Loan No. 07-0004432

GENERAL ELECTRIC CAPITAL CORPORATION

(as Administrative Agent and a Lender)

THE FINANCIAL INSTITUTIONS WHO ARE OR

HEREAFTER

BECOME PARTIES TO THIS LOAN AGREEMENT,

as Lenders,

and

CHP PORTLAND, LLC

CHP MEDFORD 1, LLC,

and

CHP FRIENDSWOOD SNF, LLC,

Each, a Delaware limited liability company,

(Borrower)

LOAN AGREEMENT

Dated as of: September 13, 2012

Cornerstone Portfolio

TABLE OF

CONTENTS

| ARTICLE I |

DEFINITIONS |

|

1 |

| |

|

|

|

| Section 1.1. |

Certain Definitions |

|

1 |

| Section 1.2. |

Definitions |

|

20 |

| Section 1.3. |

Phrases |

|

20 |

| |

|

|

|

| ARTICLE II |

LOAN TERMS |

|

20 |

| |

|

|

|

| Section 2.1. |

The Loan |

|

20 |

| Section 2.2. |

Interest Rate; Late Charge; Default Rate. |

|

21 |

| Section 2.3. |

Terms of Payment |

|

21 |

| Section 2.4. |

Prepayment. |

|

22 |

| Section 2.5. |

Security; Establishment of Funds. |

|

22 |

| Section 2.6. |

Application of Payments. |

|

24 |

| Section 2.7. |

Sources and Uses |

|

26 |

| Section 2.8. |

Capital Adequacy; Increased Costs; Illegality. |

|

26 |

| Section 2.9. |

Interest Rate Protection |

|

27 |

| Section 2.10. |

Libor Breakage Amount |

|

28 |

| Section 2.11. |

[Reserved]. |

|

28 |

| Section 2.12. |

Evidence of Debt. |

|

28 |

| Section 2.13. |

Substitution of Lenders. |

|

29 |

| Section 2.14. |

Defaulting Lenders. |

|

30 |

| Section 2.15. |

Fees and Expenses |

|

31 |

| Section 2.16. |

Withholding Taxes. |

|

31 |

| Section 2.17. |

Partial Releases. |

|

33 |

| |

|

|

|

| ARTICLE III |

INSURANCE, CONDEMNATION, AND IMPOUNDS |

|

35 |

| |

|

|

|

| Section 3.1. |

Insurance |

|

35 |

| Section 3.2. |

Use and Application of Insurance Proceeds. |

|

38 |

| Section 3.3. |

Condemnation Awards |

|

39 |

| Section 3.4. |

Insurance Impounds |

|

40 |

| Section 3.5. |

Real Estate Tax Impounds |

|

41 |

| |

|

|

|

| ARTICLE IV |

ENVIRONMENTAL MATTERS |

|

42 |

| |

|

|

|

| Section 4.1. |

Representations and Warranties on Environmental Matters |

|

42 |

| Section 4.2. |

Covenants on Environmental Matters. |

|

42 |

| Section 4.3. |

Allocation of Risks and Indemnity |

|

43 |

| Section 4.4. |

Administrative Agent’s Right to Protect Collateral |

|

43 |

| Section 4.5. |

No Waiver |

|

44 |

| ARTICLE V |

LEASING MATTERS |

|

44 |

| |

|

|

|

| Section 5.1. |

Representations and Warranties on Leases. |

|

44 |

| Section 5.2. |

[Reserved]. |

|

45 |

| Section 5.3. |

Covenants. |

|

45 |

| Section 5.4. |

Tenant Estoppels. |

|

46 |

| Section 5.5. |

Payment of Rents Under Master Lease. |

|

46 |

| |

|

|

|

| ARTICLE VI |

REPRESENTATIONS AND WARRANTIES |

|

47 |

| |

|

|

|

| Section 6.1. |

Organization, Power and Authority; Formation Documents. |

|

47 |

| Section 6.2. |

Validity of Loan Documents |

|

47 |

| Section 6.3. |

Liabilities; Litigation. |

|

48 |

| Section 6.4. |

Taxes and Assessments |

|

48 |

| Section 6.5. |

Other Agreements; Defaults |

|

48 |

| Section 6.6. |

Compliance with Law |

|

48 |

| Section 6.7. |

Condemnation |

|

48 |

| Section 6.8. |

Access |

|

49 |

| Section 6.9. |

Location of Borrower |

|

49 |

| Section 6.10. |

ERISA; Employees. |

|

49 |

| Section 6.11. |

Margin Stock |

|

49 |

| Section 6.12. |

Forfeiture |

|

49 |

| Section 6.13. |

Tax Filings |

|

49 |

| Section 6.14. |

Solvency |

|

50 |

| Section 6.15. |

Full and Accurate Disclosure |

|

50 |

| Section 6.16. |

Flood Zone |

|

50 |

| Section 6.17. |

Single Purpose Entity/Separateness |

|

50 |

| Section 6.18. |

Compliance With International Trade Control Laws and OFAC Regulations |

|

53 |

| Section 6.19. |

Borrower’s Funds |

|

54 |

| Section 6.20. |

Operators’ Agreements |

|

55 |

| Section 6.21. |

Physical Condition |

|

55 |

| Section 6.22. |

Healthcare Representations |

|

56 |

| Section 6.23. |

No Change in Facts or Circumstances; Disclosure |

|

57 |

| |

|

|

|

| ARTICLE VII |

FINANCIAL REPORTING |

|

57 |

| |

|

|

|

| Section 7.1. |

Financial Statements |

|

57 |

| Section 7.2. |

Additional Reports |

|

59 |

| Section 7.3. |

Compliance Certificate |

|

60 |

| Section 7.4. |

Accounting Principles |

|

60 |

| Section 7.5. |

Other Information; Access |

|

60 |

| Section 7.6. |

Annual Budget |

|

61 |

| Section 7.7. |

Books and Records/Audits |

|

61 |

| ARTICLE VIII |

COVENANTS |

|

61 |

| |

|

|

|

| Section 8.1. |

Transfers or Encumbrance of Property. |

|

61 |

| Section 8.2. |

Taxes; Utility Charges |

|

64 |

| Section 8.3. |

Management. |

|

64 |

| Section 8.4. |

Operation; Maintenance; Inspection |

|

65 |

| Section 8.5. |

Taxes on Security |

|

65 |

| Section 8.6. |

Legal Existence; Name, Etc |

|

66 |

| Section 8.7. |

Further Assurances |

|

66 |

| Section 8.8. |

Estoppel Certificates Regarding Loan |

|

66 |

| Section 8.9. |

Notice of Certain Events |

|

67 |

| Section 8.10. |

Indemnification |

|

67 |

| Section 8.11. |

[Intentionally Omitted]. |

|

67 |

| Section 8.12. |

Payment For Labor and Materials |

|

67 |

| Section 8.13. |

Use and Proceeds, Revenues |

|

68 |

| Section 8.14. |

Compliance with Laws and Contractual Obligations. |

|

68 |

| Section 8.15. |

Operating and Financial Covenants |

|

68 |

| Section 8.16. |

Healthcare Laws and Covenants. |

|

69 |

| Section 8.17. |

Cooperation Regarding Licenses |

|

71 |

| Section 8.18. |

Transactions With Affiliates |

|

72 |

| Section 8.19. |

Representations and Warranties |

|

72 |

| Section 8.20. |

Alterations |

|

72 |

| Section 8.21. |

Business and Operations |

|

72 |

| Section 8.22. |

Severability of Covenants |

|

72 |

| Section 8.23. |

Required Repairs and Post Closing Requirements |

|

72 |

| |

|

|

|

| ARTICLE IX |

EVENTS OF DEFAULT |

|

73 |

| |

|

|

|

| Section 9.1. |

Events of Default |

|

73 |

| Section 9.2. |

Special Right to Cure with Respect to Operational Defaults |

|

75 |

| |

|

|

|

| ARTICLE X |

REMEDIES |

|

76 |

| |

|

|

|

| Section 10.1. |

Remedies - Insolvency Events |

|

76 |

| Section 10.2. |

Remedies - Other Events |

|

77 |

| Section 10.3. |

Administrative Agent’s Right to Perform the Obligations |

|

77 |

| |

|

|

|

| ARTICLE XI |

ADMINISTRATIVE AGENT |

|

78 |

| |

|

|

|

| Section 11.1. |

Appointment and Duties. |

|

78 |

| Section 11.2. |

Binding Effect |

|

79 |

| Section 11.3. |

Use of Discretion. |

|

79 |

| Section 11.4. |

Delegation of Rights and Duties |

|

79 |

| Section 11.5. |

Reliance and Liability. |

|

80 |

| Section 11.6. |

Administrative Agent Individually |

|

81 |

| Section 11.7. |

Lender Credit Decision |

|

81 |

| Section 11.8. |

Expenses; Indemnities. |

|

81 |

| Section 11.9. |

Resignation of Administrative Agent. |

|

82 |

| Section 11.10. |

Additional Secured Parties |

|

83 |

| |

|

|

|

| ARTICLE XII |

MISCELLANEOUS |

|

83 |

| |

|

|

|

| Section 12.1. |

Notices |

|

83 |

| Section 12.2. |

Amendments and Waivers. |

|

85 |

| Section 12.3. |

Assignments and Participations; Binding Effect. |

|

87 |

| Section 12.4. |

Indemnities. |

|

90 |

| Section 12.5. |

Lender-Creditor Relationship |

|

90 |

| Section 12.6. |

Right of Setoff |

|

91 |

| Section 12.7. |

Sharing of Payments, Etc |

|

91 |

| Section 12.8. |

Marshaling; Payments Set Aside |

|

91 |

| Section 12.9. |

Limitation on Interest |

|

92 |

| Section 12.10. |

Invalid Provisions |

|

92 |

| Section 12.11. |

Reimbursement of Expenses. |

|

93 |

| Section 12.12. |

Approvals; Third Parties; Conditions |

|

94 |

| Section 12.13. |

Administrative Agent and Lenders Not in Control; No Partnership |

|

94 |

| Section 12.14. |

Contest of Certain Claims |

|

95 |

| Section 12.15. |

Time of the Essence |

|

95 |

| Section 12.16. |

Successors and Assigns |

|

95 |

| Section 12.17. |

Renewal, Extension or Rearrangement |

|

95 |

| Section 12.18. |

Waivers. |

|

95 |

| Section 12.19. |

Cumulative Rights; Joint and Several Liability |

|

95 |

| Section 12.20. |

Singular and Plural |

|

96 |

| Section 12.21. |

Exhibits and Schedules |

|

96 |

| Section 12.22. |

Titles of Articles, Sections and Subsections |

|

96 |

| Section 12.23. |

Promotional Material |

|

96 |

| Section 12.24. |

Survival |

|

96 |

| Section 12.25. |

WAIVER OF JURY TRIAL |

|

96 |

| Section 12.26. |

Waiver of Punitive or Consequential Damages |

|

97 |

| Section 12.27. |

Governing Law |

|

97 |

| Section 12.28. |

Entire Agreement |

|

97 |

| Section 12.29. |

Counterparts |

|

97 |

| Section 12.30. |

Consents and Approvals |

|

97 |

| Section 12.31. |

Right of First Refusal |

|

98 |

| Section 12.32. |

Effectiveness of Facsimile Documents and Signatures |

|

98 |

| Section 12.33. |

Venue |

|

98 |

| Section 12.34. |

Important Information Regarding Procedures for Requesting Credit |

|

99 |

| Section 12.35. |

Method of Payment |

|

99 |

| Section 12.36. |

Non-Public Information; Confidentiality; Disclosure |

|

99 |

| Section 12.37. |

Post-Closing Obligations of Borrower |

|

99 |

| Section 12.38. |

Release and Waiver Regarding Special Audits |

|

100 |

| |

|

|

|

| ARTICLE XIII |

LIMITATIONS ON LIABILITY |

|

100 |

| |

|

|

|

| Section 13.1. |

Limitation on Liability. |

|

100 |

| Section 13.2. |

Limitation on Liability of Lender’s Officers, Employees, etc |

|

103 |

| |

|

|

|

| ARTICLE XIV |

CROSS-GUARANTY |

|

104 |

| |

|

|

|

| Section 14.1. |

Cross-Guaranty |

|

104 |

| Section 14.2. |

Waivers By Borrower |

|

104 |

| Section 14.3. |

Benefit of Guaranty |

|

104 |

| Section 14.4. |

Waiver of Subrogation, Etc |

|

105 |

| Section 14.5. |

Election of Remedies |

|

105 |

| Section 14.6. |

Limitation |

|

105 |

| Section 14.7. |

Contribution with respect to Guarantee Obligations. |

|

106 |

| Section 14.8. |

Liability Cumulative |

|

107 |

Exhibits and Schedules

| Exhibit A |

Description of Projects and Operators; Allocated Loan Amounts |

| Exhibit B |

Loan Commitments |

| Schedule 2.1 |

Conditions to Advance of Loan Proceeds |

| Schedule 2.3(a) |

Amortization Schedule |

| Schedule 2.5(b) |

Required Repairs |

| Schedule 2.7 |

Sources and Uses |

| Schedule 6.1 |

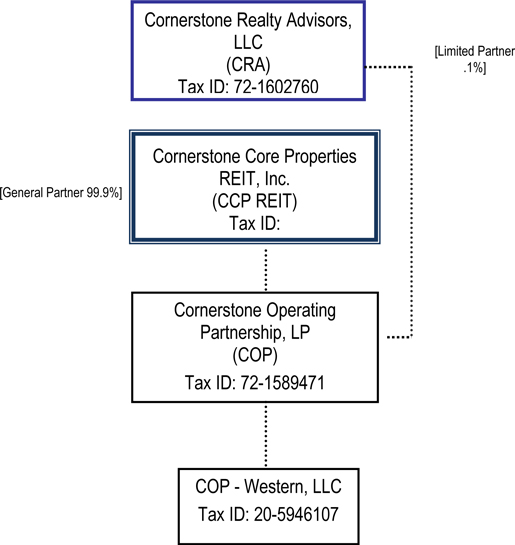

Organizational Information; Organizational Chart |

| Schedule 6.22 |

Disclosures Regarding Healthcare Matters |

| Schedule 6.22(a) |

Third Party Payor Programs |

| Schedule 6.22(b) |

Primary Licenses |

| Schedule 7.2 |

Form of Compliance Certificate |

| Schedule 12.37 |

Post-Closing Obligations |

LOAN AGREEMENT

This Loan Agreement

(this “Agreement”) is entered into as of September 13, 2012 by and among GENERAL ELECTRIC CAPITAL CORPORATION,

a Delaware corporation (“GE Capital”), as Administrative Agent and collateral agent for the Lenders (as

defined herein) (in such capacity and together with its successors and permitted assigns, the “Administrative Agent”),

THE FINANCIAL INSTITUTIONS WHO ARE OR HEREAFTER BECOME PARTIES TO THIS AGREEMENT as Lenders (together with their successors and

permitted assigns, each a “Lender” and collectively, the “Lenders”), and CHP

PORTLAND, LLC, CHP MEDFORD 1, LLC, and CHP FRIENDSWOOD SNF, LLC, each, a Delaware limited liability company (individually or collectively,

as the context may require, and together with such Affiliates of each as may from time to time become signatories hereto as “Borrowers”

“Borrower”).

ARTICLE

I

DEFINITIONS

Section

1.1. Certain Definitions. As used herein, the following terms have the meanings

indicated:

“Acceleration

Prepayment Premium” has the meaning assigned in Section 2.4(d).

“Acceptance

Notice” has the meaning assigned in Section 11.25.

“Account

Debtor” means “account debtor”, as defined in Article 9 of the UCC, and any other obligor

in respect of an Account.

“ACH”

has the meaning assigned in Section 2.6(c).

“Acknowledgement

of Property Manager” means any Collateral Assignment, Subordination and Agreement of a Property Manager (whether

one or more) executed by a Property Manager in favor of the Administrative Agent (on behalf of itself and the Lenders).

“Adjusted

Expenses” means actual operating expenses related to the Projects, excluding any rent and interest paid and depreciation

recorded by Operating Tenant on a stabilized accrual basis for the previous twelve (12) month period (as reasonably adjusted by

Administrative Agent), including: (i) recurring expenses as determined under GAAP, (ii) real estate taxes, (iii) management fees

(whether paid or not) in an amount not less than five percent (5%) of effective gross income (or the actual management fee paid,

if higher) and (iv) a replacement reserve (whether reserved or not) of not less than Three Hundred Fifty and No/100 Dollars ($350)

per Residential Unit.

“Adjusted

Net Operating Income” or “ANOI” means annualized Adjusted Revenue less Adjusted Expenses,

based upon the financial reports provided by Borrower under Article 7 and approved by Administrative Agent in its reasonable discretion.

“Adjusted

Revenue” means revenues generated by the Operator at the Projects for the period in question (and if none specified,

then for the most current twelve (12) months), as determined under GAAP, but excluding (a) nonrecurring income and non-property

related income (as determined by Administrative Agent in its sole discretion) and income from tenants that is classified as “bad

debt” under GAAP, and (b) late fees and interest income; provided, however, if actual occupancy of

the Projects, taken as a whole, exceeds 95%, Adjusted Revenue shall be proportionately reduced assuming an occupancy of 95%.

“Administrative

Agent” has the meaning assigned in the preamble to this Agreement.

“Affected

Lender” has the meaning assigned in Section 2.13(a).

“Affiliate”

means, with respect to a particular Person, (a) any corporation in which such Person or any partner, shareholder, director, officer,

member, or manager of such Person directly or indirectly owns or controls more than ten percent (10%) of the beneficial interest,

(b) any partnership, joint venture or limited liability company in which such Person or any partner, shareholder, director, officer,

member, or manager of such Person is a partner, joint venturer or member, (c) any trust in which such Person or any partner, shareholder,

director, officer, member or manager of such Person is a trustee or beneficiary, (d) any Person which is directly or indirectly

owned or controlled by such Person or any partner, shareholder, director, officer, member or manager of such Person, (e) any partner,

shareholder, director, officer, member, manager or employee of such Person, (f) any Person related by birth, adoption or marriage

to any partner, shareholder, director, officer, member, manager, or employee of such Person. Any Borrower Party shall be deemed

an Affiliate of Borrower.

“Affiliated

Manager” shall mean any property manager in which Borrower, or any Affiliate of Borrower has, directly or indirectly,

any legal, beneficial or economic interest.

“Agreement”

means this Loan Agreement, as amended, restated, supplemented, or otherwise modified from time to time.

“Anti-Money

Laundering Laws” means those laws, regulations and sanctions, state and federal, criminal and civil, that (a) limit

the use of and/or seek the forfeiture of proceeds from illegal transactions; (b) limit commercial transactions with designated

countries or individuals believed to be terrorists, narcotics dealers or otherwise engaged in activities contrary to the interests

of the United States; (c) require identification and documentation of the parties with whom a Financial Institution conducts business;

or (d) are designed to disrupt the flow of funds to terrorist organizations. Such laws, regulations and sanctions shall be deemed

to include the Patriot Act, the Bank Secrecy Act, the Trading with the Enemy Act, 50 U.S.C. App. Section 1, et seq., the

International Emergency Economic Powers Act, 50 U.S.C. Section 1701, et seq., and the sanction regulations promulgated pursuant

thereto by the OFAC, as well as laws relating to prevention and detection of money laundering in 18 U.S.C. Sections 1956 and 1957.

“Approved

Fund” means, with respect to Administrative Agent or any Lender, any Person (other than a natural Person) that (a)

is or will be engaged in making, purchasing, holding or otherwise investing in commercial loans and similar extensions of credit

in the ordinary course of its business and (b) is advised or managed by (i) Administrative Agent or such Lender, (ii) any Affiliate

of Administrative Agent or such Lender or (iii) any Person (other than an individual) or any Affiliate of any Person (other than

an individual) that administers or manages Administrative Agent or such Lender.

“Approved

Insurer” means any insurer (other than Medicaid/Medicare/TRICARE) as may be approved by Administrative Agent from

time to time in its sole discretion.

“Assignment”

means an assignment agreement entered into by a Lender, as assignor, and any Person, as assignee, pursuant to the terms and provisions

of Section 12.3 (with the consent of any party whose consent is required by Section 12.3), accepted by the Administrative

Agent, in form and substance satisfactory to Administrative Agent.

“Assignment

of Hedge Agreement” means one more collateral assignments of Hedge Agreements, as amended, restated, supplemented

or otherwise modified from time to time, which may be executed and delivered by Borrower and the counterparty under such Hedge

Agreement to Administrative Agent (on behalf of itself and the Lenders), in accordance with Section 2.9 hereof.

“Assignment

of Leases and Rents” means any Assignment of Leases and Rents (whether one or more), executed by any Borrower for

the benefit of Administrative Agent (on behalf of itself and the Lenders), and pertaining to the Leases, as amended, restated,

supplemented or otherwise modified from time to time.

“Assignment

of Membership Interests” means any Assignment of Membership Interests, executed by the sole member of any Borrower

for the benefit of Administrative Agent (on behalf of the Lenders), and pertaining to all of the membership interests in such Borrower,

as amended, restated, supplemented or otherwise modified from time to time.

“ASTM”

means the American Society for Testing and Materials.

“Award”

has the meaning assigned in Section 3.3.

“Bankruptcy

Party” has the meaning assigned in Section 9.7.

“Bank Secrecy

Act” means the Bank Secrecy Act, 31 U.S.C. Section 5311, et seq.

“Borrower”

has the meaning assigned in the preamble to this Agreement.

“Borrower

Formation Documents” has the meaning assigned in Section 6.1(b).

“Borrower

Party” means any Guarantor, any general partner of any Borrower, and any general partner in any partnership that

is a general partner of any Borrower, any manager or managing member of any Borrower, and any manager or managing member in any

limited liability company that is a managing member of any Borrower.

“Borrower’s

Knowledge” means the knowledge of any Borrower after diligent inquiry including, without limitation, review of existing

reports (e.g., environmental and property condition reports) regarding the Projects, inquiry of the current operator of the Projects.

“Business

Day” means a day other than a Saturday, a Sunday, or a legal holiday on which national banks located in the State

of Illinois are not open for general banking business.

“Cash Management

Agreement” means any agreement existing as of the date hereof or from time to time during the term of the Loan among

Administrative Agent (on behalf of itself and the Lenders), a Borrower, a Master Tenant (and any combination of the foregoing persons)

and a bank approved by Administrative Agent regarding the establishment and operation of a lockbox account, blocked account or

similar account into which rents and other Revenue are to be deposited, and includes the Deposit Account Control Agreement.

“Casualty”

has the meaning assigned in Section 3.2.

“Census

Report” means, with respect to the Projects, a report which records the number of licensed beds for the Projects,

as well s the number of patients and patient census days by Third Party Payor source.

“Closing

Date” means the date the Loan is funded by the Lenders.

“Code”

means the Internal Revenue Code of 1986, as amended, and as it may be further amended from time to time, any successor statutes

thereto, and applicable U.S. Department of Treasury regulations issued pursuant thereto in temporary or final form.

“Collateral”

means all real and personal property with respect to which Liens in favor of Administrative Agent are executed, identified or purported

to be granted pursuant to the Loan Documents and which secure the Obligations described in the Loan Documents and the Secured Hedge

Agreement, and includes, without limitation, all of a Borrower’s right, title and interest in, to and under all personal

property, real property, and other assets that arise from, are used in connection with, are related to or are located at the Projects,

whether now owned by or owing to, or hereafter acquired by or arising in favor of a Borrower (including all personal property and

other assets owned or acquired under any trade names, styles or derivations thereof), and whether owned or consigned by or to,

or leased from or to, a Borrower, and regardless of where located.

“Commercial

Lease” means any non-residential Lease of any portion of a Project, but excluding each Master Lease.

“Compliance

Certificate” means the compliance certificate in the form of Schedule 7.2 attached hereto.

“CON”

means a certificate of need or similar certificate, license or approval issued by the State Regulator for the requisite number

of Residential Units in each of the Projects.

“Condemnation”

has the meaning assigned in Section 3.3.

“Contest”

has the meaning assigned in Section 13.1(b).

“Contract

Rate” means a floating rate of interest equal to four and five tenths percent (4.50%) per annum in excess of the

LIBOR Rate.*

“Control”

or “controls” means, when used with respect to any specified Person, the power to direct the management

and policies of such Person, directly or indirectly, whether through the ownership of voting securities or other beneficial interests,

by contract, by its position with such Person as general partner or managing member, or otherwise; and the terms “Controlling”

and “Controlled” have the meanings correlative to the foregoing.

“Debt”

means, for any Person, without duplication: (a) all indebtedness of such Person for borrowed money, for amounts drawn under a letter

of credit, or for the deferred purchase price of property for which such Person or any of its assets is liable, (b) all unfunded

amounts under a loan agreement, letter of credit, or other credit facility for which such Person or any of its assets would be

liable or subject, if such amounts were advanced under the credit facility, (c) all amounts required to be paid by such Person

as a guaranteed payment to partners or a preferred or special dividend, including any mandatory redemption of shares or interests,

(d) all indebtedness guaranteed by such Person, directly or indirectly, (e) all obligations under leases that constitute capital

leases for which such Person or any of its assets is liable or subject, and (f) all obligations of such Person under interest rate

swaps, caps, floors, collars and other interest hedge agreements, in each case whether such Person or any of its assets is liable

or subject contingently or otherwise, as obligor, guarantor or otherwise, or in respect of which obligations such Person otherwise

assures a creditor against loss.

“Debt Service”

means, for any particular period, the aggregate interest, fixed principal (if applicable), and other payments due during such period

under the Loan and under any other permitted Debt relating to the Projects expressly approved by Administrative Agent (but not

including payments applied to escrows or reserves required by Administrative Agent or the Lenders). In the event that Debt Service

for a period of twelve (12) months (or other calculation period) is not available, Administrative Agent shall annualize the Debt

Service for such period of time as is available.

“Debt Service

Coverage Ratio” means the ratio of (i) Adjusted Net Operating Income for the Projects for a particular period, to

(ii) Debt Service for such period.

“Default

Rate” means the lesser of (a) the maximum rate of interest allowed by applicable law, and (b) five percent (5%) per

annum in excess of the Contract Rate.

“Defaulting

Lender” means a Lender that (a) has given written notice to Borrower, Administrative Agent, or any other Lender that

it will fail to fund any amounts to be funded by such Lender after the Closing Date under this Agreement or otherwise fails to

fund such amount under this Agreement; (b) is in default for failing to make payments under one or more syndicated credit facilities

(unless subject to a good faith dispute); (c) has declared (or the holding company of such Lender has declared) bankruptcy or is

otherwise involved in a liquidation proceeding and Administrative Agent has determined such Lender is reasonably likely to become

a Defaulting Lender or (d) is the subject of a receivership.

“Deposit

Account” means a “deposit account” (as defined in Article 9 of the UCC), an investment

account, or other account in which funds are held or invested for credit to or for the benefit of any Borrower.

“Deposit

Account Bank” means each bank in which any Borrower maintains a Deposit Account.

“Deposit

Account Control Agreement” means an agreement, in form and substance satisfactory to Administrative Agent, among

Administrative Agent, a Borrower and the Deposit Account Bank, which agreement provides that (a) such bank shall comply with instructions

originated by Administrative Agent directing disposition of the funds in such Deposit Account without further consent by Borrower,

and (b) such bank shall agree that it shall have no Lien on, or right of setoff or recoupment against, such Deposit Account or

the contents thereof, other than in respect of commercially reasonable fees and other items, in each such case expressly consented

to by Administrative Agent, and containing such other terms and conditions as Administrative Agent may require, as amended, restated,

supplemented or otherwise modified from time to time.

“Determination

Date” has the meaning assigned in Section 8.15(a).

“Dollars”

and the sign “$” each mean the lawful money of the United States of America.

“Electronic

Transmission” means any process of communication that does not directly involve the physical transfer of paper and

that is suitable for the retention, retrieval and reproduction of information by the recipient.

“Environmental

Indemnity Agreement” means that certain Hazardous Materials Indemnity Agreement dated of even date hereof in favor

of Administrative Agent (for itself and on behalf of the Lenders) executed by Borrower and Guarantor with respect to the Projects,

as amended, restated, supplemented or otherwise modified from time to time.

“Environmental

Laws” means any federal, state or local law (whether imposed by statute, ordinance, rule, regulation, administrative

or judicial order, or common law), now or hereafter enacted, governing health, safety, industrial hygiene, the environment or natural

resources, or Hazardous Materials, including, without limitation, such laws (a) governing or regulating the use, generation, storage,

removal, recovery, treatment, handling, transport, disposal, control, release, discharge of, or exposure to, Hazardous Materials,

(b) governing or regulating the transfer of property upon a negative declaration or other approval of a Governmental Authority

of the environmental condition of such property, or (c) requiring notification or disclosure of releases of Hazardous Materials

or other environmental conditions whether or not in connection with a transfer of title to or interest in property.

“ERISA”

means the Employment Retirement Income Security Act of 1974, as amended from time to time, and all rules and regulations promulgated

thereunder.

“ERISA

Affiliate” means each Restricted Party and all members of a controlled group of corporations and all trades or businesses

(whether or not incorporated) under common control that, together with such Restricted Party, are (or were at any time in the past

six years) treated as a single employer under Section 414 of the Internal Revenue Code.

“Event

of Default” has the meaning assigned in Article 9.

“Federal

Bankruptcy Code” means Chapter 11 of Title II of the United States Code (11 U.S.C. § 101, et seq.), as

amended.

“Financial

Institution” means a United States Financial Institution as defined in 31 U.S.C. 5312, as amended from time to time.

“Financing

Notice” has the meaning assigned in Section 12.32.

“FIRREA”

has the meaning assigned in Schedule 2.1.

“Friendswood

Project” means the Project described on Part 4 of Exhibit A.

“Funds”

means, collectively, the Replacement Escrow Fund, the HUD Fund and the Master Lease Fund.

“GAAP”

means general accepted accounting principles of the Accounting Principles Board of the American Institute of Certified Public Accountants

and the Financial Accounting Standards Board that are applicable on the date so indicated and consistently applied.

“GE Capital”

has the meaning assigned in the Preamble to this Agreement.

“GECB”

has the meaning specified in Section 12.3.

“Governmental

Account Debtor” means any Account Debtor that is a Governmental Authority, including, without limitation, Medicare

and Medicaid.

“Governmental

Approvals” means, collectively, all consents, licenses and permits and all other authorizations or approvals required

from any Governmental Authority to operate the Projects.

“Governmental

Authority” means any federal, state, county or municipal government or political subdivision thereof, any governmental

or quasi-governmental agency, authority, board, bureau, commission, department, instrumentality or public body (including, without

limitation, the State Regulator), or any court, administrative tribunal, or public body.

“Guarantor”

means Cornerstone Core Properties REIT, Inc.

“Hazardous

Materials” means (a) petroleum or chemical products, whether in liquid, solid, or gaseous form, or any fraction or

by product thereof, (b) asbestos or asbestos containing materials, (c) polychlorinated biphenyls (pcbs), (d) radon gas, (e) underground

storage tanks, (f)any explosive or radioactive substances, (g) lead or lead-based paint, (h) any other substance, material, waste

or mixture which is or shall be listed, defined, or otherwise determined by any Governmental Authority to be hazardous, toxic,

dangerous or otherwise regulated, controlled or giving rise to liability under any Environmental Laws, (i) any excessive moisture,

mildews, mold or other fungi in quantities and/or concentrations that could reasonably be expected to pose a risk to human health

or the environment, or negatively impact the value of the Projects or (j) any elements, material, compounds, mixtures, chemicals,

wastes, pollutants, contaminants or substances known to cause cancer or reproductive toxicity, that, because of its quantity, concentration

or physical or chemical characteristics, exposure is limited or regulated by any Governmental Authority having jurisdiction over

human health and safety, natural resources or the environment, or which poses a significant present or potential hazard to human

health and safety, or to the environment, if released into the workplace or the environment.

“Healthcare

Investigations” means any inquiries, investigations, probes, audits or proceedings concerning the business affairs,

practices, licensing or reimbursement entitlements of Borrower, Guarantor or any Operator (including, without limitation, inquiries

involving the Comprehensive Error Rate Testing and any inquiries, investigations, probes, audit or procedures initiated by Fiscal

Intermediary/Medicare Administrator Contractor, Medicaid Integrity Contractor, Recovery Audit Contractor, Program Safeguard Contractor,

Zone Program Integrity Contractor, Attorney General, Office of Inspector General, Department of Justice or similar governmental

agencies or contractors for such agencies).

“Healthcare

Laws” means all applicable state and federal statutes, codes, ordinances, orders, rules, regulations, and guidance

relating to patient healthcare and/or patient healthcare information, including HIPAA, the Health Information Technology for Economic

Clinical Health Act provisions of the American Recovery and Investment Act of 2009 and the respective rules and regulations promulgated

thereunder, and all other applicable state and federal laws regarding the privacy and security of protected health information

and other confidential patient information; the establishment, construction, ownership, operation, licensure, use or occupancy

of the Projects or any part thereof as a skilled nursing facility or other healthcare or senior living facility, and all conditions

of participation pursuant to Medicare and/or Medicaid certification; fraud and abuse, including without limitation, Section 1128B(b)

of the Social Security Act, as amended, 42 U.S.C. Section 1320a-7(b) (Criminal Penalties Involving Medicare or State Health Care

Programs), commonly referred to as the “Federal Anti-Kickback Statute,” and the Social Security Act,

as amended, Section 1877, 42 U.S.C. Section 1395nn (Prohibition Against Certain Referrals), commonly referred to as the “Stark

Statute”, 31 U.S.C Section 3729-33, and the “False Claims Act”.

“Hedge

Agreement” means any and all interest rate swap agreements, interest rate cap agreements, interest rate collar agreements

or other similar agreements pertaining to fluctuations in interest rates, now or hereafter entered into by any Borrower pursuant

to Section 2.9 of this Agreement, as the same may be renewed, extended, amended or replaced from time to time.

“HIPAA”

means the Health Insurance Portability and Accountability Act of 1996, as amended.

“HIPAA

Compliance Plan” has the meaning assigned in Section 8.16(a).

“HIPAA

Compliance Date” has the meaning assigned in Section 8.16(b).

“HIPAA

Compliant” has the meaning assigned in Section 8.16(a).

“HUD”

means the United States Department of Housing and Urban Development.

“HUD Commitment”

means a commitment letter or letter of intent entered into on or before September 13, 2013, by a lender insured by HUD and Borrower

that contemplates the funding of a HUD Loan, in an amount sufficient to repay the Loan in full, to Borrower on or before September

12, 2014.

“HUD Conditions”

means (a) no Event of Default has occurred and is continuing; (b) Borrower has delivered the HUD Commitment to Administrative

Agent; (c) the HUD Commitment remains in full force and effect; and (d) the HUD Commitment has not been amended or modified

in a manner that would reduce the funds available to Borrower to prepay the Loan to be less than the amount required to repay the

Obligations in full.

“HUD Fund” has

the meaning assigned in Section 2.5.

“HUD Loan”

means a loan to be advanced to Borrower by a lender insured by HUD, the proceeds of which shall be sufficient to repay the Obligations

in full.

“Indebtedness”

means all payment obligations of Borrower or any Borrower Party to Administrative Agent or to any Lender under the Loan or any

of the Loan Documents, including, without limitation, any and all interest, whether or not accruing after the filing of any petition

in bankruptcy or the commencement of any insolvency, reorganization or similar proceeding, and whether or not a claim for post-filing

or post petition interest is allowed in any such proceeding.

“Indemnitee”

has the meaning assigned in Section 11.3.

“Insurance

Impound” has the meaning assigned in Section 3.4.

“Insurance

Premiums” has the meaning assigned in Section 3.1(c).

“Interest

Only Period” means the first twelve (12) Payment Dates commencing with the first Payment Date on October 1, 2012,

and ending on the Payment Date on September 1, 2013.

“Land”

means the real property described in Exhibit A attached hereto.

“Laws”

means, collectively, all federal, state and local laws, statutes, codes, ordinances, orders, rules and regulations and guidances

and judicial opinions or presidential authority in the applicable jurisdiction, including quality and safety standards, accreditation

standards and requirements of any Governmental Authority or State Regulator having jurisdiction over Borrower or the ownership,

use, occupancy or operations of a Project, each as it may be amended from time to time.

“Lease

Party” means the party to any Lease that grants to the other party the right to use or occupy any portion of a Project,

whether it be Borrower or any Operator.

“Leases”

means all leases of, subleases of and occupancy agreements affecting a Project or any part thereof now existing or hereafter executed

(including all patient and resident care agreements and service agreements which include an occupancy agreement) and all amendments,

modifications or supplements thereto.

“Lender”

has the meaning assigned in the preamble to this Agreement. In addition to the foregoing, solely for the purpose of identifying

the Persons entitled to share in payments and collections from the Collateral and the benefit of any guarantees of the Obligations

as more fully set forth in this Agreement and the other Loan Documents, the term “Lender” shall include

Secured Hedge Providers. For the avoidance of doubt, any Person to whom any Obligations in respect of a Secured Hedge Agreement

are owed and which does not hold any portion of the Loan or commitments hereunder shall not be entitled to any other rights as

a “Lender” under this Agreement or the other Loan Documents.

“Lender

Transferee” has the meaning assigned in Section 12.3(f).

“Liabilities”

means all claims, actions, suits, judgments, damages, losses, liability, obligations, responsibilities, fines, penalties, sanctions,

costs, fees, taxes, commissions, charges, disbursements and expenses, in each case of any kind or nature (including interest accrued

thereon or as a result thereto and fees, charges and disbursements of financial, legal and other advisors and consultants), whether

joint or several, whether or not indirect, contingent, consequential, actual, punitive, treble or otherwise.

“Libor

Breakage Amount” means an amount, as reasonably calculated by any Lender, equal to the amount of any losses, expenses

and liabilities (including, without limitation, any loss (including interest paid) and lost opportunity cost in connection with

the re-employment of such funds) that such Lender or any of its Affiliates may sustain as a result of any payment of the Loan (or

any portion thereof) on any day that is not the last day of the Libor Interest Period applicable thereto (regardless of the source

of such prepayment and whether voluntary, by acceleration or otherwise).

“Libor

Business Day” means a Business Day on which banks in the City of London are generally open for interbank or foreign

exchange transactions.

“Libor

Interest Period” means each period commencing on the first day of a calendar month and ending on the last day of

the month that is three months thereafter; provided, any Libor Interest Period that would otherwise extend beyond the Maturity

Date shall end on the Maturity Date.

“Libor

Rate” means the greater of (a) five tenths percent (0.50%) per annum or (b) for each Libor Interest Period,

the rate determined by the Administrative Agent to be the offered rate for deposits in Dollars for the applicable Libor Interest

Period appearing on the Reuters Screen LIBOR01 page as of 11:00 a.m. (London time) two (2) Business Days prior to the next preceding

first day of each Libor Interest Period. In the event that such rate does not appear on the Reuters Screen LIBOR01 page at such

time, the “Libor Rate” shall be determined by reference to such other comparable publicly available service

for displaying the offered rate for deposit in Dollars in the London interbank market as may be selected by the Administrative

Agent and, in the absence of availability, such other method to determine such offered rate as may be selected by the Administrative

Agent in its sole discretion.

“Lien”

means any interest, or claim thereof, in a Project securing an obligation owed to, or a claim by, any Person other than the owner

of such Project, whether such interest is based on common law, statute or contract, including the lien or security interest arising

from a deed of trust, mortgage, assignment, encumbrance, pledge, security agreement, conditional sale or trust receipt or a lease,

consignment or bailment for security purposes. The term “Lien” shall include reservations, exceptions,

encroachments, easements, rights of way, covenants, conditions, restrictions, leases and other title exceptions and encumbrances

affecting such Project.

“Loan”

means the loan made by the Lenders to Borrower under this Agreement, together with all other amounts secured by the Loan Documents.

“Loan Commitment”

means, with respect to each Lender, the commitment of such Lender to make its Pro Rata Share of the Loan to Borrower, which commitment

is in the amount set forth opposite such Lender’s name on Exhibit B under the caption “Lender’s

Loan Commitment.” The aggregate amount of the Loan Commitments on the date hereof is specified on Exhibit B.

“Loan Documents”

means: (a) this Agreement, (b) the Note, (c) the Mortgage, (d) the Assignment of Leases and Rents, (e) Uniform Commercial Code

financing statements, (f) such assignments of management agreements, contracts and other rights as may be required under the Term

Sheet or otherwise requested by Administrative Agent or the Lenders, (g) the Business Associate Agreement, (h) the Recourse Guaranty

Agreement, (i) Collateral Assignment of Membership Interests, (j) the Security Agreement, (k) the Cash Management Agreement,

(l) [reserved], (m) Acknowledgment of Property Manager, (n) all other documents evidencing, securing, governing or otherwise pertaining

to the Loan, (o) any letter of credit provided to Administrative Agent (for itself and on behalf of the Lenders) in connection

with the Loan, and (p) all amendments, modifications, renewals, substitutions and replacements of any of the foregoing; provided

however, in no event shall the term “Loan Documents” include the Environmental Indemnity Agreement.

“Lockout

Period” means the period beginning on the Closing Date and ending on the last day of the calendar month that is twelve

(12) months thereafter.

“Management

Agreement” means, individually or collectively, as the context may require, any agreement, in the form approved by

Administrative Agent, between a Master Tenant and a Property Manager pursuant to which such Property Manager is engaged to manage

a Project.

“Master

Lease” means, individually and collectively, as the context may require, a lease (whether one or more), in the form

approved by Administrative Agent, between a Borrower, as landlord, and a Master Tenant, as tenant, demising a Project in its entirety,

together with all amendments, restatements, supplements and modifications thereto permitted under Section 5.3(b) hereof.

“Master

Lease Fund” has the meaning specified in Section 2.5(d).

“Master

Lease Subordination Agreement” means, individually and collectively, as the context may require, a Subordination,

Non-Disturbance and Attornment Agreement (whether one or more), in the form approved by Administrative Agent, executed by a Master

Tenant, a Borrower and Administrative Agent with respect to a Master Lease.

“Master

Tenant” means, individually or collectively as the context may require, each Person identified on Exhibit A

as the “Master Tenant” of a Project.

“Material

Action” means to file any insolvency, or reorganization case or proceeding, to institute proceedings to have a Borrower

or any Borrower Party be adjudicated bankrupt or insolvent, to institute proceedings under any applicable insolvency law, to seek

any relief under any law relating to relief from debts or the protection of debtors, to consent to the filing or institution of

bankruptcy or insolvency proceedings against a Borrower or any Borrower Party, to file a petition seeking, or consent to, reorganization

or relief with respect to a Borrower or any Borrower Party under any applicable federal or state law relating to bankruptcy or

insolvency, to seek or consent to the appointment of a receiver, liquidator, assignee, trustee, sequestrator, custodian, or any

similar official of or for a Borrower or any Borrower Party or a substantial part of its respective property, to make any assignment

for the benefit of creditors of a Borrower or any Borrower Party, the admission in writing such Borrower’s or any Borrower

Party of such Person’s inability to pay its debts generally as they become due, or to take action in furtherance of any of

the foregoing.

“Material

Adverse Change” or “material adverse change” means, in Administrative Agent’s reasonable

discretion, the business prospects, operations or financial condition of a Person or property has changed in a manner which could

impair the value of the Collateral, prevent timely repayment of the Loan or otherwise prevent the applicable Person from timely

performing any of its material obligations under the Loan Documents or Environmental Indemnity Agreement.

“Material

Adverse Effect” or “material adverse effect” means, in Administrative Agent’s reasonable

discretion, a material adverse effect on (i) the condition (financial or otherwise), operations, business, assets, liabilities

or prospects of a Borrower, (ii) the ability of a Borrower to perform any material obligation under the Loan Documents, (iii) the

rights and remedies of the Administrative Agent and the Lenders under the Loan Documents, (iv) the ability of a Borrower or an

Operator to operate all or a material portion of the Projects owned by such Borrower or operated by such Operator or (v) the ability

of a Master Tenant to make the required rental payments under a Master Lease.

“Maturity

Date” means, as applicable, the earlier of (a) September 12, 2017; or (b) the date on which the Obligations

are otherwise required to be paid in full, by acceleration or otherwise, under this Agreement or any of the other Loan Documents.

“Medicaid”

means Title XIX of the Social Security Act, which was enacted in 1965 to provide a cooperative federal-state program for low income

and medically indigent persons, which is partially funded by the federal government and administered by the states.

“Medicare”

means Title XVIII of the Social Security Act, which was enacted in 1965 to provide a federally funded and administered health program

for the aged and certain disabled persons.

“Mortgage”

means, collectively (whether one or more), as applicable, the Mortgage(s), Assignment of Leases and Rents, Security Agreement and

Fixture Filing, the Deed(s) of Trust, Assignment of Leases and Rents, Security Agreement and Fixture Filing, the Deed(s) to Secure

Debt, Assignment of Leases and Rents, Security Agreement and Fixture Filing, or any similar security agreement encumbering a Project

executed by any Borrower in favor of Administrative Agent (for itself and on behalf of the Lenders), covering the Projects, as

amended, restated, supplemented or otherwise modified from time to time.

“Non-U.S.

Lender Party” means each of the Administrative Agent, the Lenders and each participant, in each case that is not

a Domestic Person.

“Note”

and “Notes” means, respectively, (a) each Promissory Note executed at any time by a Borrower and payable

to the order of a Lender in evidence of the Loan of such Lender and (b) all such Promissory Notes, together with all renewals,

modifications and extensions thereof and any replacement or additional notes executed by any Borrower pursuant to the terms hereof.

“Obligations”

means the Indebtedness and all other obligations of Borrower hereunder and under the other Loan Documents.

“OFAC”

means the Office of Foreign Assets Control, Department of the Treasury.

“Operational

Default” has the meaning assigned in Section 9.2.

“Operational

Default Forbearance Period” has the meaning assigned in Section 9.2.

“Operator”,

individually, and “Operators”, collectively, means the applicable Property Manager, Master Tenant, property

sublessee and/or operator under any Operating Agreement, approved by Administrative Agent and any successor to such Operator

approved by Administrative Agent. If there exists a Property Manager, Master Tenant and a property sublessee, or any combination

thereof, with respect to a Project, then “Operator” shall refer to all such entities, collectively and

individually as applicable and as the context may require.

“Operators’

Agreements” means, collectively, the Master Lease, the Management Agreement and/or other similar agreement regarding

the management and operation of a Project between a Borrower and a Master Tenant or a Master Tenant and a Property Manager.

“Other

Taxes” has the meaning assigned in Section 2.16(c).

“Partial

Release” has the meaning assigned in Section 2.17.

“Partial

Release Price” has the meaning assigned in Section 2.17(a)(viii).

“Partial

Release Principal Reduction Payment” shall mean a payment of a principal an amount that, if it had been made and

applied to the principal balance of the Loan on the last day of the applicable fiscal quarter, would have reduced the principal

balance of the Loan to an amount that would have enabled the Retained Project Debt Service Coverage Ratio and the Retained Project

Debt Yield to be in compliance with the requirements specified in Section 2.17(a)(v).

“Partial

Release Project” has the meaning assigned in Section 2.17.

“Patriot

Act” means the USA Patriot Act of 2001, Pub. L. No. 107-56.

“Payment

Date” means the first (1st) day of each calendar month.

“Permit”

means, with respect to any Person, any permit, approval, authorization, license, registration, certificate (including certificates

of occupancy), concession, grant, franchise, variance or permission from, and any other contractual obligations with, any Governmental

Authority, in each case whether or not having the force of law and applicable to or binding upon such Person or any of its property

or to which such Person or any of its property is subject.

“Permitted

Exceptions” means the exceptions to title contained in the Title Policy insuring the liens created pursuant to the

Mortgages and any other title matter to which Administrative Agent consents in writing.

“Permitted

Transfer” means (a) a Sale or Pledge expressly permitted under Section 8.1(c) or (b) a Prohibited Transfer

approved by the Required Lenders pursuant to Section 8.1(d) or 8.1(e).

“Person”

means any individual, corporation, partnership, joint venture, association, joint stock company, trust, trustee, estate, limited

liability company, unincorporated organization, real estate investment trust, government or any agency or political subdivision

thereof, or any other form of entity.

“Post Closing

Obligations” means the post closing obligations described on Schedule 12.37.

“Potential

Default” means the occurrence of any event or condition which, with the giving of notice, the passage of time, or

both, would constitute an Event of Default.

“Primary

Licenses” means, with respect to a Project or Person operating a Project, as the case may be, the CON, permit or

license to operate as a skilled nursing facility, and each Medicaid/Medicare/TRICARE provider agreement.

“Prohibited

Transfer” has the meaning assigned in Section 8.1(a).

“Projects”

means the Land, and facilities located thereon, and all related facilities, amenities, fixtures and personal property owned by

Borrower and any improvements now or hereafter located on such Land, and any other real property and facilities owned by Borrower

that may from time to time be encumbered by a Mortgage. Each Project is more particularly described on Exhibit A

hereto.

“Project

Yield” means the ratio, as of any particular date, expressed as a percentage, of (a) annualized Adjusted Net Operating

Income from the Projects, as determined by Administrative Agent as of such date, to (b) the outstanding principal balance of the

Loan as of such date.

“Property

Condition Report” has the meaning assigned in Schedule 2.1.

“Property

Manager” means, individually or collectively as the context may require, each Person identified on Exhibit

A as the “Property Manager” of a Project, together with any successor thereto approved by Administrative Agent.

“Pro Rata

Outstandings” means, with respect to any Lender at any time, the outstanding principal amount of the Loan owing to

such Lender at such time.

“Pro Rata

Share” means, with respect to any Lender at any time (a) on or prior to the Closing Date, the percentage obtained

by dividing (i) the Loan Commitment of such Lender then in effect by (ii) the sum of the Loan Commitments and (b) after the making

of the Loan, the percentage obtained by dividing (i) the Pro Rata Outstandings of such Lender by (ii) the total outstanding principal

amount of the Loan; provided, however, that, if there are no Loan Commitments and no Pro Rata Outstandings, such

Lender’s Pro Rata Share shall be determined based on the Pro Rata Share most recently in effect, after giving effect to any

subsequent assignment and any subsequent non-pro rata payments of any Lender pursuant to the terms of this Agreement.

“Prorated

Interest” has the meaning assigned in Section 2.4(b).

“Rating

Agencies” means each of Standard & Poor’s Ratings Group, a division of McGraw-Hill, Inc., Moody’s

Investors Service, Inc., and Fitch, Inc., or any other nationally-recognized statistical rating agency which has been approved

by Administrative Agent to the extent that any of the foregoing have been or will be engaged by Administrative Agent or its designees.

“Rating

Agency Confirmation” means a written affirmation from each of the Rating Agencies (unless otherwise agreed by Administrative

Agent) that an action or event shall not result in the qualification, downgrade or withdrawal of any credit rating by such Rating

Agency.

“Recipient”

has the meaning assigned in Section 12.38.

“Recourse

Guaranty Agreement” means that certain Guaranty of Recourse Obligations executed by Guarantor, as amended, restated,

supplemented or otherwise modified from time to time.

“Register”

has the meaning specified in Section 2.12(b).

“Related

Persons” means, with respect to any Person, each of such Person’s Affiliates, officers, directors, employees,

agents, trustees, representatives, attorneys, accountants, and each insurance, environmental, legal, financial and other advisor

and other consultants and agents of or to such Person or any of its Affiliates, together with, if such Person is the Administrative

Agent, each other Person or individual designated, nominated or otherwise mandated by or helping the Administrative Agent pursuant

to and in accordance with Section 11.4 or any comparable provision of any Loan Document.

“Replacement

Escrow Fund” has the meaning assigned in Section 2.5.

“Replacement

Treasury Yield” means the rate of interest equal to the yield to maturity of the most recently issued U.S. Treasury

security as quoted in the Wall Street Journal on any prepayment date. If the remaining term is less than one year, the Replacement

Treasury Yield will equal the yield for 1-Year Treasury’s. If the remaining term of the Loan is 1-Year, 2-Year, etc., then

the Replacement Treasury Yield will equal the yield for the Treasury’s with a maturity equaling the remaining term. If the

remaining term of the Loan is longer than one year but does not equal one of the maturities being quoted, then the Replacement

Treasury Yield will equal the yield for Treasury’s with a maturity closest to but not exceeding the remaining term. If the

Wall Street Journal (i) quotes more than one such rate, the highest of such quotes shall apply, or (ii) ceases to publish such

quotes, the U.S. Treasury security shall be determined from such financial reporting service or source as Administrative Agent

shall determine.

“Reports”

has the meaning assigned in Section 12.38.

“Required

Lenders” means, at any time, Lenders whose Pro Rata Shares at such time are in excess of 50% in the aggregate; provided,

however, the Loan Commitment of, and the portion of the Obligations held or deemed held by, any Defaulting Lender shall

be excluded for purposes of making a determination of Required Lenders.

“Requirements

of Law” means, with respect to any Person, collectively, the common law and all federal, state, local, foreign, multinational

or international laws, statutes, codes, treaties, standards, rules and regulations, guidelines, ordinances, orders, judgments,

writs, injunctions, decrees (including administrative or judicial precedents or authorities) and the interpretation or administration

thereof by, and other determinations, directives, requirements or requests of, any Governmental Authority, in each case whether

or not having the force of law and that are applicable to or binding upon such Person or any of its property or to which such Person

or any of its property is subject.

“Residential

Units” means, collectively, (a) each skilled nursing bed, Alzheimer’s unit and/or assisted living unit authorized

under the Primary Licenses and (b) each independent living unit comprising the Projects.

“Restoration

Threshold” means, as of any date, the lesser of (a) two and one-half percent (2.5%) of the replacement value of the

improvements at the affected Project as of such date, and (b) $500,000.00.

“Restricted

Party” means Borrower, any Affiliated Manager, Guarantor or any shareholder, partner, member or non-member manager

of Borrower or of any Affiliated Manager, or of any direct or indirect legal or beneficial owner of Borrower, of any Affiliated

Manager or of any shareholder, partner, member or any non-member manager hereof.

“Retained

Project” means the Project that is not a Partial Release Project.

“Retained

Project Adjusted Expenses” means actual operating expenses (as adjusted by Administrative Agent) related to the Retained

Project on a stabilized accrual basis for the twelve (12) month period ending on a particular date, including: (i) recurring expenses

as determined under GAAP, (ii) real estate taxes, (iii) Insurance Premiums, (iv) management fees (whether paid or not) in an amount

not less than five percent (5%) of effective gross income (or the actual management fee paid, if higher) and (v) a replacement

reserve (whether reserved or not) of not less than Three Hundred Fifty and No/100 Dollars ($350.00) per Residential Unit per annum.

“Retained

Project Adjusted Net Operating Income” means the Retained Project Adjusted Revenue less the Retained Adjusted Expenses,

based upon the financial reports provided by Borrowers under Article 7 and approved by Administrative Agent in its reasonable discretion.

“Retained

Project Adjusted Revenue” means revenues (as adjusted by Administrative Agent) generated by the operation of the

Retained Project for any particular period, as determined under GAAP, but excluding (a) nonrecurring income and non-property related

income (as determined by Administrative Agent in its sole discretion) and income from tenants that is classified as “bad

debt” under GAAP, and (b) late fees and interest income; provided, however, if actual occupancy of the Retained Project exceeds

95%, Retained Project Adjusted Revenue shall be proportionately reduced assuming an occupancy of 95%.

“Retained

Project Debt Service” means, for any particular period, (1) the aggregate interest, fixed principal, and other payments

due during such period under the Loan and under any other permitted Debt relating to the Projects expressly approved by Administrative

Agent (but not including payments applied to escrows or reserves required by Administrative Agent or Lenders) minus (2) the aggregate

interest, fixed principal and other payments due during such period under the Loan that would not have been due had the Partial

Release Price been paid immediately prior to the commencement of such period. In the event that Retained Project Debt Service for

a period of twelve (12) months is not available, Administrative Agent shall annualize the Retained Project Debt Service for such

period of time as is available.

“Retained

Project Debt Service Coverage Ratio” means, as of any particular date, the ratio of (i) the Retained Project Adjusted

Net Operating Income for the twelve (12) calendar month period ending on such date, to (ii) Retained Project Debt Service for the

twelve (12) calendar month period ending on such date.

“Retained

Project Debt Yield” means the ratio, as of any particular date, expressed as a percentage, of (a) Retained Project

Adjusted Net Operating Income, as determined by Administrative Agent for the twelve (12) calendar month period ending on such date,

to (b) the outstanding principal balance of the Loan (determined on a pro forma basis after deducting the Partial Release Price

therefrom) as of such date.

“Sale or

Pledge” means a voluntary or involuntary sale, conveyance, mortgage, grant, bargain, master lease, encumbrance, pledge,

assignment, grant of any options with respect to, or any other transfer or disposition of (directly or indirectly, voluntarily

or involuntarily, by operation of law or otherwise, and whether or not for consideration or of record) a legal or beneficial interest.

“Secured

Hedge Agreement” means any Hedge Agreement between a Borrower (or Affiliate of Borrower) and a Secured Hedge Provider.

“Secured

Hedge Provider” means (i) a Lender or an Affiliate of a Lender (or a Person who was a Lender or an Affiliate of a

Lender at the time of execution and delivery of a Hedge Agreement) who has entered into a Hedge Agreement with any Borrower, or

(ii) a Person with whom Borrower has entered into a Hedge Agreement provided or arranged by GE Capital or an Affiliate of GE Capital,

and any assignee thereof.

“Secured

Parties” means the Lenders and the Administrative Agent and each such Person’s Related Persons.

“Security”

means all of the real and personal property securing the Obligations described in the Loan Documents and the Secured Hedge Agreements.

“Security

Agreement” means, collectively, the Security Agreement(s) executed by Borrower in favor of Administrative Agent (for

itself and on behalf of the Lenders) covering certain personal property described therein, as amended, restated, supplemented or

otherwise modified from time to time.

“Security

Deposits” means any and all security deposits and entrance fees from any tenant or occupant of a Project collected

or held by Borrower or any Operator.

“Single

Purpose Entity” means a Person (other than an individual, a government or any agency or political subdivision thereof),

which exists solely for the purpose of owning and leasing the Projects, observes corporate, company or partnership formalities,

as applicable, independent of any other entity, and which otherwise complies with the covenants set forth in Section 6.17

hereof.

“Site Assessment”

means an environmental engineering report for each Project prepared at Borrower’s expense by an engineer engaged by Borrower

or by Administrative Agent on behalf of Borrower, and approved by Administrative Agent, and in a manner reasonably satisfactory

to Administrative Agent, based upon an investigation relating to and making appropriate inquiries concerning the existence of Hazardous

Materials on or about such Project, and the past or present discharge, disposal, release or escape of any such substances, all

consistent with ASTM Standard E1527-05 (or any successor thereto published by ASTM) and good customary and commercial practice.

“Social

Security Act” means 42 U.S.C. 401 et seq., as enacted in 1935, and amended, restated or otherwise supplemented

thereafter from time to time and all rules and regulations promulgated thereunder.

“SPE Party”

has the meaning assigned in Section 6.17(d).

“Specially

Designated National and Blocked Persons” means those Persons that have been designated by executive order or by the

sanction regulations of OFAC as Persons with whom U.S. Persons may not transact business or must limit their interactions to types

approved by OFAC.

“State

Regulator” has the meaning assigned in Section 8.14(a).

“Substitute

Lender” has the meaning assigned in Section 2.13(a).

“Survey”

has the meaning assigned in Schedule 2.1.

“Tax Impound”

has the meaning assigned to such term in Section 3.5.

“Taxes”

has the meaning assigned in Section 8.2.

“Tenant”

means any tenant or occupant of a Project under a Lease.

“Term Sheet”

means that certain letter agreement dated June 1, 2012 from Administrative Agent and accepted by and on behalf of Borrower on June

7, 2012.

“Third

Party Payor Programs” means any participation or provider agreements with any third party payor, including Medicare,

Medicaid, TRICARE and any Approved Insurer, and any other private commercial insurance managed care and employee assistance program,

to which Borrower or any Operator may be subject with respect to any Project.

“Title

Policy” has the meaning assigned in Schedule 2.1.

“Transferee”

has the meaning assigned in Section 8.1(d).

“TWEA”

has the meaning assigned in Section 6.19(f).

“UCC”

means the Uniform Commercial Code as from time to time in effect in the State of Illinois; provided, however, that,

in the event that, by reason of mandatory provisions of any applicable Requirement of Law, any of the attachment, perfection or

priority of Administrative Agent’s or any other Lender’s security interest in any Collateral is governed by the Uniform

Commercial Code of a jurisdiction other than the State of Illinois, “UCC” shall mean the Uniform Commercial

Code as in effect in such other jurisdiction for purposes of the provisions hereof relating to such attachment, perfection or priority

and for purposes of the definitions related to or otherwise used in such provisions.

“U.S. Lender

Party” means each of Administrative Agent, the Lenders, and each participant of a Lender, in each case that is a

U.S. Person.

“U.S. Person”

means any United States citizen, any entity organized under the laws of the United States or its constituent states or territories,

or any entity, regardless of where organized, having its principal place of business within the United States or any of its territories.

“Withholding

Taxes” has the meaning assigned in Section 2.16.

“Zoning

Report” has the meaning assigned in Schedule 2.1.

Section

1.2. Definitions. All terms defined in Section

1.1 above or otherwise in this Agreement shall, unless otherwise defined therein, have the same meanings when used in any other

Loan Document or Environmental Indemnity Agreement, or any certificate or other document made or delivered pursuant hereto. The

words “hereof”, “herein”, and “hereunder” and words

of similar import when used in this Agreement shall refer to this Agreement as a whole. The words “include”

and “include(s)” when used in this Agreement and the other Loan Documents or Environmental Indemnity

Agreement means “include(s), without limitation,” and the word “including”

means “including, but not limited to.”

Section

1.3. Phrases. When used in this Agreement and

the other Loan Documents or Environmental Indemnity Agreement, the phrases “satisfactory to Administrative Agent,”

“satisfactory to Lenders,” and “satisfactory to Required Lenders” shall mean

“in form and substance satisfactory to the applicable Person in all respects”, the phrases “with

Administrative Agent’s consent,” “with the Lenders’ consent,” and “with

the Required Lenders’ consent,” or “with Administrative Agent’s approval,”

“with the Lenders’ approval,” and “with the Required Lenders’ approval”

shall mean such consent or approval at such Person’s sole discretion, and the phrases “acceptable to Administrative

Agent,” “acceptable to Lenders,” and “acceptable to the Required Lenders”

shall mean “acceptable to such Person at such Person’s sole discretion” unless otherwise specified

in this Agreement.

ARTICLE

II

LOAN

TERMS

Section

2.1. The Loan. Upon satisfaction of all the

terms and conditions set forth in the Term Sheet and Schedule 2.1 attached hereto, each Lender severally, but not

jointly, agrees to make its Pro Rata Share of the Loan in Dollars to Borrower in the amount of such Lender’s Loan Commitment,

which shall be funded in one advance on the Closing Date and repaid in accordance with the terms of this Agreement and the Notes.

Each Borrower hereby agrees to accept the Loan on the Closing Date, subject to and upon the terms and conditions set forth herein.

Section

2.2. Interest Rate; Late Charge; Default Rate.

(a) Interest

Rate. The outstanding principal balance of the Loan shall bear interest, commencing on the Closing Date, at a floating

rate of interest equal to the Contract Rate.

(b) Late

Charge. If any Borrower fails to pay any installment of interest or principal within five (5) days after the date on which

the same is due excluding the final installment due on the Maturity Date, Borrower shall pay to Administrative Agent, for the account

of the Lenders (other than any Defaulting Lender), a late charge on such past due amount, as liquidated damages and not as a penalty,

equal to five percent (5%) of such amount, but not in excess of the maximum amount of interest allowed by applicable law. The Administrative

Agent shall pay to each Lender (other than any Defaulting Lender) of the Loan its portion of the late charge based on each Lender’s

Pro Rata Share of the Loan in accordance with Section 2.6. The foregoing late charge is intended to compensate each Lender

for the expenses incident to handling any such delinquent payment and for the losses incurred by each Lender as a result of such

delinquent payment. Borrower agrees that, considering all of the circumstances existing on the date this Agreement is executed,

the late charge represents a reasonable estimate of the costs and losses each Lender will incur by reason of late payment. Borrower

and each Lender further agree that proof of actual losses would be costly, inconvenient, impracticable and extremely difficult

to fix. Acceptance of the late charge shall not constitute a waiver of the Event of Default arising from the overdue installment,