As filed with the U.S. Securities and Exchange Commission on June 10, 2019

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21666

Hatteras Master Fund, L.P.

(Exact name of registrant as specified in charter)

8510 Colonnade Center Drive Suite 150

Raleigh, NC 27615

(Address of principal executive offices) (Zip code)

David B. Perkins

8510 Colonnade Center Drive Suite 150

Raleigh, NC 27615

(Name and address of agent for service)

919-846-2324

Registrant's telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2019

Item 1. Reports to Stockholders.

ANNUAL REPORT MARCH 31, 2019 |

Hatteras Core Alternatives Fund, L.P.

Hatteras Core Alternatives TEI Fund, L.P.

Hatteras Core Alternatives Institutional Fund, L.P.

Hatteras Core Alternatives TEI Institutional Fund, L.P.

Beginning on January 1, 2021 as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically from the Fund by calling 1-800-504-9070 or by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can request to continue receiving paper copies of your shareholder reports by contacting your financial intermediary or, if you invest directly with the Fund, calling 1-800-504-9070 to let the Fund know of your request. Your election to receive in paper will apply to all funds held in your account.

Annual Review (unaudited)

For the fiscal year ended March 31, 2019, on a net basis, the Core Alternatives Institutional Fund, L.P. returned 8.48%, the Core Alternatives Fund, L.P. returned 8.35%, the Core Alternatives TEI Fund, L.P. returned 8.16%, and the Core Alternatives TEI Institutional Fund, L.P. returned 8.30%. Each Fund invests substantially all of its assets, directly or indirectly, in Hatteras Master Fund, L.P. (the “Master Fund”). Returns of the Funds will differ since the Funds have different expenses. Fund performance outperformed its benchmark, the HFRX Global Hedge Index, which returned -3.34% for the period.

Within the Core Alternatives Institutional Fund, Private Investments drove performance for the year, with gains of +10.51% (Gross), while Hedged Investments returned -0.72% (Gross). The Private Investments portfolio’s gains were led by the Buyout, Growth Capital and Venture Capital categories. Within Hedged Investments, the Event Driven and Macro categories generated losses during the period which more than offset gains from Relative Value and Long Short Equity positions.

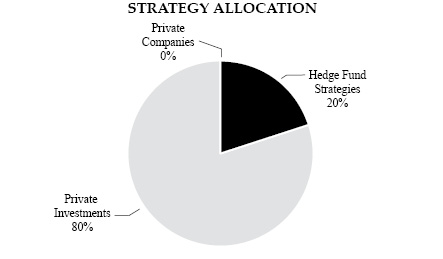

At the end of the fiscal year, Private Investment exposure was 80% and Hedged Investments comprised 20% of the Fund. Given the mature state of the portfolio, we anticipate distribution activity to continue throughout 2019.

Private Investments

Private Investments returned +10.51% (Gross) for the period. Buyout was the top performer for the year, followed by the Growth Capital and Venture Capital categories. Debt funds generated a small gain for the year, while Real Estate positions produced a modest loss. The Energy & Natural Resources category was the largest detractor for the period.

Buyout was a consistent performer with gains in each quarter of the fiscal year. The top contributor was a new position for the Fund which is focused on acquiring interests in mature businesses at a discount via the secondary market. Gains in the fund were driven by write-ups on three single asset secondary purchases, an immune-sequencing company, a ride-sharing company, and an eCommerce company. Exit activity was also a key driver of performance for the year. During the year, the Fund benefitted from the sales of companies across a variety of industries including veterinary services, recruitment process outsourcing, water filtration systems, home fashion products, automotive finance and insurance, and software. Several buyout funds also saw unrealized gains reflecting improved fundamentals and corresponding markups in valuation for underlying companies.

Growth Capital was the second largest contributor during the period. An outsized winner in the category was a China focused fund which had a successful IPO in the cloud computing and network security industry. Transaction activity was also additive to performance, as an electronic cigarette company and an Indian e-commerce company each sold material stakes in their businesses at valuations above previous funding rounds. Detractors within the category included funds with exposure to emerging market public equities, particularly positions in China and India.

Within Venture Capital, gains were led by positions which were marked up following new rounds of funding at higher valuations. A top performer in the category was a position held in two funds managed by the same general partner, where an online payment processing company completed an up round of financing in September. Other notable contributors included realized gains in a genetic testing company and a ride sharing company which was marked up twice during the year following two rounds of financing.

The Credit and Real Estate categories produced mixed performance for the year. Positive performance within the Credit category resulted from markups of portfolio companies within the Media and Health Care industries; however, the gains were partially offset by losses from distressed debt funds. Real Estate was a modest detractor with losses largely driven by a Brazil focused real estate fund which experienced unrealized losses from the weakening of the Brazilian Real during the period. These losses were limited by gains in U.S. real estate funds.

The Energy and Natural Resources category was the largest detractor for the year driven by a sharp decline in commodity prices during the fourth quarter of 2018 which weighed on the valuations of both public and private companies. Another factor which detracted from performance for the category was a transaction that was completed during the third quarter of 2018 which materially reduced the Fund’s energy allocation and exposure to private funds which held public equity positions. In total, a package of five positions representing approximately 3.5% of the Fund were sold via the secondary market. While the transaction detracted from performance within the category, it was executed in coordination with a transaction to increase domestic Buyout exposure, which in aggregate contributed to performance for the year.

The Fund received approximately $67 million in net cash flows during the 12-month period. For the year, distributions were highest from funds with vintage years between 2007 and 2010, as expected given the mature state of the portfolio (weighted average age of 8.2 years).

1

Annual Review (unaudited) (continued)

Hedged Investments

Hedged Investments returned -0.72% (Gross) for the period. Losses were driven by the Event Driven category’s exposure to legacy side pocket positions, while the Fund’s active Event Driven and Macro positions were more modest detractors for year. Positive performance was split between the Relative Value and Long Short Equity categories.

Event Driven was the largest detractor in the Hedged Investments portfolio during the year. Two related side pocket positions, comprised of the remaining assets from distressed debt funds sold in 2012 and 2013, were significant detractors for the annual period. A common asset held within each position is a satellite communications company which was marked down to reflect a declining financial status as the company awaits regulatory clearance. Outside of side pocket positions, the Fund’s three active Event Driven positions produced small losses for the year. While all three active managers share multi-strategy attributes which allow them the flexibility to trade across the capital structure, losses for year were driven by long U.S. equity positions.

The Macro category also detracted from performance for the period, with losses in a systematic strategy surpassing gains from a discretionary manager. The systematic manager’s annual losses were the result of trend following positions which were wrong footed entering two volatile periods during the year; Italian and U.S. interest rate dynamics during the second quarter of 2018 and the global sell-off in stock indices and oil markets during the fourth quarter of 2018. These losses were partially offset by gains from our discretionary manager who generated gains in fixed income and energy markets trades during the year.

Relative Value was the largest contributor during the year. Gains were led by a legacy side pocket position, where an underlying position in the media industry increased in value as the company’s cash flow metrics continued to improve. A multi-strategy fund also added to performance for the year and served as a ballast for the Hedged Investments portfolio during the fourth quarter of 2018 given its market neutral positioning. The manager’s gains were led by event driven equity, corporate credit, and developed market fixed income strategies. Within the manager’s event driven strategy, stub trades in the technology sector and merger arbitrage trades in the media industry were among the top performers.

Long/Short Equity also contributed to performance for the period. Among the top performers for the year were legacy hybrid funds, which have a combination of both public and private components of their underlying portfolios. The largest contributor within the category was a technology focused hybrid fund which generated gains in both public and private positions during the year. Results from active managers were mixed for the year. A U.S. focused manager produced gains with positive security selection in media, aerospace and defense and automotive names while maintaining modest net exposure throughout the year. A global focused manager was a small detractor from performance as the growth biased and Asia heavy portfolio was out of favor during the third and fourth quarters of 2018.

2

Fund Outlook (unaudited)

Looking ahead, pockets of volatility are likely to continue given shifting global central bank policies, uncertainty surrounding trade talks between the U.S. and China, slowing domestic corporate earnings growth, and concerns of slowing global economic growth highlighted by weakness in Europe and China. Global central banks, which had been moving towards increasingly restrictive policies for much of 2018, broadly reversed course in early 2019 as the global growth outlook weakened. A resurgence of inflation, particularly in the U.S. which has led developed economies, could lead to a resumption of tighter monetary policies. Regarding corporate earnings, the very same tax reform benefits which have supported earnings growth in 2018 could turn into a headwind in 2019 as growth metrics are typically measured on a year-over-year basis. Corporate earnings on an absolute basis may continue to grow, albeit at a slower pace due to the steeper comparison levels. We believe positioning in the Fund, diversified across private and hedged investment strategies, offers investors immediate access to a mature, evergreen private investments program for growth and a multi-manager hedge fund portfolio for potential volatility management.

The Fund’s Private Investments remain attractive. We will continue to look for opportunities to strategically reposition segments of the portfolio, following the same game plan as the transactions that were executed in the third quarter of 2018 which trimmed energy exposure and rotated capital into attractively discounted domestic buyout investments. Future opportunities may include selectively reducing venture capital, international and energy investments, and opportunistically adding to the domestic buyout, credit, and real estate categories. The Fund’s Sub-advisor, Portfolio Advisors, stands uniquely positioned to manage the evolution of the portfolio with a strong long-term performance track record, deep experience across a breadth of private investment strategies, and the necessary relationships to reposition the portfolio.

Within Hedged Investments, efforts will continue to further support the objective of providing diversification and volatility management. Both the Event Driven or Marco categories have been fully repositioned over the last two years and we do not anticipate any near-term changes with either category. While the Relative Value category has also been fully positioned in recent years, we continue to assess opportunities in the category and may periodically supplement our positions with a liquid risk premia strategy. The Long/Short Equity overweight allocation has been materially reduced over last two years and will continue to be deemphasized as redemptions are currently scheduled from the category’s remaining two managers. As we conducted due diligence on prospective managers within the Long/Short Equity category during 2018, we concluded that higher net exposure strategies generally would not help meet the objectives of providing diversification and volatility management for the Fund. We anticipate building a diversified portfolio with approximately 10 core hedge fund positions, focusing on larger organizations with proven track records and multi-strategy characteristics. We believe the Fund will benefit from more prudent and strategic utilization of hedge fund strategies specifically designed to complement the Private Investment portfolio.

3

Performance Summary1 (UNAUDITED)

HATTERAS CORE ALTERNATIVES FUND, L.P. (INCEPTION DATE: APRIL 1, 2005)

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Year2 |

2019 |

0.44% |

0.49% |

5.30% |

6.28% |

|||||||||

2018 |

0.78% |

-0.12% |

3.10% |

-1.31% |

0.34% |

-0.08% |

1.27% |

2.93% |

-0.05% |

0.25% |

-0.97% |

-0.02% |

6.20% |

2017 |

0.14% |

0.02% |

1.96% |

0.46% |

0.58% |

-0.44% |

0.87% |

0.57% |

-0.40% |

0.01% |

0.52% |

0.22% |

4.57% |

2016 |

-2.16% |

-2.72% |

-1.21% |

-0.29% |

-0.22% |

-0.19% |

1.58% |

1.21% |

0.47% |

0.04% |

-0.09% |

0.16% |

-3.44% |

2015 |

0.08% |

1.84% |

-0.11% |

0.53% |

1.39% |

-0.24% |

1.87% |

-1.25% |

-1.59% |

-1.46% |

-0.11% |

0.14% |

1.02% |

2014 |

0.60% |

1.54% |

-0.64% |

-1.38% |

1.39% |

2.07% |

0.16% |

1.47% |

0.34% |

0.57% |

0.67% |

-0.94% |

5.92% |

2013 |

1.16% |

-0.03% |

0.54% |

-0.39% |

0.59% |

-0.53% |

0.94% |

-0.50% |

1.81% |

1.88% |

1.50% |

2.94% |

10.31% |

2012 |

1.96% |

0.89% |

-0.18% |

0.07% |

-0.58% |

0.01% |

0.50% |

0.74% |

0.64% |

-0.04% |

0.08% |

0.94% |

5.10% |

2011 |

0.41% |

1.09% |

0.69% |

0.83% |

-0.22% |

-0.79% |

0.19% |

-2.37% |

-3.27% |

1.02% |

-0.96% |

-0.56% |

-3.97% |

2010 |

-0.30% |

0.06% |

1.72% |

0.94% |

-2.63% |

-1.13% |

0.34% |

-0.11% |

2.29% |

1.30% |

0.28% |

2.31% |

5.06% |

2009 |

0.17% |

-0.43% |

-0.50% |

0.49% |

3.69% |

0.79% |

2.20% |

1.20% |

2.39% |

0.11% |

0.85% |

0.95% |

12.50% |

2008 |

-2.89% |

1.86% |

-2.88% |

1.57% |

2.10% |

-0.48% |

-2.84% |

-1.53% |

-8.28% |

-7.54% |

-4.29% |

-1.01% |

-23.79% |

2007 |

0.97% |

0.67% |

1.60% |

1.86% |

2.01% |

0.78% |

-0.05% |

-1.85% |

1.93% |

2.71% |

-1.72% |

0.92% |

10.16% |

2006 |

2.80% |

-0.20% |

1.74% |

1.10% |

-1.97% |

-0.75% |

0.37% |

0.76% |

0.26% |

1.60% |

2.09% |

0.93% |

8.98% |

2005 |

-1.54% |

0.26% |

1.46% |

2.16% |

0.48% |

1.39% |

-1.46% |

1.35% |

1.85% |

6.04% |

Returns |

Fund |

S&P 5003 |

HFRXGL3 |

Historical Data |

Fund |

S&P 5003 |

HFRXGL3 |

|

Year-to-date |

6.28% |

13.65% |

2.60% |

Cumulative Return |

55.80% |

221.68% |

8.51% |

|

1-Year |

8.35% |

9.50% |

-3.34% |

Standard Deviation4 |

5.50% |

13.93% |

5.52% |

|

3-Year (average annual) |

6.62% |

13.51% |

1.94% |

Largest Drawdown5 |

-24.98% |

-50.95% |

-25.21% |

|

5-Year (average annual) |

3.83% |

10.91% |

-0.30% |

Drawdown — # of months6 |

17 |

16 |

14 |

|

10-Year (average annual) |

4.93% |

15.92% |

1.74% |

|||||

Annualized Since Inception |

3.22% |

8.70% |

0.58% |

HATTERAS CORE ALTERNATIVES TEI FUND, L.P. (INCEPTION DATE: APRIL 1, 2005)

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Year2 |

2019 |

0.42% |

0.47% |

5.35% |

6.30% |

|||||||||

2018 |

0.72% |

-0.09% |

3.00% |

-1.33% |

0.32% |

-0.10% |

1.25% |

2.92% |

-0.07% |

0.23% |

-0.99% |

-0.04% |

5.90% |

2017 |

0.13% |

0.01% |

1.96% |

0.45% |

0.58% |

-0.46% |

0.85% |

0.56% |

-0.41% |

0.00% |

0.50% |

0.01% |

4.29% |

2016 |

-2.17% |

-2.73% |

-1.28% |

-0.31% |

-0.22% |

0.00% |

1.57% |

1.21% |

0.48% |

0.04% |

-0.09% |

0.17% |

-3.55% |

2015 |

0.08% |

1.83% |

-0.12% |

0.52% |

1.28% |

0.29% |

1.68% |

-1.14% |

-1.47% |

-1.48% |

-0.13% |

0.12% |

0.90% |

2014 |

0.59% |

1.52% |

-0.65% |

-1.40% |

1.39% |

2.06% |

0.14% |

1.48% |

0.35% |

0.57% |

0.67% |

-0.94% |

5.89% |

2013 |

1.15% |

-0.04% |

0.48% |

-0.39% |

0.59% |

0.00% |

0.92% |

-0.52% |

1.77% |

1.85% |

1.47% |

2.92% |

10.02% |

2012 |

1.94% |

0.88% |

-0.20% |

0.06% |

-0.59% |

0.00% |

0.49% |

0.73% |

0.63% |

-0.05% |

0.08% |

0.93% |

4.99% |

2011 |

0.41% |

1.09% |

0.68% |

0.83% |

-0.22% |

-0.79% |

0.19% |

-2.37% |

-3.28% |

1.01% |

-0.96% |

-0.59% |

-4.02% |

2010 |

-0.34% |

0.06% |

1.72% |

0.94% |

-2.63% |

-1.12% |

0.35% |

-0.12% |

2.27% |

1.28% |

0.26% |

2.29% |

4.95% |

2009 |

0.16% |

-0.44% |

-0.50% |

0.47% |

3.71% |

0.79% |

2.19% |

1.20% |

2.39% |

0.11% |

0.85% |

0.95% |

12.48% |

2008 |

-2.95% |

1.82% |

-2.92% |

1.53% |

2.08% |

-0.52% |

-2.88% |

-1.57% |

-8.33% |

-7.56% |

-4.31% |

-0.86% |

-23.98% |

2007 |

0.94% |

0.64% |

1.58% |

1.83% |

1.99% |

0.75% |

-0.07% |

-1.88% |

1.89% |

2.68% |

-1.74% |

0.87% |

9.79% |

2006 |

2.77% |

-0.20% |

1.72% |

1.09% |

-1.98% |

-0.75% |

0.37% |

0.72% |

0.23% |

1.57% |

2.05% |

0.90% |

8.73% |

2005 |

-1.54% |

0.26% |

1.46% |

2.16% |

0.48% |

1.39% |

-1.46% |

1.32% |

1.82% |

5.97% |

Returns |

Fund |

S&P 5003 |

HFRXGL3 |

Historical Data |

Fund |

S&P 5003 |

HFRXGL3 |

|

Year-to-date |

6.30% |

13.65% |

2.60% |

Cumulative Return |

52.30% |

221.68% |

8.51% |

|

1-Year |

8.16% |

9.50% |

-3.34% |

Standard Deviation4 |

5.49% |

13.93% |

5.52% |

|

3-Year (average annual) |

6.40% |

13.51% |

1.94% |

Largest Drawdown5 |

-25.23% |

-50.95% |

-25.21% |

|

5-Year (average annual) |

3.67% |

10.91% |

-0.30% |

Drawdown — # of months6 |

17 |

16 |

14 |

|

10-Year (average annual) |

4.78% |

15.92% |

1.74% |

|||||

Annualized Since Inception |

3.05% |

8.70% |

0.58% |

|

1. |

Performance results and calculations after the Funds’ most recent fiscal year are unaudited. The principal value of the Funds will fluctuate so that an investor’s units, when redeemed, may be worth more or less than the original cost. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of the 2% redemption fee, which would reduce returns shown above. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown. The net expense ratio and total expense ratio for the Hatteras Core Alternatives Fund, L.P. are 2.42% and 6.02%, respectively. The net expense ratio and total expense ratio for the Hatteras Core Alternatives TEI Fund, L.P. are 2.49% and 6.09%, respectively. The total expense ratio for both funds includes Acquired Fund Fees and Expenses of 3.60%. Please see the current Prospectus for detailed information regarding the expenses of the Funds. |

|

2. |

Cumulative return. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of placement fees, if applicable, which would reduce returns noted above. |

|

3. |

S&P 500 Index and HFRX Global Hedge Fund Index (HFRXGL) data are sourced from Bloomberg. The indices are unmanaged portfolios of securities. Their performance results do not reflect the deduction of management fees, incentive compensation, commissions or other expenses. An investor cannot invest directly in an index. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock’s weight in the Index proportionate to its market value. HFRXGL is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

|

4. |

Measurement of the investment’s volatility. |

|

5. |

The peak to trough decline of an investment. |

|

6. |

Number of months of a peak to trough decline of an investment. |

4

Performance Summary1 (UNAUDITED)

HATTERAS CORE ALTERNATIVES INSTITUTIONAL FUND, L.P. (INCEPTION DATE: JANUARY 1, 2007)

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Year2 |

2019 |

0.44% |

0.51% |

5.33% |

6.33% |

|||||||||

2018 |

0.72% |

-0.07% |

3.01% |

-1.30% |

0.35% |

-0.08% |

1.27% |

2.94% |

-0.04% |

0.25% |

-0.97% |

-0.02% |

6.12% |

2017 |

0.14% |

0.04% |

1.97% |

0.45% |

0.59% |

-0.44% |

0.87% |

0.58% |

-0.40% |

0.01% |

0.53% |

0.21% |

4.65% |

2016 |

-2.09% |

-2.65% |

-1.20% |

-0.22% |

-0.14% |

-0.11% |

1.65% |

1.21% |

0.47% |

0.04% |

-0.09% |

0.17% |

-3.00% |

2015 |

0.14% |

1.72% |

-0.05% |

0.54% |

1.32% |

-0.15% |

1.76% |

-1.07% |

-1.38% |

-1.26% |

-0.04% |

0.19% |

1.66% |

2014 |

0.60% |

1.44% |

-0.52% |

-1.19% |

1.31% |

1.93% |

0.20% |

1.39% |

0.37% |

0.58% |

0.66% |

-0.79% |

6.09% |

2013 |

1.23% |

0.03% |

0.59% |

-0.32% |

0.65% |

-0.46% |

1.00% |

-0.43% |

1.87% |

1.94% |

1.57% |

2.75% |

10.87% |

2012 |

2.03% |

0.96% |

-0.12% |

0.13% |

-0.52% |

0.07% |

0.56% |

0.80% |

0.70% |

0.02% |

0.15% |

1.00% |

5.92% |

2011 |

0.47% |

1.15% |

0.75% |

0.89% |

-0.16% |

-0.72% |

0.25% |

-2.31% |

-3.20% |

1.09% |

-0.89% |

-0.50% |

-3.23% |

2010 |

-0.24% |

0.12% |

1.78% |

1.01% |

-2.57% |

-1.06% |

0.41% |

-0.04% |

2.36% |

1.36% |

0.34% |

2.37% |

5.89% |

2009 |

0.24% |

-0.36% |

-0.45% |

0.55% |

3.75% |

0.86% |

2.27% |

1.27% |

2.46% |

0.17% |

0.91% |

1.01% |

13.35% |

2008 |

-2.85% |

1.91% |

-2.81% |

1.63% |

2.14% |

-0.42% |

-2.78% |

-1.47% |

-8.22% |

-7.50% |

-4.23% |

-0.94% |

-23.27% |

2007 |

1.12% |

0.73% |

1.65% |

1.89% |

2.06% |

0.82% |

0.00% |

-1.89% |

2.00% |

2.75% |

-1.71% |

0.97% |

10.76% |

Returns |

Fund |

S&P 5003 |

HFRXGL3 |

Historical Data |

Fund |

S&P 5003 |

HFRXGL3 |

|

Year-to-date |

6.33% |

13.65% |

2.60% |

Cumulative Return |

43.27% |

159.11% |

-4.32% |

|

1-Year |

8.48% |

9.50% |

-3.34% |

Standard Deviation4 |

5.55% |

14.70% |

5.64% |

|

3-Year (average annual) |

6.73% |

13.51% |

1.94% |

Largest Drawdown5 |

-24.29% |

-50.95% |

-25.21% |

|

5-Year (average annual) |

4.08% |

10.91% |

-0.30% |

Drawdown — # of months6 |

17 |

16 |

14 |

|

10-Year (average annual) |

5.42% |

15.92% |

1.74% |

|||||

Annualized Since Inception |

2.98% |

8.08% |

-0.36% |

HATTERAS CORE ALTERNATIVES TEI INSTITUTIONAL FUND, L.P. (INCEPTION DATE: FEBRUARY 1, 2007)

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Year2 |

2019 |

0.42% |

0.48% |

5.31% |

6.27% |

|||||||||

2018 |

0.72% |

-0.07% |

3.01% |

-1.32% |

0.33% |

-0.09% |

1.26% |

2.93% |

-0.06% |

0.24% |

-0.98% |

-0.03% |

6.02% |

2017 |

0.14% |

0.03% |

1.98% |

0.46% |

0.59% |

-0.44% |

0.87% |

0.57% |

-0.40% |

0.01% |

0.52% |

0.20% |

4.63% |

2016 |

-2.09% |

-2.65% |

-1.24% |

-0.24% |

-0.14% |

-0.11% |

1.64% |

1.22% |

0.49% |

0.04% |

-0.08% |

0.18% |

-3.03% |

2015 |

0.14% |

1.72% |

-0.04% |

0.54% |

1.32% |

-0.15% |

1.75% |

-1.08% |

-1.39% |

-1.27% |

-0.05% |

0.18% |

1.62% |

2014 |

0.59% |

1.44% |

-0.52% |

-1.20% |

1.30% |

1.93% |

0.19% |

1.40% |

0.38% |

0.58% |

0.67% |

-0.79% |

6.10% |

2013 |

1.10% |

0.03% |

0.47% |

-0.29% |

0.59% |

-0.43% |

0.90% |

-0.41% |

1.67% |

1.73% |

1.40% |

2.71% |

9.84% |

2012 |

2.01% |

0.94% |

-0.13% |

0.13% |

-0.52% |

0.07% |

0.56% |

0.80% |

0.70% |

0.02% |

0.14% |

1.00% |

5.85% |

2011 |

0.48% |

1.16% |

0.69% |

0.81% |

-0.14% |

-0.65% |

0.23% |

-2.24% |

-3.21% |

1.07% |

-0.91% |

-0.51% |

-3.26% |

2010 |

-0.23% |

0.13% |

1.79% |

1.01% |

-2.56% |

-1.06% |

0.42% |

-0.05% |

2.34% |

1.35% |

0.33% |

2.36% |

5.88% |

2009 |

0.24% |

-0.36% |

-0.43% |

0.54% |

3.74% |

0.85% |

2.26% |

1.27% |

2.46% |

0.18% |

0.92% |

1.02% |

13.37% |

2008 |

-2.87% |

1.87% |

-2.83% |

1.59% |

2.09% |

-0.44% |

-2.82% |

-1.50% |

-8.26% |

-7.51% |

-4.24% |

-0.91% |

-23.48% |

2007 |

0.71% |

1.62% |

1.87% |

2.03% |

0.80% |

-0.04% |

-1.95% |

2.01% |

2.72% |

-1.76% |

0.96% |

9.23% |

Returns |

Fund |

S&P 5003 |

HFRXGL3 |

Historical Data |

Fund |

S&P 5003 |

HFRXGL3 |

|

Year-to-date |

6.27% |

13.65% |

2.60% |

Cumulative Return |

39.12% |

155.25% |

-5.74% |

|

1-Year |

8.30% |

9.50% |

-3.34% |

Standard Deviation4 |

6.18% |

14.75% |

5.64% |

|

3-Year (average annual) |

6.67% |

13.51% |

1.94% |

Largest Drawdown5 |

-24.53% |

-50.95% |

-25.21% |

|

5-Year (average annual) |

4.04% |

10.91% |

-0.30% |

Drawdown — # of months6 |

17 |

16 |

14 |

|

10-Year (average annual) |

5.28% |

15.92% |

1.74% |

|||||

Annualized Since Inception |

2.75% |

8.01% |

-0.48% |

|

1 |

Performance results and calculations after the Funds’ most recent fiscal year are unaudited. The principal value of the Funds will fluctuate so that an investor’s units, when redeemed, may be worth more or less than the original cost. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of the 2% redemption fee or up-front placement fees, which would reduce returns shown above. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown. The net expense ratio and total expense ratio for the Hatteras Core Alternatives Institutional Fund, L.P. are 2.10% and 5.70%, respectively. The net expense ratio and total expense ratio for the Hatteras Core Alternatives TEI Institutional Fund, L.P. are 2.09% and 5.69%, respectively. The total expense ratio for both funds includes Acquired Fund Fees and Expenses of 3.60%. Please see the current Prospectus for detailed information regarding the expenses of the Funds. |

|

2. |

Cumulative return. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of placement fees, if applicable, which would reduce returns noted above. |

|

3. |

S&P 500 Index and HFRX Global Hedge Fund Index (HFRXGL) data are sourced from Bloomberg. The indices are unmanaged portfolios of securities. Their performance results do not reflect the deduction of management fees, incentive compensation, commissions or other expenses. An investor cannot invest directly in an index. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock’s weight in the Index proportionate to its market value. HFRXGL is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

|

4. |

Measurement of the investment’s volatility. |

|

5. |

The peak to trough decline of an investment. |

|

6. |

Number of months of a peak to trough decline of an investment. |

5

Performance Summary (UNAUDITED)

ALLOCATION AS A PERCENTAGE OF TOTAL INVESTMENTS

Strategies |

Target |

Allocation |

# of Funds |

Hedge Fund Strategies |

50% |

20% |

27 |

Private Investments |

50% |

80% |

121 |

Private Companies |

0% |

0% |

1 |

Private Company Call Options |

0% |

0% |

1 |

Total |

100% |

100% |

150 |

6

Top 10 Holdings (UNAUDITED)

|

Capital Balance |

Percent of |

Sweetwater Secondaries Fund II LP |

$ 30,805,052 |

7.34% |

The Founders Fund III L.P. |

17,530,025 |

4.18% |

Orchid Asia IV, L.P. |

13,540,596 |

3.23% |

Third Point Partners Qualified L.P. |

13,086,276 |

3.12% |

HBK Multi-Strategy Fund, L.P. |

12,738,974 |

3.03% |

BDCM Partners I, L.P. |

11,220,072 |

2.67% |

The Founders Fund IV, L.P. |

11,074,642 |

2.64% |

ECP IHS (Mauritius) Limited |

10,635,797 |

2.53% |

Accel-KKR Capital Partners III, L.P. |

10,467,133 |

2.49% |

King Street Capital, L.P. |

10,064,021 |

2.40% |

Portfolio composition will change due to ongoing management of the Master Fund.

7

Definitions (UNAUDITED)

Alpha is a measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a mutual fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark index is a fund’s alpha. In other words, alpha is often considered to represent the value that a portfolio manager adds to or subtracts from a fund’s return. A positive alpha of 1.0 means the fund has outperformed its benchmark index by 1%. Correspondingly, a similar negative alpha would indicate an underperformance of 1%.

HFRX Global Hedge Fund Index: Index data, sourced from Hedge Funds Research, Inc., is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

HFRX Equity Hedge Index: Equity Hedge strategies maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. Equity Hedge managers would typically maintain at least 50%, or almost all, invested in equities, long and short.

S&P 500 Total Return Index: The Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock’s weight in the Index proportionate to its market value. You cannot invest directly in an index. Benchmark performance should not be considered reflective of performance of the Funds.

8

Strategy Definitions (UNAUDITED)

Private Investments: Investing in equity-oriented securities through a privately negotiated process. The majority of private investment transactions involve companies that are not publicly traded. Private investments are used by companies that have achieved various stages of development. Most investors access this strategy by investing in private equity funds or private equity funds of funds.

Hedged Investments: Portfolio management that uses sophisticated investment tactics to minimize risk and provide positive returns. Hedged investments are generally set up as private investment partnerships and are not subject to registration under the Investment Company Act of 1940. As such, they may lack liquidity, be available only to certain high net worth investors and institutions, and may use strategies that employ leverage and shorts.

Long/Short Equity: Investment Managers who maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios.

Event-Driven: Investment Managers who maintain positions in companies currently or prospectively involved in corporate transactions of a wide variety including but not limited to mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. Security types can range from most senior in the capital structure to most junior or subordinated, and frequently involve additional derivative securities. Event Driven exposure includes a combination of sensitivities to equity markets, credit markets and idiosyncratic, company specific developments. Investment theses are typically predicated on fundamental characteristics (as opposed to quantitative), with the realization of the thesis predicated on a specific development exogenous to the existing capital structure.

Macro: Investment Managers which trade a broad range of strategies in which the investment process is predicated on movements in underlying economic variables and the impact these have on equity, fixed income, hard currency and commodity markets. Managers employ a variety of techniques, both discretionary and systematic analysis, combinations of top down and bottom up theses, quantitative and fundamental approaches and long and short term holding periods.

Relative Value: Investment Managers who maintain positions in which the investment thesis is predicated on realization of a valuation discrepancy in the relationship between multiple securities. Managers employ a variety of fundamental and quantitative techniques to establish investment theses, and security types range broadly across equity, fixed income, derivative or other security types.

9

Safe Harbor and Forward-Looking Statements Disclosure (UNAUDITED)

Safe Harbor Statement: This presentation shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of, the securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction. Forward-Looking Statements: This presentation contains certain statements that may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things, statements about our future outlook on opportunities based upon current market conditions. Although the company believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this discussion. Other than as required by law, the company does not assume a duty to update these forward-looking statements. Past performance is no guarantee of future results. The illustrations are not intended to predict the performance of any specific investment or security. The past performance figures do not represent performance of any Hatteras security and there can be no assurance that any Hatteras security will achieve the past returns of the illustrative examples. This is not an offering to subscribe for units in any fund and is intended for informational purposes only. An offering can only be made by delivery of the Prospectus to “qualified clients” within the meaning of U.S. securities laws. Diversification does not assure a profit or protect against a loss.

Please carefully consider the investment objectives, risks, and charges and expenses of the Funds before investing. Please read the Prospectus carefully before investing as it contains important information on the investment objectives, composition, fees, charges and expenses, risks, suitability, and tax obligations of investing in the Funds. Copies of the Prospectus and performance data current to the most recent month-end may be obtained online at hatterasfunds.com or by contacting Hatteras at 866.388.6292. Past performance does not guarantee future results.

The Hatteras Core Alternatives Fund, L.P.; the Hatteras Core Alternatives TEI Fund, L.P; the Hatteras Core Alternatives Institutional Fund, L.P.; and the Hatteras Core Alternatives TEI Institutional Fund, L.P.(collectively referred to herein as the “Hatteras Core Alternatives Fund” or the “Fund”) are Delaware limited partnerships that are registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as non-diversified, closed-end management investment companies whose units are registered under the Securities Act of 1933, as amended. The Hatteras Core Alternatives Fund is a fund of alternative investments. As such, the Fund invests in private hedge funds and private equity investments. Hedge funds are speculative investments and are not suitable for all investors, nor do they represent a complete investment program. A hedge fund can be described generally as a private and unregistered investment pool that accepts investors’ money and employs hedging and arbitrage techniques using long and short positions, leverage and derivatives, and investments in many markets.

Key Risk Factors: The Fund, through an investment in the Master Fund, will invest substantially all of its assets in underlying funds that are generally not registered as investment companies under the 1940 Act and, therefore, the Fund will not have the benefit of various protections provided under the 1940 Act with respect to an investment in those underlying funds. The Fund can be highly volatile, carry substantial fees, and involve complex tax structures. Investments in the Fund involve a high degree of risk, including loss of entire capital. The underlying funds may engage in speculative investment strategies and practices, such as the use of leverage, short sales, and derivatives transactions, which can increase the risk of investment loss. The Fund provides limited liquidity, and units in the Fund are not transferable. Liquidity will be provided only through repurchase offers made by the Fund from time to time, generally on a quarterly basis upon prior written notice. The success of the Fund is highly dependent on the financial and managerial expertise of its principals and key personnel of the Fund’s investment manager. Although the investment manager for the Fund expects to receive detailed information from each underlying fund on a regular basis regarding its valuation, investment performance, and strategy, in most cases the investment manager has little or no means of independently verifying this information. The underlying funds are not required to provide transparency with respect to their respective investments. By investing in the underlying funds indirectly through the Fund, investors will be subject to a dual layer of fees, both at the Fund and underlying fund levels. Certain underlying funds will not provide final Schedule K-1s for any fiscal year before April 15th of the following year. Those funds, however, will endeavor to provide estimates of taxable income or losses with respect to their investments. Please see the Prospectus for a detailed discussion of the specific risks disclosed here and other important risks and considerations.

Securities offered through Hatteras Capital Distributors, LLC, member FINRA/SIPC. Hatteras Capital Distributors, LLC is affiliated with Hatteras Funds, LP by virtue of common control/ownership.

10

Hatteras Funds

Hatteras Core Alternatives Fund, L.P.

(a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Fund, L.P.

(a Delaware Limited Partnership)

Hatteras Core Alternatives Institutional Fund, L.P.

(a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Institutional Fund, L.P.

(a Delaware Limited Partnership)

Financial Statements

As of and for the year ended March 31, 2019

Hatteras Funds

As of and for the year ended March 31, 2019

Hatteras Core Alternatives Fund, L.P. (a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Fund, L.P. (a Delaware Limited Partnership)

Hatteras Core Alternatives Institutional Fund, L.P. (a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Institutional Fund, L.P. (a Delaware Limited Partnership)

Table of Contents

Statements of Assets, Liabilities and Partners’ Capital |

1 |

Statements of Operations |

2 |

Statements of Changes in Partners’ Capital |

3 |

Statements of Cash Flows |

4 |

Notes to Financial Statements |

5-15 |

Report of Independent Registered Public Accounting Firm |

16 |

Board of Directors (Unaudited) |

17 |

Fund Management (Unaudited) |

18 |

Other Information (Unaudited) |

19 |

Financial Statements of Hatteras Master Fund, L.P. |

20 |

HATTERAS FUNDS

(each a Delaware Limited Partnership)

Statements of Assets, Liabilities and Partners’ Capital

March 31, 2019

|

Hatteras |

Hatteras |

Hatteras |

Hatteras |

||||||||||||

Assets |

||||||||||||||||

Investment in Hatteras Master Fund, L.P., at fair value |

$ | 64,497,469 | $ | 83,440,680 | $ | 73,409,659 | $ | 198,438,311 | ||||||||

Cash and cash equivalents |

200,000 | 205,000 | 200,000 | 205,000 | ||||||||||||

Receivable for withdrawals from Hatteras Master Fund, L.P. |

4,474,967 | 6,293,584 | 4,474,722 | 12,561,222 | ||||||||||||

Other receivables |

357 | 358 | 355 | 320 | ||||||||||||

Prepaid assets |

8,764 | 11,269 | 9,794 | 27,190 | ||||||||||||

Total assets |

$ | 69,181,557 | $ | 89,950,891 | $ | 78,094,530 | $ | 211,232,043 | ||||||||

Liabilities and partners’ capital |

||||||||||||||||

Withdrawals payable |

$ | 4,239,967 | $ | 5,989,584 | $ | 4,201,722 | $ | 11,838,222 | ||||||||

Servicing fees payable |

35,296 | 45,889 | 39,848 | 107,742 | ||||||||||||

Performance allocation payable |

235,000 | 304,000 | 273,000 | 723,000 | ||||||||||||

Professional fees payable |

40,142 | 35,861 | 16,245 | 11,400 | ||||||||||||

Printing fees payable |

4,070 | 4,070 | 4,070 | 4,070 | ||||||||||||

Accounting, administration and transfer agency fees payable |

18,810 | 28,879 | 6,808 | 23,381 | ||||||||||||

Custodian fees payable |

843 | 4,770 | 843 | 4,756 | ||||||||||||

Withholding tax payable |

— | 39,634 | — | 114,800 | ||||||||||||

Other payables |

— | 82 | — | — | ||||||||||||

Total liabilities |

4,574,128 | 6,452,769 | 4,542,536 | 12,827,371 | ||||||||||||

Partners’ capital |

64,607,429 | 83,498,122 | 73,551,994 | 198,404,672 | ||||||||||||

Total liabilities and partners’ capital |

$ | 69,181,557 | $ | 89,950,891 | $ | 78,094,530 | $ | 211,232,043 | ||||||||

Components of partners’ capital |

||||||||||||||||

Capital contributions (net) |

$ | 34,595,209 | $ | 50,295,636 | $ | 36,932,971 | $ | 74,550,857 | ||||||||

Total distributable earnings |

30,012,220 | 33,202,486 | 36,619,023 | 123,853,815 | ||||||||||||

Partners’ capital |

$ | 64,607,429 | $ | 83,498,122 | $ | 73,551,994 | $ | 198,404,672 | ||||||||

Net asset value per unit |

$ | 122.86 | $ | 121.11 | $ | 129.51 | $ | 127.75 | ||||||||

Maximum offering price per unit** |

$ | 125.37 | $ | 123.58 | $ | 129.51 | $ | 127.75 | ||||||||

Number of authorized units |

7,500,000.00 | 7,500,000.00 | 7,500,000.00 | 7,500,000.00 | ||||||||||||

Number of outstanding units |

525,850.37 | 689,467.72 | 567,907.08 | 1,553,122.27 | ||||||||||||

|

* |

Consolidated Statement. See note 2 in the notes to the financial statements. |

|

** |

The maximum sales load for the Hatteras Core Alternatives Fund, L.P. and the Hatteras Core Alternatives TEI Fund, L.P. is 2.00%. The remaining funds are not subject to a sales load. |

See notes to financial statements and financial statements of Hatteras Master Fund, L.P.

1

HATTERAS

FUNDS

(each

a Delaware Limited Partnership)

Statements of Operations

For the year ended March 31, 2019

|

Hatteras |

Hatteras |

Hatteras |

Hatteras |

||||||||||||

Net investment income/(loss) allocated from Hatteras Master Fund, L.P. |

||||||||||||||||

Investment income |

$ | 537,590 | $ | 699,245 | $ | 606,051 | $ | 1,642,032 | ||||||||

Operating expenses |

(981,358 | ) | (1,275,129 | ) | (1,104,488 | ) | (2,992,744 | ) | ||||||||

Net investment income/(loss) allocated from Hatteras Master Fund, L.P. |

(443,768 | ) | (575,884 | ) | (498,437 | ) | (1,350,712 | ) | ||||||||

Feeder Fund investment income |

||||||||||||||||

Interest |

3,511 | 3,567 | 3,491 | 3,174 | ||||||||||||

Total Feeder Fund investment income |

3,511 | 3,567 | 3,491 | 3,174 | ||||||||||||

Feeder Fund expenses |

||||||||||||||||

Servicing fee |

457,515 | 593,586 | 514,753 | 1,392,261 | ||||||||||||

Accounting, administration and transfer agency fees |

81,401 | 112,855 | 72,894 | 133,497 | ||||||||||||

Insurance fees |

34,932 | 45,316 | 38,957 | 105,433 | ||||||||||||

Professional fees |

50,372 | 42,144 | 27,300 | 15,224 | ||||||||||||

Printing fees |

— | 3,124 | — | — | ||||||||||||

Custodian fees |

4,934 | 12,958 | 4,862 | 12,693 | ||||||||||||

Witholding tax |

— | 168,766 | — | 536,474 | ||||||||||||

Other expenses |

5,454 | 8,895 | 29 | — | ||||||||||||

Total Feeder Fund expenses |

634,608 | 987,644 | 658,795 | 2,195,582 | ||||||||||||

Net investment income/(loss) |

(1,074,865 | ) | (1,559,961 | ) | (1,153,741 | ) | (3,543,120 | ) | ||||||||

Net realized gain/(loss) and change in unrealized appreciation/depreciation on investments allocated from Hatteras Master Fund, L.P. |

||||||||||||||||

Net realized gain/(loss) from investments in Adviser Funds, securities and foreign exhange transactions |

8,061,216 | 10,473,113 | 9,077,404 | 24,593,550 | ||||||||||||

Net change in unrealized appreciation/depreciation on investments in Adviser Funds, securities and foreign exhange translations |

(994,356 | ) | (1,318,157 | ) | (1,086,210 | ) | (2,965,258 | ) | ||||||||

Net realized gain/(loss) and change in unrealized appreciation/depreciation on investments allocated from Hatteras Master Fund, L.P. |

7,066,860 | 9,154,956 | 7,991,194 | 21,628,292 | ||||||||||||

Net increase/(decrease) in partners’ capital resulting from operations |

$ | 5,991,995 | $ | 7,594,995 | $ | 6,837,453 | $ | 18,085,172 | ||||||||

|

* |

Consolidated Statement. See note 2 in the notes to the financial statements. |

See notes to financial statements and financial statements of Hatteras Master Fund, L.P.

2

HATTERAS

FUNDS

(each

a Delaware Limited Partnership)

Statements of Changes in Partners’ Capital

For the years ended March 31, 2018 and 2019

Hatteras |

Hatteras |

Hatteras |

Hatteras |

|||||||||||||

|

Limited |

Limited |

Limited |

Limited |

||||||||||||

Partners’ Capital, at March 31, 2017 |

$ | 90,372,581 | $ | 118,573,253 | $ | 99,771,811 | $ | 270,555,828 | ||||||||

Capital contributions |

— | — | — | 550,000 | ||||||||||||

Capital withdrawals |

(20,258,339 | ) | (27,500,221 | ) | (21,229,044 | ) | (58,571,868 | ) | ||||||||

Performance allocation |

(16,056 | ) | (357,773 | ) | (163,871 | ) | (432,758 | ) | ||||||||

Net investment income/(loss) |

(1,605,649 | ) | (2,211,724 | ) | (1,711,131 | ) | (4,703,449 | ) | ||||||||

Net realized gain/(loss) from investments in Adviser Funds, securities and foreign exchange transactions |

12,832,806 | 16,753,977 | 14,274,647 | 38,660,678 | ||||||||||||

Net change in unrealized appreciation/depreciation on investments in Adviser Funds, securities and foreign exchange translations |

(6,413,845 | ) | (8,385,031 | ) | (7,130,741 | ) | (19,302,382 | ) | ||||||||

Partners’ Capital, at March 31, 2018** |

$ | 74,911,498 | $ | 96,872,481 | $ | 83,811,671 | $ | 226,756,049 | ||||||||

Capital contributions |

— | — | — | — | ||||||||||||

Capital withdrawals |

(15,812,237 | ) | (20,360,630 | ) | (16,544,149 | ) | (44,980,987 | ) | ||||||||

Performance allocation |

(483,827 | ) | (608,724 | ) | (552,981 | ) | (1,455,562 | ) | ||||||||

Net investment income/(loss) |

(1,074,865 | ) | (1,559,961 | ) | (1,153,741 | ) | (3,543,120 | ) | ||||||||

Net realized gain/(loss) from investments in Adviser Funds, securities and foreign exchange transactions |

8,061,216 | 10,473,113 | 9,077,404 | 24,593,550 | ||||||||||||

Net change in unrealized appreciation/depreciation on investments in Adviser Funds, securities and foreign exchange translations |

(994,356 | ) | (1,318,157 | ) | (1,086,210 | ) | (2,965,258 | ) | ||||||||

Partners’ Capital, at March 31, 2019 |

$ | 64,607,429 | $ | 83,498,122 | $ | 73,551,994 | $ | 198,404,672 | ||||||||

|

* |

Consolidated Statement. See note 2 in the notes to the financial statements. |

|

** |

Including accumulated net investment income/(loss) of $(12,270,588); $(17,568,088); $4,690,494; and $11,242,146, respectively. |

See notes to financial statements and financial statements of Hatteras Master Fund, L.P.

3

HATTERAS

FUNDS

(each

a Delaware Limited Partnership)

Statements of Cash Flows

For the year ended March 31, 2019

|

Hatteras |

Hatteras |

Hatteras |

Hatteras |

||||||||||||

Cash flows from operating activities: |

||||||||||||||||

Net increase/(decrease) in partners’ capital resulting from operations |

$ | 5,991,995 | $ | 7,594,995 | $ | 6,837,453 | $ | 18,085,172 | ||||||||

Adjustments to reconcile net increase/(decrease) in partners’ capital resulting from operations to net cash provided by operating activies: |

||||||||||||||||

Purchases of interests in Hatteras Master Fund, L.P. |

— | — | — | — | ||||||||||||

Proceeds, net of change in withdrawals receivable, from Hatteras Master Fund, L.P. |

16,722,760 | 21,663,542 | 17,542,948 | 47,989,801 | ||||||||||||

Net investment (income)/loss allocated from Hatteras Master Fund, L.P. |

443,768 | 575,884 | 498,437 | 1,350,712 | ||||||||||||

Net realized (gain)/loss from investments in Adviser Funds, securities and foreign exhange transactions allocated from Hatteras Master Fund, L.P. |

(8,061,216 | ) | (10,473,113 | ) | (9,077,404 | ) | (24,593,550 | ) | ||||||||

Net change in unrealized appreciation/depreciation on investments in Adviser Funds, securities and foreign exchange translations allocated from Hatteras Master Fund, L.P. |

994,356 | 1,318,157 | 1,086,210 | 2,965,258 | ||||||||||||

(Increase)/Decrease in receivable for withdrawals from Hatteras Master Fund, L.P. |

400,714 | 538,272 | 923,075 | 1,983,866 | ||||||||||||

(Increase)/Decrease in other receivables |

(147 | ) | (144 | ) | (148 | ) | (144 | ) | ||||||||

(Increase)/Decrease in prepaid assets |

(85 | ) | 117 | (213 | ) | (1,206 | ) | |||||||||

Increase/(Decrease) in withholding tax payable |

— | (22,207 | ) | — | (23,489 | ) | ||||||||||

Increase/(Decrease) in servicing fees payable |

(7,236 | ) | (9,396 | ) | (7,706 | ) | (20,883 | ) | ||||||||

Increase/(Decrease) in accounting, administration, and transfer agency fees payable |

10,213 | 17,489 | (2,816 | ) | 9,926 | |||||||||||

Increase/(Decrease) in professional fees payable |

(12,551 | ) | 4,971 | (31,255 | ) | (21,210 | ) | |||||||||

Increase/(Decrease) in performance allocation payable |

218,944 | 145,638 | 109,129 | 290,242 | ||||||||||||

Increase/(Decrease) in custodian fees payable |

(216 | ) | 2,968 | (268 | ) | 2,723 | ||||||||||

Increase/(Decrease) in printing fees payable |

(20,577 | ) | (7,991 | ) | (21,109 | ) | (29,563 | ) | ||||||||

Increase/(Decrease) in other payables |

— | 82 | — | — | ||||||||||||

Net cash provided by operating activities |

16,680,772 | 21,349,264 | 17,856,333 | 47,987,655 | ||||||||||||

Cash flows from financing activities: |

||||||||||||||||

Capital contributions |

— | — | — | — | ||||||||||||

Capital withdrawals, net of change in withdrawals payable and performance allocation |

(16,680,772 | ) | (21,349,264 | ) | (17,856,333 | ) | (47,987,655 | ) | ||||||||

Net cash used in financing activities |

(16,680,772 | ) | (21,349,264 | ) | (17,856,333 | ) | (47,987,655 | ) | ||||||||

Net change in cash and cash equivalents |

— | — | — | — | ||||||||||||

Cash and cash equivalents at beginning of year |

200,000 | 205,000 | 200,000 | 205,000 | ||||||||||||

Cash and cash equivalents at end of year |

$ | 200,000 | $ | 205,000 | $ | 200,000 | $ | 205,000 | ||||||||

Supplemental disclosure of withholding tax paid |

$ | — | $ | 187,872 | $ | — | $ | 556,863 | ||||||||

|

* |

Consolidated Statement. See note 2 in the notes to the financial statements. |

See notes to financial statements and financial statements of Hatteras Master Fund, L.P.

4

HATTERAS

FUNDS

(each

a Delaware Limited Partnership)

Notes to Financial Statements

As of and for the year ended March 31, 2019

|

1. |

ORGANIZATION |

The Hatteras Funds, each a “Feeder Fund” and collectively the “Feeder Funds” are:

Hatteras Core Alternatives Fund, L.P.

Hatteras Core Alternatives TEI Fund, L.P.

Hatteras Core Alternatives Institutional Fund, L.P.

Hatteras Core Alternatives TEI Institutional Fund, L.P.

The Feeder Funds are organized as Delaware limited partnerships, and are registered under the Securities Act of 1933 (the “1933 Act”), as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), as closed-end, diversified, management investment companies. The primary investment objective of the Feeder Funds is to provide capital appreciation consistent with the return characteristic of the alternative investment portfolios of larger endowments. The Feeder Funds’ secondary objective is to provide capital appreciation with less volatility than that of the equity markets. To achieve their objectives, the Feeder Funds provide their investors with access to a broad range of investment strategies, asset categories and trading advisers (“Advisers”) and by providing overall asset allocation services typically available on a collective basis to larger institutions, through an investment of substantially all of their assets into the Hatteras Master Fund, L.P. (the “Master Fund” together with the Feeder Funds, the “Funds”), which is registered under the 1940 Act. Hatteras Funds, LP (the “Investment Manager” or the “General Partner”), a Delaware limited liability company registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”) serves as Investment Manager to the Master Fund. Investors who acquire units of limited partnership interest in the Feeder Funds (“Units”) are the limited partners (each, a “Limited Partner” and together, the “Limited Partners”) of the Feeder Funds.

The Hatteras Core Alternatives TEI Fund, L.P. and the Hatteras Core Alternatives TEI Institutional Fund, L.P. each invest substantially all of their assets in the Hatteras Core Alternatives Offshore Fund, LDC and Hatteras Core Alternatives Offshore Institutional Fund, LDC, (each a “Blocker Fund” and collectively the “Blocker Funds”), respectively. The Blocker Funds are Cayman Islands limited duration companies with the same investment objective as the Feeder Funds. The Blocker Funds serve solely as intermediate entities through which the Hatteras Core Alternatives TEI Fund, L.P. and the Hatteras Core Alternatives TEI Institutional Fund, L.P. invest in the Master Fund. The Blocker Funds enable tax-exempt Limited Partners (as defined below) to invest without receiving certain income in a form that would otherwise be taxable to such tax-exempt Limited Partners regardless of their tax-exempt status. The Hatteras Core Alternatives TEI Fund, L.P. owns 100% of the participating beneficial interests of the Hatteras Core Alternatives Offshore Fund, LDC and the Hatteras Core Alternatives TEI Institutional Fund, L.P. owns 100% of the participating beneficial interests of the Hatteras Core Alternatives Offshore Institutional Fund, LDC. The Notes to Financial Statements discuss the Feeder Funds’ investment in the Master Fund for Hatteras Core Alternatives TEI Fund, L.P. and Hatteras Core Alternatives TEI Institutional Fund, L.P. assuming, and as stated previously in the paragraph, their investment in the Master Fund passes through the applicable Blocker Fund.

Each Feeder Fund is considered an investment company under the 1940 Act, following the accounting principles generally accepted in the United States of America (“GAAP”) and the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946, Financial Services — Investment Companies (“ASC 946”). The financial statements of the Master Fund, including the schedule of investments, are included elsewhere in this report and should be read with the Feeder Funds’ financial statements. The percentages of the Master Fund’s beneficial limited partnership interests owned by the Feeder Funds at March 31, 2019 are:

Hatteras Core Alternatives Fund, L.P. |

15.37% |

Hatteras Core Alternatives TEI Fund, L.P. |

19.89% |

Hatteras Core Alternatives Institutional Fund, L.P. |

17.48% |

Hatteras Core Alternatives TEI Institutional Fund, L.P. |

47.26% |

Each of the Feeder Funds has an appointed Board of Directors (collectively the “Board”), which has the rights and powers to monitor and oversee the business affairs of the Feeder Funds, including the complete and exclusive authority to oversee and establish policies regarding the management, conduct and operation of the Feeder Funds’ business.

5

HATTERAS

FUNDS

(each

a Delaware Limited Partnership)

Notes to Financial Statements (Continued)

As of and for the year ended March 31, 2019

|

2. |

SIGNIFICANT ACCOUNTING POLICIES |

These financial statements have been prepared in accordance with GAAP and are expressed in United States (“U.S.”) dollars. The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

|

a. |

Investment Valuation |

The Feeder Funds do not make direct investments in securities or financial instruments, and invest substantially all of their assets in the Master Fund. The Feeder Funds record their investment in the Master Fund at fair value, based on each Feeder Fund’s pro rata percentage of partners’ capital of the Master Fund. Valuation of securities held by the Master Fund, including the Master Fund’s disclosure of investments under the three-tier hierarchy, is also discussed in the notes to the Master Fund’s financial statements included elsewhere in this report.

|

b. |

Allocations from the Master Fund |

The Feeder Funds record their allocated portion of income, expense, realized gains and losses and unrealized appreciation and depreciation from the Master Fund.

|

c. |

Feeder Fund Level Income and Expenses |

Interest income on any cash or cash equivalents held by the Feeder Funds is recognized on an accrual basis. Expenses that are specifically attributed to the Feeder Funds are charged to each Feeder Fund. Because the Feeder Funds bear their proportionate share of the management fee of the Master Fund, the Feeder Funds pay no direct management fee to the Investment Manager or sub-adviser. The Feeder Funds’ specific expenses are recorded on an accrual basis.

|

d. |

Tax Basis Reporting |

Because the Master Fund invests primarily in investment funds that are treated as partnerships for U.S. Federal tax purposes, the tax character of each of the Feeder Fund’s allocated earnings is established dependent upon the tax filings of the investment vehicles operated by the Advisers (“Adviser Funds”). Accordingly, the tax basis of these allocated earnings and the related balances are not available as of the reporting date.

|

e. |

Income Taxes |

For U.S. Federal income tax purposes, the Feeder Funds are treated as partnerships, and each Limited Partner in each respective Feeder Fund is treated as the owner of its proportionate share of the partners’ capital, income, expenses, and the realized and unrealized gains/(losses) of such Feeder Fund. Accordingly, no federal, state or local income taxes have been provided on profits of the Feeder Funds since the Limited Partners are individually liable for the taxes on their share of the Feeder Funds.

The Feeder Funds file tax returns as prescribed by the tax laws of the jurisdictions in which they operate. In the normal course of business, the Feeder Funds are subject to examination by federal, state, local and foreign jurisdictions, where applicable. For the Feeder Funds’ tax years ended December 31, 2015 through December 31, 2018, the Feeder Funds are open to examination by major tax jurisdictions under the statute of limitations.

The Feeder Funds have reviewed any potential tax positions as of March 31, 2019 and have determined that they do not have a liability for any unrecognized tax benefits or expense. The Feeder Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statements of Operations. During the year ended March 31, 2019, the Feeder Funds did not incur any interest or penalties.

The Blocker Funds may be subject to withholding of U.S. Federal income tax at the current statutory rate of their allocable share of the Master Fund’s U.S.-source dividend income and other U.S.-source fixed, determinable annual or periodic gains, profits, or income, as defined in Section 881(a) of the Internal Revenue Code of 1986, as amended. This tax treatment differs in comparison to the tax treatment of most forms of interest income.

6

HATTERAS

FUNDS

(each

a Delaware Limited Partnership)

Notes to Financial Statements (Continued)

As of and for the year ended March 31, 2019

|

2. |

SIGNIFICANT ACCOUNTING POLICIES (concluded) |

|

f. |

Cash and Cash Equivalents |

Cash and cash equivalents includes amounts held in interest bearing demand deposit accounts. Such cash, at times, may exceed federally insured limits. The Feeder Funds have not experienced any losses in such accounts and do not believe they are exposed to any significant credit risk on such accounts.

|

g. |

Use of Estimates |

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in partners’ capital from operations during the reporting period. Actual results could differ from those estimates.

|

h. |

Consolidated Financial Statements |

The asset, liability, and equity accounts of the Hatteras Core Alternatives TEI Fund, L.P. and the Hatteras Core Alternatives TEI Institutional Fund, L.P. are consolidated with their respective Blocker Funds, as presented in the Statements of Assets, Liabilities, and Partners’ Capital, Statements of Operations, Statements of Changes in Partners’ Capital, and Statements of Cash Flows. All intercompany accounts and transactions have been eliminated in consolidation.

|

3. |

ALLOCATION OF LIMITED PARTNERS’ CAPITAL |

Allocation Periods begin on the first calendar day of each month and end at the close of business on the last day of each month (“Allocation Period”). The Feeder Funds maintain a separate capital account (“Capital Account”) on their books for each Limited Partner. Net profits or net losses of the Feeder Funds for each Allocation Period will be allocated among and credited to or debited against the Capital Accounts of the Limited Partners. Net profits or net losses will be measured as the net change in the value of the Limited Partners’ capital of the Feeder Funds, which includes; net change in unrealized appreciation or depreciation of investments, realized gain/(loss), and net investment income/(loss) during an Allocation Period.

Each Limited Partner’s Capital Account will have an opening balance equal to the Limited Partner’s initial purchase of the Feeder Fund (i.e., the amount of the investment less any applicable sales load of up to 2.00% of the purchased amount for purchases of Units of Hatteras Core Alternatives Fund, L.P. and Hatteras Core Alternatives TEI Fund, L.P.), and thereafter, will be (i) increased by the amount of any additional purchases by such Limited Partner; (ii) decreased for any payments upon repurchase or sale of such Limited Partner’s Units or any distributions in respect of such Limited Partner; and (iii) increased or decreased as of the close of each Allocation Period by such Limited Partner’s allocable share of the net profits or net losses of the Feeder Fund.

|

Hatteras |

Hatteras |

Hatteras |

Hatteras |

||||||||||||

Ending Units, March 31, 2017 |

846,256.08 | 1,119,748.94 | 886,615.99 | 2,432,964.81 | ||||||||||||

Purchases |

— | — | — | 4,803.07 | ||||||||||||

Sales |

(185,622.18 | ) | (254,572.53 | ) | (184,592.63 | ) | (515,482.48 | ) | ||||||||

Ending Units, March 31, 2018 |

660,633.90 | 865,176.41 | 702,023.36 | 1,922,285.40 | ||||||||||||

Purchases |

— | — | — | — | ||||||||||||

Sales |

(134,783.53 | ) | (175,708.69 | ) | (134,116.28 | ) | (369,163.13 | ) | ||||||||

Ending Units, March 31, 2019 |

525,850.37 | 689,467.72 | 567,907.08 | 1,553,122.27 | ||||||||||||

7

HATTERAS

FUNDS

(each

a Delaware Limited Partnership)

Notes to Financial Statements (Continued)

As of and for the year ended March 31, 2019

|

4. |

RELATED PARTY TRANSACTIONS AND OTHER |

In consideration for fund services, each Feeder Fund will pay the Investment Manager (in such capacity, the “Servicing Agent”) a fund servicing fee charged at the annual rate of 0.65% of the month-end partners’ capital of each Feeder Fund. The respective Feeder Fund servicing fees payable to the Servicing Agent will be borne by all Limited Partners of the respective Feeder Fund on a pro-rata basis before giving effect to any repurchase of interests in the Master Fund effective as of that date, and will decrease the net profits or increase the net losses of the Master Fund that are credited to its interest holders, including each Feeder Fund.

The General Partner is allocated a performance allocation payable annually equal to 10% of the amount by which net new profits of the limited partner interests of the Master Fund exceed the “hurdle amount,” which is calculated as of the last day of the preceding calendar year of the Master Fund at a rate equal to the yield-to-maturity of the 90-day U.S. Treasury Bill for the last business day of the preceding calendar year (the “Performance Allocation”). The Performance Allocation is calculated for each Feeder Fund at the Master Fund level. The Performance Allocation is made on a “peak to peak,” or “high watermark” basis, which means that the Performance Allocation is made only with respect to new net profits. If the Master Fund has a net loss in any period followed by a net profit, no Performance Allocation will be made with respect to such subsequent appreciation until such net loss has been recovered. A Performance Allocation of $483,827, $608,724, $552,981, and $1,455,562 for the year ended March 31, 2019, was allocated to the Hatteras Core Alternatives Fund, L.P., Hatteras Core Alternatives TEI Fund, L.P., Hatteras Core Alternatives Institutional Fund, L.P. and Hatteras Core Alternatives TEI Institutional Fund, L.P., respectively.

Hatteras Capital Distributors, LLC (“HCD”), an affiliate of the Investment Manager, serves as the Feeder Funds’ distributor. HCD receives a servicing fee from the Investment Manager based on the partners’ capital of the Master Fund as of the last day of the month (before giving effect to any repurchase of interests in the Master Fund).

U.S. Bank, N.A. (“USB”) serves as custodian of the Feeder Funds’ cash balances and provides custodial services fore the Feeder Funds. U.S. Bancorp Fund Services, LLC, d/b/a U.S. Bank Global Fund Services (“Fund Services”), serves as the administrator and accounting agent to the Feeder Funds and provides certain accounting, record keeping and investor related services. The Feeder Funds pay a fee to the custodian and administrator based upon average total Limited Partners’ capital, subject to certain minimums.

The Investment Manager, Portfolio Advisors, LLC (“Portfolio Advisors” or the “Sub-Adviser”) and the Master Fund have entered into an investment Sub-Advisory Agreement (the “Sub-Advisory Agreement”), whereby Portfolio Advisors is compensated from the Investment Manager a portion of the management fee the Investment Manager received from the Master Fund and Performance Allocation, if any.

The Funds have engaged Cipperman Compliance Services (“Cipperman”) to provide compliance services including the appointment of the Funds’ Chief Compliance Officer. Effective January 1, 2019, Cipperman is paid an annual fee of $63,000 for services provided, which is allocated among the Funds and other affiliated entities.