UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For

the fiscal year ended |

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from to |

Commission

file number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| None | Not Applicable |

Securities registered pursuant to Section 12(g) of the Act:

Class “A” Voting Common Stock, no par value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. ☐ Yes ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.406 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Smaller

reporting company | ||

| Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

State

the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which

the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s

most recently completed second fiscal quarter. The Registrant’s shares were last sold at a price of $1.01 per share. Although the

Registrant’s stock has very few trades and limited volume, based on the last sales price of $1.01 shares held by non-affiliates

would have a market value of $

As of March 31, 2022 the Registrant had shares of common stock issued and outstanding.

No documents are incorporated into the text by reference.

Table of Contents

| 2 |

EXPLANATORY NOTE

| 3 |

PART I

ITEM 1. BUSINESS

China Foods Holdings Ltd. (the “Company”, “CFOO”, or “we”) was incorporated in Delaware on January 10, 2019. On January 23, 2019, the Company entered into an Agreement and Plan of Merger (the “Agreement”) with Trafalgar Resources, Inc., a Utah corporation (“Trafalgar”). Pursuant to the Agreement, the Company merged with Trafalgar (the “Merger”) with the Company as the surviving entity. Prior to the Merger, Trafalgar had not commenced operations for several years that had resulted in significant revenue and Trafalgar’s efforts had been devoted primarily to activities related to raising capital and attempting to acquire an operating entity.

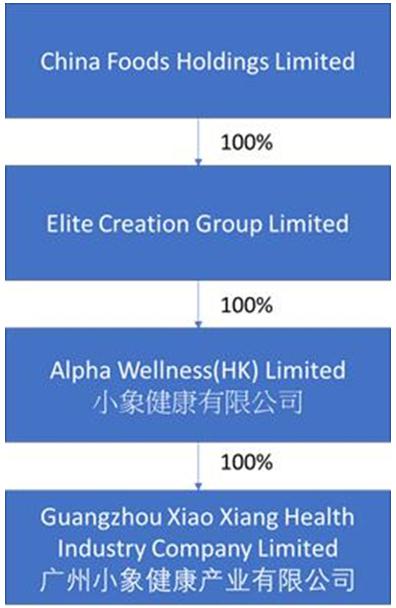

The Company is a Delaware holding company and we conduct our business through our wholly owned subsidiary Guangzhou Xiao Xiang Health Industry Company Limited, a limited liability company organized under the laws of China on March 8, 2017 (“GXXHIC”). GXXHIC is wholly owned by Alpha Wellness (HK) Limited, a limited liability company organized under the laws of Hong Kong on April 24, 2019, which is in turn wholly owned by Elite Creation Group, a limited liability company formed under the laws of the British Virgin Islands formed on September 5, 2018. Alpha Wellness (HK) Limited and Elite Creation Group are holding companies without operations and are wholly owned by the Company.

Substantially all of our operations are conducted in China, and are governed by Chinese laws, rules and regulations. Our subsidiary, GXXHIC, is subject to Chinese laws, rules, and regulations. Uncertainties with respect to the interpretation and enforcement of Chinese laws, rules and regulations could have a material adverse effect on us. Risks and uncertainties arising from the legal system in China, including risks and uncertainties regarding that the rules and regulations in China can change quickly with little advance notice and that the Chinese government may intervene or influence our operations at any time, could result in a material adverse change in our operations and the value of our securities.

Our History

Prior to the Merger, Trafalgar’s majority stockholder who owned 5,000,000 shares (approximately 95.2%) of the 5,251,309 outstanding shares of Trafalgar’s common stock, par value $0.0001, signed a written consent approving the Merger and the related transactions. Such approval and consent were sufficient under Utah law and Trafalgar’s Bylaws to approve the Merger. The boards of directors and shareholders of the Company and Trafalgar approved the Merger.

Pursuant to the Merger, each share of Trafalgar’s common stock was converted into one share of the Company’s common stock. After the Merger, HY (HK) Financial Investments Co., Ltd. owns 5,001,000 shares of common stock of the Company.

The Merger was effective on March 13, 2019.

On December 11, 2019, the Board of Directors approved a change to its fiscal year-end from September 30 to December 31. As a result of this change, the fiscal year is a 3 months transition period beginning October 1, 2019 through December 31, 2020. In these statements, including the notes thereto, financial results for fiscal 2019 are for a 3-month period. Corresponding results for the years ended September 30, 2019 and 2018 are both for 12-month periods.

On July 9, 2020, the Company consummated the Share Exchange Agreement (“the “Share Exchange Agreement”) with Elite Creation Group Limited, a private limited company organized under the laws of British Virgin Islands (“ECGL”). As a result of the acquisition of ECGL, the Company entered into the healthcare product distributing and marketing industry, pursuing a new strategy of developing and distributing health related products, including supplements, across the globe with a focus on mainland China, Europe and Australia.

| 4 |

ECGL will comprise the ongoing operations of the combined entity and its senior management will serve as the senior management of the combined entity, ECGL is deemed to be the accounting acquirer for accounting purposes. The transaction will be treated as a recapitalization of the Company. Accordingly, the consolidated assets, liabilities and results of operations of the Company will become the historical financial statements of ECGL, and the Company’s assets, liabilities and results of operations will be consolidated with ECGL beginning on the acquisition date. ECGL was the legal acquiree but deemed to be the accounting acquirer. The Company was the legal acquirer but deemed to be the accounting acquiree in the reverse merger. The historical financial statements prior to the acquisition are those of the accounting acquirer (ECGL). After completion of the Share Exchange Transaction, the Company’s consolidated financial statements include the assets and liabilities, the operations and cash flow of the accounting acquirer.

Effective July 9, 2020, we consummated the acquisition of ECGL, and its wholly owned subsidiary GXXHIC, a limited liability company organized under the laws of China on March 8, 2017. Alpha Wellness (HK) Limited, a limited liability company organized under the laws of Hong Kong on April 24, 2019, is a holding company without operations.

Corporate Org Chart

Our Products

Our health products are designed to help enhance immunity and improve general wellbeing. We provide the following categories of healthcare products and customized healthcare consultation services in China: (i) Nutrition Catering (ii) Special Health Food (iii) Health Supplement and (iv) Skincare. The products target all age groups with different needs.

Our products are taken as healthcare supplements in accordance with the principles of traditional Chinese medicine including the principle complementary medicine and ideal ratios and combinations of ingredients.

Due to the impact of the COVID-19 pandemic in the healthcare industry, we have also offered a new line of high-end wine products in our online and offline sales platform, to diversify the market demand and customer needs.

Our services

We also extend our service scope to provide the personalized health consulting services to our clients, as well as consultancy services such as tailor-made natural food supplement solutions.

| 5 |

Markets and Regions

The Great Health Industry refers to production, operation, service and information dissemination, maintenance, restoration, and promotions linked to health. It covers medical products, health supplements, nutritional foods, medical devices, health appliances, fitness, health management, health consulting and many other production and service areas closely related to human health. The Great Health Industry is an emerging industry with huge market potential, especially in China.

According to the “China Great Health Industry Strategic Planning and Enterprise Strategy Consulting Report” published by Qianzhan Industry Institute (前瞻產業研究院), the scale of the Great Health Industry in 2017 was USD 947.42 billion, which increased to over USD 1,069.66 billion in 2018. The report predicted USD 1,341.66 billion volume for 2019 and forecast over USD 1,528.09 billion for 2020. In the years till 2023, the average annual compound growth rate will be approximately 12.55%, and with the Great Health Industry reaching approximately USD 2,153.08 billion in 2023.

Our Strategies

We are focused on achieving long-term growth in revenues, cash flow and profit. We believe that we can achieve this by developing multiple distribution channels and strengthening our marketing and promotions, leading to better product turnover and revenue. We also expect to broaden our product range as well as product differentiation in the future. Based on the business experience accumulated over the years, we believe we can improve the efficiency of our supply chain with time-saving and cost-saving supply chain management and marketing planning for the target customer base with our one-stop service.

Our primary aims are (i) to strengthen our product salability; (ii) to cut logistics cost and time spent and (iii) to further expand the market share in China. Toward this end, we plan to pursue the following business strategies:

| ● | Collaborate with third-party e-commerce platforms to boost product exposure, e.g. Tmall, Jingdong mall | |

| ● | Deliver healthcare knowledge and consultation service via social media and We-media | |

| ● | Build brand image and reputation through customer experience and word of mouth | |

| ● | Increase the number of downstream distributors and wholesalers | |

| ● | Strengthen the relationship with manufacturers, suppliers, drug agents and distributors | |

| ● | Pursue strategic acquisitions and partnerships |

We intend to develop both online and offline distribution channels to increase sales volume and revenue. We expect to partner with third party e-commerce platforms, social media and We-media such as Wechat, TikTok and Xiaohongshu to build our online presence. We believe that online channels will allow us to provide real-time nutrition and healthcare consultation services as well as increase customer engagement and retention. Starting from the second half of 2020, we have launched our “nutrition consulting” support services using a major social media software to allow customer groups to receive pre-purchase consultation and after-sales service for products anytime and anywhere.

Our current offline sales channel relies on distributors and sales agents. To enhance the visibility and marketability of our products and services and to improve brand recognition and awareness, we hope to develop store-in-shop and counter experiences. We also intend to partner with high-end gyms to form nutrition clubs and hold weight-loss training camps, health assessment and fitness training camps and other activities.

We intend to create a ‘one-stop’ solution for our customers by creating a multi-channel health product supply and retail system. We not only provide personalized consultation service to our customers, but also summarize and analyze our customer feedback and experiences through our consultation service and after-sales service. We intend to share this data with our manufacturers and supply chain partners to develop products and services that better meet the demands of our customers. By pooling and addressing the needs of downstream businesses and combining it with the Consumer to Manufacturer model for upstream transformation, we anticipate establishing a close relationship between manufacturers and suppliers. We believe this model can also reduce circulation costs and improve the efficiency of our supply chain.

| 6 |

We are a Delaware corporation and we conduct our primary operations in China through our subsidiary GXXHIC. We face various risks and uncertainties related to doing business in China, Our subsidiary GXXHIC is subject to complex and evolving PRC laws and regulations. Recently, the PRC enacted rules and regulations governing offshore offerings, anti-monopoly actions, and additional oversight on cybersecurity and data privacy.

We do not believe there GXXHIC is in violation of any laws, rules or regulations but since these newly enacted rules are still evolving, we cannot assure you that our business operations comply with such regulations and authorities’ requirements in all respects during the development of these new rules. However, in terms of business operation, GXXHIC expects to adapt to the newly issued rules and take dependent measures to comply with the laws and regulations of the Chinese authorities

The PRC government’s authority in regulating our operations and its oversight and control over offerings and listings conducted overseas by, and foreign investment in, China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. Implementation of industry-wide regulations in this nature may cause the value of such securities to significantly decline or be worthless. Risks and uncertainties arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules and regulations in China, could result in a material adverse change in our operations and the value of our securities. But so far, the current operation and securities value of the CFO are stable, and we believe that its risks are to the Company are manageable.

For example, the recently promulgated PRC Data Security Law and the PRC Personal Information Protection Law in 2021 posed additional challenges to our cybersecurity and data privacy compliance. The Cybersecurity Review Measures issued by the Cyberspace Administration of China, or the CAC and several other PRC governmental authorities in December 2021, as well as the Administration Regulations on Cyber Data Security (Draft for Comments) published by the CAC for public comments in November 2021, exposes uncertainties and potential additional restrictions on China-based overseas-listed companies like us. If the detailed rules, implementations, or the enacted version of the draft measures mandate clearance of cybersecurity review and other specific actions to be completed by us, we face uncertainties as to whether such clearance can be timely obtained, the failure of which may subject us to penalties, which could materially and adversely affect our business and results of operations and the price of our securities. However, as the Company operates in a traditional food industry, we believe the promulgation of the above laws will have a low impact on the Company and CFOO believes it is in compliance with the above laws.

In addition, on December 24, 2021, the China Securities Regulatory Commission, or the CSRC, published the draft Regulations of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments), or the Administrative Provisions, and the draft Administrative Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) for public comments. Pursuant to these drafts, PRC domestic companies that directly or indirectly seek to offer or list their securities on an overseas stock exchange, including a PRC company limited by shares and an offshore company whose main business operations are in China and intends to offer securities or be listed on an overseas stock exchange based on its onshore equities, assets, incomes or similar interests, are required to file with the CSRC within three business days after submitting their application documents to the regulator in the place of intended listing or offering. Particularly, as for the PRC domestic companies that have directly or indirectly listed securities in overseas markets intend to conduct follow-on offerings in overseas markets, such companies are required to submit the filing with respect to the follow-on offering within three business days after completion of the follow-on offering.

Furthermore, the PRC anti-monopoly regulators have promulgated new anti-monopoly and competition laws and regulations and strengthened the enforcement under these laws and regulations. There remain uncertainties as to how the laws, regulations and guidelines recently promulgated will be implemented and whether these laws, regulations and guidelines will have a material impact on our business, financial condition, results of operations and prospects. We do not believe there GXXHIC is in violation of any laws, rules or regulations related to monopolies or competition but we cannot assure you that our business operations comply with such regulations and authorities’ requirements in all respects. If any non-compliance is raised by relevant authorities and determined against us, we may be subject to fines and other penalties. These risks could result in a material adverse change in our operations and the value of our securities, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline or be worthless.

| 7 |

Permissions Required from the PRC Authorities for Our Operations

GXXHIC has received a Business License from the relevant department of the State Administration for Market Regulation. Apart from the Business License, GXXHIC may be subject to additional licensing requirements for our business operation due to the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities.

Furthermore, in connection with the operations of GXXHIC, as of the date of this report, neither GXXHIC nor the Company are required to obtain any approval or permission from the CSRC, CAC or any other PRC governmental authorities, nor has the Company or GXXHIC received any formal inquiry, notice, warning or sanction from any PRC governmental authorities in connection with requirements of obtaining such approval or permission, under any currently effective PRC laws, regulations and regulatory rules.

However, the PRC government has recently indicated an intent to exert more oversight over offerings that are conducted overseas and/or foreign investment in China-based issuers like us, and published a series of proposed rules for public comments in this regard, the enaction timetable, final content, interpretation and implementation of which remains uncertain. Therefore, there are substantial uncertainties as to how PRC governmental authorities will regulate overseas listing in general and whether we are required to complete filing or obtain any specific regulatory approvals from the CSRC, CAC or any other PRC governmental authorities for our future offshore offerings. If we had inadvertently concluded that such approvals were not required, or if applicable laws, regulations or interpretations change in a way that requires us to obtain such approval in the future, we may be unable to obtain such necessary approvals in a timely manner, or at all, and such approvals may be rescinded even if obtained. Any such circumstance could subject us to penalties, including fines, suspension of business and revocation of required licenses, significantly limit or completely hinder our ability to continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

Our Subsidiary, GXXHIC, is Subject to Chinese Laws, Rules, And Regulations

Our subsidiary, GXXHIC, is subject to Chinese laws, rules, and regulations. Uncertainties with respect to the interpretation and enforcement of Chinese laws, rules and regulations could have a material adverse effect on us. We believe that GXXHIC will continue to manage any adverse effects on the premise of complying with Chinese laws, rules, and regulations. Risks and uncertainties arising from the legal system in China, including risks and uncertainties regarding that the rules and regulations in China can change quickly with little advance notice and that the Chinese government may intervene or influence our operations at any time, could result in a material adverse change in our operations and the value of our securities.

Substantially all of our operations are conducted in China, and are governed by Chinese laws, rules and regulations. The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which legal cases may be cited for reference but have limited value as precedents. In the late 1970s, the Chinese government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past four decades has significantly increased the protections afforded to various forms of foreign or private-sector investment in China. However, since these laws and regulations are relatively new and the Chinese legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties.

From time to time, we may have to resort to administrative and court proceedings to interpret and/or enforce our legal rights. However, since Chinese administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings, and the level of legal protection we enjoy, than in more developed legal systems. Any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources and management attention. Furthermore, the Chinese legal system is based in part on government policies and internal rules (some of which are not published in a timely manner or at all) that may have retroactive effect.

As a result, we may not be aware of our violation of these policies and rules until sometime after the violation. Such uncertainties, including uncertainty over the scope and effect of our contractual, property (including intellectual property) and procedural rights, and any failure to respond to changes in the regulatory environment in China could affect our business and our ability to continue our operations.

| 8 |

Changes in Chinese political policies and economic and social policies or conditions may affect and fluctuate our business, results of operations and financial condition and may affect our growth and expansion strategies.

Substantially all of our assets and business operations are located in China. Accordingly, our business, results of operations, financial condition and prospects may be influenced to a significant degree by political, economic and social conditions in China generally, by continued economic growth in China as a whole, and by geopolitical stability in the region.

The Chinese economy, markets and levels of consumer spending are influenced by many factors beyond our control, including current and future economic conditions, political uncertainty, unemployment rates, inflation, fluctuations in the level of disposable income, taxation, foreign exchange control, and changes in interest and currency exchange rates. The Chinese economy differs from the economies of most developed countries in many respects, including the level of government involvement, level of development, growth rate, foreign exchange control and fiscal measures and allocation of resources. Although the Chinese government has implemented measures since the late 1970s emphasizing the utilization of market forces for economic reform, the restructuring of state assets and state-owned enterprises, and the establishment of improved corporate governance in business enterprises, a significant portion of productive assets in China is still owned or controlled by the Chinese government. The Chinese government also exercises significant control or influence over Chinese economic growth through allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary and fiscal policies, regulating financial services and institutions and providing preferential treatment to particular industries or companies.

While the Chinese economy has experienced significant growth in recent decades, growth has been uneven, both geographically and among various sectors of the economy. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall Chinese economy but may also have an effect on us. Our results of operations and financial condition could be affected by government control over capital investments or changes in tax regulations that are applicable to us. In addition, the Chinese government has implemented certain measures, including interest rate increases, to control the pace of economic growth. These measures may cause decreased economic activity in China.

The Holding Foreign Companies Accountable Act

The Holding Foreign Companies Accountable Act (the “HFCAA”), was enacted on December 18, 2020. The HFCAA requires that the Public Company Accounting Oversight Board (the “PCAOB”) determine whether it is unable to inspect or investigate completely registered public accounting firms located in a non-U.S. jurisdiction because of a position taken by one or more authorities in that jurisdiction. Our auditor, HKCM & CPA Co., is based in Hong Kong and is subject to the determinations announced by the PCOAB on December 16, 2021 and the HFCAA. On December 16, 2021, the PCAOB reported its determination that it was unable to inspect or investigate completely registered public accounting firms headquartered in the PRC and Hong Kong, because of positions taken by PRC authorities in those jurisdictions. On March 30, 2022, based on this determination, the Company was transferred to the SEC’s “Conclusive list of issuers identified under the HFCA.” Since our auditor is located in Hong Kong, a jurisdiction where the PCAOB has been unable to conduct inspections without the approval of the Chinese authorities, our auditor is not currently inspected by the PCAOB. The HFCAA states that if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for two consecutive years beginning in 2021, the SEC shall prohibit our shares from being traded on a national securities exchange or in the over-the-counter trading market in the United States. The related risks and uncertainties could cause the value of our shares to significantly decline or be worthless.

| 9 |

ITEM 2. PROPERTIES

The Company’s operating office is located at No. 11, Qingbo Road, Ersha Island, Yuexiu District, Guangzhuou, China, and is comprised of 250 square meters. The Company entered a new lease. According to the new lease, we are obligated to pay a quarterly rent of RMB118,026 (approximately US$18,100) during the term, to be expired on March 31, 2026.

The Company also entered a lease of corporate office located at Room 2301A, China Resources Building, 26 Harbour Raod, Wanchai, Hong Kong with a monthly rent of HK$36,603 (approximately US$4,700). The lease will be expired on March 16, 2023.

ITEM 3. LEGAL PROCEEDINGS

We may be subject to litigation from time to time as a result of our normal business operations. Presently, there are no material pending legal proceedings to which we are a party or as to which any of our property is subject, and no such proceedings are known to be threatened or contemplated against us.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable

| 10 |

PART II

ITEM 5. MARKET FOR COMPANY’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s common stock is quoted on the OTC Markets under the symbol “CFOO” (former symbol “TFLG”). Set forth below are the high and low bid prices for the Company’s Common Stock for the respective quarters. Although the Company’s common stock is quoted on the OTC Markets it has traded sporadically with no real volume and there is currently no ask price. Consequently, the information provided below may not be indicative of the Company’s common stock price under different conditions.

All prices listed herein reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not represent actual transactions. There is no established public trading market for our securities and a regular trading market may not develop, or if developed, may not be sustained.

The following table sets forth, for the fiscal quarters indicated, the high and low bid information for our common stock, as reported on the OTC Markets “Pink”. The following quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| Quarter Ended | High Bid | Low Bid | ||||||

| December 2021 | $ | 2.50 | $ | 2.50 | ||||

| September 2021 | $ | 2.50 | $ | 2.50 | ||||

| June 2021 | $ | 2.00 | $ | 1.35 | ||||

| March 2021 | $ | 1.50 | $ | 1.50 | ||||

| December 2020 | $ | 1.25 | $ | 1.25 | ||||

| September 2020 | $ | 1.25 | $ | 1.25 | ||||

| June 2020 | $ | 1.25 | $ | 1.25 | ||||

| March 2020 | $ | 1.25 | $ | 1.25 | ||||

Holders

At March 30, 2022, the Company had approximately 227 shareholders of record of our common stock. Such number does not include any shareholders holding shares in nominee or “street name”.

Dividends

Holders of our common stock are entitled to receive such dividends as may be declared by our board of directors. We paid no dividends during the periods reported herein, nor do we anticipate paying any dividends in the foreseeable future.

| 11 |

Recent Sales of Unregistered Securities

The Company had no sales of securities in 2021 and 2020.

Securities authorized for issuance under equity compensation plans

The Company does not have securities authorized for issuance under any equity compensation plans.

Performance graph

Not applicable to smaller reporting companies.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The Company did not repurchase any shares of the Company’s common stock during 2021.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable to a smaller reporting company.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Special Note Regarding Forward-Looking Statements

This Form 10-K contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may”, “will”, “expect”, “believe”, “anticipate”, “estimate” or “continue” or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, and actual results may differ materially depending on a variety of factors, many of which are not within our control. These factors include by are not limited to economic conditions generally and in the industries in which we may participate; competition within our chosen industry, including competition from much larger competitors; technological advances and failure to successfully develop business relationships.

Plan of Operation

We are a health company that develops, markets, promotes and distributes a variety of customized health care products and services, including supplements, healthy snacks, meal replacements, and nutritional consultation services to consumers in China. We work with certain licensed healthcare food factories to develop and manufacture products and services that are distributed conventionally through sales agents and also through a network of e-commerce and social media platforms.

In addition to products, we are committed to providing customized science based wellness consultation and service programs to customers. Our diverse products and services target health conscious customers and differentiate based upon age and gender and seek to manage different conditions. We reach out to customers fitting certain health and lifestyle profiles through our offline and online consultation services, and track eating habits and health indicators to provide customized products such as supplements. We believe this will facilitate the ability of customers to monitor, understand and adjust their health practices and lifestyle anytime and anywhere for increased customer engagement and retention.

We conduct our business through our wholly owned subsidiary Guangzhou Xiao Xiang Health Industry Company Limited, a limited liability company organized under the laws of China on March 8, 2017. Alpha Wellness (HK) Limited, a limited liability company organized under the laws of Hong Kong on April 24, 2019, and Elite Creation Group, a limited liability company formed under the laws of the British Virgin Islands formed on September 5, 2018, are holding companies without operations.

| 12 |

Our Products and Services

Our health products are designed to help enhance immunity and improve general wellbeing. We provide the following categories of healthcare products and customized healthcare consultation services in China: (i) Nutrition Catering (ii) Special Health Food (iii) Health Supplement and (iv) Skincare. The products target all age groups with different needs.

| Product category | Representative Products | Description | ||

| Nutrition Catering Series | Jasmine Beauty | Meal replacement and healthy snacks | ||

| Special Health Food Series | Power Centinent | Products that support a healthy active lifestyle and enhance Immunity | ||

| Health Supplement Series | Fuli Fruit Juice | Functional fruit beverages and dietary and nutritional supplements containing resveratrol, anthocyanin, superoxide enzyme | ||

| Skincare Series | Tightness | Facial skin care and recovery | ||

| Wine | Ame de Purete | Bordeaux wine from France |

|

|

| Jasmine Beauty | Power Centinent |

|

|

| Fuli Fruit Juice | Tightness |

Our products are taken as healthcare supplements in accordance with the principles of traditional Chinese medicine including the principle complementary medicine and ideal ratios and combinations of ingredients.

| 13 |

Our wine business is customized production and procurement through establishing cooperative relationships with wine suppliers. Among them, high-quality wine is directly packaged and labeled in the country of origin and then imported through supply chain agents. At present, the main product of Alpha Wellness’s high-end wine business is a Puerto Rican red wine from France. The deep, strong and full-bodied Puerto Rico is a wine with rich tannins and fruit. We source this wine through a distribution agreement with Shenzhen Guisheng Supply Chain Co., Ltd.

Markets and Regions

The Great Health Industry refers to production, operation, service and information dissemination, maintenance, restoration, and promotions linked to health. It covers medical products, health supplements, nutritional foods, medical devices, health appliances, fitness, health management, health consulting and many other production and service areas closely related to human health. The Great Health Industry is an emerging industry with huge market potential, especially in China. The marketing and competitive strategy of our alcohol business is consistent with our health care product business. The market and customers of our liquor business are mainly mainland China and Hong Kong.

According to the “China Great Health Industry Strategic Planning and Enterprise Strategy Consulting Report” published by Qianzhan Industry Institute (前瞻產業研究院), the scale of the Great Health Industry in 2017 was USD 947.42 billion, which increased to over USD 1,069.66 billion in 2018. The report predicted USD 1,341.66 billion volume for 2019 and forecast over USD 1,528.09 billion for 2020. In the years till 2023, the average annual compound growth rate will be approximately 12.55%, and with the Great Health Industry reaching approximately USD 2,153.08 billion in 2023.

Our Strategies

We are focused on achieving long-term growth in revenues, cash flow and profit. We believe that we can achieve this by developing multiple distribution channels and strengthening our marketing and promotions, leading to better product turnover and revenue. We also expect to broaden our product range as well as product differentiation in the future. Based on the business experience accumulated over the years, we believe we can improve the efficiency of our supply chain with time-saving and cost-saving supply chain management and marketing planning for the target customer base with our one-stop service.

| 14 |

Our primary aims are (i) to strengthen our product saleability; (ii) to cut logistics cost and time spent and (iii) to further expand the market share in China. Toward this end, we plan to pursue the following business strategies:

| ● | Collaborate with third-party e-commerce platforms to boost product exposure, e.g. Tmall, Jingdong mall | |

| ● | Deliver healthcare knowledge and consultation service via social media and We-media | |

| ● | Build brand image and reputation through customer experience and word of mouth | |

| ● | Increase the number of downstream distributors and wholesalers | |

| ● | Strengthen the relationship with manufacturers, suppliers, drug agents and distributors | |

| ● | Pursue strategic acquisitions and partnerships |

We intend to develop both online and offline distribution channels to increase sales volume and revenue. We expect to partner with third party e-commerce platforms, social media and We-media such as Wechat, TikTok and Xiaohongshu to build our online presence. We believe that online channels will allow us to provide real-time nutrition and healthcare consultation services as well as increase customer engagement and retention. Starting from the second half of 2020, we have launched our “nutrition consulting” support services using a major social media software to allow customer groups to receive pre-purchase consultation and after-sales service for products anytime and anywhere.

Our current offline sales channel relies on distributors and sales agents. To enhance the visibility and marketability of our products and services and to improve brand recognition and awareness, we hope to develop store-in-shop and counter experiences. We also intend to partner with high-end gyms to form nutrition clubs and hold weight-loss training camps, health assessment and fitness training camps and other activities.

We intend to create a ‘one-stop’ solution for our customers by creating a multi-channel health product supply and retail system. We not only provide personalized consultation service to our customers, but also summarize and analyze our customer feedback and experiences through our consultation service and after-sales service. We intend to share this data with our manufacturers and supply chain partners to develop products and services that better meet the demands of our customers. By pooling and addressing the needs of downstream businesses and combining it with the Consumer to Manufacturer model for upstream transformation, we anticipate establishing a close relationship between manufacturers and suppliers. We believe this model can also reduce circulation costs and improve the efficiency of our supply chain.

The main sales model of wine business is to develop online and offline distribution channels to increase sales and revenue. In terms of online sales, we hope to cooperate with third-party e-commerce platforms, social media, WeChat, Tiktok, Xiaohongshu and other We Media to build our online image. For example, we have built the official flagship store of Xiao Xiang Health on the Tmall e-commerce platform. The offline sales channel mainly cooperates with dealers for sales, mainly relying on distributors and sales agents.

| 15 |

Competition

We operate in a highly competitive and fragmented industry that is sensitive to price and service. We compete with leading e-commerce companies such as Alibaba (China) which may offer substantially the same or similar product offerings as us. We also compete with businesses that focus on particular merchant categories or markets such as UNI HEALTH (HK stock code: 02211) and ALI HEALTH (HK stock code:0241). We also compete with traditional cash payments and other popular online shopping websites and apps, and other traditional media companies that provide discounts on products and services. We believe the principal competitive factors in our market include the following:

| ● | Breadth of member base and the products and services featured. | |

| ● | Close and fast pre-sales and after-sales service response. | |

| ● | Ability to reduce the product turnover time and inventory cost. | |

| ● | Relationship and bargaining power with supplier and manufacturer. | |

| ● | Healthcare product effectiveness and acceptance from customer. | |

| ● | Local presence and understanding of local business trends. | |

| ● | Ability to deliver a high volume of relevant services and information to consumers. | |

| ● | Ability to produce high purchase rates for products and services among members. | |

| ● | Strength and recognition of our brand. |

Although we believe we compete favorably on the factors described above, many of our current and potential competitors have longer operating histories, significantly greater financial, technical, marketing and other resources, larger product and services offerings, larger customer base and greater brand recognition. These factors may allow our competitors to benefit from their existing customer base with lower development costs or to respond more quickly than we can to new or emerging technologies and changes in customer requirements. These competitors may engage in more extensive research and development efforts, undertake more far-reaching marketing campaigns and adopt more aggressive pricing policies, which may allow them to build a larger customer base more effectively than us. Our competitors may develop products or services that are similar to our products and services or that achieve greater market acceptance than our products and services. In addition, although we do not believe that customer payment terms are a principal competitive factor in our market, they may become such a factor, and we may be unable to compete on such terms.

Government and Industry Regulations

We are subject to the general laws in China governing businesses including labor, occupational safety and health, general corporations, intellectual property and other similar laws.

Product Liability and Consumers Protection

Product liability claims may arise if any of our healthcare products have a harmful effect on a consumer, who may make a claim for damages or compensation as an injured party. The General Principles of the Civil Law of the PRC, which became effective in January 1987, state that manufacturers and sellers of defective products causing property damage or injury shall incur civil liabilities for such damage or injuries.

The Product Quality Law of the PRC was enacted in 1993 and amended in 2000 to strengthen the quality control of products and protect consumers’ rights and interests. Under this law, manufacturers and distributors who produce or sell defective products may be subject to confiscation of earnings from such sales, revocation of business licenses and imposition of fines, and in severe circumstances, may be subject to criminal liability.

The Law of the PRC on the Protection of the Rights and Interests of Consumers was promulgated on October 31, 1993 and became effective on January 1, 1994 to protect consumers when they purchase or use goods or services. All business operators must comply with this law when they manufacture or sell goods and/or provide services to customers. In extreme situations, product manufacturers and distributors may be subject to criminal liability if their goods or services lead to the death or injuries of customers or other third parties.

| 16 |

Summary of Financial Information

We have been significantly impacted by COVID-19 global pandemic. In addition to the devastating effects on human life, the pandemic is having a negative ripple effect on the global economy, leading to disruptions and volatility in the global financial markets. China and many other countries have issued policies intended to stop or slow the further spread of the disease.

COVID-19 and China’s response to the pandemic are significantly affecting the economy. There are no comparable events that provide guidance as to the effect the COVID-19 pandemic may have, and, as a result, the ultimate effect of the pandemic is highly uncertain and subject to change. We do not yet know the full extent of the effects on the economy, the markets we serve, our business or our operations.

The following table sets forth certain operational data for the years ended December 31, 2021 and 2020:

STATEMENT OF OPERATIONS DATA:

| For the Year Ended December 31, 2021 | For the Year Ended December 31, 2020 | |||||||

| Revenues | $ | 361,116 | $ | 1,013,141 | ||||

| Cost of revenue | (121,690 | ) | (596,530 | ) | ||||

| Gross profit | 239,426 | 416,611 | ||||||

| Total operating expenses | (695,856 | ) | (887,426 | ) | ||||

| Total other income | 7,692 | 9,554 | ||||||

| Loss before income taxes | (448,738 | ) | (461,261 | ) | ||||

| Income tax expense | (6,671 | ) | (8,215 | ) | ||||

| Net loss | (455,409 | ) | (469,476 | ) | ||||

Revenue. We generated revenues of $361,116 and $1,013,141 for the fiscal years ended December 31, 2021 and 2020. All the major customers are located in the PRC and Hong Kong. The significant decreases in the revenue due to the outbreak of COVID-19, we expected the revenue would be increased in the future once an efficacious COVID-19 vaccine emerges.

During the years ended December 31, 2021, and 2020, the nature of businesses and segment was shown as below:

Currently, the Company has two reportable business segments:

| (i) | Healthcare Segment, mainly provides health consulting advisory services and healthcare and wellness products to the customers; and |

| (ii) | Wine Segment, mainly provides wine products to the customers. |

| 17 |

In the following table, revenue is disaggregated by primary major product line, and timing of revenue recognition. The table also includes a reconciliation of the disaggregated revenue with the reportable segments.

| Year Ended December 31, 2021 | ||||||||||||

Healthcare Segment | Wine Segment | Total | ||||||||||

| Revenue from external customers: | ||||||||||||

| Consulting service income | $ | 216,850 | $ | – | $ | 216,850 | ||||||

| Sale of healthcare products | 39,996 | – | 39,996 | |||||||||

| Sale of wine products | – | 104,270 | 104,270 | |||||||||

| Total revenue | 256,846 | 104,270 | 361,116 | |||||||||

| Cost of sales: | ||||||||||||

| Consulting service income | (31,315 | ) | - | (31,315 | ) | |||||||

| Sale of healthcare products | (32,064 | ) | - | (32,064 | ) | |||||||

| Sale of wine products | - | (58,311 | ) | (58,311 | ) | |||||||

| Total cost of revenue | (63,379 | ) | (58,311 | ) | (121,690 | ) | ||||||

| Gross profit | 193,467 | 45,959 | 239,426 | |||||||||

| Operating Expenses | ||||||||||||

| Selling and distribution | - | (5,076 | ) | (5,076 | ) | |||||||

| General and administrative | (690,780 | ) | - | (690,780 | ) | |||||||

| Total operating expenses | (690,780 | ) | (5,076 | ) | (695,856 | ) | ||||||

| Segment (loss) income | $ | (497,313 | ) | $ | 40,883 | $ | (456,430 | ) | ||||

| Year Ended December 31, 2020 | ||||||||||||

Healthcare Segment | Wine Segment | Total | ||||||||||

| Revenue from external customers: | ||||||||||||

| Consulting service income | $ | 221,041 | $ | – | $ | 221,041 | ||||||

| Sale of healthcare products | 564,814 | – | 564,814 | |||||||||

| Sale of wine products | - | 227,286 | 227,286 | |||||||||

| Total revenue | 785,855 | 227,286 | 1,013,141 | |||||||||

| Cost of sales: | ||||||||||||

| Consulting service income | – | – | – | |||||||||

| Sale of healthcare products | (395,392 | ) | – | (395,392 | ) | |||||||

| Sale of wine products | – | (201,138 | ) | (201,138 | ) | |||||||

| Total cost of revenue | (395,392 | ) | (201,138 | ) | (596,530 | ) | ||||||

| Gross profit | 390,463 | 26,148 | 416,611 | |||||||||

| Operating Expenses | ||||||||||||

| Selling and distribution | – | (158,432 | ) | (158,432 | ) | |||||||

| General and administrative | (728,994 | ) | – | (728,994 | ) | |||||||

| Total operating expenses | (728,994 | ) | (158,432 | ) | (887,426 | ) | ||||||

| Segment (loss) income | $ | (338,531 | ) | $ | (132,284 | ) | $ | (470,815 | ) | |||

| 18 |

The below revenues are based on the countries in which the customer is located. Summarized financial information concerning the geographic segments is shown in the following tables:

| Years ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| Hong Kong | $ | 216,851 | $ | 221,041 | ||||

| China | 144,265 | 792,100 | ||||||

| $ | 361,116 | $ | 1,013,141 | |||||

During the years ended December 31, 2021, and 2020, the following customers accounted for 10% or more of our total net revenues:

Year ended December 31, 2021 | December 31, 2021 | |||||||||||||||

| Revenues | Percentage of revenues | Accounts receivable | ||||||||||||||

| Simmax Supply Chian Limited | $ | 165,391 | 46 | % | $ | - | ||||||||||

| Guangzhou Dexin Huamao Trading Co., Ltd. | 103,072 | 29 | % | - | ||||||||||||

| Tang Fung Limited | 51,460 | 14 | % | - | ||||||||||||

| TOTAL | $ | 319,923 | 89 | % | Total | $ | - | |||||||||

Year ended December 31, 2020 | December 31, 2020 | |||||||||||||||

| Revenues | Percentage of revenues | Accounts receivable | ||||||||||||||

| Guangdong Hualian Health Industry Co., Ltd. | $ | 394,158 | 39 | % | $ | - | ||||||||||

| Huaye Little Elephant Health Industry Co., Ltd. | 234,547 | 23 | % | - | ||||||||||||

| TOTAL | $ | 628,705 | 62 | % | Total | $ | - | |||||||||

Cost of Revenue. Cost of revenue as a percentage of net revenue was approximately 33.70% for the fiscal year ended December 31, 2021. Cost of revenue as a percentage of net revenue was approximately 58.88% for the fiscal year ended December 31, 2020. The decrease of cost of revenue as a percentage of net revenue is attributable to a decrease in import of product from supplier and manufacturer due to the COVID-19 global pandemic.

During the years ended December 31, 2021 and 2020, the following vendors accounted for 10% or more of our purchases:

| 19 |

Year ended December 31, 2021 | December 31, 2021 | |||||||||||||||

| Vendor | Purchases | Percentage of purchases | Accounts payable | |||||||||||||

| Guangzhou Jingdong Trading Co., Ltd. | $ | 195,152 | 99 | % | Total: | $ | - | |||||||||

Year ended December 31, 2020 | December 31, 2020 | |||||||||||||||

| Vendor | Purchases | Percentage of purchases | Accounts payable | |||||||||||||

| Zhejiang Hongshiliang Group Tiantai Mountain Wuyao Co., Ltd. | $ | 219,007 | 37 | % | $ | - | ||||||||||

| Tengfeng (China) Trading Co., Ltd. | 71,616 | 12 | % | - | ||||||||||||

| Guangzhou Zeli Pharmaceutical Technology Co., Ltd. | 61,222 | 10 | % | - | ||||||||||||

| Total: | $ | 351,845 | 59 | % | Total: | $ | - | |||||||||

Gross Profit. We achieved a gross profit of $239,426 and $416,611 for the fiscal years ended December 31, 2021, and 2020, respectively. The decrease in gross profit is primarily attributable to the decrease in revenue.

General and Administrative Expenses (“G&A”). We incurred G&A expenses of $690,780 and $728,994 for the fiscal years ended December 31, 2021, and 2020, respectively.

Other Income, net. We incurred net other income of $7,692 for the fiscal year ended December 31, 2021, as compared to a net other income of $9,554 for the fiscal year ended December 31, 2020. Our net other income for the year ended December 31, 2020 consisted of the subsidy funds from Government.

Income Tax Expense. We recorded income tax expense of $6,671 and $8,215 for the fiscal years ended December 31, 2021 and 2020.

Net Loss. During the year ended December 31, 2021, we incurred a net loss of $445,409, as compared to a net income $469,476 for the year ended December 31, 2020. The significant decreases due to a decrease in the revenue, cost of revenue and selling and distribution expenses due to the outbreak of COVID-19.

| 20 |

Liquidity And Capital Resources

As of December 31, 2021, we had cash and cash equivalents of $609,434, inventories of $327,551 operating right of use assets of $350,563, tax recoverable of $8,910 and prepayments and other receivables of $139,254.

As of December 31, 2020, we had cash and cash equivalents of $1,006,394, inventories of $206,272, and prepayments and other receivables of $121,501.

We believe that our current cash and other sources of liquidity discussed below are adequate to support general operations for at least the next 12 months.

| Years Ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| Net cash (used in) provided by operating activities | $ | (438,620 | ) | $ | 343,657 | |||

| Net cash used in investing activities | (27,358 | ) | (67,862 | ) | ||||

| Net cash provided by financing activities | 50,319 | 45,862 | ||||||

Net Cash (Used In) Generated from Operating Activities.

For the year ended December 31, 2021, net cash used in operating activities was $438,620 which consisted primarily of the increase in accrued liabilities and other payables of $48,884, increase in prepayment and other receivables of $17,753, decrease in accounts payables of $7,827, decrease in tax payables of $17,229, increase in inventories of $121,279, and decrease in customer deposit of $69,141.

For the year ended December 31, 2020, net cash provided by operating activities was $343,657, which consisted primarily of the decrease in prepayment and other receivables of $199,317, decrease in accounts receivables of $530,196, increase in accrued liabilities and other payables of $2,316, increase in accounts payables of $7,827, increase in tax payables of $8,219, increase in inventories of $94,655, increase in lease liabilities of $47, and increase in customer deposit of $13,044.

We expect to continue to rely on cash generated through financing from our existing shareholders and private placements of our securities, however, to finance our operations and future acquisitions.

Net Cash Used In Investing Activities.

For the year ended December 31, 2021, net cash used in investing activities was $27,358, consisted primarily of leasehold improvement.

For the year ended December 31, 2020, net cash used in investing activities was $67,862, consisted primarily of purchase of plant and equipment of $75,060, and cash from acquisition of legal acquirer of $7,198.

Net Cash Generated From Financing Activities.

For the year ended December 31, 2021, net cash provided by financing activities was $50,319, consisting primarily of advance from a related company of $150,508 and repayment of lease liabilities of $100,189.

For the year ended December 31, 2020, net cash provided by financing activities was $45,862, consisting primarily of repayment to a related company of $3,038, advance from a director 128,295 and repayment of lease liabilities of $79,395.

Material Commitments

As of the date of this Annual Report, we do not have any material commitments.

| 21 |

Material Cash Requirements

We have not achieved profitability since our inception and we expect to continue to incur net losses for the foreseeable future. We expect net cash expended in 2022 to be significantly higher than 2021. As of December 31, 2021, we had an accumulated deficit of $918,195. Our material cash requirements are highly dependent upon the additional financial support from our major shareholders in the next 12 - 18 months.

We had the following contractual obligations and commercial commitments as of December 31, 2021:

| Contractual Obligations | Total | Less than 1 year | 1-3 Years | 3-5 Years | More than 5 Years | |||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| Amounts due to a related company | 199,964 | 199,964 | – | – | – | |||||||||||||||

| Amount due to a director | 219,461 | 219,461 | – | – | – | |||||||||||||||

| Operating lease obligations | 360,154 | 114,132 | 246,022 | |||||||||||||||||

| Accrued liabilities and other payables | 51,200 | 51,200 | – | – | – | |||||||||||||||

| Customer deposits | 340,783 | 340,783 | ||||||||||||||||||

| – | – | – | ||||||||||||||||||

| Total obligations | 1,171,562 | 925,540 | 246,022 | – | – | |||||||||||||||

Off-Balance Sheet Arrangements.

The Company does not have any off-balance sheet arrangements and it is not anticipated that the Company will enter into any off-balance sheet arrangements.

Summary of Significant Accounting Policies

The Company’s consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States (GAAP). Any reference in these notes to applicable guidance is meant to refer to the authoritative GAAP as found in the Accounting Standards Codification (ASC) and Accounting Standards Update (ASU) of the Financial Accounting Standards Board (FASB). All adjustments considered necessary for a fair presentation have been included. These adjustments consist of normal and recurring accruals, as well as non-recurring charges.

The consolidated financial statements are presented in US Dollars and include the accounts of the Company and its subsidiaries. All significant inter-company accounts and transactions have been eliminated in consolidation. The results of subsidiaries acquired or disposed of during the periods are included in the consolidated statements of operations from the effective date of acquisition or up to the effective date of disposal.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Significant areas for which management uses estimates include:

| ● | revenue recognition, |

| ● | asset impairments, including goodwill and other indefinite-lived intangible assets; |

| ● | sales returns and allowances; |

| ● | inventory; |

| ● | estimated lives for tangible and intangible assets; |

| ● | income tax valuation allowances; and |

| 22 |

These estimates require the use of judgment as future events and the effect of these events cannot be predicted with certainty. The estimates will change as new events occur, as more experience is acquired and as more information is obtained. We evaluate and update our assumptions and estimates on an ongoing basis and we may consult outside experts to assist as considered necessary.

Segment Reporting

Accounting Standards Codification (“ASC”) Topic 280, “Segment Reporting” establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organization structure as well as information about geographical areas, business segments and major customers in consolidated financial statements. Currently, the Company operates in one reportable operating segment in Hong Kong and China.

Cash and cash equivalents

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

Accounts receivable

Accounts receivable are recorded at the invoiced amount and do not bear interest, which are due within contractual payment terms, generally 30 to 90 days from completion of service. Credit is extended based on evaluation of a customer’s financial condition, the customer credit-worthiness and their payment history. Accounts receivable outstanding longer than the contractual payment terms are considered past due. Past due balances over 90 days and over a specified amount are reviewed individually for collectability. At the end of fiscal year, the Company specifically evaluates individual customer’s financial condition, credit history, and the current economic conditions to monitor the progress of the collection of accounts receivables. The Company will consider the allowance for doubtful accounts for any estimated losses resulting from the inability of its customers to make required payments. For the receivables that are past due or not being paid according to payment terms, the appropriate actions are taken to exhaust all means of collection, including seeking legal resolution in a court of law. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company does not have any off-balance-sheet credit exposure related to its customers. As of December 31, 2021 and 2020, there was no allowance for doubtful accounts.

Inventories

Inventories are stated at the lower of cost or market value (net realizable value), cost being determined on a first-in-first-out method. The Company provides inventory allowances based on excess and obsolete inventories determined principally by customer demand. As of December 31, 2021 and 2020, the Company did not record an allowance for obsolete inventories, nor have there been any write-offs.

| 23 |

Plant and equipment

Plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis over the following expected useful lives from the date on which they become fully operational and after taking into account their estimated residual values:

| Expected useful lives | Residual value | |||||

| Furniture, fixture and equipment | 3 years | 5 | % | |||

| Motor vehicle | 3.33 to 4 years | 5 | % | |||

| Leasehold improvement | 2 years | 5 | % | |||

Expenditures for repairs and maintenance are expensed as incurred. When assets have been retired or sold, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is recognized in the results of operations.

Intangible assets

Intangible assets represented trademarks of their products and are stated at cost less accumulated amortization and any recognized impairment loss. Amortization is provided over the term of their registrations on a straight-line basis, which is 10 years and will expire in 2028.

Impairment of long-lived assets

In accordance with the provisions of ASC Topic 360, “Impairment or Disposal of Long-Lived Assets”, all long-lived assets such as plant and equipment, as well as intangible assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is evaluated by a comparison of the carrying amount of an asset to its estimated future undiscounted cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amounts of the assets exceed the fair value of the assets.

Revenue recognition

The Company adopted Accounting Standards Codification (“ASC”) 606 – Revenue from Contracts with Customers” (“ASC 606”). Under ASC 606, a performance obligation is a promise within a contract to transfer a distinct good or service, or a series of distinct goods and services, to a customer. Revenue is recognized when performance obligations are satisfied and the customer obtains control of promised goods or services. The amount of revenue recognized reflects the consideration to which the Company expects to be entitled to receive in exchange for goods or services. Under the standard, a contract’s transaction price is allocated to each distinct performance obligation. To determine revenue recognition for arrangements that the Company determines are within the scope of ASC 606, the Company performs the following five steps:

| ● | identify the contract with a customer; | |

| ● | identify the performance obligations in the contract; | |

| ● | determine the transaction price; | |

| ● | allocate the transaction price to performance obligations in the contract; and | |

| ● | recognize revenue as the performance obligation is satisfied. |

| 24 |

Currently, the Company operates two business segments.

Healthcare Business mainly provides health consulting advisory services and healthcare and wellness products to the customers.

Revenue is earned from the rendering of health consulting advisory services to the customers. The Company recognizes services revenue over the period in which such services are performed. Amounts expected to be recognized as revenue within the 12 months following the balance sheet date are classified as current portion of deferred revenue in the accompanying consolidated balance sheets. Amounts not expected to be recognized as revenue within the 12 months following the balance sheet date are classified as deferred revenue, net of current portion.

The sale and distribution of the healthcare products, such as (i) Nutrition Catering (ii) Special Health Food (iii) Health Supplement and (iv) Skincare, is the only performance obligation under the fixed-fee arrangements. Revenue is recognized from the sale of their healthcare products upon delivery to the customers, whereas the title and risk of loss are fully transferred to the customers. The Company records its revenues, net of value added taxes (“VAT”) on the majority of the products at the rate of 17% on the invoiced value of sales. The cost, such as shipping cost and material cost, is recognized when the product delivered to the customers. The Company records its cost including taxes.

Wine Business mainly provides the wine products to the customers. Revenue is recognized from the sale of wine products upon delivery to the customers, whereas the title and risk of loss are fully transferred to the customers. The Company records its revenues, net of value added taxes (“VAT”) on the majority of the products at the rate of 17% on the invoiced value of sales. The Company recorded product sales returns $148,208 and $0 for the years ended December 31, 2021 and 2020, respectively. The cost, such as shipping cost and material cost, is recognized when the product delivered to the customers. The Company records its cost including taxes.

| 25 |

Transfers of Cash to and from Our Subsidiaries

China Foods Holdings Ltd is a Delaware holding company with no operations of its own. We conduct our operations in Hong Kong through our subsidiary in Hong Kong, while our operations in PRC through our subsidiary in PRC. We may rely on dividends to be paid by our Hong Kong subsidiary to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses. There is a possibility that the PRC could prevent our cash maintained in Hong Kong from leaving or the PRC could restrict the deployment of the cash into our business or for the payment of dividends. Any such controls or restrictions may adversely affect our ability to finance our cash requirements, service debt or make dividend or other distributions to our shareholders. If our Hong Kong subsidiary incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us. To date, our subsidiaries have not made any transfers, dividends or distributions to China Foods Holdings Ltd. and China Foods Holdings Ltd. has not made any transfers, dividends or distributions to our subsidiaries.

China Foods Holdings Ltd. is permitted under the Delaware laws to provide funding to our subsidiaries in Hong Kong through loans or capital contributions without restrictions on the amount of the funds, subject to satisfaction of applicable government registration, approval and filing requirements. Our Hong Kong is also permitted under the laws of Hong Kong to provide funding China Foods Holdings Ltd. through dividend distribution without restrictions on the amount of the funds. As of the date of this prospectus, there has been no dividends or distributions among the holding company or the subsidiaries nor do we expect such dividends or distributions to occur in the foreseeable future among the holding company and its subsidiaries.

We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

Subject to the Delaware Statutes and our bylaws, our board of directors may authorize and declare a dividend to shareholders at such time and of such an amount as they think fit if they are satisfied, on reasonable grounds, that immediately following the dividend the value of our assets will exceed our liabilities and we will be able to pay our debts as they become due. There is no further Delaware statutory restriction on the amount of funds which may be distributed by us by dividend.

Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us. The laws and regulations of the PRC do not currently have any material impact on transfer of cash from China Foods Holdings Ltd. to our Hong Kong subsidiaries or from our Hong Kong subsidiaries to China Foods Holdings Ltd. There are no restrictions or limitation under the laws of Hong Kong imposed on the conversion of HK dollar into foreign currencies and the remittance of currencies out of Hong Kong or across borders and to U.S investors.

Current PRC regulations permit PRC subsidiaries to pay dividends to Hong Kong subsidiaries only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each of such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation. As of the date of this prospectus, we do not have any PRC subsidiaries.

| 26 |

The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations, we may be unable to pay dividends on our common stock.

Cash dividends, if any, on our common stock will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10.0%.

In order for us to pay dividends to our shareholders, we will rely on payments made from our Hong Kong subsidiary to China Foods. Certain payments from PRC subsidiaries to Hong Kong subsidiaries will be subject to PRC taxes, including business taxes and VAT. As of the date of this report, our Hong Kong subsidiary has not made any transfers or distributions.

Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be lowered to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC entity. However, the 5% withholding tax rate does not automatically apply and certain requirements must be satisfied, including, without limitation, that (a) the Hong Kong entity must be the beneficial owner of the relevant dividends; and (b) the Hong Kong entity must directly hold no less than 25% share ownership in the PRC entity during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong entity must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to dividends to be paid by a PRC subsidiary to its immediate holding company. As of the date of this prospectus, we do not have a PRC subsidiary. In the event that we acquire or form a PRC subsidiary in the future and such PRC subsidiary desires to declare and pay dividends to our Hong Kong subsidiary, our Hong Kong subsidiary will be required to apply for the tax resident certificate from the relevant Hong Kong tax authority. In such event, we plan to inform the investors through SEC filings, such as a current report on Form 8-K, prior to such actions.

| 27 |

Income taxes