UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the quarterly period ended:

For the transition period from _____to _____

Commission File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (IRS Employer |

| incorporation or organization) | Identification No.) |

(Address of principal executive offices) (Zip Code)

1-

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||

| Non-accelerated filer | ☐ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐

Yes

Indicate the number of shares outstanding of each of the issuer’s classes of Common Stock, as of the latest practicable date: shares of Common Stock outstanding as of May 9, 2024.

1

TABLE OF CONTENTS

2

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Anavex Life Sciences Corp.

Condensed Consolidated Interim Financial Statements

March 31, 2024

(Unaudited)

3

Anavex

Life Sciences Corp.

Condensed Consolidated Interim Balance Sheets

(in thousands, except share and per share amounts)

| March 31, | September 30, | |||||||

| 2024 | 2023 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Incentive and tax receivables | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total Assets | $ | $ | ||||||

| Liabilities and Stockholders' Equity | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued liabilities - Note 4 | ||||||||

| Deferred grant income - Note 3 | ||||||||

| Total Liabilities | ||||||||

| Commitments and Contingencies - Note 6 | ||||||||

| Capital stock | ||||||||

| Authorized: | ||||||||

| preferred stock, par value $ per share | ||||||||

| common stock, par value $ per share | ||||||||

| Issued and outstanding: | ||||||||

| common shares (September 30, 2023 - ) | ||||||||

| Additional paid-in capital | ||||||||

| Share proceeds receivable | ( | ) | ||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total Stockholders' Equity | ||||||||

| Total Liabilities and Stockholders' Equity | $ | $ | ||||||

See Accompanying Notes to Condensed Consolidated Interim Financial Statements

4

Anavex

Life Sciences Corp.

Condensed Consolidated Interim Statements of Operations and Comprehensive Loss

(in

thousands, except share and per share amounts)

(Unaudited)

| Three months ended March 31, | Six months ended March 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Operating expenses | ||||||||||||||||

| General and administrative | $ | $ | $ | $ | ||||||||||||

| Research and development | ||||||||||||||||

| Total operating expenses | ||||||||||||||||

| Operating loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other income | ||||||||||||||||

| Grant income | ||||||||||||||||

| Research and development incentive income | ||||||||||||||||

| Interest income, net | ||||||||||||||||

| Other financing expense | ( | ) | ( | ) | ||||||||||||

| Foreign exchange gain (loss) | ( | ) | ( | ) | ||||||||||||

| Total other income, net | ||||||||||||||||

| Net loss before provision for income taxes | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Income tax expense, current | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net loss and comprehensive loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Net Loss per share | ||||||||||||||||

| Basic and diluted | $ | ) | $ | ) | $ | ) | $ | ) | ||||||||

| Weighted average number of shares outstanding | ||||||||||||||||

| Basic and diluted | ||||||||||||||||

See Accompanying Notes to Condensed Consolidated Interim Financial Statements

5

Anavex

Life Sciences Corp.

Condensed Consolidated Interim Statements of Changes in Stockholders' Equity

For the three months ended March 31,

2024 and 2023

(in thousands, except share and per share amounts)

(Unaudited)

| Common Stock | Additional Paid-in | Share proceeds | Accumulated | |||||||||||||||||||||

| Shares | Par Value | Capital | Receivable | Deficit | Total | |||||||||||||||||||

| Balance, January 1, 2024 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||

| Shares issued under 2023 purchase agreement | ||||||||||||||||||||||||

| Purchase shares | ( | ) | ||||||||||||||||||||||

| Commitment shares | ||||||||||||||||||||||||

| Shares issued pursuant to exercise of stock options | ||||||||||||||||||||||||

| Share based compensation | — | |||||||||||||||||||||||

| Net loss | — | ( | ) | ( | ) | |||||||||||||||||||

| Balance, March 31, 2024 | $ | $ | $ | ( | ) | $ | ( | ) | $ | |||||||||||||||

| Balance, January 1, 2023 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||

| Shares issued under 2023 Purchase Agreement | ||||||||||||||||||||||||

| Initial commitment shares | ||||||||||||||||||||||||

| Purchase shares | ||||||||||||||||||||||||

| Commitment shares | ||||||||||||||||||||||||

| Shares issued pursuant to exercise of stock options | ||||||||||||||||||||||||

| Share based compensation | — | |||||||||||||||||||||||

| Net loss | — | ( | ) | ( | ) | |||||||||||||||||||

| Balance, March 31, 2023 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||

See Accompanying Notes to Condensed Consolidated Interim Financial Statements

6

Anavex

Life Sciences Corp.

Condensed Consolidated Interim Statements of Changes in Stockholders' Equity

For the six months ended March 31,

2024 and 2023

(in thousands, except share and per share amounts)

(Unaudited)

| Common Stock | Additional Paid-in | Share proceeds | Accumulated | |||||||||||||||||||||

| Shares | Par Value | Capital | Receivable | Deficit | Total | |||||||||||||||||||

| Balance, October 1, 2023 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||

| Shares issued under 2023 purchase agreement | ||||||||||||||||||||||||

| Purchase shares | ( | ) | ||||||||||||||||||||||

| Commitment shares | ||||||||||||||||||||||||

| Shares issued pursuant to exercise of stock options | ||||||||||||||||||||||||

| Share based compensation | — | |||||||||||||||||||||||

| Net loss | — | ( | ) | ( | ) | |||||||||||||||||||

| Balance, March 31, 2024 | $ | $ | $ | ( | ) | $ | ( | ) | $ | |||||||||||||||

| Balance, October 1, 2022 | $ | $ | $ | $ | ( | ) | ||||||||||||||||||

| Shares issued under 2023 Purchase Agreement | ||||||||||||||||||||||||

| Initial commitment shares | ||||||||||||||||||||||||

| Purchase shares | ||||||||||||||||||||||||

| Commitment shares | ||||||||||||||||||||||||

| Shares issued pursuant to exercise of stock options | ||||||||||||||||||||||||

| Share based compensation | — | |||||||||||||||||||||||

| Net loss | — | ( | ) | ( | ) | |||||||||||||||||||

| Balance, March 31, 2023 | $ | $ | $ | $ | ( | ) | ||||||||||||||||||

See Accompanying Notes to Condensed Consolidated Interim Financial Statements

7

Anavex

Life Sciences Corp.

Condensed Consolidated Interim Statements of Cash Flows

(in thousands, except share and per share amounts)

(Unaudited)

| Six months ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Cash Flows used in Operating Activities | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operations: | ||||||||

| Non-cash financing related charges | ||||||||

| Share-based compensation | ||||||||

| Changes in working capital balances related to operations: | ||||||||

| Incentive and tax receivables | ( | ) | ( | ) | ||||

| Prepaid expenses and deposits | ( | ) | ( | ) | ||||

| Accounts payable | ( | ) | ||||||

| Accrued liabilities | ( | ) | ||||||

| Deferred grant income | ||||||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Cash Flows provided by Financing Activities | ||||||||

| Issuance of common shares | ||||||||

| Proceeds from exercise of stock options | ||||||||

| Net cash provided by financing activities | ||||||||

| Increase (decrease) in cash and cash equivalents during the period | ( | ) | ||||||

| Cash and cash equivalents, beginning of period | ||||||||

| Cash and cash equivalents, end of period | $ | $ | ||||||

| Supplemental Cash Flow Information | ||||||||

| Cash paid for state and local minimum income taxes | $ | $ | ||||||

See Accompanying Notes to Condensed Consolidated Interim Financial Statements

8

Anavex

Life Sciences Corp.

Notes to the Condensed Consolidated Interim Financial Statements

March 31, 2024

(Unaudited)

Note 1 Business Description

Business

Anavex Life Sciences Corp. (“Anavex” or the “Company”) is a clinical stage biopharmaceutical company engaged in the development of differentiated therapeutics by applying precision medicine to central nervous system (“CNS”) diseases with high unmet need. Anavex analyzes genomic data from clinical trials to identify biomarkers, which are used in the analysis of its clinical trials for the treatment of neurodegenerative and neurodevelopmental diseases.

The Company’s lead compound ANAVEX®2-73 is being developed to treat Alzheimer’s disease, Parkinson’s disease and potentially other central nervous system diseases, including rare diseases, such as Rett syndrome, a rare severe neurological monogenic disorder caused by mutations in the X-linked gene, methyl-CpG-binding protein 2 (“MECP2”).

Note 2 Basis of Presentation

Basis of Presentation

These accompanying unaudited condensed consolidated interim financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) and accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim reporting. Accordingly, certain information and note disclosures normally included in the annual financial statements in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. In the opinion of management, the disclosures are adequate to make the information presented not misleading.

These accompanying unaudited condensed consolidated interim financial statements reflect all adjustments, consisting of normal recurring adjustments, which in the opinion of management are necessary for fair presentation of the information contained herein. The consolidated balance sheet as of September 30, 2023 was derived from the audited annual financial statements but does not include all disclosures required by U.S. GAAP. The accompanying unaudited condensed consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s annual report on Form 10-K for the year ended September 30, 2023 filed with the SEC on November 27, 2023. The Company follows the same accounting policies in the preparation of interim reports.

Operating results for the six months ended March 31, 2024 are not necessarily indicative of the results that may be expected for the year ending September 30, 2024.

Liquidity

All of the Company’s potential drug compounds are in the clinical development stage and the Company cannot be certain that its research and development efforts will be successful or, if successful, that its potential drug compounds will ever be approved for sales to pharmaceutical companies or generate commercial revenues. To date, we have not generated any revenues from our operations. The Company expects the business to continue to experience negative cash flows from operations for the foreseeable future and cannot predict when, if ever, our business might become profitable.

9

Anavex

Life Sciences Corp.

Notes to the Condensed Consolidated Interim Financial Statements

March 31, 2024

(Unaudited)

Management believes that the current working capital position will be sufficient to meet the Company’s working capital requirements beyond the next 12 months after the date that these condensed consolidated interim financial statements are issued. The process of drug development can be costly, and the timing and outcomes of clinical trials are uncertain. The assumptions upon which the Company has based its estimates are routinely evaluated and may be subject to change. The actual amount of the Company’s expenditures will vary depending upon a number of factors including but not limited to the design, timing and duration of future clinical trials, the progress of the Company’s research and development programs and the level of financial resources available. The Company has the ability to adjust its operating plan spending levels based on the timing of future clinical trials.

Other than our rights related to the 2023 Purchase Agreement (as defined below in Note 5), there can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If the Company is not able to obtain the additional financing on a timely basis, if and when it is needed, it will be forced to delay or scale down some or all of its research and development activities.

Use of Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses in the reporting period. The Company regularly evaluates estimates and assumptions related to accounting for research and development costs, incentive income receivable, valuation and recoverability of deferred tax assets, share based compensation, and loss contingencies. The Company bases its estimates and assumptions on current facts, historical experience, and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Principles of Consolidation

These consolidated financial statements include the accounts of Anavex Life Sciences Corp. and its wholly-owned subsidiaries, Anavex Australia Pty Limited (“Anavex Australia”), a company incorporated under the laws of Australia, Anavex Germany GmbH, a company incorporated under the laws of Germany, and Anavex Canada Ltd., a company incorporated under the laws of the Province of Ontario, Canada. All inter-company transactions and balances have been eliminated.

Fair Value Measurements

The fair value hierarchy under GAAP is based on three levels of inputs, of which the first two are considered observable and the last unobservable, that may be used to measure fair value which are the following:

Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2 - observable inputs other than Level 1, quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, and model-derived prices whose inputs are observable or whose significant value drivers are observable; and

Level 3 - assets and liabilities whose significant value drivers are unobservable by little or no market activity and that are significant to the fair value of the assets or liabilities.

10

Anavex

Life Sciences Corp.

Notes to the Condensed Consolidated Interim Financial Statements

March 31, 2024

(Unaudited)

At March 31, 2024 and September 30, 2023, the Company did not have any Level 3 assets or liabilities.

Basic income/(loss) per common share is computed by dividing net income/(loss) available to common stockholders by the weighted average number of common shares outstanding during the period. Diluted income/(loss) per common share is computed by dividing net income/(loss) available to common stockholders by the sum of (1) the weighted-average number of common shares outstanding during the period, (2) the dilutive effect of the assumed exercise of options and warrants using the treasury stock method and (3) the dilutive effect of other potentially dilutive securities. For purposes of the diluted net loss per share calculation, options and warrants are potentially dilutive securities and are excluded from the calculation of diluted net loss per share because their effect would be anti-dilutive.

As of March 31, 2024 loss per share excludes (March 31, 2023: ) potentially dilutive common shares related to outstanding options and warrants, as their effect was anti-dilutive.

Recently Adopted Accounting Pronouncements

In November 2023, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2023-07, “Segment Reporting: Improvements to Reportable Segment Disclosures.” This guidance requires disclosure of incremental segment information on an annual and interim basis. This amendment is effective for our fiscal year ending September 30, 2025 and our interim periods within the fiscal year ending September 30, 2026. The Company is currently assessing the impact of this guidance on its disclosures.

In December 2023, the FASB issued ASU No. 2023-09, “Income Taxes: Improvements to Income Tax Disclosures.” This guidance requires consistent categories and greater disaggregation of information in the rate reconciliation and disclosures of income taxes paid by jurisdiction. This amendment is effective for our fiscal year ending September 30, 2026. The Company is currently assessing the impact of this guidance on its disclosures.

Note 3 Other Income

Grant Income

As of March 31, 2024, the

Company had received a $

The grant income has been

deferred when received and is being amortized to other income as the related research and development expenditures are incurred. During

the three and six months ended March 31, 2024, the Company recognized $

Research and development incentive income

Research and development incentive income represents the income earned by Anavex Australia of the Australia R&D credit. This cash incentive is received by Anavex Australia, upon filing of a claim in connection with Anavex Australia’s annual income tax return.

11

Anavex

Life Sciences Corp.

Notes to the Condensed Consolidated Interim Financial Statements

March 31, 2024

(Unaudited)

During the three and six

months ended March 31, 2024 the Company recorded research and development incentive income of $

At March 31, 2024, Incentive

and tax receivables includes $

The Australia R&D credit program is a self-assess program whereby the Company must assess its eligibility each year to determine (i) if the entity is eligible (ii) if the specific R&D activities are eligible and (iii) if the individual R&D expenditures have nexus to such R&D activities. The Company evaluates its eligibility under the tax incentive program as of each balance sheet date based on the most current and relevant data available. Anavex Australia is able to continue to claim the R&D tax incentive for as long as it remains eligible and continues to incur eligible research and development expenditures.

Although the Company believes that it has complied with all the relevant conditions of eligibility under the program for all periods claimed, the Australian Tax Office (ATO) has the right to review the Company’s qualifying programs and related expenditures for a period of four years. If such a review were to occur, the ATO may have different interpretations of certain eligibility requirements. If the ATO disagreed with the Company’s assessments and any related subsequent appeals, it could require adjustment to and repayment of current or previous years’ claims already received. Additionally, if the Company was unable to demonstrate a reasonably arguable position taken on such claims, the ATO could also assess penalties and interest on such adjustment.

Currently, the Company’s tax incentive claims from 2020 to 2023 are open to potential review by the ATO. Additionally, the period open for review is indefinite if the ATO suspects fraud. The Company has not provided any allowance for any such potential adjustments, should they occur in the future.

Note 4 Accrued Liabilities

The principal components of accrued liabilities consist of (in thousands):

| March 31, | September 30, | |||||||

| 2024 | 2023 | |||||||

| Accrued clinical site and patient visits costs | $ | $ | ||||||

| Accrued compensation and benefits | ||||||||

| Fixed contract accruals | ||||||||

| Milestone based contract accruals | ||||||||

| All other accrued liabilities | ||||||||

| Total accrued liabilities | $ | $ | ||||||

Note 5 Equity Offerings

Common Stock

Common shares are voting and are entitled to dividends as declared at the discretion of the Board of Directors (the “Board”).

Preferred Stock

The Company’s Board has the authority to issue preferred stock in one or more series and to fix the rights, preferences, privileges, restrictions and the number of shares constituting any series or the designation of the series.

12

Anavex

Life Sciences Corp.

Notes to the Condensed Consolidated Interim Financial Statements

March 31, 2024

(Unaudited)

Sales Agreement

The Company entered into a Controlled Equity Offering Sales Agreement on July 6, 2018, which was amended and restated on May 1, 2020 (the “Sales Agreement”) with Cantor Fitzgerald & Co. and SVB Leerink LLC (together the “Sales Agents”), pursuant to which the Company may offer and sell shares of common stock (“Shares”) registered under an effective registration statement from time to time through the Sales Agents (the “Offering”).

Upon delivery of a placement notice based on the Company’s instructions and subject to the terms and conditions of the Sales Agreement, the Sales Agents may sell the Shares by methods deemed to be an “at the market” offering, in negotiated transactions at market prices prevailing at the time of sale or at prices related to such prevailing market prices, or by any other method permitted by law, including negotiated transactions, subject to the prior written consent of the Company. The Company is not obligated to make any sales of Shares under the Sales Agreement. The Company or Sales Agents may suspend or terminate the offering of Shares upon notice to the other party, subject to certain conditions. The Sales Agents will act as agent on a commercially reasonable efforts basis consistent with their normal trading and sales practices and applicable state and federal law, rules and regulations and the rules of Nasdaq.

The Company has agreed to pay the Sales Agents commissions

for their services of up to

2023 Purchase Agreement

On February 3, 2023, the Company entered into a $150.0 million purchase agreement (the “2023 Purchase Agreement”) with Lincoln Park Capital Fund, LLC (“Lincoln Park”), pursuant to which the Company has the right to sell and issue to Lincoln Park, and Lincoln Park is obligated to purchase, up to $150.0 million in value of its shares of common stock from time to time over a three-year period until February 3, 2026.

In consideration for entering into the 2023 Purchase

Agreement, the Company issued to Lincoln Park shares of common stock as a commitment fee (the “initial commitment shares”)

and agreed to issue up to an additional shares pro rata, when and if, Lincoln Park purchased, at the Company’s discretion,

the $

During the six months ended March 31, 2024, the

Company issued to Lincoln Park an aggregate of

shares of common stock under the 2023 Purchase Agreement, including

shares of common stock for an aggregate purchase price of $

At March 31, 2024, an amount of $

13

Anavex

Life Sciences Corp.

Notes to the Condensed Consolidated Interim Financial Statements

March 31, 2024

(Unaudited)

Note 6 Commitments and Contingencies

Leases

The Company leases office space under an operating lease with an initial term of 12 months or less. Under the terms of the office lease, the Company is required to pay its proportionate share of operating costs.

During the three and six months ended March 31, 2024 and 2023, operating lease costs were as follows (in thousands):

| Three months ended March 31, | Six months ended March 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Operating lease costs | $ | $ | $ | $ | ||||||||||||

Employee 401(k) Benefit Plan

The Company has a defined-contribution savings plan under Section 401(k) of the Internal Revenue Code. The plan covers all United States based employees. United States based employees eligible to participate in the plan may contribute up to the current statutory limits under the Internal Revenue Service regulations. The 401(k) plan permits the Company to make additional matching contributions on behalf of contributing employees.

During the three and six months ended March 31, 2024 and 2023, the Company made matching contributions under the 401(k) plan as follows (in thousands):

| Three months ended March 31, | Six months ended March 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Contributions to 401(k) plan | $ | $ | $ | $ | ||||||||||||

Litigation

The Company is subject to claims and legal proceedings that arise in the ordinary course of business. Such matters are inherently uncertain, and there can be no guarantee that the outcome of any such matter will be decided favorably to the Company or that the resolution of any such matter will not have a material adverse effect upon the Company’s consolidated financial statements. The Company does not believe that any of such pending claims and legal proceedings will have a material adverse effect on its consolidated financial statements.

On March 13, 2024, a shareholder class action complaint was filed in the United States District Court for the Southern District of New York. The complaint is captioned Blum v. Anavex Life Sciences, Corp. et al., case number 1:24-cv-01910, and names the Company and Christopher Missling as Defendants. The complaint alleges violations of the Securities and Exchange Act of 1934 resulting from disclosures and statements made about certain clinical trials for ANAVEX®2-73. The Company believes the complaint is without merit. The Company is vigorously pursuing its defenses and a potential dismissal of all claims asserted in the lawsuit.

Share Purchase Warrants

At March 31, 2024 and September 30, 2023, the Company

had

14

Anavex

Life Sciences Corp.

Notes to the Condensed Consolidated Interim Financial Statements

March 31, 2024

(Unaudited)

| Number | Exercise Price | Expiry Date | ||||||

| $ | ||||||||

| $ | ||||||||

Stock–based Compensation Plan

2015 Stock Option Plan

On September 18, 2015, the Company’s Board approved a 2015 Omnibus Incentive Plan (the “2015 Plan”), which provided for the grant of stock options and restricted stock awards to directors, officers, employees and consultants of the Company.

The maximum number of our common shares reserved for issue under the plan was shares, subject to adjustment in the event of a change of the Company’s capitalization.

2019 Stock Option Plan

On January 15, 2019, the Board approved the 2019 Omnibus Incentive Plan (the “2019 Plan”), which provides for the grant of stock options and restricted stock awards to directors, officers, employees, consultants and advisors of the Company.

The maximum number of our common shares reserved for issue under the plan was shares, subject to adjustment in the event of a change of the Company’s capitalization.

During the year ended September 30, 2022, options previously available under the 2019 Plan and the 2015 Plan became available under the 2022 Plan (as defined below).

2022 Stock Option Plan

On March 25, 2022, the Board approved the 2022 Omnibus Incentive Plan (the “2022 Plan”). The 2022 Plan was approved by stockholders on May 24, 2022. Under the terms of the 2022 Plan, additional shares of Common Stock will be available for issuance under the plan, in addition to the shares available under the 2019 Plan and the 2015 Plan. Any awards outstanding under a previous stock option plan will remain subject to and be paid under such plan, and any shares subject to outstanding awards under a previous plan that subsequently cease to be subject to such awards (other than by reason of settlement of the awards in shares) will automatically become available for issuance under the 2022 Plan.

The 2022 Plan provides that it may be administered

by the Board, or the Board may delegate such responsibility to a committee. The exercise price will be determined by the Board at the

time of grant shall be at least equal to the fair market value on such date. If the grantee is a 10% stockholder on the grant date, then

the exercise price shall not be less than 110% of fair market value of the Company’s shares of common stock on the grant date. Stock

options may be granted under the 2022 Plan for an exercise period of up to ten years from the date of grant of the option or such lesser

periods as may be determined by the Board, subject to earlier termination in accordance with the terms of the 2022 Plan. At March 31,

2024,

The following summarizes information about stock option activity during the year ended September 30, 2023 and six months ended March 31, 2024:

15

Anavex

Life Sciences Corp.

Notes to the Condensed Consolidated Interim Financial Statements

March 31, 2024

(Unaudited)

| Weighted Average Exercise Price | Weighted Average Grant Date Fair Value | Aggregate intrinsic value | ||||||||||||||||

| Number of Options | ($) | ($) | ($) | |||||||||||||||

| Outstanding, September 30, 2022 | ||||||||||||||||||

| Granted | — | |||||||||||||||||

| Exercised | ( | ) | ||||||||||||||||

| Forfeited | ( | ) | — | |||||||||||||||

| Outstanding, September 30, 2023 | ||||||||||||||||||

| Granted | — | |||||||||||||||||

| Exercised | ( | ) | ||||||||||||||||

| Forfeited | ( | ) | — | |||||||||||||||

| Outstanding, March 31, 2024 | ||||||||||||||||||

| Exercisable, March 31, 2024 | ||||||||||||||||||

The following summarizes information about stock options at March 31, 2024 by a range of exercise prices:

| Range of exercises prices | Number of outstanding | Weighted average remaining contractual life (in | Weighted average | Number of vested | Weighted average | |||||||||||||||||||||

| From | To | options | years) | exercise price | options | exercise price | ||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||

The weighted average grant date fair value of options vested at March 31, 2024 was $ (September 30, 2023: $). At March 31, 2024, the weighted average contractual life of options outstanding was years (September 30, 2023: years) and for options exercisable was years (September 30, 2023: years).

The aggregate intrinsic value is calculated as the difference between the exercise price of the underlying awards and the quoted market price of the Company’s stock for the options that were in-the-money at March 31, 2024.

During the three and six months ended March 31, 2024, the Company recognized stock-based compensation expense of $ million and $ million, respectively (2023: $ million and $ million, respectively) in connection with the issuance and vesting of stock options and warrants in exchange for services. These amounts have been included in general and administrative expenses and research and development expenses on the Company’s condensed consolidated interim statement of operations as follows (in thousands):

| Three months ended March 31, | Six months ended March 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| General and administrative | $ | $ | $ | $ | ||||||||||||

| Research and development | ||||||||||||||||

| Total stock-based compensation | $ | $ | $ | $ | ||||||||||||

16

Anavex

Life Sciences Corp.

Notes to the Condensed Consolidated Interim Financial Statements

March 31, 2024

(Unaudited)

An amount of approximately $ million in stock-based compensation is expected to be recorded over the remaining term of such options through fiscal 2026.

The fair value of each option award granted during the three and six months ended March 31, 2024 and 2023 is estimated on the date of grant using the Black Scholes option pricing model based on the following weighted average assumptions:

| 2024 | 2023 | |||||||

| Risk-free interest rate | % | % | ||||||

| Expected life of options (years) | ||||||||

| Annualized volatility | % | % | ||||||

| Dividend rate | % | % | ||||||

The fair value of stock compensation charges recognized during the three and six months ended March 31, 2024 and 2023 was determined with reference to the quoted market price of the Company’s shares on the grant date.

17

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Forward-Looking Statements

This Quarterly Report on Form 10-Q includes forward-looking statements. All statements other than statements of historical facts contained in this Quarterly Report on Form 10-Q, including statements regarding our anticipated future clinical and regulatory milestone events, future financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “expect” “should,” “forecast,” “potential,” “predict”, “could,” “would,” “will,” “suggest,” “plan” and similar expressions, as they relate to us, are intended to identify forward-looking statements. Such forward-looking statements include, without limitation, statements regarding:

| ● | volatility in our stock price and in the markets in general; | |

| ● | our ability to successfully conduct preclinical studies and clinical trials for our product candidates; | |

| ● | our ability to raise additional capital on favorable terms and the impact of such activities on our stockholders and stock price; | |

| ● | our ability to generate any revenue or to continue as a going concern; | |

| ● | our ability to execute our research and development plan on time and on budget; | |

| ● | our products candidates’ ability to demonstrate efficacy or an acceptable safety profile; | |

| ● | our ability to obtain the support of qualified scientific collaborators; | |

| ● | our ability, whether alone or with commercial partners, to successfully commercialize any of our product candidates that may be approved for sale; | |

| ● | our ability to identify and obtain additional product candidates; | |

| ● | our reliance on third parties in non-clinical studies and clinical trials; | |

| ● | our ability to defend against product liability claims; | |

| ● | our ability to safeguard against security breaches; | |

| ● | our ability to obtain and maintain sufficient intellectual property protection for our product candidates; | |

| ● | our ability to comply with our intellectual property licensing agreements; | |

| ● | our ability to defend against claims of intellectual property infringement; | |

| ● | our ability to comply with the maintenance requirements of the government patent agencies; | |

| ● | our ability to protect our intellectual property rights throughout the world; | |

| ● | competition; | |

| ● | the anticipated start dates, durations and completion dates of our ongoing and future clinical trials; | |

| ● | the anticipated designs of our future clinical trials; | |

| ● | our ability to attract and retain qualified employees; | |

| ● | the impact of Fast Track designation on receipt of actual FDA approval; | |

| ● | our anticipated future regulatory submissions and our ability to receive regulatory approvals to develop and market our product candidates, including any orphan drug or Fast Track designations; and | |

| ● | our anticipated future cash position and ability to obtain funding for our operations. |

We have based these forward-looking statements largely on our current expectations and projections about future events, including the responses we expect from regulatory authorities and financial trends that we believe may affect our financial condition, results of operations, business strategy, preclinical studies and clinical trials, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions including without limitation the risks described in “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K filed with the Securities and Exchange Commission on November 27, 2023. These risks are not exhaustive. Other sections of this Quarterly Report on Form 10-Q include additional factors which could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable laws including the securities laws of the United States, we assume no obligation to update or supplement forward-looking statements.

18

As used in this Quarterly Report on Form 10-Q, the terms “we,” “us,” “our,” “Company”, and “Anavex” mean Anavex Life Sciences Corp., unless the context clearly indicates otherwise.

Our Current Business

Anavex Life Sciences Corp. is a clinical stage biopharmaceutical company engaged in the development of differentiated therapeutics by applying precision medicine to central nervous system (“CNS”) diseases with high unmet need. We analyze genomic data from clinical trials to identify biomarkers, which we use in the analysis of our clinical trials.

Our lead product candidate, ANAVEX®2-73 (blarcamesine), is being developed to treat Alzheimer’s disease, Parkinson’s disease and potentially other central nervous system diseases, including rare diseases, such as Rett syndrome, a rare severe neurological monogenic disorder caused by mutations in the X-linked gene, methyl-CpG-binding protein 2 (“MECP2”).

We currently have two core programs and two seed programs. Our core programs are at various stages of clinical and preclinical development, in neurodegenerative and neurodevelopmental diseases.

The following table summarizes key information about our programs:

* = Orphan Drug Designation by the FDA

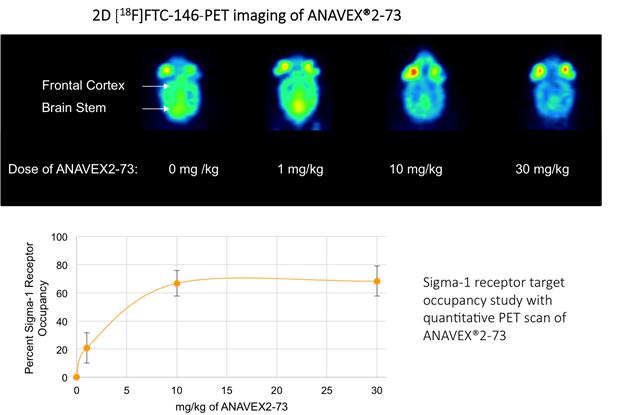

Anavex has a portfolio of compounds varying in sigma-1 receptor (SIGMAR1) binding activities. The SIGMAR1 gene encodes the SIGMAR1 protein, which is an intracellular chaperone protein with important roles in cellular communication. SIGMAR1 is also involved in transcriptional regulation at the nuclear envelope and restores homeostasis and stimulates recovery of cell function when activated. In order to validate the ability of our compounds to activate quantitatively the SIGMAR1, we performed, in collaboration with Stanford University, a quantitative Positron Emission Tomography (PET) imaging scan in mice, which demonstrated a dose-dependent ANAVEX®2-73 (blarcamesine) target engagement or receptor occupancy with SIGMAR1 in the brain.

19

Source: Reyes S et al., Sci Rep. 2021 Aug 25; 11(1):17150

Cellular Homeostasis

Many diseases are possibly directly caused by chronic homeostatic imbalances or cellular stress of brain cells. In pediatric diseases, such as Rett syndrome or infantile spasms, chronic cellular stress is possibly caused by the presence of a constant genetic mutation. In neurodegenerative diseases, such as Alzheimer’s and Parkinson’s diseases, chronic cellular stress is possibly caused by age-correlated buildup of cellular insult and hence chronic cellular stress. Specifically, defects in homeostasis of protein or ribonucleic acid (“RNA”) lead to the death of neurons and dysfunction of the nervous system. The spreading of protein aggregates resulting in a proteinopathy, a characteristic found in Alzheimer’s and Parkinson’s diseases that results from disorders of protein synthesis, trafficking, folding, processing or degradation in cells. The clearance of macromolecules in the brain is particularly susceptible to imbalances that result in aggregation and degeneration in nerve cells. For example, Alzheimer’s disease pathology is characterized by the presence of amyloid plaques, and neurofibrillary tangles, which are aggregates of hyperphosphorylated Tau protein that are a marker of other diseases known as tauopathies as well as inflammation of microglia. With the SIGMAR1 activation through SIGMAR1 agonists like ANAVEX®2-73 (blarcamesine), our approach is to restore cellular balance (i.e. homeostasis). Therapies that correct defects in cellular homeostasis might have the potential to halt or delay neurodevelopmental and neurodegenerative disease progression.

ANAVEX®2-73 (blarcamesine) specific Biomarkers

As part of some of our clinical trials, we have incorporated a genomic analysis to better understand potential populations for whom our clinical programs might benefit. In our clinical trials, a full genomic analysis of Alzheimer’s disease patients treated with ANAVEX®2-73 (blarcamesine) has helped us identify actionable genetic variants. A significant impact of the genomic biomarkers SIGMAR1, the direct target of ANAVEX®2-73 (blarcamesine) and COMT,

20

a gene involved in memory function, on the drug response level was identified, leading to an early ANAVEX®2-73 (blarcamesine) specific biomarker hypothesis. We believe that excluding patients with SIGMAR1 identified biomarker variant (approximately 10%-20% of the population) in prospective studies would identify approximately 80%-90% patients that would display clinically significant improved functional and cognitive scores. The consistency between the identified DNA and RNA data related to ANAVEX®2-73 (blarcamesine), which are considered independent of Alzheimer’s disease pathology, as well as multiple endpoints and time-points, provides support for the potential precision medicine clinical development of ANAVEX®2-73 (blarcamesine) by using genetic biomarkers identified within the trial population itself to either confirm the mechanism of action of ANAVEX®2-73 (blarcamesine) or target patients who are most likely to respond to ANAVEX®2-73 (blarcamesine) treatment. We may in the future utilize such an approach in Alzheimer’s disease as well as indications like Parkinson’s disease dementia or Rett syndrome in which ANAVEX®2-73 (blarcamesine) is currently being studied.

Clinical Trials Overview

Alzheimer’s Disease

In November 2016, we completed a Phase 2a clinical trial, consisting of Part A and Part B, which lasted a total of 57 weeks, for ANAVEX®2-73 in mild-to-moderate Alzheimer’s patients. This open-label randomized trial in Australia met both primary and secondary endpoints and was designed to assess the safety and exploratory efficacy of ANAVEX®2-73 in 32 patients. ANAVEX®2-73 targets sigma-1 and muscarinic receptors, which have been shown in preclinical studies to reduce stress levels in the brain believed to restore cellular homeostasis and to reverse the pathological hallmarks observed in Alzheimer’s disease. In October 2017, we presented positive pharmacokinetic (“PK”) and pharmacodynamic (“PD”) data from the Phase 2a clinical trial, which established a concentration-effect relationship between ANAVEX®2-73 and trial measurements. These measures obtained from all patients who participated in the entire 57 weeks include exploratory cognitive and functional scores as well as biomarker signals of brain activity. Additionally, the clinical trial appeared to show that ANAVEX®2-73 activity was enhanced by its active metabolite (ANAVEX19-144), which also targets the SIGMAR1 receptor and has a half-life approximately twice as long as the parent molecule.

Two consecutive trial extensions for the Phase 2a trial have allowed participants who completed the 52-week Part B of the trial to continue taking ANAVEX®2-73, providing an opportunity to gather extended safety data for a cumulative time period of five years. In August 2020, patients completing these Phase 2a trial extensions were granted continued access to treatment with ANAVEX®2-73 through the Australian Government Department of Health – Therapeutic Goods Administration’s compassionate use Special Access Scheme.

A larger Phase 2b/3 double-blind, placebo-controlled trial of ANAVEX®2-73 in Alzheimer’s disease commenced in August 2018. The Phase 2b/3 trial enrolled 509 patients, which were treated with a convenient once-daily oral formulation of ANAVEX®2-73 for 48 weeks, randomized 1:1:1 to two different ANAVEX®2-73 doses or placebo. The trial took place at 52 sites across North America, Europe and Australia. Primary and secondary endpoints to assess safety and both cognitive and functional efficacy, were measured through the Alzheimer’s Disease Assessment Scale – Cognitive Subscale test (“ADAS-Cog”), Alzheimer’s Disease Cooperative Study – Activities of Daily Living (“ADCS-ADL”) and Clinical Dementia Rating – Sum of Boxes for cognition and function (“CDR-SB”). In addition to the primary endpoints, the ANAVEX®2-73 Phase 2b/3 trial design incorporated pre-specified statistical analyses related to potential genomic precision medicine biomarkers previously identified in the ANAVEX®2-73 Phase 2a clinical trial. The trial was completed in mid-2022 and, in December 2022, the Company presented positive topline results from the Phase 2b/3 clinical trial.

ANAVEX®2-73 met the co-primary endpoints ADAS-Cog and ADCS-ADL and key secondary endpoint CDR-SB. ANAVEX®2-73 treatment slowed decline of cognition and function in patients with early Alzheimer’s disease over 48 weeks. In addition, patients treated with ANAVEX®2-73 had 1.84 times higher odds, or likelihood, to improve cognitively compared to placebo, with an ADAS-Cog score threshold change of -0.5 points or better [Odds Ratio = 1.84 (p = 0.015)]. At clinically significant levels of improvement in function (ADCS-ADL score threshold change of +3.5 points or better), patients treated with ANAVEX®2-73 had 2.67 times higher odds, or likelihood, to improve function compared to placebo [Odds Ratio = 2.67 (p = 0.0255)]. Additionally, treatment with ANAVEX®2-73 reduced cognitive decline at end of treatment, measured with the ADAS-Cog, as compared to placebo, by 45%, representing a treatment difference in mean score change of -1.85 points (p=0.033). Compared to placebo, ANAVEX®2-73 reduced clinical decline of cognition and function by 27% with mean score difference of -0.42 points (p=0.040) as measured by the CDR-SB. ANAVEX®2-73 was generally safe and well tolerated. All statistical analyses were performed by outside consultancy companies.

21

In September 2023, we provided additional data demonstrating that the clinical effect was complemented by two independent biomarkers. A significant reduction in pathological amyloid beta levels in plasma, as well as a significant slowing in the rate of pathological brain atrophy on Magnetic Resonance Imaging (MRI) scans. Validated biomarkers of amyloid beta pathology, plasma Aβ42/40 ratio increased significantly (P = 0.048), demonstrating strong anti-amyloid effects of ANAVEX®2-73 in Alzheimer’s disease patients, while MRI revealed significant reduction in brain volume loss, including whole brain (P = 0.0005), comparing treatment to placebo.

Furthermore, all pre-specified clinical endpoints were further analyzed using a mixed model for repeated measures (MMRM). Under the multiplicity control rule, a trial is successful in meeting the co-primary endpoints if the significance of each endpoint is P < 0.05, or if the significance of only one co-primary endpoint is P < 0.025. If only one primary endpoint is significant at an α level of 0.025, then the secondary endpoint will be evaluated at the same level of 0.025. The trial was successful, since the differences in the least-squares mean (LSM) change from baseline to 48 weeks between the ANAVEX®2-73 and placebo groups were −1.783 [95% CI, −3.314 to −0.251]; (P = 0.0226) for ADAS-Cog13, and −0.456 [95% CI, −0.831 to −0.080]; (P = 0.0175) for CDR-SB in patients with early Alzheimer’s disease.

In the respective safety population, common treatment-emergent adverse events included dizziness, which was transient and mostly mild to moderate in severity, and occurred in 120 participants (35.8%) during titration and in 76 participants (25.2%) during maintenance with ANAVEX®2-73 and 10 (6.0%) during titration and 9 (5.6%) during maintenance with placebo.

A subsequent long-term open label extension study of ANAVEX®2-73, entitled the ATTENTION-AD trial was initiated for patients who have completed the 48-week Phase 2b/3 placebo-controlled trial referenced above. This trial extension for an additional 96 weeks is currently ongoing, and provides an opportunity to evaluate longer term safety and efficacy of ANAVEX®2-73 in persons with Alzheimer’s disease.

Rett Syndrome

In February 2016, we presented positive preclinical data for ANAVEX®2-73 in Rett syndrome, a rare neurodevelopmental disease. The data demonstrated dose related and significant improvements in an array of behavioral and gait paradigms in a mouse model with an MECP2-null mutation that causes neurological symptoms that mimic Rett syndrome. The study was funded by the International Rett Syndrome Foundation (“Rettsyndrome.org”). In January 2017, we were awarded a financial grant from Rettsyndrome.org of a minimum of $0.6 million to cover some of the costs of a multicenter Phase 2 clinical trial of ANAVEX®2-73 for the treatment of Rett syndrome. This award was received in quarterly instalments which commenced during fiscal 2018.

In March 2019, we commenced the first Phase 2 clinical trial in a planned Rett syndrome program of ANAVEX®2-73 for the treatment of Rett syndrome. The clinical trials are being conducted in a range of patient age demographics and geographic regions, utilizing an oral liquid once-daily formulation of ANAVEX®2-73.

The first Phase 2 trial, (ANAVEX®2-73-RS-001), which took place in the United States, was completed in December 2020. This trial was a randomized double-blind, placebo-controlled safety, tolerability, PK and efficacy trial of oral liquid ANAVEX®2-73 formulation in 25 adult female patients with Rett syndrome over a 7-week treatment period including ANAVEX®2-73-specific genomic precision medicine biomarkers. The primary endpoint of the trial was safety. The dosing of 5 mg ANAVEX®2-73 was well-tolerated and demonstrated dose-proportional PK. All secondary efficacy endpoints of the trial showed statistically significant and clinically meaningful response in the Rett Syndrome Behaviour Questionnaire (“RSBQ”) response, when compared to placebo, in the intent to treat (“ITT”) cohort (all participants, p = 0.011). 66.7% of ANAVEX®2-73 treated subjects showed a statistically significant improvement in RSBQ response as compared to 10% of the subjects on placebo in the ITT cohort (all participants, p = 0.011). ANAVEX®2-73 treatment resulted in a sustained improvement in Clinical Global Impression Improvement (CGI-I) response throughout the 7-week clinical trial, when compared to placebo in the ITT cohort (all participants, p = 0.014). Consistent with previous ANAVEX®2-73 clinical trials, patients carrying the common form of the SIGMAR1 gene treated with ANAVEX®2-73 experienced stronger improvements in the prespecified efficacy endpoints.

22

The second, international trial of ANAVEX®2-73 for the treatment of Rett syndrome, called the AVATAR trial, commenced in June 2019. This trial took place in Australia and the United Kingdom using a higher dose than the U.S. based Phase 2 trial for Rett syndrome. The trial was a Phase 3 randomized, double-blind, placebo-controlled trial to evaluate the safety and efficacy of ANAVEX®2-73 in 33 adult patients over a 7-week treatment period including ANAVEX®2-73 specific precision medicine biomarkers. Based upon the input from the successful U.S. Phase 2 Rett syndrome trial (ANAVEX®2-73-RS-001), we updated the endpoints for the AVATAR trial (ANAVEX®2-73-RS-002) to appropriately assess the clinically meaningful outcome following International Conference on Harmonization (ICH) guidelines. These updates were approved by the respective regulatory authorities in the U.K. and in Australia, respectively, where the AVATAR trial was conducted.

The data from the AVATAR trial was released in February 2022. The clinical trial met all primary and secondary efficacy and safety endpoints, with consistent improvements in primary efficacy endpoint, RSBQ response (p = 0.037), and secondary efficacy endpoints, Anxiety, Depression, and Mood Scale (ADAMS) (p = 0.010) and CGI-I (p = 0.037) response. Efficacy endpoints demonstrated statistically significant and clinically meaningful reductions in Rett syndrome symptoms. Convenient once daily oral liquid doses of up to 30 mg of ANAVEX®2-73 were also well tolerated with good medication compliance. All patients who participated in the trial were eligible to receive ANAVEX®2-73 under a voluntary open label extension protocol and subsequent Compassionate Use Program.

The very first trial of ANAVEX®2-73 in pediatric Rett syndrome patients, the EXCELLENCE trial, completed enrollment in February 2023. This randomized, double-blind, placebo-controlled Phase 2/3 trial in pediatric patients with Rett syndrome included trial sites in Canada, Australia, and the United Kingdom. 92 pediatric patients with Rett syndrome between the ages of 5 through 17 years were treated daily with up to 30 mg ANAVEX®2-73. Participants were randomized 2:1 (ANAVEX®2-73:placebo) for 12 weeks, followed by a week 16 safety visit and topline results from this trial were announced in early January 2024.

After 12 weeks, the study showed improvement on the key co-primary endpoint RSBQ, which is a detailed 45-item questionnaire for assessing multiple Rett syndrome characteristics by the patients’ caregivers. The other co-primary endpoint, the CGI-I, which represents a less granular assessment by the site investigators using a seven-point scoring (one=“very much improved” to seven=“very much worse”), was not met.

In an ad-hoc analysis, using the predefined mixed-effect model for repeated measure (MMRM) method, after 12 weeks of treatment, ANAVEX®2-73-treated patients improved LS Mean (SE) -12.93 (2.150) points on their RSBQ total score compared to LS Mean (SE) -8.32 (2.537) points in placebo-treated patients. The LS Mean difference (SE) of -4.61 (2.439) points between treated and placebo groups did not reach statistical significance (n=77; p=0.063). ANAVEX®2-73-treated patients demonstrated a rapid onset of action with improvements at 4 weeks after treatment with a RSBQ total score LS Mean (SE) -10.32 (2.086) points in the drug-treated group compared to a LS Mean (SE) -5.67 (2.413) points in placebo-treated patients. The LS Mean difference of -4.65 (2.233) points between treated and placebo groups was statistically significant (n=77; p=0.041).

The key secondary endpoint, the ADAMS, trended favorably. In the same analysis, scores for all RSBQ and ADAMS subscales improved over the course of the study. Collectively, the RSBQ and ADAMS demonstrated improvements in multiple areas, impacting positively in particular repetitive movements, nighttime disruptive behaviors, and social avoidance.

A preliminary review of the safety results indicates there were no new safety signals in the EXCELLENCE study, reinforcing the favorable and manageable safety profile observed with ANAVEX®2-73 to date.

All patients who participated in the trial were eligible to receive ANAVEX®2-73 under a voluntary open label extension protocol.

A high enrollment rate in the OLE of over 91% and the high level of requests for the Compassionate Use Program (93%) provide solid numerical evidence for the reported positive Real World Evidence (RWE) from patients with Rett syndrome under Compassionate Use Authorization. Families whose children were previously on drug or placebo in the placebo-controlled trial commented favorably on the improvement of their child’s daily life due to ANAVEX®2-73 treatment in the Compassionate Use Program.

23

Parkinson’s Disease

In September 2016, we presented positive preclinical data for ANAVEX®2-73 in an animal model of Parkinson’s disease, which demonstrated significant improvements on behavioral, histopathological, and neuroinflammatory endpoints. The study was funded by the Michael J. Fox Foundation. Additional data announced in October 2017 indicated that ANAVEX®2-73 induced robust neurorestoration in experimental Parkinsonism. We believe the encouraging results we have gathered in this preclinical model, coupled with the favorable profile of this product candidate in the Alzheimer’s disease trial, support the notion that ANAVEX®2-73 has the potential to treat Parkinson’s disease dementia.

In October 2020, we completed a double-blind, randomized, placebo-controlled proof-of-concept Phase 2 trial with ANAVEX®2-73 in Parkinson’s disease dementia in Spain and Australia, to study the effect of the compound on both the cognitive and motor impairment of Parkinson’s disease. The Phase 2 trial enrolled approximately 132 patients for 14 weeks, randomized 1:1:1 to two different ANAVEX®2-73 doses, 30 mg and 50 mg, or placebo. The ANAVEX®2-73 Phase 2 Parkinson’s disease dementia trial design incorporated genomic precision medicine biomarkers identified in the ANAVEX®2-73 Phase 2a Alzheimer’s disease trial.

The trial demonstrated that ANAVEX®2-73 was safe and well tolerated in oral doses up to 50 mg once daily. The results showed clinically meaningful, dose-dependent, and statistically significant improvements in the Cognitive Drug Research (“CDR”) computerized assessment system analysis. Treatment with ANAVEX®2-73 also resulted in clinically meaningful improvements as measured by the global composite score of Parkinson’s disease symptom severity, MDS-Unified Parkinson’s Disease Rating Scale (“MDS-UPDRS”) total score on top of standard of care including dopaminergic therapy, levodopa and other anti-PD medications after 14 weeks of treatment, suggesting ANAVEX®2-73’s potential capability of slowing and reversing symptoms that progress in Parkinson’s disease. In addition, the trial confirmed the precision medicine approach of targeting SIGMAR1 as a genetic biomarker in response to ANAVEX®2-73 may result in improved clinical outcomes.

A 48-week Open Label Extension (“OLE”) ANAVEX2-73-PDD-EP-001 Phase 2 trial was offered to participants after completion of the double-blind placebo-controlled ANAVEX2-73-PDD-001 Phase 2 trial discussed above. The OLE trial assessed safety, tolerability and efficacy, measuring among others, MDS-Unified Parkinson’s Disease Rating Scale Parts I, II, III, REM Sleep Behavior Disorder Screening Questionnaire (RBDSQ), Clinical Global Impression – Improvement (CGI-I), as well as cognitive efficacy endpoint Montreal Cognitive Assessment (MoCA) over a 48-week period.

In March 2023, we reported the preliminary ANAVEX2-73-PDD-EP-001 OLE trial data, which demonstrated longitudinal beneficial effects of ANAVEX®2-73 on the pre-specified primary and secondary objectives. Preliminary analysis reveals that ANAVEX®2-73 was found to be generally safe and well tolerated; and safety findings in this trial were consistent with the known safety profile of ANAVEX®2-73. In respect to efficacy, across all efficacy endpoints, patients performed better while on ANAVEX®2-73. While all patients were on drug holiday due to COVID-19 between the DB EOT and the OLE Baseline, the respective efficacy endpoints, including the MDS-UPDRS Part II + III and CGI-I, measured at the end of trial of the double-blind study (DB EOT) and the OLE Baseline, were worsening, as expected in a progressive disease like Parkinson’s. However, when patients resumed daily oral ANAVEX®2-73 treatment, a consistent improvement was observed during the extension phase from OLE Baseline through OLE Week 24, and OLE Week 48, respectively. These results are consistent with the pattern observed for all efficacy measures in the extension phase. The two endpoints, MDS-UPDRS Part II + III and CGI-I measured in this study are the planned primary and key secondary endpoints in our forthcoming pivotal 6-month Parkinson’s disease study.

In January 2021, we were awarded a research grant of $1.0 million from The Michael J. Fox Foundation for Parkinson’s Research to develop ANAVEX®2-73 for the treatment of Parkinson’s disease. The award will explore utilization of PET imaging biomarkers to enable measurement of target engagement and pathway activation of the SIGMAR1 with clinically relevant doses including in people with Parkinson’s disease.

Schizophrenia, Frontotemporal Dementia and Alzheimer’s disease

In July 2020, we commenced the First-in-Human Phase 1 clinical trial of ANAVEX®3-71. ANAVEX®3-71 was previously granted orphan drug designation for the treatment of Frontotemporal Dementia (“FTD”) by the FDA. ANAVEX®3-71 is an orally administered small molecule targeting sigma-1 and M1 muscarinic receptors that is designed to be beneficial for neurodegenerative diseases. In preclinical studies, ANAVEX®3-71 demonstrated disease-modifying activity against the major hallmarks of Alzheimer’s disease in transgenic (3xTg-AD) mice, including cognitive deficits, amyloid and tau pathologies, as well as beneficial effects on mitochondrial dysfunction and neuroinflammation.

24

The Phase 1 clinical trial was a prospective double-blind, randomized, placebo-controlled trial in Australia. A total of 36 healthy male and female subjects were included. Single escalating doses of ANAVEX®3-71 were administered in order to evaluate the safety, tolerability, and PK of ANAVEX®3-71 and the effects of food and gender on its PK in healthy volunteers.

The trial met its primary and secondary endpoints of safety, with no serious adverse events (“SAEs”) or dose-limiting toxicities observed. ANAVEX®3-71 was well tolerated in all cohorts receiving ANAVEX®3-71 in single doses ranging from 5 mg to 200 mg daily with no SAEs and no significant lab abnormalities in any subject. In the trial, ANAVEX®3-71 exhibited linear PK. Its pharmacokinetics was also dose proportional for doses up to 160 mg. Gender had no effect on the PK of the drug and food had no effect on the bioavailability of ANAVEX®3-71. The trial also met the secondary objective of characterizing the effect of ANAVEX®3-71 on electrocardiogram (“ECG”) parameters. There were no clinically significant ECG parameters throughout the trial. Participant QTcF measures were normal across all dose groups with no difference between ANAVEX®3-71 and placebo.

In October 2023 a peer-reviewed publication in the journal Neurobiology of Aging, titled “Early treatment with an M1 and sigma-1 receptor agonist prevents cognitive decline in a transgenic rat model displaying Alzheimer-like amyloid pathology”, featured the orally available small molecule ANAVEX®3-71 (AF710B). The preclinical study described the potential disease-modifying properties of ANAVEX®3-71 on Alzheimer’s disease pathology as a possible drug candidate for a potential once daily oral preventive strategy for Alzheimer’s disease.

In January 2024, in another peer-reviewed publication in the journal Clinical Pharmacology in Drug Development, entitled, ‘Population-Based Characterization of the Pharmacokinetics and Food Effect of ANAVEX3-71, a Novel Sigma-1 Receptor and Allosteric M1 Muscarinic Receptor Agonist in Development for Treatment of Frontotemporal Dementia, Schizophrenia, and Alzheimer Disease’, reported the Population-based characterization of the PK and food effect of ANAVEX®3-71 as part of the single ascending dose study in healthy participants with the primary objective of assessing dose proportionality of ANAVEX®3-71, and to characterize the effect of food on the PK of ANAVEX®3-71. The results from this PK evaluation demonstrated that ANAVEX®3-71, at single ascending doses of 5 to 200 mg, is linear, dose proportional, and time invariant. Food had no effect on the PK of ANAVEX®3-71. This data also expands the safety objectives met in this first-in-human study of ANAVEX®3-71, further supporting its drug development program.

Based on these results, and ANAVEX®3-71’s pre-clinical profile, we intend to advance ANAVEX®3-71 into a biomarker-driven clinical development dementia program for the treatment of schizophrenia, FTD and Alzheimer’s disease, evaluating longitudinal effect of treatment with ANAVEX®3-71.

Schizophrenia

In March 2024, we commenced the U.S. FDA cleared ANAVEX®3-71-SZ-001 clinical trial, a double-blind, placebo-controlled Phase 2 trial in schizophrenia. The trial consists of two parts to explore multiple ascending doses in individuals with schizophrenia followed by a 28-day treatment period in a larger cohort. The trial will utilize standard clinical outcome measures for schizophrenia including the Positive and Negative Symptoms Scale (PANSS), and novel fluid and electrophysiological biomarkers will also be assessed, leveraging several advances in electroencephalography/event-related potential (EEG/ERP) biomarkers in schizophrenia developed in collaboration with the industry-led ERP Biomarker Qualification Consortium. In addition to the electrophysiological biomarkers, we are also applying novel neuroinflammatory, metabolomic, and transcriptomic biomarkers at the intersection of schizophrenia pathophysiology and ANAVEX®3-71’s novel, dual mechanism of action.

Our Pipeline

Our research and development pipeline includes ANAVEX®2-73 currently in three different clinical trial indications, and several other compounds in different stages of clinical and pre-clinical development.

Our proprietary SIGMACEPTOR™ Discovery Platform produced small molecule drug candidates with unique modes of action, based on our understanding of sigma receptors. Sigma receptors may be targets for therapeutics to combat many human diseases, both of neurodegenerative nature, including Alzheimer’s disease, as well as of neurodevelopmental nature, like Rett syndrome. When bound by the appropriate ligands, sigma receptors influence the functioning of multiple biochemical signals that are involved in the pathogenesis (origin or development) of disease. Multiple viruses including SARS-CoV-2 (COVID-19) induce cellular stress by intrinsic mitochondrial apoptosis and other related cellular processes, in order to ensure survival and replication. Hence, it is possible that SIGMAR1 could play a role in modulating the cellular response to viral infection and ameliorate pathogenesis.

25

Compounds that have been subjects of our research include the following:

ANAVEX®2-73 (blarcamesine)

We believe ANAVEX®2-73 may offer a disease-modifying approach in neurodegenerative and neurodevelopmental diseases by activation of SIGMAR1. ANAVEX®2-73 is being developed in an oral liquid once-daily formulation for rare diseases such as Rett syndrome as well as an oral once-daily capsule formulation for diseases such as Alzheimer’s disease.

In Rett syndrome, administration of ANAVEX®2-73 in liquid form resulted in both significant and dose-related improvements in an array of behavioral paradigms in the MECP2 HET Rett syndrome disease model. In addition, in a further experiment sponsored by Rettsyndrome.org, ANAVEX®2-73 was evaluated in automatic visual response and respiration tests in 7-month-old mice, an age at which advanced pathology is evident. Vehicle-treated MECP2 mice demonstrated fewer automatic visual responses than wild-type mice. Treatment with ANAVEX®2-73 for four weeks significantly increased the automatic visual response in the MECP2 Rett syndrome disease mice. Additionally, chronic oral dosing daily for 6.5 weeks of ANAVEX®2-73 starting at ~5.5 weeks of age was conducted in the MECP2 HET Rett syndrome disease mouse model assessed the different aspects of muscular coordination, balance, motor learning and muscular strengths, some of the core deficits observed in Rett syndrome. Administration of ANAVEX®2-73 resulted in both significant and dose related improvements in an array of these behavioral paradigms in the MECP2 HET Rett syndrome disease model.

In May 2016 and June 2016, the FDA granted Orphan Drug Designation to ANAVEX®2-73 for the treatment of Rett syndrome and infantile spasms, respectively. In November 2019, the FDA granted ANAVEX®2-73 the Rare Pediatric Disease (RPD) designation for the treatment of Rett syndrome. The RPD designation is intended to encourage the development of treatments for rare pediatric diseases.

Further, in February 2020, the FDA granted Fast Track designation for the ANAVEX®2-73 clinical development program for the treatment of Rett syndrome. The FDA Fast Track program is designed to facilitate and expedite the development and review of new drugs to address unmet medical needs in the treatment of serious and life-threatening conditions.

For Parkinson’s disease, data demonstrates significant improvements and restoration of function in a disease modifying animal model of Parkinson’s disease. Significant improvements were seen on all measures tested: behavioral, histopathological, and neuroinflammatory endpoints. In October 2020, we completed a double-blind, randomized, placebo-controlled proof-of-concept Phase 2 trial with ANAVEX®2-73 in Parkinson’s disease dementia, to study the effect of the compound on both the cognitive and motor impairment of Parkinson’s disease. The Phase 2 trial enrolled approximately 132 patients for 14 weeks, randomized 1:1:1 to two different ANAVEX®2-73 doses, 30mg and 50mg, or placebo. The ANAVEX®2-73 Phase 2 Parkinson’s disease dementia trial design incorporated genomic precision medicine biomarkers identified in the ANAVEX®2-73 Phase 2a Alzheimer’s disease trial.

The trial demonstrated that ANAVEX®2-73 was safe and well tolerated in oral doses up to 50mg once daily. The results showed clinically meaningful, dose-dependent, and statistically significant improvements in the CDR computerized assessment system analysis. We anticipate conducting further clinical trials of ANAVEX®2-73 in Parkinson’s disease dementia after submitting the results of the trial to the FDA to obtain regulatory guidance.

In Alzheimer’s disease animal models, ANAVEX®2-73 has shown pharmacological, histological and behavioral evidence as a potential neuroprotective, anti-amnesic, anti-convulsive and anti-depressive therapeutic agent, due to its potent affinity to SIGMAR1 and moderate affinities to M1-4 type muscarinic receptors. In addition, ANAVEX®2-73 has shown a potential dual mechanism which may impact amyloid, tau pathology and inflammation. In a transgenic Alzheimer’s disease animal model Tg2576, ANAVEX®2-73 induced a statistically significant neuroprotective effect against the development of oxidative stress in the mouse brain, as well as significantly increased the expression of functional and synaptic plasticity markers that is apparently amyloid-beta independent. It also statistically alleviated the learning and memory deficits developed over time in the animals, regardless of sex, both in terms of spatial working memory and long-term spatial reference memory.

26

Based on the results of pre-clinical testing, we initiated and completed a Phase 1 single ascending dose (SAD) clinical trial of ANAVEX®2-73. In this Phase 1 SAD trial, the maximum tolerated single dose was defined per protocol as 55-60 mg. This dose is above the equivalent dose shown to have positive effects in mouse models of Alzheimer’s disease. There were no significant changes in laboratory or ECG parameters. ANAVEX®2-73 was well tolerated below the 55-60 mg dose with only mild adverse events in some subjects. Observed adverse events at doses above the maximum tolerated single dose included headache and dizziness, which were moderate in severity and reversible. These side effects are often seen with drugs that target CNS conditions, including Alzheimer’s disease.

In November 2016, we completed a Phase 2a clinical trial for ANAVEX®2-73, for the treatment of Alzheimer’s disease. The open-label randomized trial was designed to assess the safety and exploratory efficacy of ANAVEX®2-73 in 32 patients with mild-to-moderate Alzheimer’s disease. The Phase 2a trial met both primary and secondary objectives of the trial.

In July 2018, we presented the results of a genomic DNA and RNA evaluation of the participants in the Phase 2a clinical trial. More than 33,000 genes were analyzed using unbiased, data driven, machine learning, artificial intelligence (AI) system for analyzing DNA and RNA data in patients treated with ANAVEX®2-73. The analysis identified genetic variants that impacted response to ANAVEX®2-73, among them variants related to the SIGMAR1, the target for ANAVEX®2-73. Results showed that trial participants with the common SIGMAR1 wild type gene variant, which is estimated to be about 80% of the population worldwide, demonstrated improved cognitive (MMSE) and functional (ADCS-ADL) scores. The results from this evaluation supported the continued evaluation of genomic information in subsequent clinical trials, since these signatures can now be applied to neurological indications tested in future clinical trials with ANAVEX®2-73 including Alzheimer’s disease, Parkinson’s disease dementia and Rett syndrome.

ANAVEX®2-73 data met prerequisite information in order to progress into a Phase 2b/3 placebo-controlled trial. On July 2, 2018, the Human Research Ethics Committee in Australia approved the initiation of our Phase 2b/3, double-blind, randomized, placebo-controlled 48-week safety and efficacy trial of ANAVEX®2-73 for the treatment of early Alzheimer’s disease. Clinical trial sites in Canada, the United Kingdom, the Netherlands and Germany were also added. This Phase 2b/3 trial design incorporates inclusion of genomic precision medicine biomarkers identified in the ANAVEX®2-73 Phase 2a trial.

We believe preclinical data from our studies also supports further research into the use of ANAVEX®2-73 as a potential platform drug for other neurodegenerative diseases beyond Alzheimer’s disease, Parkinson’s disease or Rett syndrome, more specifically, epilepsy, infantile spasms, Fragile X syndrome, Angelman syndrome, multiple sclerosis, and, more recently, tuberous sclerosis complex (TSC). ANAVEX®2-73 demonstrated significant improvements in all of these indications in the respective preclinical animal models.