Table of Contents

Exhibit 99.2

Table of Contents

|

FROM THE CHAIRMAN

Douglas Penrose, B.Comm, CPA, CA Chairman |

TO OUR SHAREHOLDERS:

You are invited to attend the annual general and special meeting of shareholders of First Majestic Silver Corp. to be held at 10:00 a.m. (Vancouver time) on Thursday, May 23, 2019 at the Sutton Place Hotel, 845 Burrard Street, Vancouver, British Columbia.

The business to be considered at the annual general and special meeting is described in the accompanying Notice of Meeting and Management Information Circular which contains important information about the meeting, voting, the nominees for election as directors, our governance practices and how we compensate our executives and directors.

Your vote is important. We encourage you to participate in this process by voting your shares, and, if possible, by attending the annual general and special meeting where you can consider and vote on a number of important matters.

Thank you for your support as shareholders and I look forward to seeing you at the Meeting.

Douglas Penrose, B.Comm, CPA, CA Chairman |

Table of Contents

|

FROM THE PRESIDENT AND CEO

Keith Neumeyer President and CEO |

TO OUR SHAREHOLDERS:

A long-term focus on growth and profitability This year’s theme of continuing growth in challenging markets has been our focus over the past years, and it remained the same in 2018. As a result of our continued successes in acquisitions, 2018 represented another record year of production. Our focus for the business continues on growth and profitability and stabilizing our performance amidst volatility and changing market dynamics.

Consistent with previous years, we’ve sustained our significant investments in technology, innovation, plant improvements and exploration. These efforts continue uninterrupted into 2019.

Our major milestone in 2018 was the acquisition of Primero Mining, bringing us the exceptional and famous San Dimas mine. This acquisition approximately doubled the size of First Majestic and gave the Company a world-class asset with long life and potential expandability over time. The San Dimas acquisition represents the largest acquisition in First Majestic’s history to date.

In essence, we are working to transform First Majestic into a highly efficient, highly profitable senior mining company while maintaining our status as the world’s purest senior silver producer. Key elements of this plan are technology to reduce costs and improve efficiencies, organic growth through exploration and recruiting senior industry talent to remain focused on these goals.

Through our innovative efforts and multi-year emphasis on the adoption of technology, we can now measure nearly every aspect of our operations. As a result of this oversight, we continue to adopt more advanced tracking measures and cost-cutting programs despite pressures on energy and staffing costs.

Management of First Majestic is very proud of its past two successful acquisitions which now provide 70% of our total metal production. The San Dimas and Santa Elena mines are the cornerstone assets of our Company and are expected to be the engines driving First Majestic forward in the years to come.

In closing, I must note the amazing resilience, hard work and initiative that our First Majestic Family has shown during this persistent difficult market. Not only are we surviving, we are growing, improving and laying crucial groundwork for a bright future ahead. I am most grateful to everyone for their hard work and faith in the Company’s vision.

Keith Neumeyer President and CEO |

Table of Contents

Table of Contents

Table of Contents

This summary highlights information contained in this Management Information Circular (the “Information Circular”). The summary does not contain all of the information that you should consider. Shareholders are encouraged to read the entire Information Circular carefully prior to voting.

Annual General and Special Meeting Details

|

|

Date Thursday, May 23, 2019 |

|

Location The Sutton Place Hotel 845 Burrard Street Vancouver, BC V6Z 2K6 |

|

Time 10:00 a.m. (Vancouver time) |

| Matter to be Voted on

|

Management’s

|

Reference

| ||

|

Election of Directors

|

For each nominee

|

Page 7

| ||

|

Appointment and Remuneration of Auditors

|

For

|

Page 15

| ||

|

Approval of the Long Term Incentive Plan

|

For

|

Page 15

| ||

|

Ratification and approval of the Amendments to the Advance Notice Policy

|

For

|

Page 26

| ||

|

Approval of the Amendment to the Articles to Increase Quorum Requirement

|

For

|

Page 27

| ||

|

Advisory Vote on Executive Compensation

|

For

|

Page 28

|

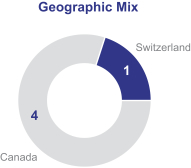

Shareholders will be asked to elect five directors to act as members of the Board until the next annual general meeting of shareholders unless an office is earlier vacated. The following chart provides summary information about each director nominee. Additional information regarding the nominees may be found beginning at page 8 of this Information Circular.

| Name

|

Principal Occupation

|

Year First

|

Independent

|

Committee Participation

| ||||||||

| Audit

|

Corporate

|

Compensation

| ||||||||||

|

Keith Neumeyer

|

President and Chief Executive Officer of the Company

|

1998

|

No

|

|||||||||

|

Douglas Penrose

|

Retired

|

2006

|

Yes

|

Chair

|

●

| |||||||

|

Marjorie Co

|

Business Development Professional/Lawyer

|

2017

|

Yes

|

● | ● | |||||||

|

Robert A. McCallum

|

Retired

|

2005

|

Yes

|

●

|

●

|

Chair

| ||||||

|

David Shaw

|

Mining Investment Consultant

|

2005

|

Yes

|

●

|

Chair

|

|||||||

2019 Management Information Circular 1

Table of Contents

Table of Contents

Part One

This Information Circular is furnished in connection with the solicitation of proxies by the management of First Majestic Silver Corp. (“First Majestic” or the “Company”). The accompanying form of proxy (the “Proxy”) is for use at the Annual General and Special Meeting of shareholders of the Company (the “Meeting”) to be held on May 23, 2019 at the time and place and for the purposes set forth in the accompanying Notice of Meeting and at any adjournment thereof. While it is expected that the solicitation will be primarily by mail, proxies may be solicited personally or by telephone by the directors and employees of the Company (for no additional compensation). The Company may retain other persons or companies to solicit proxies on behalf of management, in which event customary fees for such services will be paid. All costs of solicitation will be borne by the Company.

Unless otherwise indicated, all references in this Information Circular to “$” refer to United States dollars, unless Canadian dollars (C$) are indicated. Unless otherwise indicated, any United States dollar amounts which have been converted from Canadian dollars have been converted at an exchange rate of C$1.00 = US$0.733, being the exchange rate quoted by the Bank of Canada on December 31, 2018.

This Information Circular is dated April 16, 2019. Unless otherwise stated, information in this Information Circular is as of April 1, 2018.

The Company has adopted the notice and access model (“Notice and Access”) provided for under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) for the delivery of the Notice of Meeting, this Information Circular, financial statements and management’s discussion and analysis for the year ended December 31, 2018 (collectively, the “Meeting Materials”) to shareholders for the Meeting. The Company has adopted this alternative means of delivery in order to further its commitment to environmental sustainability and to reduce its printing and mailing costs.

Under Notice and Access, instead of receiving printed copies of the Meeting Materials, shareholders receive a Notice and Access notification containing the Meeting date, location and purpose, as well as information on how they can access the Meeting Materials electronically. Shareholders with existing instructions on their account to receive printed materials will receive a printed copy of the Meeting Materials.

Shareholders who receive a Notice and Access notification can request that printed copies of the Meeting Materials be sent to them by postal delivery at no cost to them up to one year from the date of the filing of this Information Circular on SEDAR. Shareholders with questions about the Notice and Access system, or who would like to request printed copies of the Meeting Materials, should contact the Company’s Corporate Secretary, toll-free, at 1-866-529-2807. A request for printed copies which are required in advance of the Meeting should be made no later than May 9, 2019 in order to allow sufficient time for mailing.

Registered shareholders are persons who hold common shares that are registered directly in their names. Registered shareholders may vote by attending the Meeting, by appointing proxyholders, by telephone or by voting online.

Registered shareholders that wish to vote in person at the Meeting do not need to complete and deposit the form of proxy (the “Proxy”) and should register with the scrutineer at the Meeting.

Registered shareholders that wish to appoint a proxyholder to vote at the Meeting may complete the Proxy. The Proxy names a director and/or officer of the Company as a proxyholder/alternate proxyholder (the “Management Designees”). Registered shareholders that wish to appoint another person (who need not be a shareholder) to serve as proxyholder/alternate proxyholder at the Meeting may do so by striking out the names of the Management Designees and inserting the name(s) of the desired proxyholder/alternate

2019 Management Information Circular 3

Table of Contents

Part One

proxyholder in the blank space provided in the Proxy. Registered shareholders may direct the manner in which their common shares are to be voted or withheld from voting at the Meeting by marking their instructions on the Proxy. Any common shares represented by the Proxy will be voted or withheld from voting by the Management Designees in accordance with the instructions of registered shareholders contained in the Proxy. If there are no instructions, those common shares will be voted “for” each matter set out in the Notice of Meeting. The Proxy grants the proxyholder discretion to vote as such person sees fit on any amendments or variations to matters identified in the Notice of Meeting, or any other matters which may properly come before the Meeting.

At the time of printing of this Information Circular, management knows of no other matters which may come before the Meeting other than those referred to in the Notice of Meeting. No person who is a director of the Company has informed Management that he intends to oppose any action to be taken by Management at the Meeting.

Alternatively, registered shareholders may vote by telephone (1-866-732-8683) or online (www.investorvote.com) using the control number listed on the Proxy.

To be valid, a completed Proxy must be deposited with or telephonic/online votes must be received by Computershare Investor Services Inc. (“Computershare”) by 10:00 a.m. (local time in Vancouver, British Columbia) on May 21, 2019 or at least 48 hours (excluding Saturdays, Sundays and holidays) before any postponement or adjournment of the Meeting.

A Proxy may be revoked by:

(a) completing a Proxy with a later date and depositing it by the time and at the place noted above;

(b) signing and dating a written notice of revocation and delivering it to Computershare, or by transmitting a revocation by telephonic or electronic means, to Computershare, at any time up to and including the last business day preceding the day of the Meeting, or any postponement or adjournment, at which the Proxy is to be used, or delivering a written notice of revocation and delivering it to the Chairman of the Meeting on the day of the Meeting or any postponement or adjournment; or

(c) attending the Meeting or any postponement or adjournment and registering with the scrutineer as a shareholder present in person.

Non-registered shareholders are persons who hold common shares that are registered in the name of an intermediary (such as a broker, bank, trust company, securities dealer, trustees or administrators of RRSP’s, RRIF’s, RESP’s or similar plans) or clearing agency (such as CDS Clearing and Depository Services Inc. or The Depository Trust Company). Non-registered shareholders may vote in person or through a proxyholder at the Meeting or through intermediaries using the voting instruction form (or other form). Alternatively, some non-registered shareholders may be able to vote by telephone or online and should refer to the voting instruction form (or other form) for further details and instructions.

If a non-registered shareholder wishes to vote in person or through a proxyholder at the Meeting, it is critical to follow the required procedures for appointing proxyholders given that the Company does not have unrestricted access to the names of the Company’s non-registered shareholders and accordingly would not otherwise have any record of a non-registered shareholder’s entitlement to vote at the Meeting.

Non-registered shareholders may appoint themselves or nominees as proxyholders using one of the following procedures:

(a) carefully following the instructions for appointing a proxyholder contained in the voting instruction form (or other form) and ensuring that such request is communicated to the appropriate person well in advance of the Meeting and in accordance with such instructions; or

4 First Majestic Silver Corp.

Table of Contents

Part One

(b) unless prohibited by applicable corporate law, submitting any other document in writing to the Company requesting the non-registered shareholder or its nominee be given authority to attend, vote and otherwise act for and on behalf of the registered shareholder in respect of all matters that may come before the Meeting or any postponement or adjournment by 10:00 a.m. (Vancouver, British Columbia time) on May 21, 2019 (or before 72 hours, excluding Saturdays, Sundays and holidays before any postponement or adjournment of the Meeting).

Non-registered shareholders that wish to vote through their intermediaries using the voting instruction form (or other form) accompanying the Notice and Access notification should carefully follow the instructions contained in the voting instruction form (or other form) accompanying the Notice and Access notification and should ensure that such instructions are communicated to the appropriate person well in advance of the Meeting.

Non-registered shareholders should refer to the voting instruction form (or other form) accompanying the Notice and Access notification to determine if telephonic or online voting is available.

Non-registered shareholders that wish to change their voting instructions or to appoint a proxyholder after delivering voting instructions in accordance with the instructions on a voting instruction form (or other form) accompanying the Notice and Access notification should contact the Company’s Corporate Secretary to discuss whether this is possible and what procedures must be followed.

Distribution to Non-Registered Shareholders

Pursuant to the provisions of NI 54-101, the Company is sending the Notice and Access notification to both registered and non-registered shareholders. Non-registered shareholders fall into two categories: those who object to their identity being known to the Company (“OBOs”) and those who do not object to their identity being made known to the Company (“NOBOs”).

The Company is sending the Notice and Access notification directly to NOBOs pursuant to NI 54-101. If you are a non-registered shareholder, and the Company or its agent has sent the Notice and Access notification directly to you, your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf. By choosing to send the Notice and Access notification to you directly, the Company (and not the intermediary holding common shares on your behalf) has assumed responsibility for (i) delivering the Notice and Access notification to you, and (ii) executing your proper voting instructions.

The Company will assume the costs of delivery of proxy-related materials for the Meeting to OBOs.

Voting Shares and Principal Holders Thereof

The authorized capital of the Company consists of an unlimited number of common shares without par value. As at April 1, 2019 there were 199,414,637 common shares without par value issued and outstanding.

Only registered shareholders of record at the close of business on April 1, 2019 (the “Record Date”) who either personally attend the Meeting or who have completed and delivered a Proxy or, non-registered shareholders who have delivered, a voting instruction form, in the manner and subject to the provisions described above shall be entitled to vote or to have their shares voted at the Meeting.

Each shareholder is entitled to one vote for each common share held as of the Record Date. The failure of any shareholder to receive the Notice of Meeting does not deprive such shareholder of his or her entitlement to vote at the Meeting.

To the knowledge of the directors and senior officers of the Company, as of the Record Date, the following person is the only person which beneficially owns or exercises control or direction, directly or indirectly, over shares carrying more than 10% of the voting rights attached to all outstanding shares of the Company:

| Shareholder

|

Number of Shares

|

Percentage of Issued Capital

| ||

|

Wheaton Precious Metals Corp.

|

20,914,590

|

10.5%

|

2019 Management Information Circular 5

Table of Contents

|

BUSINESS OF THE MEETING

|

The Meeting will address the following matters:

| 1. | Receiving the Company’s audited consolidated financial statements for the year ended December 31, 2018, together with the auditor’s report thereon. |

| 2. | Setting the number of directors at five. |

| 3. | Electing the directors who will serve until the next annual general meeting of shareholders. |

| 4. | Appointing the auditors that will serve until the next annual general meeting of shareholders and authorizing the board of directors to set their remuneration. |

| 5. | Considering, and if deemed appropriate, approving by ordinary resolution the adoption of the Long Term Incentive Plan of the Company, as more particularly described herein. |

| 6. | Considering, and if deemed appropriate, approving by ordinary resolution the ratification and approval of the amendment to the Advance Notice Policy adopted by the Board of the Company, as more particularly set in the section of the Information Circular entitled “Ratification and Approval of Advance Notice Policy”. |

| 7. | Considering, and if deemed appropriate, approving by special resolution the alteration to the Company’s Articles to increase the quorum for a meeting of shareholders to two persons present or represented by proxy representing not less than 25% of the outstanding common shares, as more particularly set in the section of the Information Circular entitled “Approval of Amendment to Articles to Increase Quorum Requirements”. |

| 8. | Voting on an advisory resolution with respect to the Company’s approach to executive compensation. |

| 9. | Transacting any such other business as may properly be brought before the Meeting. |

6 First Majestic Silver Corp.

Table of Contents

Part Two

Receiving the Consolidated Financial Statements

The audited financial statements of the Company for the year ended December 31, 2018, together with the auditor’s report on those statements (the “Financial Statements”), will be presented to the shareholders at the Meeting. The Financial Statements are included within the Company’s 2018 Annual Report and are available at www.firstmajestic.com/s/AGM.asp or under the Company’s profile at www.sedar.com. A paper copy may be requested, at no charge to the shareholder, by calling the Corporate Secretary of the Company toll-free at 1-866-529-2807.

The term of office of each of the present directors expires at the close of the Meeting. Management proposes to nominate the persons listed below in “Nominees for Election of Directors” for election as directors at the Meeting and the Management Designees named in the Proxy intend to vote for the election of these nominees. In the absence of instructions to the contrary, all Proxies will be voted “For” the nominees herein listed. Each director elected at the Meeting will hold office until the Company’s next annual general meeting, unless his or her office is earlier vacated. Management does not contemplate that any of the nominees will be unable to serve as a director. In the event that prior to the Meeting any of the listed nominees withdraws or for any other reason will not stand for election at the Meeting, it is intended that discretionary authority shall be exercised by the Management Designees or other proxyholder/alternate proxyholder, as the case may be, named in the Proxy as nominee to vote the shares represented by the Proxy for the election of any other person or persons nominated by the Company to stand for election as directors, unless the shareholder has specified in his, her or its Proxy that the shareholder’s shares are to be withheld from voting on the election of directors.

On April 11, 2013, the Board adopted a policy (the “Majority Voting Policy”) which requires that any nominee for director for which there are a greater number of votes “withheld” than votes “for” his or her election will be required to tender his or her resignation as a director of the Company. The Majority Voting Policy was amended on May 20, 2016 and applies only to uncontested elections, which are elections in which the number of nominees for election as director is equal to the number of positions available on the Board. If a nominee for director is required under the Majority Voting Policy to tender his or her resignation, the Board will refer the resignation to the Compensation and Nominating Committee (except in certain circumstances, in which case the Board will review the resignation without reference to the Compensation and Nominating Committee) which will consider the director’s resignation and will recommend to the Board whether or not to accept it. The Compensation and Nominating Committee will generally be expected to recommend accepting the resignation, except in situations where extraordinary circumstances would warrant the applicable director to continue to serve on the Board. The Board will act on the Compensation and Nominating Committee’s recommendation within 90 days following the certification by the scrutineer of the voting results of the applicable annual meeting and will promptly disclose by press release its decision whether to accept the director’s resignation, including the reasons for rejecting the resignation, if applicable. A director who tenders his or her resignation pursuant to the Majority Voting Policy will not participate in any meeting of the Board or the Compensation and Nominating Committee at which the resignation is considered.

Pursuant to the advance notice policy (the “Advanced Notice Policy”) adopted by the Board of Directors on April 11, 2013, as amended on March 14, 2017 and May 7, 2018, any additional director nominations for the Meeting must be received by the Company in compliance with the Advance Notice Policy no later than the close of business on April 18, 2019. No such nominations have been received by the Company as of the date hereof.

On March 6, 2015, the Board adopted a policy to ensure appropriate and ongoing renewal of the Board of Directors in order to sustain Board performance and maintain Board expertise (the “Director Tenure Policy”). The Director Tenure Policy was amended on December 3, 2015. Pursuant to the Director Tenure Policy, subject to receiving strong annual performance assessments and being annually re-elected by shareholders, non-management members of the Board may serve on the Board for the following terms:

| • | For a maximum of 15 years if such member joined the Board prior to January 1, 2015; or |

| • | For a maximum of 10 years if such member joined the Board on or after January 1, 2015. |

2019 Management Information Circular 7

Table of Contents

Part Two

The Board may, on recommendation from the Compensation and Nominating Committee extend the term of a non-management director who joined the Board on or after January 1, 2015 for a subsequent five year period.

Nominees for Election as Directors

The tables below set out the names of each of management’s nominees for election as directors, the municipality and province or state and country in which each is ordinarily resident, all offices of the Company now held by each of them, each nominee’s principal occupation, business or employment, the period of time for which each nominee has served as a director of the Company and the number of shares of the Company beneficially owned by each nominee, directly or indirectly, or over which each nominee exercised control or direction as at April 1, 2019, and as at December 31, 2018 and 2017. All of the proposed nominees were duly elected as directors at the last Annual General Meeting of shareholders held on May 24, 2018.

8 First Majestic Silver Corp.

Table of Contents

Part Two

|

|

KEITH NEUMEYER Zug, Switzerland

Age: 59

Director since December 1998

Not Independent

Principal Occupation: |

Mr. Neumeyer has worked in the investment community for over 35 years. Mr. Neumeyer began his career at a number of Canadian national brokerage firms and moved on to work with several publicly traded companies in the resource and high technology sectors. His roles have included senior management positions and directorships in the areas of finance, business development, strategic planning and corporate restructuring. Mr. Neumeyer was the original and founding President of First Quantum Minerals Ltd. (T-FM). Mr. Neumeyer founded First Majestic in 2002. Mr. Neumeyer has also listed a number of companies on the Toronto Stock Exchange (“TSX”) and as such has extensive experience dealing with the financial, regulatory, legal and accounting issues that are relevant in the investment community. |

| Primary Skills and Expertise |

2018 Continuing Education | |||

| Strategic Leadership International Business Mergers and Acquisitions Corporate Finance Industry Expertise Risk Management Human Resources Government and Community Relations

|

TD Securities Mining Conference BMO Capital Markets Global Metals & Mining Conference Prospectors & Developers Association of Canada (PDAC) Conference Investment U Conference European Gold Forum BAML Global Metals, Mining and Steel Conference Sprott Natural Resources Symposium Denver Gold Forum International Precious Metals & Commodities Show Zurich Precious Metals Summit Cambridge Silver & Gold Summit Multiple site visits to the Company’s mines | |||

| Voting Results of 2018 Annual General Meeting | ||||

| For |

Withheld | |||

| 98.39% |

1.61% | |||

| Board and Committee Membership and Attendance | ||||

| Board |

13 / 13 100% | |||

| Other Reporting Issuer Directorships | ||||

| First Mining Gold Corp. (Chairman) | ||||

| Options and Common Shares (Held as at April 1, 2019) | ||||||||

| Year |

Options | Common Shares | Total Value of in-the-money Options(1) |

Meets Ownership Guidelines | ||||

| 2019 |

1,350,000 | 3,359,500 | $22,506,293 | Yes | ||||

| Options and Common Shares (Held as at December 31) | ||||||||

| Year |

Options | Common Shares | Total Value of in-the-money Options(2)(3) |

Meets Ownership Guidelines | ||||

| 2018 |

1,340,000 | 3,355,250 | $20,834,136 | Yes | ||||

| 2017 |

1,190,000 | 3,222,000 | $23,863,229 | Yes | ||||

| (1) | The value of the common shares at April 1, 2019 is based on the closing price on the TSX as of April 1, 2019 of C$8.41 converted to $6.31 using the April 1, 2019 exchange rate of $0.75. |

| (2) | The value at December 31, 2018 is based on the closing price on the TSX as of December 31, 2018 of C$8.02 converted to $5.88 at year end exchange rate of $0.733. |

| (3) | The value at December 31, 2017 is based on the closing price on the TSX as of December 31, 2017 of C$8.48 converted to $6.76 at year end exchange rate of $0.7971. |

2019 Management Information Circular 9

Table of Contents

Part Two

|

|

DOUGLAS PENROSE, B. Comm., CPA, CA Summerland, British Columbia, Canada

Age: 71

Director since September 2006

Chairman of the Board since January 1, 2012

Independent

Principal Occupation: Retired |

Mr. Penrose received his Bachelor of Commerce degree from the University of Toronto. He has been a member of the Institute of Chartered Accountants of Ontario from 1974 to 2008 and the Institute of Chartered Accountants of British Columbia since 1978. Mr. Penrose brings over 20 years of experience in leadership positions in accounting and corporate finance. Mr. Penrose was formerly the Vice President of Finance and Corporate Services for the British Columbia Lottery Corporation. |

| Primary Skills and Expertise |

2018 Continuing Education | |||

| Strategic Leadership International Business Mergers and Acquisitions Corporate Finance Industry Expertise Accounting Risk Management Human Resources and Information Technology

|

Site visits to the Company’s mines | |||

| Voting Results of 2018 Annual General Meeting | ||||

| For |

Withheld | |||

| 97.90% |

2.10% | |||

| Board and Committee Membership and Attendance | ||||

| Board |

13 / 13 100% | |||

| Audit Committee (Chair) |

8 / 8 100% | |||

| Corporate Governance Committee |

0 / 0 N/A | |||

| Compensation and Nominating Committee |

1 / 1 100% | |||

| Other Reporting Issuer Directorships |

||||

| None |

||||

| Options and Common Shares (Held as at April 1, 2019) | ||||||||

| Year |

Options | Common Shares | Total Value of in-the-money Options(1) |

Meets Ownership Guidelines | ||||

| 2018 |

204,829 | 60,000 | $658,787 | Yes | ||||

| Options and Common Shares (Held as at December 31) | ||||||||

| Year |

Options | Common Shares | Total Value of in-the-money Options(2)(3) |

Meets Ownership Guidelines | ||||

| 2018 |

205,132 | 60,000 | $587,286 | Yes | ||||

| 2017 |

176,160 | 60,000 | $704,653 | Yes | ||||

| (1) | The value of the common shares at April 1, 2019 is based on the closing price on the TSX as of April 1, 2019 of C$8.41 converted to $6.31 using the April 1, 2019 exchange rate of $0.75. |

| (2) | The value at December 31, 2018 is based on the closing price on the TSX as of December 31, 2018 of C$8.02 converted to $5.88 at year end exchange rate of $0.733. |

| (3) | The value at December 31, 2017 is based on the closing price on the TSX as of December 31, 2017 of C$8.48 converted to $6.76 at year end exchange rate of $0.7971. |

10 First Majestic Silver Corp.

Table of Contents

Part Two

|

|

MARJORIE CO, BSc, LLB, MBA Vancouver, BC

Age: 50

Director since March 2017

Independent

Principal Occupation: |

Ms. Co brings over 20 years of legal, business and corporate development experience. She currently provides business development and legal advice for technology-focused organizations and start-up companies. Her previous roles have included being the Director of Strategic Relations at Westport Innovations and Chief Development Officer at The Proof Centre of Excellence. Ms. Co was called to the British Columbia Bar in 1996 and is a Member of the Law Society of British Columbia. Ms. Co obtained her Master of Business Administration and Bachelor of Laws degrees from the University of British Columbia, and her Bachelor of Science degree from Simon Fraser University. |

| Primary Skills and Expertise |

2018 Continuing Education | |||

| Strategic Leadership International Business Mergers and Acquisitions Corporate Finance Industry Expertise Accounting Risk Management Human Resources

|

Issues and Shareholders’ Remedies in Closely-Held Corporations | |||

| Voting Results of 2018 Annual General Meeting | ||||

| For |

Withheld | |||

| 98.04% |

1.96% | |||

| Board and Committee Membership and Attendance | ||||

| Board |

13 / 13 100% | |||

| Audit |

4 / 4 100% | |||

| Compensation and Nominating |

2 / 2 100% | |||

| Other Reporting Issuer Directorships |

||||

| None |

||||

| Options and Common Shares (Held as at April 1, 2019) | ||||||||

| Year |

Options | Common Shares | Total Value of in-the-money Options(1) |

Meets Ownership Guidelines | ||||

| 2019 |

82,264 | 13,215 | $88,728 | No(4) | ||||

| Options and Common Shares (Held as at December 31) | ||||||||

| Year |

Options | Common Shares | Total Value of in-the-money Options(2)(3) |

Meets Ownership Guidelines | ||||

| 2018 |

50,969 | 13,215 | $77,686 | No(4) | ||||

| 2017 |

21,997 | 4,938 | $33,378 | No(4) | ||||

| (1) | The value of the common shares at April 1, 2019 is based on the closing price on the TSX as of April 1, 2019 of C$8.41 converted to $6.31 using the April 1, 2019 exchange rate of $0.75. |

| (2) | The value at December 31, 2018 is based on the closing price on the TSX as of December 31, 2018 of C$8.02 converted to $5.88 at year end exchange rate of $0.733. |

| (3) | The value at December 31, 2017 is based on the closing price on the TSX as of December 31, 2017 of C$8.48 converted to $6.76 at year end exchange rate of $0.7971. |

| (4) | Ms. Co has five years to comply with the share ownership guidelines. |

2019 Management Information Circular 11

Table of Contents

Part Two

|

|

ROBERT A. McCALLUM, B.Sc., P.Eng North Vancouver, British Columbia, Canada

Age: 82

Director since December 2005

Independent

Principal Occupation: Retired |

Mr. McCallum, now retired, was most recently the president of Kensington Resources Ltd. (“Kensington”), a Canadian public mining company, prior to its merger with Shore Gold Inc. (SGF:TSX) (“Shore Gold”). During Mr. McCallum’s tenure at Kensington, he advanced Kensington from a junior exploration company to an advanced-stage development company, increasing the company’s profile and eventually orchestrating a merger with Shore Gold. Mr. McCallum graduated in 1959 from the University of Witwatersrand, South Africa, with a Bachelor of Engineering (Mining) followed in 1971 by a PMD (Program for Management Development) at Harvard Graduate School of Business, Boston, Massachusetts. He has a wealth of experience in mining having worked with DeBeers Consolidated Mines and Anglo American Corp Ltd. in South Africa followed by Denison Mines Limited, Cyprus Anvil Mining Corp. and Potash Corporation of Saskatchewan in Canada and Philex Mining in the Philippines. |

| Primary Skills and Expertise |

2018 Continuing Education | |||

| Strategic Leadership International Business Mergers and Acquisitions Corporate Finance Operations Industry Expertise Risk Management Human Resources Government and Community Relations

|

International Mining Investment Conference | |||

| Voting Results of 2018 Annual General Meeting | ||||

| For |

Withheld | |||

| 96.26% |

3.74% | |||

| Board and Committee Membership and Attendance | ||||

| Board |

13 / 13 100% | |||

| Audit Committee |

8 / 8 100% | |||

| Corporate Governance Committee |

2 / 2 100% | |||

| Compensation and Nominating Committee |

2 / 2 100% | |||

| Other Reporting Issuer Directorships |

||||

| None |

||||

| Options and Common Shares (Held as at April 1, 2019) | ||||||||

| Year |

Options | Common Shares | Total Value of in-the-money Options(1) |

Meets Ownership Guidelines | ||||

| 2019 |

117,613 | 32,816 | $288,269 | Yes | ||||

| Options and Common Shares (Held as at December 31) | ||||||||

| Year |

Options | Common Shares | Total Value of in-the-money Options(2)(3) |

Meets Ownership Guidelines | ||||

| 2018 |

117,132 | 30,000 | $295,071 | Yes | ||||

| 2017 |

98,160 | 42,000 | $462,717 | Yes | ||||

| (1) | The value of the common shares at April 1, 2019 is based on the closing price on the TSX as of April 1, 2019 of C$8.41 converted to $6.31 using the April 1, 2019 exchange rate of $0.75. |

| (2) | The value at December 31, 2018 is based on the closing price on the TSX as of December 31, 2018 of C$8.02 converted to $5.88 at year end exchange rate of $0.733. |

| (3) | The value at December 31, 2017 is based on the closing price on the TSX as of December 31, 2017 of C$8.48 converted to $6.76 at year end exchange rate of $0.7971. |

12 First Majestic Silver Corp.

Table of Contents

Part Two

|

|

DAVID SHAW, Ph.D. Vancouver, British Columbia Canada

Age: 67

Director since January 2005

Independent

Principal Occupation: Mining Investment Consultant |

Since completing his doctorate over 35 years ago, Mr. Shaw has worked both in the technical and financial communities within the resource industry. Seven years were spent with Chevron Resources (“Chevron”) in Calgary and Vancouver, employed initially as an in-house structural consultant on both metal and hydrocarbon exploration programs and then as a member of a hydrocarbon project financial evaluation team. Upon leaving Chevron, he initiated and developed the Resource Research Group at Charlton Securities Ltd., Calgary before assuming the position of Senior Mining Analyst, Corporate Finance, at Yorkton Securities Inc. in Vancouver. Throughout Mr. Shaw’s career, he has built strong relationships with European financial institutions and the global mining community. |

| Primary Skills and Expertise |

2018 Continuing Education | |||

| Strategic Leadership International Business Mergers and Acquisitions Corporate Finance Industry Expertise Human Resources Government and Community Relations

|

Prospectors & Developers Association of Canada (PDAC) Conference Cambridge Silver & Gold Summit International Precious Metals & Commodities ShowSite visits to the Company’s mines | |||

| Voting Results of 2018 Annual General Meeting | ||||

| For |

Withheld | |||

| 92.81% |

7.19% | |||

| Board and Committee Membership and Attendance | ||||

| Board |

13 / 13 100% | |||

| Corporate Governance Committee (Chair) |

2 / 2 100% | |||

| Compensation and Nominating Committee |

1 / 1 N/A | |||

| Other Reporting Issuer Directorships |

||||

| First Mining Gold Corp. Great Quest Fertilizer Ltd. Medallion Resources Ltd. Cerro de Pasco Resources Inc. |

||||

| Options and Common Shares (Held as at April 1, 2019) | ||||||||

| Year |

Options | Common Shares | Total Value of in-the-money Options(1) |

Meets Ownership Guidelines | ||||

| 2019 |

204,829 | 50,000 | $595,729 | Yes | ||||

| Options and Common Shares (Held as at December 31) | ||||||||

| Year |

Options | Common Shares | Total Value of in-the-money Options(2)(3) |

Meets Ownership Guidelines | ||||

| 2018 |

205,132 | 50,000 | $528,499 | Yes | ||||

| 2017 |

176,160 | 70,000 | $772,247 | Yes | ||||

| (1) | The value of the common shares at April 1, 2019 is based on the closing price on the TSX as of April 1, 2019 of C$8.41 converted to $6.31 using the April 1, 2019 exchange rate of $0.75. |

| (2) | The value at December 31, 2018 is based on the closing price on the TSX as of December 31, 2018 of C$8.02 converted to $5.88 at year end exchange rate of $0.733. |

| (3) | The value at December 31, 2017 is based on the closing price on the TSX as of December 31, 2017 of C$8.48 converted to $6.76 at year end exchange rate of $0.7971. |

2019 Management Information Circular 13

Table of Contents

Part Two

The information as to the municipality and province, state or country of residence, principal occupation, or business or employment and the number of shares beneficially owned by each nominee or over which each nominee exercises control or direction set out above has been furnished by the individual nominees as at April 1, 2019.

No director or proposed director of the Company is, or within the ten years prior to the date of this Information Circular has been, a director, chief executive officer or chief financial officer of any company, including the Company, that while that person was acting in that capacity:

| (a) | was the subject of a cease trade order, similar order or an order that denied the company access to any exemption under securities legislation for a period of more than 30 consecutive days; |

| (b) | was subject to an order issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (c) | within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets. |

No director or proposed director of the Company has, within the ten years prior to the date of this Information Circular, become bankrupt or made a proposal under any legislation relating to bankruptcy or insolvency, or been subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that individual.

As discussed below under “Statement of Corporate Governance Practices – Assessments”, the Board of Directors has adopted an annual formal assessment process. As a part of this process the Board of Directors assesses the skills and expertise necessary to provide effective oversight of the business of the Company. Following is a summary of the skills and expertise possessed by each of the director nominees named in this Information Circular. The lack of a specifically identified area of expertise does not mean that the person in question does not possess the applicable skill or expertise. Rather, a specifically identified area of expertise indicates that the Board of Directors currently relies upon that person for the skill or expertise.

|

Keith

|

Marjorie

|

Robert

|

Douglas

|

David

| ||||||||||

|

Strategic Leadership - Experience guiding strategic direction and growth of an organization, preferably including the management of multiple significant projects and experience with corporate governance.

|

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

|

International Business - Experience working in a major organization that carries on business in one or more international jurisdictions, preferably in countries or regions where the Company has or expects to be developing operations.

|

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

|

Mergers and Acquisitions - Experience with significant mergers and acquisitions and/or investment banking.

|

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

|

Corporate Finance - Experience in the field of finance, specifically in corporate lending/borrowing transactions and public market transactions.

|

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

|

Operations - Senior level experience with a major resource company with mineral reserves, exploration and operations expertise, and particular experience developing and implementing strong safety, environmental and operational standards.

|

✓ | ✓ | ||||||||||||

14 First Majestic Silver Corp.

Table of Contents

Part Two

|

Keith

|

Marjorie

|

Robert

|

Douglas

|

David

| ||||||||||

|

Industry Expertise - Experience in the mining industry, market and international regulatory environment.

|

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

|

Accounting - Experience as a professional accountant, a chief financial officer or a chief executive officer or member of the Audit Committee of a reporting issuer; strong understanding of the financial side of an organization, including familiarity with financial reports, internal financial controls and other financial requirements.

|

✓ | ✓ | ✓ | |||||||||||

|

Risk Management - Experience implementing best practices for risk management, including assessing and addressing potential risks of a major organization.

|

✓ | ✓ | ✓ | ✓ | ||||||||||

|

Human Resources - Experience as a board compensation committee member or senior officer responsible for the oversight of compensation and benefit programs, having particular experience with executive compensation programs.

|

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

|

Information Technology - Experience developing and implementing leading information technology practices at a major organization.

|

✓ | ✓ | ||||||||||||

|

Government and Community Relations - Experience with and fulsome understanding of governmental and public policy and experience developing strong community relations and working relationships with communities and mining regulators in the jurisdictions where the Company operates.

|

✓ | ✓ | ✓ | |||||||||||

|

Environment and Sustainability - Experience with and an understanding of environmental, health and safety issues and sustainable development practices in the mining industry.

|

✓ | |||||||||||||

The auditors for the Company are Deloitte LLP, Independent Registered Public Accounting Firm, of Four Bentall Centre, 2800 – 1055 Dunsmuir Street, Vancouver, British Columbia V7X 1P4. At the Meeting, shareholders will be asked to approve (a) the re-appointment of Deloitte LLP as auditors for the Company to hold office as such until the next Annual General Meeting of the Company and (b) a resolution authorizing the Board of Directors to fix the remuneration to be paid to the auditors for the upcoming year. Deloitte LLP was first appointed as auditors for the Company on December 14, 2004.

Approval of Long Term Incentive Plan

The Board of Directors is seeking shareholder approval for the adoption of a new long term incentive plan (the “2019 LTIP”), subject to regulatory approval, and as more particularly described below to replace the Company’s current stock option plan (the “2017 Stock Option Plan”) which was last approved by shareholders on May 25, 2017. There are currently 10,126,998 stock options outstanding, including 9,927,585, stock options granted under the 2017 Stock Option Plan and 199,413 options outstanding under the stock option plan of Primero Mining Corp. dated May 4, 2016, representing approximately 5.1% of the current outstanding common shares of the Company. The Board of Directors has deemed it appropriate to replace the 2017 Stock Option Plan with the 2019 LTIP to reflect TSX best practices and to allow for the grant of other types of equity incentive award. The Company is therefore seeking approval from the shareholders at the Meeting for the adoption of the 2019 LTIP. If the 2019 LTIP is approved, all prior options granted under the 2017 Stock Option Plan will continue to be governed by the terms of the 2017 Stock Option Plan, however, all incentive awards granted thereafter will be governed by the 2019 LTIP. If the 2019 LTIP is approved, an additional 5,826,172 common shares of the Company will be available for issue upon the exercise, redemption or settlement for all awards granted under the 2019 Plan, which, when combined with common shares available for issue upon the exercise of the outstanding options, represents

2019 Management Information Circular 15

Table of Contents

Part Two

8% of the current outstanding common shares of the Company. The full text of the 2019 LTIP is attached as Appendix “B” to this Information Circular. Capitalized words used in this summary and not otherwise defined have the meaning ascribed to them in the 2019 LTIP.

The Board of Directors is of the view that the 2019 LTIP is required in order to provide additional incentive to the directors, officers, employees, management and others who provide service to the Company to act in the best interests of the Company. If the 2019 LTIP is not approved at the Meeting, previously granted options granted under the 2017 Stock Option Plan will be unaffected, and the 2017 Stock Option Plan will remain in force and effect until May 25, 2020.

The material terms of the 2019 LTIP are set out below.

| • | Maximum Number of Shares Issuable – The maximum number of shares issuable under the 2019 LTIP, together with the number of shares issuable under any other Security-Based Compensation Arrangements of the Company, shall not in the aggregate exceed 8% of the issued and outstanding shares of the Company (calculated as at the grant date of such Awards), provided that the maximum number of Share Units (which includes Restricted Share Units, Performance Share Units and Deferred Share Units) will not exceed 1.0% of the issued and outstanding shares of the Company (calculated as at the grant date of such Awards). |

| • | Types of Awards – Pursuant to the 2019 LTIP, the Company may issue Options, Restricted Share Units, Performance Share Units and Deferred Share Units. |

| • | Plan Limits – When combined with all of the Company’s other security-based compensation arrangements, the 2019 LTIP shall not result in: |

| • | the number of Shares issuable to any one person at any time exceeding 5% of the issued and outstanding Shares; |

| • | the number of Shares issued to Insiders within a one-year period exceeding 8% of the issued and outstanding Shares; or |

| • | the number of Shares issuable to Insiders at any time exceeding 8% of the issued and outstanding Shares. |

The 2019 LTIP shall not result in:

| • | the number of Shares issuable to all non-executive directors of the Company exceeding 1% of the issued and outstanding Shares at such time; or |

| • | the number of Shares issuable to any one non-executive director within a one-year period exceeding an Award value of $150,000 per such non-executive director, of which no more than $100,000 may comprise Options based on a valuation method acceptable to the Board. |

Options

| • | Stock Option Terms and Exercise Price – The number of Shares subject to each Option grant, the exercise price, vesting, expiry date and other terms and conditions thereof will be determined by the Board. The exercise price of each Option shall in no event be lower than the Market Price of the Shares on the grant date. |

| • | Term – Unless otherwise specified at the time of grant, Options shall expire 10 years from the date of grant, unless terminated earlier in accordance with the 2019 LTIP. Options that otherwise expire during a trading blackout shall be extended until ten trading days following the expiration of the blackout period. |

| • | Vesting Schedule – Options vest and become exercisable in 25% increments on each of the 12 month, 18 month, 24 month and 30 month anniversaries from the grant date. Options granted to the Chief Executive Officer of the Corporation which have an initial expiry date which is more than five years after the Award Date shall instead vest in equal portions on each of the first, second, third, fourth and fifth anniversaries of the Award Date. |

| • | Exercise of Option – A participant may exercise vested Options by (i) payment of the exercise price per Share subject to each Option, or (ii) if permitted by the Board, on a cashless basis by receiving that number of Shares equal to the current Market Price less the Option Price multiplied by the number of Options exercised as the numerator, divided by the current Market Price, as the denominator. |

16 First Majestic Silver Corp.

Table of Contents

Part Two

| • | Circumstances Causing Cessation of Entitlement – If a Participant ceases to be a Director, Employee or Consultant of the Company, the Options will vest and expire in accordance with Section 5.5 of the 2019 LTIP. A summary of these provisions for Directors and Employees in contained in the table below: |

(a) If the Participant is an Employee:

|

Reason for Termination

|

Vesting

|

Expiry of Option

|

||||

| Death or Disability |

Any Options held by a Participant on the date of death or disability and which are unvested as of such date will not vest. |

The expiry date of the Options will be the earlier of (i) the expiry date established under Section 5.2(c) of the 2019 LTIP and (ii) one year from the date of death or Disability of the Participant.

|

||||

| Change in Control |

Options will vest in accordance with Section 11 of the 2019 LTIP.

|

Options expire in accordance with Section 11 of the 2019 LTIP.

|

||||

| Ceasing to be Employed for Employee Cause Event |

Any Options which are unvested as of the date the Participant ceases to be an Employee will not vest, unless determined otherwise by the Board.

|

The expiry date of the Options will be the date the Participant ceases to be an Employee. |

||||

| Mandatory Retirement |

All unvested Options of the Participant will immediately vest and become immediately exercisable |

The expiry date of the Options will be the earlier of (i) the expiry date established under Section 5.2(c) of the 2019 LTIP and (ii) one year from the date of retirement.

|

||||

| Ceasing to be Employed but continues to be engaged as a Director or Consultant

|

The vesting of the Options will continue as set out in the Option Award Agreement.

|

The expiry date of the Options will remain unchanged. |

||||

| Ceasing to be Employed other than as set out above |

Any Options which are unvested as of the date the Participant ceases to be an Employee will not vest, unless determined otherwise by the Board. |

The expiry date of the Options will be the earlier of (i) the expiry date established under Section 5.2(c) of the 2019 LTIP and (ii) the 60th day following the date the Participant ceases to be an Employee.

|

||||

(b) If the Participant is a Director:

|

Reason for Termination

|

Vesting

|

Expiry of Option

|

||||

| Death or Disability |

Unvested Options will automatically vest in full as of the date of death or disability and become immediately exercisable. |

The expiry date of the Options will be the earlier of (i) the expiry date established under Section 5.2(c) of the 2019 LTIP and (ii) one year from the date of death or Disability of the Participant.

|

||||

| Change in Control |

Options will vest in accordance with Section 11 of the 2019 LTIP.

|

Options expire in accordance with Section 11 of the 2019 LTIP.

|

||||

| Ceasing to Hold Office but continues to be engaged as an Employee or Consultant

|

The vesting of the Options will continue as set out in the Option Award Agreement.

|

The expiry date of the Options will remain unchanged. |

||||

| Ceasing to Hold Office for Director Cause Event |

Any Options held by Participant on the date the Participant ceases to be a Director which are unvested as of such date will not vest.

|

The expiry date of the Options will be the date the Participant ceases to be a Director. |

||||

2019 Management Information Circular 17

Table of Contents

Part Two

|

Reason for Termination

|

Vesting

|

Expiry of Option

|

||||

| Mandatory Retirement |

All unvested Options of the Participant will immediately vest and become immediately exercisable |

The expiry date of the Options will be the earlier of (i) the expiry date established under Section 5.2(c) of the 2019 LTIP and (ii) one year from the date the Participant ceases to be a Director.

|

||||

| Ceasing to Hold Office other than as set out above |

All unvested Options of the Participant will immediately vest and become immediately exercisable. |

The expiry date of the Options will be the earlier of (i) the expiry date established under Section 5.2(c) of the 2019 LTIP and (ii) the 180th day following the date the Participant ceases to be a Director.

|

||||

(c) If the Participant is a Consultant:

|

Reason for Termination

|

Vesting

|

Expiry of Option

|

||||

| Death or Disability |

Any Options held by a Participant on the date of death or Disability and which are unvested as of such date will not vest. |

The expiry date of the Options will be the earlier of (i) the expiry date established under Section 5.2(c) of the 2019 LTIP and (ii) one year from the date of death or Disability of the Participant.

|

||||

| Change in Control |

Options will vest in accordance with Section 11 of the 2019 LTIP.

|

Options expire in accordance with Section 11 of the 2019 LTIP.

|

||||

| Ceasing to be a Consultant due to completion/termination of contract |

Any Options which are unvested as of the date the Participant ceases to be a Consultant will not vest, unless determined otherwise by the Board |

The expiry date of the Options will be the earlier of (i) the expiry date established under Section 5.2(c) of the 2019 LTIP and (ii) the 60th day following the date the Participant ceases to be a Consultant

|

||||

| Ceasing to be a Consultant due to completion/termination of contract but continues to be engaged as a Director or Employee

|

The vesting of the Options will continue as set out in the Option Award Agreement. |

The expiry date of the Options will remain unchanged. |

||||

| Ceasing to be a Consultant and concurrently hired and becomes an Employee |

The Options previously granted to the Consultant will flow through to the Employee on the same terms and conditions of the original grant of Options.

|

The Options previously granted to the Consultant will flow through to the Employee on the same terms and conditions of the original grant of Options.

|

||||

Restricted Share Units and Performance Share Units

| • | Terms – Restricted Share Units and Performance Share Units are notional securities that entitle the recipient to receive cash or Shares at the end of a vesting period. Vesting of Performance Share Units is contingent upon achieving certain performance criteria, thus ensuring greater alignment with the long-term interests of shareholders. The terms applicable to Restricted Share Units and Performance Share Units under the 2019 LTIP (including the vesting schedule, performance cycle, performance criteria for vesting and whether dividend equivalents will be credited to a participant’s account) are determined by the Board at the time of the grant. |

18 First Majestic Silver Corp.

Table of Contents

Part Two

| • | Vesting – Unless otherwise provided, Restricted Share Units typically vest in three equal instalments on the first three anniversaries of the date the Restricted Share Unit was granted. Unless otherwise noted, Performance Share Units shall vest as at the date that is the end of their specified performance cycle, subject to any performance criteria having been satisfied. |

| • | Settlement – On settlement, the Company shall, for each vested Restricted Share Unit or Performance Share Unit being settled, deliver to a Participant either (a) one Share, (b) a cash payment equal to the Market Price of one Share as of the vesting date, or (c) any combination of cash and Shares equal to the Market Price of one Share as of the vesting date, at the discretion of the Board. |

| • | Dividend Equivalents – As dividends are declared, additional Restricted Share Units and Performance Share Units may be credited to a Participant in an amount equal to the greatest whole number which may be obtained by dividing (i) the value of such dividend or distribution on the payment date therefore by (ii) the Market Price of one Share on such date. |

| • | Circumstances Causing Cessation of Entitlement – If a Participant ceases to be a Director, Employee or Consultant of the Company, the Restricted Share Units and Performance Share Units will be treated in accordance with Section 7.6 and 6.6 of the 2019 LTIP respectively. A summary of these provisions for Directors and Employees in contained in the table below: |

(a) Restricted Share Units – If the Participant is an Employee:

|

Reason for Termination

|

Treatment of Restricted Share Units

|

|||

| Death or Disability |

Outstanding Restricted Share Units that were vested on or before the date of death or disability will be settled as of the date of death or disability. Outstanding Restricted Share Units that were not vested on or before the date of death or disability will in all respects terminate as of the date of death or disability.

|

|||

| Change in Control

|

Restricted Share Units vest in accordance with Section 11 of the 2019 LTIP.

|

|||

| Ceasing to be Employed for Employee Cause Event

|

Outstanding Restricted Share Units (whether vested or unvested) will automatically terminate on the date the Participant ceases to be an Employee.

|

|||

| Mandatory Retirement |

Outstanding Restricted Share Units that were vested on or before the date the Participant ceases to be an Employee will be settled as of the date the Participant ceases to be an Employee. Outstanding Restricted Share Units that would have vested on the next vesting date following the date the Participant ceases to be an Employee will vest and be settled as of such vesting date. Subject to the foregoing, any remaining Restricted Share Units will in all respects terminate as of the date the Participant ceases to be an Employee.

|

|||

| Ceasing to be Employed but continues to be engaged as a Director or Consultant

|

Outstanding Restricted Share Units will continue to vest pursuant to the RSU Award Agreement. |

|||

| Ceasing to be Employed other than as set out above |

Outstanding Restricted Share Units that were vested on or before the date the Participant ceases to be an Employee will be settled as of the date the Participant ceases to be an Employee. Outstanding Restricted Share Units that would have vested on the next vesting date following the date the Participant ceases to be an Employee will vest and be settled as of such vesting date. Subject to the foregoing, any remaining Restricted Share Units will in all respects terminate as of the date the Participant ceases to be an Employee.

|

|||

2019 Management Information Circular 19

Table of Contents

Part Two

(b) Restricted Share Units – If the Participant is a Director:

|

Reason for Termination

|

Treatment of Restricted Share Units

|

|||

| Death or Disability |

Outstanding Restricted Share Units that were vested on or before the date of death or disability will be settled as of the date of death or disability. Outstanding Restricted Share Units that would have vested on the next vesting date following the date of death or disability will vest and be settled as of the date of death or disability, prorated to reflect the actual period between the Grant Date and the date of death or disability. Subject to the foregoing, any remaining Restricted Share Units will in all respects terminate as of the date of death or disability.

|

|||

| Change in Control

|

Restricted Share Units vest in accordance with Section 11 of the 2019 LTIP. |

|||

| Ceasing to Hold Office but continues to be engaged as an Employee or Consultant

|

Outstanding Restricted Share Units will continue to vest pursuant to the RSU Award Agreement. |

|||

| Ceasing to Hold Office for Director Cause Event

|

Outstanding Restricted Share Units (whether vested or unvested) will automatically terminate on the date the Participant ceases to be a Director.

|

|||

| Ceasing to Hold Office other than as set out above including Mandatory Retirement

|

Outstanding Restricted Share Units that were vested on or before the date the Participant ceases to be a Director will be settled as of the date of the Participant ceases to be a Director. Outstanding Restricted Share Units that would have vested on the next vesting date following the date the Participant ceases to be a Director will vest and be settled as of such vesting date. Subject to the foregoing, any remaining Restricted Share Units will in all respects terminate as of the date the Participant ceases to be a Director.

|

|||

(c) Restricted Share Units – If the Participant is a Consultant:

|

Reason for Termination

|

Treatment of Restricted Share Units

|

|||

| Death or Disability |

Outstanding Restricted Share Units that were vested on or before the date of death or Disability will be settled as of the date of death. Outstanding Restricted Share Units that were not vested on or before the date of death or Disability will in all respects terminate as of the date of death or Disability.

|

|||

| Change in Control

|

Restricted Share Units vest in accordance with Section 11 of the 2019 LTIP.

|

|||

| Ceasing to be a Consultant due to completion/termination of contract

|

Outstanding Restricted Share Units (whether vested or unvested) will automatically terminate on the date the Participant ceases to be a Consultant. |

|||

| Ceasing to be a Consultant due to completion/termination of contract but continues to be engaged as a Director or Employee

|

Outstanding Restricted Share Units will continue to vest pursuant to the RSU Award Agreement. |

|||

| Ceasing to be a Consultant and concurrently hired and becomes an Employee

|

The Restricted Share Units previously granted to the Consultant will flow through to the Employee on the same terms and conditions of the original grant of Restricted Share Units.

|

|||

20 First Majestic Silver Corp.

Table of Contents

Part Two

(d) Performance Share Units – If the Participant is an Employee:

|

Reason for Termination

|

Treatment of Performance Share Units

|

|||

| Death or Disability |

Outstanding Performance Share Units that were vested on or before the date of death or disability will be settled as of the date of death or disability. Outstanding Performance Share Units that were not vested on or before the date of death or disability will in all respects terminate as of the date of death or disability.

|

|||

| Change in Control

|

Performance Share Units vest in accordance with Section 11 of the 2019 LTIP.

|

|||

| Ceasing to be Employed for Employee Cause Event

|

Outstanding Performance Share Units (whether vested or unvested) will automatically terminate on the date the Participant ceases to be an Employee.

|

|||

| Mandatory Retirement |

Outstanding Performance Share Units that were vested on or before the date the Participant ceases to be an Employee will be settled as of the date the Participant ceases to be an Employee. Outstanding Performance Share Units that would have vested on the next vesting date following the date the Participant ceases to be an Employee, prorated to reflect the actual period between the commencement of the performance cycle and the date the Participant ceases to be an Employee, based on the Participant’s performance for the applicable performance period(s) up to the date the Participant ceases to be an Employee, will be settled as of such vesting date. Subject to the foregoing, any remaining Performance Share Units will in all respects terminate as of the date the Participant ceases to be an Employee.

|

|||

| Ceasing to be Employed but continues to be engaged as a Director or Consultant

|

Outstanding Performance Share Units will continue to vest pursuant to the PSU Award Agreement.

|

|||

| Ceasing to be Employed other than as set out above |

Outstanding Performance Share Units that were vested on or before the date the Participant ceases to be an Employee will be settled as of the date the Participant ceases to be an Employee. Outstanding Performance Share Units that would have vested on the next vesting date following the date the Participant ceases to be an Employee, prorated to reflect the actual period between the commencement of the performance cycle and the date the Participant ceases to be an Employee, based on the Participant’s performance for the applicable performance period(s) up to the date the Participant ceases to be an Employee, will be settled as of such vesting date. Subject to the foregoing, any remaining Performance Share Units will in all respects terminate as of the date the Participant ceases to be an Employee.

|

|||

(e) Performance Share Units – If the Participant is a Director:

|

Reason for Termination

|

Treatment of Performance Share Units

|

|||

| Death or Disability |

Outstanding Performance Share Units that were vested on or before the date of death or disability will be settled as of the date of death or disability. Outstanding Performance Share Units that were not vested on or before the date of death or disability will vest and be settled as of the date of death or disability, prorated to reflect the actual period between the commencement of the performance cycle and the date of death or disability, based on the Participant’s performance for the applicable performance period(s) up to the date of death or disability. Subject to the foregoing, any remaining Performance Share Units will in all respects terminate as of the date of death or disability.

|

|||

2019 Management Information Circular 21

Table of Contents

Part Two

|

Reason for Termination

|

Treatment of Performance Share Units

|

|||

| Change in Control

|

Performance Share Units vest in accordance with Section 11 of the 2019 LTIP.

|

|||

| Ceasing to Hold Office but continues to be engaged as an Employee or Consultant

|

Outstanding Performance Share Units will continue to vest pursuant to the PSU Award Agreement. |

|||

| Ceasing to Hold Office for Director Cause Event

|

Outstanding Performance Share Units (whether vested or unvested) will automatically terminate on the date the Participant ceases to be a Director.

|

|||

| Ceasing to Hold Office other than as set out above including Mandatory Retirement |

Outstanding Performance Share Units that were vested on or before the date the Participant ceases to be a Director will be settled as of the date the Participant ceases to be a Director. Outstanding Performance Share Units that would have vested on the next vesting date following the date the Participant ceases to be a Director, prorated to reflect the actual period between the commencement of the performance cycle and the date the Participant ceases to be a Director, based on the Participant’s performance for the applicable performance period(s) up to the date the Participant ceases to be a Director, will be settled as of such vesting date. Subject to the foregoing, any remaining Performance Share Units will in all respects terminate as of the date the Participant ceases to be a Director.

|

|||

(f) Performance Share Units – If the Participant is a Consultant

|

Reason for Termination

|

Treatment of Performance Share Units

|

|||

| Death or Disability |

Outstanding Performance Share Units that were vested on or before the date of death or Disability will be settled as of the date of death or disability. Outstanding Performance Share Units that were not vested on or before the date of death or Disability will in all respects terminate as of the date of death.

|

|||

| Change in Control |

Performance Share Units vest in accordance with Section 11 of the 2019 LTIP.

|

|||

| Ceasing to be a Consultant due to completion/termination of contract

|

Outstanding Performance Share Units (whether vested or unvested) will automatically terminate on the date the Participant ceases to be a Consultant. |

|||

| Ceasing to be a Consultant due to completion/termination of contract but continues to be engaged as a Director or Employee

|

Outstanding Performance Share Units will continue to vest pursuant to the PSU Award Agreement. |

|||

| Ceasing to be a Consultant and concurrently hired and becomes an Employee

|

The Performance Share Units previously granted to the Consultant will flow through to the Employee on the same terms and conditions of the original grant of Performance Share Units.

|

|||

Deferred Share Units

| • | Terms – A Deferred Share Unit is a notional security that entitles the recipient to receive cash or Shares upon termination of the holder from all positions with the Company The terms applicable to Deferred Share Units under the 2019 LTIP (including whether dividend equivalents will be credited to a Participant’s DSU Account) are determined by the Board at the time of the grant. |

Under the 2019 LTIP, the Board may grant discretionary Deferred Share Units and mandatory or elective Deferred Share Units that are granted as a component of a non-executive director’s annual retainer or an officer or employee’s annual incentive.

| • | Vesting – Unless otherwise provided, mandatory or elective Deferred Share Units vest immediately and the Board determines the vesting schedule for discretionary Deferred Share Units at the time of grant. |

22 First Majestic Silver Corp.

Table of Contents

Part Two

| • | Settlement – Deferred Share Units may only be settled after the DSU Separation Date. At the grant date, the Board shall stipulate whether the Deferred Share Units are paid in cash, Shares, or a combination of both, in an amount equal to the Market Price of the notional Shares represented by the Deferred Share Units in the Participant’s DSU Account. |

| • | Credit to Account – As dividends are declared, additional Deferred Share Units may be credited to a Participant in an amount equal to the greatest whole number which may be obtained by dividing (i) the value of such dividend or distribution on the payment date therefore by (ii) the Market Price of one Share on such date. |

| • | Circumstances Causing Cessation of Entitlement – If a Participant ceases to be a Director, Employee or Consultant of the Company, the Deferred Share Units will be treated in accordance with Section 8.6 of the 2019 LTIP. A summary of these provisions for Directors and Employees is contained in the table below: |

(a) If the Participant is an Employee:

|

Reason for Termination

|

Treatment of Deferred Share Units

|

|||

| Death or Disability |

Outstanding Deferred Share Units that were vested on or before the date of death or disability will be settled as of the date of death or disability. Outstanding Deferred Share Units that were not vested on or before the date of death or disability will in all respects terminate as of the date of death or disability.

|

|||

| Change in Control

|

Deferred Share Units vest in accordance with Section 11 of the 2019 LTIP.

|

|||

| Ceasing to be Employed for Employee Cause Event

|

Outstanding Deferred Share Units (whether vested or unvested) will automatically terminate on the date the Participant ceases to be an Employee.

|

|||

| Mandatory Retirement |