Table of Contents

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ |

Preliminary Proxy Statement | |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ |

Definitive Proxy Statement | |

| ☐ |

Definitive Additional Materials | |

| ☐ |

Soliciting Materials under § 240.14a-12 | |

Klondex Mines Ltd.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

No fee required. | |||

| ☒ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) |

Title of each class of securities to which transaction applies:

Common shares, no par value (“Klondex Shares”), of Klondex Mines Ltd. (“Klondex”) | |||

| (2) |

Aggregate number of securities to which transaction applies:

The maximum number of Klondex Shares to which this transaction applies is estimated to be 195,649,339, which consists of: (A) 180,179,588 Klondex Shares issued and outstanding as of May 16, 2018; (B) 3,695,604 Klondex Shares issuable upon exercise of options to purchase Klondex Shares outstanding as of May 16, 2018; (C) 1,017,011 Klondex Shares underlying restricted share units outstanding as of May 16, 2018; (D) 395,528 Klondex Shares underlying performance-based restricted share units outstanding as of May 16, 2018; (E) 360,366 Klondex Shares underlying deferred share units outstanding as of May 16, 2018; and (F) 10,001,242 Klondex Shares issuable upon exercise of warrants to purchase Klondex Shares outstanding as of May 16, 2018. | |||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

Solely for the purposes of calculating the filing fee, the maximum aggregate value of the transaction was determined based upon the sum of: (A) 180,179,588 Klondex Shares multiplied by the estimated share consideration of US$2.455 (estimated based on the average of the high and low prices of the Klondex Shares as reported on the NYSE American on May 16, 2018, the “Estimated Share Consideration”); (B) 1,028,334 Klondex Shares issuable upon vesting of options to purchase Klondex Shares (assuming a Company Share Value (as defined herein) of US$2.71) pursuant to the terms of the Arrangement (as defined herein) multiplied by the Estimated Share Consideration; (C) 1,017,011 Klondex Shares underlying restricted share units multiplied by the Estimated Share Consideration; (D) 395,528 Klondex Shares underlying performance-based restricted share units multiplied by the Estimated Share Consideration; (E) 360,366 Klondex Shares underlying deferred share units multiplied by the Estimated Share Consideration; and (F) 5,001,242 Klondex Shares issuable upon exercise of warrants to purchase Klondex Shares, with an exercise price of less than US$2.71, multiplied by the Estimated Share Consideration. In calculating the maximum aggregate value of the transaction, no value was attributed to (A) 300,000 Klondex Shares issuable upon exercise of options to purchase Klondex Shares with an exercise price greater than US$2.71, which will be cancelled under the Arrangement without any consideration, or (B) 5,000,000 Klondex Shares issuable upon exercise of warrants to purchase Klondex Shares with an exercise price greater than US$2.71, which will remain outstanding, subject to being adjusted as discussed herein. | |||

| (4) |

Proposed maximum aggregate value of transaction:

US$461,495,978.17 | |||

| (5) |

Total fee paid:

US$57,456.25 (determined by multiplying 0.0001245 by the proposed maximum aggregate value of the transaction of US$461,495,978.17.) | |||

| ☐ |

Fee paid previously with preliminary materials. | |||

| ☐ |

Check the box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount Previously Paid:

N/A | |||

| (2) |

Form, Schedule or Registration Statement No.:

N/A | |||

| (3) |

Filing Party:

N/A | |||

| (4) |

Date Filed:

N/A | |||

Table of Contents

These materials are important and require your immediate attention. They require securityholders of Klondex Mines Ltd. to make important decisions. If you are in doubt as to how to make such decisions, please contact your financial, legal or other professional advisor. If you have any questions, you may contact the proxy solicitation agent, D.F. King & Co., Inc., by telephone at 1(800) 330-8705 (toll-free in North America) or 1(212) 771-1133 (collect call outside North America), or by email at inquiries@dfking.com.

NOTICE OF MEETING

and

MANAGEMENT INFORMATION CIRCULAR

for the

ANNUAL AND SPECIAL MEETING OF SECURITYHOLDERS

to be held on

[●], 2018

DATED AS OF [●], 2018

The accompanying management information circular and proxy is first being mailed to securityholders of Klondex Mines Ltd. on or about [●], 2018.

The Board of Directors of Klondex Mines Ltd.

UNANIMOUSLY recommends that securityholders vote FOR the Arrangement Resolution.

Table of Contents

KLONDEX MINES LTD.

1055 West Hastings Street, Suite 2200

Vancouver, British Columbia V6E 2E9

[●], 2018

Dear Klondex Securityholder:

You are invited to attend an annual and special meeting (the “Meeting”) of the holders (“Klondex Shareholders”) of common shares (“Klondex Shares”) in the capital of Klondex Mines Ltd. (“Klondex” or the “Company”), holders of Klondex Options (as defined below) (“Klondex Optionholders”), holders of Klondex RSUs (as defined below) (“Klondex RSU Holders”) and holders of Klondex DSUs (as defined below) (collectively, the “Klondex Securityholders”), to be held at the Toronto Region Board of Trade, Lennox Hall East, 4th Floor, 77 Adelaide St. West, Toronto, Ontario on [●], 2018 at [8:00 a.m. (Eastern Daylight Time)].

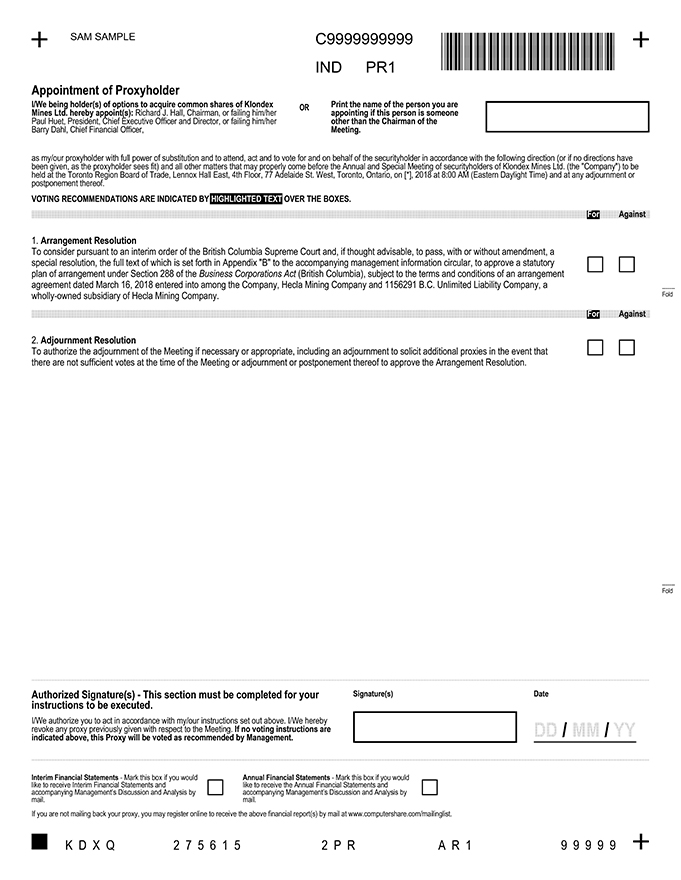

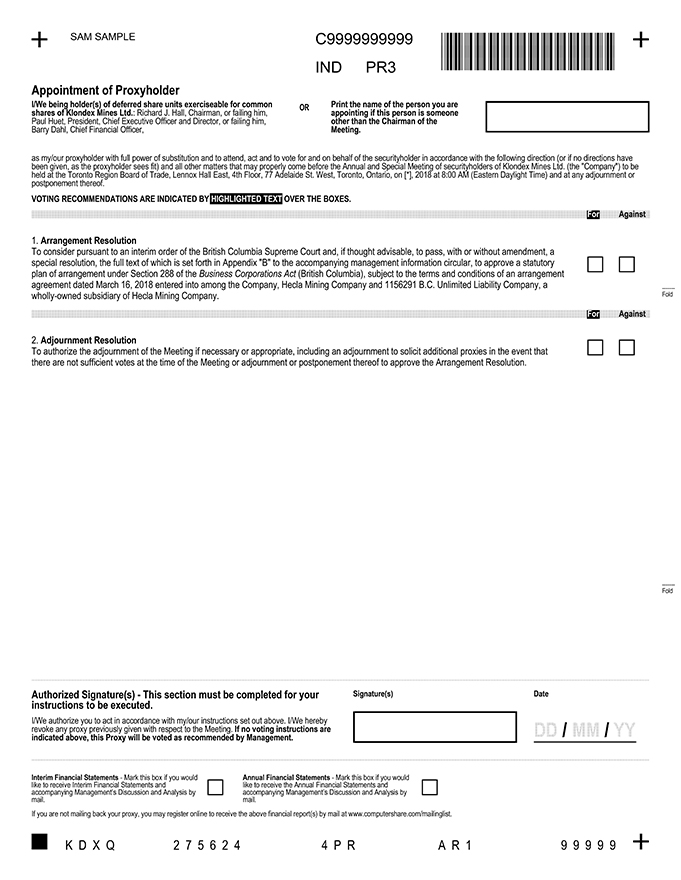

At the Meeting, Klondex Securityholders will be asked, among other things, to consider and vote on a special resolution (the “Arrangement Resolution”) approving a statutory plan of arrangement (the “Plan of Arrangement”) pursuant to Section 288 of the Business Corporations Act (British Columbia) (the “Arrangement”), subject to the terms and conditions of an arrangement agreement (the “Arrangement Agreement”) dated March 16, 2018 entered into among Klondex, Hecla Mining Company (“Hecla”) and 1156291 B.C. Unlimited Liability Company (“Hecla Acquisition Subco”), a wholly-owned subsidiary of Hecla. Under the terms of the Arrangement Agreement, Hecla Acquisition Subco will acquire all of the outstanding Klondex Shares (including Klondex Shares issued to holders of In-the-Money Klondex Options (as defined herein) and Klondex RSUs pursuant to the Arrangement), and Klondex Shareholders will receive, for each Klondex Share, consideration as set out in the Plan of Arrangement (the “Arrangement Consideration”) consisting of: (i) the equivalent of US$2.47 in either cash, shares of Hecla common stock (“Hecla Shares”), or a combination of cash and Hecla Shares (the “Hecla Consideration”); plus (ii) 0.125 of a share (the “Havilah Shares”) of Havilah Mining Corporation (“Havilah”), a new company formed to hold Klondex’s Canadian assets.

With respect to the Hecla Consideration described in (i) above, Klondex Shareholders, Klondex Optionholders and Klondex RSU Holders may elect to receive, for each Klondex Share, either: (i) US$2.47 in cash (subject to proration) (the “Cash Consideration”); (ii) 0.6272 of a Hecla Share (subject to proration) (the “Share Consideration”); or (iii) US$0.8411 in cash and 0.4136 of a Hecla Share (the “Combination Consideration”). The Cash Consideration and the Share Consideration are subject to proration, as more particularly provided for in the Plan of Arrangement. Klondex Shareholders, Klondex Optionholders and Klondex RSU Holders who do not elect, or fail to properly elect, to receive either the Cash Consideration or the Share Consideration will be deemed to have elected to receive the Combination Consideration. Klondex Shareholders, Klondex Optionholders and Klondex RSU Holders who elect, or are deemed to elect, to receive the Combination Consideration will not be subject to proration. If all Klondex Shareholders, Klondex Optionholders and Klondex RSU Holders elect to receive the Cash Consideration or, alternatively, all Klondex Shareholders, Klondex Optionholders and Klondex RSU Holders elect to receive the Share Consideration, then under the proration provisions in the Plan of Arrangement, each Klondex Shareholder, Klondex Optionholder and Klondex RSU Holder would be entitled to receive, for each Klondex Share, US$0.8411 in cash and 0.4136 of a Hecla Share, in addition to 0.125 of a Havilah Share, for each Klondex Share.

Under the Arrangement, each: (a) option to acquire Klondex Shares (a “Klondex Option”) that is outstanding immediately prior to the effective time of the Arrangement and is “in-the-money” (an “In-the-Money Klondex Option”); (b) right to receive a Klondex Share awarded under the Share Incentive Plan dated May 9, 2013 of the Company or time-based restricted share unit awarded under the Share Option and Restricted Share Unit Plan dated May 13, 2016 of the Company which is outstanding immediately prior to the effective time

- i -

Table of Contents

of the Arrangement, whether or not vested (a “Klondex RSU”); and (c) deferred share unit (a “Klondex DSU”) issued under the Deferred Share Unit Plan dated May 13, 2016 of the Company which is outstanding immediately prior to the effective time of the Arrangement, will be exchanged for Klondex Shares or cash, as applicable, pursuant to the Plan of Arrangement. Under the Arrangement, each Performance RSU (as such term is defined in the Share Option and Restricted Share Unit Plan dated May 13, 2016 of the Company) will be settled by a cash payment to the holder thereof on the effective date of the Arrangement of an amount determined by Hecla to be properly due to such holder based on the terms of such Performance RSU.

The Independent Committee (as defined in the accompanying management information circular for the Meeting (the “Circular”)) and the board of directors of the Company (the “Klondex Board”) have unanimously determined that the Arrangement is in the best interests of the Company and that the Arrangement is fair to the Klondex Securityholders, and the Klondex Board has authorized the submission of the Arrangement Resolution to the Klondex Securityholders for their approval at the Meeting. The Klondex Board has unanimously determined to recommend to Klondex Securityholders that they vote FOR the Arrangement Resolution to approve the Arrangement. All of the directors and senior officers of the Company have entered into agreements with Hecla to support the Arrangement. In addition, two institutional Klondex Shareholders, exercising beneficial ownership or control over an aggregate of 23.60% of the outstanding Klondex Shares, have entered into agreements with Hecla agreeing to vote, or cause to be voted, all of the Klondex Shares that each such shareholder exercises control over in favour of the Arrangement Resolution. In reaching its conclusion that the Arrangement is fair to Klondex Securityholders and that the Arrangement is in the best interests of the Company, the Klondex Board considered and relied upon a number of factors and reasons, including those described under the headings “Part 7 – The Arrangement – Background to the Arrangement”, “Part 7 – The Arrangement – Reasons for the Arrangement” and “Part 7 – The Arrangement – Fairness Opinions” of the Circular.

To become effective, the Arrangement Resolution must be approved by at least two-thirds (66 2⁄3%) of the votes cast at the Meeting in person or by proxy by: (i) Klondex Shareholders; and (ii) Klondex Securityholders voting together as a single class. The Arrangement is also subject to certain other conditions, including the approval of the British Columbia Supreme Court.

In addition, at the Meeting, Klondex Shareholders will, among other things, be asked to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution to approve a share option plan for Havilah (the “Havilah Option Plan Resolution”), as more particularly described in the accompanying Circular, provided that such resolution shall not become effective unless the Arrangement becomes effective. The Klondex Board, after consultation with its legal counsel, has unanimously determined to recommend to Klondex Shareholders that they vote FOR the Havilah Option Plan Resolution.

To become effective, the Havilah Option Plan Resolution must be approved by at least a simple majority of the votes cast by the Klondex Shareholders who vote in person or by proxy at the Meeting.

The accompanying notice of annual and special meeting and Circular describe the Arrangement and include certain additional information to assist you in considering how to vote on the Arrangement Resolution. You are urged to read this information carefully and, if you require assistance, to consult your financial, legal, tax or other professional advisors.

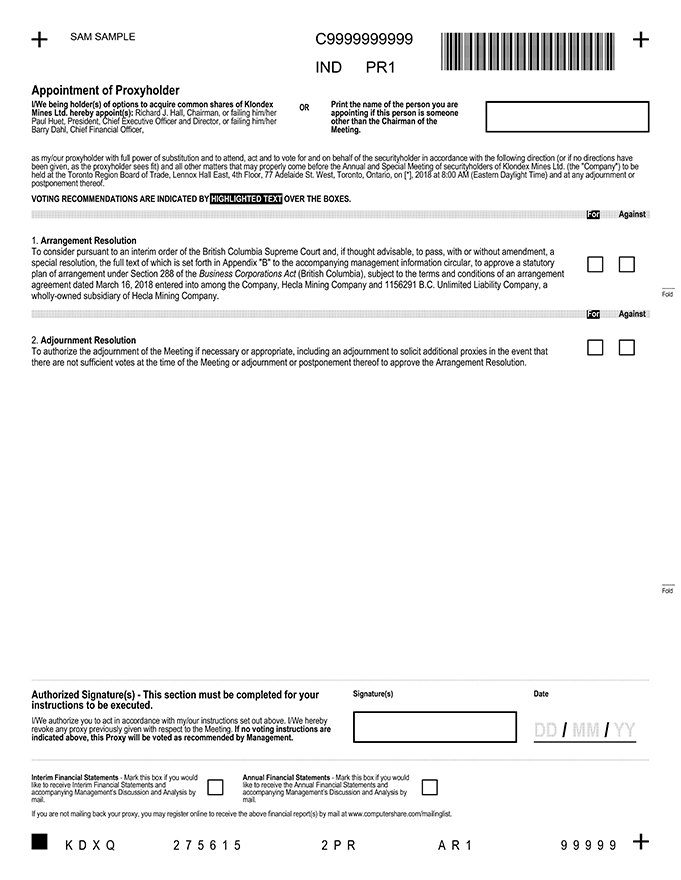

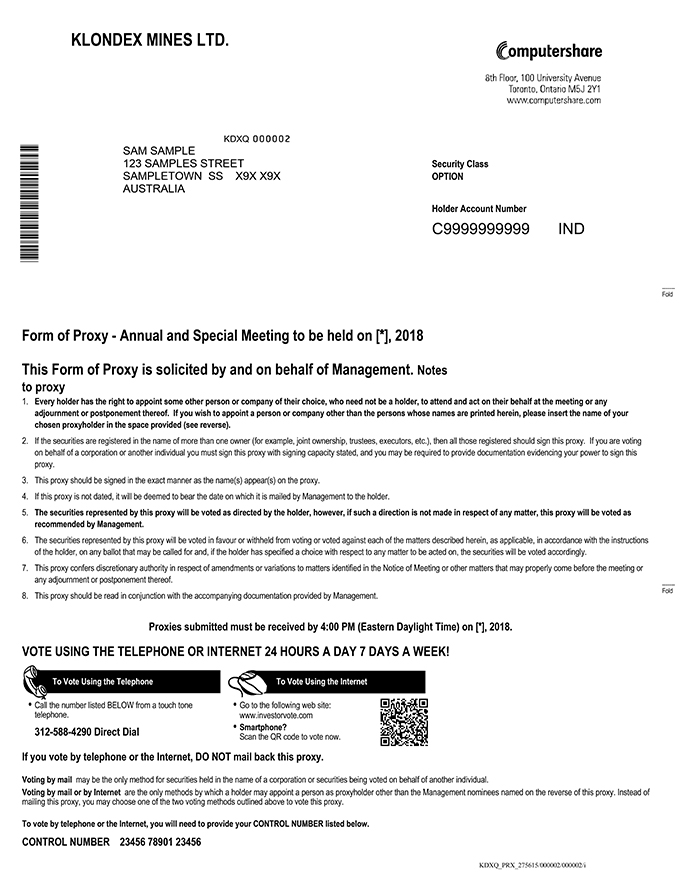

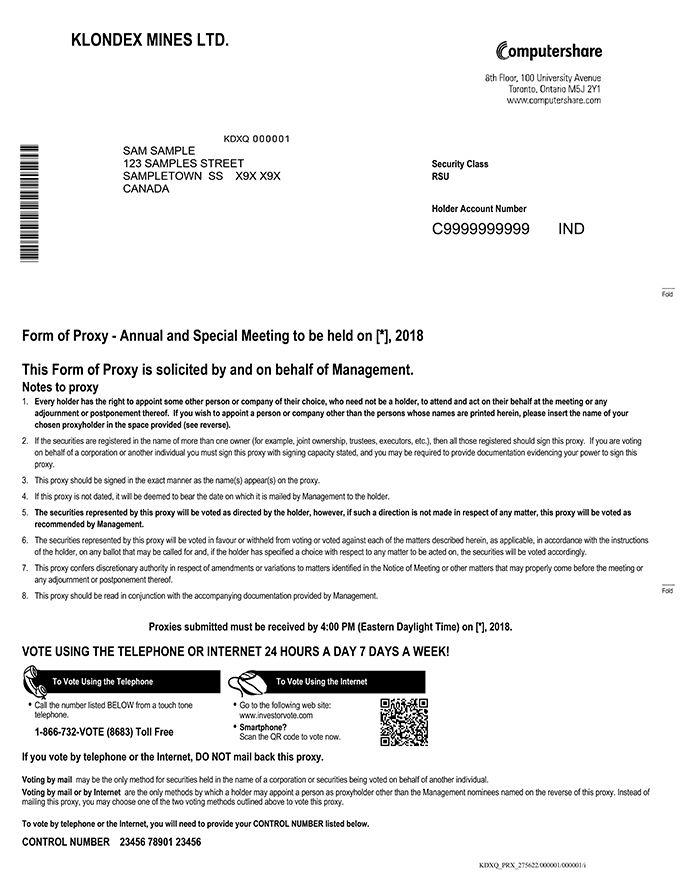

Your vote is important regardless of the number of Klondex Shares, Klondex Options, Klondex RSUs or Klondex DSUs (collectively, the “Affected Securities”) that you own. Even if you are a registered holder of Affected Securities and plan to attend the Meeting in person, we encourage you to take the time now to follow the instructions on the enclosed forms of proxy so that your Affected Securities can be voted at the Meeting in accordance with your instructions. We encourage you to use the internet or telephone voting options to ensure your vote is received prior to the voting deadline. Alternatively, you can complete, sign, date and return the enclosed form by mail or fax. Registered holders of Klondex Shares are asked to complete the form of proxy printed on green paper, registered holders of Klondex Options are asked to complete the form of proxy

- ii -

Table of Contents

printed on pink paper, registered holders of Klondex RSUs are asked to complete the form of proxy printed on blue paper and registered holders of Klondex DSUs are asked to complete the form of proxy printed on yellow paper. If you hold more than one type of Affected Security, you will need to complete the applicable form of proxy for each of the different types of Affected Securities held by you.

If you hold your Affected Securities through a broker, trustee, financial institution or other intermediary, you will receive instructions from such intermediary, or Computershare Investor Services Inc. on the intermediary’s behalf, on how to vote your Affected Securities. We encourage non-registered holders of Affected Securities to carefully follow such instructions so that your Affected Securities can be voted at the Meeting.

If you are a registered holder of Klondex Shares, we encourage you to complete, sign, date and return the enclosed Letter of Transmittal and Election Form (printed on white paper), along with the share certificate(s) representing your Klondex Shares, to the Company’s depositary, Computershare Investor Services Inc., at the address specified in the Letter of Transmittal and Election Form. If you are a holder of Klondex Options or Klondex RSUs, we encourage you to complete, sign, date and return the enclosed Option/RSU Election Form (printed on grey paper) to the Company’s depositary, Computershare Investor Services Inc., at the address specified in the Option/RSU Election Form. If you are a registered holder of Klondex Shares as well as Klondex Options and/or Klondex RSUs, you will have to submit both the Letter of Transmittal and Election Form (printed on white paper) as it relates to your Klondex Shares and the Option/RSU Election Form (printed on grey paper) as it relates to your Klondex Options and/or Klondex RSUs.

The Letter of Transmittal and Election Form and the Option/RSU Election Form (together, the “Election Document(s)”) each contain other procedural information relating to the Arrangement and should be reviewed carefully. It is recommended that you complete, sign and return the applicable Election Document(s) (with accompanying Klondex Share certificate(s) if you are a registered holder of Klondex Shares) to Computershare Investor Services Inc., the Company’s depositary, as soon as possible.

To make a valid election as to the Hecla Consideration that you wish to receive under the Arrangement (subject to proration), you must sign and make a proper election in the applicable Election Document(s) and return it (with accompanying Klondex Share certificate(s) if you are a registered holder of Klondex Shares) to the Company’s depositary, Computershare Investor Services Inc., prior to 1:00 p.m. (Pacific Daylight Time) / 4:00 p.m. (Eastern Daylight Time) on [●], 2018 or such later date as may be determined and published in accordance with the Arrangement Agreement (the “Election Deadline”). IF YOU FAIL TO MAKE A PROPER ELECTION PRIOR TO THE ELECTION DEADLINE, YOU WILL BE DEEMED TO HAVE ELECTED TO RECEIVE THE COMBINATION CONSIDERATION IN RESPECT OF EACH KLONDEX SHARE, KLONDEX OPTION AND KLONDEX RSU, AS APPLICABLE.

Subject to obtaining court approval and satisfying certain other conditions, including the approval of Klondex Securityholders, it is anticipated that the Arrangement will be completed in the second quarter of 2018, but no later than July 16, 2018 unless otherwise agreed to between Klondex and Hecla.

Completion of the Arrangement or approval of the Arrangement Resolution is not conditional upon the approval of the Havilah Option Plan Resolution.

If you have any questions or need assistance in your consideration of the Arrangement or with the completion and delivery of your proxy, please contact the Company’s proxy solicitation agent, D.F. King & Co., Inc., by telephone at 1(800) 330-8705 (toll-free in North America) or 1(212) 771-1133 (collect call outside North America), or by email at inquiries@dfking.com.

- iii -

Table of Contents

On behalf of the Klondex Board, I would like to thank all Klondex Securityholders for their ongoing support as we prepare to take part in this important event in the Company’s history.

Sincerely,

On behalf of the Board of Directors,

(Signed) “Paul Huet”

Paul Huet

Director, President and Chief Executive Officer

Klondex Mines Ltd.

- iv -

Table of Contents

KLONDEX MINES LTD.

1055 West Hastings Street, Suite 2200

Vancouver, British Columbia V6E 2E9

NOTICE OF ANNUAL AND SPECIAL MEETING

OF SECURITYHOLDERS

NOTICE is hereby given that the annual and special meeting (the “Meeting”) of the holders (“Klondex Shareholders”) of common shares (“Klondex Shares”) of Klondex Mines Ltd. (the “Company” or “Klondex”), holders of options to acquire Klondex Shares (“Klondex Options”), holders of certain rights to receive Klondex Shares (“Klondex RSUs”) and holders of deferred share units of Klondex (“Klondex DSUs”) (collectively, the “Klondex Securityholders” and the Klondex Shares, Klondex Options, Klondex RSUs and Klondex DSUs, collectively, the “Affected Securities”) will be held at the Toronto Region Board of Trade, Lennox Hall East, 4th Floor, 77 Adelaide St. West, Toronto, Ontario on [●], 2018 at [8:00 a.m. (Eastern Daylight Time)], for the following purposes:

| 1. | To consider pursuant to an interim order of the British Columbia Supreme Court dated [●], 2018 (the “Interim Order”) and, if thought advisable, to pass, with or without amendment, a special resolution of the Klondex Securityholders (the “Arrangement Resolution”), the full text of which is set forth in Appendix “B” to the accompanying management information circular (the “Circular”), to approve a statutory plan of arrangement (the “Plan of Arrangement”) under Section 288 of the Business Corporations Act (British Columbia) (the “BCBCA”) (the “Arrangement”), subject to the terms and conditions of an arrangement agreement dated March 16, 2018 entered into among Klondex, Hecla Mining Company (“Hecla”) and 1156291 B.C. Unlimited Liability Company, a wholly-owned subsidiary of Hecla. |

| 2. | To consider and, if thought advisable, to pass, with or without amendment, an ordinary resolution of the Klondex Shareholders, the full text of which is set forth in Appendix “N” to the Circular, approving a share option plan for Havilah Mining Corporation (the “Havilah Option Plan Resolution”), all as more particularly set forth in the Circular, provided that such resolution shall not become effective unless the Arrangement becomes effective. |

| 3. | For Klondex Shareholders to elect directors of the Company for the ensuing year (or, if the Arrangement Resolution is approved and the Arrangement is completed, for the period up to the effective time of the Arrangement). |

| 4. | For Klondex Shareholders to receive the audited consolidated financial statements of the Company for the year ended December 31, 2017 and the report of the auditors thereon. |

| 5. | For Klondex Shareholders to appoint the auditors of the Company for the ensuing year and to authorize the directors of the Company to fix their remuneration. |

| 6. | For Klondex Shareholders to consider and, if deemed appropriate, to pass, with or without variation, a non-binding advisory resolution of the Klondex Shareholders on the Company’s approach to executive compensation. |

| 7. | For Klondex Securityholders to authorize the adjournment of the Meeting if necessary or appropriate, including an adjournment to solicit additional proxies in the event that there are not sufficient votes at the time of the Meeting or adjournment or postponement thereof to approve the Arrangement Resolution (the “Adjournment Resolution”). |

| 8. | To transact such further and other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

Completion of the Arrangement or approval of the Arrangement Resolution is not conditional upon the approval of any of items 2 to 6 above.

The directors of the Company have fixed the close of business on May 15, 2018 as the record date (the “Record Date”) for the determination of the Klondex Securityholders entitled to receive this notice of the

- i -

Table of Contents

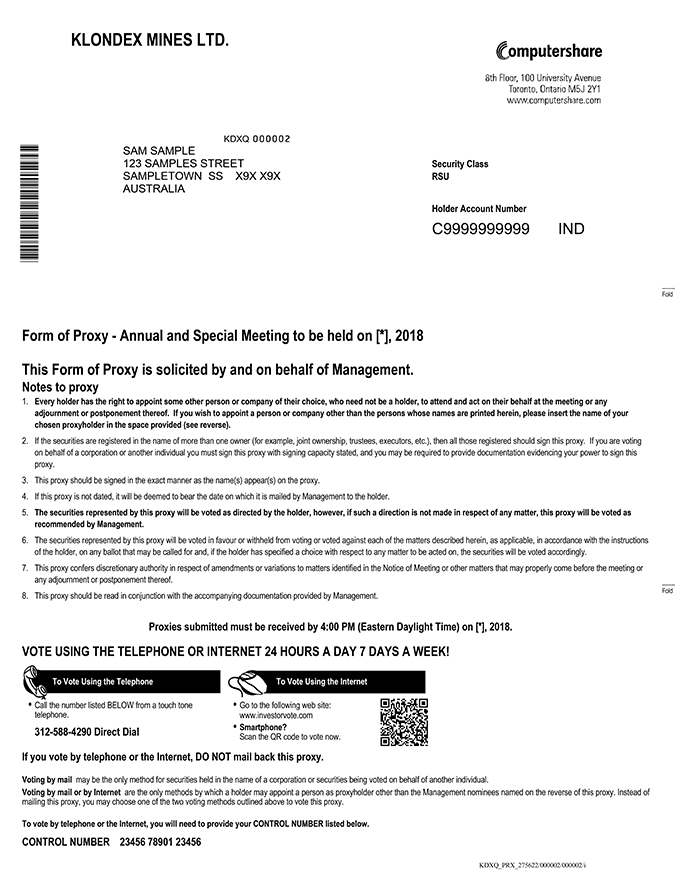

Meeting (this “Notice of Meeting”). A Klondex Securityholder wishing to be represented by proxy at the Meeting or any adjournment thereof must deposit his, her or its duly executed form of proxy with the Company’s transfer agent and registrar, Computershare Investor Services Inc., by mail at 3rd Floor, 510 Burrard Street, Vancouver, British Columbia, V6C 3B9, Attention: Proxy Department, or by facsimile to (416) 263-9524 or 1(866) 249-7775, not later than 4:00 p.m. (Eastern Daylight Time) on [●], 2018 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting. A Klondex Securityholder may also vote by telephone or via the internet by following the instructions on the applicable form of proxy. If a Klondex Securityholder votes by telephone or via the internet, completion or return of the form of proxies is not needed. Registered holders of Klondex Shares are asked to complete the form of proxy printed on green paper, registered holders of Klondex Options are asked to complete the form of proxy printed on pink paper, registered holders of Klondex RSUs are asked to complete the form of proxy printed on blue paper and registered holders of Klondex DSUs are asked to complete the form of proxy printed on yellow paper. If you hold more than one type of Affected Security, you will need to complete the applicable form of proxy for each of the different types of Affected Securities held by you.

If you are a non-registered Klondex Securityholder, please refer to “Part 5 – General Proxy Information – Non-Registered Klondex Securityholders” of the Circular for information on how to vote your Klondex Shares, Klondex Options, Klondex RSUs or Klondex DSUs, as applicable.

Take notice that, pursuant to the Interim Order, each registered Klondex Shareholder as of the Record Date has been granted the right to dissent in respect of the Arrangement Resolution and, if the Arrangement becomes effective, to be paid the fair value of the Klondex Shares in respect of which such registered Klondex Shareholder validly dissents, in accordance with the dissent procedures contained in Division 2 of Part 8 of the BCBCA, as modified and supplemented by the Interim Order, the Plan of Arrangement (as defined in the Circular) and the Final Order (as defined in the Circular). To exercise such right: (a) a written notice of dissent with respect to the Arrangement Resolution from the registered Klondex Shareholder must be received by Klondex at its address for such purpose, c/o Bennett Jones LLP at 3400 One First Canadian Place, P.O. Box 130, Toronto, Ontario, M5X 1A4, Attention: [●], by no later than 4:00 p.m. (Eastern Daylight Time) on [●], 2018, or two business days prior to any adjournment or postponement of the Meeting; (b) the registered Klondex Shareholder must not have voted in favour of the Arrangement Resolution; and (c) the registered Klondex Shareholder must have otherwise complied with the dissent procedures in Division 2 of Part 8 of the BCBCA, as modified and supplemented by the Interim Order, the Plan of Arrangement and the Final Order. The right to dissent is described in the Circular, and the text of each of the Plan of Arrangement, the Interim Order and Division 2 of Part 8 of the BCBCA is set forth in Appendix “E”, Appendix “F” and Appendix “H”, respectively, to the Circular.

Failure to strictly comply with the provisions of the BCBCA, as modified and supplemented by the Plan of Arrangement, the Interim Order and the Final Order, may result in the loss of any right of dissent.

The Circular accompanying this Notice of Meeting is incorporated into, and shall be deemed to form part of, this Notice of Meeting.

DATED as of the [●] day of [●], 2018.

By Order of the Board of Directors

(signed) “Paul Huet”

Paul Huet

Director, President and Chief Executive Officer

Klondex Mines Ltd.

ii

Table of Contents

| FREQUENTLY ASKED QUESTIONS ABOUT THE ARRANGEMENT AND THE MEETING |

5 | |||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| PART 3. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION |

19 | |||

| 21 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 59 | ||||

| 63 | ||||

| 63 | ||||

| 63 | ||||

| 64 | ||||

| 64 | ||||

| 64 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| MI 61-101 Protection of Minority Security Holders in Special Transactions |

69 | |||

| 70 | ||||

| 70 | ||||

| 71 | ||||

| 71 | ||||

| 72 | ||||

| Effects of the Arrangement on Klondex Securityholders’ Rights |

72 | |||

| 72 | ||||

| 72 | ||||

| 73 | ||||

| 73 | ||||

- 1 -

Table of Contents

| 75 | ||||

| 79 | ||||

| 80 | ||||

| 81 | ||||

| 84 | ||||

| 87 | ||||

| 89 | ||||

| 92 | ||||

| 98 | ||||

| 101 | ||||

| 102 | ||||

| 103 | ||||

| 106 | ||||

| 106 | ||||

| 107 | ||||

| 108 | ||||

| PART 13. STOCK EXCHANGE DE-LISTING AND REPORTING ISSUER STATUS |

109 | |||

| 110 | ||||

| 113 | ||||

| 117 | ||||

| 117 | ||||

| 118 | ||||

| 119 | ||||

| 120 | ||||

| 121 | ||||

| PART 18. CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS |

129 | |||

| 129 | ||||

| U.S. Federal Income Tax Consequences of the Arrangement to U.S. Holders |

131 | |||

| 134 | ||||

| 134 | ||||

| Additional Considerations Relevant to U.S. Holders of Havilah Shares |

139 | |||

| U.S. Federal Income Tax Consequences to Non-U.S. Holders Related to the Arrangement |

141 | |||

| 142 | ||||

| Additional Considerations Relevant to Non-U.S. Holders of Hecla Shares |

143 | |||

| 144 | ||||

| 145 | ||||

| 145 | ||||

| 147 | ||||

| 147 | ||||

| 148 | ||||

| Financial Statements and Management’s Discussion and Analysis |

162 | |||

| 162 | ||||

- 2 -

Table of Contents

| 163 | ||||

| 163 | ||||

| 163 | ||||

| 163 | ||||

| 164 | ||||

| 164 | ||||

| 165 | ||||

| 165 | ||||

| 165 | ||||

| Unaudited Pro Forma Condensed Combined Financial Information |

165 | |||

| 165 | ||||

| 165 | ||||

| 166 | ||||

| 166 | ||||

| 166 | ||||

| 169 | ||||

| 170 | ||||

| 171 | ||||

| 172 | ||||

| 172 | ||||

| PART 28. INFORMATION CONCERNING THE BOARD OF DIRECTORS AND EXECUTIVE OFFICERS |

172 | |||

| 172 | ||||

| 175 | ||||

| 176 | ||||

| 177 | ||||

| 177 | ||||

| 188 | ||||

| 189 | ||||

| 191 | ||||

| Securities Authorized for Issuance Under Equity Compensation Plans |

195 | |||

| 195 | ||||

| 200 | ||||

| 200 | ||||

| 201 | ||||

| 202 | ||||

| 202 | ||||

| 203 | ||||

| 203 | ||||

| 203 | ||||

| 203 | ||||

| 213 | ||||

| PART 32. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

218 | |||

| 221 | ||||

| 221 | ||||

| 221 | ||||

- 3 -

Table of Contents

| 222 | ||||

| 222 | ||||

| 222 | ||||

| 224 | ||||

| 225 | ||||

| 225 | ||||

| Compensation and Governance Committee Interlocks and Insider Participation |

227 | |||

| 227 | ||||

| 227 | ||||

| 228 | ||||

| 228 | ||||

| 228 | ||||

| 229 | ||||

| 229 | ||||

| 230 | ||||

| 230 | ||||

| 231 | ||||

| 231 | ||||

| PART 35. INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS |

231 | |||

| PART 36. INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON |

232 | |||

| PART 37. KLONDEX SHAREHOLDER COMMUNICATION WITH THE KLONDEX BOARD |

232 | |||

| 232 | ||||

| 233 | ||||

| 233 | ||||

| 233 | ||||

| 233 | ||||

| 235 | ||||

| 236 | ||||

| 237 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

| D-1 | ||||

| E-1 | ||||

| F-1 | ||||

| G-1 | ||||

| H-1 | ||||

| I-1 | ||||

| APPENDIX “J” CARVE OUT U.S. GAAP FINANCIAL STATEMENTS OF HAVILAH |

J-1 | |||

| K-1 | ||||

| APPENDIX “L” PRO FORMA FINANCIAL STATEMENTS OF THE COMBINED COMPANY |

L-1 | |||

| M-1 | ||||

| N-1 | ||||

| APPENDIX “O” COMPARISON OF SHAREHOLDER RIGHTS BETWEEN HECLA AND KLONDEX |

O-1 | |||

| P-1 | ||||

- 4 -

Table of Contents

FREQUENTLY ASKED QUESTIONS ABOUT THE ARRANGEMENT AND THE MEETING

The following are some questions that you, as a Klondex Securityholder, may have relating to the Meeting and answers to those questions. These questions and answers do not provide all of the information relating to the Meeting or the matters to be considered at the Meeting and are qualified in their entirety by the more detailed information contained elsewhere in, or incorporated by reference into, this Circular. You are urged to read this Circular in its entirety including the appendices to this Circular, any documents incorporated by reference herein, the forms of proxy and the applicable Election Document(s) before making a decision related to your Affected Securities. All capitalized terms used but not defined herein have the meanings ascribed to them in the “Glossary of Terms” at Appendix “A” of this Circular.

| Q: | What am I voting on? |

| A: | In connection with the Meeting, Klondex Securityholders are being asked to consider and vote on the Arrangement Resolution which, if approved and if the Arrangement is completed, will result in: (i) Hecla, through its wholly-owned subsidiary Hecla Acquisition Subco, acquiring all of the issued and outstanding Klondex Shares (including Klondex Shares issued to holders of In-the-Money Klondex Options and Klondex RSUs pursuant to the Arrangement); and (ii) Klondex Shareholders (other than Dissenting Shareholders) receiving the Arrangement Consideration for each Klondex Share held by them. |

In addition, Klondex Shareholders will be asked to vote on the Havilah Option Plan Resolution which, if approved, will become effective when the Arrangement becomes effective. Completion of the Arrangement or approval of the Arrangement Resolution is not conditional upon the approval of the Havilah Option Plan Resolution.

In connection with the Meeting, Klondex Shareholders also are being asked to approve certain other matters, including the election of the directors of the Company, the appointment of auditors of the Company and a non-binding advisory resolution on the Company’s approach to executive compensation and such other business that may properly come before the Meeting. In addition to the Arrangement Resolution, Klondex Securityholders are being asked to approve the adjournment of the Meeting if necessary or appropriate, including for purposes of soliciting additional proxies to approve the Arrangement Resolution.

| Q: | When and where is the Meeting? |

| A: | The Meeting will be held at the Toronto Region Board of Trade, Lennox Hall East, 4th Floor, 77 Adelaide St. West, Toronto, Ontario on [●], 2018 at [8:00 a.m. (Eastern Daylight Time)]. |

| Q: | What constitutes a quorum for the Meeting? |

| A: | A quorum for the transaction of business at the Meeting is the presence of one person who holds, or who represents by proxy one or more Klondex Shareholders who hold, in the aggregate, at least 5% of the issued and outstanding Klondex Shares entitled to be voted at the Meeting. |

| Q: | Who is soliciting my proxy? |

| A: | Your proxy is being solicited by senior management of Klondex. This Circular is furnished in connection with that solicitation. While it is anticipated that solicitation of proxies for the Meeting will be made primarily by mail, proxies may be solicited personally or by telephone by the directors and regular employees of Klondex at nominal cost paid by Klondex. In addition, Klondex has engaged D.F. King as Proxy Solicitation Agent in connection with the Meeting. |

If you have questions or need assistance completing your form of proxy or voting instruction form, please contact the Company’s Proxy Solicitation Agent, D.F. King, by telephone at 1(800) 330-8705 (toll-free in North America) or 1(212) 771-1133 (collect call outside North America), or by email at inquiries@dfking.com.

- 5 -

Table of Contents

| Q: | What is the recommendation of the Klondex Board with respect to the Arrangement Resolution? |

| A: | After taking into consideration, among other things, the merits of the Arrangement, the Fairness Opinions and the unanimous recommendation of the Independent Committee, the Klondex Board has concluded that the Arrangement is in the best interests of Klondex and fair to the Klondex Securityholders, and unanimously recommends that Klondex Securityholders vote FOR the Arrangement Resolution to approve the Arrangement. |

| Q: | Why is the Klondex Board making this recommendation? |

| A: | In reaching its conclusion that the Arrangement is fair to Klondex Securityholders and that the Arrangement is in the best interests of Klondex, the Klondex Board considered and relied upon a number of factors and reasons, including those described under the headings “Part 7 – The Arrangement – Background to the Arrangement”, “Part 7 – The Arrangement – Reasons for the Arrangement”, “Part 7 – The Arrangement – Fairness Opinions”, “Part 9 – Opinion of Maxit Capital” and “Part 10 – Opinion of GMP Securities” of this Circular. |

| Q: | What is the recommendation of the Klondex Board with respect to the Havilah Share Option Resolution? |

| A: | At the request of the proposed directors of Havilah, and after taking into consideration, among other things, the role a stock option plan or similar share incentive plan plays in the motivation, attraction and retention of key employees, directors and consultants of Havilah due to the opportunity offered to them to acquire a proprietary interest in Havilah, and after consultation with its legal counsel, the Klondex Board has unanimously determined to recommend to Klondex Shareholders that they vote FOR the Havilah Option Plan Resolution. |

| Q: | Have the Klondex Directors and officers of Klondex entered into Klondex Voting Agreements or Klondex Support Agreements? |

| A. | Yes. Hecla has entered into a Klondex Voting Agreement or a Klondex Support Agreement with each of the Klondex Directors and the officers of Klondex. Hecla has entered into Klondex Voting Agreements with each of William Matlack, Blair Schultz, Paul Huet, Richard Hall, Barry Dahl, James Haggarty and Rodney Cooper, pursuant to which each of the aforementioned Klondex Directors and officers of Klondex has agreed to, among other things, support the Arrangement and to vote their Klondex Shares and Other Affected Securities (including any Klondex Shares issued upon the exercise or exchange of any Other Affected Securities) in favour of the Arrangement Resolution. Additionally, Hecla has entered into Klondex Support Agreements with each of Brian Morris, Charles Oliver, John Antwi, Mark Daniel and Michael Doolin, pursuant to which each of the aforementioned Klondex Directors and officers of Klondex has agreed to, among other things, cooperate with Klondex and Hecla to successfully complete the Arrangement. |

One of the directors of Klondex who has entered into a Klondex Voting Agreement intends to pledge his Klondex Shares to a third party lender for personal financial planning purposes. The director will still have complete control and direction over voting of the Klondex Shares and will continue to be subject to the Klondex Voting Agreement.

As of the Record Date, 6,897,535 of the 185,152,053 outstanding Affected Securities were held by Klondex Directors or officers of Klondex that were subject to Klondex Voting Agreements and Klondex Support Agreements, representing approximately 3.73% of the votes which may be cast by Klondex Securityholders at the Meeting.

| Q: | Have any institutional shareholders entered into Klondex Support Letter Agreements? |

| A. | Yes. Hecla has entered into Klondex Support Letter Agreements with two institutional Klondex Shareholders. The Klondex Support Letter Agreements entered into by the two institutional Klondex |

- 6 -

Table of Contents

| Shareholders set forth, among other things, their agreement to support the Arrangement and to vote, or cause to be voted, any Klondex Shares that such Klondex Shareholder exercises beneficial control over in favour of the Arrangement Resolution. |

As of the Record Date, 42,495,259 of the 180,079,072 outstanding Klondex Shares were subject to the Klondex Support Letter Agreements with voting requirements, representing approximately 23.60% of the votes which may be cast by Klondex Securityholders at the Meeting.

| Q: | What is the recommendation of the Klondex Board with respect to the other matters to be approved at the Meeting? |

| A: | The Klondex Board unanimously recommends that Klondex Shareholders vote FOR each of the other proposals set forth in this Circular, including the election of the directors of the Company, the appointment of auditors of the Company, a non-binding advisory resolution on the Company’s approach to executive compensation, the adjournment of the Meeting if necessary or appropriate, including for purposes of soliciting additional proxies to approve the Arrangement Resolution, and such other business that may properly come before the Meeting. |

| Q: | Who can attend and vote at the Meeting? |

| A: | Only Klondex Securityholders of record as of the close of business on May 15, 2018, being the Record Date for the Meeting, are entitled to receive notice of and to attend, and vote at, the Meeting or any adjournment(s) or postponement(s) of the Meeting. Registered holders of Klondex Shares will be entitled to vote with respect to all matters at the Meeting, whereas registered holders of Other Affected Securities will only be entitled to vote at the Meeting with respect to the Arrangement Resolution and the Adjournment Resolution, and not with respect to any other matters at the Meeting. |

| Q: | How many Affected Securities are entitled to be voted? |

| A: | As of the Record Date, there were 180,079,072 Klondex Shares entitled to be voted at the Meeting. Each Klondex Shareholder is entitled to one vote for each Klondex Share held by such holder in respect of all matters at the Meeting. In addition, as of the Record Date, there were 3,695,604 Klondex Options outstanding, 1,017,011 Klondex RSUs outstanding, and 360,366 Klondex DSUs outstanding. Pursuant to the Interim Order, each Klondex Option, Klondex RSU and Klondex DSU carries one vote with respect to the vote on the Arrangement Resolution and the Adjournment Resolution. Klondex Options, Klondex RSUs and Klondex DSUs are not entitled to a vote on any matter at the Meeting other than the approval of the Arrangement Resolution and the Adjournment Resolution. |

| Q: | How do I vote if I am a Registered Klondex Securityholder? |

| A: | If you are a Registered Klondex Securityholder, you can vote your Affected Securities: |

| 1) | by voting in person at the Meeting; |

| 2) | by signing and returning the applicable enclosed proxy form by mail appointing the named persons or some other person you choose, who need not be a Klondex Securityholder, to represent you as proxyholder and vote your Affected Securities at the Meeting; |

| 3) | by telephone at 1(866) 732-VOTE (8683); or |

| 4) | via the internet at www.investorvote.com. |

| If you are a Registered Klondex Shareholder, you should complete the form of proxy printed on green paper. If you are a holder of Klondex Options, you should complete the form of proxy printed on pink paper. If you are a holder of Klondex RSUs, you should complete the form of proxy printed on blue paper. If you are a registered holder of Klondex DSUs, you should complete the form of proxy printed on yellow paper. If you hold more than one type of Affected Security, you will need to complete the applicable form of proxy for each of the different types of Affected Securities held by you. |

- 7 -

Table of Contents

| Q: | How do I vote if I am a Non-Registered Klondex Securityholder? |

| A: | If you are a Non-Registered Klondex Securityholder, you should receive voting instructions from your nominee. |

| Q. | If I am a Non-Registered Klondex Securityholder, can I vote in person at the Meeting? |

| A: | Yes. To vote in person at the Meeting, print your own name in the space provided on the applicable proxy form or the voting instruction form sent to you by your nominee and return it by following the instructions included. In doing so you are instructing your nominee to appoint you as a proxyholder. Please register with Klondex’s Transfer Agent and Registrar, Computershare Investor Services Inc., when you arrive at the Meeting as the Company has no access to the names of Non-Registered Klondex Securityholders; if you attend the meeting without following this procedure, the Company will have no record of your security holdings or entitlement to vote. |

| Q: | How do I vote if I am both a Registered Klondex Securityholder and a Non-Registered Klondex Securityholder? |

| A: | If you hold some Affected Securities as a Registered Klondex Securityholder and others as a Non-Registered Klondex Securityholder, you will have to use the separate voting methods described above, as applicable, for those of your Affected Securities for which you are a Registered Klondex Securityholder and for those of your Affected Securities for which you are a Non-Registered Klondex Securityholder. |

| Q: | What will I receive under the Arrangement if I am a Klondex Shareholder? |

| A: | Under the Arrangement, Klondex Shareholders will be entitled to receive, for each Klondex Share held: (i) the Hecla Consideration, as described in more detail below; and (ii) the Havilah Consideration, consisting of 0.125 of a Havilah Share (after giving effect to the Havilah Share Consolidation). For purposes of the following, references to Klondex Shareholders include holders of In-the-Money Klondex Options and Klondex RSUs who receive Klondex Shares pursuant to the Arrangement. |

With respect to the Hecla Consideration, Hecla has agreed to pay to each Klondex Shareholder the equivalent of US$2.47 per Klondex Share (based on the relative values of the Klondex Shares and Hecla Shares as at March 16, 2018). The Hecla Consideration to be received by each Klondex Shareholder will consist of either: (i) the Cash Consideration; (ii) the Share Consideration; or (iii) the Combination Consideration, depending on which form of Hecla Consideration the Klondex Shareholder elects to receive (or is deemed to have elected to receive), all as more particularly described below. Klondex Shareholders will be entitled to make an election as to the form of Hecla Consideration they wish to receive with respect to all, but not less than all, of their Klondex Shares. The actual Hecla Consideration received by a Klondex Shareholder will depend upon such Klondex Shareholder’s consideration election (or deemed election) and, in the case of Klondex Shareholders electing to receive the Cash Consideration or Share Consideration, on the effect of proration.

Klondex Shareholders who elect to receive the Combination Consideration will receive 0.4136 of a Hecla Share and US$0.8411 in cash for each Klondex Share held by them. Klondex Shareholders (other than Dissenting Shareholders) who do not elect to receive the Cash Consideration or the Share Consideration, or who fail to make a valid election as to the form of Hecla Consideration that they wish to receive, will be deemed to have elected to receive the Combination Consideration for each Klondex Share held by them. Klondex Shareholders who elect, or who are deemed to have elected, to receive the Combination Consideration will not be subject to any proration with respect to the cash and Hecla Shares to be received by them.

Set forth below is a summary description of the proration calculations arising as a result of the Maximum Cash Consideration and Maximum Shares Consideration that Hecla is required to deliver under the

- 8 -

Table of Contents

Arrangement. As a result of the maximums on both cash and Hecla Shares that Hecla is required to deliver under the Arrangement, along with the proration calculations that ensue from those maximums, it is likely that Klondex Shareholders who elect to receive either the Cash Consideration or the Share Consideration will end up receiving both cash and Hecla Shares, notwithstanding their election. If all Klondex Shareholders were to elect to receive either the Cash Consideration or the Share Consideration, then as a result of proration the Hecla Consideration received by each Klondex Shareholder would consist of 0.4136 of a Hecla Share and US$0.8411 in cash for each Klondex Share.

Klondex Shareholders who validly elect to receive the Cash Consideration will, subject to the proration mechanism described below, be entitled to receive US$2.47 in cash for each Klondex Share held by them. The Maximum Cash Consideration that Hecla is required to deliver under the Arrangement is US$157,410,417. The Maximum Cash Consideration will be allocated, first, to Klondex Shareholders who elect, or who are deemed to have elected, to receive the Combination Consideration, to the extent of US$0.8411 per Klondex Share. Consequently, Klondex Shareholders who elect to receive the Cash Consideration will only be entitled to receive the Cash Consideration in respect of each Klondex Share held by them if other Klondex Shareholders elect to receive the Share Consideration in respect of an equivalent or greater number of Klondex Shares. If the number of Klondex Shares in respect of which Klondex Shareholders elect to receive the Share Consideration is less than the number of Klondex Shares in respect of which Klondex Shareholders elect to receive the Cash Consideration, Klondex Shareholders who elect to receive the Cash Consideration will, instead of receiving US$2.47 in cash for each Klondex Share, receive a lesser amount of cash (which shall be not less than US$0.8411) and a portion of a Hecla Share (not exceeding 0.4136 of a Hecla Share) for each Klondex Share, all as more particularly provided for in the Plan of Arrangement. If all Klondex Shareholders validly elect to receive the Cash Consideration, or if no Klondex Shareholders elect to receive the Share Consideration, a Klondex Shareholder electing to receive the Cash Consideration would receive US$0.8411 in cash and 0.4136 of a Hecla Share for each Klondex Share held by them.

Klondex Shareholders who validly elect to receive the Share Consideration will, subject to the proration mechanism described below, be entitled to receive 0.6272 of a Hecla Share for each Klondex Share held by them. The Maximum Shares Consideration that Hecla is required to pay under the Arrangement is 77,411,859 Hecla Shares. The Maximum Shares Consideration will be allocated, first, to Klondex Shareholders who elect, or who are deemed to have elected, to receive the Combination Consideration, to the extent of 0.4136 of a Hecla Share per Klondex Share. Consequently, Klondex Shareholders who elect to receive the Share Consideration will only be entitled to receive the Share Consideration in respect of each Klondex Share held by them if other Klondex Shareholders elect to receive the Cash Consideration in respect of an equivalent or greater number of Klondex Shares. If the number of Klondex Shares in respect of which Klondex Shareholders elect to receive the Cash Consideration is less than the number of Klondex Shares in respect of which Klondex Shareholders elect to receive the Share Consideration, Klondex Shareholders who elect to receive the Share Consideration will, instead of receiving 0.6272 of a Hecla Share for each Klondex Share, receive a lesser portion of a Hecla Share (which shall not be less than 0.4136 of a Hecla Share) and cash (not exceeding US$0.8411) for each Klondex Share, all as more particularly provided for in the Plan of Arrangement. If all Klondex Shareholders validly elect to receive the Share Consideration, or if no Klondex Shareholders elect to receive the Cash Consideration, a Klondex Shareholder electing to receive the Share Consideration would receive US$0.8411 in cash and 0.4136 of a Hecla Share for each Klondex Share held by them.

To the extent the aggregate number of Hecla Shares or Havilah Shares that a Klondex Shareholder would otherwise be entitled to receive under the Arrangement includes a fractional share, the actual number of Hecla Shares or Havilah Shares, as applicable, to be received by the Klondex Shareholder will, without additional compensation, be rounded down to the nearest whole number of shares.

Any cash component of the Arrangement Consideration payable pursuant to the Arrangement that is less than one cent will be rounded down to the next whole cent.

- 9 -

Table of Contents

| Q: | What will I receive under the Arrangement if I am a Klondex Option, RSU or DSU Holder? |

| A: | Under the Arrangement: |

| (i) | each In-the-Money Klondex Option outstanding immediately prior to the Effective Time will be deemed to be unconditionally vested and transferred to Klondex in exchange for that number of Klondex Shares (rounded down to the nearest whole number) obtained by dividing (i) the In-the-Money Amount of such option, by (ii) the Company Share Value, while each Out-of-the-Money Klondex Option will be cancelled without any payment therefor; |

| (ii) | each Klondex RSU outstanding immediately prior to the Effective Time will be deemed to be assigned and transferred to Klondex in exchange for one Klondex Share for each such Klondex RSU; and |

| (iii) | each Klondex DSU outstanding immediately prior to the Effective Time will be cancelled in exchange for a cash payment equal to the Company Share Value, |

all as more particularly set out in the Plan of Arrangement.

Each holder of In-the-Money Klondex Options and/or Klondex RSUs who, pursuant to the Arrangement, receives Klondex Shares in exchange for their In-the-Money Klondex Options or Klondex RSUs, as applicable, will, pursuant to the Arrangement, be entitled to receive the Hecla Consideration and the Havilah Consideration for each such Klondex Share to the same extent as Klondex Shareholders (including making an election as to which form of Hecla Consideration they wish to receive).

Each Performance RSU will be settled by a cash payment to the holder thereof on the Effective Date of the Arrangement of an amount determined by Hecla to be properly due to such holder based on the terms of such Performance RSU.

| Q: | How do I elect which form of Hecla Consideration I would like to receive? |

| A: | Each Registered Klondex Shareholder will have the right to elect to receive the Cash Consideration (subject to proration), the Share Consideration (subject to proration), or the Combination Consideration in respect of all, but not less than all, of their Klondex Shares by delivering to the Depositary by the Election Deadline a duly completed Letter of Transmittal and Election Form (printed on white paper) specifying their election. |

Each holder of Klondex Options and/or Klondex RSUs will have the right to elect to receive the Cash Consideration (subject to proration), the Share Consideration (subject to proration), or the Combination Consideration in respect of all, but not less than all, of the Klondex Shares to be received by them upon the exchange of their In-the-Money Klondex Options or Klondex RSUs pursuant to the Arrangement, by delivering to the Depositary by the Election Deadline a duly completed Option/RSU Election Form (printed on grey paper) delivered specifying their election.

Non-Registered Klondex Securityholders should contact their broker, investment dealer or other Intermediary for instructions and assistance in making an election with respect to the form of Hecla Consideration they wish to receive.

If you fail to make a specific election by the Election Deadline, or the Depositary determines that your election was not properly made with respect to any Klondex Shares, Klondex Options or Klondex RSUs held by you, then you will be deemed to have elected to receive the Combination Consideration in respect of any such securities.

| Q: | Who is Hecla? |

| A: | Hecla is a reporting issuer in each of the provinces of Canada and its shares are registered under the U.S. Exchange Act. Hecla is a company incorporated under, and governed by, the Laws of the State of Delaware. The principal executive office of Hecla is located at 6500 North Mineral Drive, Suite 200, Coeur d’Alene, Idaho, 83815-9408, United States of America, and the telephone number is (208) 769-4100. |

Hecla is a U.S.-based precious and base metals mining company engaged in the exploration, acquisition, development, production and marketing of silver, gold, lead and zinc. In business since 1891, Hecla is

- 10 -

Table of Contents

among the oldest U.S.-based precious metals mining companies and one of the lowest-cost primary silver producers in North America. Hecla produces both metal concentrates, which it sells to smelters and brokers, and unrefined gold and silver precipitate and bullion bars (doré), which are sold as precipitate and doré, or are further refined before sale, to refiners and precious metals traders. Hecla has producing precious metals mining operations in Alaska, Idaho, Québec and Durango, Mexico and additional development and exploration projects in Alaska, Idaho, Canada and Mexico.

The Hecla Shares are listed for trading on the NYSE under the trading symbol “HL”.

| Q: | What vote is required at the Meeting to approve the Arrangement Resolution? |

| A: | The Arrangement Resolution must be approved by: (a) at least two-thirds (66 2⁄3%) of the votes cast at the Meeting by Klondex Shareholders present in person or represented by proxy and entitled to vote at the Meeting; and (b) at least two-thirds (66 2⁄3%) of the votes cast at the Meeting by Klondex Securityholders voting together as a single class, present in person or represented by proxy and entitled to vote at the Meeting. |

| Q. | What vote is required at the Meeting to approve the proposals at the Meeting, other than the Arrangement Resolution? |

| A: | With respect to the election of directors, directors are elected by a plurality of votes. This means nominees receiving the eight highest number of votes at the Meeting will be elected. However, Klondex has adopted a majority voting policy which stipulates that in an uncontested election, as is the case at this Meeting, any nominee for director who receives more “withhold” votes than “for” votes must tender his resignation to the Klondex Board. |

With respect to the appointment of auditors, the auditors are appointed by a plurality of votes. This means that auditors receiving the highest number of votes at the Meeting will be appointed.

To be effective, each of: (i) the Havilah Option Plan Resolution; and (ii) the proposal concerning “Say on Pay” must be approved by at least a simple majority of the votes cast at the Meeting by Klondex Shareholders, present in person or represented by proxy and entitled to vote at the Meeting.

To be effective, the Adjournment Resolution must be approved by at least a simple majority of the votes cast at the Meeting by Klondex Securityholders voting together as a single class, present in person or represented by proxy and entitled to vote at the Meeting.

See “Part 5 – General Proxy Information – Voting Standards” of this Circular.

| Q: | What if I return my proxy but do not mark it to show how I wish to vote? |

| A: | If your proxy relating to your Klondex Shares is signed and dated and returned without specifying your voting choice (or specifying both voting choices), then your Klondex Shares will be voted FOR: (a) the Arrangement Resolution in accordance with the recommendation of the Klondex Board; (b) the Havilah Option Plan Resolution; (c) the election of the nominated directors as set out on the form of proxy; (d) the appointment of PwC as the auditors of the Company for the ensuing year and authorizing the directors of the Company to fix their remuneration; (e) the non-binding advisory resolution on the Company’s approach to executive compensation; (f) the adjournment of the Meeting if necessary or appropriate, including an adjournment to solicit additional proxies in the event that there are not sufficient votes at the time of the Meeting or adjournment or postponement thereof to approve the Arrangement Resolution; and (g) the transaction of such further and other business as may properly come before the Meeting or any adjournment or adjournments thereof, all in accordance with the recommendation of the Klondex Board. |

If your proxy relating to any Other Affected Securities is signed and dated and returned without specifying your voting choice (or specifying both voting choices), then your Other Affected Securities will be voted

- 11 -

Table of Contents

FOR the Arrangement Resolution and the Adjournment Resolution in accordance with the recommendation of the Klondex Board.

| Q: | When is the cut-off time for delivery of proxies? |

| A: | Proxies must be delivered to Klondex’s Transfer Agent and Registrar, Computershare Investor Services Inc., by mail to 3rd Floor, 510 Burrard Street, Vancouver, British Columbia, V6C 3B9 or by fax to (416) 263-9524 or 1(866) 249-7775, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the Meeting or any adjournment or postponement thereof. In this case, assuming no adjournment or postponement, the proxy-cut off time is 4:00 p.m. (Eastern Daylight Time) on [•], 2018. The deadline for deposit of proxies may be waived or extended by the Chairman of the Meeting at his discretion, without notice. |

| Q: | What are broker non-votes? |

| A: | A broker non-vote occurs when shares held by a broker for the account of a beneficial owner are not voted for or against a particular proposal because the broker has not received voting instructions from that beneficial owner and the broker does not have discretionary authority to vote those shares. Klondex Shares constituting broker non-votes are not counted or deemed to be present in person or by proxy for the purpose of voting on a non-routine matter at the Meeting and, therefore, are not counted for the purpose of determining whether Klondex Shareholders and/or Klondex Securityholders have approved any matter except the proposal to appoint the auditors of the Company, because all proposals at the Meeting, except the proposal to appoint the auditors, are considered non-routine. If you do not provide voting instructions to your broker, your broker will have discretion to vote your Klondex Shares only on the proposal to appoint the auditors of the Company, because the Company expects that matter to be considered a routine matter. |

| Q: | What are the effects of broker non-votes and “withhold” votes? |

| A: | Brokers are permitted to exercise their discretion and vote without specific instruction on the proposal relating to the appointment of the auditors. Accordingly, the Company does not expect there to be any broker non-votes in connection with the proposal on the appointment of auditors. On all of the other proposals at the Meeting, broker non-votes will have no effect on the outcome of the vote. |

With respect to the election of directors and appointment of auditors, Klondex Shareholders will have the option of voting “for” or “withhold”. A “withhold” vote will have no effect on the proposal in respect of the appointment of auditors but because of Klondex’s Majority Voting Policy, may have an effect on the election of directors should a director receive more “withhold” votes than “for” votes.

See “Part 5 – General Proxy Information – Voting Standards” of this Circular.

| Q: | Can I abstain from voting? |

| A: | Depending on the matter being voted on at the Meeting, under the BCBCA, Klondex Shareholders have the option to either vote “for”, “against” or “withhold” on the matter and Klondex Option, RSU and DSU Holders have the option to either vote “for” or “against” the Arrangement Resolution or the Adjournment Resolution at the Meeting. A Registered Klondex Securityholder present in person at the Meeting who has not provided a proxy may abstain from voting by not casting a vote. However, a proxyholder cannot similarly abstain as he or she must vote in accordance with the direction of the Klondex Securityholder completing the proxy. If no choice is specified in the form of proxy, the Affected Securities will be voted FOR the relevant proposal(s). |

| Q: | Can I revoke my proxy or change my vote after I submit a signed proxy? |

| A: | Yes. In addition to revocation in any other manner permitted by law, a proxy may be revoked by an instrument in writing executed by the Klondex Securityholder or by his or her attorney authorized in writing |

- 12 -

Table of Contents

| deposited either at the registered office of the Company at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used or with the Chairman of the Meeting on the day of the Meeting, or adjournment thereof, and upon either of such deposits, the proxy is revoked. If you revoke your proxy and do not replace it with another that is deposited with the Company before the deadline, then you can still vote your Affected Securities, but to do so, you must attend the Meeting in person. |

| Q. | In addition to the approval of the Klondex Securityholders, are there any other approvals required for the Arrangement? |

| A: | Yes. The Arrangement requires the approval of the Court and also is subject to the receipt of certain regulatory approvals. |

See “Part 7 – The Arrangement – Court Approval of the Arrangement” and “Part 12– Regulatory Matters” of this Circular.

| Q: | Does Hecla need to obtain approval from its shareholders? |

| A: | Hecla is not required to obtain shareholder approval for the Arrangement. |

| Q: | Do any Klondex Directors or executive officers of Klondex have any interests in the Arrangement that are different from, or in addition to, those of the Klondex Securityholders? |

| A: | In considering the unanimous recommendation of the Klondex Board to vote in favour of the matters discussed in this Circular, Klondex Securityholders should be aware that certain of the Klondex Directors and executive officers of Klondex have interests in the Arrangement that are different from, or in addition to, the interests of Klondex Shareholders generally. |

See “Part 7 – The Arrangement – Interests of Certain Persons in the Arrangement”, “Part 7 – The Arrangement – MI 61-101 Protection of Minority Security Holders in Special Transactions”, “Part 11 – Securities Law Matters” and “Part 12 – Regulatory Matters” of this Circular.

| Q: | Will the Klondex Shares continue to be listed on the TSX and the NYSE American after the Arrangement? |

| A: | No. The Klondex Shares will be de-listed from the TSX and the NYSE American when the Arrangement is completed. |

| Q: | Should I send in my Election Document(s) now? |

| A: | Yes. It is recommended that: (a) all Registered Klondex Shareholders complete, sign and return the Letter of Transmittal and Election Form (printed on white paper), together with accompanying Klondex Share certificate(s) or DRS Statement, to the Depositary as soon as possible; and (b) all registered holders of Klondex Options and Klondex RSUs complete, sign and return the Option/RSU Election Form (printed on grey paper) to the Depositary as soon as possible. To make a valid election as to the form of Hecla Consideration you wish to receive, you must sign and return the applicable Election Document(s) to the Depositary prior to the [●], 2018 Election Deadline. If you fail to make a specific election by the Election Deadline, or the Depositary determines that your election was not properly made with respect to any Klondex Shares, Klondex Options or Klondex RSUs, as applicable, then you will be deemed to have elected to receive the Combination Consideration in respect of such securities. |

Non-Registered Klondex Securityholders whose Klondex Shares, Klondex Options and Klondex RSUs, as applicable, are registered in the name of a broker, investment dealer, bank, trust company, trustee or other nominee should contact that nominee for assistance in depositing such securities and should follow the instructions of such nominee in order to make their election and deposit such securities.

- 13 -

Table of Contents

See “Part 16 – Procedure for Receipt of Arrangement Consideration” of this Circular.

| Q: | When can I expect to receive the Arrangement Consideration for my Affected Securities? |

| A: | If you are a holder of Klondex Shares, then, provided that a duly completed Letter of Transmittal and Election Form, along with the applicable Klondex Share certificate(s) or DRS Statement for such Klondex Shares and all other required documents, have been received by the Depositary, you should receive the Arrangement Consideration due to you under the Arrangement promptly after the Arrangement becomes effective. |

If you are a holder of In-the-Money Klondex Options or Klondex RSUs, you should receive the Arrangement Consideration due to you under the Arrangement promptly after the Arrangement becomes effective.

See “Part 16 – Procedure for Receipt of Arrangement Consideration” of this Circular.

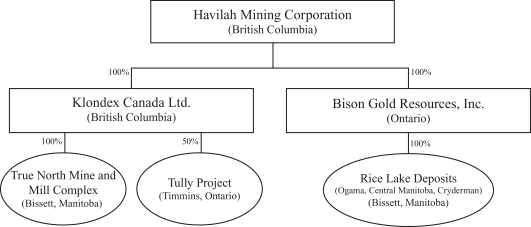

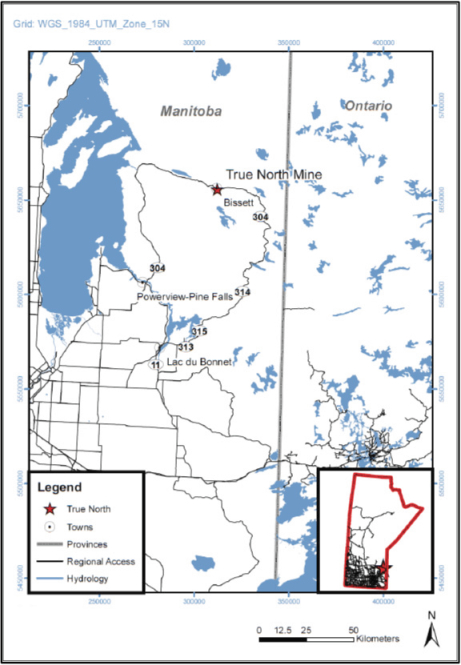

| Q: | What assets will Havilah hold? |

| A: | Upon completion of the Arrangement, Havilah will hold all of the legal and beneficial right, title and interest in Klondex’s Canadian assets, including True North and the Bison Manitoba properties, as well as additional Manitoba and Ontario mineral interests. |

| Q: | Who will be on the management team and board of directors of Havilah? |

| A: | The following individuals are anticipated to be on the management team of Havilah: (a) John Antwi, Interim President and Chief Executive Officer; and (b) Blair Schultz, Interim Chief Financial Officer. |

The following individuals are anticipated to be on the board of directors of Havilah: Messrs. Blair Schultz (Chairman), John Antwi, Brian Morris, James Haggarty, Michael Hoffman and Paul Huet.

| Q: | Will Havilah Shares be publicly listed? |

| A: | It is a condition to the completion of the Arrangement that one of the TSX, the TSXV or the Canadian Securities Exchange conditionally approve the listing of the Havilah Shares to be distributed under the Arrangement. Havilah has applied to have the Havilah Shares listed on the TSXV. Listing is subject to the approval of the TSXV in accordance with its original listing requirements. The TSXV has not conditionally approved the listing of the Havilah Shares on the TSXV and there is no assurance that the TSXV will approve the listing application. There is no present intention to list Havilah Shares for trading on any national securities exchange in the United States. |

| Q: | How will I know when the Arrangement will be implemented? |

| A: | The Effective Date will only occur following satisfaction or waiver of all of the conditions to the completion of the Arrangement. If the Arrangement Resolution is approved at the Meeting, and all other required approvals are obtained and conditions satisfied or waived, then the Effective Date is expected to occur in the second quarter of 2018, but no later than July 16, 2018, unless otherwise agreed to between Klondex and Hecla. On the Effective Date, upon completion of the Arrangement, Klondex and Hecla will publicly announce that the Arrangement has been implemented. |

| Q: | Are there risks I should consider in deciding whether to vote for the Arrangement Resolution? |

| A: | Yes. Klondex Securityholders should carefully consider the risk factors relating to the Arrangement. Some of these risks include, but are not limited to the following: (a) Hecla and Klondex may not integrate |

- 14 -

Table of Contents

| successfully; (b) uncertainty surrounding the Arrangement could adversely affect Klondex’s retention of customers and suppliers and could negatively impact Klondex’s future business and operations; (c) the pro forma condensed combined financial statements are presented for illustrative purposes only and may not be an indication of the Combined Company’s financial condition or results of operations following the Arrangement; (d) directors and executive officers of Klondex may have interests in the Arrangement that are different from those of Klondex Securityholders generally; (e) the issuance of a significant number of Hecla Shares, or securities convertible into Hecla Shares, could adversely affect the market price of the Hecla Shares; (f) the Arrangement Agreement may be terminated in certain circumstances, including in the event of a change having a Klondex Material Adverse Effect; (g) there can be no certainty that all conditions precedent to the Arrangement will be satisfied; (h) the exchange ratio is fixed and will not be adjusted to reflect any change in the market value of the Hecla Shares or Klondex Shares prior to the closing of the Arrangement; (i) Klondex will incur costs even if the Arrangement is not completed and may have to pay the Klondex Termination Fee to Hecla in certain circumstances; (j) if the Arrangement is not approved by the Klondex Securityholders, or the Arrangement is otherwise not completed, then the market price for Klondex Shares may decline; (k) if the Arrangement Resolution is not approved by the Klondex Securityholders, Klondex will continue as a standalone entity and will need to consider and secure financing alternatives; (l) owning Hecla Shares will expose Klondex Shareholders to different risks; (m) the value of the Havilah Shares may fluctuate; and (n) the TSXV may not approve Havilah’s listing application. The foregoing list is not exhaustive. Please carefully read all of the risks disclosed elsewhere in this Circular as well as risks disclosed in Klondex’s and Hecla’s publicly disclosed documents available on SEDAR and EDGAR. |

See “Part 15 – Risks Factors Relating to the Arrangement” of this Circular.

| Q: | What are the Canadian income tax consequences of the Arrangement? |

| A: | For a summary of certain Canadian income tax consequences of the Arrangement applicable to a Klondex Shareholder, see “Part 17 – Certain Canadian Federal Income Tax Considerations”. Such summary is not intended to be legal or tax advice to any particular Klondex Shareholder. Klondex Shareholders should consult their own tax advisors with respect to their particular circumstances. In addition, holders of Other Affected Securities should consult their own tax advisors with respect to their particular circumstances. |

| Q: | What are the U.S. federal income tax consequences of the Arrangement? |

| A: | For a summary of certain material U.S. federal income tax consequences of the Arrangement applicable to a U.S. Holder (as defined herein) and a non-U.S. Holder (as defined herein), see “Part 18 – Certain United States Federal Income Tax Considerations”. Such summary is not intended to be legal or tax advice to any particular Klondex Securityholders. Klondex Securityholders should consult their own tax advisors with respect to their particular circumstances. |

| Q: | Am I entitled to Dissent Rights? |

| A: | The Interim Order and Plan of Arrangement provides Registered Klondex Shareholders with Dissent Rights in connection with the Arrangement. Registered Klondex Shareholders considering exercising Dissent Rights should seek the advice of their own legal counsel and tax and investment advisors and should carefully review the description of such rights set forth in this Circular, the Interim Order and the Plan of Arrangement, and must comply with the dissent procedures in Division 2 of Part 8 of the BCBCA, as modified and supplemented by the Interim Order, the Plan of Arrangement and the Final Order. The right to dissent is described in this Circular, and the texts of each of the Plan of Arrangement, the Interim Order and Division 2 of Part 8 of the BCBCA is set forth in Appendix “E”, Appendix “F” and Appendix “H”, respectively, to this Circular. |

See “Part 14 – Dissenting Shareholders’ Rights” in this Circular.

- 15 -

Table of Contents

KLONDEX MINES LTD.

MANAGEMENT INFORMATION CIRCULAR

This management information circular (this “Circular”) and accompanying forms of proxy are furnished in connection with the solicitation of proxies by the management of Klondex Mines Ltd. (the “Company” or “Klondex”) for use at the annual and special meeting (the “Meeting”) of Klondex Securityholders to be held at the Toronto Region Board of Trade, Lennox Hall East, 4th Floor, 77 Adelaide St. West, Toronto, Ontario on [•], 2018 at [8:00 a.m. (Eastern Daylight Time)], and at any adjournment or postponement thereof, for the purposes set forth in the accompanying notice of annual and special meeting (the “Notice of Meeting”). All summaries of, and references to, the Arrangement Agreement, the Plan of Arrangement, the Arrangement Resolution, the Maxit Capital Fairness Opinion and the GMP Securities Fairness Opinion in this Circular are qualified in their entirety by reference to the complete text of those documents, each of which is either included as an appendix to this Circular or filed under the Company’s issuer profile on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and Electronic Data Gathering, Analysis, and Retrieval system (“EDGAR”) at www.sec.gov/edgar. Klondex Securityholders are urged to carefully read the full text of these documents.

In this Circular, unless otherwise indicated or the context otherwise requires, terms defined in Appendix “A” – Glossary of Terms shall have the meanings attributed thereto. Words importing the singular include the plural and vice versa and words importing gender include all genders.

Information Contained in this Circular

The information contained in this Circular, unless otherwise indicated, is given as of [•], 2018.

No person has been authorized by the Company to give any information (including any representations) in connection with the matters to be considered at the Meeting other than the information contained in this Circular. This Circular does not constitute an offer to buy, or a solicitation of an offer to acquire, any securities, or a solicitation of a proxy, by any person in any jurisdiction in which such an offer or solicitation is not authorized or is unlawful. Information contained in this Circular should not be construed as legal, tax or financial advice, and Klondex Securityholders should consult their own professional advisors concerning the consequences of the Arrangement in their own circumstances.