Exhibit 10.2

Final Form

LiqTech International, Inc.

Senior Convertible Note due 2023

THE ISSUANCE AND SALE OF NEITHER THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE CONVERTIBLE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION AND PROSPECTUS-DELIVERY REQUIREMENTS OF THE SECURITIES ACT.

LiqTech International, Inc.

Convertible Note due 2023

Certificate No. A-1

LiqTech International, Inc., a Nevada corporation, for value received, promises to pay to HT Investments MA LLC (the “Initial Holder”), or its registered assigns, one hundred and twelve percent (112%) of the principal sum of fifteen million dollars ($15,000,000) (such principal sum, the “Principal Amount,” and 112% of such Principal Amount, the “Maturity Principal Amount”) on October 1, 2023, and to pay interest thereon, as provided in this Note, in each case as provided in and subject to the other provisions of this Note, including the earlier redemption, repurchase or conversion of this Note.

Additional provisions of this Note are set forth on the other side of this Note.

[The Remainder of This Page Intentionally Left Blank; Signature Page Follows]

IN WITNESS WHEREOF, LiqTech International, Inc. has caused this instrument to be duly executed as of the date set forth below.

| LiqTech International, Inc. | ||

| Date: March [ ● ], 2021 | By: | |

| Name: | ||

| Title: | ||

[Signature Page to Senior Convertible Note due 2023, Certificate No. A-1]

LiqTech International, Inc.

Senior Convertible Note due 2023

This Note (this “Note” and, collectively with any Note issued in exchange therefor or in substitution thereof, the “Notes”) is issued by LiqTech International, Inc., a Nevada corporation (the “Company”), and designated as its “Senior Convertible Notes due 2023”.

|

Section 1. |

Definitions. |

“Affiliate” has the meaning set forth in Rule 144 under the Securities Act.

“Attribution Parties” means, collectively, the following Persons and entities: (i) any investment vehicle, including, any funds, feeder funds or managed accounts, currently, or from time to time after the Issue Date, directly or indirectly managed or advised by the Holder's investment manager or any of its Affiliates or principals, (ii) any direct or indirect Affiliates of the Holder or any of the foregoing, (iii) any Person acting or who could be deemed to be acting as a “group” (within the meaning of Section 13(d)(3) of the Exchange Act) together with the Holder or any of the foregoing and (iv) any other Persons whose beneficial ownership of the Common Stock would or could be aggregated with the Holder's and the other Attribution Parties for purposes of Section 13(d) of the Exchange Act. For clarity, the purpose of the foregoing is to subject collectively the Holder and all other Attribution Parties to the Maximum Percentage.

“Authorized Denomination” means, with respect to the Notes, a Principal Amount thereof equal to $1,000 or any integral multiple of $1,000 in excess thereof, or, if such Principal Amount then-outstanding is less than $1,000, then such outstanding Principal Amount.

“Bankruptcy Law” means Title 11, United States Code, or any similar U.S. federal or state or non-U.S. law for the relief of debtors.

“Board of Directors” means the board of directors of the Company or a committee of such board duly authorized to act on behalf of such board.

“Business Combination Event” has the meaning set forth in Section 10.

“Business Day” has the meaning in the Securities Purchase Agreement.

“Capital Lease” means, with respect to any Person, any leasing or similar arrangement conveying the right to use any property, whether real or personal property, or a combination thereof, by that Person as lessee that, in conformity with GAAP, is required to be accounted for as a capital lease on the balance sheet of such Person.

“Capital Lease Obligation” means, at the time any determination is to be made, the amount of the liability in respect of a Capital Lease that would at that time be required to be capitalized on a balance sheet prepared in accordance with GAAP, and the stated maturity thereof shall be the date of the last payment of rent or any other amount due under such lease prior to the first date upon which such lease may be prepaid by the lessee without payment of a penalty.

“Capital Stock” of any Person means any and all shares of, interests in, rights to purchase, warrants or options for, participations in, or other equivalents of, in each case however designated, the equity of such Person, but excluding any debt securities convertible into such equity.

“Cash” means all cash and liquid funds.

“Cash Equivalents” means, as of any date of determination, any of the following: (A) marketable securities (i) issued or directly and unconditionally guaranteed as to interest and principal by the United States Government, or (ii) issued by any agency of the United States the obligations of which are backed by the full faith and credit of the United States, in each case maturing within one (1) year after such date; (B) marketable direct obligations issued by any state of the United States of America or any political subdivision of any such state or any public instrumentality thereof, in each case maturing within one (1) year after such date and having, at the time of the acquisition thereof, a rating of at least A-1 from Standard & Poor’s Corporation or at least P-1 from Moody’s Investors Service; (C) commercial paper maturing no more than one (1) year from the date of creation thereof and having, at the time of the acquisition thereof, a rating of at least A-1 from Standard & Poor’s Corporation or at least P-1 from Moody’s Investors Service; (D) certificates of deposit or bankers’ acceptances maturing within one (1) year after such date and issued or accepted by any commercial bank organized under the laws of the United States of America or any State thereof or the District of Columbia that (i) is at least “adequately capitalized” (as defined in the regulations of its primary federal banking regulator), and (ii) has Tier 1 capital (as defined in such regulations) of not less than $100,000,000; and (E) shares of any money market mutual fund that (i) has substantially all of its assets invested continuously in the types of investments referred to in clauses (A) and (B) above, (ii) has net assets of not less than $500,000,000, and (iii) has the highest rating obtainable from either Standard & Poor’s Corporation or Moody’s Investors Service.

“Close of Business” means 5:00 p.m., New York City time.

“Commission” means the U.S. Securities and Exchange Commission.

“Common Stock” means the common stock, $0.001 par value per share, of the Company, subject to Section 8(J).

“Common Stock Change Event” has the meaning set forth in Section 8(J).

“Contingent Obligation” means, as applied to any Person, any direct or indirect liability, contingent or otherwise, of that Person with respect to (A) any Indebtedness or other obligations of another Person, including any such obligation directly or indirectly guaranteed, endorsed, co-made or discounted or sold with recourse by that Person, or in respect of which that Person is otherwise directly or indirectly liable; (B) any obligations with respect to undrawn letters of credit, corporate credit cards or merchant services issued for the account of that Person; and (C) all obligations arising under any interest rate, currency or commodity swap agreement, interest rate cap agreement, interest rate collar agreement, or other agreement or arrangement designated to protect a Person against fluctuation in interest rates, currency exchange rates or commodity prices; provided, however, that the term “Contingent Obligation” shall not include endorsements for collection or deposit in the ordinary course of business. The amount of any Contingent Obligation shall be deemed to be an amount equal to the stated or determined amount of the primary obligation in respect of which such Contingent Obligation is made or, if not stated or determinable, the maximum reasonably anticipated liability in respect thereof as determined by such Person in good faith; provided, however, that such amount shall not in any event exceed the maximum amount of the obligations under the guarantee or other support arrangement.

“Conversion Consideration” has the meaning set forth in Section 8(D)(i).

“Conversion Date” means, with respect to a Note, the first Business Day on which the requirements set forth in Section 8(C)(i) to convert such Note are satisfied.

“Conversion Price” means, as of any time, an amount equal to (A) one thousand dollars ($1,000) divided by (B) the Conversion Rate in effect at such time.

“Conversion Rate” initially means [Insert an amount (rounded to the nearest fourth decimal place) equal to a fraction (1) whose numerator is $1,000; and (2) whose denominator is 120% of the average of (i) the average of the Daily VWAPs for March 24, 2021 and the five (5) Trading Days commencing March 26, 2021] shares of Common Stock per $1,000 Principal Amount of Notes; provided, however, that the Conversion Rate is subject to adjustment pursuant to Section 8; provided, further, that whenever this Note refers to the Conversion Rate as of a particular date without setting forth a particular time on such date, such reference will be deemed to be to the Conversion Rate immediately after the Close of Business on such date.

“Copyright License” means any written agreement granting any right to use any Copyright or Copyright registration, now owned or hereafter acquired by the Company or in which the Company now holds or hereafter acquires any interest.

“Copyrights” means all copyrights, whether registered or unregistered, held pursuant to the laws of the United States, any State thereof, or of any other country.

“Covering Price” has the meaning set forth in Section 8(D)(vi)(1).

“Daily VWAP” means, for any VWAP Trading Day, the per share volume-weighted average price of the Common Stock as displayed under the heading “Bloomberg VWAP” on Bloomberg page “LIQT <EQUITY> VAP” (or, if such page is not available, its equivalent successor page) in respect of the period from the scheduled open of trading until the scheduled close of trading of the primary trading session on such VWAP Trading Day (or, if such volume-weighted average price is unavailable, the market value of one share of Common Stock on such VWAP Trading Day, determined, using a volume-weighted average price method, by a nationally recognized independent investment banking firm selected by the Company). The Daily VWAP will be determined without regard to after-hours trading or any other trading outside of the regular trading session.

“Default” means any event that is (or, after notice, passage of time or both, would be) an Event of Default.

“Default Interest” has the meaning set forth in Section 4(B).

“Defaulted Amount” has the meaning set forth in Section 4(B).

“Defaulted Shares” has the meaning set forth in Section 8(D)(vi).

“Disqualified Stock” means, with respect to any Person, any Capital Stock that by its terms (or by the terms of any security into which it is convertible or for which it is exchangeable at the option of the holder) or upon the happening of any event:

(A) matures or is mandatorily redeemable pursuant to a sinking fund obligation or otherwise;

(B) is convertible or exchangeable for Indebtedness or Disqualified Stock (excluding Capital Stock convertible or exchangeable solely at the option of the Company or a Subsidiary of the Company; provided that any such conversion or exchange will be deemed an incurrence of Indebtedness or Disqualified Stock, as applicable); or

(C) is redeemable at the option of the holder thereof, in whole or in part,

in the case of each of clauses (A), (B) and (C), at any point prior to the one hundred eighty-first (181st) day after the Maturity Date.

“DTC” means The Depository Trust Company.

“Eligible Market” has the meaning set forth in the Securities Purchase Agreement.

“Equipment” means all “equipment” as defined in the UCC with such additions to such term as may hereafter be made, and includes without limitation all machinery, fixtures, goods, vehicles (including motor vehicles and trailers), and any interest in any of the foregoing.

“Equity Conditions” will be deemed to be satisfied as of any date if all of the following conditions are satisfied as of such date and on each of the ten (10) previous Trading Days: (A) the shares issuable upon conversion of this Note are Freely Tradable; (B) the Holder is not in possession of any material non-public information provided by or on behalf of the Company; (C) the issuance of such shares will not be limited by Section 8(K) (Limitations on Conversions); (D) the Company is in compliance with Section 8(E)(i) (Stock Reserve) and such shares will satisfy Section 8(E)(ii) (Status of Conversion Shares; Listing); (E) no public announcement of a pending, proposed or intended Fundamental Change has occurred that has not been abandoned, terminated or consummated; (F) the Daily VWAP per share of Common Stock is not less than $5.00 (subject to proportionate adjustments for events of the type set forth in Section 8(G)(i)(1)); (G) the daily dollar trading volume (as reported on Bloomberg) of the Common Stock on the applicable Eligible Market is not less than three hundred thousand dollars ($300,000); and (H) no Default shall have occurred and be continuing and no Event of Default shall have occurred .

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the regulations promulgated thereunder.

“Event of Default” has the meaning set forth in Section 11(A).

“Event of Default Acceleration Amount” means, with respect to the delivery of a notice pursuant to Section 11(B) declaring this Note to be due and payable immediately on account of an Event of Default, a cash amount equal to one hundred fifteen percent (115%) of the greater of (A) the then outstanding Principal Amount of this Note plus accrued and unpaid interest on this Note; and (B) the product of (i) the Conversion Rate in effect as of the Trading Day immediately preceding the date such notice is so delivered; (ii) the total then outstanding principal portion of the Principal Amount plus accrued and unpaid interest on this Note (expressed in thousands) of this Note; and (iii) the greater of (x) the highest Daily VWAP per share of Common Stock occurring during the ten (10) consecutive VWAP Trading Days ending on, and including, the VWAP Trading Day immediately before the date such notice is so delivered and (y) the highest Daily VWAP per share of Common Stock occurring during the ten (10) consecutive VWAP Trading Days ending on, and including, the VWAP Trading Day immediately before the date the applicable Event of Default occurred.

“Event of Default Additional Shares” means, with respect to the conversion of this Note (or any portion of this Note), an amount equal to the excess, if any, of (A) the Event of Default Conversion Rate applicable to such conversion over (B) the Conversion Rate that would otherwise apply to such conversion without giving effect to Section 8(I). For the avoidance of doubt, the Event of Default Additional Shares cannot be a negative number.

“Event of Default Conversion Period” means, with respect to an Event of Default, the period beginning on, and including, the date such Event of Default occurs and ending on the twentieth (20th) Trading Day after the Holder’s receipt of an Event of Default Notice.

“Event of Default Conversion Price” means, with respect to the conversion of this Note (or any portion of this Note), the greater of (i) the Floor Price and (ii) the lesser of (A) the Conversion Price that would be in effect immediately after the Close of Business on the Conversion Date for such conversion, without giving effect to Section 8(I); and (B) seventy five percent (75%) of the lowest Daily VWAP per share of Common Stock during the ten (10) consecutive VWAP Trading Days ending on, and including, such Conversion Date (or, if such Conversion Date is not a VWAP Trading Day, the immediately preceding VWAP Trading Day).

“Event of Default Conversion Rate” means, with respect to the conversion of this Note (or any portion of this Note), an amount (rounded to the nearest 1/10,000th of a share of Common Stock (with 5/100,000ths rounded upward)) equal to (A) one thousand dollars ($1,000) divided by (B) the Event of Default Conversion Price applicable to such conversion.

“Event of Default Notice” has the meaning set forth in Section 11(C).

“Ex-Dividend Date” means, with respect to an issuance, dividend or distribution on the Common Stock, the first date on which shares of Common Stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive such issuance, dividend or distribution (including pursuant to due bills or similar arrangements required by the relevant stock exchange). For the avoidance of doubt, any alternative trading convention on the applicable exchange or market in respect of the Common Stock under a separate ticker symbol or CUSIP number will not be considered “regular way” for this purpose.

“Excess Shares” has the meaning set forth in Section 8(K)(i).

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Expiration Date” has the meaning set forth in Section 8(G)(i)(5).

“Expiration Time” has the meaning set forth in Section 8(G)(i)(5).

“Floor Price” means one dollar and seventy five cents ($1.75).

“Forced Conversion” means the conversion of this Note pursuant to Section 8(F).

“Freely Tradable” means, with respect to any shares of Common Stock issued or issuable under this Note (whether upon conversion of this Note or otherwise), that (A) such shares would be eligible to be offered, sold or otherwise transferred by the Holder pursuant to Rule 144, without any requirements as to volume, manner of sale, availability of current public information (whether or not then satisfied) or notice under the Securities Act and without any requirement for registration under any state securities or “blue sky” laws; or (B) such shares are (or, when issued, will be) (i) represented by book-entries at DTC and identified therein by an “unrestricted” CUSIP number; (ii) not represented by any certificate that bears a legend referring to transfer restrictions under the Securities Act or other securities laws; and (iii) listed and admitted for trading, without suspension or material limitation on trading, on an Eligible Market; and (C) no delisting or suspension by such Eligible Market has been threatened (with a reasonable prospect of delisting occurring after giving effect to all applicable notice, appeal, compliance and hearing periods) or reasonably likely to occur or pending as evidenced by (x) a writing by such Eligible Market or (y) the Company falling below the minimum listing maintenance requirements of such Eligible Market.

“Fundamental Change” means any of the following events:

(A) a “person” or “group” (within the meaning of Section 13(d)(3) of the Exchange Act), other than the Company or its Wholly Owned Subsidiaries, or the employee benefit plans of the Company or its Wholly Owned Subsidiaries, files any report with the Commission indicating that such person or group has become the direct or indirect “beneficial owner” (as defined below) of shares of the Company’s common equity representing more than fifty percent (50%) of the voting power of all of the Company’s then-outstanding common equity;

(B) the consummation of (i) any sale, lease or other transfer, in one transaction or a series of transactions, of all or substantially all of the assets of the Company and its Subsidiaries, taken as a whole, to any Person (other than solely to one or more of the Company’s Wholly Owned Subsidiaries); or (ii) any transaction or series of related transactions in connection with which (whether by means of merger, consolidation, share exchange, combination, reclassification, recapitalization, acquisition, liquidation or otherwise) all of the Common Stock is exchanged for, converted into, acquired for, or constitutes solely the right to receive, other securities, cash or other property (other than a subdivision or combination, or solely a change in par value, of the Common Stock); provided, however, that any merger, consolidation, share exchange or combination of the Company pursuant to which the Persons that directly or indirectly “beneficially owned” (as defined below) all classes of the Company’s common equity immediately before such transaction directly or indirectly “beneficially own,” immediately after such transaction, more than fifty percent (50%) of all classes of common equity of the surviving, continuing or acquiring company or other transferee, as applicable, or the parent thereof, in substantially the same proportions vis-à-vis each other as immediately before such transaction will be deemed not to be a Fundamental Change pursuant to this clause (B);

(C) the Company’s stockholders approve any plan or proposal for the liquidation or dissolution of the Company; or

(D) the Common Stock ceases to be listed on any Eligible Market.

For the purposes of this definition, (x) any transaction or event described in both clause (A) and in clause (B)(i) or (ii) above (without regard to the proviso in clause (B)) will be deemed to occur solely pursuant to clause (B) above (subject to such proviso); and (y) whether a Person is a “beneficial owner” and whether shares are “beneficially owned” will be determined in accordance with Rule 13d-3 under the Exchange Act.

“Fundamental Change Base Repurchase Price” means, with respect to this Note (or any portion of this Note to be repurchased) upon a Repurchase Upon Fundamental Change, a cash amount equal to one hundred fifteen percent (115%) of the greater of (i) the then outstanding Principal Amount of this Note (or portion thereof) plus accrued and unpaid interest on such Note to, but excluding, the Fundamental Change Repurchase Date for such Fundamental Change and (ii) the product of (A) the Conversion Rate in effect as of the Trading Day immediately preceding the effective date of such Fundamental Change; (B) the Principal Amount of this Note to be repurchased upon a Repurchase Upon Fundamental Change, plus accrued and unpaid interest on such Note to, but excluding, the Fundamental Change Repurchase Date for such Fundamental Change, divided by $1,000; and (C) the Fundamental Change Stock Price for such Fundamental Change.

“Fundamental Change Notice” has the meaning set forth in Section 6(C).

“Fundamental Change Repurchase Date” means the date as of which this Note must be repurchased for cash in connection with a Fundamental Change, as provided in Section 6(B).

“Fundamental Change Repurchase Price” means the cash price payable by the Company to repurchase this Note (or any portion of this Note) upon its Repurchase Upon Fundamental Change, calculated pursuant to Section 6(D).

“Fundamental Change Stock Price” means, with respect to any Fundamental Change, the highest Daily VWAP per share of Common Stock occurring during the ten (10) consecutive VWAP Trading Days ending on, and including, the VWAP Trading Day immediately before the effective date of such Fundamental Change.

“GAAP” means generally accepted accounting principles in the United States of America, as in effect from time to time; provided that the definitions set forth in this Note and any financial calculations required by thereby shall be computed to exclude any change to lease accounting rules from those in effect pursuant to Financial Accounting Standards Board Accounting Standards Codification 840 (Leases) and other related lease accounting guidance as in effect on the date hereof.

“Holder” means the person in whose name this Note is registered on the books of the Company, which initially is the Initial Holder.

The term “including” means “including without limitation,” unless the context provides otherwise.

“Indebtedness” means, indebtedness of any kind, including, without duplication (A) all indebtedness for borrowed money or the deferred purchase price of property or services, including reimbursement and other obligations with respect to surety bonds and letters of credit, (B) all obligations evidenced by notes, bonds, debentures or similar instruments, (C) all Capital Lease Obligations, (D) all Contingent Obligations, and (E) Disqualified Stock.

“Independent Investigator” has the meaning set forth in Section 9(Q).

“Initial Holder” has the meaning set forth in the cover page of this Note.

“Interest Payment Date” means, with respect to a Note, (A) each June 1, September 1, December 1 and March 1 of each calendar year, beginning on June 1, 2021; and (B) if not otherwise included in clause (A), the Maturity Date.

“Intellectual Property” means all of the Company’s Copyrights; Trademarks; Patents; Licenses; trade secrets and inventions; mask works; the Company’s applications therefor and reissues, extensions, or renewals thereof; and the Company’s goodwill associated with any of the foregoing, together with the Company’s rights to sue for past, present and future infringement of Intellectual Property and the goodwill associated therewith.

“Investment” means any beneficial ownership (including stock, partnership or limited liability company interests) of or in any Person, the creation of or entrance into any contractual arrangement for the creation of a Person that is a Joint Venture, or any loan, advance or capital contribution to any Person or the acquisition of all, or substantially all, of the assets of another Person or the purchase of any assets of another Person for greater than the fair market value of such assets to solely the extent of the amount in excess of the fair market value.

“Issue Date” means March [ ● ], 2021.

“Joint Venture” means any joint venture entity or similar arrangement, whether a company, unincorporated firm, undertaking, association, joint venture or partnership or any other entity.

“Last Reported Sale Price” of the Common Stock for any Trading Day means the closing sale price per share (or, if no closing sale price is reported, the average of the last bid price and the last ask price per share or, if more than one in either case, the average of the average last bid prices and the average last ask prices per share) of Common Stock on such Trading Day as reported in composite transactions for the principal U.S. national or regional securities exchange on which the Common Stock is then listed. If the Common Stock is not listed on a U.S. national or regional securities exchange on such Trading Day, then the Last Reported Sale Price will be the last quoted bid price per share of Common Stock on such Trading Day in the over-the-counter market as reported by OTC Markets Group Inc. or a similar organization. If the Common Stock is not so quoted on such Trading Day, then the Last Reported Sale Price will be the average of the mid-point of the last bid price and the last ask price per share of Common Stock on such Trading Day from a nationally recognized independent investment banking firm selected by the Company.

“License” means any Copyright License, Patent License, Trademark License or other license of rights or interests.

“Lien” means any mortgage, deed of trust, pledge, hypothecation, assignment for security, security interest, encumbrance, levy, lien or charge of any kind, whether voluntarily incurred or arising by operation of law or otherwise, against any property, any conditional sale or other title retention agreement, and any lease in the nature of a security interest; provided, that for the avoidance of doubt, licenses, strain escrows and similar provisions in collaboration agreements, research and development agreements that do not create or purport to create a security interest, encumbrance, levy, lien or charge of any kind shall not be deemed to be Liens for purposes of this Note.

“Market Disruption Event” means, with respect to any date, the occurrence or existence, during the one-half hour period ending at the scheduled close of trading on such date on the principal U.S. national or regional securities exchange or other market on which the Common Stock is listed for trading or trades, of any material suspension or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant exchange or otherwise) in the Common Stock or in any options contracts or futures contracts relating to the Common Stock.

“Market Stock Payment Price” means, with respect to any Interest Payment Date or Partial Redemption Stock Payment Date, as applicable, an amount equal to the greater of (A) the Floor Price and (B) ninety percent (90%) of the lesser of (i) the Daily VWAP on the VWAP Trading Day immediately prior to such Interest Payment Date or Partial Redemption Stock Payment Date, as applicable, and (ii) the average of the lowest three (3) Daily VWAPs during the ten (10) VWAP Trading Day period ending on the VWAP Trading Day immediately prior to such Interest Payment Date or Partial Redemption Stock Payment Date, as applicable.

“Maturity Date” means October 1, 2023.

“Maturity Principal Amount” has the meaning set forth in the cover page of this Note.

“Maximum Percentage” has the meaning set forth in Section 8(K)(i).

“Open of Business” means 9:00 a.m., New York City time.

The term “or” is not exclusive, unless the context expressly provides otherwise.

“Other Holder” means any person in whose name any Other Note is registered on the books of the Company.

“Other Notes” means any Notes that are of the same class of this Note and that are represented by one or more certificates other than the certificate representing this Note.

“Partial Redemption Date” means, with respect to a Note, (A) the first calendar day of each month beginning on March 1, 2022; and (B) if not otherwise included in clause (A), the Maturity Date.

“Partial Redemption Payment” means, up to eight hundred forty thousand dollars ($840,000), as determined by Holder in its sole discretion on each such Partial Redemption Date; provided, that the Holder and the Company may agree to increase the size of any Partial Redemption Payment by mutual written consent; and provided further, that in no event shall the amount of any Partial Redemption Payment exceed one hundred and twelve percent (112%) of the portion of the Principal Amount being redeemed as of such Partial Redemption Date.

“Partial Redemption Stock Payment Date” has the meaning set forth in Section 5(B).

“Partial Redemption Stock Payment Notice” has the meaning set forth in Section 5(B).

“Partial Redemption Stock Payment Period” has the meaning set forth in Section 5(B).

“Patent License” means any written agreement granting any right with respect to any invention on which a Patent is in existence or a Patent application is pending, in which agreement the Company now holds or hereafter acquires any interest.

“Patents” means all letters patent of, or rights corresponding thereto, in the United States or in any other country, all registrations and recordings thereof, and all applications for letters patent of, or rights corresponding thereto, in the United States or any other country.

“Permitted Indebtedness” means (A) Indebtedness evidenced by this Note; (B) Indebtedness actually or deemed to be disclosed pursuant to the Securities Purchase Agreement, as in effect as of the Issue Date; (C) Indebtedness arising from lease obligations related to equipment and facilities outstanding at any time secured by a Lien described in clause (G) of the defined term “Permitted Liens,” provided such Indebtedness does not exceed the cost of the Equipment and related expenses financed with such Indebtedness; (D) Indebtedness to trade creditors incurred in the ordinary course of business, including Indebtedness incurred in the ordinary course of business with corporate credit cards; (E) Indebtedness that also constitutes a Permitted Investment; (F) Subordinated Indebtedness of the Company; (G) reimbursement obligations, performance bonds or similar obligations arising from contractual obligations for the delivery of goods or services or warranty obligations related to goods or services provided by the Company; (H) letters of credit or similar instruments that are secured by Cash or Cash Equivalents and issued on behalf of the Company or a Subsidiary thereof in an aggregate amount not to exceed one million five hundred thousand dollars ($1,500,000); (I) Indebtedness in the form of purchase money Indebtedness (whether in the form of a loan or a lease) used solely to acquire equipment used in the ordinary course of business and secured only by such equipment and sale and insurance proceeds in respect thereof; and (J) Contingent Obligations that are guarantees of Indebtedness described in clauses (A) through (E) and (I).

“Permitted Intellectual Property Licenses” means Intellectual Property (A) licenses in existence at the Issue Date and (B) non-perpetual licenses granted in the ordinary course of business on arm’s length terms consisting of the licensing of technology, the development of technology or the providing of technical support which may include licenses with unlimited renewal options solely to the extent such options require mutual consent for renewal or are subject to financial or other conditions as to the ability of licensee to perform under the license; provided such license was not entered into during continuance of a Default or an Event of Default.

“Permitted Investment” means: (A) Investments deemed to be disclosed pursuant to the Securities Purchase Agreement, as in effect as of the Issue Date; (B) (i) marketable direct obligations issued or unconditionally guaranteed by the United States of America or any agency or any State thereof maturing within one year from the date of acquisition thereof, (ii) commercial paper maturing no more than one year from the date of creation thereof and currently having a rating of at least A-2 or P-2 from either Standard & Poor’s Corporation or Moody’s Investors Service, (iii) certificates of deposit issued by any bank headquartered in the United States with assets of at least five billion dollars $5,000,000,000 maturing no more than one year from the date of investment therein, and (iv) money market accounts; (C) Investments accepted in connection with Permitted Transfers; (D) Investments (including debt obligations) received in connection with the bankruptcy or reorganization of customers or suppliers and in settlement of delinquent obligations of, and other disputes with, customers or suppliers arising in the ordinary course of the Company’s business; (E) Investments consisting of notes receivable of, or prepaid royalties and other credit extensions, to customers and suppliers in the ordinary course of business and consistent with past practice, provided that this clause (E) shall not apply to Investments of the Company in any Subsidiary of the Company; (F) Investments consisting of loans not involving the net transfer on a substantially contemporaneous basis of cash proceeds to employees, officers or directors relating to the purchase of Capital Stock of the Company pursuant to employee stock purchase plans or other similar agreements approved by the Company’s Board of Directors; (G) Investments consisting of travel advances in the ordinary course of business; (H) Investments in Wholly Owned Subsidiaries; (I) Permitted Intellectual Property Licenses; (J) any Investments that are Joint Venture in an amount that does not exceed forty million dollars ($40,000,000) in the aggregate; (K) additional Investments that do not exceed two hundred fifty thousand dollars ($250,000) in the aggregate in any twelve (12) month period; and (L) any Investment that involves the acquisition of a controlling interest in a Person; provided that any such Investments for consideration in excess of twenty-five million dollars ($25,000,000) in the aggregate taken with all other such Investments from the Issue Date shall require the consent of the Holder.

“Permitted Liens” means any and all of the following: (A) Liens deemed to be disclosed pursuant to the Securities Purchase Agreement, as in effect as of the Issue Date; (B) Liens for taxes, fees, assessments or other governmental charges or levies, either not delinquent or being contested in good faith by appropriate proceedings; provided, that the Company maintains adequate reserves therefor in accordance with GAAP; (C) Liens securing claims or demands of materialmen, artisans, mechanics, carriers, warehousemen, landlords and other like Persons arising in the ordinary course of business; provided, that the payment thereof is not yet required; (D) Liens arising from judgments, decrees or attachments in circumstances which do not constitute a Default or an Event of Default hereunder; (E) the following deposits, to the extent made in the ordinary course of business: deposits under workers’ compensation, unemployment insurance, social security and other similar laws, or to secure the performance of bids, tenders or contracts (other than for the repayment of borrowed money) or to secure indemnity, performance or other similar bonds for the performance of bids, tenders or contracts (other than for the repayment of borrowed money) or to secure statutory obligations (other than Liens arising under ERISA or environmental Liens) or surety or appeal bonds, or to secure indemnity, performance or other similar bonds; (F) Liens on Equipment or software or other intellectual property constituting purchase money Liens and Liens in connection with Capital Leases securing Indebtedness permitted in clause (C) of “Permitted Indebtedness”; (G) leasehold interests in leases or subleases and licenses granted in the ordinary course of the Company’s business and not interfering in any material respect with the business of the licensor; (H) Liens in favor of customs and revenue authorities arising as a matter of law to secure payment of custom duties that are promptly paid on or before the date they become due; (I) Liens on insurance proceeds securing the payment of financed insurance premiums that are promptly paid on or before the date they become due (provided that such Liens extend only to such insurance proceeds and not to any other property or assets); (J) statutory and common law rights of set-off and other similar rights as to deposits of cash and securities in favor of banks, other depository institutions and brokerage firms; (K) easements, zoning restrictions, rights-of-way and similar encumbrances on real property imposed by law or arising in the ordinary course of business so long as they do not materially impair the value or marketability of the related property; (L) Liens on Cash or Cash Equivalents securing obligations permitted under clause (D) and (G) of the definition of Permitted Indebtedness; and (M) Liens incurred in connection with the extension, renewal or refinancing of the Indebtedness secured by Liens of the type described in clauses (B) through (L) above (other than any Indebtedness repaid with the proceeds of this Note); provided, that any extension, renewal or replacement Lien shall be limited to the property encumbered by the existing Lien and the principal amount of the Indebtedness being extended, renewed or refinanced (as may have been reduced by any payment thereon) does not increase.

“Permitted Transfers” means (A) dispositions of inventory sold, and Permitted Intellectual Property Licenses entered into, in each case, in the ordinary course of business, (B) dispositions of worn-out, obsolete or surplus property at fair market value in the ordinary course of business; (C) dispositions of accounts or payment intangibles (each as defined in the UCC) resulting from the compromise or settlement thereof in the ordinary course of business for less than the full amount thereof; (D) transfers consisting of Permitted Investments in Wholly Owned Subsidiaries under clause (H) of Permitted Investments; and (E) other transfers of assets to any Person other than to a Joint Venture and which have a fair market value of not more than one hundred thousand dollars ($100,000) in the aggregate in any fiscal year.

“Person” or “person” means any individual, sole proprietorship, partnership, limited liability company, Joint Venture, company, trust, unincorporated organization, association, corporation, institution, public benefit corporation, firm, joint stock company, estate, entity or government agency.

“Principal Amount” has the meaning set forth in the cover page of this Note; provided, however, that the Principal Amount of this Note will be subject to reduction (A) pursuant to Section 6, Section 7, and Section 8 and (B) by an amount equal to (i) the sum of all Partial Redemption Payments made prior to date of determination of the Principal Amount of the Note then outstanding, divided by (ii) one and twelve hundredths (1.12).

“Reference Property” has the meaning set forth in Section 8(J)(i).

“Reference Property Unit” has the meaning set forth in Section 8(J)(i).

“Reported Outstanding Share Number” has the meaning set forth in Section 8(K)(i).

“Repurchase Upon Fundamental Change” means the repurchase of any Note by the Company pursuant to Section 6.

“Conversion Requisite Stockholder Approval” means the stockholder approval contemplated by Nasdaq Listing Standard Rule 5635(d) with respect to the issuance of shares of Common Stock upon conversion of this Note in excess of the limitations imposed by such rule; provided, however, that the Conversion Requisite Stockholder Approval will be deemed to be obtained if, due to any amendment or binding change in the interpretation of the applicable listing standards of The Nasdaq Capital Market, such stockholder approval is no longer required for the Company to settle all conversions of this Note by delivering shares of Common Stock without limitation pursuant to Section 8(K)(ii).

“Rule 144” means Rule 144 promulgated under the Securities Act.

“Scheduled Trading Day” means any day that is scheduled to be a Trading Day on the principal U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then traded. If the Common Stock is not so listed or traded, then “Scheduled Trading day” means a Business Day.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Securities Purchase Agreement” means that certain Securities Purchase Agreement, dated as of March 24, 2021, by and among the Company and each of the investors listed on the Schedule of Buyers attached thereto providing for the issuance of this Note.

“Share Authorization Increase Requisite Stockholder Approval” means stockholder approval with respect to an increase in the number of the Company’s authorized shares to at least one hundred million (100,000,000) shares of Common Stock.

“Significant Subsidiary” means, with respect to any Person, any Subsidiary of such Person that constitutes a “significant subsidiary” (as defined in Rule 1-02(w) of Regulation S-X under the Exchange Act) of such Person.

“Spin-Off” has the meaning set forth in Section 8(G)(i)(3)(b).

“Spin-Off Valuation Period” has the meaning set forth in Section 8(G)(i)(3)(b).

“Stock Payment Notice” has the meaning set forth in Section 5(B).

“Stated Interest Rate” means, as of any date, a rate per annum equal to 5.00%.

“Subordinated Indebtedness” means Indebtedness subordinated to the Notes pursuant to a written agreement between the Holder and the applicable lender in amounts and on terms and conditions satisfactory to the Holder in its sole discretion.

“Subsidiary” means, with respect to any Person, (A) any corporation, association or other business entity (other than a partnership or limited liability company) of which more than fifty percent (50%) of the total voting power of the Capital Stock entitled (without regard to the occurrence of any contingency, but after giving effect to any voting agreement or stockholders’ agreement that effectively transfers voting power) to vote in the election of directors, managers or trustees, as applicable, of such corporation, association or other business entity is owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person; and (B) any partnership or limited liability company where (i) more than fifty percent (50%) of the capital accounts, distribution rights, equity and voting interests, or of the general and limited partnership interests, as applicable, of such partnership or limited liability company are owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person, whether in the form of membership, general, special or limited partnership or limited liability company interests or otherwise; and (ii) such Person or any one or more of the other Subsidiaries of such Person is a controlling general partner of, or otherwise controls, such partnership or limited liability company.

“Successor Corporation” has the meaning set forth in Section 10(A).

“Successor Person” has the meaning set forth in Section 8(J)(i).

“Tender/Exchange Offer Valuation Period” has the meaning set forth in Section 8(G)(i)(5).

“Trademark License” means any written agreement granting any right to use any Trademark or Trademark registration, now owned or hereafter acquired by the Company or in which the Company now holds or hereafter acquires any interest.

“Trademarks” means all trademarks (registered, common law or otherwise) and any applications in connection therewith, including registrations, recordings and applications in the United States Patent and Trademark Office or in any similar office or agency of the United States, any State thereof or any other country or any political subdivision thereof.

“Trading Day” means any day on which (A) trading in the Common Stock generally occurs on the principal U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then traded; and (B) there is no Market Disruption Event. If the Common Stock is not so listed or traded, then “Trading Day” means a Business Day.

“Transaction Documents” has the meaning set forth in the Securities Purchase Agreement.

“UCC” means the Uniform Commercial Code as the same is, from time to time, in effect in the State of New York.

“VWAP Market Disruption Event” means, with respect to any date, (A) the failure by the principal U.S. national or regional securities exchange on which the Common Stock is then listed, or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, the principal other market on which the Common Stock is then traded, to open for trading during its regular trading session on such date; or (B) the occurrence or existence, for more than one half hour period in the aggregate, of any suspension or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant exchange or otherwise) in the Common Stock or in any options contracts or futures contracts relating to the Common Stock, and such suspension or limitation occurs or exists at any time before 1:00 p.m., New York City time, on such date.

“VWAP Trading Day” means a day on which (A) there is no VWAP Market Disruption Event; provided that the Holder, by written notice to the Company, may waive any such VWAP Market Disruption Event; and (B) trading in the Common Stock generally occurs on the principal U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then traded. If the Common Stock is not so listed or traded, then “VWAP Trading Day” means a Business Day.

“Wholly Owned Subsidiary” of a Person means any Subsidiary of such Person all of the outstanding Capital Stock or other ownership interests of which (other than directors’ qualifying shares) are owned by such Person or one or more Wholly Owned Subsidiaries of such Person.

“Withheld Shares” has the meaning set forth in Section 8(K)(ii).

|

Section 2. |

Persons Deemed Owners. |

The Holder of this Note will be treated as the owner of this Note for all purposes.

|

Section 3. |

Registered Form. |

This Note, and any Note issued in exchange therefor or in substitution thereof, will be in registered form, without coupons.

|

Section 4. |

Accrual of Interest. |

(A) Accrual of Stated Interest. This Note will accrue interest (the “Stated Interest”) at a rate per annum equal to the Stated Interest Rate. Stated Interest on this Note will (i) accrue on the Principal Amount of this Note; (ii) accrue from, and including, the most recent date to which Stated Interest has been paid or duly provided for (or, if no Stated Interest has theretofore been paid or duly provided for, the Issue Date) to, but excluding, the date of payment of such Stated Interest; (iii) be payable in arrears on each Interest Payment Date, and, with respect to the amount of interest then accrued on the portion of the Principal Amount being redeemed on a Partial Redemption Date or a Partial Redemption Stock Payment Date, be payable in arrears as of each Partial Redemption Date and each Partial Redemption Stock Payment Date, as applicable; and (iv) be computed on the basis of a 360-day year comprised of twelve 30-day months.

(B) Accrual of Default Interest. If a Default or an Event of Default occurs, then to the extent lawful, in lieu of the Stated Interest, interest (“Default Interest”) will accrue on the Principal Amount outstanding as of the date of such Default or Event of Default at a rate per annum equal to twelve percent (12.0%), from, and including, the date of such Default or Event of Default as applicable to, but excluding the date such Default is cured. Default Interest hereunder will be payable in arrears on the first day of each calendar month and will be computed on the basis of a 360-day year comprised of twelve 30-day months.

|

Section 5. |

Method of Payment; When Payment Date is Not a Business Day. |

(A) Method of Payment. Except as set forth in Section 5(B), the Company will pay all cash amounts due under this Note by wire transfer of immediately available funds to the account of the Holder set forth in the Flow of Funds Letter (as defined in the Securities Purchase Agreement) (or, if such Holder provides the Company, at least five (5) Business Days before the date such amount is due, with written notice of an account or address of such Holder within the United States, as applicable, by wire transfer of immediately available funds or check to such account or address set forth in such written notice, as applicable).

(B) Company’s Election to Pay Stated Interest in Cash or Common Stock. With respect to Stated Interest payable on any Interest Payment Date, at least eight (8) Trading Days (but no more than twenty (20) Trading Days) prior to such Interest Payment Date, the Company, if it desires to elect to make a payment of Stated Interest due on such Interest Payment Date in shares of Common Stock, shall deliver to the Holder a written notice of such election (a “Stock Payment Notice”) (and such election shall be irrevocable as to such Interest Payment Date). Failure to timely deliver such written notice to the Holder shall be deemed an election by the Company to pay the Stated Interest on such Interest Payment Date in cash. With respect to any Interest Payment Date for which the Company has elected to make a payment of Stated Interest in shares of Common Stock in accordance with this Section 5(B), the Company shall issue to the Holder, in lieu of such payment in cash of Stated Interest, a number of validly issued, fully paid and Freely Tradable shares of Common Stock equal to the quotient (rounded up to the closest whole number) obtained by dividing such payment of Stated Interest by the Market Stock Payment Price for such payment of Stated Interest. Notwithstanding the foregoing, in the event that the Market Stock Payment Price is lower than the Floor Price on such Interest Payment Date (i) the Floor Price rather than the Market Stock Payment Price shall be used for purpose of calculating the number of shares of Common Stock to be issued on such date pursuant to this Section 5(B) and (ii) the Company shall concurrently with the issuance of such shares also pay to the Holder an amount, in cash, equal to the product of (x) the number of shares by which the shares issuable pursuant to this Section 5(B) was reduced as a result of the preceding clause (i), multiplied by (y) the Market Stock Payment Price. Notwithstanding anything herein to the contrary, the Company will not have the right to, and will not, make any payment of Stated Interest in shares of Common Stock if the Equity Conditions are not satisfied for each VWAP Trading Day occurring between the day of the delivery of the Stock Payment Notice and the applicable Interest Payment Date and such payment of Stated Interest shall instead be paid in cash in accordance with Section 5(A), unless such failure of the Equity Conditions to be so satisfied is waived in writing by the Holder, which waiver may be granted or withheld by the Holder in its sole discretion.

(C) Company’s Election to Pay Partial Redemption Payments in Cash or Common Stock. At least fifteen (15) Trading Days (but no more than twenty (20) Trading Days) prior to a Partial Redemption Date, the Company, if it desires to elect to make a Partial Redemption Payment with respect to such Partial Redemption Date, entirely or partially, in shares of Common Stock, shall deliver to the Holder a written notice of such election stating which portion thereof the Company has elected to pay in shares of Common Stock (a “Partial Redemption Stock Payment Notice”) (and such election shall be irrevocable as to such Partial Redemption Date). Failure to timely deliver such written notice to the Holder shall be deemed an election by the Company to pay the Partial Redemption Payment with respect to such Partial Redemption Date in cash. With respect to any Partial Redemption Date for which the Company has elected to make a Partial Redemption Payment (or any applicable portion thereof) in shares of Common Stock in accordance with this Section 5(C), (i) the Holder shall have the right to (x) convert such Partial Redemption Payment (or any applicable portion thereof) into shares of Common Stock pursuant to Section 8 hereof at any time up until the subsequent Partial Redemption Date, (y) allocate all or any portion of the applicable Partial Redemption Payment (or applicable portion thereof) to one or more Scheduled Trading Days (any such date, a “Partial Redemption Stock Payment Date”) during the period beginning on, and including, the applicable Partial Redemption Date and ending on, and including, the Scheduled Trading Day immediately before the subsequent Partial Redemption Date (the “Partial Redemption Stock Payment Period”) or (z) defer such Partial Redemption Payment (or applicable portion thereof) to any future Partial Redemption Date selected by the Holder; and (ii) the Company shall issue to the Holder, a number of validly issued, fully paid and Freely Tradable shares of Common Stock equal to the quotient (rounded up to the closest whole number) obtained by dividing such Partial Redemption Payment (or any applicable portion thereof) by the Market Stock Payment Price as of such Partial Redemption Stock Payment Date. Any portion of the Partial Redemption Payment not paid in shares of Common Stock because the Holder did not allocate such Partial Redemption Payment (or applicable portion thereof) to a Scheduled Trading Day during the applicable Partial Redemption Stock Payment Period or because the Holder elected to defer the receipt of such Partial Redemption Payment (or portion thereof) during the applicable Partial Redemption Stock Payment Period will be automatically deferred to the next Partial Redemption Date or such future Partial Redemption Date as was elected by the Holder, as applicable. Notwithstanding the foregoing, in the event that the Market Stock Payment Price is lower than the Floor Price on such Partial Redemption Stock Payment Date (i) the Floor Price rather than the Market Stock Payment Price shall be used for purpose of calculating the number of shares of Common Stock to be issued on such date pursuant to this Section 5(C) and (ii) the Company shall concurrently with the issuance of such shares also pay to the Holder an amount, in cash, equal to the product of (x) the number of shares by which the shares issuable pursuant to this Section 5(C) was reduced as a result of the preceding clause (i), multiplied by (y) the Market Stock Payment Price. The Holder must provide notice to the Company of its election of any Partial Redemption Stock Payment Date and the applicable portion of the Partial Redemption Payment it is electing to receive on each such Partial Redemption Stock Payment Date no later than 4:30 p.m. New York Time on such Partial Redemption Stock Payment Date. Notwithstanding anything herein to the contrary, the Company will not have the right to, and will not, make any Partial Redemption Payment (or any applicable portion thereof) in shares of Common Stock if the Equity Conditions are not satisfied for each VWAP Trading Day occurring between the Partial Redemption Stock Payment Notice and the applicable Partial Redemption Date, and such Partial Redemption Payment (or any applicable portion thereof) shall instead be paid in cash in accordance with Section 5(A), unless such failure of the Equity Conditions to be so satisfied is waived in writing by the Holder, which waiver may be granted or withheld by the Holder in its sole discretion. The Company shall not pay any portion of the Partial Redemption Payment in shares of Common Stock on any day that the Holder has not designated as a Partial Redemption Stock Payment Date. Any such shares of Common Stock will be delivered by the Company to the Holder on or before the second (2nd) Business Day following the applicable Partial Redemption Stock Payment Date.

(D) Delay of Payment when Payment Date is Not a Business Day. If the due date for a payment on this Note as provided in this Note is not a Business Day, then, notwithstanding anything to the contrary in this Note, such payment may be made on the immediately following Business Day and no interest will accrue on such payment as a result of the related delay.

|

Section 6. |

Required Repurchase of Note upon a Fundamental Change. |

(A) Repurchase Upon Fundamental Change. Subject to the other terms of this Section 6, if a Fundamental Change occurs, then the Holder will have the right to require the Company to repurchase this Note (or any portion of this Note in an Authorized Denomination) on the Fundamental Change Repurchase Date for such Fundamental Change for a cash purchase price equal to the Fundamental Change Repurchase Price.

(B) Fundamental Change Repurchase Date. The Fundamental Change Repurchase Date for any Fundamental Change will be a Business Day of the Holder’s choosing that is no more than twenty (20) Business Days after the later of (x) the date the Company delivers to the Holder the related Fundamental Change Notice pursuant to Section 6(C); and (y) the effective date of such Fundamental Change.

(C) Fundamental Change Notice. No later than the fifth (5th) Business Day before the occurrence of any Fundamental Change, the Company will send to the Holder a written notice (the “Fundamental Change Notice”) thereof, stating the expected date such Fundamental Change will occur.

(D) Fundamental Change Repurchase Price. The Fundamental Change Repurchase Price for this Note (or any portion of this Note to be repurchased) upon a Repurchase Upon Fundamental Change following a Fundamental Change is an amount in cash equal to the Fundamental Change Base Repurchase Price for such Fundamental Change. For the avoidance of doubt, if such Fundamental Change Repurchase Date is on an Interest Payment Date, then the interest otherwise payable on this Note (or such portion of this Note) on such Interest Payment Date will be paid as part of the Fundamental Change Repurchase Price, in satisfaction of the Company’s obligation to pay such interest on such Interest Payment Date.

(E) Effect of Repurchase. If this Note (or any portion of this Note) is to be repurchased upon a Repurchase Upon Fundamental Change, then, from and after the date the related Fundamental Change Repurchase Price is paid in full, this Note (or such portion) will cease to be outstanding and interest will cease to accrue on this Note (or such portion).

|

Section 7. |

Partial Redemption Payments; Holder Optional Redemption. |

(A) Partial Redemption Payments. At the Holder’s election, in its sole discretion, the Company shall be required to redeem a portion of this Note equal to the applicable Partial Redemption Payment on each Partial Redemption Date; provided, however, that the Holder may, in its sole discretion, defer any Partial Redemption Payment (or any portion thereof) to any subsequent Partial Redemption Date. The Holder shall deliver to the Company a written notice of any such election under this Section 7(A) at least fifteen (15) Trading Days prior to the applicable Partial Redemption Date in order to make an effective election; provided, however, that the Holder may, in its sole discretion, defer any Partial Redemption Payment (or any portion thereof) to any subsequent Partial Redemption Date in accordance with the immediately preceding sentence at any time prior to the applicable Partial Redemption Date.

(B) Effect of Partial Redemption Payment. If this Note (or any portion of this Note) is redeemed pursuant to Section 7(A), then, from and after the date the related Partial Redemption Payment is paid in full this Note (or such portion) will cease to be outstanding and interest will cease to accrue on this Note (or such portion).

|

Section 8. |

Conversion. |

(A) Right to Convert.

(i) Generally. Subject to the provisions of this Section 8, the Holder may, at its option, convert this Note, including any portion constituting a Partial Redemption Payment that the Holder has elected to convert pursuant to Section 5(C) hereof or that is required to be paid by the Company on the next Partial Redemption Date or Partial Redemption Stock Payment Date, as applicable, or a deferred Partial Redemption Payment, into Conversion Consideration.

(ii) Conversions in Part. Subject to the terms of this Section 8, this Note may be converted in part, but only in an Authorized Denomination. Provisions of this Section 8 applying to the conversion of this Note in whole will equally apply to conversions of any permitted portion of this Note.

(B) When this Note May Be Converted.

(i) Generally. The Holder may convert this Note at any time until the Close of Business on the second (2nd) Scheduled Trading Day immediately before the Maturity Date. For the avoidance of doubt, the Holder’s right to convert this Note shall not be impacted by a prior notice or election to defer any Partial Redemption Payment pursuant to Section 7(A) hereof.

(ii) Limitations and Closed Periods. Notwithstanding anything to the contrary in this Section 8, if this Note (or any portion of this Note) is to be repurchased upon a Repurchase Upon Fundamental Change pursuant to Section 6, then in no event may this Note (or such portion) be converted after the Close of Business on the Scheduled Trading Day immediately before the related Fundamental Change Repurchase Date; provided, that this Section 8(B)(ii) shall no longer apply to this Note (or such applicable portion) if the applicable Fundamental Change Repurchase Price is not delivered on the Fundamental Change Repurchase Date in accordance with Section 6.

(C) Conversion Procedures.

(i) Generally. To convert this Note, the Holder must (1) complete, manually sign and deliver to the Company the conversion notice attached to this Note or a portable document format (.pdf) version of such conversion notice (at which time such conversion will become irrevocable); and (2) pay any amounts due pursuant to Section 8(C)(iii). For the avoidance of doubt, the conversion notice may be delivered by e-mail in accordance with Section 14. If the Company fails to deliver, by the related Conversion Settlement Date, any shares of Common Stock forming part of the Conversion Consideration of the conversion of this Note, the Holder, by notice to the Company, may rescind all or any portion of the corresponding conversion notice at any time until such Defaulted Shares are delivered.

(ii) Holder of Record of Conversion Shares. The person in whose name any shares of Common Stock is issuable upon conversion of this Note will be deemed to become the holder of record of such shares as of the Close of Business on the Conversion Date for such conversion, conferring, as of such time, upon such person, without limitation, all voting and other rights appurtenant to such shares.

(iii) Taxes and Duties. If the Holder converts a Note, the Company will pay any documentary, stamp or similar issue or transfer tax or duty due on the issue of any shares of Common Stock upon such conversion; provided, however, that if any tax or duty is due because such Holder requested such shares to be issued in a name other than that of such Holder, then such Holder will pay such tax or duty and, until having received a sum sufficient to pay such tax or duty, the Company may refuse to deliver any such shares to be issued in a name other than that of such Holder.

(D) Settlement upon Conversion.

(i) Generally. The consideration (the “Conversion Consideration”) due in respect of each $1,000 Principal Amount of this Note, including any portion constituting a Partial Redemption Payment required to be paid by the Company on the next Partial Redemption Date or Partial Redemption Stock Payment Date, as applicable, or any outstanding deferred Partial Redemption Payment, to be converted will consist of the following:

(1) subject to Section 8(D)(ii), a number of shares of Common Stock equal to the Conversion Rate in effect on the Conversion Date for such conversion; and

(2) cash in an amount equal to the aggregate accrued and unpaid interest on this Note to, but excluding, the Conversion Settlement Date for such conversion.

(ii) Fractional Shares. The total number of shares of Common Stock due in respect of any conversion of this Note, including any portion constituting a Partial Redemption Payment required to be paid by the Company on the next Partial Redemption Date or Partial Redemption Stock Payment Date, as applicable, or any outstanding deferred Partial Redemption Payment, will be determined on the basis of the total Principal Amount of this Note to be converted with the same Conversion Date; provided, however, that if such number of shares of Common Stock is not a whole number, then such number will be rounded up to the nearest whole number.

(iii) Conversion of Partial Redemption Payment. For the avoidance of doubt, with respect to the conversion of any Partial Redemption Payment (or any portion thereof) or any outstanding deferred Partial Redemption Payment (or any portion thereof), the Principal Amount of this Note converted shall be deemed to be equal to (x) the amount of such Partial Redemption Payment (or portion thereof) or outstanding deferred Partial Redemption Payment (or portion thereof) being converted divided by (y) one and twelve hundredths (1.12).

(iv) Delivery of the Conversion Consideration. The Company will pay or deliver, as applicable, the Conversion Consideration due upon the conversion of this Note, including any portion constituting a Partial Redemption Payment required to be paid by the Company on the next Partial Redemption Date or Partial Redemption Stock Payment Date, as applicable, or any outstanding deferred Partial Redemption Payment, to the Holder on or before the second (2nd) Business Day (or, if earlier, the standard settlement period for the primary Eligible Market on which the Common Stock is traded) immediately after the Conversion Date for such conversion (the “Conversion Settlement Date”).

(v) Effect of Conversion. If this Note is converted, then, from and after the date the Conversion Consideration therefor is issued or delivered in settlement of such conversion, this Note will cease to be outstanding and interest will cease to accrue on this Note.

(vi) Conversion Settlement Defaults. If (x) the Company fails to deliver, by the related Conversion Settlement Date, any shares of Common Stock (the “Defaulted Shares”) forming part of the Conversion Consideration of the conversion of this Note, including any portion constituting a Partial Redemption Payment required to be paid by the Company on the next Partial Redemption Date or Partial Redemption Stock Payment Date, as applicable, or any outstanding deferred Partial Redemption Payment; and (y) the Holder (whether directly or indirectly, including by any broker acting on the Holder’s behalf or acting with respect to such Defaulted Shares) purchases any shares of Common Stock (whether in the open market or otherwise) to cover any such Defaulted Shares (whether to satisfy any settlement obligations with respect thereto of the Holder or otherwise), then, without limiting the Holder’s right to pursue any other remedy available to it (whether hereunder, under applicable law or otherwise), the Holder will have the right, exercisable by notice to the Company, to cause the Company to either:

(1) pay, on or before the second (2nd) Business Day after the date such notice is delivered, cash to the Holder in an amount equal to the aggregate purchase price (including any brokerage commissions and other out-of-pocket costs) incurred to purchase such shares (such aggregate purchase price, the “Covering Price”); or

(2) promptly deliver, to the Holder, such Defaulted Shares in accordance with this Note, together with cash in an amount equal to the excess, if any, of the Covering Price over the product of (x) the number of such Defaulted Shares; and (y) the Daily VWAP per share of Common Stock on the Conversion Date relating to such conversion.

To exercise such right, the Holder must deliver notice of such exercise to the Company, specifying whether the Holder has elected clause (1) or (2) above to apply. If the Holder has elected clause (1) to apply, then the Company’s obligation to deliver the Defaulted Shares in accordance with this Note will be deemed to have been satisfied and discharged to the extent the Company has paid the Covering Price in accordance with clause (1).

(E) Reserve and Status of Common Stock Issued upon Conversion.

(i) Stock Reserve. Upon the issuance of this Note, the Company will reserve 586,000 shares of Common Stock from its authorized but unissued and unreserved shares of Common Stock for issuance upon a conversion of this Note. The Company will obtain the Share Authorization Increase Requisite Stockholder Approval by no later than the earlier to occur of (x) the Company's 2021 Annual Meeting of Stockholders and (y) November 1, 2021, and after such approval is obtained, at all times when this Note is outstanding, the Company will reserve, out of its authorized but unissued and unreserved shares of Common Stock, a number of shares of Common Stock equal to the greater of (A) (x) the then outstanding Principal Amount of this Note, divided by (y) the Conversion Price then in effect; and (B) two hundred percent (200%) of a fraction, the numerator of which shall be (x) the then outstanding Principal Amount of this Note plus an amount equal to (i) the accrued but unpaid interest on the this Note plus (ii) all interest not yet accrued but accruable on such outstanding Principal Amount through October 1, 2023, and the denominator of which shall be (y) the Market Stock Payment Price.

(ii) Status of Conversion Shares; Listing. Each share of Common Stock delivered upon conversion of this Note will be a newly issued or treasury share and will be duly and validly issued, fully paid, non-assessable, free from preemptive rights and free of any Lien or adverse claim (except to the extent of any Lien or adverse claim created by the action or inaction of the Holder or the Person to whom such share will be delivered). If the Common Stock is then listed on any securities exchange, or quoted on any inter-dealer quotation system, then the Company will cause each share of Common Stock issued upon conversion of this Note, when delivered upon such conversion, to be admitted for listing on such exchange or quotation on such system.

(iii) Transferability of Conversion Shares. Any shares of Common Stock issued upon conversion of this Note will be issued in the form of book-entries at the facilities of DTC, identified therein by an “unrestricted” CUSIP number.

(F) Forced Conversion.

(i) Generally. If (1) the Daily VWAP per share of Common Stock exceeds one hundred and seventy-five percent (175%) of the Conversion Price on each of twelve (12) consecutive VWAP Trading Days beginning after [insert the date that is six months after the date of this Note]; and (2) the Equity Conditions are satisfied on each of such twelve (12) consecutive VWAP Trading Days, then, subject to the limitations on conversion contained in Section 8(K), the Company may provide written notice to the Holder electing to convert the entire Principal Amount of this Note (or applicable portion thereof) into Conversion Consideration; provided that no Forced Conversion will be effected unless (x) the Daily VWAP per share of Common Stock exceeds one hundred and seventy-five percent (175%) of the Conversion Price and (y) the Equity Conditions are satisfied, in the case of each of clauses (x) and (y) (A) on each of the VWAP Trading Days in the twelve (12) consecutive VWAP Trading Day period ending on the date upon which notice of election of such conversion is given and (B) on each VWAP Trading Day from the date of such notice until the corresponding Conversion Consideration is delivered. The Conversion Date with respect to any such Forced Conversion will be deemed to occur on the fifth (5th) Business Day after such written notice to the Holder.

(ii) Effect of Forced Conversion. A Forced Conversion will have the same effect as a conversion of the entire Principal Amount of this Note (or applicable portion thereof) effected at the Holder’s election pursuant to Section 8(A)(i) with a Conversion Date occurring on the Business Day referred to in Section 8(F)(i) (for the avoidance of doubt, without the need for the Holder to deliver a conversion notice); provided, however, that the Company will not be obligated to deliver the Conversion Consideration until the Holder has complied, if applicable, with its obligations under Section 8(C)(iii).

(G) Adjustments to the Conversion Rate.

(i) Events Requiring an Adjustment to the Conversion Rate. The Conversion Rate will be adjusted from time to time as follows:

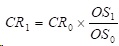

(1) Stock Dividends, Splits and Combinations. If the Company issues solely shares of Common Stock as a dividend or distribution on all or substantially all shares of the Common Stock, or if the Company effects a stock split or a stock combination of the Common Stock (in each case excluding an issuance solely pursuant to a Common Stock Change Event, as to which Section 8(J) will apply), then the Conversion Rate will be adjusted based on the following formula:

where:

CR0 = the Conversion Rate in effect immediately before the Open of Business on the Ex-Dividend Date for such dividend or distribution, or immediately before the Open of Business on the effective date of such stock split or stock combination, as applicable;

CR1 = the Conversion Rate in effect immediately after the Open of Business on such Ex-Dividend Date or the Open of Business on such effective date, as applicable;

OS0 = the number of shares of Common Stock outstanding immediately before the Open of Business on such Ex-Dividend Date or effective date, as applicable, without giving effect to such dividend, distribution, stock split or stock combination; and

OS1 = the number of shares of Common Stock outstanding immediately after giving effect to such dividend, distribution, stock split or stock combination.

If any dividend, distribution, stock split or stock combination of the type described in this Section 8(G)(i)(1) is declared or announced, but not so paid or made, then the Conversion Rate will be readjusted, effective as of the date the Board of Directors determines not to pay such dividend or distribution or to effect such stock split or stock combination, to the Conversion Rate that would then be in effect had such dividend, distribution, stock split or stock combination not been declared or announced.

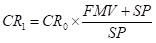

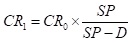

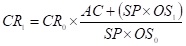

(2) Rights, Options and Warrants. If the Company distributes, to all or substantially all holders of Common Stock, rights, options or warrants (other than rights issued or otherwise distributed pursuant to a stockholder rights plan, as to which the provisions set forth in Sections 8(G)(i)(3)(a) and 8(G)(v) will apply) entitling such holders, for a period of not more than sixty (60) calendar days after the record date of such distribution, to subscribe for or purchase shares of Common Stock at a price per share that is less than the average of the Last Reported Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before the date such distribution is announced, then the Conversion Rate will be increased based on the following formula:

where: