JPMorgan Institutional Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21638

JPMorgan

Institutional Trust

(Exact name of registrant as specified in charter)

270 Park Avenue

New

York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park

Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 343-1113

Date of fiscal year end: Last day of February

Date of reporting period: March 1, 2015 through August 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders

of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this

information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments

concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection

of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Semi-Annual Report

JPMorgan Institutional Trust Funds

August 31, 2015 (Unaudited)

JPMorgan Core Bond Trust

JPMorgan Equity Index Trust

JPMorgan Intermediate Bond Trust

CONTENTS

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured

or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are

subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be,

and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

This report is intended for distribution only to accredited investors. Distribution of this document to anyone other than the intended user is expressly

prohibited. This document may not be copied, faxed or otherwise distributed to the general public.

CEO’S LETTER

September 25, 2015 (Unaudited)

Dear Shareholder,

After a weak start to 2015, the U.S. economy strengthened over the next several months and policy makers indicated a more normalized U.S. monetary policy may be in order, even as central bankers in Europe,

Japan and Asia unleashed unprecedented stimulus measures to bolster flagging growth. Over the same period, financial market volatility increased until it truly erupted in mid-August amid acute worries that China’s economy — the

world’s second largest — was faltering.

|

|

|

|

|

“The U.S. economic recovery remained largely intact amid historically low interest rates, while central banks in the

U.S., Europe, Japan and China continued to maintain or increase economic stimulus.” |

Though U.S. financial markets largely recovered by the end of August, the shock from the global sell-off in equities, among

other considerations, was apparently enough to convince the U.S. Federal Reserve (the “Fed”) to postpone an interest rate increase in September.

Amid an environment of low interest rates, falling energy prices and global growth, U.S. equity prices rose and essentially remained near their closing highs for the first five months of 2015, hitting a peak

in mid-May. Meanwhile, U.S. bond markets provided lackluster returns, caught between investor concerns about the timing and impact of a Fed interest rate increase and periodic “flights to safety” as investors reacted to specific market or

geopolitical events.

While there was notable weakness the U.S. economy in the first three months of 2015 — mainly due to severe winter

weather and a labor dispute at vital West Coast ports — the upward trajectory of the economy resumed in the second quarter and U.S. gross domestic product rose 3.9%. Unemployment continued its steady decline throughout the six month reporting

period to 5.1% in August from 5.5% in March.

Importantly, inflationary pressure remained subdued in the U.S. amid lower energy prices and notably

stagnant wage growth. Global oil prices dipped below $60 a barrel in March 2015, before rebounding somewhat and then dropping again to below $50 a barrel by August. Global commodities prices also fell sharply through the summer of 2015.

Part of the decline in commodities prices was attributable to signs of slowing growth in China, the world’s leading consumer

of raw materials. In response to falling domestic equity prices and weakening economic data, Chinese policy makers enacted a range of stimulus measures, including cutting interest rates and

easing bank lending rules in June and July. Then on August 11th, China’s central bank shocked global markets by devaluing the yuan by nearly 2% and two days later, weaker-than-expected retail sales and industrial production data again

shook investor confidence.

On Monday, August 24th, China’s stock market suffered its biggest one-day drop since 2011. The Shanghai

Composite Index closed down 8.5% for the day. Chinese regulators suspended trading in hundreds of stocks that had each lost 10% or more. The selloff spread rapidly and key equity indexes in developed markets from Asia to Europe closed down by

roughly 5%. Emerging market equities also fell, dragging local currencies lower. In U.S. trading, the Standard & Poor’s 500 Index closed down 3.9%.

Government bonds of developed market nations initially benefitted from the sell-off as investors fled to the perceived safety of fixed income securities. But prices for longer-dated U.S. Treasury bonds

declined, partly due to massive selling of foreign-exchange reserves (including U.S. Treasuries) by China and partly due to expectations of an imminent Fed interest rate increase.

While the global economic environment at the end of August 2015 was markedly different than it was six months earlier, in fundamental ways it remained unchanged. The U.S. economic recovery remained largely

intact amid historically low interest rates, while central banks in the U.S., Europe, Japan and China continued to maintain or increase economic stimulus. Global energy prices remained under pressure. What appeared to have changed is the intensity

of investor concern about both the health of China’s economy and the timing of any increase in U.S. interest rates. This uncertain environment and its effects on financial markets may provide opportunities for those investors who have long-term

objectives and a well-diversified portfolio.

On behalf of everyone at J.P. Morgan Asset Management, thank you for your continued support. We look

forward to managing your investment needs for years to come.

Sincerely yours,

George C.W. Gatch

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2015 |

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

|

|

|

1 |

|

JPMorgan Institutional Trust Funds

MARKET OVERVIEW

SIX MONTHS ENDED AUGUST 31, 2015 (Unaudited)

U.S. financial markets slumped at the end of the six month reporting

period amid investor concerns about slowing growth in China’s economy and expectations of an increase in U.S. interest rates. After reaching record highs in May, U.S. equities came under pressure in June and July and volatility rose sharply. On

August 24, 2015, a global sell-off in equities drove leading market indexes lower. The Standard & Poor’s 500 Index (“S&P 500”) closed down 3.9% on the day. Though markets rebounded during the following days, they

ended the period lower. For the six months ended August 31, 2015, the S&P 500 returned -5.3%.

Overall, bond markets fared little better

than equities. While increasing financial market volatility drove some investors to fixed income assets, it was insufficient to bolster prices in large sectors of the bond market, already under pressure from historically low interest rates. U.S.

Treasury bond yields, which generally move in the opposite direction of bond prices, rose across all maturities. For the six month reporting period, the Barclays U.S. Aggregate Index returned -0.68%.

|

|

|

|

|

|

|

|

|

|

|

| 2 |

|

|

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

AUGUST 31, 2015 |

JPMorgan Core Bond Trust

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2015 (Unaudited)

|

|

|

|

|

| REPORTING PERIOD RETURN: |

|

| JPMorgan Core Bond Trust* |

|

|

0.07% |

|

| Barclays U.S. Aggregate Index |

|

|

-0.68% |

|

|

|

| Net Assets as of 8/31/2015 (In Thousands) |

|

$ |

4,482,664 |

|

| Duration as of 8/31/2015 |

|

|

5.1 years |

|

INVESTMENT OBJECTIVE**

The JPMorgan Core Bond Trust (the “Fund”) seeks to maximize total return by investing primarily in a diversified portfolio of intermediate- and long-term debt securities.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the six months ended August 31, 2015, the Fund outperformed the Barclays U.S. Aggregate Index (the “Benchmark”). Relative to the Benchmark, the Fund’s overweight position and security

selection in the mortgage-backed securities sector were leading contributors to performance. The Fund’s underweight position in the corporate credit sector also contributed to relative performance, as did the Fund’s shorter overall

duration. Duration measures the price sensitivity of a bond or a portfolio of bonds to relative changes in interest rates. Generally, bonds with longer duration will experience a larger increase or decrease in price as interest rates fall or rise,

respectively.

The Fund’s allocation to U.S. Treasury Inflation Protected Securities (TIPS) detracted slightly from relative performance amid

a decline in inflation expectations among investors. The Fund’s security selection in foreign sovereign debt and foreign agency debt also detracted slightly from relative performance.

HOW WAS THE FUND POSITIONED?

The Fund continued to focus on security selection and relative

value, which seeks to exploit pricing discrepancies between

individual securities or market sectors. The Fund’s portfolio managers used bottom-up fundamental research to construct, in their view, a portfolio of undervalued fixed income securities. At

the end of the reporting period, the Fund was underweight in U.S. Treasury securities and overweight in mortgage-backed securities.

|

|

|

|

|

| PORTFOLIO COMPOSITION*** |

|

| U.S. Treasury Obligations |

|

|

26.2 |

% |

| Corporate Bonds |

|

|

18.6 |

|

| Collateralized Mortgage Obligations |

|

|

18.1 |

|

| Mortgage Pass-Through Securities |

|

|

16.1 |

|

| Asset-Backed Securities |

|

|

10.4 |

|

| Commercial Mortgage-Backed Securities |

|

|

3.4 |

|

| U.S. Government Agency Securities |

|

|

2.2 |

|

| Foreign Government Securities |

|

|

1.1 |

|

| Others (each less than 1.0%) |

|

|

0.4 |

|

| Short-Term Investment |

|

|

3.5 |

|

| * |

|

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects

adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** |

|

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** |

|

Percentages indicated are based on total investments as of August 31, 2015. The Fund’s portfolio composition is subject to change.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2015 |

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

|

|

|

3 |

|

JPMorgan Core Bond Trust

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2015 (Unaudited)

(continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE ANNUAL TOTAL RETURNS AS OF AUGUST 31,

2015 |

|

|

|

|

|

|

|

| |

|

INCEPTION DATE OF

CLASS |

|

6 MONTH* |

|

|

1 YEAR |

|

|

5 YEAR |

|

|

10 YEAR |

|

|

|

February 7, 2005 |

|

|

0.07 |

% |

|

|

2.34 |

% |

|

|

3.86 |

% |

|

|

5.41 |

% |

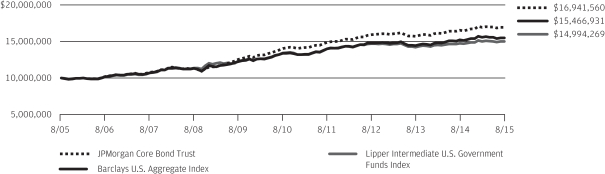

TEN YEAR PERFORMANCE (8/31/05

TO 8/31/15)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future

results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current

performance may be higher or lower than the performance data shown.

The graph illustrates comparative performance for $10,000,000

invested in the JPMorgan Core Bond Trust, the Barclays U.S. Aggregate Index and the Lipper Intermediate U.S. Government Funds Index from August 31, 2005 to August 31, 2015. The performance of the Fund assumes reinvestment of all dividends

and capital gain distributions, if any, and does not include a sales charge. The performance of the Barclays U.S. Aggregate Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment

of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Intermediate U.S. Government Funds Index includes expenses associated with a mutual fund, such as investment

management fees. These expenses are not identical to the expenses incurred by the Fund. The Barclays U.S. Aggregate Index is an unmanaged index that represents securities that are SEC-registered,

taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through

securities, and asset-backed securities. The Lipper Intermediate U.S. Government Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest

directly in an index.

The Fund’s shares have a $10,000,000 minimum investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have

been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset

values in accordance with accounting principles generally accepted in the United States of America.

|

|

|

|

|

|

|

|

|

|

|

| 4 |

|

|

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

AUGUST 31, 2015 |

JPMorgan Equity Index Trust

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2015 (Unaudited)

|

|

|

|

|

| REPORTING PERIOD RETURN: |

|

| JPMorgan Equity Index Trust* |

|

|

-5.32% |

|

| S&P 500 Index** |

|

|

-5.31% |

|

|

|

| Net Assets as of 8/31/2015 (In Thousands) |

|

|

$287,656 |

|

INVESTMENT OBJECTIVE***

The JPMorgan Equity Index Trust (the “Fund”) seeks investment results that correspond to the aggregate price and dividend performance of securities in the Standard & Poor’s 500

Composite Stock Price Index (S&P 500 Index).

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund performed in line with the S&P 500 Index (the “Benchmark”) for the six months ended August 31, 2015. This was consistent with its

indexing strategy and investment objective, as the Fund looks to generate returns that are comparable to that of the Benchmark.

The U.S. equity

market reached several record highs in the first half of the six month reporting period amid continued low interest rates, mergers and acquisitions, weak oil prices and healthy corporate earnings. U.S. equity prices peaked in mid-May before

succumbing to periodic selling by investors amid high valuations and investor concerns about slowing growth in China and expectations that the U.S. Federal Reserve would soon raise interest rates.

All sectors in the Benchmark posted negative returns for the six month reporting period. The energy and information technology sectors were the greatest

detractors from Benchmark performance, while the telecommunication services and utilities sectors were the smallest detractors from Benchmark performance.

HOW WAS THE FUND POSITIONED?

The Fund was managed in conformity with an index replication

strategy and aimed to hold the same stocks in nearly the same proportions as those found in the Benchmark.

|

|

|

|

|

|

|

|

|

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** |

|

| |

1. |

|

|

Apple, Inc. |

|

|

3.7 |

% |

| |

2. |

|

|

Microsoft Corp. |

|

|

2.0 |

|

| |

3. |

|

|

Exxon Mobil Corp. |

|

|

1.8 |

|

| |

4. |

|

|

Johnson & Johnson |

|

|

1.5 |

|

| |

5. |

|

|

General Electric Co. |

|

|

1.4 |

|

| |

6. |

|

|

Wells Fargo & Co. |

|

|

1.4 |

|

| |

7. |

|

|

Berkshire Hathaway, Inc., Class B |

|

|

1.4 |

|

| |

8. |

|

|

JPMorgan Chase & Co. |

|

|

1.3 |

|

| |

9. |

|

|

AT&T, Inc. |

|

|

1.2 |

|

| |

10. |

|

|

Pfizer, Inc. |

|

|

1.1 |

|

|

|

|

|

|

| PORTFOLIO COMPOSITION BY SECTOR**** |

|

| Information Technology |

|

|

19.7 |

% |

| Financials |

|

|

16.4 |

|

| Health Care |

|

|

15.0 |

|

| Consumer Discretionary |

|

|

12.7 |

|

| Industrials |

|

|

9.8 |

|

| Consumer Staples |

|

|

9.5 |

|

| Energy |

|

|

7.1 |

|

| Utilities |

|

|

2.9 |

|

| Materials |

|

|

2.9 |

|

| Telecommunication Services |

|

|

2.4 |

|

| Exchange Traded Fund |

|

|

0.4 |

|

| Short-Term Investments |

|

|

1.2 |

|

| * |

|

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects

adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** |

|

“S&P 500 Index” is a registered service mark of Standard & Poor’s Corporation, which does not sponsor, and is in no way affiliated with the Fund.

|

| *** |

|

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** |

|

Percentages indicated are based on total investments as of August 31, 2015. The Fund’s portfolio composition is subject to change.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2015 |

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

|

|

|

5 |

|

JPMorgan Equity Index Trust

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2015 (Unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE ANNUAL TOTAL RETURNS AS OF AUGUST 31,

2015 |

|

|

|

|

|

|

|

| |

|

INCEPTION DATE OF

CLASS |

|

6 MONTH* |

|

|

1 YEAR |

|

|

5 YEAR |

|

|

10 YEAR |

|

|

|

February 7, 2005 |

|

|

(5.32 |

)% |

|

|

0.43 |

% |

|

|

15.73 |

% |

|

|

7.03 |

% |

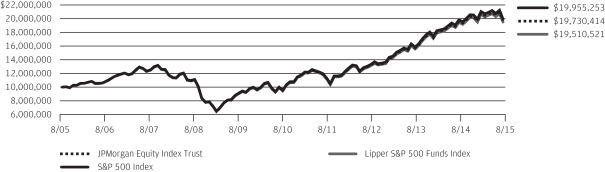

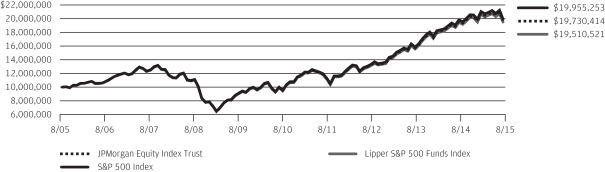

TEN YEAR PERFORMANCE (8/31/05

TO 8/31/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are

subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower

than the performance data shown.

The graph illustrates comparative performance for $10,000,000 invested in the JPMorgan Equity Index

Trust, the S&P 500 Index and the Lipper S&P 500 Funds Index from August 31, 2005 to August 31, 2015. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales

charge. The performance of the S&P 500 Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the

benchmark, if applicable. The performance of the Lipper S&P 500 Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The S&P

500 Index is an

unmanaged index generally representative of the performance of large companies in the U.S. Stock Market. Index levels are based on total return in U.S. dollars. The Lipper S&P 500 Funds Index

is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

The Fund’s shares have a $10,000,000 minimum investment.

Fund performance may reflect the waiver

of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction

of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values

calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of

America.

|

|

|

|

|

|

|

|

|

|

|

| 6 |

|

|

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

AUGUST 31, 2015 |

JPMorgan Intermediate Bond Trust

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31,

2015 (Unaudited)

|

|

|

|

|

| REPORTING PERIOD RETURN: |

|

| JPMorgan Intermediate Bond Trust* |

|

|

0.61% |

|

| Barclays Intermediate U.S. Government/Credit Index |

|

|

0.14% |

|

|

|

| Net Assets as of 8/31/2015 (In Thousands) |

|

$ |

465,175 |

|

| Duration as of 8/31/2015 |

|

|

3.9 years |

|

INVESTMENT OBJECTIVE**

The JPMorgan Intermediate Bond Trust (the “Fund”) seeks current income consistent with the preservation of capital by investing in high- and medium-grade fixed income securities with intermediate

maturities.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the six months ended August 31, 2015, the Fund outperformed the Barclays Intermediate U.S. Government/Credit Index (the “Benchmark”). During the six month reporting period, the Fund’s

out-of-Benchmark position in mortgage-backed securities was the leading contributor to performance relative to the Benchmark. The Fund’s shorter overall duration also contributed to relative performance. Duration measures the price sensitivity

of a bond or a portfolio of bonds to relative changes in interest rates. Generally, bonds with longer duration will experience a larger increase or decrease in price as interest rates fall or rise, respectively.

The Fund’s position on the yield curve, particularly its overweight position in the 10-year portion, was a slight detractor from performance relative to

the Benchmark. The yield curve shows the relationship between yields and maturity dates for a set of similar bonds for a given point in time. The Fund’s underweight positions in U.S. Treasury bonds and agency bonds also detracted from

performance.

HOW WAS THE FUND POSITIONED?

The Fund continued to focus on security selection and relative value, which seeks to exploit pricing discrepancies between

individual securities or market sectors. The Fund’s portfolio managers used bottom-up fundamental research to construct, in their view, a portfolio of undervalued fixed income securities. At

the end of the reporting period, the Fund was underweight in U.S. Treasuries and in the corporate credit sector. The Fund was overweight in securities with maturities in the intermediate part (5-10 years) of the yield curve.

|

|

|

|

|

| PORTFOLIO COMPOSITION*** |

|

| U.S. Treasury Obligations |

|

|

34.6 |

% |

| Corporate Bonds |

|

|

18.2 |

|

| Collateralized Mortgage Obligations |

|

|

16.8 |

|

| Asset-Backed Securities |

|

|

11.8 |

|

| Mortgage Pass-Through Securities |

|

|

9.0 |

|

| Commercial Mortgage-Backed Securities |

|

|

2.0 |

|

| U.S. Government Agency Securities |

|

|

1.9 |

|

| Others (each less than 1.0%) |

|

|

1.0 |

|

| Short-Term Investment |

|

|

4.7 |

|

| * |

|

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects

adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** |

|

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** |

|

Percentages indicated are based on total investments as of August 31, 2015. The Fund’s portfolio composition is subject to change.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2015 |

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

|

|

|

7 |

|

JPMorgan Intermediate Bond Trust

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31,

2015 (Unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE ANNUAL TOTAL RETURNS AS OF AUGUST 31,

2015 |

|

|

|

|

|

|

|

| |

|

INCEPTION DATE OF

CLASS |

|

|

6 MONTH* |

|

|

1 YEAR |

|

|

5 YEAR |

|

|

10 YEAR |

|

|

|

|

February 7, 2005 |

|

|

|

0.61 |

% |

|

|

2.35 |

% |

|

|

3.22 |

% |

|

|

4.84 |

% |

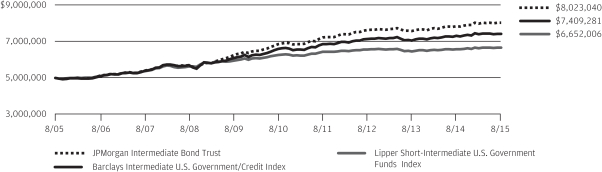

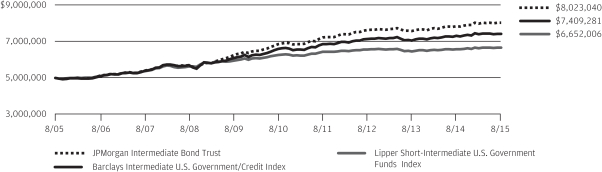

TEN YEAR PERFORMANCE (8/31/05

TO 8/31/15)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future

results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current

performance may be higher or lower than the performance data shown.

The graph illustrates comparative performance for $5,000,000 invested

in the JPMorgan Intermediate Bond Trust, the Barclays Intermediate U.S. Government/Credit Index and the Lipper Short-Intermediate U.S. Government Funds Index from August 31, 2005 to August 31, 2015. The performance of the Fund assumes reinvestment

of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Barclays Intermediate U.S. Government/Credit Index does not reflect the deduction of expenses associated with a mutual fund and has

been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Short-Intermediate U.S. Government Funds Index includes expenses

associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Barclays Intermediate

U.S. Government/Credit Index is an unmanaged index comprised of intermediate maturity U.S. Treasury and agency securities and investment grade corporate securities. The Lipper

Short-Intermediate U.S. Government Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

The Fund’s shares have a $5,000,000 minimum investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have

been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset

values in accordance with accounting principles generally accepted in the United States of America.

|

|

|

|

|

|

|

|

|

|

|

| 8 |

|

|

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

AUGUST 31, 2015 |

JPMorgan Core Bond Trust

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2015 (Unaudited)

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Asset-Backed Securities — 10.4% |

|

|

|

|

|

Academic Loan Funding Trust, |

|

|

|

|

| |

1,354 |

|

|

Series 2012-1A, Class A1, VAR, 0.999%, 12/27/22 (e) |

|

|

1,349 |

|

| |

1,835 |

|

|

Series 2013-1A, Class A, VAR, 0.999%, 12/26/44 (e) |

|

|

1,813 |

|

|

|

|

|

Ally Auto Receivables Trust, |

|

|

|

|

| |

1,341 |

|

|

Series 2013-2, Class A3, 0.790%, 01/15/18 |

|

|

1,340 |

|

| |

300 |

|

|

Series 2013-2, Class A4, 1.240%, 11/15/18 |

|

|

300 |

|

| |

1,981 |

|

|

Series 2014-SN2, Class A3, 1.030%, 09/20/17 |

|

|

1,979 |

|

|

|

|

|

American Credit Acceptance Receivables Trust, |

|

|

|

|

| |

154 |

|

|

Series 2013-1, Class A, 1.450%, 04/16/18 (e) |

|

|

154 |

|

| |

463 |

|

|

Series 2014-2, Class A, 0.990%, 10/10/17 (e) |

|

|

463 |

|

| |

1,182 |

|

|

Series 2014-2, Class B, 2.260%, 03/10/20 (e) |

|

|

1,185 |

|

| |

549 |

|

|

Series 2014-4, Class A, 1.330%, 07/10/18 (e) |

|

|

548 |

|

| |

1,318 |

|

|

Series 2015-1, Class A, 1.430%, 08/12/19 (e) |

|

|

1,317 |

|

| |

2,793 |

|

|

Series 2015-2, Class A, 1.570%, 06/12/19 (e) |

|

|

2,793 |

|

| |

1,225 |

|

|

Series 2015-2, Class C, 4.320%, 05/12/21 (e) |

|

|

1,231 |

|

| |

4,225 |

|

|

American Homes 4 Rent, Series 2015-SFR1, Class A, 3.467%, 04/17/52 (e) |

|

|

4,251 |

|

|

|

|

|

American Homes 4 Rent Trust, |

|

|

|

|

| |

1,000 |

|

|

Series 2014-SFR1, Class C, VAR, 2.198%, 06/17/31 (e) |

|

|

984 |

|

| |

2,959 |

|

|

Series 2014-SFR2, Class A, 3.786%, 10/17/36 (e) |

|

|

3,035 |

|

| |

2,000 |

|

|

Series 2014-SFR2, Class D, 5.149%, 10/17/36 (e) |

|

|

2,034 |

|

| |

850 |

|

|

Series 2014-SFR2, Class E, 6.231%, 10/17/36 (e) |

|

|

878 |

|

| |

2,965 |

|

|

Series 2014-SFR3, Class A, 3.678%, 12/17/36 (e) |

|

|

3,016 |

|

| |

500 |

|

|

Series 2014-SFR3, Class C, 4.596%, 12/17/36 (e) |

|

|

504 |

|

| |

1,025 |

|

|

Series 2014-SFR3, Class E, 6.418%, 12/17/36 (e) |

|

|

1,072 |

|

| |

1,275 |

|

|

Series 2015-SFR1, Class E, 5.639%, 04/17/52 (e) |

|

|

1,249 |

|

|

|

|

|

AmeriCredit Automobile Receivables Trust, |

|

|

|

|

| |

538 |

|

|

Series 2013-5, Class A3, 0.900%, 09/10/18 |

|

|

538 |

|

| |

822 |

|

|

Series 2015-2, Class A2A, 0.830%, 09/10/18 |

|

|

821 |

|

| |

3,703 |

|

|

ARLP Securitization Trust, Series 2015-1, Class A1, SUB, 3.967%, 05/25/55 (e) |

|

|

3,703 |

|

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

| |

763 |

|

|

AXIS Equipment Finance Receivables II LLC, Series 2013-1A, Class A, 1.750%, 03/20/17 (e) |

|

|

762 |

|

| |

1,903 |

|

|

AXIS Equipment Finance Receivables III LLC, Series 2015-1A, Class A2, 1.900%, 03/20/20 (e) |

|

|

1,898 |

|

| |

1,830 |

|

|

B2R Mortgage Trust, Series 2015-1, Class A1, 2.524%, 05/15/48 (e) |

|

|

1,811 |

|

| |

1,400 |

|

|

BA Credit Card Trust, Series 2015-A2, Class A, 1.360%, 09/15/20 |

|

|

1,398 |

|

| |

1,706 |

|

|

Banc of America Funding Corp., Series 2012-R6, Class 1A1, 3.000%, 10/26/39 (e) |

|

|

1,691 |

|

|

|

|

|

BCC Funding Corp. X, |

|

|

|

|

| |

3,470 |

|

|

Series 2015-1, Class A2, 2.224%, 10/20/20 (e) |

|

|

3,480 |

|

| |

550 |

|

|

Series 2015-1, Class D, 4.544%, 12/21/20 (e) |

|

|

554 |

|

| |

357 |

|

|

Bear Stearns Asset-Backed Securities Trust, Series 2006-SD1, Class A, VAR, 0.569%, 04/25/36 |

|

|

342 |

|

| |

428 |

|

|

BMW Vehicle Owner Trust, Series 2013-A, Class A3, 0.670%, 11/27/17 |

|

|

427 |

|

| |

728 |

|

|

BXG Receivables Note Trust, Series 2012-A, Class A, 2.660%, 12/02/27 (e) |

|

|

725 |

|

|

|

|

|

Cabela’s Credit Card Master Note Trust, |

|

|

|

|

| |

700 |

|

|

Series 2012-1A, Class A1, 1.630%, 02/18/20 (e) |

|

|

704 |

|

| |

880 |

|

|

Series 2015-2, Class A1, 2.250%, 07/17/23 |

|

|

881 |

|

| |

178 |

|

|

California Republic Auto Receivables Trust, Series 2012-1, Class A, 1.180%, 08/15/17 (e) |

|

|

178 |

|

| |

4,494 |

|

|

CAM Mortgage LLC, Series 2015-1, Class A, SUB, 3.500%, 07/15/64 (e) |

|

|

4,492 |

|

|

|

|

|

CarFinance Capital Auto Trust, |

|

|

|

|

| |

75 |

|

|

Series 2013-2A, Class A, 1.750%, 11/15/17 (e) |

|

|

75 |

|

| |

419 |

|

|

Series 2014-1A, Class A, 1.460%, 12/17/18 (e) |

|

|

418 |

|

| |

375 |

|

|

Series 2014-1A, Class B, 2.720%, 04/15/20 (e) |

|

|

378 |

|

| |

1,351 |

|

|

Series 2015-1A, Class A, 1.750%, 06/15/21 (e) |

|

|

1,352 |

|

| |

3,207 |

|

|

Carlyle Global Market Strategies Commodities Funding Ltd., (Cayman Islands),

Series 2014-1A, Class A, VAR, 2.189%, 10/15/21 (e) |

|

|

3,207 |

|

|

|

|

|

CarMax Auto Owner Trust, |

|

|

|

|

| |

616 |

|

|

Series 2013-4, Class A3, 0.800%, 07/16/18 |

|

|

616 |

|

| |

440 |

|

|

Series 2013-4, Class A4, 1.280%, 05/15/19 |

|

|

438 |

|

| |

5,091 |

|

|

Series 2015-2, Class A2A, 0.820%, 06/15/18 |

|

|

5,088 |

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2015 |

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

|

|

|

9 |

|

JPMorgan Core Bond Trust

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2015 (Unaudited) (continued)

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Asset-Backed Securities — continued |

|

| |

750 |

|

|

Carnow Auto Receivables Trust, Series 2014-1A, Class B, 1.890%, 11/15/18 (e) |

|

|

751 |

|

| |

218 |

|

|

Centex Home Equity Loan Trust, Series 2004-D, Class AF4, SUB, 4.680%, 06/25/32 |

|

|

222 |

|

| |

1,076 |

|

|

Chase Funding Trust, Series 2003-6, Class 1A7, SUB, 4.277%, 11/25/34 |

|

|

1,094 |

|

|

|

|

|

Citi Held For Asset Issuance, |

|

|

|

|

| |

2,326 |

|

|

Series 2015-PM1, Class A, 1.850%, 12/15/21 (e) |

|

|

2,325 |

|

| |

1,459 |

|

|

Series 2015-PM1, Class B, 3.750%, 12/15/21 (e) |

|

|

1,482 |

|

| |

800 |

|

|

Citibank Credit Card Issuance Trust, Series 2007-A3, Class A3, 6.150%,

06/15/39 |

|

|

1,052 |

|

| |

247 |

|

|

Citigroup Mortgage Loan Trust, Inc., Series 2003-HE3, Class A, VAR, 0.579%,

12/25/33 |

|

|

237 |

|

| |

4,945 |

|

|

Colony American Homes, Series 2014-2A, Class A, VAR, 1.150%, 07/17/31 (e) |

|

|

4,864 |

|

| |

2,800 |

|

|

Concord Funding Co. LLC, Series 2012-2, Class A, 3.145%, 01/15/17 (e) |

|

|

2,800 |

|

| |

1,079 |

|

|

Conix Mortgage Asset Trust, Series 2013-1, Class A, VAR, 12/25/47 (d) |

|

|

442 |

|

| |

1,107 |

|

|

Consumer Credit Origination Loan Trust, Series 2015-1, Class A, 2.820%, 03/15/21 (e) |

|

|

1,111 |

|

|

|

|

|

CPS Auto Receivables Trust, |

|

|

|

|

| |

286 |

|

|

Series 2011-C, Class A, 4.210%, 03/15/19 (e) |

|

|

290 |

|

| |

155 |

|

|

Series 2012-A, Class A, 2.780%, 06/17/19 (e) |

|

|

157 |

|

| |

981 |

|

|

Series 2012-B, Class A, 2.520%, 09/16/19 (e) |

|

|

987 |

|

| |

1,137 |

|

|

Series 2013-C, Class A, 1.640%, 04/16/18 (e) |

|

|

1,139 |

|

| |

1,634 |

|

|

Series 2013-D, Class A, 1.540%, 07/16/18 (e) |

|

|

1,635 |

|

| |

226 |

|

|

Series 2014-A, Class A, 1.210%, 08/15/18 (e) |

|

|

226 |

|

| |

2,973 |

|

|

Series 2014-D, Class A, 1.490%, 04/15/19 (e) |

|

|

2,986 |

|

| |

700 |

|

|

Series 2014-D, Class C, 4.350%, 11/16/20 (e) |

|

|

712 |

|

| |

1,802 |

|

|

Series 2015-A, Class A, 1.530%, 07/15/19 (e) |

|

|

1,809 |

|

| |

223 |

|

|

Series 2015-A, Class C, 4.000%, 02/16/21 (e) |

|

|

224 |

|

| |

6,623 |

|

|

Series 2015-B, Class A, 1.650%, 11/15/19 (e) |

|

|

6,628 |

|

| |

2,535 |

|

|

Series 2015-B, Class C, 4.200%, 05/17/21 (e) |

|

|

2,553 |

|

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CPS Auto Trust, |

|

|

|

|

| |

599 |

|

|

Series 2012-C, Class A, 1.820%, 12/16/19 (e) |

|

|

601 |

|

| |

96 |

|

|

Series 2012-D, Class A, 1.480%, 03/16/20 (e) |

|

|

96 |

|

|

|

|

|

Credit Acceptance Auto Loan Trust, |

|

|

|

|

| |

1,800 |

|

|

Series 2014-1A, Class A, 1.550%, 10/15/21 (e) |

|

|

1,801 |

|

| |

3,022 |

|

|

Series 2015-2A, Class A, 2.400%, 02/15/23 (e) |

|

|

3,022 |

|

| |

579 |

|

|

Series 2015-2A, Class C, 3.760%, 02/15/24 (e) |

|

|

579 |

|

| |

586 |

|

|

CWABS, Inc. Asset-Backed Certificates Trust, Series 2004-6, Class M1, VAR, 1.099%, 10/25/34 |

|

|

565 |

|

|

|

|

|

Drive Auto Receivables Trust, |

|

|

|

|

| |

1,419 |

|

|

Series 2015-AA, Class A2, 1.010%, 11/15/17 (e) |

|

|

1,418 |

|

| |

1,471 |

|

|

Series 2015-AA, Class D, 4.120%, 06/15/22 (e) |

|

|

1,478 |

|

| |

2,449 |

|

|

Series 2015-BA, Class B, 2.120%, 06/17/19 (e) |

|

|

2,448 |

|

| |

2,882 |

|

|

Series 2015-BA, Class D, 3.840%, 07/15/21 (e) |

|

|

2,864 |

|

| |

1,017 |

|

|

Series 2015-CA, Class A2A, 1.030%, 02/15/18 (e) |

|

|

1,017 |

|

| |

1,059 |

|

|

Series 2015-CA, Class D, 4.200%, 09/15/21 (e) |

|

|

1,061 |

|

|

|

|

|

DT Auto Owner Trust, |

|

|

|

|

| |

1,642 |

|

|

Series 2014-3A, Class A, 0.980%, 04/16/18 (e) |

|

|

1,642 |

|

| |

1,192 |

|

|

Series 2015-1A, Class A, 1.060%, 09/17/18 (e) |

|

|

1,192 |

|

| |

3,007 |

|

|

Series 2015-2A, Class A, 1.240%, 09/17/18 (e) |

|

|

3,007 |

|

| |

1,808 |

|

|

Series 2015-2A, Class D, 4.250%, 02/15/22 (e) |

|

|

1,821 |

|

|

|

|

|

Exeter Automobile Receivables Trust, |

|

|

|

|

| |

64 |

|

|

Series 2013-1A, Class A, 1.290%, 10/16/17 (e) |

|

|

64 |

|

| |

218 |

|

|

Series 2013-2A, Class A, 1.490%, 11/15/17 (e) |

|

|

218 |

|

| |

355 |

|

|

Series 2014-1A, Class A, 1.290%, 05/15/18 (e) |

|

|

356 |

|

| |

1,236 |

|

|

Series 2014-2A, Class A, 1.060%, 08/15/18 (e) |

|

|

1,233 |

|

| |

2,435 |

|

|

Series 2014-3A, Class A, 1.320%, 01/15/19 (e) |

|

|

2,432 |

|

| |

556 |

|

|

Series 2014-3A, Class B, 2.770%, 11/15/19 (e) |

|

|

561 |

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

| 10 |

|

|

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

AUGUST 31, 2015 |

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Asset-Backed Securities — continued |

|

| |

1,884 |

|

|

Series 2015-1A, Class A, 1.600%, 06/17/19 (e) |

|

|

1,885 |

|

| |

2,125 |

|

|

Series 2015-1A, Class B, 2.840%, 03/16/20 (e) |

|

|

2,140 |

|

| |

3,367 |

|

|

Series 2015-2A, Class A, 1.540%, 11/15/19 (e) |

|

|

3,365 |

|

|

|

|

|

Fifth Third Auto Trust, |

|

|

|

|

| |

191 |

|

|

Series 2013-1, Class A3, 0.880%, 10/16/17 |

|

|

191 |

|

| |

838 |

|

|

Series 2014-3, Class A2A, 0.570%, 05/15/17 |

|

|

838 |

|

| |

413 |

|

|

Series 2014-3, Class A3, 0.960%, 03/15/19 |

|

|

412 |

|

|

|

|

|

First Investors Auto Owner Trust, |

|

|

|

|

| |

67 |

|

|

Series 2012-2A, Class A2, 1.470%, 05/15/18 (e) |

|

|

67 |

|

| |

1,529 |

|

|

Series 2014-3A, Class A2, 1.060%, 11/15/18 (e) |

|

|

1,528 |

|

| |

884 |

|

|

Series 2014-3A, Class A3, 1.670%, 11/16/20 (e) |

|

|

880 |

|

| |

2,196 |

|

|

Series 2015-1A, Class A2, 1.210%, 04/15/19 (e) |

|

|

2,193 |

|

| |

2,414 |

|

|

Series 2015-2A, Class A1, 1.590%, 12/16/19 (e) |

|

|

2,415 |

|

| |

373 |

|

|

Series 2015-2A, Class D, 4.220%, 12/15/21 (e) |

|

|

374 |

|

|

|

|

|

FirstKey Lending Trust, |

|

|

|

|

| |

6,818 |

|

|

Series 2015-SFR1, Class A, 2.553%, 03/09/47 (e) |

|

|

6,774 |

|

| |

2,246 |

|

|

Series 2015-SFR1, Class B, 3.417%, 03/09/47 (e) |

|

|

2,240 |

|

|

|

|

|

Flagship Credit Auto Trust, |

|

|

|

|

| |

282 |

|

|

Series 2013-1, Class A, 1.320%, 04/16/18 (e) |

|

|

282 |

|

| |

631 |

|

|

Series 2013-2, Class A, 1.940%, 01/15/19 (e) |

|

|

633 |

|

| |

705 |

|

|

Series 2014-1, Class A, 1.210%, 04/15/19 (e) |

|

|

703 |

|

| |

245 |

|

|

Series 2014-1, Class B, 2.550%, 02/18/20 (e) |

|

|

246 |

|

| |

1,669 |

|

|

Series 2014-2, Class A, 1.430%, 12/16/19 (e) |

|

|

1,663 |

|

| |

892 |

|

|

Series 2014-2, Class B, 2.840%, 11/16/20 (e) |

|

|

895 |

|

| |

440 |

|

|

Series 2014-2, Class C, 3.950%, 12/15/20 (e) |

|

|

443 |

|

| |

2,303 |

|

|

Series 2015-1, Class A, 1.630%, 06/15/20 (e) |

|

|

2,296 |

|

|

|

|

|

Ford Credit Auto Lease Trust, |

|

|

|

|

| |

188 |

|

|

Series 2013-B, Class A3, 0.760%, 09/15/16 |

|

|

189 |

|

| |

48 |

|

|

Series 2014-A, Class A2A, 0.500%, 10/15/16 |

|

|

48 |

|

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ford Credit Auto Owner Trust, |

|

|

|

|

| |

107 |

|

|

Series 2012-D, Class A3, 0.510%, 04/15/17 |

|

|

107 |

|

| |

1,033 |

|

|

Series 2014-C, Class A2, 0.610%, 08/15/17 |

|

|

1,033 |

|

| |

1,223 |

|

|

Series 2014-C, Class A3, 1.060%, 05/15/19 |

|

|

1,223 |

|

| |

5,600 |

|

|

Series 2015-B, Class A2A, 0.720%, 03/15/18 |

|

|

5,596 |

|

| |

669 |

|

|

Ford Credit Floorplan Master Owner Trust, Series 2013-1, Class A2, VAR, 0.578%, 01/15/18 |

|

|

669 |

|

| |

260 |

|

|

Freedom Trust, Series 2011-2, Class A11, VAR, 5.000%, 08/01/46 (e) |

|

|

263 |

|

|

|

|

|

FRT Trust, |

|

|

|

|

| |

1 |

|

|

Series 2013-1A, Class A1N, SUB, 3.960%, 10/25/33 (e) |

|

|

1 |

|

| |

12 |

|

|

Series 2013-1A, Class AR, SUB, 4.210%, 10/25/18 (e) |

|

|

12 |

|

| |

3,853 |

|

|

GCAT, Series 2015-2, Class A1, 3.750%, 07/25/20 (e) |

|

|

3,852 |

|

| |

229 |

|

|

GE Capital Mortgage Services, Inc. Trust, Series 1999-HE1, Class M, VAR, 6.705%, 04/25/29 |

|

|

219 |

|

| |

254 |

|

|

GE Equipment Midticket LLC, Series 2012-1, Class A4, 0.780%, 09/22/20 |

|

|

254 |

|

| |

4,003 |

|

|

GLC II Trust, Series 2014-A, Class A, 4.000%, 12/18/20 (e) |

|

|

4,003 |

|

| |

2,178 |

|

|

GLC Trust, Series 2014-A, Class A, 3.000%, 07/15/21 (e) |

|

|

2,168 |

|

|

|

|

|

GLS Auto Receivables Trust, |

|

|

|

|

| |

5,918 |

|

|

Series 2015-1A, Class A, 2.250%, 12/15/20 (e) |

|

|

5,893 |

|

| |

1,431 |

|

|

Series 2015-1A, Class B, 4.430%, 12/15/20 (e) |

|

|

1,428 |

|

|

|

|

|

GMAT Trust, |

|

|

|

|

| |

1,045 |

|

|

Series 2013-1A, Class A, SUB, 3.967%, 11/25/43 (e) |

|

|

1,049 |

|

| |

357 |

|

|

Series 2014-1A, Class A, SUB, 3.721%, 02/25/44 (e) |

|

|

357 |

|

|

|

|

|

GO Financial Auto Securitization Trust, |

|

|

|

|

| |

5,000 |

|

|

Series 2015-1, Class A, 1.810%, 03/15/18 (e) |

|

|

4,995 |

|

| |

1,618 |

|

|

Series 2015-1, Class B, 3.590%, 10/15/20 (e) |

|

|

1,618 |

|

| |

1,765 |

|

|

Gold Key Resorts LLC, Series 2014-A, Class A, 3.220%, 03/17/31 (e) |

|

|

1,769 |

|

|

|

|

|

HLSS Servicer Advance Receivables Backed Notes, |

|

|

|

|

| |

1,000 |

|

|

Series 2013-T3, Class D3, 3.130%, 05/15/46 (e) |

|

|

975 |

|

| |

2,140 |

|

|

Series 2013-T7, Class AT7, 1.981%, 11/15/46 (e) |

|

|

2,129 |

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2015 |

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

|

|

|

11 |

|

JPMorgan Core Bond Trust

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2015 (Unaudited) (continued)

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Asset-Backed Securities — continued |

|

|

|

|

|

HLSS Servicer Advance Receivables Trust, |

|

|

|

|

| |

1,560 |

|

|

Series 2012-T2, Class A2, 1.990%, 10/15/45 (e) |

|

|

1,558 |

|

| |

1,197 |

|

|

Series 2013-T1, Class A2, 1.495%, 01/16/46 (e) |

|

|

1,196 |

|

| |

497 |

|

|

Series 2013-T1, Class B2, 1.744%, 01/16/46 (e) |

|

|

497 |

|

| |

997 |

|

|

Series 2014-T2, Class AT2, 2.217%, 01/15/47 (e) |

|

|

995 |

|

| |

150 |

|

|

Home Equity Mortgage Loan Asset-Backed Trust, Series 2006-A, Class A3, VAR, 0.399%, 03/25/36 |

|

|

134 |

|

|

|

|

|

Honda Auto Receivables Owner Trust, |

|

|

|

|

| |

1,278 |

|

|

Series 2013-4, Class A3, 0.690%, 09/18/17 |

|

|

1,277 |

|

| |

930 |

|

|

Series 2014-2, Class A3, 0.770%, 03/19/18 |

|

|

928 |

|

| |

797 |

|

|

Series 2015-1, Class A2, 0.700%, 06/15/17 |

|

|

797 |

|

| |

933 |

|

|

HSBC Home Equity Loan Trust USA, Series 2007-3, Class APT, VAR, 1.403%,

11/20/36 |

|

|

930 |

|

|

|

|

|

Hyundai Auto Receivables Trust, |

|

|

|

|

| |

1,030 |

|

|

Series 2015-A, Class A2, 0.680%, 10/16/17 |

|

|

1,030 |

|

| |

937 |

|

|

Series 2015-B, Class A2A, 0.690%, 04/16/18 |

|

|

937 |

|

| |

931 |

|

|

Series 2015-B, Class A3, 1.120%, 11/15/19 |

|

|

929 |

|

| |

3,750 |

|

|

Invitation Homes Trust, Series 2014-SFR1, Class A, VAR, 1.198%, 06/17/31 (e) |

|

|

3,698 |

|

| |

581 |

|

|

John Deere Owner Trust, Series 2012-B, Class A4, 0.690%, 01/15/19 |

|

|

578 |

|

| |

14,749 |

|

|

KGS-Alpha Capital Markets LP, IO, VAR, 0.407%, 08/25/38 |

|

|

484 |

|

| |

10,016 |

|

|

KGS-Alpha SBA COOF Trust, Series 2013-2, Class A, IO, VAR, 1.572%, 03/25/39 (e) |

|

|

549 |

|

| |

335 |

|

|

Long Beach Mortgage Loan Trust, Series 2006-WL2, Class 2A3, VAR, 0.399%,

01/25/36 |

|

|

323 |

|

|

|

|

|

LV Tower 52 Issuer LLC, |

|

|

|

|

| |

4,357 |

|

|

Series 2013-1, Class A, 5.500%, 07/15/19 (e) |

|

|

4,349 |

|

| |

2,150 |

|

|

Series 2013-1, Class M, 7.500%, 07/15/19 (e) |

|

|

2,137 |

|

| |

130 |

|

|

Madison Avenue Manufactured Housing Contract Trust, Series 2002-A, Class M2, VAR, 2.449%, 03/25/32 |

|

|

130 |

|

|

|

|

|

MarketPlace Loan Trust, |

|

|

|

|

| |

3,615 |

|

|

Series 2015-OD1, Class A, 3.250%, 06/17/17 (e) |

|

|

3,615 |

|

| |

500 |

|

|

Series 2015-OD1, Class B, 5.250%, 06/17/17 (e) |

|

|

500 |

|

| |

4,041 |

|

|

Series 2015-OD2, Class A, 3.250%, 08/17/17 (e) |

|

|

4,041 |

|

| |

713 |

|

|

Series 2015-OD2, Class B, 5.250%, 08/17/17 (e) |

|

|

713 |

|

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

| |

3,273 |

|

|

Mercedes-Benz Auto Receivables Trust, Series 2015-1, Class A2A, 0.820%, 06/15/18 |

|

|

3,265 |

|

| |

993 |

|

|

Mid-State Capital Corp. Trust, Series 2006-1, Class M1, 6.083%, 10/15/40 (e) |

|

|

1,039 |

|

| |

625 |

|

|

MMCA Auto Owner Trust, Series 2012-A, Class A4, 1.570%, 08/15/17 (e) |

|

|

626 |

|

|

|

|

|

Nationstar Agency Advance Funding Trust, |

|

|

|

|

| |

439 |

|

|

Series 2013-T2A, Class AT2, 1.892%, 02/18/48 (e) |

|

|

433 |

|

| |

216 |

|

|

Series 2013-T2A, Class BT2, 2.487%, 02/18/48 (e) |

|

|

214 |

|

| |

1,916 |

|

|

Nationstar HECM Loan Trust, Series 2015-1A, Class A, 3.844%, 05/25/18 (e) |

|

|

1,919 |

|

| |

346 |

|

|

Navitas Equipment Receivables LLC, Series 2013-1, Class A, 1.950%,

11/15/16 (e) |

|

|

346 |

|

| |

560 |

|

|

NCUA Guaranteed Notes Trust, Series 2010-A1, Class A, VAR, 0.540%, 12/07/20 |

|

|

559 |

|

| |

839 |

|

|

New Century Home Equity Loan Trust, Series 2003-5, Class AI6, SUB, 5.171%, 11/25/33 |

|

|

863 |

|

|

|

|

|

Nissan Auto Lease Trust, |

|

|

|

|

| |

341 |

|

|

Series 2013-B, Class A3, 0.750%, 06/15/16 |

|

|

341 |

|

| |

4,050 |

|

|

Series 2015-A, Class A2A, 0.990%, 11/15/17 |

|

|

4,055 |

|

|

|

|

|

Nissan Auto Receivables Owner Trust, |

|

|

|

|

| |

241 |

|

|

Series 2012-A, Class A4, 1.000%, 07/16/18 |

|

|

241 |

|

| |

799 |

|

|

Series 2014-B, Class A3, 1.110%, 05/15/19 |

|

|

797 |

|

| |

1,729 |

|

|

Normandy Mortgage Loan Co. LLC, Series 2013-NPL3, Class A, SUB, 4.949%,

09/16/43 (e) |

|

|

1,727 |

|

|

|

|

|

NRPL Trust, |

|

|

|

|

| |

3,277 |

|

|

Series 2015-1A, Class A1, SUB, 3.875%, 11/01/54 (e) |

|

|

3,275 |

|

| |

1,522 |

|

|

Series 2015-1A, Class A2, SUB, 3.875%, 11/01/54 (e) |

|

|

1,456 |

|

| |

7,357 |

|

|

Series 2015-2A, Class A1, VAR, 3.750%, 10/25/57 (e) |

|

|

7,321 |

|

|

|

|

|

NRZ Advance Receivables Trust Advance Receivables Backed Notes, |

|

|

|

|

| |

3,500 |

|

|

Series 2015-T1, Class AT1, 2.315%, 08/15/46 (e) |

|

|

3,500 |

|

| |

1,000 |

|

|

Series 2015-T1, Class CT1, 3.100%, 08/15/46 (e) |

|

|

999 |

|

| |

1,500 |

|

|

Series 2015-T1, Class DT1, 3.600%, 08/15/46 (e) |

|

|

1,495 |

|

| |

2,411 |

|

|

Series 2015-T2, Class DT2, 4.679%, 08/17/48 (e) |

|

|

2,411 |

|

|

|

|

|

NYMT Residential LLC, |

|

|

|

|

| |

868 |

|

|

Series 2012-RP1A, Class NOTE, VAR, 4.250%, 12/25/17 (e) |

|

|

868 |

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

| 12 |

|

|

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

AUGUST 31, 2015 |

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Asset-Backed Securities — continued |

|

| |

1,416 |

|

|

Series 2013-RP3A, Class NOTE, SUB, 4.850%, 09/25/18 (e) |

|

|

1,416 |

|

|

|

|

|

Oak Hill Advisors Residential Loan Trust, |

|

|

|

|

| |

2,976 |

|

|

Series 2015-NPL1, Class A1, SUB, 3.475%, 01/25/55 (e) |

|

|

2,971 |

|

| |

1,558 |

|

|

Series 2015-NPL1, Class A2, SUB, 4.000%, 01/25/55 (e) |

|

|

1,517 |

|

| |

3,372 |

|

|

Series 2015-NPL2, Class A1, SUB, 3.721%, 07/25/55 (e) |

|

|

3,373 |

|

| |

769 |

|

|

Series 2015-NPL2, Class A2, SUB, 4.000%, 07/25/55 (e) |

|

|

745 |

|

|

|

|

|

OAK Hill Advisors Residential Loan Trust, |

|

|

|

|

| |

4,710 |

|

|

Series 2014-NPL2, Class A1, SUB, 3.475%, 04/25/54 (e) |

|

|

4,699 |

|

| |

1,371 |

|

|

Series 2014-NPL2, Class A2, SUB, 4.000%, 04/25/54 (e) |

|

|

1,354 |

|

|

|

|

|

Ocwen Freddie Advance Funding LLC, |

|

|

|

|

| |

1,248 |

|

|

Series 2015-T1, Class AT1, 2.062%, 11/15/45 (e) |

|

|

1,248 |

|

| |

332 |

|

|

Series 2015-T1, Class BT1, 2.557%, 11/15/45 (e) |

|

|

332 |

|

| |

125 |

|

|

Series 2015-T1, Class CT1, 3.051%, 11/15/45 (e) |

|

|

125 |

|

| |

206 |

|

|

Series 2015-T1, Class DT1, 3.790%, 11/15/45 (e) |

|

|

206 |

|

|

|

|

|

Ocwen Freddie Advance Funding LLC Advance Receivables Backed Notes, |

|

|

|

|

| |

4,311 |

|

|

Series 2015-T2, Class AT2, 2.014%, 09/15/45 (e) |

|

|

4,311 |

|

| |

774 |

|

|

Series 2015-T2, Class BT2, 2.509%, 09/15/45 (e) |

|

|

774 |

|

| |

213 |

|

|

Series 2015-T2, Class CT2, 3.003%, 09/15/45 (e) |

|

|

213 |

|

| |

491 |

|

|

Series 2015-T2, Class DT2, 3.743%, 09/15/45 (e) |

|

|

491 |

|

| |

2,952 |

|

|

OnDeck Asset Securitization Trust LLC, Series 2014-1A, Class A, 3.150%, 05/17/18 (e) |

|

|

2,952 |

|

|

|

|

|

OneMain Financial Issuance Trust, |

|

|

|

|

| |

2,744 |

|

|

Series 2014-1A, Class A, 2.430%, 06/18/24 (e) |

|

|

2,777 |

|

| |

402 |

|

|

Series 2014-1A, Class B, 3.240%, 06/18/24 (e) |

|

|

405 |

|

| |

3,672 |

|

|

Series 2014-2A, Class A, 2.470%, 09/18/24 (e) |

|

|

3,689 |

|

| |

1,491 |

|

|

Series 2014-2A, Class B, 3.020%, 09/18/24 (e) |

|

|

1,496 |

|

| |

4,603 |

|

|

Series 2015-1A, Class A, 3.190%, 03/18/26 (e) |

|

|

4,657 |

|

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

| |

550 |

|

|

Series 2015-1A, Class B, 3.850%, 03/18/26 (e) |

|

|

561 |

|

| |

9,374 |

|

|

Series 2015-2A, Class A, 2.570%, 07/18/25 (e) |

|

|

9,372 |

|

| |

1,911 |

|

|

Series 2015-2A, Class B, 3.100%, 07/18/25 (e) |

|

|

1,907 |

|

| |

470 |

|

|

Park Place Securities, Inc., Asset-Backed Pass-Through Certificates,

Series 2004-MCW1, Class M1, VAR, 1.137%, 10/25/34 |

|

|

469 |

|

| |

431 |

|

|

PFS Tax Lien Trust, Series 2014-1, Class NOTE, 1.440%, 04/15/16 (e) |

|

|

432 |

|

|

|

|

|

Pretium Mortgage Credit Partners I LLC, |

|

|

|

|

| |

1,916 |

|

|

Series 2015-NPL2, Class A1, SUB, 3.750%, 07/27/30 (e) |

|

|

1,914 |

|

| |

2,000 |

|

|

Series 2015-NPL2, Class A2, SUB, 4.250%, 07/27/30 (e) |

|

|

1,967 |

|

| |

2,353 |

|

|

Progreso Receivables Funding II LLC, Series 2014-A, Class A, 3.500%, 07/08/19 (e) |

|

|

2,364 |

|

|

|

|

|

Progreso Receivables Funding III LLC, |

|

|

|

|

| |

3,531 |

|

|

Series 2015-A, Class A, 3.625%, 02/08/20 (e) |

|

|

3,540 |

|

| |

906 |

|

|

Series 2015-A, Class B, 5.500%, 02/08/20 (e) |

|

|

909 |

|

|

|

|

|

Progreso Receivables Funding LLC, |

|

|

|

|

| |

1,603 |

|

|

Series 2015-B, Class A, 3.000%, 07/28/20 (e) |

|

|

1,603 |

|

| |

726 |

|

|

Series 2015-B, Class B, 5.000%, 07/28/20 (e) |

|

|

726 |

|

|

|

|

|

Progress Residential Trust, |

|

|

|

|

| |

3,974 |

|

|

Series 2015-SFR2, Class A, 2.740%, 06/12/32 (e) |

|

|

3,941 |

|

| |

2,012 |

|

|

Series 2015-SFR2, Class B, 3.138%, 06/12/32 (e) |

|

|

1,993 |

|

| |

2,566 |

|

|

Series 2015-SFR2, Class C, 3.436%, 06/12/32 (e) |

|

|

2,524 |

|

| |

1,230 |

|

|

Series 2015-SFR2, Class E, 4.427%, 06/12/32 (e) |

|

|

1,176 |

|

| |

1,409 |

|

|

RAMP Trust, Series 2006-RZ1, Class A3, VAR, 0.499%, 03/25/36 |

|

|

1,376 |

|

| |

1,770 |

|

|

RBSHD Trust, Series 2013-1A, Class A, SUB, 4.685%, 10/25/47 (e) |

|

|

1,771 |

|

| |

294 |

|

|

Renaissance Home Equity Loan Trust, Series 2007-2, Class AF2, SUB, 5.675%, 06/25/37 |

|

|

152 |

|

| |

3,247 |

|

|

RMAT LLC, Series 2015-NPL1, Class A1, SUB, 3.750%, 05/25/55 (e) |

|

|

3,239 |

|

|

|

|

|

Santander Drive Auto Receivables Trust, |

|

|

|

|

| |

2,424 |

|

|

Series 2015-S1, Class R1, 1.930%, 09/17/19 (e) |

|

|

2,423 |

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2015 |

|

JPMORGAN INSTITUTIONAL TRUST FUNDS |

|

|

|

|

13 |

|

JPMorgan Core Bond Trust

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2015 (Unaudited) (continued)

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Asset-Backed Securities — continued |

|

| |

689 |

|

|

Series 2015-S2, Class R1, 1.840%, 11/18/19 (e) |

|

|

689 |

|

| |

2,674 |

|

|

Series 2015-S7, Class R1, 1.970%, 03/16/21 (e) |

|

|

2,674 |

|

| |

302 |

|

|

Saxon Asset Securities Trust, Series 2003-1, Class AF6, SUB, 4.795%, 06/25/33 |

|

|

305 |

|

| |

289 |

|

|

Securitized Asset-Backed Receivables LLC Trust, Series 2006-CB1, Class AF2, SUB, 3.400%, 01/25/36 |

|

|

212 |

|

| |

1,581 |

|

|

Selene Non-Performing Loans LLC, Series 2014-1A, Class A, SUB, 2.981%,

05/25/54 (e) |

|

|

1,566 |

|

| |

286 |

|

|

SNAAC Auto Receivables Trust, Series 2014-1A, Class A, 1.030%, 09/17/18 (e) |

|

|

287 |

|

|

|

|

|

SpringCastle America Funding LLC, |

|

|

|

|

| |

6,927 |

|

|

Series 2014-AA, Class A, 2.700%, 05/25/23 (e) |

|

|

6,952 |

|

| |

1,500 |

|

|

Series 2014-AA, Class B, 4.610%, 10/25/27 (e) |

|

|

1,530 |

|

|

|

|

|

Springleaf Funding Trust, |

|

|

|

|

| |

3,933 |

|

|

Series 2013-AA, Class A, 2.580%, 09/15/21 (e) |

|

|

3,944 |

|

| |

3,000 |

|

|

Series 2013-BA, Class A, 3.920%, 01/16/23 (e) |

|

|

3,011 |

|

| |

2,000 |

|

|

Series 2013-BA, Class B, 4.820%, 01/16/23 (e) |

|

|

2,000 |

|

| |

6,533 |

|

|

Series 2014-AA, Class A, 2.410%, 12/15/22 (e) |

|

|

6,516 |

|

| |

525 |

|

|

Series 2014-AA, Class B, 3.450%, 12/15/22 (e) |

|