Notice of 2023 Annual Meeting of Stockholders

970 Park Place

San Mateo, California 94403

To the Stockholders of Roblox Corporation:

On behalf of our board of directors, it is our pleasure to invite you to attend the 2023 annual meeting of stockholders (including any adjournment or postponement thereof, the “Annual Meeting”) of Roblox Corporation. The Annual Meeting will be held virtually via live webcast at https://web.lumiagm.com/215721927 (password: roblox2023), originating from San Mateo, California, on Thursday, May 25, 2023 at 8:00 a.m., Pacific Time.

We are holding the Annual Meeting to seek your approval of the following proposals:

Proposals |

| Board Vote Recommendation |

| For Further Details |

1. Election of Class II Directors | “FOR” each director nominee | Page 9 | ||

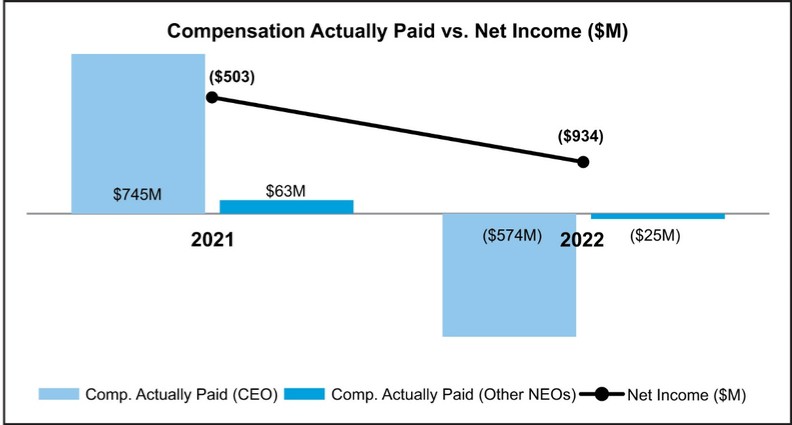

2. Advisory Vote on the Compensation of our Named Executive Officers | “FOR” | Page 34 | ||

3. Ratification of the Independent Registered Public Accounting Firm | “FOR” | Page 63 |

These items of business are more fully described in the proxy statement accompanying this letter.

Stockholders will also act on any other business properly brought before the meeting. At this time we are not aware of any such additional matters.

The record date for the Annual Meeting is March 27, 2023. Only stockholders of record of our Class A common stock and Class B common stock at the close of business on the record date may vote at the Annual Meeting. For stockholders of record, to vote in the Annual Meeting, you will need the control number included on your Notice of Internet Availability of Proxy Materials (the “Notice”) or proxy card. If you are a street name stockholder you should contact your broker, bank or other nominee and obtain a legal proxy then submit a request for registration to our transfer agent, American Stock Transfer & Trust Company, LLC, by following the process outlined in the section titled “How Do I Vote?” in the proxy statement accompanying this letter, in order to vote your shares at the Annual Meeting.

On or about April 3, 2023, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and annual report. This notice provides instructions on how to vote via the Internet or by telephone and includes instructions on how to receive a paper copy of our proxy materials by mail. The accompanying proxy statement and our annual report can be accessed directly at the following Internet address: http://astproxyportal.com/ast/24055/.

Whether or not you plan to attend the Annual Meeting, we urge you to submit your proxy or voting instructions via the Internet, telephone, or mail as soon as possible.

In the event of a technical malfunction or other situation that the meeting chair determines may affect the ability of the Annual Meeting to satisfy the requirements for a meeting of stockholders to be held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the Annual Meeting, the meeting chair or secretary will convene the meeting at 9:00 a.m. Pacific Time on the date specified above and at the Company’s address specified above solely for the purpose of adjourning the meeting to reconvene at a date, time and physical or virtual location announced by the meeting chair. Under either of the foregoing circumstances, we will post information regarding the announcement on the Investors page of Roblox’s website at https://ir.roblox.com.

By order of the board of directors,

MARK REINSTRA

General Counsel and Corporate Secretary

San Mateo, California

April 3, 2023