FALSE0001309402DEF 14A00013094022022-01-012022-12-31iso4217:USD00013094022021-01-012021-12-3100013094022020-01-012020-12-310001309402gpre:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMemberecd:PeoMember2022-01-012022-12-310001309402ecd:NonPeoNeoMembergpre:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMember2022-01-012022-12-310001309402gpre:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMemberecd:PeoMember2021-01-012021-12-310001309402ecd:NonPeoNeoMembergpre:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMember2021-01-012021-12-310001309402gpre:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMemberecd:PeoMember2020-01-012020-12-310001309402ecd:NonPeoNeoMembergpre:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMember2020-01-012020-12-310001309402ecd:PeoMembergpre:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfUnvestedAwardsGrantedInPriorYearsMember2022-01-012022-12-310001309402ecd:NonPeoNeoMembergpre:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfUnvestedAwardsGrantedInPriorYearsMember2022-01-012022-12-310001309402ecd:PeoMembergpre:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfUnvestedAwardsGrantedInPriorYearsMember2021-01-012021-12-310001309402ecd:NonPeoNeoMembergpre:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfUnvestedAwardsGrantedInPriorYearsMember2021-01-012021-12-310001309402ecd:PeoMembergpre:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfUnvestedAwardsGrantedInPriorYearsMember2020-01-012020-12-310001309402ecd:NonPeoNeoMembergpre:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfUnvestedAwardsGrantedInPriorYearsMember2020-01-012020-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMemberecd:PeoMember2022-01-012022-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMemberecd:NonPeoNeoMember2022-01-012022-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMemberecd:PeoMember2021-01-012021-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMemberecd:NonPeoNeoMember2021-01-012021-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMemberecd:PeoMember2020-01-012020-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMemberecd:NonPeoNeoMember2020-01-012020-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueOfPriorYearAwardsForfeitedDuringCurrentYearMemberecd:PeoMember2022-01-012022-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueOfPriorYearAwardsForfeitedDuringCurrentYearMemberecd:NonPeoNeoMember2022-01-012022-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueOfPriorYearAwardsForfeitedDuringCurrentYearMemberecd:PeoMember2021-01-012021-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueOfPriorYearAwardsForfeitedDuringCurrentYearMemberecd:NonPeoNeoMember2021-01-012021-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueOfPriorYearAwardsForfeitedDuringCurrentYearMemberecd:PeoMember2020-01-012020-12-310001309402gpre:EquityAwardsAdjustmentsChangeInFairValueOfPriorYearAwardsForfeitedDuringCurrentYearMemberecd:NonPeoNeoMember2020-01-012020-12-31000130940212022-01-012022-12-31000130940222022-01-012022-12-31000130940232022-01-012022-12-31000130940242022-01-012022-12-31000130940252022-01-012022-12-31000130940262022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | | | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant | |

| | | | | | | | |

| CHECK THE APPROPRIATE BOX: |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material under §240.14a-12 |

GREEN PLAINS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| ☑ | | No fee required |

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Letter from our

Board of Directors

| | | | | | | | | | | |

Dear Shareholders: The employees of Green Plains continued to show their impressive drive toward success, even through a challenging year in 2022. Because of that hard work, Green Plains remains on track for its full transformation into an ag-tech innovator creating sustainable ingredients that matter. The year brought more volatile markets, weather challenges, supply chain disruptions, transportation issues, inflation and staffing shortages, but management has maintained their focus toward executing on strategic business initiatives, evolving when necessary to continue on a path to success. Sustainability in Action Our board of directors is actively engaged in all aspects of environmental, social and governance (ESG) initiatives, as 2022 brought our second annual sustainability report showing progress toward our goal of reducing our operational emissions by 50% by 2030 and 100% by 2050. By shareholder vote, the Board of Directors was declassified in 2022. Shareholder rights have been and always will be paramount to us, as they are crucial to Green Plains’ success. We will continue to make progress in strengthening governance, and all ESG areas. Looking forward into 2023, we are confident in Green Plains’ transformation into the biorefinery platform of the future, helping to meet the world’s growing demand for feed, fuel and fermentation. With the help of our employees, customers, shareholders and communities, we are making more with less, while helping to reduce the world’s carbon emissions. Thank you for your continued support.

Sincerely, Wayne Hoovestol The Board of Directors | | “By shareholder vote, the Board of Directors was declassified in 2022. Shareholder rights have been and always will be paramount to us, as they are crucial to Green Plains' success. We will continue to make progress in strengthening governance, and all ESG areas.” |

| |

| | | | | |

2 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Notice of Annual Meeting of Shareholders

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

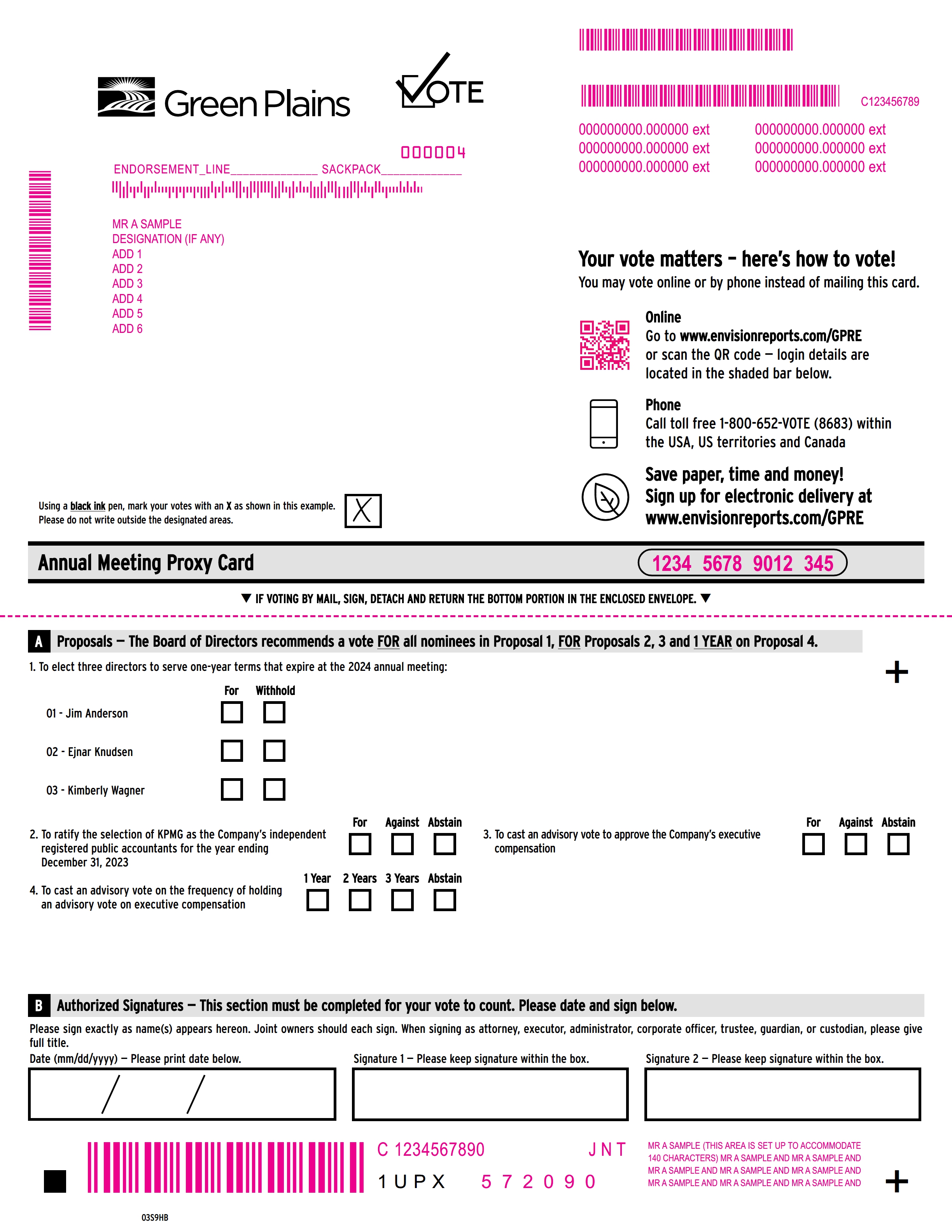

| | DATE AND TIME 10:00 a.m., Central Daylight Time, on Tuesday,

May 9, 2023 LOCATION www.meetnow.global/MLRY7H6 RECORD DATE March 15, 2023 | | | | Items of Business |

| | | | |

| | Proposals | Board Vote Recommendation | For Further Details |

| | | | | |

| | | | | | | | | |

| | | | | | 1.To elect three directors to serve one year terms that expire at the 2024 annual meeting | Vote FOR all nominees | u Page 13 |

| | | | | | 2.To ratify the selection of KPMG as the Company’s independent registered public accountants for the year ending December 31, 2023 | Vote FOR | u Page 37 |

| | | | | | 3.To cast an advisory vote to approve the Company’s executive compensation | Vote FOR | u Page 43 |

| | | | | | 4.To cast an advisory vote on the frequency of holding an advisory vote on executive compensation | Vote FOR every "One Year" | u Page 82 |

| | | | | | |

| | | | | | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

| |

| | | | |

|

| | |

| |

| | | | |

| | |

| | How To Vote Whether or not you expect to attend the annual meeting online, we urge you to vote your shares via the following: INTERNET Go to: www.envisionreports.com/GPRE PHONE Call our toll-free telephone number 1-800-652-VOTE (8683) within the USA, US Territories and Canada MAIL Sign, date and mail the proxy card in the envelope provided. | | | | | The foregoing items are more fully described in the accompanying Proxy Statement. Each share of our Common Stock is entitled to one vote on all matters presented at the Annual Meeting. Dissenters’ rights are not applicable to these matters. To provide a safe experience for our stockholders and employees, as well as to provide expanded access, improved communications and cost and time savings for our shareholders and the Company, we will once again conduct a virtual annual meeting. You will be able to attend and participate in the meeting by visiting www.meetnow.global/MLRY7H6, where you will be able to listen to the meeting live, submit questions, and vote. To access the online meeting, you must have the information that is printed on the shaded bar area located on the reverse side of the Notice. A password is not required for this meeting. By Order of the Board of Directors, Michelle Mapes Corporate Secretary Omaha, Nebraska March 29, 2023 Important Notice Regarding the Availability of Proxy Materials for Shareholder Meeting to be held on May 9, 2023. Pursuant to rules promulgated by the Securities and Exchange Commission, we have elected to provide access to our proxy materials by notifying you of the availability of our proxy materials on the Internet. Instead of mailing paper copies of our proxy materials, we sent shareholders the Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 9, 2023, with instructions for accessing the proxy materials and voting via the Internet (the “Notice”) and attending the Annual Meeting online. The Notice, which was mailed on or around March 29, 2023, also provides information on how shareholders may obtain paper copies of our proxy materials if they so choose. The Notice, the Proxy Statement and our 2022 Annual Report may be accessed at www.edocumentview.com/GPRE. |

Table of Contents

| | | | | |

| |

| |

| |

| |

| |

| |

| Advisory Vote on the Frequency of Holding an Advisory Vote on Executive Compensation |

| |

| |

| |

| |

| |

| |

| | | | | |

4 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Proxy Statement

This Proxy Statement is provided to the shareholders of Green Plains Inc. in connection with the solicitation of proxies by our Board of Directors (the “Board”) to be voted at an Annual Meeting of Shareholders to be held at 10:00 a.m., Central Daylight Time, online at www.meetnow.global/MLRY7H6 on Wednesday, May 9, 2023, and at any adjournment or postponement thereof (the “Annual Meeting”).

Proxy Summary

This summary highlights selected information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider in deciding how to vote. You should read the

Proxy Statement carefully before voting.

| | | | | | | | |

| About Our Company Transformation. It’s what we do every day when we convert a kernel of corn into sustainable products to help meet the global demand for high-value feed ingredients and low-carbon fuel. We are in the midst of a broader transformation extracting even more low-carbon ingredients from the same annually renewable crops. Our suite of proprietary technologies and industry partnerships makes our broad transformation possible. We are leading the way in producing sustainable ingredients to meet the demands of a growing world. Our transformation includes deploying our patented, world-class mechanical and process technology at each of our locations, while combining the knowledge and resources of exclusive strategic partnerships with our expertise in fermentation to develop nutritious, valuable ingredients that make a positive global impact. We are focused on reducing our operating expenses, expanding our ability to isolate the highest-value proteins for use in feed ingredients in pet, aquaculture and other high-value markets and producing higher-value alcohols to meet global demand—all while capturing more low-carbon corn oil from each kernel to serve the rapidly expanding renewable diesel market. Our goal is to transform our platform by 2024-25, and we believe each fully executed initiative will result in a growing financial contribution. |

| |

Company Highlights

The Company operates three business segments: (1) ethanol production, which includes the production of ethanol, including distillers grains, Ultra-High Protein and renewable corn oil, (2) agribusiness and energy services, which includes grain handling and storage, commodity marketing and merchant trading for company-produced and third-party ethanol, distillers grains, corn oil, natural gas and other commodities, and (3) partnership, which includes fuel storage and transportation services.

Transforming into the Biorefinery Platform of the Future

Green Plains is transforming from a traditional dry-mill ethanol producer into a sustainable biorefinery platform, innovating through ag-technology to produce higher-value products with stable cash flows, for tomorrow’s sustainable economy.

Investments in critical technology, infrastructure and strategic partnerships are driving progress to accelerate the transformation into the Biorefinery Platform of the Future.

| | | | | | | | | | | |

| | | |

| | | |

GREEN PLAINS 1.0 | TRANSFORMATION | GREEN PLAINS 2.0 |

| | Biorefinery Platform |

Ethanol DDGs Corn Oil | Strategic Partnerships MSCTM Technology Creates Ultra-High Protein and enhances Corn Oil yields Clean Sugar TechnologyTM | Ultra-High Protein DDGs Ethanol | Carbon Capture Corn Oil Dextrose |

| | |

| | |

| | | |

Strategic Growth Areas

Verticals positioned to capitalize on rapidly growing demand.

| | | | | | | | | | | |

| Sustainable

Ultra-High Protein Sustainable ingredients for high-value global markets in pet, aquaculture, dairy and poultry industries as demand for higher quality animal feed grows. | | Renewable Corn Oil Responsible low-carbon feedstock for the high-growth renewable diesel and sustainable aviation fuel industries. |

|

| | |

| Carbon Capture & Sequestration Participating in one of the largest carbon capture and storage (CCS) platforms in the world with potential for direct injection of CO2 as well. | | Clean Sugar Technology Low-carbon dextrose for a variety of biochemical, bioplastics, synthetic biology and food industries. |

| | | | | |

6 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

2022 Performance Highlights

Green Plains made unprecedented progress across all aspects of our transformation in 2022, installing three Maximized Stillage Co-productsTM systems for a total of five across our platform; commencing construction on the first-of-its-kind commercial-scale dry mill Clean Sugar TechnologyTM facility at Green Plains Shenandoah; reaching record yields of renewable corn oil; and exploring the feasibility of producing synthetic methane from biogenic carbon with partners Tallgrass and Osaka Gas USA.

Through these accomplishments and many others from 2022, we continue the transition into a sustainable, value-added ingredient producer less reliant on volatile commodities markets. We are expanding production of our ingredients, attracting new partners and entering new markets.

Through our investments in innovation and technology, we are pursuing novel pathways to value creation for our shareholders, with a focus on managing risk and generating stable operating margins. We own and operate assets throughout the ethanol value chain: upstream, with grain handling and storage; through our ethanol production facilities; and downstream, with marketing and distribution services to reduce uncertainties.

| | |

|

Achievements —Completed plant modernization and upgrade programs, returning platform to full utilization rate capability; —Installation of three Maximized Stillage Co-productsTM systems, bringing total protein capacity to approximately 330,000 tons; —Achieved 60% protein concentration during trial at Green Plains Wood River, using Fluid Quip Technologies’ MSC™ system combined with biological solutions exclusive to Green Plains; —Commenced construction of first commercial deployment of Clean Sugar Technology™ at Green Plains Shenandoah; —Announced aquafeed partnership with Riverence to expand trout and salmon feed production in Idaho; —Expanded protein sales to customers in North America, South America and Asia Pacific across multiple species; and —Updated executive leadership, including the addition of seasoned experts, reassignment of current leaders, and the creation of a Chief Transformation Officer to lead the way as we achieve critical mass in our transformation. |

|

Board Highlights

Our Board of Directors

Wayne Hoovestol, Chairman of the Board and a member of our Board since our Company formed in 2006, will retire as a director at the end of his current term at the Annual Meeting, and as such is not standing for

re-election. The Board has approved that immediately upon the conclusion of the Annual Meeting the size of the Board be reduced from nine to eight directors. The Board will elect a new Chairperson of the Board following the Annual Meeting.

| | | | | | | | | | | | | | | | | | | | |

| | | Director

Since | Committee

Membership |

| | | | | |

| Name and Primary Occupation | Age | AC | CC | NGC |

| | | | | | |

| Director Nominees |

| | | | | | |

| JIM ANDERSON  Lead Independent Director Chief Executive Officer, Moly-Cop | 65 | 2008 | | | |

| | | | | | |

| EJNAR KNUDSEN Founder and Chief Executive Officer, AGR Partners | 54 | 2016 | | | |

| | | | | | |

| KIMBERLY WAGNER  Founder, TBGD Partners | 59 | 2020 | | | |

| Continuing Directors with Terms Expiring in 2024 |

| | | | | | |

| TODD BECKER President and Chief Executive Officer, Green Plains Inc. | 57 | 2009 | | | |

| | | | | | |

| BRIAN PETERSON  President and Chief Executive Officer, Whiskey Creek Enterprises | 59 | 2005 | | | |

| | | | | | |

| ALAIN TREUER  Co-Founder, VBV LLC | 50 | 2008 | | | |

| Continuing Directors with Terms Expiring in 2025 |

| | | | | | |

| FARHA ASLAM  Managing Partner, Crescent House Capital | 54 | 2021 | | |

|

| | | | | | |

| MARTIN SALINAS JR.  Former Chief Financial Officer, Energy Transfer Partners, LP | 51 | 2021 | | | |

| | | | | | | | | | | | | | | | | |

| | | | IND Independent Director |

| Chair | | Member | | AC Audit Committee | CC Compensation Committee |

| | | | NGC Nominating and Governance Committee |

| | | | | |

8 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

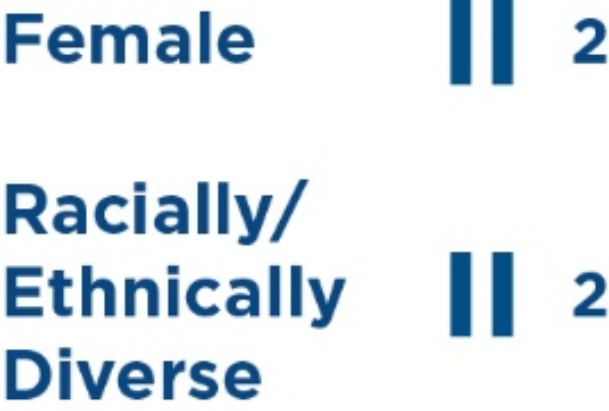

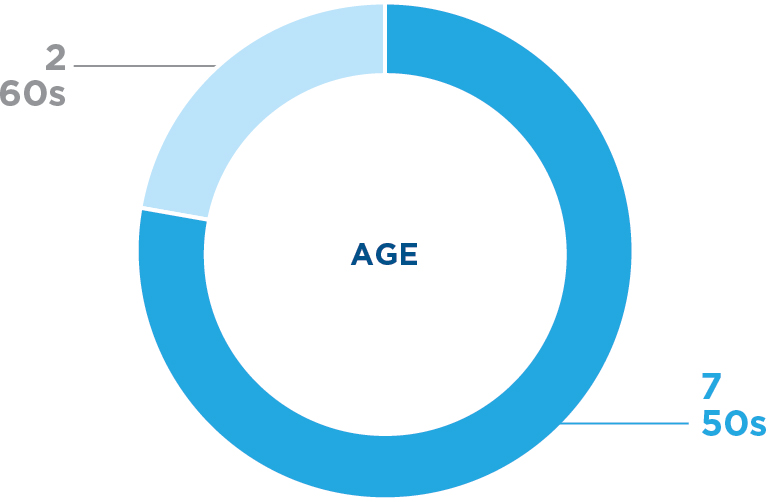

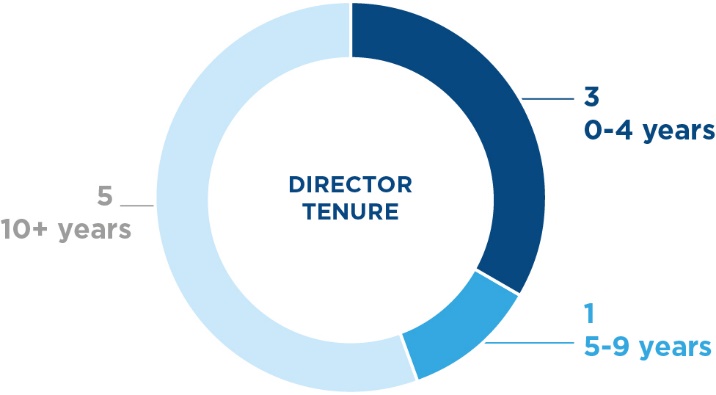

Board Snapshot

| | | | | | | | | | | | | | | | | |

| | | |

| INDEPENDENCE | AGE | DIRECTOR TENURE | DIVERSITY |

| | | |

67% independent | 57 years average | 9.7 years average | 33% diverse |

| | | |

| | | |

| | | |

| | | 2/3 committee chairs are diverse |

| | | |

| | | |

| SKILLS AND EXPERIENCE | | |

| | | |

| EXECUTIVE

LEADERSHIP | | | INTERNATIONAL

BUSINESS | |

| | | | | |

| PUBLIC

COMPANY /CORP

GOVERNANCE/

ESG | | | MERGERS &

ACQUISITIONS | |

| | | | | |

| EXECUTIVE

COMPENSATION | | | CAPITAL

MARKETS | |

| | | | | |

| INDUSTRIAL MFG

& INGREDIENT

PROD | | | AUDIT/RISK/

CYBERSECURITY | |

| | | | | |

| COMMODITY

MARKETS/

MARKETING | | | LEGAL/

REGULATORY

GOVERNMENT

RELATIONS | |

| | | | | |

| STRATEGY

DEVELOPMENT | | | | |

| | | | | |

Upon Mr. Hoovestol's retirement from the board, 75% of directors are independent, the average age of directors is 56, the average director tenure is 8.8 years and diversity is 38%.

| | | | | |

|

|

Key Skills &

Experiences | Description of Skills and Explanation of Importance |

|

|

Executive

Leadership | —One of the core considerations of our Board in examining director candidates is that the director should have an established track record of professional accomplishment in the candidate’s chosen field. It is important we have highly qualified directors with a diverse range of complementary skill sets, but the common thread is that our directors have experience leading large, complex organizations and teams. Green Plains is a company with an array of important stakeholders, including employees, stockholders, customers, partners, regulators, and communities. It is important for our Board to have directors who have experience dealing with a similar range of stakeholders and managing the challenges associated with operating a large organization. |

|

|

| |

Public

Company/

Corporate

Governance/

ESG | —Our Board is responsible for overseeing the successful execution of our strategy and the selection and retention of key executives, which affects the fundamental operation of the Company. It is important for our Board to have directors who understand the fiduciary obligations of public company directors and who have experience shaping a company’s priorities and structure. Effective corporate governance, ongoing board refreshment and a commitment to diversity are all part of a broader effort to ensure that ESG considerations and goals are incorporated into the company’s corporate strategy. Also, the implementation of leading ESG practices is a very important component of our business as the effects of global climate change continues to attract considerable attention with widespread concerns about the impacts of human activity, especially the emissions of greenhouse gases. |

|

|

|

|

Executive

Compensation | —The Board believes that aligning executive compensation with shareholder interests is consistent with the Company’s philosophy of driving performance and building long-term shareholder value. This pay-for-performance philosophy is embraced by the Board and is intended to align the interests of key executives, attract and retain high-performing employees, and link a significant amount of compensation to the achievement of pre-established performance metrics directly tied to our business goals and strategies. It is important for Green Plains to have board members who have participated in the design and supervision of executive compensation programs. |

|

|

|

|

Industrial

Manufacturing

& Ingredient

Production | —Green Plains has grown to be one of the leading corn processors in the world for low-carbon products at our biorefineries, inclusive of ethanol, corn oil,

Ultra-High Protein, and distillers grains as our core sources of revenue. We operate 11 biorefineries located in six states. It is important for our Board to have a deep understanding of industrial manufacturing, the biorefinery and the proprietary and patented protein production processes, as well as potential future technologies applicable to our biorefineries. |

|

|

|

|

Commodity

Markets/

Marketing | —Green Plains procures grain and natural gas to produce our products and markets, sells and distributes our products, e.g., ethanol, distillers grains,

Ultra-High Protein, and corn oil produced at our biorefineries. A strong understanding of commodity markets is essential as well as an understanding of US and global markets impacting the supply and demand characteristics driving the needs for our products. |

|

|

| | | | | |

10 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

| | | | | |

|

|

Strategy

Development | —We believe that we can maximize our competitive advantage to create lasting value for our stockholders, both in the near- and longer-term, by successfully executing on our strategic plan, to take advantage of the world’s growing demand for protein feed ingredients. It is important for our Board to have directors who have experience developing, delivering and directing corporate strategy. Further, it is important to have board members who have experience transforming organizations and culture and improving processes, services, and products with an aim of enhancing long-term value. |

|

|

| |

International

Business | —Global competition, international trade and product related policies, and international activities can have a significant impact on our business. |

|

|

|

|

Mergers &

Acquisitions /

Partnerships | —Joint ventures, partnerships, mergers and acquisitions are an important part of maintaining a competitive advantage by maximizing our production capabilities, leveraging our proprietary technology and expanding new products into

fast-growing, higher margin markets. We intend to continue exploring potential growth opportunities and strategies through these disciplines. As such, it is important to have board members well-versed in M&A-related activities to ensure that the right opportunities are being pursued, operational and financial risks can be quantified and effectively managed while expected synergies and growth projections are reasonable and realistic. |

|

|

|

|

Capital

Markets | —As our company continues to transform, having expertise in capital markets and various equity and debt financing alternatives will continue to be a critical skill set for our Board to ensure we have the optimal capital structure, and financing needed to support these efforts. |

|

|

|

|

Audit/Risk/

Cybersecurity | —As a public company, we are subject to various auditing, accounting, and financial reporting obligations. Our Audit Committee’s responsibilities include reviewing the Company’s financial statements, financial reporting, and internal controls, as well as overseeing the independent auditor. Green Plains is also subject to various forms of risk, including, without limitation, cybersecurity risk, liquidity risk, credit risk, market risk, interest rate risk, operational risk, legal and compliance risk and reputational risk. It is important for our Board to have directors who are financial experts and who understand financial reporting as well as effective risk management practices. |

|

|

|

|

Legal/

Regulatory/

Government

Relations | —Our operations are regulated by various government entities that can impose significant costs on our business. It is important to have board members who have a strong comprehension of the legal and regulatory landscape specific to our business. Our production levels, markets and grain we procure are affected by federal government programs. Government policies such as tariffs, duties, subsidies, import and export restrictions and embargos can also impact our business. |

|

|

Corporate Governance Highlights

Our Company has a history of strong corporate governance. By evolving our governance approach in light of best practices, our Board drives sustained shareholder value and best serves the interests of our shareholders.

| | | | | | | | | | | |

| | |

| Corporate Governance Improvements | |

| | | |

| | | |

| 2020 | —Appointed diverse director | |

| | | |

| | | |

| 2021 | —Appointed two additional diverse directors —Lead Independent Director appointed —Published governance guidelines with independent executive sessions —Annual charter reviews broadening scope for cyber and ESG oversight —Updated bylaws for proxy access and majority voting standard —Lowered threshold for special meeting to 20% —Rotated Committee chairs with two of the three Committee chairs diverse —Proposed reduction of the board from nine to eight members by no later than the 2023 annual meeting | |

| | | |

| | | |

| 2022 | —Recommended and declassified the board of directors | |

| | | |

| | | | | |

12 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Environmental Stewardship and Social Responsibility Highlights

Sustainability is both a driver and an outcome of our ongoing transformation into a customer-centric producer of low-carbon ingredients. We are passionate about delivering on the rapidly expanding opportunities and crucial benefits of the emerging bioeconomy. In concrete terms, this means that we continually innovate across our four pillars of Protein, Oil, Sugar and Carbon. We are advancing and multiplying our renewable processes and co-products to benefit a far-reaching set of stakeholders—employees, farmers, customers, suppliers, shareholders, communities and our shared environment. In parallel, we continue to evolve our social and governance infrastructure to enable the success of our ambitious initiatives. We work to continually evaluate and improve our practices in these areas, to position Green Plains to meet the growing sustainability needs of a changing world. Below are some highlights reflecting the impact we have in Environmental Stewardship and Social Responsibility.

| | | | | |

| |

Environmental Stewardship Creating the biorefinery platform of the future is synonymous with expanding environmental stewardship. We are driving innovation to further protect and benefit the natural environment on which so much depends. | —In 2022, we submitted our near-term GHG reduction targets to the Science-Based Targets Initiative (SBTi) for validation. —Since 2018, we’ve continued to realize a consistent reduction in operational GHG emissions intensity. —In 2022, we aligned our ESG disclosures with the Task Force on Climate-Related Financial Disclosures (TCFD), in addition to our current alignment with the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB) and United Nations Sustainable Development Goals (UNSDGS). —We have placed enhanced focus on further developing our carbon reduction strategy to make progress toward achieving our absolute GHG and intensity targets. —Also in 2022, we developed a multi-year farm carbon/grain origination roadmap to advance sustainable sourcing and farming with our growers. |

| |

| |

Social Responsibility We continually work to enhance our programs and policies to support and empower our employees, customers, suppliers and communities. Key investments in this area include prioritizing employee health and safety efforts; working to advance workforce diversity, equity and inclusion; partnering with our customers and suppliers to create shared benefits; and giving back to our local communities. | —In 2022, we reduced our OSHA Total Recordable Incident Rate (TRIR) by more than 35% compared to our 2020 baseline, achieving our 2025 target. —Our people volunteered over 4,000 hours in 2022, surpassing our stated target of 2,000 hours by 100% —We also launched a host of initiatives in 2022 to enhance our talent retention and put ourselves in position to attract new talent, including —Updated our Employee Referral Program; —Developing structured interviewing and selection training and beginning its implementation; —Standardizing our orientation and trainings; and —Developing a communication plan to better reach diverse audiences. |

| |

Corporate Governance

In accordance with the General Corporation Law of the State of Iowa, our Third Articles of Amendment to Second Amended and Restated Articles of Incorporation, as amended (our “Charter”), and our Fifth Amended and Restated Bylaws (“Bylaws”), our business, property and affairs are managed under the direction of the Board.

| | | | | | | | | | | | | | | | | |

| | | Proposal 1 | | |

| | | | |

| | | Election of Directors | |

| | | | |

| | | | |

| | | To be elected, each nominee for director must receive plurality of all votes cast (assuming a quorum is present) with respect to that nominee’s election. Abstentions and broker “non-votes” will not be counted as a vote cast with respect to a nominee. | |

| | | | |

| | | The Board recommends that stockholders vote “FOR” each of the nominees set forth in Proposal 1. | |

| | | | | |

The Board currently consists of nine members and is currently divided into three groups. Previously each group of directors was elected at each annual meeting of shareholders for a three-year term. Each year a different group of directors was elected on a rotating basis. At last year's annual meeting, there was a declassification of the board of directors such that each group going forward will serve one year terms through a phase in period until 2025. Beginning with the 2026 annual meeting, all directors will be elected annually.

Wayne Hoovestol, Chairman of the Board and a director who has served on our Board since our Company began in 2006, will retire from the Board at the end of his term at the Annual Meeting and is not standing for re-election. The terms of Jim Anderson, Ejnar Knudsen and Kimberly Wagner are up for election at the Annual Meeting (to serve until the 2024 annual meeting or until their respective successors shall be elected and qualified). The terms of Todd Becker, Brian Peterson and Alain Treuer expire at the 2024 annual meeting, at which time they will be up for annual election. The terms of Martin Salinas Jr. and Farha Aslam expire at the 2025 annual meeting, at which time they will be up for annual election.

Board Recommendation

The Board recommends that stockholders vote for each of the nominees outlined.

| | | | | |

14 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Director Nominee Biographical Information and Experience

Nominees for Election at the 2023 Annual Meeting

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Jim Anderson Lead Independent Director

Chief Executive Officer, Moly-Cop Age: 65 Director Since: 2008 Committees: Audit, Compensation |

| | | | | | | | |

Director Qualifications Mr. Anderson is qualified to serve as a director because of his commodity experience and agribusiness knowledge, which provides the Board with a relevant depth of understanding of our operations. Past Public Company Directorships —United Malt Holdings | | | | | Background —Chief Executive Officer of Moly-Cop since November 2017 —Served as Managing Director and Operating Partner at CHAMP Private Equity —Served The Gavilon Group, LLC as its President and Chief Executive Officer from October 2014 until February 2016 as well as its Chief Operating Officer, Fertilizer, since February 2010 —Served as Chief Executive Officer and member of the board of directors at United Malt Holdings, a producer of malt for use in the brewing and distilling industries, from September 2006 to February 2010 —Served as Chief Operating Officer / Executive Vice President of CT Malt, a joint venture between ConAgra Foods, Inc. and Tiger Brands of South Africa, beginning in April 2003 —Served as Senior Vice President and then President of ConAgra Grain Companies —His career has also included association with the firm Ferruzzi USA and as an Operations Manager for Pillsbury Company —Served as a Board Member of the North American Export Grain Association and the National Grain and Feed Association —Holds a Bachelor of Arts degree with a Finance emphasis from the University of Wisconsin - Platteville |

| | | | | | | | |

| | | | | | |

| Skills | —Industrial Mfg & Ingredient Prod —Commodity Markets/ Marketing —Strategy Development | | | | —International Business —M&A/Partnerships —Capital Markets | —Audit/Risk/Cybersecurity —Legal/Regulatory/Gov’t Rel —Public Co/Corp Govern/ESG | —Executive Leadership —Executive Compensation |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Ejnar Knudsen Founder and Chief Executive Officer, AGR Partners Age: 54 Director Since: 2016 Committees: None |

| | | | | | | | |

Director Qualifications Mr. Knudsen is qualified to serve as a director because of his operating company and finance experience, as well as his agribusiness industry network and knowledge, which provides the Board with a relevant depth of understanding of our operations. Current Public Company Directorships —Ridley Corporation Limited (RIC:AX) | | | | | Background —Founder and CEO of AGR Partners, and oversees the firm’s strategy with investments totaling over $400 million in food processors, manufacturers and agribusinesses —Co-portfolio manager of Passport Capital’s Agriculture Fund from 2009 to 2012 —Served as EVP of Western Milling, a grain and feed milling company that grew from a small California startup to over $1 billion in sales —Spent 10 years with Rabobank, in its New York office, managing a loan portfolio and venture capital investments as well as providing corporate advisory services —Received his Bachelor of Science degree from Cornell University and is a CFA charter holder |

| | | | | | | | |

| | | | | | |

| Skills | —Industrial Mfg & Ingredient Prod —Commodity Markets/Marketing | | | | —Strategy Development —International Business | —M&A/Partnerships —Capital Markets | —Audit/Risk/Cybersecurity —Executive Leadership —Public Co/Corp Govern/ESG |

| | | | | | |

| | | | | |

16 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Kimberly Wagner Founder, TBGD Partners Age: 59 Director Since: 2020 Committees: Nominating and Governance (Chair), Audit |

| | | | | | | | |

Director Qualifications Ms. Wagner is qualified to serve as a director because of her extensive agribusiness and food/nutrition experience, which provides the Board with a relevant depth of understanding of our operations. Ms. Wagner is a scientist, entrepreneur and business leader with over two decades of experience advising companies on strategy and operational improvement in the agricultural, food and life sciences sectors with an emphasis in technology, sustainability, research and innovation, and new product development. | | | | | Background —Founder of TBGD Partners, a boutique firm providing expertise to early and mid-stage ventures in the agribusiness, food/nutrition and life sciences sectors —Former Venture Partner at Flagship Pioneering and President and Chief Operating Officer of CiBO Technologies, a Flagship VentureLabs company —Former Partner at McKinsey & Co. and a Senior Partner and Managing Director at The Boston Consulting Group, Inc. —Her accomplishments in client service have been acknowledged through multiple awards, including being named a Women Leader in Consulting by Consulting magazine in 2012 —Alumni-elected member of Cornell University’s Board of Trustees and serves on the boards of several not-for-profit organizations with agricultural, sustainability and/or educational missions and is an active member of several national and international scientific societies —Holds a PhD in Biological Chemistry and Molecular Pharmacology from Harvard University, a Master of Science in Animal Science from Texas A&M University, and a Bachelor of Science with distinction in Biology and Animal Science from Cornell University |

| | | | | | | | |

| | | | | | |

| Skills | —Industrial Mfg & Ingredient Prod —Strategy Development | | | | —International Business —M&A/Partnerships | —Audit/Risk/Cybersecurity —Legal/Regulatory/Gov’t Rel | —Public Co/Corp Govern/ESG —Executive Leadership |

| | | | | | |

Continuing Directors with Terms Expiring in 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Todd Becker President and Chief Executive Officer, Green Plains Inc. Age: 57 Director Since: 2009 Committees: None |

| | | | | | | | |

Director Qualifications Mr. Becker is qualified to serve as a director because he provides an insider’s perspective about our business and strategic direction to Board discussions. His extensive commodity experience and leadership make him an essential member of the Board. Current Public Company Directorships —Green Plains Partners LP (GPP) Past Public Company Directorships —Hillshire Brands Company | | | | | Background —Our President and Chief Executive Officer since January 2009 —Served as President and Chief Executive Officer, as well as a director, of the general partner of Green Plains Partners LP since March 2015 —Served as our President and Chief Operating Officer from October 2008 to December 2008 —Served as Chief Executive Officer of VBV LLC from May 2007 to October 2008 —Executive Vice President of Sales and Trading at Global Ethanol from May 2006 to May 2007 —Worked for ten years at ConAgra Foods, Inc. in various management positions, including Vice President of International Marketing for ConAgra Trade Group and President of ConAgra Grain Canada —Has 35 years of related experience in various commodity processing businesses, risk management and supply chain management, along with extensive international trading experience in agricultural markets —Mr. Becker has a Master’s degree in Finance from the Kelley School of Business at Indiana University and a Bachelor of Science degree in Business Administration with a Finance emphasis from the University of Kansas |

| | | | | | | | |

| | | | | | |

| Skills | —Industrial Mfg & Ingredient Prod —Commodity Markets/ Marketing —Strategy Development | | | | —International Business —M&A/Partnerships —Capital Markets | —Audit/Risk/ Cybersecurity —Legal/Regulatory/Gov’t Rel —Public Co/Corp Govern/ESG | —Executive Leadership —Corporate Governance |

| | | | | | |

| | | | | |

18 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Brian Peterson President and Chief Executive Officer, Whiskey Creek Enterprises Age: 59 Director Since: 2005 Committees: Compensation (Chair) |

| | | | | | | | |

Director Qualifications Mr. Peterson is qualified to serve as a director because of his ethanol and grain industry experience, which serves as an important resource to the Board. | | | | | Background —President and Chief Executive Officer of Whiskey Creek Enterprises —Served as our Executive Vice President in charge of site development from 2005 to October 2008 —Sole founder and owner of Superior Ethanol LLC, which was acquired by us in 2006 —For over twenty years, he has owned and operated grain farming entities, which now includes acreages in Iowa, Arkansas and South Dakota —Built, owns and operates a cattle feedlot in northwest Iowa —Has a Bachelor of Science degree in Agricultural Business from Dordt College —Investor in several other ethanol companies |

| | | | | | | | |

| | | | | | |

| Skills | —Industrial Mfg & Ingredient Prod | | | | —Commodity Markets/ Marketing | —Audit/Risk/ Cybersecurity | —Executive Leadership |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Alain Treuer Co-Founder, VBV LLC Age: 50 Director Since: 2008 Committees: Nominating and Governance |

| | | | | | | | |

Director Qualifications Mr. Treuer is qualified to serve as a director because his business experiences, combined with his education and global acumen, allow him to provide unique operational insights to the Board. | | | | | Background —Co-Founder of VBV LLC, a joint venture formed in 2006 to develop and expand ethanol production in a vertical manner in the U.S. (VBV LLC and Green Plains merged in 2008) —Co-Founder and Executive Chairman of Local Ocean France, a land-based RAS fish farming company —Chairman of Trivon AG (Virgin Connect) —Chairman and Chief Executive Officer of Tellac Reuert Partners (TRP SA), a global investment firm, since 2005 —Chairman and Chief Executive Officer of TIGC, a global telecommunications company that he founded in 1992 and sold in 2001 —Has approximately 30 years of experience as an entrepreneur in various industries around the globe —Has a Master’s degree in Business Administration from the Graduate School of Business at Columbia University in New York, a Bachelor of Economics degree from the University of St. Gallen in Switzerland, a Presidents’ Program in Leadership from Harvard Business School and is an active member of the Young Presidents Organization |

| | | | | | | | |

| | | | | | |

| Skills | —Industrial Mfg & Ingredient Prod —Commodity Markets/ Marketing —Strategy Development | | | | —International Business —M&A/Partnerships —Capital Markets | —Audit/Risk/ Cybersecurity —Public Co/Corp ESG | —Executive Leadership —Corporate Governance |

| | | | | | |

| | | | | |

20 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Continuing Directors with Terms Expiring in 2025

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Farha Aslam Managing Partner, Crescent House Capital Age: 54 Director Since: 2021 Committees: Compensation |

| | | | | | | | |

Director Qualifications Ms. Aslam is qualified to serve as a director because of her extensive knowledge of the agriculture and ethanol industries, as well as her investor and financial knowledge from years working at a leading investment bank, providing the Board with valued industry experience. Current Public Company Directorships —Pilgrim’s Pride Corporation (PPC) —Calavo Growers, Inc. (CVGW) —AdvanSix Inc. (ASIX) | | | | | Background —Managing Partner of Crescent House Capital —Previous experience includes service as Managing Director at Stephens Inc where she led the firm’s Food and Agribusiness equity research team. Previously she was a vice president at Merrill Lynch and a risk management advisor at USB —In addition to the current public company directorships, also serves on the boards of Farmers Fridge, Packers Sanitation Services, Inc. and Saffron Road —Serves as a member of the audit and sustainability committees at Pilgrim's Pride and a member of the audit and compensation committees at AdvanSix —Has a Master’s in Business Administration from Columbia University and a Bachelor of Arts degree in Economics from the University of California |

| | | | | | | | |

| | | | | | |

| Skills | —Industrial Mfg & Ingredient Prod —Commodity Markets/Marketing —Strategy Development | | | | —International Business —M&A/Partnerships —Capital Markets | —Audit/Risk/ Cybersecurity —Legal/Regulatory/ Gov’t Rel —Public Co/Corp Govern/ESG | —Executive Leadership —Executive Compensation |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Martin Salinas Jr. Former Chief Financial Officer Energy Transfer Partners, LP Age: 51 Director Since: 2021 Committees: Audit (Chair), Nominating and Governance |

| | | | | | | | |

Director Qualifications Mr. Salinas is qualified to serve as a director because he possesses the requisite education and business acumen to serve as an audit committee financial expert along with having served on other boards as well as the CFO of another public company. Current Public Company Directorships —NuStar Energy L.P. (NS) Past Public Company Directorships —Noble Midstream Partners L.P. (NBLX) —Green Plains Partners LP (GPP) | | | | | Background —Former Chief Financial Officer of Energy Transfer Partners, LP, one of the largest publicly traded master limited partnerships from 2008 to 2015. Prior to that, he served as their controller and vice president of finance from 2004 to 2008 —Serves as an audit committee member at NuStar Energy —Began his career at KPMG —Advisory council member of the University of Texas in San Antonio —Holds a Bachelor’s Degree in Business Administration from the University of Texas in San Antonio. He is a member of the Texas Society of Certified Public Accountants |

| | | | | | | | |

| | | | | | |

| Skills | —Commodity Markets/Marketing —Strategy Development | | | | —M&A/Partnerships —Capital Markets | —Audit/Risk/ Cybersecurity —Public Co/Corp Govern/ESG | —Executive Leadership —Executive Compensation |

| | | | | | |

| | | | | |

22 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Board Diversity Matrix

| | |

|

Total Current Number of Directors: 9 |

|

| | | | | | | | | | | | | | |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | 2 | 7 | – | – |

| Part II: Demographic Background | | | | |

| African American or Black | – | – | – | – |

| Alaskan Native or Native American | – | – | – | – |

| Asian | 1 | – | – | – |

| Hispanic or Latinx | – | 1 | – | – |

| Native Hawaiian or Pacific Islander | – | – | – | – |

| White | 1 | 6 | – | – |

| Two or More Races or Ethnicities | – | – | – | – |

| LGBTQ+ | – | – | – | – |

| Did Not Disclose Demographic Background | – | – | – | – |

Director Nomination Process

The Board is responsible for approving nominees for election as directors. To assist in this task, the Nominating and Governance Committee is responsible for reviewing and recommending nominees to the Board. This committee is comprised solely of independent directors as defined by the rules of the NASDAQ and the SEC.

The Board has a policy of considering director nominees recommended by our shareholders. A shareholder who wishes to recommend a prospective board nominee for the Nominating and Governance Committee’s consideration can write to the Nominating and Governance Committee, c/o Michelle S. Mapes, Corporate Secretary, Green Plains Inc., 1811 Aksarben Drive, Omaha, NE 68106. In addition to considering nominees recommended by shareholders, our Nominating and Governance Committee also considers prospective board nominees recommended by current directors, management and other sources. Our Nominating and Governance Committee evaluates all prospective board nominees in the same manner regardless of the source of the recommendation.

| | | | | |

| 1. Assessment |

|

|

| As part of the nomination process, our Nominating and Governance Committee is responsible for reviewing with the Board periodically the appropriate skills and characteristics required of directors in the context of the current make-up of the Board. This assessment includes issues of judgment, diversity, experience and skills. |

|

|

| 2. Evaluation of prospective nominees |

| |

| In evaluating prospective nominees, including nominees recommended by shareholders, our Nominating and Governance Committee looks for the following minimum qualifications, qualities and skills: —highest personal and professional ethics, integrity and values; —outstanding achievement in the individual’s personal career; —breadth of experience; —ability to make independent, analytical inquiries; —ability to contribute to a diversity of viewpoints among board members; —willingness and ability to devote the time required to perform board activities adequately (in this regard, the committee will consider the number of other boards of directors on which the individual serves); and —ability to represent the total corporate interests of our Company (a director will not be selected to, nor will he or she be expected to, represent the interests of any particular group). |

| |

| 3. Screening/ interview of shortlisted candidates |

| |

| Candidates go through a rigorous interview process with Nominating and Governance Committee members as well as Board leadership and CEO interviews. They are subjected to thorough background checks and complete the Company’s directors and officer’s questionnaire. |

| |

| 4. Decision, nomination, and onboarding |

| |

| Board members who interview candidates provide their candidate reviews for consideration by the Nominating and Governance Committee. Once a candidate is elected or appointed to the Board, they partake in an extensive onboarding process with both Board members and the executive leadership of the Company. |

| | | | | |

24 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

As set forth above, our Nominating and Governance Committee considers diversity as one of a number of factors in identifying nominees for director. The Committee adopted a policy in 2017 specifically addressing gender diversity whereby it resolved to ensure that when a vacancy arises on the Board, it will ensure the candidate pool always contains at least one diverse candidate specifically with respect to gender. Based on shareholder comments, the Committee evaluated ways to address gender diversity in particular, and after completing a search process, in October 2020, the Board appointed Ms. Wagner to the Board of Directors, in July 2021, the Board appointed Mr. Salinas to the Board of Directors, and in October 2021, the Board appointed Ms. Aslam to the Board of Directors.

Shareholders who wish to submit a proposal for inclusion of a nominee for director in our proxy materials must also comply with the deadlines and requirements of our Bylaws and of Rule 14a-8 promulgated by the SEC. Please see “Additional Information” in this Proxy Statement for more information regarding the procedures for submission by a shareholder of a director nominee or other proposals.

Leadership Structure

Board Leadership

In 2021, the Board appointed a lead independent director and defined the role of the Lead Independent Director in its governance guidelines published on the Company's website. The Board believes the addition of the lead independent director is appropriate given the Chairman’s non-independent status. The roles of the Chairman and the Lead Independent Director are as follows:

| | | | | | | | | | | | | | | | | |

| | | | | |

| | Responsibilities of the

Chairman of the Board | | | Responsibilities of the Lead

Independent Director |

| | | | | |

| | | | |

|

| | —Presides at all meetings of the Board of Directors. —Is available, when appropriate, for consultation and direct communication with stockholders. —Sets the Board agenda in conjunction with the CEO and Lead Independent Director. —Together with the Lead Independent Director and CEO, sets the annual calendar agenda for the Board. | | | —Presides at all meetings of the Board of Directors at which the Chairman is not present, including at least two executive sessions of the independent Directors. —Sets agenda for executive sessions. —Has the authority to call meetings of the Independent Directors. —Serve as the principal liaison between the Chairman and the Independent Directors. —In conjunction with Chairman and CEO, establishes meeting agendas for the Board of Directors. —Conjunction with Chairman and CEO, sets the annual calendar agenda for the Board of Directors. —Available for consultation and direct communication with stockholders, when appropriate. |

Diversity and Refreshment

Based on investor feedback and the 2017 policy of the Board focused on diversity, the Board has increased its diversity so that one-third of the Board is now diverse. Further, it has placed two of its diverse directors in Committee leadership roles. In July of 2021, it refreshed the Board with four of its prior Board members retiring or otherwise resigning to allow for the appointment of new directors who brought age, gender and racial diversity to the Board.

| | | | | | | | | | | | | | |

| AGE | DIRECTOR TENURE | GENDER DIVERSITY | RACIALLY/ ETHNICALLY

DIVERSE |

| | | Asian | 1 |

| Hispanic | 1 |

| Caucasian | 7 |

In 2023, the size of the board will be reduced from nine members to eight members with the retirement of Mr. Hoovestol.

Independent Directors

Under the corporate governance listing standards of the NASDAQ and our committee charters, the Board must consist of a majority of independent directors. In making independence determinations, the Board observes NASDAQ and SEC criteria and considers all relevant facts and circumstances. The Board, in coordination with its Nominating and Governance Committee, annually reviews all relevant business relationships any director nominee may have with our Company. As a result of its annual review, the Board has determined that each of its current non-employee directors, other than Messrs. Hoovestol and Knudsen, meet the independence requirements of the NASDAQ and the SEC. Upon Mr. Hoovestol's retirement, the number of non-independent members was reduced from three to two, increasing director independence from 67% to 75%.

| | | | | |

26 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Committees of the Board

The Board has a standing Audit Committee, Compensation Committee, and Nominating and Governance Committee, each of which has a charter setting forth its responsibilities. Each charter can be found at https://investor.gpreinc.com/governance/governance-documents.

The tables which follow set forth committee memberships as of the date of this proxy:

| | | | | | | | |

| | |

Audit

Committee | Members Martin Salinas (Chair)

Jim Anderson

Kimberly Wagner | Meetings in 2022: 6 The Audit Committee consists of directors who are independent under the rules of the NASDAQ and the SEC. During each of these meetings, the Audit Committee met directly with our independent auditors. Please see page 39 of this Proxy Statement for the “Audit Committee Report.” |

| | |

Principal Responsibilities:

—Provide assistance to the Board in fulfilling its responsibility to the shareholders, potential shareholders, and investment community relating to corporate accounting, reporting practices, and the quality and integrity of our financial reports, as well as oversight of the Company’s information technology, including cybersecurity practices.

—Maintain free and open means of communication between the directors, the independent auditors and our management.

The Audit Committee continued its standing practice of meeting directly with our internal audit staff to discuss the current year’s audit plan and to allow for direct interaction between the Audit Committee members and our internal auditors. The Audit Committee also meets directly with our independent auditors.

The Audit Committee, which was established in accordance with section 3(a)(58)(A) of the Exchange Act, consists of directors who are independent under the rules of the NASDAQ and the SEC. Messrs. Salinas and Anderson have been determined to be audit committee financial experts as defined in Rule 407(d)(5) of Regulation S-K.

| | | | | | | | |

| | |

Compensation

Committee | Members Brian Peterson (Chair)

Jim Anderson

Farha Aslam | Meetings in 2022: 5 The Compensation Committee consists of directors who are independent under the rules of the NASDAQ and the SEC. Please see page 66 of this Proxy Statement for the “Compensation Committee Report.” |

|

| |

Principal Responsibilities:

—Establish our general compensation policy and, except as prohibited by law, may take any and all actions that the Board could take relating to compensation of directors, executive officers, employees and other parties.

—Evaluate the performance of our executive officers.

—Set compensation for directors and executive officers.

—Make recommendations to the Board on adoption of compensation plans.

—Administer our compensation plans, including choosing performance measures, setting performance targets and evaluating performance, in consultation with the Chief Executive Officer.

—When evaluating potential compensation adjustments, the Compensation Committee solicits and considers input provided by the Chief Executive Officer relating to the individual performance and contribution to our overall performance by executive officers (other than himself) and other key employees.

As permitted by the Compensation Committee Charter, which is available on the Company’s website, the Compensation Committee retained the services of an independent compensation adviser to provide consulting services with respect to the Company’s executive compensation program. In 2021, the Compensation Committee engaged a new consultant, Pay Governance (“Pay Governance”), as its compensation adviser. Pursuant to the terms of its engagement by the Compensation Committee, Pay Governance provided advice regarding our executive compensation programs in relation to the objectives of those programs and provided information and advice on competitive compensation practices and trends, peer groups, and short term and long-term incentive plan designs. In its role as the Committee’s independent compensation consultant, representatives of Pay Governance engaged in discussions with the Compensation Committee and responded on a regular basis to questions from the Committee, providing them with their opinions with respect to the design of current or proposed compensation programs. Pay Governance reported directly to the Compensation Committee and the Committee retained the sole authority to retain or terminate their services.

| | | | | |

28 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

| | | | | | | | |

| | |

| Nominating and Governance Committee | Members Kim Wagner (Chair)

Martin Salinas

Alain Treuer | Meetings in 2022: 4 The Nominating and Governance Committee consists of directors who are independent under the rules of the NASDAQ and the SEC. |

| | |

Principal Responsibilities:

—Recommend to the Board the slate of director nominees for election to the Board.

—Identify and recommend candidates to fill vacancies occurring between annual shareholder meetings.

—Review and address governance items.

—Oversight of the Company’s ESG initiatives.

The Nominating and Governance Committee has established certain broad qualifications in order to consider a proposed candidate for election to the Board. The Nominating and Governance Committee will also consider such other factors as it deems appropriate to assist in developing a Board and committees that are diverse in nature and comprised of experienced and seasoned advisors. These factors include judgment, skill, diversity (such as race, gender or experience), integrity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other Board members, and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board.

During 2021, as part of a board refreshment and diversity initiative, four board members retired or resigned. In conjunction with the efforts, the CEO recommended, and the Nominating and Governance Committee nominated Martin Salinas and Farha Aslam to join the Board. In addition, the Nominating and Governance Committee reviewed committee leadership and recommended to the Board that leadership for each of the committees be refreshed. Accordingly, in July 2021, Martin Salinas was named Chairperson of the Audit Committee and in August 2021, the Board accepted the recommendation of the Nominating and Governance Committee to name Brian Peterson as the chairperson of the Compensation Committee and Kim Wagner as chairperson for the Nominating and Governance Committee.

Board Oversight

Risk Oversight

The Board and each of its committees are involved in overseeing risk associated with our Company.

| | | | | | | | |

|

| |

| Board | In its oversight role, the Board annually reviews our Company’s strategic plan, which addresses, among other things, the risks and opportunities facing our Company. While the Board has the ultimate oversight responsibility for the risk management process, it has delegated certain risk management oversight responsibilities to the Board committees. |

|

| |

| |

|

| |

| Audit

Committee | —Acts on behalf of the Board in fulfilling its responsibilities to oversee company processes for the management of business/financial risk and for compliance with applicable legal, ethical and regulatory requirements. —Charged with (i) inquiring of management and our Company’s outside auditors about significant risks and exposures and assessing the steps management has taken or needs to take to minimize such risks and (ii) overseeing our Company’s policies with respect to risk assessment and risk management, including the development and maintenance of an internal audit function to provide management and the Audit Committee with ongoing assessments of our Company’s risk management processes and internal controls. —Has regular meetings with our Company’s management, internal auditors and independent, external auditors. |

|

| |

|

| |

|

| |

| Compensation Committee | —Considers risks related to the attraction and retention of talented senior management and other employees as well as risks relating to the design of compensation programs and arrangements. |

|

| |

|

| |

|

| |

| Nominating and Governance Committee | —Annually reviews our Company’s corporate governance guidelines and their implementation, as well as regularly evaluates new and continuing directors for election to the Board. —Annually leads the board evaluation process. —Annually reviews the CEO succession plans. |

|

| |

Each committee provides the Board with regular, detailed reports regarding committee meetings and actions.

| | | | | |

30 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Strategic Oversight

The Board is elected by the shareholders to oversee their interests in the long-term performance and success of the Company’s business and financial performance. The Board serves as the ultimate decision-making body of the Company, except for those matters reserved to or shared with the shareholders. The Board oversees the proper safeguarding of the assets of the Company, the maintenance of appropriate financial and other internal controls and the Company’s compliance with applicable laws and regulations and proper governance. The Board selects the Chief Executive Officer and oversees the members of senior management, who are charged by the Board with conducting the business of the Company.

| | | | | |

| |

Oversight of Strategy | —The Board oversees and monitors strategic planning. —Business strategy is a key focus at the Board level and embedded in the work of Board committees. —Company management is charged with executing business strategy and provides regular performance updates to the Board. |

| |

| |

Oversight

of Risk | —The Board oversees risk management —Board committees, which meet regularly and report back to the full Board, play significant roles in carrying out the risk oversight function. —Company management is charged with managing risk, through robust internal processes and effective internal controls. |

| |

| |

Succession Planning | —The Board oversees succession planning and talent development for senior executive positions. —The Nominating & Governance Committee, which meets regularly and reports back to the Board, has primary responsibility for developing succession plans for the CEO position. |

| |

Oversight of Strategy

Oversight of the Company’s business strategy and strategic planning is a key responsibility of the Board. The Board believes that overseeing and monitoring strategy is a continuous process and takes a multilayered approach in exercising its duties.

While the Board and its committees oversee strategic planning, Company management is charged with executing the business strategy. To monitor performance against the Company’s strategic goals, the Board receives regular updates and actively engages in dialogue with our Company’s senior leaders. These boardroom discussions are enhanced with site visits from time to time, which provide Directors an opportunity to see strategy execution first hand.

The Board’s oversight and management’s execution of business strategy are viewed with a long-term mindset and a focus on assessing both opportunities for and potential risks to the Company.

Oversight of Risk

Inherent in the Board’s responsibilities is an understanding of and oversight over the various risks facing the Company. The Board does not view risk in isolation. Risks are considered in virtually every business decision. The Board recognizes that it is neither possible nor prudent to eliminate all risk. Indeed, purposeful and appropriate risk taking is essential for the Company to be competitive and to achieve the Company’s long-term strategic objectives. Effective risk oversight is an important priority of the Board. The Board undertakes to understand critical risks in the Company’s business and strategy; allocate responsibilities for risk oversight among the full Board and its committees; evaluate if the Company’s risk management and control processes are sufficient and functioning properly and to facilitate open dialogue between the Board and management on all aspects of risks facing the Company.

To learn more about risks facing the Company, you can review the factors included in Part I, "Item 1A. Risk Factors" in the Form 10-K. The risks described in the Form 10-K are not the only risks facing the Company. Additional risks and uncertainties not currently known or that may currently be deemed to be immaterial based on the information known to the Company also may materially adversely affect the Company’s business, financial condition or results of operations in future periods.

Cybersecurity

The Company has developed an information security framework to safeguard the confidentially and availability of its information system infrastructure. The Audit Committee oversees cybersecurity risk. The Company has experienced, and anticipates future occurrences of cybersecurity threats and incidents, and the Audit Committee receives quarterly reports on various cybersecurity incidents which may have occurred during the quarter. To date, no such incidents have been material to the Company.

ESG and Sustainability Oversight

Our sustainability strategy is structured around the three primary focus areas of ESG: Environmental, Social and Governance. Extending beyond those pillars are our key ESG topics and areas of impact, prioritized based on a data-driven, stakeholder-oriented and forward-looking approach. The Board maintains oversight of all key ESG topics including, but not limited to climate change, GHG emissions and employee safety. The Nominating and Governance Committee of the Board holds primary oversight of ESG initiatives and strategy. The remaining committees provide oversight of certain key ESG topics and areas of impact. For example, our Audit Committee is responsible for oversight of information security, cyber security and SEC reporting oversight. The day-to-day management and identification of ESG topics, including climate change, and their impacts, risks and opportunities is the responsibility of our internal ESG workgroup composed of associate, management and executive level employees. Our ESG reporting is aligned with the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) standards, UN Sustainable Development Goals and the Task Force on Climate-Related Financial Disclosures (TCFD). We also receive external third party assurance of select data within our annual sustainability report, including climate-related metrics, from a third party assurance provider and have submitted our climate-related targets to the Science-Based Targets Initiative (SBTi) for validation.

| | | | | |

32 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

| | | | | | | | |

| | |

| Pillars | Key ESG Topics | Areas of Impact |

| | |

| | |

Environmental | —Climate Change and GHG Emissions —Energy Use and Efficiency —Water Management —Biodiversity and Land Stewardship —Waste, Circularity and Environmental Compliance | —Climate Risk and Opportunity Management —Enhanced ESG Governance —Climate Change Strategy: Scenario Analysis —Risks, Opportunities and Carbon Reduction Strategy —Tracking Climate Performance —Path to Carbon-Neutral Operations —Non-GHG Emissions —Enterprise-Wide Air Emissions —Clean Energy from Renewable Corn Oil —Product Transportation and Infrastructure —Water Sourcing, Water Resource Management and Environmental Compliance —Sustainable Agriculture, Land Stewardship, Sustainable Sourcing |

| | |

| | |

Social | —Employee Health and Safety —Talent Acquisition, Engagement and DE&I —Customers, Suppliers and Communities | —EHS Programs and Policies —Cardinal Rules —Hazard and Incident Risk Assessment —Hazard and Incident Reporting and Remediation —Employee Safety Training —Safety Goals and Executive Compensation —Proactive Outreach, audits and training —Internship Program —Compensation and Benefits —Training, Learning and Career Development —Quality Assurance and Quality Control —Suppliers and Service Provider Screening —Community Engagement, Environmental Stewardship and Capital Investment |

| | |

| | |

Governance | —Board Composition and Structure —Ethics and Compliance | —Board Composition and Participation —Board Diversity —Anti-Corruption, Human and Labor Rights and Cyber Security |

| | |

More information can be found on the Sustainability section of our website. Visit https://gpreinc.com/who-we-are/sustainability.

The information on our website is not incorporated by reference in this proxy statement.

Investor Engagement

We are receptive to listening to investor feedback as part of our robust shareholder engagement program. We attend numerous investor conferences throughout the year as well as participate in one-on-one investor calls. Our CEO, CFO and other members of management are available to investors. Feedback from investors is shared with the Board of Directors and the executive team at regularly scheduled meetings. Our engagement has focused on topics including our business strategy, ongoing initiatives, financial performance, and the execution of our transformation. We have incorporated feedback received through engagement with a number of our largest shareholders as well as guidelines published by shareholders and proxy advisory firms over the past year. Our shareholders voted in favor of declassifying the board last year. We updated executive leadership, including the addition of seasoned experts, reassignment of current leaders, and the creation of a Chief Transformation Officer to lead the way as we achieve critical mass in our transformation.

| | | | | |

| |

| Topics discussed with shareholders during 2022: | |

| |

—Company strategy —Government policy —Inflation Reduction Act —Transformation progress —Ultra-High Protein —Renewable Corn Oil —Clean Sugar Technology —Carbon Capture and Sequestration —Industry supply and demand drivers —Capital allocation —Risk management —Executive compensation programs —Sustainability —Economic drivers | In 2022, we connected with shareholders representing approximately: |

|

| | | | | |

| |

| What We Heard | What We Did |

| |

| |

—Board structure and independence are important to shareholders. | —Held a shareholder vote to declassify the Board which passed. |

—Shareholders are interested in sustainability initiatives. | —Under the oversight of our Nominating and Governance Committee, we published our second Sustainability Report in April 2022, highlighting our progress toward our sustainability goals. |

—Continue executing on our Green Plains 2.0 Total Transformation Plan. | —Deployed capital to multiple MSC™ initiatives, with approximately half of our platform now operating MSC technology. Achieved record renewable corn oil yields. Began construction on a first-of-its-kind commercial scale Clean Sugar Technology™ system in Shenandoah, Iowa. |

—Shareholders are supportive of our strategy and managements execution to date to transform the Company to Green Plains 2.0. | —We have continued to communicate and update shareholders on our successful completion of key initiatives toward our 2024-25 Total Transformation Plan. We have been transparent in our progress and our performance to date and path to completion have been well received. |

| | | | | |

34 | GREEN PLAINS INC. 2023 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Other Governance Principles

Code of Ethics and Other Policies

The Board updated in 2021 the Company’s Code of Ethics to which all officers, directors and employees, who for purposes of the Code of Ethics are collectively referred to as employees, are required to adhere in addressing the legal and ethical issues encountered in conducting their work. The Code of Ethics requires that all officers, directors and employees avoid conflicts of interest, comply with all laws, rules and regulations, conduct business in an honest and fair manner, and otherwise act with integrity. All parties covered by the Code of Ethics are required to report any violations of the Code of Ethics and may do so anonymously by contacting the Company’s anonymous hotline at https://gpreinc.alertline.com. The Code of Ethics includes specific provisions applicable to the Company’s principal executive officer and senior financial officers. The full text of the code of ethics is published on our website in the “Investors and Media – Governance” section.