UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

Form 10-K

_______________________________________

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2013

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-32407

_______________________________________

ARC DOCUMENT SOLUTIONS, INC.

(Exact name of Registrant as specified in its Charter)

_______________________________________

Delaware | 20-1700361 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1981 N. Broadway, Suite 385

Walnut Creek, California 94596

(925) 949-5100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $0.001 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ý Non-accelerated filer ¨ Smaller reporting company ¨ (Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

Based on the closing price of $4.00 of the registrant’s Common Stock on the New York Stock Exchange on June 28, 2013 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the voting common equity held by non-affiliates of the registrant on that date was approximately $151,879,992.

As of February 26, 2014, there were 46,365,078 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for its 2014 Annual Meeting of Stockholders scheduled to be held on May 1, 2014 are incorporated by reference in this Annual Report on Form 10-K in response Items 10, 11, 12, 13 and 14 of Part III.

_______________________________________

ARC DOCUMENT SOLUTIONS, INC.

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2013

Table of Contents

Page

PART I | |

Item 1. Business | |

Item 1A. Risk Factors | |

Item 1B. Unresolved Staff Comments | |

Item 2. Properties | |

Item 3. Legal Proceedings | |

Item 4. Mine Safety Disclosures | |

PART II | |

Item 5. Market for Registrants's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Item 6. Selected Financial Data | |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. Quantitative and Qualitative Disclosures About Market Risk | |

Item 8. Financial Statements and Supplementary Data | |

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A. Controls and Procedures | |

Item 9B. Other Information | |

PART III | |

Item 10. Directors, Executive Officers and Corporate Governance | |

Item 11. Executive Compensation | |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. Certain Relationships and Related Transactions, and Director Independence | |

Item 14. Principal Accountant Fees and Services | |

PART IV | |

Item 15. Exhibits and Financial Statement Schedules | |

Signatures | |

Exhibit 10.45 | |

Exhibit 10.47 | |

Exhibit 10.48 | |

Exhibit 21.1 | |

Exhibit 23.1 | |

Exhibit 31.1 | |

Exhibit 31.2 | |

Exhibit 32.1 | |

Exhibit 32.2 | |

Exhibit 101 INS | |

Exhibit 101 SCH | |

Exhibit 101 CAL | |

Exhibit 101 LAB | |

Exhibit 101 PRE | |

3

ARC DOCUMENT SOLUTIONS, INC.

2013 ANNUAL REPORT ON FORM 10-K

In this Annual Report on Form 10-K, “ARC Document Solutions,” “ARC,” “the Company,” “we,” “us,” and “our” refer to ARC Document Solutions, Inc., a Delaware corporation, and its consolidated subsidiaries, unless the context otherwise dictates.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this Annual Report on Form 10-K, the words “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “project,” “target,” “likely,” “will,” “would,” “could,” and variations of such words and similar expressions as they relate to our management or to the Company are intended to identify forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those contemplated herein. We have described in Part I, Item 1A-“Risk Factors” a number of factors that could cause our actual results to differ from our projections or estimates. These factors and other risk factors described in this report are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results. Consequently, there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us. Given these uncertainties, you are cautioned not to place undue reliance on such forward-looking statements.

Except where otherwise indicated, the statements made in this Annual Report on Form 10-K are made as of the date we filed this report with the Securities and Exchange Commission and should not be relied upon as of any subsequent date. All future written and verbal forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We undertake no obligation, and specifically disclaim any obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You should, however, consult further disclosures we make in future filings of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and any amendments thereto, as well as our proxy statements.

TRADEMARKS AND TRADE NAMES

We own or have rights to a number of trademarks, service marks, and trade names that we use in conjunction with the operation of our business, including the name and design mark “ARC American Reprographics Company®,” “PlanWell®,” “PlanWell PDS®,” “Riot Creative Imaging®,” and various design marks associated therewith. We have a service mark application pending for “ARC Document Solutions” with the United States Patent and Trademark Office (USPTO). In addition, we own or have rights to various trademarks, service marks, and trade names that we use regionally in conjunction with our operations. This report also includes trademarks, service marks and trade names of other companies.

4

PART I

Item 1. Business

Our Company

ARC Document Solutions, Inc. (“ARC Document Solutions,” “ARC,” “we,” “us,” or “our”), a Delaware corporation, is a leading document solutions provider to businesses of all types, with an emphasis on the non-residential segment of the architecture, engineering and construction (“AEC”) industry. We help our customers reduce their costs and improve efficiency in the use of their documents, improve their access and control over documents, and offer a wide variety of ways to print, produce, distribute, collaborate on, and store documents.

Our offerings include:

Managed Print Services (“MPS”) – An onsite service where we install a complete document solution platform in our customers’ offices on an outsourced basis. We use our proprietary software, Abacus, to capture, control, manage, print, account for and store documents. We also supply, maintain, and manage entire office printing networks, including printing equipment. We bill for this service on a per-use basis and issue a single consolidated invoice.

Facilities Management (“FM”) – An onsite service where we install large-format print devices and other related equipment in our customers’ offices on an outsourced basis, primarily for construction-related project printing. We provide customers with complete cost recovery programs enabled by our proprietary software, Abacus, which allows our customers to capture and pass through their project expenses related to print. We bill for this service on a per-use basis and issue a single consolidated invoice.

Offsite Services – We operate 175 offsite service centers in major metropolitan markets in the U.S. and abroad which offer our MPS and FM customers flexibility and overflow capacity during peak workloads, as well as local support and maintenance staff. Our service centers also provide local AEC customers with high-volume, project-related printing of construction documents, and increasingly support and enhance our customers’ scanning needs in archive and information management (“AIM”) services.

Archive and Information Management (“AIM”) –We enable our customers to store information and intellectual property in a cloud-based and searchable digital archive. We do this by scanning existing paper documents or importing digital documents, organizing them, and storing them in our proprietary content management software. We also offer the ability to add documents to the digital archive as they are printed.

Specialized Color Printing – We operate a nationwide network of production centers focused on color printing, finishing, and assembly of graphic materials for regional and national retailers, franchises, marketing departments, theme parks, and cultural institutions.

Software and Web-Based Document Management Applications – We develop and offer proprietary tools to our customers that facilitate project collaboration, manage print networks, track equipment fleets, create and maintain project document archives, and other document and content management tasks.

Digital Shipping / Managed File Transfer – We enable our customers to “distribute-then-print” documents rather than printing locally and then shipping physical documents to their final destination. Using our cloud-based software, ishipdocs, we save our customers time, money, and support their “green” business practices by digitally transmitting document files closest to their delivery point, and then printing and delivering locally from an ARC service center or from one of our partner locations around the world.

Equipment and Supplies Sales – We sell equipment and supplies primarily to customers in the AEC industry and provide ancillary services such as service, and maintenance.

The combination of our services allows us to provide a comprehensive document management ecosystem where any document, anywhere in the enterprise, can be captured, stored, managed, accessed, and distributed anywhere in the world.

Our online services are administered via a powerful cloud solution hosted by Amazon which provides best-in-class speed, reliability, scalability and security. We have also made significant progress in expanding the capabilities of our cloud-based services for mobile platforms.

We believe we are the largest document solutions provider to the AEC market in North America, and the only national provider offering onsite, offsite and cloud-based document management solutions for regional, national and global customers. We offer comprehensive services across geographical boundaries and frequently bill under a single monthly invoice, consolidating purchasing, vendor relations, and administration for companies seeking a unified document management platform.

5

We serve our clients onsite in their offices in approximately 7,700 locations, and offsite or virtually via a combination of 175 service centers globally, a variety of web-based applications and software, and a global network of service partners. We operate in major metropolitan markets across the U.S., with significant operations in China, Canada, and the United Kingdom.

As our origins lie in the reprographics industry and we still maintain robust reprographics operations, we also believe that we remain the largest reprographics company in the United States as measured by revenue, number of customers, and number of service centers.

Our base of more than 90,000 customers includes most of the largest AEC firms in North America, and many of the top design and construction companies in the world. Our legacy as the largest reprographics company in the U.S. has allowed us to leverage our relationships, domain expertise, and national presence as we have evolved into a technology-enabled document solutions company.

Our largest customers are served by a corporate sales force called Global Solutions. This sales force is focused on large regional and national customers. Our diverse customer base results in no individual customer accounting for more than 4% of our overall revenue.

ARC was organized as a limited liability company under the name American Reprographics Holdings L.L.C. (“Holdings”) in 1997. In 2005, we reorganized as a Delaware corporation in connection with our initial public offering. While our service centers historically marketed their offerings under local brand names, we consolidated our operations under a single brand, “ARC,” in 2011 in order to highlight the scope and scale of our business, and to generate synergies in our overall national marketing efforts to the consolidating AEC market. At the end of 2012 we formally changed our corporate name to “ARC Document Solutions, Inc.,” leaving our New York Stock Exchange ticker symbol “ARC” unchanged. We conduct our operations through our wholly-owned subsidiary, American Reprographics Company, L.L.C., a California limited liability company, and its subsidiaries.

Principal Products and Services

We report revenues from our service and product offerings under the following categories:

Onsite Services consists of MPS and FM service offerings.

Digital Services consists of digital document management services of all kinds, including AIM, “digital shipping” and managed file transfer, software licensing, and technology consulting services.

Color Services consists of specialized digital color printing and finishing services for our non-AEC and traditional AEC customer base. This includes services provided under our Riot Creative Imaging brand.

Traditional Reprographics consists of the management, distribution and print-on-demand of black and white construction drawings (frequently referred to as “blueprints”) and specification books, with the majority of revenue reported from the sale of large- and small-format black and white printing. These services are provided "off customer site" at our service centers.

Equipment and Supplies consists of reselling printing, imaging, and related equipment, as well as supplies to customers primarily in the AEC industry.

Operations

Our products and services are available from any of our 175 service centers around the world, and nearly all of our services can be made available in our customers’ offices. Our geographic presence is concentrated in the U.S., with additional service centers in Canada, China, and the United Kingdom. Our corporate headquarters are located in Walnut Creek, California.

Historically, our business grew through acquisitions to expand our share of the reprographics market and enhance our geographic footprint to serve our larger customers. Since our inception we have acquired more than 140 companies. As we have consolidated, diversified our service offerings, and optimized our operations during the past several years, we have limited recent acquisition activity in order to focus instead on organic sales growth. Our origin as a company was in California, and our early acquisition activity was concentrated there. Thus we still derive 31% of our total revenue from California.

We operate a technology center in Silicon Valley with approximately 20 employees who develop, maintain, and support our software. We operate a similar facility in Kolkata, India, with approximately 110 employees who support our research and development efforts. All of our production facilities are connected via a high-performance, dedicated, wide-area network, to facilitate data transmissions to and from our customers and our operating facilities. We employ a combination of proprietary and industry-leading technologies to provide redundancy, backup and security of all data in our system.

6

Historically, the majority of our revenue has been derived from the customers engaged in seasonal, non-residential construction market. While our Traditional Reprographics business is still influenced by the non-residential seasonality and building cycles, our other offerings are less so. Onsite Services are driven by the generation of office documents and our customers' desire to improve business processes and reduce print-related costs. Color Services are affected by retail marketing calendars, advertising campaigns, as well as the marketing needs of our architectural and real estate development clients. Our Digital Services are influenced primarily by the desire for document workflow improvements and our ability to market our technology-based solutions. Equipment and Supplies Sales are driven by purchasing cycles of individual customers, as well as by new features and advancements by manufacturers.

As of December 31, 2013, the company employed approximately 2,600 employees.

Our Customers and Markets

We serve both the enterprise and project content management needs of companies primarily within the AEC industry. Our customers include senior management teams, IT and procurement departments, project architects, engineers, general contractors, and others.

The mix of services demanded by the AEC industry continues to shift toward document management for a wide variety of document types provided at customer locations (represented primarily by our Onsite Services revenue line), and away from its historical emphasis on printing of large-format black and white construction drawings in our service centers (represented primarily by our Traditional Reprographics revenue line). We believe the market forces of the recent recession and its aftermath are causing our customers in the construction industry to emphasize efficiency in their production and distribution of printed documents, to reduce their dependence on print as it relates to construction projects, and to improve access and control over all the documents related to their business. We also believe that consolidation in the AEC industry is contributing to this trend as companies seek to reduce costs, eliminate redundant business practices, and procure products and services from vendors who can centrally serve their business with a comprehensive offering.

We believe that these trends are advantageous to us for four reasons: first, we are well-positioned to provide our customers with software, web applications, and cloud-based offerings to meet their demand for technology-enabled content management services; second, our diversification into services such as MPS allow us to capture long-term contracted revenue streams that are less exposed to the volatility and cyclicality of project-related printing; third, as our customers merge, consolidate, and grow larger, we believe ARC becomes a more compelling choice because of our extensive geographic reach and ability to act as a single-source supplier of document solutions; and fourth, our market-leading presence as a traditional reprographer in major metropolitan areas allows us to capture large-format printing and document management work associated with local building projects.

In addition to the AEC industry, we also provide document management and printing services to the retail, technology, entertainment, and healthcare industries, among others. A significant portion of our non-AEC revenues are derived from supplying Color Services to customers with short-run, high quality, frequently updated promotional, advertising and marketing materials. We began to market these services in 2010 under a separate brand known as Riot Creative Imaging. Likewise, our Digital Services appeal to companies outside of the construction industry, but with similar document management needs, including manufacturers, airlines, and healthcare/hospital companies.

In general, we address customers based on size and geographic reach. Local markets tend to be highly fragmented with a wide variety of specialized, geographically differentiated business practices. We serve smaller customers in these markets with service offerings aligned with local market expectations. Larger regional, national and international customers often consolidate purchasing and the acquisition of services through a single corporate department, and seek centralized management of document solutions. We serve these customers with a corporate sales force called Global Solutions.

Competition

The level of competition varies in each of the areas in which we provide services. Further, we believe we are unique; that no other company provides the complete portfolio of services and products we provide. We compete with different firms in our different business lines who can provide a portion of our services. However, we do not know of any other firm that can provide a full suite of physical and digital content management services similar to our offering. We believe service levels, breadth of offering, terms and conditions, price, quality, responsiveness, and convenience to the customer are competitive elements in each of the industry segments in which we compete.

In addressing larger local and regional customers, there are several companies that provide onsite and reprographic print services but in general, these companies cannot provide or integrate software or technology that enables the digital management of documents and centralized cost control management that we provide. More specifically, in our local onsite business line, we often compete against print equipment resellers. These resellers are limited to enabling customers’ print needs by selling or leasing

7

print equipment to the customer and the customer thereby incurs a fixed cost. In comparison, our customers pay per use and take advantage of our print recovery and document management softwares, Abacus and PlanWell. In our Traditional Reprographics and Color Services businesses, local copy shops and self-serve franchises are often aggressive competitors for printing business, but rarely offer the breadth of document management and logistics services we do.

With regard to large national and international customers, there are no other document solutions companies in the U.S. with the national presence and global reach that we have established, but we often compete against equipment manufacturers and business suppliers who offer some of the same products and services we do. Related services are offered by large printing/multifunctional device manufacturers such as Xerox, Canon, Konica Minolta, Ricoh, and Sharp, but most offerings from these companies are focused on selling equipment as opposed to ARC’s offering of comprehensive document management services for both project and enterprise documents. Further, our deep knowledge of the AEC industry document workflows, which is incorporated into our software, provides us an advantage against local printers and national equipment manufacturers.

In our Traditional Reprographics and Color Services businesses, local copy shops and self-serve franchises are often aggressive competitors for printing business, but rarely offer the breadth of document management and logistics services we do. In addressing larger local and regional customers, there are several companies that provide reprographic and onsite print services but in general, these companies cannot provide or integrate software or technology that enables the digital management of documents and centralized cost control management that we provide. With regard to large national and international customers, there are no other document solutions companies in the U.S. with the national presence and global reach that we have established, but we often compete against equipment manufacturers and business suppliers who offer some of the same products and services we do. Related services are offered by large printing/multifunctional device manufacturers such as Océ, Xerox, Canon, Konica Minolta, Ricoh and Sharp, but most offerings from these companies are focused on selling equipment as opposed to ARC's offering of comprehensive document management services.

We believe that we have a strong competitive position in the marketplace for the following reasons:

Strong domain expertise: No other national vendor/service provider possesses the document management and technology expertise that we have in the AEC market. Construction professionals have highly specialized needs in document capture, short-term storage, management, fulfillment, distribution, and archival services. We believe our domain expertise is unmatched thanks to our legacy in reprographics and software development.

Customer relationships in AEC industry: Our relationships with our local customers frequently span generations, and we do business with nearly all of the top 100 AEC companies in the U.S. In addition, our Global Solutions sales force has established long-term contract relationships with 19 of the largest 50 AEC firms. We believe this provides a competitive advantage by leveraging our success through referrals.

Service center footprint: We possess an extensive national network of service centers creating an extraordinary distribution and customer service system that can cater to both large and small customers. We operate service centers in more than 140 cities in the U.S., and in 37 states. We also have a significant market presence in Canada and China, and growing operations in India and the U.K. We are not aware of any other provider of MPS that has as extensive a network to supplement their onsite services and provide overflow and remote document management and printing capabilities.

Equipment agnostic: We are not required to sell or use any particular brands of equipment, nor do we manufacture equipment. We are free to place the products best suited for the required task in our own service centers or in our customers’ offices, regardless of manufacturer. This, combined with the competitive market for printing and imaging products, provides us with an advantage relative to onsite service providers owned by equipment manufacturers.

Capabilities in a wide variety of formats: Several equipment manufacturers who also market managed print services do not produce the full range of large- and small-format equipment demanded by the AEC, manufacturing, and building industries. In addition, we are not aware of any manufacturers that provide the breadth of services and technology related to large- and small-format document production that we possess.

Unique combination Onsite, Offsite, and Cloud-based offerings: We are the only national company that integrates (1) document production on customer sites (Onsite), (2) document production at company service centers (Offsite), and (3) digital management of documents in the cloud. We have proprietary technology built by our own development team that interacts with our production machines. We believe we are the only company that both develops document management software and manages the equipment that produces documents.

Suppliers and Vendors

We purchase or lease equipment for use in our production facilities and at our customers’ sites. We also purchase paper, toner and other consumables for the operation of our and our customers’ production equipment. As a high-volume purchaser, we believe we receive favorable prices as compared to other service providers, and price increases have been historically passed on to customers.

8

Our primary vendors of equipment, maintenance services, and reprographics supplies include Canon Solutions America (Océ), Azerty, and Xpedx, a division of International Paper Company. Purchases from these vendors during 2013 comprised approximately 36% of our total purchases of inventory and supplies. Although there are a limited number of suppliers that could supply our inventory, we believe any shortfalls from existing suppliers would be absorbed from other suppliers on comparable terms.

Research and Development

We conduct research and development to support our document management services, enhance our existing software and web-based applications, and create new proprietary technology products. In total, research and development costs amounted to $5.5 million, $5.4 million, and $4.9 million during the fiscal years ended December 31, 2013, 2012, and 2011, respectively.

Proprietary Rights

We rely on a combination of copyright, trademark and trade secret laws, license agreements, nondisclosure and non-competition agreements, reseller agreements, customer contracts, and technical measures to establish and protect our rights in our proprietary technology. We also rely on a variety of technologies that are licensed from third parties to perform key functions.

We have a service mark application, pending registration, for “ARC Document Solutions” with the United States Patent and Trademark Office (USPTO), and we have registered our historical name and logo, “ARC American Reprographics Company,” as a service mark in the U.S. We have registered “PlanWell,” “PlanWell PDS” and "Riot Creative Imaging" as trademarks with the USPTO and in other countries. We do not own any other registered trademarks or service marks, or any patents, that are material to our business.

For a discussion of the risks associated with our proprietary rights, see Item 1A — “Risk Factors — Our failure to adequately protect the proprietary aspects of our technology, including PlanWell and Abacus, may cause us to lose market share.”

Executive Officers of the Registrant

The following sets forth certain information regarding all of our executive officers as of March 3, 2014:

Name | Age | Position | ||

Kumarakulasingam Suriyakumar | 60 | Chairman, President and Chief Executive Officer Director | ||

John E.D. Toth | 44 | Chief Financial Officer, Secretary | ||

Rahul K. Roy | 54 | Chief Technology Officer | ||

Dilantha Wijesuriya | 52 | Chief Operating Officer | ||

Jorge Avalos | 38 | Chief Accounting Officer, Vice President Finance | ||

Kumarakulasingam (“Suri”) Suriyakumar has served as our President and Chief Executive Officer since June 1, 2007, and he served as the Company’s President and Chief Operating Officer from 1991 until his appointment as Chief Executive Officer. On July 24, 2008, Mr. Suriyakumar was appointed Chairman of our Board of Directors. Mr. Suriyakumar served as an advisor of Holdings from March 1998 until his appointment as a director of the Company in October 2004. Mr. Suriyakumar joined Micro Device, Inc. (our predecessor company) in 1989. He became the Vice President of Micro Device, Inc. in 1990. Prior to joining the Company, Mr. Suriyakumar was employed with Aitken Spence & Co. LTD, a highly diversified conglomerate and one of the five largest corporations in Sri Lanka.

John E.D. Toth was appointed Chief Financial Officer and Secretary in July 2011. Prior to his joining the Company, Mr. Toth was Chief Financial Officer of Bell-Carter Foods, Inc., a $200 million privately-held company operating in the food manufacturing industry. From 2006 to 2008, Mr. Toth served as Chief Financial Officer of Fresh Express, Inc., a subsidiary of Chiquita Brands International, Inc. Mr. Toth began his career in investment banking where he was an analyst with Goldman, Sachs & Co. and later joined J.P. Morgan’s investment banking division. From 2001 until 2006, Mr. Toth was a Managing Partner of Tennyson West, LLC, a boutique mergers and acquisitions advisory firm. Mr. Toth received a Master’s Degree in Economics, and Bachelor’s degree in Economics and Political Science, both from Stanford University.

Rahul K. Roy joined Holdings as its Chief Technology Officer in September 2000. Prior to joining the Company, Mr. Roy was the founder, President and Chief Executive Officer of MirrorPlus Technologies, Inc., which developed software for the reprographics industry, from August 1993 until it was acquired by the Company in 1999. Mr. Roy also served as the Chief Operating Officer of InPrint, a provider of printing, software, duplication, packaging, assembly and distribution services to technology companies, from 1993 until it was acquired by the Company in 1999.

9

Dilantha ("Dilo") Wijesuriya joined Ford Graphics, a division of the Company, in January 1991. He subsequently became president of that division in 2001, and became a Company regional operations head in 2004, which position he retained until his appointment as the Company’s Senior Vice President, National Operations in August 2008. Mr. Wijesuriya was appointed Chief Operating Officer of the Company on February 25, 2011. Prior to his employment with the Company, Mr. Wijesuriya was a divisional manager with Aitken Spence & Co. LTD, a highly diversified conglomerate and one of the five largest corporations in Sri Lanka.

Jorge Avalos was appointed Chief Accounting Officer/Vice President Finance of the Company on April 14, 2011. Mr. Avalos joined the Company in June 2006 as the Company’s Director of Finance, and became the Company’s Corporate Controller in December 2006, and Vice President, Corporate Controller in December 2010. From March 2005 through June 2006, Mr. Avalos was employed with Vendare Media Group, an online network and social media company, as its controller. From September 1998 through March 2005, Mr. Avalos was employed with PricewaterhouseCoopers LLP, a global professional services firm focusing on audit and assurance, tax and advisory services, and left as an audit and assurance manager.

Available Information

ARC Document Solutions, Inc. uses its corporate website, www.e-arc.com, as a channel for routine distribution of important information, including news releases, analyst presentations and financial information. The company files with or furnishes to the SEC Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports, as well as proxy statements and annual reports to shareholders, and, from time to time, other documents. The reports and other documents filed with or furnished to the SEC are available to investors on or through our corporate website free of charge as soon as reasonably practicable after we electronically file them with or furnish them to the SEC. In addition, the public may read and copy any of the materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site located at http://www.sec.gov that contains reports, proxy and information statements and other information regarding issuers, such as ARC, that file electronically with the SEC. ARC’s SEC filings and other documents pertaining to the conduct of its business can be found on the “Investors” page of its website. These documents are available in print to any shareholder who requests a copy by writing or by calling ARC Document Solutions as set forth on the “Info Request” link on the main “Investor” web page.

Item 1A. Risk Factors

Our business faces significant risks. The following risk factors could adversely affect our results of operations and financial condition and the price of our common stock. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also impair or adversely affect our results of operations and financial condition.

We are highly dependent on the architectural, engineering and construction (AEC) industry and any decline in that industry could adversely affect our future revenue and profitability.

We estimate that customers in the AEC industry accounted for approximately 76% of our net sales for the year ended December 31, 2013, therefore our results largely depend on the strength of that industry. Our historical operating results reflect the cyclical and variable nature of the AEC industry. We believe that the industry generally experiences downturns several months after a downturn in the general economy, and that there may be a similar delay in the recovery of the AEC industry following a recovery of the general economy. A downturn in the AEC industry would diminish demand for some of our products and services, and would therefore negatively affect our revenues and have a material adverse effect on our business, operating results and financial condition.

Adverse domestic and global economic conditions and disruption of financial and commercial real estate markets could have a material adverse effect on our business and results of operations.

During the past several years, domestic and international financial markets have experienced significant disruption, including, among other things, extreme volatility and severely diminished liquidity and credit availability. These developments and the related severe domestic and international economic downturn, have continued to adversely affect our business and financial condition in a number of ways, including effects beyond those that were experienced in recent previous recessions. A prolonged economic downturn may adversely affect the ability of our customers and suppliers to obtain financing and to perform their obligations under agreements with us. These restrictions could result in a decrease in, or cancellation of, existing business, could limit new business, and could negatively affect our ability to collect on our accounts receivable on a timely basis, if at all. These events may, in the aggregate, have a material adverse effect on our results of operations and financial condition.

10

Because a significant portion of our overall costs are fixed, our earnings are highly sensitive to changes in revenue.

Our network of service centers, equipment and related support activities involves substantial fixed costs which cannot be adjusted quickly to respond to declines in demand for our services. We estimate approximately 36% of our overall costs were fixed for the year ended December 31, 2013. As a consequence, our results of operations are subject to relatively high levels of volatility and our earnings could deteriorate rapidly in the face of declining revenues because our ability to reduce fixed costs in the short-term is limited. If we fail to manage our fixed costs appropriately, or to maintain adequate cash reserves to cover such costs, we may suffer material adverse effects on our results of operations and financial condition.

Impairment of goodwill may adversely affect future results of operations.

We have intangible assets, including goodwill and other identifiable acquired intangibles on our balance sheet due to prior acquisitions. At September 30, 2013, we assessed goodwill for impairment and determined that goodwill was not impaired.

The results of our impairment analysis are as of a particular point in time. If our assumptions regarding future forecasted revenue or profitability of our operating segments (or “reporting units”) are not achieved, we may be required to record additional goodwill impairment charges in future periods, if any such change constitutes a triggering event prior to the quarter in which we perform our annual goodwill impairment test.

The reduction in our number of service center locations and employee headcount could adversely affect our future revenue and profitability.

During the fourth quarter of 2012, management initiated a restructuring plan which culminated in the closure or downsizing of 56 of our service centers and a reduction in our workforce of approximately 300 employees through December 2013. The reduction or downsizing of our service centers and headcount may lead to a reduction in revenue and profitability due to the loss of customers serviced through the closed locations.

Competition in our industry and innovation by our competitors may hinder our ability to execute our business strategy and adversely affect our profitability.

The markets for our products and services are highly competitive, with competition primarily at local and regional levels. We compete primarily based on the level and quality of customer service, technological leadership, and price. Our future success depends, in part, on our ability to continue to improve our service and product offerings, and develop and integrate new technology solutions. In addition, current and prospective customers may decide to perform certain services themselves instead of outsourcing these services to us. These competitive pressures could adversely affect our sales and consolidated results of operations.

We also face the possibility that competition will continue to increase, particularly if copy and printing or business services companies choose to compete in lines of business similar to ours. Many of these companies are substantially larger and have significantly greater financial resources than us, which could place us at a competitive disadvantage. In addition, we could encounter competition in the future from large, well-capitalized companies such as equipment dealers and system integrators that can produce their own technology and leverage their existing distribution channels. Any such future competition could adversely affect our business and reduce our future revenue and profitability.

If we are unable to charge for our value-added services to offset declines in print volumes, our long-term revenue could decline.

Our customers value the ability to view and order prints over the internet and print to output devices in their own offices and other locations throughout the country and the world. In 2013, our Traditional Reprographics sales represented approximately 29% of our total net sales, and our Onsite Services represented approximately 30% of our total net sales. Both categories of revenue are generally derived from a charge per square foot of printed material. Future technology advances may further facilitate and improve our customers’ ability to reduce print and the associated costs thereof. As technology continues to improve, this trend toward printing on an “as needed” basis could result in further decreased printing volumes and sales decline in the longer term. Failure to offset these declines in printing volumes by changing how we charge for our services and develop additional revenue sources could significantly affect our business and reduce our long term revenue, resulting in an adverse effect on our results of operations and financial condition.

We derive a significant percentage of net sales from within the State of California and our business could be disproportionately harmed by an economic downturn or natural disaster affecting California.

We derived approximately 31% of our net sales in 2013 from our operations in California. As a result, we are dependent to a large extent upon the AEC industry in California and, accordingly, are sensitive to economic factors affecting AEC activity in

11

California, including general and local economic conditions, macroeconomic trends, political factors affecting commercial and residential real estate development and natural disasters (including drought, earthquakes and wildfires). Any adverse developments affecting California could have a disproportionately negative effect on our results of operations and financial condition.

Our growth strategy depends, in part, on our ability to successfully market and execute several different, but related, service offerings. Failure to do so could impede our future growth and adversely affect our competitive position.

As part of our growth strategy, we intend to continue to offer and grow a variety of service offerings that are relatively new to the company. Our efforts will be affected by our ability to acquire new customers for our new service offerings as well as sell the new service offerings to existing customers. If we fail to procure new customers, our growth may be adversely affected and we may incur operating losses as a result of a failure to realize revenue from investments made in new service offerings.

The transition to more centralized management may negatively impact our ability to successfully monitor and manage our operations, and therefore our business and profitability could suffer.

Historically, we delegated the responsibility for marketing, pricing, and selling practices to local and operational managers. Over the past three years we have begun the process of centralizing many marketing, selling and pricing practices that we traditionally delegated to local and operational mangers. The transition to more centralized management presents organizational and management challenges that may result in lost market opportunities, additional costs, failure to achieve desired synergies and a loss of focus in business planning, all of which could harm our business and profitability.

We are dependent upon our vendors to continue to supply us equipment, parts, supplies, and services at comparable terms and price levels as the business grows.

Our access to equipment, parts, supplies, and services depends upon our relationships with, and our ability to purchase these items on competitive terms from our principal vendors. These vendors are not required to use us to distribute their equipment and are generally free to change the prices and other terms at which they sell to us. In addition, we compete with the selling efforts of some of these vendors. Significant deterioration in relationships with, or in the financial condition of, these significant vendors could have an adverse effect on our ability to sell equipment as well as our ability to provide effective service and technical support. If one of these vendors terminates or significantly curtails its relationship with us, or if one of these vendors ceases operations, we would be forced to expand our relationships with our other existing vendors or seek out new relationships with previously unused vendors.

Our failure to adequately protect the proprietary aspects of our technology, including PlanWell and Abacus, may cause us to lose market share.

Our success depends on our ability to protect and preserve the proprietary aspects of our technology products. We rely on a combination of copyright, trademark and trade secret protection, confidentiality agreements, license agreements, non-competition agreements, reseller agreements, customer contracts, and technical measures to establish and protect our rights in our proprietary technologies. These protections, however, may not be adequate to remedy harm we suffer due to misappropriation of our proprietary rights by third parties. Furthermore, we may, from time to time, be subject to intellectual property litigation which can be expensive, a burden on management’s time and our Company’s resources, and the outcome of any such litigation may be uncertain.

In performing our document management services, we handle customers’ confidential information. Our failure to protect our customers’ confidential information against security breaches could damage our reputation, harm our business and adversely affect our results of operations.

Our document management services involve the handling of our customers’ confidential information. Any compromise of security, accidental loss or theft of customer data in our possession could damage our reputation and expose us to risk of liability, which could harm our business and adversely affect our consolidated results of operation.

Added risks are associated with our international operations.

We have international operations in China, India, the United Kingdom and Canada. Approximately 13% of our revenues for fiscal 2013 were derived from our international operations, with approximately 8% derived from China. Our future revenues, costs of operations and net income could be adversely affected by a number of factors related to our international operations, including changes in economic conditions from country to country, currency fluctuations, changes in a country’s political condition, trade protection measures, licensing and other legal requirements and local tax issues.

A large percentage of our cash and cash equivalents are held outside of the United States, and we could be subject to repatriation delays and costs which could reduce our financial flexibility.

12

A large percentage of our cash and cash equivalents is currently held outside the U.S., while many of our liabilities are payable in the U.S. Repatriation of some of the funds could be subject to delay for local country approvals and could have potential adverse tax consequences. As a result of having a lower amount of the cash and cash equivalents in the U.S., our financial flexibility may be reduced.

Our business could suffer if we fail to attract, retain, and successfully integrate skilled personnel.

We believe that our ability to attract, retain, and successfully integrate qualified personnel is critical to our success. As we continue to place more emphasis on document management and storage technology, our need to hire and retain software and other technology focused personnel has and can be expected to continue to increase. Competition for such personnel, particularly in the San Francisco Bay Area, is intense. If we lose key personnel and/or are unable to recruit qualified personnel, our ability to manage and grow our business will be adversely affected. In addition, the loss of the services of one or more members of our senior management team would disrupt our business and impede our ability to successfully execute our business strategy.

Damage or disruption to our facilities, including our technology center, could impair our ability to effectively provide our services and may have a significant effect on our revenues, expenses and financial condition.

Our IT systems are an important part of our operations. We currently store most of our customer data at our technology center located in Silicon Valley near known earthquake fault zones. Although we have redundant systems and offsite backup procedures in place, interruption in service, damage to or destruction of our technology center or a disruption of our data storage processes resulting from sustained process abnormalities, human error, acts of terrorism, violence, war or a natural disaster, such as fire, earthquake or flood, could result in delays, in reduced levels of customer service and have a material adverse effect on the markets in which we operate and on our business operations.

Although we currently maintain general property damage insurance, if we incur losses from uninsured events, we could incur significant expenses which would adversely affect our results of operations and financial condition.

Downgrades in our credit rating may adversely affect our business, financial condition and results of operations.

Independent credit rating agencies are required to rate our credit worthiness in accordance with the terms of our Term Loan Credit Agreement. Credit market deterioration and its actual or perceived effects on our business, financial condition and results of operation, along with deterioration in general economic conditions, may increase the likelihood that major independent credit agencies will downgrade our credit rating. Any downgrade in our credit rating could increase our cost of borrowing, which would adversely affect our financial condition and results of operations, perhaps materially. Any downgrade in our credit rating may also cause a decline in the market price of our common stock.

Results of tax examinations may adversely affect our future results of operations.

We are subject to various tax examinations on an ongoing basis. Adverse results of tax examinations for income, payroll, value added, sales-based and other taxes may require future material tax payments if we are unable to sustain our position with the relevant jurisdiction. Where appropriate, we have made accruals for these matters which are reflected in our Consolidated Balance Sheets and Statements of Operations.

Our debt instruments impose certain restrictions on our ability to operate which in turn could negatively affect our ability to respond to business and market conditions and therefore could have adverse effect on our business and results of operations.

As of December 31, 2013, we had $219.7 million in outstanding short and long-term borrowings under term loans, lines of credit, and capital leases, excluding trade payables. The terms of the agreements under which this indebtedness was incurred may limit or restrict, among other things, our ability to incur certain additional additional debt, make certain restricted payments, consummate certain asset sales, and enter into certain transactions with affiliates.

We are also required to maintain specified financial ratios, including a leverage and interest coverage ratios, as outlined in our Term Loan Credit Agreement. If certain conditions are met under our 2012 Credit Agreement, we would also be required to maintain a minimum fixed charge coverage ratio. Our inability to meet these ratios could result in the acceleration of the repayment of the related debt, the termination of our revolving line of credit, the increase in our effective cost of funds or the cross-default of other credit arrangements. As a result, our ability to operate may be restricted and our ability to respond to business and market conditions may be limited, which could have an adverse effect on our business and operating results.

Item 1B. Unresolved Staff Comments

13

None.

Item 2. Properties

At the end of 2013, we operated 175 service centers, of which 153 were in the United States, 9 were in Canada, 9 were in China, 2 were in London, England and 2 in India. We also occupied a technology center in Silicon Valley, California, a software programming facility in Kolkata, India, as well as other facilities including our executive offices located in Walnut Creek, California.

In total the Company occupied approximately 1.2 million square feet as of December 31, 2013.

We lease nearly all of our service centers, each of our administrative facilities and our technology centers. The two facilities that we own are subject to liens under our credit agreements. In addition to the facilities that are owned, our fixed assets are comprised primarily of machinery and equipment, vehicles, and computer equipment. We believe that our facilities are adequate and appropriate for the purposes for which they are currently used in our operations and are well maintained.

Item 3. Legal Proceedings

On October 21, 2010, a former employee, individually and on behalf of a purported class consisting of all non-exempt employees who work or worked for American Reprographics Company, L.L.C. and American Reprographics Company in the State of California at any time from October 21, 2006 through the present, filed an action against the Company in the Superior Court of California for the County of Orange. The complaint alleges, among other things, that the Company violated the California Labor Code by failing to (i) provide meal and rest periods, or compensation in lieu thereof, (ii) timely pay wages due at termination, and (iii) that those practices also violate the California Business and Professions Code. The relief sought includes damages, restitution, penalties, interest, costs, and attorneys’ fees and such other relief as the court deems proper. On March 15, 2013, the Company participated in a private mediation session with claimants’ counsel which did not result in resolution of the claim. Subsequent to the mediation session, the mediator issued a proposal that was accepted by both parties. The proposed settlement is subject to approval by the Court. A continued hearing on the motion for preliminary approval of the settlement will be held on March 19, 2014. The Company recorded a liability of $0.9 million as of December 31, 2013 related to the claim, which represents management's best estimate of the probable outcome based on information available. The case remains unresolved as of December 31, 2013. As such, the ultimate resolution of the claim could result in a loss different than the estimated loss recorded.

In addition to the matter described above, the Company is involved in various additional legal proceedings and other legal matters from time to time in the normal course of business. The Company does not believe that the outcome of any of these matters will have a material effect on its consolidated financial position, results of operations or cash flows.

Item 4. Mine Safety Disclosures

Not applicable.

14

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock, par value $0.001, is listed on the New York Stock Exchange (“NYSE”) under the stock symbol “ARC”. The following table sets forth for the fiscal periods indicated the high and low sales prices per share of our common stock as reported by the NYSE.

2013 | 2012 | |||||||||||||||

High | Low | High | Low | |||||||||||||

First Quarter | $ | 3.03 | $ | 2.12 | $ | 6.99 | $ | 4.53 | ||||||||

Second Quarter | 4.25 | 2.76 | 6.08 | 4.63 | ||||||||||||

Third Quarter | 5.24 | 4.00 | 5.95 | 3.68 | ||||||||||||

Fourth Quarter | 9.35 | 4.58 | 4.38 | 2.19 | ||||||||||||

Performance Graph

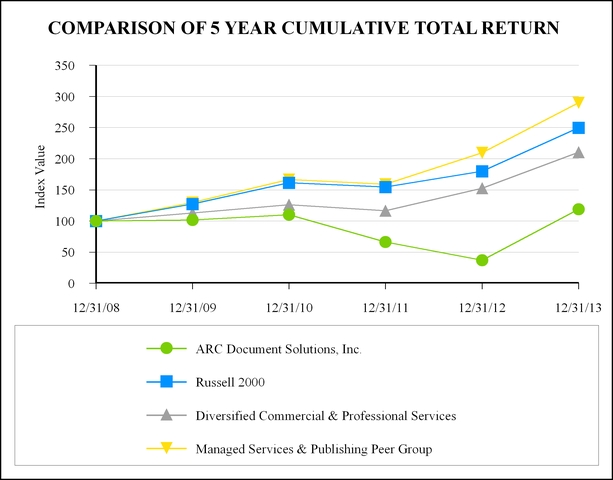

The following graph compares the cumulative 5-year total return to shareholders of ARC Document Solutions’ common stock relative to the cumulative total returns of (a) the Russell 2000 index, (b) a customized peer group of six commercial and professional services companies, and (c) an updated customized peer group of 15 companies identified as: (1) having a business-to-business focus, (2) offering outsourced/managed services, (3) having a digital or technology service that is significant to their customer offering, and (4) involved in print publishing.

In recognition of the transformation the Company has undergone in both its financial profile as well as its product and service offerings, the Company conducted an internal review to update its peer group. The updated peer group, Managed Services & Publishing Peer Group, will replace ARC's previous customized peer group, Diversified Commercial & Professional Services.

The following criteria were used to select ARC's updated peer group:

• | Annual revenues between $200.0 million and $1.0 billion |

• | 3-Year average 3-yr total return above the Commercial Services & Supplies GICS Industry 75th Percentile |

• | Business alignment as noted above |

The graph assumes that the value of the investment in the company’s common stock, in the peer group, and the index (including reinvestment of dividends) was $100 on December 31, 2008 and tracks it through December 31, 2013.

15

2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |||||||||||||

ARC Document Solutions, Inc. | 100.00 | 101.59 | 110.00 | 66.52 | 37.10 | 119.13 | ||||||||||||

Russell 2000 | 100.00 | 127.17 | 161.32 | 154.59 | 179.86 | 249.69 | ||||||||||||

Diversified Commercial & Professional Services | 100.00 | 113.10 | 126.15 | 116.43 | 152.53 | 210.61 | ||||||||||||

Managed Services & Publishing Peer Group | 100.00 | 129.61 | 166.57 | 158.94 | 209.63 | 289.89 | ||||||||||||

The stock price performance included in the graph above is not necessarily indicative of future stock price performance.

Holders

As of February 21, 2014, the approximate number of stockholders of record of our common stock was 128 and the closing price of our common stock was $7.53 per share as reported by the NYSE. Because many of the shares of our common stock are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of beneficial owners represented by these stockholders of record.

Dividends

We have never declared or paid cash dividends on our common stock. We currently intend to retain all available funds and any future earnings for use in the operation of our business and do not anticipate paying any cash dividends in the foreseeable future. Any future determination to declare cash dividends will be made at the discretion of our board of directors, subject to compliance with Delaware corporate law, certain covenants under our debt instruments which restrict or limit our ability to declare or pay dividends, and will depend on our financial condition, results of operations, capital requirements, general business conditions, and other factors that our board of directors may deem relevant.

16

Issuer Purchases of Equity Securities

Period | (a) Total Number of Shares Purchased(1) (in thousands) | (b) Average Price Paid per Share(1) | (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | (d) Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs | |||||||||

October 1, 2013—October 31, 2013 | 6 | $ | 6.23 | — | — | ||||||||

November 1, 2013—November 30, 2013 | — | — | — | — | |||||||||

December 1, 2013—December 31, 2013 | — | — | — | — | |||||||||

Total | 6 | $ | 6.23 | — | — | ||||||||

(1) | Our 2005 Stock Plan provides us with the right to deduct or withhold, or require employees to remit to us, an amount sufficient to satisfy any applicable tax withholding requirements applicable to stock-based compensation awards. To the extent permitted, employees may elect to satisfy all or part of such withholding requirements by having us withhold shares having a fair market value equal to the minimum statutory tax withholding rate that could be imposed on the transaction. All shares shown in this table were withheld during the fourth quarter of 2013 in connection with the settlement of vested restricted stock awards to satisfy tax withholding requirements. |

17

Item 6. Selected Financial Data

The selected historical financial data presented below is derived from the audited consolidated financial statements of ARC Document Solutions for the fiscal years ended December 31, 2013, 2012, 2011, 2010, and 2009. The selected historical financial data does not purport to represent what our financial position or results of operations might be for any future period or date. The financial data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements included elsewhere in this report.

Year Ended December 31, | ||||||||||||||||||||

2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

(In thousands) | ||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Service Sales | ||||||||||||||||||||

Traditional Reprographics | $ | 116,673 | $ | 126,785 | $ | 145,449 | $ | 173,364 | $ | 225,824 | ||||||||||

Color | 83,601 | 79,080 | 84,062 | 81,552 | 81,873 | |||||||||||||||

Digital | 33,534 | 35,578 | 38,020 | 39,639 | 42,794 | |||||||||||||||

Subtotal | 233,808 | 241,443 | 267,531 | 294,555 | 350,491 | |||||||||||||||

Onsite Services (1) | 121,550 | 108,817 | 100,682 | 89,994 | 97,401 | |||||||||||||||

Equipment and Supplies Sales | 51,837 | 55,858 | 54,519 | 57,090 | 53,657 | |||||||||||||||

Total net sales | 407,195 | 406,118 | 422,732 | 441,639 | 501,549 | |||||||||||||||

Cost of sales | 272,858 | 282,599 | 288,434 | 299,307 | 323,360 | |||||||||||||||

Gross profit | 134,337 | 123,519 | 134,298 | 142,332 | 178,189 | |||||||||||||||

Selling, general and administrative expenses | 96,800 | 93,073 | 101,315 | 107,744 | 115,020 | |||||||||||||||

Amortization of intangibles | 6,612 | 11,035 | 18,715 | 11,657 | 11,367 | |||||||||||||||

Goodwill impairment | — | 16,707 | 65,444 | 38,263 | 37,382 | |||||||||||||||

Impairment of long-lived assets | — | — | — | — | 781 | |||||||||||||||

Restructuring expense | 2,544 | 3,320 | — | — | — | |||||||||||||||

Income (loss) from operations | 28,381 | (616 | ) | (51,176 | ) | (15,332 | ) | 13,639 | ||||||||||||

Other income, net | (106 | ) | (100 | ) | (103 | ) | (156 | ) | (171 | ) | ||||||||||

Loss on early extinguishment of debt | 16,339 | — | — | 2,509 | — | |||||||||||||||

Interest expense, net | 23,737 | 28,165 | 31,104 | 24,091 | 25,781 | |||||||||||||||

Loss before income tax provision (benefit) | (11,589 | ) | (28,681 | ) | (82,177 | ) | (41,776 | ) | (11,971 | ) | ||||||||||

Income tax provision (benefit) | 2,986 | 2,784 | 50,931 | (14,186 | ) | 3,018 | ||||||||||||||

Net loss | (14,575 | ) | (31,465 | ) | (133,108 | ) | (27,590 | ) | (14,989 | ) | ||||||||||

(Income) loss attributable to noncontrolling interest | (748 | ) | (503 | ) | 21 | 88 | 104 | |||||||||||||

Net loss attributable to ARC Document Solutions | $ | (15,323 | ) | $ | (31,968 | ) | $ | (133,087 | ) | $ | (27,502 | ) | $ | (14,885 | ) | |||||

Fiscal Year Ended December 31, | ||||||||||||||||||||

2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

(In thousands, except per share amounts) | ||||||||||||||||||||

Loss per share attributable to ARC shareholders: | ||||||||||||||||||||

Basic | $ | (0.33 | ) | $ | (0.70 | ) | $ | (2.93 | ) | $ | (0.61 | ) | $ | (0.33 | ) | |||||

Diluted | $ | (0.33 | ) | $ | (0.70 | ) | $ | (2.93 | ) | $ | (0.61 | ) | $ | (0.33 | ) | |||||

Weighted average common shares outstanding: | ||||||||||||||||||||

Basic | 45,856 | 45,668 | 45,401 | 45,213 | 45,123 | |||||||||||||||

Diluted | 45,856 | 45,668 | 45,401 | 45,213 | 45,123 | |||||||||||||||

18

Fiscal Year Ended December 31, | ||||||||||||||||||||

2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

(In thousands) | ||||||||||||||||||||

Other Financial Data: | ||||||||||||||||||||

Depreciation and amortization | $ | 34,745 | $ | 39,522 | $ | 47,876 | $ | 45,649 | $ | 49,543 | ||||||||||

Capital expenditures | $ | 18,191 | $ | 20,348 | $ | 15,553 | $ | 8,634 | $ | 7,506 | ||||||||||

Interest expense, net | $ | 23,737 | $ | 28,165 | $ | 31,104 | $ | 24,091 | $ | 25,781 | ||||||||||

As of December 31, | ||||||||||||||||||||

2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

(In thousands) | ||||||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 27,362 | $ | 28,021 | $ | 25,437 | $ | 26,293 | $ | 29,377 | ||||||||||

Total assets | $ | 409,922 | $ | 415,839 | $ | 441,357 | $ | 569,085 | $ | 620,954 | ||||||||||

Long term obligations | $ | 233,058 | $ | 241,429 | $ | 240,900 | $ | 221,088 | $ | 228,711 | ||||||||||

Total ARC stockholders’ equity | $ | 91,690 | $ | 103,896 | $ | 130,677 | $ | 256,506 | $ | 276,007 | ||||||||||

Working capital | $ | 28,705 | $ | 40,650 | $ | 40,405 | $ | 22,387 | $ | (3,739 | ) | |||||||||

(1) | Represents services provided at our customers’ sites, which includes both Managed Print Services (MPS) and Facilities Management (FM). |

19

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the other sections of this Annual Report on Form 10-K, including Part 1, “Item 1 — Business”; Part I, “Item 1A — Risk Factors”; Part II, “Item 6 — Selected Financial Data”; and Part II, “Item 8 — Financial Statements and Supplementary Data.”

Business Summary

ARC Document Solutions, Inc. (“ARC Document Solutions,” “ARC,” “we,” “us,” or “our”) is a leading document solutions company serving businesses of all types, with an emphasis on the non-residential segment of the architecture, engineering and construction (“AEC”) industry.

We help our customers reduce their costs and improve productivity of their documents, improve their access and control over documents, and offer a wide variety of ways to print, produce, distribute, collaborate on, and store documents.

We have categorized our service and product offerings to report distinct sales recognized from our Onsite Services, Color Services, Digital Services, Traditional Reprographics Services, and Equipment and Supplies Sales.

Onsite Services consists of placement, management, and optimization of print and imaging equipment in our customer’s facilities, relieving them of the burden of owning and managing print devices and print networks, and shifting their costs to a “per-use” basis. Onsite Services sales are driven by the ongoing print needs of our customers, and are less exposed to the episodic large-format printing needs associated with construction projects. This category was renamed in 2013 from “Facilities Management,” but the service offerings reported in this category remain unchanged.

Color Services consists of specialized color printing and finishing services to marketing departments, regional and national retailers, and our traditional AEC customer base. This includes services provided under our Riot Creative Imaging brand.

Digital Services consists of digital document management services of all kinds, including archiving and information management (“AIM”), “digital shipping” and managed file transfer, software licensing, and technology consulting services.

Traditional Reprographics consists of the management, distribution, and print-on-demand of black and white construction drawings (frequently referred to as “blueprints”) and specification books. It derives a majority of its revenue from large-format black and white printing.

Equipment and Supplies consists of reselling printing, imaging, and related equipment to customers primarily in the AEC industry.

We are expanding our business beyond the services we have traditionally provided to the AEC industry and are currently focused on growing managed print services, technology-based document management services, and digital color imaging, as we believe the mix of services demanded by the AEC industry continues to shift toward document management at customer locations (represented primarily by our Onsite Services revenue line), and away from its historical emphasis on printing of large-format black and white construction drawings “offsite” in our service centers (represented primarily by our Traditional Reprographics revenue line). This belief is supported by the fact that our Onsite Services in 2013 are 30% of our total sales as compared to 29% for Traditional Reprographics. Onsite Services is now our largest service offering and continues to grow at a rate of more than 10% on a year-over-year basis. In comparison, our revenue mix in 2012 consisted of 31% of our sales coming from Traditional Reprographics, and 27% of our sales coming from Onsite Services.

We deliver our services through a nationwide network of service centers, regionally-based technical specialists, locally-based sales executives, and a national/regional sales force known as Global Solutions.

Acquisition activity during the last three years has been minimal and did not materially affect our overall business.

We believe we offer a distinct portfolio of services within the AEC industry that include our legacy reprographics business as well as our newer offerings in Onsite Services, Color Services, and Digital Services. Our customer base for these services, however, is still distinctly related to the AEC industry. Based on our analysis of our operating results, we estimate that sales to the AEC industry accounted for approximately 76% of our net sales for the year ended December 31, 2013, with the remaining 24% consisting of sales to non-AEC industries.

We identify operating segments based on the various business activities that earn revenue and incur expense. Since operating segments have similar products and services, classes of customers, production processes and economic characteristics, we are deemed to operate as a single reportable segment. See Note 2 “Summary of Significant Accounting Policies” for further information.

Costs and Expenses.

20

Our cost of sales consists primarily of materials (paper, toner and other consumables), labor, and “indirect costs” which consist primarily of expenses for service center ('offsite') facilities and equipment. Facilities and equipment expenses include maintenance, repairs, rents, insurance, and depreciation. Paper is the largest component of our material cost. However, paper pricing typically does not significantly affect our operating margins due, in part, to our efforts to pass increased costs on to our customers. We closely monitor material cost as a percentage of net sales to measure volume and waste. We also track labor utilization, or net sales per employee, to measure productivity and determine staffing levels.

We maintain low levels of inventory. Historically, our capital expenditure requirements have varied due to the cost and availability of capital lease lines of credit. During 2012 and through most of 2013, we were more frequently electing to purchase equipment for our facilities and onsite service installations rather than lease equipment due to the availability of cash to fund capital expenditures and the interest savings thereby. As we continue to foster our relationships with credit providers and obtain attractive lease rates, we may increasingly choose to lease rather than purchase equipment in the future.

Research and development costs consist mainly of the salaries, leased building space, and computer equipment that comprises our data storage and development centers in Fremont, California and Kolkata, India. Such costs are primarily recorded to cost of sales.

We believe customers are increasingly (1) adopting technology and digital document management practices, and (2) changing their workflow patterns and thereby their document and printing needs. While there were some indications that the non-residential construction market strengthened in 2012, we believe that there was a growing body of evidence by the third quarter of 2012 that demonstrated Traditional Reprographics sales would not likely recover at the same pace due to these factors. To ensure that the Company’s costs and resources were in line with demand for our current portfolio of services and products, management initiated a restructuring plan in October of 2012. The restructuring plan included the closure or downsizing of 33 of the Company’s service centers in 2012, which represented more than 10% of our total number of service center locations, and an additional 23 service centers in 2013. In addition, as part of the restructuring plan, we reduced headcount and middle management associated with our service center locations, streamlined the senior operational management team, and allocated more resources into growing sales categories such as Onsite Services and Digital Services. The reduction in headcount totaled approximately 300 full-time employees, which represented approximately 10% of our total workforce.

In the twelve months of 2013, our gross margins improved by 260 basis points compared to the same period in 2012, which we attribute primarily to our restructuring efforts initiated in October 2012. We believe our restructuring actions suggest continuing year-over-year margin expansion in future periods.

Non-GAAP Financial Measures.