Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM 10-Q

_________________________________

|

| |

☒

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2019

OR

|

| |

☐

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-51948

_________________________________

Jones Lang LaSalle Income Property Trust, Inc.

(Exact name of registrant as specified in its charter)

_________________________________

|

| | |

Maryland | | 20-1432284 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

333 West Wacker Drive, Chicago IL, 60606

(Address of principal executive offices, including Zip Code)

(312) 897-4000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_________________________________

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. |

| | | | | | |

Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

Non-accelerated filer | | x | | Smaller reporting company | | ☐ |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO ☒

The number of shares of the registrant’s Common Stock, $.01 par value, outstanding on May 8, 2019 were 75,947,860 shares of Class A Common Stock, 41,078,600 shares of Class M Common Stock, 10,955,847 of Class A-I Common Stock, 12,530,848 of Class M-I Common Stock and 5,448,111 shares of Class D Common Stock.

Jones Lang LaSalle Income Property Trust, Inc.

INDEX

Item 1. Financial Statements.

Jones Lang LaSalle Income Property Trust, Inc.

CONSOLIDATED BALANCE SHEETS

$ in thousands, except per share amounts |

| | | | | | | |

| March 31, 2019 | | December 31, 2018 |

| (Unaudited) | | |

ASSETS | | | |

Investments in real estate: | | | |

Land (including from VIEs of $23,659 and $23,659, respectively) | $ | 385,247 |

| | $ | 355,820 |

|

Buildings and equipment (including from VIEs of $134,128 and $133,639, respectively) | 1,451,317 |

| | 1,441,765 |

|

Less accumulated depreciation (including from VIEs of $(22,776) and $(21,886), respectively) | (144,391 | ) | | (135,480 | ) |

Net property and equipment | 1,692,173 |

| | 1,662,105 |

|

Investment in unconsolidated real estate affiliates | 162,360 |

| | 163,314 |

|

Real estate fund investment | 93,734 |

| | 92,414 |

|

Investments in real estate and other assets held for sale | — |

| | 112,586 |

|

Net investments in real estate | 1,948,267 |

| | 2,030,419 |

|

Cash and cash equivalents (including from VIEs of $2,784 and $4,185, respectively) | 80,490 |

| | 37,109 |

|

Restricted cash (including from VIEs of $90 and $88, respectively) | 22,649 |

| | 7,831 |

|

Tenant accounts receivable, net (including from VIEs of $2,151 and $1,621, respectively) | 4,533 |

| | 4,159 |

|

Deferred expenses, net (including from VIEs of $453 and $460, respectively) | 8,070 |

| | 7,584 |

|

Acquired intangible assets, net (including from VIEs of $5,355 and $5,652, respectively) | 89,461 |

| | 84,468 |

|

Deferred rent receivable, net (including from VIEs of $1,077 and $1,079, respectively) | 17,488 |

| | 16,972 |

|

Prepaid expenses and other assets (including from VIEs of $80 and $66, respectively) | 11,473 |

| | 8,052 |

|

TOTAL ASSETS | $ | 2,182,431 |

| | $ | 2,196,594 |

|

LIABILITIES AND EQUITY | | | |

Mortgage notes and other debt payable, net (including from VIEs of $81,853 and $81,954, respectively) | $ | 719,023 |

| | $ | 818,095 |

|

Liabilities held for sale | — |

| | 56,263 |

|

Accounts payable and other liabilities (including from VIEs of $1,867 and $1,379, respectively) | 35,423 |

| | 19,495 |

|

Accrued offering costs | 75,052 |

| | 72,468 |

|

Distributions payable | 16,976 |

| | 15,840 |

|

Accrued interest (including from VIEs of $298 and $299, respectively) | 2,194 |

| | 2,191 |

|

Accrued real estate taxes (including from VIEs of $786 and $1,793, respectively) | 5,248 |

| | 6,065 |

|

Advisor fees payable | 1,823 |

| | 2,861 |

|

Acquired intangible liabilities, net | 17,110 |

| | 16,024 |

|

TOTAL LIABILITIES | 872,849 |

| | 1,009,302 |

|

Commitments and contingencies | — |

| | — |

|

Equity: | | | |

Class A common stock: $0.01 par value; 200,000,000 shares authorized; 73,138,318 and 71,187,722 shares issued and outstanding at March 31, 2019 and December 31, 2018, respectively | 731 |

| | 712 |

|

Class M common stock: $0.01 par value; 200,000,000 shares authorized; 40,505,870 and 39,869,130 shares issued and outstanding at March 31, 2019 and December 31, 2018, respectively | 405 |

| | 399 |

|

Class A-I common stock: $0.01 par value; 200,000,000 shares authorized; 10,989,003 and 11,083,034 shares issued and outstanding at March 31, 2019 and December 31, 2018, respectively | 110 |

| | 111 |

|

Class M-I common stock: $0.01 par value; 200,000,000 shares authorized; 11,253,166 and 9,738,086 shares issued and outstanding at March 31, 2019 and December 31, 2018, respectively | 113 |

| | 97 |

|

Class D common stock: $0.01 par value; 200,000,000 shares authorized; 5,448,111 and 6,270,479 shares issued and outstanding at March 31, 2019 and December 31, 2018, respectively | 54 |

| | 63 |

|

Additional paid-in capital (net of offering costs of $151,621 and $145,075 as of March 31, 2019 and December 31, 2018, respectively) | 1,601,084 |

| | 1,568,474 |

|

Distributions to stockholders | (335,770 | ) | | (318,780 | ) |

Retained earnings (accumulated deficit) | 36,086 |

| | (70,650 | ) |

Total Jones Lang LaSalle Income Property Trust, Inc. stockholders’ equity | 1,302,813 |

| | 1,180,426 |

|

Noncontrolling interests | 6,769 |

| | 6,866 |

|

Total equity | 1,309,582 |

| | 1,187,292 |

|

TOTAL LIABILITIES AND EQUITY | $ | 2,182,431 |

| | $ | 2,196,594 |

|

The abbreviation “VIEs” above means consolidated Variable Interest Entities.

See notes to consolidated financial statements.

Jones Lang LaSalle Income Property Trust, Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS

$ in thousands, except share and per share amounts

(Unaudited)

|

| | | | | | | |

| Three Months Ended March 31, 2019 | | Three Months Ended March 31, 2018 |

Revenues: | | | |

Rental revenue | $ | 38,861 |

| | $ | 40,639 |

|

Other revenue | 2,268 |

| | 1,401 |

|

Total revenues | 41,129 |

| | 42,040 |

|

Operating expenses: | | | |

Real estate taxes | 6,015 |

| | 6,478 |

|

Property operating expenses | 7,246 |

| | 7,140 |

|

Property general and administrative | 296 |

| | 390 |

|

Advisor fees | 5,233 |

| | 4,822 |

|

Company level expenses | 702 |

| | 723 |

|

Depreciation and amortization | 14,575 |

| | 14,847 |

|

Total operating expenses | 34,067 |

| | 34,400 |

|

Other income and (expenses): | | |

|

Interest expense | (9,632 | ) | | (5,729 | ) |

Income from unconsolidated real estate affiliates and fund investments | 2,197 |

| | 1,115 |

|

Gain on disposition of property and extinguishment of debt, net | 107,108 |

| | 29,665 |

|

Total other income and (expenses) | 99,673 |

| | 25,051 |

|

Net income | 106,735 |

| | 32,691 |

|

Less: Net loss (income) attributable to the noncontrolling interests | 1 |

| | (47 | ) |

Net income attributable to Jones Lang LaSalle Income Property Trust, Inc. | $ | 106,736 |

| | $ | 32,644 |

|

Net income attributable to Jones Lang LaSalle Income Property Trust, Inc. per share-basic and diluted: |

|

| |

|

|

Class A | 0.76 |

| | 0.25 |

|

Class M | 0.76 |

| | 0.25 |

|

Class A-I | 0.76 |

| | 0.25 |

|

Class M-I | 0.76 |

| | 0.25 |

|

Class D | 0.76 |

| | 0.25 |

|

Weighted average common stock outstanding-basic and diluted | 139,744,220 |

| | 133,231,349 |

|

See notes to consolidated financial statements.

Jones Lang LaSalle Income Property Trust, Inc.

CONSOLIDATED STATEMENTS OF EQUITY

$ in thousands, except share and per share amounts

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid In Capital | | Distributions to Stockholders | | Retained Earnings / (Accumulated Deficit) | | Noncontrolling Interests | | Total Equity |

Shares | | Amount |

Balance, January 1, 2018 | 133,307,105 |

| | $ | 1,333 |

| | $ | 1,522,123 |

| | $ | (256,811 | ) | | $ | (96,217 | ) | | $ | 7,829 |

| | $ | 1,178,257 |

|

Issuance of common stock | 2,171,505 |

| | 21 |

| | 25,510 |

| | — |

| | — |

| | — |

| | 25,531 |

|

Repurchase of shares | (1,943,028 | ) | | (19 | ) | | (22,759 | ) | | — |

| | — |

| | — |

| | (22,778 | ) |

Offering costs | — |

| | — |

| | (2,124 | ) | | — |

| | — |

| | — |

| | (2,124 | ) |

Stock based compensation | 3,419 |

| | — |

| | 40 |

| | — |

| | — |

| | — |

| | 40 |

|

Net income | — |

| | — |

| | — |

| | — |

| | 32,644 |

| | 47 |

| | 32,691 |

|

Cash distributed to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | (115 | ) | | (115 | ) |

Distributions declared per share ($0.13) | — |

| | — |

| | — |

| | (14,985 | ) | | — |

| | — |

| | (14,985 | ) |

Balance, March 31, 2018 | 133,539,001 |

| | $ | 1,335 |

| | $ | 1,522,790 |

| | $ | (271,796 | ) | | $ | (63,573 | ) | | $ | 7,761 |

| | $ | 1,196,517 |

|

| | | | | | | | | | | | | |

Balance, December 31, 2018 | 138,148,451 |

| | $ | 1,382 |

| | $ | 1,568,474 |

| | $ | (318,780 | ) | | $ | (70,650 | ) | | $ | 6,866 |

| | $ | 1,187,292 |

|

Issuance of common stock | 5,762,222 |

| | 57 |

| | 70,492 |

| | — |

| | — |

| | — |

| | 70,549 |

|

Repurchase of shares | (2,583,618 | ) | | (26 | ) | | (31,376 | ) | | — |

| | — |

| | — |

| | (31,402 | ) |

Offering costs | — |

| | — |

| | (6,546 | ) | | — |

| | — |

| | — |

| | (6,546 | ) |

Stock based compensation | 7,413 |

| | — |

| | 40 |

| | — |

| | — |

| | — |

| | 40 |

|

Net income | — |

| | — |

| | — |

| | — |

| | 106,736 |

| | (1 | ) | | 106,735 |

|

Cash distributed to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | (96 | ) | | (96 | ) |

Distributions declared per share ($0.135) | — |

| | — |

| | — |

| | (16,990 | ) | | — |

| | — |

| | (16,990 | ) |

Balance, March 31, 2019 | 141,334,468 |

| | $ | 1,413 |

| | $ | 1,601,084 |

| | $ | (335,770 | ) | | $ | 36,086 |

| | $ | 6,769 |

| | $ | 1,309,582 |

|

See notes to consolidated financial statements.

Jones Lang LaSalle Income Property Trust, Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

$ in thousands (Unaudited)

|

| | | | | | | |

| Three Months Ended March 31, 2019 | | Three Months Ended March 31, 2018 |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

Net income | $ | 106,735 |

| | $ | 32,691 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation and amortization | 14,604 |

| | 14,520 |

|

Gain on disposition of property | (107,108 | ) | | (29,665 | ) |

Straight line rent | (530 | ) | | (637 | ) |

Income from unconsolidated real estate affiliates and fund investment | (2,197 | ) |

| (1,115 | ) |

Distributions from unconsolidated real estate affiliates and fund investment | 1,844 |

| | 1,125 |

|

Net changes in assets, liabilities and other | (1,499 | ) | | (3,410 | ) |

Net cash provided by operating activities | 11,849 |

| | 13,509 |

|

CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

Purchase of real estate investments | (44,525 | ) | | — |

|

Proceeds from sale of real estate investments and fixed assets | 216,010 |

| | 74,478 |

|

Capital improvements and lease commissions | (4,280 | ) | | (6,808 | ) |

Investment in unconsolidated real estate affiliates | (13 | ) | | — |

|

Deposits for investments under contract | (3,100 | ) | | — |

|

Net cash provided by investing activities | 164,092 |

| | 67,670 |

|

CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

Issuance of common stock | 74,756 |

| | 15,943 |

|

Repurchase of shares | (31,402 | ) | | (22,812 | ) |

Offering costs | (3,961 | ) | | (3,833 | ) |

Distributions to stockholders | (5,370 | ) | | (4,930 | ) |

Distributions paid to noncontrolling interests | (96 | ) | | (115 | ) |

Payment on credit facility | (90,000 | ) | | (20,000 | ) |

Debt issuance costs | 7 |

| | — |

|

Principal payments on mortgage notes and other debt payable | (62,005 | ) | | (853 | ) |

Net cash used in financing activities | (118,071 | ) | | (36,600 | ) |

Net increase in cash, cash equivalents and restricted cash | 57,870 |

| | 44,579 |

|

Cash, cash equivalents and restricted cash at the beginning of the period | 45,269 |

| | 42,432 |

|

Cash, cash equivalents and restricted cash at the end of the period | $ | 103,139 |

| | $ | 87,011 |

|

| | | |

Reconciliation of cash, cash equivalents and restricted cash shown per Consolidated Balance Sheets to cash, cash equivalents and restricted per Consolidated Statements of Cash Flows | | | |

Cash and cash equivalents | $ | 80,490 |

| | $ | 40,647 |

|

Restricted cash | 22,649 |

| | 46,364 |

|

Cash, cash equivalents and restricted cash at the end of the period | $ | 103,139 |

| | $ | 87,011 |

|

| | | |

Supplemental disclosure of cash flow information: | | | |

Interest paid | $ | 7,487 |

| | $ | 8,377 |

|

Non-cash activities: | | | |

Write-offs of receivables | $ | (24 | ) | | $ | (19 | ) |

Write-offs of retired assets and liabilities | 1,663 |

| | 2,161 |

|

Change in liability for capital expenditures | 452 |

| | 4,924 |

|

Net liabilities transferred at sale of real estate investment | 2,100 |

| | 659 |

|

Net liabilities assumed at acquisition | 235 |

| | — |

|

Change in issuance of common stock receivable and redemption of common stock payable | 793 |

| | 288 |

|

Change in accrued offering costs | 2,585 |

| | (1,709 | ) |

Jones Lang LaSalle Income Property Trust, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

$ in thousands, except per share amounts

NOTE 1—ORGANIZATION

General

Except where the context suggests otherwise, the terms “we,” “us,” “our” and the “Company” refer to Jones Lang LaSalle Income Property Trust, Inc. The terms “Advisor” and “LaSalle” refer to LaSalle Investment Management, Inc.

Jones Lang LaSalle Income Property Trust, Inc. is an externally advised, daily valued perpetual-life real estate investment trust ("REIT") that owns and manages a diversified portfolio of apartment, industrial, office, retail and other properties located in the United States. Over time our real estate portfolio may be further diversified on a global basis through the acquisition of properties outside of the United States and may be complemented by investments in real estate-related debt and equity securities. We were incorporated on May 28, 2004 under the laws of the State of Maryland. We believe that we have operated in such a manner to qualify to be taxed as a REIT for U.S. federal income tax purposes commencing with the taxable year ended December 31, 2004, when we first elected REIT status. As of March 31, 2019, we owned interests in a total of 69 properties, located in 20 states.

On April 1, 2018, we converted to an “UPREIT” structure by contributing substantially all of our assets to JLLIPT Holdings LP, a Delaware limited partnership (our “operating partnership”), of which we are the initial limited partner and JLLIPT Holdings GP, LLC (our wholly owned subsidiary) is the sole general partner. We refer to this re-structuring as the "contribution." An "Umbrella Partnership Real Estate Investment Trust" ("UPREIT") is a REIT that holds all or substantially all of its assets through a partnership in which a REIT holds an interest. We converted to this structure to facilitate tax-free contributions of properties to our operating partnership in exchange for limited partnership interests in our operating partnership. A transfer of property directly to a REIT in exchange for shares of common stock of a REIT is generally a taxable transaction to the transferring property owner. In an UPREIT structure, a property owner who desires to defer taxable gain on the disposition of his property may transfer the property to our operating partnership in exchange for limited partnership interests in the operating partnership and defer taxation of gain until the limited partnership interests are disposed of in a taxable transaction.

From our inception to January 15, 2015, we raised equity proceeds through various public and private offerings of shares of our common stock. On January 16, 2015, our follow-on Registration Statement on Form S-11 was declared effective by the Securities and Exchange Commission (the "SEC") with respect to our continuous public offering of up to $2,700,000 in any combination of shares of our Class A, Class M, Class A-I and Class M-I common stock, consisting of up to $2,400,000 of shares offered in our primary offering and up to $300,000 in shares offered pursuant to our distribution reinvestment plan (the “First Extended Public Offering”). As of July 6, 2018, the date our First Extended Public Offering terminated, we had raised aggregate gross proceeds from the sale of shares of our common stock in our First Extended Public Offering of $1,138,053.

On July 6, 2018, the SEC declared our second follow-on Registration Statement on Form S-11 (the "Second Extended Public Offering") effective (Commission File No. 333-222533) to offer of up to $3,000,000 in any combination of shares of our Class A, Class M, Class A-I and Class M-I common stock, consisting of up to $2,700,000 of shares offered in our primary offering and up to $300,000 in shares offered pursuant to our distribution reinvestment plan. We reserve the right to terminate the Second Extended Public Offering at any time and to extend the Second Extended Public Offering term to the extent permissible under applicable law. As of March 31, 2019, we have raised aggregate gross proceeds from the sale of shares of our common stock in our Second Extended Public Offering of $152,008.

On March 3, 2015, we commenced a private offering (the "Follow-on Private Offering") of up to $350,000 in shares of our Class D common stock with an indefinite duration. As of March 31, 2019, we have raised aggregate gross proceeds from the sale of shares of our Class D common stock in our Follow-on Private Offering of $68,591.

As of March 31, 2019, 73,138,318 shares of Class A common stock, 40,505,870 shares of Class M common stock, 10,989,003 shares of Class A-I common stock, 11,253,166 shares of Class M-I common stock, and 5,448,111 shares of Class D common stock were outstanding and held by a total of 14,163 stockholders.

LaSalle acts as our advisor pursuant to the advisory agreement among us, our operating partnership and LaSalle (the "Advisory Agreement"). On May 7, 2019, we renewed the Advisory Agreement for a one-year term expiring on June 5, 2020. Our Advisor, a registered investment advisor with the SEC, has broad discretion with respect to our investment decisions and is responsible for selecting our investments and for managing our investment portfolio pursuant to the terms of the Advisory Agreement. Our executive officers are employees of and compensated by our Advisor. We have no employees, as all operations are managed by our Advisor.

LaSalle is a wholly-owned, but operationally independent subsidiary of our sponsor, Jones Lang LaSalle Incorporated ("JLL" or our "Sponsor"), a New York Stock Exchange-listed professional services firm that specializes in real estate and investment management. Affiliates of our sponsor invested an aggregate of $50,200 (with a current value of $62,639) through purchases of shares of our common stock.

NOTE 2—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation and Principles of Consolidation

The accompanying consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), the instructions to Form 10-Q and Rule 10-01 of Regulation S-X and include the accounts of our wholly owned subsidiaries, consolidated variable interest entities ("VIE") and the unconsolidated investment in real estate affiliates accounted for under the equity method of accounting. We consider the authoritative guidance of accounting for investments in common stock, investments in real estate ventures, investors accounting for an investee when the investor has the majority of the voting interest but the minority partners have certain approval or veto rights, determining whether a general partner or general partners as a group controls a limited partnership or similar entity when the limited partners have certain rights and the consolidation of VIEs in which we own less than a 100% interest. All significant intercompany balances and transactions have been eliminated in consolidation.

Parenthetical disclosures are shown on our Consolidated Balance Sheets regarding the amounts of VIE assets and liabilities that are consolidated. As of March 31, 2019, our VIEs include The District at Howell Mill, Grand Lakes Marketplace and Townlake of Coppell due to the limited partnership structures and our partners having limited participation rights and no kick-out rights. The creditors of our VIEs do not have general recourse to us.

Noncontrolling interests represent the minority members’ proportionate share of the equity in our VIEs. At acquisition, the assets, liabilities and noncontrolling interests were measured and recorded at the estimated fair value. Noncontrolling interests will increase for the minority members’ share of net income of these entities and contributions and decrease for the minority members’ share of net loss and distributions. As of March 31, 2019, noncontrolling interests represented the minority members’ proportionate share of the equity of the entities listed above as VIEs.

Certain of our joint venture agreements include provisions whereby, at certain specified times, each party has the right to initiate a purchase or sale of its interest in the joint ventures at an agreed upon fair value. Under these provisions, we are not obligated to purchase the interest of our outside joint venture partners.

The accompanying unaudited interim consolidated financial statements have been prepared in accordance with the accounting policies described in the consolidated financial statements and related notes included in our Annual Report on Form 10-K filed with the SEC on March 8, 2019 (our “2018 Form 10-K”) and should be read in conjunction with such consolidated financial statements and related notes. The following notes to these interim consolidated financial statements highlight changes to the notes included in the December 31, 2018 audited consolidated financial statements included in our 2018 Form 10-K and present interim disclosures as required by the SEC.

The interim financial data as of March 31, 2019 and for the three months ended March 31, 2019 and 2018 is unaudited. In our opinion, the interim data includes all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the results for the interim periods.

Restricted Cash

Restricted cash includes amounts established pursuant to various agreements for loan escrow accounts, loan commitments and property sale proceeds. When we sell a property, we can elect to enter into a like-kind exchange pursuant to the applicable Internal Revenue Service guidance whereby the proceeds from the sale are placed in escrow with a qualified intermediary until a replacement property can be purchased. At March 31, 2019, our restricted cash balance on our Consolidated Balance Sheet was primarily related to common stock subscriptions received in advance of the issuance of the common stock and loan escrow amounts.

Deferred Expenses

Deferred expenses consist of lease commissions. Lease commissions are capitalized and amortized over the term of the related lease as a component of depreciation and amortization expense. Accumulated amortization of deferred expenses at March 31, 2019 and December 31, 2018 was $3,918 and $5,305, respectively.

Acquisitions

We have allocated a portion of the purchase price of our acquisitions to acquired intangible assets, which include acquired in-place lease intangibles, acquired above-market in-place lease intangibles and acquired ground lease intangibles, which are reported net of accumulated amortization of $62,851 and $58,433 at March 31, 2019 and December 31, 2018, respectively, on the accompanying Consolidated Balance Sheets. The acquired intangible liabilities represent acquired below-market in-place leases, which are reported net of accumulated amortization of $9,091 and $10,280 at March 31, 2019 and December 31, 2018, respectively, on the accompanying Consolidated Balance Sheets.

Assets and Liabilities Measured at Fair Value

The Financial Accounting Standards Board’s (“FASB”) guidance for fair value measurement and disclosure states that fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability. As a basis for considering assumptions, authoritative guidance establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

| |

• | Level 1—Inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that we have access to at the measurement date. |

| |

• | Level 2—Observable inputs, other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| |

• | Level 3—Unobservable inputs for the asset or liability. Unobservable inputs are those inputs that reflect our own assumptions that market participants would use to price the asset or liability based on the best available information. |

The authoritative guidance requires the disclosure of the fair value of our financial instruments for which it is practicable to estimate that value. The guidance does not apply to all balance sheet items. Market information as available or present value techniques have been utilized to estimate the amounts required to be disclosed. Since such amounts are estimates, there can be no assurance that the disclosed value of any financial instrument could be realized by immediate settlement of the instrument.

Real estate fund investments accounted for under the fair value option fall within Level 3 of the hierarchy. The fair value is recorded based upon changes in the net asset value of the limited partnership as determined from the financial statements of the real estate fund. During the three months ended March 31, 2019 and 2018, we recorded an increase in fair value classified within the Level 3 category of $1,320 and $893, respectively, in our investment in the NYC Retail Portfolio (see Note 4-Unconsolidated Real Estate Affiliates and Fund Investments). We have estimated the fair value of our mortgage notes and other debt payable reflected on the Consolidated Balance Sheets at amounts that are based upon an interpretation of available market information and valuation methodologies (including discounted cash flow analysis with regard to fixed rate debt) for similar loans made to borrowers with similar credit ratings and for the same maturities. The fair value of our mortgage notes and other debt payable using Level 2 inputs was $2,791 and $14,422 lower than the aggregate carrying amounts at March 31, 2019 and December 31, 2018, respectively. Such fair value estimates are not necessarily indicative of the amounts that would be realized upon disposition of our mortgage notes payable.

Derivative Financial Instruments

We record all derivatives on the Consolidated Balance Sheets at fair value in prepaid expenses and other assets or accounts payable and other accrued expenses. Changes in the fair value of our derivatives are recorded as a component of interest expense on our Consolidated Statements of Operations as we have not designated our derivative instruments as hedges. Our objective in using interest rate derivatives is to manage our exposure to interest rate movements. To accomplish this objective, we use interest rate caps and swaps.

As of March 31, 2019, we had the following outstanding interest rate derivatives related to managing our interest rate risk:

|

| | | | | | |

Interest Rate Derivative | | Number of Instruments | | Notional Amount |

Interest Rate Swaps | | 6 | | $ | 212,800 |

|

The fair value of our interest rate caps and swaps represent assets of $1,732 and $3,921 at March 31, 2019 and December 31, 2018, respectively.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires us to make estimates and assumptions. These estimates and assumptions impact the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. For example, significant estimates and assumptions have been made with respect to useful lives of assets, recoverable amounts of receivables, fair value of derivatives and real estate assets, initial valuations and related amortization periods of deferred costs and intangibles, particularly with respect to property acquisitions. Actual results could differ from those estimates.

Recently Adopted Accounting Pronouncements

Effective January 1, 2019, we adopted Accounting Standard Update ("ASU") 2016-02 Leases (Topic 842). The new guidance sets out the principles for the recognition, measurement, presentation and disclosure of leases for both parties to a contract (i.e., lessees and lessors). We elected a practical expedient, by class of underlying assets, to not separate non-lease components from the related lease components and, instead, to account for those components as a single lease component, when certain criteria are met. Upon adoption we reclassified these components for prior periods to conform with the current period presentation. We also elected permitted practical expedients to not reassess lease classification and use of the standard’s effective date as the date of initial application and therefore financial information under Topic 842 is not provided for periods prior to January 1, 2019. The accounting for lessors will remain largely unchanged from current GAAP; however, the standard requires that lessors expense, on an as-incurred basis, certain initial direct costs that are not incremental in negotiating a lease. Under existing standards, certain of these costs are capitalizable and therefore this new standard will result in certain of these costs being expensed as incurred after adoption. Additionally, the standard requires lessors to evaluate whether the collectability of all rents is probable before recognizing rental revenues on a straight-line basis over the applicable lease term.

The new standard requires lessees to apply a dual approach, classifying leases as either finance or operating leases based on the principle of whether or not the lease is effectively a financed purchase by the lessee. This classification will determine whether lease expense is recognized based on an effective interest method or on a straight line basis over the term of the lease. A lessee is also required to record a right-of-use asset and a lease liability for all leases with a term of greater than 12 months regardless of their classification. Leases with a term of 12 months or less will be accounted for similar to existing guidance for operating leases today. We have a ground lease arrangement for which we are the lessee and recorded a right-of-use asset within prepaid expenses and other assets and a lease liability within accounts payable and other liabilities on our Consolidated Balance Sheets in the amount of $2,226.

Reclassification

Upon adoption of ASU 842, we are reclassfying amounts previously recorded as recovery revenue and amounts determined to be uncollectable, previously recorded as provision for doubtful accounts, to rental revenue to conform with the current year presentation. The following table summarizes the reclassifications being made on our Consolidated Statement of Operations for the three month period ending March 31, 2018:

|

| | | | | | | | | | | |

| Previously Reported | | Reclassification | | Newly Reported |

Rental Revenue | $ | 34,023 |

| | $ | 6,616 |

| | $ | 40,639 |

|

Other Revenue | 8,059 |

| | (6,658 | ) | | 1,401 |

|

Provision for Doubtful Accounts | (42 | ) | | 42 |

| | — |

|

NOTE 3—PROPERTY

The primary reason we make acquisitions of real estate investments in the apartment, industrial, office, retail and other property sectors is to invest capital contributed by stockholders in a diversified portfolio of real estate assets. All references to square footage and units are unaudited.

Acquisition

On March 29, 2019, we acquired Fremont Distribution Center, consisting of two industrial manufacturing buildings located in Fremont, California, for approximately $47,000. The acquisition was funded with cash on hand.

We allocated the purchase price for our 2019 acquisition in accordance with authoritative guidance as follows:

|

| | | |

| 2019 Acquisition |

Land | $ | 29,427 |

|

Building and equipment | 7,024 |

|

In-place lease intangible (acquired intangible assets) | 10,030 |

|

Below-market lease intangible (acquired intangible liabilities) | (1,721 | ) |

| $ | 44,760 |

|

Amortization period for intangible assets and liabilities | 77 - 80 months |

|

Disposition

On February 7, 2019, we sold 111 Sutter Street for approximately $227,000 less closing costs. In connection with the disposition, the mortgage loan associated with the property of approximately $52,297 was retired. We recorded a gain on the sale of property in the amount of $107,108.

NOTE 4—UNCONSOLIDATED REAL ESTATE AFFILIATES AND FUND INVESTMENTS

Unconsolidated Real Estate Affiliates

Chicago Parking Garage

On December 23, 2014, we acquired Chicago Parking Garage, a 366-stall, multi-level parking facility located in a large mixed-use property in Chicago, Illinois owned as a condominium interest. In accordance with authoritative guidance, Chicago Parking Garage is accounted for as an investment in an unconsolidated real estate affiliate. At March 31, 2019 and December 31, 2018, the carrying amount of our investment in Chicago Parking Garage was $17,309 and $17,260, respectively.

Pioneer Tower

On June 28, 2016, we acquired Pioneer Tower, a 17 story, 296,000 square foot multi-tenant office property in Portland, Oregon for approximately $121,750. using cash on hand. Pioneer Tower is a component of a mixed-use property that includes Portland's largest urban regional mall owned by an independent third party. The land component of this mixed-use property is owned as a condominium interest with the owner of the regional mall. The acquisition was funded with cash on hand. In accordance with authoritative guidance, Pioneer Tower is accounted for as an investment in an unconsolidated real estate affiliate. At March 31, 2019 and December 31, 2018, the carrying amount of our investment in Pioneer Tower was $110,421 and $111,091, respectively.

The Tremont

On July 19, 2018, we acquired a 75% interest in The Tremont, a 180 unit apartment property in Burlington, Massachusetts. The joint venture acquired the property for approximately $73,500. The acquisition was funded by the assumption of a 19 year mortgage loan that bears interest at a fixed-rate of 3.62% in the amount of $42,520 and cash on hand. In accordance with authoritative guidance, The Tremont is accounted for as an investment in an unconsolidated real estate affiliate. At March 31, 2019 and December 31, 2018, the carrying amount of our investment in The Tremont was $21,761 and $21,881, respectively.

The Huntington

On July 19, 2018, we acquired a 75% interest in The Huntington, a 117 unit apartment property in Burlington, Massachusetts. The joint venture acquired the property for approximately $48,500. The acquisition was financed with a ten year mortgage loan that bears interest at a fixed rate of 4.07% in the amount of $31,000 and cash on hand. In accordance with authoritative guidance, The Huntington is accounted for as an investment in an unconsolidated real estate affiliate. At March 31, 2019 and December 31, 2018, the carrying amount of our investment in The Huntington was $12,869 and $13,082, respectively.

Summarized Combined Statements of Operations—Unconsolidated Real Estate Affiliates—Equity Method Investments

|

| | | | | | | |

| Three Months Ended March 31, 2019 |

| Three Months Ended March 31, 2018 |

Total revenues | $ | 4,830 |

| | $ | 3,012 |

|

Total operating expenses | 3,993 |

| | 2,790 |

|

Operating income | $ | 837 |

| | $ | 222 |

|

Interest expense | 541 |

| | — |

|

Net income | $ | 296 |

| | $ | 222 |

|

Real Estate Fund Investment

NYC Retail Portfolio

On December 8, 2015, a wholly-owned subsidiary of the Company acquired an approximate 28% interest in a newly formed limited partnership, Madison NYC Core Retail Partners, L.P., which acquired an approximate 49% interest in entities that initially owned 15 retail properties located in the greater New York City area (the “NYC Retail Portfolio”), the result of which is that we own an approximate 14% interest in the NYC Retail Portfolio. The purchase price for such portion was approximately $85,600 including closing costs. As of March 31, 2019, the NYC Retail Portfolio owned 10 retail properties totaling approximately 2,230,000 square feet across urban infill locations in Manhattan, Brooklyn, Queens, Staten Island and New Jersey.

At acquisition we made the election to account for our interest in the NYC Retail Portfolio under the fair value option. This fair value election was made as the investment is in the form of a commingled fund with institutional partners where fair value accounting provides the most relevant information about the financial condition of the investment. We record increases and decreases in our investment each reporting period based on the change in the fair value of the investment as estimated by the general partner. Critical inputs to NAV estimates include valuations of the underlying real estate assets which incorporate investment-specific assumptions such as discount rates, capitalization rates and rental growth rates. We did not consider adjustments to NAV estimates provided by the general partner, including adjustments for any restrictions to the transferability of ownership interests embedded within the investment agreement to which we are a party, to be necessary based upon (1) our understanding of the methodology utilized and inputs incorporated to estimate NAV at the investment level, (2) consideration of market demand for the retail assets held by the venture, and (3) contemplation of real estate and capital markets conditions in the localities in which the venture operates. We have no unfunded commitments. Our investment in the NYC Retail Portfolio is presented on our Consolidated Balance Sheets within real estate fund investment. Changes in the fair value of our investment as well as cash distributions received are recorded on our Consolidated Statements of Operations within income from unconsolidated real estate affiliates and fund investment. As of March 31, 2019 and December 31, 2018, the carrying amount of our investment in the NYC Retail Portfolio was $93,734 and $92,414, respectively. During the three months ended March 31, 2019, we recorded an increase in fair value of our investment in the NYC Retail Portfolio of $1,320. During the three months ended March 31, 2019, we received distributions of income totaling $581. This cash distribution of income increased equity in income of unconsolidated real estate affiliates and fund investment. On January 7, 2019, two retail properties in the NYC Retail Portfolio with a combined 148,000 square feet were sold and the mortgage loans were extinguished. During the three months ended March 31, 2018, we recorded increases in fair value of our investment in the NYC Retail Portfolio of $893 and received no cash distribution.

Summarized Statement of Operations—NYC Retail Portfolio Investment—Fair Value Option Investment

|

| | | | | | | |

| Three Months Ended March 31, 2019 | | Three Months Ended March 31, 2018 |

Total revenue | $ | 2,545 |

| | $ | 1,871 |

|

| | | |

Net investment income | 2,127 |

| | 1,512 |

|

Net change in unrealized gain on investment in real estate venture | 4,771 |

| | 2,959 |

|

Net income | $ | 6,898 |

| | $ | 4,471 |

|

NOTE 5—MORTGAGE NOTES AND OTHER DEBT PAYABLE

Mortgage notes and other debt payable have various maturities through 2054 and consist of the following:

|

| | | | | | | | | | | | |

Mortgage notes and other debt payable | | Maturity Date | | Interest

Rate | | Amount payable as of |

March 31, 2019 | | December 31, 2018 |

Mortgage notes payable | | April 2020 - March 2054 | | 3.00% - 5.30% | | $ | 627,097 |

| | $ | 636,649 |

|

Credit facility | | | | | | | | |

Revolving line of credit | | May 25, 2021 | | 3.85% | | — |

| | 90,000 |

|

Term loans | | May 25, 2023 | | 3.10% | | 100,000 |

| | 100,000 |

|

TOTAL | | | | | | $ | 727,097 |

| | $ | 826,649 |

|

Net debt discount on assumed debt and debt issuance costs | |

| | (8,074 | ) | | (8,554 | ) |

Mortgage notes and other debt payable, net | | $ | 719,023 |

| | $ | 818,095 |

|

Aggregate future principal payments of mortgage notes and other debt payable as of March 31, 2019 are as follows:

|

| | | | |

Year | | Amount |

2019 | | $ | 3,228 |

|

2020 | | 75,094 |

|

2021 | | 28,270 |

|

2022 | | 6,241 |

|

2023 | | 228,251 |

|

Thereafter | | 386,013 |

|

Total | | $ | 727,097 |

|

Credit Facility

On May 26, 2017, we entered into a credit agreement providing for a $250,000 revolving line of credit and unsecured term loan with a syndicate of six lenders led by JPMorgan Chase Bank, N.A., Bank of America, N.A., and PNC Bank, National Association. The $250,000 credit facility (the "Credit Facility") consists of a $200,000 revolving line of credit (the “Revolving Line of Credit”) and a $50,000 term loan. On August 4, 2017, we expanded our Credit Facility to $300,000. The additional $50,000 borrowing was in the form of a five-year term loan maturing on May 26, 2022. We collectively refer to the two term loans as the "Term Loan". On December 12, 2018, we expanded and extended our Credit Facility to provide for a borrowing capacity of $400,000, by increasing our Revolving Line of Credit to $300,000 with a new maturity date of May 25, 2021. We also extended our Term Loans by one year with new maturity dates of May 25, 2023. The primary interest rate is based on LIBOR, plus a margin ranging from 1.25% to 2.00% depending on our leverage ratio or alternatively, we can choose to borrow at a “base rate” equal to (i) the highest of (a) the Federal Funds Rate plus 0.5%, (b) the prime rate announced by JPMorgan Chase Bank, N.A., and (c) LIBOR plus 1.0%, plus (ii) a margin ranging from 0.25% to 1.00% for base rate loans. The maturity date of the Revolving Line of Credit is May 25, 2021 and contains two 12-month extension options that we may exercise upon (i) payment of an extension fee equal to 0.15% of the gross capacity under the Revolving Line of Credit at the time of the extension, and (ii) compliance with the other conditions set forth in the credit agreement. We intend to use the Revolving Line of Credit to cover short-term capital needs, for new property acquisitions and working capital. We may not draw funds on our Credit Facility if we (i) experience a material adverse effect, which is defined to include, among other things, (a) a material adverse effect on the business, assets, operations or financial condition of the Company taken as a whole; (b) the inability of any loan party to perform any of its obligations under any loan document; or (c) a material adverse effect upon the validity or enforceability of any loan document or (ii) are in default, as that term is defined in the agreement, including a default under certain other loan agreements and/or guarantees entered into by us or our subsidiaries. As of March 31, 2019, we believe no material adverse effects had occurred.

Borrowings under the Credit Facility are guaranteed by us and certain of our subsidiaries. The Credit Facility requires the maintenance of certain financial covenants, including: (i) unencumbered property pool leverage ratio; (ii) debt service coverage ratio; (iii) maximum total leverage ratio; (iv) fixed charges coverage ratio; (v) minimum net asset value; (vi) maximum secured debt ratio; (vii) maximum secured recourse debt ratio; (viii) maximum permitted investments; and (ix) unencumbered property pool criteria. The Credit Facility provides the flexibility to move assets in and out of the unencumbered property pool during the term of the Credit Facility.

At March 31, 2019, we had no outstanding borrowings under the Revolving Line of Credit and $100,000 outstanding under the Term Loans at LIBOR + 1.30%. We swapped the LIBOR portion of our $100,000 in Term Loans to a blended fixed rate of 1.80% (all in rate of 3.10% at March 31, 2019).

Covenants

At March 31, 2019, we were in compliance with all debt covenants.

Debt Issuance Costs

Debt issuance costs are capitalized, and presented net of mortgage notes and other debt payable, and amortized over the terms of the respective agreements as a component of interest expense. Accumulated amortization of debt issuance costs at March 31, 2019 and December 31, 2018 was $4,847 and $4,537, respectively.

NOTE 6—COMMON STOCK

We have five classes of common stock: Class A, Class M, Class A-I, Class M-I, and Class D. The fees payable to LaSalle Investment Management Distributors, LLC, an affiliate of our Advisor and the dealer manager for our offerings (the "Dealer Manager"), with respect to each outstanding share of each class, as a percentage of net asset value ("NAV"), are as follows:

|

| | | | |

| | Selling Commission (1) | | Dealer Manager Fee (2) |

Class A Shares | | up to 3.0% | | 0.85% |

Class M Shares | | — | | 0.30% |

Class A-I Shares | | up to 1.5% | | 0.30% |

Class M-I Shares | | — | | None |

Class D Shares (3) | | up to 1.0% | | None |

________

| |

(1) | Selling commissions are paid on the date of sale of our common stock. |

| |

(2) | We accrue all future dealer manager fees up to the ten percent regulatory limitation as accrued offering costs on our Consolidated Balance Sheets on the date of sale of our common stock. For NAV calculation purposes, dealer manager fees are accrued daily, on a continuous basis equal to 1/365th of the stated fee. |

| |

(3) | Shares of Class D common stock are only being offered pursuant to a private offering. |

The selling commissions and dealer manager fees are offering costs and are recorded as a reduction of additional paid in capital.

Stock Transactions

The stock transactions for each of our classes of common stock for the three months ended March 31, 2019 were as follows:

|

| | | | | | | | | | | | | | |

| Shares of Class A Common Stock | | Shares of Class M Common Stock | | Shares of Class A-I Common Stock | | Shares of Class M-I Common Stock | | Shares of Class D Common Stock |

Balance, December 31, 2018 | 71,187,722 |

| | 39,869,130 |

| | 11,083,034 |

| | 9,738,086 |

| | 6,270,479 |

|

Issuance of common stock | 2,669,264 |

| | 1,423,430 |

| | 148,290 |

| | 1,528,651 |

| | — |

|

Repurchase of common stock | (718,668 | ) | | (786,690 | ) | | (242,321 | ) | | (13,571 | ) | | (822,368 | ) |

Balance, March 31, 2019 | 73,138,318 |

| | 40,505,870 |

| | 10,989,003 |

| | 11,253,166 |

| | 5,448,111 |

|

Stock Issuances

The stock issuances for our classes of common stock, including those issued through our distribution reinvestment plan, for the three months ended March 31, 2019 were as follows:

|

| | | | | | |

| | Three Months Ended March 31, 2019 |

| | # of shares | | Amount |

Class A Shares | | 2,669,264 | | $ | 32,837 |

|

Class M Shares | | 1,423,430 | | 17,315 |

|

Class A-I Shares | | 148,290 | | 1,820 |

|

Class M-I Shares | | 1,528,651 | | 18,617 |

|

Total | | | | $ | 70,589 |

|

Share Repurchase Plan

Our share repurchase plan allows stockholders, subject to a one-year holding period, with certain exceptions, to request that we repurchase all or a portion of their shares of common stock on a daily basis at that day's NAV per share, limited to 5% of aggregate Company NAV per quarter. For the three months ended March 31, 2019, we repurchased 2,583,618 shares of common stock in the amount of $31,402. During the three months ended March 31, 2018, we repurchased 1,943,028 shares of common stock in the amount of $22,778.

Distribution Reinvestment Plan

Pursuant to our distribution reinvestment plan, holders of shares of any class of our common stock may elect to have their cash distributions reinvested in additional shares of our common stock at the NAV per share applicable to the class of shares being purchased on the distribution date. For the three months ended March 31, 2019, we issued 863,412 shares of common stock for $10,483 under the distribution reinvestment plan. For the three months ended March 31, 2018, we issued 795,606 shares of common stock for $9,311 under the distribution reinvestment plan.

Earnings Per Share

We compute net income per share for Class A, Class M, Class A-I, Class M-I and Class D common stock using the two-class method. Our Advisor may earn a performance fee (see Note 8- Related Party Transactions), which may impact the net income of each class of common stock differently. In periods where no performance fee is recognized in our Consolidated Statements of Operations, the net income per share will be the same for each class of common stock. Basic and diluted net income per share for each class of common stock is computed using the weighted-average number of common shares outstanding during the period for each class of common stock. We have not issued any dilutive or potentially dilutive securities, and thus the basic and diluted net income per share for a given class of common stock is the same for each period presented.

The following table sets forth the computation of basic and diluted net income per share for each of our Class A, Class M, Class A-I, Class M-I and Class D common stock: |

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2019 |

| Class A | | Class M | | Class A-I | | Class M-I | | Class D |

Basic and diluted net income per share: | | | | | | | | | |

Allocation of net income per share before performance fee | $ | 55,224 |

| | $ | 30,623 |

| | $ | 8,475 |

| | $ | 8,016 |

| | $ | 4,398 |

|

Weighted average number of common shares outstanding | 72,309,548 |

| | 40,085,862 |

| | 11,101,704 |

| | 10,488,323 |

| | 5,758,783 |

|

Basic and diluted net income per share: | $ | 0.76 |

| | $ | 0.76 |

| | $ | 0.76 |

| | $ | 0.76 |

| | $ | 0.76 |

|

| | | | | | | | | |

| Three Months Ended March 31, 2018 |

| Class A | | Class M | | Class A-I | | Class M-I | | Class D |

Basic and diluted net income per share: | | | | | | | | | |

Allocation of net income per share before performance fee | $ | 17,024 |

| | $ | 9,366 |

| | $ | 2,667 |

| | $ | 1,743 |

| | $ | 1,844 |

|

Weighted average number of common shares outstanding | 69,471,681 |

| | 38,229,153 |

| | 10,879,108 |

| | 7,119,693 |

| | 7,531,714 |

|

Basic and diluted net income per share: | $ | 0.25 |

| | $ | 0.25 |

|

| $ | 0.25 |

| | $ | 0.25 |

| | $ | 0.25 |

|

Organization and Offering Costs

Organization and offering costs include, but are not limited to, legal, accounting and printing fees and personnel costs of our Advisor attributable to our organization, preparation of the registration statement, registration and qualification of our common stock for sale with the SEC and in the various states and filing fees incurred by our Advisor. LaSalle agreed to fund our organization and offering expenses for the Second Extended Public Offering until July 6, 2018, the day the registration statement was declared effective by the SEC, following which time we commenced reimbursing LaSalle over 36 months. Following the Second Extended Public Offering commencement date, we began paying directly or reimbursing LaSalle if it pays on our behalf any organization and offering costs incurred during the Second Extended Public Offering period (other than selling commissions and dealer manager fees) as and when incurred. After the termination of the Second Extended Public Offering, LaSalle has agreed to reimburse us to the extent that the organization and offering costs that we incur exceed 15% of our gross proceeds from the Second Extended Public Offering. Organization costs are expensed, whereas offering costs are recorded as a reduction of capital in excess of par value. As of March 31, 2019 and December 31, 2018, LaSalle had paid $2,227 and $2,017, respectively, of organization and offering costs on our behalf which we had not yet been reimbursed. These costs are included in accrued offering costs on the Consolidated Balance Sheets.

NOTE 7—RENTALS UNDER OPERATING LEASES

We receive rental income from operating leases. The minimum future rentals from consolidated properties based on operating leases in place at March 31, 2019 are as follows:

|

| | | | |

Year | | Amount |

2019 | | $ | 84,925 |

|

2020 | | 84,194 |

|

2021 | | 70,399 |

|

2022 | | 64,132 |

|

2023 | | 57,026 |

|

Thereafter | | 227,467 |

|

Total | | $ | 588,143 |

|

Minimum future rentals do not include amounts payable by certain tenants based upon a percentage of their gross sales or as reimbursement of property operating expenses. During the three months ended March 31, 2019, no individual tenant accounted for greater than 10% of minimum base rents.

NOTE 8—RELATED PARTY TRANSACTIONS

Pursuant to our Advisory Agreement with LaSalle, we pay a fixed advisory fee of 1.25% of our NAV calculated daily. The Advisory Agreement allows for a performance fee to be earned for each share class based on the total return of that share class during the calendar year. The performance fee is calculated as 10% of the return in excess of 7% per annum. On May 7, 2019, we renewed our Advisory Agreement for a one year term expiring on June 5, 2020.

Fixed advisory fees for the three months ended March 31, 2019 and 2018 were $5,233 and $4,822, respectively. There were no performance fees for the three months ended March 31, 2019 and 2018. Included in Advisor fees payable at March 31, 2019 was $1,823 of fixed fee expense. Included in Advisor fees payable for the year ended December 31, 2018 was $1,786 of fixed fee expense and $1,075 of performance fee expense.

We pay Jones Lang LaSalle Americas, Inc. (“JLL Americas”), an affiliate of our Advisor, for property management, construction management, leasing, mortgage brokerage and sales brokerage services performed at various properties we own. For the three months ended March 31, 2019 and 2018, JLL Americas was paid $576 and $215, respectively, for property management and leasing services.

We pay the Dealer Manager selling commissions and dealer manager fees in connection with our offerings. For the three months ended March 31, 2019 and 2018, we paid the Dealer Manager selling commissions and dealer manager fees totaling $2,551 and $2,469, respectively. A majority of the selling commissions and dealer manager fees are reallowed to participating broker-dealers. Included in Accrued offering costs, at March 31, 2019 and December 31, 2018, were $72,826 and $70,451 of future dealer manager fees payable, respectively.

As of March 31, 2019 and December 31, 2018, we owed $2,227 and $2,017, respectively, for organization and offering costs paid by LaSalle (see Note 6-Common Stock). These costs are included in Accrued offering costs. NOTE 9—COMMITMENTS AND CONTINGENCIES

We are involved in various claims and litigation matters arising in the ordinary course of business, some of which involve claims for damages. Many of these matters are covered by insurance, although they may nevertheless be subject to deductibles or retentions. Although the ultimate liability for these matters cannot be determined, based upon information currently available, we believe the ultimate resolution of such claims and litigation will not have a material adverse effect on our financial position, results of operations or liquidity.

From time to time, we have entered into contingent agreements for the acquisition and financing of properties. Such acquisitions and financings are subject to satisfactory completion of due diligence or meeting certain leasing or occupancy thresholds.

We are subject to fixed ground lease payments on South Beach Parking Garage of $100 per year until September 30, 2021, which will increase every five years thereafter by the lesser of 12% or the cumulative CPI over the previous five year period. We are also subject to a variable ground lease payment calculated as 2.5% of revenue. The lease expires September 30, 2041 and has a ten-year renewal option.

The operating agreement for Townlake of Coppell allows the unrelated third party joint venture partner, owning a 10% interest, to put their interest to us at a market determined value for a period of 90 days beginning in 2019. As of March 31, 2019, the joint venture partner has not executed this option.

NOTE 10—SEGMENT REPORTING

We have five reportable operating segments: apartment, industrial, office, retail and other properties. Consistent with how our chief operating decision makers evaluate performance and manage our properties, the financial information summarized below is presented by operating segment and reconciled to net income for the three months ended March 31, 2019 and 2018.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Apartment | | Industrial | | Office | | Retail | | Other | | Total |

Assets as of March 31, 2019 | | $ | 600,173 |

| | $ | 518,199 |

| | $ | 140,412 |

| | $ | 557,115 |

| | $ | 24,134 |

| | $ | 1,840,033 |

|

Assets as of December 31, 2018 | | 604,553 |

| | 474,622 |

| | 255,101 |

| | 560,802 |

| | 21,549 |

| | 1,916,627 |

|

| | | | | | | | | | | | |

Three Months Ended March 31, 2019 | | | | | | | | | | | | |

| | | | | | | | | | | | |

Capital expenditures by segment | | $ | 998 |

| | $ | 784 |

| | $ | — |

| | $ | 2,030 |

| | $ | 16 |

| | $ | 3,828 |

|

| | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | |

Rental revenue | | $ | 12,598 |

| | $ | 9,828 |

| | $ | 5,037 |

| | $ | 11,305 |

| | $ | 93 |

| | $ | 38,861 |

|

Other revenue | | 755 |

| | 351 |

| | 7 |

| | 504 |

| | 651 |

| | 2,268 |

|

Total revenues | | $ | 13,353 |

| | $ | 10,179 |

| | $ | 5,044 |

| | $ | 11,809 |

| | $ | 744 |

| | $ | 41,129 |

|

Operating expenses: | | | | | | | | | | | |

|

Real estate taxes | | $ | 2,369 |

| | $ | 1,690 |

| | $ | 440 |

| | $ | 1,388 |

| | $ | 128 |

| | $ | 6,015 |

|

Property operating expenses | | 3,587 |

| | 778 |

| | 1,049 |

| | 1,647 |

| | 185 |

| | 7,246 |

|

Total segment operating expenses | | $ | 5,956 |

| | $ | 2,468 |

| | $ | 1,489 |

| | $ | 3,035 |

| | $ | 313 |

| | $ | 13,261 |

|

| | | | | | | | | | | | |

Reconciliation to net income |

Property general and administrative | | | | | | | | | | | | $ | 296 |

|

Advisor fees | | | | | | | | | | | | 5,233 |

|

Company level expenses | | | | | | | | | | | | 702 |

|

Depreciation and amortization | | | | | | | | | | | | 14,575 |

|

Total operating expenses | | | | | | | | | | | | $ | 34,067 |

|

Other income and (expenses): | | | | | | | | | | | |

|

Interest expense | | | | | | | | | | | | $ | (9,632 | ) |

Income from unconsolidated real estate affiliates and fund investment | | | | | | | | 2,197 |

|

Gain on disposition of property | | | | 107,108 |

|

Total other income and (expenses) | | | | | | | | | | | | $ | 99,673 |

|

Net income | | | | | | | | | | | | $ | 106,735 |

|

| | | | | | | | | | | | |

Reconciliation to total consolidated assets as of March 31, 2019 |

Assets per reportable segments | | | | | | | | | | | | $ | 1,840,033 |

|

Investment in unconsolidated real estate affiliates, real estate fund investment and corporate level assets | | 342,398 |

|

Total consolidated assets | | | | | | | | | | | | $ | 2,182,431 |

|

| | | | | | | | | | | | |

Reconciliation to total consolidated assets as of December 31, 2018 |

Assets per reportable segments | | | | | | | | | | | | $ | 1,916,627 |

|

Investment in unconsolidated real estate affiliates, real estate fund investment and corporate level assets | | 279,967 |

|

Total consolidated assets | | | | | | | | | | | | $ | 2,196,594 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Apartment | | Industrial | | Office | | Retail | | Other | | Total |

Three Months Ended March 31, 2018 | | | | | | | | | | | |

| | | | | | | | | | | |

Capital expenditures by segment | $ | 1,096 |

| | $ | 159 |

| | $ | 36 |

| | $ | 568 |

| | $ | 21 |

| | $ | 1,880 |

|

| | | | | | | | | | | |

Revenues: | | | | | | | | | | | |

Rental revenue | $ | 11,702 |

| | $ | 10,216 |

| | $ | 6,942 |

| | $ | 11,703 |

| | $ | 76 |

| | $ | 40,639 |

|

Other revenue | 663 |

| | 1 |

| | 69 |

| | 62 |

| | 606 |

| | 1,401 |

|

Total revenues | $ | 12,365 |

| | $ | 10,217 |

| | $ | 7,011 |

| | $ | 11,765 |

| | $ | 682 |

| | $ | 42,040 |

|

Operating expenses: | | | | | | | | | | | |

Real estate taxes | $ | 2,095 |

| | $ | 1,993 |

| | $ | 745 |

| | $ | 1,532 |

| | $ | 113 |

| | $ | 6,478 |

|

Property operating expenses | 3,265 |

| | $ | 650 |

| | 1,352 |

| | 1,664 |

| | 209 |

| | 7,140 |

|

Total segment operating expenses | $ | 5,360 |

| | $ | 2,643 |

| | $ | 2,097 |

| | $ | 3,196 |

| | $ | 322 |

| | $ | 13,618 |

|

| | | | | | | | | | | |

Reconciliation to net income |

Property general and administrative | | | | | | | | | | | $ | 390 |

|

Advisor fees | | | | | | | | | | | 4,822 |

|

Company level expenses | | | | | | | | | | | 723 |

|

Depreciation and amortization | | | | | | | | | | | 14,847 |

|

Total operating expenses | | | | | | | | | | | $ | 34,400 |

|

Other income and (expenses): | | | | | | | | | | | |

Interest expense | | | | | | | | | | | $ | (5,729 | ) |

Income from unconsolidated real estate affiliates and fund investment | | | | | | 1,115 |

|

Gain on disposition of property and extinguishment of debt | | | | | 29,665 |

|

Total other income and (expenses) | | | | | | | | | | | $ | 25,051 |

|

Net income | | | | | | | | | | | $ | 32,691 |

|

NOTE 11—DISTRIBUTIONS PAYABLE

On March 5, 2019, our board of directors approved a gross dividend for the first quarter of 2019 of $0.135 per share to stockholders of record as of March 28, 2019. The dividend was paid on April 29, 2019. Class A, Class M, Class A-I, Class M-I and Class D stockholders received $0.135 per share, less applicable class-specific fees, if any.

NOTE 12—SUBSEQUENT EVENTS

On May 7, 2019, our board of directors approved a gross dividend for the second quarter of 2019 of $0.135 per share to stockholders of record as of June 27, 2019. The dividend will be paid on or around August 1, 2019. Class A, Class M, Class A-I, Class M-I and Class D stockholders will receive $0.135 per share, less applicable class-specific fees, if any.

On May 7, 2019, we renewed our Advisory Agreement for a one year term expiring on June 5, 2020.

* * * * * *

|

| |

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

$ in thousands, except per share amounts

Cautionary Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q may contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), regarding, among other things, our plans, strategies and prospects, both business and financial. Forward-looking statements include, but are not limited to, statements that represent our beliefs concerning future operations, strategies, financial results or other developments. Forward-looking statements can be identified by the use of forward-looking terminology such as, but not limited to, “may,” “should,” “expect,” “anticipate,” “estimate,” “would be,” “believe,” or “continue” or the negative or other variations of comparable terminology. Because these forward-looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond our control or are subject to change, actual results could be materially different. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this Form 10-Q is filed with the SEC. Except as required by law, we do not undertake to update or revise any forward-looking statements contained in this Form 10-Q. Important factors that could cause actual results to differ materially from the forward-looking statements are disclosed in “Item 1A. Risk Factors,” “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our 2018 Form 10-K and our periodic reports filed with the SEC.

Management Overview

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help the reader understand our results of operations and financial condition. This MD&A is provided as a supplement to, and should be read in conjunction with, our consolidated financial statements and the accompanying notes to the consolidated financial statements appearing elsewhere in this Form 10-Q. All references to numbered Notes are to specific notes to our Consolidated Financial Statements beginning on page 7 of this Form 10-Q, and the descriptions referred to are incorporated into the applicable portion of this section by reference. References to “base rent” in this Form 10-Q refer to cash payments made under the relevant lease(s), excluding real estate taxes and certain property operating expenses that are paid by us and are recoverable under the relevant lease(s) and exclude adjustments for straight-line rent revenue and above- and below-market lease amortization.

The discussions surrounding our Consolidated Properties refer to our wholly or majority owned and controlled properties, which as of March 31, 2019, were comprised of:

Apartment

| |

• | Jory Trail at the Grove, |

| |

• | The Reserve at Johns Creek, and |

| |

• | The Villas at Legacy (acquired in 2018). |

Industrial

| |

• | Kendall Distribution Center, |

| |

• | Norfleet Distribution Center, |

| |

• | Suwanee Distribution Center, |

| |

• | South Seattle Distribution Center, |

| |

• | Grand Prairie Distribution Center, |

| |

• | Charlotte Distribution Center, |

| |

• | DFW Distribution Center, |

| |

• | O'Hare Industrial Portfolio, |

| |

• | Tampa Distribution Center, |

| |

• | Aurora Distribution Center, |

| |

• | Valencia Industrial Portfolio, |

| |

• | Pinole Point Distribution Center, |

| |

• | Mason Mill Distribution Center, and |

| |

• | Fremont Distribution Center (acquired 2019). |

Office

| |

• | Monument IV at Worldgate, |

| |

• | San Juan Medical Center. |

Retail

| |

• | The District at Howell Mill, |

| |

• | Grand Lakes Marketplace, |

| |

• | Rancho Temecula Town Center, |

| |

• | Silverstone Marketplace, |

| |

• | Kierland Village Center, |

| |

• | Timberland Town Center, and |

Other

| |

• | South Beach Parking Garage. |

Sold Properties

| |

• | Station Nine Apartments (sold in 2018), and |

| |

• | 111 Sutter Street (sold in 2019). |

Discussions surrounding our Unconsolidated Properties refer to the following properties as of March 31, 2019:

|

| | |

Property | | Property Type |

Chicago Parking Garage | | Parking |

NYC Retail Portfolio | | Retail |

Pioneer Tower | | Office |

The Tremont | | Apartment |

The Huntington | | Apartment |

Our primary business is the ownership and management of a diversified portfolio of apartment, industrial, office, retail and other properties primarily located in the United States. It is expected that over time our real estate portfolio will be further diversified on a global basis and will be complemented by investments in real estate-related assets.

We are managed by our Advisor, LaSalle Investment Management, Inc., a subsidiary of our Sponsor, Jones Lang LaSalle Incorporated (NYSE: JLL), a leading global financial and professional services firm that specializes in commercial real estate and investment management. We hire property management and leasing companies to provide the on-site, day-to-day management and leasing services for our properties. When selecting a property management or leasing company for one of our properties, we look for service providers that have a strong local market or industry presence, create portfolio efficiencies, have the ability to develop new business for us and will provide a strong internal control environment that will comply with our Sarbanes-Oxley Act of 2002 internal control requirements. We currently use a mix of property management and leasing service providers that include large national real estate service firms, including an affiliate of our Advisor and smaller local firms.

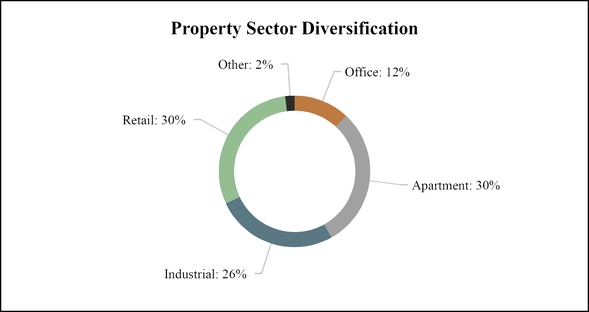

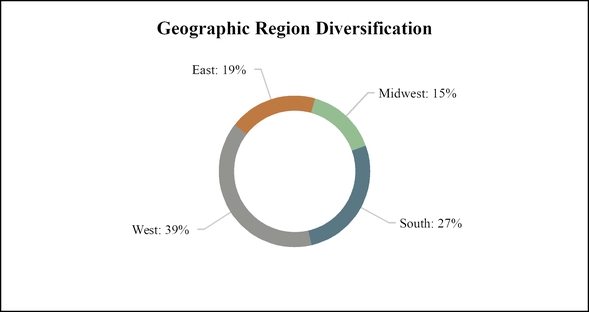

We seek to minimize risk and maintain stability of income and principal value through broad diversification across property sectors and geographic markets and by balancing tenant lease expirations and debt maturities across the real estate portfolio. Our diversification goals also take into account investing in sectors or regions we believe will create returns consistent with our investment objectives. Under normal conditions, we intend to pursue investments principally in well-located, well-leased properties within the apartment, industrial, office, retail and other sectors. We expect to actively manage the mix of properties and markets over time in response to changing operating fundamentals within each property sector and to changing economies and real estate markets in the geographic areas considered for investment. When consistent with our investment objectives, we also seek to maximize the tax efficiency of our investments through like-kind exchanges and other tax planning strategies.

The following charts summarize our portfolio diversification by property sector and geographic region based upon the fair value of our properties. These tables provide examples of how our Advisor evaluates our real estate portfolio when making investment decisions.

Estimated Percent of Fair Value as of March 31, 2019:

Our investments are not materially impacted by seasonality, despite certain of our retail tenants being impacted by seasonality. Percentage rents (rents computed as a percentage of tenant sales) that we earn from investments in retail properties may, in the future, be impacted by seasonality.

Use of Estimates