ | 16,819 |

| | $ | 856,622 |

|

Interest rate sensitive gap | $ | 65,609 |

| | $ | (164,042 | ) | | $ | 68,307 |

| | $ | 152,802 |

| | $ | 107,778 |

| | $ | 230,454 |

|

Cumulative interest rate gap | $ | 65,609 |

| | $ | (98,433 | ) | | $ | (30,126 | ) | | $ | 122,676 |

| | $ | 230,454 |

| | $ | — |

|

Ratio of rate-sensitive assets to rate-sensitive liabilities | 147.40 | % | | 49.61 | % | | 127.37 | % | | 221.00 | % | | 740.81 | % | | 126.90 | % |

Liquidity describes our ability to meet the financial obligations that arise out of the ordinary course of business. Liquidity addresses the Company's ability to meet deposit withdrawals on demand or at contractual maturity, to repay borrowings as they mature, and to fund current and planned expenditures. Liquidity is derived from increased repayment and income from earning assets. Our loan to deposit ratio was 116.8% and 108.0% at December 31, 2017 and December 31, 2016, respectively. Funds received from new and existing depositors provided a large source of liquidity during 2017 and 2016. The Company seeks to rely primarily on core deposits from customers to provide stable and cost-effective sources of funding to support loan growth. The Bank also seeks to augment such deposits with longer term and higher yielding certificates of deposit.

Brokered deposits are a more volatile source of funding than core deposits and do not increase the deposit franchise of the Bank. In a rising rate environment, the Bank may be unwilling or unable to pay a competitive rate. To the extent that such deposits do not remain with the Bank, they may need to be replaced with borrowings which could increase the Bank’s cost of funds and negatively impact its interest rate spread, financial condition and results of operation. To mitigate the potential negative impact associated with brokered deposits, the Bank joined Promontory Inter Financial Network to secure an additional alternative funding source. Promontory provides the Bank an additional source of external funds through their weekly CDARS® settlement process. The rates are comparable to brokered deposits and can be obtained within a shorter period time than brokered deposits. The Bank’s CDARS deposits included within the brokered deposit total amounted to $83.5 million and $51.2 million at December 31, 2017 and December 31, 2016, respectively. To the extent that retail deposits are not adequate to fund customer loan demand, liquidity needs can be met in the short-term funds market. Longer term funding requirements can be obtained through advances from the FHLBNY. As of December 31, 2017, the Bank maintained unused lines of credit with the FHLBNY totaling $64.5 million.

As of December 31, 2017, the Bank's investment securities portfolio included $37.2 million of mortgage-backed securities and collateralized debt securities that provide additional cash flow each month. The majority of the investment portfolio is classified as available for sale, is readily marketable, and is available to meet liquidity needs. The Bank's residential real estate portfolio includes loans, which are underwritten to secondary market criteria, and provide an additional source of liquidity. Presently the residential mortgage loan portfolio and certain qualifying commercial real estate loans are pledged under a blanket lien to the FHLBNY as collateral. Management is not aware of any known trends, demands, commitments or uncertainties that are reasonably likely to result in material changes in liquidity.

Off-Balance Sheet Arrangements

The Bank is a party to financial instruments with off-balance sheet risk in the normal course of business to meet the financing needs of its customers. These financial instruments include commitments to extend credit and standby letters of credit. These instruments involve, to varying degrees, elements of credit risk in excess of the amount recognized in the consolidated balance sheet. The contract or notional amounts of these instruments reflect the extent of the Bank's involvement in these particular classes of financial instruments. The Bank's exposure to credit loss in the event of nonperformance by the other party to the financial instruments for commitments to extend credit and standby letters of credit is represented by the contractual or notional amount of those instruments. The Bank uses the same credit policies in making commitments and conditional obligations as they do for on-balance sheet instruments.

Commitments to extend credit are agreements to lend to a customer as long as there is no violation of any condition established in the contract. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. Since many of the commitments are expected to expire without being drawn upon, the total commitment amounts do not necessarily represent future cash requirements. The Bank evaluates each customer's credit-worthiness on a case-by-case basis. The amount of collateral obtained, if deemed necessary upon the extension of credit, is based on management's credit evaluation. Collateral held varies but may include accounts receivable, inventory, property, plant and equipment and income-producing commercial properties. As of December 31, 2017, and 2016, commitments to extend credit amounted to approximately $118.7 million and $78.3 million, respectively.

Standby letters of credit are conditional commitments issued by the Bank to guarantee the performance of a customer to a third party. The credit risk involved in issuing letters of credit is essentially the same as that involved in extending loan facilities to customers. As of December 31, 2017 and 2016, standby letters of credit with customers were $14.0 million and $13.1 million, respectively.

Loan commitments and standby letters of credit are issued in the ordinary course of business to meet customer needs. Commitments to fund fixed-rate loans were immaterial at December 31, 2017. Variable-rate commitments are generally issued for less than one year and carry market rates of interest. Such instruments are not likely to be affected by annual rate caps triggered by rising interest rates. Management believes that off-balance sheet risk is not material to the results of operations or financial condition.

The following table sets forth information regarding the Bank’s contractual obligations and commitments as of December 31, 2017.

|

| | | | | | | | | | | | | | | | | | | |

| Payments Due by Period |

| Less than 1 year | | 1-3 Years | | 3-5 years | | More than 5 years | | Total |

| | | (Amounts in thousands) | | |

Retail time deposits | $ | 200,537 |

| | $ | 69,501 |

| | $ | 14,306 |

| | $ | — |

| | $ | 284,344 |

|

Brokered time deposits | 83,517 |

| | — |

| | — |

| | — |

| | 83,517 |

|

Borrowed funds | 98,150 |

| | 16,500 |

| | — |

| | — |

| | 114,650 |

|

Operating lease obligations | 309 |

| | 965 |

| | 290 |

| | 700 |

| | 2,264 |

|

Total contractual obligations | $ | 382,513 |

| | $ | 86,966 |

| | $ | 14,596 |

| | $ | 700 |

| | $ | 484,775 |

|

| | | | | | | | | |

| Amount of Commitments Expiring by Period |

| Less than 1 year | | 1-3 Years | | 3-5 years | | More than 5 years | | Total |

| |

| | (Amounts in thousands) | | |

|

Loan Commitments | $ | 158,894 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 158,894 |

|

Lines of Credit | 38,472 |

| | 11,548 |

| | 16,259 |

| | 52,410 |

| | 118,689 |

|

Total Commitments | $ | 197,366 |

| | $ | 11,548 |

| | $ | 16,259 |

| | $ | 52,410 |

| | $ | 277,583 |

|

Impact of Inflation and Changing Prices

The consolidated financial statements and notes have been prepared in accordance with accounting principles generally accepted within the United States ("GAAP"), which require the measurement of financial position and operating results in terms of historical dollars without considering the change in the relative purchasing power of money over time and due to inflation. The impact of inflation is reflected in the increased cost of our operations. Unlike most industrial companies, nearly all of our assets are monetary in nature. As a result, market interest rates have a greater impact on our performance than do the effects of general levels of inflation. Interest rates do not necessarily move in the same direction or to the same extent as the price of goods and services.

MARKET PRICES AND DIVIDENDS

General

The Company's common stock is listed on the Nasdaq Capital Market under the trading symbol of "PKBK". The following table reflects high and low daily closing prices of the common stock during the periods indicated in 2017 and 2016, and cash dividends paid during each quarter. Prices reflect a 10% stock dividend paid in May 2017 and May 2016.

|

| | | | | | | | | | | |

2017 | Cash Dividends Paid | | High | | Low |

1st Quarter | $ | 0.10 |

| | $ | 19.51 |

| | $ | 17.05 |

|

2nd Quarter | $ | 0.10 |

| | $ | 22.51 |

| | $ | 19.11 |

|

3rd Quarter | $ | 0.12 |

| | $ | 22.68 |

| | $ | 18.00 |

|

4th Quarter | $ | 0.12 |

| | $ | 22.73 |

| | $ | 19.70 |

|

2016 | |

| | |

| | |

|

1st Quarter | $ | 0.06 |

| | $ | 11.64 |

| | $ | 9.81 |

|

2nd Quarter | $ | 0.07 |

| | $ | 12.36 |

| | $ | 11.28 |

|

3rd Quarter | $ | 0.08 |

| | $ | 14.02 |

| | $ | 11.08 |

|

4th Quarter | $ | 0.08 |

| | $ | 17.93 |

| | $ | 13.26 |

|

The number of shareholders of record of common stock as of March 8, 2018, was approximately 291. This does not reflect the number of persons or entities who held stock in nominee or "street" name through various brokerage firms. At March 15, 2018, there were 8,021,982 shares of our common stock outstanding.

The Company paid quarterly cash dividends in 2017 and 2016 totaling $3.2 million and $2.0 million, respectively. The timing and amount of future dividends will be within the discretion of the Board of Directors and will depend on the consolidated earnings, financial condition, liquidity, and capital requirements of the Company and its subsidiaries, applicable governmental regulations and policies, and other factors deemed relevant by the Board.

The Company's ability to pay dividends is substantially dependent upon the dividends it receives from the Bank and is subject to other restrictions. Under current regulations, the Bank's ability to pay dividends is restricted as well.

Under the New Jersey Banking Act of 1948, a bank may declare and pay dividends only if after payment of the dividend the capital stock of the bank will be unimpaired and either the bank will have a surplus of not less than 50% of its capital stock or the payment of the dividend will not reduce the bank's surplus.

Pursuant to the terms of the Series B Preferred Stock, the Company may not pay a cash dividend on the common stock unless all dividends on the Series B Preferred Stock for the then-current dividend period have been paid or set aside.

The Federal Deposit Insurance Act generally prohibits all payments of dividends by any insured bank that is in default of any assessment to the FDIC. Additionally, because the FDIC may prohibit a bank from engaging in unsafe or unsound practices, it is possible that under certain circumstances the FDIC could claim that a dividend payment constitutes an unsafe or unsound practice. The New Jersey Department of Banking and Insurance has similar power to issue cease and desist orders to prohibit what might constitute unsafe or unsound practices. The payment of dividends may also be affected by other factors (e.g., the need to maintain adequate capital or to meet loan loss reserve requirements).

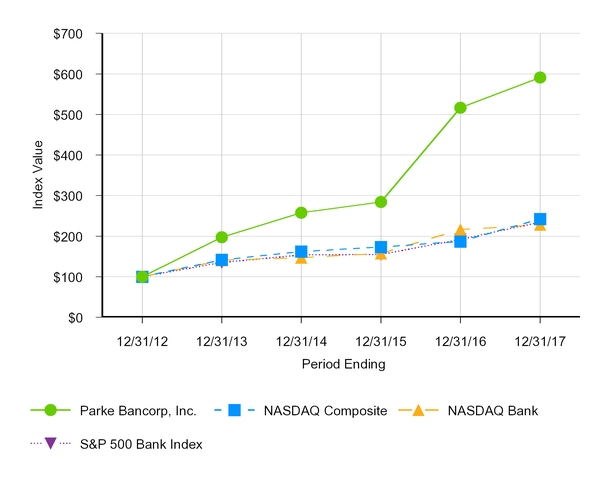

Stock Performance Graph

The following graph shows a comparison of total stockholder return on the Company's, common stock, based on the market price of the Company's common stock with the cumulative total return of companies in the Nasdaq Composite Index, the Nasdaq Bank Index and S&P 500 Bank Index for the period December 31, 2012 through December 31, 2017. The graph may not be indicative of possible future performance of the Company's common stock. Cumulative return assumes the reinvestment of dividends and is expressed in dollars based on an initial investment of $100.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Parke Bancorp, Inc., the NASDAQ Composite Index, the NASDAQ Bank Index,

and S&P 500 Bank Index

*$100 invested on 12/31/12 in stock or index, including reinvestment of dividends. Fiscal year ending December 31.

|

| | | | | | |

| 12/12 | 12/13 | 12/14 | 12/15 | 12/16 | 12/17 |

Parke Bancorp, Inc. | 100.00 | 197.21 | 257.89 | 284.11 | 516.35 | 591.29 |

NASDAQ Composite | 100.00 | 141.63 | 162.09 | 173.33 | 187.19 | 242.29 |

NASDAQ Bank | 100.00 | 140.76 | 146.90 | 157.63 | 216.24 | 227.94 |

S&P 500 Bank Index | 100.00 | 135.27 | 153.57 | 155.02 | 191.66 | 234.48 |

Parke Bancorp, Inc. and Subsidiaries

Consolidated Financial Report

December 31, 2017

Parke Bancorp, Inc. and Subsidiaries

|

| |

Contents | |

| Page |

| |

Management's Report on Internal Control Over Financial Reporting......................................................... | |

Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting | |

Report of Independent Registered Public Accounting Firm on the Consolidated Financial Statements.... | |

| |

Financial Statements | |

Consolidated Balance Sheets.............................................................................................................. | |

Consolidated Statements of Income.................................................................................................... | |

Consolidated Statements of Comprehensive Income.......................................................................... | |

Consolidated Statements of Equity...................................................................................................... | |

Consolidated Statements of Cash Flows............................................................................................. | |

Notes to Consolidated Financial Statements....................................................................................... | |

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a- 15(f). The Company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorization of management and directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the financial statements.

Internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements prepared for external purposes in accordance with generally accepted accounting principles. Because of inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies and procedures may deteriorate.

Under supervision and with the participation of management, including our principal executive officer and principal financial officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission in 2013. Based on our evaluation under the framework in Internal Control - Integrated Framework, management concluded that our internal control over financial reporting was effective as of December 31, 2017.

RSM US LLP, an independent registered public accounting firm that audited the 2017 consolidated financial statements of the Company included in this Annual Report on 10-K, has audited the effectiveness of the Company's internal control over financial reporting as of December 31, 2017. Their report, which expresses an unqualified opinion on the effectiveness of the Company’s internal control over financial reporting as of December 31, 2017 is included in this Item under the heading “Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting.”

March 15, 2018

|

| |

| |

Vito S. Pantilione | John F. Hawkins |

President and Chief Executive Officer | Senior Vice President and Chief Financial Officer |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of Parke Bancorp, Inc. and Subsidiaries

Opinion on the Internal Control Over Financial Reporting

We have audited Parke Bancorp, Inc. and subsidiaries (the Company) internal control over financial reporting as of December 31, 2017, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission in 2013. In our opinion, the Company maintain, in all material respects, effective internal control over financial reporting as of December 31, 2017, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission in 2013.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated balance sheets as of December 31, 2017 and 2016, and the consolidated statements of income, comprehensive income, shareholders' equity and cash flows for each of the three years in the period ended December 31, 2017, and the related notes to the consolidated financial statements of the Company and our report dated March 15, 2018 expressed an unqualified opinion.

Basis for Opinion

The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

Definition and Limitations of Internal Control Over Financial Reporting

A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company's assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Blue Bell, Pennsylvania

March 15, 2018

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Directors of Parke Bancorp, Inc. and Subsidiaries

Opinion on the Financial Statements