UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ¨ | |

| Filed by a Party other than the Registrant x | |

| Check the appropriate box: | |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| HAMPDEN BANCORP, INC. |

| (Name of Registrant as Specified In Its Charter) |

|

CLOVER PARTNERS, L.P. MHC MUTUAL CONVERSION FUND, L.P. CLOVER INVESTMENTS, L.L.C. MICHAEL C. MEWHINNEY JOHNNY GUERRY GAROLD R. BASE |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Filed by Clover Partners, L.P. and Others

A copy of a letter being sent to shareholders is being filed herewith under Rule 14a-6 of the Securities Exchange Act of 1934, as amended.

AN IMPORTANT MESSAGE

FOR FELLOW STOCKHOLDERS OF HAMPDEN BANCORP, INC.

FROM MHC MUTUAL CONVERSION FUND, L.P.

October 3, 2014

Dear Fellow Hampden Bancorp, Inc. Stockholder:

You have by now received a letter from Hampden Bancorp, Inc. (“Hampden”, “Hampden Bancorp” or the “Company”), in which the Company asserts that it “has tried everything in its power to avoid” the proxy contest. This is not true.

The Company could have simply appointed Mr. Guerry to the Board, and saved the Company the $500,000 that it estimates it will spend on the proxy contest. The Company knows full well that one person on a ten-member board has no power to do anything contrary to the wishes of the other directors. Mr. Guerry’s appointment would have simply meant that for once the board would have the benefit of the viewpoint of someone who has not been handpicked by the Company to serve on the board and is directly aligned with fellow shareholders.

We are puzzled by the Company’s strong resistance to Mr. Guerry and our other nominee Mr. Base. As further explained in our letter, here are some of the key reasons why change at the board level is imperative:

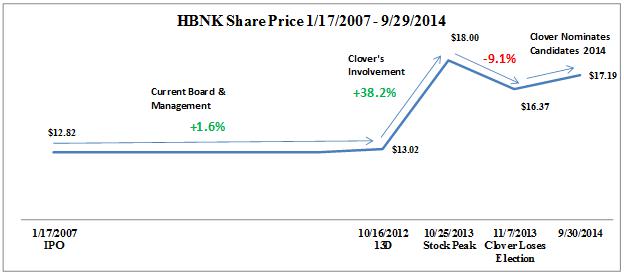

| · | After advancing almost 40% from Clover’s initial 13-D filing, the bank’s shares fell approximately 9% after Hampden’s nominees were re-elected in 2013. |

| · | Clover’s candidates have a far superior track record of delivering value for their investors. In fact, Clover made more money for its investors in 2013 than Hampden has made in cumulative net income since going public. |

| · | Hampden’s “record” earnings translate into a meager 5.6% return on equity, well below their cost of equity. |

| · | Contrary to shareholder’s interest, Hampden has recently bought back stock at a premium to tangible book value, and we fear is doing so merely to advantage themselves in the pending proxy contest. |

| · | After spending $410,000 of stockholders money last year on the proxy contest, and expressing insiders’ confidence in the Company’s growth plan, insiders sold 3.5x more stock than was purchased. |

| · | According to SNL Financial, since going public the Company’s insiders have purchased less than $80,000 of stock in the open market, while selling over $1,600,000. |

Recent Actions of Hampden’s Management and Board Call Into Question Their Professionalism

Over the past few years, we have always strived to conduct ourselves in a professional manner during our contested elections and other communications with Hampden’s board members and management team.

It is quite ironic that Hampden has chosen to emphasize Johnny Guerry’s age as an important factor, while Hampden’s officers seem to lack the maturity to keep this contest on a professional level and have resorted to personal assaults on Mr. Guerry. Hampden mischaracterized a former landlord/tenant relationship and implied that this relationship sheds insight into Mr. Guerry’s business judgment. Clover Partners is not in the leasing business. Aside from the prejudicial nature of Hampden’s statements, it is a smoke screen designed to divert shareholders from our message, that Hampden is a poorly run institution with a poor management team and poor board of directors. We reiterate that Hampden’s personal attack directed at Mr. Guerry is diversionary and representative of an institution which greatly fears a shareholder friendly voice in the board room.

In contrast, Clover Partners is a firm with an excellent reputation. The founding partner graduated from West Point and served as a Captain in the United States Army during the Vietnam war prior to getting his MBA from Harvard Business School and founding one of the largest money management firms in the Southwest (Barrow, Hanley, Mewhinney & Strauss). Mr. Guerry’s other partner has an MBA from The University of Pennsylvania and worked at Goldman Sachs for over 30 years. The analyst who works with Mr. Guerry was ranked the number two overall stock-picker in the world for 2007 and 2008 as ranked by the Financial Times.

We worked in good faith and with professionalism throughout the entire summer to avoid this proxy contest, including traveling to Springfield at Hampden’s request to meet with management and the board. We were led to believe an agreement was imminent and only first learned the company had formally rejected our proposal when Hampden filed its preliminary proxy (we had a call scheduled for the following day), further evidence of Hampden’s lack of professionalism. We fear the Company may have intentionally misled us so that it could get the first word in front of shareholders.

The Company then appears to have cherry-picked through the personal information Mr. Guerry provided and penned a defamatory letter about Mr. Guerry to shareholders. Hampden’s actions are professionally reprehensible, and underscore the need for new representation on the board.

Hampden Continues to Take Credit for Share Price Appreciation That Only Happened Once We Became Involved

As evidenced in the chart below, the bank’s share price consistently responds favorably to our involvement. To be sure, after advancing almost 40% after our initial 13-D filing, the bank’s shares fell approximately 9% after Hampden’s nominees were re-elected in 2013. Most recently, the bank’s shares have improved with our nominations to the board of directors for the 2014 election.

Hampden is a Poorly Performing Bank

Hampden continues to tout their “record” earnings without providing any scale in order to measure this figure. Hampden’s “record” earnings translate into a return on equity of 5.6% (excluding costs related to the contest), well below their cost of equity and what shareholders should demand from a bank touting operational accomplishments. While getting your first C is exciting to a student who has historically averaged Ds, it is still a C and far from laudable. Under reasonable assumptions, it would take Hampden more than a decade to achieve a return on equity in excess of their cost of capital.

It is evident that Hampden’s share price does not correlate with their advertised operational improvements. Hampden touted record earnings during last year’s proxy contest, only to see the share price fall after our campaign was unsuccessful.

Hampden has suggested the share price appreciation that took place once Glenn Welch took over is somehow a result of his efforts. However, we were already involved when Mr. Welch was named CEO, and Hampden is again attempting to mislead shareholders by suggesting the shares have reacted positively to their poor operating history. In fact, the only time the market could possibly grade Mr. Welch’s performance independent from our involvement was after last year’s proxy contest, and we will again reiterate the share price declined 9%. This is a failing grade and more representative of Mr. Welch’s and Hampden’s feats.

Hampden is NOT Acting in the Best Interest of Shareholders

It is highly disconcerting to hear Hampden has recently completed its buyback program and approved another. Buying back stock at a premium to tangible book is not in the interest of shareholders as it dilutes tangible book value. It is an exceptionally poor decision given Hampden's earnings capacity. The fact that Hampden’s board is either unaware of this or is willing to engage in the buybacks despite it hurting shareholders further shows the urgent need for change in the boardroom. Furthermore, it is quite ironic that Hampden characterizes Mr. Guerry as unqualified when they appear to be making such amateurish mistakes.

Clover’s Candidates are the Best Choice to Protect Your Investment

Gary Base has 40 years of banking experience, which is more than the other directors on the board, including Mr. Welch. Furthermore, Mr. Base ran a far larger and more successful bank (VPFG) than Hampden. During Mr. Base’s tenure as CEO, the banks shares advanced 52%, while Hampden’s shares only began to appreciate after Clover’s involvement.

While Mr. Base offers years of operational experience, Mr. Guerry offers a unique skillset which no other member of the board possesses and is urgently needed, especially in light of the board’s dilutive buyback activity:

| · | For approximately 10 years, Mr. Guerry has analyzed and invested in hundreds of banks nationwide and is an expert in the banking sector. Through this experience, he has a strong understanding of the different geographic sectors of the country and their respective opportunities and challenges. The hundreds of in-depth examinations he has made of the financial reports and public disclosures of banks have provided him with a keen sense of the factors that either hinder or enhance the financial performance of banks. This allows him to provide valuable insights into the factors that are impacting the financial performance of the Company. |

| · | Mr. Guerry has raised over $400 million in assets and delivered strong returns for his investors. While Hampden characterizes Clover, one of their largest shareholders, as a “small” hedge fund, Clover made more money last year for its investors than Hampden has made in cumulative net income since going public. In 2008, during the height of the financial crisis, Mr. Guerry’s fund returned 26%. In other words, Mr. Guerry knows what it means to carry the responsibility of caring for the hard earned money of investors, and will work to ensure that the shareholders of the Company, who have invested their hard earned money in the Company, have their interests protected. |

| · | Mr. Guerry regularly collaborates with bank management teams and their boards of directors, advising them on capital management strategies and market perspective. |

Management and the Board are MISALIGNED with Shareholders

The fact Hampden even argues about insider activity is amusing. Exercising GRANTED stock options is not synonymous with buying the stock with your own hard-earned money in the open market.

When the Company quibbles over the nature of the sales we have referenced in their materials, they miss the point because they do not explain why management and the board have not been buying shares of the Company. After spending $410,000 of stockholders money last year on the proxy contest, and expressing insiders’ confidence in the Company’s growth plan, insiders sold 3.5x more stock than was purchased.

You might surmise that at least one of the three nominees up for election and endorsed by the board has purchased stock in the open market at some point in the preceding seven years since the bank went public. Unfortunately, not one of them has.

According to SNL Financial, since going public the Company’s insiders have purchased less than $80,000 of stock in the open market, while selling over $1,600,000.

You Deserve Better

You can vote for Hampden’s entrenched insiders, who have been on the board for approximately 14 and 19 years respectively, never bought the stock, overseen abysmal operating results and lackluster share price performance. OR, you can vote for two industry experts who have a strong history of something greatly lacking at Hampden: creating tremendous value for their investors.

* * * * * * *

We urge you to read our proxy materials (along with the Company’s proxy materials) before you vote. The proxy materials contain background information on all of the director candidates and information on how to vote.

We urge you to vote on the WHITE PROXY CARD FOR JOHNNY GUERRY AND GAROLD R. BASE.

Please feel free to contact us using the contact information noted below.

Best regards,

Johnny Guerry

MHC Mutual Conversion Fund, L.P.

100 Crescent Court, Suite 575

Dallas, Texas 75201

(214) 273-5200

(214) 273-5199 (fax)

JGuerry@cloverpartners.com

Important Information

MHC Mutual Conversion Fund, L.P. has nominated Johnny Guerry and Garold R. Base as nominees to the board of directors of Hampden Bancorp Inc. (the “Company”) and intends to solicit votes for the election of Mr. Guerry and Mr. Base as members of the board. MHC Mutual Conversion Fund, L.P. has sent a definitive proxy statement, WHITE proxy card and related proxy materials to shareholders of the Company seeking their support of Mr. Guerry and Mr. Base at the Company’s 2014 Annual Meeting of Stockholders. Stockholders are urged to read the definitive proxy statement and WHITE proxy card because they contain important information about the participants in the solicitation, Mr. Guerry and Mr. Base, the Company and related matters. Stockholders may obtain a free copy of the definitive proxy statement and WHITE proxy card and other documents filed by MHC Mutual Conversion Fund, L.P. with the Securities and Exchange Commission (“SEC”) at the SEC’s web site at www.sec.gov. The definitive proxy statement and other related SEC documents filed by MHC Mutual Conversion Fund, L.P. with the SEC may also be obtained free of charge from the MHC Mutual Conversion Fund.

Participants in Solicitation

The participants in the solicitation by MHC Mutual Conversion Fund, L.P. currently consist of the following persons: MHC Mutual Conversion Fund, L.P., Clover Partners, L.P., Clover Investments, L.L.C., Michael C. Mewhinney, Johnny Guerry and Garold R. Base. Such participants may have interests in the solicitation, including as a result of holding shares of the Company’s common stock. Information regarding the participants and their interests may be found in the definitive proxy statement.