exh_9910.htm

Exhibit 99.10

NOTICE OF CONFIDENTIALITY RIGHTS: IF YOU ARE A NATURAL PERSON, YOU MAY REMOVE OR STRIKE ANY OR ALL OF THE FOLLOWING INFORMATION FROM ANY INSTRUMENT THAT TRANSFERS AN INTEREST IN REAL PROPERTY BEFORE IT IS FILED FOR RECORD IN THE PUBLIC RECORDS: YOUR SOCIAL SECURITY NUMBER OR YOUR DRIVER’S LICENSE NUMBER.

ATTENTION: COUNTY CLERK – THIS INSTRUMENT COVERS GOODS THAT ARE OR ARE TO BECOME FIXTURES ON THE REAL PROPERTY DESCRIBED HEREIN AND IS TO BE FILED FOR RECORD IN THE RECORDS WHERE DEEDS OF TRUST ON REAL ESTATE ARE RECORDED. ADDITIONALLY, THIS INSTRUMENT SHOULD BE APPROPRIATELY INDEXED, NOT ONLY AS A DEED OF TRUST, BUT ALSO AS A FINANCING STATEMENT COVERING GOODS THAT ARE OR ARE TO BECOME FIXTURES ON THE REAL PROPERTY DESCRIBED HEREIN. THE MAILING ADDRESSES OF THE TRUSTOR (DEBTOR) AND BENEFICIARY (SECURED PARTY) ARE SET FORTH IN THIS INSTRUMENT.

DEED OF TRUST, ASSIGNMENT OF LEASES AND RENTS,

SECURITY AGREEMENT AND FIXTURE FILING

made by

GLOBAL GEOPHYSICAL SERVICES, INC.

(Trustor)

To

STAN KEETON

For the benefit of

TPG SPECIALTY LENDING, INC.,

as Collateral Agent

(Beneficiary)

Property Location:

Fort Bend County, Texas

Dated as of November 26, 2013

This Deed of Trust Was Prepared By and When Recorded, Return to:

| |

Schulte Roth & Zabel LLP

919 Third Avenue

New York, New York 10022

Attention: Julian M. Wise, Esq.

Ref. No.: 079464.0031

|

|

Table of Contents

Page

|

ARTICLE I DEFINITIONS

|

5 |

|

Section 1.01

|

Terms Defined Above

|

5

|

|

Section 1.02

|

Definitions

|

5

|

|

Section 1.03

|

Terminology

|

8

|

|

Section 1.04

|

Other Defined Terms

|

8

|

| |

|

|

|

ARTICLE II GRANT OF LIEN AND SECURITY INTEREST

|

8 |

|

Section 2.01

|

Grant of Lien

|

8

|

|

Section 2.02

|

Grant of Security Interest

|

9

|

|

Section 2.03

|

No Obligation of Beneficiary

|

9

|

|

Section 2.04

|

Fixture Filing

|

9

|

|

Section 2.05

|

Future Advances

|

10

|

|

Section 2.06

|

Advances Secured By Deed of Trust

|

10

|

| |

|

|

|

ARTICLE III ASSIGNMENT OF LEASES AND RENTS

|

10 |

|

Section 3.01

|

Assignment

|

11

|

|

Section 3.02

|

Revocable License

|

11

|

|

Section 3.03

|

Intentionally Omitted

|

11

|

|

Section 3.04

|

Remedies

|

12

|

|

Section 3.05

|

Direction to Tenants

|

12

|

|

Section 3.06

|

Appointment of Attorney-in-Fact

|

12

|

|

Section 3.07

|

No Liability of Beneficiary

|

13

|

|

Section 3.08

|

No Modification of Trustor’s Obligations

|

13

|

| |

|

|

|

ARTICLE IV REPRESENTATIONS AND WARRANTIES

|

14 |

|

Section 4.01

|

Power to Create Lien and Security

|

14

|

|

Section 4.02

|

Loan and Loan Documents

|

14

|

|

Section 4.03

|

No Condemnation

|

14

|

|

Section 4.04

|

Flood Zone

|

14

|

| |

|

|

|

ARTICLE V AFFIRMATIVE COVENANTS

|

15 |

|

ARTICLE VI NEGATIVE COVENANTS

|

15 |

|

ARTICLE VII EVENTS OF DEFAULT AND REMEDIES

|

15

|

|

Section 7.01

|

Event of Default

|

15

|

|

Section 7.02

|

Sale of Trust Property in Texas

|

15

|

|

Section 7.03

|

Trustee’s Successors, Substitutes and Agents

|

17

|

|

Section 7.04

|

Judicial Foreclosure

|

17

|

|

Section 7.05

|

Receiver

|

17

|

|

Section 7.06

|

Foreclosure for Installments

|

17

|

|

Section 7.07

|

Separate Sales

|

18

|

|

Section 7.08

|

Possession of Trust Property

|

18

|

|

Section 7.09

|

Occupancy After Acceleration

|

18

|

|

Section 7.10

|

Remedies Cumulative, Concurrent and Nonexclusive

|

19

|

|

Section 7.11

|

No Release of Obligations

|

19

|

|

Section 7.12

|

Release of and Resort to Collateral

|

19

|

|

Section 7.13

|

Waiver of Redemption, Notice and Marshaling of Assets

|

19

|

|

Section 7.14

|

Discontinuance of Proceedings

|

20

|

|

Section 7.15

|

Application of Proceeds

|

20

|

|

Section 7.16

|

Uniform Commercial Code Remedies

|

21

|

|

Section 7.17

|

Indemnity

|

21

|

| |

|

|

| ARTICLE VIII TRUSTEE |

22 |

|

Section 8.01

|

Duties, Rights, and Powers of Trustee

|

22

|

|

Section 8.02

|

Successor Trustee

|

22

|

|

Section 8.03

|

Retention of Moneys

|

22

|

| |

|

|

| ARTICLE IX MISCELLANEOUS |

23 |

|

Section 9.01

|

Instrument Construed as Mortgage, Etc.

|

23

|

|

Section 9.02

|

Performance at Trustor’s Expense

|

23

|

|

Section 9.03

|

Survival of Obligations

|

23

|

|

Section 9.04

|

Further Assurances

|

23

|

|

Section 9.05

|

Notices

|

23

|

|

Section 9.06

|

No Waiver

|

23

|

|

Section 9.07

|

Beneficiary’s Right to Perform; Beneficiary’s Expenditures

|

24

|

|

Section 9.08

|

Successors and Assigns

|

24

|

|

Section 9.09

|

Severability

|

24

|

|

Section 9.10

|

Entire Agreement and Modification

|

25

|

|

Section 9.11

|

Applicable Law

|

25

|

|

Section 9.12

|

Satisfaction of Prior Encumbrance

|

25

|

|

Section 9.13

|

No Partnership

|

25

|

|

Section 9.14

|

Headings

|

25

|

|

Section 9.15

|

Release of Deed of Trust

|

25

|

|

Section 9.16

|

Limitation of Obligations with Respect to Trust Property

|

26

|

|

Section 9.17

|

Inconsistency with Financing Agreement

|

26

|

|

Section 9.18

|

Limitation on Interest Payable

|

26

|

|

Section 9.19

|

Covenants To Run With the Land

|

27

|

|

Section 9.20

|

Amount Secured; Last Dollar

|

27

|

|

Section 9.21

|

Defense of Claims

|

27

|

|

Section 9.22

|

Exculpation Provisions

|

27

|

|

Section 9.23

|

Modifications to Financing Agreement

|

28

|

|

Section 9.24

|

No Merger of Estates

|

28

|

| |

|

|

| |

|

|

|

EXHIBIT A - LEGAL DESCRIPTION

|

|

DEED OF TRUST, ASSIGNMENT OF LEASES AND RENTS,

SECURITY AGREEMENT AND FIXTURE FILING

THIS DEED OF TRUST, ASSIGNMENT OF LEASES AND RENTS, SECURITY AGREEMENT AND FIXTURE FILING (hereinafter, together with any and all amendments, supplements, modifications or restatements of any kind, referred to as this “Deed of Trust”), is made as of November 26, 2013 (the “Effective Date”), by GLOBAL GEOPHYSICAL SERVICES, INC., a Delaware corporation, having its principal place of business at 13927 South Gessner Road, Missouri City, Texas 77489, as trustor (“Trustor”), to STAN KEETON, an individual, having an address at c/o Fidelity National Title Insurance, 10010 San Pedro, Suite 630, San Antonio, Texas 78216 (including any successor trustee at the time acting as such hereunder, “Trustee”) for the benefit of TPG SPECIALTY LENDING, INC., a Delaware corporation, having an address at 301 Commerce Street, Suite 3300 Fort Worth, Texas 76102, as Collateral Agent (in such capacity, together with any successors and assigns, “Beneficiary”) and for each of the lenders and their respective successors and assigns which from time to time shall be a “Lender” under the Financing Agreement (as hereinafter defined).

R E C I T A L S:

WHEREAS, Trustor is the owner and holder of fee simple title in and to the Land (as hereinafter defined) described on Exhibit A attached hereto and made a part hereof;

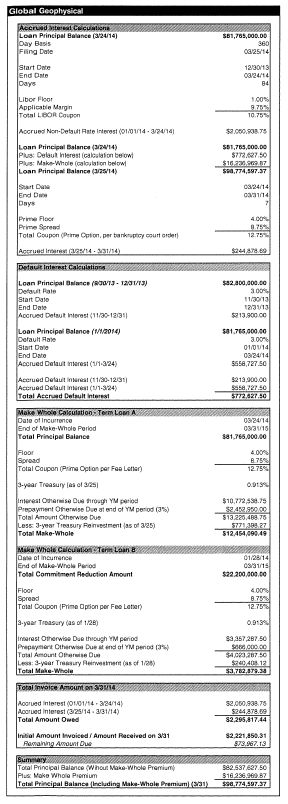

WHEREAS, on the date hereof, Trustor and each Subsidiary (as defined in the Financing Agreement) of Trustor from time to time party thereto as a Guarantor (as defined in the Financing Agreement), the Lenders (as defined in the Financing Agreement), Mortgagee, as administrative agent and collateral agent for the Lenders and as co-lead arrangers, and Tennenbaum Capital Partners, LLC, as co-lead arranger, entered into that certain Financing Agreement, dated as of September 30, 2013 (as the same may be amended, modified or otherwise supplemented and in effect from time to time, the “Financing Agreement”), pursuant to which the Lenders agreed to extend to Trustor certain credit facilities in an aggregate principal amount not exceeding One Hundred Five Million and 00/100 Dollars ($105,000,000.00), consisting of term loans in the aggregate principal amount of (a) Eighty-Two Million Eight Hundred Thousand and 00/100 Dollars ($82,800,000.00) for the Term Loan A (as defined in the Financing Agreement), and (b) Twenty-Two Million Two Hundred Thousand and 00/100 Dollars ($22,200,000.00) for the Term Loan B (as defined in the Financing Agreement) (collectively, the “Loan”);

WHEREAS, as a condition to Beneficiary executing the Financing Agreement and making the Loan to Trustor, Beneficiary is requiring that Trustor grant to Trustee, for the benefit of Beneficiary, as collateral agent for the Lenders, a security interest in and a first lien upon the Trust Property (as hereinafter defined), to secure the payment and performance of all of the Obligations (as defined in the Financing Agreement).

NOW, THEREFORE, in order to comply with the terms and conditions of the Financing Agreement and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Trustor hereby agrees with Beneficiary as follows:

ARTICLE I

DEFINITIONS

Section 1.01 Terms Defined Above. As used in this Deed of Trust, the terms defined in the introductory paragraph to this Deed of Trust and in the Recitals set forth above shall have the meanings respectively assigned to such terms in such paragraph and Recitals.

Section 1.01 Definitions. As used herein, the following terms shall have the following meanings:

“Applicable UCC” means the Uniform Commercial Code as presently in effect in the State where the Trust Property is located.

“Beneficiary” has the meaning assigned to such term in the Preamble.

“Buildings” means any and all buildings, structures, garages, utility sheds, workrooms, air conditioning towers, open parking areas and other improvements, and any and all additions, alterations, betterments or appurtenances thereto, now or at any time hereafter situated, placed or constructed upon the Land or any part thereof.

“Deed of Trust” has the meaning assigned to such term in the Preamble.

“Event of Default” has the meaning assigned to such term in Section 7.01 hereof.

“Fixtures” means all materials, supplies, equipment, apparatus and other items of personalty now or hereafter acquired by Trustor and incorporated into the Trust Property so as to constitute fixtures under the Applicable UCC or otherwise under the laws of the state in which such items are located.

“Impositions” means any and all real estate and personal property taxes; water, gas, sewer, electricity and other utility rates and charges; charges for any easement, license or agreement maintained for the benefit of the Trust Property; and any and all other taxes, charges and assessments, whether general or special, ordinary or extraordinary, foreseen or unforeseen, of any kind and nature whatsoever which at any time prior to or after the execution hereof may be assessed, levied or imposed upon the Trust Property or the ownership, use, occupancy, benefit or enjoyment thereof, together with any interest, costs or penalties that may become payable in connection therewith.

“Land” means the real property or interest therein described in Exhibit A attached hereto, and all rights, titles and interests appurtenant thereto.

“Leases” means any and all leases, master leases, subleases, licenses, occupancy agreements, assignments, concessions or other agreements (whether written or oral, and whether now or hereafter in effect) which grant to third Persons a possessory interest in and to, or the right to use, all or any part of the Trust Property, including the Land, the Buildings and/or the Fixtures, together with all security and other deposits made in connection therewith and any guarantee of the obligations of the landlord or the tenant thereunder, and all amendments, modifications, renewals, extensions and substitutions of the foregoing.

“License” has the meaning assigned to such term in Section 3.02(a) hereof.

“Loan” has the meaning assigned to such term in the Recitals.

“Losses” means all obligations, damages, claims, causes of action, costs, fines, fees, charges, penalties, deficiencies, losses, diminutions in value expenses (including, without limitation, court costs, fees and expenses of attorneys, accountants, consultants and other experts) and other liabilities, and, with respect to any indemnity, includes all attorneys’ fees and expenses incurred by the Indemnitee in connection with the enforcement and collection of such indemnity.

“Personalty” means all of Trustor’s right, title and interest in and to all furniture, furnishings, equipment, machinery, goods, general intangibles, money, insurance proceeds, contract rights, option rights, inventory, together with all refundable, returnable or reimbursable fees, deposits or other funds or evidences of credit or indebtedness deposited by or on behalf of Trustor with any Governmental Authority, boards, corporations, providers of utility services, public or private (including, without limitation all refundable, returnable or reimbursable tap fees, utility deposits, commitment fees and development costs, and all other personal property of any kind or character), in each case to the extent assignable, and including, without limitation all such property that is now or hereafter located or to be located upon, within or about the Land and the Buildings, or which are or may be used in or related to the planning, development, financing or operation of the Trust Property, together with all accessories, replacements and substitutions thereto or therefor and the proceeds thereof; provided that, notwithstanding the foregoing, “Personalty” shall not include any property of the type described in Section 2.2 of the Pledge and Security Agreement.

“Principal Balance” has the meaning assigned to such term in Section 7.02 hereof.

“Rents” means all of the rents, additional rents, revenues, income, proceeds, issues, profits, security and other types of deposits (after Trustor acquires title thereto), and other benefits paid or payable by parties (other than Trustor), including any payments in connection with any termination, cancellation or surrender, for using, leasing, licensing, possessing, operating from, residing in, benefiting from or otherwise enjoying all or any part of the Land, the Buildings, the Fixtures and/or the Personalty.

“Secured Amount” has the meaning assigned to such term in Section 2.07(a) hereof.

“Trust Property” means all of Trustor’s right, title, interest and estate, whether now owned or hereafter acquired, in and to the Land, the Buildings, the Fixtures and the Personalty, together with:

(i) all rights, privileges, tenements, hereditaments, rights-of-way, easements, air rights, development rights or credits, zoning rights, appendages and appurtenances in anywise appertaining thereto, and all right, title and interest of Trustor in and to any streets, ways, alleys, strips or gores of land adjoining the Land or any part thereof, and all right, title and interest of Trustor, in and to all rights, royalties and profits with respect to all minerals, coal, oil, gas and other substances of any kind or character on or underlying the Land, together with all right, title and interest of Trustor in and to all water and water rights (whether riparian, appropriative or otherwise and whether or not appurtenant);

(ii) all rights of Trustor (but not its obligations) under any contracts and agreements, relating to the Land, the Buildings, the Fixtures or the Personalty including, without limitation, construction contracts and architectural agreements;

(iii) all of Trustor’s right, title and interest in and to all permits, licenses, franchises, certificates, authorizations, consents, approvals and other rights and privileges (each, a “Permit”) obtained in connection with the Land, the Buildings, the Fixtures or the Personalty or the use or operation thereof;

(iv) all of Trustor’s right, title and interest in and to all plans and specifications, designs, schematics, drawings and other information, materials and matters heretofore or hereafter prepared relating to the Land, the Buildings, the Fixtures or the Personalty;

(v) all of Trustor’s right, title and interest in and to all proceeds arising from or by virtue of the sale, lease or other disposition of the Land, the Buildings, the Fixtures or the Personalty or any part thereof or any interest therein or from the operation thereof;

(vi) all of Trustor’s right, title and interest in and to all Leases now or hereafter in effect and all Rents, royalties, bonuses, issues, profits, revenues, or other benefits arising from or attributable to the Land, the Buildings, the Fixtures or the Personalty;

(vii) all of Trustor’s right, title and interest in and to all betterments, additions, alterations, appurtenances, substitutions, replacements and revisions to the Land, the Buildings, the Fixtures or the Personalty and all reversions and remainders relating thereto;

(viii) all of Trustor’s right, title and interest in and to any awards, remuneration, settlements or compensation now or hereafter made by any Governmental Authority pertaining to the Land, the Buildings, the Fixtures or the Personalty, including those arising from or attributable to any vacation of, or change of grade in, any streets affecting the Land or the Buildings;

(ix) all of Trustor’s right, title and interest in and to any and all other security and collateral of any nature whatsoever, whether now or hereafter given, for the repayment, performance and discharge of the Obligations (as hereinafter defined);

(x) all of Trustor’s right, title and interest in and to all awards, payments, and proceeds of conversion, whether voluntary or involuntary, of any of the Land, the Buildings, the Fixtures, the Personalty or any of the property and rights described in the foregoing clauses (i) through (ix), including without limitation, all insurance, condemnation and tort claims, refunds of real estate taxes and assessments, rent claims and other obligations dischargeable in cash or cash equivalents;

(xi) all options to purchase or lease the Land or the Buildings or any portion thereof or interest therein, or any other rights, interests or greater estates in the rights and properties comprising the Trust Property now owned or hereafter acquired by Trustor;

(xii) any interests, estates or other claims of every name, kind or nature, both in law and in equity, which Trustor now has or may acquire in the Land and the Buildings, or other rights, interests or properties comprising the Trust Property now owned or hereafter acquired; and

(xiii) all other property and rights of Trustor of every kind and character relating to and/or used or to be used in connection with the foregoing, and all proceeds and products of any of the foregoing.

As used in this Deed of Trust, the term “Trust Property” shall be expressly defined as meaning all or, where the context permits or requires, any portion of the above, and all or, where the context permits or requires, any interest therein.

“Trustee” has the meaning assigned to such term in the preamble hereto.

“Trustor” has the meaning assigned to such term in the preamble hereto.

Section 1.03 Terminology. Except as otherwise provided herein:

(a) references to Articles and Sections shall mean the corresponding Article or Section of this Deed of Trust;

(b) words used herein in the singular, where the context so permits, shall be deemed to include the plural and vice versa, and the definitions of words used in the singular herein shall apply to such words when used in the plural where the context so permits and vice versa; and

(c) the words “herein,” “hereof,” “hereunder,” and other words of similar import when used in this Deed of Trust refer to this Deed of Trust as a whole, and not to any particular Article or Section.

Section 1.04 Other Defined Terms. Any capitalized term used in this Deed of Trust and not otherwise defined herein shall have the meaning assigned to such term in the Financing Agreement.

ARTICLE II

GRANT OF LIEN AND SECURITY INTEREST

Section 2.01 Grant of Lien.

(a) To secure the full and timely payment, performance and discharge of all of the Obligations, Trustor hereby irrevocably GRANTS, BARGAINS, SELLS, ASSIGNS, TRANSFERS, MORTGAGES, CONVEYS and CONFIRMS unto Trustee, WITH POWER OF SALE, with right of entry and possession, for the use and benefit of Beneficiary, for the benefit of the Secured Parties, all right, title, interest and estate in, to and under the Trust Property, subject, however, to the Permitted Liens; TO HAVE AND TO HOLD the Trust Property unto Trustee for the benefit of the Secured Parties, subject to the terms and conditions of this Deed of Trust, WITH POWER OF SALE, forever, and Trustor does hereby bind itself, its successors and assigns to WARRANT AND FOREVER DEFEND the title to the Trust Property unto Beneficiary against every Person whomsoever lawfully claiming or to claim the same or any part thereof by, through or under Trustor but not otherwise, subject, however, to the Permitted Liens and the terms and conditions contained herein. The Liens, estates and rights granted by this Deed of Trust shall remain fully in effect and shall not cease and terminate until all the Obligations (other than contingent indemnity obligations as to which no claim has been made and Cash Management Obligations) have been fully paid, performed and discharged in accordance with the Financing Agreement and the other Loan Documents and the Loan has been repaid in full.

Section 2.02 Grant of Security Interest. This Deed of Trust shall be construed as a mortgage on the Land and the Buildings and it shall also constitute and serve as a “security agreement” within the meaning of, and shall constitute a first and prior security interest under, the Applicable UCC with respect to the Personalty and the Fixtures. To this end, Trustor by these presents does GRANT, BARGAIN, CONVEY, ASSIGN, SELL, TRANSFER, and SET OVER unto Beneficiary for the benefit of the Secured Parties pursuant to the Financing Agreement, a security interest in all of Trustor’s right, title and interest in, to and under the Personalty and the Fixtures, to secure the full and timely payment, performance and discharge of the Obligations subject to the terms and conditions contained herein. Trustor hereby consents to Beneficiary filing and recording financing statements (and continuations thereof) with the appropriate filing and recording offices in order to perfect (and maintain the perfection of) the security interests granted herein.

Section 2.03 No Obligation of Beneficiary. The assignment and security interest herein granted to Beneficiary shall not be deemed or construed to constitute Beneficiary as a Beneficiary-in-possession of the Trust Property, obligate Beneficiary to lease the Trust Property or attempt to do the same, or to take any action, incur any expense or perform or discharge any obligation, duty or liability whatsoever.

Section 2.04 Fixture Filing. Without in any manner limiting the generality of any of the other provisions of this Deed of Trust: (a) some portions of the goods described or to which reference is made herein are or are to become Fixtures on the Land described or to which reference is made herein or on Exhibit A attached to this Deed of Trust; (b) this Deed of Trust is to be filed of record in the real estate records as a financing statement and shall constitute a “fixture filing” for purposes of the Applicable UCC; and (c) Trustor is the record owner of the real estate or interests in the real estate constituting the Trust Property hereunder. Information concerning the security interest herein granted may be obtained at the addresses set forth on the first page hereof. The addresses of the Secured Party (Beneficiary) and of the Debtor (Trustor) are set forth on the first page hereof. In that regard, the following information is provided:

|

Name of Debtor:

|

GLOBAL GEOPHYSICAL SERVICES, INC.

|

|

Type of Organization:

|

corporation

|

|

State of Organization:

|

Delaware

|

|

Address of Debtor:

|

13927 South Gessner Road

Missouri City, Texas 77489

|

|

Name of Secured Party:

|

TPG SPECIALTY LENDING, INC.,

a Delaware corporation

|

|

Address of Secured Party:

|

301 Commerce Street, Suite 3300

Fort Worth, Texas 76102

|

Section 2.05 Future Advances. This Deed of Trust is being given to secure the Obligations in accordance with the Financing Agreement and any other Loan Document to which Trustor is a party, as limited and otherwise further described herein, and shall secure not only Obligations with respect to presently existing indebtedness or other extensions of credit under the foregoing documents and agreements but also any and all other indebtedness now owing which may hereafter be owing by Trustor to Beneficiary, the Lenders, the Secured Parties or any of them pursuant to the Financing Agreement and any other Loan Document to which Trustor is a party, however incurred, whether interest, discount or otherwise, and whether the same shall be deferred, accrued or capitalized, including future advances and re-advances pursuant to the Financing Agreement or other Loan Documents, whether such advances are obligatory or to be made at the option of the Lender, or otherwise, to the same extent as if such future advances or re-advances were made on the date of the execution of this Deed of Trust. The lien of this Deed of Trust shall be valid as to all indebtedness secured hereby, including future advances and re-advances, from the time of its filing for record in the recorder’s office of the county in which the Trust Property is located. This Deed of Trust is intended to and shall be valid and have priority over all subsequent liens and encumbrances, including statutory liens, excepting solely Permitted Liens.

Section 2.06 Advances Secured By Deed of Trust. Upon the occurrence and during the continuance of an Event of Default as a result of the failure of Trustor to comply with any covenants and agreements contained in the Financing Agreement as to the payment of taxes, assessments, insurance premiums, repairs, protection of the Trust Property or Beneficiary’s lien thereon, and other charges and the costs of procurement of title evidence and insurance as aforesaid, Beneficiary may, at its option, pay the same, and any sums so paid by Beneficiary, together with the reasonable fees of counsel employed by Beneficiary in consultation and in connection therewith, shall be charged against Trustor, shall be immediately due and payable by Trustor, shall bear interest at the Default Rate and shall be a lien upon the Trust Property and be secured by this Deed of Trust and may be collected in the same manner as the principal debt hereby secured.

ARTICLE III

ASSIGNMENT OF LEASES AND RENTS

Section 3.01 Assignment. For Ten Dollars ($10.00) and other good and valuable consideration, including the indebtedness evidenced by the Financing Agreement, the receipt and sufficiency of which are hereby acknowledged and confessed, Trustor has presently, absolutely and irrevocably GRANTED, BARGAINED, SOLD, ASSIGNED, TRANSFERRED, CONVEYED and CONFIRMED, and by these presents does presently, absolutely and irrevocably GRANT, BARGAIN, SELL, ASSIGN, TRANSFER, CONVEY and CONFIRM, unto Beneficiary, for the benefit of the Secured Parties, as security for the payment, performance and discharge of the Obligations, all of the Rents (if any) payable under the Leases, subject only to the Permitted Liens applicable thereto and the License (as hereinafter defined); TO HAVE AND TO HOLD the Leases and the Rents unto Beneficiary, forever, and Trustor does hereby bind itself, its successors and assigns to warrant and forever defend the title to the Leases and the Rents unto Beneficiary against every Person whomsoever lawfully claiming or to claim the same or any part thereof; provided, however, that if Trustor shall pay (or cause to be paid) and perform and discharge (or cause to be performed and discharged) all of the Obligations on or before the date on which the same are to be paid, performed and discharged, then this assignment shall terminate, and all rights, titles and interests conveyed pursuant to this assignment shall become vested in Trustor. Notwithstanding anything to the contrary contained in this Article III, or elsewhere in this Deed of Trust, to the contrary, any assignment of rents set forth in this Deed of Trust shall be subject to, and construed and enforced in accordance with, the provisions of Chapter 64 of the Texas Property Code.

Section 3.02 Revocable License.

(a) Beneficiary hereby grants to Trustor a revocable license (the “License”), nonexclusive with the rights of Beneficiary reserved in Sections 3.02(b), 3.04 and 3.05 hereof, to exercise and enjoy all incidences of the status of a lessor under the Leases and the Rents, including, without limitation, the right to collect, demand, sue for, attach, levy, recover and receive the Rents and to give proper receipts, releases and acquittances therefor. Trustor hereby agrees to receive all Rents and hold the same as a trust fund to be applied, and to apply the Rents so collected, except to the extent otherwise provided in the Financing Agreement, first to the payment, performance and discharge of the Obligations and then to the payment of the Impositions. Thereafter, Trustor may use the balance of the Rents collected in any manner not inconsistent with the Loan Documents.

(b) If an Event of Default shall occur and be continuing, the License shall immediately and automatically terminate without the necessity of any action by Beneficiary or any other Person, and Beneficiary shall have the right in such event to exercise the rights and remedies provided under this Deed of Trust or otherwise available to Beneficiary under applicable law. Upon demand by Beneficiary at any time that an Event of Default shall have occurred, Trustor shall promptly pay to Beneficiary all security deposits under the Leases and all Rents allocable to any period commencing from and after the occurrence of such Event of Default. Any Rents received hereunder by Beneficiary shall be applied and disbursed to the payment, performance and discharge of the Obligations, subject to the terms of the Financing Agreement; provided, however, that, subject to any applicable requirement of law, any security deposits actually received by Beneficiary shall be held, applied and disbursed as provided in the applicable Leases.

Section 3.03 Intentionally Omitted.

Section 3.04 Remedies. If an Event of Default shall occur and be continuing, Beneficiary shall have the right in such event to exercise the rights and remedies provided under this Deed of Trust or otherwise available to Beneficiary under applicable law. Upon demand by Beneficiary at any time that an Event of Default shall have occurred and be continuing, Trustor shall promptly pay to Beneficiary all security deposits under the Leases and all Rents allocable to any period commencing from and after the occurrence of such Event of Default. Any Rents received hereunder by Beneficiary shall be applied and disbursed to the payment, performance and discharge of the Obligations, subject to the terms of the Financing Agreement; provided, however, that, subject to any applicable requirement of law, any security deposits actually received by Beneficiary shall be held, applied and disbursed as provided in the applicable Leases.

Section 3.05 Direction to Tenants. Upon and at any time following the occurrence and during the continuance of an Event of Default, Trustor shall, at the direction of Beneficiary, authorize and direct, in writing, the tenant under each Lease to pay directly to, or as directed by, Beneficiary all Rents accruing or due under its Lease, without proof to the tenant of the occurrence and continuance of such Event of Default. Trustor hereby authorizes the tenant under each Lease to rely upon and comply with any notice or demand from Beneficiary for payment of Rents to Beneficiary, and Trustor shall have no claim against any tenant for Rents paid by such tenant to Beneficiary pursuant to such notice or demand; provided that Beneficiary shall not provide any tenant with any such notice or demand except at such time as an Event of Default shall have occurred and be continuing. All Rents collected by Beneficiary pursuant to this Section 3.04 shall be applied in accordance with the Financing Agreement.

Section 3.06 Appointment of Attorney-in-Fact.

(a) Trustor hereby constitutes and appoints Beneficiary the true and lawful attorney-in-fact, coupled with an interest, of Trustor, and Trustor hereby confers upon Beneficiary the right, in the name, place and stead of Trustor, to, upon the occurrence and during the continuance of an Event of Default, demand, sue for, attach, levy, recover and receive any of the Rents and any premium or penalty payable upon the exercise by any third Person under any Lease of a privilege of cancellation originally provided in such Lease and to give proper receipts, releases and acquittances therefor and, after deducting expenses of collection, to apply the net proceeds as provided in the Financing Agreement. Trustor hereby authorizes and directs any such third Person to deliver such payment to Beneficiary in accordance with this Article III, and Trustor hereby ratifies and confirms all that its said attorney-in-fact, the Beneficiary, shall do or cause to be done in accordance with this Deed of Trust and by virtue of the powers granted hereby. The foregoing appointment shall continue only until the curing or waiver of such Event of Default by Trustor, and such rights, powers and privileges shall be exclusive in Beneficiary, and its successors and assigns, so long as any part of the Obligations (other than contingent indemnity obligations as to which no claim has been made and Cash Management Obligations) remains unpaid or unperformed and undischarged, and shall not have been terminated in accordance with the Financing Agreement and the other Loan Documents.

(b) Trustor hereby constitutes and appoints Beneficiary the true and lawful attorney-in-fact, coupled with an interest, of Trustor and Trustor hereby confers upon Beneficiary the right, in the name, place and stead of Trustor upon occurrence and during the

continuance of an Event of Default, to subject and subordinate at any time and from time to time under any Lease or any part thereof to the lien, assignment and security interest of this Deed of Trust and to the terms hereof, or to any other mortgage, deed of trust, assignment or security agreement, or to any ground lease or surface lease, with respect to all or a portion of the Trust Property, or to request or require such subordination, where such reservation, option or authority was reserved to Trustor under any such Lease, or in any case where Trustor otherwise would have the right, power or privilege so to do. The foregoing appointment shall continue only until the curing or waiver of such Event of Default by Trustor, and such rights, powers and privileges shall be exclusive in Beneficiary, and its successors and assigns, so long as any part of the Obligations (other than contingent indemnity obligations as to which no claim has been made and Cash Management Obligations) remains unpaid or unperformed and undischarged, and shall not have been terminated in accordance with the Financing Agreement and the other Loan Documents. Trustor hereby represents and warrants that it has not at any time prior to the date hereof exercised (or appointed any Person as attorney-in-fact to exercise) any of the rights described in this Section 3.04(b), and Trustor hereby covenants not to exercise (or allow or appoint any other Person as attorney-in-fact to exercise) any such right, nor (except at Beneficiary’s written request) to subordinate any such Lease to the lien of this Deed of Trust or to any other mortgage, deed of trust, assignment or security agreement or to any ground lease or surface lease.

Section 3.07 No Liability of Beneficiary. Neither the acceptance hereof nor the exercise of the rights and remedies hereunder nor any other action on the part of Beneficiary or any Person exercising the rights of Beneficiary or any Lender hereunder shall be construed to: (a) be an assumption by Beneficiary or any such Person or to otherwise make Beneficiary or such Person liable or responsible for the performance of any of the obligations of Trustor under or with respect to the Leases or for any Rents, security deposit or other amount delivered to Trustor, provided that Beneficiary or any such Person exercising the rights of Beneficiary shall be accountable for any Rents, security deposits or other amounts actually received by Beneficiary or such Person, as the case may be; or (b) obligate Beneficiary or any such Person to take any action under or with respect to the Leases or with respect to the Trust Property, to incur any expense or perform or discharge any duty or obligation under or with respect to the Leases or with respect to the Trust Property, to appear in or defend any action or proceeding relating to the Leases or the Trust Property, to constitute Beneficiary as a Beneficiary-in-possession (unless Beneficiary actually enters and takes possession of the Trust Property), or to be liable in any way for any injury or damage to Persons or property sustained by any Person in or about the Trust Property, other than to the extent caused by the willful misconduct or gross negligence of Beneficiary or any Person exercising the rights of Beneficiary hereunder.

Section 3.08 No Modification of Trustor’s Obligations. Nothing herein contained shall modify or otherwise alter the obligation of Trustor to make prompt payment of all Obligations as and when the same become due, regardless of whether the Rents described in this Article III are sufficient to pay the Obligations, and the security provided to Beneficiary pursuant to this Article III shall be cumulative of all other security of any and every character now or hereafter existing to secure payment of the Obligations.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES

Trustor hereby unconditionally represents and warrants to Beneficiary as follows:

Section 4.01 Power to Create Lien and Security.

(a) Trustor (i) is a corporation duly organized, validly existing and in good standing under the laws of the State of Texas and (ii) has all requisite power and lawful authority to conduct its business as now conducted and as presently contemplated, to grant, bargain, sell, assign, transfer, mortgage and convey a Lien and security interest in all of the Trust Property in the manner and form herein provided and to execute and deliver this Deed of Trust, and to consummate the transactions contemplated hereby.

(b) The execution, delivery and performance by Trustor of this Deed of Trust (i) has been duly authorized by all necessary action, (ii) do not and will not contravene its organization documents, or any applicable law or any material Contractual Obligation binding on or otherwise affecting it or any of its properties, (iii) does not and will not result in or require the creation of any Lien (other than pursuant to this Deed of Trust) upon or with respect to any of the Trust Property, (iv) does not and will not result in any default, noncompliance, suspension, revocation, impairment, forfeiture or nonrenewal of any permit, license, authorization or approval applicable to its operations or any of the Trust Property, and (v) does not require any authorization or approval or other action by, and no notice to or filing with, any grantor, lessor, sublessor, Governmental Authority or other Person whomsoever, other than filings relating to the perfection of Liens and the release of Liens and except for such authorizations, approvals or other actions which have already been obtained or taken.

Section 4.02 Loan and Loan Documents. All representations and warranties made by or on behalf of Trustor in the Financing Agreement and the other Loan Documents applicable to the Trust Property or to Trustor, are incorporated herein by reference and are hereby made by Trustor as to itself and the Trust Property as though such representations and warranties were set forth at length herein as the representations and warranties of Trustor.

Section 4.03 No Condemnation. As of the Effective Date, no part of any property subject to this Deed of Trust has been taken in condemnation or other like proceeding nor is any proceeding pending or to the best of Trustor’s knowledge, threatened or known to be contemplated for the partial or total condemnation or taking of the Trust Property.

Section 4.04 Flood Zone. The Trust Property is not located in an area identified by the Federal Emergency Management Agency (“FEMA”) as having special flood hazards or if the Land or any part thereof is identified by the Federal Emergency Management Agency as an area having special flood hazards (including, without limitation, those areas designated as Zone A, Zone AE or Zone V), then Trustor has obtained the insurance required under Section 5.5 of the Financing Agreement.

ARTICLE V

AFFIRMATIVE COVENANTS

All affirmative covenants made by Trustor in the Financing Agreement are incorporated herein by reference and are hereby also made by Trustor as to itself and the Trust Property as though such covenants were set forth at length herein as the covenants of Trustor.

ARTICLE VI

NEGATIVE COVENANTS

All negative covenants made by Trustor in the Financing Agreement and the other Loan Documents are incorporated herein by reference and are hereby also made by Trustor as applicable to itself and the Trust Property as though such negative covenants were set forth at length herein as the negative covenants of Trustor.

ARTICLE VII

EVENTS OF DEFAULT AND REMEDIES

Section 7.01 Event of Default. The “Events of Default” set forth in Article VIII of the Financing Agreement are hereby incorporated herein as if fully set forth herein, and, without limiting the generality of the foregoing, the occurrence of an “Event of Default” under the Financing Agreement or any other Loan Document shall constitute an “Event of Default” hereunder.

Section 7.02 Sale of Trust Property in Texas. If any Event of Default has occurred and is continuing, the Trustee is hereby authorized and empowered to sell any part of the Trust Property located in the State of Texas at public sale to the highest bidder for cash in the area at the county courthouse of the county in Texas in which the Texas portion of the Trust Property or any part thereof is situated, as herein described, designated by such county’s commissioner’s court for such proceedings, or if no area is so designated, at the door of the county courthouse of said county, at a time between the hours of 10:00 A.M. and 4:00 P.M. which is no later than three (3) hours after the time stated in the notice described immediately below as the earliest time at which such sale would occur on the first Tuesday of any month, after advertising the earliest time at which said sale would occur, the place, and terms of said sale, and the portion of the Trust Property to be sold, by (a) posting (or by having some person or persons acting for the Trustee post) for at least twenty-one (21) days preceding the date of the sale, written or printed notice of the proposed sale at the courthouse door of said county in which the sale is to be made; and if such portion of the Trust Property lies in more than one county, one such notice of sale shall be posted at the courthouse door of each county in which such part of the Trust Property is situated and such part of the Trust Property may be sold in the area at the county courthouse of any one of such counties designated by such county’s commissioner’s court for such proceedings, or if no area is so designated, at the courthouse door of such county, and the notice so posted shall designate in which county such property shall be sold, and (b) filing in the office of the county clerk of each county in which any part of the Texas portion of

the Trust Property which is to be sold at such sale is situated a copy of the notice posted in accordance with the preceding clause (a). In addition to such posting and filing of notice, the Beneficiary or other holder of the Obligations shall, at least twenty-one (21) days preceding the date of sale, serve or cause to be served written notice of the proposed sale by certified mail on the Trustor and on each other debtor, if any, obligated to pay the Obligations according to the records of the Beneficiary or other holder of the Obligations. Service of such notice shall be completed upon deposit of the notice, enclosed in a postpaid wrapper properly addressed to the Trustor and such other debtors at their most recent address or addresses as shown by the records of the Beneficiary or other holder of the Obligations in a post office or official depository under the care and custody of the United States Postal Service. The affidavit of any person having knowledge of the facts to the effect that such a service was completed shall be prima facie evidence of the fact of service. The Trustor agrees that no notice of any sale, other than as set out in this paragraph, need be given by the Trustee, the Beneficiary, the other Secured Parties or any other person, except as otherwise may be required by applicable law. The Trustor hereby designates as its address for the purpose of such notice the address set out in the notice section hereof; and agrees that such address shall be changed only by depositing notice of such change enclosed in a postpaid wrapper in a post office or official depository under the care and custody of the United States Postal Service, certified mail, postage prepaid, return receipt requested, addressed to the Beneficiary or other holder of the Obligations at the address for the Beneficiary set out herein (or to such other address as the Beneficiary or other holder of the Obligations may have designated by notice given as above provided to the Trustor and such other debtors). Any such notice of change of address of the Trustor or other debtors or of the Beneficiary or of other holder of the Obligations shall be effective three (3) business days after such deposit if such post office or official depository is located in the State of Texas, otherwise to be effective upon receipt. The Trustor authorizes and empowers the Trustee to sell the Texas portion of the Trust Property in lots or parcels or in its entirety as the Trustee shall deem expedient; and to execute and deliver to the purchaser or purchasers thereof good and sufficient deeds of conveyance thereto by fee simple title, with evidence of general warranty by the Trustor, and the title of such purchaser or purchasers when so made by the Trustee, the Trustor binds itself to warrant and forever defend. Where portions of the Trust Property lie in different counties, sales in such counties may be conducted in any order that the Trustee may deem expedient; and one or more such sales may be conducted in the same month, or in successive or different months as the Trustee may deem expedient. Notwithstanding anything to the contrary contained herein, the Trustee may postpone the sale provided for in this Section 7.02 at any time without the necessity of a public announcement. The provisions hereof with respect to the posting and giving of notices of sale are intended to comply with the provisions of Section 51.002 of the Property Code of the State of Texas, effective January 1, 1984, and in the event the requirements, or any notice, under such Section 51.002 of the Property Code of the State of Texas shall be eliminated or the prescribed manner of giving such notices modified by future amendment to, or adoption of any statute superseding, Section 51.002 of the Property Code of the State of Texas, the requirement for such particular notices shall be deemed stricken from or modified in this instrument in conformity with such amendment or superseding statute, effective as of the effective date thereof. All notices sent pursuant to this Section 7.02 shall be sent via certified or registered mail to the extent required by law. Further, pursuant to Section 51.0074(b)(1) of the Property Code of the State of Texas, all duties of the Trustee arising under this Deed of Trust are granted in furtherance of the Trustee’s power of sale. With respect to any Texas portion of the Trust Property, to the extent that there is a direct conflict between the provisions of this Deed of Trust and this Section 7.02 and such conflict cannot be reconciled so as to give effect to the provisions of both Sections, the provisions of this Section 7.02 shall prevail.

Section 7.03 Trustee’s Successors, Substitutes and Agents. Trustee or any successor to or substitute for Trustee may appoint or delegate any one or more Persons as agent to perform any act or acts necessary or incident to any sale held by Trustee, including, without limitation, the posting of notices and the conduct of sale, but in the name and on behalf of Trustee. If Trustee or any successor Trustee shall have given notice of sale hereunder, any successor may complete the sale and the conveyance of the Trust Property pursuant thereto as if such notice had been given by the successor Trustee conducting the sale.

Section 7.04 Judicial Foreclosure. If any Event of Default shall occur and be continuing, Beneficiary shall have the right and power to proceed by a suit or suits in equity or at law, whether for the specific performance of any covenant or agreement herein contained or in aid of the execution of any power herein granted, or for any foreclosure hereunder or for the sale of the Trust Property under the judgment or decree of any court or courts of competent jurisdiction, or for the appointment of a receiver pending any foreclosure hereunder or the sale of the Trust Property under the order of a court or courts of competent jurisdiction or under executory or other legal process, or for the enforcement of any other appropriate legal or equitable remedy.

Section 7.05 Receiver. If any Event of Default shall occur and be continuing, Beneficiary shall have the right and power to proceed by a suit or suits in equity or at law, whether for the specific performance of Trustor which Beneficiary may apply for and obtain as a matter of right and without notice to Trustor, which notice is hereby expressly waived by Trustor, the appointment of a receiver to collect the Rents of the Trust Property and to preserve the security hereof, either before or after any foreclosure sale or the sale of the Trust Property under the order of a court or courts of competent jurisdiction or under executory or other legal process, without regard to the value of the Trust Property as security for the amount then due to Beneficiary, or the solvency of any entity or entities, person or persons primarily or secondarily liable for the payment of such amounts; the Rents of the Trust Property, in any such event, having heretofore been assigned to Beneficiary pursuant to Section 3.01 hereof as additional security for the payment of the Obligations secured hereby. Any money advanced by Beneficiary in connection with any such receivership shall be a demand obligation (which obligation Trustor hereby expressly promises to pay) owing by Trustor to Beneficiary and shall be subject to the provisions of Section 9.07(b) hereof.

Section 7.06 Foreclosure for Installments. To the extent allowed by applicable law, Beneficiary shall also have the option to proceed with foreclosure in satisfaction of any installments of the Obligations which have not been paid when due, either through the courts or otherwise, by non-judicial power in satisfaction of the matured but unpaid portion of the Obligations as if under a full foreclosure, conducting the sale as herein provided and without declaring the entire principal balance and accrued interest due. Such sale may be made subject to the unmatured portion of the Obligations, and any such sale shall not in any manner affect the unmatured portion of the Obligations, but as to such unmatured portion of the Obligations this Deed of Trust shall remain in full force and effect just as though no sale had been made hereunder. It is further agreed that several sales may be made hereunder without exhausting the right of sale for any unmatured part of the Obligations, it being the intent and purpose hereof to provide for a foreclosure and sale of the security for any matured portion of the Obligations without exhausting the power to foreclose and sell the Trust Property for any subsequently maturing portion of the Obligations.

Section 7.07 Separate Sales. To the extent allowed by applicable law, the Trust Property may be sold in one or more parcels and in such manner and order as Beneficiary, in its sole discretion, may elect, it being expressly understood and agreed that the right of sale arising out of any Event of Default shall not be exhausted by any one or more sales.

Section 7.08 Possession of Trust Property. Trustor agrees to the full extent that it lawfully may, that, in case one or more of the Events of Default shall have occurred and be continuing, then, and in every such case, Trustee or Beneficiary (or its successor, if applicable) shall have the right and power to enter into and upon and take possession of all or any part of the Trust Property in the possession of Trustor, its successors or assigns, or its or their agents or servants, and may exclude Trustor, its successors or assigns, and all Persons claiming by, through or under Trustor, and its or their agents or servants wholly or partly therefrom; and, holding the same, Trustee or Beneficiary may use, administer, manage, operate and control the Trust Property and conduct the business thereof to the same extent as Trustor, its successors or assigns, might at the time do and may exercise all rights and powers of Trustor, in the name, place and stead of Trustor, or otherwise as Trustee or Beneficiary shall deem best. All reasonable costs, expenses and liabilities of every character incurred by Beneficiary in administering, managing, operating and controlling the Trust Property shall constitute a demand obligation (which obligation Trustor hereby expressly promises to pay) owing by Trustor to Trustee and/or Beneficiary and shall be subject to the provisions of Section 9.07(b) hereof. Trustor hereby irrevocably constitutes and appoints Beneficiary as Trustor’s attorney-in-fact (coupled with an interest) to perform such acts and execute such documents as Beneficiary, in its sole discretion, shall deem appropriate, including, without limitation, endorsement of Trustor’s name on any instruments. Regardless of any provision of this Deed of Trust, the Financing Agreement or any other Loan Document, Beneficiary shall not be considered to have accepted any property other than cash or immediately available funds in satisfaction of any obligation of Trustor to Beneficiary, unless Beneficiary shall have given express written notice of Beneficiary’s election to the contrary.

Section 7.09 Occupancy After Acceleration. In the event that there is an acceleration of all or any part of the Obligations and Trustor or Trustor’s representatives, successors or assigns or any other Person claiming any interest in the Trust Property by, through or under Trustor, continues to occupy or use the Trust Property or any part thereof, each and all shall immediately become the tenant of Beneficiary (or its successor, if applicable), which tenancy shall be a tenancy from day-to-day, terminable at the will of either the landlord or tenant, at a rent to be determined by Beneficiary (which may be in excess of fair market value); provided, however, that until Beneficiary sets forth the amount of such rent, such rent shall be a fair market rental per day based upon the value of the Trust Property as a whole; and such rental shall be due daily to the Beneficiary (or its successor, if applicable). To the extent permitted by applicable law, Beneficiary (or its successor, if applicable) shall, notwithstanding any language herein to the contrary, have the sole option to demand immediate possession or to permit the occupants to remain as tenants at will. In the event that the tenant fails to surrender possession of said property upon demand, Beneficiary (and its successor, if applicable) shall be entitled to institute and maintain a summary action for possession of the Trust Property (such as an action for forcible entry and detainer) in any court having appropriate jurisdiction.

Section 7.10 Remedies Cumulative, Concurrent and Nonexclusive. Every right, power and remedy herein given to Trustee or Beneficiary shall be cumulative and in addition to every other right, power and remedy herein specifically given or now or hereafter existing in equity, at law or by statute (including, without limitation, specifically those granted by the Applicable UCC). Each such right, power and remedy, whether specifically herein given or otherwise existing, may be exercised from time to time and so often and in such order as may be deemed expedient by Trustee or Beneficiary, and the exercise, or the beginning of the exercise, of any such right, power or remedy shall not be deemed a waiver of the right to exercise, at the same time or thereafter, any other right, power or remedy. Beneficiary shall be entitled to collect all costs and expenses incurred in exercising its rights hereunder as set forth in Section 9.07(b) hereof. No delay or omission by Trustee or Beneficiary in the exercise of any such right, power or remedy shall impair any such right, power or remedy or operate as a waiver thereof or of any other right, power or remedy then or thereafter existing.

Section 7.11 No Release of Obligations. Neither Trustor, any Guarantor, nor any other Person now or hereafter obligated for the payment or performance of all or any part of the Obligations shall be relieved of any such obligation by reason of (a) the failure of Trustee or Beneficiary to comply with any request of Trustor, any Guarantor, or any other Person so obligated to foreclose the Lien of this Deed of Trust or to enforce any provision hereunder or under the Financing Agreement; (b) the release, regardless of consideration, of the Trust Property or any portion thereof or interest therein or the addition of any other property to the Trust Property; (c) any agreement or stipulation between any subsequent owner of the Trust Property and Beneficiary extending, renewing, rearranging or in any other way modifying the terms of this Deed of Trust without first having obtained the consent of, given notice to or paid any consideration to Trustor, any Guarantor, or other Person, and in any such event Trustor, all Guarantors and all such other Persons shall continue to be liable to make payment according to the terms of any such extension or modification agreement unless expressly released and discharged in writing by Beneficiary; or (d) any other act or occurrence save and except the complete payment and performance of all of the Obligations.

Section 7.12 Release of and Resort to Collateral. Beneficiary may release, regardless of consideration, any part of the Trust Property without, as to the remainder, in any way impairing, affecting, subordinating or releasing the Lien or security interest created in or evidenced by this Deed of Trust or its stature as a first and prior Lien and security interest in and to the Trust Property, and without in any way releasing or diminishing the liability of any Person liable for the payment or performance of the Obligations. Subject to applicable Governmental Authorizations, Beneficiary may resort to any other security for the payment and performance of the Obligations held by Trustee or Beneficiary in such manner and order as Beneficiary may elect.

Section 7.13 Waiver of Redemption, Notice and Marshaling of Assets. To the fullest extent permitted by applicable law, Trustor hereby irrevocably and unconditionally waives and releases (a) all benefits that might accrue to Trustor by virtue of any present or future moratorium law or other law exempting the Trust Property from attachment, levy or sale on execution or providing for any appraisement, valuation, stay of execution, exemption from civil process, redemption or extension of time for payment; (b) except for notices expressly provided for herein or in the Financing Agreement or required by Governmental Authorizations, all notices of any Event of Default or of Beneficiary’s intention to accelerate maturity of the Obligations or of Trustee or Beneficiary’s election to exercise or actual exercise of any right, remedy or recourse provided for hereunder or under the Financing Agreement; and (c) any right to a marshaling of assets or a sale in inverse order of alienation. If any law referred to in this Deed of Trust and now in force, of which Trustor or its successor or successors might take advantage despite the provisions hereof, shall hereafter be repealed or cease to be in force, such law shall thereafter be deemed not to constitute any part of the contract herein contained or to preclude the operation or application of the provisions hereof.

Section 7.14 Discontinuance of Proceedings. In case Beneficiary shall have proceeded to invoke any right, remedy or recourse permitted hereunder or under the Financing Agreement and shall thereafter elect to discontinue or abandon same for any reason, Beneficiary shall have the unqualified right so to do and, in such an event, Trustor and Beneficiary shall be restored to their former positions with respect to the Obligations, this Deed of Trust, the Financing Agreement, the Trust Property and otherwise, and the rights, remedies, recourses and powers of Beneficiary shall continue as if the same had never been invoked, but no such discontinuance or abandonment shall waive any Event of Default which may then exist or the right of Beneficiary thereafter to exercise any right, remedy or recourse under the Loan Documents for such Event of Default.

Section 7.15 Application of Proceeds. After the occurrence and during the continuance of an Event of Default, the proceeds of any sale of and any other amounts generated by the holding, leasing, operating or other use of the Trust Property shall be applied by Beneficiary (or the receiver, if one is appointed), to the extent that funds are so available therefrom, in accordance with the provisions of the Financing Agreement or, if not so provided, then in the following order of priority, except to the extent otherwise required by applicable law:

(a) first, to the payment of the reasonable and necessary costs and expenses of taking possession of the Trust Property and of holding, using, leasing, repairing, improving the same, including reasonable (i) receivers’ fees, (ii) court costs, (iii) attorneys’ and accountants’ fees, (iv) costs of advertisement and title search fees, and (v) the payment of any and all Impositions, Liens, security interests or other rights, titles or interests equal or superior to the lien and security interest of this Deed of Trust (except those to which the Trust Property has been sold subject to and without in any way implying Beneficiary’s prior consent to the creation thereof);

(b) second, to the payment of all amounts other than the Principal Balance and accrued but unpaid interest which may be due to Beneficiary hereunder or under the other Loan Documents, together with interest thereon as provided herein;

(c) third, to the payment of the Obligations in such order and manner as Beneficiary determines in its sole discretion; and

(d) fourth, to Trustor or as otherwise required by any Governmental Authorization.

Trustor shall be liable for any deficiency remaining.

Section 7.16 Uniform Commercial Code Remedies. Beneficiary shall have all of the rights, remedies and recourses with respect to the Personalty and the Fixtures afforded to it by the Applicable UCC, including, without limitation, the right to take possession of the Personalty and the Fixtures or any part thereof, and to take such other measures as Beneficiary may deem necessary for the care, protection and preservation of the Personalty and the Fixtures, in addition to, and not in limitation of, the other rights, remedies and recourses afforded by this Deed of Trust and the other Loan Documents.

Section 7.17 Indemnity. In connection with any action taken by Trustee, Beneficiary and/or any Indemnitee pursuant to this Deed of Trust, Trustee, Beneficiary and/or any such Indemnitee shall not be liable for any Loss sustained by Trustor and/or any other Loan Party, including, without limitation, those resulting from (a) any assertion that Beneficiary, or any such Indemnitee has received funds from the operations of the Trust Property claimed by any third Person, or (b) any act or omission of Trustee or Beneficiary, or any such Indemnitee in administering, managing, operating or controlling the Trust Property, including, without limitation, in either case such Loss as may result from the ordinary negligence of Beneficiary or such Indemnitee or which may result from strict liability, whether under applicable law or otherwise unless such Loss is caused by the gross negligence or willful misconduct, Beneficiary and/or such other Indemnitee, nor shall Trustee, Beneficiary and/or any other Indemnitee be obligated to perform or discharge any obligation, duty or liability of Trustor and/or any other Loan Party. Trustor shall and does hereby agree to indemnify Trustee, Beneficiary and each of the other Indemnitees for, and to hold Trustee, Beneficiary and each such other Indemnitees harmless from, any and all Losses which may or might be incurred by Trustee, Beneficiary or any of Indemnitee by reason of this Deed of Trust or the exercise of rights or remedies hereunder, including, without limitation, such Losses as may result from the ordinary negligence of Beneficiary or any Indemnitee or which may result from strict liability, whether under applicable law or otherwise, unless such Loss is caused by the gross negligence or willful misconduct of Trustee, Beneficiary or such other Indemnitee. WITHOUT LIMITATION, THE FOREGOING INDEMNITY SHALL APPLY TO BENEFICIARY AND EACH INDEMNITEE WITH RESPECT TO LOSSES WHICH IN WHOLE OR IN PART ARE CAUSED BY OR ARISE OUT OF ANY NEGLIGENT ACT OR OMISSION OF BENEFICIARY, SUCH INDEMNITEE OR ANY OTHER PERSON. Should Trustee, Beneficiary and/or any other Indemnitee make any expenditure on account of any such Losses, the amount thereof, including, without limitation, costs, expenses and reasonable attorneys’ fees, shall be a demand obligation (which obligation Trustor hereby expressly promises to pay) owing by Trustor to Beneficiary and/or Trustee and shall be subject to the provisions of Section 9.07(b) hereof. Trustor hereby assents to, ratifies and confirms any and all actions of Trustee and/or Beneficiary with respect to the Trust Property taken under this Deed of Trust. This Section 7.17 shall survive the termination of this Deed of Trust and the payment and performance of the Obligations.

ARTICLE VIII

TRUSTEE

Section 8.01 Duties, Rights, and Powers of Trustee. It shall be no part of the duty of Trustee to see to any recording, filing or registration of this Deed of Trust or any other instrument in addition or supplemental thereto, or to give any notice thereof, or to see to the payment of or be under any duty in respect of any tax or assessment or other governmental charge which may be levied or assessed on the Trust Property, or any part thereof, or against Trustee, or to see to the performance or observance by Trustee of any of the covenants and agreements contained herein. Trustee shall not be responsible for the execution, acknowledgment or validity of this Deed of Trust or of any instrument in addition or supplemental hereto or for the sufficiency of the security purported to be created hereby, and makes no representation in respect thereof or in respect of the rights of Beneficiary. Trustee shall have the right to confer with counsel upon any matters arising hereunder and shall be fully protected in relying as to legal matters on the advice of counsel. Trustee shall not incur any personal liability hereunder except for Trustee’s own gross negligence or willful misconduct, and Trustee shall have the right to rely on any instrument, document or signature authorizing or supporting any action taken or proposed to be taken by Trustee hereunder, believed by Trustee in good faith to be genuine.

Section 8.02 Successor Trustee. Trustee may resign by written notice addressed to Beneficiary or be removed at any time with or without cause by an instrument in writing duly executed on behalf of Beneficiary. In case of the death, resignation or removal of Trustee, a successor trustee may be appointed by Beneficiary by instrument of substitution complying with any applicable requirements of law, or, in the absence of any such requirement, without other formality than appointment and designation in writing. Written notice of such appointment and designation shall be given by Beneficiary to Trustee, but the validity of any such appointment shall not be impaired or affected by failure to give such notice or by any defect therein. Such appointment and designation shall be full evidence of the right and authority to make the same and of all the facts therein recited, and, upon the making of any such appointment and designation, this Deed of Trust shall vest in the successor trustee all the estate and title in and to all of the Trust Property, and the successor trustee shall thereupon succeed to all of the rights, powers, privileges, immunities and duties hereby conferred upon Trustee named herein, and one such appointment and designation shall not exhaust the right to appoint and designate a successor trustee hereunder but such right may be exercised repeatedly as long as any Obligations remain unpaid hereunder. To facilitate the administration of the duties hereunder, Beneficiary may appoint multiple trustees to serve in such capacity or in such jurisdictions as Beneficiary may designate.

Section 8.03 Retention of Moneys. All moneys received by Trustee shall, until used or applied as herein provided, be held in trust for the purposes for which they were received, but need not be segregated in any manner from any other moneys (except to the extent required by law), and Trustee shall be under no liability for interest on any moneys received by Trustee hereunder.

ARTICLE IX

MISCELLANEOUS

Section 9.01 Instrument Construed as Mortgage, Etc. This Deed of Trust may be construed as a mortgage, deed of trust, chattel mortgage, conveyance, assignment, security agreement, pledge, financing statement, hypothecation or contract, or any one or more of them, in order to fully effectuate the liens and security interests created hereby and the purposes and agreements set forth herein.

Section 9.02 Performance at Trustor’s Expense. The cost and expense of performing or complying with any and all of the Obligations shall be borne solely by Trustor, and no portion of such cost and expense shall be, in any way or to any extent, credited against any installment on or portion of the Obligations.

Section 9.03 Survival of Obligations. Each and all of the Obligations shall survive the execution and delivery of this Deed of Trust and shall continue in full force and effect until all of the Obligations shall have been fully satisfied.

Section 9.04 Further Assurances. Trustor, upon the request of Beneficiary, shall execute, acknowledge, deliver and record and/or file such further instruments, including, without limitation, financing statements, and do such further acts as may be necessary, desirable or proper to carry out more effectively the purpose of this Deed of Trust and to subject to the Liens and security interests hereof any property intended by the terms hereof to be covered hereby, including, without limitation, any renewals, additions, substitutions, replacements, betterments or appurtenances to the then Trust Property.

Section 9.05 Notices. All notices or other communications required or permitted to be given pursuant to this Deed of Trust shall be in writing and shall be considered properly given if given in the manner prescribed by Section 10.1 of the Financing Agreement to the parties and at the addresses set forth in the first paragraph hereof, and to each of the parties to the Financing Agreement at the addresses specified in Section 10.1 thereof. Any party shall have the right to change its address for notice hereunder to any other location within the continental United States by the giving of ten (10) days’ notice to the other party in the manner set forth above.

Section 9.06 No Waiver. Any failure by Beneficiary to insist, or any election by Beneficiary not to insist, upon strict performance by Trustor of any of the terms, provisions or conditions of this Deed of Trust shall not be deemed to be a waiver of the same or of any other terms, provisions or conditions hereof, and Beneficiary shall have the right, at any time or times thereafter, to insist upon strict performance by Trustor of any and all of such terms, provisions and conditions. Beneficiary may, in Beneficiary’s sole and absolute discretion, (i) in the case of a Default, determine whether such Default has been cured, and (ii) in the case of an Event of Default, accept or reject any proposed cure of an Event of Default. In no event shall any provision of this Deed of Trust or any other Loan Document which provides that Beneficiary shall have certain rights and/or remedies only during the continuance of an Event of Default be construed so as to require Beneficiary to accept a cure of any such Event of Default. Unless and until Beneficiary accepts any proposed cure of an Event of Default, such Event of Default shall be deemed to be continuing for purposes of this Deed of Trust and the other Loan Documents.

Section 9.07 Beneficiary’s Right to Perform; Beneficiary’s Expenditures.

(a) Trustor agrees that if Trustor fails to perform any act or take any action which Trustor is required to perform or take hereunder or under the Financing Agreement or to pay any money which Trustor is required to pay hereunder or under the Financing Agreement, beyond any applicable notice, cure and/or grace period Beneficiary may, but shall not be obligated to, perform or cause to be performed such act or take such action or pay such money.