|

As filed with the Securities and Exchange Commission on June 22, 2012

|

OMB APPROVAL

|

|

Registration No. 333-121449

|

OMB Number: 3235-0336

Expires: October 31, 2013

Estimated average burden

hours per response. . .1312.9

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

/ X /

|

|

PRE-EFFECTIVE AMENDMENT NO. __

|

/ /

|

|

POST-EFFECTIVE AMENDMENT NO. __

|

/ /

|

|

OPPENHEIMER PORTFOLIO SERIES

|

|

(Exact Name of Registrant as Specified in Charter)

|

|

6803 South Tucson Way, Centennial, Colorado 80112-3924

|

|

(Address of Principal Executive Offices)

|

|

303-768-3200

|

|

(Registrant's Area Code and Telephone Number)

|

|

Arthur S. Gabinet, Esq.

|

|

Executive Vice President & General Counsel

|

|

OppenheimerFunds, Inc.

|

|

Two World Financial Center, 225 Liberty Street

|

|

New York, New York 10281-1008

|

|

(Name and Address of Agent for Service)

|

|

As soon as practicable after the Registration Statement becomes effective.

|

|

(Approximate Date of Proposed Public Offering)

|

Title of Securities Being Registered: Class A, Class B, Class C, Class N and Class Y of Oppenheimer Portfolio Series: Active Allocation Fund.

It is proposed that this filing will become effective on July 23, 2012, pursuant to Rule 488.

No filing fee is due because of reliance on Section 24(f) of the Investment Company Act of 1940, as amended.

CONTENTS OF REGISTRATION STATEMENT

This Registration Statement contains the following pages and documents:

Front Cover

Contents Page

Part A

Prospectus and Proxy Statement of Oppenheimer Portfolio Series: Active Allocation Fund

Part B

Statement of Additional Information

Part C

Other Information

Signatures

Exhibits

Oppenheimer Transition 2030 Fund

Oppenheimer Transition 2040 Fund

Oppenheimer Transition 2050 Fund

6803 South Tucson Way, Centennial, Colorado 80112

1.800.225.5677

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON SEPTEMBER 14, 2012

To the Shareholders of Oppenheimer Transition 2030 Fund, Oppenheimer Transition 2040 Fund and Oppenheimer Transition 2050 Fund:

Notice is hereby given that a Special Meeting of the Shareholders of Oppenheimer Transition 2030 Fund (“Transition 2030 Fund”), Oppenheimer Transition 2040 Fund (“Transition 2040 Fund”) and Oppenheimer Transition 2050 Fund (“Transition 2050 Fund,” and together with Transition 2030 Fund and Transition 2040 Fund, the “Target Funds” and each, a “Target Fund”), each a registered open-end management investment company, will be held at 6803 South Tucson Way, Centennial, Colorado 80112 at 1:00 p.m. Mountain time, on September 14, 2012, or any adjournments thereof (the “Meeting”). Shareholders of each Target Fund will be asked to vote on the following proposals:

|

|

1.

|

To approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) between their Target Fund and Oppenheimer Portfolio Series: Active Allocation Fund, a series of Oppenheimer Portfolio Series (“the Acquiring Fund”), and the transactions contemplated thereby, including: (a) the transfer of all of the assets of the Target Fund to the Acquiring Fund in exchange for Class A, Class B, Class C, Class N and Class Y shares of the Acquiring Fund, (b) the distribution of shares of the Acquiring Fund to the corresponding Class A, Class B, Class C, Class N and Class Y shareholders of the Target Fund in complete liquidation of the Target Fund, and (c) the cancellation of the outstanding shares of the Target Fund (the foregoing with respect to each Target Fund being referred to as the “Reorganization,” and with respect to all of the Target Funds, the “Reorganizations”); and |

2. To act upon such other matters as may properly come before the Meeting.

Shareholders of record at the close of business on May 25, 2012 are entitled to notice of, and to vote at, the Meeting. Each Reorganization is more fully discussed in the Combined Prospectus/Proxy Statement. Please read it carefully before telling us, through your proxy or in person, how you wish your shares to be voted. The Board of Trustees of the Target Funds believes the Reorganization is in the best interests of each of the Target Funds and recommends that you vote “For” the Reorganization.

YOU CAN VOTE ON THE INTERNET, BY TELEPHONE OR BY MAIL.

WE URGE YOU TO VOTE PROMPTLY.

YOUR VOTE IS IMPORTANT

PLEASE VOTE THE ENCLOSED PROXY TODAY.

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN.

By Order of the Board of Trustees,

Arthur S. Gabinet, Secretary

July 27, 2012

OPPENHEIMER PORTFOLIO SERIES ACTIVE ALLOCATION FUND

6803 South Tucson Way, Centennial, Colorado 80112

1.800.225.5677

COMBINED PROSPECTUS/PROXY STATEMENT

Dated July 27, 2012

SPECIAL MEETING OF SHAREHOLDERS OF

OPPENHEIMER TRANSITION 2030 FUND

OPPENHEIMER TRANSITION 2040 FUND

OPPENHEIMER TRANSITION 2050 FUND

to be held on September 14, 2012

Acquisition of the Assets of

OPPENHEIMER TRANSITION 2030 FUND

OPPENHEIMER TRANSITION 2040 FUND

OPPENHEIMER TRANSITION 2050 FUND

6803 South Tucson Way, Centennial, Colorado 80112

1.800.225.5677

By and in exchange for Class A, Class B, Class C, Class N and Class Y shares of

Oppenheimer Portfolio Series: Active Allocation Fund

This Combined Prospectus/Proxy Statement is furnished to you as a shareholder of Oppenheimer Transition 2030 Fund, a Massachusetts business trust (“Transition 2030 Fund”), Oppenheimer Transition 2040 Fund, a Massachusetts business trust (“Transition 2040 Fund”) and Oppenheimer Transition 2050 Fund, a Massachusetts business trust (“Transition 2050 Fund,” and together with Transition 2030 Fund and Transition 2040 Fund, the “Target Funds” and each, a “Target Fund”). A joint special meeting of shareholders of each of the Target Funds, or any adjournments thereof, (the “Meeting”) will be held at the offices of OppenheimerFunds, Inc. (the “Manager”) at 6803 South Tucson Way, Centennial, Colorado 80112 on September 14, 2012, at 1:00 p.m., Mountain time, to consider the items that are listed below and discussed in greater detail elsewhere in this Combined Prospectus/Proxy Statement. Shareholders of record of each Target Fund as of the close of business on May 25, 2012 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting. This Combined Prospectus/Proxy Statement, proxy card and accompanying Notice of Special Meeting of Shareholders will be sent to shareholders of each Target Fund on July 27, 2012, or as soon as practicable thereafter.

The purposes of the Special Meeting are:

|

|

1.

|

To approve a separate Agreement and Plan of Reorganization (the “Reorganization Agreement”) between each Target Fund and Oppenheimer Portfolio Series: Active Allocation Fund, a series of Oppenheimer Portfolio Series (“the Acquiring Fund”), and the transactions contemplated thereby, including: (a) the transfer of all the assets of the Target Fund to the Acquiring Fund in exchange for Class A, Class B, Class C, Class N and Class Y shares of the Acquiring Fund, (b) the distribution of shares of the Acquiring Fund to the corresponding Class A, Class B, Class C, Class N and Class Y shareholders of the Target Fund in complete liquidation of the Target Fund; and (c) the cancellation of the outstanding shares of the Target Fund (with respect to each Target Fund all of the foregoing being referred to as the “Reorganization,” and with respect to all of the Target Funds, the “Reorganizations”); and |

2. To act upon such other matters as may properly come before the Meeting.

At meetings held on May 15, 2012, the Board of Trustees of the Transition 2030 Fund (the “Transition 2030 Fund Board of Trustees”), the Board of Trustees of the Transition 2040 Fund (the “Transition 2040 Fund Board of Trustees”), and the Board of Trustees of the Transition 2050 Fund (the “Transition 2050 Fund Board of Trustees”), along with the Board of Trustees of the Acquiring Fund (together with the Transition 2030 Fund Board of Trustees, the Transition 2040 Fund Board of Trustees and the Transition 2050 Fund Board of Trustees, the “Boards” and each, a “Board”) have each unanimously approved the Reorganization with respect to each Target Fund by which each Target Fund, each an open-end investment company, would be acquired by the Acquiring Fund, an open-end investment company. Each Target Fund has an investment objective and investment policies and strategies that are similar to those of the Acquiring Fund. The investment objective of the Acquiring Fund is to seek long-term growth of capital with a secondary objective of current income. The investment objective of the Transition 2030 Fund, Transition 2040 Fund and Transition 2050 Fund is to seek total return until 2030, 2040 and 2050, respectively, and then to seek income and secondarily capital growth. The Acquiring Fund and each of the Target Funds are special types of mutual funds known as “fund of funds” because they primarily invest in other mutual funds. The Reorganizations are part of a larger initiative to consolidate certain of the comparable Oppenheimer mutual funds to eliminate redundancies and achieve certain operating efficiencies.

Each Board requests that shareholders vote their shares by completing and returning the enclosed proxy card or by following one of the other methods for voting specified on the proxy card.

This Combined Prospectus/Proxy Statement constitutes the Prospectus of the Acquiring Fund and the Proxy Statement of each of the Target Funds filed on Form N-14 with the Securities and Exchange Commission (“SEC”). This Combined Prospectus/Proxy Statement sets forth concisely the information shareholders of each Target Fund should know before voting on the Reorganization and constitutes an offering of the shares of the Acquiring Fund being issued in the Reorganizations. Please read it carefully and retain it for future reference. The following documents each have been filed with the SEC, and are incorporated herein by reference into (each legally forms a part of) this Combined Prospectus/Proxy Statement:

|

·

|

A Statement of Additional Information dated July 27, 2012 (the “Reorganization SAI”), relating to this Combined Prospectus/Proxy Statement;

|

|

·

|

The Prospectus of the Acquiring Fund, dated May 30, 2012 as supplemented (the “Acquiring Fund Prospectus”). The Acquiring Fund Prospectus includes additional information about the Acquiring Fund and is enclosed herewith and accompanies this Combined Prospectus/Proxy Statement.

|

|

·

|

The Statement of Additional Information relating to the Acquiring Fund, dated May 30, 2012, as supplemented (the “Acquiring Fund SAI”);

|

|

·

|

The Annual Report to shareholders of the Acquiring Fund for the fiscal year ended January 31, 2012 (the “Acquiring Fund Annual Report”);

|

|

·

|

The Prospectus of the Transition 2030 Fund, dated June 27, 2012, as supplemented (the “Transition 2030 Fund Prospectus”);

|

|

·

|

The Statement of Additional Information of the Transition 2030 Fund, dated June 27, 2012, as supplemented, (the “Transition 2030 Fund SAI”)’

|

|

·

|

The Annual Report to shareholders of the Transition 2030 Fund for the fiscal year ended February 29, 2012 (the “Transition 2030 Fund Annual Report”);

|

|

·

|

The Prospectus of the Transition 2040 Fund, dated June 27, 2012, as supplemented (the “Transition 2040 Fund Prospectus”);

|

|

·

|

The Statement of Additional Information of the Transition 2040 Fund, dated June 27, 2012, as supplemented, (the “Transition 2040 Fund SAI”);

|

|

·

|

The Annual Report to shareholders of the Transition 2040 Fund for the fiscal year ended February 29, 2012 (the “Transition 2040 Fund Annual Report”);

|

|

·

|

The Prospectus of the Transition 2050 Fund, dated June 27, 2012, as supplemented (the “Transition 2050 Fund Prospectus”);

|

|

·

|

The Statement of Additional Information of the Transition 2050 Fund, dated June 27, 2012, as supplemented, (the “Transition 2050 Fund SAI”);

|

|

·

|

The Annual Report to shareholders of the Transition 2050 Fund for the fiscal year ended February 29, 2012 (the “Transition 2050 Fund Annual Report”);

|

The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “Investment Company Act”), and in accordance therewith, file reports and other information, including proxy materials and charter documents, with the SEC.

You may request a free copy of the foregoing documents and any more recent reports filed after the date hereof by writing to OppenheimerFunds Services (the “Transfer Agent”) at P.O. Box 5270, Denver, Colorado 80217, by visiting the OppenheimerFunds Internet website at www.oppenheimerfunds.com or by calling toll-free 1.800.225.5677.

You also may view or obtain these documents from the SEC:

|

In Person:

|

At the SEC’s Public Reference Room at 100 F Street, N.E.,

Washington, DC 20549

|

|

By Phone:

|

(202) 551-8090

|

|

By Mail:

|

Public Reference Section

Office of Consumer Affairs and Information Services

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

(duplicating fee required)

|

|

By E-mail:

|

publicinfo@sec.gov

(duplicating fee required)

|

|

By Internet:

|

www.sec.gov

|

Mutual fund shares are not deposits or obligations of any bank, and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other U.S. government agency. Mutual fund shares involve investment risks including the possible loss of principal.

As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Combined Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

This Combined Prospectus/Proxy Statement is dated July 27, 2012.

TABLE OF CONTENTS

COMBINED PROSPECTUS/PROXY STATEMENT

|

Page

|

|||

|

Synopsis

|

|||

|

The Proposed Reorganization

|

|||

|

Investment Objectives and Principal Investment Strategies

|

|||

|

Fees and Expenses

|

|||

|

Portfolio Turnover

|

|||

|

U.S. Federal Income Tax Consequences of the Reorganization

|

|||

|

Purchase, Exchange, Redemption and Valuation of Shares

|

|||

|

Comparison of the Funds

|

|||

|

Principal Investment Risks

|

|||

|

Fundamental Investment Restrictions

|

|||

|

Performance Information

|

|||

|

Management of the Funds

|

|||

|

Investment Advisory Agreements

|

|||

|

Pending Litigation

|

|||

|

Distribution Services

|

|||

|

Payments to Financial Intermediaries and Service Providers

|

|||

|

Dividends and Distributions

|

|||

|

Purchase, Exchange, Redemption and Valuation of Shares

|

|||

|

Fund Service Providers

|

|||

|

Shareholder Rights

|

|||

|

Information About the Reorganization

|

|||

|

Terms of the Reorganization Agreement

|

|||

|

Board Consideration of the Reorganization

|

|||

|

Expenses of the Reorganization

|

|||

|

Material U.S. Federal Income Tax Consequences of the Reorganization

|

|||

|

Voting Information

|

|||

|

How to Vote

|

|||

|

Quorum and Required Vote

|

|||

|

Solicitation of Proxies

|

|||

|

Revoking a Proxy

|

|||

|

Other Matters to be Voted upon at the Meeting

|

|||

|

Shareholder Proposals and Communications

|

|||

|

Additional Information About the Funds

|

|||

|

Capitalization of the Funds

|

|||

|

Householding of Reports to Shareholders and Other Fund Documents

|

|||

|

Shareholder Information

|

|||

|

Exhibit A: Form of Agreement and Plan of Reorganization

|

A-

|

||

|

Exhibit B: Principal Shareholders

Exhibit C: More Information on Underlying Funds

|

B-

C-

|

||

SYNOPSIS

This is only a summary and is qualified in its entirety by the more detailed information contained in or incorporated by reference in this Combined Prospectus/Proxy Statement and by the Reorganization Agreement which is attached as Exhibit A. Shareholders should carefully review this Combined Prospectus/Proxy Statement and the Reorganization Agreement in their entirety and the Acquiring Fund Prospectus, which accompanies this Combined Prospectus/Proxy Statement and is incorporated herein by reference.

The Proposed Reorganization

If shareholders of a Target Fund vote to approve the Reorganization Agreement and the Reorganization, on the Closing Date (as such term is defined in the Reorganization Agreement attached hereto as Exhibit A), all of the assets of the Target Fund will be transferred to the Acquiring Fund in exchange for the assumption of all liabilities and for full and fractional shares of the Acquiring Fund having an aggregate net asset value equal to the aggregate net asset value of the shareholders’ Target Fund shares as of the Valuation Date (as such term is defined in the Reorganization Agreement) according to the following chart:

|

Transition 2030 Fund – Share Class Exchanged

|

Transition 2040 Fund – Share Class Exchanged

|

Transition 2050 Fund – Share Class Exchanged

|

Acquiring Fund – Share Class Received

|

|

Class A

|

Class A

|

Class A

|

Class A

|

|

Class B

|

Class B

|

Class B

|

Class B

|

|

Class C

|

Class C

|

Class C

|

Class C

|

|

Class N

|

Class N

|

Class N

|

Class N

|

|

Class Y

|

Class Y

|

Class Y

|

Class Y

|

Immediately thereafter, the Target Fund will distribute these shares of the Acquiring Fund to its shareholders. After distributing these shares, the Target Fund will be terminated. No sales charge will be imposed on the shares of the Acquiring Fund received by each of the Target Fund’s shareholders in connection with the Reorganizations. However, any other purchase or redemption would be subject to any applicable sales charges. After each Target Fund’s Reorganization is completed, any contingent deferred sales charge (“CDSC”) on the redemption of shares of the Acquiring Fund received in the Reorganization would be calculated from the date of original purchase of the respective Target Fund’s shares.

The Reorganization Agreement is subject to approval by the shareholders of each of the Target Funds. The Reorganizations, if approved by shareholders of the Target Funds, are scheduled to be effective as of the close of business on October 19, 2012 with respect to Transition 2030 Fund, October 5, 2012 with respect to Transition 2040 Fund and November 2, 2012 with respect to Transition 2050, or on such later date as the parties may agree (“Closing Date”). As a result of the Reorganizations, each shareholder of the respective Target Fund will become the owner of the number of full and fractional shares of the Acquiring Fund having an aggregate net asset value equal to the aggregate net asset value of the shareholder’s Target Fund shares as of the close of business on the Valuation Date (hereinafter defined). Class A, Class B, Class C, Class N and Class Y shareholders of the each Target Fund will receive the same class of shares of the Acquiring Fund. See “Information About the Reorganization” below.

Approval of the Reorganization of each Target Fund will require the affirmative vote of a majority of the outstanding voting securities of the respective Target Fund, as defined in the Investment Company Act. A “majority of the outstanding voting securities” is defined in the Investment Company Act as the lesser of (i) 67% or more of the voting power of the voting securities present at the Meeting, if the holders of more than 50% of the outstanding voting securities of the respective Target Fund are present at the Meeting or represented by proxy, or (ii) more than 50% of the voting power of the outstanding voting securities of the respective Target Fund. See “Voting Information – Quorum and Required Vote” below.

In the absence of sufficient votes to approve the Reorganization, the Meeting shall be adjourned until a quorum shall attend. Additional information on voting and quorum requirements is provided in the section “Voting Information - Quorum and Required Vote.”

The Acquiring Fund, following the completion of one or more of the Reorganizations, may be referred to as the “Combined Fund” in this Combined Prospectus/Proxy Statement. The Target Funds, the Acquiring Fund, and the Combined Fund may also be generally referred to as a “Fund” or the “Funds.”

OppenheimerFunds, Inc. (the “Manager”) serves as the investment adviser of each of the Funds. The Manager believes that the Acquiring Fund has greater prospects for attracting new assets than each of the Target Funds. The Funds seek to provide certain combinations of long-term growth of capital and current income, depending on the investors’ age and/or risk tolerance, by primarily investing in both equity and fixed income funds. The Funds are all “fund of funds” because they primarily invest in other OppenheimerFunds mutual funds (“Underlying Funds”). The Acquiring Fund also contains an actively managed component and may employ certain investments directly. The Funds have been managed in a substantially similar manner and the performance of the Funds is similar. The Transition 2030 Fund was organized in 2006 and the Transition 2040 Fund and Transition 2050 Fund were organized in 2007 among other similar Lifecycle Transition funds, to support the Manager’s proprietary retirement plan business by serving as funds to accommodate a range of investor preferences and retirement time horizons. Each of those Transition funds is managed based on an approximate retirement year (the "transition" date in each fund's name) and their investments in the Underlying Funds change over time in a manner designed to help the fund become more conservative both as the transition date gets closer and for 10 years after that date. Recently, the Manager exited its retirement plan business. As the Manager has exited this business, the Target Funds would be unlikely to gain market share in the target date fund marketplace. As a result, the Target Funds may not continue to grow their assets, and may experience reverse economies of scale. A declining asset base could result in an increase in “other expenses” for Target Fund shareholders in the future.

The Manager believes that shareholders of each Fund will have the benefit of additional assets as a result of the Reorganizations and the corresponding potential for lower total expenses as a percentage of net assets in the future. In addition, Target Fund shareholders will be in an actively sold product, which has the opportunity to continue to garner assets and gain economies of scale. As a result, the Manager believes that the shareholders of each Fund generally will benefit more from the potential operating efficiencies and economies of scale that may be achieved by combining the Fund’s assets in the Reorganizations, than by continuing to operate the Funds separately. The Manager believes that the Acquiring Fund’s investment objective and strategies make it a compatible fund within the OppenheimerFunds complex for a reorganization with each of the Target Funds. As a result of the similar investment objectives and investment strategies of the Funds, there is substantial overlap in the portfolio securities currently owned by the Funds.

Since the Funds are “fund of funds” and primarily invest in other mutual funds, they do not charge a direct management fee, but rather indirectly collect management fees through their investments in Underlying Funds. The Acquiring Fund charges a 0.10% asset allocation fee in addition to the Acquired Fund Fees and Expenses, which compensates the Manager for the active management component of the Fund. As shown in the fee tables below, based on assets as of January 31, 2012, the Acquired Fund Fees and Expenses for the Combined Fund are lower than the Target Fund in all of the Reorganization scenarios. Additionally, the Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimbursements for each Target Fund’s shareholders will generally decrease following the Reorganizations (with exceptions to certain share classes noted below).

Consistent with the flexibility permitted by each Fund’s investment strategies, each portfolio management team is generally managing the Target Funds in a similar manner as the Acquiring Fund. In particular, as noted above, as of March 31, 2012, 100% of the Transition 2030 Fund’s assets were invested in securities that were also held by the Acquiring Fund and 87.11% of the Acquiring Fund’s assets were invested in securities that were also held by the Transition 2030 Fund; 99.67% of the Transition 2040 Fund’s assets were invested in securities that were also held by the Acquiring Fund and 87.11% of the Acquiring Fund’s assets were invested in securities that were also held by the Transition 2040 Fund; and 99.60% of the Transition 2050 Fund’s assets were invested in securities that were also held by the Acquiring Fund and 87.11% of the Acquiring Fund’s assets were invested in securities that were also held by the Transition 2050 Fund.

The Board of each of the Target Funds reviewed and discussed with the Manager and the Board’s independent legal counsel the proposed Reorganizations. Information with respect to, but not limited to, each Fund’s respective investment objectives and policies, advisory fees, distribution fees and other operating expenses, historical performance and asset size, was also considered by the Board of each of the Target Funds.

Based on the considerations discussed above and the reasons more fully described under “Information About the Proposed Reorganization—Board Consideration of the Reorganization,” the Board of each of the Target Funds, including all of the Board members (each, a “Board Member”) who are not “interested persons” of the Funds under the Investment Company Act (the “Independent Board Members”), has unanimously concluded that participation in the Reorganizations is in the best interests of each Target Fund and its shareholders and that the interests of the respective Target Fund’s existing shareholders would not be diluted as a result of the respective Reorganization. The Board, therefore, is hereby submitting the Reorganization Agreement to the shareholders of each of the Target Funds and recommending that shareholders of each of the Target Funds vote “FOR” the Reorganization Agreement effecting the Reorganization. The Board of the Acquiring Fund has also approved the Reorganizations on behalf of the Acquiring Fund. Shareholders of the Acquiring Fund do not vote on the Reorganizations.

THE BOARD, INCLUDING ALL OF THE INDEPENDENT BOARD MEMBERS, RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF THE REORGANIZATION AGREEMENT

Investment Objectives and Principal Investment Strategies

Investment Objectives. The investment objectives of the Funds are similar. The investment objective of the Acquiring Fund is to seek long-term growth of capital with a secondary objective of current income. The investment objective of the Transition 2030 Fund, Transition 2040 Fund and Transition 2050 Fund is to seek total return until 2030, 2040 and 2050, respectively, and then to seek income and secondarily capital growth. The Acquiring Fund and each of the Target Funds are special types of mutual funds known as “fund of funds” because they primarily invest in other mutual funds. The investment objective of each Fund is non-fundamental, which means it may be changed without the approval of the Fund’s shareholders. Should any Fund’s Board determine that the investment objective of the Fund should be changed, shareholders must be given advance notice before any such change is implemented. Certain investment objectives and strategies of the Underlying Funds are fundamental policies and others are non-fundamental policies, as indicated in each Underlying Fund's prospectus or Statement of Additional Information. Each Underlying Fund's Board can change non-fundamental policies without shareholder approval, including without the approval of the Fund.

Principal Investment Strategies. The Target Fund and the Acquiring Fund employ similar principal investment strategies in achieving their respective objectives. The similarities and differences of the principal investment strategies of the Funds are described in the chart below.

|

Transition 2030 Fund

Transition 2040 Fund

Transition 2050 Fund

|

Acquiring Fund

|

|

Principal Investment Strategies

|

|

|

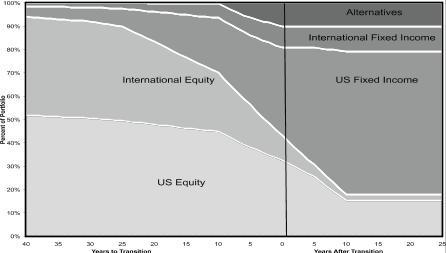

The Fund is a special type of mutual fund known as a “fund of funds” because it primarily invests in other mutual funds. Those funds are referred to as the “Underlying Funds.” To accommodate a range of investor preferences and retirement time horizons, the Oppenheimer LifeCycle Funds offer seven funds with different asset allocations. Each of those funds is

managed based on an approximate retirement year (the “transition” date in each fund’s name) and their investments in the Underlying Funds change over time in a manner designed to help the Fund become more conservative both as the transition date gets closer and for 10 years after that date. This approach is designed to help investors accumulate the assets needed to generate income during their retirement years.

Choosing a fund with an earlier transition date generally represents a more conservative choice; choosing a Fund with a later transition date generally represents a more aggressive choice. The changes to the Fund’s asset allocations are illustrated in its “glide path” shown below. The Fund’s asset allocations will continue to change until ten years after the transition date and then remain at its final allocation targets. The Fund has, and is expected to continue to maintain, some equity exposure. Equity securities generally have higher risks, however they have historically offered higher rates of return than fixed-income securities over the long term, and may play a role both in preparing for and during retirement.

The Transition 2030 Fund currently allocates its assets among the Underlying Funds based on asset allocation targets of approximately 46% in U.S. equities, 37% in foreign equities, 13% in U.S. fixed-income, 4% in foreign fixed-income and 0% in alternatives funds that are designed to help provide asset diversification.

The Transition 2040 Fund currently allocates its assets among the Underlying Funds based on asset allocation targets of approximately 50% in U.S. equities, 41% in foreign equities, 6% in U.S. fixed-income, 2% in foreign fixed-income and 0% in alternatives funds that are designed to help provide asset diversification.

The Transition 2050 Fund currently allocates its assets among the Underlying Funds based on asset allocation targets of approximately 52% in U.S. equities, 42% in foreign equities, 5% in U.S. fixed-income, 2% in foreign fixed-income and 0% in alternatives funds that are designed to help provide asset diversification.

The portfolio managers may use some or all of the Underlying Funds in different combinations to implement the Fund’s target allocations and the relative mix of those Underlying Funds will vary over time.

Equity securities include common stock, preferred stock, rights and warrants, and securities convertible into common stock. Fixed income securities (also referred to as “debt securities”) represent money borrowed by the issuer that must be repaid. Some Underlying Funds invest in debt securities that are rated below investment grade (commonly referred to as “junk bonds”) and certain of them may invest most or a significant percentage of their assets in those securities. Some of the Underlying Funds invest partially or primarily in securities of issuers outside of the United States, including issuers in emerging or developing markets countries. The alternatives Underlying Funds that are used for asset diversification may invest in commodities, gold and other special metals, real estate (including through equity

or other securities) or in inflation protected securities. For temporary periods, the Fund may hold a greater portion of its assets in money market funds, money market securities, cash or other similar, liquid investments. This may occur at times when the Manager is unable to immediately invest cash received from purchases of Fund shares or from redemptions of its investments.

|

The Fund is a special type of mutual fund known as a “fund of funds” because it invests in other mutual funds. Those funds are referred to as the “Underlying Funds."

The Manager seeks to diversify the Fund’s assets by selecting Underlying Funds with different investment guidelines and styles. Under normal market conditions, the Fund allocates 75-85% of its assets based on a “static” allocation among the Underlying Funds and 15-25% of its assets based on a “tactical allocation” to those funds and to other investments. The static portion of the Fund’s allocation is divided between the Underlying Funds based on asset allocation target ranges of 30-40% in U.S. equities, 15-25% in foreign equities, 20-25% in fixed-income and approximately 5% in alternative funds that provide asset diversification. The Fund’s “tactical allocation” strategy adjusts the asset mix to take advantage of temporary market conditions that may present opportunities. For this tactical allocation, the Fund may invest in money market securities or may invest additional assets in any of the above Underlying Funds. The Fund and some Underlying

Funds may use derivatives to seek income or capital gain or to hedge against the risks of other investments. Options, futures, forward contracts and swaps are some of the types of derivatives the Fund and the Underlying Funds can use. The Fund’s asset allocation targets may vary in particular cases and may change over time.

Equity securities include common stock, preferred stock, rights and warrants, and securities convertible into common stock. Fixed income securities (also referred to as “debt securities”) represent money borrowed by the issuer that must be repaid. Some Underlying Funds invest in debt securities that are rated below investment grade (commonly referred to as “junk bonds”) and certain of them may invest most, or a significant percentage, of their assets in those securities. Some of the Underlying Funds invest partially or primarily in securities of issuers outside of the United States, including issuers in emerging or developing market countries. The Underlying Funds that are used for asset diversification may include investments related to commodities, gold and other special metals, real estate or that are inflation protected.

For temporary periods, the Fund may hold a portion of its assets in cash, money market securities or other similar, liquid investments. This will generally occur at times when the Manager is unable to immediately invest cash received from purchases of Fund shares or from redemptions of other investments.

|

|

How Securities are Selected

|

|

|

Investments in individual Underlying Funds are determined by the Manager in seeking to meet the Fund’s asset allocation targets and achieve its investment objective. The Fund’s actual asset allocations will usually change daily, based on changes in the market values of the securities held by the Underlying Funds, and they will generally vary from the Fund’s target allocations. The Manager monitors the Underlying Fund selections and periodically rebalances the Fund’s investments to bring them closer to their target asset allocations.

The Fund’s most recent month-end investments in the individual Underlying Funds are available on its website. Its quarter-end asset allocations to the individual Underlying Funds are also available in its Annual and Semi-Annual Reports and in its Forms N-Q. In response to changing market or economic

conditions, the Manager may change the Underlying Funds or the Fund’s target asset allocations at any time, without prior approval from or notice to shareholders

Under normal market conditions, the Fund will invest in shares of some or all of the following Underlying Funds that were chosen based on the Manager’s determination that they may provide income and secondarily capital growth: Oppenheimer Capital Appreciation Fund, Oppenheimer Champion Income Fund, Oppenheimer Commodity Strategy Total Return Fund, Oppenheimer Core Bond Fund, Oppenheimer Developing Markets Fund, Oppenheimer Discovery Fund, Oppenheimer Global Fund, Oppenheimer Global Opportunities Fund, Oppenheimer Gold & Special Minerals Fund, Oppenheimer Institutional Money Market Fund, Oppenheimer International Bond Fund, Oppenheimer International Growth Fund, Oppenheimer International Small Company Fund, Oppenheimer International Value Fund, Oppenheimer Limited-Term Government Fund, Oppenheimer Main Street Fund®, Oppenheimer Main Street Select Fund®, Oppenheimer Main Street Small- & Mid-Cap Fund®, Oppenheimer Real Estate Fund, Oppenheimer Rising Dividends Fund, Oppenheimer

Small- & Mid- Cap Value Fund, Oppenheimer Master Inflation Protected Securities Fund, LLC, Oppenheimer Master Loan Fund, LLC, Oppenheimer Master International Value, LLC, Oppenheimer U.S. Government Trust and Oppenheimer Value Fund. At times, the Fund may invest in other Oppenheimer funds, including Oppenheimer money market funds.

The transition date represents an approximate retirement date and investors may plan to retire either before or after that date. Some investors may choose to stop making additional contributions to the Fund or to withdraw some or all of their investment at the transition date, however the Fund’s glide path is intended to continue after the transition date to an allocation designed to place greater emphasis on income and to seek to reduce investors’ overall risks through their retirement years.

Approximately 10 years after the Fund’s stated “transition” year, the Fund’s asset allocation will reach and remain at approximately 15% in U.S. equities, 3% in foreign equities, 61% in U.S. fixed-income, 11% in foreign fixed-income and 10% in alternatives Underlying Funds (which may result in up to 10% additional equity exposure).

|

The Manager uses proprietary tactical asset allocation models (including computer aided models) as guides to selecting Underlying funds for the tactical allocation. These models use quantitative techniques to identify valuation opportunities across assets and sectors to which the Underlying funds have exposures.

The Manager monitors the Underlying Fund selections and periodically rebalances the Fund’s investments to bring them back within their target asset allocation ranges. In response to changing market or economic conditions, the Manager may change the Underlying Funds or the Fund’s target asset allocation ranges at any time, without prior approval from or notice to shareholders.

Under normal market conditions, the Fund will invest in shares of some or all of the following Underlying Funds that were chosen based on the Manager’s determination that they could provide long term growth of capital and, secondarily, income: Oppenheimer Capital Appreciation Fund, Oppenheimer Champion Income Fund, Oppenheimer Commodity Strategy Total Return Fund, Oppenheimer Core Bond Fund, Oppenheimer Developing Markets Fund, Oppenheimer Discovery Fund, Oppenheimer Global Fund, Oppenheimer Global Opportunities Fund, Oppenheimer Gold & Special Minerals Fund, Oppenheimer Institutional Money Market Fund, Oppenheimer International Bond Fund, Oppenheimer International Growth Fund, Oppenheimer International Small Company Fund, Oppenheimer International Value Fund, Oppenheimer Limited-Term Government Fund, Oppenheimer Main Street Fund,® Oppenheimer Main Street Select Fund,® Oppenheimer Main Street Small- & Mid-Cap Fund,® Oppenheimer Master Event-Linked Bond Fund, LLC, Oppenheimer Master Inflation Protected Securities Fund, LLC, Oppenheimer Master International Value Fund, LLC, Oppenheimer Master Loan Fund, LLC, Oppenheimer Real Estate Fund, Oppenheimer Rising Dividends Fund, Oppenheimer Rochester National Municipals, Oppenheimer Small- & Mid-Cap Value Fund, Oppenheimer U.S. Government Trust and Oppenheimer Value Fund. |

|

Who is the Fund Designed For?

|

|

|

The Fund is designed primarily for investors seeking to simplify the accumulation of assets prior to and during retirement. Investors must weigh many factors when considering retirement, including when to retire, what their retirement needs will be, and what other sources of income they may have. In general, the Fund's investment program assumes a retirement age of 65 but the transition date does not necessarily represent the specific year you intend to retire or start drawing retirement assets. It should be used as an approximate guide, depending on your investment goals and risk tolerance. Investors should realize that the Fund is not a complete solution to their retirement needs.

|

The Fund is designed primarily for investors seeking to combine the growth potential of stocks with a smaller allocation to bonds. Because some Underlying Funds generally invest a substantial portion of their assets in stocks, those investors should be willing to assume the risks of share price fluctuations that are typical for substantial stock investments. The Fund is not a complete investment program.

|

Comparison. As shown in the chart above, each of the Target Fund’s investment objective focuses on seeking total return until its transition date, and then seeks income and secondarily capital growth. Similarly, the Acquiring Fund seeks long-term capital growth and secondarily current income. These investment objectives are similar in that each Fund is designed to provide total return (or a combination of growth of capital and current income). Each Fund employs similar investment strategies in order to achieve their respective investment objectives, depending on the investors’ age and/or risk tolerance, by investing in both equity and fixed income funds; the Acquiring Fund also allocates a portion of its assets based on a “tactical” allocation, to adjust the asset mix to take advantage of temporary market conditions that may present opportunities. The Funds are all “fund of funds” because they primarily invest in other Underlying Funds. The primary differences in management style are that the Target Funds’ portfolio holdings in Underlying Funds are periodically rebalanced based on established “glidepaths” based on an approximate retirement year (the "transition" date in each fund's name) in a manner designed to help the Fund become more conservative both as the transition date gets closer and for 10 years after that date, and that the Acquiring Fund has an actively managed component of its portfolio. Each Target Fund's allocations to various asset classes is illustrated in the following charts, which reflect an investor's need to pursue a reduction in investment risks both before and after his or her approximate retirement year.

The Transition 2030 Fund currently allocates its assets among the Underlying Funds based on the following approximate asset allocation targets (rounded to the nearest percentage):

|

Underlying Fund Target Percentage

|

|

|

U.S. Equities

|

46%

|

|

Oppenheimer Value Fund

|

23%

|

|

Oppenheimer Capital Appreciation Fund

|

16%

|

|

Oppenheimer Main Street Small- & Mid-Cap Fund®

|

6%

|

|

Foreign Equities

|

37%

|

|

Oppenheimer International Growth Fund

|

20%

|

|

Oppenheimer International Value Fund

|

10%

|

|

Oppenheimer Developing Markets Fund

|

6%

|

|

Oppenheimer International Small Company Fund

|

2%

|

|

U.S. Fixed-Income

|

13%

|

|

Oppenheimer Core Bond Fund

|

6%

|

|

Oppenheimer Limited-Term Government Fund

|

4%

|

|

Oppenheimer Champion Income Fund

|

1%

|

|

Oppenheimer Institutional Money Market Fund

|

1%

|

|

Foreign Fixed-Income

|

4%

|

|

Oppenheimer International Bond Fund

|

4%

|

|

Alternatives

|

0%

|

The Transition 2040 Fund currently allocates its assets among the Underlying Funds based on the following approximate asset allocation targets (rounded to the nearest percentage):

|

Underlying Fund Target Percentage

|

|

|

U.S. Equities

|

50%

|

|

Oppenheimer Value Fund

|

25%

|

|

Oppenheimer Capital Appreciation Fund

|

18%

|

|

Oppenheimer Main Street Small- & Mid-Cap Fund®

|

7%

|

|

Foreign Equities

|

41%

|

|

Oppenheimer International Growth Fund

|

22%

|

|

Oppenheimer International Value Fund

|

11%

|

|

Oppenheimer Developing Markets Fund

|

6%

|

|

Oppenheimer International Small Company Fund

|

2%

|

|

U.S. Fixed-Income

|

6%

|

|

Oppenheimer Core Bond Fund

|

3%

|

|

Oppenheimer Limited-Term Government Fund

|

2%

|

|

Oppenheimer Champion Income Fund

|

1%

|

|

Oppenheimer Institutional Money Market Fund

|

1%

|

|

Foreign Fixed-Income

|

2%

|

|

Oppenheimer International Bond Fund

|

2%

|

|

Alternatives

|

0%

|

The Transition 2050 Fund currently allocates its assets among the Underlying Funds based on the following approximate asset allocation targets (rounded to the nearest percentage):

|

Underlying Fund Target Percentage

|

|

|

U.S. Equities

|

52%

|

|

Oppenheimer Value Fund

|

26%

|

|

Oppenheimer Capital Appreciation Fund

|

19%

|

|

Oppenheimer Main Street Small- & Mid-Cap Fund®

|

7%

|

|

Foreign Equities

|

42%

|

|

Oppenheimer International Growth Fund

|

23%

|

|

Oppenheimer International Value Fund

|

11%

|

|

Oppenheimer Developing Markets Fund

|

6%

|

|

Oppenheimer International Small Company Fund

|

2%

|

|

U.S. Fixed-Income

|

5%

|

|

Oppenheimer Core Bond Fund

|

2%

|

|

Oppenheimer Limited-Term Government Fund

|

2%

|

|

Foreign Fixed-Income

|

2%

|

|

Oppenheimer International Bond Fund

|

2%

|

|

Alternatives

|

0%

|

In contrast, the Acquiring Fund contains generally static Underlying Fund allocations designed to fit an appropriate risk portfolio, combined with an active allocation component to adjust the asset mix. Under normal market conditions, the Acquiring Fund allocates 75%-85% of its assets based on a “static allocation” among the Underlying Funds and 15%-25% of its assets based on a “tactical allocation” to those funds and to other investments. Instead of a “glidepath,” under normal market conditions the Acquiring Fund will allocate its assets for the static portion of the Acquiring Fund’s allocation among the Underlying Funds based on asset allocation target ranges of 30-40% in U.S. equities, 15-25% in foreign equities, 20-25% in fixed-income and approximately 5% in alternative funds that provide asset diversification. The Acquiring Fund’s “tactical allocation” strategy adjusts the asset mix to take advantage of temporary market conditions that may present opportunities. For this tactical allocation the Acquiring Fund may invest in money market securities or may invest additional assets in any of the Underlying Funds. The Acquiring Fund and some Underlying Funds may use derivatives to seek income or capital gain or to hedge against the risks of other investments. The Acquiring Fund's asset allocation targets may vary in particular cases and may change over time.

Each of the Target Fund and the Acquiring Fund may invest in generally the same Underlying Funds. In addition, at times, the Funds may invest in other Oppenheimer funds, including Oppenheimer money market funds. With respect to each Fund, the mix of Underlying Funds was chosen to seek diversification and to implement the Fund's allocation strategies. The choice of Underlying Funds, the objectives and policies of the Underlying Funds and the Fund's allocations to the Underlying Funds may change from time to time without approval by the Fund's shareholders.

Notwithstanding the differences in the investment strategies of the Funds, as noted above, because of the similar investment objectives and investment strategies there is substantial overlap in the portfolio securities currently owned by the Funds. Consistent with the flexibility permitted by each Fund’s investment strategies, the portfolio management teams are generally managing the Funds in a similar manner. The portfolio managers are also similar for the Funds. Alan Gilston and Krishna Memani are the portfolio managers of the Target Funds, and Alan Gilston, Krishna Memani, and Caleb Wong are the portfolio managers of the Acquiring Fund. The portfolio management team of the Acquiring Fund is expected to manage the Combined Fund after the Reorganization. In particular, as noted above, as of March 31, 2012, 100% of the Transition 2030 Fund’s assets were invested in securities that were also held by the Acquiring Fund and 87.11% of the Acquiring Fund’s assets were invested in securities that were also held by the Transition 2030 Fund; 99.67% of the Transition 2040 Fund’s assets were invested in securities that were also held by the Acquiring Fund and 87.11% of the Acquiring Fund’s assets were invested in securities that were also held by the Transition 2040 Fund; and 99.60% of the Transition 2050 Fund’s assets were invested in securities that were also held by the Acquiring Fund and 87.11% of the Acquiring Fund’s assets were invested in securities that were also held by the Transition 2050 Fund. The portfolio managers of the Acquiring Fund have reviewed the portfolio holdings of each of the Target Funds and do not anticipate disposing of, or requesting the disposition of, any material portion of the assets of each of the Target Funds in preparation for, or as a result of, the applicable Reorganization. Thus, the proposed Reorganizations are not expected to cause significant portfolio turnover or transaction expenses associated with the sale of securities held by the Target Funds.

Fees and Expenses

The tables below compare the fees and expenses of each class of shares of the Funds, assuming the Reorganizations had taken place on January 31, 2012 and the estimated pro forma fees and expenses attributable to each class of shares of the Combined Fund’s Pro Forma combined portfolio. Future fees and expenses may be greater or less than those indicated below. For information concerning the net assets of each Fund as of January 31, 2012, see “Additional Information About the Funds—Capitalization of the Funds.” You may qualify for sales charge discounts if you (or you and your spouse) invest, or agree to invest in the future, at least $25,000 in certain funds in the Oppenheimer family of funds. More information about these and other discounts is available from your financial professional and in the section “About Your Account” in the Acquiring Fund Prospectus and in the sections “How to Buy Shares” and “Appendix A” of the Acquiring Fund SAI, which are incorporated herein by reference.

Fee Tables of the Transition 2030 Fund, the Transition 2040 Fund, the Transition 2050 Fund, the Acquiring Fund, and the Combined Fund (as of January 31, 2012 (unaudited))

|

Transition 2050 Fund

Class A

|

Transition 2040 Fund Class A

|

Transition 2030 Fund

Class A

|

PS: Active Allocation Fund

Class A

|

PS: Active Allocation Fund

Pro Forma Combined Fund

Class A

|

|||

|

Shareholder Fees (fees paid directly from your investment)

|

|||||||

|

Maximum Sales Charge (Load) imposed on purchases (as a % of offering price)

|

5.75%

|

5.75%

|

5.75%

|

5.75%

|

5.75%

|

||

|

Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds)

|

None1

|

None1

|

None1

|

None1

|

None1

|

||

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|||||||

|

Management Fees

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

||

|

Distribution and/or Service (12b-1) Fees

|

0.25%

|

0.25%

|

0.25%

|

0.25%

|

0.25%

|

||

|

Asset Allocation Fee

|

0.00%

|

0.00%

|

0.00%

|

0.10%

|

0.10%

|

||

|

Other Expenses

|

0.80%

|

0.42%

|

0.28%

|

0.19%

|

0.20%

|

||

|

Acquired Fund Fees and Expenses

|

0.76%

|

0.75%

|

0.74%

|

0.71%

|

0.71%

|

||

|

Total Annual Fund Operating Expenses

|

1.81%

|

1.42%

|

1.27%

|

1.25%

|

1.26%

|

||

|

Fee Waiver and/or Expense Reimbursement5, 6, 7

|

-0.31%

|

0.00%

|

0.00%

|

-0.04%

|

-0.05%

|

||

|

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement

|

1.50%

|

1.42%

|

1.27%

|

1.21%

|

1.21%

|

||

|

Transition 2050 Fund

Class B

|

Transition 2040 Fund Class B

|

Transition 2030 Fund Class B

|

PS: Active Allocation Fund

Class B

|

PS: Active Allocation Fund

Pro Forma Combined Fund

Class B

|

||

|

Shareholder Fees (fees paid directly from your investment)

|

||||||

|

Maximum Sales Charge (Load) imposed on purchases (as a % of offering price)

|

None

|

None

|

None

|

None

|

None

|

|

|

Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds)

|

5%2

|

5%2

|

5%2

|

5%2

|

5%2

|

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

||||||

|

Management Fees

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

|

|

Distribution and/or Service (12b-1) Fees

|

1.00%

|

1.00%

|

1.00%

|

1.00%

|

1.00%

|

|

|

Asset Allocation Fee

|

0.00%

|

0.00%

|

0.00%

|

0.10%

|

0.10%

|

|

|

Other Expenses

|

0.85%

|

0.57%

|

0.37%

|

0.29%

|

0.29%

|

|

|

Acquired Fund Fees and Expenses

|

0.76%

|

0.75%

|

0.74%

|

0.71%

|

0.71%

|

|

|

Total Annual Fund Operating Expenses

|

2.61%

|

2.32%

|

2.11%

|

2.10%

|

2.10%

|

|

|

Fee Waiver and/or Expense Reimbursement5, 6, 7

|

-0.36%

|

-0.07%

|

0.00%

|

-0.04%

|

-0.04%

|

|

|

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement

|

2.25%

|

2.25%

|

2.11%

|

2.06%

|

2.06%

|

|

|

Transition 2050 Fund

Class C

|

Transition 2040 Fund Class C

|

Transition 2030 Fund Class C

|

PS: Active Allocation Fund

Class C

|

PS: Active Allocation Fund

Pro Forma Combined Fund

Class C

|

||

|

Shareholder Fees (fees paid directly from your investment)

|

||||||

|

Maximum Sales Charge (Load) imposed on purchases (as a % of offering price)

|

None

|

None

|

None

|

None

|

None

|

|

|

Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds)

|

1%3

|

1%3

|

1%3

|

1%3

|

1%3

|

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

||||||

|

Management Fees

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

|

|

Distribution and/or Service (12b-1) Fees

|

1.00%

|

1.00%

|

1.00%

|

1.00%

|

1.00%

|

|

|

Asset Allocation Fee

|

0.00%

|

0.00%

|

0.00%

|

0.10%

|

0.10%

|

|

|

Other Expenses

|

0.89%

|

0.47%

|

0.29%

|

0.19%

|

0.21%

|

|

|

Acquired Fund Fees and Expenses

|

0.76%

|

0.75%

|

0.74%

|

0.71%

|

0.71%

|

|

|

Total Annual Fund Operating Expenses

|

2.65%

|

2.22%

|

2.03%

|

2.00%

|

2.02%

|

|

|

Fee Waiver and/or Expense Reimbursement5, 6, 7

|

-0.40%

|

-0.02%

|

0.00%

|

-0.04%

|

-0.06%

|

|

|

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement

|

2.25%

|

2.20%

|

2.03%

|

1.96%

|

1.96%

|

|

|

Transition 2050 Fund

Class N

|

Transition 2040 Fund Class N

|

Transition 2030 Fund Class N

|

PS: Active Allocation Fund

Class N

|

PS: Active Allocation Fund

Pro Forma Combined Fund

Class N

|

||

|

Shareholder Fees (fees paid directly from your investment)

|

||||||

|

Maximum Sales Charge (Load) imposed on purchases (as a % of offering price)

|

None

|

None

|

None

|

None

|

None

|

|

|

Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds)

|

1%4

|

1%4

|

1%4

|

1%4

|

1%4

|

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

||||||

|

Management Fees

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

|

|

Distribution and/or Service (12b-1) Fees

|

0.50%

|

0.50%

|

0.50%

|

0.50%

|

0.50%

|

|

|

Asset Allocation Fee

|

0.00%

|

0.00%

|

0.00%

|

0.10%

|

0.10%

|

|

|

Other Expenses

|

0.72%

|

0.34%

|

0.22%

|

0.14%

|

0.20%

|

|

|

Acquired Fund Fees and Expenses

|

0.76%

|

0.75%

|

0.74%

|

0.71%

|

0.71%

|

|

|

Total Annual Fund Operating Expenses

|

1.98%

|

1.59%

|

1.46%

|

1.45%

|

1.51%

|

|

|

Fee Waiver and/or Expense Reimbursement5, 6, 7

|

-0.25%

|

0.00%

|

0.00%

|

-0.04%

|

-0.10%

|

|

|

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement

|

1.73%

|

1.59%

|

1.46%

|

1.41%

|

1.41%

|

|

|

Transition 2050 Fund

Class Y

|

Transition 2040 Fund Class Y

|

Transition 2030 Fund Class Y

|

PS: Active Allocation Fund

Class Y

|

PS: Active Allocation Fund

Pro Forma Combined Fund

Class Y

|

||

|

Shareholder Fees (fees paid directly from your investment)

|

||||||

|

Maximum Sales Charge (Load) imposed on purchases (as a % of offering price)

|

None

|

None

|

None

|

None

|

None

|

|

|

Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds)

|

None

|

None

|

None

|

None

|

None

|

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

||||||

|

Management Fees

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

|

|

Distribution and/or Service (12b-1) Fees

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

|

|

Asset Allocation Fee

|

0.00%

|

0.00%

|

0.00%

|

0.10%

|

0.10%

|

|

|

Other Expenses

|

0.11%

|

0.07%

|

0.04%

|

0.09%

|

0.07%

|

|

|

Acquired Fund Fees and Expenses

|

0.76%

|

0.75%

|

0.74%

|

0.71%

|

0.71%

|

|

|

Total Annual Fund Operating Expenses

|

0.87%

|

0.82%

|

0.78%

|

0.90%

|

0.88%

|

|

|

Fee Waiver and/or Expense Reimbursement5, 6, 7

|

0.00%

|

0.00%

|

0.00%

|

-0.04%

|

-0.04%

|

|

|

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement

|

0.87%

|

0.82%

|

0.78%

|

0.86%

|

0.84%

|

|

|

1.

|

A Class A contingent deferred sales charge may apply to redemptions of investments of $1 million or more or to certain retirement plan redemptions.

|

|

2.

|

Applies to redemptions in the first year after purchase. The contingent deferred sales charge gradually declines from 5% to 1% during years one through six and is eliminated after that.

|

|

3.

|

Applies to shares redeemed within 12 months of purchase.

|

|

4.

|

May apply to shares redeemed within 18 months of a retirement plan's first purchase of Class N shares.

|

|

5.

|

With respect to Transition 2040 Fund and Transition 2050 Fund, the Manager has voluntarily agreed to waive fees and/or reimburse the Fund for certain expenses in order to limit "Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement" (including the combined direct (fund level) and indirect (underlying fund level) expenses, but excluding (i) interest, taxes, dividends tied to short sales, brokerage commissions, and other expenditures which are capitalized in accordance with generally accepted accounting principles; (ii) certain other expenses attributable to, and incurred as a result of, a Fund's investments; and (iii) other extraordinary expenses (including litigation expenses) not incurred in the ordinary course of the Fund's business) to annual rates of 1.50% for Class A shares, 2.25% for Class B shares, 2.25% for Class C shares, 1.75% for Class N shares, and 1.25% for Class Y shares as calculated on the daily net assets of the Fund. This limitation will be applied after giving effect to any reimbursements by the Distributor of 12b-1 fees paid by the Fund with respect to investments in Class A shares of Underlying Funds that do not offer Class Y shares. The Manager is not required to waive or reimburse Fund expenses in excess of the amount of indirect management fees earned from investments in the Underlying Funds. The Fund's Transfer Agent has voluntarily agreed to limit its fees to 0.35% of average daily net assets per fiscal year for all classes. Each of these voluntary fee waivers and/or reimbursements may not be amended or withdrawn until one year from the date of the respective Fund’s prospectus. |

|

6.

|

With respect to the Acquiring Fund, the Manager has voluntarily agreed to waive fees and/or reimburse certain Fund expenses at an annual rate of 0.04% as calculated on the daily net assets of the Fund. This waiver and/or reimbursement is applied after (and in addition to) any other applicable waivers and/or expense reimbursements that may apply, and may not be amended or withdrawn until one year from the date of the Acquiring Fund’s prospectus. The Manager is not required to waive or reimburse Fund expenses in excess of the amount of indirect management fees earned from investments in the Underlying Funds. The fee waivers and/or expense reimbursements of the Acquiring Fund will apply to the Combined Fund following the Reorganizations.

|

|

7.

|

The Manager has voluntarily agreed to waive fees and/or reimburse the Combined Fund for certain expenses in order to limit "Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement" (excluding any applicable dividend expense, taxes, interest and fees from borrowing, any subsidiary expenses, Acquired Fund Fees and Expenses, brokerage commissions, extraordinary expenses and certain other Fund expenses) so that such expenses of the Combined Fund do not exceed those of the Acquiring Fund to the extent any difference is attributed to the Reorganization. This fee waiver and/or expense limitation may not be amended or withdrawn until one year from the Closing Date of the Reorganization.

|

Example

This Example is intended to help you compare the cost of investing in the relevant Fund with the cost of investing in other mutual funds. This Example assumes that you invest $10,000 in the Funds for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

If shares are redeemed1:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Transition 2030 Fund Class A

|

$698

|

$957

|

$1,236

|

$2,030

|

|

Transition 2040 Fund Class A

|

$712

|

$1,001

|

$1,312

|

$2,190

|

|

Transition 2050 Fund Class A

|

$720

|

$1,088

|

$1,479

|

$2,573

|

|

PS: Active Allocation Fund Class A

|

$692

|

$947

|

$1,222

|

$2,005

|

|

PS: Active Allocation Fund

Pro Forma Combined Fund Class A

|

$692

|

$949

|

$1,226

|

$2,015

|

|

If shares are not redeemed2:

|

||||

|

Transition 2030 Fund Class A

|

$698

|

$957

|

$1,236

|

$2,030

|

|

Transition 2040 Fund Class A

|

$712

|

$1,001

|

$1,312

|

$2,190

|

|

Transition 2050 Fund Class A

|

$720

|

$1,088

|

$1,479

|

$2,573

|

|

PS: Active Allocation Fund Class A

|

$692

|

$947

|

$1,222

|

$2,005

|

|

PS: Active Allocation Fund

Pro Forma Combined Fund Class A

|

$692

|

$949

|

$1,226

|

$2,015

|

|

If shares are redeemed1:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Transition 2030 Fund Class B

|

$716

|

$968

|

$1,346

|

$2,0483

|

|

Transition 2040 Fund Class B

|

$731

|

$1,026

|

$1,448

|

$2,2403

|

|

Transition 2050 Fund Class B

|

$731

|

$1,087

|

$1,570

|

$2,5723

|

|

PS: Active Allocation Fund Class B

|

$711

|

$961

|

$1,337

|

$2,0293

|

|

PS: Active Allocation Fund

Pro Forma Combined Fund Class B

|

$711

|

$961

|

$1,337

|

$2,0343

|

|

If shares are not redeemed2:

|

||||

|

Transition 2030 Fund Class B

|

$216

|

$668

|

$1,146

|

$2,0483

|

|

Transition 2040 Fund Class B

|

$231

|

$726

|

$1,248

|

$2,2403

|

|

Transition 2050 Fund Class B

|

$231

|

$787

|

$1,370

|

$2,5723

|

|

PS: Active Allocation Fund Class B

|

$211

|

$661

|

$1,137

|

$2,0293

|

|

PS: Active Allocation Fund

Pro Forma Combined Fund Class B

|

$211

|

$661

|

$1,137

|

$2,0343

|

|

If shares are redeemed1:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Transition 2030 Fund Class C

|

$308

|

$643

|

$1,104

|

$2,382

|

|

Transition 2040 Fund Class C

|

$326

|

$700

|

$1,201

|

$2,581

|

|

Transition 2050 Fund Class C

|

$331

|

$795

|

$1,387

|

$2,992

|

|

PS: Active Allocation Fund Class C

|

$301

|

$630

|

$1,085

|

$2,347

|

|

PS: Active Allocation Fund

Pro Forma Combined Fund Class C

|

$301

|

$634

|

$1,093

|

$2,367

|

|

If shares are not redeemed2:

|

||||

|

Transition 2030 Fund Class C

|

$208

|

$643

|

$1,104

|

$2,382

|

|

Transition 2040 Fund Class C

|

$226

|

$700

|

$1,201

|

$2,581

|

|

Transition 2050 Fund Class C

|

$231

|

$795

|

$1,387

|

$2,992

|

|

PS: Active Allocation Fund Class C

|

$201

|

$630

|

$1,085

|

$2,347

|

|

PS: Active Allocation Fund

Pro Forma Combined Fund Class C

|

$201

|

$634

|

$1,093

|

$2,367

|

|

If shares are redeemed:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Transition 2030 Fund Class N

|

$250

|

$465

|

$803

|

$1,759

|

|

Transition 2040 Fund Class N

|

$263

|

$506

|

$872

|

$1,904

|

|

Transition 2050 Fund Class N

|

$277

|

$603

|

$1,054

|

$2,308

|

|

PS: Active Allocation Fund Class N

|

$245

|

$458

|

$794

|

$1,744

|

|

PS: Active Allocation Fund

Pro Forma Combined Fund Class N

|

$245

|

$471

|

$820

|

$1,806

|

|

If shares are not redeemed:

|

||||

|

Transition 2030 Fund Class N

|

$150

|

$465

|

$803

|

$1,759

|

|

Transition 2040 Fund Class N

|

$163

|

$506

|

$872

|

$1,904

|

|

Transition 2050 Fund Class N

|

$177

|

$603

|

$1,054

|

$2,308

|

|

PS: Active Allocation Fund Class N

|

$145

|

$458

|

$794

|

$1,744

|

|

PS: Active Allocation Fund

Pro Forma Combined Fund Class N

|

$145

|

$471

|

$820

|

$1,806

|

|

If shares are redeemed:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Transition 2030 Fund Class Y

|

$80

|

$250

|

$435

|

$970

|

|

Transition 2040 Fund Class Y

|

$84

|

$263

|

$457

|

$1,018

|

|

Transition 2050 Fund Class Y

|

$89

|

$279

|

$484

|

$1,077

|

|

PS: Active Allocation Fund Class Y

|

$88

|

$284

|

$497

|

$1,109

|

|

PS: Active Allocation Fund

Pro Forma Combined Fund Class Y

|

$86

|

$278

|

$486

|

$1,085

|

|

If shares are not redeemed:

|

||||

|

Transition 2030 Fund Class Y

|

$80

|

$250

|

$435

|

$970

|

|

Transition 2040 Fund Class Y

|

$84

|

$263

|

$457

|

$1,018

|

|

Transition 2050 Fund Class Y

|

$89

|

$279

|

$484

|

$1,077

|

|

PS: Active Allocation Fund Class Y