united

states

securities and exchange commission

washington, d.c. 20549

form n-csr/A

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21720

Northern Lights Fund Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Eric Kane, Ultimus Fund Solutions, LLC.

80 Arkay Drive, Suite 110 Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 6/30

Date of reporting period: 6/30/22

Explanatory Note:

The registrant is filing this amendment to its filing on Form N-CSR for the year ended June 30, 2022, which was originally filed with the Securities and Exchange Commission on September 7, 2022 (Accession Number 0001580642-22-004561), solely to correct (i) cost of investments in the Schedule of Investments and Statement of Assets and Liabilities, (ii) net realized gains and net change in unrealized depreciation in the Statement of Operations and Statement of Changes in Net Assets, (iii) the Portfolio Turnover Rate for the year ended June 30, 2022 included in the Financial Highlights, and (iv) the purchases and sales disclosed in Note 3 to the financial statements. (v) Tax Basis as disclosed in Note 6 to the financial statement and (vi) components of accumulated earnings/(deficit) on a tax basis as disclosed in Note 7 to the financial statements. Other than the aforementioned corrections, this amended Form N-CSR does not reflect events occurring after the filing of the original Form N-CSR, or modify or update the disclosures contained therein.

Item 1. Reports to Stockholders.

June 30, 2022

The Altegris Mutual Funds

A SERIES OF NORTHERN LIGHTS FUND TRUST

Annual Report

Altegris Futures Evolution Strategy Fund

Advised by:

Altegris Advisors, LLC

1200 Prospect, Suite 400

La Jolla, CA 92037

877.524.9441 | WWW.ALTEGRIS.COM

Letter to Shareholders

Annual

Report

for Altegris Mutual Funds

Altegris Futures Evolution Strategy Fund

Dear Investor:

One year ago, we explained our rationale for changes to the portfolio that included:

| 1) | Increasing ISAM’s target allocation to 25% (from 21%) |

| 2) | Reducing Winton’s allocation to 75% (from 79%) |

| 3) | Changing fixed income strategy weighting to 100% DoubleLine Low Duration |

While the changes may have seemed marginal, we are pleased with the decision one year later. Increasing ISAM’s allocation (and reducing Winton’s) increased the overall speed of the trend-following program and increased the Fund’s exposure to alternative markets vis-à-vis ISAM’s ultra-diversified models. While the decision to increase the aggregate trend-following speed has yet to be overly impactful (the last year has been a favorable environment for both long- and medium-term trend-followers), we maintain that a more responsive program will be beneficial in the future.

However, increasing ISAM’s allocation also increased the Fund’s exposure to what ISAM dubs ‘alternative markets.’ In hindsight, this seems more prescient than we should get credit for, as we certainly did not make the change based on energy supply shock or European power crisis forecasts. However, we highlighted ISAM’s greater exposure to commodities and alternative markets, such as European power contracts, interest rate swaps, and various other instruments, which led it to outperform the other futures programs. Additionally, the Winton strategies generated gains for the Fund as they captured profits from the trends in fixed income, commodities, and FX.

Lastly, we are pleased with our decision to streamline the implementation of our fixed income allocations to utilize DoubleLine mutual funds versus separately managed accounts. In addition, the 100% weight to DoubleLine Low Duration was beneficial as interest rates have risen in 2022. While our fixed income allocations detracted from performance over the period, we believe we have limited the downside by lowering the aggregate duration of the collateral management strategy.

Market Summary

The Fund was +22.48% over the one-year ended June 30, 2022. The market environment was favorable for risk assets until the end of 2021 when CPI began to shoot up globally, and volatility began to surface in equities. In 2022, however, there has been no place to hide amongst traditional asset classes. Equities endured a paradigm shift as global monetary policy tightened, and the Russian invasion of Ukraine weighed on the global economic outlook. Moreover, bonds failed to provide diversification for equities during the first half of 2022 as yields rose while the Fed continued its aggressive rate hike policy.

1

At the beginning of the period, the Federal Reserve began to remove accommodative policies while contemplating the timing and mechanics of tapering. Until the fourth quarter of 2021, the board maintained their ‘transitory’ stance on inflation, even as CPI began to creep up to highs not seen in decades. In the fourth quarter of 2021, however, they signaled their intention to retire the word transitory regarding inflation and began aggressively hiking rates in the first half of 2022. After a forecast for three rate hikes at the end of 2021, the Fed has raised rates a total of 2.00% over four meetings through July, with consecutive June and July increases of 0.75% each. The consensus is that there are more to come as the Federal Reserve continues to try to combat an elevated CPI.

In Europe, inflation is also an acute concern, and the EU is working to curb further energy supply shocks and consumer price increases. Consequently, the euro moved closer to parity with the USD over the second quarter, a downtrend that has persisted since mid-2021. In Japan, the yen fell to levels not seen since the late 1990s as the BoJ is amongst the last developed world central bank holdouts to pursue monetary tightening. Overall, the US Dollar Index (DXY) finished the period near highs not seen in two decades.

Despite the moves from policymakers, inflation remains elevated despite some risk-off price movements in commodities, bonds, and FX during Q2 2022. More recent market action has increasingly played out like a battle between inflation versus recession pricing in various asset classes. Regardless of the outcome, we believe the current tension will break soon. We believe there is a real possibility of continued inflation driven by food and energy supply shocks and a recession created by the Fed and other central banks. While many predict that the U.S. will avoid a recession, history suggests some skepticism of the Fed’s ability to engineer a soft landing is prudent.

Whatever the outcome, we believe that the environment remains conducive to sustaining tradeable trends across all global asset classes.

Altegris Futures Evolution Strategy Fund

12-Month Period Ending June 30, 2022

Fund Overview

The Altegris Futures Evolution Strategy Fund is an actively managed mutual fund that allocates to what we believe are two of the best trend-following managed futures managers, Winton Capital Management and ISAM, and offers an innovative, active approach to fixed income management via a fixed income industry leader, DoubleLine Capital LP (“DoubleLine”).

The Fund allocates its capital to investments providing exposure to the Winton Diversified Macro Strategy and the Winton Trend Fund managed by Winton Capital Management (“Winton”), a London-based commodity trading advisor (“CTA”) with assets under advisement of $9.2B as of June 30, 2022, and the ISAM Systematic Program managed by ISAM, a New York and London-based CTA managing $7.2B in assets as of June 30, 2022. All three programs are trend-following managed futures strategies that utilize proprietary, quantitative trading systems to identify market

2

trends and react to corresponding price movements in futures markets across all major asset classes.

| Figure 1: Futures Exposure by Manager | As of June 30, 2022 (unaudited) |

CTA Allocation* | As of 6/30/22

Regarding its managed futures strategy, the Fund will invest up to 25% of its total assets in a wholly-owned subsidiary, which in turn invests the majority of its assets in a portfolio of investments. These include investments in a combination of (1) securities of one or more commodity futures trading companies (e.g., underlying pools), (2) swaps, notes or similar derivatives structured to provide exposure to and the returns of managed futures strategies, and (3) investments intended to serve as collateral for such derivative positions (collectively, “managed futures investments”). These investments are selected to provide aggregate exposure to the managed futures managers listed above as if between 100% and 125% of the Fund’s net assets were invested in those managers and their programs. The Fund also holds fixed income securities, cash, and cash equivalents, which are excluded from the chart above.

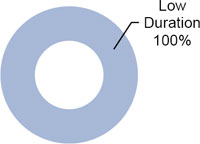

The fixed income portion of the Fund’s portfolio may allocate to fixed income strategies – Core Fixed Income, Low Duration, and Flexible Income – that are accessed via mutual funds actively managed by DoubleLine, a fixed income investment specialist based in Los Angeles with assets under management of over $107B as of June 30, 2022. Investments in fixed income securities actively managed by DoubleLine represented approximately 75% of Fund assets. As of June 30, 2022, the Fund allocated 100% to the DoubleLine Low Duration mutual fund. We continue to evaluate the current sub-strategy allocations to seek the best possible combination of underlying exposures. (Figure 2)

3

| Figure 2: Fixed Income Sub-Strategy Allocation | As of June 30, 2022 (unaudited) |

Sub-Strategy Allocation* | As of 6/30/22

| * | The adviser expects less than 100%, typically 60%-80%, of the Fund’s total net assets will be allocated to fixed income strategies managed by DoubleLine. |

Fund Performance Summary

As seen in Figure 3 (below), for the twelve months ended June 30, 2022, the Fund’s Class A (at NAV), Class C, Class I, and Class N shares returned 22.48%, 22.83%, 21.62%, and 22.49% respectively, while the BofA Merrill Lynch 3 Month T-Bill Index, the SG Trend Index, and the S&P 500 TR Index returned 0.17%, 31.00%, and -10.62% respectively. The Fund’s net assets under management were approximately $155 million as of June 30, 2022.

Figure 3: Altegris Futures Evolution Strategy Fund Performance Review

July 1, 2021 – June 30, 2022 |

| Quarterly Returns | ||||||

| 1-Year | Since Inception* | Q2 2022 | Q1 2022 | Q4 2021 | Q3 2021 | |

| Class I (NAV) | 22.83% | 4.32% | 3.76% | 15.24% | -2.27% | 5.11% |

| Class A (NAV) | 22.48% | 4.06% | 3.63% | 15.25% | -2.28% | 4.95% |

| Class C (NAV) | 21.62% | 3.25% | 3.51% | 14.93% | -2.45% | 4.79% |

| Class N (NAV) | 22.49% | 4.06% | 3.73% | 15.09% | -2.24% | 4.95% |

| BofA ML 3-Month T-Bill Index | 0.17% | 0.60% | 0.11% | 0.04% | 0.01% | 0.02% |

| Class A (max load)** | 15.41% | 3.48% | -2.31% | 8.57% | -7.89% | -1.12% |

| * | Inception date for Class A, Class I, and Class N was October 31, 2011. The inception date for Class C was February 16, 2012. |

| ** | The maximum sales charge for Class A shares is 5.75%. Class A share investors may be eligible for a reduction in sales charges. See Prospectus for more information. |

Performance for periods of less than one year is not annualized.

Per the prospectus dated October 28, 2021, the total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, is 2.15% for Class A, 2.90% for Class C, 1.90% for Class I, and 2.15% for Class N.

The performance data quoted here represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above.

4

Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The Fund’s adviser has contractually agreed to reduce its fees and to reimburse expenses, at least until October 31, 2022, to ensure that total annual Fund operating expenses will not exceed 1.59%, 2.34%, 1.34%, and 1.59% of average daily net assets attributable to Class A, Class C, Class I and Class N shares, respectively, subject to possible recoupment in future years. Results shown reflect the waiver, without which the results would have been lower. A Fund’s performance, especially for very short periods, should not be the sole factor in making your investment decisions. For performance information current to the most recent month-end, please call (888) 524-9441. The referenced indices and benchmarks are shown for general market comparisons and are not meant to represent any particular investment. The returns include reinvestment of income but do not reflect the impact of sales charges or other fees. An index is unmanaged and not available for direct investment. See the end of the letter for a complete description of each index and benchmark.

Drivers of Fund Performance

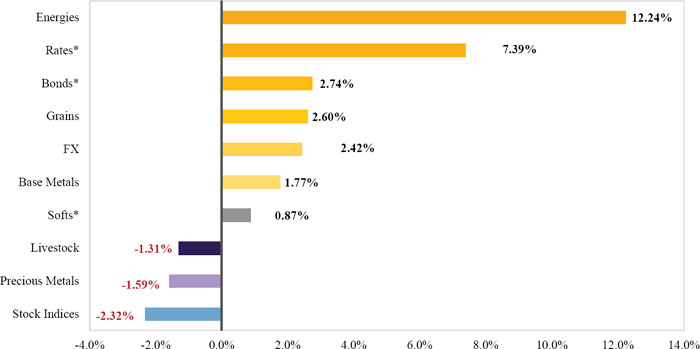

The Fund was up +22.48% for the twelve months ended June 30, 2022. Commodities and fixed income made the largest gains, while FX made smaller gains, and stock indices were slightly down.

Commodities were the best performing asset class; the Fund captured profits from upward trends in energy, grains, and base metals prices. Within energies, natural gas and crude oil made the largest contributions in the subsector. Livestock and precious metals were the only detractors in the commodity space as longs in lean hogs, gold, and silver detracted.

Fixed income was also profitable as shorts in shorter-dated contracts made the largest contribution. Most fixed income profits were generated after March of 2022 as the Fund’s short exposure benefitted from the sell-off in rates and bonds as interest rates rose along the curve. The largest contributors were 3M Euribor and Eurodollar contract shorts, while smaller longs in rate swaps and the 10Y JGB slightly detracted.

FX was slightly up for the period after being led higher by short positions in the Euro and Yen in 2022. However, longs in the British pound, Canadian dollar, and Australian dollar offset some of these profits.

Stock indices made losses for the period as trend-following strategies were generally whipsawed over the period. Aggregate stock index trading was profitable for The Fund until December 2021, when equity market volatility notably increased but could not maintain them as equity markets declined in 2022. From a position standpoint, shorts in the China H-Shares Index, Nasdaq Index, and Russell 2000 Index made the largest gains. However, they were insufficient to offset broader losses led by long positions in the Nikkei, TOPIX, and S&P/ASX 200 Indices.

5

Figure 4: Futures Performance Attribution by Sector | July 1, 2021 – June 30, 2022 (unaudited)

Past performance is no guarantee of future results. The data is estimated and obtained from third parties, including managers, clearing firms, and exchanges. These sources are believed to be reliable, but their accuracy cannot, in all cases, be independently verified. As such, the data is subject to correction or change without notice and should not be relied upon to make an investment decision or recommendation.

| * | Softs, or soft commodities, are commodities such as coffee, cocoa, sugar, and fruit. This term generally refers to commodities that are grown rather than mined. Bonds are defined as having a maturity of two years or more at inception, and rates are defined as having a maturity of fewer than two years at inception. |

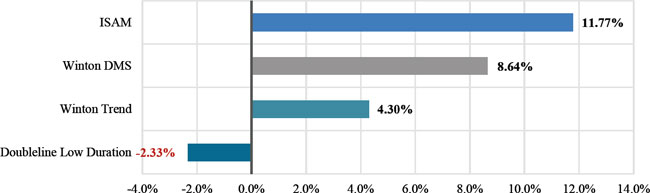

All futures programs were positive for the period, with ISAM generating the largest % gains, followed by Winton DMS and Winton Trend

ISAM generated its largest profits in commodities and fixed income and made losses in FX and stock index trading. From a sector standpoint, long energy positions and short rates contracts were the largest contributors, while longs in livestock and precious metals detracted.

Winton DMS profits were primarily driven by commodity trading with smaller but meaningful contributions from fixed income and FX. Stock indices were slightly down for the period. From a sector standpoint, energy and rates again led the way while longs in precious metals and livestock detracted.

Winton Trend generated its largest profits in fixed income and commodities while FX trading was roughly flat and stock indices were slightly down. Energy was also the largest contributor from a

6

sector standpoint, followed by short positions in rates contracts. Longs in precious metals and stock indices generated the largest losses.

The active cash management strategy of the Fund detracted for the period as bonds were subject to increased duration risk as interest rates rose.

Figure 5: Performance Attribution by Manager | July 1, 2021 – June 30, 2022 (unaudited)

Past performance is no guarantee of future results. The data is estimated and is subject to correction or change without notice and should not be relied upon to make an investment decision or recommendation.

Outlook

Our near-term base case view is continued hawkishness from the Fed to combat inflation, likely meaning a stronger US dollar for longer and a gloomy environment for risk assets. The Fed, in fact, rarely ends a rate hiking cycle with short-end rates below YoY CPI changes. While the possibility of the current cycle stopping short of CPI is real, we believe it would only result from an even more adverse environment for risk assets. In our opinion, the data would have to indicate a substantial economic slowdown to put the Fed on pause, perhaps even a credit-driven recession. Further, a YoY CPI print of 9.1% for June 2022, the exact opposite of “transitory,” effectively put the Fed between a rock and a hard place. Finally, the economic slowdown and banking problems in China are further amplifying concerns of a global economic slowdown, making it, in our opinion, the toughest environment for risk assets since the GFC. With that said, trend-following strategies have been a port in the storm through the recent turmoil for investors as long-only approaches in most asset classes have been challenged. As a result, we have higher conviction than ever in the Fund’s ability to generate absolute returns regardless of global macro outcomes.

Sincerely,

Matt Osborne

Chief Investment Officer

Portfolio Manager

7

INDEX DEFINITIONS

The SG Trend Index, which is equal-weighted and reconstituted annually, calculates the net daily rate of return for a group of 10 trend-following CTAs selected from the largest managers open to new investment.

BofA Merrill Lynch 3 Month T-Bill Index is an unmanaged index that measures returns of three-month Treasury Bills.

S&P 500 Total Return Index is the total return version of the S&P 500 index. The S&P 500 index is unmanaged and is generally representative of certain portions of the U.S. equity markets. For the S&P 500 Total Return Index, dividends are reinvested on a daily basis, and the base date for the index is January 4, 1988. All regular cash dividends are assumed reinvested in the S&P 500 index on the ex-date. Special cash dividends trigger a price adjustment in the price return index.

An index is unmanaged and not available for direct investment.

GLOSSARY

Long. Buying an asset/security that gives partial ownership to the buyer of the position. Long positions profit from an increase in price.

Short. Selling an asset/security that may have been borrowed from a third party with the intention of buying back at a later date. Short positions profit from a decline in price. If a short position increases in price, covering the short position at a higher price may result in a loss.

8

| Altegris Futures Evolution Strategy Fund |

| PORTFOLIO REVIEW (Unaudited) |

| June 30, 2022 |

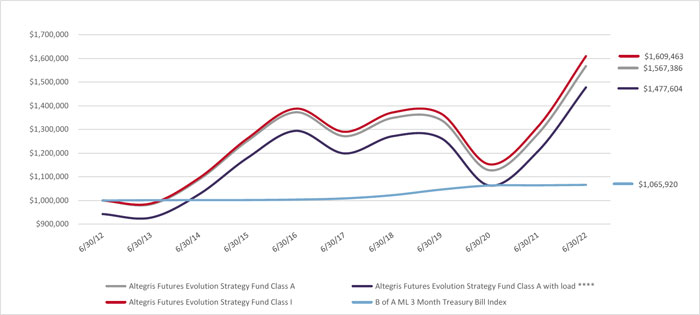

The Fund’s performance figures* for the period ended June 30, 2022, compared to its benchmark:

| Since Inception | Since Inception | ||||

| One Year | Five Years | Ten Years | February 16, 2012 | October 31, 2011 | |

| Altegris Futures Evolution Strategy Fund - Class A | 22.48% | 4.27% | 4.60% | N/A | 4.06% |

| Altegris Futures Evolution Strategy Fund - Class A with load ** | 15.41% | 3.05% | 3.98% | N/A | 3.48% |

| Altegris Futures Evolution Strategy Fund - Class C | 21.62% | 3.47% | 3.83% | 3.25% | N/A |

| Altegris Futures Evolution Strategy Fund - Class I | 22.83% | 4.52% | 4.87% | N/A | 4.32% |

| Altegris Futures Evolution Strategy Fund - Class N | 22.49% | 4.27% | 4.61% | N/A | 4.06% |

| Bank of America Merrill Lynch 3-Month Treasury Bill Index *** | 0.17% | 1.11% | 0.64% | 0.62% | 0.60% |

| S&P 500 Total Return Index ^ | (10.62)% | 11.31% | 12.96% | 12.59% | 13.14% |

| SG Trend Index + | 31.00% | 10.24% | 5.59% | 5.14% | 5.29% |

| * | The Performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Redemptions made within 30 days of purchase may be assessed a redemption fee of 1.00%. The Fund’s total annual operating expense ratios, before any fee waivers, are 2.15%, 2.90%, 1.90%, and 2.15% for Class A, Class C, Class I, and Class N shares, respectively, per the Fund’s prospectus dated October 28, 2021. Class A shares are subject to a sales charge imposed on purchase of 5.75% and Class A and Class C Shares are subject to a maximum deferred sales charge of 1.00%. For performance information current to the most recent month-end, please call 1-877-772-5838. |

| ** | Class A with load total return is calculated using the maximum sales charge of 5.75%. |

| *** | Bank of America Merrill Lynch 3-Month Treasury Bill Index: Is an unmanaged index that measures the returns of three-month Treasury Bills. Investors cannot directly invest in an index. |

| ^ | S&P 500 Total Return Index is unmanaged and is generally representative of certain portions of the U.S. equity markets. Investors cannot directly invest in an index. |

| + | SG Trend Index calculates the net daily rate of return for a group of 10 trend following CTAs selected from the largest managers open to new investment. Investors cannot directly invest in an index. |

Comparison

of the Change in Value of a $1,000,000 Investment | June 30, 2012– June 30, 2022

Past performance is not necessarily indicative of future results.

| **** | Initial investment has been adjusted for the maximum sales charge of 5.75%. |

| Holdings by Type of Investment as of June 30, 2022 | % of Net Assets | |||

| Open Ended Fund | 70.3 | % | ||

| Purchased Options | 22.7 | % | ||

| Other, Cash & Cash Equivalents | 7.0 | % | ||

| 100.0 | % | |||

Please refer to the Portfolio of Investments in this report for a detailed listing of the Fund’s holdings.

9

| ALTEGRIS FUTURES EVOLUTION STRATEGY |

| SCHEDULE OF INVESTMENTS |

| June 30, 2022 |

| Shares | Fair Value | |||||||||||||

| OPEN END FUNDS — 70.3% | ||||||||||||||

| FIXED INCOME - 70.3% | ||||||||||||||

| 11,470,464 | DoubleLine Low Duration Bond Fund, Cl I (Cost $113,000,619) | $ | 108,854,705 | |||||||||||

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | (%) | Maturity | ||||||||||||

| CORPORATE BONDS — 0.0% | ||||||||||||||

| MACHINERY — 0.0% | ||||||||||||||

| 52,619 | INVEPAR A-1(a)(b)(c)(d)(e) (Cost $3,430) | 0.000 | 12/30/28 | 0 | ||||||||||

| Shares | ||||||||||||||

| WARRANT — 0.0% | ||||||||||||||

| ENGINEERING & CONSTRUCTION - 0.0% | ||||||||||||||

| 43,904 | OAS S.A. (Brazil)(b)(c)(e) (Cost $8,837) | 0.000 | 01/21/39 | 0 | ||||||||||

| Contracts(f) | Broker/Counterparty | Expiration Date | Exercise Price | Notional Value | Fair Value | |||||||||||||||

| EQUITY OPTIONS PURCHASED - 22.7% (g) | ||||||||||||||||||||

| CALL OPTIONS PURCHASED - 22.7% | ||||||||||||||||||||

| 95,054 | NOMURA CALL OPTION ISAM | Nomura | 08/16/2023 | $ | 0.001 | $ | 14,684,289 | $ | 14,346,139 | |||||||||||

| 101,780 | NOMURA CALL OPTION WNTN | Nomura | 08/16/2023 | 0.001 | 14,309,068 | 13,739,079 | ||||||||||||||

| 15,801 | NOMURA CALL OPTION WNTN TRND | Nomura | 08/16/2023 | 0.001 | 7,771,206 | 7,188,912 | ||||||||||||||

| TOTAL CALL OPTIONS PURCHASED (Cost - $36,764,563) | 35,274,130 | |||||||||||||||||||

| TOTAL INVESTMENTS - 93.0% (Cost $149,777,449) | $ | 144,128,835 | ||||||||||||||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES- 7.0% | 10,807,254 | |||||||||||||||||||

| NET ASSETS - 100.0% | $ | 154,936,089 | ||||||||||||||||||

| (a) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of June 30, 2022 the total market value of 144A securities is $0 or 0.0% of net assets. |

| (b) | Illiquid holdings. |

| (c) | Non-income producing. |

| (d) | Default bond. |

| (e) | The value of these securities has been determined in good faith under the policies of the Board of Trustee as of June 30, 2022 |

| (f) | Each option contract allows the holder of the option to purchase 100 shares of the underlying security. |

| (g) | These securities provide exposure to daily returns of the reference asset that are not publicly available, the Top 50 holdings for each option is shown on the subsequent pages. |

See accompanying notes to financial statements.

10

| Altegris Futures Evolution Strategy Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2022 |

| ISAM Top 50 Holdings ^ | ||||||||||||||||||

| FUTURES CONTRACTS | ||||||||||||||||||

| Number of Contracts | Description | Expiration Date | Notional Value at June 30, 2022 | Unrealized Appreciation/ (Depreciation) | % of Fund Net Assets | |||||||||||||

| Long Contracts | ||||||||||||||||||

| 13 | Carbon Emission Futures | Dec-22 | 1,228,809 | $ | 37,585 | 0.02 | % | |||||||||||

| 10 | LME Zinc Future | Sep-22 | 790,188 | (169,193 | ) | (0.11 | )% | |||||||||||

| Subtotal | $ | (131,608 | ) | |||||||||||||||

| Short Contracts | ||||||||||||||||||

| (11 | ) | 2 Yr Treasury Note Futures | Sep-22 | 2,310,172 | $ | 6,094 | 0.00 | % | ||||||||||

| (52 | ) | Australian 3 Yr Bond Futures | Sep-22 | 3,857,327 | (8,128 | ) | (0.01 | )% | ||||||||||

| (16 | ) | AS BK Bill | Jun-23 | 781,228 | 31,722 | 0.02 | % | |||||||||||

| (31 | ) | AS BK Bill | Sep-23 | 1,513,815 | 12,824 | 0.01 | % | |||||||||||

| (825 | ) | BMF 1D Interbank Future | Jan-25 | 830,569 | (39,694 | ) | (0.03 | )% | ||||||||||

| (90 | ) | Cocoa Future | Sep-22 | 2,106,000 | 87,670 | 0.06 | % | |||||||||||

| (31 | ) | ERX 2 Bund Future | Sep-22 | 3,547,256 | 2,731 | 0.00 | % | |||||||||||

| (7 | ) | Euro BTP Future | Sep-22 | 903,553 | 10,044 | 0.01 | % | |||||||||||

| (43 | ) | Euro BTS Future | Sep-22 | 4,908,892 | (3,533 | ) | (0.00 | )% | ||||||||||

| (3 | ) | Ice 3 Month Saron Futures | Sep-23 | 777,350 | 340 | 0.00 | % | |||||||||||

| (4 | ) | Ice 3 Month Sonia Futures | Jun-23 | 1,181,631 | 4,780 | 0.00 | % | |||||||||||

| (12 | ) | Ice 3 Month Sonia Futures | Mar-23 | 3,542,337 | 26,320 | 0.02 | % | |||||||||||

| (1 | ) | Japan Bond | Sep-22 | 1,094,810 | (13,261 | ) | (0.01 | )% | ||||||||||

| (26 | ) | Korea 10 Year Treasury Bond | Sep-22 | 2,236,451 | (21,064 | ) | (0.01 | )% | ||||||||||

| (94 | ) | Korean Bond | Sep-22 | 7,551,406 | (23,478 | ) | (0.02 | )% | ||||||||||

| (28 | ) | L Cattle Future | Aug-22 | 1,484,840 | 6,730 | 0.00 | % | |||||||||||

| (17 | ) | L Cattle Future | Oct-22 | 943,670 | 1,240 | 0.00 | % | |||||||||||

| (9 | ) | LME Zinc Future | Sep-22 | 711,169 | 65,288 | 0.04 | % | |||||||||||

| (20 | ) | Silver Future | Sep-22 | 2,035,200 | 82,125 | 0.05 | % | |||||||||||

| (58 | ) | Sugar Future | Oct-22 | 1,201,760 | (2,598 | ) | (0.00 | )% | ||||||||||

| Subtotal | 226,152 | |||||||||||||||||

| CREDIT DEFAULT SWAPS | ||||||||||||||||||

| Number of Contracts | Description | Maturity Date | Notional Value at June 30, 2022 | Unrealized Appreciation/ (Depreciation) | % of Fund Net Assets | |||||||||||||

| 1,250,000 | Markit CDX North America Investment Grade Index | 6/20/2027 | $ | 1,250,000 | $ | 563 | 0.00 | % | ||||||||||

| 1,900,000 | MARKIT ITRX EUROPE | 6/20/2027 | 1,991,960 | 16,728 | 0.01 | % | ||||||||||||

| 1,600,000 | MARKIT ITRX EUROPE | 6/20/2027 | 1,677,440 | 21,360 | 0.01 | % | ||||||||||||

| Subtotal | $ | 38,651 | ||||||||||||||||

| EQUITY SWAP | ||||||||||||||||||

| Number of Contracts | Description | Notional Value at June 30, 2022 | Unrealized Appreciation/ (Depreciation) | % of Fund Net Assets | ||||||||||||||

| 23,200 | J.P. Morgan iDex U.S. Custom Market Cap Healthcare USD Index | 821,512 | (67 | ) | (0.00 | )% | ||||||||||||

| INTEREST RATE SWAPS | ||||||||||||||||||

| Number of Contracts | Description | Maturity Date | Notional Value at June 30, 2022 | Unrealized Appreciation/ (Depreciation) | % of Fund Net Assets | |||||||||||||

| 40,000,000 | CZK Rate Swap | 9/15/2027 | 882,771 | 2,896,532 | 1.87 | % | ||||||||||||

| 2,000,000 | AUD Rate Swap | 12/15/2027 | 754,426 | 8,859 | 0.01 | % | ||||||||||||

| 200,000,000 | JPY Rate Swap | 12/15/2027 | 805,137 | (268,996 | ) | (0.17 | )% | |||||||||||

| 2,000,000,000 | KRW Rate Swap | 12/15/2027 | 848,525 | 18,905 | 0.01 | % | ||||||||||||

| 2,000,000 | SGD Rate Swap | 12/15/2027 | 786,667 | 34,503 | 0.02 | % | ||||||||||||

| 25,000,000 | ZAR Rate Swap | 12/15/2027 | 839,030 | 599,263 | 0.39 | % | ||||||||||||

| 700,000 | EUR Rate Swap | 6/15/2032 | 733,880 | (11,080 | ) | (0.01 | )% | |||||||||||

| 800,000 | US INFL Rate Swap | 6/15/2032 | 800,000 | (26,076 | ) | (0.02 | )% | |||||||||||

| 2,000,000 | NZD Rate Swap | 9/15/2032 | 1,274,286 | 170,628 | 0.11 | % | ||||||||||||

| 20,000,000 | MXN Rate Swap | 12/8/2032 | 1,036,250 | 195,588 | 0.13 | % | ||||||||||||

| Subtotal | $ | 3,618,126 | ||||||||||||||||

| FORWARD FOREIGN CURRENCY CONTRACTS | ||||||||||||||||||||||||

| Settlement Date | Currency to Deliver/ Receive | Value | In Exchange For | Value | U.S. Dollar Value | Unrealized Appreciation/ (Depreciation) | % of Fund Net Assets | |||||||||||||||||

| To Buy: | ||||||||||||||||||||||||

| 09/21/22 | USD | 1,000,000 | COP | 4,091,715,100 | $ | 1,011,305 | $ | 28,107 | 0.02 | % | ||||||||||||||

| 09/21/22 | USD | 700,000 | CZK | 16,642,749 | 707,244 | 2,041 | 0.00 | % | ||||||||||||||||

| 09/21/22 | USD | 2,200,000 | IDR | 32,579,594,000 | 2,215,042 | 28,136 | 0.02 | % | ||||||||||||||||

| 09/21/22 | USD | 1,000,000 | ILS | 3,365,417 | 995,002 | 31,234 | 0.02 | % | ||||||||||||||||

| 09/21/22 | USD | 1,200,000 | INR | 94,678,990 | 1,208,065 | 9,051 | 0.01 | % | ||||||||||||||||

| 09/21/22 | USD | 700,000 | PHP | 2,676,560 | 705,508 | 5,936 | 0.00 | % | ||||||||||||||||

| 09/21/22 | USD | 1,400,000 | THB | 75,466,820 | 1,408,505 | 36,593 | 0.02 | % | ||||||||||||||||

| 09/21/22 | USD | 2,600,000 | TRY | 89,348,884 | 2,592,675 | 61,600 | 0.04 | % | ||||||||||||||||

| 09/21/22 | USD | 1,200,000 | TWD | 23,022,094 | 1,285,245 | (93,779 | ) | (0.06 | )% | |||||||||||||||

| 1,200,000 | 35,186,740 | 1,192,795 | 9,676 | |||||||||||||||||||||

| To Sell: | ||||||||||||||||||||||||

| 7/30/2022 | INR | 31 | USD | 788,686 | $ | 785,168 | 5,688 | 0.00 | % | |||||||||||||||

| 09/21/22 | USD | 1,100,000 | PEN | 22,177,110 | 1,116,733 | (40,225 | ) | (0.03 | )% | |||||||||||||||

| 09/21/22 | USD | 1,500,000 | MXN | 5,630,251 | 1,511,803 | (13,644 | ) | (0.01 | )% | |||||||||||||||

| 09/21/22 | USD | 900,000 | TRY | 16,916,917 | 963,934 | 49,390 | 0.03 | % | ||||||||||||||||

| Subtotal | $ | 119,804 | ||||||||||||||||||||||

| All Other Investments | 10,475,081 | |||||||||||||||||||||||

| Total Value of Purchased Option | 14,346,139 | |||||||||||||||||||||||

| ^ | This investment is not a direct holding of the Fund. The top 50 holdings were determined based on the absolute notional values of the positions within the underlying basket. |

See accompanying notes to financial statements.

11

| Altegris Futures Evolution Strategy Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2022 |

| WNTN Top 50 Holdings ^ | ||||||||||||||||||

| FUTURES CONTRACTS | ||||||||||||||||||

| Number of Contracts | Description | Expiration Date | Notional Value at June 30, 2022 | Unrealized Appreciation/ (Depreciation) | % of Fund Net Assets | |||||||||||||

| Long Contracts | ||||||||||||||||||

| 13 | Soybean Future | Aug-22 | 1,014,325 | $ | 1,850 | 0.00 | % | |||||||||||

| 15 | Soybean Future | Nov-22 | 1,093,500 | (23,150 | ) | (0.01 | )% | |||||||||||

| Subtotal | $ | (21,300 | ) | |||||||||||||||

| Short Contracts | ||||||||||||||||||

| (63 | ) | 2 Year T Note Futures | Sep-22 | 13,230,984 | $ | 14,625 | 0.01 | % | ||||||||||

| (28 | ) | 5 Year T Note Futures | Sep-22 | 3,143,000 | 344 | 0.00 | % | |||||||||||

| (22 | ) | Australian 10 Yr Bond Futures | Sep-22 | 1,805,610 | (15,803 | ) | (0.01 | )% | ||||||||||

| (14 | ) | Australian 3 Yr Bond Futures | Sep-22 | 1,038,511 | (8,676 | ) | (0.01 | )% | ||||||||||

| (18 | ) | Canadian Bond Future | Sep-22 | 1,733,678 | 33,332 | 0.02 | % | |||||||||||

| (4 | ) | Dax Index Future | Sep-22 | 1,338,912 | 30,980 | 0.02 | % | |||||||||||

| (19 | ) | Emini MSCI EM Future | Sep-22 | 952,565 | 2,840 | 0.00 | % | |||||||||||

| (4 | ) | Emini Nasdaq Future | Sep-22 | 922,360 | (7,410 | ) | (0.00 | )% | ||||||||||

| (7 | ) | Emini S&P 500 Future | Sep-22 | 1,326,325 | (11,858 | ) | ||||||||||||

| (40 | ) | ERX 2 Bund Future | Sep-22 | 4,577,105 | (8,482 | ) | (0.01 | )% | ||||||||||

| (13 | ) | ERX Bobl Future | Sep-22 | 1,692,610 | (2,097 | ) | (0.00 | )% | ||||||||||

| (7 | ) | Euro Bund Future | Sep-22 | 1,091,867 | (765 | ) | (0.00 | )% | ||||||||||

| (42 | ) | Eurostoxx 50 Future | Sep-22 | 1,515,169 | 10,683 | 0.01 | % | |||||||||||

| (20 | ) | Gold Future | Aug-22 | 3,614,600 | 72,330 | 0.05 | % | |||||||||||

| (26 | ) | Hogs Future | Aug-22 | 1,061,840 | 36,760 | 0.02 | % | |||||||||||

| (3 | ) | Ice 3 Month Sonia Futures | Mar-23 | 885,584 | 1,614 | 0.00 | % | |||||||||||

| (9 | ) | Ice 3 Month Sonia Futures | Jun-23 | 2,658,671 | 23,397 | 0.02 | % | |||||||||||

| (11 | ) | Ice 3 Month Sonia Futures | Sep-23 | 3,252,500 | 18,023 | 0.01 | % | |||||||||||

| (12 | ) | Ice 3 Month Sonia Futures | Dec-23 | 3,550,922 | 2,025 | 0.00 | % | |||||||||||

| (13 | ) | Ice 3 Month Sonia Futures | Mar-24 | 3,849,405 | 8,890 | 0.01 | % | |||||||||||

| (12 | ) | Ice 3 Month Sonia Futures | Jun-24 | 3,556,220 | 5,267 | 0.00 | % | |||||||||||

| (11 | ) | Ice 3 Month Sonia Futures | Sep-24 | 3,262,212 | 4,171 | 0.00 | % | |||||||||||

| (9 | ) | Ice 3 Month Sonia Futures | Dec-24 | 2,670,179 | 11,767 | 0.01 | % | |||||||||||

| (5 | ) | Ice 3 Month Sonia Futures | Jun-25 | 1,483,889 | 6,409 | 0.00 | % | |||||||||||

| (8 | ) | Ice 3 Month Sonia Futures | Mar-25 | 2,373,979 | 7,596 | 0.00 | % | |||||||||||

| (5 | ) | Japan Bond Future | Sep-22 | 5,474,049 | (8,546 | ) | (0.01 | )% | ||||||||||

| (19 | ) | Lcattle Future | Oct-22 | 1,054,690 | 8,840 | 0.01 | % | |||||||||||

| (6 | ) | LME Copper Future | Aug-22 | 1,239,375 | 96,921 | 0.06 | % | |||||||||||

| (20 | ) | Long Guilt Future | Sep-22 | 2,776,097 | 65,822 | 0.04 | % | |||||||||||

| (5 | ) | OSK Nikkei Future | Sep-22 | 971,707 | 4,809 | 0.00 | % | |||||||||||

| (23 | ) | Silver Future | Sep-22 | 2,340,480 | 102,915 | 0.07 | % | |||||||||||

| (10 | ) | Treasury Note Future | Sep-22 | 1,185,313 | 2,953 | 0.00 | % | |||||||||||

| Subtotal | $ | 509,676 | ||||||||||||||||

| FORWARD FOREIGN CURRENCY CONTRACTS | ||||||||||||||||||||||||

| Settlement Date | Currency to Deliver/ Receive | Value | In Exchange For | Value | U.S. Dollar Value | Unrealized Appreciation/ (Depreciation) | % of Fund Net Assets | |||||||||||||||||

| To Buy: | ||||||||||||||||||||||||

| 07/05/22 | BRL | 15,503,170 | USD | 2,959,750 | $ | 2,948,703 | $ | 6,229 | 0.00 | % | ||||||||||||||

| 07/05/22 | USD | 3,000,000 | BRL | 15,503,170 | 2,998,988 | 50,285 | 0.03 | % | ||||||||||||||||

| 07/29/22 | USD | 1,600,000 | INR | 125,662,900 | 1,603,143 | 11,748 | 0.01 | % | ||||||||||||||||

| 9/30/2022 | AUD | 43 | USD | 3,052,215 | 2,968,290 | (80,485 | ) | (0.05 | )% | |||||||||||||||

| 9/30/2022 | CAD | 78 | USD | 6,152,215 | 6,059,040 | (91,615 | ) | (0.06 | )% | |||||||||||||||

| To Sell: | ||||||||||||||||||||||||

| 07/05/22 | BRL | 15,033,658 | USD | 2,870,114 | $ | 2,859,402 | $ | (6,040 | ) | (0.00 | )% | |||||||||||||

| 07/05/22 | USD | 3,000,000 | BRL | 15,033,658 | 2,998,988 | (139,586 | ) | (0.09 | )% | |||||||||||||||

| 07/29/22 | USD | 900,000 | IDR | 13,322,869,000 | 903,582 | (9,284 | ) | (0.01 | )% | |||||||||||||||

| 07/29/22 | USD | 4,600,000 | INR | 360,422,840 | 4,609,037 | (44,643 | ) | (0.03 | )% | |||||||||||||||

| 08/02/22 | USD | 2,200,000 | BRL | 11,477,185 | 2,218,273 | (35,312 | ) | (0.02 | )% | |||||||||||||||

| 9/21/2022 | CNH | 8,500,000 | USD | 1,268,844 | 1,269,900 | (156 | ) | (0.00 | )% | |||||||||||||||

| 9/30/2022 | CHF | 12 | USD | 1,520,431 | 1,570,800 | (61,094 | ) | (0.04 | )% | |||||||||||||||

| 9/30/2022 | EUR | 120 | USD | 16,016,704 | 15,726,000 | 209,704 | 0.14 | % | ||||||||||||||||

| 9/30/2022 | GBP | 28 | USD | 2,134,578 | 2,131,150 | (247 | ) | (0.00 | )% | |||||||||||||||

| 9/30/2022 | JPY | 259 | USD | 24,326,179 | 23,850,663 | 318,498 | 0.21 | % | ||||||||||||||||

| 9/30/2022 | NZD | 25 | USD | 1,588,795 | 1,561,000 | 28,295 | 0.02 | % | ||||||||||||||||

| Subtotal | $ | 156,297 | ||||||||||||||||||||||

| All Other Investments | 13,594,900 | |||||||||||||||||||||||

| Total Value of Purchased Option | 13,739,079 | |||||||||||||||||||||||

| ^ | This investment is not a direct holding of the Fund. The top 50 holdings were determined based on the absolute notional values of the positions within the underlying basket. |

See accompanying notes to financial statements.

12

| Altegris Futures Evolution Strategy Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2022 |

| WNTN TRND Top 50 Holdings ^ | ||||||||||||||||||||

| FUTURES CONTRACTS | ||||||||||||||||||||

| Number

of Contracts | Description | Expiration Date | Notional

Value at June 30, 2022 | Value

and Unrealized Appreciation/ (Depreciation) | %

of Fund Net Assets | |||||||||||||||

| Long Contracts | ||||||||||||||||||||

| 7 | LME Lead Future | Jul-22 | 334,863 | (61,989 | ) | (0.04 | )% | |||||||||||||

| 4 | LME Zinc Future | Jul-22 | 318,175 | (102,492 | ) | (0.07 | )% | |||||||||||||

| 4 | Soybean Future | Aug-22 | 312,100 | 125 | 0.00 | % | ||||||||||||||

| Subtotal | $ | (164,356 | ) | |||||||||||||||||

| Short Contracts | ||||||||||||||||||||

| (34 | ) | 2 Year Treasury Note Futures | Sep-22 | $ | 7,140,531 | $ | 10,313 | 0.01 | % | |||||||||||

| (25 | ) | 5 Year Treasury Note Futures | Sep-22 | 2,806,250 | 4,586 | 0.00 | % | |||||||||||||

| (22 | ) | Aussie 10 Year Bond Futures | Sep-22 | 1,805,610 | (14,600 | ) | (0.01 | )% | ||||||||||||

| (48 | ) | Aussie 3 Year Bond Futures | Sep-22 | 3,560,610 | (16,554 | ) | (0.01 | )% | ||||||||||||

| (7 | ) | AS BK Bill Future | Sep-22 | 342,825 | 5,945 | 0.00 | % | |||||||||||||

| (6 | ) | As index future | Sep-22 | 669,004 | 6,109 | 0.00 | % | |||||||||||||

| (2 | ) | Dax Index Future | Sep-22 | 669,456 | 30,220 | 0.02 | % | |||||||||||||

| (13 | ) | Emini MSCi Futures | Sep-22 | 651,755 | 2,880 | 0.00 | % | |||||||||||||

| (4 | ) | Emini Nasdaq Future | Sep-22 | 922,360 | 4,904 | 0.00 | % | |||||||||||||

| (9 | ) | Emin S&P500 Future | Sep-22 | 1,705,275 | (16,463 | ) | (0.01 | )% | ||||||||||||

| (14 | ) | ERX 2 Bund Future | Sep-22 | 1,601,987 | (5,001 | ) | (0.00 | )% | ||||||||||||

| (18 | ) | Erx Bobl Futures | Sep-22 | 2,343,614 | (14,028 | ) | (0.01 | )% | ||||||||||||

| (18 | ) | Euro Dollar Future | Jun-23 | 310,388 | 17,163 | 0.01 | % | |||||||||||||

| (19 | ) | Euro Dollar Future | Sep-23 | 328,276 | 24,588 | 0.02 | % | |||||||||||||

| (19 | ) | Euro Dollar Future | Dec-23 | 328,785 | 18,375 | 0.01 | % | |||||||||||||

| (19 | ) | Euro Dollar Future | Mar-24 | 329,175 | 8,238 | 0.01 | % | |||||||||||||

| (18 | ) | Euro Dollar Future | Jun-24 | 312,139 | (1,488 | ) | (0.00 | )% | ||||||||||||

| (3 | ) | Euro Bts Future | Sep-22 | 342,481 | (4,099 | ) | (0.00 | )% | ||||||||||||

| (23 | ) | Euro Bund Future | Sep-22 | 3,587,562 | 409 | 0.00 | % | |||||||||||||

| (3 | ) | Euro oat future | Sep-22 | 435,705 | 5,976 | 0.00 | % | |||||||||||||

| (28 | ) | Euro Stoxx Future | Sep-22 | 1,010,112 | 5,719 | 0.00 | % | |||||||||||||

| (4 | ) | Eurx Bobl-Buxl Future | Sep-22 | 685,905 | 13,420 | 0.01 | % | |||||||||||||

| (3 | ) | Gold Future | Aug-22 | 542,190 | 8,240 | 0.01 | % | |||||||||||||

| (5 | ) | ICE 3 month Sonia Futures | 331/23 | 1,475,974 | 9,316 | 0.01 | % | |||||||||||||

| (6 | ) | ICE 3 month Sonia Futures | Jun-23 | 1,772,447 | 10,275 | 0.01 | % | |||||||||||||

| (6 | ) | ICE 3 month Sonia Futures | Sep-23 | 1,774,091 | 12,665 | 0.01 | % | |||||||||||||

| (6 | ) | ICE 3 month Sonia Futures | Dec-23 | 1,775,461 | 12,011 | 0.01 | % | |||||||||||||

| (6 | ) | ICE 3 month Sonia Futures | Mar-24 | 1,776,648 | 3,593 | 0.00 | % | |||||||||||||

| (6 | ) | ICE 3 month Sonia Futures | Jun-24 | 1,778,110 | 11,052 | 0.01 | % | |||||||||||||

| (5 | ) | ICE 3 month Sonia Futures | Sep-24 | 1,482,824 | 7,276 | 0.00 | % | |||||||||||||

| (4 | ) | ICE 3 month Sonia Futures | Dec-24 | 1,186,746 | 7,794 | 0.01 | % | |||||||||||||

| (4 | ) | ICE 3 month Sonia Futures | Mar-25 | 1,186,990 | 2,253 | 0.00 | % | |||||||||||||

| (2 | ) | ICE 3 month Sonia Futures | Jun-25 | 593,556 | 320 | 0.00 | % | |||||||||||||

| (6 | ) | Japanese Bond Future | Sep-22 | 6,568,859 | (13,703 | ) | (0.01 | )% | ||||||||||||

| (6 | ) | Lcattle Future | Aug-22 | 318,180 | 860 | 0.00 | % | |||||||||||||

| (5 | ) | LME Aluminum Future | Jul-22 | 304,813 | 12,713 | 0.01 | % | |||||||||||||

| (2 | ) | LME Copper Future | Aug-22 | 413,125 | 21,462 | 0.01 | % | |||||||||||||

| (7 | ) | LME Lead Futures | Jul-22 | 334,863 | 37,793 | 0.02 | % | |||||||||||||

| (8 | ) | LME Lead Futures | Aug-22 | 382,700 | 29,220 | 0.02 | % | |||||||||||||

| (4 | ) | Lme Zinc Future | Jul-22 | 318,175 | 44,243 | 0.03 | % | |||||||||||||

| (7 | ) | Long Guilt Future | Sep-22 | 971,634 | 9,937 | 0.01 | % | |||||||||||||

| (2 | ) | Mini Dow Future | Sep-22 | 307,810 | (3,370 | ) | (0.00 | )% | ||||||||||||

| (2 | ) | Osk Nikkei Future | Sep-22 | 388,683 | (7,809 | ) | (0.01 | )% | ||||||||||||

| (6 | ) | Silver Futures | Sep-22 | 610,560 | 26,215 | 0.02 | % | |||||||||||||

| (6 | ) | T Bond Future | Sep-22 | 831,750 | (4,203 | ) | (0.00 | )% | ||||||||||||

| (15 | ) | T Note Future | Sep-22 | 1,777,969 | 6,656 | 0.00 | % | |||||||||||||

| (3 | ) | Ultra T Bond Future | Sep-22 | 463,031 | (1,523 | ) | (0.00 | )% | ||||||||||||

| Subtotal | $ | 329,898 | ||||||||||||||||||

| All Other Investments | 7,023,370 | |||||||||||||||||||

| Total Value of Purchased Option | 7,188,912 | |||||||||||||||||||

| ^ | This investment is not a direct holding of the Fund. The top 50 holdings were determined based on the absolute notional values of the positions within the underlying basket. |

See accompanying notes to financial statements.

13

| Altegris Futures Evolution Strategy Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| June 30, 2022 |

| ASSETS | ||||

| Investment securities: | ||||

| At cost | $ | 149,777,449 | ||

| At value | $ | 144,128,835 | ||

| Cash | 10,375,426 | |||

| Receivable for Fund shares sold | 523,219 | |||

| Interest receivable | 196,443 | |||

| Prepaid expenses and other assets | 46,087 | |||

| TOTAL ASSETS | 155,270,010 | |||

| LIABILITIES | ||||

| Payable for Fund shares repurchased | 69,755 | |||

| Investment advisory fees payable | 147,341 | |||

| Payable to related parties | 14,127 | |||

| Distribution (12b-1) fees payable | 17,285 | |||

| Foreign cash due to custodian (Cost: $8,474) | 8,474 | |||

| Accrued expenses and other liabilities | 76,939 | |||

| TOTAL LIABILITIES | 333,921 | |||

| NET ASSETS | $ | 154,936,089 | ||

| Composition of Net Assets: | ||||

| Paid in capital | $ | 160,388,444 | ||

| Accumulated loss | (5,452,355 | ) | ||

| NET ASSETS | $ | 154,936,089 | ||

See accompanying notes to financial statements.

14

| Altegris Futures Evolution Strategy Fund |

| STATEMENT OF ASSETS AND LIABILITIES (Continued) |

| June 30, 2022 |

| Net Asset Value Per Share: | ||||

| Class A Shares: | ||||

| Net Assets | $ | 6,752,082 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 695,407 | |||

| Net asset value (Net Assets ÷ Shares Outstanding)and redemption price per share (a)(b) | $ | 9.71 | ||

| Maximum offering price per share (net asset value plus maximum sales charge of 5.75%) (c) | $ | 10.30 | ||

| Class C Shares: | ||||

| Net Assets | $ | 5,501,912 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 566,155 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (b)(d) | $ | 9.72 | ||

| Class I Shares: | ||||

| Net Assets | $ | 131,216,790 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 13,599,702 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (b) | $ | 9.65 | ||

| Class N Shares: | ||||

| Net Assets | $ | 11,465,305 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 1,178,648 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (b) | $ | 9.73 |

| (a) | Purchases of $1 million or more, a contingent deferred sales charge of up to 1.00% may apply to redemptions made within 18 months of purchase. |

| (b) | Redemptions made within 30 days of purchase may be assessed a redemption fee of 1.00%. |

| (c) | On investments of $25,000 or more, the sales load is reduced. |

| (d) | A contingent deferred sales charge of up to 1.00% may be applied to shares redeemed within 12 months of purchase. |

See accompanying notes to financial statements.

15

| Altegris Futures Evolution Strategy Fund |

| STATEMENT OF OPERATIONS |

| Year ended June 30, 2022 |

| INVESTMENT INCOME | ||||

| Dividends | $ | 1,634,483 | ||

| Interest | 4,497 | |||

| TOTAL INVESTMENT INCOME | 1,638,980 | |||

| EXPENSES | ||||

| Advisory fees | 1,628,018 | |||

| Distribution (12b-1) fees: | ||||

| Class A | 16,479 | |||

| Class C | 41,974 | |||

| Class N | 32,686 | |||

| Administrative services fees | 94,916 | |||

| Third party administrative services fees | 87,780 | |||

| Registration fees | 80,573 | |||

| Transfer agent fees | 56,257 | |||

| Audit fees | 44,161 | |||

| Custodian fees | 41,948 | |||

| Accounting services fees | 28,632 | |||

| Printing and postage expenses | 27,237 | |||

| Compliance officer fees | 20,000 | |||

| Trustees fees and expenses | 16,994 | |||

| Legal fees | 16,314 | |||

| Interest expenses | 5,910 | |||

| Insurance expense | 5,615 | |||

| Other expenses | 3,448 | |||

| TOTAL EXPENSES | 2,248,942 | |||

| Less: Fees waived by the Advisor | (255,113 | ) | ||

| NET EXPENSES | 1,993,829 | |||

| NET INVESTMENT LOSS | (354,849 | ) | ||

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | ||||

| Net realized gain/(loss) from: | ||||

| Investments | (401,376 | ) | ||

| Purchased Options | 34,003,455 | |||

| Net Realized Gain | 33,602,079 | |||

| Net change in unrealized appreciation/(depreciation) on: | ||||

| Investments | (4,147,091 | ) | ||

| Purchased Options | (2,306,464 | ) | ||

| Foreign Currency Translations | 363 | |||

| Net change in unrealized depreciation | (6,453,192 | ) | ||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 27,148,887 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 26,794,038 |

See accompanying notes to financial statements.

16

| Altegris Futures Evolution Strategy Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the Year Ended | For the Year Ended | |||||||

| June 30, | June 30, | |||||||

| 2022 | 2021 | |||||||

| INCREASE/(DECREASE) IN NET ASSETS FROM OPERATIONS | ||||||||

| Net investment income/(loss) | $ | (354,849 | ) | $ | 1,592,898 | |||

| Net realized gain on investments, purchased options, foreign currency contracts and translations | 33,602,079 | 8,210,786 | ||||||

| Net change in unrealized appreciation/(depreciation) on investments, purchased options and foreign currency translations | (6,453,192 | ) | 9,429,420 | |||||

| Net increase in net assets resulting from operations | 26,794,038 | 19,233,104 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Total Distributions Paid | ||||||||

| Class A | (480,064 | ) | (118,757 | ) | ||||

| Class C | (290,386 | ) | (64,765 | ) | ||||

| Class I | (9,349,743 | ) | (3,363,103 | ) | ||||

| Class N | (1,076,158 | ) | (469,349 | ) | ||||

| Total distributions to shareholders | (11,196,351 | ) | (4,015,974 | ) | ||||

| SHARES OF BENEFICIAL INTEREST | ||||||||

| Proceeds from shares sold: | ||||||||

| Class A | 5,446,813 | 888,380 | ||||||

| Class C | 1,352,350 | 32,580 | ||||||

| Class I | 80,293,721 | 30,512,730 | ||||||

| Class N | 3,218,434 | 10,769,195 | ||||||

| Net asset value of shares issued in reinvestment of distributions: | ||||||||

| Class A | 422,582 | 109,203 | ||||||

| Class C | 277,910 | 60,501 | ||||||

| Class I | 5,130,294 | 2,264,215 | ||||||

| Class N | 1,040,302 | 460,985 | ||||||

| Redemption fee proceeds: | ||||||||

| Class A | 294 | 612 | ||||||

| Class C | — | 5 | ||||||

| Class I | 771 | 4,621 | ||||||

| Class N | 103 | 401 | ||||||

| Payments for shares redeemed: | ||||||||

| Class A | (5,862,708 | ) | (5,588,227 | ) | ||||

| Class C | (934,910 | ) | (4,955,070 | ) | ||||

| Class I | (100,834,081 | ) | (145,646,611 | ) | ||||

| Class N | (11,030,898 | ) | (36,370,890 | ) | ||||

| Net decrease from shares of beneficial interest transactions | (21,479,023 | ) | (147,457,370 | ) | ||||

| NET DECREASE IN NET ASSETS | (5,881,336 | ) | (132,240,240 | ) | ||||

| NET ASSETS | ||||||||

| Beginning of Year | 160,817,425 | 293,057,665 | ||||||

| End of Year | $ | 154,936,089 | $ | 160,817,425 | ||||

| (a) | As corrected from $33,266,798 and ($6,117,911), as previously reported. |

See accompanying notes to financial statements.

17

| Altegris Futures Evolution Strategy Fund |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| For the Year Ended | For the Year Ended | |||||||

| June 30, | June 30, | |||||||

| 2022 | 2021 | |||||||

| SHARE ACTIVITY | ||||||||

| Class A: | ||||||||

| Shares Sold | 597,133 | 112,685 | ||||||

| Shares Reinvested | 51,038 | 14,345 | ||||||

| Shares Redeemed | (620,829 | ) | (713,697 | ) | ||||

| Net increase/(decrease) in shares of beneficial interest outstanding | 27,342 | (586,667 | ) | |||||

| Class C: | ||||||||

| Shares Sold | 137,515 | 4,173 | ||||||

| Shares Reinvested | 33,466 | 7,983 | ||||||

| Shares Redeemed | (106,548 | ) | (644,996 | ) | ||||

| Net increase/(decrease) in shares of beneficial interest outstanding | 64,433 | (632,840 | ) | |||||

| Class I: | ||||||||

| Shares Sold | 8,431,657 | 3,896,862 | ||||||

| Shares Reinvested | 624,179 | 298,155 | ||||||

| Shares Redeemed | (10,999,945 | ) | (19,000,514 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (1,944,109 | ) | (14,805,497 | ) | ||||

| Class N: | ||||||||

| Shares Sold | 339,265 | 1,387,936 | ||||||

| Shares Reinvested | 125,312 | 61,011 | ||||||

| Shares Redeemed | (1,259,739 | ) | (4,740,396 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (795,162 | ) | (3,291,449 | ) | ||||

See accompanying notes to financial statements.

18

| Altegris Futures Evolution Strategy Fund |

| FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year

| Class A | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| June 30, | June 30, | June 30, | June 30, | June 30, | ||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018^ | ||||||||||||||||

| Net asset value, beginning of year | $ | 8.64 | $ | 7.74 | $ | 9.31 | $ | 9.82 | $ | 9.37 | ||||||||||

| Income/(loss) from investment operations: | ||||||||||||||||||||

| Net investment income/(loss) (1) | (0.04 | ) | 0.04 | 0.12 | 0.11 | 0.09 | ||||||||||||||

| Net realized and unrealized gain/(loss) on investments | 1.85 | 0.98 | (1.59 | ) | (0.17 | ) | 0.48 | |||||||||||||

| Total from investment operations | 1.81 | 1.02 | (1.47 | ) | (0.06 | ) | 0.57 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.74 | ) | (0.12 | ) | (0.10 | ) | (0.45 | ) | (0.12 | ) | ||||||||||

| Total distributions | (0.74 | ) | (0.12 | ) | (0.10 | ) | (0.45 | ) | (0.12 | ) | ||||||||||

| Redemption fees collected (2) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||

| Net assets, at end of year | $ | 9.71 | $ | 8.64 | $ | 7.74 | $ | 9.31 | $ | 9.82 | ||||||||||

| Total return (3) | 22.48 | % | 13.46 | % | (15.94 | )% (4) | (0.52 | )% (4) | 6.06 | % (4) | ||||||||||

| Net assets, at end of year(000s) | $ | 6,752 | $ | 5,771 | $ | 9,711 | $ | 21,669 | $ | 40,624 | ||||||||||

| Ratios including the expenses and income of AFES Fund Limited applicable for the year ended 2018: | ||||||||||||||||||||

| Ratio of gross expenses to average net assets (5) | 1.77 | % | 2.20 | % | 2.18 | % | 2.08 | % | 2.00 | % | ||||||||||

| Ratio of net expenses to average net assets | 1.59 | % | 1.94 | % | 1.94 | % | 1.94 | % | 1.94 | % | ||||||||||

| Ratio of net investment income to average net assets | (0.42 | )% | 0.55 | % | 1.30 | % | 1.17 | % | 0.94 | % | ||||||||||

| Portfolio Turnover Rate | 70 | % | 146 | % | 68 | % | 64 | % | 53 | % | ||||||||||

| ^ | Consolidated. |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (2) | Represents less than $0.01 per share. |

| (3) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes reinvestment of all distributions. |

| (4) | Includes adjustments in accordance with accounting principles generally accepted in the United States and consequently the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (5) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the advisor. |

See accompanying notes to financial statements.

19

| Altegris Futures Evolution Strategy Fund |

| FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year

| Class C | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| June 30, | June 30, | June 30, | June 30, | June 30, | ||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018^ | ||||||||||||||||

| Net asset value, beginning of year | $ | 8.60 | $ | 7.72 | $ | 9.30 | $ | 9.75 | $ | 9.31 | ||||||||||

| Income/(loss) from investment operations: | ||||||||||||||||||||

| Net investment income/(loss) (1) | (0.10 | ) | (0.01 | ) | 0.05 | 0.04 | 0.02 | |||||||||||||

| Net realized and unrealized gain/(loss) on investments | 1.85 | 0.97 | (1.58 | ) | (0.18 | ) | 0.47 | |||||||||||||

| Total from investment operations | 1.75 | 0.96 | (1.53 | ) | (0.14 | ) | 0.49 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.63 | ) | (0.08 | ) | (0.05 | ) | (0.31 | ) | (0.05 | ) | ||||||||||

| Total distributions | (0.63 | ) | (0.08 | ) | (0.05 | ) | (0.31 | ) | (0.05 | ) | ||||||||||

| Redemption fees collected (2) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||

| Net assets, at end of year | $ | 9.72 | $ | 8.60 | $ | 7.72 | $ | 9.30 | $ | 9.75 | ||||||||||

| Total return (3) | 21.62 | % | 12.62 | % | (16.54 | )% | (1.42 | )% (4) | 5.26 | % (4) | ||||||||||

| Net assets, at end of year(000s) | $ | 5,502 | $ | 4,315 | $ | 8,763 | $ | 15,878 | $ | 22,237 | ||||||||||

| Ratios including the expenses and income of AFES Fund Limited applicable for the year ended 2018: | ||||||||||||||||||||

| Ratio of gross expenses to average net assets (5) | 2.52 | % | 2.95 | % | 2.93 | % | 2.83 | % | 2.75 | % | ||||||||||

| Ratio of net expenses to average net assets | 2.34 | % | 2.69 | % | 2.69 | % | 2.69 | % | 2.69 | % | ||||||||||

| Ratio of net investment income to average net assets | (1.16 | )% | (0.16 | )% | 0.55 | % | 0.45 | % | 0.18 | % | ||||||||||

| Portfolio Turnover Rate | 70 | % | 146 | % | 68 | % | 64 | % | 53 | % | ||||||||||

| ^ | Consolidated. |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (2) | Represents less than $0.01 per share. |

| (3) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes reinvestment of all distributions. |

| (4) | Includes adjustments in accordance with accounting principles generally accepted in the United States and consequently the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (5) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the advisor. |

See accompanying notes to financial statements.

20

| Altegris Futures Evolution Strategy Fund |

| FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year

| Class I | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| June 30, | June 30, | June 30, | June 30, | June 30, | ||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018^ | ||||||||||||||||

| Net asset value, beginning of year | $ | 8.60 | $ | 7.71 | $ | 9.27 | $ | 9.80 | $ | 9.36 | ||||||||||

| Income/(loss) from investment operations: | ||||||||||||||||||||

| Net investment income/(loss) (1) | (0.02 | ) | 0.07 | 0.14 | 0.14 | 0.12 | ||||||||||||||

| Net realized and unrealized gain/(loss) on investments | 1.84 | 0.96 | (1.57 | ) | (0.17 | ) | 0.46 | |||||||||||||

| Total from investment operations | 1.82 | 1.03 | (1.43 | ) | (0.03 | ) | 0.58 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.77 | ) | (0.14 | ) | (0.13 | ) | (0.50 | ) | (0.14 | ) | ||||||||||

| Total distributions | (0.77 | ) | (0.14 | ) | (0.13 | ) | (0.50 | ) | (0.14 | ) | ||||||||||

| Redemption fees collected (2) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||

| Net assets, at end of year | $ | 9.65 | $ | 8.60 | $ | 7.71 | $ | 9.27 | $ | 9.80 | ||||||||||

| Total return (3) | 22.83 | % | 13.66 | % | (15.67 | )% | (0.24 | )% (4) | 6.22 | % (4) | ||||||||||

| Net assets, at end of year(000s) | $ | 131,217 | $ | 133,684 | $ | 233,878 | $ | 424,680 | $ | 515,569 | ||||||||||

| Ratios including the expenses and income of AFES Fund Limited applicable for the year ended 2018: | ||||||||||||||||||||

| Ratio of gross expenses to average net assets (5) | 1.52 | % | 1.95 | % | 1.93 | % | 1.83 | % | 1.75 | % | ||||||||||

| Ratio of net expenses to average net assets | 1.34 | % | 1.69 | % | 1.69 | % | 1.69 | % | 1.69 | % | ||||||||||

| Ratio of net investment income to average net assets | (0.19 | )% | 0.86 | % | 1.55 | % | 1.45 | % | 1.20 | % | ||||||||||

| Portfolio Turnover Rate | 70 | % | 146 | % | 68 | % | 64 | % | 53 | % | ||||||||||

| ^ | Consolidated. |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (2) | Represents less than $0.01 per share. |

| (3) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes reinvestment of all distributions. |

| (4) | Includes adjustments in accordance with accounting principles generally accepted in the United States and consequently the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (5) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the advisor. |

See accompanying notes to financial statements.

21

| Altegris Futures Evolution Strategy Fund |

| FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year

| Class N | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| June 30, | June 30, | June 30, | June 30, | June 30, | ||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018^ | ||||||||||||||||

| Net asset value, beginning of year | $ | 8.64 | $ | 7.73 | $ | 9.30 | $ | 9.82 | $ | 9.37 | ||||||||||

| Income/(loss) from investment operations: | ||||||||||||||||||||

| Net investment income/(loss) (1) | (0.04 | ) | 0.05 | 0.12 | 0.11 | 0.09 | ||||||||||||||

| Net realized and unrealized gain/(loss) on investments | 1.85 | 0.98 | (1.59 | ) | (0.19 | ) | 0.48 | |||||||||||||

| Total from investment operations | 1.81 | 1.03 | (1.47 | ) | (0.07 | ) | 0.57 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.72 | ) | (0.12 | ) | (0.10 | ) | (0.45 | ) | (0.12 | ) | ||||||||||

| Total distributions | (0.72 | ) | (0.12 | ) | (0.10 | ) | (0.45 | ) | (0.12 | ) | ||||||||||

| Redemption fees collected (2) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||

| Net assets, at end of year | $ | 9.73 | $ | 8.64 | $ | 7.73 | $ | 9.30 | $ | 9.82 | ||||||||||

| Total return (3) | 22.49 | % | 13.57 | % | (15.95 | )% | (0.62 | )% (4) | 6.07 | % (4) | ||||||||||

| Net assets, at end of year(000s) | $ | 11,465 | $ | 17,047 | $ | 40,706 | $ | 80,032 | $ | 90,121 | ||||||||||

| Ratios including the expenses and income of AFES Fund Limited applicable for the year ended 2018: | ||||||||||||||||||||

| Ratio of gross expenses to average net assets (5) | 1.77 | % | 2.20 | % | 2.19 | % | 2.08 | % | 2.00 | % | ||||||||||

| Ratio of net expenses to average net assets | 1.59 | % | 1.94 | % | 1.94 | % | 1.94 | % | 1.94 | % | ||||||||||

| Ratio of net investment income to average net assets | (0.46 | )% | 0.66 | % | 1.29 | % | 1.21 | % | 0.95 | % | ||||||||||

| Portfolio Turnover Rate | 70 | % | 146 | % | 68 | % | 64 | % | 53 | % | ||||||||||

| ^ | Consolidated. |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (2) | Represents less than $0.01 per share. |

| (3) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes reinvestment of all distributions. |

| (4) | Includes adjustments in accordance with accounting principles generally accepted in the United States and consequently the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (5) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the advisor. |

See accompanying notes to financial statements.

22

Altegris Futures Evolution Strategy Fund

NOTES TO FINANCIAL STATEMENTS

June 30, 2022

| 1. | ORGANIZATION |

The Altegris Futures Evolution Strategy Fund (the “Fund”) is a series of shares of beneficial interest of Northern Lights Fund Trust (the “Trust”), a statutory trust organized under the laws of the State of Delaware on January 19, 2005, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund’s commencement date, diversification status and investment objective is as follows:

| Commencement | Diversification | ||

| Date | Status | Investment Objective | |

| Altegris Futures Evolution Strategy Fund | October 31, 2011 | Diversified | Long term capital appreciation. |

The Fund offers Class A, Class C, Class I, and Class N shares. Class A shares are offered at net asset value (“NAV”) plus a maximum sales charge of 5.75%. Investors that purchase $1,000,000 or more of a Fund’s Class A shares will not pay any initial sales charge on the purchase. However, purchases of $1,000,000 or more of Class A shares may be subject to a contingent deferred sales charge (“CDSC”) on shares redeemed during the first 18 months after their purchase of up to 1.00% (the amount of the commissions paid on the shares redeemed). Class C and Class N shares of the Funds are offered at their NAV without an initial sales charge. Purchases of $1,000,000 of more of Class C shares are subject to a CDSC of up to 1.00% on shares redeemed within 12 months of purchase. If you redeem Class C shares within one year after purchase, you will be charged a CDSC of up to 1.00%. The charge will apply to the lesser of the original cost of the Class C shares being redeemed or the proceeds of your redemption and will be calculated without regard to any redemption fee. When you redeem Class C shares, the redemption order is processed so that the lowest CDSC is charged. Class I shares of the Funds are sold at NAV without an initial sales charge and are not subject to 12b-1 distribution fees, but have a higher minimum initial investment than Class A and Class C shares. All classes are subject to a 1.00% redemption fee on redemptions made with 30 days of the original purchase. Each share class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of their financial statements. The policies are in conformity with the generally accepted accounting principles in the United States of America (“GAAP”). The Fund operates as an investment company and accordingly follows the Investment Company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies. The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the year ended. Actual results could differ from those estimates.

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price (“NOCP”) . In the absence of a sale, such securities shall be valued at the mean between the current bid and ask prices on the primary exchange on the day of valuation. Debt securities (other than short-term obligations) are valued each day by an independent pricing service approved by the Trust’s Board of Trustees (the “Board”) using methods which include current market quotations from a major market maker in the securities and based on methods which include the consideration of yields or prices of securities of comparable quality, coupon, maturity and type. Options are valued based on the daily price reported from the counterparty or pricing agent. Investments valued in currencies other than the U.S. dollar are converted to U.S. dollars- using exchange rates obtained from pricing services. The independent- pricing service does not distinguish between smaller sized bond positions known as “odd lots” and larger institutional sized bond positions known as “round lots”. The Fund may fair value a particular bond if the adviser does not believe that the round lot value provided by the independent pricing service reflects fair value of the Fund’s holding. Short-term debt obligations with remaining maturities in excess of sixty days are valued at current market prices by an independent pricing

23

Altegris Futures Evolution Strategy Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2022

service approved by the Board. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost.

Valuation of Fund of Funds - The Fund may invest in portfolios of open- end or closed-end investment companies (the “underlying funds”) .. Underlying open-end investment companies are valued at their respective net asset values as reported by such investment companies. The underlying funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value by the methods established by the boards of the underlying funds.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to a fair value committee composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor and/or sub-advisor. The committee may also enlist third party consultants such as a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value. The Board has also engaged a third party valuation firm to attend valuation meetings held by the Trust, review minutes of such meetings and report to the Board on a quarterly basis. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly to assure the process produces reliable results.

Fair Valuation Process – As noted above, the fair value committee is composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor. The applicable investments are valued collectively via inputs from each of these groups. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source), (ii) securities for which, in the judgment of the advisor or sub-advisor, the prices or values available do not represent the fair value of the instrument. Factors which may cause the advisor or sub-advisor to make such a judgment include, but are not limited to, the following: only a bid price or an ask price is available; the spread between bid and ask prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to a Fund’s calculation of its NAV. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities are valued via inputs from the advisor or sub-advisor based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If the advisor or sub-advisor is unable to obtain a current bid from such independent dealers or other independent parties, the fair value committee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of all of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing

24

Altegris Futures Evolution Strategy Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2022

the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.