UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

For the fiscal year ended

OR

For the transition period from ____________ to ____________

Commission file number

(Exact Name of Registrant as Specified in its Charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of Principal Executive Offices with Zip Code)

Registrant’s telephone number, including

area code

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The |

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

State the aggregate market value of the voting

and non-voting common equity held by non-affiliates: $

As of April 8, 2024, there were

THE OLB GROUP, INC.

TABLE OF CONTENTS

i

PART I

Item 1. Business.

Forward-Looking Statements

Unless the context indicates otherwise, as used in this Annual Report, the terms “OLB,” “we,” “us,” “our,” “our company” and “our business” refer, to The OLB Group, Inc., including its subsidiaries named herein. Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

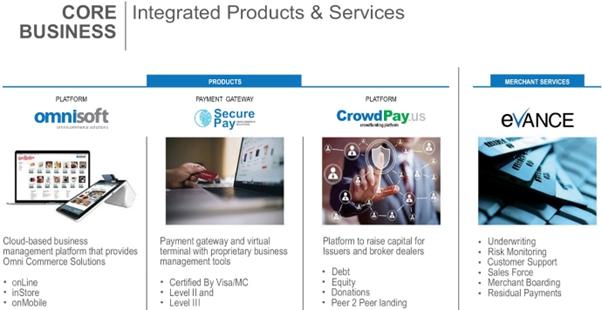

Overview

We are a FinTech company that focuses on a suite of products in the merchant services marketplace and seeks to provide integrated business solutions to merchants throughout the United States. We seek to provide merchants with a wide range of products and services through our various online platforms, including financial and transaction processing services. We also have products that provide support for crowdfunding and other capital raising initiatives. We supplement our online platforms with certain hardware solutions that are integrated with our online platforms. Our business functions primarily through three wholly-owned subsidiaries, eVance, Inc., a Delaware corporation (“eVance”), OmniSoft.io, Inc., a Delaware corporation (“OmniSoft”), and CrowdPay.Us, Inc., a New York corporation (“CrowdPay”).

OmniSoft operates a cloud-based business management platform that provides turnkey solutions for merchants to enable them to build and manage their retail businesses, whether online or at a “brick and mortar” location. The OmniSoft platform, which can be accessed by merchants through any mobile and computing device, allows merchants to, among other features, manage and track inventory, track sales and process customer transactions and can provide interactive data analysis concerning sales of products and need for additional inventory. Merchants generally utilize the platform by uploading to the platform information about their inventory (description of units, number of units, price per unit, and related information). Once such information has been uploaded, merchants, either with their own device or with hardware that we sell directly to them, are able to utilize the platform to monitor inventory and process and track sales of their products (including coordinating shipping of their products with third party logistics companies). We manage and maintain the OmniSoft platform through a variety of domain names or a merchant can integrate our platform with their own domain name. Using the OmniSoft platform, merchants can “check-out” their customers at their “brick and mortar” stores or can sell products to customers online, in both cases accepting payment via a simple credit card or debit card transaction (either swiping the credit card or entering the credit card number), a cash payment, or by use of a QR code or loyalty and reward points, and then print or email receipts to the customer. For more information regarding our OmniSoft platform, see “Description of our OmniSoft Business.”

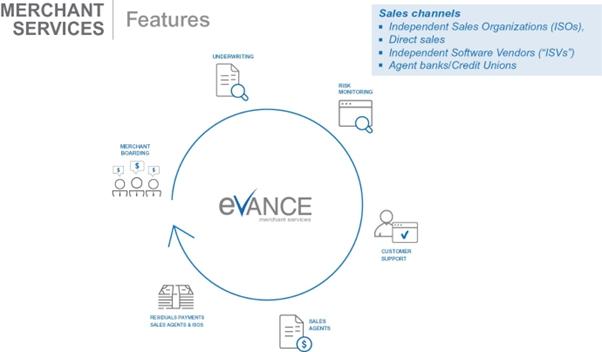

1

eVance provides competitive payment processing solutions to merchants which enable merchants to process credit and debit card-based internet payments for sales of their products at competitive prices (whether such sales occur online or at a “brick and mortar” location). eVance is an independent sales organization (an “ISO”) that signs up new merchants on behalf of acquiring banks and processors that provides financial and transaction processing solutions to merchants throughout the United States. eVance differentiates itself from other ISOs by focusing on both obtaining and maintaining new merchant contracts for its own account (including, but not limited to, merchants that utilize the OmniSoft platform) and also obtaining and maintaining merchant contracts obtained by third-party ISOs (for which we negotiate a shared fee arrangement) and utilizing our own software and technology to provide merchants and other ISOs differentiating products and software. In particular, we (i) own our own payments gateway, (ii) have proprietary omni-commerce software platform, (iii) have in-house underwriting and customer service, (iv) have in-house sub-ISO management system which offers sub-ISOs and agents tools for online boarding, account management, residual reports among other tools, and (v) offer a suite of products in the financial markets (through CrowdPay). Leveraging our relationship with three of the top five merchant processors in the United States (representing a majority of the merchant processing market) and with the use of our proprietary software, our payment gateway (which we call “SecurePay”) enables merchants to reduce the cost of transacting with their customers by removing the need for a third-party payment gateway solution. eVance operates as both a wholesale ISO and a retail ISO depending on the risk profile of the merchant and the applicable merchant processor and acquiring bank. As a wholesale ISO, eVance underwrites the processing transactions for merchants, establishing a direct relationship with the merchant and generating individual merchant processing contracts in exchange for future residual payments. As a retail ISO, eVance primarily gathers the documents and information that our partners (acquiring banks and acquiring processors) need to underwrite merchants’ transactions and as a result receives only residual income as commission for merchants it places with our partners. For more information regarding the electronic payment industry, see “Business — Description of our eVance Business — Our Industry.”

2

3

SecurePay

SecurePay is a payment gateway and virtual terminal with proprietary business management tools that is in compliance with the Payment Card Industry (PCI).

SecurePay has been certified by Visa and MasterCard (certified Level II and Level III) and finalized implementation of “3D Secure” in 2019 (a feature that is unique to what we offer in order to provide for more secure environment for E-commerce and mobile payments in-store and online).

On June 15, 2023, the Company entered into a Membership Interest Purchase Agreement (the “Agreement”) with SDI Black 001, LLC (“Seller”) whereby it acquired 80.01% of the membership interests of Cuentas SDI, LLC, a Florida limited liability company (the “LLC”). The LLC’s owns the platform of Black011.com and the network serving over 31,000 convenience stores (“Bodegas”) in and around New York and New Jersey.

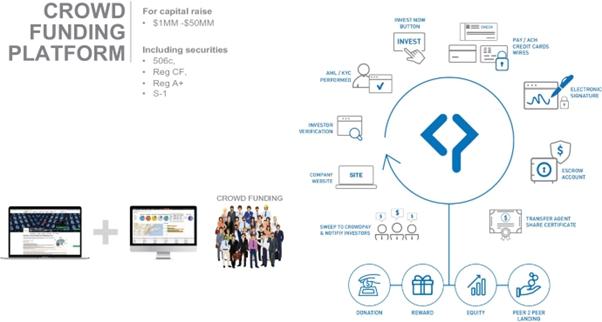

Crowdpay

CrowdPay.us™ operates a white label capital raising platform that targets small and midsized businesses seeking to raise capital and registered broker-dealers seeking to host capital raising campaigns for such businesses by integrating the platform onto such company’s or broker-dealer’s website. Our CrowdPay platform is tailored for companies seeking to raise money through a crowdfunding offering of between $1 million and $50 million pursuant to Regulation CF under Title III of the Jumpstart Our Business Startups (the “JOBS Act”), offerings pursuant to Rule 506(b) and Rule 506(c) under Regulation D of the Securities Act of 1933, as amended (the “Securities Act”), and offerings pursuant to Regulation A+ of the Securities Act. Our platform, which can be used for multiple offerings at once, provides companies and broker-dealers with an easy-to-use, turnkey solution to support company offerings, allowing companies and broker-dealers to easily present online to potential investors relevant marketing and offering materials and by aiding in the accreditation and background check processes to ensure investors meets the applicable requirements under the rules and regulations of the Securities Exchange Commission (the “SEC”). CrowdPay charges a fee to each company and broker-dealer for the use of its platform under a fee structure that is agreed to between CrowdPay and the Company and/or broker-dealer prior to the initiation of the offering. CrowdPay also generates revenues by providing ancillary services to the companies and broker-dealers utilizing our platform, including running background checks and providing anti-money laundering and know-your-customer compliance. CrowdPay is not a registered funding portal or a registered broker-dealer.

4

On January 3, 2022, the Company entered into a share exchange agreement with all of the shareholders of Crowd Ignition, Inc. (“Crowd Ignition”) whereby the Company would purchase 100% of the equity of Crowd Ignition in exchange for 1,318,408 shares of the common stock, par value $0.0001 of the Company (the “CI Issued Shares”). The value of the CI Issued Shares was, for purposes of the Agreement, based on the closing trading price of the Company on October 1, 2021 (the date on which a third-party fairness opinion was issued), resulting in an aggregate purchase price for Crowd Ignition of $5.3 million.

Crowd Ignition is a web-based crowdfunding software system. Ronny Yakov, Chairman and CEO of the Company and John Herzog, a significant shareholder of the Company, own 100% of the equity of Crowd Ignition. The software provides broker-dealer, merchant banks and law firms a platform to market crowdfunding offerings, collect payments and issue securities. The software has been developed in response to, and to comply with, recent changes in investment regulations including Regulation D 506(b) and 506(v), Regulation A+ and Title III of the Jobs Act (Regulation CF), including raising the crowdfunding limit from $1.07 million to $5.0 million. Crowd Ignition is one of only about 50 companies registered with the SEC to provide the services permitted under Regulation CF.

OLBit and DMINT

On May 14, 2021, the Company formed OLBit, Inc., a wholly owned subsidiary (“OLBit”). The purpose of OLBit is to hold the Company’s assets and operate its business related to its emerging money transmission and transactional business. OLBit had been in the process of applying for money transmission licenses in all 50 states along with New York Bitlicense. Around June 2023, it was decided to delay the process of applying for licenses in order to have a greater focus of financial and management resources on the Company’s payment processing business and DMINT’s Bitcoin mining business.

On July 23, 2021, we formed DMINT, Inc., a wholly owned subsidiary (“DMINT”) to operate in the Bitcoin mining industry. DMINT initiated the first phase of the Bitcoin mining operation by establishing data centers and ASIC-based Antminer S19J Pro mining computers specifically configured to mine Bitcoin in Bradford, Pennsylvania. As of December 31, 2023, DMINT had 400 computers online and mining for Bitcoin. It has six data centers located in Tennessee. In February 2023, DMINT redeployed its mining computers from its Pennsylvania location and focus the mining efforts at the Selmer, TN location because of the lower cost of operations in the location.

5

On August 16, 2022, DMINT Real Estate Holdings, Inc. (“DREH”), a wholly owned subsidiary of purchased 4.73 acres of land and a building located at 565 Industrial Park Drive, Selmer, McNairy County, Tennessee for a purchase price of $408,000.00. DMINT established a Bitcoin mining data center powered on the local power grid. The location is expected to have capacity for up to 5,000 mining machines. The Company plans to complete the buildout of the building to be fully operational with 5,000 machines in 2024 following a spin-off of DMINT into a standalone entity which is currently in process.

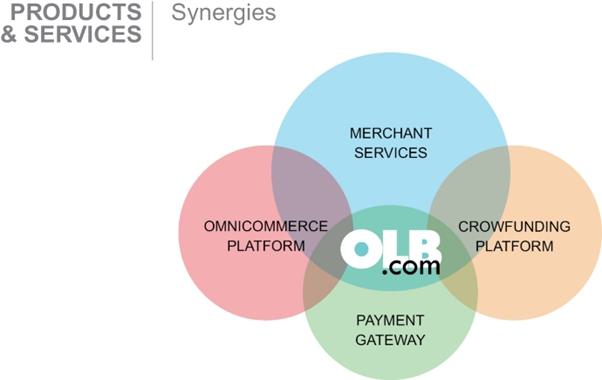

Synergies between the subsidiaries

The success of our business model is dependent on the synergies between the business segments operated by our subsidiaries. We have created and developed products that we believe, form an ecosystem of e-commerce to provide a variety of clients, from online equity financing companies or merchants selling online or in brick and mortar stores, with multiple product offerings and ancillary services from underwriting with the banks and merchant billing from the cloud software. We expect that these synergies will create additional revenue by charging transaction fees on each service provided to clients by our partnerships with Merchant Acquiring Banks and PCI Compliance.

We believe that our wholly-owned subsidiaries combine to create an ecosystem where each subsidiary benefits the other. Starting with the services provided by eVance, we enable each of our products and platforms to communicate with each other and create an ecosystem among our products and, potentially, third-party products. These services are provided to other subsidiaries such as Black011, the bodega distribution subsidiary.

The product environment created with a new registered merchant or issuer enables all merchant information to be stored in a single, centralized location but utilized by all subsidiaries. For example, merchant services utilizing eVance provide electronic payment processing services that can be utilized for payments on the Crowdfunding platform. The platform is used by merchant services to allow mobile and online processing to merchants.

The Omni commerce platform will be offered to all of the merchant services clients. The offered Merchant Services products we provide will enable all processing needs for the OmniCommerce system. The gateway will allow merchants that are using the platform to accept online eCommerce transactions.

6

Competitive Advantages

We believe that our platform of services will provide the following key advantages.

| ● | Time to Market — we can create a customized website for retailers within days and have it fully operational in less than 2 weeks. During 2022 and 2023, we did not develop any new retailer websites but continue to offer the service. |

| ● | Cost — we believe that we are the only content service provider that does not charge a setup fee. |

| ● | Flexibility — our platform has the flexibility to provide customized solutions for partners. |

| ● | Pricing — we provide partners with a price comparison feature which they can utilize if they wish to set prices for products or run promotions. |

| ● | Payment processing — we can provide financial service companies with the ability to have their customers’ accounts directly debited for payment. |

| ● | We can assist existing “brick & mortar” businesses that have inventory and fulfilment capability but do not wish to create and maintain an e-commerce website and infrastructure to sell their products. |

| ● | We can provide a platform for early-stage companies looking for an effective and less costly way to raise capital. |

Risks Associated with our Business

Our business and ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy our securities. In particular, you should consider the following risks, which are discussed more fully in the section entitled “Risk Factors” in this Annual Report:

| ● | We operate in a regulatory environment that is evolving and uncertain and any changes to regulations could have a material impact on our business and financial condition; |

| ● | We rely on a combination of confidentiality clauses, assignment agreements and license agreements with employees and third parties, trade secrets, copyrights and trademarks to protect our intellectual property and competitive advantage, all of which offer only limited protection meaning that we may be unable to maintain and protect our intellectual property rights and proprietary information or prevent third-parties from making unauthorized use of our technology; |

| ● | Our growth may not be sustainable and depends on our ability to attract new merchants, retain existing merchants and increase sales to both new and existing merchants; |

| ● | While we believe that we have sufficient capital to continue operations for a period of at least twelve months from the date of this Annual Report, if there are unanticipated expenses, insufficient cash from operations, we may require additional capital to continue our operations that may not be available or, if available, may not be available on reasonable terms; |

| ● | We are substantially dependent on our eVance business for revenue. If we are unable to maintain our eVance business for any reason (including the various reasons described in the risk factors herein) or for no reason, it will have a material adverse effect on our company; |

7

| ● | Our ability to anticipate and respond to changing industry trends and the needs and preferences of our merchants and consumers may adversely affect our competitiveness or the demand for our products and services; |

| ● | The properties included in our mining network may experience damages; |

| ● | Regulatory changes or actions may alter the nature of an investment in us or restrict the use of cryptocurrencies in a manner that adversely affects our business, prospects or operations; |

| ● | Banks and financial institutions may not provide banking services, or may cut off services, to businesses that provide cryptocurrency-related services or that accept cryptocurrencies as payment, including financial institutions of investors in our securities; |

| ● | It may be illegal in the future, to acquire, own, hold, sell or use Bitcoin or other cryptocurrencies, participate in the blockchain or utilize similar digital assets in one or more countries, the ruling of which would adversely affect us. |

| ● | Acquisitions create certain risks and may adversely affect our business, financial condition or results of operations; and |

| ● | If we fail to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform in a manner that responds to our merchants’ evolving needs, our business may be adversely affected. |

Regulations

Various aspects of our service areas are subject to U.S. federal, state, and local regulation. Certain of our services also are subject to rules promulgated by various card networks and banking and other authorities as more fully described below.

The Dodd-Frank Act

In July 2010, the Dodd-Frank Act was signed into law in the United States. The Dodd-Frank Act has resulted in significant structural and other changes to the regulation of the financial services industry. Among other things, Title X of the Dodd-Frank Act established a new, independent regulatory agency known as the Consumer Financial Protection Bureau (the “CFPB”) to regulate consumer financial products and services (including some offered by our customers). The CFPB may also have authority over us as a provider of services to regulated financial institutions in connection with consumer financial products. Separately, under the Dodd-Frank Act, debit interchange transaction fees that a card issuer receives and are established by a payment card network for an electronic debit transaction are now regulated by the Federal Reserve and must be “reasonable and proportional” to the cost incurred by the card issuer in authorizing, clearing, and settling the transaction. Effective October 1, 2011, the Federal Reserve capped debit interchange rates for card issuers operating in the United States with assets of $10 billion or more at the sum of $0.21 per transaction and an ad valorem component of 5 basis points to reflect a portion of the issuer’s fraud losses plus, for qualifying issuers, an additional $0.01 per transaction in debit interchange for fraud prevention costs. In addition, the new regulations contain non-exclusivity provisions that ban debit card networks from prohibiting an issuer from contracting with any other card network that may process an electronic debit transaction involving an issuer’s debit cards and prohibit card issuers and card networks from inhibiting the ability of merchants to direct the routing of debit card transactions over any network that can process the transaction. Beginning April 1, 2012, all debit card issuers in the United States were required to participate in at least two unaffiliated debit card networks. On April 1, 2013, the ban on network exclusivity arrangements became effective for prepaid card and healthcare debit card issuers, with certain exceptions for prepaid cards issued before that date.

Effective July 22, 2010, merchants were allowed to set minimum dollar amounts (not to exceed $10) for the acceptance of a credit card (while federal governmental entities and institutions of higher education may set maximum amounts for the acceptance of credit cards). They were also allowed to provide discounts or incentives to entice consumers to pay with an alternative payment method, such as cash, checks or debit cards.

8

Association and network rules

We are subject to the rules of credit card associations and other credit and debit networks. In order to provide processing services, a number of our subsidiaries are registered with Visa or Mastercard as service providers for member institutions. Various subsidiaries of ours are also processor level members of numerous debit and electronic benefits transaction networks or are otherwise subject to various network rules in connection with processing services and other services we provide. As such, we are subject to applicable network rules. Card networks and their member financial institutions regularly update and generally expand security expectations and requirements related to the security of cardholder data and environments. We are also subject to network operating rules promulgated by the National Automated Clearing House Association relating to payment transactions processed by us using the Automated Clearing House Network and to various state federal and foreign laws regarding such operations, including laws pertaining to electronic benefits transactions.

Privacy and information security regulations

We provide services that may be subject to various state, federal, and foreign privacy laws and regulations, including, among others, the Financial Services Modernization Act of 1999 (the “Gramm-Leach-Bliley Act”). These laws and their implementing regulations restrict certain collection, processing, storage, use, and disclosure of personal information, require notice to individuals of privacy practices, and provide individuals with certain rights to prevent use and disclosure of protected information. These laws also impose requirements for the safeguarding and proper destruction of personal information through the issuance of data security standards or guidelines. Certain federal, state and foreign laws and regulations impose similar privacy obligations and, in certain circumstances, obligations to notify affected individuals, state officers or other governmental authorities, the media, and consumer reporting agencies, as well as businesses and governmental agencies, of security breaches affecting personal information. In addition, there are state and foreign laws restricting the ability to collect and utilize certain types of information such as Social Security and driver’s license numbers.

Unfair trade practice regulations

We and our clients are subject to various federal and state laws prohibiting unfair or deceptive trade practices, such as Section 5 of the Federal Trade Commission Act. Various regulatory agencies, including the Federal Trade Commission, the Consumer Financial Protection Bureau, and state attorneys general, have authority to take action against parties that engage in unfair or deceptive trade practices or violate other laws, rules, and regulations, and to the extent we are processing payments for a client that may be in violation of laws, rules, and regulations, we may be subject to enforcement actions and incur losses and liabilities that may impact our business.

Anti-money laundering, anti-bribery, sanctions, and counter-terrorist regulations

We are subject to anti-money laundering laws and regulations, including certain sections of the USA PATRIOT Act of 2001. We are also subject to anti-corruption laws and regulations, including the U.S. Foreign Corrupt Practices Act (the “FCPA”) and other laws, that prohibit the making or offering of improper payments to foreign government officials and political figures and includes anti-bribery provisions enforced by the Department of Justice and accounting provisions enforced by the SEC. The FCPA has a broad reach and requires maintenance of appropriate records and adequate internal controls to prevent and detect possible FCPA violations. Many other jurisdictions where we conduct business also have similar anticorruption laws and regulations. We have policies, procedures, systems, and controls designed to identify and address potentially impermissible transactions under such laws and regulations.

We are also subject to certain economic and trade sanctions programs that are administered by the Office of Foreign Assets Control (“OFAC”) which prohibit or restrict transactions to or from or dealings with specified countries, their governments, and in certain circumstances, their nationals, and with individuals and entities that are specially-designated nationals of those countries, narcotics traffickers, and terrorists or terrorist organizations. Other group entities may be subject to additional local sanctions requirements in other relevant jurisdictions.

9

Securities Act

Since the JOBS Act was passed, Crowdfunding, Regulation D offerings and Regulation A and A+ offerings rapidly became a familiar concept among investment firms, venture capitalists, real estate developers and small to medium sized businesses as a way to facilitate and democratize financing. We believe it has created, and continues to create, a profound shift in the world of investments. Below is a brief overview of the rules that permit the offer and sale of securities through such platforms. This overview is in no way intended to be a comprehensive review of all the rules and regulations associated with the above mentioned offerings and should not be relied upon by anyone.

Regulation D under the Securities Act is the most common regulatory exemption used small businesses to raise capital through equity financing. It exempts private placement offerings under Rule 506(b) and 506(c) when sold to accredited investors, as defined under Rule 501 of Regulation D. Companies relying on the Rule 506 exemptions can raise an unlimited amount of money, so long as they comply with the rule’s requirements. Regulation A and Regulation A+ are more similar to a public offerings, and require filing Form 1-A with the SEC. Regulation A and Regulation A+ offer two tiers of offerings; the first tier is for offerings of up to $20 million within any 12 month period and the second tier is for offerings of up to $50 million, within any 12 month period. Regulation CF allows a company to raise up to $1.07 million from non-accredited investors.

Intellectual property

Our products and services utilize a combination of proprietary software and hardware that we own and license from third parties. Over the last few years, we have developed a payment gateway, merchant boarding system, E-commerce platform, recurring billings and a crowdfunding platform. We generally control access to and use of our proprietary software and other confidential information through the use of internal and external controls, including entering into non-disclosure and confidentiality agreements with both our employees and third parties. As of the date of this report, we have a patent pending on transferable QR codes on Omni Commerce devices.

Employees

As of December 31, 2023, we had six key employees as part of our overall staff of 26 full-time employees. Our risk, compliance, underwriting and analyst’s accounting and customer service functions are primarily located in Georgia. In addition, we have operations in India where we retain 35 developers at any given time depending on our requirements and scope of projects. None of our employees are represented by a labor union or covered by a collective bargaining agreement. We consider our relationship with our employees to be good.

Corporate Information

We were incorporated in the State of Delaware on November 18, 2004, for the purpose of merging with OLB.com, Inc., a New York corporation incorporated in 1993 (“OLB.com”). The merger was done for the purpose of changing our state of incorporation from New York to Delaware. In April 2018, we completed an acquisition of substantially all of the assets of Excel Corporation and its subsidiaries Payprotec Oregon, LLC, Excel Business Solutions, Inc. and eVance Processing, Inc. (such assets are the foundation of our eVance business). In connection with the Asset Acquisition, in May 2018, we entered into share exchange agreements with CrowdPay and OmniSoft, affiliate companies owned by Mr. Yakov and John Herzog, an affiliate of our company, pursuant to which each of CrowdPay and OmniSoft became wholly owned subsidiaries of our company.

Our Company’s headquarters is located at 1120 Avenue of the Americas, 4th Floor, New York, NY 10036. Our telephone number is (212) 278-0900.

10

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined under the Securities Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (or the Sarbanes-Oxley Act); | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

In addition, an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have elected to avail ourselves of this extended transition period. We will remain an emerging growth company until the earliest to occur of: (i) our reporting $1.07 billion or more in annual gross revenues; (ii) the end of fiscal year 2024; (iii) our issuance, in a three year period, of more than $1 billion in non-convertible debt; and (iv) the end of the fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million on the last business day of our second fiscal quarter.

Item 1A. Risk Factors

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information contained in this annual report, before deciding to invest in our common stock. If any of the following risks materialize, our business, financial condition, results of operation and prospects will likely be materially and adversely affected. In that event, the market price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Company

The substantial and continuing losses, and significant operating expenses incurred in the past few years may cause us to be unable to pursue all of our operational objectives if sufficient financing and/or additional cash from revenues is not realized.

We have limited cash resources and operating losses throughout our history. As of December 31, 2023 we had a working capital deficit of $5,413,927 and a net loss of $23,273,939. Our cash flow provided by operating activities for the year ended December 31, 2023 was $2,046,922. Notwithstanding the foregoing, management has concluded that it has sufficient liquidity to continue operations for a period of at least twelve months from the date of this Annual Report, which conclusion would not have been possible without close monitoring of the Company’s projected cash flow and operating expenses for a period of at least the next twelve months.

11

We have historically relied on related parties and affiliates to finance our operations, but there is no guarantee that these parties will continue to finance our operations in the future.

While we will be able to fund future liquidity and capital requirements through cash flows generated from our operating activities alone for a period of twelve months, we previously have financed our operations from short-term loans from Ronny Yakov, our Chief Executive Officer and John Herzog, a significant shareholder of the Company. It is not assured that Mr. Yakov or Mr. Herzog would continue to provide such assistance if the Company were to require it in the future.

We may be subject to liabilities arising prior to the Asset Acquisition under certain “successor liability” theories.

We acquired our business by means of a foreclosure of the relevant secured lender’s security interest in the assets in the Asset Acquisition through an auction under Article 9 of the Uniform Commercial Code. Although the general rule in the context of transactions such as the Asset Acquisition is that a purchaser of assets does not assume the seller’s liabilities, various courts have established exceptions to this general rule, including where the purchaser is a ‘mere continuation’ of the seller and there is a ‘continuity of enterprise.’ To date, we have had one lawsuit whereby we have been found to have successor liability. However, we are currently appealing the decision. This is a highly fact specific inquiry, and there can be no assurance that any interested creditor, the United States (through the Internal Revenue Service) or state or local taxing agencies will not seek to hold us responsible for any existing liabilities at the time of the Asset Acquisition under one or more of these successor liability theories, for which we have no indemnification protection under the agreements relating to the Asset Acquisition.

We operate in a complex regulatory environment, and failure to comply with applicable laws and regulations could adversely affect our business.

Our operations are subject to a broad range of complex and evolving laws and regulations. As a result, we must perform our services in compliance with the legal and regulatory requirements of multiple jurisdictions. Some of these laws and regulations may be difficult to ascertain or interpret and may change from time to time. Violation of such laws and regulations could subject us to fines and penalties, damage our reputation, constitute a breach of our client agreements, impair our ability to obtain and renew required licenses, and decrease our profitability or competitiveness. If any of these effects were to occur, our operating results and financial condition could be adversely affected.

We may not be able to integrate new technologies and provide new services in a cost-efficient manner.

The online E-commerce industry is subject to rapid and significant changes in technology, frequent new service introductions and evolving industry standards. We cannot predict the effect of these changes on our competitive position, our profitability or the industry generally. Technological developments may reduce the competitiveness of our networks and our software solutions and require additional capital expenditures or the procurement of additional products that could be expensive and time consuming. In addition, new products and services arising out of technological developments may reduce the attractiveness of our services. If we fail to adapt successfully to technological advances or fail to obtain access to new technologies, we could lose customers and be limited in our ability to attract new customers and/or sell new services to our existing customers. In addition, delivery of new services in a cost-efficient manner depends upon many factors, and we may not generate anticipated revenue from such services.

12

Disruptions in our networks and infrastructure may result in customer dissatisfaction, customer loss or both, which could materially and adversely affect our reputation and business.

Our systems are an integral part of our customers’ business operations. It is critical for our customers, that our systems provide a continued and uninterrupted performance. Customers may be dissatisfied by any system failure that interrupts our ability to provide services to them. Sustained or repeated system failures would reduce the attractiveness of our services significantly and could result in decreased demand for our services.

We face the following risks to our networks, infrastructure and software applications:

| ● | our territory can have significant weather events which physically damage access lines; |

| ● | power surges and outages, computer viruses or hacking, earthquakes, terrorism attacks, vandalism and software or hardware defects which are beyond our control; and |

| ● | Unusual spikes in demand or capacity limitations in our or our suppliers’ networks. |

Disruptions may cause interruptions in service or reduced capacity for customers, either of which could cause us to lose customers and/or incur expenses, and thereby adversely affect our business, revenue and cash flow.

Our positioning in the marketplace as a smaller provider places a significant strain on our resources, and if not managed effectively, could result in operational inefficiencies and other difficulties.

Our positioning in the marketplace may place a significant strain on our management, operational and financial resources, and increase demand on our systems and controls. To manage this position effectively, we must continue to implement and improve our operational and financial systems and controls, invest in development and engineering, critical systems and network infrastructure to maintain or improve our service quality levels, purchase and utilize other systems and solutions, and train and manage our employee base. As we proceed with our development, operational difficulties could arise from additional demand placed on customer provisioning and support, billing and management information systems, product delivery and fulfilment, sales and marketing and administrative resources.

For instance, we may encounter delays or cost overruns or suffer other adverse consequences in implementing new systems when required. In addition, our operating and financial control systems and infrastructure could be inadequate to ensure timely and accurate financial reporting.

13

We must attract and retain skilled personnel. If we are unable to hire and retain technical, technical sales and operational employees, our business could be harmed.

Our ability to integrate our acquired assets and to grow will be particularly dependent on our ability to hire, develop and retain an effective sales force and qualified technical and managerial personnel. We need software development specialists with in-depth knowledge of a blend of IT and telecommunications or with a blend of security and telecom. We intend to hire additional necessary employees, including software engineers, communication engineers, project managers, sales consultants, employees and operational employees, on a permanent basis. The competition for qualified technical sales, technical, and managerial personnel in the communications and software industry is intense in the markets where we operate, and we may not be able to hire and retain sufficient qualified personnel. In addition, we may not be able to maintain the quality of our operations, control our costs, maintain compliance with all applicable regulations, and expand our internal management, technical, information and accounting systems in order to support our desired growth, which could have an adverse impact on our operations. Volatility in the stock market and other factors could diminish our use, and the value, of our equity awards as incentives to employees, putting us at a competitive disadvantage or forcing us to use more cash compensation.

We are dependent on the continued services and performance of our senior management and other key employees, the loss of any of whom could adversely affect our business, operating results and financial condition.

Our future performance depends on the continued services and contributions of our senior management, including our Chief Executive Officer, Ronny Yakov, Vice President, Finance, Patrick Smith and other key employees to execute on our business plan and to identify and pursue new opportunities and product innovations. The loss of services of senior management or other key employees could significantly delay or prevent the achievement of our strategic objectives. In addition, some of the members of our current senior management team have only been working together for a short period of time, which could adversely impact our ability to achieve our goals. From time to time, there may be changes in our senior management team resulting from the hiring or departure of executives, which could disrupt our business. We do not maintain key person life insurance policies on any of our employees other than a policy providing limited coverage on the life of our Chief Executive Officer. The loss of the services of one or more of our senior management or other key employees for any reason could adversely affect our business, financial condition and operating results and require significant amounts of time, training and resources to find suitable replacements and integrate them within our business, and could affect our corporate culture.

Our Chief Financial Officer is currently employed on a part-time basis.

Given the size of the Company and our operational needs, we initially hired our Chief Financial Officer, Rachel Boulds, on a part-time basis. While we have discussed with Ms. Boulds the possibility of becoming our full-time Chief Financial Officer, it is anticipated that Ms. Boulds will continue to be employed on a part-time basis for the next twelve months. In addition to her role as Chief Financial Officer, Ms. Boulds is also operating her solo accounting practice providing services for clients unrelated to the Company. While we believe that Ms. Boulds currently devotes adequate time to the Company to perform the role and duties of our Chief Financial Officer, we cannot guarantee that she will be able to continue to do so until she is with the Company on a fulltime basis. If Ms. Boulds cannot devote adequate time to our Company to fulfil her role and duties as Chief Financial Officer or if any conflicts of interest arise during this time, it could have a material adverse impact on our Company.

Our success depends on our continued investment in research and development, the level and effectiveness of which could reduce our profitability.

We intend to continue to make investments in research and development and product development in seeking to sustain and improve our competitive position and meet our customers’ needs. These investments currently include streamlining our suite of software functionalities, including modularization and improving scalability of our integrated solutions. To maintain our competitive position, we may need to increase our research and development investment, which could reduce our profitability and cash flows. In addition, we cannot assure you that we will achieve a return on these investments, nor can we assure you that these investments will improve our competitive position or meet our

14

Risks Related to Our Business

CROWDPAY.US, INC.

We operate in a regulatory environment that is evolving and uncertain.

The regulations that govern the companies and broker-dealers that utilize our platform and the investors that find investment opportunities on our platform have been in existence for a very few years. Further, there are constant discussions among legislators and regulators with respect to changing this regulatory environment. New laws and regulations could be adopted in the United States and abroad. Further, existing laws and regulations may be interpreted in ways that would impact our platform, including our ability to communicate and work with investors, broker-dealers and the companies that use our platforms’ services. For instance over the past year, there have been several attempts to modify the current regulatory regime. Some of those suggested reforms could make it easier for anyone to sell securities (without using our platform), or could increase our regulatory burden, including requiring us to register as a broker-dealer or funding portal before we choose to do so. Any such changes would have a negative impact on our business.

We may be liable for misstatements made by issuers on our platform.

Under the Securities Act and the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), issuers making offerings through our platform may be liable for including untrue statements of material facts or for omitting information that could make the statements made misleading. This liability may also extend in Regulation Crowdfunding offerings to funding portals. Even though we are not a registered funding portal, there can be no assurance that if we were sued we would prevail. Further, even if we do succeed, lawsuits are time consuming and expensive, and being a party to such actions may cause us reputational harm that would negatively impact our business.

Our compliance is focused on U.S. laws and we have not analyzed foreign laws regarding the participation of non-U.S. residents.

Some of the investment opportunities posted on our platform are open to non-U.S. residents. We have not researched all the applicable foreign laws and regulations, and therefore we have not set up our structure to be compliant with all those laws. It is possible that we may be deemed in violation of those laws, which could result in fines or penalties as well as reputational harm. This may limit our ability in the future to assist companies in accessing money from those investors, and compliance with those laws and regulation may limit our business operations and plans for future expansion.

The types of offerings that we expect to be posted on our platform are relatively new in an industry that is still quickly evolving.

The principal types of offerings that are posted on our platform are pursuant to Regulation A and Regulation Crowdfunding (CF) which have only been in effect in their current form since 2015 and 2016, respectively. Our ability to penetrate the market to host these types of offerings remains uncertain as potential issuer companies may choose to use different platforms or providers (including, in the case of Regulation A, using their own online platform), or determine alternative methods of financing. Investors may decide to invest their money elsewhere. Further, our potential market may not be as large, or our industry may not grow as rapidly, as anticipated. With a smaller market than expected, we may have fewer customers. Success will likely be a factor of investing in the development and implementation of marketing campaigns, subsequent adoption by issuer companies as well as investors, and favorable changes in the regulatory environment.

15

CrowdPay and its providers are vulnerable to hackers and cyber-attacks.

As an internet-based business, we may be vulnerable to hackers who may access the data of the investors and the issuer companies that utilize our platform. Further, any significant disruption in service on our platform or in our computer systems could reduce the attractiveness of the platform and result in a loss of investors and companies interested in using our platform. Further, we rely on a third-party technology provider to provide some of our back-up technology as well as act as our escrow agent. Any disruptions of services or cyber-attacks either on our technology provider or on our company could harm our reputation and materially negatively impact our financial condition and business.

CrowdPay currently relies on one escrow agent and technology service provider.

We currently rely on Microsoft Azure to serve as our technology provider and all escrow accounts are held at MVB Bank, Inc. Any change in these relationships will require us to find another technology service provider, escrow agent and escrow bank. This may cause us delays as well as additional costs in transitioning our technology.

We are dependent on general economic conditions.

Our business model is dependent on investors investing in the companies presented on our platform. Investment dollars are disposable income. Our business model is thus dependent on national and international economic conditions. Adverse national and international economic conditions may reduce the future availability of investment dollars, which would negatively impact revenues generated by CrowdPay and possibly our ability to continue operations at CrowdPay. It is not possible to accurately predict the potential adverse impacts on us, if any, of current economic conditions on its financial condition, operating results and cash flow.

We face significant market competition.

We facilitate online capital formation. Though this is a new market, we compete against a variety of entrants in the market as well likely new entrants into the market. Some of these follow a regulatory model that is different from ours and might provide them competitive advantages. New entrants could include those that may already have a foothold in the securities industry, including some established broker-dealers. Further, online capital formation is not the only way to address helping start-ups raise capital, and we have to compete with a number of other approaches, including traditional venture capital investments, loans and other traditional methods of raising funds and companies conducting crowdfunding raises on their own websites. Additionally, some competitors and future competitors may be better capitalized than us, which would give them a significant advantage in marketing and operations.

Our revenues and profits are subject to fluctuations.

It is difficult to accurately forecast our revenues and operating results, and these could fluctuate in the future due to a number of factors. These factors may include adverse changes in the number of investors and amount of investors’ dollars that utilize our platform to make investments, the success of world securities markets, general economic conditions, our ability to market our platform to companies and investors, headcount and other operating costs, and general industry and regulatory conditions and requirements. Our operating results may fluctuate from year to year due to the factors listed above and others not listed. At times, these fluctuations may be significant and could impact our ability to operate our business.

EVANCE, INC.

We are substantially dependent on our eVance business for revenue. If we are unable to maintain our eVance business for any reason (including the various reasons described in the risk factors herein) or for no reason it will have a material adverse effect on our company.

Historically, substantially all of our revenue has been generated from our eVance business, though we did begin generating revenue from our OmniSoft business during the second half of 2019. In addition, the launch of our Bitcoin Mining business in 2021 has started to generate revenue in 2021 and 2022. While we expect to continue to build out our OmniSoft software business and to rely more heavily on individualized merchant services offerings and to generate revenue and to transition away from such significant reliance on our eVance business, there is no guarantee that we will be able to do so. Accordingly, if we are unable to maintain our eVance business it will have a material adverse effect on our company.

16

Our ability to anticipate and respond to changing industry trends and the needs and preferences of our merchants and consumers may adversely affect our competitiveness or the demand for our products and services.

The financial services and payments technology industries are subject to rapid technological advancements, resulting in new products and services, including mobile payment applications and customized integrated software payment solutions, and an evolving competitive landscape, as well as changing industry standards and merchant and consumer needs and preferences. We expect that new services and technologies applicable to the financial services and payment technology industries will continue to emerge. These changes may limit the competitiveness of and demand for our services. Also, our merchants and consumers continue to adopt new technology for business and personal uses. We must anticipate and respond to these changes in order to remain competitive within our relative markets. In addition, failure to develop value-added services that meet the needs and preferences of our merchants could adversely affect our ability to compete effectively in our industry. Furthermore, merchants’ or consumers’ potential negative reaction to our products and services can spread quickly through social media and damage our reputation before we have the opportunity to respond. If we are unable to anticipate or respond to technological or industry standard changes on a timely basis, our ability to remain competitive could be adversely affected.

Substantial and increasingly intense competition worldwide in the financial services and payment technology industries may adversely affect our overall business and operations.

The financial services and payment technology industries are highly competitive, and our payment services and solutions compete against all forms of financial services and payment systems, including cash and checks, and electronic, mobile, E-commerce and integrated payment platforms. If we are unable to differentiate ourselves from our competitors and drive value for our merchants, we may not be able to compete effectively. Our competitors may introduce their own value-added or other innovative services or solutions more effectively than we do, which could adversely impact our current competitive position and prospects for growth. They also may be able to offer and provide services that we do not offer. In addition, in certain of our markets in which we operate, we process “on-us” transactions whereby we receive fees as a merchant acquirer and for processing services for the issuing bank. As competition in these markets grows, the number of transactions in which we receive fees for both of these roles may decrease, which could reduce our revenue and margins in these jurisdictions. We also compete against new entrants that have developed alternative payment systems, E-commerce payment systems, payment systems for mobile devices and customized integrated software payment solutions. Failure to compete effectively against any of these competitive threats could adversely affect our business, financial condition or results of operations. In addition, some of our competitors are larger and have greater financial resources than us, enabling them to maintain a wider range of product offerings, mount extensive promotional campaigns and be more aggressive in offering products and services at lower rates, which may adversely affect our business, financial condition or results of operations.

Potential changes in the competitive landscape, including disintermediation from other participants in the payments chain, could harm our business.

We expect that the competitive landscape will continue to change, including:

| ● | rapid and significant changes in technology, resulting in new and innovative payment methods and programs, that could place us at a competitive disadvantage and reduce the use of our products and services; |

| ● | competitors, merchants, governments and other industry participants may develop products and services that compete with or replace our value-added products and services, including products and services that enable card networks and banks to transact with consumers directly; |

| ● | participants in the financial services and payment technology industries may merge, create joint ventures, or form other business combinations that may strengthen their existing business services or create new payment services that compete with our services; and |

17

| ● | new services and technologies that we develop may be impacted by industry-wide solutions and standards, including chip technology, tokenization, Blockchain and other safety and security technologies. |

Failure to compete effectively against any of these or other competitive threats could adversely affect our business, financial condition or results of operations.

Global economic, political and other conditions may adversely affect trends in consumer, business and government spending, which may adversely impact the demand for our services and our revenue and profitability.

The financial services and payment technology industries in which we operate depend heavily upon the overall level of consumer, business and government spending. A sustained deterioration in general economic conditions (including distress in financial markets, turmoil in specific economies around the world, public health crises, and additional government intervention), particularly in the United States, or increases in interest rates in key countries in which we operate, may adversely affect our financial performance by reducing the number or average purchase amount of transactions we process. If our customers make fewer sales of products and services using electronic payments, or consumers spend less money through electronic payments, we will have fewer transactions to process at lower dollar amounts, resulting in lower revenue.

Adverse economic trends will and may continue to accelerate the timing, or increase the impact of, risks to our financial performance. These trends could include:

| ● | declining economies, foreign currency fluctuations and the pace of economic recovery can change consumer spending behaviors, such as cross-border travel patterns, on which the majority of our revenue is dependent; |

| ● | low levels of consumer and business confidence typically associated with recessionary environments, and those markets experiencing relatively high unemployment, may result in decreased spending by cardholders; |

| ● | budgetary concerns in the United States and other countries around the world could affect the United States and other specific sovereign credit ratings, impact consumer confidence and spending, and increase the risks of operating in those countries; |

| ● | emerging market economies tend to be more volatile than the more established markets we serve in North America and Europe, and adverse economic trends may be more pronounced in those emerging markets where we conduct business; |

| ● | financial institutions may restrict credit lines to cardholders or limit the issuance of new cards to mitigate cardholder credit concerns; |

| ● | uncertainty and volatility in the performance of our merchants’ businesses may make estimates of our revenues and financial performance less predictable; |

| ● | cardholders may decrease spending for value-added services we market and sell; |

| ● | government intervention, including the effect of laws, regulations and government investments in our merchants, may have potential negative effects on our business and our relationships with our merchants or otherwise alter their strategic direction away from our products and services. |

18

We are subject to U.S. governmental regulation and other legal obligations, particularly related to privacy, data protection and information security, and consumer protection laws across different markets where we conduct our business. Our actual or perceived failure to comply with such obligations could harm our business.

In the United States, we are subject to various consumer protection laws (including laws on disputed transactions) and related regulations. If we are found to have breached any consumer protection laws or regulations in any such market, we may be subject to enforcement actions that require us to change our business practices in a manner which may negatively impact revenue, as well as litigation, fines, penalties and adverse publicity that could cause our customers to lose trust in us, which could have an adverse effect on our reputation and business in a manner that harms our financial position.

We collect personally identifiable information and other data from our consumers and merchants. Laws and regulations in several countries restrict certain collection, processing, storage, use, disclosure and security of personal information, require notice to individuals of privacy practices, and provide individuals with certain rights to prevent use and disclosure of protected information.

Future restrictions on the collection, use, sharing or disclosure of personally identifiable information or additional requirements and liability for security and data integrity could require us to modify our solutions and features, possibly in a material manner, and could limit our ability to develop new services and features. If our privacy or data security measures fail to comply with applicable current or future laws and regulations, we may be subject to litigation, regulatory investigations, enforcement notices requiring us to change the way we use personal data or our marketing practices, fines or other liabilities, as well as negative publicity and a potential loss of business.

Our inability to protect our systems and data from continually evolving cybersecurity risks or other technological risks could affect our reputation among our merchants and consumers and may expose us to liability.

In conducting our business, we process, transmit and store sensitive business information and personal information about our merchants, consumers, sales and financial institution partners, vendors, and other parties. This information may include account access credentials, credit and debit card numbers, bank account numbers, social security numbers, driver’s license numbers, names and addresses and other types of sensitive business or personal information. Some of this information is also processed and stored by our merchants, sales and financial institution partners, third-party service providers to whom we outsource certain functions and other agents, which we refer to collectively as our associated third parties. We have certain responsibilities to card networks and their member financial institutions for any failure, including the failure of our associated third parties, to protect this information.

We are a regular target of malicious third-party attempts to identify and exploit system vulnerabilities, and/or penetrate or bypass our security measures, in order to gain unauthorized access to our networks and systems or those of our associated third parties. Such access could lead to the compromise of sensitive, business, personal or confidential information. As a result, we proactively employ multiple methods at different layers of our systems to defend our systems against intrusion and attack and to protect the data we collect. However, we cannot be certain that these measures will be successful and will be sufficient to counter all current and emerging technology threats that are designed to breach our systems in order to gain access to confidential information.

Our computer systems and our associated third parties’ computer systems could be in the future, subject to breach, and our data protection measures may not prevent unauthorized access. The techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and are often difficult to detect. Threats to our systems and our associated third parties’ systems can derive from human error, fraud or malice on the part of employees or third parties, or may result from accidental technological failure. Computer viruses and other malware can be distributed and could infiltrate our systems or those of our associated third parties. In addition, denial of service or other attacks could be launched against us for a variety of purposes, including to interfere with our services or create a diversion for other malicious activities. Our defensive measures may not prevent downtime, unauthorized access or use of sensitive data. While we maintain cyber errors and omissions insurance coverage that may cover certain aspects of cyber risks, our insurance coverage may be insufficient to cover all losses. Further, while we select our associated third parties carefully, we do not control their actions. Any problems experienced by these third parties, including those resulting from breakdowns or other disruptions in the services provided by such parties or cyber-attacks and security breaches, could adversely affect our ability to service our merchant customers or otherwise conduct our business.

19

We could also be subject to liability for claims relating to misuse of personal information, such as unauthorized marketing purposes and violation of data privacy laws. We cannot provide assurance that the contractual requirements related to security and privacy that we impose on our service providers who have access to customer and consumer data will be followed or will be adequate to prevent the unauthorized use or disclosure of data. In addition, we have agreed in certain agreements to take certain protective measures to ensure the confidentiality of merchant and consumer data. The costs of systems and procedures associated with such protective measures may increase and could adversely affect our ability to compete effectively. Any failure to adequately enforce or provide these protective measures could result in liability, protracted and costly litigation, governmental and card network intervention and fines and, with respect to misuse of personal information of our merchants and consumers, lost revenue and reputational harm.

Any type of security breach, attack or misuse of data described above or otherwise, whether experienced by us or an associated third party, could harm our reputation and deter existing and prospective merchants from using our services or from making electronic payments generally, increase our operating expenses in order to contain and remediate the incident, expose us to unbudgeted or uninsured liability, disrupt our operations (including potential service interruptions), distract our management, increase our risk of regulatory scrutiny, result in the imposition of penalties and fines under state, federal and foreign laws or by card networks and adversely affect our continued card network registration and financial institution sponsorship. If we were to be removed from networks’ lists of PCI DSS compliant service providers, our existing merchants, sales and financial institution partners or other third parties may cease using or referring our services. Also, prospective merchants, sales partners, financial institution partners or other third parties may choose to terminate their relationship with us, or delay or choose not to consider us for their processing needs. In addition, card networks could refuse to allow us to process through their networks.

We may experience failures in our processing systems due to software defects, computer viruses and development delays, which could damage customer relations and expose us to liability.

Our core business depends heavily on the reliability of our processing systems. A system outage or other failure could adversely affect our business, financial condition or results of operations, including by damaging our reputation or exposing us to third-party liability. Card network rules and certain governmental regulations allow for possible penalties if our systems do not meet certain operating standards. To successfully operate our business, we must be able to protect our processing and other systems from interruption, including from events that may be beyond our control. Events that could cause system interruptions include fire, natural disaster, unauthorized entry, power loss, telecommunications failure, computer viruses, terrorist acts and war. Although we have taken steps to protect against data loss and system failures, there is still risk that we may lose critical data or experience system failures. To help protect against these events, we perform a significant portion of disaster recovery operations ourselves, as well as utilize select third parties for certain operations, particularly outside of the United States. To the extent we outsource any disaster recovery functions, we are at risk of the vendor’s unresponsiveness or other failures in the event of breakdowns in our systems. In addition, our property and business interruption insurance may not be adequate to compensate us for all losses or failures that may occur.

Our products and services are based on sophisticated software and computing systems that are constantly evolving. We often encounter delays and cost overruns in developing changes implemented to our systems. In addition, the underlying software may contain undetected errors, viruses or defects. Defects in our software products and errors or delays in our processing of electronic transactions could result in additional development costs, diversion of technical and other resources from our other development efforts, loss of credibility with current or potential merchants, harm to our reputation or exposure to liability claims. In addition, we rely on technologies supplied to us by third parties that may also contain undetected errors, viruses or defects that could adversely affect our business, financial condition or results of operations. Although we attempt to limit our potential liability for warranty claims through disclaimers in our software documentation and limitation of liability provisions in our licenses and other agreements with our merchants and partners, we cannot assure that these measures will be successful in limiting our liability. Additionally, we and our merchants and partners are subject to card network rules. If we do not comply with card network requirements or standards, we may be subject fines or sanctions, including suspension or termination of our registrations and licenses necessary to conduct business.

Degradation of the quality of the products and services we offer, including support services, could adversely impact our ability to attract and retain merchants and partners.

Our merchants and partners expect a consistent level of quality in the provision of our products and services. The support services we provide are a key element of the value proposition to our merchants and partners. If the reliability or functionality of our products and services is compromised or the quality of those products or services is otherwise degraded, or if we fail to continue to provide a high level of support, we could lose existing merchants and partners and find it harder to attract new merchants and partners. If we are unable to scale our support functions to address the growth of our merchant and partner network, the quality of our support may decrease, which could adversely affect our ability to attract and retain merchants and partners.

20

Continued consolidation in the banking industry could adversely affect our growth.

The banking industry remains subject to consolidation regardless of overall economic conditions. In addition, in times of economic distress, various regulators in the markets we serve have acquired and in the future may acquire financial institutions, including banks with which we partner. If a current financial institution referral partner of ours is acquired by another bank, the acquiring bank may seek to terminate our agreement and impose its own merchant services program on the acquired bank. If a financial institution referral partner acquires another bank, our financial institution referral partner may take the opportunity to conduct a competitive bidding process to determine whether to maintain our merchant acquiring services or switch to another provider. In either situation, we may be unable to retain the relationship post-acquisition, or may have to offer financial concessions to do so, which could adversely affect our results of operations or growth. If a current financial institution referral partner of ours is acquired by a regulator, the regulator may seek to alter the terms or terminate our existing agreement with the acquired financial institution.

Increased customer, referral partner or sales partner attrition could cause our financial results to decline.