News Release

CELANESE AND BLACKSTONE TO FORM JOINT VENTURE IN ACETATE TOW

Brings together complementary tow portfolios to drive innovation and enhance cost competitiveness;

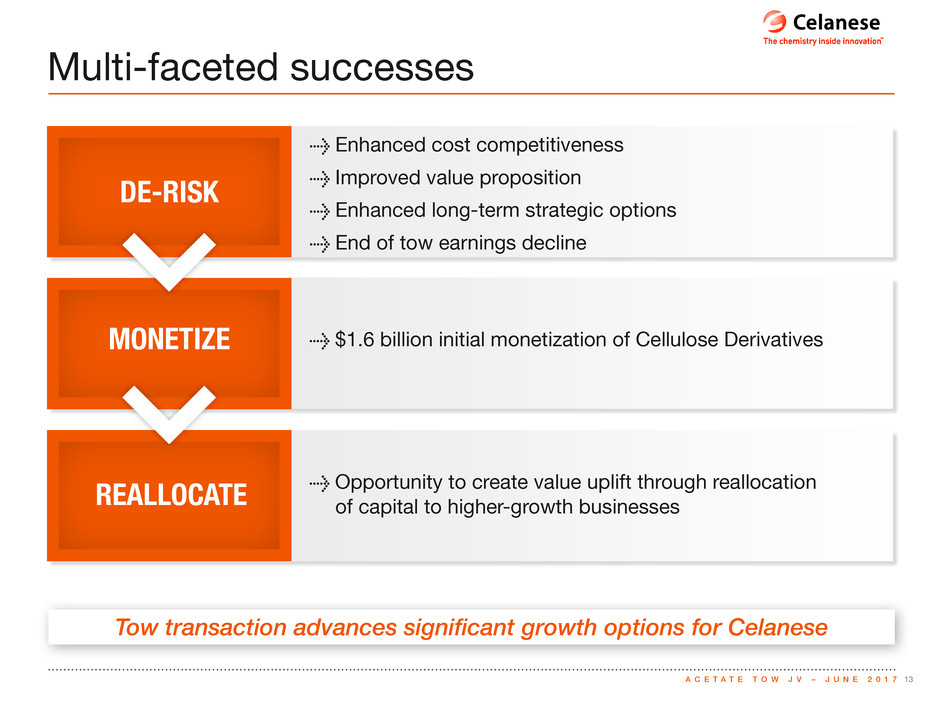

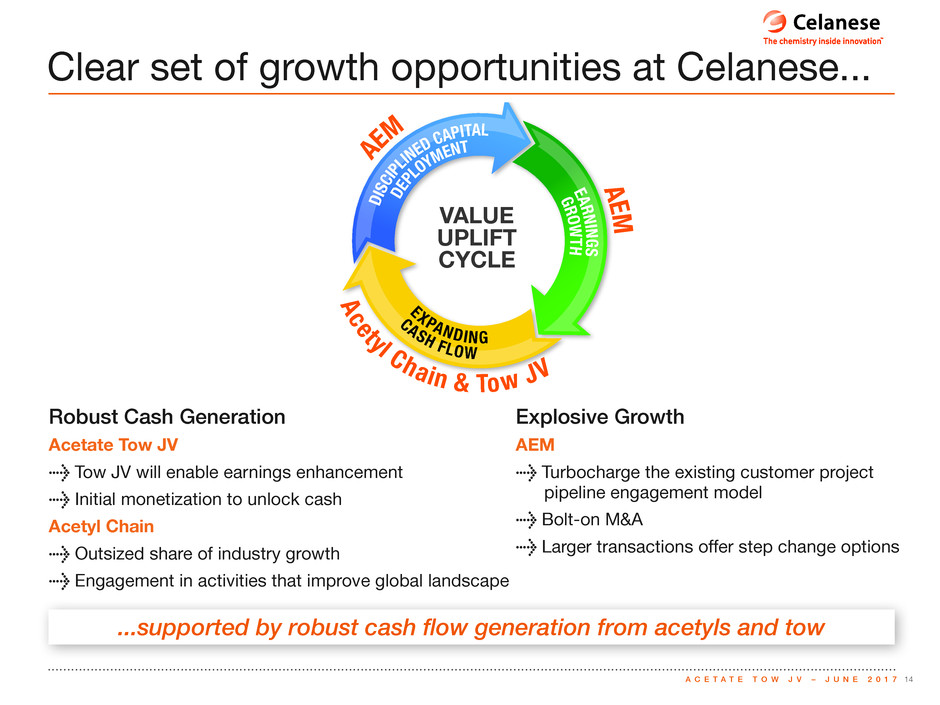

Proceeds from transaction to be deployed in high-growth businesses at Celanese

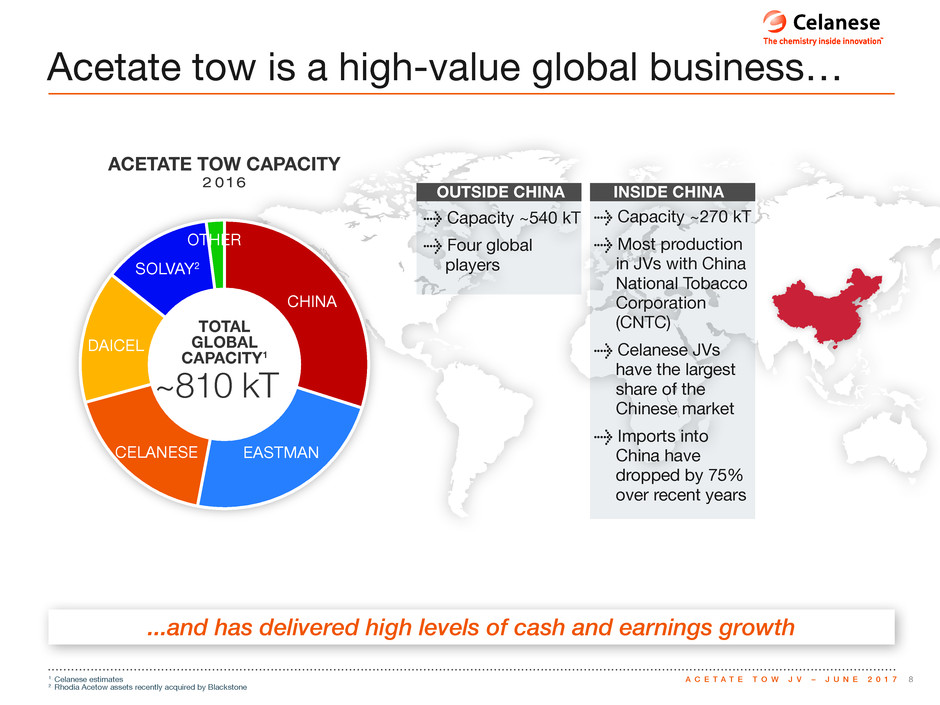

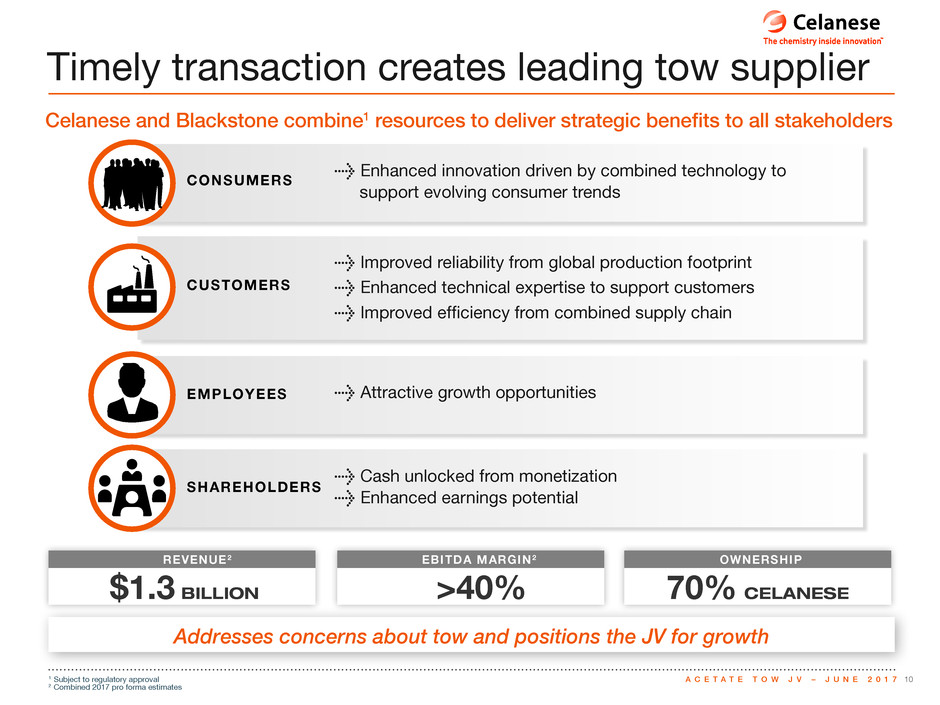

• | Proposed joint venture (JV) to combine Celanese’s Cellulose Derivatives and Blackstone’s Rhodia Acetow businesses. |

• | Combination to create a global acetate tow supplier with increased ability to serve customers efficiently and reliably while enhancing opportunities for innovation and productivity. |

• | Celanese and Blackstone will own 70% and 30% of the JV, respectively. |

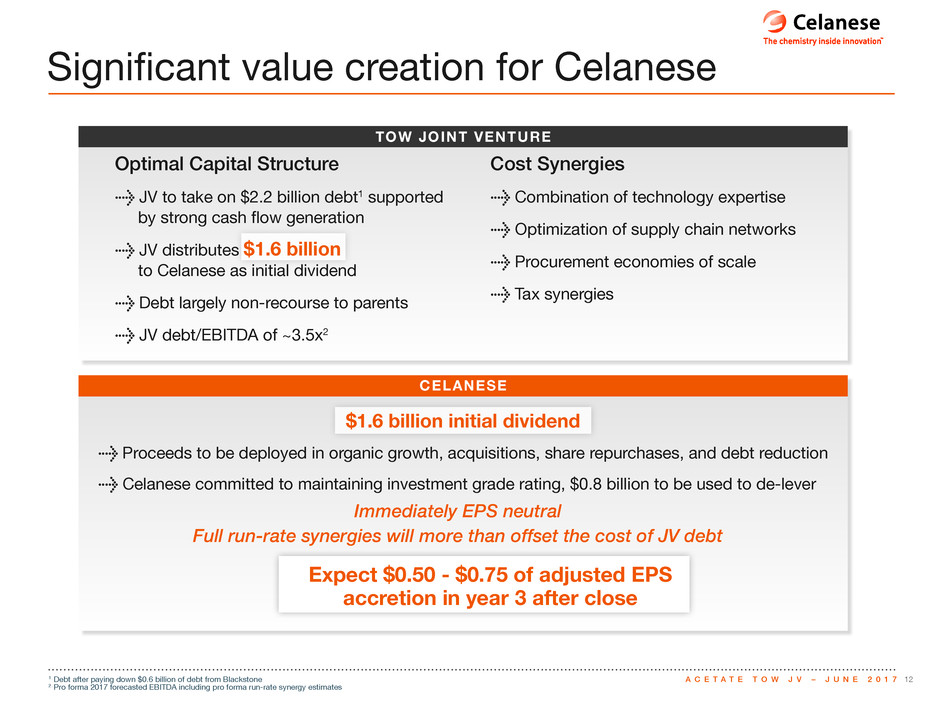

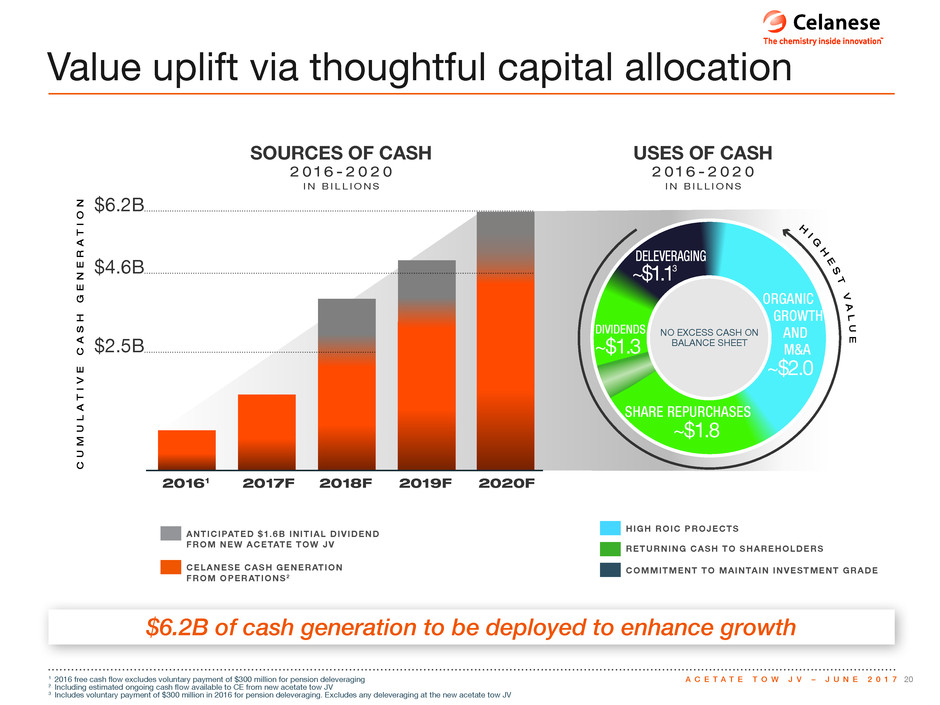

• | JV to distribute $1.6 billion in cash to Celanese at close. |

• | Transaction to be earnings per share neutral for Celanese in the first year and accretive thereafter. |

DALLAS, NEW YORK AND LONDON, June 18, 2017: Celanese Corporation (NYSE: CE), a global technology and specialty materials company, and funds managed by Blackstone (NYSE: BX), one of the world’s leading investment firms, today announced a definitive agreement to form a JV that will create a global acetate tow supplier. Celanese and Blackstone will own 70 percent and 30 percent of the JV, respectively.

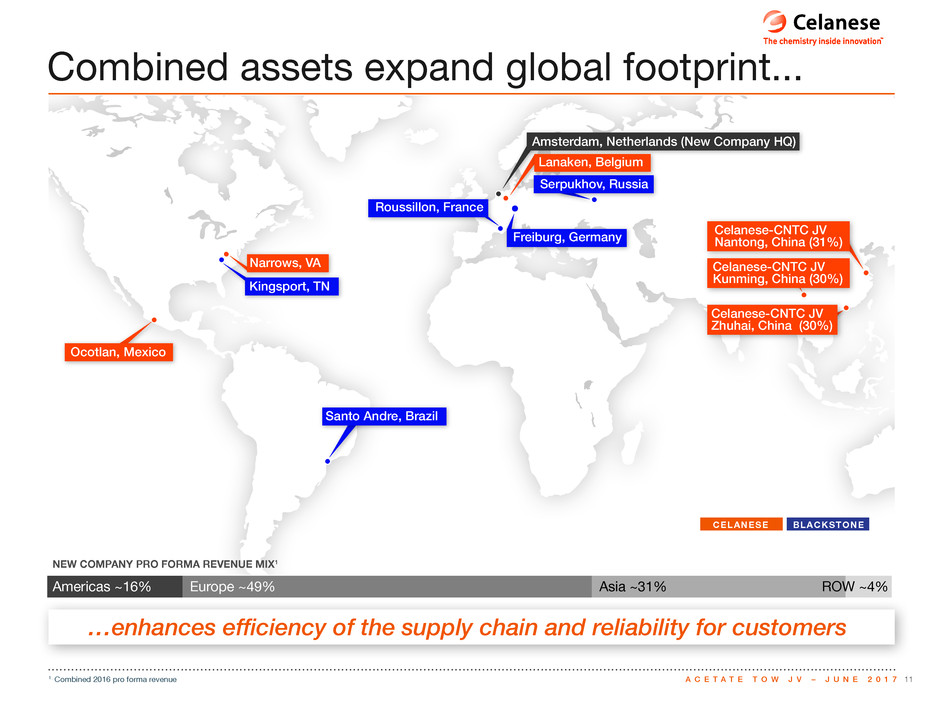

Transaction Overview

Under the terms of the agreement, Celanese will contribute its Cellulose Derivatives business unit, including its equity interest in existing JVs with China National Tobacco Corporation, and Blackstone will contribute its Rhodia Acetow business unit, which it recently acquired from Solvay. The new company is expected to generate 2017 annual pro forma revenue of approximately $1.3 billion with around 2,400 employees. The JV will have an extended global footprint that includes eight wholly-owned manufacturing facilities and three existing JV sites.

The new company will be well positioned to meet customers’ current and evolving needs efficiently while providing the highest level of quality and service. The complementary nature of the tow businesses and a combination of technology expertise will result in

1

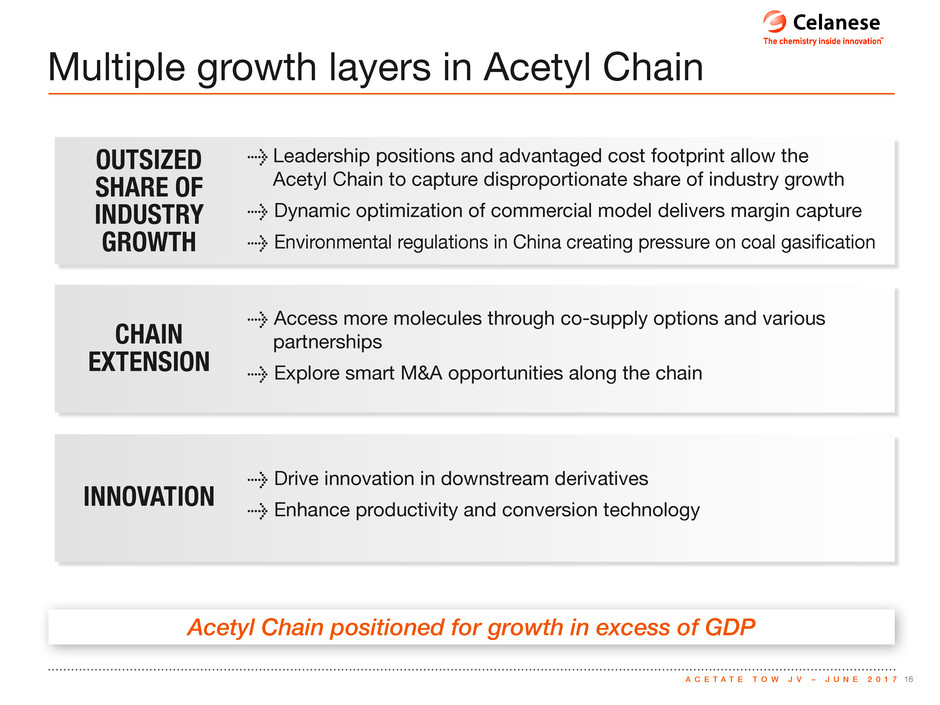

synergies mainly from optimization of supply chain networks and procurement of raw materials, energy, equipment, and other services.

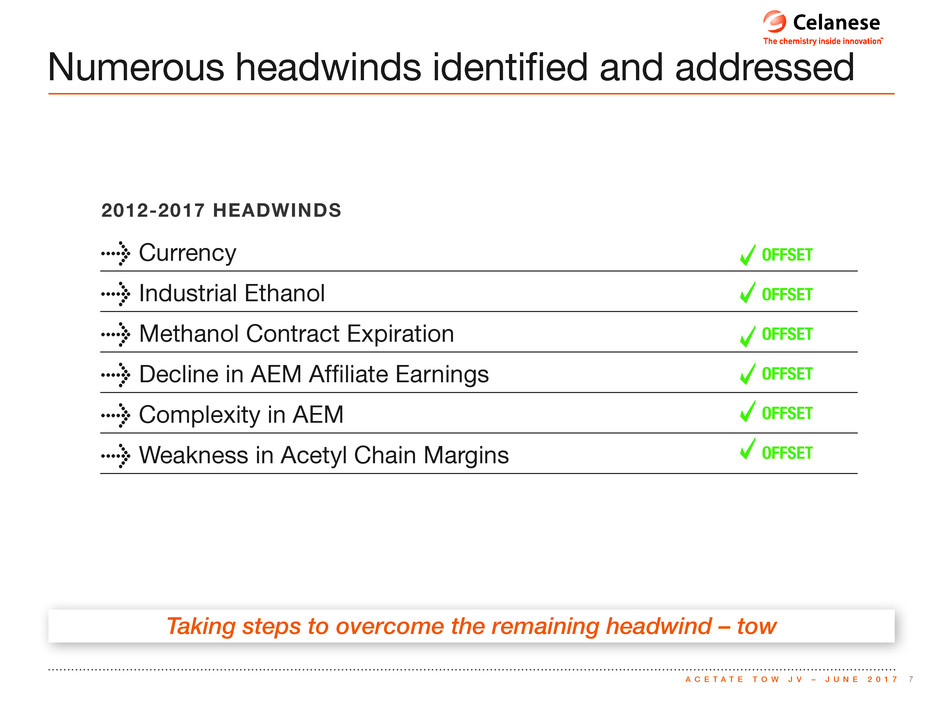

“This is an exciting opportunity for Celanese to partner with Blackstone in a way that creates significant value for all stakeholders. The combination of these tow assets will enhance our ability to serve customers more efficiently and reliably from a global production footprint while also creating growth opportunities for employees,” said Mark Rohr, chairman and chief executive officer of Celanese. “Celanese has delivered strong results in the last several years through differentiated business models. This transaction gives us the opportunity to partially monetize Cellulose Derivatives and reallocate significant capital to higher growth businesses within Celanese to accelerate our growth momentum.”

Lionel Assant, Head of Private Equity Europe at Blackstone, said: “The combination of these two companies provides an excellent opportunity to create a new, international business focused on innovation and growth to the benefit of its customers and employees. We are excited to work with Celanese on this strategic development.”

Governance and Management

Upon closing, the JV will be governed by a Board of Directors consisting of three directors appointed by Celanese and two by Blackstone. The board, management team, and name of the new company will be decided at a later date.

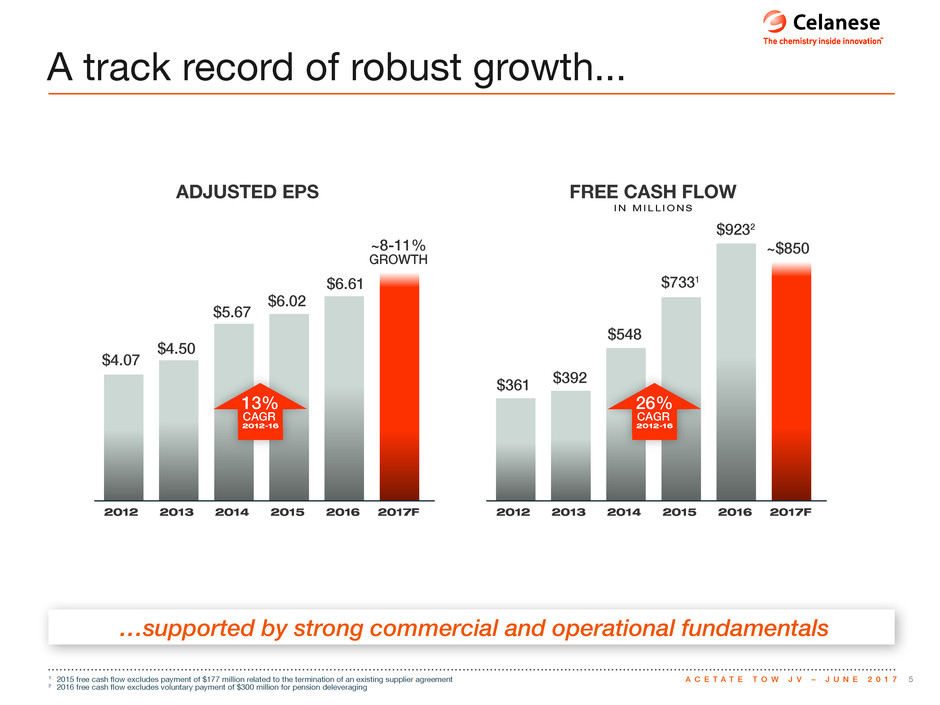

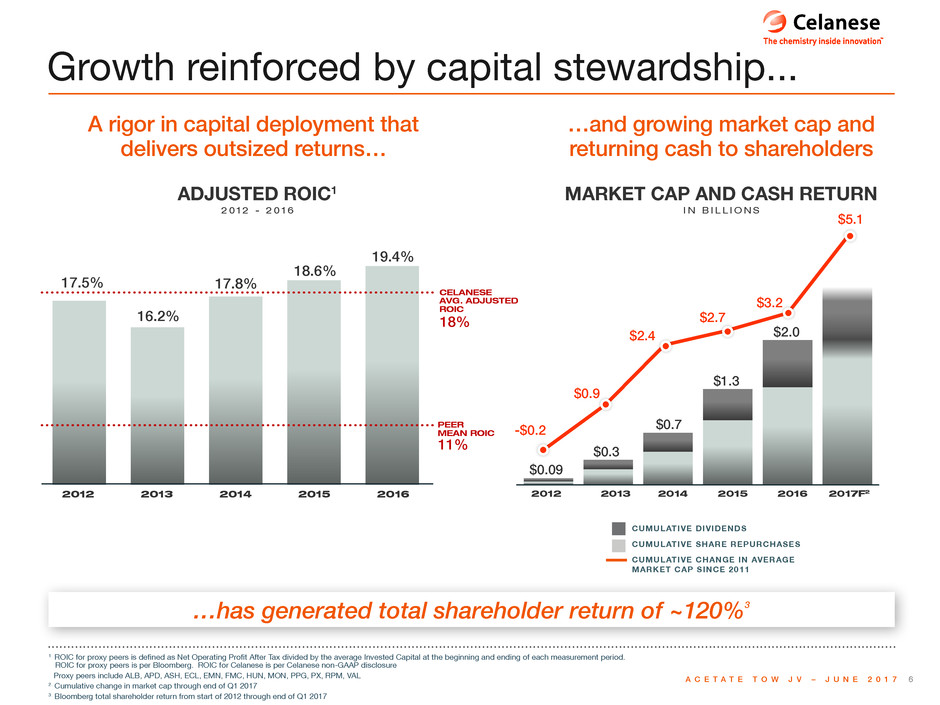

Financial Highlights

Related to this transaction, commitments for $2.2 billion of debt have been received by the partners on behalf of the JV. The debt is expected to be supported by cash generation at the JV and is largely non-recourse to Celanese and Blackstone. An initial dividend of approximately $1.6 billion will be distributed to Celanese following the formation of the JV. Celanese is expected to deploy the proceeds in value uplift opportunities, including investment in organic growth, acquisitions, share repurchases and debt reduction.

Pursuant to the terms of the agreement, once approved and upon closing, Celanese is expected to consolidate JV results in its financial statements, subject to Blackstone’s minority interest.

Celanese is committed to maintaining its investment grade rating.

2

Approvals and Time to Close

The formation of the JV is subject to regulatory approvals and customary closing conditions, which will determine the timing of close. Until then, Celanese’s Cellulose Derivatives and Blackstone’s Rhodia Acetow will continue to operate independently.

Conference Call with Celanese Management at 8:30 a.m. Eastern, June 19, 2017

Celanese management will host a conference call tomorrow at 8:30 a.m. Eastern Daylight time. Mark Rohr, chairman and chief executive officer, Scott Sutton, chief operating officer, and Chris Jensen, chief financial officer, will be available to discuss the JV, Celanese’s broader corporate strategy, and capital allocation priorities. The Company’s presentation and prepared remarks can be found on its website at www.celanese.com under Investor Relations/Events and Presentations. This call will be available by webcast at www.celanese.com in the Investor Relations section or by phone:

Dial-in Number: 1-866-235-9919

International Dial-In Number: 1-412-902-4105

Please ask for the Celanese Webcast

Alternatively, to enter the call immediately without waiting for operator assistance, attendees may pre-register for the call by clicking the link below. Once registered, attendees will receive an Outlook calendar invite with the date and time of call, the dial-in phone number and the unique attendee pin which is sent automatically to the email address provided.

http://dpregister.com/10109308

An audio replay and transcript of the webcast will be available at the same link. The materials will be filed with the Securities and Exchange Commission on a Form 8-K prior to the call.

Celanese Contacts:

Investor Relations | Media Relations – Global | Media Relations Asia (Shanghai) | Media Relations Europe (Germany) |

Surabhi Varshney | W. Travis Jacobsen | Helen Zhang | Jens Kurth |

+1 972 443 3078 | +1 972 443 3750 | +86 21 3861 9279 | +49(0)69 45009 1574 |

surabhi.varshney@celanese.com | william.jacobsen@celanese.com | lan.zhang@celanese.com | j.kurth@celanese.com |

3

Celanese Corporation

222 West Las Colinas Blvd.

Suite 900N

Irving, Texas 75039

Blackstone Contacts:

Andrew Dowler |

+44 (0)20 7451 4275 |

andrew.dowler@blackstone.com |

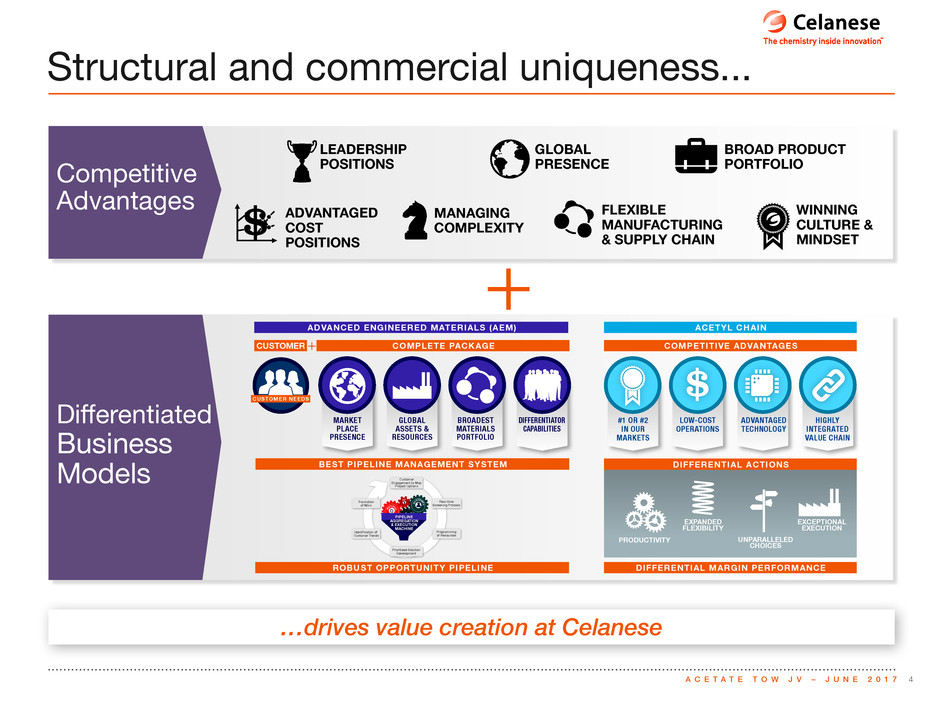

About Celanese

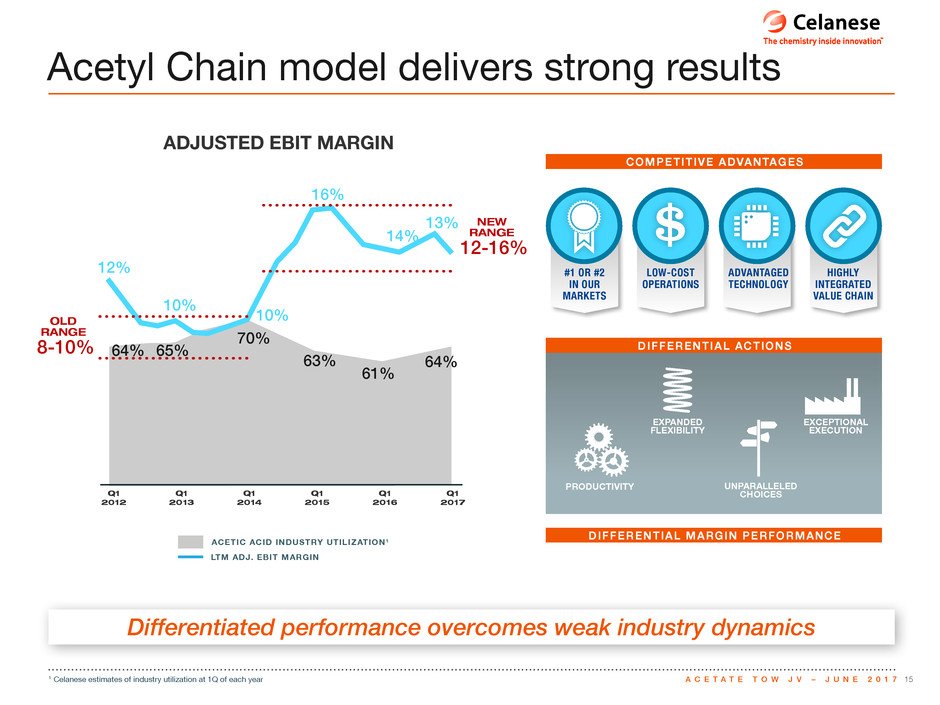

Celanese Corporation is a global technology leader in the production of differentiated chemistry solutions and specialty materials used in most major industries and consumer applications. Our two complementary business cores, Acetyl Chain and Materials Solutions, use the full breadth of Celanese's global chemistry, technology and business expertise to create value for our customers and the corporation. As we partner with our customers to solve their most critical business needs, we strive to make a positive impact on our communities and the world through The Celanese Foundation. Based in Dallas, Celanese currently employs approximately 7,500 employees worldwide and had 2016 net sales of $5.4 billion. For more information about Celanese Corporation and its product offerings, visit www.celanese.com or our blog at www.celaneseblog.com.

All registered trademarks are owned by Celanese International Corporation or its affiliates.

About Blackstone

Blackstone is one of the world’s leading investment firms. We seek to create positive economic impact and long-term value for our investors, the companies we invest in, and the communities in which we work. We do this by using extraordinary people and flexible capital to help companies solve problems. Our asset management businesses, with over $360 billion in assets under management, include investment vehicles focused on private equity, real estate, public debt and equity, non-investment grade credit, real assets and secondary funds, all on a global basis. Further information is available at www.blackstone.com. Follow Blackstone on Twitter @Blackstone.

About Rhodia Acetow

Rhodia Acetow, headquartered in Freiburg, Germany, is a global leader in cellulose acetate tow used in the manufacturing of cigarette filters. It operates plants in Germany, Brazil, France, Russia and the USA.

Forward-Looking Statements

This release may contain "forward-looking statements," which include information concerning the Company's plans, objectives, goals, strategies, future revenues, synergies or performance, financing needs and other information that is not historical information. All forward-looking statements are based upon current expectations and beliefs and various assumptions, including the announced joint venture. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking statements contained in this release, including with respect to the joint venture. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and industry business cycles, particularly in the automotive, electrical, textiles, electronics and construction industries; changes in the price and availability of raw materials, particularly changes in the demand for, supply of, and market prices of ethylene, methanol, natural gas, wood pulp and fuel oil and the prices for electricity and other energy sources; the ability to pass increases in raw material prices on to customers or otherwise improve margins through price

4

increases; the ability to maintain plant utilization rates and to implement planned capacity additions and expansions; the ability to reduce or maintain their current levels of production costs and to improve productivity by implementing technological improvements to existing plants; the ability to identify desirable potential acquisition targets and to consummate acquisition or investment transactions consistent with the Company's strategy; increased price competition and the introduction of competing products by other companies; changes in the degree of intellectual property and other legal protection afforded to our products or technologies, or the theft of such intellectual property; compliance and other costs and potential disruption or interruption of production or operations due to accidents, interruptions in sources of raw materials, cyber security incidents, terrorism or political unrest or other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions, the occurrence of acts of war or terrorist incidents or as a result of weather or natural disasters; potential liability for remedial actions and increased costs under existing or future environmental regulations, including those relating to climate change; potential liability resulting from pending or future litigation, or from changes in the laws, regulations or policies of governments or other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; our level of indebtedness, which could diminish our ability to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry; and various other factors discussed from time to time in the Company's filings with the Securities and Exchange Commission.

In addition to the risks and uncertainties identified above, the following risks and uncertainties, among others, could cause the Company’s actual results of operations regarding the joint venture to differ materially from the results expressed or implied in this press release: the timing or ultimate completion of the transaction as the transaction is subject to closing conditions, including antitrust clearance; the expected benefits of the transaction may not materialize as expected; ability to successfully implement the integration strategy for the joint venture; and the ability to ensure continued performance or market growth of the combined tow businesses. Any forward-looking statement speaks only as of the date on which it is made, and the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances.

Non-GAAP Financial Measures

Presentation

This document presents the Company's business segments in two subtotals, reflecting our two cores, the Acetyl Chain and Materials Solutions, based on similarities among customers, business models and technical processes. As described in the Company's annual report on Form 10-K and quarterly reports on Form 10-Q, the Acetyl Chain includes the Company's Acetyl Intermediates segment and the Industrial Specialties segment. Materials Solutions includes the Company's Advanced Engineered Materials segment and the Consumer Specialties segment. The Company’s cellulose derivatives business is included in the Consumer Specialties segment.

Use of Non-US GAAP Financial Information

This release uses the following Non-US GAAP measures: adjusted EBIT, adjusted EBIT margin, adjusted earnings per share, return on invested capital (adjusted) and free cash flow. These measures are not recognized in accordance with US GAAP and should not be viewed as an alternative to US GAAP measures of performance or liquidity. The most directly comparable financial measure presented in accordance with US GAAP in our consolidated financial statements for adjusted EBIT is net earnings (loss) attributable to Celanese Corporation; for adjusted EBIT margin is operating margin; for adjusted earnings per share is earnings (loss) from continuing operations attributable to Celanese Corporation per common share-diluted; for return on invested capital (adjusted) is net earnings (loss) attributable to Celanese Corporation divided by the sum of the average of beginning and end of the year short- and long-term debt and Celanese Corporation stockholders' equity; and for free cash flow is net cash provided by (used in) operations.

Definitions of Non-US GAAP Financial Measures

Adjusted EBIT is a performance measure used by the Company and is defined by the Company as net earnings (loss) attributable to Celanese Corporation, plus (earnings) loss from discontinued operations, less interest income, plus interest expense, plus refinancing expense and taxes, and further adjusted for Certain Items (refer to Table 8 of our Non-US GAAP Financial Measures and Supplemental Information document). We may provide guidance on adjusted EBIT but are unable to reconcile forecasted adjusted EBIT to a US GAAP financial measure without unreasonable efforts because a forecast of Certain Items, such as mark-to-market pension gains and losses, which may be significant, is not practical. Adjusted EBIT margin is defined by the Company as adjusted EBIT divided by net sales.

Adjusted EBIT by core (i.e. Acetyl Chain and/or Materials Solutions) may also be referred to by management as core income. Adjusted EBIT margin by core may also be referred to by management as core income margin. Adjusted EBIT by business segment may also be referred to by management as segment income. Adjusted EBIT margin by business segment may also be referred to by management as segment income margin.

Adjusted earnings per share is a performance measure used by the Company and is defined by the Company as earnings (loss) from continuing operations attributable to Celanese Corporation, adjusted for income tax (provision) benefit, Certain Items, and refinancing and related expenses, divided by the number of basic common shares and dilutive restricted stock units and stock options calculated using the treasury method. We may provide guidance on adjusted earnings per share but are unable to reconcile forecasted adjusted earnings per share to a US GAAP financial measure without unreasonable

5

efforts because a forecast of Certain Items, such as mark-to-market pension gains and losses, which may be significant, is not practical.

Note: The income tax expense (benefit) on Certain Items ("Non-GAAP adjustments") is determined using the applicable rates in the taxing jurisdictions in which the Non-GAAP adjustments occurred and includes both current and deferred income tax expense (benefit). The income tax rate used for adjusted earnings per share approximates the midpoint in a range of forecasted tax rates for the year. This range may include certain partial or full-year forecasted tax opportunities and related costs, where applicable, and specifically excludes changes in uncertain tax positions, discrete recognition of GAAP items on a quarterly basis, other pre-tax items adjusted out of our GAAP earnings for adjusted earnings per share purposes and changes in management's assessments regarding the ability to realize deferred tax assets for GAAP. In determining the adjusted earnings per share tax rate, we reflect the impact of foreign tax credits when utilized, or expected to be utilized, absent discrete events impacting the timing of foreign tax credit utilization. We analyze this rate quarterly and adjust it if there is a material change in the range of forecasted tax rates; an updated forecast would not necessarily result in a change to our tax rate used for adjusted earnings per share. The adjusted tax rate is an estimate and may differ from the actual tax rate used for GAAP reporting in any given reporting period. Table 3a of our Non-US GAAP Financial Measures and Supplemental Information document summarizes the reconciliation of our estimated GAAP effective tax rate to the adjusted tax rate. The estimated GAAP rate excludes discrete recognition of GAAP items due to our inability to forecast such items. As part of the year-end reconciliation, we will update the reconciliation of the GAAP effective tax rate to the adjusted tax rate for actual results.

Return on invested capital (adjusted) is defined by the Company as adjusted EBIT, tax effected using the adjusted tax rate, divided by the sum of the average of beginning and end of the year short- and long-term debt and Celanese Corporation stockholders' equity. We believe that return on invested capital (adjusted) provides useful information to management, investors, analysts and other parties in order to assess our income generation from the point of view of our stockholders and creditors who provide us with capital in the form of equity and debt and whether capital invested in the Company yields competitive returns. In addition, achievement of certain predetermined targets relating to return on invested capital (adjusted) is one of the factors we consider in determining the amount of performance-based compensation received by our management.

Free cash flow is a liquidity measure used by the Company and is defined by the Company as cash flow from operations, less capital expenditures on property, plant and equipment, and adjusted for capital contributions from or distributions to Mitsui & Co., Ltd. ("Mitsui") related to our methanol joint venture, Fairway Methanol LLC ("Fairway").

Reconciliation of Non-US GAAP Financial Measures

Reconciliations of the Non-US GAAP financial measures used in this press release to the comparable US GAAP financial measure, together with information about the purposes and uses of Non-US GAAP financial measures, are included in our Non-US GAAP Financial Measures and Supplemental Information documents dated June 18, 2017 filed as an exhibit to our Current Report on Form 8-K filed with the SEC on June 19, 2017 and also available on our website at www.celanese.com under Financial Information, Non-GAAP Financial Measures, or at this link: http://investors.celanese.com/interactive/lookandfeel/4103411/Non-GAAP.PDF.

Results Unaudited

The results in this document, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year.

Supplemental Information

Additional information about our prior period performance is included in our Quarterly Reports on Form 10-Q and in our Non-US GAAP Financial Measures and Supplemental Information document.

6