Exhibit 4.178

|

[_]

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

OR

|

|

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2014

|

|

|

[_]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

|

|

[_]

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Title of class

|

Name of exchange on which registered

|

|

|

Common Stock, $0.01 par value

|

The NASDAQ Stock Market LLC

|

|

|

Preferred Stock Purchase Rights

|

The NASDAQ Stock Market LLC

|

|

US GAAP ☒

|

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐

|

Other

|

☐

|

| ● | our future operating or financial results; |

| ● | statements about planned, pending or recent acquisitions, business strategy and expected capital spending or operating expenses, including drydocking, surveys, upgrades and insurance costs; |

| ● | our ability to procure or have access to financing, our liquidity and the adequacy of cash flow for our operations; |

| ● | our continued borrowing availability under our debt agreements and compliance with the covenants contained therein; |

| ● | our substantial leverage, including our ability to generate sufficient cash flow to service our existing debt and the incurrence of substantial indebtedness in the future; |

| ● | our ability to successfully employ both our existing and newbuilding drybulk and tanker vessels and drilling units; |

| ● | our drilling contract backlog, drilling contract commencements, drilling contract terminations, drilling contract option exercises, drilling contract revenues, drilling contract awards and rig and drillship mobilizations and performance provisions, |

| ● | our future capital expenditures and investments in the construction, acquisition and refurbishment of our vessels and drilling units (including the amount and nature thereof and the timing of completion thereof, the delivery and commencement of operations dates, expected downtime and lost revenue); |

| ● | statements about drybulk and tanker shipping market trends, charter rates and factors affecting supply and demand; |

| ● | statements about the offshore drilling market, including supply and demand, utilization rates, dayrates, |

| ● | our expectations regarding the availability of vessel and drilling unit acquisitions; and |

| ● | anticipated developments with respect to pending litigation. |

|

PART I

|

1

|

|

|

Item 1.

|

Identity of Directors, Senior Management and Advisers

|

1

|

|

Item 2.

|

Offer Statistics and Expected Timetable

|

1

|

|

Item 3.

|

Key Information

|

1

|

|

Item 4.

|

Information on the Company

|

39

|

|

Item 4A.

|

Unresolved Staff Comments

|

63

|

|

Item 5.

|

Operating and Financial Review and Prospects

|

64

|

|

Item 6.

|

Directors and Senior Management

|

103

|

|

Item 7.

|

Major Shareholders and Related Party Transactions

|

109

|

|

Item 8.

|

Financial Information

|

114

|

|

Item 9.

|

The Offer and Listing

|

115

|

|

Item 10.

|

Additional Information

|

116

|

|

Item 11.

|

Quantitative and Qualitative Disclosures about Market Risk

|

125

|

|

Item 12.

|

Description of Securities Other than Equity Securities

|

127

|

|

PART II

|

127

|

|

|

Item 13.

|

Defaults, Dividend Arrearages and Delinquencies

|

127

|

|

Item 14.

|

Material Modifications to the Rights of Security Holders and Use of Proceeds

|

127

|

|

Item 15.

|

Controls and Procedures

|

127

|

|

Item 16A.

|

Audit Committee Financial Expert

|

128

|

|

Item 16B.

|

Code of Ethics

|

128

|

|

Item 16C.

|

Principal Accountant Fees and Services

|

128

|

|

Item 16D.

|

Exemptions from the Listing Standards for Audit Committees

|

129

|

|

Item 16E.

|

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

|

129

|

|

Item 16F.

|

Changes in Registrant's Certifying Accountant

|

129

|

|

Item 16G.

|

Corporate Governance

|

129

|

|

Item 16H.

|

Mine Safety Disclosure

|

129

|

|

PART III.

|

130

|

|

|

Item 17.

|

Financial Statements

|

130

|

|

Item 18.

|

Financial Statements

|

130

|

|

Item 18.1.

|

Schedule I – Condensed Financial Information of Dryships Inc. (Parent Company only)

|

130

|

|

Item 19.

|

Exhibits

|

130

|

|

Year Ended December 31,

|

||||||||||||||||||||

|

(In thousands of U.S. dollars except per share and share data)

|

2010

|

2011

|

2012

|

2013

|

2014

|

|||||||||||||||

|

STATEMENT OF OPERATIONS

|

||||||||||||||||||||

|

Total revenues

|

$

|

859,745

|

$

|

1,077,662

|

$

|

1,210,139

|

$

|

1,492,014

|

$

|

2,185,524

|

||||||||||

|

Voyage expenses

|

27,433

|

20,573

|

30,012

|

103,211

|

117,165

|

|||||||||||||||

|

Vessels, drilling rigs and drillships operating expenses

|

190,614

|

373,122

|

649,722

|

609,765

|

844,260

|

|||||||||||||||

|

Depreciation and amortization

|

192,891

|

274,281

|

335,458

|

357,372

|

449,792

|

|||||||||||||||

|

Loss/(gain) on sale of assets, net

|

(9,435

|

)

|

3,357

|

)

|

1,179

|

—

|

-

|

|||||||||||||

|

Gain on contract cancellation

|

—

|

(6,202

|

)

|

—

|

—

|

-

|

||||||||||||||

|

Contract termination fees and other

|

—

|

—

|

41,339

|

33,293

|

1,307

|

|||||||||||||||

|

Vessel impairment charge

|

3,588

|

144,688

|

—

|

43,490

|

38,148

|

|||||||||||||||

|

Gain from vessel insurance proceeds

|

—

|

(25,064

|

)

|

—

|

—

|

-

|

||||||||||||||

|

General and administrative expenses – cash(1)

|

64,376

|

96,679

|

132,636

|

173,298

|

182,593

|

|||||||||||||||

|

General and administrative expenses – non-cash

|

24,200

|

26,568

|

13,299

|

11,424

|

11,093

|

|||||||||||||||

|

Legal settlements and other, net

|

—

|

—

|

(9,360

|

)

|

4,585

|

(2,013

|

)

|

|||||||||||||

|

Operating income

|

366,078

|

169,660

|

15,854

|

155,576

|

543,179

|

|||||||||||||||

|

Interest and finance costs

|

(66,825

|

)

|

(146,173

|

)

|

(210,128

|

)

|

(332,129

|

)

|

(411,021

|

)

|

||||||||||

|

Interest income

|

21,866

|

16,575

|

4,203

|

12,498

|

12,146

|

|||||||||||||||

|

Gain/(loss) on interest rate swaps

|

(120,505

|

)

|

(68,943

|

)

|

(54,073

|

)

|

8,373

|

(15,528

|

)

|

|||||||||||

|

Other, net

|

10,272

|

9,023

|

(492

|

)

|

2,245

|

7,067

|

||||||||||||||

|

Income/(loss) before income taxes

|

210,886

|

(19,858

|

)

|

(244,636

|

)

|

(153,437

|

)

|

135,843

|

||||||||||||

|

Income taxes

|

(20,436

|

)

|

(27,428

|

)

|

(43,957

|

)

|

(44,591

|

)

|

(77,823

|

)

|

||||||||||

|

Net Income/(loss)

|

190,450

|

(47,286

|

)

|

(288,593

|

)

|

(198,028

|

)

|

58,020

|

||||||||||||

|

Less: Net (income)/loss attribute to non-controlling interests

|

(2,123

|

)

|

(22,842

|

)

|

41,815

|

(25,065

|

)

|

(105,532

|

)

|

|||||||||||

|

Net income/(loss) attributable to DryShips Inc.

|

188,327

|

(70,128

|

)

|

(246,778

|

)

|

(223,093

|

)

|

(47,512

|

)

|

|||||||||||

|

Net Income/ (loss) attributable to common stockholders

|

172,564

|

(74,594

|

)

|

(246,778

|

)

|

(223,149

|

)

|

(48,209

|

)

|

|||||||||||

|

Earnings/(loss) per common share attributable to DryShips Inc. common stockholders, basic

|

$

|

0.64

|

$

|

(0.21

|

)

|

$

|

(0.65

|

)

|

$

|

(0.58

|

)

|

$

|

(0.11

|

)

|

||||||

|

Weighted average number of common shares, basic

|

268,858,688

|

355,144,764

|

380,159,088

|

384,063,306

|

456,031,628

|

|||||||||||||||

|

Earning / (loss) per common share attributable to DryShips Inc. common stockholders, diluted

|

$

|

0.61

|

$

|

(0.21

|

)

|

$

|

(0.65

|

)

|

$

|

(0.58

|

)

|

$

|

(0.11

|

)

|

||||||

|

Weighted average number of common shares, diluted

|

305,425,852

|

355,144,764

|

380,159,088

|

384,063,306

|

456,031,628

|

|

(1)

|

Cash compensation to members of our senior management and our directors amounted to $11.8 million, $6.8 million, $5.7 million, $4.8 million, and $5.8 million for the years ended December 31, 2010, 2011, 2012, 2013 and 2014, respectively.

|

|

As of and for the

Year Ended December 31,

|

||||||||||||||||||||

|

(In thousands of U.S. dollars except per share and share data and fleet data)

|

2010

|

2011

|

2012

|

2013

|

2014

|

|||||||||||||||

|

Total current assets

|

$

|

1,065,110

|

570,077

|

903,529

|

1,184,199

|

1,227,277

|

||||||||||||||

|

Total assets

|

6,984,494

|

8,621,689

|

8,878,491

|

10,123,692

|

10,371,603

|

|||||||||||||||

|

Current liabilities, including current portion of long-term debt, net of deferred finance cost

|

935,435

|

756,263

|

1,573,529

|

2,171,714

|

1,621,760

|

|||||||||||||||

|

Total long-term debt, including current portion

|

2,719,692

|

4,241,835

|

4,386,715

|

5,568,003

|

5,517,613

|

|||||||||||||||

|

DryShips common stock

|

3,696

|

4,247

|

4,247

|

4,326

|

7,060

|

|||||||||||||||

|

Number of shares issued

|

369,649,777

|

424,762,094

|

424,762,244

|

432,654,477

|

706,064,321

|

|||||||||||||||

|

Total DryShips Inc. stockholders' equity

|

3,255,827

|

3,145,328

|

2,846,460

|

2,613,636

|

2,992,821

|

|||||||||||||||

|

OTHER FINANCIAL DATA

|

||||||||||||||||||||

|

Net cash provided by operating activities

|

476,801

|

349,205

|

237,529

|

245,980

|

475,108

|

|||||||||||||||

|

Net cash used in investing activities

|

(1,680,748

|

)

|

(1,822,394

|

)

|

(389,947

|

)

|

(1,234,330

|

)

|

(754,717

|

)

|

||||||||||

|

Net cash provided by financing activities

|

902,308

|

1,332,802

|

243,225

|

1,241,542

|

250,709

|

|||||||||||||||

|

EBITDA (1)

|

449,736

|

384,021

|

296,747

|

523,566

|

984,510

|

|||||||||||||||

|

DRYBULK FLEET DATA:

|

||||||||||||||||||||

|

Average number of vessels (2)

|

37.21

|

35.80

|

35.67

|

37.15

|

38.69

|

|||||||||||||||

|

Total voyage days for drybulk carrier fleet (3)

|

13,430

|

12,831

|

13,027

|

13,442

|

13,889

|

|||||||||||||||

|

Total calendar days for drybulk carrier fleet (4)

|

13,583

|

13,068

|

13,056

|

13,560

|

14,122

|

|||||||||||||||

|

Drybulk carrier fleet utilization (5)

|

98.87

|

%

|

98.19

|

%

|

99.78

|

%

|

99.13

|

%

|

98.35

|

%

|

||||||||||

|

(In Dollars)

|

||||||||||||||||||||

|

AVERAGE DAILY RESULTS:

|

||||||||||||||||||||

|

Time charter equivalent (6)

|

32,045

|

26,912

|

15,896

|

12,062

|

12,354

|

|||||||||||||||

|

Vessel operating expenses (7)

|

5,245

|

6,271

|

5,334

|

5,796

|

6,400

|

|||||||||||||||

|

TANKER FLEET DATA:

|

||||||||||||||||||||

|

Average number of vessels (2)

|

—

|

2.64

|

6.27

|

9.86

|

10.00

|

|||||||||||||||

|

Total voyage days for tanker fleet (3)

|

—

|

963

|

2,293

|

3,598

|

3,650

|

|||||||||||||||

|

Total calendar days for tanker fleet (4)

|

—

|

963

|

2,293

|

3,598

|

3,650

|

|||||||||||||||

|

Tanker fleet utilization

|

—

|

100

|

%

|

100

|

%

|

100

|

%

|

100

|

%

|

|||||||||||

|

(In Dollars)

|

||||||||||||||||||||

|

AVERAGE DAILY RESULTS:

|

||||||||||||||||||||

|

Time Charter Equivalent (6)

|

—

|

12,592

|

13,584

|

12,900

|

21,835

|

|||||||||||||||

|

Vessel Operating Expenses (7)

|

—

|

9,701

|

7,195

|

7,286

|

7,138

|

|||||||||||||||

|

(1)

|

EBITDA, a non-U.S. GAAP measure, represents net income before interest, taxes, depreciation and amortization. EBITDA does not represent and should not be considered as an alternative to net income or cash flow from operations, as determined by U.S. GAAP and our calculation of EBITDA may not be comparable to that reported by other companies. EBITDA is included herein because it is a basis upon which the Company measures its operations. Please see below for a reconciliation of EBITDA to net income attributable to DryShips, the most directly comparable financial measure calculated in accordance with U.S. GAAP.

|

|

(2)

|

Average number of vessels is the number of vessels that constituted the respective fleet for the relevant period, as measured by the sum of the number of days each vessel in that fleet was a part of the fleet during the period divided by the number of calendar days in that period.

|

|

(3)

|

Total voyage days for the respective fleet are the total days the vessels in that fleet were in the Company's possession for the relevant period net of off-hire days associated with drydockings or special or intermediate surveys.

|

|

(4)

|

Calendar days are the total days the vessels in that fleet were in the Company's possession for the relevant period including off-hire days associated with major repairs, drydockings or special or intermediate surveys.

|

|

(5)

|

Fleet utilization is the percentage of time that the vessels in that fleet were available for revenue-generating voyage days, and is determined by dividing voyage days by fleet calendar days for the relevant period.

|

|

(6)

|

Time charter equivalent, or TCE, is a measure of the average daily revenue performance of a vessel on a per voyage basis. The Company's method of calculating TCE is determined by dividing voyage revenues (net of voyage expenses) by voyage days for the relevant time period. Voyage expenses primarily consist of port, canal and fuel costs that are unique to a particular voyage, which would otherwise be paid by the charterer under a time charter contract, as well as commissions. TCE revenues, a non-U.S. GAAP measure, provides additional meaningful information in conjunction with revenues from our vessels, the most directly comparable U.S. GAAP measure, because it assists Company's management in making decisions regarding the deployment and use of its vessels and in evaluating their financial performance. TCE is also a standard shipping industry performance measure used primarily to compare period-to-period changes in a shipping company's performance despite changes in the mix of charter types (i.e., spot charters, time charters and bareboat charters) under which the vessels may be employed between the periods. The following table reflects the calculation of our TCE rates for the periods presented.

|

|

(7)

|

Daily vessel operating expenses, which includes crew costs, provisions, deck and engine stores, lubricating oil, insurance, maintenance and repairs, is calculated by dividing vessel operating expenses by fleet calendar days for the relevant time period.

|

|

For the Year Ended December 31,

|

||||||||||||||||||||

| (U.S. dollars in thousands) | 2010 | 2011 | 2012 | 2013 | 2014 | |||||||||||||||

|

Net income/(loss) attributable to DryShips Inc.

|

188,327

|

(70,128

|

)

|

(246,778

|

)

|

(223,093

|

)

|

(47,512

|

)

|

|||||||||||

|

Add: Net interest expense/income

|

45,959

|

129,598

|

205,925

|

319,631

|

398,875

|

|||||||||||||||

|

Add: Depreciation and amortization

|

192,891

|

274,281

|

335,458

|

357,372

|

449,792

|

|||||||||||||||

|

Add: Income taxes

|

20,436

|

27,428

|

43,957

|

44,591

|

77,823

|

|||||||||||||||

|

Add: Net income/(loss) attributable to Non controlling interests

|

2,123

|

22,842

|

(41,815

|

)

|

25,065

|

105,532

|

||||||||||||||

|

EBITDA

|

449,736

|

384,021

|

296,747

|

523,566

|

984,510

|

|||||||||||||||

| Drybulk Carrier Segment | Year Ended December 31, | |||||||||||||||||||

| (In thousands of U.S. dollars, except for TCE rates, | ||||||||||||||||||||

| which are expressed in U.S. dollars and voyage days) | 2010 | 2011 | 2012 | 2013 | 2014 | |||||||||||||||

|

Voyage revenues

|

457,804

|

365,361

|

227,141

|

191,024

|

205,630

|

|||||||||||||||

|

Voyage expenses

|

(27,433

|

)

|

(20,047

|

)

|

(20,064

|

)

|

(28,886

|

)

|

(34,044

|

)

|

||||||||||

|

Time charter equivalent revenues

|

430,371

|

345,314

|

207,077

|

162,138

|

171,586

|

|||||||||||||||

|

Total voyage days for drybulk fleet

|

13,430

|

12,831

|

13,027

|

13,442

|

13,889

|

|||||||||||||||

|

Time charter equivalent (TCE) rate

|

32,045

|

26,912

|

15,896

|

12,062

|

12,354

|

|||||||||||||||

| Tanker Segment | Year Ended December 31, | |||||||||||||||||||

| (In thousands of U.S. dollars, except for TCE rates, which are | ||||||||||||||||||||

| expressed in U.S. dollars and voyage days) | 2010 | 2011 | 2012 | 2013 | 2014 | |||||||||||||||

|

Voyage revenues

|

-

|

12,652

|

41,095

|

120,740

|

162,817

|

|||||||||||||||

|

Voyage expenses

|

-

|

(526

|

)

|

(9,948

|

)

|

(74,325

|

)

|

(83,121

|

)

|

|||||||||||

|

Time charter equivalent revenues

|

-

|

12,126

|

31,147

|

46,415

|

79,696

|

|||||||||||||||

|

Total voyage days for drybulk fleet

|

-

|

963

|

2,293

|

3,598

|

3,650

|

|||||||||||||||

|

Time charter equivalent (TCE) rate

|

-

|

12,592

|

13,584

|

12,900

|

21,835

|

|||||||||||||||

| ● | supply and demand for energy resources, commodities, semi-finished and finished consumer and industrial products; |

| ● | changes in the exploration or production of energy resources, commodities, semi-finished and finished consumer and industrial products; |

| ● | the location of regional and global exploration, production and manufacturing facilities; |

| ● | the location of consuming regions for energy resources, commodities, semi-finished and finished consumer and industrial products; |

| ● | the globalization of production and manufacturing; |

| ● | global and regional economic and political conditions, including armed conflicts, terrorist activities, embargoes and strikes; |

| ● | natural disasters and other disruptions in international trade; |

| ● | developments in international trade; |

| ● | changes in seaborne and other transportation patterns, including the distance cargo is transported by sea; |

| ● | environmental and other regulatory developments; |

| ● | currency exchange rates; and |

| ● | weather. |

| ● | the number of newbuilding deliveries; |

| ● | port and canal congestion; |

| ● | the scrapping rate of older vessels; |

| ● | vessel casualties; and |

| ● | the number of vessels that are out of service. |

| ● | prevailing level of charter rates; |

| ● | general economic and market conditions affecting the shipping industry; |

| ● | types and sizes of vessels; |

| ● | supply of and demand for vessels; |

| ● | other modes of transportation; |

| ● | cost of newbuildings; |

| ● | governmental and other regulations; and |

| ● | technological advances. |

| ● | marine disaster; |

| ● | environmental accidents; |

| ● | cargo and property losses or damage; |

| ● | business interruptions caused by mechanical failure, human error, war, terrorism, political action in various countries, labor strikes or adverse weather conditions; and |

| ● | piracy. |

| ● | worldwide production and demand for oil and gas and any geographical dislocations in supply and demand; |

| ● | the cost of exploring for, developing, producing and delivering oil and gas; |

| ● | expectations regarding future energy prices; |

| ● | advances in exploration, development and production technology; |

| ● | the ability of the Organization of Petroleum Exporting Countries, or OPEC, to set and maintain levels and pricing; |

| ● | the level of production in non-OPEC countries; |

| ● | government regulations; |

| ● | local and international political, economic and weather conditions; |

| ● | domestic and foreign tax policies; |

| ● | development and exploitation of alternative fuels; |

| ● | the policies of various governments regarding exploration and development of their oil and gas reserves; and |

| ● | the worldwide military and political environment, including uncertainty or instability resulting from an escalation or additional outbreak of armed hostilities, insurrection or other crises in the Middle East or other geographic areas or further acts of terrorism in the United States, or elsewhere. |

| ● | the availability of competing offshore drilling vessels and the level of newbuilding activity for drilling vessels; |

| ● | the level of costs for associated offshore oilfield and construction services; |

| ● | oil and gas transportation costs; |

| ● | the discovery of new oil and gas reserves; |

| ● | the cost of non-conventional hydrocarbons, such as the exploitation of oil sands; and |

| ● | regulatory restrictions on offshore drilling. |

| ● | terrorist and environmental activist acts, armed hostilities, war and civil disturbances; |

| ● | acts of piracy; |

| ● | significant governmental influence over many aspects of local economies; |

| ● | seizure, nationalization or expropriation of property or equipment; |

| ● | repudiation, nullification, modification or renegotiation of contracts; |

| ● | limitations on insurance coverage, such as war risk coverage, in certain areas; |

| ● | political unrest; |

| ● | foreign and U.S. monetary policy, government debt downgrades and potential defaults and foreign currency fluctuations and devaluations; |

| ● | the inability to repatriate income or capital; |

| ● | complications associated with repairing and replacing equipment in remote locations; |

| ● | import-export quotas, wage and price controls, imposition of trade barriers; |

| ● | regulatory or financial requirements to comply with foreign bureaucratic actions; |

| ● | changing taxation policies, including confiscatory taxation; |

| ● | other forms of government regulation and economic conditions that are beyond our control; and |

| ● | governmental corruption. |

| ● | the equipping and operation of drilling units; |

| ● | repatriation of foreign earnings; |

| ● | oil and gas exploration and development; |

| ● | taxation of offshore earnings and earnings of expatriate personnel; and |

| ● | use and compensation of local employees and suppliers by foreign contractors. |

| ● | supply of and demand for oil and oil products; |

| ● | global and regional economic and political conditions, including developments in international trade, national oil reserves policies, fluctuations in industrial and agricultural production and armed conflicts, which, among other things, could impact the supply of oil as well as trading patterns and the demand for various types of vessels; |

| ● | regional availability of refining capacity; |

| ● | environmental and other legal and regulatory developments; |

| ● | the distance oil and oil products are to be moved by sea; |

| ● | changes in seaborne and other transportation patterns, including changes in the distances over which tanker cargoes are transported by sea; |

| ● | increases in the production of oil in areas linked by pipelines to consuming areas, the extension of existing, or the development of new, pipeline systems in markets we may serve, or the conversion of existing non-oil pipelines to oil pipelines in those markets; |

| ● | currency exchange rates; |

| ● | weather and acts of God and natural disasters; |

| ● | competition from alternative sources of energy and from other shipping companies and other modes of transport; |

| ● | international sanctions, embargoes, import and export restrictions, nationalizations, piracy and wars; and |

| ● | regulatory changes including regulations adopted by supranational authorities and/or industry bodies, such as safety and environmental regulations and requirements by major oil companies. |

| ● | current and expected purchase orders for tankers; |

| ● | the number of tanker newbuilding deliveries; |

| ● | any potential delays in the delivery of newbuilding vessels and/or cancellations of newbuilding orders; |

| ● | the scrapping rate of older tankers; |

| ● | the successful implementation of the phase-out of single-hull tankers; |

| ● | technological advances in tanker design and capacity; |

| ● | tanker freight rates, which are affected by factors that may effect the rate of newbuilding, swapping and laying up of tankers; |

| ● | port and canal congestion; |

| ● | price of steel and vessel equipment; |

| ● | conversion of tankers to other uses or conversion of other vessels to tankers; |

| ● | the number of tankers that are out of service; and |

| ● | changes in environmental and other regulations that may limit the useful lives of tankers. |

| ● | general economic and market conditions affecting the shipping industry; |

| ● | competition from other shipping companies; |

| ● | supply of and demand for tankers and the types and sizes of tankers we own; |

| ● | alternative modes of transportation; |

| ● | ages of vessels; |

| ● | cost of newbuildings; |

| ● | governmental or other regulations; |

| ● | prevailing level of charter rates; and |

| ● | technological advances. |

| ● | enter into other financing arrangements; |

| ● | incur or guarantee additional indebtedness; |

| ● | create or permit liens on our assets; |

| ● | consummate a merger, consolidation or sale of our all or substantially all of our assets or the shares of our subsidiaries; |

| ● | make investments; |

| ● | change the general nature of our business; |

| ● | pay dividends, redeem capital stock or subordinated indebtedness or make other restricted payments; |

| ● | incur dividend or other payment restrictions affecting the restricted subsidiaries under the indenture governing our Senior Secured Notes (as defined below); |

| ● | change the management and/or ownership of our vessels and drilling units; |

| ● | enter into transactions with affiliates; |

| ● | transfer or sell assets; |

| ● | amend, modify or change our organizational documents; |

| ● | make capital expenditures; |

| ● | change the flag, class or management of our vessels or drilling units; |

| ● | drop below certain minimum cash deposits, as defined in our credit facilities; and |

| ● | compete effectively to the extent our competitors are subject to less onerous restrictions. |

| ● | we may not be able to satisfy our financial obligations under our indebtedness and our contractual and commercial commitments, which may result in possible defaults on and acceleration of such indebtedness; |

| ● | we may not be able to obtain financing in the future for working capital, capital expenditures, acquisitions, debt service requirements or other purposes; |

| ● | we may not be able to use operating cash flow in other areas of our business because we must dedicate a substantial portion of these funds to service the debt; |

| ● | we could become more vulnerable to general adverse economic and industry conditions, including increases in interest rates, particularly given our substantial indebtedness, some of which bears interest at variable rates; |

| ● | our ability to refinance indebtedness may be limited or the associated costs may increase; |

| ● | less leveraged competitors could have a competitive advantage because they have lower debt service requirements and, as a result, we may not be better positioned to withstand economic downturns; and |

| ● | we may be less able to take advantage of significant business opportunities and to react to changes in market or industry conditions than our competitors and our management's discretion in operating our business may be limited. |

|

Amounts in thousand of US dollars

|

2014

|

|||||||||||

|

Level of impairment

|

5 year

|

3 year

|

1 year

|

|||||||||

|

Drybulk carriers

|

$

|

704,461

|

$

|

735,691

|

$

|

735,518

|

||||||

|

Tankers

|

14,451

|

14,671

|

-

|

|||||||||

|

Total

|

$

|

718,912

|

$

|

750,362

|

$

|

735,518

|

||||||

| ● | shipyard unavailability; |

| ● | shortages of equipment, materials or skilled labor for completion of repairs or upgrades to our equipment; |

| ● | unscheduled delays in the delivery of ordered materials and equipment or shipyard construction; |

| ● | financial or operating difficulties experienced by equipment vendors or the shipyard; |

| ● | unanticipated actual or purported change orders; |

| ● | local customs strikes or related work slowdowns that could delay importation of equipment or materials; |

| ● | engineering problems, including those relating to the commissioning of newly designed equipment; |

| ● | design or engineering changes; |

| ● | latent damages or deterioration to the hull, equipment and machinery in excess of engineering estimates and assumptions; |

| ● | work stoppages; |

| ● | client acceptance delays; |

| ● | weather interference, storm damage or other events of force majeure; |

| ● | disputes with shipyards and suppliers; |

| ● | shipyard failures and difficulties; |

| ● | failure or delay of third-party equipment vendors or service providers; |

| ● | unanticipated cost increases; and |

| ● | difficulty in obtaining necessary permits or approvals or in meeting permit or approval conditions. |

| ● | locate and acquire suitable vessels and drilling units; |

| ● | identify and consummate acquisitions or joint ventures; |

| ● | enhance our customer base; |

| ● | manage our expansion; and |

| ● | obtain required financing on acceptable terms. |

| ● | authorizing our board of directors to issue "blank check" preferred stock without stockholder approval; |

| ● | providing for a classified board of directors with staggered, three-year terms; |

| ● | prohibiting cumulative voting in the election of directors; |

| ● | authorizing the removal of directors only for cause and only upon the affirmative vote of the holders of a majority of the outstanding shares of our common shares entitled to vote for the directors; |

| ● | prohibiting stockholder action by written consent unless the written consent is signed by all shareholders entitled to vote on the action; |

| ● | limiting the persons who may call special meetings of stockholders; |

| ● | establishing advance notice requirements for nominations for election to our board of directors or for proposing matters that can be acted on by stockholders at stockholder meetings; and |

| ● | restricting business combinations with interested shareholders. |

|

Redelivery

|

|||||||||||||||

|

Year

Built

|

DWT

|

Type

|

Current employment

or employment

upon delivery

|

Gross

rate

per day

|

Earliest

|

Latest

|

|||||||||

|

Capesize:

|

|||||||||||||||

|

Rangiroa

|

2013

|

206,026

|

Capesize

|

T/C (1)

|

$23,000

|

May-18

|

Dec-23

|

||||||||

|

Negonego

|

2013

|

206,097

|

Capesize

|

T/C (1)

|

$21,500

|

Mar-20

|

Feb-28

|

||||||||

|

Fakarava

|

2012

|

206,152

|

Capesize

|

T/C

|

$25,000

|

Sept-15

|

Sept-20

|

||||||||

|

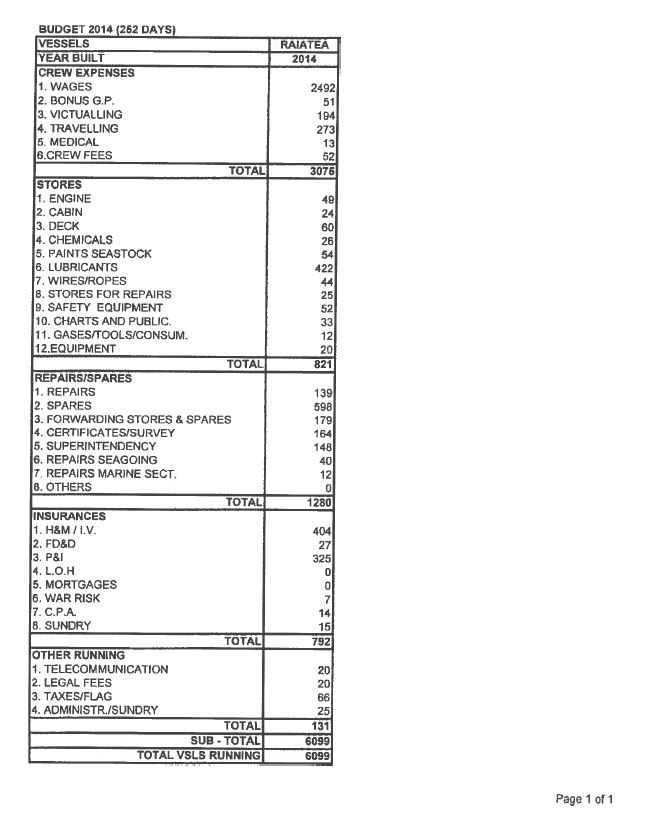

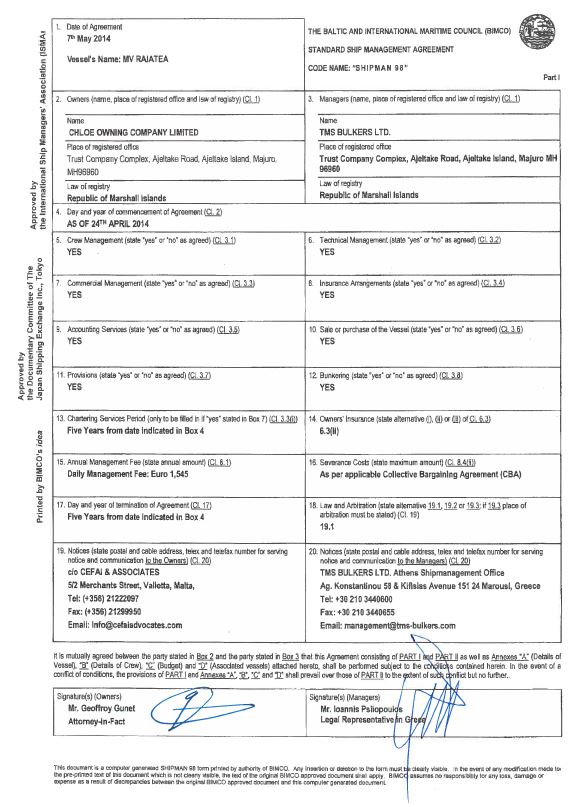

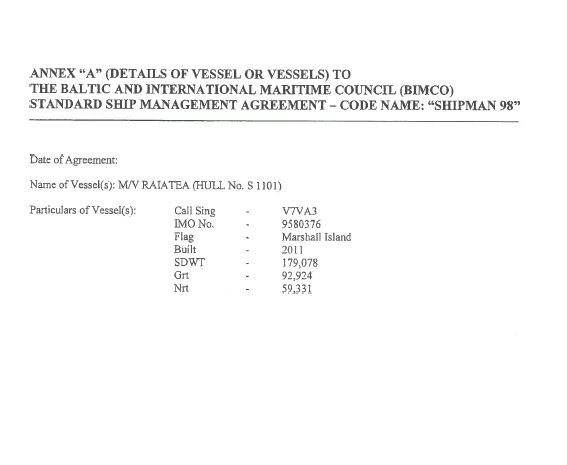

Raiatea

|

2011

|

179,078

|

Capesize

|

T/C (1)

|

$23,500

|

Oct-19

|

Dec-19

|

||||||||

|

Mystic

|

2008

|

170,040

|

Capesize

|

T/C

|

$52,310

|

Aug-18

|

Dec-18

|

||||||||

|

Robusto

|

2006

|

173,949

|

Capesize

|

T/C (1)

|

$23,500

|

Jul-19

|

Sep-19

|

||||||||

|

Cohiba

|

2006

|

174,234

|

Capesize

|

T/C (1)

|

$23,500

|

Sep-19

|

Nov-19

|

||||||||

|

Montecristo

|

2005

|

180,263

|

Capesize

|

T/C (1)

|

$23,500

|

Jul-19

|

Sep-19

|

||||||||

|

Flecha

|

2004

|

170,012

|

Capesize

|

T/C

|

$55,000

|

Jul-18

|

Nov-18

|

||||||||

|

Manasota

|

2004

|

171,061

|

Capesize

|

T/C

|

$30,000

|

Jan-18

|

Aug-18

|

||||||||

|

Partagas

|

2004

|

173,880

|

Capesize

|

T/C (1)

|

$23,500

|

Sep-19

|

Nov-19

|

||||||||

|

Alameda

|

2001

|

170,662

|

Capesize

|

T/C

|

$27,500

|

Nov-15

|

Jan-16

|

||||||||

|

Capri

|

2001

|

172,579

|

Capesize

|

T/C

|

$20,000

|

Jan-16

|

May-16

|

||||||||

|

Average age based on year built/ Sum of DWT/ Total number of vessels

|

7.6 years

|

2,354,033

|

13

|

||||||||||||

|

Redelivery

|

|||||||||||||||

|

Year

Built

|

DWT

|

Type

|

Current employment

or employment

upon delivery

|

Gross

rate

per day

|

Earliest

|

Latest

|

|||||||||

|

Panamax:

|

|||||||||||||||

|

Raraka

|

2012

|

76,037

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Woolloomooloo

|

2012

|

76,064

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Amalfi

|

2009

|

75,206

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Rapallo

|

2009

|

75,123

|

Panamax

|

T/C Index linked

|

T/C Index linked

|

Jul-16

|

Sep-16

|

||||||||

|

Catalina

|

2005

|

74,432

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Majorca

|

2005

|

74,477

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Ligari

|

2004

|

75,583

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Saldanha

|

2004

|

75,707

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Sorrento

|

2004

|

76,633

|

Panamax

|

T/C

|

$24,500

|

Aug-21

|

Dec-21

|

||||||||

|

Mendocino

|

2002

|

76,623

|

Panamax

|

T/C Index linked

|

T/C Index linked

|

Sep-16

|

Nov-16

|

||||||||

|

Bargara

|

2002

|

74,832

|

Panamax

|

T/C Index linked

|

T/C Index linked

|

Sep-16

|

Nov-16

|

||||||||

|

Oregon

|

2002

|

74,204

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Ecola

|

2001

|

73,931

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Samatan

|

2001

|

74,823

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Sonoma

|

2001

|

74,786

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Capitola

|

2001

|

74,816

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Levanto

|

2001

|

73,925

|

Panamax

|

T/C Index linked

|

T/C Index linked

|

Aug-16

|

Oct-16

|

||||||||

|

Maganari

|

2001

|

75,941

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Coronado

|

2000

|

75,706

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Marbella

|

2000

|

72,561

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Redondo

|

2000

|

74,716

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Topeka

|

2000

|

74,716

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Ocean Crystal

|

1999

|

73,688

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Helena

|

1999

|

73,744

|

Panamax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Average age based on year built / Sum of DWT/ Total number of vessels

|

11.7 years

|

1,798,274

|

24

|

||||||||||||

|

Supramax:

|

|||||||||||||||

|

Byron

|

2003

|

51,118

|

Supramax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Galveston

|

2002

|

51,201

|

Supramax

|

Spot

|

Spot

|

N/A

|

N/A

|

||||||||

|

Average age based on year built / Sum of DWT/ Total number of vessels

|

12.5 years

|

102,319

|

2

|

||||||||||||

|

Totals (38)

|

|||||||||||||||

|

Average age based on year built / Sum of DWT/ Total number of vessels

|

9.5 years

|

4,254,626

|

39

|

||||||||||||

|

Drilling Unit Operating

Drilling Rigs

|

Year Built or

Scheduled

Delivery/

Generation

|

Water

Depth to the

Wellhead

(ft)

|

Drilling

Depth to the

Oil Field

(ft)

|

Customer

|

Expected Contract Term(1)

|

Average

Maximum

Dayrate

|

Drilling

Location

|

|||||||||

|

Leiv Eiriksson

|

2001/5th

|

10,000

|

30,000

|

Rig Management Norway AS(2)

|

Q2 2013–Q1 2016

|

$

|

545,000

|

Norwegian Continental Shelf

|

||||||||

|

Eirik Raude

|

2002/5th

|

10,000

|

30,000

|

Premier Oil Exploration and Production Ltd.(3)

|

Q1 2015 – Q4 2015

|

$

|

561,350

|

Falkland Islands

|

||||||||

|

Operating Drillships

|

||||||||||||||||

|

Ocean Rig Corcovado

|

2011/6th

|

10,000

|

40,000

|

Petroleo Brasileiro S.A.

|

Q2 2012–Q2 2015

|

$

|

439,402

|

(4)

|

Brazil

|

|||||||

|

Petroleo Brasileiro S.A.

|

Q2 2015–Q2 2018

|

$

|

523,306

|

(5)

|

Brazil

|

|||||||||||

|

Ocean Rig Olympia

|

2011/6th

|

10,000

|

40,000

|

Total E&P Angola

|

Q3 2012–Q3 2015

|

(6)

|

$

|

585,437

|

Angola

|

|||||||

|

ENI Angola S.p.A.(7)

|

Q4 2015-Q4 2015

|

$

|

355,000

|

Angola

|

||||||||||||

|

Ocean Rig Poseidon

|

2011/6th

|

10,000

|

40,000

|

ENI Angola S.p.A.

|

Q2 2013–Q2 2016

|

$

|

690,300

|

(8)

|

Angola

|

|||||||

|

ENI Angola S.p.A.(10)

|

Q2 2016-Q2 2017

|

$

|

539,150

|

Angola

|

||||||||||||

|

Ocean Rig Mykonos

|

2011/6th

|

10,000

|

40,000

|

Petroleo Brasileiro S.A.

|

Q1 2012–Q1 2015

|

$

|

433,044

|

(4)

|

Brazil

|

|||||||

|

Petroleo Brasileiro S.A.

|

Q1 2015–Q1 2018

|

$

|

514,090

|

(5)

|

Brazil

|

|||||||||||

|

Ocean Rig Mylos

|

2013/7th

|

12,000

|

40,000

|

Repsol Sinopec Brasil S.A.

|

Q3 2013–Q3 2016

|

$

|

637,270

|

(9)

|

Brazil

|

|||||||

|

Ocean Rig Skyros

|

2013/7th

|

12,000

|

40,000

|

ENI Angola S.p.A.(7)

|

Q2 2015-Q3 2015

|

$

|

355,000

|

Nigeria, Angola

|

||||||||

|

Total E&P Angola

|

Q4 2015-Q3 2021

|

$

|

592,834

|

Angola

|

||||||||||||

|

Ocean Rig Athena

|

2014/7th

|

12,000

|

40,000

|

ConocoPhillips Angola 36 & 37 Ltd

|

Q1 2014–Q2 2017

|

$

|

662,523

|

(10)

|

Angola

|

|||||||

| Ocean Rig Apollo |

Q1 2015/7th

|

12,000

|

40,000

|

Total E&P Congo

|

Q1 2015-Q2 2018

|

$ |

594,646

|

(11) |

West Africa

|

|||||||

|

Newbuilding Drillships

|

||||||||||||||||

|

|

$

|

|

(11)

|

|

||||||||||||

|

Ocean Rig Santorini

|

Q2 2016/7th

|

12,000

|

40,000

|

|||||||||||||

|

Ocean Rig TBN#1

|

Q1 2017/7th

|

12,000

|

40,000

|

|||||||||||||

|

Ocean Rig TBN#2

|

Q2 2017/7th

|

12,000

|

40,000

|

|||||||||||||

|

Redelivery

|

|||||||||||||||

|

Year Built

|

DWT

|

Type

|

Current employment or

employment upon delivery

|

Gross rate

per day

|

Earliest

|

Latest

|

|||||||||

|

Suezmax:

|

|||||||||||||||

|

Bordeira

|

2013

|

158,513

|

Suezmax

|

Spot

|

N/A

|

N/A

|

N/A

|

||||||||

|

Petalidi

|

2012

|

158,532

|

Suezmax

|

Spot

|

N/A

|

N/A

|

N/A

|

||||||||

|

Lipari

|

2012

|

158,425

|

Suezmax

|

Spot

|

N/A

|

N/A

|

N/A

|

||||||||

|

Vilamoura

|

2011

|

158,622

|

Suezmax

|

Spot

|

N/A

|

N/A

|

N/A

|

||||||||

|

Aframax

|

|||||||||||||||

|

Alicante

|

2013

|

115,708

|

Aframax

|

Spot

|

N/A

|

N/A

|

N/A

|

||||||||

|

Mareta

|

2013

|

115,796

|

Aframax

|

Spot

|

N/A

|

N/A

|

N/A

|

||||||||

|

Calida

|

2012

|

115,812

|

Aframax

|

Spot

|

N/A

|

N/A

|

N/A

|

||||||||

|

Saga

|

2011

|

115,738

|

Aframax

|

Spot

|

N/A

|

N/A

|

N/A

|

||||||||

|

Daytona

|

2011

|

115,896

|

Aframax

|

Spot

|

N/A

|

N/A

|

N/A

|

||||||||

|

Belmar

|

2011

|

115,904

|

Aframax

|

Spot

|

N/A

|

N/A

|

N/A

|

||||||||

| ● | Very Large Ore Carriers, or VLOCs, have a carrying capacity of more than 200,000 dwt and are a comparatively new sector of the drybulk carrier fleet. VLOCs are built to exploit economies of scale on long-haul iron ore routes. |

| ● | Capesize vessels, have carrying capacities of 110,000 – 199,999 dwt. These vessels generally operate along long-haul iron ore and coal trade routes. There are relatively few ports around the world with the infrastructure to accommodate vessels of this size. |

| ● | Panamax vessels, have a carrying capacity of between 60,000 and 85,000 dwt. These vessels carry coal, grains, and, to a lesser extent, minor bulks, including steel products, forest products and fertilizers. Panamax vessels are able to pass through the Panama Canal making them more versatile than larger vessels. |

| ● | Handymax vessels, have a carrying capacity of between 35,000 and 60,000 dwt. The subcategory of vessels that have a carrying capacity of between 45,000 and 60,000 dwt are called Supramax. These vessels operate along a large number of geographically dispersed global trade routes mainly carrying grains and minor bulks. Vessels below 60,000 dwt are sometimes built with on-board cranes enabling them to load and discharge cargo in countries and ports with limited infrastructure. |

| ● | Handysize vessels, have a carrying capacity of up to 35,000 dwt. These vessels carry exclusively minor bulk cargo. Increasingly, these vessels have operated along regional trading routes. Handysize vessels are well suited for small ports with length and draft restrictions that may lack the infrastructure for cargo loading and unloading. |

|

Customer

|

Year ended

December 31, 2012

|

Year ended

December 31, 2013

|

Year ended

December 31, 2014

|

|||||||||

|

Customer A

|

-

|

-

|

14%

|

|||||||||

|

Customer B

|

49%

|

33%

|

18%

|

|||||||||

|

Customer C

|

18%

|

-

|

-

|

|||||||||

|

Customer D

|

12%

|

-

|

-

|

|||||||||

|

Customer E

|

-

|

13%

|

12%

|

|||||||||

|

Customer F

|

-

|

18%

|

30%

|

|||||||||

|

Customer G

|

-

|

12%

|

14%

|

|||||||||

| ● | maintaining their pool vessels in seaworthy condition and to the agreed technical and operational standards of the pool; |

| ● | maintaining all required ISM certificates and keeping the pool vessel classed with a classification society that is a member of the International Association of Classification Societies, or the IACS; |

| ● | obtaining and maintaining a minimum number of agreed oil major approvals in accordance with the pool agreement; |

| ● | providing for inspections to insure that ship inspection reports are obtained at least every six months; |

| ● | obtaining, for its own account, in accordance with standards consistent with prudent first class owners of vessels, all relevant insurance policies for its pool vessels, including hull and machinery, protection and indemnity and war risk insurance policies; and |

| ● | providing for the technical management of its pool vessels, including all matters related to vessel seaworthiness, crewing and crew administration, victualling, maintenance and repairs, drydocking, provisioning (lube oils, stores and spare parts), compliance with class requirements and compliance with the requirements of relevant authorities. |

| ● | marketing the vessels; |

| ● | trading pattern analysis; |

| ● | handling of charters and employment contracts; |

| ● | commercial operations and payment and collection of expenses and revenues relating to commercial operations; |

| ● | handling of any post-fixture claims; and |

| ● | budgeting, accounting and performance of the pool. |

| ● | on-board installation of automatic identification systems to provide a means for the automatic transmission of safety-related information from among similarly equipped ships and shore stations, including information on a ship's identity, position, course, speed and navigational status; |

| ● | on-board installation of ship security alert systems, which do not sound on the vessel but only alert the authorities on shore; |

| ● | the development of vessel security plans; |

| ● | ship identification number to be permanently marked on a vessel's hull; |

| ● |

a continuous synopsis record kept onboard showing a vessel's history including the name of the ship, the state whose flag the ship is entitled to fly, the date on which the ship was registered with that state, the ship's identification number, the port at which the ship is registered and the name of the registered owner(s) and their registered address; and

|

| ● | compliance with flag state security certification requirements. |

| ● | Calendar days. We define calendar days as the total number of days in a period during which each vessel in our fleet was in our possession including off-hire days associated with major repairs, drydockings or special or intermediate surveys. Calendar days are an indicator of the size of our fleet over a period and affect both the amount of revenues and the amount of expenses that we record during that period. |

| ● | Voyage days. We define voyage days as the total number of days in a period during which each vessel in our fleet was in our possession net of off-hire days associated with drydockings or special or intermediate surveys. The shipping industry uses voyage days (also referred to as available days) to measure the number of days in a period during which vessels are available to generate revenues. |

| ● | Fleet utilization. We calculate fleet utilization by dividing the number of our voyage days during a period by the number of our calendar days during that period. The shipping industry uses fleet utilization to measure a company's efficiency in finding suitable employment for its vessels and minimizing the amount of days that its vessels are off-hire for reasons such as scheduled repairs, vessel upgrades, drydockings or special or intermediate surveys. |

| ● | Spot charter rates. Spot charter rates are volatile and fluctuate on a seasonal and year to year basis. Fluctuations are caused by imbalances in the availability of cargoes for shipment and the number of vessels available at any given time to transport these cargoes. |

| ● | TCE rates. We define TCE rates as our voyage and time charter revenues less voyage expenses during a period divided by the number of our available days during the period, which is consistent with industry standards. TCE rate, a non-U.S. GAAP measure, provides additional meaningful information in conjunction with revenues from our drybulk carriers, the most directly comparable U.S. GAAP measure, because it assists Company management in making decisions regarding the deployment and use of its vessels and in evaluating their financial performance. TCE rate is also a standard shipping industry performance measure used primarily to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charterhire rates for vessels on voyage charters are generally not expressed in per day amounts while charterhire rates for vessels on time charters generally are expressed in such amounts. |

|

Year Ended December 31,

|

|||||||||||||||||||||

|

2010

|

2011

|

2012

|

2013

|

2014

|

|||||||||||||||||

|

Average number of vessels

|

37.21

|

35.80

|

35.67

|

37.15

|

38.69

|

||||||||||||||||

|

Total voyage days for fleet

|

13,430

|

12,831

|

13,027

|

13,442

|

13,889

|

||||||||||||||||

|

Total calendar days for fleet

|

13,583

|

13,068

|

13,056

|

13,560

|

14,122

|

||||||||||||||||

|

Fleet Utilization

|

98.87

|

%

|

98.19

|

%

|

99.78

|

%

|

99.13

|

%

|

98.35

|

% | |||||||||||

|

Time charter equivalent

|

32,045

|

26,912

|

15,896

|

12,062

|

12,354

|

||||||||||||||||

| ● | Employment Days: We define employment days as the total number of days the drilling units are employed on a drilling contract. |

| ● | Dayrates or maximum dayrates: Unless otherwise stated, we define drilling dayrates as the maximum rate in U.S. Dollars possible to earn for drilling services for one 24 hour day at 100% efficiency under the drilling contract. Such dayrate may be measured by quarter-hour, half-hour or hourly basis and may be reduced depending on the activity performed according to the drilling contract. |

| ● | Economic utilization: We measure our revenue earning performance over a period as a percentage of the maximum revenues that we could earn under our drilling contracts in such period.More specifically, all drilling contracts provide for an operating or base rate that applies for the period during which the drillship is operational and at the client's drilling location.Furthermore,drilling contracts generally provide for a general repair allowance for preventive maintenance or repair of equipment;such allowance varies from contract to contract,and we may be compensated at the full operating dayrate or at a reduced operating day rate for such general repair allowance.Inaddition,drilling contracts typically provide for situations where the drillships would operate at reduced operating dayrates,such as, among other things:a standby rate,where the drillship is prevented from commencing operations for reasons such as bad weather,waiting for customer orders, waiting on other contractors; a moving rate, where the drillship is in transit betweenl ocations; a reduced performance rate in the eventofmajor equipment failure;or a force majeure rate in the event of a force majeure that causes the suspension of operations.At these instances we are compensated with a portion of the base rate. In addition there are circumstances that due to equipment failure or other events defined in our drilling contracts, we do not earn the base rate. |

| ● | Mobilization / demobilization fees: In connection with drilling contracts, we may receive revenues for preparation and mobilization of equipment and personnel or for capital improvements to the drilling vessels, dayrate or fixed price mobilization and demobilization fees. |

| ● | Revenue: For each contract, we determine whether the contract, for accounting purposes, is a multiple element arrangement, meaning it contains both a lease element and a drilling services element, and, if so, identify all deliverables (elements). For each element we determine how and when to recognize revenue. |

| Term contracts: These are contracts pursuant to which we agree to operate the unit for a specified period of time. For these types of contracts, we determine whether the arrangement is a multiple element arrangement. For revenues derived from contracts that contain a lease, the lease elements are recognized as "Leasing revenues" in the statement of operations on a basis approximating straight line over the lease period. The drilling services element is recognized as "Service revenues" in the period in which the services are rendered at fair value rates. |

|

Revenues related to the drilling element of mobilization and direct incremental expenses of drilling services are deferred and recognized over the estimated duration of the drilling period.

|

| ● | Vessel Revenues: Vessel revenues primarily include revenues from spot and pool revenues. Vessel revenues are affected by spot rates and the number of days a vessel operates. Vessel revenues are also affected by the mix of business between vessels on spot and vessels in pools. Revenues from vessels in pools are more volatile, as they are typically tied to prevailing market rates. |

| ● | Voyage related and vessel operating costs: Voyage expenses, primarily consisting of commissions, port, canal and bunker expenses that are unique to a particular charter, are paid for by the Company under voyage charter arrangements, except for commissions, which are either paid for by the Company or are deducted from the freight revenue. All voyage and vessel operating expenses are expensed as incurred, except for commissions. Commissions are deferred and amortized over the related voyage charter period to the extent revenue has been deferred since commissions are earned as the Company's revenues are earned. |

| ● | Depreciation: Depreciation expense typically consists of charges related to the depreciation of the historical cost of our fleet (less an estimated residual value) over the estimated useful lives of the vessels. |

| ● | Drydocking: We must periodically drydock each of our vessels for inspection, repairs and maintenance and any modifications to comply with industry certification or governmental requirements. Generally, each vessel is required to be drydocked every 30 months. We directly expense costs incurred during drydocking and costs for routine repairs and maintenance performed during drydocking that do not improve or extend the useful lives of the assets. The number of drydockings undertaken in a given period and the nature of the work performed determine the level of drydocking expenditures. |

| ● | Time Charter Equivalent Rates: Time charter equivalent, or TCE, rates, are a standard industry measure of the average daily revenue performance of a vessel. The TCE rate achieved on a given voyage is expressed in U.S. dollars/day and is generally calculated by subtracting voyage expenses, including bunkers and port charges, from voyage revenue and dividing the net amount (time charter equivalent revenues) by the number of days in the period. |

| ● | Revenue Days: Revenue days are the total number of calendar days our vessels were in our possession during a period, less the total number of off-hire days during the period associated with major repairs or drydockings. Consequently, revenue days represent the total number of days available for the vessel to earn revenue. Idle days, which are days when a vessel is available to earn revenue, yet is not employed, are included in revenue days. We use revenue days to show changes in net voyage revenues between periods. |

| ● | Average Number of Vessels: Historical average number of vessels consists of the average number of vessels that were in our possession during a period. We use average number of vessels primarily to highlight changes in vessel operating costs and depreciation and amortization. |

| ● | .Commercial Pools: To increase vessel utilization to gain economies of scale and thereby revenues, we participate in commercial pools with other shipowners of similar modern, well-maintained vessels. By operating a large number of vessels as an integrated transportation system, commercial pools offer customers greater flexibility and a higher level of service while achieving scheduling efficiencies. Pools employ experienced commercial charterers and operators who have close working relationships with customers and brokers, while technical management is performed by each shipowner. Pools negotiate charters with customers primarily in the spot market. The size and scope of these pools enable them to enhance utilization rates for pool vessels by securing backhaul voyages and COAs, thus generating higher effective TCE revenues than otherwise might be obtainable in the spot market while providing a higher level of service offerings to customers. |

| ● | obtain the charterer's consent to us as the new owner; |

| ● | obtain the charterer's consent to a new technical manager; |

| ● | in some cases, obtain the charterer's consent to a new flag for the vessel; |

| ● | arrange for a new crew for the vessel, and where the vessel is on charter, in some cases, the crew must be approved by the charterer; |

| ● | replace all hired equipment on board, such as gas cylinders and communication equipment; |

| ● | negotiate and enter into new insurance contracts for the vessel through our own insurance brokers; |

| ● | register the vessel under a flag state and perform the related inspections in order to obtain new trading certificates from the flag state; |

| ● | implement a new planned maintenance program for the vessel; and |

| ● | ensure that the new technical manager obtains new certificates for compliance with the safety and vessel security regulations of the flag state. |

| ● | employment and operation of our drybulk and tanker vessels and drilling units; and |

| ● | management of the financial, general and administrative elements involved in the conduct of our business and ownership of our drybulk and tanker vessels and drilling units. |

| ● | vessel maintenance and repair; |

| ● | crew selection and training; |

| ● | vessel spares and stores supply; |

| ● | contingency response planning; |

| ● | onboard safety procedures auditing; |

| ● | accounting; |

| ● | vessel insurance arrangement; |

| ● | vessel chartering; |

| ● | vessel security training and security response plans (ISPS); |

| ● | obtain ISM certification and audit for each vessel within the six months of taking over a vessel; |

| ● | vessel hire management; |

| ● | vessel surveying; and |

| ● | vessel performance monitoring. |

| ● | management of our financial resources, including banking relationships, i.e., administration of bank loans and bank accounts; |

| ● | management of our accounting system and records and financial reporting; |

| ● | administration of the legal and regulatory requirements affecting our business and assets; and |

| ● | management of the relationships with our service providers and customers. |

| ● | Charter rates and periods of charterhire for our drybulk and tanker vessels; |

| ● | dayrates and duration of drilling contracts; |

| ● | utilization of drilling units (earnings efficiency); |

| ● | levels of drybulk and tanker vessel and drilling unit operating expenses; |

| ● | depreciation and amortization expenses; |

| ● | financing costs; and |

| ● | fluctuations in foreign exchange rates. |

| ● | reports by industry analysts and data providers that focus on our industry and related dynamics affecting vessel values; |

| ● | news and industry reports of similar vessel sales; |

| ● | news and industry reports of sales of vessels that are not similar to our vessels where we have made certain adjustments in an attempt to derive information that can be used as part of our estimates; |

| ● | approximate market values for our vessels or similar vessels that we have received from shipbrokers, whether solicited or unsolicited, or that shipbrokers have generally disseminated; |

| ● | offers that we may have received from potential purchasers of our vessels; and |

| ● | vessel sale prices and values of which we are aware through both formal and informal communications with shipowners, shipbrokers, industry analysts and various other shipping industry participants and observers. |

|

Drybulk Vessels

|

Dwt

|

Year Built

|

Carrying Value December 31, 2013

(in millions) ****

|

Carrying Value December 31, 2014

(in millions) ****

|

||||||||||||

|

Montecristo

|

180,263

|

2005

|

33.9

|

**

|

32.2

|

**

|

||||||||||

|

Cohiba

|

174,234

|

2006

|

34.3

|

**

|

32.7

|

**

|

||||||||||

|

Robusto

|

173,949

|

2006

|

34.3

|

**

|

32.7

|

**

|

||||||||||

|

Partagas

|

173,880

|

2004

|

30.3

|

**

|

28.7

|

**

|

||||||||||

|

Capri

|

172,579

|

2001

|

108.0

|

**

|

99.9

|

**

|

||||||||||

|

Manasota

|

171,061

|

2004

|

56.0

|

**

|

52.6

|

**

|

||||||||||

|

Alameda

|

170,662

|

2001

|

47.2

|

**

|

44.0

|

**

|

||||||||||

|

Mystic

|

170,040

|

2008

|

117.8

|

**

|

112.1

|

**

|

||||||||||

|

Flecha

|

170,012

|

2004

|

119.6

|

**

|

112.3

|

**

|

||||||||||

|

Sorrento

|

76,633

|

2004

|

65.8

|

**

|

61.8

|

**

|

||||||||||

|

Mendocino

|

76,623

|

2002

|

29.5

|

**

|

27.5

|

**

|

||||||||||

|

Maganari

|

75,941

|

2001

|

21.0

|

**

|

19.5

|

**

|

||||||||||

|

Saldanha

|

75,707

|

2004

|

54.6

|

**

|

51.1

|

**

|

||||||||||

|

Coronado

|

75,706

|

2000

|

26.3

|

**

|

24.2

|

**

|