UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form

(Mark one)

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended:

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No.

YUS INTERNATIONAL GROUP LIMITED

( Exact name of small business issuer as specified in its charter )

(State or other jurisdiction of(IRS Employer

incorporation or organization)Identification No.)

(Address of Principal Executive Offices)(Zip Code)

Registrant's telephone number, including area code:

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [ ]

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] No [ ]

Indicate by check mark if the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

(1)Yes [ ] No [x] (2) Yes [x] No [ ]

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes [ ] No [x]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company:

Large accelerated filer | [ ]Accelerated filer | [ ] |

Non-accelerated filer | [ ]Smaller reporting company | [x] |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [x] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter: N/A.

Number of the issuer's Common Stock outstanding as of the latest practicable date:

Documents incorporated by reference: None.

1

| TABLE OF CONTENTS | Page |

Part I |

|

|

Item 1 | 4 | |

Item 1A | 7 | |

Item 1B | 8 | |

Item 2 | 8 | |

Item 3 | 8 | |

Item 4 |

| |

Part II |

|

|

Item 5 | 9 | |

Item 6 | 9 | |

Item 7 | Management's Discussion and Analysis of Financial Condition and Results of Operations | 9 |

Item 7A | 12 | |

Item 8 | 12 | |

Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 12 |

Item 9A | 12 | |

Item 9B | 13 | |

Part III |

|

|

Item 10 .01 | 28 | |

Item 10.02 | 28 | |

Item 11 | 29 | |

Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 30 |

Item 13 | Certain Relationships and Related Transactions, and Director Independence | 30 |

Item 14 | 30 | |

Part IV |

|

|

Item 15 | 31 | |

| 31 |

2

Forward Looking Statements

This report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as "anticipate," "expect," "intend," "plan," "will," "we believe," "our company believes," "management believes" and similar language. These forward-looking statements are based on our current expectations and are subject to certain risks, uncertainties and assumptions, including those set forth in the discussion under Part 1, Item 1 "Description of Business" and Part 1, Item 7 "Management's Discussion and Analysis", including under the heading "– Risk Factors" under Part 1, Item 1A. Our actual results may differ materially from results anticipated in these forward-looking statements. We base our forward- looking statements on information currently available to us, and we assume no obligation to update them. In addition, our historical financial performance is not necessarily indicative of the results that may be expected in the future and we believe that such comparisons cannot be relied upon as indicators of future performance.

1

PART I

ITEM 1. BUSINESS

Background Information

The Company was incorporated under the laws of the State of Delaware on July 15, 2002 with authorized common stock of 50,000,000 shares at $0.001 par value with the name "North America Marketing Corporation". On March 29, 2004, the Company changed the domicile to the State of Nevada.

On December 30, 2008, the Company entered into and completed an agreement for share exchange to acquire 100% ownership of Asian Trends Broadcasting Inc. ("Asian Trends") from its shareholders. Asian Trends operates liquid crystal display ("LCD") flat-panel televisions and LCD billboards that advertise throughout Hong Kong and creates revenue by selling advertising airtime.

On August 31, 2010 the Company closed an Agreement for a Share Exchange with Global Mania Empire Management Limited ("GME") to acquire 100% ownership of GME from its shareholders. GME is a Hong Kong company that specializes in project and artist management. On January 21, 2011, the Company sold GME back to its original shareholders.

On March 20, 2013, the Board approved the change of the Company's name to Yus International Group Limited and a one hundred-for-one (100:1) reverse stock split applying to all shares of common stock in the Company.

On April 29, 2013, the majority shareholder of the Company entered into a series of stock purchase agreements wherein the majority shareholder of the Company agreed to sell a total of 6,624,789 shares of common stock in the Company to 4 third party entities. On April 30, 2013, after the receipt of consideration and completion of all conditions precedent, the stock purchase agreements were completed and closed.

On May 16, 2013, Zhi Jian Zeng resigned as the Chief Executive Officer and director of the Company and Huang Jian Nan resigned as the Chief Financial Officer and director of the Company.

On May 16, 2013, Mr. Ho Kam Hang was appointed as the Chief Executive Officer of the Company and Dr. Chong Cheuk Man Yuki was appointed as the Chief Financial Officer of the Company. On that same date, the company appointed Mr. Yu Cheung Fai Alex, Ms. Chan Fuk Yu, Mr. Yu Lok Man and Mr. Yu Ka Wai as Directors of the Company.

On April 9, 2014, Mr. Yu Lok Man resigned as director of the Company and Dr. Chong Cheuk Man Yuki resigned as Chief Financial Officer of the Company. On the same date, Ms. Chen Yongqi Dawn was appointed as Chief Financial Officer of the Company.

On July 31, 2014, Miss Chen Yongqi Dawn resigned as the Chief Financial Officer of the Company. On the same date, Ms. Chan Fuk Yu was appointed as Chief Financial Officer of the Company.

On January 12, 2017, the Company acquired 100% of the outstanding equity capital of YUS International Holdings Limited (“YIH”) for US$10,000 from Ho Kam Hang, the Company’s Chief Executive Officer, and Yu Cheung Fai Alex, a director of the Company. This transaction has the effect of making YIH a wholly-owned subsidiary of the Company. YIH is a limited company organized under the laws of Hong Kong. Other than holding dormant bank accounts, YIH has no material assets, liabilities, or operations. It is accounted for as a common control business combination under ASC 805.

Details of the Company’s wholly owned subsidiaries and its Affiliated Hong Kong Entity as of December 31, 2017 and 2016 are as follows:

Company |

| Date of Establishment |

| Place of Establishment |

| Percentage of Ownership by the Company |

|

| Principal Activities | |

YUS International Holdings Limited |

| December 23, 2013 |

| Hong Kong |

|

| 100% |

|

| Dormant |

On September 30, 2017, Mr. Yu Ka Wai resigned as director of the Company.

Business Overview and Operations

Before the change of control on April 30, 2013, through Asian Trends, the Company provided one stop solutions for advertisers, including the brainstorming, storyboarding, production of commercials and advertisements and media planning. However, no business has been generated since January 1, 2013 up to the date of the change of control. Since then, the company became dormant and has remained so until the date of this report. The Company is actively looking for merger candidate.

Business Plan

Our current business plan is to seek and identify appropriate business opportunity for development of our new line of business. We have no capital and must depend on the resources of our shareholders to provide us with the necessary funds to implement our business plan. We intend to seek opportunities demonstrating the potential of long-term growth as opposed to short-term earnings. However, at the present time, we have not identified any business opportunity that we plan to pursue, nor have we reached any agreement or definitive understanding with any person concerning an acquisition or merger.

2

Our Board of Directors will be primarily responsible for investigating combination opportunities. However, we believe that business opportunities may also come to our attention from various sources, including professional advisors such as attorneys, and accountants, securities broker-dealers, venture capitalists, members of the financial community, and others who may present unsolicited proposals. We have no plan, understanding, agreements, or commitments with any individual for such person to act as a finder of opportunities for us.

No direct discussions regarding the possibility of a combination are currently ongoing and we can give no assurances that we will be successful in finding or acquiring a desirable business opportunity. Furthermore, we can give no assurances that any acquisition, if it occurs, will be on terms that are favorable to us or our current stockholders.

We do not propose to restrict our search for business opportunity to any particular geographical area or industry, and therefore, we are unable to predict the nature of our future business operations. Our management's discretion in the selection of business opportunities is unrestricted, subject to the availability of such opportunities, economic conditions, and other factors.

Investigation and Selection of Business Opportunities

Certain types of business acquisition transactions may be completed without requiring us to first submit the transaction to our stockholders for their approval. If the proposed transaction is structured in such a fashion our stockholders (other than our majority stockholder) will not be provided with financial or other information relating to the candidate prior to the completion of the transaction.

If a proposed business combination or business acquisition transaction is structured that requires our stockholder approval, and we are a reporting company, we will be required to provide our stockholders with information as applicable under Regulations 14A and 14C under the Exchange Act.

The analysis of business opportunities will be undertaken by or under the supervision of our Board of Directors. In analyzing potential merger candidates, our management will consider, among other things, the following factors:

·Potential for future earnings and appreciation of value of securities;

·Perception of how any particular business opportunity will be received by the investment community and by our stockholders;

·Historical results of operation;

·Liquidity and availability of capital resources;

·Competitive position as compared to other companies of similar size and experience within the industry segment as well as within the industry as a whole;

·Strength and diversity of existing management or management prospects that are scheduled for recruitment;

·Amount of debt and contingent liabilities; and

·The products and/or services and marketing concepts of the target business

There is no single factor that will be controlling in the selection of a business opportunity. Our management will attempt to analyze all factors appropriate to each opportunity and make a determination based upon reasonable investigative measures and available data. Potentially available business opportunities may occur in many different industries and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities. We may not discover or adequately evaluate adverse facts about the business opportunity to be acquired.

We are unable to predict when we may participate in a business opportunity. We expect, however, that the analysis of specific proposals and the selection of a business opportunity may take several months.

Prior to making a decision to participate in a business transaction, we will generally request that we be provided with written materials regarding the business opportunity containing as much relevant information as possible, including, but not limited to, a description of products, services and company history; management resumes; financial information; available projections, with related assumptions upon which they are based; an explanation of proprietary products and services; evidence of existing patents, trademarks, or service marks, or rights thereto; present and proposed forms of compensation to management; a description of transactions between such company and its affiliates during the relevant periods; a description of present and required facilities; an analysis of risks and competitive conditions; a financial plan of operation and estimated capital requirements; audited financial statements, or if audited financial statements are not available, unaudited financial statements, together with reasonable assurance that audited financial statements would be able to be produced to comply with the requirements of a Current Report on Form 8-K to be filed with the Securities and Exchange Commission, or Commission, upon consummation of the business combination.

As part of our investigation, our directors may meet personally with management and key personnel, may visit and inspect material facilities, obtain independent analysis or verification of certain provided information, check references of management and key personnel, and take other reasonable investigative measures, to the extent of our limited financial and management resources.

3

ITEM 1A. RISK FACTORS

Before you invest in our common stock, you should be aware that there are risks, as described below. You should carefully consider these risk factors together with all of the other information included in this prospectus before you decide to purchase shares of our common stock. Any of the following risks could adversely affect our business, financial condition and results of operations. We have incurred substantial losses from inception while realizing limited revenues and we may never generate substantial revenues or be profitable in the future.

Limited Operating History Makes Potential Difficult to Assess

We began operations of our commercial location network in July 2008. Accordingly, we have a very limited p ast operating history which you can evaluate the viability and sustainability of our future business and its acceptance by future consumers. The Company currently has no assets or financial resources. The Company will, in all likelihood, continue to sustain minimal operating expenses without corresponding revenues, at least until the commencement of a new business. This will most likely result in the Company incurring a small operating loss until the Company can start a new business. There is no assurance that the Company can identify such a new line of business in the near future.

There is No Agreement for A Business Combination and No Minimum Requirements for a Business Combination

The Company has no current arrangement, agreement or understanding with respect to engaging in a business combination with a specific entity. There can be no assurance that the Company will be successful in identifying and evaluating suitable business opportunities or in concluding a business combination. No particular industry or specific business within an industry has been selected for a target company. The Company has not established a specific length of operating history or a specified level of earnings, assets, net worth or other criteria in the past few years which it will require a target company to have achieved, or without which the Company would not consider a business combination with such business entity. Accordingly, the Company may enter into a business combination with a business entity having no significant operating history, losses, limited or no potential for immediate earnings, limited assets, negative net worth or other negative characteristics. There is no assurance that the Company will be able to negotiate a business combination on terms favorable to the Company.

No Assurance of Success or Profitability

There is no assurance that the Company will start a favorable business. Even if the Company should become involved in a business opportunity, there is no assurance that it will generate revenues or profits, or that the market price of the Company's outstanding shares will be increased thereby.

Lack of Diversification

Because of the limited financial resources that the Company has, it is unlikely that the Company will be able to diversify its acquisitions or operations. The Company's probable inability to diversify its activities into more than one area will subject the Company to economic fluctuations within a particular business or industry and therefore increase the risks associated with the Company's operations.

Dependence upon Management, Limited Participation of Management

The Company will be entirely dependent upon the experience of its officer s and director s in seeking, investigating, and acquiring business opportunities and in making decisions regarding the Company's operations. Because investors will not be able to evaluate the merits of possible future business opportunitie s by the Company, they should critically assess the information concerning the Company's officers and directors. (See Management.)

Possible Need for Additional Financing

The Company has very limited funds, and such funds, may not be adequate to take advantage of any available business opportunities. Even if the Company's currently available funds prove to be sufficient to pay for its operations until it is able to acquire an interest in, or complete a transaction with, a business opportunity, such funds will clearly not be sufficient to enable it to exploit the opportunity. Thus, the ultimate success of the Company will depend, in part, upon its availability to raise additional capital. In the event that the Company requires modest amounts of additional capital to fund its operations until it is able to complete a business acquisition or transaction, such funds, are expected to be provided by the principal shareholder s . However, the Company has not investigated the availability, source, or terms that might govern the acquisition of the additional capital which is expected to be required in order to exploit a business opportunity, and will not do so until it has determined the level of need for such additional financing. There is no assurance that additional capital will be available from any source or, if available, that it can be obtained on terms acceptable to the Company. If not available, the Company's operations will be limited to those that can be financed with its modest capital.

Dependence upon Outside Advisors

To supplement the business experience of its officer and director, the Company may be required to employ accountants, technical experts, appraisers, attorneys, or other consultants or advisors. The selection of any such advisors will be made by the Company's officer, without any input by shareholders. Furthermore, it is anticipated that such persons may be engaged on an as needed basis without a continuing fiduciary or other obligation to the Company. In the event the officer of the Company considers it necessary to hire outside advisors, he may elect to hire persons who are affiliates, if those affiliates are able to provide the required services.

4

Regulation of Penny Stocks

The U. S. Securities and Exchange Commission (SEC) has adopted a number of rules to regulate "penny stocks." Because the securities of the Company may constitute "penny stocks" within the meaning of the rules (as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, largely traded in the National Association of Securities Dealers' (NASD) OTC Bulletin Board or the "Pink Sheets", the rules would apply to the Company and to its securities. The Commission has adopted Rule 15g-9 which established sales practice requirements for certain low price securities. Unless the transaction is exempt, it shall be unlawful for a broker or dealer to sell a penny stock to, or to effect the purchase of a penny stock by, any person unless prior to the transaction: (i) the broker or dealer has approved the person's account for transactions in penny stock pursuant to this rule and (ii) the broker or dealer has received from the person a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stock, the broker or dealer must: (a) obtain from the person information concerning the person's financial situation, investment experience, and investment objectives; (b) reasonably determine that transactions in penny stock are suitable for that person, and that the person has sufficient knowledge and experience in financial matters that the person reasonably may be expected to be capable of evaluating the risks of transactions in penny stock; deliver to the person a written statement setting forth the basis on which the broker or dealer made the determination (i) stating in a highlighted format that it is unlawful for the broker or dealer to affect a transaction in penny stock unless the broker or dealer has received, prior to the transaction, a written agreement to the transaction from the person; and (ii) stating in a highlighted format immediately preceding the customer signature line that (iii) the broker or dealer is required to provide the person with the written statement; and (iv) the person should not sign and return the written statement to the broker or dealer if it does not accurately reflect the person's financial situation, investment experience, and investment objectives; and Ó receive from the person a manually signed and dated copy of the written statement. It is also required that disclosure be made as to the risks of investing in penny stock and the commissions payable to the broker-dealer, as well as current price quotations and the remedies and rights available in cases of fraud in penny stock transactions. Statements, on a monthly basis, must be sent to the investor listing recent prices for the Penny Stock and information on the limited market. Shareholders should be aware that, according to Securities and Exchange Commission Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) "boiler room" practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid ask differential and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. The Company's management is aware of the abuses that have occurred historically in the penny stock market. Although the Company does not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to the Company's securities.

There May Be A Scarcity of and/or Significant Competition For Business Opportunities and/or Combinations

The Company is and will continue to be an insignificant participant in the business of seeking mergers with and acquisitions of business entities. A large number of established and well financed entities, including venture capital firms, are active in mergers and acquisitions of companies which may be merger or acquisition target candidates for the Company. Nearly all such entities have significantly greater financial resources, technical expertise and managerial capabilities than the Company and, consequently, the Company will be at a competitive disadvantage in identifying possible business opportunities and successfully completing a business combination. Moreover, the Company will also compete in seeking merger or acquisition candidates with other public shell companies, some of which may also have funds available for use by an acquisition candidate.

Reporting Requirements May Delay or Preclude Acquisition

Pursuant to the requirements of Section 13 of the Exchange Act, the Company is required to provide certain information about significant acquisitions including audited financial statements of the acquired company. These audited financial statements must be furnished within 4 days following the effective date of a business combination. Obtaining audited financial statements are the economic responsibility of the target company. The additional time and costs that may be incurred by some potential target companies to prepare such financial statements may significantly delay or essentially preclude consummation of an otherwise desirable acquisition by the Company. Acquisition prospects that do not have or are unable to obtain the required audited statements may not be appropriate for acquisition so long as the reporting requirements of the Exchange Act are applicable. When a non-reporting company becomes the successor of a reporting company by merger, consolidation, exchange of securities, and acquisition of assets or otherwise, the successor company is required to provide in a Current Report on Form 8-K the same kind of information that would appear in a Registration Statement or an Annual Report on Form 10-K, including audited and pro forma financial statements. The Commission treats these Form 8-K filings in the same way it treats the filing of Registration Statements on Form 10. The Commission subjects them to its standards of review selection, and the Commission may issue substantive comments on the sufficiency of the disclosures represented. If the Company enters into a business combination with a non-reporting company, such non-reporting company will not receive reporting status until the Commission has determined that it will not review the 8-K filing or all of the comments have been cleared by the Commission.

Lack of Market Research or Marketing Organization

The Company has neither conducted, nor have others made available to it, market research indicating that demand exists for the transactions contemplated by the Company. In the event demand exists for a transaction of the type contemplated by the Company, there is no assurance the Company will be successful in completing any such business combination.

Limited or No Public Market Exists

There is currently a limited public market for the Company's common stock and no assurance can be given that a market will develop or that a shareholder ever will be able to liquidate his investment without considerable delay, if at all. If a market should develop, the price may be highly volatile. Factors such as those discussed in this "Risk Factors" section may have a significant impact upon the market price of the securities offered hereby. Owing to the low price of the securities, many

5

brokerage firms may not be willing to effect transactions in the securities. Even if a purchaser finds a broker willing to effect a transaction in these securities, the combination of brokerage commissions, state transfer taxes, if any, and any other selling costs may exceed the sales proceeds.

Blue Sky Consideration

Because the securities registered hereunder have not been registered for resale under the Blue Sky laws of any state, the holders of such shares and persons who desire to purchase them in any trading market that might develop in the future, should be aware, that there may be significant state Blue Sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. Accordingly, investors should consider the secondary market for the Company's securities to be a limited one.

Additional Risks Doing Business in a Foreign Country

The Company may effectuate business operations or even headquarters, place of formation or primary place of business are located outside the United States of America. In such event, the Company may face the significant additional risks associated with doing business in that country. In addition to the language barriers, different presentations of financial information, different business practices, and other cultural differences and barriers that may make it difficult to evaluate such a merger target, ongoing business risks result from the international political situation, uncertain legal systems and applications of law, prejudice against foreigners, corrupt practices, uncertain economic policies and potential political and economic instability that may be exacerbated in various foreign countries.

Taxation

Federal and state tax consequences will, in all likelihood, be major considerations in any business combination that the Company may undertake. Currently, such transactions may be structured so as to result in tax-free treatment to both companies, pursuant to various federal and state tax provisions. The Company intends to structure any business combination so as to minimize the federal and state tax consequences to both the Company and the target entity; however, there can be no assurance that such business combination will meet the statutory requirements of a tax-free reorganization or that the parties will obtain the intended tax-free treatment upon a transfer of stock or assets. A non-qualifying reorganization could result in the imposition of both federal and state taxes, which may have an adverse effect on both parties to the transaction.

ITEM 1B. UNSOLVED STAFF COMMENTS

The Company received a letter from the SEC dated January 31, 2019 that stated that the Company had fifteen days to file all delinquent reports. The SEC noted in its letter that if we did not file all delinquent reports within this time period, we may be subject to administrative proceedings to revoke our registration under the Securities and Exchange Act of 1934 without further notice. We received the letter on or about February 20, 2019 and have been working as quickly as possible to become current in our reporting requirements.

ITEM 2. PROPERTIES

The Company currently maintains a mailing address at Room A, Block B, 21/F , Billion Centre, 1 Wang Kwong Road , Kowloon Bay, Kowloon, Hong Kong. The Company's telephone number there is +852 36986699. Other than this mailing address, the Company does not currently maintain any physical or other office facilities . The Company pays no rent or other fees for the use of the mailing address as these address is used virtually full-time by its shareholders . It is likely that the Company will not establish an physical office until it has commenced a new line of business, but it is not possible to predict what arrangements will actually be made with respect to future office facilities..

ITEM 3. LEGAL PROCEEDINGS

The Company is not a party to any material legal proceedings.

ITEM 4. MINE SAFETY PROCEDURES

Not applicable.

6

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDERS MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Price Range of Common Stock

The Company’s common stock is quoted on the OTC Pink Market under the symbol “YUSG.”

| High |

| Low | ||

Fiscal Year 2017 |

|

|

|

|

|

Fourth quarter ended December 31, 2017 | $ | 1.75 |

| $ | 1.00 |

Third quarter ended September 30, 2017 |

| 2.25 |

|

| 0.055 |

Second quarter ended June 30, 2017 |

| 0.055 |

|

| 0.055 |

First quarter, ended March 31, 2017 |

| 0.055 |

|

| 0.055 |

Fiscal Year 2016 |

|

|

|

|

|

Fourth quarter ended December 31, 2016 | $ | 1.5 |

| $ | 0.055 |

Third quarter ended September 30, 2016 |

| 1.5 |

|

| 1.5 |

Second quarter ended June 30, 2016 |

| 1.5 |

|

| 1.5 |

First quarter, ended March 31, 2016 |

| 1.5 |

|

| 1.25 |

Approximate Number of Equity Security Holders

On December 31 , 2017 , the Company's common stock had a closing price quotation of $1.00. As of December 31 , 2017, there were approximately 41 certificate holders of record of the Company's common stock. As of March 31, 2019, the Company had 7,443,912 shares issued and outstanding held by 41 shareholders.

Dividends

We have not declared or paid cash dividends on our common stock.

ITEM 6. SELECTED FINANCIAL DATA

Not Applicable.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Cautionary Notice Regarding Forward Looking Statements

The information contained in Item 7 contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Actual results may materially differ from those projected in the forward-looking statements as a result of certain risks and uncertainties set forth in this report. Although management believes that the assumptions made and expectations reflected in the forward- looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual results will not be different from expectations expressed in this report.

We desire to take advantage of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. This filing contains a number of forward- looking statements which reflect management's current views and expectations with respect to our business, strategies, products, future results and events, and financial performance. All statements made in this filing other than statements of historical fact, including statements addressing operating performance, events, or developments which management expects or anticipates will or may occur in the future, including statements related to distributor channels, volume growth, revenues, profitability, new products, adequacy of funds from operations, statements expressing general optimism about future operating results, and non-historical information, are forward looking statements. In particular, the words "believe," "expect," "intend," "anticipate," "estimate," "may," variations of such words, and similar expressions identify forward-looking statements, but are not the exclusive means of identifying such statements, and their absence does not mean that the statement is not forward-looking. These forward-looking statements are subject to certain risks and uncertainties, including those discussed below. Our actual results, performance or achievements could differ materially from historical results as well as those expressed in, anticipated, or implied by these forward-looking statements. We do not undertake any obligation to revise these forward-looking statements to reflect any future events or circumstances.

Readers should not place undue reliance on these forward-looking statements, which are based on management's current expectations and projections about future events, are not guarantees of future performance, are subject to risks, uncertainties and assumptions (including those described below), and apply only as of the date of this filing. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors which could cause or contribute to such differences include, but are not limited to, the risks to be discussed in our Annual Report on form 10-K and in the press releases and other communications to shareholders issued by us from time to time which attempt to advise interested parties of the risks and factors which may affect our business. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

7

Use of Generally Accepted Accounting Principles ("GAAP") Financial Measures

We use GAAP financial measures in the section of this report captioned "Management's Discussion and Analysis or Plan of Operation" ("MD&A"). All of the GAAP financial measures used by us in this report relate to the inclusion of financial information.

Overview

This subsection of MD&A provides an overview of the important factors that management focuses on in evaluating our businesses, financial condition and operating performance, our overall business strategy and our earnings or losses for the periods covered.

Results of Operation- Year Ended December 31, 2017 and 2016

The following table summarizes the result of our operation during the twelve months ended December 31, 2017 and 2016:

| For the year ended December 31, | |

| 2017 | 2016 |

Revenue | $ - | $ - |

Gross profit | - | - |

Other income | - | - |

General & administrative | (26,812) | (26,727) |

Other income / (expense) | - | - |

Interest income | 1 | - |

Loss on disposal of a subsidiary | - | (4263) |

Loss from operations | (26,811) | (30,990) |

Income tax expenses | - | - |

Loss for the year | $ (26,811) | $ (30,990) |

Revenues

There was no revenue for both years ended December 31, 2017 and 2016. Despite the change of control in May 2013, the Company remained dormant. Originally, the new management had no intention to change the principal activity of the Company. However, towards the end of 2013, it was realized that the new management was not in a position to continue the old line of business. As of date of this report, the new management is actively seeking other profitable business opportunities for the company.

General and administrative expenses

General and administrative expenses increased from $26,727 in 2016 to $26,812 in 2017. The Company is an investment holding company, the general and administrative expenses for both years represent professional fees to accountants, lawyer and transfer agent to enable the Company to fulfill the ongoing requirements of the US SEC.

Loss before tax

As a result of the above reasons, loss for the year ended December 31, 2017 and 2016 was $26,811 and $30,990 accordingly.

Liquidity and Capital Resources

As of December 31, 2017, we had a balance of cash and cash equivalents of $48,896. Liabilities at December 31, 2017 totaled $157,185 and consisted mainly of $132,462 in amount due a director and $24,723 in accrued expenses.

As of December 31, 2017, the Company may need additional cash resources to operate during the upcoming 12 months, and the continuation of the Company may dependent upon the continuing financial support of shareholders of the Company. The Company intends to attempt to acquire additional operating capital through private equity offerings to the public and existing investors to fund its business plan. However, there is no assurance that equity or debt offerings will be successful in raising sufficient funds to assure the eventual profitability of the Company. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence.

8

Cash Position

| For the year ended December 31, | |

| 2017 | 2016 |

Net cash used in operating activities | $ (108,342) | $ (35,932) |

Net cash generated from financing activities | 150,362 | 36,314 |

Net change in cash and cash equivalents | 42,020 | 382 |

Cash flows used in operating activities

Net cash used in operating activities was $108,342 for the year ended December 31, 2017. It was mainly attributable to net loss and increase in prepayment for the year.

Cash flows from financing activities

Net cash provided by financing activities for the year ended December 31, 2017 was $150,362. It was due to the increase of amount due to a director and net proceed from issuance of new share capital.

Inflation

Inflation does not materially affect our business or the results of our operations.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements .

Critical Accounting Policies

The Company's significant accounting policies are presented in the Company's notes to financial statements for the year ended December 31, 2017, which are contained in this filing, the Company's 2017 Annual Report on Form 10-K. The significant accounting policies that are most critical and aid in fully understanding and evaluating the reported financial results include the following:

The Company prepares its financial statements in conformity with generally accepted accounting principles in the United States of America. These principals require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management believes that these estimates are reasonable and have been discussed with the Board of Directors; however, actual results could differ from those estimates.

Recent Accounting Pronouncements

On October 2, 2017, The FASB has issued Accounting Standards Update (ASU) No. 2017-13, “Revenue Recognition (Topic 605), Revenue from Contracts with Customers (Topic 606), Leases (Topic 840), and Leases (Topic 842): Amendments to SEC Paragraphs Pursuant to the Staff Announcement at the July 20, 2017 EITF Meeting and Rescission of Prior SEC Staff Announcements and Observer Comments.” The ASU adds SEC paragraphs to the new revenue and leases sections of the Codification on the announcement the SEC Observer made at the 20 July 2017 Emerging Issues Task Force (EITF) meeting. The SEC Observer said that the SEC staff would not object if entities that are considered public business entities only because their financial statements or financial information is required to be included in another entity’s SEC filing use the effective dates for private companies when they adopt ASC 606, Revenue from Contracts with Customers, and ASC 842, Leases. This would include entities whose financial statements are included in another entity’s SEC filing because they are significant acquirees under Rule 3-05 of Regulation S-X, significant equity method investees under Rule 3-09 of Regulation S-X and equity method investees whose summarized financial information is included in a registrant’s financial statement notes under Rule 4-08(g) of Regulation S-X. The ASU also supersedes certain SEC paragraphs in the Codification related to previous SEC staff announcements and moves other paragraphs, upon adoption of ASC 606 or ASC 842. The Company does not expect that the adoption of this guidance will have a material impact on its consolidated financial statements.

On November 22, 2017, the FASB ASU No. 2017-14, “Income Statement—Reporting Comprehensive Income (Topic 220), Revenue Recognition (Topic 605), and Revenue from Contracts with Customers (Topic 606): Amendments to SEC Paragraphs Pursuant to Staff Accounting Bulletin No. 116 and SEC Release 33-10403.” The ASU amends various paragraphs in ASC 220, Income Statement — Reporting Comprehensive Income; ASC 605, Revenue Recognition; and ASC 606, Revenue From Contracts With Customers, that contain SEC guidance. The amendments include superseding ASC 605-10-S25-1 (SAB Topic 13) as a result of SEC Staff Accounting Bulletin No. 116 and adding ASC 606-10-S25-1 as a result of SEC Release No. 33-10403. The Company does not expect that the adoption of this guidance will have a material impact on its consolidated financial statements.

In February 2018, the FASB issued ASU No. 2018-02, “Reclassification of Certain Tax Effects From Accumulated Other Comprehensive Income.” The ASU amends ASC 220, Income Statement — Reporting Comprehensive Income, to “allow a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the Tax Cuts and Jobs Act.” In addition, under the ASU, an entity will be required to provide certain disclosures regarding stranded tax effects. The ASU is effective for all entities for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. The Company does not expect that the adoption of this guidance will have a material impact on its consolidated financial statements.

9

In March 2018, the FASB issued ASU 2018-05 — Income Taxes (Topic 740): Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 118 (“ASU 2018-05”), which amends the FASB Accounting Standards Codification and XBRL Taxonomy based on the Tax Cuts and Jobs Act (the “Act”) that was signed into law on December 22, 2017 and Staff Accounting Bulletin No. 118 (“SAB 118”) that was released by the Securities and Exchange Commission. The Act changes numerous provisions that impact U.S. corporate tax rates, business-related exclusions, and deductions and credits and may additionally have international tax consequences for many companies that operate internationally. The Company does not believe this guidance will have a material impact on its consolidated financial statements.

In July 2018, the FASB issued ASU 2018-10, “Codification Improvements to Topic 842, Leases.” The ASU addresses 16 separate issues which include, for example, a correction to a cross reference regarding residual value guarantees, a clarification regarding rates implicit in lease contracts, and a consolidation of the requirements about lease classification reassessments. The guidance also addresses lessor reassessments of lease terms and purchase options, variable lease payments that depend on an index or a rate, investment tax credits, lease terms and purchase options, transition guidance for amounts previously recognized in business combinations, and certain transition adjustments, among others. For entities that early adopted Topic 842, the amendments are effective upon issuance of this Update, and the transition requirements are the same as those in Topic 842. For entities that have not adopted Topic 842, the effective date and transition requirements will be the same as the effective date and transition requirements in Topic 842. The Company does not believe this guidance will have a material impact on its consolidated financial statements.

ITEM 7A. QUANTITATIVE AND QUALITIATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company, as defined by Rule 229.10(f)(1) and are not required to provide the information required by this Item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The audited financial statements for the year ended December 31, 2017 begin on the next page.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

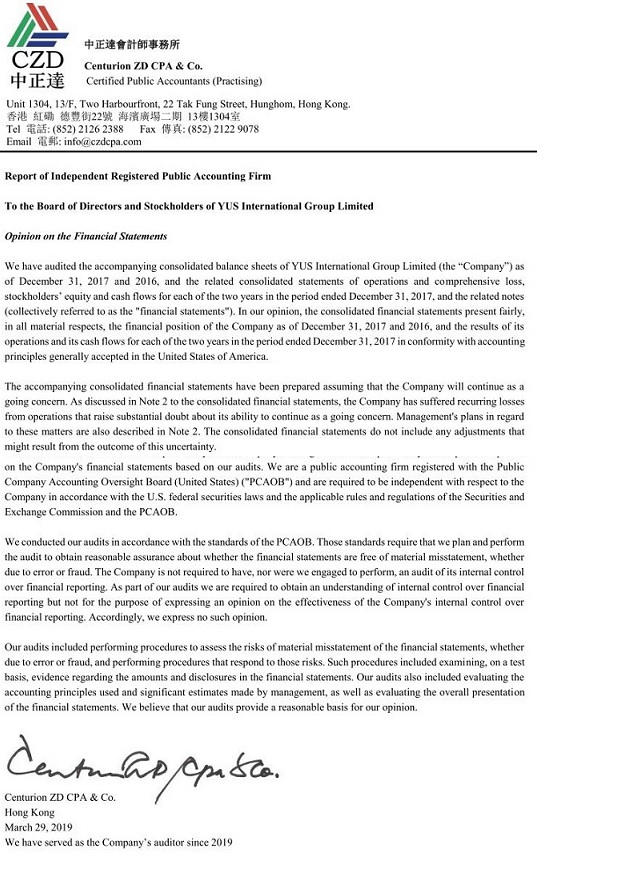

On March 6, 2019, the Company engaged Centurion ZD CPA & Co. as the independent registered public accounting firm and auditors of the Company’s financial statements. Concurrently the Company dismissed the prior independent registered public accounting firm, Anthony Kam & Associates Ltd. after the Company was informed that the Public Company Accounting Oversight Board (“PCAOB”) had revoked the registration of Anthony Kam & Associates Ltd. in 2017. This was disclosed on our Current Report on Form 8-K filed with the Securities and Exchange Commission on March 12 , 2019 . In connection with the change in accountants, there have been no disagreements as required by this item.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

The Chief Executive Officer, Director s , and Chief Financial Officer have evaluated the effectiveness of the Company's disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of the fiscal period ending December 31, 2017 covered by this Annual Report on Form 10-K. Based upon such evaluation, the Chief Executive Officer, Director s , and Chief Financial Officer ha d concluded that, as of the end of such period, the Company's disclosure controls and procedures were effective as required under Rules 13a-15(e) and 15d-15(e) under the Exchange Act. This conclusion by the Company's Chief Executive Officer, Director s , and Chief Financial Officer does not relate to reporting periods after December 31, 2017.

Management's Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act) of the Company. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America.

The Company's internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management, under the supervision of the Company's Chief Executive Officer, Director s , and Chief Financial Officer conducted an evaluation of the effectiveness of internal control over financial reporting based on the framework in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, management concluded that the Company's internal control over financial reporting was effective as of December 31, 2017 under the criteria set forth in the in Internal Control—Integrated Framework .

10

A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the Company's annual or interim financial statements will not be prevented or detected on a timely basis. Management has determined that material weaknesses did not exist.

This annual report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the SEC that permit us to provide only management's report in this Annual Report on Form 10-K.

Changes in Internal Control Over Financial Reporting

There were no significant changes in the Company's internal controls, or other factors, that could significantly affect the Company's controls subsequent to the date of the evaluations performed by the executive officers of the Company. No deficiencies or material weaknesses were found that would require corrective action.

ITEM 9B. OTHER INFORMATION

None.

11

12

YUS INTERNATIONALGROUP LIMITED

CONSOLIDATED BALANCE SHEETS

AS OF DECEMBER 31, 2017 AND 2016

(IN USD)

|

| December 31, |

| December 31, |

ASSETS |

| 2017 |

| 2016 |

|

|

|

| (restated) |

Current assets |

|

|

|

|

Prepayment |

|

| ||

Amount due from a shareholder |

|

| ||

Cash and cash equivalents |

|

| ||

|

|

|

|

|

TOTAL ASSETS |

|

| ||

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

Accrued expenses |

|

| ||

Amount due to a shareholder |

|

| ||

Amount due to a director |

|

| ||

Amount due to a related parties |

|

| ||

|

|

|

|

|

Total liabilities |

|

| ||

|

|

|

|

|

Stockholders ‘equity |

|

|

|

|

Common stock, Par value $ |

|

| ||

Additional paid in capital |

|

| ||

Merger reserve |

|

| ||

Accumulated deficit |

| ( |

| ( |

|

|

|

|

|

Total stockholders’ equity / (default) |

|

| ( | |

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

|

See accompanying notes to the financial statements

13

YUS INTERNATIONAL GROUP LIMITED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

(IN USD)

|

| December 31, |

| December 31, |

|

| 2017 |

| 2016 |

|

|

|

| (restated) |

Revenue |

|

| ||

|

|

|

|

|

Cost of sales |

|

| ||

|

|

|

|

|

Gross profit |

|

| ||

|

|

|

|

|

Expenses |

|

|

|

|

General & administrative |

|

| ||

|

|

|

|

|

Loss from operations |

| ( |

| ( |

|

|

|

|

|

Other income / (expenses) |

|

|

|

|

Interest income |

|

| ||

Loss on disposal of a subsidiary |

|

| ( | |

|

|

|

|

|

Loss before provision for income taxes |

| ( |

| ( |

|

|

|

|

|

Provision for income taxes |

|

| ||

|

|

|

|

|

Net loss for the year |

| ( |

| ( |

|

|

|

|

|

Other comprehensive income |

|

| ||

|

|

|

|

|

Total comprehensive loss for the Year |

| ( |

| ( |

|

|

|

|

|

Loss per share, basic and diluted |

| ( |

| ( |

|

|

|

|

|

Weighted average number of shares outstanding - basic and diluted |

|

|

See accompanying notes to the financial statements

14

YUS INTERNATIONAL GROUP LIMITED

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

|

| Common stock |

|

|

|

|

|

|

|

| ||

|

| Number of |

|

|

| Additions paid-in |

|

Merger |

| Accumulated |

| Total |

|

| Shares |

| Amount |

| capital |

| reserve |

| deficits |

| Equity |

Balance at January 1, 2016 (restated) |

|

|

|

|

|

| ( |

| ( | |||

|

|

|

|

|

|

|

|

|

|

|

|

|

Merged with a subsidiary under common control |

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year (restated) |

|

|

|

|

|

| ( |

| ( | |||

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2016 and January 1, 2017 (restated) |

|

|

|

|

|

|

( |

|

( | |||

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares issued for the year |

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Merged reserve |

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year |

|

|

|

|

|

| ( |

| ( | |||

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2017 |

|

|

|

|

| ( |

| |||||

See accompanying notes to the financial statements

15

YUS INTERNATIONAL GROUP LIMITED

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

(IN USD)

|

| December 31, |

| December 31, |

|

| 2017 |

| 2016 |

|

|

|

| (restated) |

Cash flows from operating activities: |

|

|

|

|

Net loss for the year |

| ( |

| ( |

|

|

|

|

|

Adjustments to reconcile net income/loss to net cash flows used in operating activities for:Changes in operating assets and liabilities: |

|

|

|

|

Increase in prepayment |

| ( |

| |

Increase in accrued expenses and other payables |

|

| ( | |

|

|

|

|

|

Net cash used in operating activities |

| ( |

| ( |

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

Net proceed from issuance of new share capital |

| |

| |

Addition in merge reserve |

|

| ||

Increase in amount due from shareholder |

| ( |

| |

Increase in amount due to a director |

|

| ||

Decrease / (increase) in amount due to a shareholder |

| ( |

| |

(Increase) / decrease in amount due to related parties |

| ( |

| |

|

|

|

|

|

Net cash generated from financing activities |

|

| ||

|

|

|

|

|

Net change in cash and cash equivalents |

|

| ||

|

|

|

|

|

Cash and cash equivalents at beginning of year |

|

| ||

|

|

|

|

|

Cash and cash equivalents at the end of year |

|

|

See accompanying notes to the financial statements

16

YUS INTERNATIONAL GROUP LIMITED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

(IN USD)

NOTE 1 - ORGANIZATION AND PRINCIPAL ACTIVITIES

The Company was incorporated under the laws of the State of Delaware on July 15, 2002 with authorized common stock of

At the beginning of 2010, the Company was principally engaged in operating LCD flat-panel televisions and LCD billboards that advertise throughout Hong Kong, creating revenue by selling advertising airtime. On August 31, 2010 the Company acquired

On April 29, 2013, the majority shareholder of the Company entered into a series of stock purchase agreements wherein the majority shareholder of the Company agreed to sell a total of 6,624,789 shares of common stock in the Company to four third party entities. On April 30, 2013, after the receipt of consideration and completion of all conditions precedent, the stock purchase agreements were completed and closed.

On May 16, 2013, Zhi Jian Zeng resigned as the Chief Executive Officer and director of the Company and Huang Jian Nan resigned as the Chief Financial Officer and director of the Company.

On May 16, 2013, Mr. Ho Kam Hang was appointed as the Chief Executive Officer of the Company and Dr. Chong Cheuk Man Yuki was appointed as the Chief Financial Officer of the Company. On that same date, the company appointed Mr. Yu Cheung Fai Alex, Ms. Chan Fuk Yu, Mr. Yu Lok Man and Mr. Yu Ka Wai as Directors of the Company.

On April 9, 2014, Mr. Yu Lok Man resigned as director of the Company and Dr. Chong Cheuk Man Yuki resigned as Chief Financial Officer of the Company. On the same day, Ms. Chen Yongqi Dawn was appointed as Chief Financial Officer of the Company.

On July 31, 2014, Ms. Chen Yongqi Dawn resigned as Chief Financial Officer of the Company. On the same day, Ms. Chan Fuk Yu was appointed as Chief Financial Officer of the Company.

17

YUS INTERNATIONAL GROUP LIMITED.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

(IN USD)

NOTE 1 - ORGANIZATION AND PRINCIPAL ACTIVITIES (CONTINUED)

On January 12, 2017, the Company acquired

Details of the Company’s wholly owned subsidiaries and its Affiliated Hong Kong Entity as of December 31, 2017 and 2016 are as follows:

Company |

| Date of Establishment |

| Place of Establishment |

| Percentage of Ownership by the Company |

|

| Principal Activities | |

YUS International Holdings Limited |

| December 23, 2013 |

| Hong Kong |

|

| 100% |

|

| Dormant |

On September 30, 2017, Mr. Yu Ka Wai resigned as director of the Company.

The Company is engaged in investment holding business.

Our current business plan is to seek and identify appropriate business opportunity for development of our new line of business. We intend to seek opportunities demonstrating the potential of long-term growth as opposed to short-term earnings. However, at the present time, we have not identified any business opportunity that we plan to pursue, nor have we reached any agreement or definitive understanding with any person concerning an acquisition or merger.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of accounting and presentation

The audited consolidated financial statements of the Company have been prepared pursuant to the rules and regulations of the SEC. Certain information and disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the following disclosures are adequate to make the information presented not misleading. All significant intercompany balances and transactions have been eliminated.

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and the disclosure of contingent assets and liabilities. Actual results could differ from these estimates.

All consolidated financial statements and notes to the consolidated financial statements are presented in United States dollars (“US Dollar” or “US$” or “$”).

18

YUS INTERNATIONAL GROUP LIMITED.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

(IN USD)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Basis of accounting and presentation (continued)

For the year ended 31 December, 2017 and 2016, the audited consolidated financial statements include the accounts of the Company and the following wholly-owned subsidiary:

YUS International Holdings Limited (a Hong Kong corporation) (“YIH”)

The acquisition of all of the issued and outstanding stock of YIH on January 12, 2017 was accounted for as a common control business combination under ASC 805. All significant inter-company balances and transactions have been eliminated.

Cash and cash equivalents

The Company considers all highly liquid investments purchased with original maturities of three months or less to be cash equivalents.

Income tax

The Company has adopted the provisions of statements of Financial Accounting Standards No. 109, “Accounting for Income Taxes,” which incorporates the use of the asset and liability approach of accounting for income taxes. The Company allows for recognition of deferred tax benefits in future years. Under the asset and liability approach, deferred taxes are provided for the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is provided for deferred tax assets if it is more likely than not these items will either expire before the Company is able to realize their benefits, or that future realization is uncertain.

The Company has

Fair value of financial instruments

The carrying amounts of the Company's cash, accounts receivable, accounts payable, other payable, accrued expenses, advances from shareholders and notes payable approximate to their fair values because of the short maturity of these items.

Revenue recognition

The company has remained dormant. Other revenue is recognized when it is considered to be reliably earned.

19

YUS INTERNATIONAL GROUP LIMITED.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

(IN USD)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Earnings per share

Basic earnings per share is computed by dividing income available to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted earnings per share is computed similar to basic earnings per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. As of December 31, 2017 and 2016, there was no dilutive security outstanding.

Use of estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates.

Comprehensive income

Comprehensive income is defined to include all changes in equity except those resulting from investments by owners and distributions to owners. Among other disclosures, all items that are required to be recognized under current accounting standards as components of comprehensive income are required to be reported in a financial statement that is presented with the same prominence as other financial statements. Comprehensive income includes net income and the foreign currency translation gain, net of tax.

Foreign currency translation

The accompanying financial statements are presented in United States Dollar (US$). The functional currency of the Company is Hong Kong Dollar (HK$). Capital accounts of the financial statements are translated into US$ from HK$ at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rates as of balance sheet date. Income and expenditures are translated at the average exchange rate of the year. The translation rates are as follows:

|

| 2017 |

|

| 2016 |

| ||

|

|

|

|

|

|

| ||

Year end HK$: US$ exchange rate |

|

|

|

|

|

| ||

Average yearly HK$: US$ exchange rate |

|

|

|

|

|

| ||

20

YUS INTERNATIONAL GROUP LIMITED.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

(IN USD)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Going Concern

The accompanying financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America, which contemplates the Company’s continuation as a going concern. As of December 31, 2017 and 2016, the Company has accumulated deficits of $

As of December 31, 2017 and 2016, the Company may need additional cash resources to operate during the upcoming 12 months, and the continuation of the Company may dependent upon the continuing financial support of investors, directors and/or stockholders of the Company. The Company intends to attempt to acquire additional operating capital through private equity offerings to the public and existing investors to fund its business plan. However, there is no assurance that equity or debt offerings will be successful in raising sufficient funds to assure the eventual profitability of the Company. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence.

Recent accounting pronouncements

On October 2, 2017, The FASB has issued Accounting Standards Update (ASU) No. 2017-13, “Revenue Recognition (Topic 605), Revenue from Contracts with Customers (Topic 606), Leases (Topic 840), and Leases (Topic 842): Amendments to SEC Paragraphs Pursuant to the Staff Announcement at the July 20, 2017 EITF Meeting and Rescission of Prior SEC Staff Announcements and Observer Comments.” The ASU adds SEC paragraphs to the new revenue and leases sections of the Codification on the announcement the SEC Observer made at the 20 July 2017 Emerging Issues Task Force (EITF) meeting. The SEC Observer said that the SEC staff would not object if entities that are considered public business entities only because their financial statements or financial information is required to be included in another entity’s SEC filing use the effective dates for private companies when they adopt ASC 606, Revenue from Contracts with Customers, and ASC 842, Leases. This would include entities whose financial statements are included in another entity’s SEC filing because they are significant acquirees under Rule 3-05 of Regulation S-X, significant equity method investees under Rule 3-09 of Regulation S-X and equity method investees whose summarized financial information is included in a registrant’s financial statement notes under Rule 4-08(g) of Regulation S-X. The ASU also supersedes certain SEC paragraphs in the Codification related to previous SEC staff announcements and moves other paragraphs, upon adoption of ASC 606 or ASC 842. The Company does not expect that the adoption of this guidance will have a material impact on its consolidated financial statements.

On November 22, 2017, the FASB ASU No. 2017-14, “Income Statement—Reporting Comprehensive Income (Topic 220), Revenue Recognition (Topic 605), and Revenue from Contracts with Customers (Topic 606): Amendments to SEC Paragraphs Pursuant to Staff Accounting Bulletin No. 116 and SEC Release 33-10403.” The ASU amends various paragraphs in ASC 220, Income Statement — Reporting Comprehensive Income; ASC 605, Revenue Recognition; and ASC 606, Revenue From Contracts With Customers, that contain SEC guidance. The amendments include superseding ASC 605-10-S25-1 (SAB Topic 13) as a result of SEC Staff Accounting Bulletin No. 116 and adding ASC 606-10-S25-1 as a result of SEC Release No. 33-10403. The Company does not expect that the adoption of this guidance will have a material impact on its consolidated financial statements.

21

YUS INTERNATIONAL GROUP LIMITED.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

(IN USD)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Recent accounting pronouncements (continued)

In February 2018, the FASB issued ASU No. 2018-02, “Reclassification of Certain Tax Effects From Accumulated Other Comprehensive Income.” The ASU amends ASC 220, Income Statement — Reporting Comprehensive Income, to “allow a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the Tax Cuts and Jobs Act.” In addition, under the ASU, an entity will be required to provide certain disclosures regarding stranded tax effects. The ASU is effective for all entities for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. The Company does not expect that the adoption of this guidance will have a material impact on its consolidated financial statements.

In March 2018, the FASB issued ASU 2018-05 — Income Taxes (Topic 740): Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 118 (“ASU 2018-05”), which amends the FASB Accounting Standards Codification and XBRL Taxonomy based on the Tax Cuts and Jobs Act (the “Act”) that was signed into law on December 22, 2017 and Staff Accounting Bulletin No. 118 (“SAB 118”) that was released by the Securities and Exchange Commission. The Act changes numerous provisions that impact U.S. corporate tax rates, business-related exclusions, and deductions and credits and may additionally have international tax consequences for many companies that operate internationally. The Company does not believe this guidance will have a material impact on its consolidated financial statements.

In July 2018, the FASB issued ASU 2018-10, “Codification Improvements to Topic 842, Leases.” The ASU addresses 16 separate issues which include, for example, a correction to a cross reference regarding residual value guarantees, a clarification regarding rates implicit in lease contracts, and a consolidation of the requirements about lease classification reassessments. The guidance also addresses lessor reassessments of lease terms and purchase options, variable lease payments that depend on an index or a rate, investment tax credits, lease terms and purchase options, transition guidance for amounts previously recognized in business combinations, and certain transition adjustments, among others. For entities that early adopted Topic 842, the amendments are effective upon issuance of this Update, and the transition requirements are the same as those in Topic 842. For entities that have not adopted Topic 842, the effective date and transition requirements will be the same as the effective date and transition requirements in Topic 842. The Company does not believe this guidance will have a material impact on its consolidated financial statements.

22

YUS INTERNATIONAL GROUP LIMITED.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

(IN USD)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Recent accounting pronouncements (continued)