UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

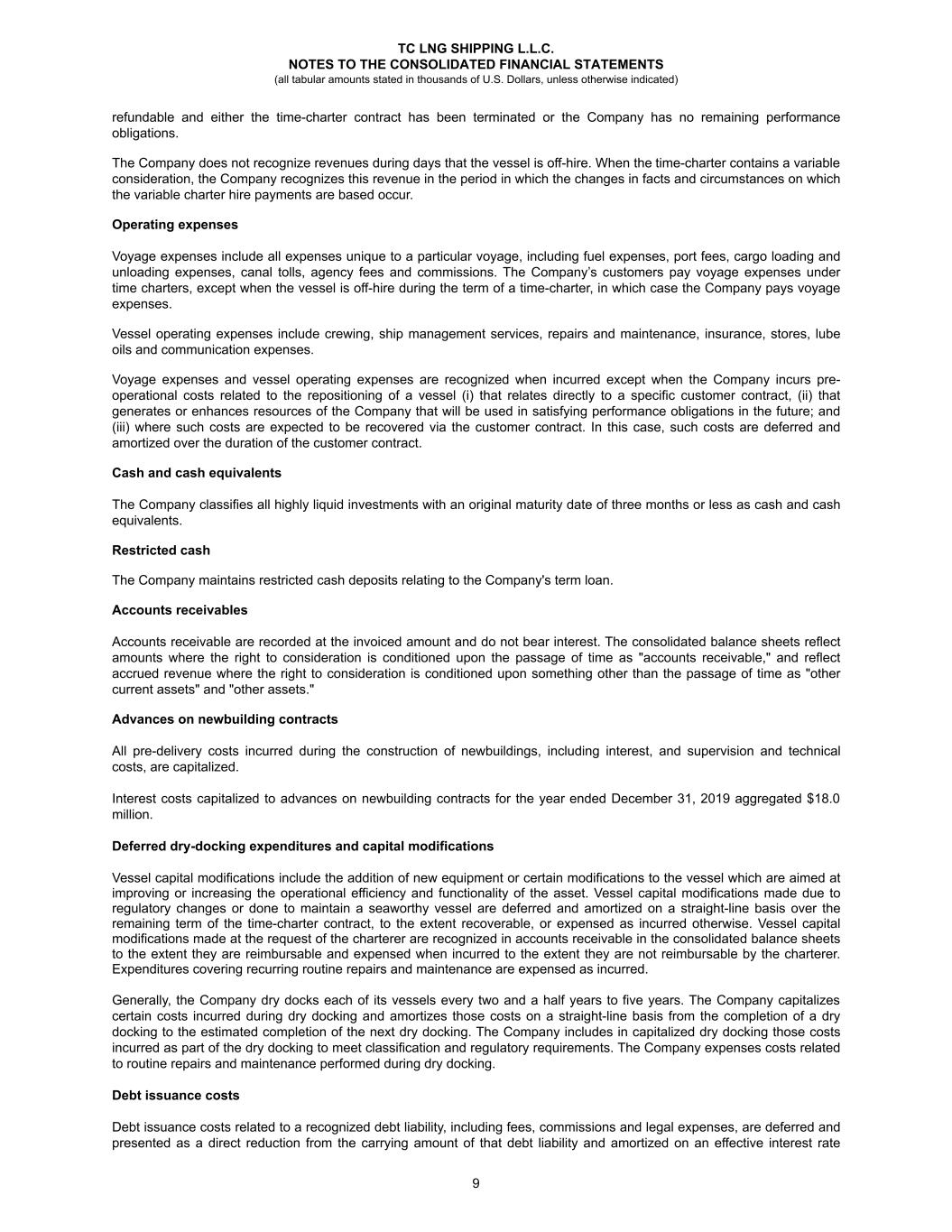

_______________________________

FORM 20-F

_______________________________

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2021

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

Date of event requiring this shell company report

For the transition period from to

Commission file number 1-32479

_______________________________

(Exact name of Registrant as specified in its charter)

_______________________________

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Telephone: (604 ) 844-6609

Email: Enquiries@seapeak.com

(Name, Telephone, Email and/or Facsimile number and Address of company Contact Person)

Securities registered, or to be registered, pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

Securities registered, or to be registered, pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

_______________________________

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ý | Accelerated Filer | ¨ | Non-Accelerated Filer | ¨ | Emerging growth company | ||||||||||||||||||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ý No ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ý | International Financial Reporting Standards as issued by the International Accounting Standards Board | ¨ | Other | ¨ | |||||||||||||

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ý

Auditor Name: KPMG LLP Auditor Location: Vancouver BC, Canada Auditor Firm ID: 85

SEAPEAK LLC

INDEX TO REPORT ON FORM 20-F

| Page | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 4A. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 8. | ||||||||

1

| Item 9. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16A. | ||||||||

| Item 16B. | ||||||||

| Item 16C. | ||||||||

| Item 16D. | ||||||||

| Item 16E. | ||||||||

| Item 16F. | ||||||||

| Item 16G. | ||||||||

| Item 16H. | ||||||||

| Item 17. | ||||||||

| Item 18. | ||||||||

| Item 19. | ||||||||

2

PART I

This Annual Report should be read in conjunction with the consolidated financial statements and accompanying notes included in this report.

Unless otherwise indicated, references in this Annual Report to “Seapeak,” the “Company,” “we,” “us” and “our” and similar terms refer to Seapeak LLC (formerly Teekay LNG Partners L.P.) and/or one or more of its subsidiaries, except that those terms, when used in this Annual Report in connection with common units or the preferred units described herein, shall mean specifically Seapeak LLC. References in this Annual Report to (a) the “Partnership” refer to Teekay LNG Partners L.P. prior to its conversion from a Marshall Islands limited partnership into a Marshall Islands limited liability company and its renaming as Seapeak LLC on February 25, 2022 and (b) “Teekay GP” or the “General Partner” refer to Teekay GP L.L.C., the general partner of the Partnership.

In addition to historical information, this Annual Report contains forward-looking statements that involve risks and uncertainties. Such forward-looking statements relate to future events and our operations, objectives, expectations, performance, financial condition and intentions. When used in this Annual Report, the words “expect,” “intend,” “plan,” “believe,” “anticipate,” “estimate” and variations of such words and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this Annual Report include, in particular, statements regarding:

•our ability to make cash distributions on our preferred units;

•our future financial condition and results of operations, our future revenues, expenses and capital expenditures, and our expected financial flexibility to pursue capital expenditures, acquisitions and other expansion opportunities, including vessel acquisitions;

•our liquidity needs and meeting our going concern requirements, including our anticipated funds and sources of financing for liquidity and working capital needs and the sufficiency of cash flows, and our estimation that we will have sufficient liquidity for at least a one-year period;

•our ability to obtain financing, including new bank financings, and to refinance existing indebtedness;

•the expected scope, duration and effects of the novel coronavirus (or COVID-19) pandemic, and the consequences of any future epidemic or pandemic crises;

•growth prospects and future trends of the markets in which we operate;

•our expectations regarding demand in the gas industry;

•our expectations regarding tax liabilities, including whether applicable tax authorities may agree with our tax positions;

•liquefied natural gas (or LNG) and liquefied petroleum gas (or LPG) market fundamentals, including the balance of supply and demand in the LNG and LPG markets, estimated growth in size of the world LNG and LPG fleets and spot LNG and LPG charter rates;

•our expectations as to the useful lives of our vessels;

•our expectations and estimates regarding future charter business, including with respect to minimum charter hire payments, revenues and our vessels’ ability to perform to specifications and maintain their hire rates in the future;

•our expectations regarding the ability of our customers to make charter payments to us;

•our ability to maximize the use of our vessels, including the redeployment or disposition of vessels no longer under long-term charter or whose charter contract is expiring in 2022 and 2023;

•the impact of the invasion of Ukraine by Russia on the economy, our industry and our business, including as the result of sanctions on Russian companies and individuals and any retaliatory measures by Russia or other countries in response;

•the adequacy of our insurance coverage, less any applicable deductible;

•the possibility of future resumption of the LNG plant in Yemen operated by Yemen LNG Company Limited (or YLNG) and the repayment of deferred hire amounts from YLNG on our two 52%-owned vessels, the Marib Spirit and Arwa Spirit;

•our ability to continue to derive a significant portion of our revenues and cash flow from a limited number of customers;

•our continued ability to enter into long-term, fixed-rate time-charters with our LNG and LPG customers;

•obtaining LNG and LPG projects that we bid on;

•our expectations regarding the performance of the receiving and regasification terminal in Bahrain owned by Bahrain LNG W.L.L., a joint venture owned by us (30%), the Kingdom of Bahrain's Ministry of Oil and Gas (formerly National Oil & Gas Authority) (30%), Gulf Investment Corporation (24%) and Samsung C&T (16%) (or the Bahrain LNG Joint Venture);

•our ability to obtain all permits, licenses, and certificates with respect to the conduct of our operations;

•the impact and expected cost of, and our ability and plans to comply with, new and existing governmental regulations and maritime self-regulatory organization standards applicable to our business, including the expected cost to install ballast water treatment systems on our vessels;

•the impact on our business of heightened awareness of and concern with climate change, including on demand for our services and alternative energy sources to LNG and LPG;

•the expected impact of heightened environmental and quality concerns of insurance underwriters, regulators and charterers;

3

•the expected impact of the cessation of the London Inter-bank Offered Rate (or LIBOR), adoption of the "Poseidon Principles" by financial institutions or any change in jurisdictional economic substance requirements;

•the future valuation or impairment of our assets, including goodwill;

•our hedging activities relating to foreign exchange, interest rate and spot market risks, and the effects of fluctuations in foreign currency exchange, interest rate and spot market rates on our business and results of operations;

•the potential impact of new accounting standards guidance or the adoption of new accounting standards;

•our ability to maintain good relationships with the labor unions that work with us;

•the outcome of pending litigation and claims; and

•our business strategy and other plans and objectives for future operations, including our Environmental, Social and Governance (or ESG) initiatives.

Forward-looking statements involve known and unknown risks and are based upon a number of assumptions and estimates that are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially include, but are not limited to, those factors discussed in “Item 3 – Key Information: Risk Factors,” and other factors detailed from time to time in other reports we file with or furnish to the U.S. Securities and Exchange Commission (or the SEC).

We do not intend to revise any forward-looking statements in order to reflect any change in our expectations or events or circumstances that may subsequently arise. You should carefully review and consider the various disclosures included in this Annual Report and in our other filings made with the SEC that attempt to advise interested parties of the risks and factors that may affect our business prospects and results of operations.

Item 1.Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2.Offer Statistics and Expected Timetable

Not applicable.

Item 3.Key Information

RISK FACTORS

Some of the risks summarized below and discussed in greater detail in the following pages relate principally to the industry in which we operate and to our business in general. Other risks relate principally to the securities market and to ownership of our preferred units. The occurrence of any of the events described in this section could materially and adversely affect our business, financial condition, operating results and ability to pay distributions on, and the trading price of, our preferred units.

Risk Factor Summary

Risks Related to Our Industry

•The COVID-19 pandemic is dynamic. The continuation of the pandemic, or the emergence of other epidemic or pandemic crises, could have material adverse effects on our business, results of operations, or financial condition.

•Our future performance depends on growth in LNG production, demand and supply for LNG and LPG, and LNG and LPG shipping.

•Adverse economic conditions or other developments, including disruptions in the global credit markets, could adversely affect our business and may affect our customers’ ability to pay for our services.

•Significant declines in natural gas and oil prices may adversely affect our growth prospects and results of operations.

•If the active short-term, medium-term or spot LNG shipping markets continue to develop, entering into long-term, fixed-rate LNG time-charters may be difficult.

•Marine transportation incidents involving any of our vessels could harm our business.

•Terrorist attacks, increased hostilities, political change or war could lead to further economic instability, increased costs and business disruption.

•Acts of piracy on ocean-going vessels continue to be a risk, which could adversely affect our business.

Risks Related to Our Business

•We may not have sufficient cash from operations to enable us to pay distributions on our preferred units.

•Over time, the value of our vessels may decline, which could result in both write-downs and an adverse effect on our operating results.

•Substantial operations outside the United States expose us and our customers to political, governmental and economic instability, which could harm our operations.

4

•We depend on certain of our joint venture partners to assist us in operating our business.

•We may be unable to charter or recharter vessels at attractive rates, which may lead to reduced revenues and profitability.

•The loss of any key customer, charter or vessel, or any material adjustment to our charter contracts could result in a significant loss of revenues and cash flow.

•Financing agreements containing operating and financial restrictions may restrict our business and financing activities.

•We may make substantial capital expenditures to expand the size of our fleet or gas business, which may impact our liquidity position.

•Any capital expenditures may impact our liquidity position. Funding of any capital expenditures with debt may significantly increase our interest expense and financial leverage. Our failure to obtain the funds for necessary future capital expenditures could have a material adverse effect on our business.

•Our substantial debt levels may limit our flexibility in obtaining additional financing, refinancing credit facilities upon maturity, and pursuing other business opportunities.

•Restrictions in our debt agreements may prevent us from paying distributions on our preferred units.

•We and certain of our joint venture partners may be unable to attract and retain qualified, skilled employees or crew necessary to operate our business, or may have to pay substantially increased costs for our employees and crew.

•Changes in the LPG markets could result in decreased demand for our LPG vessels operating in the spot market.

•We may face substantial competition to expand relationships with existing customers and obtain new customers.

•We have recognized vessel and goodwill write-downs in the past and we may recognize additional write-downs in the future.

•Increased technological innovation in vessel design or equipment could reduce the competitive capability of certain of our vessels, our charter hire rates and the value of vessels.

•Actual results of new technologies or vessel upgrades may differ from expected results and affect our results of operations.

•We or our partners may be exposed to conditions or requirements that adversely affect us or our joint venture.

•Implementing our strategy through acquisitions may harm our business and we may not realize expected benefits.

•Our insurance may not be sufficient to cover losses that may occur to our property or result from our operations.

•Sanctions against participants in the Yamal LNG Project could impede its performance of the project.

•Failure, shutdown or other adverse events impacting the Yamal LNG Project may result in our inability to re-deploy the ARC7 LNG carriers.

•We assume credit risk by entering into agreements with unrated entities.

•Exposure to currency exchange rate fluctuations will result in fluctuations in our cash flows and operating results.

•Exposure to interest rate fluctuations will result in fluctuations in our cash flows and operating results.

•Increased regulatory oversight, uncertainty relating to the nature and timing of the potential phasing out of LIBOR, and agreement on any new alternative reference rates may adversely impact our ability to manage our exposure to fluctuations in interest rates and borrowing costs.

•Many of our seafaring employees are covered by collective bargaining agreements and the failure to renew those agreements or any future labor agreements may disrupt our operations and adversely affect our cash flows.

•Our directors and officers and Stonepeak Partners L.P. (or Stonepeak) and its other affiliates have conflicts of interest and limited or no fiduciary duties, which may permit them to favor their own interests to those of us or our unitholders.

•Except in limited circumstances, our board of directors (or Board) has the power and authority to conduct our business without member approval.

•Our joint venture arrangements impose obligations upon us but in certain circumstances limit our control of the joint ventures, which may affect our ability to achieve our joint venture objectives.

Legal and Regulatory Risks

•Climate change and greenhouse gas (or GHG) restrictions may adversely impact our operations and markets.

•Increasing scrutiny and changing expectations with respect to ESG policies and practices may impose additional costs on us or expose us to additional risks.

•The marine energy transportation industry is subject to substantial environmental and other regulations.

•Regulations relating to ballast water discharge may adversely affect our operational results and financial condition.

•Failure to comply with anti-bribery legislation could result in fines, criminal penalties, contract terminations and an adverse effect on our business.

•Our operations may be subject to economic substance requirements in the Marshall Islands and other offshore jurisdictions, which could impact our business.

5

Information and Technology Risks

•A cyber-attack could materially disrupt our business.

•Our failure to comply with data privacy laws could damage our relationships and expose us to litigation risks and fines.

Risks Related to an Investment in Our Securities

•It may be difficult to serve us with legal process or enforce judgments against us, our directors or our management.

Tax Risks

•U.S. tax authorities could treat us as a “passive foreign investment company” (or PFIC) which could have adverse U.S. federal income tax consequences to U.S. holders.

•We are subject to taxes, which may reduce our liquidity position. In addition, unitholders may be subject to Canadian withholding tax on distributions if we are determined to be resident in Canada.

•Unitholders may be subject to income tax in one or more non-U.S. countries as a result of owning our units if we are considered to be carrying on business there, which may require a tax return to be filed and taxes to be paid.

Risks Related to Our Industry

The COVID-19 pandemic is dynamic. The continuation of this pandemic, and the emergence of other epidemic or pandemic crises, could have material adverse effects on our business, results of operations, or financial condition.

The ongoing spread of COVID-19, including the developments of variants of the virus, and the emergence of other epidemic or pandemic crises, may negatively impact our business, results of operations and financial condition. Although global demand for LNG has remained relatively stable, the COVID-19 pandemic has resulted in volatility in global demand for LPG and crude oil. As our business includes the transportation of LNG and LPG, any significant decrease in demand for the cargo we transport could adversely affect demand for our services. COVID-19 has also increased certain crewing-related costs, which has reduced our cash flows, and the pandemic was a contributing factor to a reduction in vessel values which resulted in the write-down of certain of our multi-gas vessels during the year ended December 31, 2020, as described in "Item 18 - Financial Statements: Note 19a - (Write-down) and Gain on Sales of Vessels".

Other effects of the current pandemic include, or may include, among others:

•disruptions to our operations as a result of the potential health impact on our employees and crew, and on the workforces of our customers and business partners;

•supply chain and other business disruptions from, or additional costs related to, a limited supply of labor, parts or goods;

•disruptions to our business from, or additional costs related to, new regulations, directives or practices implemented in response to the pandemic, such as travel restrictions (including for any of our onshore personnel or any of our crew members to timely embark or disembark from our vessels), increased inspection regimes, hygiene measures (such as quarantining and physical distancing) or increased implementation of remote working arrangements;

•potential delays in the loading and discharging of cargo on or from our vessels, and any related off hire due to quarantine, worker health, or vetting requirements or regulations, which in turn could disrupt our operations and result in a reduction of revenue;

•potential shortages or a lack of access to required spare parts for our vessels, or potential delays in any repairs to, or scheduled or unscheduled maintenance or modifications or dry docking of, our vessels (including the currently scheduled drydocks for 19 of our LNG and LPG carriers in 2022), as a result of a lack of berths available by shipyards from a shortage in labor or due to other business disruptions;

•potential delays in vessel inspections and related certifications by class societies, customers or government agencies;

•potential reduced cash flows and financial condition, including potential liquidity constraints;

•reduced access to capital, including the ability to refinance any existing obligations, as a result of any credit tightening generally or due to declines in global financial markets;

•a reduced ability to opportunistically sell any of our LNG or LPG vessels on the second-hand market, either as a result of a lack of buyers or a general decline in the value of second-hand vessels;

•a decline in the market value of our vessels, which may cause us to (a) incur additional impairment charges or (b) breach certain covenants under our financing agreements (including our secured facility agreements and financial leases) relating to vessel-to-loan covenants;

•disruptions, delays or cancellations in the construction of new LNG projects (including production, liquefaction, regasification, storage and distribution facilities), which could limit or adversely affect our ability to pursue future growth opportunities; and

•potential deterioration in the financial condition and prospects of our customers or joint venture or business partners, or attempts by customers or third parties to invoke force majeure contractual clauses as a result of delays or other disruptions.

6

Although we have taken measures to limit the impact of COVID-19 on business continuity, including implementation of a “work from home” policy for shore-based employees, as required depending on each location, and the commencement of select rotations of our shore personnel where possible, these and other measures may not be sufficient to protect our business against the impact of COVID-19.

Our future performance and ability to secure future employment for our LNG and LPG vessels depends on growth (including any continued growth) in LNG production, demand and supply for LNG and LPG, and associated demand and supply for LNG and LPG shipping.

Our future performance, including our ability to strengthen our balance sheet and to profitably employ and expand our fleet, will depend on growth in LNG production, demand and supply for LNG and LPG, and associated demand and supply for LNG and LPG shipping services. Accordingly, our future performance depends on growth in world and regional demand and supply for LNG and LPG, and marine transportation of LNG and LPG, as well as the supply of LNG and LPG. Demand or supply for LNG and LPG and for the marine transportation of LNG and LPG could be negatively affected by a number of factors, such as:

•increases in the cost of natural gas derived from LNG relative to the cost of natural gas generally;

•increases in the cost of LPG relative to the cost of naphtha and other competing petrochemicals;

•increases in the production of natural gas in areas linked by pipelines to consuming areas, the extension of existing, or the development of new, pipeline systems in markets we may serve, or the conversion of existing non-natural gas pipelines to natural gas pipelines in those markets;

•decreases in the consumption of natural gas due to increases in its price relative to other energy sources, such as oil, or other factors making consumption of natural gas less attractive;

•increases in availability of additional sources of natural gas, including shale gas;

•increases in the number of LNG or LPG newbuilding vessels, which could lead to an oversupply of vessels in the market and in turn create downward pressure on the demand for LNG and LPG shipping services;

•changes in weather patterns leading to warmer winters in the northern hemisphere and lower gas demand in the traditional peak heating season;

•increases in availability of alternative or renewable energy sources; and

•negative global or regional economic or political conditions, particularly in LNG and LPG consuming regions, which could reduce energy consumption or its growth, including labor or political unrest or military conflicts affecting existing or proposed areas of LNG production or regasification.

Furthermore, spot charter rates initially came under pressure commencing in 2020 due to the impact of the COVID-19 pandemic. In addition, trading prices of our preferred units have been volatile due in part to the recent impact of the pandemic on the energy markets and global macro events, and which may also be affected by the impact of the Russian invasion of Ukraine. The ongoing pandemic and such invasion may significantly impact global economic activity (including the demand for LNG and LPG, and associated shipping rates, which may in turn negatively affect our spot chartered vessels) and may disrupt, delay or lead to cancellations of the construction of new LNG projects (including production, liquefaction, regasification, storage and distribution facilities), which could negatively affect our business, results of operations and financial condition.

Reduced demand for LNG and LPG shipping could have a material adverse effect on our future growth and could harm our business, results of operations and financial condition.

Adverse economic conditions or other developments may affect our customers’ ability to charter our vessels and pay for our services and may adversely affect our business, financial condition and results of operations.

Adverse economic conditions or other developments relating directly to our customers may lead to a decline in our customers’ operations or ability to pay for our services, which could result in decreased demand for our vessels and services. Our customers’ inability to pay for any reason could also result in their default on our current contracts and charters. The decline in the amount of services requested by our customers or their default on our contracts with them could have a material adverse effect on our business, financial condition and results of operations.

Adverse economic conditions, including disruptions in the global credit markets, could adversely affect our business, financial condition, and results of operations.

Economic downturns and financial crises in the global markets could produce illiquidity in the capital markets, market volatility, increased exposure to interest rate and credit risks and reduced access to capital markets. If global financial markets and economic conditions significantly deteriorate in the future, we may face restricted access to the capital markets or bank lending, which may make it more difficult and costly to fund future growth. Decreased access to such resources could have a material adverse effect on our business, financial condition and results of operations.

7

Significant declines in natural gas and oil prices may adversely affect our growth prospects and results of operations.

Low energy prices may negatively affect both the competitiveness of natural gas as a fuel for power generation and the market price of natural gas, to the extent that natural gas prices are benchmarked to the price of crude oil. Low energy prices may adversely affect, and may continue to adversely affect energy and capital markets and available sources of financing for our capital expenditures and debt repayment obligations. A sustained low energy price environment may adversely affect our business, results of operations and financial condition and our ability to make cash distributions as a result of, among other things, the following events which are beyond our control:

•fluctuations in worldwide and regional supply of and demand for natural gas;

•a reduction in exploration for or development of new natural gas reserves or projects, or the delay or cancellation of existing projects as energy companies lower their capital expenditures budgets, which may reduce our growth opportunities;

•lower demand for vessels of the types we own and operate, which may reduce available charter rates and revenue to us upon redeployment of our vessels following expiration or termination of existing contracts or upon the initial chartering of vessels, or which may result in extended periods of our vessels being idle between contracts;

•customers potentially seeking to renegotiate or terminate existing vessel contracts, or failing to extend or renew contracts upon expiration, or seeking to negotiate cancellable contracts;

•the inability or refusal of customers to make charter payments to us or to our joint ventures, due to financial constraints or otherwise; or

•declines in vessel values, which may result in losses to us upon vessel sales or impairment charges against our earnings.

We may have more difficulty entering into long-term, fixed-rate LNG time-charters if the active short-term, medium-term or spot LNG shipping markets continue to develop.

LNG shipping historically has been transacted with long-term, fixed-rate time-charters, usually with terms ranging from 15 to 20 years. One of our principal strategies is to enter into additional long-term, fixed-rate LNG time-charters. In recent years, the amount of LNG traded on a spot and short-term basis (defined as contracts with a duration of three years or less) has been increasing.

If the active spot, short-term or medium-term markets continue to develop, we may have increased difficulty entering into long-term, fixed-rate time-charters for our LNG carriers and, as a result, our cash flow may decrease and be less stable. In addition, an active short-term, medium-term or spot LNG shipping market may require us to enter into charters with rates based on changing market prices, as opposed to contracts based on a fixed rate, which could result in a decrease in our cash flow in periods when the market price for shipping LNG is depressed.

Marine transportation is inherently risky, and an incident involving significant loss of or environmental contamination by any of our vessels could harm our reputation and business.

Our vessels, crew and cargoes are at risk of being damaged, injured or lost because of events such as:

•marine disasters;

•bad weather or natural disasters;

•mechanical failures;

•grounding, fire, explosions and collisions;

•piracy (hijacking and kidnapping);

•cyber-attack;

•acute-onset illness in connection with global or regional pandemics or similar public health crises;

•mental health of crew members;

•human error; and

•war and terrorism.

An accident involving any of our vessels could result in any of the following:

•significant litigation with our customers or other third parties;

•death or injury to persons, loss of property or environmental damage;

•delays in the delivery of cargo;

•liabilities or costs to recover any spilled oil and to restore the environment affected by the spill;

•loss of revenues from or termination of charter contracts;

•governmental fines, penalties or restrictions on conducting business;

•higher insurance rates; and

•damage to our reputation and customer relationships generally.

8

Any of these results could have a material adverse effect on our business, financial condition and operating results. In addition, any damage to, or environmental contamination involving, oil production facilities serviced by our vessels could result in the suspension or curtailment of operations by our customer, which would in turn result in loss of revenues.

Terrorist attacks, increased hostilities, political change or war could lead to further economic instability, increased costs and business disruption.

Terrorist attacks, and current or future conflicts in Ukraine, the Middle East, Libya, East Asia, South East Asia, West Africa and elsewhere, and political change, may adversely affect our business, operating results, financial condition, and ability to raise capital and future growth. Recent hostilities in Ukraine, the Middle East, especially among Qatar, Saudi Arabia, the United Arab Emirates, Iran, Yemen and elsewhere may lead to additional armed conflicts or to further acts of terrorism and civil disturbance in the United States, or elsewhere, which may contribute to economic instability and disruption of LNG and LPG production and distribution, which could result in reduced demand for our services or impact on our operations and or our ability to conduct business.

Furthermore, Russia's recent invasion of Ukraine, in addition to sanctions announced in February and March 2022 by President Biden and several European and world leaders and nations against Russia and any further sanctions, may also adversely impact our business given Russia’s role as a major global exporter of crude oil and natural gas. Our business could be harmed by trade tariffs, trade embargoes or other economic sanctions by the United States or other countries against Russia, companies with Russian connections or the Russian energy sector and harmed by any retaliatory measures by Russia or other countries in response. While much uncertainty remains regarding the global impact of the Russia's invasion of Ukraine, it is possible that such tensions could adversely affect our business, financial condition, results of operation and cash flows. In addition, it is possible that third parties with which we have charter contracts may be impacted by events in Russia and Ukraine, which could adversely affect our operations and financial condition.

LNG and LPG facilities, shipyards, vessels, pipelines and gas fields could be targets of future terrorist attacks and warlike operations and our vessels could be targets of hijackers, terrorists or warlike operations. Any such attacks could lead to, among other things, bodily injury or loss of life, vessel or other property damage, increased vessel operational costs, including insurance costs, and the inability to transport LNG and LPG to or from certain locations. Terrorist attacks, war, hijacking or other events beyond our control that adversely affect the distribution, production or transportation of LNG and LPG to be shipped by us could entitle our customers to terminate our charter contracts, which would harm our cash flow and our business.

Terrorist attacks, or the perception that LNG or LPG facilities and carriers are potential terrorist targets, could materially and adversely affect the expansion of LNG and LPG infrastructure and the continued supply and export of LNG and LPG involving the United States and other countries. Concern that LNG or LPG facilities may be targeted for attack by terrorists, as well as environmental concerns, has contributed to significant community resistance to the construction of a number of LNG or LPG facilities, primarily in North America. If a terrorist incident involving an LNG or LPG facility or LNG or LPG carrier did occur, in addition to the possible effects identified in the previous paragraph, the incident may adversely affect the construction of additional LNG or LPG facilities in the United States and other countries or lead to the temporary or permanent closing of various LNG or LPG facilities currently in operation.

Acts of piracy on ocean-going vessels continue to be a risk, which could adversely affect our business.

Acts of piracy have historically affected ocean-going vessels trading in regions of the world such as the South China Sea, Gulf of Guinea and the Indian Ocean off the coast of Somalia. While there continues to be a significant risk of piracy incidents in the Southern Red Sea, Gulf of Aden and Indian Ocean, recently there have been increases in the frequency and severity of piracy incidents off the coast of West Africa and a resurgent risk of piracy and/or armed robbery in the Straits of Malacca, Sulu & Celebes Sea, Gulf of Mexico and surrounding waters. If these piracy attacks result in regions in which our vessels are deployed being named on the Joint War Committee Listed Areas, war risk insurance premiums payable for such coverage may increase significantly and such insurance coverage may be more difficult to obtain. In addition, crew costs, including costs which may be incurred to the extent we employ on-board security guards and escort vessels, could increase in such circumstances. We may not be adequately insured to cover losses from these incidents, which could have a material adverse effect on us. In addition, hijacking as a result of an act of piracy against our vessels, or an increase in cost or unavailability of insurance for our vessels, could have a material adverse impact on our business, financial condition and results of operations.

Risks Related to Our Business

We may not have sufficient cash from operations to enable us to pay distributions on our preferred units.

Our ability to pay distributions on our preferred units principally depends upon our ability to continue generating cash from our operations, which may fluctuate based on, among other things:

•the rates we obtain from our charters and the performance by our charterers of their obligations under the charters;

•the expiration of charter contracts;

•the charterers' option to terminate charter contracts or repurchase vessels, in either case upon our breach of the relevant contract, or payment of any applicable early termination or repurchase amounts;

•the occurrence of off-hire days;

•the utilization levels of our vessels trading in the spot or short-term market;

•the level of our operating costs, such as the cost of crews and insurance;

•the continued availability of LNG and LPG production, liquefaction and regasification facilities;

9

•the number of unscheduled off-hire days for our fleet and the timing of, and number of days required for, scheduled dry docking of our vessels;

•prevailing global and regional economic and political conditions;

•currency exchange rate fluctuations;

•the effect of governmental regulations and maritime self-regulatory organization standards on the conduct of our business; and

•limitations on obtaining cash distributions from joint venture entities due to similar restrictions on the joint venture entities.

The actual amount of cash we will have available for distribution also will depend on factors such as:

•the level of capital expenditures we make, including for maintaining or repairing vessels, building new vessels, acquiring existing vessels and complying with regulations;

•our debt service requirements, financial covenants and restrictions on distributions contained in our debt instruments;

•fluctuations in our working capital needs;

•our ability to make working capital borrowings, including to pay distributions to unitholders; and

•the amount of any cash reserves, including reserves for future capital expenditures, anticipated future credit needs and other matters, established by our Board, in its discretion.

Over time, the value of our vessels may decline, which could adversely affect our operating results.

Vessel values for LNG and LPG carriers can fluctuate substantially over time due to a number of different factors, including:

•prevailing economic conditions in natural gas and energy markets;

•a substantial or extended decline in demand for natural gas, LNG or LPG;

•competition from more technologically advanced vessels;

•the age of the vessel relative to other alternative vessels that are available in the market;

•increases in the supply of vessel capacity; and

•the cost of retrofitting or modifying existing vessels, as a result of technological advances in vessel design or equipment, changes in applicable environmental or other regulation or standards, or otherwise.

Vessel values may decline from existing levels. If the operation of a vessel is not profitable, or if we cannot redeploy a chartered vessel at attractive rates upon charter termination, rather than continue to incur costs to maintain and finance the vessel, we may seek to dispose of it. Our inability to dispose of the vessel at a fair market value or the disposal of the vessel at a fair market value that is lower than its book value could result in a loss on its sale and adversely affect our results of operations and financial condition. Further, if we determine at any time that a vessel’s future useful life and earnings require us to impair its value on our financial statements, we may need to recognize a significant charge against our earnings.

Our and many of our customers’ substantial operations outside the United States expose us and them to political, governmental and economic instability, which could harm our operations.

Because our operations, and the operations of certain of our customers, are primarily conducted outside of the United States, they may be affected by economic, political and governmental conditions in the countries where we or our customers engage in business or where our vessels are registered. Any disruption caused by these factors could harm our business or the business of these customers, including through reduction in the levels of oil and gas exploration, development and production activities in these areas or restricting the pool of customers. We derive some of our revenues from shipping LNG and LPG from politically and economically unstable regions, such as Angola and Yemen. In addition, our vessels may transit through high risk areas such as the Gulf of Aden or Strait of Hormuz. Hostilities, strikes, or other political or economic instability in regions where we or these customers operate or where we or they may operate could have a material adverse effect on the growth of our business, results of operations and financial condition and ability to make cash distributions, or on the ability of these customers to make payments or otherwise perform their obligations to us.

In addition, tariffs, trade embargoes and other economic sanctions by the United States or other countries against countries in which we operate, or to which we trade, or to which we or any of our customers, joint venture partners or business partners become subject, may harm our business. For example, general trade tensions between the United States and China escalated in 2018 and continued through much of 2019, with the United States imposing a series of tariffs on China and China responding by imposing tariffs on United States products. Although during the last quarter of 2019, the United States and China negotiated an agreement to reduce trade tensions which became effective in February 2020, our business could be harmed by increasing trade protectionism or trade tensions between the United States and China, as well as any trade embargoes or other economic sanctions by the United States or other countries against countries in the Middle East, Asia, Russia or elsewhere as a result of terrorist attacks, hostilities, or diplomatic or political pressures that limit trading activities with those countries. In addition, sanctions imposed on certain Russian companies and individuals starting in 2014 based on Russia's involvement in divesting control by Ukraine of the Crimea region and sanctions announced in February and March 2022 by President Biden and several European and world leaders and nations against Russia and any further sanctions may also adversely impact our business, given Russia’s role as a major global exporter of crude oil and natural gas. Further, a government could requisition one or more of our vessels, which is most likely during war or national emergency. Any such requisition would cause a loss of the vessel and could harm our cash flow and financial results. Please see below relating to our two vessels chartered out to YLNG in “Item 3 – Risk Factors: We derive a substantial majority of our revenues from a limited number of customers, and the loss of any customer, charter or vessel, or any adjustment to our charter contracts could result in a significant loss of revenues and cash flow.”

10

We depend on certain of our joint venture partners to assist us in operating our business and competing in our markets.

We have entered into, and expect to enter into additional, joint venture arrangements with third parties to expand our fleet and access growth opportunities. In particular, we rely on the expertise and relationships that our joint ventures and joint venture partners may have with current and potential customers to jointly pursue LNG and LPG projects and provide assistance in competing in new markets.

Our ability to compete for the transportation requirements of certain LNG and LPG projects, enter into new charter contracts, secure financings and expand our customer relationships depends in part on our ability to leverage our relationships with our joint venture partners and their reputations and relationships in the shipping industry. If certain of our joint venture partners suffer material damage to their reputations or relationships it may harm our ability to:

•renew existing charters upon their expiration;

•obtain new charters;

•successfully interact with shipyards during periods of shipyard construction constraints;

•obtain financing on commercially acceptable terms; or

•maintain satisfactory relationships with our employees and suppliers.

If our ability to do any of the things described above is impaired, it could have a material adverse effect on our business, results of operations and financial condition and our ability to make cash distributions to unitholders.

We may be unable to charter or recharter vessels at attractive rates, which may lead to reduced revenues and profitability.

Our ability to charter or recharter our LNG and LPG carriers upon the expiration or termination of their current time charters and the charter rates payable under any renewal or replacement charters depend upon, among other things, the then current states of the LNG and LPG carrier markets. As of December 31, 2021, in our LNG and LPG operating fleet, including the Magellan Spirit chartered-in from 52%-owned joint venture with Marubeni Corporation (or the MALT Joint Venture), we had zero and three vessels, respectively, that were trading in the spot market; we had four and 13 vessels, respectively, with charters scheduled to expire in 2022, excluding extension options; and three and six vessels, respectively, with charters scheduled to expire in 2023, excluding extension options. If charter rates are low when existing time charters expire, we may be required to recharter our vessels at reduced rates or even possibly at a rate whereby we incur a loss, which would harm our results of operations. Alternatively, we may determine to leave such vessels off-charter, which would also harm our results of operations. The size of the current orderbooks for LNG carriers and LPG carriers is expected to result in the increase in the size of the world LNG and LPG fleets over the next few years. An over-supply of vessel capacity, combined with stability or any decline in the demand for LNG or LPG carriers, may result in a reduction of charter hire rates.

We derive a substantial majority of our revenues from a limited number of customers, and the loss of any customer, charter or vessel, or any adjustment to our charter contracts could result in a significant loss of revenues and cash flow.

We have derived, and believe that we will continue to derive, a significant portion of our revenues and cash flow from a limited number of customers. Please read “Item 18 – Financial Statements: Note 4 – Segment Reporting.”

We could lose a customer or the benefits of a time-charter if:

•the customer fails to make charter payments because of its financial inability, disagreements with us or otherwise;

•we agree to reduce the charter payments due to us under a charter because of the customer’s inability to continue making the original payments;

•upon our breach of the relevant contract, the customer exercises certain rights to terminate the charter, purchase or cause the sale of the vessel or, under some of our charters, convert the time-charter to a bareboat charter (some of which rights are exercisable at any time);

•the customer terminates the charter because we fail to deliver the vessel within a fixed period of time, the vessel is lost or damaged beyond repair, there are serious deficiencies in the vessel or prolonged periods of off-hire, or we default under the charter;

•under some of our time-charters, the customer terminates the charter because of the termination of the charterer’s sales agreement or a prolonged force majeure event affecting the customer, including damage to or destruction of relevant facilities, war or political unrest preventing us from performing services for that customer; or

•the customer becomes subject to applicable sanctions laws which prohibit our ability to lawfully charter our vessel to such customer.

Two of the six MALT LNG Carriers in our 52%-owned MALT Joint Venture, the Marib Spirit and Arwa Spirit, were chartered-out to Yemen LNG under long-term charter contracts with YLNG. However, due to the political unrest in Yemen, YLNG decided to temporarily close operation of its LNG plant in Yemen in 2015. As a result, commencing January 1, 2016, the MALT Joint Venture agreed to successive deferral arrangements with YLNG pursuant to which a portion of the charter payments were deferred. Concurrently with the expiration of the most recent deferral arrangement, in February 2022, the MALT Joint Venture entered into a second suspension agreement with YLNG (or the Second Suspension Agreement) pursuant to which the MALT Joint Venture and YLNG agreed to suspend the two charter contracts for a further period of up to three years beyond the expiry of the Original Suspension Agreement. Please read “Item 5 – Operating and Financial Review and Prospects: Significant Developments in 2021 and Early 2022 – Charter Contracts for MALT LNG Carriers."

If we lose a key LNG time-charter, we may be unable to redeploy the related vessel on terms as favorable to us due to the long-term nature of most LNG time-charters and fluctuations in the LNG spot market. If we are unable to redeploy a LNG carrier, we will not receive any revenues from that

11

vessel, but we may be required to pay expenses necessary to maintain the vessel in proper operating condition. In addition, if a customer exercises its right to purchase a vessel, we would not receive any further revenue from the vessel and may be unable to obtain a substitute vessel and charter. This may cause us to receive decreased revenue and cash flows from having fewer vessels operating in our fleet. Any compensation under our charters for a purchase of the vessels may not adequately compensate us for the loss of the vessel and related time-charter.

The loss of certain of our customers, time-charters or vessels, or a decline in payments under our charters, could have a material adverse effect on our business, results of operations and financial condition and our ability to make cash distributions to unitholders.

Financing agreements containing operating and financial restrictions may restrict our business and financing activities.

The operating and financial restrictions and covenants in our financing arrangements and any future financing agreements could adversely affect our ability to finance future operations or capital needs or to pursue and expand our business activities. For example, these financing arrangements may restrict our ability to:

•incur or guarantee indebtedness;

•change ownership or structure, including mergers, consolidations, liquidations and dissolutions;

•make dividends or distributions when in default of the relevant loans;

•make certain negative pledges and grant certain liens;

•sell, transfer, assign or convey assets;

•make certain investments; and

•enter into new lines of business.

Some of our financing arrangements require us to maintain a minimum level of tangible net worth, to maintain certain ratios of vessel values as it relates to the relevant outstanding principal balance, to maintain a minimum level of aggregate liquidity, to maintain leverage below a maximum level and require certain of our subsidiaries to maintain restricted cash deposits. Please read "Item 5 – Operating and Financial Review and Prospects: Credit Facilities and Finance Leases." Our ability to comply with covenants and restrictions contained in debt instruments and finance lease obligations may be affected by events beyond our control, including prevailing economic, financial and industry conditions, and in certain cases the ability of our joint venture partners to comply with applicable laws and regulations (including business corruption and sanctions regulations). If any such events were to occur, compliance with these covenants may be impaired. If restrictions, covenants, ratios or tests in the financing agreements are breached, and we are unable to cure such breach within the prescribed cure period, a significant portion or all of the obligations may, at the election of the relevant lender, become immediately due and payable, and the lenders’ commitment to make further loans available to us may terminate. In certain circumstances, this could lead to cross-defaults under other financing agreements which in turn could result in obligations becoming due and commitments being terminated under such agreements. A default under financing agreements could also result in foreclosure on any of our vessels and other assets securing related loans and finance leases or our need to sell assets or take other actions in order to meet our debt obligations.

Furthermore, the termination of any of our charter contracts by our customers could result in the repayment of the debt facilities to which the chartered vessels relate.

We may make substantial capital expenditures to expand the size of our fleet or gas business and generally are required to make significant installment payments for acquisitions of newbuilding vessels or for construction of receiving and regasification terminals prior to their delivery or completion and generation of revenue.

We have previously made substantial capital expenditures to increase the size of our fleet or gas business. In the event that we further increase the size of our fleet or gas business, we may incur further substantial capital expenditures. Please read “Item 5 – Operating and Financial Review and Prospects: Contractual Obligations and Contingencies” for additional information about our commitments associated with our capital expenditures. The obligations of us and our joint ventures to pay the committed expenditures is not conditional upon our or their ability to obtain financing for such expenditures.

Any capital expenditures, including as a result of pursuing future fleet expansion opportunities, may impact our liquidity position. Funding of any capital expenditures with debt may significantly increase our interest expense and financial leverage. Our failure to obtain the funds for necessary future capital expenditures could have a material adverse effect on our business, results of operations and financial condition and on our ability to make cash distributions to our preferred unitholders.

We regularly evaluate and pursue opportunities to provide the marine transportation requirements for new or expanding LNG and LPG projects. The award process relating to LNG transportation opportunities typically involves various stages and takes several months to complete. We may not be awarded charters relating to any of the projects we pursue. If we bid on and are awarded contracts relating to any LNG and LPG project, we will need to incur significant capital expenditures to build the LNG and LPG carriers.

To fund any future capital expenditures, we will be required to use cash from operations or incur borrowings or raise capital through the sale of debt or equity securities. Use of cash from operations may impact our liquidity and ability to pay distributions to preferred unitholders. Our ability to obtain bank financing or to access the capital markets for future offerings may be limited by our financial condition at the time of any such financing or offering as well as by adverse market conditions resulting from, among other things, general economic conditions and contingencies and uncertainties that are beyond our control. Our failure to obtain the funds for future capital expenditures could have a material adverse effect on our business, results of operations and financial condition.

12

In addition, although delivery of a completed vessel will not occur until much later (approximately two to three years from the time an order is placed), we typically must pay an initial installment up-front upon signing the purchase contract. During the construction period, we generally are required to make installment payments on newbuildings prior to their delivery, in addition to incurring financing, miscellaneous construction and project management costs, but we do not derive any income from the vessel until after its delivery.

Our substantial debt levels may limit our flexibility in obtaining additional financing, refinancing credit facilities upon maturity, and pursuing other business opportunities.

As at December 31, 2021, our consolidated debt and obligations related to finance leases totaled $2.6 billion and we had the capacity to borrow an additional $235.4 million under our revolving credit facilities. These facilities may be used by us for general corporate purposes. If we obtain debt financing for future newbuilding orders or we are awarded contracts for new LNG or LPG projects, our consolidated debt and obligations related to finance leases will increase, perhaps significantly. We will continue to have the ability to incur additional debt, subject to limitations in our credit facilities. Our level of debt could have important consequences to us, including the following:

•our ability to obtain additional financing, if necessary, for working capital, capital expenditures, acquisitions or other purposes may be impaired, or such financing may not be available on favorable terms, if at all;

•we will need a substantial portion of our cash flow to make principal and interest payments on our debt, reducing the funds that would otherwise be available for operations and future business opportunities;

•our debt level may make us more vulnerable than our competitors with less debt to competitive pressures or a downturn in our industry or the economy generally; and

•our debt level may limit our flexibility in responding to changing business and economic conditions.

Our ability to service our debt and obligations related to finance leases depends upon, among other things, our future financial and operating performance, which is affected by prevailing economic conditions and financial, business, regulatory and other factors, some of which are beyond our control. Furthermore, our ability to borrow against the vessels in our existing fleet and any vessels we may acquire in the future largely depends on the value of the vessels, which in turn depends in part on charter hire rates, charter lengths and the ability of our charterers to comply with the terms of the charters. If our operating results are not sufficient to service our current or future indebtedness or obligations related to finance leases, we will be forced to take actions such as reducing distributions, reducing, canceling or delaying our business activities, acquisitions, investments or capital expenditures, selling assets, seeking to restructure or refinance our debt, seeking additional debt or equity capital or seeking bankruptcy protection. We may not be able to affect any of these remedies on satisfactory terms, or at all.

Restrictions in our debt agreements may prevent us from paying distributions.

The payment of principal and interest on our debt and obligations related to finance leases reduces cash available for distribution on our preferred units. In addition, our financing agreements prohibit the payment of distributions upon the occurrence of the following events, among others:

•failure to pay any principal, interest, fees, expenses or other amounts when due;

•breach or lapse of any insurance with respect to vessels securing the facility;

•breach of certain financial covenants;

•failure to observe any other agreement, security instrument, obligation or covenant beyond specified cure periods in certain cases;

•default under other indebtedness;

•bankruptcy or insolvency events;

•failure of any representation or warranty to be materially correct;

•a change of control, as defined in the applicable agreement; or

•a material adverse effect, as defined in the applicable agreement.

We and certain of our joint venture partners may be unable to attract and retain qualified, skilled employees or crew necessary to operate our business, or may have to pay substantially increased costs for its employees and crew.

Our success depends in large part on the ability of us and certain of our joint venture partners to attract and retain highly skilled and qualified personnel. In crewing our vessels, we require technically skilled employees with specialized training who can perform physically demanding work. The ability to attract and retain qualified crew members under a competitive industry environment continues to put upward pressure on crew manning costs.

If we are not able to increase our charter rates to compensate for any crew cost increases, our financial condition and results of operations may be adversely affected. Any inability we experience in the future to hire, train and retain a sufficient number of qualified employees could impair our ability to manage, maintain and grow our business.

Changes in the LPG markets could result in decreased demand for our LPG vessels operating in the spot market.

Our LPG/multi-gas carriers that operate in the LPG spot market are either owned by us or owned or chartered-in by our 50/50 LPG-related joint venture with Exmar NV (or Exmar) (or the Exmar LPG Joint Venture), a joint venture entity formed pursuant to a joint venture agreement made in

13

February 2013 between us and Belgium-based Exmar to own and charter-in LPG carriers with a primary focus on the mid-size LPG carrier segment. The charters in the spot market operate for short durations and are priced on a current, or “spot,” market rate. The LPG spot market is volatile and fluctuates based upon the many conditions and events that affect the price, production and transport of LPG, including competition from alternative energy sources and negative global or regional economic or political conditions. Any adverse changes in the LPG markets may impact our ability to enter into economically beneficial charters when our LPG/multi-gas carriers complete their existing short-term charters in the LPG spot market, which may reduce vessel earnings and impact our operating results.

Our growth depends on our ability to expand relationships with existing customers and obtain new customers, for which we will face substantial competition.

One of our principal objectives is to enter into long-term, fixed-rate LNG charters. The process of obtaining new long-term charters is highly competitive and generally involves an intensive screening process and competitive bids, and often extends for several months. Shipping contracts are awarded based upon a variety of factors relating to the vessel operator, including:

•size, age, technical specifications and condition of the vessel;

•shipping industry relationships and reputation for customer service and safety;

•shipping experience and quality of ship operations (including cost effectiveness);

•operational reliability and performance capabilities of the vessel;

•quality and experience of seafaring crew;

•safety record;

•the ability to finance vessels at competitive rates and financial stability generally;

•relationships with shipyards and the ability to get suitable berths;

•construction management experience, including the ability to obtain on-time delivery of new vessels according to customer specifications;

•willingness to accept operational risks pursuant to the charter, such as allowing termination of the charter for prolonged off-hire; and

•competitiveness of the bid in terms of overall price.

We compete for providing marine transportation services for potential energy projects with a number of experienced companies, including state-sponsored entities and major energy companies affiliated with the energy project requiring energy shipping services. Many of these competitors have significantly greater financial resources than we do. We anticipate that an increasing number of marine transportation companies – including many with strong reputations and extensive resources and experience – will enter the energy transportation sector. This increased competition may cause greater price competition for time-charters. As a result of these factors, we may be unable to expand our relationships with existing customers or to obtain new customers on a profitable basis, if at all, which could have a material adverse effect on our business, results of operations and financial condition.

We have recognized asset impairments in the past and we may recognize additional impairments in the future, which will reduce our earnings and net assets.

If we determine at any time that an asset has been impaired, we may need to recognize an impairment charge that will reduce our earnings and net assets. We review our vessels for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable, which occurs when an asset's carrying value is greater than the estimated undiscounted future cash flows the asset is expected to generate over its remaining useful life. We review our goodwill for impairment annually and if a reporting unit's goodwill carrying value is greater than the estimated fair value, the goodwill attributable to that reporting unit is impaired. We evaluate our investments in equity-accounted joint ventures for impairment when events or circumstances indicate that the carrying value of such investment may have experienced an other-than-temporary decline in value below its carrying value.

During 2020, we recognized total write-downs of vessels of $51.0 million. During 2021, we recognized a $30.0 million write-down on our investment in our 50% owned joint venture with Exmar (or the Excalibur Joint Venture). For information about these write-downs, please read "Item 5 – Operating and Financial Review and Prospects: Management's Discussion and Analysis of Financial Condition and Results of Operations – Year Ended December 31, 2021 versus Year Ended December 31, 2020", "Item 18 - Financial Statements: Note 7 - Equity-Accounted Joint Ventures", and "Item 18 – Financial Statements: Note 19 – (Write-down) and Gain on Sales of Vessels."

Increased technological innovation in vessel design or equipment could reduce our charter hire rates and the value of our vessels.

The charter hire rates and the value and operational life of a vessel are determined by a number of factors, including the vessel’s efficiency, operational flexibility and physical life. Efficiency includes speed, fuel economy, boil-off ratio (in the case of LNG vessels) and the ability for LNG or LPG cargo to be loaded and unloaded quickly. More efficient vessel designs, engines or other features may increase overall vessel efficiency. Flexibility includes the ability to access LNG and LPG storage facilities, utilize related docking facilities and pass through canals and straits. Physical life is related to the original design and construction, maintenance and the impact of the stress of operations. If new LNG or LPG carriers are built that are more efficient or flexible or have longer physical lives than our vessels, competition from these more technologically advanced LNG or LPG carriers could reduce recharter rates available to our vessels and the resale value of the vessels. As a result, our business, results of operations and financial condition could be harmed.

14

Actual results of new technologies or technologies upgrades may differ from expected results and affect our results of operations.

We have invested and are investing in vessel technology upgrades such as MEGI engines and other equipment and designs for certain LNG carriers, including, among other things, to improve fuel efficiency and vessel performance. These new engine designs and other equipment may not perform to expectations during actual operations, which may result in our exposure to performance claims based on failure to achieve specified performance requirements included in certain charter party agreements. During certain operations, actual fuel consumption for our MEGI LNG carriers may exceed specified levels in certain charter party agreements, which may result in reimbursement by us to the charterer for the cost of the excess fuel consumed. We are installing additional equipment on certain of our MEGI LNG carriers to lower fuel consumption on these vessels. Continued reimbursement obligations, unrecovered capital expenditures, delays in the installation of the equipment, or new equipment installations not performing to our expectations could harm our results of operations or financial condition.

We or our joint venture partners may be unable to operate an LNG receiving and regasification terminal and may be exposed from time to time to conditions, developments, or requirements that may adversely affect us or our joint venture.

We have a 30% ownership interest in an LNG regasification and receiving terminal in Bahrain (please read “Item 18 – Financial Statements: Note 7a(ii) – Equity-Accounted Joint Ventures”). Although the Bahrain LNG Joint Venture has completed mechanical construction and commissioning of the Bahrain terminal and is currently receiving terminal use payments, certain handover arrangements in respect of the Bahrain terminal remain subject to the approval of the lenders of the Bahrain LNG Joint Venture. As a result, the Bahrain LNG Joint Venture may experience associated delays in the formal acceptance of the terminal and the commencement of commercial operations if the Bahrain LNG Joint Venture does not satisfy all applicable conditions and obtain all necessary consents in accordance with its financing agreements. Accordingly, we or our joint venture partners may be unable to operate the LNG receiving and regasification terminal properly, whether due to a lack of satisfaction of such conditions, a lack of obtaining such consents, a lack of industry experience, or otherwise, which could affect our ability to operate the terminal, including as a result of a reduction in the expected output of the terminal. Any such reduction could decrease revenues to the Bahrain LNG Joint Venture which may harm our business, results of operations and financial condition.

In addition, the development, construction and operation of large-scale energy and regasification projects, such as the Bahrain terminal, are inherently subject to unforeseen conditions or developments. Such conditions or developments may include, among others: shortages or delays in deliveries of equipment, materials or labor; significant cost over-runs; labor disruptions; government issues; regulatory changes; legal disputes with third-parties, including contractors, sub-contractors and customers; investigations involving various authorities; adverse weather conditions; unanticipated increases in equipment, material or labor costs; reductions in access to financing, an increase in the amount of required support from shareholders of the Bahrain LNG Joint Venture under the terms of the financing, the ability to comply with all conditions and requirements under the terms of the financing, and the ability to obtain any applicable waivers or consents from our lenders on a timely basis or at all; unforeseen engineering, technical and technological design, environmental, infrastructure or engineering issues; the inability to operate the Bahrain terminal at its full designed capacity; a temporary shutdown of the Bahrain terminal; and a general inability to realize the anticipated benefits of the Bahrain terminal, including all the benefits associated with the long-term contract with the customer. In the event that one or more of these conditions or developments were to materialize or continue for a prolonged period (in particular, any legal disputes with third parties or the Bahrain LNG Joint Venture’s inability to comply with all conditions and requirements under the terms of its financing or obtain any applicable waivers or consents from its lenders under the terms of its financing), our business, results of operations and financial condition could be harmed.

We may be unable to make or realize expected benefits from acquisitions, and implementing our strategy through acquisitions may harm our business, financial condition and operating results.

Part of our strategy includes acquiring existing LNG and LPG carriers or LNG and LPG shipping businesses as the opportunities arise. Historically, there have been very few purchases of existing vessels and businesses in the LNG and LPG shipping industries. Factors that may contribute to a limited number of acquisition opportunities in the LNG and LPG shipping industries in the near term include the relatively small number of independent LNG and LPG fleet owners and the limited number of LNG and LPG carriers not subject to existing long-term charter contracts. In addition, competition from other companies could reduce our acquisition opportunities or cause us to pay higher prices.

Any acquisition of a vessel or business may not be profitable to us at or after the time we acquire it and may not generate cash flow sufficient to justify our investment. In addition, acquisitions may expose us to risks that may harm our business, financial condition and operating results, including risks that we may:

•fail to realize anticipated benefits, such as new customer relationships, cost-savings or cash flow enhancements;

•be unable to hire, train or retain qualified shore and seafaring personnel to manage and operate our growing business and fleet;