UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-21700

Tortoise North American Energy Corporation

(Exact name of registrant

as specified in charter)

11550 Ash Street, Suite 300,

Leawood, KS 66211

(Address of

principal executive offices) (Zip code)

Terry

Matlack

Diane

Bono

11550 Ash Street, Suite

300, Leawood, KS 66211

(Name and

address of agent for service)

913-981-1020

Registrant's

telephone number, including area code

Date of fiscal year end:

November 30

Date of reporting period:

May 31, 2013

Item 1. Reports to Stockholders.

Tortoise North American Energy Corp. (NYSE: TYN) is a non-diversified closed-end investment company focused primarily on investing in equity securities of companies in the energy sector with their primary operations in North America, including oil and gas exploitation, energy infrastructure and energy shipping companies. Our investments are primarily in Master Limited Partnerships (MLPs) and their affiliates, but may also include Canadian royalty and income trusts, common stock, debt and other securities issued by energy companies that are not MLPs.

Investment Goals: Yield, Growth and Quality

TYN seeks a high level of total return with an emphasis on current distributions paid to stockholders.

In seeking to achieve yield, we target distributions to our stockholders that are roughly equal to the underlying yield on a direct investment in MLPs. In order to accomplish this, we maintain our strategy of investing primarily in companies in the energy sector with attractive current yields and growth potential.

We seek to achieve distribution growth as revenues of our underlying companies grow with the economy, with the population and through rate increases. This revenue growth generally leads to increased operating profits, and when combined with internal expansion projects and acquisitions, is expected to provide attractive growth in distributions to us.

TYN seeks to achieve quality by investing in companies operating energy infrastructure assets that are critical to the North American economy. Often these assets would be difficult to replicate. We also back experienced management teams with successful track records. By investing in TYN, our stockholders have access to a portfolio that is diversified through geographic regions and across product lines, including natural gas, natural gas liquids, crude oil and refined products.

About U.S. Energy Infrastructure Master Limited Partnerships (MLPs)

MLPs are limited partnerships whose units trade on public exchanges such as the New York Stock Exchange (NYSE), the NYSE Alternext US and the NASDAQ. Buying MLP units makes an investor a limited partner in the MLP. There are currently more than 90 MLPs in the market in industries related to energy and natural resources. We invest primarily in MLPs in the energy infrastructure sector. Energy infrastructure MLPs are engaged in the transportation, storage and processing of crude oil, natural gas and refined products from production points to the end users.

TYN Investment Features

We provide stockholders an alternative to investing directly in MLPs and their affiliates. We offer investors the opportunity to receive an attractive distribution return with a historically low return correlation to returns on stocks and bonds.

Additional features include:

- One Form 1099 per stockholder at

the end of the year, multiple K-1s and multiple state filings for individual

partnership investments;

- A professional management team, with more

than 130 years combined investment experience;

- The ability to access investment grade credit

markets to enhance stockholder return; and

- Access to direct placements and other

investments not available through the public

market.

|

June 18, 2013 |

Dear Fellow Stockholders,

The equity market continued its bullish start in fiscal year 2013, with the S&P 500 Index® gaining 8.2 percent and 16.4 percent for the three and six months ending May 31st. A confluence of events conspired to buoy investor confidence and sustain the market’s upward trajectory during the period as fiscal cliff concerns abated and economic data continued to suggest a moderate economic recovery. MLPs had a positive first half, continuing to demonstrate the resiliency of underlying fundamentals and to benefit from energy infrastructure build-out across North America.

Master Limited Partnership Sector Review

The Tortoise MLP Index® had a total return of 4.8 percent and 15.9 percent for the three and six months ending May 31, 2013, respectively. Midstream MLPs outperformed upstream MLPs during both periods and particularly in the second fiscal quarter, supported by strong distribution growth and visible cash flow streams. While MLPs enjoyed a strong out-of-the-gate performance, they took a break late in the second fiscal quarter, underperforming broader equities in May as interest rate concerns began to surface following the release of the Federal Open Market Committee’s (FOMC) rather ambiguous statement on quantitative easing. The markets responded with some immediate volatility, particularly impacting yield-oriented securities, a reaction we often see in the wake of uncertain comments out of the FOMC, and attractive yielding MLPs were not immune to this. However, we believe that quality MLPs are different from most yielding securities as they offer the potential for growth in addition to income. While market volatility can prevail in the short term, we believe that those growth-oriented MLPs with quality business models remain fundamentally well positioned over the longer term.

Growing production levels out of the country’s oil and gas shale deposits remains a dominant story across the U.S. energy value chain, where the ongoing development of these unconventional resources has become a predominant driver of growth. In just the next three years through 2015, we project that approximately $50 billion will be invested in MLP organic growth projects. The bulk of projects currently underway involve the build out of petroleum pipelines particularly in the resource-rich Bakken, Eagle Ford and Permian fields.

Capital markets continued to be active, with MLPs raising approximately $19 billion in equity and $17 billion in debt fiscal year-to-date through May 31st. This included the launch of eight new MLP initial public offerings, which included oil and gas production, gathering/processing and natural gas pipeline MLPs, among other less-traditional businesses. Merger and acquisition (M&A) activity also has been healthy for the period, with announced MLP transactions totaling more than $22 billion. The largest among these was Kinder Morgan Energy Partners’ $5 billion acquisition of Copano Energy, L.L.C., a gathering and processing MLP, which closed on May 1st.

Fund Performance Review

Our total assets increased from $226.0 million on Nov. 30, 2012 to $252.6 million on May 31, 2013, resulting primarily from market appreciation of our investments. Our market-based total return to stockholders was 12.4 percent and 28.0 percent (both including the reinvestment of distributions) for the three and six months ending May 31, 2013, respectively. Our NAV-based total return was 3.5 percent and 12.2 percent for the same periods. The difference between our market value total returns as compared to our NAV total returns reflected the increase in our stock price to a market premium over our NAV during the period.

During the fiscal first half of 2013, our asset performance was driven by our stakes in both refined products pipeline and gathering and processing MLPs, which benefitted from robust oil and natural gas production out of U.S. shales and related build-out. Although they contributed to absolute returns, natural gas pipeline MLPs continued to face some short-term growth challenges. Our exposure to upstream oil and gas production MLPs marginally restrained results, as these firms saw their earnings slow due to lower natural gas and liquids prices.

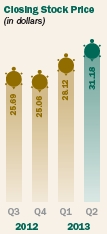

We paid a distribution of $0.3975 per common share ($1.59 annualized) to our stockholders on June 3, 2013, an increase of 0.6 percent quarter over quarter and of 2.6 percent year over year. This distribution represented an annualized yield of 5.1 percent based on our second fiscal quarter closing price of $31.18. Our distribution payout coverage (distributable cash flow divided by distributions) for the fiscal quarter was 109.1 percent, reflective of our emphasis on sustainability. For tax purposes, we currently expect 80 to 100 percent of TYN’s distributions to be characterized as qualified dividend income, or QDI, with the remainder characterized as a return of capital. A final determination of the characterization will be made in January 2014.

(Unaudited)

2013 2nd Quarter Report 1

We ended the first fiscal half of 2013 with leverage (bank debt) at 13.0 percent of total assets, below our long-term target of 20 percent. This provides us flexibility in managing the portfolio across market cycles and allows us to add leverage when compelling opportunities arise. As of May 31, 2013, our leverage, which included the impact of interest rate swaps, had a weighted average maturity of 4.2 years and a weighted average cost of 2.24 percent, with 76 percent at fixed rates. We believe TYN’s balance sheet is strong, with rates fixed on the majority of our leverage, laddered due dates and extended average maturities.

Concluding Thoughts

We continue to be excited about the significant transformation underway in North American energy, with MLPs playing a key role in the significant build-out underway. However, we also think it is important to note that while a rising tide may lift all boats, market cycles will separate quality companies from those with weaker business models. We believe this will play out over time and we look forward to serving you as your professional investment adviser in navigating the course ahead.

As a final note, if you have not yet had a chance to listen to our May webcast, we invite and encourage you to do so at www.tortoiseadvisors.com.

Sincerely,

The Managing Directors

Tortoise Capital Advisors,

L.L.C.

The adviser to Tortoise North

American Energy Corp.

|

|

|

| P. Bradley Adams |

H. Kevin

Birzer |

Zachary A. Hamel |

|

|

|

|

Kenneth P. Malvey |

Terry Matlack |

David J. Schulte |

The Tortoise MLP Index® is a float-adjusted, capitalization-weighted index of energy master limited partnerships (MLPs). The S&P 500 Index® is an unmanaged market-value weighted index of stocks, which is widely regarded as the standard for measuring large-cap U.S. stock market performance.

(Unaudited)

2 Tortoise North American Energy Corp.

|

Key Financial Data (Supplemental Unaudited Information) (dollar amounts in thousands unless otherwise indicated) |

The information presented below regarding Distributable Cash Flow and Selected Financial Information is supplemental non-GAAP financial information, which we believe is meaningful to understanding our operating performance. The Distributable Cash Flow Ratios include the functional equivalent of EBITDA for non-investment companies, and we believe they are an important supplemental measure of performance and promote comparisons from period-to-period. This information is supplemental, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction with our full financial statements.

| 2012 | 2013 | |||||||||||||||||||

| Q2(1) | Q3(1) | Q4(1) | Q1(1) | Q2(1) | ||||||||||||||||

| Total Income from Investments | ||||||||||||||||||||

| Distributions received from

master limited partnerships |

$ | 3,086 | $ | 3,221 | $ | 3,257 | $ | 3,298 | $ | 3,423 | ||||||||||

| Dividends paid in stock | 211 | 218 | 241 | 250 | 205 | |||||||||||||||

| Dividends from common stock | 151 | 87 | 79 | 53 | 63 | |||||||||||||||

| Interest and dividend income | — | — | 1 | — | — | |||||||||||||||

| Total from investments | 3,448 | 3,526 | 3,578 | 3,601 | 3,691 | |||||||||||||||

| Operating Expenses Before

Leverage Costs and Current Taxes |

||||||||||||||||||||

| Advisory fees, net of fees waived | 549 | 535 | 559 | 570 | 640 | |||||||||||||||

| Other operating expenses | 129 | 119 | 111 | 129 | 123 | |||||||||||||||

| 678 | 654 | 670 | 699 | 763 | ||||||||||||||||

| Distributable cash flow before

leverage costs and current taxes |

2,770 | 2,872 | 2,908 | 2,902 | 2,928 | |||||||||||||||

| Leverage costs(2) | 189 | 190 | 190 | 189 | 193 | |||||||||||||||

| Current income tax expense(3) | — | — | — | — | — | |||||||||||||||

| Distributable Cash Flow(4) | $ | 2,581 | $ | 2,682 | $ | 2,718 | $ | 2,713 | $ | 2,735 | ||||||||||

| As a percent of average total assets(5) | ||||||||||||||||||||

| Total from investments | 6.22 | % | 6.51 | % | 6.33 | % | 6.24 | % | 5.77 | % | ||||||||||

| Operating expenses before

leverage costs and current taxes |

1.22 | % | 1.21 | % | 1.19 | % | 1.21 | % | 1.19 | % | ||||||||||

| Distributable cash flow before

leverage costs and current taxes |

5.00 | % | 5.30 | % | 5.14 | % | 5.03 | % | 4.58 | % | ||||||||||

| As a percent of average net assets(5) | ||||||||||||||||||||

| Total from investments | 8.52 | % | 8.97 | % | 8.86 | % | 8.83 | % | 8.19 | % | ||||||||||

| Operating expenses before

leverage costs and current taxes |

1.68 | % | 1.66 | % | 1.66 | % | 1.71 | % | 1.69 | % | ||||||||||

| Leverage costs and current taxes | 0.47 | % | 0.48 | % | 0.47 | % | 0.46 | % | 0.43 | % | ||||||||||

| Distributable cash flow | 6.37 | % | 6.83 | % | 6.73 | % | 6.66 | % | 6.07 | % | ||||||||||

| Selected Financial Information | ||||||||||||||||||||

| Distributions paid on common stock | $ | 2,440 | $ | 2,455 | $ | 2,473 | $ | 2,489 | $ | 2,507 | ||||||||||

| Distributions paid on common

stock per share |

0.3875 | 0.3900 | 0.3925 | 0.3950 | 0.3975 | |||||||||||||||

| Distribution coverage percentage for period(6) | 105.8 | % | 109.2 | % | 109.9 | % | 109.0 | % | 109.1 | % | ||||||||||

| Net realized gain, net of income

taxes, for the period |

495 | 2,791 | 7,239 | 1,513 | 6,156 | |||||||||||||||

| Total assets, end of period | 202,720 | 224,011 | 225,988 | 244,726 | 252,597 | |||||||||||||||

| Average total assets during period(7) | 220,486 | 215,393 | 227,259 | 234,107 | 253,747 | |||||||||||||||

| Leverage(8) | 30,000 | 31,000 | 34,800 | 32,400 | 32,900 | |||||||||||||||

| Leverage as a percent of total assets | 14.8 | % | 13.8 | % | 15.4 | % | 13.2 | % | 13.0 | % | ||||||||||

| Net unrealized appreciation, end of period | 51,876 | 62,950 | 58,204 | 70,500 | 71,249 | |||||||||||||||

| Net assets, end of period | 149,643 | 160,792 | 160,717 | 171,777 | 175,468 | |||||||||||||||

| Average net assets during period(9) | 160,994 | 156,379 | 162,512 | 165,339 | 178,907 | |||||||||||||||

| Net asset value per common share | 23.77 | 25.54 | 25.51 | 27.26 | 27.82 | |||||||||||||||

| Market value per common share | 24.09 | 25.69 | 25.06 | 28.12 | 31.18 | |||||||||||||||

| Shares outstanding (actual) | 6,295,750 | 6,295,750 | 6,301,191 | 6,301,191 | 6,306,162 | |||||||||||||||

| (1) | Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period from June through August. Q4 is the period from September through November. |

| (2) | Leverage costs include interest expense, interest rate swap expenses and other recurring leverage expenses. |

| (3) | Includes taxes paid on net investment income and foreign taxes, if any. Taxes related to realized gains are excluded from the calculation of Distributable Cash Flow (“DCF”). |

| (4) | “Net investment income (loss), before income taxes” on the Statement of Operations is adjusted as follows to reconcile to DCF: increased by the return of capital on MLP distributions and the value of paid-in-kind distributions; and decreased by realized and unrealized gains (losses) on interest rate swap settlements. |

| (5) | Annualized for periods less than one full year. |

| (6) | Distributable Cash Flow divided by distributions paid. |

| (7) | Computed by averaging month-end values within each period. |

| (8) | Leverage consists of short-term borrowings. |

| (9) | Computed by averaging daily net assets within each period. |

2013 2nd Quarter Report 3

|

Management’s Discussion (Unaudited) |

The information contained in this section should be read in conjunction with our Financial Statements and the Notes thereto. In addition, this report contains certain forward-looking statements. These statements include the plans and objectives of management for future operations and financial objectives and can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” or “continue” or the negative thereof or other variations thereon or comparable terminology. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors that could cause actual results and conditions to differ materially from those projected in these forward-looking statements are set forth in the “Risk Factors” section of our public filings with the SEC.

Overview

Tortoise North American Energy Corp.’s (“TYN” or the “Company”) investment objective is to seek a high level of total return for our stockholders, with an emphasis on distribution income paid to stockholders. Our investment strategy requires us to invest at least 80 percent of our total assets in equity securities of companies in the energy sector with their primary operations in North America, including energy infrastructure, oil and gas production and energy shipping companies. The equity securities of the energy companies purchased by TYN consist primarily of interests in MLPs. MLPs are publicly traded partnerships whose equity interests are traded in the form of units on public exchanges, such as the NYSE or NASDAQ. We invest primarily in MLPs through public market and private purchases. While we are a registered investment company under the Investment Company Act of 1940, as amended (the “1940 Act”), we are not a “regulated investment company” for federal tax purposes. Our distributions do not typically generate unrelated business taxable income (“UBTI”) and our stock may therefore be suitable for holding by pension funds, IRAs and mutual funds, as well as taxable accounts. Tortoise Capital Advisors, L.L.C. serves as our investment adviser.

Company Update

Total assets increased approximately $7.9 million during the 2nd quarter, primarily as a result of increased market values of our MLP investments. Average total assets for the quarter increased as compared to 1st quarter 2013, resulting in increased asset-based expenses. Distribution increases from our MLP investments were in-line with our expectations. Total leverage as a percent of total assets decreased during the quarter and we increased our quarterly distribution to $0.3975 per share. Additional information on these events and results of our operations are discussed in more detail below.

Critical Accounting Policies

The financial statements are based on the selection and application of critical accounting policies, which require management to make significant estimates and assumptions. Critical accounting policies are those that are both important to the presentation of our financial condition and results of operations and require management’s most difficult, complex, or subjective judgments. Our critical accounting policies are those applicable to the valuation of investments, tax matters and certain revenue recognition matters as discussed in Note 2 in the Notes to Financial Statements.

Determining Distributions to Stockholders

Our portfolio generates cash flow from which we pay distributions to stockholders. Our Board of Directors has adopted a policy of declaring what it believes to be sustainable distributions. In determining distributions, our Board of Directors considers a number of current and anticipated factors, including, among others, distributable cash flow (“DCF”), realized and unrealized gains, leverage amounts and rates, current and deferred taxes payable, and potential volatility in returns from our investments and the overall market. While the Board considers many factors in determining distributions to stockholders, particular emphasis is given to DCF and distribution coverage. Distribution coverage is DCF divided by distributions paid to stockholders and is discussed in more detail below. Over the long term, we expect to distribute substantially all of our DCF to holders of common stock. Our Board of Directors reviews the distribution rate quarterly and may adjust the quarterly distribution throughout the year.

Determining DCF

DCF is distributions received from investments, less expenses. The total distributions received from our investments include the amount received by us as cash distributions from MLPs, paid-in-kind distributions, and dividend and interest payments. The total expenses include current or anticipated operating expenses, leverage costs and current income taxes. Current income taxes include taxes paid on our net investment income in addition to foreign taxes, if any. Taxes incurred from realized gains on the sale of investments, expected tax benefits and deferred taxes are not included in DCF.

The Key Financial Data table discloses the calculation of DCF and should be read in conjunction with this discussion. The difference between distributions received from investments in the DCF calculation and total investment income as reported in the Statement of Operations, is reconciled as follows: the Statement of Operations, in conformity with U.S. generally accepted accounting principles (“GAAP”), recognizes distribution income from MLPs and common stock on their ex-dates, whereas the DCF calculation may reflect distribution income on their pay dates; GAAP recognizes that a significant portion of the cash distributions received from MLPs are characterized as a return of capital and therefore excluded from investment income, whereas the DCF calculation includes the return of capital; and distributions received from investments in the DCF calculation include the value of dividends paid-in-kind (additional stock or MLP units), whereas such amounts are not included as income for GAAP purposes, and includes distributions related to direct investments when the purchase price is reduced in lieu of receiving cash distributions. The treatment of expenses in the DCF calculation also differs from what is reported in the Statement of Operations. In addition to the total operating expenses, including expense reimbursement, as disclosed in the Statement of Operations, the DCF calculation reflects interest expense, realized and unrealized gains (losses) on interest rate swap settlements, other leverage expenses, and taxes paid on net investment income. A reconciliation of Net Investment Loss, before Income Taxes to DCF is included below.

4 Tortoise North American Energy Corp.

|

Management’s Discussion (Unaudited) (Continued) |

Distributions Received from Investments

Our ability to generate cash is dependent on the ability of our portfolio of investments to generate cash flow from their operations. In order to maintain and grow distributions to our stockholders, we evaluate each holding based upon its contribution to our investment income, our anticipation of its growth rate, and its risk relative to other potential investments.

We concentrate on investments we believe can expect an increasing demand for services from economic and population growth. We seek well-managed businesses with hard assets and stable recurring revenue streams.

Total distributions received from our investments for the 2nd quarter 2013 were approximately $3.7 million. This represents a 2.5 percent increase as compared to 1st quarter 2013 and an increase of 7.0 percent as compared to 2nd quarter 2012. These changes reflect increases in per share distribution rates on our MLP investments and the distributions received from additional investments funded from leverage proceeds.

Expenses

We incur two types of expenses: (1) operating expenses, consisting primarily of the advisory fee, and (2) leverage costs. On a percentage basis, operating expenses before leverage costs and current taxes were an annualized 1.19 percent of average total assets for the 2nd quarter 2013 as compared to 1.22 percent for the 2nd quarter 2012 and 1.21 percent for the 1st quarter 2013.

Advisory fees for the 2nd quarter 2013 increased 12.3 percent from 1st quarter 2013 as a result of increased average managed assets for the quarter as discussed above. Other operating expenses decreased approximately $6,000 as compared to 1st quarter 2013.

Leverage costs consist of two major components: (1) the direct interest expense, which will vary from period to period as our margin borrowing facility has a variable interest rate, and (2) the realized and unrealized gain or loss on our interest rate swap settlements. Detailed information on our margin borrowing facility is included in the Liquidity and Capital Resources section below.

Total leverage costs for DCF purposes were approximately $193,000 for the 2nd quarter 2013, a slight increase as compared to the 1st quarter 2013. Our average annualized total cost of leverage, including interest rate swaps, was 2.24 percent as of May 31, 2013.

As indicated in Note 10 of our Notes to Financial Statements, we have entered into $25 million notional amount of interest rate swap contracts with The Bank of Nova Scotia in an attempt to reduce a portion of the interest rate risk arising from our leveraged capital structure. TYN has agreed to pay The Bank of Nova Scotia a fixed rate while receiving a floating rate based upon the 1-month U.S. Dollar London Interbank Offered Rate (“LIBOR”). The spread between the fixed swap rate and LIBOR is reflected in our Statement of Operations as a realized or unrealized gain when LIBOR exceeds the fixed rate (The Bank of Nova Scotia pays TYN the net difference) or a realized or unrealized loss when the fixed rate exceeds LIBOR (TYN pays The Bank of Nova Scotia the net difference). The interest rate swap contracts have a weighted average fixed rate of 1.70 percent and weighted average remaining maturity of approximately 5.3 years at May 31, 2013. This swap arrangement effectively fixes the cost of approximately 76 percent of our outstanding leverage as of May 31, 2013 over the remaining swap period.

Interest accrues on the margin facility at a rate equal to 1-month LIBOR plus 0.85 percent and unused balances are subject to a fee of 0.25 percent. The annual rate of leverage may vary in future periods as a result of changes in LIBOR, the utilization of our margin facility, and maturity of our interest rate swap contracts. Additional information on our leverage is disclosed below in Liquidity and Capital Resources and in our Notes to Financial Statements.

Distributable Cash Flow

For 2nd quarter 2013, our DCF was approximately $2.7 million, an increase of 6.0 percent as compared to 2nd quarter 2012 and an increase of 0.8 percent as compared to 1st quarter 2013. The changes are the net result of changes to distributions and expenses as outlined above. We declared a distribution of $2.5 million, or $0.3975 per share, during the quarter. This represents an increase of $0.01 per share as compared to 2nd quarter 2012 and an increase of $0.0025 per share as compared to 1st quarter 2013.

Our distribution coverage ratio was 109.1 percent for 2nd quarter 2013, an increase in the coverage ratio of 3.1 percent as compared to 2nd quarter 2012 and an increase of 0.1 percent as compared to 1st quarter 2013. Our goal is to pay what we believe to be sustainable distributions with any increases safely covered by earned DCF. A distribution coverage ratio of greater than 100 percent provides flexibility for on-going management of the portfolio, changes in leverage costs, the impact of taxes from realized gains and other expenses. An on-going distribution coverage ratio of less than 100 percent will, over time, erode the earning power of a portfolio and may lead to lower distributions. We expect to allocate a portion of the projected future growth in DCF to increase distributions to stockholders while also continuing to build critical distribution coverage to help preserve the sustainability of distributions to stockholders for the years ahead.

Net investment loss before income taxes on the Statement of Operations is adjusted as follows to reconcile to DCF for 2013 YTD and 2nd quarter 2013 (in thousands):

| 2013 | 2nd Qtr | ||||||

| YTD | 2013 | ||||||

| Net Investment Loss, before Income Taxes | $ | (1,752 | ) | $ | (1,338 | ) | |

| Adjustments to reconcile to DCF: | |||||||

| Dividends paid in stock | 455 | 205 | |||||

| Distributions characterized as return of capital | 6,934 | 3,964 | |||||

| Interest rate swap expenses | (189 | ) | (96 | ) | |||

| DCF | $ | 5,448 | $ | 2,735 | |||

2013 2nd Quarter Report 5

|

Management’s Discussion (Unaudited) (Continued) |

Liquidity and Capital Resources

We had total assets of $253 million at quarter-end. Our total assets reflect the value of our investments, which are itemized in the Schedule of Investments. It also reflects cash, interest and receivables and any expenses that may have been prepaid. During 2nd quarter 2013, total assets increased by approximately $7.9 million, primarily the result of a $6.7 million increase in the value of our investments as reflected by the change in realized and unrealized gains on investments (excluding return of capital on distributions) and net purchases of approximately $1.1 million.

Total leverage outstanding at May 31, 2013 was $32.9 million, an increase of $0.5 million as compared to February 28, 2013. Total leverage represented 13.0 percent of total assets at May 31, 2013, a decrease from 13.2 percent of total assets at February 28, 2013 and 14.8 percent at May 31, 2012. Our leverage as a percent of total assets remains below our long-term target level of 20 percent of total assets. This allows the opportunity to add leverage when compelling investment opportunities arise. Temporary increases to up to 25 percent of our total assets may be permitted, provided that such leverage is consistent with the limits set forth in the 1940 Act, and that such leverage is expected to be reduced over time in an orderly fashion to reach our long-term target. Our leverage ratio is impacted by increases or decreases in MLP values, issuance of equity and/or the sale of securities where proceeds are used to reduce leverage.

We have used leverage to acquire securities consistent with our investment philosophy. The terms of our leverage are governed by regulatory and contractual asset coverage requirements that arise from the use of leverage. Additional information on our leverage and asset coverage requirements is discussed in Note 9 in the Notes to Financial Statements. Our coverage ratio is updated each week on our Web site at www.tortoiseadvisors.com.

Taxation of our Distributions and Income Taxes

We invest in partnerships that generally have cash distributions in excess of their income for accounting and tax purposes. Accordingly, the distributions include a return of capital component for accounting and tax purposes. Distributions declared and paid by us in a year generally differ from taxable income for that year, as such distributions may include the distribution of current year taxable income or return of capital.

The taxability of the distribution you receive depends on whether we have annual earnings and profits (“E&P”). E&P is primarily comprised of the taxable income from MLPs with certain specified adjustments as reported on annual K-1s, fund operating expenses and net realized gains. If we have E&P, it is first allocated to preferred shares (if any) and then to the common shares.

In the event we have E&P allocated to our common shares, all or a portion of our distribution will be taxable at the Qualified Dividend Income (“QDI”) rate, assuming various holding requirements are met by the stockholder. The QDI rate is variable based on the taxpayer’s taxable income. The portion of our distribution that is taxable may vary for either of two reasons. First, the characterization of the distributions we receive from MLPs could change annually based upon the K-1 allocations and result in less return of capital and more in the form of income. Second, we could sell an MLP investment and realize a gain or loss at any time. It is for these reasons that we inform you of the tax treatment after the close of each year as the ultimate characterization of our distributions is undeterminable until the year is over.

E&P for 2012 exceeded total distributions to stockholders. As a result, for tax purposes, distributions to common stockholders for the year ended 2012 were 100 percent qualified dividend income. This information is reported to stockholders on Form 1099-DIV and is available on our Web site at www.tortoiseadvisors.com. For book purposes, the source of distributions to common stockholders for the year ended 2012 was 100 percent return of capital. We currently estimate that 80 to 100 percent of 2013 distributions will be characterized as qualified dividend income for tax purposes, with the remaining percentage, if any, characterized as return of capital. A final determination of the characterization will be made in January 2014.

As of November 30, 2012, we had approximately $6 million in capital loss carryforwards and $13 million in net operating losses. To the extent we have taxable income in the future that is not offset by either capital loss carryforwards or net operating losses, we will owe federal and state income taxes. Tax payments can be funded from investment earnings, fund assets or borrowings.

The unrealized gain or loss we have in the portfolio is reflected in the Statement of Assets and Liabilities. At May 31, 2013, our investments are valued at $252.4 million, with an adjusted cost of $157.8 million. The $94.6 million difference reflects unrealized gain that would be realized for financial statement purposes if those investments were sold at those values. The Statement of Assets and Liabilities also reflects either a net deferred tax liability or net deferred tax asset depending primarily upon unrealized gains (losses) on investments, realized gains (losses) on investments, capital loss carryforwards and net operating losses. At May 31, 2013, the balance sheet reflects a net deferred tax liability of approximately $40.0 million or $6.34 per share. Accordingly, our net asset value per share represents the amount which would be available for distribution to stockholders after payment of taxes. Details of our taxes are disclosed in Note 5 in our Notes to Financial Statements.

6 Tortoise North American Energy Corp.

|

Schedule of Investments May 31, 2013 |

| (Unaudited) |

| Shares | Fair Value | ||||

| Master Limited Partnerships and | |||||

| Related Companies — 141.0%(1) | |||||

| Crude/Refined Products Pipelines — 44.7%(1) | |||||

| United States — 44.7%(1) | |||||

| Buckeye Partners, L.P.(2) | 155,600 | $ | 10,291,384 | ||

| Enbridge Energy Partners, L.P.(2) | 290,604 | 8,575,724 | |||

| Holly Energy Partners, L.P.(2) | 95,360 | 3,429,146 | |||

| Magellan Midstream Partners, L.P.(2) | 301,400 | 15,669,786 | |||

| MPLX LP | 86,500 | 3,211,745 | |||

| NuStar Energy L.P.(2) | 125,400 | 5,842,386 | |||

| Oiltanking Partners, L.P. | 24,900 | 1,232,550 | |||

| Plains All American Pipeline, L.P.(2) | 290,600 | 16,325,908 | |||

| Rose Rock Midstream, L.P. | 19,042 | 703,792 | |||

| Sunoco Logistics Partners L.P.(2) | 158,440 | 9,591,958 | |||

| Tesoro Logistics L.P.(2) | 57,800 | 3,585,912 | |||

| 78,460,291 | |||||

| Natural Gas/Natural Gas Liquids Pipelines — 63.4%(1) | |||||

| United States — 63.4%(1) | |||||

| Boardwalk Pipeline Partners, L.P.(2) | 151,612 | 4,487,715 | |||

| El Paso Pipeline Partners, L.P.(2) | 370,310 | 15,216,038 | |||

| Energy Transfer Equity, L.P.(2) | 110,400 | 6,310,464 | |||

| Energy Transfer Partners, L.P.(2) | 206,800 | 10,052,548 | |||

| Enterprise Products Partners L.P.(2)(3) | 293,700 | 17,442,843 | |||

| EQT Midstream Partners, L.P. | 44,263 | 2,162,690 | |||

| Inergy Midstream, L.P. | 125,900 | 2,831,491 | |||

| Inergy Midstream, L.P.(4) | 23,809 | 533,798 | |||

| Kinder Morgan Energy Partners, L.P.(2) | 67,991 | 5,670,449 | |||

| Kinder Morgan Management, L.L.C.(2)(5) | 159,991 | 12,994,451 | |||

| ONEOK Partners, L.P.(2) | 144,240 | 7,465,862 | |||

| Regency Energy Partners L.P.(2) | 392,400 | 10,061,136 | |||

| Spectra Energy Partners, L.P.(2) | 121,100 | 4,312,371 | |||

| TC PipeLines, L.P.(2) | 27,000 | 1,176,390 | |||

| Williams Partners L.P.(2) | 212,300 | 10,591,647 | |||

| 111,309,893 | |||||

| Natural Gas Gathering/Processing — 19.5%(1) | |||||

| United States — 19.5%(1) | |||||

| Access Midstream Partners, L.P.(2) | 139,200 | 5,988,384 | |||

| Crestwood Midstream Partners, L.P. | 54,317 | 1,344,346 | |||

| DCP Midstream Partners, L.P.(2) | 130,100 | 6,218,780 | |||

| MarkWest Energy Partners, L.P.(2) | 92,400 | 6,083,616 | |||

| Summit Midstream Partners, LP | 45,300 | 1,412,001 | |||

| Targa Resources Partners L.P.(2) | 134,400 | 6,250,944 | |||

| Western Gas Equity Partners, LP | 41,104 | 1,538,112 | |||

| Western Gas Partners L.P.(2) | 90,700 | 5,335,881 | |||

| 34,172,064 | |||||

| Oil and Gas Production — 12.1%(1) | |||||

| United States — 12.1%(1) | |||||

| BreitBurn Energy Partners L.P.(2) | 181,288 | 3,359,267 | |||

| EV Energy Partners, L.P.(2) | 72,900 | 2,774,574 | |||

| Legacy Reserves, L.P.(2) | 109,155 | 2,892,607 | |||

| Linn Energy, LLC(2) | 256,200 | 8,428,980 | |||

| Pioneer Southwest Energy Partners L.P. | 47,800 | 1,553,500 | |||

| Vanguard Natural Resources, LLC(2) | 78,000 | 2,195,700 | |||

| 21,204,628 | |||||

| Marine Transportation — 1.3%(1) | |||||

| Republic of the Marshall Islands — 1.3%(1) | |||||

| Teekay LNG Partners L.P.(2) | 53,500 | 2,295,150 | |||

| Total Master Limited Partnerships and | |||||

| Related Companies (Cost $153,920,395) | 247,442,026 | ||||

| Common Stock — 2.4%(1) | |||||

| Marine Transportation — 0.9%(1) | |||||

| Republic of the Marshall Islands — 0.9%(1) | |||||

| Teekay Offshore Partners L.P.(2) | 52,700 | 1,709,061 | |||

| Other — 1.5%(1) | |||||

| Republic of the Marshall Islands — 1.5%(1) | |||||

| Seadrill Partners LLC | 90,000 | 2,592,000 | |||

| Total Common Stock (Cost $3,239,530) | 4,301,061 | ||||

| Short-Term Investment — 0.4%(1) | |||||

| United States Investment Company — 0.4%(1) | |||||

| Fidelity Institutional Money Market Portfolio — | |||||

| Class I, 0.08%(6) (Cost $640,512) | 640,512 | 640,512 | |||

| Total Investments — 143.8%(1) | |||||

| (Cost $157,800,437) | 252,383,599 | ||||

| Interest Rate Swap Contracts — (0.4%)(1) | |||||

| $25,000,000 notional — Unrealized Depreciation(7) | (689,676 | ) | |||

| Other Assets and Liabilities — (43.4%)(1) | (76,226,106 | ) | |||

| Total Net Assets Applicable to Common | |||||

| Stockholders — 100.0%(1) | $ | 175,467,817 | |||

| (1) | Calculated as a percentage of net assets applicable to common stockholders. |

| (2) | All or a portion of the security is segregated as collateral for the margin borrowing facility. See Note 9 to the financial statements for further disclosure. |

| (3) | All or a portion of the security is segregated as collateral for the unrealized depreciation of interest rate swap contracts of $689,676. |

| (4) | Restricted securities have been fair valued in accordance with procedures approved by the Board of Directors and have a total fair value of $533,798, which represents 0.3% of net assets. See Note 7 to the financial statements for further disclosure. |

| (5) | Security distributions are paid-in-kind. |

| (6) | Rate reported is the current yield as of May 31, 2013. |

| (7) | See Note 10 to the financial statements for further disclosure. |

See accompanying Notes to Financial Statements.

2013 2nd Quarter Report 7

|

Statement of Assets & Liabilities May 31, 2013 |

| (Unaudited) |

| Assets | |||

| Investments at fair value (cost $157,800,437) | $ | 252,383,599 | |

| Receivable for investments sold | 73,006 | ||

| Distributions receivable from master limited partnerships | 15,990 | ||

| Prepaid expenses and other assets | 124,218 | ||

| Total assets | 252,596,813 | ||

| Liabilities | |||

| Cash overdraft | 500,000 | ||

| Payable to Adviser | 429,474 | ||

| Distributions payable to common stockholders | 2,506,702 | ||

| Accrued expenses and other liabilities | 127,063 | ||

| Unrealized depreciation of interest rate swap contracts | 689,676 | ||

| Deferred tax liability | 39,976,081 | ||

| Short-term borrowings | 32,900,000 | ||

| Total liabilities | 77,128,996 | ||

| Net assets applicable to common stockholders | $ | 175,467,817 | |

| Net Assets Applicable to Common Stockholders Consist of: | |||

| Capital stock, $0.001 par value; 6,306,162 shares issued | |||

| and outstanding (100,000,000 shares authorized) | $ | 6,306 | |

| Additional paid-in capital | 92,248,700 | ||

| Accumulated net investment loss, net of income taxes | (3,121,726 | ) | |

| Undistributed net realized gain, net of income taxes | 15,085,713 | ||

| Net unrealized appreciation of investments and | |||

| interest rate swap contracts, net of income taxes | 71,248,824 | ||

| Net assets applicable to common stockholders | $ | 175,467,817 | |

| Net Asset Value per common share outstanding | |||

| (net assets applicable to common stock, | |||

| divided by common shares outstanding) | $ | 27.82 | |

| Statement

of Operations Period from December 1, 2012 through May 31, 2013 |

| (Unaudited) |

| Investment Income | |||

| Distributions from master limited partnerships | $ | 6,721,202 | |

| Less return of capital on distributions | (6,933,875 | ) | |

| Net distributions from master limited partnerships | (212,673 | ) | |

| Dividend income | 115,721 | ||

| Dividends from money market mutual funds | 116 | ||

| Total Investment Loss | (96,836 | ) | |

| Operating Expenses | |||

| Advisory fees | 1,210,101 | ||

| Professional fees | 80,869 | ||

| Administrator fees | 48,439 | ||

| Directors’ fees | 26,740 | ||

| Stockholder communication expenses | 26,397 | ||

| Fund accounting fees | 19,575 | ||

| Registration fees | 12,252 | ||

| Custodian fees and expenses | 6,865 | ||

| Stock transfer agent fees | 6,015 | ||

| Other operating expenses | 24,283 | ||

| Total Operating Expenses | 1,461,536 | ||

| Leverage Expenses | |||

| Interest expense | 193,067 | ||

| Total Expenses | 1,654,603 | ||

| Net Investment Loss, before Income Taxes | (1,751,439 | ) | |

| Deferred tax benefit | 648,682 | ||

| Net Investment Loss | (1,102,757 | ) | |

| Realized and Unrealized Gain on Investments | |||

| and Interest Rate Swaps | |||

| Net realized gain on investments | 12,368,123 | ||

| Net realized loss on interest rate swap settlements | (187,357 | ) | |

| Net realized gain, before income taxes | 12,180,766 | ||

| Deferred tax expense | (4,511,402 | ) | |

| Net realized gain on investments and | |||

| interest rate swaps | 7,669,364 | ||

| Net unrealized appreciation of investments | 20,045,644 | ||

| Net unrealized appreciation of interest rate swap contracts | 672,637 | ||

| Net unrealized appreciation, before income taxes | 20,718,281 | ||

| Deferred tax expense | (7,673,450 | ) | |

| Net unrealized appreciation of investments | |||

| and interest rate swap contracts | 13,044,831 | ||

| Net Realized and Unrealized Gain on Investments | |||

| and Interest Rate Swaps | 20,714,195 | ||

| Net Increase in Net Assets Applicable to | |||

| Common Stockholders Resulting from Operations | $ | 19,611,438 |

See accompanying Notes to Financial Statements.

8 Tortoise North American Energy Corp.

|

Statement of Changes in Net Assets |

| Period from | |||||||

| December 1, 2012 | |||||||

| through | Year Ended | ||||||

| May 31, 2013 | November 30, 2012 | ||||||

| (Unaudited) | |||||||

| Operations | |||||||

| Net investment loss | $ | (1,102,757 | ) | $ | (1,439,536 | ) | |

| Net realized gain on investments and interest rate swaps | 7,669,364 | 12,025,458 | |||||

| Net unrealized appreciation of investments and interest rate swap contracts | 13,044,831 | 3,842,041 | |||||

| Net

increase in net assets applicable to common stockholders resulting from operations |

19,611,438 | 14,427,963 | |||||

| Distributions to Common Stockholders | |||||||

| Return of capital | (4,995,669 | ) | (9,792,027 | ) | |||

| Capital Stock Transactions | |||||||

| Issuance of 4,971 and 5,441 common

shares from reinvestment of distributions to stockholders, respectively |

135,509 | 138,963 | |||||

| Total increase in net assets applicable to common stockholders | 14,751,278 | 4,774,899 | |||||

| Net Assets | |||||||

| Beginning of period | 160,716,539 | 155,941,640 | |||||

| End of period | $ | 175,467,817 | $ | 160,716,539 | |||

| Accumulated net investment loss, net of income taxes, end of period | $ | (3,121,726 | ) | $ | (2,018,969 | ) | |

See accompanying Notes to Financial Statements.

2013 2nd Quarter Report 9

|

Statement of Cash Flows Period from December 1, 2012 through May 31, 2013 |

| (Unaudited) |

| Cash Flows from Operating Activities | |||

| Distributions received from master limited partnerships | $ | 6,721,007 | |

| Dividend income received | 115,835 | ||

| Purchases of long-term investments | (24,798,972 | ) | |

| Proceeds from sales of long-term investments | 24,269,042 | ||

| Purchases of short-term investments, net | (568,907 | ) | |

| Payments on interest rate swap contracts, net | (187,357 | ) | |

| Interest expense paid | (193,129 | ) | |

| Operating expenses paid | (1,465,319 | ) | |

| Net cash provided by operating activities | 3,892,200 | ||

| Cash Flows from Financing Activities | |||

| Advances from margin loan facility | 12,300,000 | ||

| Repayments on margin loan facility | (14,200,000 | ) | |

| Distributions paid to common stockholders | (2,492,200 | ) | |

| Net cash used in financing activities | (4,392,200 | ) | |

| Net change in cash | (500,000 | ) | |

| Cash — beginning of period | — | ||

| Cash overdraft — end of period | $ | (500,000 | ) |

| Reconciliation of net increase in net assets applicable | |||

| to common stockholders resulting from operations | |||

| to net cash provided by operating activities | |||

| Net increase in net assets applicable to common | |||

| stockholders resulting from operations | $ | 19,611,438 | |

| Adjustments to reconcile net increase in net assets | |||

| applicable to common stockholders resulting from | |||

| operations to net cash provided by operating activities: | |||

| Purchases of long-term investments | (24,798,972 | ) | |

| Proceeds from sales of long-term investments | 24,342,048 | ||

| Purchases of short-term investments, net | (568,907 | ) | |

| Return of capital on distributions received | 6,933,875 | ||

| Deferred tax expense | 11,536,170 | ||

| Net unrealized appreciation of investments and | |||

| interest rate swap contracts | (20,718,281 | ) | |

| Net realized gain on investments | (12,368,123 | ) | |

| Changes in operating assets and liabilities: | |||

| Increase in distributions receivable from | |||

| master limited partnerships | (195 | ) | |

| Increase in receivable for investments sold | (73,006 | ) | |

| Increase in prepaid expenses and other assets | (29,971 | ) | |

| Increase in payable to Adviser | 53,186 | ||

| Decrease in accrued expenses and other liabilities | (27,062 | ) | |

| Total adjustments | (15,719,238 | ) | |

| Net cash provided by operating activities | $ | 3,892,200 | |

| Non-Cash Financing Activities | |||

| Reinvestment of distributions by common stockholders | |||

| in additional common shares | $ | 135,509 |

See accompanying Notes to Financial Statements.

10 Tortoise North American Energy Corp.

|

Financial Highlights |

| Period

from December 1, 2012 through May 31, 2013 |

Year

Ended November 30, 2012 |

Year

Ended November 30, 2011 |

Year

Ended November 30, 2010 |

Year

Ended November 30, 2009 |

Year

Ended November 30, 2008 | |||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||

| Per Common Share Data(1) | ||||||||||||||||||||||||||||||||||||

| Net Asset Value, beginning of period | $ | 25.51 | $ | 24.77 | $ | 24.51 | $ | 20.22 | $ | 10.78 | $ | 27.25 | ||||||||||||||||||||||||

| Income (Loss) from Investment Operations | ||||||||||||||||||||||||||||||||||||

| Net investment income (loss)(2) | (0.17 | ) | (0.23 | ) | (0.12 | ) | (0.09 | ) | 0.25 | 0.43 | ||||||||||||||||||||||||||

| Net

realized and unrealized gain (loss) on investments and interest rate swaps contracts(2) |

3.27 | 2.53 | 1.89 | 5.86 | 10.67 | (15.14 | ) | |||||||||||||||||||||||||||||

| Total income (loss) from investment operations | 3.10 | 2.30 | 1.77 | 5.77 | 10.92 | (14.71 | ) | |||||||||||||||||||||||||||||

| Distributions to Preferred Stockholders | ||||||||||||||||||||||||||||||||||||

| Return of capital | — | — | — | — | — | (0.17 | ) | |||||||||||||||||||||||||||||

| Distributions to Common Stockholders | ||||||||||||||||||||||||||||||||||||

| Net realized gain | — | — | — | — | — | (0.10 | ) | |||||||||||||||||||||||||||||

| Return of capital | (0.79 | ) | (1.56 | ) | (1.51 | ) | (1.48 | ) | (1.48 | ) | (1.49 | ) | ||||||||||||||||||||||||

| Total distributions to common stockholders | (0.79 | ) | (1.56 | ) | (1.51 | ) | (1.48 | ) | (1.48 | ) | (1.59 | ) | ||||||||||||||||||||||||

| Net Asset Value, end of period | $ | 27.82 | $ | 25.51 | $ | 24.77 | $ | 24.51 | $ | 20.22 | $ | 10.78 | ||||||||||||||||||||||||

| Per common share market value, end of period | $ | 31.18 | $ | 25.06 | $ | 24.05 | $ | 24.44 | $ | 19.49 | $ | 9.25 | ||||||||||||||||||||||||

| Total Investment Return Based on Market Value(3) | 27.96 | % | 10.87 | % | 4.77 | % | 33.62 | % | 131.66 | % | (55.98 | )% | ||||||||||||||||||||||||

| Supplemental Data and Ratios | ||||||||||||||||||||||||||||||||||||

| Net assets applicable

to common stockholders, end of period (000’s) |

$ | 175,468 | $ | 160,717 | $ | 155,942 | $ | 154,289 | $ | 126,609 | $ | 49,716 | ||||||||||||||||||||||||

| Average net assets (000’s) | $ | 172,197 | $ | 160,825 | $ | 157,410 | $ | 141,986 | $ | 80,041 | $ | 113,045 | ||||||||||||||||||||||||

| Ratio of Expenses to Average Net Assets(4) | ||||||||||||||||||||||||||||||||||||

| Advisory fees | 1.41 | % | 1.36 | % | 1.28 | % | 1.19 | % | 1.13 | % | 1.50 | % | ||||||||||||||||||||||||

| Other expenses | 0.29 | 0.31 | 0.32 | 0.38 | 1.01 | 0.48 | ||||||||||||||||||||||||||||||

| Fee waiver | — | (0.01 | ) | (0.07 | ) | (0.12 | ) | (0.12 | ) | (0.23 | ) | |||||||||||||||||||||||||

| Subtotal | 1.70 | 1.66 | 1.53 | 1.45 | 2.02 | 1.75 | ||||||||||||||||||||||||||||||

| Leverage expenses(5) | 0.22 | 0.24 | 0.47 | 0.75 | 1.17 | 3.71 | ||||||||||||||||||||||||||||||

| Income tax expense (benefit)(6) | 13.44 | 5.31 | 4.30 | 13.10 | (4.70 | ) | 0.06 | |||||||||||||||||||||||||||||

| Total expenses | 15.36 | % | 7.21 | % | 6.30 | % | 15.30 | % | (1.51 | )% | 5.52 | % | ||||||||||||||||||||||||

See accompanying Notes to Financial Statements.

2013 2nd Quarter Report 11

|

Financial Highlights (Continued) |

| Period

from December 1, 2012 through May 31, 2013 |

Year

Ended November 30, 2012 |

Year

Ended November 30, 2011 |

Year

Ended November 30, 2010 |

Year

Ended November 30, 2009 |

Year

Ended November 30, 2008 | |||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||

| Ratio of net

investment income (loss) to average net assets before fee waiver(4)(5) |

(1.28 | )% | (0.90 | )% | (0.54 | )% | (0.50 | )% | 1.82 | % | 1.51 | % | ||||||||||||||||||||||||

| Ratio of net

investment income (loss) to average net assets after fee waiver(4)(5) |

(1.28 | )% | (0.89 | )% | (0.47 | )% | (0.38 | )% | 1.94 | % | 1.74 | % | ||||||||||||||||||||||||

| Portfolio turnover rate | 10.01 | % | 22.37 | % | 27.34 | % | 27.89 | % | 41.90 | % | 36.69 | % | ||||||||||||||||||||||||

| Short-term borrowings, end of period (000’s) | $ | 32,900 | $ | 34,800 | $ | 31,300 | $ | 10,400 | $ | 5,900 | — | |||||||||||||||||||||||||

| Long-term debt obligations, end of period (000’s) | — | — | — | $ | 15,000 | $ | 15,000 | $ | 15,000 | |||||||||||||||||||||||||||

| Preferred stock, end of period (000’s) | — | — | — | — | — | $ | 10,000 | |||||||||||||||||||||||||||||

| Per common share

amount of long-term debt obligations outstanding, end of period |

— | — | — | $ | 2.38 | $ | 2.40 | $ | 3.25 | |||||||||||||||||||||||||||

| Per common share

amount of net assets, excluding long-term debt obligations, end of period |

$ | 27.82 | $ | 25.51 | $ | 24.77 | $ | 26.89 | $ | 22.61 | $ | 14.03 | ||||||||||||||||||||||||

| Asset coverage, per

$1,000 of principal amount of long-term debt obligations and short-term borrowings(7) |

$ | 6,333 | $ | 5,618 | $ | 5,982 | $ | 7,074 | $ | 7,058 | $ | 4,981 | ||||||||||||||||||||||||

| Asset coverage ratio

of long-term debt obligations and short-term borrowings(7) |

633 | % | 562 | % | 598 | % | 707 | % | 706 | % | 498 | % | ||||||||||||||||||||||||

| Asset coverage, per

$25,000 liquidation value per share of preferred stock(8) |

— | — | — | — | — | $ | 74,716 | |||||||||||||||||||||||||||||

| Asset coverage ratio of preferred stock(8) | — | — | — | — | — | 299 | % | |||||||||||||||||||||||||||||

| (1) | Information presented relates to a share of common stock outstanding for the entire period. |

| (2) | The per common share data for the years ended November 30, 2012, 2011, 2010, 2009, and 2008 do not reflect the change in estimate of investment income and return of capital, for the respective year. See Note 2E to the financial statements for further disclosure. |

| (3) | Not annualized for periods less than one full year. Total investment return is calculated assuming a purchase of common stock at the beginning of the period and a sale at the closing price on the last day of the period reported (excluding broker commissions). The calculation also assumes reinvestment of distributions at actual prices pursuant to the Company’s dividend reinvestment plan. |

| (4) | Annualized for periods less than one full year. |

| (5) | The expense ratios and net investment income (loss) ratios do not reflect the effect of distributions to preferred stockholders. |

| (6) | For the period from December 1, 2012 through May 31, 2013, the Company accrued $11,536,170 for net deferred income tax expense. For the year ended November 30, 2012, the Company accrued $13,102 for current income tax expense and $8,530,007 for net deferred income tax expense. For the years ended November 30, 2011 and 2010, the Company accrued $6,732,194 and $18,559,864, respectively, for net deferred income tax expense. For the year ended November 30, 2009, the Company accrued $3,732,366 for net deferred income tax benefit, which included $5,488,509 of deferred income tax benefit for the timing differences at December 1, 2008 when the Company converted to a taxable corporation. The Company accrued $44,786, $39,097, $(28,837) and $68,509 for the years ended November 30, 2011, 2010, 2009 and 2008, respectively, for current and foreign tax (benefit) expense. |

| (7) | Represents value of total assets less all liabilities and indebtedness not represented by long-term debt obligations, short-term borrowings and preferred stock at the end of the period divided by long-term debt obligations and short-term borrowings outstanding at the end of the period. |

| (8) | Represents value of total assets less all liabilities and indebtedness not represented by long-term debt obligations, short-term borrowings and preferred stock at the end of the period divided by long-term debt obligations, short-term borrowings and preferred stock outstanding at the end of the period. |

See accompanying Notes to Financial Statements.

12 Tortoise North American Energy Corp.

|

Notes to Financial Statements (Unaudited) May 31, 2013 |

1. Organization

Tortoise North American Energy Corporation (the “Company”) was organized as a Maryland corporation on January 13, 2005, and is a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Company’s investment objective is to seek a high level of total return with an emphasis on distribution income paid to stockholders. The Company seeks to provide its stockholders with a vehicle to invest in a portfolio consisting primarily of publicly traded U.S. master limited partnerships (“MLPs”), including oil and gas exploitation, energy infrastructure and energy shipping companies. The Company commenced operations on October 31, 2005. The Company’s stock is listed on the New York Stock Exchange under the symbol “TYN.”

2. Significant Accounting Policies

A. Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of distribution income and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

B. Investment Valuation

The Company primarily owns securities that are listed on a securities exchange or over-the-counter market. The Company values those securities at their last sale price on that exchange or over-the-counter market on the valuation date. If the security is listed on more than one exchange, the Company uses the price from the exchange that it considers to be the principal exchange on which the security is traded. Securities listed on the NASDAQ will be valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. If there has been no sale on such exchange or over-the-counter market on such day, the security will be valued at the mean between the last bid price and last ask price on such day.

The Company may invest up to 50 percent of its total assets in restricted securities. Restricted securities are subject to statutory and contractual restrictions on their public resale, which may make it more difficult to obtain a valuation and may limit the Company’s ability to dispose of them. Investments in restricted securities and other securities for which market quotations are not readily available will be valued in good faith by using fair value procedures approved by the Board of Directors. Such fair value procedures consider factors such as discounts to publicly traded issues, time until conversion date, securities with similar yields, quality, type of issue, coupon, duration and rating. If events occur that affect the value of the Company’s portfolio securities before the net asset value has been calculated (a “significant event”), the portfolio securities so affected will generally be priced using fair value procedures.

An equity security of a publicly traded company acquired in a direct placement transaction may be subject to restrictions on resale that can affect the security’s liquidity and fair value. Such securities that are convertible or otherwise will become freely tradable will be valued based on the market value of the freely tradable security less an applicable discount. Generally, the discount will initially be equal to the discount at which the Company purchased the securities. To the extent that such securities are convertible or otherwise become freely tradable within a time frame that may be reasonably determined, an amortization schedule may be used to determine the discount.

The Company generally values debt securities at prices based on market quotations for such securities, except those securities purchased with 60 days or less to maturity are valued on the basis of amortized cost, which approximates market value.

The Company generally values its interest rate swap contracts using industry-accepted models which discount the estimated future cash flows based on the stated terms of the interest rate swap agreement by using interest rates currently available in the market, or based on dealer quotations, if available.

C. Foreign Currency Translation

For foreign currency, investments in foreign securities, and other assets and liabilities denominated in a foreign currency, the Company translates these amounts into U.S. dollars on the following basis:

| (1) | market value of investment securities, assets and liabilities at the current rate of exchange on the valuation date and | |

| (2) | purchases and sales of investment securities, income and expenses at the relevant rates of exchange on the respective dates of such transactions. |

The Company does not isolate that portion of gains and losses on investments that is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities.

D. Foreign Withholding Taxes

The Company may be subject to taxes imposed by countries in which it invests with respect to its investment in issuers existing or operating in such countries. Such taxes are generally based on income earned. The Company accrues such taxes when the related income is earned.

E. Security Transactions and Investment Income

Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on an identified cost basis. Interest income is recognized on the accrual basis, including amortization of premiums and accretion of discounts. Dividend and distribution income is recorded on the ex-dividend date. Distributions received from the Company’s investments in MLPs generally are comprised of ordinary income and return of capital from the MLPs. The Company allocates distributions between investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on information provided by each MLP and other industry sources. These estimates may subsequently be revised based on actual allocations received from MLPs after their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Company.

2013 2nd Quarter Report 13

|

Notes to Financial Statements (Unaudited) (Continued) |

For the period from December 1, 2011 through November 30, 2012, the Company estimated the allocation of investment income and return of capital for the distributions received from MLPs within the Statement of Operations. For this period, the Company had estimated approximately 10 percent of total distributions as investment income and approximately 90 percent as return of capital.

Subsequent to November 30, 2012, the Company reallocated the amount of investment income and return of capital it recognized for the period from December 1, 2011 through November 30, 2012 based on the 2012 tax reporting information received from the individual MLPs. This reclassification amounted to a decrease in pre-tax net investment income of approximately $775,000 or $0.123 per share ($486,000 or $0.077 per share, net of deferred tax benefit), an increase in unrealized appreciation of investments of approximately $726,000 or $0.115 per share ($455,000 or $0.072 per share, net of deferred tax expense), and an increase in realized gains of approximately $49,000 or $0.008 per share ($31,000 or $0.005 per share, net of deferred tax expense) for the period from December 1, 2012 through May 31, 2013.

Subsequent to the period ended February 28, 2013, the Company reallocated the amount of investment income and return of capital it recognized in the current fiscal year based on its revised 2013 estimates, after considering the final allocations for 2012. This reclassification amounted to a decrease in pre-tax net investment income of approximately $57,000 or $0.009 per share ($36,000 or $0.006 per share, net of deferred tax benefit), a decrease in unrealized appreciation of investments of approximately $162,000 or $0.026 per share ($101,000 or $0.016 per share, net of deferred tax benefit), and an increase in realized gains of approximately $219,000 or $0.035 per share ($137,000 or $0.022 per share, net of deferred tax expense).

F. Distributions to Stockholders

Distributions to common stockholders are recorded on the ex-dividend date. The Company may not declare or pay distributions to its common stockholders if it does not meet asset coverage ratios required under the 1940 Act or the rating agency guidelines for its debt and preferred stock (if any) following such distribution. The character of distributions to stockholders made during the year may differ from their ultimate characterization for federal income tax purposes. For book purposes, the source of the Company’s distributions to common stockholders for the year ended November 30, 2012 and the period ended May 31, 2013 was 100 percent return of capital. For tax purposes, the Company’s distributions to common stockholders for the year ended November 30, 2012 were 100 percent qualified dividend income. The tax character of distributions paid to common stockholders in the current year will be determined subsequent to November 30, 2013.

G. Federal Income Taxation

From the Company’s inception through November 30, 2008, the Company qualified as a regulated investment company (“RIC”) under the U.S. Internal Revenue Code of 1986, as amended (the “Code”). Effective December 1, 2008, the Company is treated as a taxable corporation for federal and state income tax purposes. The Company, as a corporation, is obligated to pay federal and state income tax on its taxable income. Currently, the highest regular marginal federal income tax rate for a corporation is 35 percent; however, the Company anticipates a marginal effective rate of 34 percent due to expectations of the level of taxable income relative to the federal graduated tax rates, including the tax rate anticipated when temporary differences reverse. The Company may be subject to a 20 percent federal alternative minimum tax (“AMT”) on its federal alternative minimum taxable income to the extent that its AMT exceeds its regular federal income tax.

The Company invests in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Company reports its allocable share of the MLP’s taxable income in computing its own taxable income. The Company’s tax expense or benefit is included in the Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is recognized if, based on the weight of available evidence, it is more likely than not that some portion or all of the deferred income tax asset will not be realized.

H. Offering and Debt Issuance Costs

Offering costs related to the issuance of common and preferred stock are charged to additional paid-in capital when the stock is issued. Debt issuance costs related to long-term debt obligations are capitalized and amortized over the period the debt is outstanding.

I. Derivative Financial Instruments

The Company uses derivative financial instruments (principally interest rate swap and forward foreign currency contracts) to manage interest rate and currency risks. The Company has established policies and procedures for risk assessment and the approval, reporting and monitoring of derivative financial instrument activities. The Company does not hold or issue derivative financial instruments for speculative purposes. All derivative financial instruments are recorded at fair value with changes in fair value during the reporting period, and amounts accrued under the agreements, included as unrealized gains or losses in the accompanying Statement of Operations. Cash settlements under the terms of the interest rate swap and forward foreign currency contracts and termination of such contracts are recorded as realized gains or losses in the accompanying Statement of Operations.

J. Indemnifications

Under the Company’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Company. In addition, in the normal course of business, the Company may enter into contracts that provide general indemnification to other parties. The Company’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Company that have not yet occurred, and may not occur. However, the Company has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

14 Tortoise North American Energy Corp.

|

Notes to Financial Statements (Unaudited) (Continued) |

K. Recent Accounting Pronouncements

In December 2011, the Financial Accounting Standards Board issued ASU 2011-11 “Balance Sheet (Topic 210) Disclosures about Offsetting Assets and Liabilities”. ASU 2011-11 requires new disclosures for recognized financial instruments and derivative instruments that are either offset on the balance sheet in accordance with the offsetting guidance in ASC 210-20-45 or ASC 815-10-45 or are subject to an enforceable master netting arrangement or similar arrangement. ASU 2011-11 is effective for periods beginning on or after January 1, 2013 and must be applied retrospectively. Management is currently evaluating the impact of these amendments on the financial statements.

In January 2013, the Financial Accounting Standards Board issued Accounting Standards Update No. 2013-01 “Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities” (“ASU 2013-01”) which amended Accounting Standards Codification Subtopic 210-20, Balance Sheet Offsetting. ASU 2013-01 clarified the scope of ASU No. 2011-11 “Disclosures about Offsetting Assets and Liabilities” (“ASU 2011-11”). ASU 2013-01 clarifies the scope of ASU 2011-11 as applying to derivatives accounted for in accordance with Topic 815, Derivatives and Hedging, including bifurcated embedded derivatives, repurchase agreements and reverse repurchase agreements, and securities borrowing and securities lending transactions that are offset either in accordance with other requirements of U.S. GAAP or subject to an enforceable master netting arrangement or similar agreement. The guidance in ASU 2013-01 and ASU 2011-11 is effective for interim and annual periods beginning on or after January 1, 2013. Adoption of ASU 2011-11 will have no effect on the Company’s net assets. Management is currently evaluating any impact ASU 2013-01 and ASU 2011-11 may have on the Company’s financial statements.

3. Concentration of Risk

Under normal conditions, the Company will have at least 80 percent of its total assets in equity securities of companies in the energy sector with their primary operations in North America (“Energy Companies”). Energy Companies include companies that derive more than 50 percent of their revenues from transporting, processing, storing, distributing or marketing natural gas, natural gas liquids, electricity, coal, crude oil or refined petroleum products, or exploring, developing, managing or producing such commodities. The Company may invest up to 50 percent of its total assets in restricted securities. In determining application of these policies, the term “total assets” includes assets obtained through leverage. Companies that primarily invest in a particular sector may experience greater volatility than companies investing in a broad range of industry sectors. The Company may, for defensive purposes, temporarily invest all or a significant portion of its assets in investment grade securities, short-term debt securities and cash or cash equivalents. To the extent the Company uses this strategy, it may not achieve its investment objective.

4. Agreements

The Company has entered into an Investment Advisory Agreement with Tortoise Capital Advisors, L.L.C. (the “Adviser”). Under the terms of the agreement, the Company pays the Adviser a fee equal to an annual rate of 1.00 percent of the Company’s average monthly total assets (including any assets attributable to leverage) minus accrued liabilities (other than debt entered into for purposes of leverage and the aggregate liquidation preference of outstanding preferred stock, if any) (“Managed Assets”), in exchange for the investment advisory services provided.

U.S. Bancorp Fund Services, LLC serves as the Company’s administrator. The Company pays the administrator a monthly fee computed at an annual rate of 0.04 percent of the first $1,000,000,000 of the Company’s Managed Assets, 0.01 percent on the next $500,000,000 of Managed Assets and 0.005 percent on the balance of the Company’s Managed Assets.

Computershare Trust Company, N.A. serves as the Company’s transfer agent and registrar and Computershare Inc. serves as the Company’s dividend paying agent and agent for the automatic dividend reinvestment plan.

U.S. Bank, N.A. serves as custodian of the Company’s cash and investment securities. The Company pays the custodian a monthly fee computed at an annual rate of 0.004 percent of the Company’s portfolio assets, plus portfolio transaction fees.

5. Income Taxes

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting and tax purposes. Components of the Company’s deferred tax assets and liabilities as of May 31, 2013, are as follows:

| Deferred tax assets: | |||

| Net operating loss carryforwards | $ | 6,301,994 | |

| Capital loss carryforwards | 621,918 | ||

| AMT credit | 33,959 | ||

| Organization costs | 39,097 | ||

| State of Kansas credit | 4,055 | ||

| 7,001,023 | |||

| Deferred tax liabilities: | |||

| Basis reduction of investment in MLPs | 11,990,143 | ||

| Net unrealized gains on investment securities | 34,986,961 | ||

| 46,977,104 | |||

| Total net deferred tax liability | $ | 39,976,081 |

At May 31, 2013, a valuation allowance on deferred tax assets was not deemed necessary because the Company believes it is more likely than not that there is an ability to realize its deferred tax assets through future taxable income of the appropriate character. Any adjustments to the Company’s estimates of future taxable income will be made in the period such determination is made. The Company recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. The Company’s policy is to record interest and penalties on uncertain tax positions as part of tax expense. As of May 31, 2013, the Company had no uncertain tax positions and no penalties and interest were accrued. Tax years subsequent to the year ending November 30, 2008 remain open to examination by federal and state tax authorities.

2013 2nd Quarter Report 15

|

Notes to Financial Statements (Unaudited) (Continued) |

Total income tax expense differs from the amount computed by applying the federal statutory income tax rate of 34 percent to net investment loss and net realized and unrealized gains on investments for the period ended May 31, 2013, as follows:

| Application of statutory income tax rate | $ | 10,590,187 | ||

| State income taxes, net of federal tax benefit | 1,012,297 | |||

| Dividends received deduction | (66,314 | ) | ||

| Total income tax expense | $ | 11,536,170 |

Total income taxes are computed by applying the federal statutory rate plus a blended state income tax rate.