ASSET PURCHASE AGREEMENT

by and between

CONFORMIS, INC.,

as Purchaser

BROAD PEAK MANUFACTURING, LLC,

as Seller

and

the Unitholders named herein,

solely with respect to the Sections referred to herein

August 9, 2017

{M1108931.1 }

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement (the “Agreement”) is made as of this 9th day of August, 2017(the “Effective Date”) by and between ConforMIS, Inc., a Delaware corporation, with a principal place of business at 600 Technology Park Drive, Billerica, Massachusetts 01821 (“Purchaser”),Broad Peak Manufacturing, LLC, a limited liability company formed under the laws of Connecticut, with a principal place of business at 10 Beaumont Road, Wallingford, Connecticut 06492 (“Seller”), and the persons executing this Agreement as Unitholders below (“Unitholders”), solely in connection with Article III, Section 5.6 and Article VII herein. Purchaser and Seller are sometimes referred to herein individually as a “Party” and collectively as the “Parties”), and such term shall include Unitholders, as applicable, in Article III, Section 5.6 and Article VII herein.

Recitals

WHEREAS, the Board of Directors of Purchaser and the managers of Seller (the “Managers”), and the Unitholders, owners of all outstanding membership interests of Seller, have approved the sale of the Purchased Assets (as defined herein), such Purchased Assets constituting all of the tangible and intangible personal property and assets that are used or held for use by Seller to manufacture and deliver custom surface preparation and finishing facility solutions to ConforMIS for the manufacture and delivery of customized partial and total knee replacement implants and implant components(the “Business”);

WHEREAS, Seller desires to sell, and Purchaser desires to purchase, certain assets and assume certain liabilities of Seller for the consideration and on the terms set forth in this Agreement (the “Transaction”); and

WHEREAS, each of the Parties to the Agreement desires to make certain representations, warranties, and agreements in connection with the Transaction between the Parties and to prescribe various conditions thereto.

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained, and for other good and valuable consideration, the receipt, adequacy and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

PURCHASE AND SALE OF ASSETS

PURCHASE AND SALE OF ASSETS

1.1. Sale and Purchase of Assets. At the Closing (as defined in Section 1.10 hereof) and subject to and upon the terms and conditions of this Agreement, Seller shall sell, convey, transfer, assign and deliver or cause to be sold, conveyed, transferred, assigned and delivered to Purchaser, and Purchaser will purchase from Seller, free and clear of all security interests, liens, claims, mortgages, debts, charges, restrictions or other encumbrances (“Liens”), the Purchased Assets (as

{M1108931.1 } - 2 -

hereinafter defined). The term “Purchased Assets” shall mean all of Seller’s right, title and interest in and to, as of the Closing, all of the assets and properties, whether tangible or intangible, wherever situated, and whether or not specifically referred to in any instrument or conveyance delivered pursuant hereto, free and clear of all Liens. The Purchased Assets include all of the assets and properties of the Seller used to manufacture ConforMIS custom products other than the Excluded Assets (as defined in Section 1.2 hereof) and subject to the limitation in Section 1.1(f) below, and shall include, but not be limited to, the following items of Seller:

(a) all tangible assets, including fixed assets, furniture, fixtures, machines, equipment and computer hardware, wherever located, including the tangible assets listed on Schedule 1.1(a) (collectively, the “Equipment”);

(b) all Intellectual Property owned by Seller (the “Seller Intellectual Property”) and all of Seller’s rights under any nondisclosure and assignment-of-rights agreement for the benefit of Seller vesting all rights in work product created by any Seller employee, consultant, independent contractor or service provider, during such period of time during which such Seller employee, consultant, independent contractor or service provider provided services to the Seller, with and in Seller (“Employee IP Agreements”);

(c) all work-in-process and inventories of finished product and supplies (collectively, the “Inventory”), as listed on Schedule 1.1(c);

(d) all right, title and interest in, to and under any assignable Permits;

(e) all rights, title and interest in, and claims under, the Contracts of Seller with ConforMIS (“Customer Contracts”), including each of the Customer Contracts set forth on Schedule 1.1(e).

(f) all rights, title and interest in, and claims under, the Contracts with all suppliers and vendors, including all licensing agreements, software agreements and know-how agreements, and agreements related to leased real property and leased personal property, only if such Contract is set forth on Schedule 1.1(f) (the items to be disclosed on Schedule 1.1(f) the “Vendor Agreements”, together with the Customer Contracts and any Contracts designated by Purchaser following the Closing Date pursuant to Section 1.2, collectively, the “Assumed Agreements”);

(g) all right, title and interest in all security deposits, surety deposits and bonds presently maintained on behalf of Seller which relate to the Assumed Agreements;

(h) all lists of consultants, product partners, licensees, and suppliers (including contact names, telephone numbers, email addresses, and street addresses, and, as appropriate, other information customarily maintained by or for the benefit of Seller and associated with the manufacture of ConforMIS custom products);

(i) all claims, causes of action and other rights relating to the Purchased Assets or relating to the Business;

(j) all prepaid expenses, deposits and other prepaid items and credits, including the items listed on Schedule 1.1(j);

{M1108931.1 } - 3 -

(k) all books and records (including personnel files or copies thereof to the extent legally permissible for employees being hired by ConforMIS) of Seller associated with the manufacture of ConforMIS custom products, including such items stored in computer or by any other means or media;

(l) all of the goodwill of Seller related to the Business; and

(m) all other assets, properties, and rights of every kind (other than the assets described in Section 1.2 hereof) relating to the Purchased Assets or relating to or used in the Business held by Seller, or in which Seller has an interest, on the Closing Date.

In confirmation of the foregoing sale, assignment and transfer, Seller shall execute and deliver to Purchaser at the Closing a Bill of Sale in the form of Exhibit A (the “Bill of Sale”) and such other instruments and assignments as may be reasonably requested by Purchaser necessary to convey to Purchaser, or evidence in Purchaser, good marketable title to the Purchased Assets.

1.2. Excluded Assets. Notwithstanding anything contained in Section 1.1 to the contrary, Seller shall retain, as of and following the Closing, all of Seller’s right, title and interest in and to all of the following assets and properties of Seller, and are not included in the Purchased Assets and are not being purchased by Purchaser pursuant to this Agreement: (a) Seller’s cash and cash equivalents, (b) Seller’s company minute books and equity records, (c) books of account and other records of Seller which are required by Law to be kept in Seller’s possession, including Tax Returns, (d) all assets and rights in and with respect to any Employee Benefit Plans, (e) Contracts not expressly set forth on Schedule 1.1(f) or included in Customer Contracts, (f) all accounts, notes, and other receivables (collectively, the “Accounts Receivable”) and (g) the assets, rights and properties set forth on Schedule 1.2 (collectively, the “Excluded Assets”). Notwithstanding the foregoing, in the event a Contract to which Seller is a party (other than a Customer Contract) is not set forth on Schedule 1.1(e) and is not expressly set forth on Schedule 1.2 as an Excluded Asset, then to the extent such Contract is necessary or desirable to the Business then Seller, at Purchaser’s sole option and request, shall transfer such Contract to Purchaser following the Closing Date at no additional cost or expense to Purchaser. If the transfer of such Contract would constitute a breach thereof or would otherwise constitute an event of default thereunder, the parties shall follow the procedures set forth in Section 5.11 with respect to such Contract.

1.3. Assumption of Liabilities. Subject to the terms and conditions contained in this Agreement, in addition to the Purchase Price, Purchaser shall, at the Closing, assume and agree to pay or perform, or cause to be paid or performed, as they become due or payable, only the following liabilities, duties and obligations of Seller: (a) liabilities and obligations under the Assumed Agreements but only to the extent such liabilities or obligations arise from goods or services received by Purchaser on or after the Closing Date or arise from goods or services to be provided to Purchaser on or after the Closing Date (subject to Section 5.11), and (b) trade accounts payable to vendors and suppliers for products or services set forth on Schedule 1.3, which trade accounts payable relate to either work in process or work not yet begun as of the date hereof and which were received prior to the Closing but for which payment is due in the Ordinary Course(as defined below) after the Closing (none of which payment obligations are overdue or will be overdue as of the Closing Date),

{M1108931.1 } - 4 -

but no other liabilities or obligations whatsoever. The specific liabilities to be assumed by Purchaser pursuant to this Section 1.3 are hereinafter collectively referred to as the “Assumed Liabilities”.

1.4. Retained Liabilities. Notwithstanding any other provisions in this Agreement, the Purchaser shall not assume any liabilities of the Seller (or any Affiliates of Seller), whether relating to the Purchased Assets, the Business or otherwise, other than, for the avoidance of doubt, the Assumed Liabilities set forth in Section 1.3 (all such liabilities other than the Assumed Liabilities, collectively, the “Retained Liabilities”).

1.5. Further Conveyances and Assumptions; Consent of Third Parties.

(a) From time to time following the Closing, Seller shall make available to Purchaser such non-confidential data in personnel records of Transferred Employees (as defined in Section 5.12 below) as is reasonably necessary for Purchaser to transition such Transferred Employees into Purchaser’s records.

(b) From time to time following the Closing, Seller and Purchaser shall execute, acknowledge and deliver all such further conveyances, notices, assumptions, releases and acquaintances and such other instruments, and shall take such further actions, as may be reasonably necessary or appropriate to assure fully to Purchaser and its successors or assigns, all of the properties, rights, titles, interests, estates, remedies, powers and privileges intended to be conveyed to Purchaser under this Agreement and any ancillary agreements thereto and to assure fully to Seller and its Affiliates and their successors and assigns, the assumption of the liabilities and obligations intended to be assumed by Purchaser under this Agreement and any ancillary agreements thereto, and to otherwise make effective the transactions contemplated hereby and thereby.

(c) Nothing in this Agreement nor the consummation of the transactions contemplated hereby shall be construed as an attempt or agreement to assign any Purchased Asset, including any Contract, Permit, certificate, approval, authorization or other right, which by its terms or by Law is nonassignable without the consent of a third party or a Governmental Entity or is cancelable by a third party in the event of an assignment (“Nonassignable Assets”) unless and until such consent shall have been obtained. Seller shall, and shall cause its Affiliates to, use commercially reasonable efforts to cooperate with Purchaser at its request in endeavoring to obtain such consents promptly.

1.6. Purchase Price; Escrow; Closing Payment; Earn-Out Payment.

(a) Purchase Price. The aggregate consideration for the Purchased Assets shall consist of (i) cash in an amount equal to Five Million Seven Hundred Fifty Thousand Dollars ($5,750,000) (the “Cash Consideration”) and (ii) the number of shares of Purchaser Common Stock as is equal to the quotient obtained by dividing Seven Hundred Fifty Thousand Dollars ($750,000) by the Effective Price (as defined below) (the “Stock Consideration”, and collectively with the Cash Consideration, the “Purchase Price”), such Purchase Price subject to adjustment as set forth below, and the assumption of the Assumed Liabilities. The term “Effective Price” shall mean the average closing price for Purchaser Common Stock as reflected on the Nasdaq Capital

{M1108931.1 } - 5 -

Market exchange for the 30-day trading period ending on the trading day immediately preceding the Effective Date.

(b) Earn-Out Escrow. On the Closing Date (i) cash in an amount equal to thirty-four percent (34%) of the Purchase Price, or Two Million Two Hundred Ten Thousand Dollars ($2,210,000) (the “Escrow Earn-Out Consideration”), shall be paid to and deposited with BNY Mellon, National Association, a national banking association, as escrow agent (the “Escrow Agent”) at Closing, such Escrow Earn-Out Consideration to be released and paid to Seller, or a portion thereof, in accordance with the terms herein and in accordance with the terms of the Escrow Agreement. In the event that any portion of the Escrow Earn-Out Consideration shall not be payable to Seller, then such Escrow Earn-Out Consideration shall be released and returned to Purchaser, in accordance with the terms of the Escrow Agreement.

(c) Closing Payment. At the Closing, Purchaser shall deliver to the Seller a portion of the Purchase Price as follows: (i) an amount in cash, by wire transfer of immediately available U.S. funds to an account or accounts designated by the Seller in writing, equal to the Cash Consideration, minus an amount equal to the Escrow Earn-Out Consideration, minus the amount of all outstanding Indebtedness of the Seller, if any, as of the Closing Date, together with the amount of all interest and premiums required to be paid to repay or redeem such Indebtedness as of the Closing Date (the “Seller Indebtedness”), such amount referred to herein as the “Closing Cash Consideration” and (ii) the number of shares of Purchaser Common Stock representing the Stock Consideration (the “Closing Stock Consideration”, and together with the Closing Cash Consideration, the “Closing Consideration”). The Closing Consideration will represent sixty-six percent (66%) of the Purchase Price, subject to the payment of any Seller Indebtedness or liabilities of Seller at Closing.

(d) Escrow Earn-Out Consideration. As additional consideration for the Purchased Assets, Purchaser shall pay to Seller an earn-out amount, if any, determined in accordance with the terms set forth in this Section 1.6(d). The Seller shall be entitled to earn the Escrow Earn-Out Consideration during the Earn-Out Period, as follows:

(i) Retention Earn-Out. Provided that Edward Kilgallen remains an employee of Purchaser, pursuant to the terms of the Employment Agreement, from the Closing Date until the expiration of the Earn-Out Period, Seller shall be entitled to payment of the Retention Earn-Out Consideration, such Retention Earn-Out Consideration to be paid and/or delivered, as the case may be, to Seller within ten (10) business days after the final determination that Seller is entitled to such Retention Earn-Out Consideration. Notwithstanding the foregoing, in the event that Purchaser terminates the employment of Edward Kilgallen without Cause (as defined in the Employment Agreement) or Edward Kilgallen resigns from employment with the Purchaser for Good Reason (as defined in the Employment Agreement), Seller shall remain eligible to receive such Retention Earn-Out Consideration upon the expiration of the Earn-Out Period. In the event that Edward Kilgallen is terminated by the Purchaser prior to the expiry of the Earn-Out Period as a result of (i) a conviction of Edward Kilgallen of a felony involving moral turpitude, (ii) the gross negligence of Edward Kilgallen or (iii) the Insubordination of Edward Kilgallen, then Seller shall remain eligible to receive the Retention Earn-Out Consideration upon the expiration of the Earn-Out Period. As used herein “Insubordination” means the refusal of Edward Kilgallen to comply in any material respect with his duties and responsibilities to Purchaser, as determined

{M1108931.1 } - 6 -

by the Purchaser, so long as such duties and responsibilities are identified in the Employment Agreement. The Retention Earn-Out Consideration shall be paid and/or delivered, as the case may be, to Seller within ten (10) business days after the expiration of the Earn-Out Period.

(ii) Value Earn-Out.

(a) Prior to the Closing, Purchaser and Seller shall agree upon the methodology to be used to calculate both the Estimated Value Earn-Out Consideration and the Actual Value Earn-Out Consideration, which shall be consistent with the methodology set forth and attached hereto as Exhibit B (the “Value Earn-Out Methodology”).

(b) Prior to Closing, Purchaser and Seller shall agree upon the Estimated Value-Earn-Out Consideration, as set forth and attached hereto as Exhibit C, and calculated consistent with the Value Earn-Out Methodology.

(c) Within forty-five (45) days after the conclusion of the Earn-Out Period, Purchaser will prepare, or cause to be prepared, and deliver to Seller, a statement setting forth the Actual Value Earn-Out Consideration (“Actual Value Earn-Out Consideration Statement”), consistent with the Value Earn-Out Methodology which shall set forth Purchaser’s calculation of that portion of the Value Earn-Out Consideration payable to Seller.

(a) Upon receipt from Purchaser, Seller shall review the Actual Value Earn-Out Consideration Statement for a period of thirty (30) days. If Seller disagrees with Purchaser’s computation of the Actual Value Earn-Out Consideration, Seller may, on or prior to such thirty (30) day period, deliver an objection notice (an “Earn-Out Objection Notice”) to Purchaser, which sets forth its objections to Purchaser’s calculation of Actual Value Earn-Out Consideration; provided, however, the Earn-Out Objection Notice shall include only objections based on (i) non-compliance with the Value Earn-Out Methodology and (ii) mathematical errors in the computation of Actual Value Earn-Out Consideration. Any Earn-Out Objection Notice shall specify those items or amounts with which Seller disagrees, together with a detailed written explanation of the reasons for disagreement with each such item or amount, and shall set forth Seller’s calculation of Actual Value Earn-Out Consideration based on such objections. To the extent not set forth in the Earn-Out Objection Notice, Seller shall be deemed to have agreed with Purchaser’s calculation of all other items and amounts contained in the Actual Value Earn-Out Consideration Statement.

(b) Unless Seller delivers the Earn-Out Objection Notice to Purchaser within such thirty (30) day period, Seller shall be deemed to have accepted Purchaser’s calculation of Actual Value Earn-Out Consideration and the Actual Value Earn-Out Consideration Statement shall be final, conclusive and binding. If Seller delivers the Earn-Out Objection Notice to Purchaser within such thirty (30) day period, Purchaser and Seller shall, during the thirty (30) days following such delivery or any mutually agreed extension thereof, use their commercially reasonable efforts to reach agreement on the disputed items and amounts in order to determine the amount of Actual Value Earn-Out Consideration. If, at the end of such period or any mutually agreed to extension thereof, Purchaser and Seller are unable to resolve their disagreements, they shall jointly retain and refer their disagreement to the Neutral Accounting Firm (as defined below). The parties shall instruct the Neutral Accounting Firm promptly to review this Section 1.6 and to determine solely with respect to the disputed items and amounts so submitted whether and to what

{M1108931.1 } - 7 -

extent, if any, the Actual Value Earn-Out Consideration set forth in the Actual Value Earn-Out Consideration Statement requires adjustment. The Neutral Accounting Firm shall base its determination solely on written submissions by Purchaser and Seller and not on independent review. Purchaser and Seller shall make available to the Neutral Accounting Firm all relevant books and records and other items reasonably requested by the Neutral Accounting Firm. The parties shall request that the Neutral Accounting Firm deliver to Purchaser and Seller, a report which sets forth its resolution of the disputed items and amounts and its calculation of Actual Value Earn-Out Consideration, which report shall be delivered to Purchaser and Seller as soon as practicably possible within thirty (30) days after its retention. The decision of the Neutral Accounting Firm shall be final, conclusive and binding on the parties. The fees and expenses of the Neutral Accounting Firm in connection with the resolution of the Notice of Objection shall be shared equally by the Seller, on the one hand, and the Purchaser, on the other hand; provided that if the Neutral Accounting Firm determines that one such party has adopted a position or positions with respect to the Actual Value Earn-Out Consideration Statement that is frivolous or clearly without merit, the Neutral Accounting Firm may, in its discretion, assign a greater portion of any such fees and expenses to such party.

(c) Upon a final determination of the Actual Value Earn-Out Consideration in accordance with this Section 1.6, Seller shall be entitled to payment from Purchaser of that portion of the Value Earn-Out Consideration as determined in the Actual Value Earn-Out Consideration Statement, with any amounts payable up to One Million Three Hundred Thousand Dollars ($1,300,000) being satisfied from the Escrow Earn-Out Consideration held by the Escrow Agent, and any remaining amounts payable by Purchaser to Seller above One Million Three Hundred Thousand Dollars ($1,300,000) being satisfied by payment from Purchaser directly to Seller. The Value Earn-Out Consideration shall be paid and/or delivered, as the case may be, to Seller within ten (10) business days after the final determination that Seller is entitled to the Value Earn-Out Consideration, or any portion thereof.

(d) As set forth in the Value Earn-Out Methodology, the Value Earn-Out Consideration, after the calculation thereof, may result in a Value Earn-Out Consideration equal to an amount of up to One Million Nine Hundred Fifty Thousand Dollars ($1,950,000), provided however, that in the event the Value Earn-Out Methodology is determined to be an amount equal to less than to One Million Three Hundred Thousand Dollars ($1,300,000), then any adjustments to costs associated with the operation of the Business by Purchaser after the Closing Date, which are inconsistent with the current costs of Seller, or costs contemplated as of the Closing Date by Seller, on a proportionate basis, will be excluded from the calculation of the Actual Value Earn-Out Consideration, provided further, that the exclusion of any such costs shall result in a Value Earn-Out Consideration not greater than One Million Three Hundred Thousand Dollars ($1,300,000), and the volume adjustment in the Value Earn-Out Methodology will not be considered in this instance. For clarity, the following examples, without limitation, would constitute an adjustment to costs as contemplated above: (i) the use of additional inspectors in the manufacturing process despite volume remaining unchanged and/or (ii) material changes to the cleaning process in the manufacturing process.

(iii) Operational Considerations. The Purchaser hereby covenants and agrees that during the Earn-Out Period, the Purchaser shall: (i) not take or omit to take any action with the express purpose and intent of, absent an independent and good faith business rationale for its actions, depriving the Seller of the opportunity to earn any Retention Earn-Out

{M1108931.1 } - 8 -

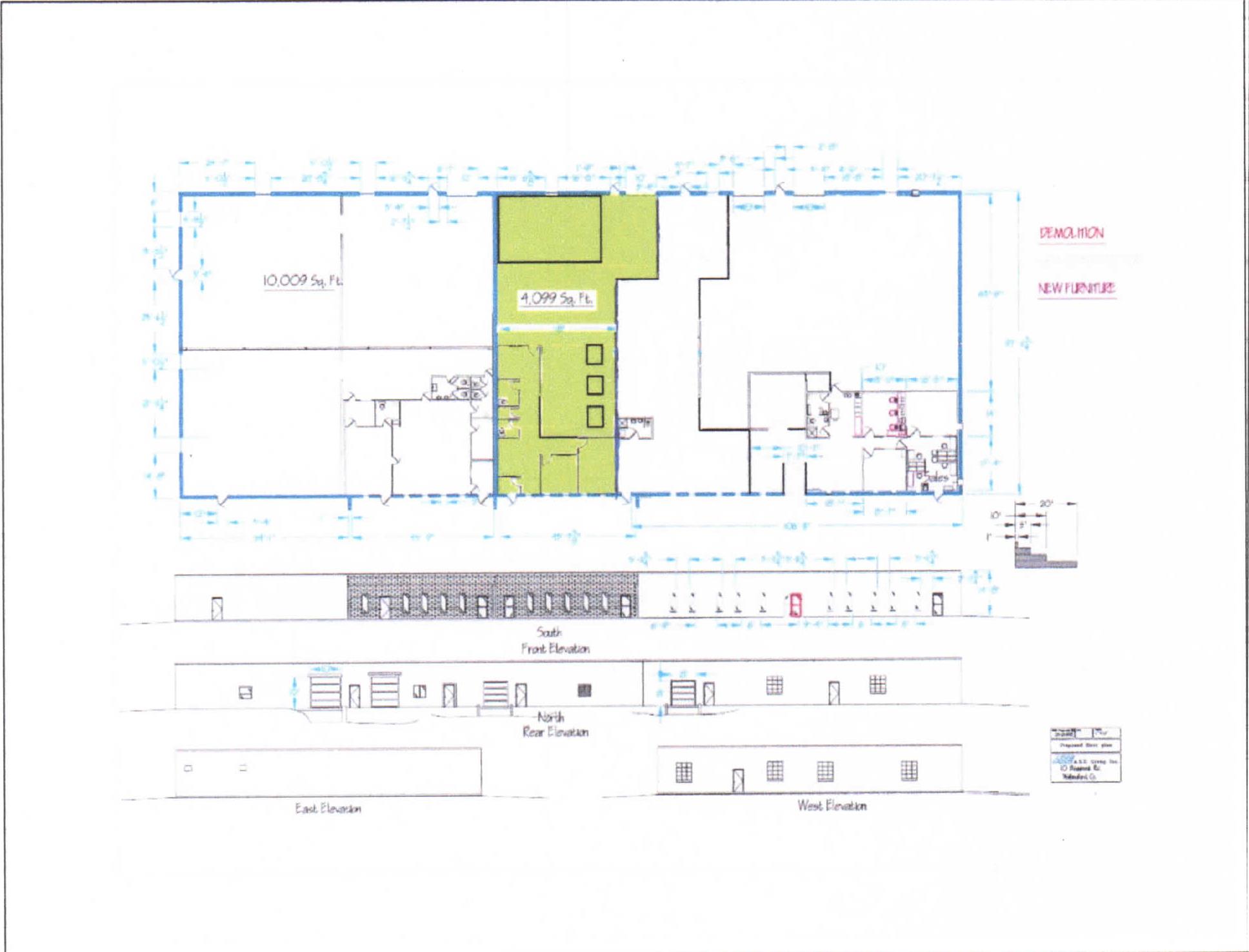

Consideration or Value Earn-Out Consideration; (ii) use commercially reasonable efforts in a manner reasonably consistent with the Seller’s past practice to operate the Business of Seller and related services related to the Retention Earn-Out Consideration or Value Earn-Out Consideration; and (iii) not relocate the principal place of business of the Business, or cause the principal place of business of the Business to be relocated, to a location more than fifty (50) miles from the current principal place of business of the Business in Wallingford Connecticut, unless otherwise agreed to by the parties. Purchaser and Seller shall review performance in relation to the Earn Out no less than quarterly.

(iv) Other. Any rights accruing to a party under this Section 1.6 shall be in addition to and independent of the rights to indemnification under Article VII and any payments made to any party under this Section 1.6 shall not be subject to the terms of Article VII.

1.7. Reserved.

1.8. Issuance and Delivery of Stock Consideration. At the Closing, Purchaser shall deliver to the transfer agent, instructions to issue a stock certificate in the name of Seller for that number of shares of Purchaser Common Stock equal to the Closing Stock Consideration, such stock certificate representing the Closing Stock Consideration to be delivered to Seller at Closing. No fractional shares of Purchaser Common Stock shall be issued, but in lieu thereof, Seller shall receive from Purchaser an amount of cash (rounded to the nearest whole cent) equal to the product of (i) such fraction and (ii) the Effective Price.

1.9. Allocation of Purchase Price. Seller and Purchaser will report the allocation of the Purchase Price, any subsequent adjustment to the Purchase Price and payment of the Retention Earn-Out Consideration and Value Earn-Out Consideration (“Allocation”) as provided in Section 1060 of the Code and the regulations promulgated thereunder and agree to prepare and file all income Tax Returns (including IRS Form 8594) in a manner consistent with the Allocation. Neither Purchaser nor Seller shall take any position (whether in audits, Tax Returns, or otherwise) that is inconsistent with the Allocation unless required to do so by applicable Law. The estimated Allocation is set forth on Schedule 1.9 hereto and shall be agreed to prior to closing,.

1.10. Closing. The closing (the “Closing”) of the Transaction contemplated by this Agreement shall take place on a date and time to be specified by Purchaser and Seller (the “Closing Date”), at the offices of Morse, Barnes-Brown & Pendleton, P.C., 230 Third Avenue, Suite 400, Waltham, Massachusetts, 02451. The Parties need not be physically present at the Closing in order to consummate the Transaction contemplated herein. The parties agree that the execution and delivery of this Agreement and all ancillary agreements may take place by means of facsimile signature pages or .pdf signature pages with original signature pages to follow.

{M1108931.1 } - 9 -

ARTICLE II

REPRESENTATIONS AND WARRANTIES OF SELLER

REPRESENTATIONS AND WARRANTIES OF SELLER

In order to induce Purchaser to enter into this Transaction, Seller represents and warrants to Purchaser that, except as set forth in the disclosure schedules of Seller (the “Disclosure Schedules”), the statements made in this Article II are true and correct as of the date hereof, except to the extent such representations and warranties are specifically made as of a particular date (in which case such representations and warranties will be true and correct as of such date). The Disclosure Schedule will be arranged in paragraphs corresponding to the numbered and lettered sections contained in this Article II and the disclosure in any paragraph shall qualify other sections in this Article II to the extent that it is apparent from a reading of such disclosure that it also qualifies or applies to such other sections. Whenever in this Article II the term “to the knowledge of Seller” is used, it shall mean the actual knowledge of Seller after reasonable inquiry.

2.1. Organization and Company Power. Seller is a limited liability company duly organized, validly existing and in good standing under the laws of the State of Connecticut and has the power and authority to carry on its business as presently conducted. There is no other jurisdiction wherein the character of Seller’s property, or the nature of the activities presently conducted by Seller, makes such qualification necessary, except where the failure to be so qualified will not have a Material Adverse Effect on the Seller.

2.2. Authorization. Seller has the right, power and legal capacity and has taken all necessary legal, manager and member action required for the due and valid authorization, execution, delivery and performance by Seller of this Agreement and any other agreement or instrument executed by Seller in connection herewith (collectively, the “Transaction Documents”) and the consummation of the Transaction contemplated herein or therein. This Agreement is, and to the extent that Seller is a party thereto, each of the Transaction Documents upon execution and delivery is, a valid and binding obligation of Seller enforceable in accordance with its respective terms, except to the extent that such enforcement may be subject to applicable bankruptcy, reorganization, insolvency, fraudulent conveyance or other laws affecting creditors’ rights generally and to the application of general equitable principles.

2.3. No Conflicts. Except as set forth on the Disclosure Schedule, the execution, delivery and performance of this Agreement and the Transaction Documents and the consummation of the Transaction contemplated hereby and thereby by Seller does not and will not violate, conflict with, result in a breach of or constitute a default under (or which with notice or lapse of time, or both, would constitute a breach of or default under), or result in the creation of any lien, security interest or other encumbrance under (a) any note, agreement, contract, license, instrument, lease or other obligation to which Seller is a party or by which Seller is bound, and for which Seller has not previously obtained a written waiver of such breach or default, which waiver has been delivered to Purchaser, except where such violation would not have a Material Adverse Effect on Seller, (b) any judgment, order, decree, ruling or injunction known and applicable to Seller, (c) any statute, law, regulation or rule of any governmental agency or authority, or (d) the limited liability operating

{M1108931.1 } - 10 -

agreement, certificate of formation or equivalent documents of Seller (collectively, the “Seller Charter Documents”). This Agreement and the Transaction contemplated hereby has been unanimously approved by Seller’s Managers or similar body and the Unitholders and does not require any further legal action or authorization, and is not and will not be subject to any right of first refusal, put, call or similar right.

2.4. Government Approvals. No consent, approval, license, order or authorization of, or registration, qualification, declaration, designation, or filing (each a “Consent”) with any court, arbitral tribunal, administrative agency or commission or other governmental or regulatory agency (each a “Governmental Entity”), is or will be required on the part of Seller in connection with the execution, delivery and performance of this Agreement, the other Transaction Documents and any other agreements or instruments executed by Seller in connection herewith or therewith, the failure of which would have a Material Adverse Effect on Seller.

2.5. Authorized and Outstanding Equity Interests. The Disclosure Schedule sets forth the issued and outstanding equity interests of Seller, all of which are validly issued and outstanding, and all options and warrants or similar rights to acquire equity interests of Seller. Such equity interests are all of the issued and outstanding equity interests, actual or contingent, in Seller and are validly issued. Except as set forth in the Seller Charter Documents or on the Disclosure Schedule, there are no voting agreements, voting trusts, registration rights, rights of first refusal, preemptive rights, buy-sell agreements, co-sale rights, or other restrictions applicable to any equity interests in Seller. All of the issued and outstanding equity interests in Seller were issued in transactions complying with or exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”) and any applicable state “blue sky” laws.

2.6. Subsidiaries and Investments. The Seller has no Subsidiaries and except as set forth on the Disclosure Schedule, Seller does not have any investment or other interest in, or any outstanding loan or advance to or from, any Person, including, without limitation, any officer, manager or equity holder.

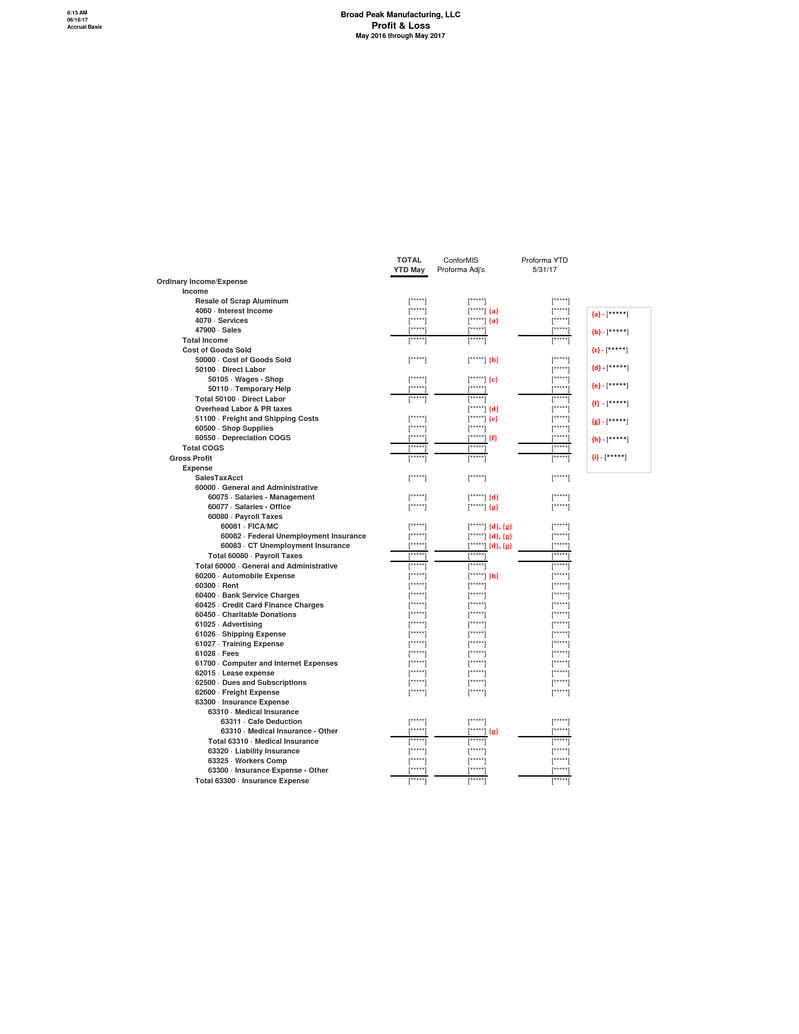

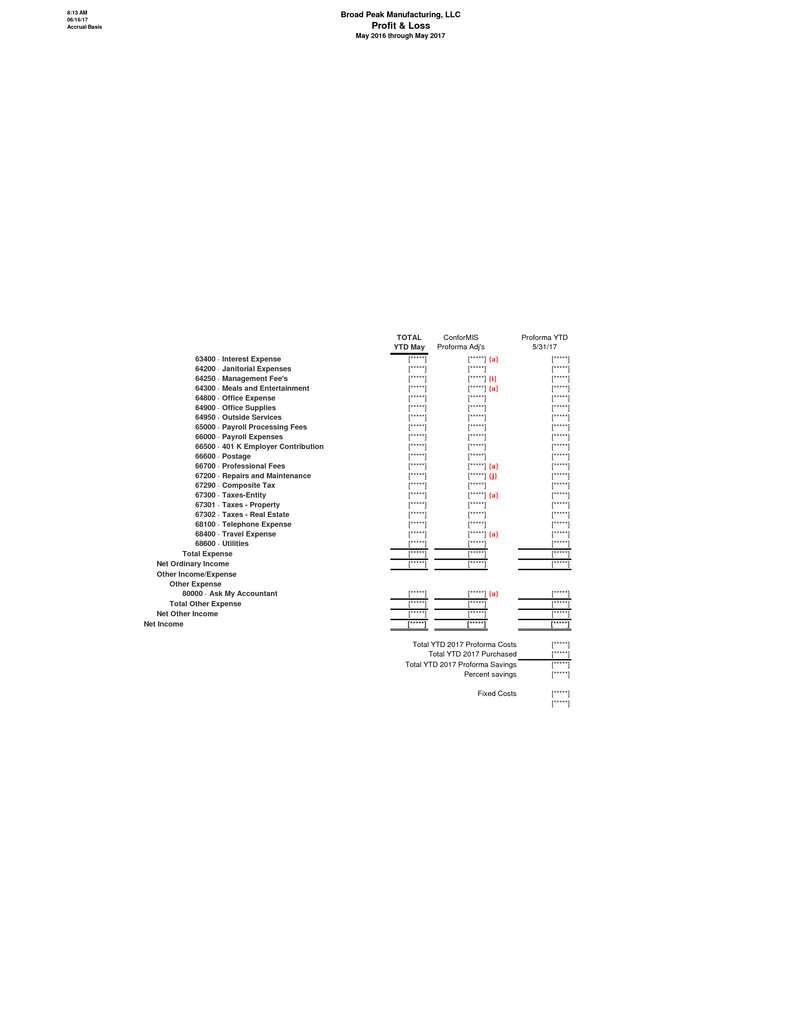

2.7. Financial Information. Seller has previously delivered to Purchaser the unaudited balance sheet and income statement of the Seller as at December 31, 2016 and December 31, 2015 and the related statements of operations and cash flows (collectively, the “Annual Seller Financial Statements”). In addition, Seller has previously delivered to Purchaser an unaudited balance sheet and income statement of the Seller as at May 31, 2017, for the five (5) months then ended, and the related statements of operations and cash flows (the “Interim Financial Statements”, and together with the Annual Financial Statements, the “Financial Statements”). The Financial Statements present fairly, in all material respects, the financial condition and results of operations of Seller as related to the manufacture of ConforMIS custom product as of and for the relevant periods and have been prepared from, and are consistent with, the books and records of the Seller and are in accordance with generally accepted accounting principles. Except as set forth on the Disclosure Schedule, Seller has no liability, contingent or otherwise, which is not adequately reflected in or reserved against in the Annual Seller Financial Statements or Interim Seller Financial Statements that is reasonably likely to have a Material Adverse Effect on the

{M1108931.1 } - 11 -

financial condition of Seller. Except as set forth in the Interim Seller Financial Statements or on the Disclosure Schedule, since December 31, 2016 (the “Balance Sheet Date”), (i) there has been no change in the business, property, assets, liabilities, condition (financial or otherwise), operations, results of operations, affairs or prospects of Seller except for changes in the Ordinary Course which, in the aggregate, would not have a Material Adverse Effect on the Purchased Assets or the Business, and (ii) none of the business, property, assets, liabilities, condition (financial or otherwise), operations, results of operations, affairs or prospects of Seller as related to the manufacture of ConforMIS custom product have been materially adversely affected by any occurrence or development, in the aggregate, whether or not insured against.

2.8. Events Subsequent to the Balance Sheet Date. Except as set forth on the Disclosure Schedule, or in the Financial Statements, since the Balance Sheet Date and as related to the Purchased Assets or the Business, Seller has not, in excess of $5,000 (i) issued any equity interest, (ii) borrowed any amount or incurred or become subject to any material liability (absolute, accrued or contingent), except liabilities under contracts entered into in the Ordinary Course, (iii) discharged or satisfied any lien or encumbrance or incurred or paid any obligation or liability (absolute, accrued or contingent) other than current liabilities shown on the Financial Statements and incurred in the Ordinary Course, (iv) declared or made any payment, other than ordinary payments of compensation in amounts consistent with the historic levels, or distribution to the Unitholders or purchased or redeemed any equity interests, (v) mortgaged, pledged or subjected to lien any of its assets, tangible or intangible, other than liens of current real property taxes not yet due and payable or such liabilities or obligations which are not reasonably likely to have a Material Adverse Effect on Seller, (vi) sold, assigned or transferred any of its tangible assets except in the Ordinary Course, or canceled any material debt or claim, except in the Ordinary Course, in an individual amount in excess of $2,500, or $7,500 in the aggregate, (vii) sold, assigned, transferred or granted any license with respect to any patent, trademark, trade name, service mark, copyright, trade secret or other intangible asset, except pursuant to a license or other agreement entered into in the Ordinary Course, in an individual amount in excess of $2,500, or $7,500 in the aggregate, (viii) suffered any material loss of property or knowingly waived any right of substantial value whether or not in the Ordinary Course, (ix) made any change in officer compensation, (x) made any material change in the manner of business or operations of Seller, (xi) entered into any transaction except in the Ordinary Course or as otherwise contemplated hereby, or (xii) entered into any commitment (contingent or otherwise) to do any of the foregoing.

2.9. Litigation. Except as otherwise set forth on the Disclosure Schedule, there is no litigation or governmental proceeding, investigation, or judicial, administrative or arbitration inquiry or proceeding (a “Legal Proceeding”) pending or, to Seller’s knowledge, threatened, against Seller or affecting any of Seller’s properties or assets, or against any manager, officer, key employee, present or former manager or member of Seller in his capacity as such, nor to Seller’s knowledge has there occurred any event or does there exist any condition on the basis of which any Legal Proceeding might properly be instituted. Except as set forth on the Disclosure Schedule, each incident or proceeding described on the Disclosure Schedule is fully covered by insurance except to the extent of applicable insurance deductibles. To Seller’s knowledge, Seller is not in default with respect to any order, writ, injunction, decree, ruling or decision of any court, commission,

{M1108931.1 } - 12 -

board or other government agency, except for such order, writ, injunction, decree, ruling or decision which would not have a Material Adverse Effect on Seller.

2.10. Compliance with Laws and Other Instruments.

(a) Except as set forth on the Disclosure Schedule, Seller is in compliance with the Seller Charter Documents, and in all material respects with the provisions of each mortgage, indenture, lease, license, other agreement or instrument, judgment, decree, judicial order, statute and regulation by which it is bound or to which its properties are subject and where non-compliance would not have a Material Adverse Effect on Seller.

(b) The Seller is and has been at all times in compliance in all material respects with all Laws and Orders applicable to the Seller and any of its business, properties or assets (including, for the avoidance of doubt, Environmental Laws). To the Knowledge of the Seller, no condition or state of facts exists that is reasonably likely to give rise to a material violation of, or a material liability or default under, any applicable Law or Order. The Seller has not received any written notice to the effect that a Governmental Entity claimed or alleged that the Seller was not in compliance in all material respects with all Laws or Orders applicable to the Seller and any of its business, properties, or assets, and no facts exist that would reasonably be expected to form the basis for any such claim or allegation. No manager, officer, or, to the Knowledge of the Seller, agent, employee, consultant, representative or other Person acting on behalf of the Seller has, directly or indirectly, violated any provision of any Environmental Law.

2.11. Taxes.

(a) The term “Taxes” as used in this Agreement means all federal, state, local, foreign net income, alternative or add-on minimum tax, estimated, gross income, gross receipts, sales, use, ad valorem, value added, transfer, franchise, capital profits, lease, service, license, withholding, payroll, employment, excise, severance, stamp, occupation, premium, property, environmental or windfall profit taxes, customs, duties and other taxes, governmental fees and other like assessments and charges of any kind whatsoever, together with all interest, penalties, additions to tax and additional amounts with respect thereto, and the term “Tax” means any one of the foregoing Taxes. The term “Tax Returns” as used herein means all returns, declarations, reports, claims for refund, information statements and other documents relating to Taxes, including all schedules and attachments thereto, and including all amendments thereof, and the term “Tax Return” means any one of the foregoing Tax Returns. “Tax Authority” means any governmental authority responsible for the imposition of any Tax.

(b) Seller has timely filed all Tax Returns required to be filed by it and has paid all Taxes owed (whether or not shown as due on such returns), including, without limitation, all Taxes which Seller is obligated to withhold for amounts paid or owing to employees, creditors and third parties. All Tax Returns filed by Seller were complete and correct in all material respects. Except as set forth on the Disclosure Schedule, none of the Tax Returns filed by Seller or Taxes payable by Seller have been the subject of an audit, action, suit, proceeding, claim, examination, deficiency or assessment by any governmental authority, and no such audit, action, suit, proceeding, claim, examination, deficiency or assessment is currently pending or, to the knowledge of Seller,

{M1108931.1 } - 13 -

threatened. Except as set forth on the Disclosure Schedule, Seller is not currently the beneficiary of any extension of time within which to file any Tax Return, and Seller has not waived any statute of limitation with respect to any Tax or agreed to any extension of time with respect to a Tax assessment or deficiency. All material elections with respect to Taxes with respect to Seller, as of the Closing Date, are set forth in the Financial Statements or in the Disclosure Schedule.

(c) To the best of the Seller’s knowledge, no circumstances exist or have existed which would constitute grounds for assessment against Seller of any tax liability with respect to the Transaction contemplated by this Agreement or any period for which Tax Returns have been filed. No member of Seller is a nonresident alien for purposes of U.S. income taxation, including for purposes of Section 897 of the Code.

(d) Seller is not party to any Tax sharing agreement or similar arrangement. Seller has never been a member of a group filing a consolidated federal income Tax Return (other than a group the common parent of which was the Seller), and has no liability for the Taxes of any Person.

(e) There are no liens for Taxes upon any of the assets. The unpaid Taxes of Seller did not, as of December 31, 2016, exceed by any material amount the accrual for current Taxes (as opposed to any accrual for deferred Taxes established to reflect timing differences between book and Tax income) as shown on the Annual Seller Financial Statements, and will not exceed by any material amount such reserve as adjusted for the passage of time through the Closing Date in accordance with the past custom and practice of Seller in filing its Tax Returns. Seller has not incurred any liability for Taxes from January 1, 2017 through the Closing Date other than in the Ordinary Course consistent with past practice. Seller is not obligated to file any Tax Return in any jurisdiction (whether foreign or domestic) other than those jurisdictions in which it currently files Tax Returns.

(f) Each Employee Plan (as defined in Section 2.23) that is a non-qualified deferred compensation plan subject to Section 409A of the Code has been operated in good faith compliance with Section 409A of the Code and IRS Notice 2005-1 since January 1, 2012 and Seller does not have, and does not expect to have any future, Tax withholding obligation in respect of Section 409A under any Employee Plan.

(g) Seller is not a party to any agreement, contract, arrangement or plan that has resulted or would result, separately or in the aggregate, in the payment of (i) any “excess parachute payments” within the meaning of Section 280G of the Code (without regard to the exceptions set forth in Sections 280G(b)(4) and 280G(b)(5) of the Code).

(h) Seller has not been a United States real property holding corporation within the meaning of Section 897(c)(2) of the Code during the applicable period specified in Section 897(c)(1)(A)(2) of the Code.

2.12. Real Property.

(a) The Disclosure Schedule sets forth the addresses and uses of all real property that Seller owns, leases or subleases, and any lien or encumbrance on any such owned real property or Seller’s leasehold interest therein, specifying in the case of each such lease or

{M1108931.1 } - 14 -

sublease, the name of the lessor or sublessor, as the case may be, the lease term and the rental obligations of the lessee thereunder.

(b) There are no defaults by Seller under any existing leases, subleases or other contractual obligations pertaining to real property that Seller owns, leases or subleases, and to the best knowledge of Seller, by any other party, which might curtail in any material respect the present use of Seller’s property listed on the Disclosure Schedule.

2.13. Assets. Seller is the true and lawful owner and has good and marketable title to the Purchased Assets, free and clear of all Liens. Upon execution and delivery by Seller to Purchaser of the instruments of conveyance referred to herein, Purchaser will become the true and lawful owner of, and will receive good marketable title to, the Purchased Assets free and clear of all Liens. The Purchased Assets include all of the properties and other assets necessary for Seller to conduct the Business as presently conducted and as presently proposed to be conducted and constitute all assets used by Seller in the Business. Except as set forth in the Disclosure Statements, each tangible Purchased Asset is free from material defects, has been maintained in accordance with normal industry practice, is in good operating condition and repair (subject to normal wear and tear) and is suitable for the purpose for which it is presently used. The Disclosure Schedule sets forth a full and complete list of all personal property, including capital equipment, owned or leased by Seller.

2.14. Intellectual Property.

(a) The Disclosure Schedule lists all (i) patented or registered Intellectual Property owned by the Seller in connection with the Business, (ii) pending patent applications and applications for registrations of other Intellectual Property filed by or on behalf of the Seller in connection with the Business, (iii) domain names and Internet websites maintained solely by or on behalf of the Seller in connection with the Business, (iv) all products and services of Seller currently being licensed, offered, or sold or that are currently being developed, (v) computer software programs (other than “off-the-shelf’ software applications) that are owned or licensed by the Seller in connection with the Business and (vi) all Trade Secret Rights identified in Section 2.14(d) below. The Disclosure Schedule also contains a complete and accurate list of all licenses, sublicenses and other agreements to which Seller is a party and pursuant to which Seller or any other person is authorized to use the Intellectual Property owned by Seller and all licenses, sublicenses and other agreements granted by any third party to the Seller in connection with the Business with respect to any Intellectual Property (other than “off-the-shelf’ software applications).

(b) Seller owns all right, title and interest in and to all Intellectual Property that it purports to own as described on the Disclosure Schedule (in each case free and clear of all Liens). To Seller’s knowledge, there have been no written claims made against the Seller asserting the invalidity, misuse or unenforceability of any of such Intellectual Property or asserting that the conduct by Seller of the Business has infringed or misappropriated any Intellectual Property of any other person. To Seller’s knowledge, the Intellectual Property owned by the Seller has not been infringed or misappropriated by any other person. The consummation of Transaction will not have a Material Adverse Effect on any Intellectual Property owned by Seller.

{M1108931.1 } - 15 -

(c) Seller has protected all Trade Secret Rights from unauthorized use or disclosure by the Seller, by Persons for whom it is responsible, by Persons to whom it disclosed such materials, or by Persons accessing or seeking to access such materials. The Seller has maintained materials protected by Trade Secret Rights in confidence and preserved their status as Trade Secret Rights. The Disclosure Schedule (A) lists each material Trade Secret of the Seller; (B) lists each material Trade Secret of a customer or other third party that has been provided to or accessed by the Seller and that is used materially in connection with the businesses of the Seller; (C) lists each inbound intellectual property license (where applicable) that governs such provision or access; and (D) lists each written policy of the Seller that concerns the collection, use, storage, security, tracking, or retention of (1) Trade Secrets of the Seller, and (2) Trade Secrets of a customer or other third party that are provided to, or that are accessed by the Seller (each a “Trade Secret Policy”). True, correct and complete copies of each Trade Secret Policy have been made available to Purchaser. The Trade Secret Policies do not impose on the Seller any obligations with respect to Trade Secrets subject to those policies that are inconsistent (x) with any Contracts between the Seller and customers or other third parties; and (y) with any applicable Laws. To the Knowledge of the Seller, there have been no breaches or deviations from the Trade Secret Policies. There have been no breaches by the Seller of any Contract between the Seller and customers or other third parties with respect to Trade Secrets and no unauthorized use or disclosure of such trade secrets by the Seller.

(d) Seller owns or has the rights to use all Intellectual Property necessary to operate Seller’s internal systems that are material to the business or operations of Seller, including without limitation, computer hardware systems, software applications and embedded systems (the “Seller Internal Systems”). None of the Seller Internal Systems, or the use thereof, infringes or violates, or constitutes a misappropriation of, any Intellectual Property rights of any person or entity.

2.15. Agreements of Managers, Officers, Employees and Consultants.

(a) Except as set forth on the Disclosure Schedule, to Seller’s knowledge, no current or former manager, officer or employee of or consultant to Seller is in violation of any term of any employment contract, non-competition agreement, non-disclosure agreement, patent disclosure or assignment agreement or other contract or agreement containing restrictive covenants relating to the conduct of any such current or former manager, member, officer, employee, or consultant or otherwise relating to the use of Trade Secrets or proprietary information of others by any such person. The Disclosure Schedule sets forth the name and address of each person currently serving as a manager or officer of Seller, and each person listed on the Disclosure Schedule was duly elected and is presently serving as such manager or officer. Set forth on the Disclosure Schedule is a list of all current and former managers, officers, employees, and consultants of Seller. Except as set forth on the Disclosure Schedule, each current and former manager, officer, employee and consultant of Seller has executed a non-disclosure and non-competition agreement with Seller in the form provided to Purchaser. Except as disclosed on the Disclosure Schedule, since December 31, 2016, Seller has not paid or become committed to pay any bonus or similar additional compensation to any manager, officer or employee of Seller.

{M1108931.1 } - 16 -

(b) The Disclosure Schedule lists the following information for each employee of the Seller, including each employee on leave of absence or layoff status: employer, name, job title, date of hiring, date of commencement of employment, details of leave of absence or layoff, rate of compensation, bonus arrangement, and any change in compensation or bonus since December 31, 2015, vacation, sick time, and personal leave accrued as of December 31, 2016, and service credited for purposes of vesting and eligibility to participate under any Employee Plan.

(c) The Disclosure Schedule lists the following information for every independent contractor, consultant, distributor or sales agent of the Seller: name, responsibilities, date of engagement, and compensation. Each such independent contractor, consultant, or sales agent qualifies as an independent contractor in relation to the Seller for purposes of all applicable Laws, including those relating to Taxes, insurance, and employee benefits.

(d) Except as set forth in the Disclosure Schedule, to the knowledge of Seller, (i) no manager, officer, or other key employee of the Seller intends to terminate such Person’s employment with the Seller, and (ii) no independent contractor, consultant, or sales agent intends to terminate such Person’s arrangement with the Seller.

2.16. Governmental Licenses. Seller has all the material Permits, licenses, orders, franchises and other rights and privileges of all federal, state, local or foreign governmental or regulatory bodies necessary for Seller to conduct its Business as presently conducted. All such permits, licenses, orders, franchises and other rights and privileges are in full force and effect and, to Seller’s knowledge, no suspension or cancellation of any of them is threatened, and none of such Permits, licenses, orders, franchises or other rights and privileges will be Materially Adversely Affected by the consummation of the Transaction contemplated by this Agreement or any of the Transaction Documents. As used in this Agreement “Permits” (or “Permit” where the context requires) means any license, permit, order, authorization, approval, consent, or certificate of or from any Governmental Entity.

2.17. List of Material Contracts and Commitments. The Disclosure Schedule sets forth a complete and accurate list of all material contracts associated with the manufacture of ConforMIS custom product to which Seller is a party or by or to which any of their assets or properties are bound or subject. As used on the Disclosure Schedule, the phrase “Seller Material Contract” means and includes every material agreement or material understanding of any kind, written or oral, which is legally enforceable by or against Seller, and specifically includes without limitation (a) contracts and other agreements with any current or former manager, officer, employee, consultant or member or any partnership, company, joint venture or any other entity in which any such person or entity has an interest; (b) agreements with any labor union or association representing any Seller employee; (c) contracts and other agreements for the provision of services other than by employees of Seller which entail a reasonably foreseeable financial consequence to any contracting party of at least $15,000; (d) bonds or other security agreements provided by any party in connection with the Business; (e) contracts and other agreements for the sale of any of the assets or properties of Seller other than in the Ordinary Course or for the grant to any person or entity of any preferential rights to purchase any of said assets or properties; (f) joint venture agreements relating to the assets, properties or Business of Seller or by or to which any of their assets or properties are bound or subject; (g) contracts or other agreements under which Seller agrees to indemnify any party, to share

{M1108931.1 } - 17 -

tax liability of any party, or to refrain from competing with any party; (h) any contracts or other agreements with regard to any indebtedness of Seller; or (i) any other contract or other agreement whether or not made in the Ordinary Course and involving a reasonably foreseeable financial consequence to any contracting party of at least $15,000. Seller has delivered to Purchaser true, correct and complete copies of all such contracts, together with all modifications and supplements thereto. Except as set forth on the Disclosure Schedule, each of the contracts listed on the Disclosure Schedule is in full force and effect. Seller is not in breach of any of the material provisions of any such Seller Material Contract, nor, to the best knowledge of Seller, is any other party to any such contract in default thereunder, nor does any event or condition exist which with notice or the passage of time or both would constitute a default of a material provision thereunder, except for any such breach or default that individually and in the aggregate would not have a Material Adverse Effect on Seller. Seller has performed in all material respects all obligations required to be performed by them under each such contract as of the Closing.

2.18. Employee Matters. Except as set forth on the Disclosure Schedule, Seller nor any person that together with Seller would be treated as a single employer (an “ERISA Affiliate”) under Section 414 of the Code has established or maintains or is obligated to contribute to (a) any bonus, severance, stock option, or other type of incentive compensation plan, program, agreement, policy, commitment, contract or arrangement (written or oral), (b) any pension, profit-sharing, retirement or other plan, program or arrangement, or (c) any other employee benefit plan, fund or program, including, but not limited to, those described in Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). All such plans (individually, a “Employee Plan” and collectively, the “Employee Plans”) have been operated and administered in all material respects in accordance with their terms, as applicable, with the requirements prescribed by any and all statutes, orders, rules and regulations, including but not limited to ERISA and the Code. No act or failure to act by Seller has resulted in, nor does Seller have knowledge of a non-exempt “prohibited transaction” (as defined in ERISA) with respect to the Employee Plans. Seller nor any ERISA Affiliate maintains or has ever maintained or contributed to any Employee Plan subject to Title IV of ERISA. With respect to the employees and former employees of Seller, there are no employee post-retirement medical or health plans in effect, except as required by Section 4980B of the Code. Seller has funded, or made adequate reserves for, the full amounts of the employer contributions that are required under the terms of said plan to be paid by Seller with respect to the year ended December 31, 2016 and the period from and including January 1, 2017 through and including the Closing Date.

2.19. Suppliers. Except as set forth on the Disclosure Schedule: No supplier has notified the Seller that it intends to cancel or otherwise substantially modify its relationship with Seller or to decrease materially or limit its services, supplies or materials to Seller, or its usage or purchase of the services of Seller, and, to the knowledge of Seller, the consummation of the Transaction contemplated hereby will not materially adversely affect the relationship of Purchaser with any such supplier. The Disclosure Schedule contains a correct and complete list of the ten (10) largest suppliers for the Seller for the fiscal years ending December 31, 2016 and December 31, 2015 showing the aggregate amount of the cost of goods purchased during each such period,

{M1108931.1 } - 18 -

in addition to any supplier which is the sole source from which the Seller has purchased goods during such periods.

2.20. Brokers or Finders. No person or entity has or will have, as a result of the actions of Seller, any right, interest or claim against or upon Seller for any commission, fee or other compensation as a finder or broker arising from the Transaction contemplated by this Agreement.

2.21. Guarantees. Except as set forth on the Disclosure Schedule, Seller has not assumed, guaranteed, endorsed or otherwise become directly or contingently liable on or for any indebtedness of any other person or entity, except guarantees by endorsement of negotiable instruments for deposit or collection or similar transactions in the Ordinary Course.

2.22. Books and Records. The books and records of Seller made available to Purchaser for inspection include copies of the operating agreement and other governing documents as currently in effect and accurately record therein in all material respects all actions, proceedings, consents and meetings of the managers and members of Seller and any committees thereof.

2.23. Solvency. Seller has no knowledge of any facts or circumstances which may cause it to file for reorganization or liquidation or to have filed against it any proceeding under the bankruptcy or reorganization laws of any jurisdiction within eighteen (18) months from the Closing Date.

2.24. Transactions with Insiders. Except as set forth on the Disclosure Schedule, there are no currently outstanding loans, leases or other contracts between Seller and any officer or manager of Seller, or any person or entity owning five percent (5%) or more of outstanding equity interests of Seller, or any respective family member or affiliate of any such officer, manager or member. There is no agreement or understanding of any kind, written or oral, which is legally enforceable by or against Seller, by and between Seller and Edward Kilgallen, whereby Seller has agreed, following the Closing Date, to pay to Edward Kilgallen any portion of the Purchase Price, including without limitation, any bonus payment upon the payment of any portion of the Retention Earn-Out Consideration or Value Earn-Out Consideration.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF UNITHOLDERS

In order to induce Purchaser to enter into this Transaction, Unitholders represent and warrant to Purchaser that the statements made in this Article III are true and correct as of the date hereof, except to the extent such representations and warranties are specifically made as of a particular date (in which case such representations and warranties will be true and correct as of such date).

3.1. Title. Unitholders own, beneficially and of record, free and clear of any Lien the entire membership interest of Seller.

{M1108931.1 } - 19 -

3.2. Authority to Execute and Perform Agreements. Unitholders have the legal right, power and capacity to enter into, execute and deliver the Transaction Documents to which they are a signatory and to perform their individual obligations under the Transaction Documents to which they are a signatory. The Transaction Documents to which such Unitholders are a signatory have been duly executed and delivered and are the valid and binding obligation of such Unitholders enforceable in accordance with their terms, except as may be limited by bankruptcy, moratorium, reorganization, insolvency or other similar Laws now or hereafter in effect generally affecting the enforcement of creditors’ rights.

3.3. No Breach. The execution and delivery of the Transaction Documents to which such Unitholders are signatories, the consummation of the transactions contemplated hereby and thereby and the performance by such Unitholders of the Transaction Documents to which they are signatory in accordance with their respective terms and conditions will not (i) require the approval or consent of any Governmental Entity or the approval or consent of any other Person; (ii) conflict with or result in any breach or violation of any of the terms and conditions of, or constitute (or with notice or lapse of time or both would constitute) a default under, any Law applicable to such Unitholders, the organizational or governing documents of Seller, or any instrument or Contract to which such Unitholders are a party or by or to which such Unitholders are bound or subject.

3.4. Stock Consideration Representations. Unitholders represent that their present intention is to acquire the shares of Stock Consideration by way of assignment from Seller that may be issued in connection with this Agreement for his or its own account and that such Stock Consideration is being and will be acquired for the purpose of investment and not with a view to distribution or resale thereof. Unitholders represent that it has had an opportunity to ask questions of and receive answers from the authorized representatives of Purchaser and to review any relevant documents and records concerning the business of Purchaser and the terms and conditions of this investment and that any such questions have been answered to such equity holder’s satisfaction. Unitholders each acknowledge receipt of the most recent Annual Report on Form 10-K of Purchaser and the most recent proxy statement relating to the annual meeting of stockholders of Purchaser. Seller and each Unitholder acknowledge that it has been called to his or its attention that this investment involves a high degree of risk and that Purchaser has a limited operating history. Unitholders each acknowledge that they can bear the economic risks of its investment in the Stock Consideration and that they have such knowledge and experience in financial or business matters that they are capable of evaluating the merits and risks of this investment in the Stock Consideration and protecting its own interests in connection with this investment. Except as set forth on the Recipient Disclosure Schedule attached hereto, Unitholders hereby represent and warrant to Purchaser that each is an “accredited investor” as such term is defined under Section 501(a) of Regulation D promulgated under the Securities Act. Unitholders understand that the Stock Consideration to be issued in connection with the transactions contemplated hereby has not been and will not be registered under the Securities Act, that such shares must be held indefinitely unless a subsequent disposition thereof is permitted under the Securities Act or is exempt from such registration, and that Purchaser has no obligation to register or qualify the shares of Stock Consideration. Seller and each Unitholder further represent that he and it understands and agrees that unless and until transferred as herein provided, or transferred pursuant to the provisions of Rule

{M1108931.1 } - 20 -

144 of the Securities Act, all certificates issued in respect of or exchange for the Stock Consideration that may be issued hereunder shall bear a legend (and Purchaser will make a notation on its transfer books to such effect) prominently stamped or printed thereon reading substantially as follows:

THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THESE SECURITIES HAVE BEEN ACQUIRED FOR INVESTMENT AND NOT WITH A VIEW TO DISTRIBUTION OR RESALE ANDMAY NOT BE SOLD, MORTGAGED, PLEDGED, HYPOTHECATED, OR OTHERWISE TRANSFERRED WITHOUT AN EFFECTIVE REGISTRATION STATEMENT FOR SUCH SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND APPLICABLE STATE SECURITIES LAWS, OR WITHOUT AN OPINION OF COUNSEL IN THE FORM SATIFACTORY TO THE COMPANY IF AN EXEMPTION FROM REGISTRATION UNDER SUCH ACT IS AVAILABLE.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF PURCHASER

In order to induce Seller to enter into this Transaction, Purchaser represents and warrants to Seller that the statements made in this Article IV are true and correct as of the date hereof, except to the extent such representations and warranties are specifically made as of a particular date (in which case such representations and warranties will be true and correct as of such date).

4.1. Organization and Qualification. Purchaser is a corporation duly organized, validly existing and in corporate good standing in the State of Delaware and has the power and authority to carry on its business as presently conducted. Purchaser is duly qualified to do business and is in good standing in all jurisdictions in which its ownership of property or the character of its business requires such qualification, except where the failure to be so qualified will not have a Material Adverse Effect on Purchaser. Each subsidiary of Purchaser is a corporation duly organized, validly existing and in corporate good standing under the laws of its jurisdiction of incorporation.

4.2. Authority. This Agreement, and to the extent Purchaser is a party to the Transaction Documents, each of the Transaction Documents, has been duly authorized, executed and delivered by Purchaser and constitutes a legal, valid and binding obligation of Purchaser, enforceable against it in accordance with its terms except to the extent that such enforcement may be subject to applicable bankruptcy, reorganization, insolvency, fraudulent conveyance or other laws affecting creditors’ rights generally and to the application of general equitable principles. Purchaser has the right, power and authority to enter into this Agreement and to carry out the terms and provisions of this Agreement, and to enter into and carry out the terms of all agreements and instruments required to be delivered by Purchaser by the terms of this Agreement, without obtaining the consent of any third parties or authorities. This Agreement and the Transaction contemplated hereby have been unanimously approved by the Board of Directors of Purchaser and no additional

{M1108931.1 } - 21 -

corporate action or authorization is required by Purchaser in connection with the consummation of the Transaction contemplated by this Agreement.

4.3. No Conflicts. The execution, delivery and performance of this Agreement and the Transaction Documents, and the consummation of the Transaction contemplated hereby and thereby by Purchaser, and compliance with the provisions hereof, do not and will not: (a) violate, conflict with or result in a breach of any provision or constitute a default under (i) the Certificate of Incorporation or By-laws of Purchaser (the “Purchaser Charter Documents”), or (ii) any contract or agreement to which Purchaser is a party or to which the assets or business of Purchaser may be subject, except where such violation would not have a Material Adverse Effect on Purchaser; or (b) violate any judgment, ruling, order, writ, injunction, award, decree, statute, law, ordinance, code, rule or regulation of any court or foreign, federal, state, county or local government or any other governmental, regulatory or administrative agency or authority which is applicable to the assets, properties or business of Purchaser, except where such violation would not have a Material Adverse Effect on Purchaser.

4.4. Government Approvals. No Consent with any Governmental Entity is or will be required on the part of the Purchaser in connection with the execution, delivery and performance of this Agreement, the other Transaction Documents and any other agreements or instruments executed by Purchaser in connection herewith or therewith, the failure of which would have a Material Adverse Effect on Purchaser.

4.5. SEC Filings. Since July 1, 2016, Purchaser has filed all reports, registrations, prospectuses, schedules, forms, statements and other documents (including all exhibits to any of the foregoing), together with any required amendments thereto, that Purchaser is required to file with the Securities Exchange Commission (“SEC”), including forms 10-K, 10Q, 8-K and proxy statements (collectively, the “Purchaser SEC Reports”). The Purchaser SEC Reports (i) were prepared in compliance with the requirements of the Securities Act and (ii) did not, at the time they were filed, contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading.

ARTICLE V

ADDITIONAL AGREEMENTS

5.1. Employee Matters. Nothing contained herein will be considered as requiring Seller or Purchaser to continue the employment of any employee for any specified period, at any specified location or under any specified job category, except as specifically provided for in an offer letter or other agreement of employment. Except as otherwise set forth herein, it is specifically understood that continued employment with Seller or employment with Purchaser is not offered or implied for any employees of Seller.

{M1108931.1 } - 22 -

5.2. Additional Agreements. In case at any time after the Closing Date any further action is reasonably necessary or desirable to carry out the purposes of this Agreement or to vest Purchaser with full title to all properties, assets, rights, approvals, immunities and franchises of Seller, the parties will take all such necessary action.

5.3. Public Announcements. Purchaser and Seller may disclose the transaction to the extent reasonably required by law or stock market regulations and otherwise in a manner consistent with a press release disseminated by Purchaser on or shortly after the Closing Date. Neither Purchaser nor Seller will disseminate any other press release or other announcement concerning this Agreement or the Transaction contemplated herein to any third party (except to the managers, directors, officers and employees of the parties to this Agreement whose direct involvement is necessary for the consummation of the Transaction contemplated under this Agreement, or to the attorneys, advisors and accountants of the parties hereto) without the prior written agreement of Purchaser and Seller.

5.4. Confidentiality. Seller and Purchaser have previously entered into a Non-Disclosure Agreement dated as of February 16, 2017 (the “Confidentiality Agreement”) concerning each party’s obligations to protect the confidential information of the other party. Seller and Purchaser each hereby affirm each of their obligations under such Confidentiality Agreement.

5.5. Benefit Plans. As soon as administratively practicable after the Closing Date and to the extent allowable under the employee benefit plan, program or arrangement of Purchaser of general applicability (the “Purchaser Benefits Plans”), Purchaser shall take all reasonable action so that employees of Seller that become employees of Purchaser after the Closing Date shall be entitled to participate in an employee benefit plan for Connecticut based Purchaser employees, which applicable employee benefit plan will be similar to each applicable Purchaser Benefit Plan.

5.6. Restrictive Undertakings.

(a) Noncompetition Covenant. The restrictive covenants set forth in this Section 5.6 are a material inducement for Purchaser to enter into this Agreement. For good and valuable consideration provided pursuant to this Agreement, the receipt and sufficiency of which is hereby acknowledged, Seller, any Affiliates of Seller, and the Unitholders agree that, during the Restrictive Period (as hereinafter defined), they shall not, directly or indirectly, (i) engage in any activities either on their own behalf or that of any other business organization (whether as principal, partner, shareholder, member, officer, director, stockholder, agent, joint venturer, consultant, creditor, investor or otherwise) which involve any aspect of surface preparation and finishing for the manufacture of customized partial and total articular joint replacement implants and implant components in the United States (the “Competitive Services”), (ii) undertake planning for an organization or offering of Competitive Services, or (iii) combine or collaborate with other employees or representatives of Purchaser or any third party for the purpose of organizing, engaging in, or offering Competitive Services. Notwithstanding anything to the contrary contained herein, Purchaser acknowledges and agrees that actions taken by the officers or managers of the Seller following

{M1108931.1 } - 23 -

the consummation of the Transaction to perform their obligations in accordance with Section 5.9 hereof shall not violate the restrictive covenants set forth in this Section 5.6. Purchaser further acknowledges that Seller has disclosed that it will continue to manufacture and sell reconstructive implants and medical devices that may be marketed as patient specific implants but use traditional off the shelf components.